Example 25-Mark Essay in style of AQA Economics A-level

Below is an example model answer to a 25 mark question in the style of AQA Economics A-level.

To practise your AQA exam technique with 2024 practice questions, click the button below:

Question for model answer

Consider the following question. I have written this question in the style of a 25-mark AQA Economics A-level question for section B:

Taking effect from 1st April 2023, the UK Government has committed to increasing the corporation tax rate from 19% to 25% for companies with profits above £250,000 per year. For firms with profits below £50,000, there is no increase in corporation tax rates. But for firms with profits between £50,000 and £250,000 there will be a smaller increase in corporation tax rates.

(Source: here )

Evaluate the effects on the UK economy of increasing corporation tax rates on firms making high profits (25 marks) .

This is a key macroeconomics essay on current affairs. A quick essay plan is here:

- Define key terms.

- Laffer curve – higher government revenue.

- Evaluation – position on Laffer curve.

- AD effect – lower investment and negative multiplier effect.

- Evaluation – proportion of AD that comes from investment.

- LRAS effect – reduced incentives and productivity.

- Evaluation – need to compare corporation tax rates to those of other economies.

Conclusion.

Possible model answer

Corporation tax is a tax on firms’ profits. Aggregate demand (AD) is the total demand in the economy, AD = C+I+G+X-M.

Increasing corporation tax rates may increase tax revenue for the UK Government. The Laffer curve shows this. An increase in tax rates from T to T1 raises tax revenue from R to R1. This revenue could go towards reducing the budget deficit. The government’s budget deficit is very high at 4.2% of the UK’s GDP in 2023-24. This is because of government spending on Covid support programmes such as the furlough scheme, energy subsidies and other tax cuts. Reducing the budget deficit may lead to government borrowing and hence reduced debt interest payments . With less spending on debt interest the UK Government could choose to spend more money in the future on other priorities such as healthcare spending. Sounder public finances might also make investors more confident in the UK Government’s ability to make bond repayments. This may reduce the interest rates at which investors are willing to buy government bonds and thus reduce future borrowing costs.

Whether the tax increase raises government revenue depends on the position of the UK economy on the Laffer curve. If instead the economy is at point (T1,R1) before raising corporation taxes, then increasing the corporation tax rate to T2 may decrease revenue to R. This is because a corporation tax rise may reduce incentives to start or grow a business, reducing the size of the tax base. The UK Government does predict that tax revenue would rise by over £10bn a year because of the corporation tax rate rise. With corporate tax rates relatively low now, it is likely that there will be higher revenue. But the effect of higher taxes on incentives may reduce the extent to which revenue increases.

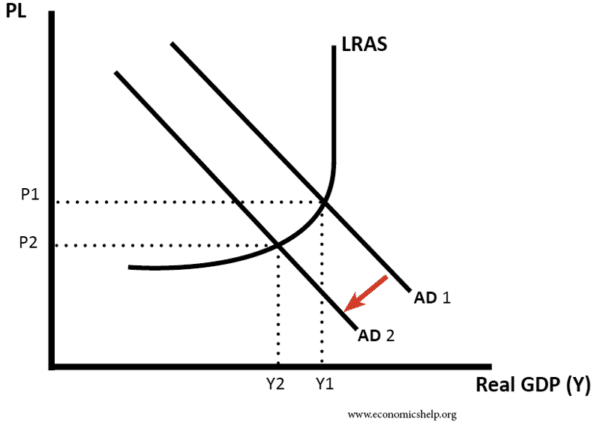

Increasing corporation tax rates “from 19% to 25% for companies with profits above £250,000 per year” reduces the post-tax profits of these firms. This leaves reduced funds for investment, so investment may fall. Also as firms know any future profits will be taxed at a higher rate, this will disincentivise investment further. This is because firms will have reduced returns (lower post-tax profits) from any new investment. So investment falls and as investment is a component of aggregate demand (AD=C+I+G+X-M), aggregate demand shifts left from AD to AD1. This may cause a negative multiplier effect . This is where a fall in investment leads to a larger than proportionate fall in A. Lower investment results in lower incomes for firms and cuts in wages, so consumers cut their spending, meaning consumption also falls and so on. So AD shifts further left to AD2. This results in lower real GDP as real GDP falls from Y to Y2. Hence corporation tax may lower real GDP, likely resulting in lower living standards.

However this argument depends on the proportion of AD influenced by the corporation tax rate rise. Only firms making larger profits are facing a corporation tax rise. So firms making lower profits, for example small businesses, are less likely to reduce their investment. Also consumption is the largest component of AD, making up roughly 60% of AD, not investment. So a given percentage fall in investment may have only a smaller effect on AD. Corporation tax is likely to reduce AD leading to lower real GDP. But these impacts are limited by the relative importance of investment to AD and the design of the policy to target high profit firms only.

Decreased investment can also influence the supply side of the economy. Lower investment could mean reduced firm spending on capital goods and human capital. So this could reduce productivity and hence the productive capacity of the economy. This means the LRAS could shift to the left. Higher corporation taxes could mean higher business costs, shifting the short-run aggregate supply curve left too. Lower productivity and higher business costs could lead to a higher price level in the UK economy, reducing the price competitiveness of UK exports which may widen the current account deficit. Productivity for the UK economy is 15% below the average of other G7 economies (as of 2015), so corporate tax rises could further worsen this UK productivity gap with other nations. There may also be fewer businesses choosing to set up in the UK, preferring to set up abroad in locations with lower taxes. This would further reduce the productive potential of the economy, compared to a situation of lower corporation tax rates.

