- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

The Missing Ingredient in Kraft Heinz’s Restructuring

- John P. Kotter

- Gaurav Gupta

As the company cut costs, its ability to innovate suffered.

There has been a company restructuring recipe that has worked for decades. Buy a company, trim the fat, then reinvest to facilitate growth, and make lots of money. But sometimes this recipe doesn’t work — and the story of Kraft Heinz is a prime example. Earlier this year, the company suffered a massive loss in less than 24 hours — $4.3 billion, to be precise. As Kraft Heinz focused on aggressive cost cutting, they significantly impaired their ability to innovate to keep up with the changing landscape. Leaders need to understand that the pace of change is accelerating everywhere, not just in packaged foods. Understanding how humans are biologically hardwired to respond to threats and opportunities can help leaders navigate these rapid shifts.

There has been a company restructuring recipe that has worked for decades. Buy a company, trim the fat, then reinvest to facilitate growth, and make lots of money. But sometimes this recipe doesn’t work — and the story of Kraft Heinz is a prime example. Earlier this year, the company suffered a massive loss in less than 24 hours — $4.3 billion , to be precise. And over a two-year period, the fiasco cost Berkshire Hathaway $20 billion, possibly its worst loss ever.

- JK John P. Kotter is a best-selling author, award-winning business and management thought leader, business entrepreneur, and the Konosuke Matsushita Professor of Leadership, Emeritus at Harvard Business School. His ideas, books, and company, Kotter , help people lead organizations in an era of increasingly rapid change. He is a coauthor of the book Change , which details how leaders can leverage challenges and opportunities to make sustainable workplace changes in a rapidly accelerating world.

- GG Gaurav Gupta is a Director at Kotter , and founder of Ka Partners, with global business experience translating strategy into successful implementation for clients in diverse industries. He is the co-author of the book Change , which details how leaders can leverage challenges and opportunities to make sustainable workplace changes in a rapidly accelerating world.

Partner Center

- Contributors

SEC Charges Kraft Heinz with Improper Expense Management Scheme

Cydney S. Posner is special counsel at Cooley LLP. This post is based on her Cooley memorandum.

On Friday, the SEC announced settled charges against Kraft Heinz Company, its Chief Operating Officer and Chief Procurement Officer for “engaging in a long-running expense management scheme that resulted in the restatement of several years of financial reporting.” According to the SEC’s Order regarding the company and the COO, as well as the SEC’s complaint against the CPO, the company employed a number of expense management strategies that “misrepresented the true nature of transactions,” including recognizing unearned discounts from suppliers, maintaining false and misleading supplier contracts and engaging in other accounting misconduct, all of which resulted in accounting errors and misstatements. The misconduct, the SEC contended, was designed to allow the company to report sham cost savings consistent with the operational efficiencies it had touted would result from the 2015 merger of Kraft and Heinz, as well as to inflate EBITDA—a critical earnings measure for the market—and to achieve certain performance targets. And, once again, charges of failure to design and implement effective internal controls played a prominent role. After the SEC began its investigation, KHC restated its financials, reversing “$208 million in improperly-recognized cost savings arising out of nearly 300 transactions.” According to Anita B. Bandy, Associate Director of Enforcement, “Kraft and its former executives are charged with engaging in improper expense management practices that spanned many years and involved numerous misleading transactions, millions in bogus cost savings, and a pervasive breakdown in accounting controls. The violations harmed investors who ultimately bore the costs and burdens of a restatement and delayed financial reporting….Kraft and its former executives are being held accountable for placing the pursuit of cost savings above compliance with the law.” KHC agreed to pay a civil penalty of $62 million. Interestingly, this case comes on the heels of an earnings management case brought by the SEC against Healthcare Services Group, Inc. for alleged failures to properly accrue and disclose litigation loss contingencies.

