- International Center for Finance

- ICF Case Studies

Finance Case Studies

Featured finance case studies:.

Canary Wharf: Financing and Placemaking

Fondaco dei Tedeschi: A New Luxury Shopping Destination for Venice

Nathan Cummings Foundation: Mission-Driven Investing

The Decline of Malls

Expand the sections below to read more about each case study:, nathan cummings foundation, ellie campion, dwayne edwards, brad wayman, anna williams, william goetzmann, and jean rosenthal.

Asset Management, Investor/Finance, Leadership & Teamwork, Social Enterprise, Sourcing/Managing Funds

The Nathan Cummings Foundation Investment Committee and Board of Trustees had studied the decision to go “all in” on a mission-related investment approach. The Board voted 100% to support this new direction and new goals for financial investments, but many questions remained. How could NCF operationalize and integrate this new strategy? What changes would it need to make to support the investment strategies' long-term success? How could NCF measure and track its progress and success with this new strategy?

William Goetzmann, Jean Rosenthal, Jaan Elias, Edoardo Pasinato, Lukas Cejnar, Ellie Campion

Business History, Competitor/Strategy, Customer/Marketing, Innovation & Design, Investor/Finance, Sourcing/Managing Funds, State & Society

The renovation of the Fondaco dei Tedeschi in Venice represented a grand experiment. Should an ancient building in the midst of a world heritage site be transformed into a modern mall for luxury goods? How best to achieve the transformation and make it economically sustainable? Would tourists walk to the mall? And would they buy or just look? What could each stakeholder learn from their experiences with the Fondaco dei Tedeschi?

Gardner Denver

James quinn, adam blumenthal, and jaan elias.

Asset Management, Employee/HR, Investor/Finance, Leadership & Teamwork

As KKR, a private equity firm, prepared to take Gardner-Denver, one of its portfolio companies, public in mid-2017, a discussion arose on the Gardner-Denver board about the implications of granting approximately $110 million in equity to its global employee base as part of its innovative "broad-based employee ownership program." Was the generous equity package that Pete Stavros proposed be allotted to 6,100 employees the wisest move and the right timing for Gardner Denver and its new shareholders?

Home Health Care

Jean rosenthal, jaan elias, adam blumenthal, and jeremy kogler.

Asset Management, Competitor/Strategy, Healthcare, Investor/Finance

Blue Wolf Capital Partners was making major investments in the home health care sector. The private equity fund had purchased two U.S. regional companies in the space. The plan was to merge the two organizations, creating opportunities for shared expertise and synergies in reducing management costs. Two years later, the management team was considering adding a third company. Projected revenues for the combined organization would top $1 billion annually. What was the likelihood that this opportunity would succeed?

Suwanee Lumber Company

Jaan elias, adam blumenthal, james shovlin, and heather e. tookes.

Asset Management, Investor/Finance, Sustainability

In 2016, Blue Wolf, a private equity firm headquartered in New York City, confronted a number of options when it came to its lumber business. They could put their holdings in the Suwanee Lumber Company (SLC), a sawmill they had purchased in 2013, up for sale. Or they could continue to hold onto SLC and run it as a standalone business. Or they could double down on the lumber business by buying an idle mill in Arkansas to run along with SLC.

Alternative Meat Industry: How Should Beyond Meat be Valued?

Nikki springer, leon van wyk, jacob thomas, k. geert rouwenhorst and jaan elias.

Competitor/Strategy, Customer/Marketing, Investor/Finance, Sourcing/Managing Funds, Sustainability

In 2009, when experienced entrepreneur Ethan Brown decided to build a better veggie burger, he set his sights on an exceptional goal – create a plant-based McDonald’s equally beloved by the American appetite. To do this, he knew he needed to transform the idea of plant-based meat alternatives from the sleepy few veggie burger options in the grocer’s freezer case into a fundamentally different product. Would further investments in research and development help give Beyond Meat an edge? Would Americans continue to embrace meat alternatives, or would the initial fanfare subside below investor expectations?

Hertz Global Holdings (A): Uses of Debt and Equity

Jean rosenthal, geert rouwenhorst, jacob thomas, allen xu.

Asset Management, Financial Regulation, Sourcing/Managing Funds

By 2019, Hertz CEO Kathyrn Marinello and CFO Jamere Jackson had managed to streamline the venerable car rental firm's operations. Their next steps were to consider ways to fine-tune Hertz's capital structure. Would it make sense for Marinello and Jackson to lead Hertz to issue more equity to re-balance the structure? One possibility was a stock rights offering, but an established company issuing equity was not generally well-received by investors. How well would the market respond to an attempt by Hertz management to increase shareholder equity?

Twining-Hadley Incorporated

Jaan elias, k geert rouwenhorst, jacob thomas.

Employee/HR, Investor/Finance, Metrics & Data, Sourcing/Managing Funds

Jessica Austin has been asked to compute THI's Weighted Average Cost of Capital, a key measure for making investments and deciding executive compensation. What should she consider in making her calculation?

Shake Shack IPO

Vero bourg-meyer, jaan elias, jake thomas and geert rouwenhorst.

Competitor/Strategy, Innovation & Design, Investor/Finance, Leadership & Teamwork, Sourcing/Managing Funds, Sustainability

Shake Shack's long lines of devoted fans made investors salivate when the company went public in 2015 and shares soared above expectations. Was the enthusiasm justified? Could the company maintain its edge in the long run?

Strategy for Norway's Pension Fund Global

Jean rosenthal, william n. goetzmann, olav sorenson, andrew ang, and jaan elias.

Asset Management, Investor/Finance, Sourcing/Managing Funds

Norway's Pension Fund Global was the largest sovereign wealth fund in the world. With questions in 2014 on policies, ethical investment, and other concerns, what was the appropriate investment strategy for the Fund?

Factor Investing for Retirement

Jean rosenthal, jaan elias and william goetzmann.

Asset Management, Investor/Finance

Should this investor look for a portfolio of factor funds to meet his goals for his 401(k) Retirement Plan?

Bank of Ireland

Jean w. rosenthal, eamonn walsh, matt spiegel, will goetzmann, david bach, damien p. mcloughlin, fernando fernandez, gayle allard, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance, Leadership & Teamwork, Macroeconomics, State & Society

In August 2011, Wilbur Ross, an American investor specializing in distressed and bankrupt companies, purchased 35% of the stock of Bank of Ireland. Even for Ross, investing in an Irish bank seemed risky. Observers wondered if the investment made sense.

Commonfund ESG

Jaan elias, sarah friedman hersh, maggie chau, logan ashcraft, and pamela jao.

Asset Management, Investor/Finance, Metrics & Data, Social Enterprise

ESG (Environmental Social and Governance) investing had become an increasingly hot topic in the financial community. Could Commonfund offer its endowment clients some investment vehicle that would satisfy ESG concerns while producing sufficient returns?

Glory, Glory Man United!

Charles euvhner, jacob thomas, k. geert rouwenhorst, and jaan elias.

Competitor/Strategy, Employee/HR, Investor/Finance, Leadership & Teamwork, Sourcing/Managing Funds

Manchester United might be the greatest English sports dynasty of all time. But valuation poses unique challenges. How much should a team's success on the pitch count toward its net worth?

Walmart de México: Investing in Renewable Energy

Jean rosenthal, k. geert rouwenhorst, isabel studer, jaan elias, and juan carlos rivera.

Investor/Finance, Operations, State & Society, Sustainability

Walmart de México y Centroamérica contracted for power from EVM's wind farm, saving energy costs and improving sustainability. What should the company's next steps be to advance its goals?

Voltaire, Casanova, and 18th-Century Lotteries

Jean rosenthal and william n. goetzmann.

Business History, State & Society

Gambling has been a part of human activity since earliest recorded history, and governments have often attempted to turn that impulse to benefit the state. The development of lotteries in the 18th century helped to develop the study of probabilities and enabled the financial success of some of the leading figures of that era.

Alexander Hamilton and the Origin of American Finance

Andrea nagy smith, william goetzmann, and jeffrey levick.

Business History, Financial Regulation, Investor/Finance

Alexander Hamilton is said to have invented the future. At a time when the young United States of America was disorganized and bankrupt, Hamilton could see that the nation would become a powerful economy.

Kmart Bankruptcy

Jean rosenthal, heather tookes, henry s. miller, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance

Less than 18 months after Kmart entered Chapter 11, the company emerged and its stocked soared. Why had the chain entered Chapter 11 in the first place and how had the bankruptcy process allowed the company to right itself?

