Market Structures Essay

Introduction, types of market structures.

In an ordinary market structure, there is the assumption that there are several and different sellers and buyers. The result of this is fair competition where price of goods is determined by the forces of demand and supply. This is so because, in such a market, both the seller and buyer are equally able to influence the price.

However, this is not always the case. Some market industries have only a single seller or much fewer sellers than consumers, limiting the buyer’s ability to influence the price. This paper discusses the various market structures that exist in our market today and the various pricing strategies that could be applied in their management.

Pure monopoly

This type of market exists when there is only a single seller controlling the supply of goods or services in the entire market. He alone can control the price and prevents other businesses from entering the market. They commonly exist in a government-regulated setting. A case in point is the provision of electric and Natural gas utilities in the United States.

The government is the sole provider of these utilities and regulates their delivery to the public through the state, federal and local agencies. The prices are not arrived at through the forces of demand and supply but by the structures of the government. “The agencies govern the prices they charge, the terms of their services to consumers, their budgets and construction plans, and their programs for energy efficiency and other services,” (Regulatory Assistance Project 2011, P. 3).

Competition in this sector cannot thrive since the government provides subsidies to these utilities so as to provide cheaper services to the public, something that small private entities are unable to do. In addition, the infrastructural and technological requirement for the provision of the services would be so much of an expense for a private entity to meet.

Even though the government is the price maker here, it cannot set prices at a level that the consumer will not be able to afford if it wants to make profits. To set the prices, the monopolist should use the market demand curve and use it to set its own prices. The position marginal revenue for the monopolist should be less than the marginal revenue (MR). The position and elasticity of the demand curve works to limit the pricing mechanism of the monopolist.

The firm can only make maximum profits, on a short term, where the additional cost used to produce one more unit is equal to the resulting revenue from that one unit. For normal profits, the average revenue (AR) should be equal to the Average Total Cost (ATC). In the long run, the firm will only make profits where the AR is greater than the average cost (AC). (Mcconnel & Brue, 2009)

Pure Competition Market structure

This is a kind of a market where no single entity monopolizes the price determination process. Prices of goods are determined by forces of demand and supply and every player in the market has a part to play. A classic example would be a street vendor business.

In this kind of business, there is a large number of buyers and sellers and anyone may enter or leave the market at will without any barrier to doing so. Both consumers and producers are well informed of the prices and quality of goods and goods are homogenous across the market without much differentiation.

Every partaker is interested in maximizing profits as opposed to monopolizing the market whose returns are non-increasing to scale. Factors of production are freely mobile within the market with flexibility to ever-changing market circumstances. There are no new firms in the industry thus the same number of firms remains throughout.

In this market, the price is normally given by the demand and supply curve, as determined by the market forces, hence referred to as a ‘price taker’. The firm will sell its products at the current market prices and has no power to alter those prices. The stock is fixed while the supply curve will be perfectly elastic. In the short run, the firm can try to increase supply by increasing variable inputs. Profit will be maximized when MR is equal to MC. The firm must however fix their output to the prevailing market prices.

In the long run, the firm may change their unit of output as new firms enter the market. Supernormal profits will be realized where AR is greater than AC. When AR is greater than AC small firms starts quitting the market resulting into a decreased price. This will go on until AR is equal to AC and the firm makes normal profits. (McConnell & Brue, 2009)

Monopolistic Competition

This is a form of market where sellers deal with competitive products but which are differentiated from one another. It is almost like a perfect competition but though there are many firms in the industry, the products of each company are differentiated to make them unique to products of other firms.

An example is the Nike shoes. Even though many firms make shoes, which are equally competitive, only Nike makes that kind of shoe and one cannot obtain it from any other firm. The shoe is homogenous and specific to the firm and their differentiation gives monopoly over Nike to make the shoe alone.

Here, just like perfect market, the firm will take the market prices as determined by rival firms and will be forced to disregard their own influence on prices. In the short run, the firm may determine the prices depending on its level of differentiation and will have the same effects as a monopoly making huge economic prices.

However, as time goes by and competition increases, the effect of differentiation loosens gradually and the market changes to a perfect competitive one, with less profits. At the optimum quantity of production and optimum price, the firms will now earn normal profits. The equilibrium point, no new firms will be entering the industry.

Oligopoly market structure

This is a situation where there are few sellers of a commodity. The commodity being sold is however very similar but not identical to the others in the market. Products are close substitutes of each other but each firm has monopoly power over its own product. It also includes a duopoly where there are only two firms dealing with the product, e.g., Coca-cola and Pepsi. These two companies are the only known producers of carbonated soft drinks, yet their products are differentiated from each other.

For other firms to enter the market, they will require heavy investment and highly developed technology and incur high costs of promotion, thus posing a major barrier to entry of new firms and competition. The existing firms may also decide to merge, presenting even more difficulty to new entry. Both sellers have a substantial amount of influence on the pricing policies but there is mutual interdependency in price. The prices therefore remain relatively stable.

In this case, the pricing of Coca-cola will affect Pepsi’s price appreciably and the vice versa. Therefore, the best way is to agree, as between the two firms, on a pricing policy that is comfortable to the two firms. When such collusion of price determination occurs, the firms agree on an identical price, normally high, maximizing their profits and minimizing the production costs.

The pricing may be done through cost-plus pricing, which involves adding percentages of profit margin to Average Variables Cost to obtain the price. It may also be arrived at through the Mark-up pricing. Here the percentage mark-up it predetermined to cover the average margin. The AVC is estimated through the units of output produced over a given period of time. The level of output is used to determine the average cost.

Monopsony competition

Denotes a situation where one buyer buys from several existing sellers and he is therefore, the main determinant of the price in the entire market.

It is mostly found in the market for the exchange of factor services. The price he sets is lower than the market price and the quality exchanged is not correspondent to the price. For example, major sports clubs such as the National Baseball Association (NBA).

A baseball player wishing to be professional baseball player can only seek employment from NBA only. NBA will determine the minimum factor price which the player will and can take.

Though the monopsony is the price maker, if he wants to obtain quantity services, he has to part with a higher price or incur additional expenses or wages to hire more workers. The additional wages will enable him to earn more profits. These additional expenses are the marginal factor cost and the additional profits are the marginal revenue product. For maximization of profits, the firm should hire the quantity equal to the marginal factor cost and marginal revenue product, where these two curves meet, (Africa Awards, 2011).

The basic assumption of the existence of a perfect competitive market therefore, rarely exists. We have seen that there are markets dominated by one or two sellers or even one buyer.

Each market structure’s existence, however, is dependent on its power to influence the market price. There are also other minor types of markets that exist apart from the ones covered in this paper, for example a bilateral monopoly-duopsony, a market with two buyers and one seller. Also

Bilateral oligopoly-monopsony; one buyer and few sellers. However, all these are embedded in the five main ones discussed above.

Africa Awards. (2011). Market Structures: Monopsony , AmosWEB Encyclynomic WEB*pedia. Web.

McConnell, Campbell., & Brue, Stanley. (2009). Microeconomics: Principles, problems, and policies . New York: McGraw Hill. (18th Edition).