However this depends on the level of corporation tax rates in other economies . The UK has the lowest corporate tax rate among the G7 economies, even after the tax rise. Hence there may be fewer incentives to set up a business abroad, so the effect on competitiveness is reduced. Also many economies have agreed to a global minimum corporation tax of 15%, further reducing the risk to competitiveness from raising corporation taxes. While the corporation tax rate rise may reduce investment, it is less likely to have a significant impact on competitiveness.

Overall raising corporation tax on firms making high profits is likely to be effective in raising revenue. While raising corporation tax will reduce aggregate demand and aggregate supply, by raising taxes only on higher-profit firms, the impact is limited. The impact of the tax rise does depend on how other countries respond – if other countries maintain or reduce their tax rates to attract more businesses, then increasing corporate taxes could significantly reduce the incentive for international businesses to set up in the UK. However, given the increasing degree of tax cooperation globally , as shown by the 15% minimum corporate tax rate agreement, it seems likely that countries will not seek to undercut each other’s corporate tax rates.

Application is throughout using examples from the short extract and from own knowledge to support analysis and evaluation.

Analysis is detailed, using chains of reasoning and graphs to support the answer.

Evaluation is also detailed, making use of chains of reasoning and where relevant, data about the economy. The conclusion addresses the question and justifies the answer.

Note for the conclusion you could have picked another side for this policy too depending on the arguments used. You could also use other possible points – there is no right way of doing this. For example with interest rates at historical lows, how does that impact the cost of government borrowing and the necessity of raising taxes? What other factors may matter for investment beside corporate tax rates?

This essay would likely score level 5 according to AQA Economics A-level criteria.

For more guidance on AQA exam technique (25 markers, 15 markers, 9 markers and more), check out the blue button below:

Other Questions

How many words should there be in a 25 marker economics.

Most 25 mark responses, that can be replicated within exam conditions, are within the range of 700 to 1000 words.

However this is arbitrary. Word count does not matter as much, provided you answer the question and write in depth.

Achieving depth in analysis and evaluation, answering the question – see my economics resources here for more information on essay structures and how to evaluate.

How should you structure a 25 marker economics essay?

Introduction

Depending on depth of your previous points, add another round of analysis and evaluation.

For more information on AQA Economics essay structure, I recommend the following article linked here .

How should you write a conclusion for 25 markers economics?

A conclusion has these key elements:

- Answer the question.

- Justify your answer in step 1.

- Consider other evaluation points, including real-world context, for further justification or that may go against your answer.

How should you evaluate in economics 25 markers?

I recommend the “depends on” structure for AQA Economics style evaluation. For more information on this, see my AQA Economics style evaluation guide here .

More Resources

For AQA style practice questions on recent current affairs, click the blue button below:

If you are interested in more A-level Economics resources, please feel free to click the button below:

About the author

Helping economics students online since 2015. Previously an economist, I now provide economics resources on tfurber.com and tutor A Level Economics students. Read more about me here .

Latest Posts

- 14 Practice Papers for A Level Economics 2024

- 1.4.2 Government failure

- 11 Practice Questions in style of Edexcel Economics Paper 2

- 25 Practice Questions in style of Edexcel Economics Paper 1

- 22 Real World Examples for Microeconomics 2024

PMT Education is recruiting online tutors

AQA A-level Economics Revision

A-level paper 1, a-level paper 2, a-level paper 3.

- Revision Courses

- Past Papers

- Solution Banks

- University Admissions

- Numerical Reasoning

- Legal Notices

Tips for writing economics essays

Some tips for writing economics essays Includes how to answer the question, including right diagrams and evaluation – primarily designed for A Level students.

1. Understand the question

Make sure you understand the essential point of the question. If appropriate, you could try and rephrase the question into a simpler version.

For example:

Q. Examine the macroeconomic implications of a significant fall in UK House prices, combined with a simultaneous loosening of Monetary Policy.

In plain English.

- Discuss the effect of falling house prices on the economy

- Discuss the effect of falling interest rates (loose monetary policy) on economy

In effect, there are two distinct parts to this question. It is a valid response, to deal with each separately, before considering both together.

It helps to keep reminding yourself of the question as you answer. Sometimes candidates start off well, but towards the end forget what the question was. Bear in mind, failure to answer the question can lead to a very low mark.

2. Write in simple sentences

For clarity of thought, it is usually best for students to write short sentences. The main thing is to avoid combining too many ideas into one sentence. If you write in short sentences, it may sound a little stilted; but it is worth remembering that there are no extra marks for a Shakespearian grasp of English. (at least in Economics Exams)

Look at this response to a question:

Q. What is the impact of higher interest rates?

Higher interest rates increase the cost of borrowing. As a result, those with mortgages will have lower disposable income. Also, consumers have less incentive to borrow and spend on credit cards. Therefore consumption will be lower. This fall in consumption will cause a fall in Aggregate Demand and therefore lead to lower economic growth. A fall in AD will also reduce inflation.

I could have combined 1 or 2 sentences together, but here I wanted to show that short sentences can aid clarity of thought. Nothing is wasted in the above example.

Simple sentences help you to focus on one thing at once, which is another important tip.

3. Answer the question

Quite frequently, when marking economic essays, you see a candidate who has a reasonable knowledge of economics, but unfortunately does not answer the question. Therefore, as a result, they can get zero for a question. It may seem harsh, but if you don’t answer the question, the examiner can’t give any marks.