Oil, ETFs, and Speculation

So alex roelof, k. geert rouwenhorst, and jaan elias.

Since the markets' origins, traders sought standardized wares to increase market liquidity. In the 1960s and later, they sought assets uncorrelated to traditional bonds and equities. By late 2004, commodity-based exchange-traded securities emerged.

Newhall Ranch Land Parcel

Acquired by a partnership of two closely intertwined homebuilders, Newhall Ranch was the last major tract of undeveloped land in Los Angeles County in 2003.

Brandeis and the Rose Museum

Arts Management, Asset Management, Investor/Finance, Social Enterprise, Sourcing/Managing Funds

The question of the role museums should play in university life became urgent for Brandeis in early 2009. Standard portfolios of investments had just taken a beating. Given that environment, should Brandeis sell art in order to save its other programs?

Taking EOP Private

Allison mitkowski, william goetzmann, and jaan elias.

Asset Management, Financial Regulation, Investor/Finance, Leadership & Teamwork

With 594 properties nationwide, EOP was the nation’s largest office landlord. Despite EOP's dominance of the REIT market, analysts had historically undervalued EOP. However, Blackstone saw something in EOP that the analysts didn’t, and in November, Blackstone offered to buy EOP for $48.50 per share. What did Blackstone and Vornado see that the market didn’t?

Subprime Lending Crisis

Jaan elias and william n. goetzmann.

Asset Management, Financial Regulation, Investor/Finance, State & Society

To understand the collapse of the subprime mortgage market, we look at a failing Mortgage Backed Security (MBS) and then drill down to look at a single loan that has gone bad.

William N. Goetzmann, Jean Rosenthal, and Jaan Elias

Asset Management, Business History, Customer/Marketing, Entrepreneurship, Innovation & Design, Investor/Finance, Sourcing/Managing Funds, State & Society

The financial engineering of London's Canary Wharf was as impressive as the structural engineering. However, Brexit and the rise of fintech represented new challenges. Would financial firms leave the U.K.? Would fintech firms seek new kinds of space? How should the Canary Wharf Group respond?

The Future of Malls: Was Decline Inevitable?

Jean rosenthal, anna williams, brandon colon, robert park, william goetzmann, jessica helfand .

Business History, Customer/Marketing, Innovation & Design, Investor/Finance

Shopping malls became the "Main Street" of US suburbs beginning in the mid-20th century. But will they persist into the 21st?

Hirtle Callaghan & Co

James quinn, jaan elias, and adam blumenthal.

Asset Management, Investor/Finance, Leadership & Teamwork

In August 2019, Stephen Vaccaro, Yale MBA ‘03, became the director of private equity at Hirtle, Callaghan & Co., LLC (HC), a leading investment management firm associated with pioneering the outsourced chief investment office (OCIO) model for college endowments, foundations, and wealthy families. Vaccaro was tasked with spearheading efforts to grow HC’s private equity (PE) market value from $1 billion to a new target of roughly $3 billion in order to contribute to the effort of generating higher long-term returns for clients. Would investment committees overseeing endowments typically in the 10s or 100s of millions embrace this shift, and, more pointedly, was this the best move for client portfolios?

The Federal Reserve Response to 9-11

Jean rosenthal, william b. english, jaan elias.

Financial Regulation, Investor/Finance, Leadership & Teamwork, State & Society

The attacks on New York City and the Pentagon in Washington, DC, on September 11, 2001, shocked the nation and the world. The attacks crippled the nerve center of the U.S. financial system. Information flow among banks, traders in multiple markets, and regulators was interrupted. Under Roger Ferguson's leadership, the Federal Reserve made a series of decisions designed to provide confidence and increase liquidity in a severely damaged financial system. In hindsight, were these the best approaches? Were there other options that could have taken place?

Suwanee Lumber Company (B)

In early 2018, Blue Wolf Capital Management received an offer to sell both its mill in Arkansas (Caddo) and its mill in Florida (Suwanee) to Conifex, an upstart Canadian lumber company. Blue Wolf hadn’t planned to put both mills up for sale yet, but was the deal too good to pass up? Blue Wolf had invested nearly $36.5 million into rehabilitating the Suwanee and Caddo mills. However, neither was fully operational yet. Did the offer price fairly value the prospects of the mills? How should Blue Wolf consider the Conifex stock? Should Blue Wolf conduct a more extensive sales process rather than settle for this somewhat unexpected offer?

Occidental Petroleum's Acquisition of Anadarko

Jaan elias, piyush kabra, jacob thomas, k. geert rouwenhorst.

Asset Management, Competitor/Strategy, Investor/Finance, Sourcing/Managing Funds

In May of 2019, Vicki Hollub, the CEO of Occidental Petroleum (Oxy), pulled off a blockbuster. Bidding against Chevron, one of the world's largest oil firms, she had managed to buy Anadarko, another oil company that was roughly the size of Oxy. Hollub believed that the combination of the two firms brought the possibility for billions of dollars in synergies, more than offsetting the cost of the acquisition. Had Hollub hurt shareholder value with Oxy's ambitious deal, or had she bolstered a mid-size oil firm and made it a major player in the petroleum industry? Why didn't investors see the tremendous synergies in which Hollub fervently believed?

Hertz Global Holdings (B): Uses of Debt and Equity 2020

In 2019, Hertz held a successful rights offering and restructured some of its debt. CEO Kathyrn Marinello and CFO Jamere Jackson were moving the company toward what seemed to be sustainable profitability, having implemented major structural and financial reforms. Analysts predicted a rosy future. Travel, particularly corporate travel, was increasing as the economy grew. With all the creativity that the company had shown in its financial arrangements, did it have any options remaining, even while under the court-led reorganization?

Prodigy Finance

Vero bourg-meyer, javier gimeno, jaan elias, florian ederer.

Competitor/Strategy, Investor/Finance, Social Enterprise, State & Society, Sustainability

Having pioneered a successful financing model for student loans, Prodigy also was considering other financial services that could make use of the company’s risk model. What new products could Prodigy offer to support its student borrowers? What strategy should guide the company’s new product development? Or should the company stick to the educational loans it pioneered and knew best?

tronc: Valuing the Future of Newspapers

Jean rosenthal, heather e. tookes, and jaan elias.

Business History, Competitor/Strategy, Investor/Finance, Leadership & Teamwork

Gannet offered Tribune Publishing an all-cash buyout offer. Tribune then made a strategic pivot: new stock listing, new name "tronc," and a goal of posting 1,000 videos/day. Should the Tribune board take the buyout opportunity? What was the right price?

Role of Hedge Funds in Institutional Portfolios: Florida Retirement System

Jaan elias, william goetzmann and lloyd baskin.

Asset Management, Financial Regulation, Investor/Finance, Metrics & Data, State & Society

The Florida Retirement System, one of the country’s largest state pensions, had been slow to embrace hedge funds, but by 2015, they had 7% of their assets in the category. How should they manage their program?

Social Security 1935

Jean rosenthal, william n. goetzmann, and jaan elias.

Business History, Financial Regulation, Innovation & Design, Investor/Finance, State & Society

Frances Perkins, Franklin Roosevelt's Secretary of Labor, shaped the Social Security Act of 1935, changing America’s pension landscape. What might she have done differently?

Ant Financial: Flourishing Farmer Loans at MYbank

Jingyue xu, jean rosenthal, k. sudhir, hua song, xia zhang, yuanfang song, xiaoxi liu, and jaan elias.

Competitor/Strategy, Customer/Marketing, Entrepreneurship, Innovation & Design, Investor/Finance, Leadership & Teamwork, Operations, State & Society

In 2015 Ant Financial's MYbank (an offshoot of Jack Ma’s Alibaba company) created the Flourishing Farmer Loan program, an all-internet banking service for China's rural areas. Could MYbank use financial technology to create a program with competitive costs and risk management?

Low-Carbon Investing: Commonfund & GPSU

Jaan elias, william goetzmann, and k. geert rouwenhorst.

Asset Management, Ethics & Religion, Investor/Finance, Social Enterprise, State & Society, Sustainability

In August of 2014, the movement to divest fossil fuel investments from endowment portfolios was sweeping campuses across the United States, including Gifford Pinchot State University (GPSU). How should GPSU and its investment partner Commonfund react?