Regulatory Assistance Project. (2011). Electricity Regulation in the US: A Guide, Home Office, 50 State Street, Suite 3, Montpelier, Vermont 05602.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2018, October 12). Market Structures. https://ivypanda.com/essays/market-structures/

"Market Structures." IvyPanda , 12 Oct. 2018, ivypanda.com/essays/market-structures/.

IvyPanda . (2018) 'Market Structures'. 12 October.

IvyPanda . 2018. "Market Structures." October 12, 2018. https://ivypanda.com/essays/market-structures/.

1. IvyPanda . "Market Structures." October 12, 2018. https://ivypanda.com/essays/market-structures/.

Bibliography

IvyPanda . "Market Structures." October 12, 2018. https://ivypanda.com/essays/market-structures/.

- Augmented Reality in Business Applications

- Virtual and Augmented Reality in Ten Square Games

- Subsequent Cloning of PARK2 Gene

- Similarities Between Capitalism and Socialism. Compare & Contrast

- Compare of Capitalism and Socialism

- Money and Modern Life

- The mysteries of Capital

- Relationship Between Economic Woes and Having Children

Table of Contents

What is market structure, types of market structures, monopolistic markets characteristics, oligopoly characteristics, perfectly competitive market characteristics, final thought, market structure: definition, types, features and fluctuations.

You all must have read about the immense scope of markets in economics textbooks. But what does market structure look like in the real world? Market structure can be categorized based on the competition levels and the nature of markets. Let’s look into the details of market structure in this article.

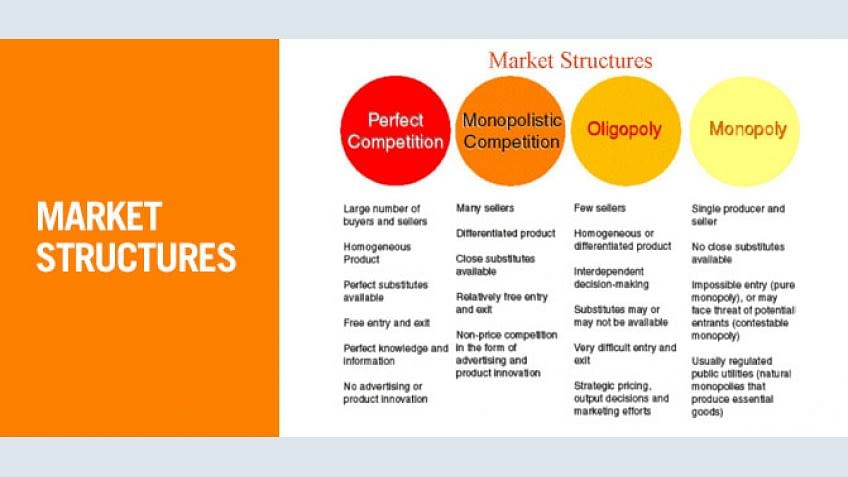

Market structure refers to the way that various industries are classified and differentiated in accordance with their degree and nature of competition for products and services. It consists of four types: perfect competition, oligopolistic markets, monopolistic markets, and monopolistic competition.

According to economic theory, market structure describes how firms are differentiated and categorized by the types of products they sell and how those items influence their operations. A market structure helps us to understand what differentiates markets from one another.

In economics, market structure is the number of firms producing identical products which are homogeneous. The types of market structures include the following:

- Monopolistic competition, also called competitive market, where there is a large number of firms, each having a small proportion of the market share and slightly differentiated products.

- Oligopoly, in which a market is by a small number of firms that together control the majority of the market share.

- Duopoly, a special case of an oligopoly with two firms.

- Monopsony, when there is only one buyer in a market.

- Oligopsony, a market in which many sellers can be present but meet only a few buyers.

- Monopoly, in which there is only one provider of a product or service.

- Natural monopoly, a monopoly in which economies of scale cause efficiency to increase continuously with the size of the firm. A firm is a natural monopoly if it is able to serve the entire market demand at a lower cost than any combination of two or more smaller, more specialized firms.

- Perfect competition, a theoretical market structure that features no barriers to entry, an unlimited number of producers and consumers, and a perfectly elastic demand curve.

Become a Business and Leadership Professional

- Top 10 skills in demand Business Analysis As A Skill In 2020

- 14% Growth in Jobs Of Business Analysis Profile By 2028

Business Analyst

- Industry-recognized certifications from IBM and Simplilearn

- Masterclasses from IBM experts

Post Graduate Program in Digital Marketing

- Joint Purdue-Simplilearn Digital Marketer Certificate

- Become eligible to be part of the Purdue University Alumni Association

Here's what learners are saying regarding our programs:

Assistant Consultant at Tata Consultancy Services , Tata Consultancy Services

My experience with Simplilearn has been great till now. They have good materials to start with, and a wide range of courses. I have signed up for two courses with Simplilearn over the past 6 months, Data Scientist and Agile and Scrum. My experience with both is good. One unique feature I liked about Simplilearn is that they give pre-requisites that you should complete, before a live class, so that you go there fully prepared. Secondly, there support staff is superb. I believe there are two teams, to cater to the Indian and US time zones. Simplilearn gives you the most methodical and easy way to up-skill yourself. Also, when you compare the data analytics courses across the market that offer web-based tutorials, Simplilearn, scores over the rest in my opinion. Great job, Simplilearn!

Allan Joaquin

Senior copywriter , ami group.

Completing the PGP in Digital Marketing course and gaining knowledge in the field allowed me to service new clients who needed consultancy on digital marketing strategies. I was also able to increase my revenue by 50%.

The imperfectly competitive structure is quite identical to the realistic market conditions where some monopolistic competitors, monopolists, oligopolists and duopolists exist and dominate the market conditions. The elements of Market Structure include the number and size distribution of firms, entry conditions, and the extent of differentiation.

These somewhat abstract concerns tend to determine some but not all details of a specific concrete market system where buyers and sellers actually meet and commit to trade. Competition is useful because it reveals actual customer demand and induces the seller (operator) to provide service quality levels and price levels that buyers (customers) want, typically subject to the seller’s financial need to cover its costs. In other words, competition can align the seller’s interests with the buyer’s interests and can cause the seller to reveal his true costs and other private information. In the absence of perfect competition, three basic approaches can be adopted to deal with problems related to the control of market power and an asymmetry between the government and the operator with respect to objectives and information: (a) subjecting the operator to competitive pressures, (b) gathering information on the operator and the market, and (c) applying incentive regulation.

Monopolistically competitive markets have the following characteristics:

- There are many producers and many consumers in the market, and no business has total control over the market price.

- Consumers perceive that there are non-price differences among the competitors' products.

- There are few barriers to entry and exit.

- Producers have a degree of control over price.

The long-run characteristics of a monopolistically competitive market are almost the same as a perfectly competitive market. Two differences between the two are that monopolistic competition produces heterogeneous products and that monopolistic competition involves a great deal of non-price competition, which is based on subtle product differentiation. A firm making profits in the short run will nonetheless only break even in the long run because demand will decrease and average total cost will increase. This means in the long run, a monopolistically competitive firm will make zero economic profit. This illustrates the amount of influence the firm has over the market; because of brand loyalty, it can raise its prices without losing all of its customers. This means that an individual firm's demand curve is downward sloping, in contrast to perfect competition, which has a perfectly elastic demand schedule.