At the end of each paragraph you can ask yourself; how does this paragraph answer the question? If necessary, you can write a one-sentence summary, which directly answers the question. Don’t wait until the end of the essay to realise you have answered a different question.

Discuss the impact of Euro membership on UK fiscal and monetary policy?

Most students will have revised a question on: “The benefits and costs of the Euro. Therefore, as soon as they see the Euro in the title, they put down all their notes on the benefits and costs of the Euro. However, this question is quite specific; it only wishes to know the impact on fiscal and monetary policy.

The “joke” goes, put 10 economists in a room and you will get 11 different answers. Why? you may ask. The nature of economics is that quite often there is no “right” answer. It is important that we always consider other points of view, and discuss various different, potential outcomes. This is what we mean by evaluation.

Macro-evaluation

- Depends on the state of the economy – full capacity or recession?

- Time lags – it may take 18 months for interest rates to have an effect

- Depends on other variables in the economy . Higher investment could be offset by fall in consumer spending.

- The significance of factors . A fall in exports to the US is only a small proportion of UK AD. However, a recession in Europe is more significant because 50% of UK exports go to EU.

- Consider the impact on all macroeconomic objectives . For example, higher interest rates may reduce inflation, but what about economic growth, unemployment, current account and balance of payments?

- Consider both the supply and demand side . For example, expansionary fiscal policy can help to reduce demand-deficient unemployment, however, it will be ineffective in solving demand-side unemployment (e.g. structural unemployment)

Example question :

The effect of raising interest rates will reduce consumer spending.

- However , if confidence is high, higher interest rates may not actually discourage consumer spending.

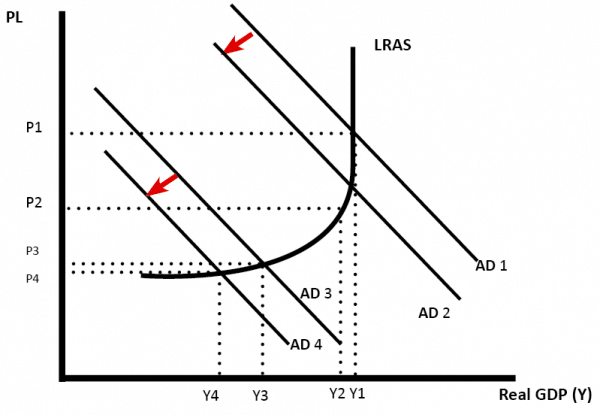

If the economy is close to full capacity a rise in interest rates may reduce inflation but not reduce growth. (AD falls from AD1 to AD2)

- However , if there is already a slowdown in the economy, rising interest rates may cause a recession. (AD3 to AD3)

Micro-evaluation

1. The impact depends on elasticity of demand

In both diagrams, we place the same tax on the good, causing supply to shift to the left.

- When demand is price inelastic, the tax causes only a small fall in demand.

- If demand is price elastic, the tax causes a bigger percentage fall in demand.

2. Time lag

In the short term, demand for petrol is likely to be price inelastic. However, over time, consumers may find alternatives, e.g. they buy electric cars. In the short-term, investment will not increase capacity, but over time, it may help to increase a firms profitability. Time lags.

3. Depends on market structure

If markets are competitive, then we can expect prices to remain low. However, if a firm has monopoly power, then we can expect higher prices.

4. Depends on business objectives

If a firm is seeking to maximise profits, we can expect prices to rise. However, if a firm is seeking to maximise market share, it may seek to cut prices – even if it means less profit.

5. Behavioural economics

In economics, we usually assume individuals are rational and seeking to maximise their utility. However, in the real world, people are subject to bias and may not meet expectations of classical economic theory. For example, the present-bias suggest consumers will give much higher weighting to present levels of happiness and ignore future costs. This may explain over-consumption of demerit goods and under-consumption of merit goods. See: behavioural economics

Exam tips for economics – Comprehensive e-book guide for just £5

8 thoughts on “Tips for writing economics essays”

I really want to know the difference between discussion questions and analysis questions and how to answer them in a correct way to get good credit in Economics

Analysis just involves one sided answers while Discussion questions involve using two points of view

This is a great lesson learnd by me

how can I actually manage my time

The evaluation points in this article are really useful! The thing I struggle with is analysis and application. I have all the knowledge and I have learnt the evaluation points like J-curve analysis and marshall learner condition, but my chains of reasoning are not good enough. I will try the shorter sentences recommended in this article.

What kind of method for costing analysis is most suitable for a craft brewery, in order to analyze the cost of production of different types of beer_

Really useful!Especially for the CIE exam papers

Does anyone know how to evaluate in those advantages/disadvantages essay questions where you would basically analyse the benefits of something and then evaluate? Struggling because wouldn’t the evaluation just be the disadvantages ?? Like how would you evaluate without just stating the disadvantage?

Leave a comment Cancel reply

AQA A-Level Economics Past Papers

This section includes recent A-Level Economics past papers from AQA (7135 & 7136). You can download each of the AQA A-Level Economics past papers and marking schemes by clicking the links below.