360 State Street: Real Options

Andrea nagy smith and mathew spiegel.

Asset Management, Investor/Finance, Metrics & Data, Sourcing/Managing Funds

360 State Street proved successful, but what could Bruce Becker construct on the 6,000-square-foot vacant lot at the southwest corner of the project? Under what set of circumstances and at what time would it be most advantageous to proceed? Or should he build anything at all?

Centerbridge

Jean rosenthal and olav sorensen.

When Jeffrey Aronson and Mark Gallogly founded Centerbridge, they hoped to grow the firm, but not to a point that it would lose its culture. Having added an office in London, could the firm add more locations and maintain its collegial character?

George Hudson and the 1840s Railway Mania

Andrea nagy smith, james chanos, and james spellman.

Business History, Financial Regulation, Investor/Finance, Metrics & Data

Railways were one of the original disruptive technologies: they transformed England from an island of slow, agricultural villages into a fast, urban, industrialized nation. George Hudson was the central figure in the mania for railroad shares in England. After the share value crashed, some analysts blamed Hudson, others pointed to irrational investors and still others maintained the crash was due to macroeconomic factors.

Demosthenes and Athenian Finance

Andrea nagy smith and william goetzmann.

Business History, Financial Regulation, Law & Contracts

Demosthenes' Oration 35, "Against Lacritus," contains the only surviving maritime loan contract from the fourth century B.C., proving that the ancient Greeks had devised a commercial code to link the economic lives of people from all over the Greek world. Athenians and non-Athenians alike came to the port of Piraeus to trade freely.

South Sea Bubble

Frank newman and william goetzmann.

Business History, Financial Regulation

The story of the South Sea Company and its seemingly absurd stock price levels always enters into conversations about modern valuation bubbles. Because of its modern application, discerning what was at the root of the world's first stock market crash merits considerable attention. What about the South Sea Company and the political, economic and social context in which it operated led to its stunning collapse?

Jean W. Rosenthal, Jaan Elias, William N. Goetzmann, Stanley Garstka, and Jacob Thomas

Asset Management, Healthcare, Investor/Finance, Sourcing/Managing Funds, State & Society

A centerpiece of the 2007 contract negotiations between the UAW and GM - and later with Chrysler and Ford - was establishing a Voluntary Employee Beneficiary Association (VEBA) to provide for retiree healthcare costs. The implications were substantial.

Northern Pulp: A Private Equity Firm Resurrects a Troubled Paper Company

Heather tookes, peter schott, francesco bova, jaan elias and andrea nagy smith.

Investor/Finance, Macroeconomics, State & Society, Sustainability

In 2008, the lumber industry was in a severe recession, yet Blue Wolf Capital Management was considering investment in a paper mill in Nova Scotia. How should they proceed?

Lahey Clinic: North Shore Expansion

Jaan elias, andrea r. nagy, jessica p. strauss, and william n. goetzmann.

Asset Management, Financial Regulation, Healthcare, Investor/Finance

In early 2007 the Lahey Clinic in Massachusetts believed that expansion of its North Shore facility was not only a smart strategy but also a business necessity. The two years of turmoil in the Massachusetts health care market prompted observers to question Lahey's 2007 decisions. Did the expansion strategy still make sense?

Carry Trade ETF

K. geert rouwenhorst, jean w. rosenthal, and jaan elias.

Innovation & Design, Investor/Finance, Macroeconomics, Sourcing/Managing Funds

In 2006 Deutsche Bank (DB) brought a new product to market – an exchange traded fund (ETF) based on the carry trade, a strategy of buying and selling currency futures. The offering received the William F. Sharpe Indexing Achievement Award for “Most Innovative Index Fund or ETF” at the 2006 Sharpe Awards. These awards are presented annually by IndexUniverse.com and Information Management Network for innovative advances in the indexing industry. The carry trade ETF shared the award with another DB/PowerShares offering, a Commodity Index Tracking Fund. Jim Wiandt, publisher of IndexUniverse.com, said, "These innovators are shaping the course of the index industry, creating new tools and providing new insights for the benefit of all investors." What was it that made this financial innovation successful?

William Goetzmann and Jaan Elias

Asset Management, Business History

Hawara is the site of the massive pyramid of Amenemhat III, a XII Dynasty [Middle Kingdom, 1204 – 1604 B.C.E.] pharaoh. The Hawara Labyrinth and Pyramid Complex present a wealth of information about the Middle Kingdom. Among its treasures are papyri covering property rights and transfers of ownership.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

HBS Case Selections

OpenAI: Idealism Meets Capitalism

- Shikhar Ghosh

- Shweta Bagai

Generative AI and the Future of Work

- Christopher Stanton

- Matt Higgins

Copilot(s): Generative AI at Microsoft and GitHub

- Frank Nagle

- Shane Greenstein

- Maria P. Roche

- Nataliya Langburd Wright

- Sarah Mehta

Innovation at Moog Inc.

- Brian J. Hall

- Ashley V. Whillans

- Davis Heniford

- Dominika Randle

- Caroline Witten

Innovation at Google Ads: The Sales Acceleration and Innovation Labs (SAIL) (A)

- Linda A. Hill

- Emily Tedards

Juan Valdez: Innovation in Caffeination

- Michael I. Norton

- Jeremy Dann

UGG Steps into the Metaverse

- Shunyuan Zhang

- Sharon Joseph

- Sunil Gupta

- Julia Kelley

Metaverse Wars

- David B. Yoffie

Roblox: Virtual Commerce in the Metaverse

- Ayelet Israeli

- Nicole Tempest Keller

Timnit Gebru: "SILENCED No More" on AI Bias and The Harms of Large Language Models

- Tsedal Neeley

- Stefani Ruper

Hugging Face: Serving AI on a Platform

- Kerry Herman

- Sarah Gulick

SmartOne: Building an AI Data Business

- Karim R. Lakhani

- Pippa Tubman Armerding

- Gamze Yucaoglu

- Fares Khrais

Honeywell and the Great Recession (A)

- Sandra J. Sucher

- Susan Winterberg

Target: Responding to the Recession

- Ranjay Gulati

- Catherine Ross

- Richard S. Ruback

- Royce Yudkoff

Hometown Foods: Changing Price Amid Inflation

- Julian De Freitas

- Jeremy Yang

- Das Narayandas

Elon Musk's Big Bets

- Eric Baldwin

Elon Musk: Balancing Purpose and Risk

Tesla's ceo compensation plan.

- Krishna G. Palepu

- John R. Wells

- Gabriel Ellsworth

China Rapid Finance: The Collapse of China's P2P Lending Industry

- William C. Kirby

- Bonnie Yining Cao

- John P. McHugh

Forbidden City: Launching a Craft Beer in China

- Christopher A. Bartlett

- Carole Carlson

Booking.com

- Stefan Thomke

- Daniela Beyersdorfer

Innovation at Uber: The Launch of Express POOL

- Chiara Farronato

- Alan MacCormack

Racial Discrimination on Airbnb (A)

- Michael Luca

- Scott Stern

- Hyunjin Kim

Unilever's Response to the Future of Work

- William R. Kerr

- Emilie Billaud

- Mette Fuglsang Hjortshoej

AT&T, Retraining, and the Workforce of Tomorrow

- Joseph B. Fuller

- Carl Kreitzberg

Leading Change in Talent at L'Oreal

- Lakshmi Ramarajan

- Vincent Dessain

- Emer Moloney

- William W. George

- Andrew N. McLean

Eve Hall: The African American Investment Fund in Milwaukee

- Steven S. Rogers

- Alterrell Mills

United Housing - Otis Gates

- Mercer Cook

The Home Depot: Leadership in Crisis Management

- Herman B. Leonard

- Marc J. Epstein

- Melissa Tritter

The Great East Japan Earthquake (B): Fast Retailing Group's Response

- Hirotaka Takeuchi

- Kenichi Nonomura

- Dena Neuenschwander

- Meghan Ricci

- Kate Schoch

- Sergey Vartanov

Insurer of Last Resort?: The Federal Financial Response to September 11

- David A. Moss

- Sarah Brennan

Under Armour

- Rory McDonald

- Clayton M. Christensen

- Daniel West

- Jonathan E. Palmer

- Tonia Junker

Hunley, Inc.: Casting for Growth

- John A. Quelch

- James T. Kindley

Bitfury: Blockchain for Government

- Mitchell B. Weiss

- Elena Corsi

Deutsche Bank: Pursuing Blockchain Opportunities (A)

- Lynda M. Applegate

- Christoph Muller-Bloch

Maersk: Betting on Blockchain

- Scott Johnson

Yum! Brands

- Jordan Siegel

- Christopher Poliquin

Bharti Airtel in Africa

- Tanya Bijlani

Li & Fung 2012

- F. Warren McFarlan

- Michael Shih-ta Chen

- Keith Chi-ho Wong

Sony and the JK Wedding Dance

- John Deighton

- Leora Kornfeld

United Breaks Guitars

David dao on united airlines.