- Profit maximization conditions: An oligopoly maximizes profits by producing where marginal revenue equals marginal costs.

- Ability to set price: Oligopolies are price setters rather than price takers.

- Entry and exit: Barriers to entry are high. The most important barriers are economies of scale, patents, access to expensive and complex technology, and strategic actions by incumbent firms designed to discourage or destroy nascent firms. Additional sources of barriers to entry often result from government regulation favoring existing firms making it difficult for new firms to enter the market.

- Number of firms: "Few" – a "handful" of sellers. There are so few firms that the actions of one firm can influence the actions of the other firms.

- Long run profits: Oligopolies can retain long run abnormal profits. High barriers of entry prevent sideline firms from entering the market to capture excess profits.

- Product differentiation: Product may be homogeneous (steel) or differentiated (automobiles).

- Perfect knowledge: Assumptions about perfect knowledge vary but the knowledge of various economic factors can be generally described as selective. Oligopolies have perfect knowledge of their own cost and demand functions but their inter-firm information may be incomplete. Buyers have only imperfect knowledge as to price, cost and product quality.

- Interdependence: The distinctive feature of an oligopoly is interdependence. Oligopolies are typically composed of a few large firms. Each firm is so large that its actions affect market conditions. Therefore the competing firms will be aware of a firm's market actions and will respond appropriately. This means that in contemplating a market action, a firm must take into consideration the possible reactions of all competing firms and the firm's countermoves. It is very much like a game of chess or pool in which a player must anticipate a whole sequence of moves and countermoves in determining how to achieve his or her objectives. For example, an oligopoly considering a price reduction may wish to estimate the likelihood that competing firms would also lower their prices and possibly trigger a ruinous price war. Or if the firm is considering a price increase, it may want to know whether other firms will also increase prices or hold existing prices constant. This high degree of interdependence and need to be aware of what other firms are doing or might do is to be contrasted with lack of interdependence in other market structures. In a perfectly competitive (PC) market there is zero interdependence because no firm is large enough to affect market price. All firms in a PC market are price takers, as current market selling price can be followed predictably to maximize short-term profits. In a monopoly, there are no competitors to be concerned about. In a monopolistically-competitive market, each firm's effects on market conditions is so negligible as to be safely ignored by competitors.

- Non-Price Competition: Oligopolies tend to compete on terms other than price. Loyalty schemes, advertisement, and product differentiation are all examples of non-price competition

- Infinite buyers and sellers – An infinite number of consumers with the willingness and ability to buy the product at a certain price, and infinite producers with the willingness and ability to supply the product at a certain price.

- Zero entry and exit barriers – A lack of entry and exit barriers makes it extremely easy to enter or exit a perfectly competitive market.

- Perfect factor mobility – In the long run factors of production are perfectly mobile, allowing free long term adjustments to changing market conditions.

- Perfect information - All consumers and producers are assumed to have perfect knowledge of price, utility, quality and production methods of products.

- Zero transaction costs - Buyers and sellers do not incur costs in making an exchange of goods in a perfectly competitive market.

- Profit maximizing - Firms are assumed to sell where marginal costs meet marginal revenue, where the most profit is generated.

- Homogenous products - The qualities and characteristics of a market good or service do not vary between different suppliers.

- Non-increasing returns to scale - The lack of increasing returns to scale (or economies of scale) ensures that there will always be a sufficient number of firms in the industry.

- Property rights - Well defined property rights determine what may be sold, as well as what rights are conferred on the buyer.

The correct sequence of the market structure from most to least competitive is perfect competition, imperfect competition, oligopoly and pure monopoly. The main criteria by which one can distinguish between different market structures are the number and size of producers and consumers in the market, the type of goods and services being traded and the degree to which information can flow freely.

If you have good ideas about different markets and their specific characteristics, making a career in Marketing will be a good option for you. Become a Digital Marketing expert with the help of the professional certificate , offered by IMT Ghaziabad in collaboration with Simplilearn. Get a holistic understanding of the digital marketing field by exploring topics like SEO , Social Media , PPC , Web Analytics , and Marketing Analytics . Sign-up today and start learning!

Get Free Certifications with free video courses

Business and Leadership

Business Analysis Basics

Digital Marketing

Introduction to Digital Marketing Fundamentals Course

Learn from Industry Experts with free Masterclasses

Finance management.

Financial Modeling statistical functions in Excel

Career Information Session: Find Out How to Become a Business Analyst with IIT Roorkee

Recommended Reads

Free eBook: Agile and Scrum Salary Report

What Is Product-Market Fit? A Product Manager's Guide

Implementing Stacks in Data Structures

Data Scientist Resume Guide: The Ultimate Recipe for a Winning Resume

A Comprehensive Guide on How to Do Market Research

A Comprehensive Look at Queue in Data Structure

Get Affiliated Certifications with Live Class programs

- PMP, PMI, PMBOK, CAPM, PgMP, PfMP, ACP, PBA, RMP, SP, and OPM3 are registered marks of the Project Management Institute, Inc.

Quickonomics

The Four Types of Market Structure

Four basic types of market structure characterize most economies: perfect competition, monopolistic competition, oligopoly, and monopoly. Each of them has its own set of characteristics and assumptions, which in turn affect the decision-making of firms and the profits they can make.

It is important to note that not all of these market structures exist in reality; some of them are just theoretical constructs (which can be really useful in economics sometimes). Nevertheless, they are critical because they help us understand how competing firms make decisions. With that said, let’s look at the four market structures in more detail.

1. Perfect Competition

Perfect competition describes a type of market structure where a large number of small firms compete against each other. In this scenario, a single firm does not have any significant market share or market power. As a result, the industry as a whole produces the socially optimal level of output because none of the firms can influence market prices.

Perfect competition is defined by the following characteristics:

- All firms maximize profits

- Entry and exit to the market are free (i.e., no barriers to entry or exit)

- All firms sell entirely identical (i.e., homogenous) goods

- There are no consumer preferences.

By looking at those assumptions, it becomes obvious that we will hardly ever find perfect competition in reality. This is important to note because it is the only market structure that can (theoretically) result in a socially optimal level of output.

Probably the best example of an almost perfectly competitive market we can find in reality is the stock market. If you are looking for more information on different types of competitive firms, you can also check our post on perfect competition vs. imperfect competition .

2. Monopolistic Competition

Monopolistic competition also refers to a type of market structure where a large number of small firms compete against each other. However, unlike in perfect competition, the firms in monopolistic competition sell similar but slightly differentiated products. That gives them a certain degree of market power despite small market shares, which allows them to charge higher prices within a specific range.

Monopolistic competition is defined by the following characteristics:

- All firms are profit-maximizing

- Firms sell differentiated products

- Consumers may prefer one product over the other (however, they are still very close substitutes).

Note that those assumptions are a bit closer to reality than the ones we looked at in perfect competition. However, this market structure no longer results in a socially optimal level of output because the firms have more power and can influence market prices to increase their total revenue and profit at the expense of the consumers.

An example of monopolistic competition is the market for cereals. There is a vast number of different brands (e.g., Cap’n Crunch, Lucky Charms, Froot Loops, Apple Jacks). Most of them probably taste slightly different, but at the end of the day, they are all breakfast cereals.