June 2022 - AQA A-Level Economics Past Papers (7136)

A-Level Paper 1: Markets and Market Failure (7136/1) Download Past Paper - Download Mark Scheme

A-Level Paper 2: National and international economy (7136/2) Download Past Paper - Download Mark Scheme

A-Level Paper 3: Economics principles and issues (7136/3) Download Insert - Download Past Paper - Download Mark Scheme

November 2021 - AQA A-Level Economics Past Papers (7136) (Labelled as June 2021)

November 2020 - AQA A-Level Economics Past Papers (7135 & 7136) (Labelled as June 2020)

A-Level Paper 3: Economics principles and issues (7136/3) Download Insert - Download Past Paper - Download Mark Scheme

AS Paper 1: The Operation of Markets and Market Failure (7135/1) Download Insert - Download Past Paper - Download Mark Scheme

AS Paper 2: The National Economy in a Global Context (7135/2) Download Insert - Download Past Paper - Download Mark Scheme

June 2019 - AQA A-Level Economics Past Papers (7135 & 7136)

June 2018 - AQA A-Level Economics Past Papers (7135 & 7136)

June 2017 - AQA A-Level Economics Past Papers (7135 & 7136)

A-Level Paper 3: Economics principles and issues (7135/3) Download Insert - Download Past Paper - Download Mark Scheme

AQA A-Level Economics Specimen Papers (7136)

For more A-Level Economics past papers from other exam boards click here .

A-Level Economics Notes & Questions (AQA)

We have summarised the Economic concepts from the AQA Economics syllabus, and linked our A-Level Economics notes and questions to key topics on this page. We hope this will serve as a directory of our Economics resources for AQA Economics students in AS and A2. For some topics in AS, certain slides/concepts will not be applicable until A2, which is noted in the brackets. Concepts not applicable to the specification are also in brackets. Topics without links are either coming soon or not available, but a close substitute for these resources will be provided to students receiving mentoring or tuition from us.

Please do bookmark this page and share it if you find it helpful. AQA A2 Past papers and AQA AS Past papers are also available on the site to test/consolidate your knowledge.

AQA Economics (AS / Year 1)

3.1 The Operation of Markets and Market Failure – Microeconomics 3.1.1 Economic Methodology and the Economic Problem – Scarcity, Opportunity Cost, Factors of Production – Production Possibility Diagrams: PPF/PPCs

3.1.2 Price Determination in a Competitive Market – Demand & Supply: Factors, Shifts, Diagrams & Equilibrium Price Determination – Price, Income & Cross Elasticity of Demand; Price Elasticity of Supply – Interrelated Markets: Joint Demand, Demand for Substitute Goods, Composite Demand, Derived Demand, Joint Supply

3.1.3 Production, Costs and Revenue – Specialisation, Division of Labour, Money – Costs: Total & Average Costs, Fixed & Variable Costs (Not required: marginal cost and law of diminishing marginal returns) – Economies of Scale & Diseconomies of Scale, Long-Run Average Costs (LRAC) – Revenues: Total (TR), Average (AR) (Not required: marginal revenue and law of diminishing marginal returns)

3.1.4 Competitive and Concentrated Markets – Market Structure Determinants: No. of Firms, Product Differentiation & Ease of Entry (No diagrams required) – Business Objectives (No diagrams required) – Competitive Markets: Perfect Competition (No diagrams required) – Monopoly and Monopoly power (No diagrams required, but need to show a monopoly raises price on a demand curve)

3.1.5 The Market Mechanism, Market Failure and Government Intervention in Markets Market Mechanism – Rationing, Incentive and Signalling Price Functions Market Failure – Public Goods, Quasi-Public Goods and the Free-Rider Problem – Market imperfections: Asymmetric Information, Monopoly Power & the Immobility of Factors of Production – Wealth & Income Inequality Externalities: (No marginal cost/benefit required – can use supply/demand curves instead) – Merit and Demerit Goods (Coming soon) – Over-production in Negative Externalities – Under-production in Positive Externalities Government intervention – Indirect Taxes – Subsidies – Price Controls: Maximum & Minimum Prices – Other Intervention: State Provision of Public Goods & Regulation – Government Failure: Inadequate/Imperfect Information, Conflicting Objectives & Admin/Opportunity Costs

3.2 The National Economy in a Global Context – Macroeconomics 3.2.1 The Measurement of Macroeconomic Performance – Macroeconomic Objectives: Economic Growth, Price Stability, Low Unemployment & Stable Current Account – Macroeconomic Indicators: Index Numbers; Real GDP, GDP per Capita, CPI/RPI, Productivity

3.2.2 How the Macroeconomy Works: the Circular Flow of Income, Aggregate Demand (AD) & Aggregate Supply (AS) Analysis – Circular flow of income: Injections, Withdrawals – Aggregate Demand (AD) & Aggregate Supply (AS): Equation, Components, Shifts, SRAS, LRAS – Classical Long-Run Aggregate Supply (LRAS) – The Accelerator Process (No calculations required) – The Multiplier (Calculation required by dividing change in national income by initial injection. Other calculations not needed)

3.2.3 Economic Performance – Economic Growth: Output Gaps, Demand/Supply-Side Shocks, Causes and Impact of Growth – Employment/Unemployment: Measures, Types, AD/AS Factors (real wage and natural rate unemployment not required) – Inflation/Deflation: Cost Push & Demand Pull Inflation, Commodity Prices – Balance of Payments: Current Account – Conflicts and Tradeoffs between Objectives

3.2.4 Macroeconomic policy – Fiscal Policy: Government Spending, Types of Taxes, Budget Balance, Effects on AD/AS – Monetary Policy: Changing Interest Rates, Money Supply, Exchange Rates; Monetary Policy Committee – Supply-Side Policies: Government Spending on Education/Training, Tax Changes & Incentive Policies

AQA AS Past-Papers to consolidate AQA AS Economics knowledge. Alternatively, use AQA AS Old Specification Papers to consolidate AS Microeconomics (Unit 1) and AS Macroeconomics (Unit 2) knowledge.