- Benjamin Edelman

- Jenny Sanford

Marketing Reading: Digital Marketing

- Joseph Davin

Social Strategy at Nike

- Mikolaj Jan Piskorski

- Ryan Johnson

The Tate's Digital Transformation

Social strategy at american express, mellon financial and the bank of new york.

- Carliss Y. Baldwin

- Ryan D. Taliaferro

The Walt Disney Company and Pixar, Inc.: To Acquire or Not to Acquire?

- Juan Alcacer

- David J. Collis

Dow's Bid for Rohm and Haas

- Benjamin C. Esty

Finance Reading: The Mergers and Acquisitions Process

- John Coates

Apple: Privacy vs. Safety? (A)

- Henry W. McGee

- Nien-he Hsieh

- Sarah McAra

Sidewalk Labs: Privacy in a City Built from the Internet Up

- Leslie K. John

Data Breach at Equifax

- Suraj Srinivasan

- Quinn Pitcher

- Jonah S. Goldberg

Apple's Core

- Noam Wasserman

Design Thinking and Innovation at Apple

- Barbara Feinberg

Apple Inc. in 2012

- Penelope Rossano

Iz-Lynn Chan at Far East Organization (Abridged)

- Anthony J. Mayo

- Dana M. Teppert

Barbara Norris: Leading Change in the General Surgery Unit

- Boris Groysberg

- Nitin Nohria

- Deborah Bell

Adobe Systems: Working Towards a "Suite" Release (A)

- David A. Thomas

- Lauren Barley

Home Nursing of North Carolina

Castronics, llc, gemini investors, angie's list: ratings pioneer turns 20.

- Robert J. Dolan

Basecamp: Pricing

- Frank V. Cespedes

- Robb Fitzsimmons

J.C. Penney's "Fair and Square" Pricing Strategy

J.c. penney's 'fair and square' strategy (c): back to the future.

- Jose B. Alvarez

Osaro: Picking the best path

- James Palano

- Bastiane Huang

HubSpot and Motion AI: Chatbot-Enabled CRM

- Thomas Steenburgh

GROW: Using Artificial Intelligence to Screen Human Intelligence

- Ethan S. Bernstein

- Paul D. McKinnon

- Paul Yarabe

Arup: Building the Water Cube

- Robert G. Eccles

- Amy C. Edmondson

- Dilyana Karadzhova

(Re)Building a Global Team: Tariq Khan at Tek

Managing a global team: greg james at sun microsystems, inc. (a).

- Thomas J. DeLong

Organizational Behavior Reading: Leading Global Teams

Ron ventura at mitchell memorial hospital.

- Heide Abelli

Anthony Starks at InSiL Therapeutics (A)

- Gary P. Pisano

- Vicki L. Sato

Wolfgang Keller at Konigsbrau-TAK (A)

- John J. Gabarro

Midland Energy Resources, Inc.: Cost of Capital

- Timothy A. Luehrman

- Joel L. Heilprin

Globalizing the Cost of Capital and Capital Budgeting at AES

- Mihir A. Desai

- Doug Schillinger

Cost of Capital at Ameritrade

- Mark Mitchell

- Erik Stafford

Finance Reading: Cost of Capital

David Neeleman: Flight Path of a Servant Leader (A)

- Matthew D. Breitfelder

Coach Hurley at St. Anthony High School

- Scott A. Snook

- Bradley C. Lawrence

Shapiro Global

- Michael Brookshire

- Monica Haugen

- Michelle Kravetz

- Sarah Sommer

Kathryn McNeil (A)

- Joseph L. Badaracco Jr.

- Jerry Useem

Carol Fishman Cohen: Professional Career Reentry (A)

- Myra M. Hart

- Robin J. Ely

- Susan Wojewoda

Alex Montana at ESH Manufacturing Co.

- Michael Kernish

Michelle Levene (A)

- Tiziana Casciaro

- Victoria W. Winston

John and Andrea Rice: Entrepreneurship and Life

- Howard H. Stevenson

- Janet Kraus

- Shirley M. Spence

Partner Center

Case Related Links

Case studies collection.

Business Strategy Marketing Finance Human Resource Management IT and Systems Operations Economics Leadership and Entrepreneurship Project Management Business Ethics Corporate Governance Women Empowerment CSR and Sustainability Law Business Environment Enterprise Risk Management Insurance Innovation Miscellaneous Business Reports Multimedia Case Studies Cases in Other Languages Simplified Case Studies

Short Case Studies

Business Ethics Business Environment Business Strategy Consumer Behavior Human Resource Management Industrial Marketing International Marketing IT and Systems Marketing Communications Marketing Management Miscellaneous Operations Sales and Distribution Management Services Marketing More Short Case Studies >

JavaScript seems to be disabled in your browser. You must have JavaScript enabled in your browser to utilize the functionality of this website.

- My Wishlist

- Customer Login / Registration

FB Twitter linked in Youtube G+

- ORGANIZATIONAL BEHAVIOR

- MARKETING MANAGEMENT

- STATISTICS FOR MANAGEMENT

- HUMAN RESOURCE MANAGEMENT

- STRATEGIC MANAGEMENT

- OPERATIONS MANAGEMENT

- MANAGERIAL ECONOMICS

FINANCIAL MANAGEMENT

- CONSUMER BEHAVIOR

- BRAND MANAGEMENT

- MARKETING RESEARCH

- SUPPLY CHAIN MANAGEMENT

- ENTREPRENEURSHIP & STARTUPS

- CORPORATE SOCIAL RESPONSIBILITY

- INFORMATION TECHNOLOGY

- BANKING & FINANCIAL SERVICES

- CUSTOMER RELATIONSHIP MANAGEMENT

- ADVERTISING

- BUSINESS ANALYTICS

- BUSINESS ETHICS

- DIGITAL MARKETING

- HEALTHCARE MANAGEMENT

- SALES AND DISTRIBUTION MANAGEMENT

- FAMILY BUSINESS

- MEDIA AND ENTERTAINMENT

- CORPORATE CASES

- Case Debate

- Course Case Maps

- Sample Case Studies

- IIM KOZHIKODE

- VINOD GUPTA SCHOOL OF MANAGEMENT, IIT KHARAGPUR

- GSMC - IIM RAIPUR

- IMT GHAZIABAD

- INSTITUTE OF PUBLIC ENTERPRISE

- IBM Corp. & SAP SE

- Classroom Classics

- Free Products

- Case Workshops

- Home

- Case Categories

Pricing of Swap Contracts

Time and money: home investment dilemma, the basil tree day care centre, evaluation of atal pension yojana using time value of money, investment in wee infant milk formula: a capital budgeting dilemma, dividend payout policy of infosys limited: how much to pay, investment fraud: the case of sahara india pariwar*.

Solar Photovoltaic Systems Bring Happiness to Residential Societies*

What went wrong with ‘bombay dyeing’, the implications of sebi & fmc merger on financial services sector: a case of daruwala broking pvt ltd.*.

Securitization between Reliance Communications Ltd. and Reliance Jio Infocomm Ltd.: Strategic Financial Analysis*

Microsoft acquisition of nokia: an analysis from strategic and financial perspective*.

MP Taps and Fittings Enterprise*

Feasibility study: case of a biomass project*, take over of transportation business in uttarakhand*.

- last 6 months (0)

- last 12 months (0)

- last 24 months (0)

- older than 24 months (47)

- FINANCIAL MANAGEMENT (47)

- Finance, Insurance & Real Estate (1)

- CASE FLYER (1)

- CASE SLIDE (1)

- CASE STUDY (20)

- CASELET (25)

Information

- Collaborations

- Privacy Policy

- Terms & Conditions

- Case Format

- Pricing and Discount

- Subscription Model

- Case Writing Workshop

- Case Submission

- Reprint Permissions

CUSTOMER SERVICE

Phone: +91 9626264881

Email: [email protected]

ET CASES develops customized case studies for corporate organizations / government and non-government institutions. Once the query is generated, one of ET CASES’ Case Research Managers will undertake primary/secondary research and develop the case study. Please send an e-mail to [email protected] to place a query or get in touch with us.