3. Oligopoly

An oligopoly describes a market structure that is dominated by only a small number of firms that serve many buyers. That results in a state of limited competition. The firms can either compete against each other or collaborate (see also Cournot vs. Bertrand Competition ). By doing so, they can use their collective market power to drive up prices and earn a higher profit.

An oligopoly market is defined by the following characteristics:

- Oligopolies can set prices (i.e., they are price-makers)

- Barriers to entry and exit exist in the market

- Products may be homogeneous or differentiated

- Only a few firms dominate the market.

Unfortunately, it is not clearly defined what a “few firms” means precisely. As a rule of thumb, we say that an oligopoly typically consists of about 3-5 dominant firms.

To give an example of an oligopoly, we can look at the gaming console industry. This market is dominated by three powerful companies: Microsoft, Sony, and Nintendo. That leaves all of them with a significant amount of market power.

4. Monopoly

A monopoly refers to a type of market structure where a single firm controls the entire market. In this scenario, the firm has the highest level of market power, as it supplies the entire demand curve and consumers do not have any alternatives. As a result, monopolies often reduce output to increase prices and earn more profit.

A monopoly is defined by the following characteristics:

- The monopolist is profit-maximizing

- It can set the price (i.e., it is the price-maker)

- There are high barriers to entry and exit

- Only one firm dominates the entire industry.

From the perspective of society, most monopolies are not desirable because they result in lower outputs and higher prices compared to competitive markets. Therefore, they are often regulated by the government.

An example of a real-life monopoly could be Monsanto. This company trademarks about 80% of all corn harvested in the US, which gives it a high level of market power. You can find additional information about monopolies in our post on monopoly power .

Frequently Asked Questions (FAQ)

How do real-world markets deviate from the ideal types of market structures outlined in the theory, especially in dynamic industries like technology.

Real-world markets often blend characteristics from different theoretical models, especially in dynamic sectors like technology, where innovation and strategic behaviors create more complex scenarios than those described by pure market structures.

What role does government regulation play in shaping and maintaining these market structures, and how do these regulations impact competition?

Government regulations are pivotal in shaping market structures, employing antitrust laws and policies to foster competition, prevent monopolistic dominance, and protect consumer interests, thereby influencing the competitive landscape.

How do market structures evolve over time with technological advancements and changing consumer preferences?

Market structures are not static; they evolve over time as a result of technological advancements, shifts in consumer preferences, and changes in regulatory landscapes. These evolutions can disrupt existing market equilibriums, leading to the emergence of new business models and the decline of others.

There are four basic types of market structure in economics: perfect competition, imperfect competition, oligopoly, and monopoly. Perfect competition describes a market structure where a large number of small firms compete against each other with homogeneous products. Meanwhile, monopolistic competition refers to a type of market structure where a large number of small firms compete against each other with differentiated products. An Oligopoly describes a market structure where a small number of firms compete against each other. And last but not least, a monopoly refers to a type of market structure where a single firm controls the entire industry.

Related Posts

- Macroeconomics

The Demographic Transition Model

- Microeconomics

The Economics Of Advertising

What is game theory.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

- Liberty Fund

- Adam Smith Works

- Law & Liberty

- Browse by Author

- Browse by Topic

- Browse by Date

- Search EconLog

- Latest Episodes

- Browse by Guest

- Browse by Category

- Browse Extras

- Search EconTalk

- Latest Articles

- Liberty Classics

- Book Reviews

- Search Articles

- Books by Date

- Books by Author

- Search Books

- Browse by Title

- Biographies

- Search Encyclopedia

- #ECONLIBREADS

- College Topics

- High School Topics

- Subscribe to QuickPicks

- Search Guides

- Search Videos

- Library of Law & Liberty

- Home /

ECONLIB Guides

Competition and Market Structures

Definitions and Basics

Competition , from the Concise Encyclopedia of Economics

“Competition,” wrote Samuel Johnson, “is the act of endeavoring to gain what another endeavors to gain at the same time.” We are all familiar with competition—from childhood games, from sporting contests, from trying to get ahead in our jobs. But our firsthand familiarity does not tell us how vitally important competition is to the study of economic life. Competition for scarce resources is the core concept around which all modern economics is built….

What are Market Structures? An Economics Topic Detail, by Arnold Kling

Market structures, or industrial organization, describe the extent to which markets are competitive. At one extreme, pure monopoly means that there is only one firm in an industry. At the other extreme, economists describe a theoretical possibility termed perfect competition. In between are the market structures found most often in the real world, which are oligopoly and monopolistic competition.

Competition and Market Structure : A Video and Quiz from EconEdLink

Monopoly , from the Concise Encyclopedia of Economics

A monopoly is an enterprise that is the only seller of a good or service. In the absence of government intervention, a monopoly is free to set any price it chooses and will usually set the price that yields the largest possible profit. Just being a monopoly need not make an enterprise more profitable than other enterprises that face competition: the market may be so small that it barely supports one enterprise. But if the monopoly is in fact more profitable than competitive enterprises, economists expect that other entrepreneurs will enter the business to capture some of the higher returns. If enough rivals enter, their competition will drive prices down and eliminate monopoly power…. The main kind of monopoly that is both persistent and not caused by the government is what economists call a “natural” monopoly. A natural monopoly comes about due to economies of scale—that is, due to unit costs that fall as a firm’s production increases. When economies of scale are extensive relative to the size of the market, one firm can produce the industry’s whole output at a lower unit cost than two or more firms could. The reason is that multiple firms cannot fully exploit these economies of scale. Many economists believe that the distribution of electric power (but not the production of it) is an example of a natural monopoly. The economies of scale exist because another firm that entered would need to duplicate existing power lines, whereas if only one firm existed, this duplication would not be necessary. And one firm that serves everyone would have a lower cost per customer than two or more firms.

The Costs and Benefits of Monopoly , at Marginal Revolution University

Timothy Taylor, The Blurry Line Between Competition and Cooperation , Econlib, February 2015.

What is the opposite of “competition”? If you fear that this is a trick question and run off to check a synonym/antonym dictionary, you will find an answer that probably came to mind in the first place: “cooperation.” Indeed, many people view economics as morally suspect because they perceive economics as emphasizing competition, rather than the arguably more virtuous approach of cooperation.

Industrial Concentration , from the Concise Encyclopedia of Economics

Industrial concentration occurs when a small number of companies sell a large percentage of an industry’s product. The most widely used measure of concentration is the so-called four-firm concentration ratio, which is the percentage of the industry’s product sold by the four largest producers. If, for example, four firms each sell 10 percent of an industry’s product, the four-firm concentration ratio for that industry is 40 percent….

In the News and Examples

Teaching Market Structures with a Competitive Gum Marke t, from EconEd at the St. Louis Fed

In this lesson, students participate in an activity that demonstrates a key economic idea: The level of competition in an industry is a major determinant of product prices. Students are placed in groups that replicate four competitive conditions—perfect competition, monopoly, competitive oligopoly, and collusive oligopoly. Students act as firms in each industry competing to sell their product to the teacher (acting as a consumer).