According to the Order, in connection with the 2015 merger between Kraft and Heinz, the combined company promoted its strategy to “eliminate redundancies and reduce operational costs,” including achieving cost savings throughout the company, but especially in the procurement division. The cost savings strategy “was widely covered by analysts at the time.” To incentivize employees to achieve this cost savings strategy, “the company set performance targets for procurement division employees tied to savings realized through negotiations with suppliers.” Notably, the performance criterion for the CPO with the heaviest weight was “based on the amount of year-over-year savings the procurement division obtained from its supplier contracts.” Similarly, bonus compensation for the COO was tied to success at generating operational cost savings, “which not only were a key factor in determining the company’s annual budget, but were also directly impacted by the year-over-year savings achieved by the procurement division.”

Initially, the company met its savings targets largely through synergies resulting from the merger, but by 2017, those synergies were fully “exhausted,” and the costs of many ingredients and packaging were actually rising. To continue to achieve incremental savings improvements, the procurement division, under the direction of the CPO and the oversight of the COO, “implemented overly ambitious annual budget and division-level savings targets, based on corporate KHC targets. They, in turn, pushed procurement division employees to come up with ideas to generate additional immediate, same-year, savings, and did not adjust the internal targets.”

And come up with ideas they did.

The procurement division’s alleged expense management misconduct involved 59 transactions over several years that were ultimately corrected in connection with the restatement:

- “‘Prebate Transactions’—KHC procurement division employees agreed to future-year commitments, like contract extensions and future-year volume purchases, in exchange for savings discounts and credits by suppliers (‘Prebates’), but mischaracterized the savings in contract documentation, which stated that they were for past or same-year purchases made by KHC (‘Rebates’);

- “‘Clawback Transactions’—KHC procurement division employees agreed to take upfront payments subject to repayment through future price increases or volume commitments, but documented the transaction in ways which obscured the repayment obligation; and

- “‘Price Phasing Transactions’—Suppliers agreed to reduce their prices during a certain period in exchange for an offsetting price increase in a future period, but the full nature of the arrangement was not communicated by KHC procurement division employees to KHC controller group employees.”

Under GAAP, the Order charges, the company should have recognized the savings that were in exchange for future commitments over the period of time that the company performed the commitments. That is, “if the upfront cash and discounts are tied to future commitments, then the expense savings must be recognized over the period the future obligations are satisfied.” As a result, the savings from prebates given for a contract extension or future volume commitment “should have been recognized over the life of the extension or the future period in which KHC purchased the goods from the supplier. Conversely, rebate savings from past or same-year commitments should have been recognized ratably over the period in which they were earned. Finally, clawback transactions should have been recognized ratably over the clawback period—when it was reasonably estimable that KHC would satisfy its repayment obligation.”

The Order provides numerous alleged instances of these types of misconduct, including some that predated the merger. For example, when the procurement division of Heinz faced a $10 million gap on its cost savings goal, creating pressure to find ways to close the gap, the CPO, who worked at Heinz at the time, was alleged to have improperly recognized additional cost savings from a previously negotiated agreement. The prior agreement called for a $3.5 million prebate in exchange for the parties’ signing a new three-year contract in 2015. Following the merger, the company renegotiated that provision to state that the payment was a “non-refundable” payment for 2015 purchases, mischaracterizing “the true nature of the supplier payment,” which “remained linked to a three-year contract.” However, the company recognized the cost savings in 2015, which the SEC alleges was improper. The COO received monthly performance reports of these negotiations, and various “planning documents” presented by the CPO to the COO “acknowledged that Heinz was in the process of negotiating a new supplier contract for the purpose of generating ‘improved, backdated impact for CY15’ in the form of a ‘rebate’”; without these changes, “the company could ‘book only 1/3 of benefit’ in 2015.” They just needed to get the “wording” right.

In addition, the Order alleges that the CPO and COO restructured a $2 million retention bonus that the supplier had awarded to legacy Kraft before the merger into a “supposed purchase volume rebate,” which “enabled KHC to improperly recognize the full $2 million in 2015.” The SEC charged that, as a result of these rebate transactions, as well as an alleged history of unsuccessful efforts by procurement employees to mischaracterize transactions, the COO and CPO should have been on notice of “the appropriate accounting treatment for these types of transactions, that procurement division employees misrepresented the true economic nature of rebate transactions, and the importance placed on not linking payments from suppliers to future contract obligations in order to achieve premature costs savings.”