Don’t miss out!

Be the first to hear about new cases, special promotions and more – just pop your email in the box below.

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Book Title: Family Financial Management Case Studies (an OER resource)

Authors: M. E. Betsy Garrison, PhD

Book Information

Book description.

Family financial management involves decisions based on both economic and social factors, including the quality of life and well-being of all family members. Family composition changes throughout the life course of people, including formation and re-formation, and are affected by laws, regulations and policies at multiple levels, from local or national. Six case studies were developed for students to critically think about and through the myriad of decisions that diverse families make as manage their lives and financial resources. Each case study features a different family type: a relocating family with same-sex parents, an uncoupling family with heterosexual parents, widowhood, coupling, a divorcing gay couple, and a single parent family, all within the context of current events in the U.S. For each case study, students are asked by their employer or in a professional role to prepare a report that makes use of highly credible and trusted sources of information and a chart or table as well as a recommendation for the family. To further student learning four reflection questions were also developed. The case studies were piloted in spring 2023 course, revised summer 2023 and will be fully deployed fall 2023 in an undergraduate online course of ~50 students. Case studies will be updated as needed based on current events, including legislative and judicial decisions.

Family Financial Management Case Studies (an OER resource) Copyright © 2023 by M. E. Betsy Garrison is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License , except where otherwise noted.

Budgeting and financial management

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

FINANCIAL MANAGEMENT CASE STUDIES

Related Papers

Zosue Sabillon

WORLD JOURNAL OF PHARMACY AND PHARMACEUTICAL SCIENCES

Abubakr Nur

In this study different contents of low viscosity grade hydroxypropyl methylcellulose (HPMC, 50cps) and Tragacanth were conceived to develop and optimize salbutamol gastric floating capsules capable to sustain the release of loaded drug over a prolonged time duration through consecutive application of full factorial and composite index based mathematical designs. Tragacanth content was established to have a more influence on floating duration of developed capsule formulations whilst content of both HPMC and Tragacanth were found to affect the rate and kinetics of the drug release. Significant increase (p< 0.05) in floating duration and drug release rate was monitored with increasing content of HPMC in capsule formulations composed of polymer combination. Formulation composed of 16% w/w HPMC and 36% w/w Tragacanth (F8) was considered as best ranked formulation that fulfill preset constraints for floating duration, % drug release in the first hour and % drug release within 4 hours....

Dr. Biswajit Bhunia

MENSTRUATION AND SPORTS PERFORMANCE Dr. Biswajit Bhunia Assistant Professor, Government College of Physical Education for Women P.O.-Dinhata, Dist.-Coochbehar, State- West Bengal Abstract In recent years women’s participation and involvement in sports have been increased more. Specifically it got acceleration after while women were allowed to take part from the second modern Olympic Games held in Paris in 1900. However, there is a common question asked that whether the gynecological factor affects sport performance or not. In which the considerations are menstruation, exercise and menstruation disorders, performance and menstruation, training and competition during menstruation, menstruation and iron deficiency, effect of the exercises on the breast, reproductive organs, pregnancy, child birth, injuries to the breast and reproductive organs, pregnancy and child birth. From available evidences of Tokyo found that Olympic performance during menstruation had been better in track and field for 29% athletes, for 63% athletes were unchanged and poorer for 8% athlete. In other reference in case of variety sports there were better performance for 19% Athlete, unchanged for 43%, poorer for 38%. Studies also revealed the results better, unchanged and fewer as 3, 37 and 17 percent respectively. Menstruation has been considered the most important factor of the gynecological considerations in the study. Key words: Exercises, Menstruation, Gynecological consideration

International Forum of Allergy & Rhinology

Vincenzo Capriotti

Computers, Materials & Continua

Abdelaziz Abdelhamid

Eliška Maršálková

Cyanobacterial water blooms represent toxicological, ecological and technological problems around the globe. When present in raw water used for drinking water production, one of the best strategies is to remove the cyanobacterial biomass gently before treatment, avoiding cell destruction and cyanotoxins release. This paper presents a new method for the removal of cyanobacterial biomass during drinking water pre-treatment that combines hydrodynamic cavitation with cold plasma discharge. Cavitation produces press stress that causes Microcystis gas vesicles to collapse. The cyanobacteria then sink, allowing for removal by sedimentation. The cyanobacteria showed no signs of revitalisation, even after seven days under optimal conditions with nutrient enrichment, as photosynthetic activity is negatively affected by hydrogen peroxide produced by plasma burnt in the cavitation cloud. Using this method, cyanobacteria can be removed in a single treatment, with no increase in microcystin conce...

EAS Publications Series

Héctor Velázquez

Editions Notre Savoir

Aamir Al-Mosawi

L'indice H est de plus en plus utilisé dans le classement des institutions académiques, y compris les universités, car il est de plus en plus considéré comme un outil important pour l'évaluation du leadership académique. L'indice H collectif des universitaires d'un établissement représente l'indice H de l'établissement. Le classement des établissements d'enseignement supérieur, y compris les universités, vise en fait à déterminer quels établissements sont leaders dans leur domaine et à leur attribuer un crédit de réputation en fonction de leur rang. L'objectif principal de ce livre est de fournir les connaissances essentielles dont les universitaires ont besoin sur l'indice H et les sujets qui s'y rapportent.

Abstract: This project describes the motivation and design considerations of an economical head operated surveillance camera for people with disabilities. In addition, it focuses on the invention of a head-set operated device to control the movement of the camera, such that the camera can turn left and right according to the movement of the human head. It employs one tilt sensor, which placed in the headset to determine head position and to function as simple headset control system. The tilt sensor detects the lateral head motion to drive the left or right displacement of the camera. This system was invented to assist people with disabilities to live an independent life or even allow them to work as security personnel to earn their life. The idea can be employed in other application such as robotics, intelligent home devices and vehicle control as well.

BioMed Research International

giovanni damiani

Chronic Obstructive Pulmonary Disease (COPD) is defined as a disease characterized by persistent, progressive airflow limitation. Recent studies have underlined that COPD is correlated to many systemic manifestations, probably due to an underlying pattern of systemic inflammation. In COPD fractional exhaled Nitric Oxide (FeNO) levels are related to smoking habits and disease severity, showing a positive relationship with respiratory functional parameters. Moreover FeNO is increased in patients with COPD exacerbation, compared with stable ones. In alpha-1 antitrypsin deficiency, a possible cause of COPD, FeNO levels may be monitored to early detect a disease progression. FeNO measurements may be useful in clinical setting to identify the level of airway inflammation,per seand in relation to comorbidities, such as pulmonary arterial hypertension and cardiovascular diseases, either in basal conditions or during treatment. Finally, some systemic inflammatory diseases, such as psoriasis,...

RELATED PAPERS

IEEE Transactions on Appiled Superconductivity

abbas kargar

Asian Diasporic Visual Cultures and the Americas

Michelle Stephens

الاغتراب عن مفهوم الأسرة الحقيقي والتفكك الأسري

Rafaella Stradiotto Vignandi

Development

K VijayRaghavan

42nd AIAA Aerospace Sciences Meeting and Exhibit

Circulation Journal

Cristina Messa

Dr. Edna Ben-Izhak Monselise

HUMAN REVIEW. International Humanities Review / Revista Internacional de Humanidades

Alicia Sanchez Ortiz

Social Science Research Network

Christian A. L. Hilber

mohammad homayoune sadr

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Analytics transformation in wealth management

The wealth management industry is typically seen as embodying old-fashioned values and providing discrete, tailored services. These attributes remain valuable parts of the business, but for many clients, they are no longer sufficient. In a highly connected world, people want faster and more convenient offerings and a cutting-edge digital experience. Amid rising competition, established wealth managers need to keep pace with new offerings as they retain the values that set them apart.

About the authors

This article is a collaborative effort by Anutosh Banerjee , Fumiaki Katsuki , Vishal Kaushik, Aditya Saxena, Sanchit Suneja, and Renny Thomas .