In Defense of Apple , by Richard McKenzie at Econlib, July 2012.

Richard McKenzie examines the 2012 antitrust case against Apple, providing a defense of the tech company based on antitrust enforcers misunderstanding of monopoly theory.

Antitrust , from the Concise Encyclopedia of Economics

Before 1890 the only “antitrust” law was the common law. Contracts that allegedly restrained trade (price-fixing agreements, for example) often were not legally enforceable, but such contracts did not subject the parties to any legal sanctions. Nor were monopolies generally illegal. Economists generally believe that monopolies and other restraints of trade are bad because they usually have the effect of reducing total output and, therefore, aggregate economic welfare (see Monopoly). Indeed, the term “restraint” of trade indicates exactly why economists dislike monopolies and cartels. But the law itself did not penalize monopolies. The Sherman Act of 1890 changed all that. It outlawed cartelization (every “contract, combination… or conspiracy” that was “in restraint of trade”) and monopolization (including attempts to monopolize)….

Don Boudreaux on Market Failure, Government Failure and the Economics of Antitrust Regulation . EconTalk podcast episode, October 1, 2007.

Don Boudreaux of George Mason University talks with EconTalk host Russ Roberts about when market failure can be improved by government intervention. After discussing the evolution of economic thinking about externalities and public goods, the conversation turns to the case for government’s role in promoting competition via antitrust regulation. Boudreaux argues that the origins of antitrust had nothing to do with protecting consumers from greedy monopolists. The source of political demand for antitrust regulation came from competitors looking for relief from more successful rivals.

A Little History: Primary Sources and References

Of Competition and Custom , by John Stuart Mill . Book II, Chap. 4 from Principles of Political Economy

Under the rule of individual property, the division of the produce is the result of two determining agencies: Competition, and Custom. It is important to ascertain the amount of influence which belongs to each of these causes, and in what manner the operation of one is modified by the other. Political economists generally, and English political economists above others, have been accustomed to lay almost exclusive stress upon the first of these agencies; to exaggerate the effect of competition, and to take into little account the other and conflicting principle. They are apt to express themselves as if they thought that competition actually does, in all cases, whatever it can be shown to be the tendency of competition to do. This is partly intelligible, if we consider that only through the principle of competition has political economy any pretension to the character of a science….

Steven Horwitz, Competition and Entrepreneurship : The Fountainhead of the Contemporary Austrian School , Econlib, December 2020.

One way of seeing the contribution of Competition and Entrepreneurship , and Kirzner’s work on entrepreneurship more generally, is that he provided a Misesian solution to a Hayekian problem…The Hayekian problem was how to explain the process of social learning that led to the coordination that characterized equilibrium. What ensured that the tendency toward equilibrium would be effective? The answer Kirzner offered was to take from Mises the idea of the entrepreneurial element of human action- the idea that we are not just maximizers but active agents who do not take our means-ends frameworks as given, and to make entrepreneurship the prime mover of the market process. Kirzner argued that the process of plan coordination is set in motion by entrepreneurial alertness to hitherto unseen opportunities, the exploiting of which constitutes the competitive market process.

Garret Edwards, Competition as a Discovery Procedure: Smith, Hayek, and Leoni , AdamSmithWorks, May 19, 2021.

‘Competition is thus, like experimentation in science, first and foremost a discovery procedure. […] Competition as a discovery procedure must rely on the self-interest of the producers, that is it must allow them to use their knowledge for their purposes, because nobody else possesses the information on which they must base their decision.’ But what does that really tell us about competition? How is competition relevant in discovering new ways to improve our everyday lives? Is it possible that competition ends up being useful for entrepreneurs to innovate even when government regulations get in the way?

Non-market activity within the family: Gary Becker , biography from the Concise Encyclopedia of Economics

One of Becker’s insights was that a major cost of investing in education is one’s time. Possibly that insight led him to his next major area, the study of the allocation of time within a family. Applying the economist’s concept of opportunity cost, Becker showed that as market wages rose, the cost to married women of staying home would rise. They would want to work outside the home and economize on household tasks by buying more appliances and fast food….

Advanced Resources

Shedding Light on Market Power , by Morgan Rose at Econlib.

How should government react to firms with too much supposed market power? How ought barriers to entry be dealt with?

Why Predatory Pricing is Highly Unlikely , by David Henderson at Econlib, May 2017.

A widely held belief is that large firms with some market power can use their profits generated in particular markets to cut prices below costs in another market and drive out their competitors. Then, according to this belief, once the competitors are driven out, the large firms can raise their prices in that market and collect higher-than-competitive prices. There are two problems with this view. First, it is logically deficient. Second, there is little evidence to support it.

Is Market Failure a Sufficient Condition for Government Intervention? , by Art Carden and Steven Horwitz at Econlib, April 2013.

Externality problems are market ‘failures’ only in comparison to the perfectly competitive model’s equilibrium. In other words, the ‘failure’ here is not that markets ‘do not work’ in practice, but that they fail to live up to a blackboard ideal.

Related Topics

Markets and Prices

Roles of Government

Edinburgh Research Archive

- ERA Home

- Economics, School of

- Economics thesis and dissertation collection

Essays on market structure

Collections.

Take 10% OFF— Expires in h m s Use code save10u during checkout.

Chat with us

- Live Chat Talk to a specialist

- Self-service options

- Search FAQs Fast answers, no waiting

- Ultius 101 New client? Click here

- Messenger

International support numbers

For reference only, subject to Terms and Fair Use policies.

- How it Works

Learn more about us

- Future writers

- Explore further

Ultius Blog

Essay on market structure.

Select network

Business competition takes on different forms depending on the type of market structure present in a given industry. This sample essay explores the four primary models of market structure:

- Perfect competition

- Monopolistic competition

Different types of market structure and competition

In the world of economics, the competition between businesses is not always the same or level. Certain fields of industry have very different types of markets than that of others. Where one business could find itself in a field of competition where the playing field is leveled and easy to gain a foothold within, others find themselves in playing fields that are heavily stacked to favor one (or several large) industrial player. The most common forms of market structure that are seen in the economic world are:

All of these market structures have defining characteristics that separate them from each other and are all set up in a way that will have a dramatic distinction on how the competition within that market works. The defining characteristics of the market structure will be one of the most important determining factors in how many, as well as, how large the major players within that particular market become.

One such example of a company that operates efficiently within its particular market structure is Samsung Electronics. By understanding and playing to the strengths of the market structure that the company finds itself within, Samsung Electronics has been able to become one of the largest and most financially successful companies in the business world.

Perfect competition and equilibrium within the market structure

The first market structure to be described is named perfect competition. This market structure is most easily recognized by the fact that its low barriers for entry on both the buyer and seller allow for the continued operation of a large number of firms (Econ Guru, 2006). With a market structure such as this, new firms are able to constantly enter the market so long as they offer a product or service to a consumer base that is well received.

The economic efficiency within the perfect competition market structure, therefore, is seen to be very high because of these low entry barriers for new firms, which allows for a constant and continued level of competition to be maintained by the different number of firms within the particular market (Riley, 2012). One of the benefits of perfect competition is easier access to market segmentation and determining the demographics of the market . One of the most surprising factors about this sort of market structure, however, is seen when examining the innovative behavior of firms within this market.