Beginning in 2017, as a result of inflation, unfavorable foreign exchange rates and other factors, the SEC alleged, the company’s ability to achieve incremental costs savings ran into more “headwinds.” Nevertheless, the COO “failed to adjust expense reduction expectations for the procurement division, creating a high-pressure environment focused on obtaining same-year cost savings.” In 2017 and 2018, the SEC alleged, this pressure, at least in part, led members of the procurement division to manipulate 54 supplier transactions “to improperly obtain premature recognition of cost savings.” Based on past experience, the SEC charged, the COO and CPO should have known of the possibility that contracts submitted by procurement employees “did not reflect the true nature of the underlying agreements and would result in improper accounting treatment.”

For example, in 2017, the Order charged, one agreement with a sugar supplier provided for a $2 million prebate to KHC “in exchange for a three-year contract extension and future sugar purchases. In addition, the agreement called for KHC to return the $2 million back to the supplier, in the form of paying higher prices for sugar over the three-year period. Thus, the agreement did not produce any actual cost savings.” Although the CPO and COO should have recognized the “the true structure of the transaction,” the SEC charged, the company recognized the full cost savings in August 2017. What’s more, the COO, a member of the company’s disclosure committee, “affirmed the accuracy and completeness of KHC’s quarterly filings spanning the recognition of this transaction.” Accordingly, the SEC charged, he “failed to implement the internal accounting control of disclosure committee review of SEC filings.”

In 2018, the SEC alleged, the sugar supply agreement was extended, giving the company an immediate sugar price reduction, with inflated prices resuming later in the year and continuing over an extended time period. However, the company immediately recognized new cost savings of $500,000.

Through 2017 and 2018, the company continued to enter into other agreements with suppliers providing for “upfront payments that were recognized prematurely, even though they were tied to future commitments and allowed the suppliers to ‘clawback’ an agreed-upon percentage of the upfront prebate.” In addition, the CPO was alleged to have “approved ‘price phasing’ transactions, which created the illusion of immediate cost savings through price decreases from suppliers, but, in reality, were structured to include an offsetting price increase later in time. These ‘price phasing’ transactions violated GAAP because they purported to generate cost savings that did not exist.”

During these periods, the COO “failed to review the quarterly and annual SEC filings provided to him as part of his disclosure committee responsibilities, yet he still certified that he was unaware of inaccuracies or omissions in those filings,” and both the COO and CPO signed sub-certifications as to the accuracy and completeness of the financial statements.

Throughout the period, the SEC charged, the company did not design or maintain effective controls for the procurement division. Notably, the SEC charged, the controller group, under pressure and without adequate documentation, allowed the company “to recognize fully in 2017 a rebate that it had previously determined correctly to spread over a future-year period.” Similarly, finance personnel in gatekeeping roles were alleged to have overlooked indications of improper accounting—including acknowledged efforts “to ‘jam [a] rebate in to help [KHC’s] results in 2017’”—without reporting the conduct to legal or compliance. The procurement legal staff was also under-staffed and under-resourced and subject to internal performance metrics and compensation tied to assisting the procurement division’s efforts to reduce costs. The SEC charged that the COO “should have known that, in not properly addressing several indicia that supplier contracts were being used to manage expenses, he caused KHC’s internal accounting controls failures.”

Similarly, the complaint against the CPO also alleged that “[d]espite numerous warning signs that should have alerted [the CPO] that KHC procurement division employees were circumventing KHC’s internal controls in order to achieve artificial cost savings targets in supplier contracts, [the CPO] negligently approved and failed to prevent supplier contracts that masked the true nature of the transactions. [The CPO] also should have known that the false and misleading contract documentation that he negligently approved and failed to prevent was provided to KHC’s finance and controller groups responsible for preparing KHC’s financial statements…, thus causing KHC to prematurely recognize cost savings in its financial statements.”