AQA Economics (A-Level / Year 1 & 2)

4.1 Individuals, Firms, Markets and Market Failure – Microeconomics 4.1.1 Economic Methodology and the Economic Problem – Scarcity, Opportunity Cost, Factors of Production – Production Possibility Diagrams: PPF/PPCs

4.1.2 Individual Economic Decision Making – Utility Theory: Diminishing Marginal Utility, Total Utility, Utility Maximisation & Relationship with Demand – Imperfect Information: Asymmetric Information – Behavioural Economics: Rationality, Self-Control, Rules of Thumb, Anchoring, Availability, Social Norms – Behavioural Economic Policies: Choice Architecture, Framing, Nudges, Default/Restricted/Mandated Choices

4.1.3 Price Determination in a Competitive Market – Demand & Supply: Factors, Shifts, Diagrams & Equilibrium Price Determination – Price, Income & Cross Elasticity of Demand; Price Elasticity of Supply – Interrelated Markets: Joint Demand, Demand for Substitute Goods, Composite Demand, Derived Demand, Joint Supply

4.1.4 Production, Costs and Revenue – Production Returns: Marginal, Total and Average Returns; Law of Diminishing Marginal Returns; Returns to Scale – Specialisation, Division of Labour, Money – Costs: Total Cost (TC), Average Cost (AC), Marginal Cost (MC), Fixed Cost (FC), Variable Cost (VC) – Economies of Scale & Diseconomies of Scale, Long-Run Average Costs (LRAC), Minimum Efficient Scale (MES) – Revenues: Total (TR), Average (AR), Marginal (MR) – Technological Change & Creative Destruction: New Products; Impacts on Costs, Market Structure and Monopolies

4.1.5 Perfect Competition, Imperfectly Competitive Markets and Monopoly – Profit Maximisation Rule – Other Business Objectives: Survival, Growth, Quality, Sales Revenue Maximisation and Market Share – Perfect Competition – Oligopoly – Monopoly and Monopoly Power – Market Efficiency – Price Discrimination – Monopolistic Competition – Contestability – Market Efficiency: Allocative, Productive and Dynamic Efficiency – Producer & Consumer Surplus

4.1.6 The Labour Market – Marginal Productivity Theory of Labour – Demand & Supply of Labour: Factors, Elasticity, Wage Determination Labour Market Influences & Failure – Monopsony (Labour market portion only) – Labour Immobility, Trade Unions, Minimum Wage and Discrimination

4.1.7 The Distribution of Income and Wealth: Poverty and Inequality – Wealth/Income Inequality: Lorenz curve and Gini coefficient, Government Redistribution Policies – Absolute/Relative poverty

4.1.8 The Market Mechanism, Market Failure and Government Intervention in Markets Market Mechanism – Rationing, Incentive and Signalling Price Functions Market Failure – Public Goods, Quasi-Public Goods and the Free-Rider Problem – Market Imperfections: Asymmetric Information, Monopoly Power & the Immobility of Factors of Production – Nationalisation vs Privatisation – EU/UK Competition Policies, Arguments For/Against Regulation, Regulatory Capture Externalities: (No marginal cost/benefit required – can use supply/demand curves instead) – Merit and Demerit Goods (Coming soon) – Over-production in Negative Externalities – Under-production in Positive Externalities Government intervention – Indirect Taxes – Subsidies – Price Controls: Maximum & Minimum Prices – Other Intervention: State Provision of Public Goods & Regulation – Government Failure: Inadequate/Imperfect Information, Conflicting Objectives & Admin/Opportunity Costs

4.2 The National and International Economy – Macroeconomics 4.2.1 The Measurement of Macroeconomic Performance – Macroeconomic Objectives: Economic Growth, Price Stability, Low Unemployment & Stable Current Account – Macroeconomic Indicators: Index Numbers; Real GDP, GDP per Capita, CPI/RPI, Productivity

4.2.2 How the Macroeconomy Works: the Circular Flow of Income, Aggregate Demand (AD) & Aggregate Supply (AS) Analysis – Circular flow of income: Injections, Withdrawals – Aggregate Demand (AD) & Aggregate Supply (AS): Equation, Components, Shifts, SRAS, LRAS – Keynesian & Classical Long-Run Aggregate Supply (LRAS) – The Accelerator Process (No calculations required) – The Multiplier (Calculation required by dividing change in national income by initial injection. Other calculations not needed)

4.2.3 Economic performance – Economic growth: Output Gaps, Demand/Supply-Side Shocks, Causes and Impact of Growth – Employment/Unemployment: Measures, Types, AD/AS Factors, Real Wage and Natural Rate Unemployment – Inflation/Deflation: Cost Push and Demand Pull Inflation, Commodity Prices – Fisher’s Equation, Quantity Theory of Money, and Effects on Inflation – Short-Run Phillips Curve (SRPC), Long-Run Phillips Curve (LRPC) – Macroeconomic Objective/Policy Conflicts & Resolution