Upon first glance, one would naturally be inclined to believe that the innovative behavior for a perfect competition market would be very strong because start-up firms would want to bring new, creative ways to market in order to propel their firms into a position of exposure and success. Research shows this hypothesis to be incorrect, though. Instead, the innovative behavior of a perfect competition market is relatively weak.

“In capitalist reality as distinguished from its textbook picture, it is not that kind of competition which counts but the competition which commands a decisive cost or quality advantage and which strikes not at the margins of profits and the outputs of the existing firms but at their foundations and their very lives,” (Riley, 2012).

The old style monopolistic competition market structure

The next type of market structure to be examined is the monopolistic competition market structure.

Within this type of market, one would typically expect to see a large number of firms that produce a “congeneric product with distinguishable differentiations,” (Econ Guru, 2006).

This means that firms within this market structure will have many different competitors within the market, but each competitor will be selling a slightly different type of product. Within this market, the entry barriers for both the buyer and the seller are very low and allow for easy entry or exit from the market (Hubbard & O’Brien). Compare Google Docs and Microsoft Word for example. Both companies offer data and word processing software that have similar but distinctly difference attributes.

One of the distinguishing features for firms within this market structure comes from the pricing found within it. Within a monopolistic competition market, the firms act as the price makers; they can set, raise, and lower the price of their products because they are selling something that is highly individualized (Economics Online).

Because of the set up of this market structure, the level of innovation is considered to be quite strong as firms entering the market can make subtle changes to existing products to form new, unique ones. This market structure, therefore, places a high emphasis on advertising.

Firms that operate within the monopolistic competition market are, “often in fierce competition with other (local) firms offering a similar product or service, and may need to advertise on a local basis, to let customers know their differences, ” (Economics Online).

Studying high-level marketing? Consider using Ultius for your thesis needs .

Monopoly's role within a structured economy

A third market structure seen in the economic world is the monopoly. The monopoly is characterized as a market in which there is only one provider for a good or service to consumers (Econ Guru). Within this type of market structure, the barriers for entry are extremely high as the firm with all of the power in the market can undercut its prices and force competitors out of the market. The United States started to abolish monopolies within the nation during the 1890's with the enactment of the Sherman Antitrust Act .

From a buyer’s perspective, the barriers are low as their selection for products or services is so limited. In a pure monopoly with only one firm controlling the market, the type of product is very limited; in fact, it is exclusively limited to what that particular firm offers to its consumers (Riley, 2012).

Being the controlling power of the market, a firm operating within a monopoly is considered to be a price maker in that it will be able to continually set, raise, and lower the cost of its offered product or service. Within this type of market structure, the economic efficiency does run the risk of being damaged as the controlling firm will not have to deal with any competition, which could allow for the firm to become inefficient over time (Riley, 2012).

The same holds true for the innovative behavior within a monopolistic market. The controlling firm has no real reason to be constantly reimagining and redesigning its products or services and can instead release upgrades and updates at its own pace with no real urgency. Although, it is worth noting that a firm that holds a monopoly on the market could also have a strong innovative behavior because it is able to spend a great deal of its profits on research and development.

Oligopolies and corporations' efforts to control the market

The final market structure to observe is the oligopoly. Similar to a monopoly in many regards, the oligopoly has one major difference when compared to the former. Within a monopoly, there is one firm that controls the market, whereas an oligopoly has a few firms that dominate the market (Econ Guru, 2006). A market structure such as this will place considerable barriers on new firms that are entering the market as they must compete with several corporate giants, but will put limited barriers on the buyer because of the different options available to him or her.

The firms that dominate the market of an oligopoly can act, for the greater part, as price makers so long as the dominant firms keep their prices relatively similar (Riley, 2012). One such example of this occurring in the real world is seen in the gas industry. The large firms that control the industry are able to set the price for gasoline to whatever they should choose so long as the competition does not dramatically lower their own prices and attract a larger proportion of the market to utilize its product exclusively. It is within this market that the innovative behavior is observed to be the highest (Riley, 2012).

The dominant firms are seen to spend a significant portion of their marketing resources on research and development so that they can have the most innovative products to offer to their consumer base in order to attempt to gain a larger control of the market and gain a competitive advantage over their major competitors. It is this sort of market structure that Samsung Electronics finds itself a part of.

Samsung Electronics operates in a market that is clearly an oligopoly. One of the major components to this firm is seen in its cellular phone sales. In this market, Samsung operates as a dominant force along with such companies as Apple, Motorola, and LG. Outside of these major players, the competition is much more limited.

It is extremely difficult for outside firms to gain a foothold in this market because the dominant firms have such a large percentage control of the consumer base currently. The effectiveness of the market structure is extremely beneficial for Samsung, and they have taken full advantage of it to become one of the most dominant firms in their particular market. It is directly from the structure of the market that the forms of labor and demand are shaped for Samsung.

Samsung and the oligopoly

The demand that Samsung receives is based almost entirely as a consequence of the market structure of an oligopoly. Because Samsung created a business strategy that is able to dominate the market and place a high emphasis on the research and development of new, innovative products, the firm is able to offer technologically superior products to its consumer base that allows for the demand for its products to rise.

The Galaxy S III is a perfect example of this. This particular product is so innovative and well designed that it has allowed Samsung to become one of the top sellers of mobile phones worldwide and has consistently beaten out the iPhone 5 (Samsung’s main competition from Apple) on a consistent basis. In terms of labor, as well as supply, the same basic principle holds true.

It is because of the dominant share of the market that Samsung controls by successfully navigating its market structure that allows for the company to produce so many products and keep its supply high enough to meet the demand facing it, and in order to produce such a high supply of new, innovative products, Samsung is able to employ a large labor force for everything from assembly of a product to research and development of new ways to design, market, and ultimately sell to its consumer base.

Market structures play a key role in the way a firm is able to do business. By understanding what sort of market structure that a firm is placed in, that firm will be able to see if the cost of business is worth continuing to fight for. The factors that separate the different types of market structures can be the difference in whether or not a start-up firm will be able to become successful or be driven from business by the major players that currently exist in that particular market structure.

It is by understanding and playing to the market structure that certain companies such as Samsung Electronics have been able to become so successful. Different market structures place emphasis on different factors; however, one truth is held. In the end, every firm is simply trying to push its products or services onto its consumer base. This is one of many economic axioms that has come about as a result of study and research paper writing .

Econ Guru. (2006). Market structure. EconGuru Economics Guide, Retrieved from http://www.econguru.com/micro/market-structure.shtml

Economics Online. (2012). Monopolistic competition. Economics Online, Retrieved from http://www.economicsonline.co.uk/Business_economics/Monopolistic_competition.html

Hubbard, R. G., & O'Brien, (2012). Economics. (4th ed.). Prentice Hall.

Riley, G. (2012, September 23). Market structure summary. Tutor2u, Retrieved from http://www.tutor2u.net/economics/revision-notes/a2-micro-market-structures-summary.html

https://www.ultius.com/ultius-blog/entry/essay-on-market-structure.html

- Chicago Style

Ultius, Inc. "Essay on Market Structure." Ultius | Custom Writing and Editing Services. Ultius Blog, 06 Dec. 2013. https://www.ultius.com/ultius-blog/entry/essay-on-market-structure.html

Copied to clipboard

Click here for more help with MLA citations.