The Order found that Kraft violated the negligence-based anti-fraud provisions of the Securities Act (Sections 17(a)(2) and (3) in connection with the issuance of debt securities and employee securities), the periodic and current reporting requirements of the Exchange Act (Section 13(a)), and the books and records and internal accounting controls provisions of the Exchange Act (Sections 13(b)(2)(A) and (B)). KHC agreed to pay a civil penalty of $62 million. The Order also found that the COO violated the negligence-based anti-fraud, books and records, and internal accounting controls provisions of the federal securities laws and, additionally, failed to provide KHC’s accountants with accurate information and caused KHC’s reporting, books and records, and internal accounting controls violations (Section 13(b)(5) of the Exchange Act, Rule 13b2-1 and Rule 13b2-2(a)). He agreed to pay disgorgement and prejudgment interest of just over $14,000, and a civil penalty of $300,000. The SEC’s complaint against the CPO alleged that he violated the negligence-based anti-fraud provisions, failed to provide accurate information to accountants, and violated the books and records and internal accounting controls provisions of the federal securities laws. Under the settlement with the CPO, which is subject to court approval, he agreed to pay a civil penalty of $100,000, and will be barred from serving as an officer or director of a public company for five years.

Supported By:

Subscribe or Follow

Program on corporate governance advisory board.

- William Ackman

- Peter Atkins

- Kerry E. Berchem

- Richard Brand

- Daniel Burch

- Arthur B. Crozier

- Renata J. Ferrari

- John Finley

- Carolyn Frantz

- Andrew Freedman

- Byron Georgiou

- Joseph Hall

- Jason M. Halper

- David Millstone

- Theodore Mirvis

- Maria Moats

- Erika Moore

- Morton Pierce

- Philip Richter

- Marc Trevino

- Steven J. Williams

- Daniel Wolf

HLS Faculty & Senior Fellows

- Lucian Bebchuk

- Robert Clark

- John Coates

- Stephen M. Davis

- Allen Ferrell

- Jesse Fried

- Oliver Hart

- Howell Jackson

- Kobi Kastiel

- Reinier Kraakman

- Mark Ramseyer

- Robert Sitkoff

- Holger Spamann

- Leo E. Strine, Jr.

- Guhan Subramanian

- Roberto Tallarita

Company Filings | More Search Options

Company Filings More Search Options -->

- Commissioners

- Reports and Publications

- Securities Laws

- Commission Votes

- Corporation Finance

- Enforcement

- Investment Management

- Economic and Risk Analysis

- Trading and Markets

- Office of Administrative Law Judges

- Examinations

- Litigation Releases

- Administrative Proceedings

- Opinions and Adjudicatory Orders

- Accounting and Auditing

- Trading Suspensions

- How Investigations Work

- Receiverships

- Information for Harmed Investors

- Rulemaking Activity

- Proposed Rules

- Final Rules

- Interim Final Temporary Rules

- Other Orders and Notices

- Self-Regulatory Organizations

- Staff Interpretations

- Investor Education

- Small Business Capital Raising

- EDGAR – Search & Access

- EDGAR – Information for Filers

- Company Filing Search

- How to Search EDGAR

- About EDGAR

- Press Releases

- Speeches and Statements

- Securities Topics

- Upcoming Events

- Media Gallery

- Divisions & Offices

- Public Statements

Press Release

Sec charges the kraft heinz company and two former executives for engaging in years-long accounting scheme, company will pay $62 million to settle charges related to inflated cost savings that caused it to restate several years of financial reporting.

FOR IMMEDIATE RELEASE 2021-174

Washington D.C., Sept. 3, 2021 —

The Securities and Exchange Commission today charged The Kraft Heinz Company with engaging in a long-running expense management scheme that resulted in the restatement of several years of financial reporting. The SEC also charged Kraft's former Chief Operating Officer Eduardo Pelleissone and its former Chief Procurement Officer Klaus Hofmann for their misconduct related to the scheme.