Wealth managers are unlikely to be able to serve modern clients effectively without a digitized operating model. This will support advisory and non-advisory activities and service everchanging investment preferences. Some leading managers are building modular data and IT architectures, which enable smart decision-making, personalization at scale, and more extensive product offerings. 1 For an in-depth look at how some of these elements are being developed in an overall banking context, see our collection “ Building the AI bank of the future ,” May 2021, mckinsey.com. The changes are also helping them meet their regulatory obligations, boosting the productivity of relationship managers (RMs), and lifting compressed margins.

For wealth managers interested in pursuing these benefits, this article lays out the potential of deploying advanced analytics and offers a playbook of measures that wealth managers should consider including in a digital transformation.

The case for advanced analytics

Meeting the needs of today’s customers requires a business model that is at the same time efficient and adaptable to individual clients. Wealth managers are finding success with two approaches:

- Serve clients across the wealth continuum on a flat-fee advisory basis. Instead of the still-prevalent product-focused model, wealth managers need to build in pricing flexibility aligned to clients’ needs at every stage of their lives. An increasingly common pricing model is for clients to negotiate a flat fee based on the value of their investments. To maintain revenues with this model, wealth managers need to create new efficiencies and ensure RMs are more productive, which means spending more time with clients.

- Embrace personalization aligned to client life stages and goals. Today’s customers are increasingly dissatisfied with a one-size-fits-all service model, so wealth managers should consider transitioning to needs-based personalization. This requires RMs to get comfortable with a wider range of solutions, from the simplest products to complex higher-yielding investments (private markets, venture capital, pre-IPO, and structured products). In addition, RMs must be equipped to help clients make complex investment decisions, supported by analytics.

In today’s context, each of these goals is achievable only with advanced capabilities in data and analytics, especially targeting relationship management.

Focus on relationship management

Modernization can be game changing when it targets the role of RMs. Based on conversations with industry participants, we estimate that RMs typically spend 60 to 70 percent of their time on non-revenue-generating activities, amid rising regulatory and compliance obligations (Exhibit 1). One reason is that most still work with legacy IT systems or even spreadsheets. As clients demand more engagement and remote channel options, that needs to change.

A few leading wealth managers are using technology to provide RMs with the tools to serve clients more efficiently and effectively. Some have taken a zero-based approach, rebuilding their tech stacks and embracing advanced analytics to inform more personalized services. By providing targeted solutions, these firms have been able to boost revenues and reduce operational costs.

Clear benefits of being more client focused

The benefits of digitization are relevant in most markets, but the potential to leverage digitization to achieve a significant performance uplift is especially great in regions where wealth managers have not yet seized the opportunity. In Asia, for example, many wealth managers still need to fully embrace digital ways of working (Exhibit 2). We estimate that IT-based transformations could create some $40 billion to $45 billion of incremental value for wealth managers serving high-net-worth individuals in Asia, equating to roughly 25 basis points on a wealth pool of $17 trillion. 2 Wealth management penetration in the region is 35 to 40 percent, but for the purposes of the calculation, we assume 100 percent of high-networth individuals’ personal financial assets (investable assets of more than $1 million).

Would you like to learn more about our Financial Services Practice ?

Drilling down in the potential gains from data and analytics, we see benefits in three key areas: acquisition and onboarding, engagement and deepening of client relationships, and servicing and retention.

Acquisition and onboarding. Basic acquisition and onboarding applications include client discovery, risk profiling, account opening, and onboarding. RMs and investment teams can use analytics for lead generation, share-of-wallet modeling, and automated proposals. There are also multiple applications in investment management, risk, and compliance, including social-profile checking, anti-money-laundering and know your customer, and fraud protection.

How analytics creates sustainable impact: Two examples from Asia

One leading Asian wealth manager deployed an analytics-led program to produce granular client insights that enabled it to offer responsive, timely, and personalized services to client microsegments. The bank leveraged personalization at scale to boost assets under management by 30 to 40 percent per client in six to eight months.

A second wealth manager created the position of chief investment officer to inform a bankwide view of asset classes and geographies. The CIO used analytics to link product selection to the “house view,” ensuring consistency across model portfolios.

Engagement and deepening. Client-focused applications include personalized research, portfolio management, and notifications. RMs and investment teams can implement client clustering, propensity modeling, recommendation engines, and digital performance management (see sidebar “How analytics creates sustainable impact: Two examples from Asia”). In investment management, risk, and compliance, there are opportunities to de-bias investment decisions, data analysis, and trade execution.

Servicing and retention. Client-related applications include portfolio simulations and optimization, as well as self-execution of trades. RMs can leverage applications such as churn predictors and work planners, while investment management, risk, and compliance can scale up portfolio planning and trade surveillance.

A playbook for analytics-driven wealth management

Early success stories are encouraging, but they are the exception rather than the rule. More often, firms have started the transformation journey but have faltered along the way. Common reasons include a lack of ownership at senior levels and budgetary or strategic restraints that prevent project teams from executing effectively.

The challenges of transforming service models are significant but not insurmountable. Indeed, as analytics use cases become more pervasive, implementation at scale becomes more achievable. In the following paragraphs, we present five ingredients of an analytics-based transformation (Exhibit 3). These can be supported by strong leadership, a rigorous focus on outcomes, and a willingness to embrace new ways of working. Indeed, managers who execute effectively will get ahead of the competition and be much more adept in meeting client needs.

Set a leadership vision

Analytics-driven transformations are often restricted to narrow silos occupied by a few committed experts. As a result, applications fail to pick up enough momentum to make a real difference to performance. Conversely, if support for change programs comes from the top and is guided by an outcomes-driven approach, the business can break away from entrenched operating norms and reset for structural change. With that in mind, executive teams should communicate a vision that can be cascaded through the business. They should also create a safe environment, or sandbox, for business lines to experiment before scaling.

Plot the change journey

Wealth managers have applied advanced analytics to achieving different objectives. Some have found that the application of advanced analytics to business problems delivers significant value and enables them to make better decisions faster and more consistently. Others are using data and advanced analytics to improve sales and marketing, inform investment decision-making, and boost RM productivity.

Any plan for data-driven change must fit the organization’s business model. Implementation will vary based on the technical feasibility, data accuracy and accessibility, time to impact, scalability, and availability of funds. The first few use cases will set the mood and direction, so careful thought is required ahead of action.

One common impediment to scaling is the lack of a single metric to describe impact, which makes it hard for tech teams to communicate benefits. Still, there are workarounds. Financial key performance indicators (KPIs) can show flows across key mandates or volumes of advisory, rather than execution-driven assets under management. Nonfinancial metrics can focus on cross-sell ratios, increased client retention, number of RMs trained, or adoption rates for solutions. Other helpful evaluations include customer satisfaction scores, new trust-based RM-client relationships, time to market, and cultural shifts. Progress on these measures will boost organizational conviction that transformation is beneficial.

The value of personal advice: Wealth management through the pandemic

Build a strong foundation, leading with technology.

Data and technology together form the backbone that supports analytics-led transformation. A strong analytics backbone requires a rigorous standard of data management, coupled with informed decisions about the IT applications and systems to employ.

A digital approach to client-centric servicing

A leading bank created a digital and analytics-powered application that ingests internal and external data points, enabling it to identify “hidden affluence” among its clients.

Another bank combined demographic data with information from client conversations to generate real-time product recommendations and facilitate cross-selling. To continuously train the recommendation engine, the bank built a central data lake—consolidated, centralized storage for raw, unstructured, semistructured, and structured data from multiple sources—so the system has an ever-growing set of data to work from. It then pushed product recommendations through multiple client channels.

A leading investment bank continuously scrapes more than 2,000 financial news sources and more than 800 blogs, stock message sites, and social-media platforms. This exercise helped to enrich the data used by the analytics engine to assess sentiment and inform insights on stocks, bonds, commodities, countries, currencies, and cryptocurrencies.

Wealth managers are routinely in touch with their clients offline. These interactions elicit significant information about client preferences and requirements, but the information is often stored on paper or in RMs’ heads. To mine this knowledge fully, wealth managers must capture it digitally and convert it into a structured format that can be processed to create insights and personalized services (see sidebar “A digital approach to client-centric servicing”). In doing so, they need to put systems in place to ingest, store, and organize the data in line with regulatory obligations while ensuring the data are accurate, available, and accessible.

On the technology side, some leading wealth managers use natural-language processing to analyze text and voice data and identify personalized triggers and insights. Others are building feedback loops across channels to train artificial intelligence algorithms. Technologies can also be applied to processes: robotic process automation, for example, can replace routine manual labor and mental processing in regulatory compliance, risk assessment, reporting, and query management.