Ultius, Inc. (2013, December 06). Essay on Market Structure. Retrieved from Ultius | Custom Writing and Editing Services, https://www.ultius.com/ultius-blog/entry/essay-on-market-structure.html

Click here for more help with APA citations.

Ultius, Inc. "Essay on Market Structure." Ultius | Custom Writing and Editing Services. December 06, 2013 https://www.ultius.com/ultius-blog/entry/essay-on-market-structure.html.

Click here for more help with CMS citations.

Click here for more help with Turabian citations.

Ultius is the trusted provider of content solutions and matches customers with highly qualified writers for sample writing, academic editing, and business writing.

Tested Daily

Click to Verify

About The Author

This post was written by Ultius.

- Writer Options

- Custom Writing

- Business Documents

- Support Desk

- +1-800-405-2972

- Submit bug report

- A+ BBB Rating!

Ultius is the trusted provider of content solutions for consumers around the world. Connect with great American writers and get 24/7 support.

© 2024 Ultius, Inc.

- Refund & Cancellation Policy

Free Money For College!

Yeah. You read that right —We're giving away free scholarship money! Our next drawing will be held soon.

Our next winner will receive over $500 in funds. Funds can be used for tuition, books, housing, and/or other school expenses. Apply today for your chance to win!

* We will never share your email with third party advertisers or send you spam.

** By providing my email address, I am consenting to reasonable communications from Ultius regarding the promotion.

Past winner

- Name Samantha M.

- From Pepperdine University '22

- Studies Psychology

- Won $2,000.00

- Award SEED Scholarship

- Awarded Sep. 5, 2018

Thanks for filling that out.

Check your inbox for an email about the scholarship and how to apply.

Economic Analysis of Market Structure

Checked : Grayson N. , Curtis H.

Latest Update 21 Jan, 2024

12 min read

Table of content

Market structure

The features of a market structure, perfect competition, contestable market.

Major economic activities that lead to growth and development are defined by the strength of the markets that operate within it. This is because markets have the biggest role to play in these economies. When a single firm makes a decision, it may not have much impact on the general economy. But when many companies within a market setup make a decision, for instance, to stop production, the whole market faces the impact, which extends to the whole economy.

Consider the events that led to the 2008-2009 financial crisis, for instance. The US economy has been booming over several years before this event. Therefore, the economic bubble seemed like a good idea for investors to take loans and take their investments to other levels, especially in the housing industry. Financial institutions were so confident in their clients that they flexed the requirements for taking loans. Many of them did not do a proper background check to ascertain borrowers' ability to repay the loans. The economy was at its peak, and many indicators showed it would continue on an upward scale for another long period. Until the worst happened and house prices dropped significantly. The banks that had taken these properties as collateral were unable to sell them, let alone give out at a price that would help recover the lent money.

And this was the beginning of trouble for many financial institutions. With things getting worse by the day, some failed to recover completely, which forced them to announce a state of bankruptcy. Financial markets were the worse hit by the situation, and even when some monetary policies were applied to salvage the economy, many of them were unable to recover. This was defined as the worse economic crisis faced within financial markets.

As we already know, financial markets are among the biggest contributors to the general economy. For instance, many banks in the developing world lend money to small scale businesses, helping them pick up the pace and grow at a pace they would not have expected. It is also the financial markets that determine how much money is given into the economy or how much is withdrawn. When interest rates go high, the financial markets are there to ensure borrowers are taking money they can pay back, and when the rates go down, the same markets give out money at a controlled rate to ensure everything flows smoothly.

Economic growth and development have been relying a lot on the events taking place within financial markets. And when we talk about financial markets, we are referring to all financial intermediaries and money lending institutions, including insurance companies, which play a crucial role in any given economy.

When the financial markets fell, the effect spread fast into other sectors of the world economy. It became hard to import and export different products as inflation rates rose, leading to higher or lower r exchange rates went through the roof. Businesses that relied on borrowed resources from banks were unable to access these resources, making some to close some branches. And those that defaulted in their loans were forced to sell off some of their assets to cover their premiums. Households went into a state of panic and started withdrawing money from banks at a high rate. Since some of the banks had already shown signs of struggle, these mass withdrawals further crippled the operations, making it even hard to recover.

When reports came about the crisis, the main headlines talked about an economic crisis and not much about banks' falling. In other words, the fall of these markets was viewed from their effects on the general economy. When governments came up with fiscal and monetary policies to salvage the situation, they also talked about saving the economy, even though many steps were towards rescuing major financial intermediaries.

This shows just how important markets are in economies. They begin with firms operating under similar rules, or selling the same type of products, growing into a large community of firms. But that is not all. In the market, there must be producers and consumers. In any case, consumers are the households who are the final users of these products. The relationship between these two players creates the perfection of the market.

All markets are structured in a specific way, with laws and policies that guide firms' operations with the system. The best way to define market structure is, it's the organizational and other characteristics of a market. There are different features that make markets unique of similar, mostly depending on the goods and services linked to that market. When a company wants to enter or exit a market, they have to follow a specific set of guiding rules that tell them what to do. Companies don't just operate as they want in any market. For instance, when it comes to setting prices, come markets are defined as price givers, and others as price takers. It is all about the organizational features of those markets.

Consider financial markets, for instance. It is the Central Banks that determine how much money a bank can hold at any given time, and they also determine the interest rates to be charged on borrowed money. In this case, Central Banks become the regulatory body that sets the standards for operating in financial markets. When the economy is booming, they raise interest rates to discourage excessive borrowing and shield banks from the aftermath. And when the economy is low, interest rates are reduced to encourage borrowing.

There is only an example of what market structure is, and an idea of what happens within them. There are many other characteristics that make up proper market structures. But the main ones concern features that affect the nature of competition and pricing. Many people put too much emphasis simply on the market share of the existing firms in an industry – which is also a good approach to market structure, but there is a lot more than needs to be carefully considered.

Traditionally, important features of a market structure include:

- The number of companies. As stated above, we are looking at market structure in terms of competition and pricing. In this case, a complete market is expected to carry a specific number of firms, including the scale and extent of foreign competition. As more companies join a market, the competition level increases, making it even easier to describe the market. But this also means increased competition, which affects even the pricing models.

- The markets share of the largest companies. In a perfect market, each firm operates on the same level, and there is no big or small. But such markets are only theoretical. Imperfect competition is major in many economies, especially developed ones. Hence, market structures are defined by these firms' market capitalization, who are also the main decision-makers. This is measured mainly by the concentration ratio – that is, how popular the firms' products are with different consumers.

- The nature of costs. The cost of production is among the main determining factors for pricing, and essentially the company's growth. In this case, the costs include the potential for firms to exploit economies of scale and also the presence of sunk costs that affect the contestability of markets in the long run.

- The extent to which the industry is integrated vertically. Vertical integration is the main feature for explaining the process by which different stages in production and distribution of a product are under ownership and control of one enterprise. One example of such integration is the oil markets in which large firms own the rights to extract from oil fields. They also run a fleet of tankers, operate refineries, and control the sales at their own filling stations. In such a case, it is very hard for new firms to join the industry since a few have already taken control of everything.