4.2.4 Financial Markets and Monetary Policy – Type of Money & Banks, Debt and Equity – Interest Rates and Relationship to Bond Prices (Coming soon) – Central Banks: Functions, Monetary Policy Committee (MPC), Bank of England and Money Supply – Monetary Policy: Transmission Mechanism, Changing Interest Rates, Money Supply, Exchange Rates – Financial Market Regulation: Bank Failures, Liquidity/Capital Ratios, UK Regulatory Bodies, Moral Hazard & Systematic Risk

4.2.5 Fiscal Policy and Supply-Side Policies – Fiscal Policy: Government Spending, Types of Taxes, Cyclical & Structural Budget Deficits, Effects on AD/AS – Supply-Side Policies: Free-Market & Interventionist Policies, Effects on Natural Unemployment & Economic Growth

4.2.6 The International Economy – Globalisation – International Trade: Patterns of Trade , Trading Blocs (EU, WTO) – Trade Restrictions: Tariffs, Quotas, Export Subsidies – Comparative & Absolute Advantage – Balance of Payments: Current, Capital & Financial Accounts, FDI Effects on Economies – Current Account: Deficit & Surplus Causes, Implications, Imbalance Correction Strategies/Impact – Exchange Rates: Floating, Fixed Exchange Rate Systems ; Currency Unions – Economic Development: Growth vs Development; Factors, Barriers and Policies for Development; Aid & Trade (Coming soon)

AQA A2 Past-Papers to consolidate AQA A2 Economics knowledge. Alternatively, use AQA Old Specification Papers to consolidate all Microeconomics (Unit 1 & 3) and all Macroeconomics (Unit 2 & 4) knowledge.

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

- Exam Support

2018 Practice Essays for A Level Economics

3rd May 2018

- Share on Facebook

- Share on Twitter

- Share by Email

At this time of year lots of teachers work feverishly through essay plans as a way of revising core content and honing those all-important essay exam skills. Here is a selection of micro & macro essay titles that I have been using in class.

Micro Essays

Home ownership has become increasingly difficult to access, particularly for first-time buyers, as house price growth has outstripped growth in wages. Median house prices in England are now 7.7 times higher than median earnings. In London, the ratio can be considerably higher: in Chelsea & Fulham, it is 24.8.

Assess the policies that might be most effective in improving housing affordability in the UK economy (25)

Evaluate the micro and macroeconomic impact of a significant rise in average UK house prices (25)

Regulation of monopoly

Using your own knowledge, evaluate the argument that economic welfare can be best promoted through regulation of businesses with monopoly power (25)

Barriers to entry and profit

Examine the role of barriers to entry in earning economic profit in industries of your choice. (25)

Contestable markets

Neo-classical theory of competition implies that more firms in a market is the only way to improve outcomes for consumers”. With reference to examples, to what extent do you agree? (25)

Food prices and consumer welfare

Examine the policies a government might use to make food affordable to lower income groups. (25)

Energy market

Evaluate the argument that consumers would benefit from the government imposing a price cap on household energy bills (25)

Plastic pollution, public bads and externalities

Assess the policies that might be most effective in reducing the scale of plastic pollution in the UK and other countries of your choice (25)

Environmental market failure

Discuss the view that the overuse of common access resources is best addressed by government intervention (25)

The Gig Economy

Discuss the impact of the expansion of the gig economy on UK economic performance. (25)

Trade unions in the labour market

Evaluate the possible effects on the UK labour market of a decrease in trade union membership (25)

Discuss the microeconomic and macroeconomic effects of stronger trade unions on the UK economy (25)

Assess the argument that a universal basic income is likely to be the most effective policy for reducing the scale of income and wealth inequality in the UK (25)

Evaluate the micro and macroeconomic causes of inequality and poverty in the UK (25)

Essential Revision Resources to Get Before June!

Revision flashcards for a-level economics students.

Resource Collection

Macroeconomics

Globalisation

Evaluate the extent to which globalisation inevitably leads to a rise in income and wealth inequality in one or more countries of your choice (25)

Exchange rates

Using your own knowledge, examine some of the likely macroeconomic effects of a depreciation in the sterling exchange rate (25)

Trade and the European Union

Discuss the likely micro and macroeconomic effects on the UK economy of leaving the EU customs union (25)

Evaluate the view that membership of a customs union has more advantages than disadvantages for an economy. Discuss with reference to any developed or developing country of your choice (25)

Quantitative easing

Using your own knowledge, discuss the impact that quantitative easing has had on UK macroeconomic objectives in recent years (25)

Monetary Policy

Policy interest rates in the UK have been too low for too long and now risk damaging the health of the UK economy. Assess the validity of this view (25)

Development policies

Drawing on knowledge from countries of your choice, evaluate the argument that sustainable development is best achieved by allowing free market forces to allocate resources (25)

Fiscal policy

Since the 2007-08 financial crisis, increases in tax revenues and, to a greater extent, reductions in public spending have contributed to the UK fiscal deficit falling by 7.5 percent of national income by 2016/17. Revenues increased by 1.7 percent of national income and spending decreased by 5.9 percent of national income between 2009/10 and 2016/17.

Assess the view that the policy of fiscal austerity used by the UK government over recent years has been damaging to the long-term prospects for the UK economy. (25)

Macroeconomic trade-offs

UK unemployment has fallen to a 45 year low of 4.2% of the labour force, yet CPI inflation remains relatively stable and close to target.