Deployment of data-driven decision-making requires scalable, adaptable, and resilient core technology components—a unified data and technology stack that connects across IT activities. 3 Sven Blumberg, Rich Isenberg, Dave Kerr, Milan Mitra, and Renny Thomas, “ Beyond digital transformations: Modernizing core technology for the AI bank of the future ,” April 2021, McKinsey.com. This will enable managers to adopt a tech-first approach to designing customer journeys.

In building data and IT architecture, wealth managers require a basic tool kit with four key components:

- a rationalized IT stack to create a common front-and back-end platform and a unified resource for mobile and web applications

- a scalable data platform with modular data pipelines and application-programming-interface (API)-based microservices for building and deploying analytics solutions at scale

- a semi-autonomous lab environment to enable experimentation, coupled with an at-scale factory environment for production of analytics solutions

- a highly scalable distributed network on the cloud to respond to variable demand for data storage and processing

In parallel to assembling these components, banks must consolidate data from across geographies and business lines. This will enable analysts to elicit insights based on the maximum amount of information. Some leading players first experiment in a sandbox environment and work with external partners to acquire the necessary skills, after which they scale up incrementally.

Build the team and prioritize change management

It is not easy to scale and sustain analytics impact. Organizational silos and cultural resistance are common inhibiting factors, while the vital role that RMs play in forming and maintaining relationships must be adapted to the new environment. Indeed, RMs must be front and center of the transformation process. For this, organizations need effective team building and change management.

Team building. A productive approach to team building is to create cross-functional squads with a range of talents (Exhibit 4). Product owners and designers should be responsible for ensuring that the team meets the needs of its clients (RMs or end clients) and stays focused on delivering value. Data scientists and data engineers implement use cases and check that insights are generated as data are ingested—a minimal-viable-product (MVP) approach. IT architects and software engineers, meanwhile, build the slick interfaces and back-end systems that deliver insights to clients across channels.

How three Asian wealth managers engaged clients and boosted RM productivity

A leading private bank deployed machine learning to generate next-best conversation ideas. It built propensity models and analyzed customer clusters to identify anchor clients and learn from transaction patterns.

Another private bank built a digital workbench that enables RMs to serve clients via a single platform. The workbench was integrated with a centrally hosted recommendation engine that provides personalized recommendations based on life events and transaction data.

A third private bank used explanatory and predictive modeling to identify “moments of truth.” These informed RM coverage and outreach strategy, which helped the bank develop initiatives to support growth and focus RMs on high-value activities.

A core objective should be to explore analytics and AI use cases that boost RM productivity (see sidebar “How three Asian wealth managers engaged clients and boosted RM productivity”). To that end, the squad should embed business and channel management teams so that ideas are aligned with RM client services. Several firms have found that involving RMs and other domain experts in squads leads to significant improvements in data interpretation and modeling.

In many cases, assembling productive squads will require new talent. In particular, banks will need data scientists to be responsible for building analytics software and data engineers to scope and build data pipelines and data architecture. Translators, who act as conduits between the business and technology teams, will be critical for ensuring that squads understand business needs. Finally, squads need IT skill sets to ensure that analytics and digital solutions are compatible with core data and technology stacks.

The best approach to talent acquisition is to take baby steps: get one squad right, foster RM adoption, and then gradually expand capabilities as use cases multiply and are scaled up. Some of the required skill sets are in high demand, so outsourcing may be a realistic early option. In the longer term, however, it makes sense to build internally.

Change management. Relationship managers should be encouraged to embrace analytics and convinced that new applications lead to better services and higher levels of performance. Change management strategies can help. Examples include creating teams of “influencers,” running capability-building sessions, developing change narratives that generate widespread excitement, redefining roles, and aligning performance with financial or nonfinancial awards.

Institutionalize new ways of working

Analytics-driven transformation at scale should be predicated on collaboration, team self-steering, and an iterative approach to problem-solving—elements of the so-called agile approach, which originated in software development. In running agile sprints, it pays to keep business needs in sight, accepting that failure is part of the process. Two-week sprints are usually sufficient to get pilots up and running, and the aim should be to produce an MVP with every sprint.

Wealth managers can apply these basic principles via four process disciplines:

- Inspect and adapt. Daily check-ins will ensure that teams identify roadblocks, such as product backlogs, and maintain their focus on goals.

- Engage end users. Sprint reviews with end users, stakeholders, and sponsors enable teams to gather feedback and bake in recommendations.

- Embed a sense of unity and purpose. Teams should hold retrospectives to incorporate learnings.

- Institutionalize support infrastructure. Agile tooling (for example, Confluence, Jira, and Zeplin) will facilitate experimentation and support remote working where necessary.

Organizations using agile operating models must embrace flexible learning. This is a departure from traditional waterfall-based approaches, in which decision-making occurs at the beginning of each project. In agile, capability building and a relentless focus on change management will be vital elements of optimizing the program. To cement the relationship between innovation and growth, leading firms also assign KPIs to application rollouts, and they reward decision makers based on the value created.

Most wealth managers would say they have already embarked on an analytics journey; many have begun deploying digital applications in various aspects of their businesses. Often, however, the whole system is less than the sum of its parts, and people remain attached to established ways of working. To make a leap forward, wealth managers should commit to bold agendas that will support the scaling up of analytics-driven approaches.

Anutosh Banerjee is a partner in McKinsey’s Singapore office, where Vishal Kaushik and Aditya Saxena are associate partners; Fumiaki Katsuki is a partner in the Hanoi office; and Sanchit Suneja is an associate partner in the Mumbai office, where Renny Thomas is a senior partner.

The authors wish to thank Tiffany Kwok and Charu Singhal for their contributions to this article.

Explore a career with us

Related articles.

Building the AI bank of the future

Asia wealth management post-COVID-19: Adapting and thriving in an uncertain world

- Audit and Assurance

- Business Succession Plan

- Business Transformation

- Cloud Services

- Consulting Services

- CRM and ERP Products

- CRM Services

- Cybersecurity

- Data and Analytics

- ERP Services

- Forensic and Valuation

- Governance, Risk and Compliance

- HEADSTART Implementations

- Human Capital Management and Payroll

- Insurance Services

- Internal Audit

- Investment Banking

- Lender Services

- IT and Security Managed Services

- Marketing and Communication

- Modern Workplace

- Outsourced Accounting

- Regulatory, Quality and Compliance

- Site Selection and Incentives

- Spend Management

- Tax Services

- Transaction Advisory

- Wealth Management

- Workforce Risk Management

Navigating the Potential of Generative AI in Life Sciences

On Demand - 2024 Yellowbook Webinar Series: Session 4 - Capital Assets

On Demand - Building a Dream Team: Utilizing Assessments to Elevate Talent

- Construction and Real Estate

- Discrete Manufacturing

- Federal Government

Financial Services

- Government Contractors

- Industrial Equipment Manufacturing

- Life Sciences

- Manufacturing and Distribution

- Not-for-Profit

- Professional Services

- Rolled Products Manufacturing

- State and Local Government

- Title IV Audit and Consulting

- Distribution and Supply Chain

- Audit & Assurance

- Forensic & Valuation

- Human Capital Management & Payroll

- IT and Managed Services

- Marketing and Communications

- Regulatory, Quality & Compliance

- Site Selection & Incentives

- Construction & Real Estate

- Not-for-profit

- Process Manufacturing

- Rolled Products

- State & Local Government

- Title IV Audit & Consulting

- Distribution & Supply Chain

- Lessons from Leadership

WORKING WITH US

Sikich has a deep and wide knowledge of the financial services industry. For more than 30 years, we’ve helped companies and organizations thrive, grow and compete.

In a rapidly evolving digital landscape, our teams understand the methods and tools to chart against your strategic initiatives. This is why we’ve developed our HEAD START solution for Private Equity companies built on Salesforce .

CASE STUDY: TECH DEPLOYMENT IN WEALTH MANAGEMENT

Stratos Wealth Partners was looking for a solution to get their advisors the tools they needed to help their clients succeed. With the help of Sikich and a smart deployment of Salesforce, they were able to see the benefits and then some.

OUR FINANCIAL SERVICES SPECIALIZATIONS

We have a wide array of financial service experience, especially when it relates to Salesforce.

TAILORED APPROACH FOR FINANCIAL SERVICES WITH SIKICH HEADSTART

Private equity, wealth management, insights and resources.