- Product differentiation degree. Even though some firms may be producing the same products, they come with different degrees of difference, which affect cross-price elasticity of demand. For instance, some manufactures may be making low-quality products, whereas others only make the highest quality.

- The structure of buyers in a market. It most industries, buyers are structured in different forms. For instance, a buyer will make more informed decisions if they have all the information they need about the manufacturer and the general industry. This is where the aspect of the brand loyalty comes in.

- The turnover buyers. This feature is also called 'market churn,' and it means how many product users are ready to switch their supplier over a specific period where there is a change in the market conditions. The degree of customer turnover is determined by the extent of consumer or brand loyalty. It is also impacted by the influence of persuasive advertising and the market. Many loyal customers will find it very hard to change unless the firm stops advertising, and the competition becomes very aggressive in this.

The type of competition in them defines market structures. And there are four main characteristics that determine these structures. They include:

A perfect competition market is one that has many firms selling homogenous products. The firms are price takers since price competition does not exist. There is no big or small company, and there is not a better or worse product. All consumers have perfect information about the products, and they will buy with a proper understanding of what they need.

Also, firms gain supernormal short-run profit but not supernormal long-run profit. All conditions are favorable for the joining and exit of other firms. In perfect competition, firms do not set prices since they don't have much control over this and their customers' consumption needs.

The best thing about the type of markets is that firms don't have to worry about too much marketing. Consumers already know the products, and the market is open for anyone who wishes to join. There are no barriers to entry. Most importantly, such industries are defined by high-economic output.

Perfect competition is, however, only in the books. We live in a world of imperfect information, which creates imperfect competition. Firms with access to more information are less willing to share, applying it only to the advantage.

We Will Write an Essay for You Quickly

This is another feature of market structure that defines an industry with few dominant firms. The products are differentiated, and there are many barriers to entry. Firms are established to gain supernormal short-term and long-run profits.

The firms are price makers, though they feature independent behavior. Non-price competition is very crucial in these markets, and the economic value is low allocative. These markets are the most common in modern economies.

A monopoly, as the name suggests, is a market that has one firm with pure monopoly. An effective duopoly is also common in many cases. Product type is limited since there is only one firm producing and supply the goods. Supernormal short-run and long-run profits are very high.

The firms are price makers, though the demand curve and possible regulations constrain them. There is a non-price competition, though not as important as in oligopoly markets.

These are markets that also have many firms. The products are differentiated, and there are low entry and exit barriers. They gain any profit possible in terms of supernormal short-run and long-run profits. The pricing power fall with the firms, who are the price maker – though the real power and potential competition limit pricing power. Non-pricing competition is very important in these markets.

In economics, markets are categorized based on the structure of the industry serving the market. On the other hand, the industry structure is categorized based on market variables that, many believed, determine how far the characteristics of competition go.

The four market structures explained above from an abstract (generic) in the characterization of a type of I real industry. Market structure affects the outcomes of that market due to its impact on the motivations, opportunities, and economic actors' decisions taking part in the market. Economic market structure analysis aims at setting apart these effects as they try to explain and predict market outcomes.

Looking for a Skilled Essay Writer?

- University of Nottigharm Bachelor of Applied Science

No reviews yet, be the first to write your comment

Write your review

Thanks for review.

It will be published after moderation

Latest News

What happens in the brain when learning?

10 min read

20 Jan, 2024

How Relativism Promotes Pluralism and Tolerance

Everything you need to know about short-term memory

Home — Essay Samples — Business — Amazon — Market Structure Analysis – Amazon

Market Structure Analysis – Amazon

- Categories: Amazon

About this sample

Words: 382 |

Published: Jan 29, 2024

Words: 382 | Page: 1 | 2 min read

Table of contents

Overview of amazon's market structure, dominance of amazon in the e-commerce market, oligopolistic aspects of amazon's market structure, analysis of amazon's pricing strategy, antitrust and regulatory concerns.

- References> Evans, D. S. (2018). The antitrust economics of two-sided markets. Competition Policy International. Khan, L., & Vahe, R. (2016). Market power and inequality: The antitrust counterrevolution and its discontents. Harvard Law Review. Picker, R. (2017). Antitrust, competition policy, and inequality. The Antitrust Bulletin. Stucke, M. E., & Grunes, A. P. (2016). Big data and competition policy. Oxford University Press.

References> Evans, D. S. (2018). The antitrust economics of two-sided markets. Competition Policy International. Khan, L., & Vahe, R. (2016). Market power and inequality: The antitrust counterrevolution and its discontents. Harvard Law Review. Picker, R. (2017). Antitrust, competition policy, and inequality. The Antitrust Bulletin. Stucke, M. E., & Grunes, A. P. (2016). Big data and competition policy. Oxford University Press.

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Dr. Karlyna PhD

Verified writer

- Expert in: Business

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

5 pages / 2452 words

2 pages / 878 words

4 pages / 1609 words

3 pages / 1757 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Amazon

Amazon, as a global e-commerce giant, has been the subject of scrutiny regarding its treatment of workers. The article "Unethical Working Conditions and Monitoring at Amazon" delves into the controversial labor practices and [...]

Amazon, the global retail and technology giant, has made significant impacts on the global market with its expansive operations and innovative business strategies. However, amidst its success, Amazon has faced scrutiny for its [...]

The Great Barrier Reef, located off the coast of Queensland, Australia, is the world's largest coral reef system. It is home to a vast array of marine life and plays a crucial role in the global ecosystem. However, in recent [...]

In the ever-evolving landscape of e-commerce, two giants stand out among the rest: Flipkart and Amazon. These two companies have revolutionized the way people shop online, offering a wide range of products and services at [...]

The Amazon Rainforest extends over South America from the Atlantic Ocean in the east to the Andes Mountains in the west. It is home to the myriad species of fauna and flora, containing 50 percent of the world's biodiversity. [...]

It is important to establish some causes, effects, and factors of online shopping scams through past researches and even first-hand experiences of the scammed buyers. Scammers use the latest technology to set up fake retailer [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Live revision! Join us for our free exam revision livestreams Watch now →

Reference Library

Collections

- See what's new

- All Resources

- Student Resources

- Assessment Resources

- Teaching Resources

- CPD Courses

- Livestreams

Study notes, videos, interactive activities and more!

Economics news, insights and enrichment

Currated collections of free resources

Browse resources by topic

- All Economics Resources

Resource Selections

Currated lists of resources

Economics Revision Essay Plans

Last updated 17 Dec 2019

- Share on Facebook

- Share on Twitter

- Share by Email

This series of resources provides revision essay plans for a wide variety of essay topics, including synoptic questions.

For the 2019 papers check out our collection of videos on building A* evaluation into your answers

Have you tried our series of more than 50 Quizlet revision activities? Click here to access!

Essay Plan: Limits on Monopoly Power

Topic Videos

Chains of Reasoning and Evaluation: Fuel Prices in the UK

Exam Support

EU Customs Union Membership (Revision Essay Plan)

Practice Exam Questions

Market for Electric Vehicles (Revision Essay Plan)