Evaluate the view that, in the case of the UK economy, the standard Phillips Curve trade-off between jobs and prices is no longer valid (25)

European Monetary Union and the EU Economy

To what extent should the Euro Area be considered an optimal currency area? (25)

Discuss the factors that may have contributed to slow economic growth in the European Union (25)

Financial economics

Examine the view that market failure is inevitable in financial markets. Justify your answer with reference to economic theory and evidence (25)

Assess the policies that have been introduced to reduce financial market failures in the UK economy since the Global Financial Crisis. (25)

Evaluate the view that increased regulation of the banking system can be damaging to the competitiveness of an economy. Discuss with reference with countries of your choice. (25)

Assess the extent to which the financial sector has been responsible for speculative bubbles in one or more countries of your choice. (25)

Geoff Riley

Geoff Riley FRSA has been teaching Economics for over thirty years. He has over twenty years experience as Head of Economics at leading schools. He writes extensively and is a contributor and presenter on CPD conferences in the UK and overseas.

You might also like

Ocr f585 june 2016 case study articles.

2nd November 2015

Answering Supported Multiple Choice in Unit 3 Economics

12th April 2016

Must Watch Revision Videos on Theory of the Firm and Market Structures

31st May 2018

Eight more (Edexcel) Synoptic Practice Questions

16th May 2018

60 Second Shorts on Key Economic Concepts

4th April 2023

Economics Topics in 60 Seconds!

2nd May 2023

Edexcel (A) A Level Economics Synoptic Connections Planner

24th January 2024

Aiming for A-A* Economics 2024 - Live Daily Revision

17th March 2024

Our subjects

- › Criminology

- › Economics

- › Geography

- › Health & Social Care

- › Psychology

- › Sociology

- › Teaching & learning resources

- › Student revision workshops

- › Online student courses

- › CPD for teachers

- › Livestreams

- › Teaching jobs

Boston House, 214 High Street, Boston Spa, West Yorkshire, LS23 6AD Tel: 01937 848885

- › Contact us

- › Terms of use

- › Privacy & cookies

© 2002-2024 Tutor2u Limited. Company Reg no: 04489574. VAT reg no 816865400.

- Centre Services

- Associate Extranet

- All About Maths

Request blocked

This request has been blocked as part of the aqa security policy.

Your support ID is: 14772493162910721394

If you're seeing this message in error, call us on 0800 197 7162 (or +44 161 696 5995 outside the UK) quoting the support ID above.

Return to previous page

- International

- Education Jobs

- Schools directory

- Resources Education Jobs Schools directory News Search

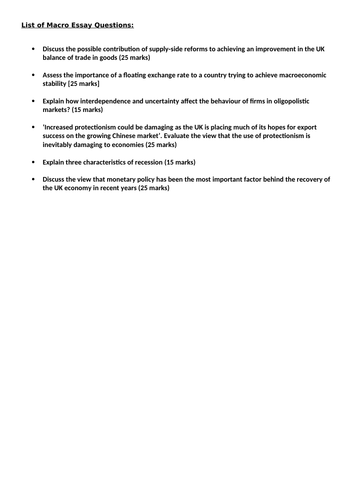

AQA Economics A-Level: Macro Exemplar Essay Questions

Subject: Economics

Age range: 16+

Resource type: Assessment and revision

Last updated

24 April 2023

- Share through email

- Share through twitter

- Share through linkedin

- Share through facebook

- Share through pinterest

AQA Economics A-level: specification 7135, 7136 I sat my Economics exam in summer 2018 and achieved A star (A ) grades across all three papers. Here is a collection of some A* grade exemplar essays.

Complete written essays included: • Discuss the possible contribution of supply-side reforms to achieving an improvement in the UK balance of trade in goods (25 marks)

• Assess the importance of a floating exchange rate to a country trying to achieve macroeconomic stability [25 marks]

• Explain how interdependence and uncertainty affect the behaviour of firms in oligopolistic markets? (15 marks)

• ‘Increased protectionism could be damaging as the UK is placing much of its hopes for export success on the growing Chinese market’. Evaluate the view that the use of protectionism is inevitably damaging to economies (25 marks)

• Explain three characteristics of recession (15 marks)

• Discuss the view that monetary policy has been the most important factor behind the recovery of the UK economy in recent years (25 marks)

Tes paid licence How can I reuse this?

Your rating is required to reflect your happiness.

It's good to leave some feedback.

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

Report this resource to let us know if it violates our terms and conditions. Our customer service team will review your report and will be in touch.

Not quite what you were looking for? Search by keyword to find the right resource:

IMAGES

VIDEO

COMMENTS

A Level Economics. Our extensive collection of resources is the perfect tool for students aiming to ace their exams and for teachers seeking reliable resources to support their students' learning journey. Here, you'll find an array of revision notes, topic questions, fully explained model answers, past exam papers and more, meticulously ...

Insert (Modified A3 36pt) (A-level): Paper 3 Economic principles and issues - June 2022. Question paper (A-level): Paper 1 Markets and market failure - June 2022. Question paper (AS): Paper 2 The national economy in a global context - June 2022. Question paper (A-level): Paper 2 National and international economy - June 2022.

Economics Revision Essay Plans. This series of resources provides revision essay plans for a wide variety of essay topics, including synoptic questions. For the 2019 papers check out our collection of videos on building A* evaluation into your answers. Have you tried our series of more than 50 Quizlet revision activities?