THE BEGINNER’S GUIDE TO FINANCIAL SERVICES CLOUD

What comes next for relationships in financial services.

SALESFORCE FOR PRIVATE EQUITY

Salesforce investment banking overview, salesforce wealth management overview.

READY TO GET A HEADSTART?

Learn how you can take advantage of expertise and knowledge in the financial services industry with a custom, pre-configured technology solution using Salesforce.

Latest Insights

May 16, 2024

I recently spoke at the Informa Life Sciences Accounting & Reporting conference in Philadelphia, PA. Apart from the expected presentations about a...

On Demand – 2024 Yellowbook Webinar Series: Session 4 ...

https://youtu.be/341EiMTEcSA Tune into the fourth session of our Yellowbook Webinar Series, where our government finance experts covered key com...

On Demand – Building a Dream Team: Utilizing Assessmen...

May 15, 2024

https://youtu.be/npN83_26bDE?si=WcvI12UaMzvvWk-U In this webinar, Sikich talent experts explore the strategic role assessments play in the hirin...

Creation of Vendor Bank Account Details Just Got a Whole Lot...

In order to use the Electronic Bank Payments feature in NetSuite to electronically pay vendor bills, you need to create a vendor bank account record. ...

A Case for the Poly Studio X50

May 14, 2024

In business, it should surprise no one that effective communication and collaboration are essential for success. Almost every business has a need to h...

Simon Roofing Case Study

May 13, 2024

Simon Roofing deploys Microsoft Dynamics 365 to continue improving customer services and outperform the competition. Simon Roofing collaborated wi...

Advanced Warehousing Replenishment Strategies and Configurat...

“Hey forklift driver Joe, can you come over to aisle 10 and drop down some goods from the top overflow rack?” The point of this article is for war...

Infographic: Empowering City of Austin’s Economic Deve...

May 10, 2024

Innovation isn't just a buzzword; it's a necessity, especially for governmental bodies striving to serve their communities better. The City of Austin'...

Multithreading Batch Jobs with Microsoft Dynamics 365 Financ...

May 9, 2024

Let’s take a look at how to create multithreaded batch jobs in Microsoft Dynamics 365 F&SCM. In most cases a single threaded batch job will be p...

Technology-Enabled Professional Services Firm Sikich Secures...

INVESTMENT ACCELERATES VALUE CREATION AND FORGES NEW ERA FOR THE FIRM CHICAGO – May 9, 2024 – Sikich LLC, a global technology-enabled pro...

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

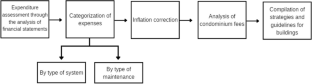

Case study of condominium management in Brazil: survey of 30 years of maintenance and renovation costs of a 1982 multifamily residential building

- Research Article

- Published: 15 May 2024

- Volume 9 , article number 88 , ( 2024 )

Cite this article

- Adryelle Dias Novaes Machado ORCID: orcid.org/0009-0006-7623-7671 1 ,

- Anna Luiza Dias Siqueira ORCID: orcid.org/0009-0001-4092-828X 1 ,

- Júlia Assumpção de Castro ORCID: orcid.org/0000-0002-2175-0199 1 ,

- Aldo Ribeiro de Carvalho ORCID: orcid.org/0000-0003-2767-4374 1 ,

- Romário Parreira Pita ORCID: orcid.org/0009-0008-8196-6443 1 &

- Julia Castro Mendes ORCID: orcid.org/0000-0002-6323-5355 1 , 2

This study carries out a case study of maintenance costs in a multi-family residential building built in 1982 in a mid-size city in Brazil. The condominium's monthly cost reports (maintenance fees) were analyzed for 30 years, between 1991 and 2021. This long period of analysis unprecedented in the literature. Expenses were classified by system and type of maintenance (preventive, corrective or modernization renovation). We identified that maintenance on elevator systems and gardens summed up the highest costs throughout the period, while envelope conservation, sewage systems and water tanks presented the lowest costs. Disregarding the extreme years and correcting for inflation, the average expenditure on maintenance in the last 5 years (2017–2021) was 175% higher than the first 5 years analyzed (1991–1995), with the condominium fee being 43.6% higher. If the (predictable) maintenance expenses over the years were considered from the beginning of the building's operation, current families could be paying around 15% less in condominium fees. In conclusion, for an efficient maintenance management system, construction professional must focus on maintenance from the project design stage, provide a financial reserve for future upkeeping and renovation from the beginning of occupation, and prepare a robust user manual.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

References

Silva MM (2020) Bim na operação e manutenção de edifícios. Build Inform Model 20

Possan E, Demoliner CA (2013) Desempenho, durabilidade e vida útil das edificações: abordagem geral. Revista Técnico-Científica do CREA PR, p 14

de Carvalho AR, da Silva Calderón-Morales BR, Júnior JCB, de Oliveira TM, Silva GJB (2023) Proposition of geopolymers obtained through the acid activation of iron ore tailings with phosphoric acid. Constr Build Mater 403:133078

Article Google Scholar

Chen F, Zhao J, Zhong H, Feng Y, Chen C, Xie J (2023) An investigation of the durability of ultra-lightweight high-strength geopolymeric composites. J Build Eng 80:107990

França S, Oliveira MNC, Sousa LN, de Moura Solar Silva MV, Borges PHR, da Silva Bezerra AC (2023) The durability of alkali-activated mortars based on sugarcane bagasse ash with different content of Na2O. J Build Pathol Rehabil 8:74

Joshi SP, Ramaswamy V, Sohail MAS (2023) Enhancing frost resistance and durability of self-compacting concrete through basalt fiber reinforcement. J Build Pathol Rehabil. https://doi.org/10.1007/s41024-023-00346-7

Ghodousian O, Garcia R, Ghodousian A, Ayandeh MHMN (2024) Properties of fibre-reinforced self-compacting concrete subjected to prolonged mixing: an experimental and fuzzy logic investigation. J Build Pathol Rehabil 9:22

Betz T, El-Rayes K, Grussing M, Bartels L (2023) Optimizing facility maintenance planning under uncertainty. J Build Eng 77:107479

Solanki SK, Paul VK, Singh V (2023) Blueprint for maintenance management of institutional buildings. J Build Pathol Rehabil 8:84

ABNT (2021) NBR 15575: Edifcações habitacionais — Desempenho. Associação Brasileira de Normas Técnicas, Rio de Janeiro

Google Scholar

Adegoriola MI, Lai JH, Abidoye R (2023) Critical success factors of heritage building maintenance management: an ISM-MICMAC analysis. J Build Eng 75:106941

Bolina FL, Tutikian BF, Helene P (2019) Patologia de Estruturas. Oficina de Textos, São Paulo

ABNT (2024) NBR 5674 - Manutenção de edificações: Requisitos para o sistema de gestão de manutenção. Associação Brasileira de Normas Técnicas, Rio de Janeiro

ABNT (2011) NBR 14037: Diretrizes para elaboração de manuais de uso, operação e manutenção das edificações — Requisitos para elaboração e apresentação dos conteúdos. ABNT, Rio de Janeiro

Medeiros MHFD, Andrade JJ, Helene P (2011) Durabilidade e Vida Útil das Estruturas de Concreto. Em Concreto: Ciênc Tecnol 1:773–808

S Muduc (2021) Análise de custo-benefício da manutenção corretiva versus manutenção preventiva das infraestruturas da Guarda Nacional Republicana. Lisboa

Silva BAP (2013) Avaliação de edifícios em serviço: Índice de custo de manutenção de edifícios. Universidade do Porto, Porto - Portugal

G1 (2023) Laudo aponta falhas na construção e problemas de manutenção no prédio em que 13 sacadas caíram de uma vez em Belém. [Online]. Available: https://g1.globo.com/pa/para/noticia/2023/07/20/laudo-aponta-falhas-na-construcao-e-problemas-de-manutencao-no-predio-em-que-13-sacadas-cairam-de-uma-vez-em-belem.ghtml . [Acesso em 09 Agosto 2023].

G1 (2020) Dois engenheiros e um pedreiro são indiciados pelo desabamento do Edifício Andrea, em Fortaleza. [Online]. Available: https://g1.globo.com/ce/ceara/noticia/2020/01/30/dois-engenheiros-e-um-pedreiro-sao-indiciados-pelo-desabamento-do-edificio-andrea-em-fortaleza.ghtml . [Acesso em 21 Agosto 2023].