Question for model answer. Consider the following question. I have written this question in the style of a 25-mark AQA Economics A-level question for section B: Taking effect from 1st April 2023, the UK Government has committed to increasing the corporation tax rate from 19% to 25% for companies with profits above £250,000 per year.

Question paper (Modified A3 36pt) (A-level): Paper 1 Markets and market failure - June 2022. Published 14 Jul 2023 | PDF | 894 KB. Examiner report (A-level): Paper 3 Economic principles and issues - June 2022. Published 14 Jul 2023 | PDF | 149 KB. Question paper (Modified A4 18pt) (A-level): Paper 2 National and international economy - June 2022.

essay. Information • The marks for questions are shown in brackets. • The maximum mark for this paper is 80. • There are 40 marks for . Section A. and 40 marks for . Section B. Advice • You are advised to spend 1 hour on . Section A . and 1 hour on . Section B. A-level ECONOMICS Paper 1 Markets and Market Failure

This pdf download provides a complete set of suggested answers to all three 2019 exam papers for AQA A-Level Economics. Please note: These suggested answers have been prepared solely to help students develop their exam technique for future exam sittings. These answers are not endorsed by AQA. These answers were not written under exam conditions ...

AQA A-level Economics Revision. Approaching end of year exams? Keen to recap everything you learnt in Year 12? Check out our 2-day online AS-level Economics Recap Course on 25-26th May. Book now! There are notes for each of the topics below.

Paper 1: Markets and market failure. Marked answers from students for questions from the June 2022 exams. Supporting commentary is provided to help you understand how marks are awarded and how students can improve performance. Version 1.0 April 2024. The below content table is interactive.

Some tips for writing economics essays Includes how to answer the question, including right diagrams and evaluation - primarily designed for A Level students. 1. Understand the question. Make sure you understand the essential point of the question. If appropriate, you could try and rephrase the question into a simpler version.

Question paper (Modified A4 18pt) (AS): Paper 2 The national economy in a global context - June 2022 Published 14 Jul 2023 | PDF | 722 KB Question paper (Modified A4 18pt) (A-level): Paper 1 Markets and market failure - June 2022

Paper 2: National and international economy. Marked answers from students for questions from the June 2022 exams. Supporting commentary is provided to help you understand how marks are awarded and how students can improve performance. Version 1.0 April 2024. The below content table is interactive.

November 2020 - AQA A-Level Economics Past Papers (7135 & 7136) (Labelled as June 2020) A-Level Paper 1: Markets and Market Failure (7136/1) Download Past Paper - Download Mark Scheme. A-Level Paper 2: National and international economy (7136/2) Download Past Paper - Download Mark Scheme. A-Level Paper 3: Economics principles and issues (7136/3 ...

Here is what I feel is a superbly clear and well-structured essay answer to a question on the economic and social effects of collusion within an oligopoly. Question. Evaluate the view that collusion between firms in an oligopoly always works against consumer and society's interests. Use game theory in your answer. KAA 1:

The six characteristics of good money. Divisibility: to be a valued medium of exchange, currency must be divisible. €50 notes can be exchanged for €10 euro notes or €1 coins. Acceptability: the currency must be valued and widely accepted by society as a valid way to pay for goods/services. Durability: the currency must be robust, not ...

Question paper (Modified A3 36pt) (A-level): Paper 1 Markets and market failure - June 2022. Published 14 Jul 2023. Question paper (Modified A4 18pt) (A-level): Paper 2 National and international economy - June 2022. Published 14 Jul 2023. Question paper (Modified A3 36pt) (A-level): Paper 2 National and international economy - June 2022.

Assessment resources. Question papers. Paper 1. Showing 16 results. Insert (AS): Paper 1 The operation of markets and market failure - June 2022. Published 14 Jul 2023 | PDF | 238 KB. Question paper (A-level): Paper 1 Markets and market failure - June 2022. Published 14 Jul 2023 | PDF | 758 KB. Insert (Modified A4 18pt) (AS): Paper 1 The ...

Step 1 Determine a level. Start at the lowest level of the mark scheme and use it as a ladder to see whether the answer meets the descriptor for that level. The descriptor for the level indicates the different qualities that might be seen in the student's answer for that level. If it meets the lowest level then go to the next one and decide ...

AQA Economics (AS / Year 1) 3.1 The Operation of Markets and Market Failure - Microeconomics. 3.1.1 Economic Methodology and the Economic Problem. - Scarcity, Opportunity Cost, Factors of Production. - Production Possibility Diagrams: PPF/PPCs. 3.1.2 Price Determination in a Competitive Market. - Demand & Supply: Factors, Shifts ...

2018 Practice Essays for A Level Economics. Geoff Riley. 3rd May 2018. Share : At this time of year lots of teachers work feverishly through essay plans as a way of revising core content and honing those all-important essay exam skills. Here is a selection of micro & macro essay titles that I have been using in class.

Insert (A-level): Paper 3 Economic principles and issues - Sample set 1. Insert (AS): Paper 1 The operation of markets and market failure - June 2022. Insert (AS): Paper 1 The operation of markets and market failure - November 2020. Insert (AS): Paper 2 The national economy in a global context - June 2022.

AQA Economics A-Level: Macro Exemplar Essay Questions. Subject: Economics. Age range: 16+. Resource type: Assessment and revision. File previews. docx, 520.23 KB. AQA Economics A-level: specification 7135, 7136. I sat my Economics exam in summer 2018 and achieved A star (A) grades across all three papers. Here is a collection of some A* grade ...