According to the SEC's order, from the last quarter of 2015 to the end of 2018, Kraft engaged in various types of accounting misconduct, including recognizing unearned discounts from suppliers and maintaining false and misleading supplier contracts, which improperly reduced the company's cost of goods sold and allegedly achieved "cost savings." Kraft, in turn, touted these purported savings to the market, which were widely covered by financial analysts. The accounting improprieties resulted in Kraft reporting inflated adjusted "EBITDA," a key earnings performance metric for investors. In June 2019, after the SEC investigation commenced, Kraft restated its financials, correcting a total of $208 million in improperly-recognized cost savings arising out of nearly 300 transactions.

"Investors rely on public companies to be 100% truthful and accurate in their public statements, especially when it comes to their financials. When they fall short in this regard, we will hold them accountable," said Gurbir S. Grewal, Director of the SEC's Division of Enforcement. "Today's action demonstrates that no matter how complex and far-reaching the financial misconduct, we will vigorously pursue wrongdoers because that’s what investor protection requires."

As alleged in the SEC's order and in its complaint against Hofmann, Kraft failed to design and maintain effective internal accounting controls for its procurement division. As a result, finance and gatekeeping personnel repeatedly overlooked indications that expenses were being improperly accounted for. In addition, Pelleissone was presented with numerous warning signs that expenses were being managed through manipulated agreements with Kraft's suppliers, but rather than addressing these risks, he pressured the procurement division to deliver unrealistic savings targets. Hofmann approved several improper supplier contracts used to further the misconduct despite numerous warning signs that procurement division employees were circumventing internal controls, and certified the accuracy and completeness of the procurement division's financial statements when the misconduct was occurring. As a member of Kraft's disclosure committee, Pelleissone then improperly approved the company's financial statements.

"Kraft and its former executives are charged with engaging in improper expense management practices that spanned many years and involved numerous misleading transactions, millions in bogus cost savings, and a pervasive breakdown in accounting controls. The violations harmed investors who ultimately bore the costs and burdens of a restatement and delayed financial reporting," said Anita B. Bandy, Associate Director of the SEC's Division of Enforcement. "Kraft and its former executives are being held accountable for placing the pursuit of cost savings above compliance with the law."

The SEC's order finds that Kraft violated the negligence-based anti-fraud, reporting, books and records, and internal accounting controls provisions of the federal securities laws. The order also finds that Pelleissone violated the negligence-based anti-fraud, books and records, and internal accounting controls provisions of the federal securities laws and additionally, failed to provide Kraft's accountants with accurate information and caused Kraft's reporting, books and records, and internal accounting controls violations. The SEC's complaint against Hofmann alleges that he violated the negligence-based anti-fraud provisions, failed to provide accurate information to accountants, and violated the books and records and internal accounting controls provisions of the federal securities laws.

Without admitting or denying the SEC's findings as to them, Kraft consented to cease and desist from future violations and pay a civil penalty of $62 million, whereas Pelleissone consented to cease and desist from future violations, pay disgorgement and prejudgment interest of $14,211.31, and pay a civil penalty of $300,000. And without admitting or denying the SEC's allegations, Hofmann consented to a final judgment permanently enjoining him from future violations, ordering him to pay a civil penalty of $100,000, and barring him from serving as an officer or director of a public company for five years. The settlement with Hofmann is subject to court approval.

The SEC's investigation was conducted by Seth M. Nadler, Thomas B. Rogers, James Connor, Gary Peters, with assistance from Sarah Concannon and Thomas Bednar, and was supervised by Greg Faragasso and Ms. Bandy.

Related Materials

- SEC Complaint

8720 Red Oak Blvd., Suite 201

Charlotte, nc 28217, (704) 676-1190, [email protected].

Copyright MHI © 2023 | All Rights Reserved

Food & Beverage

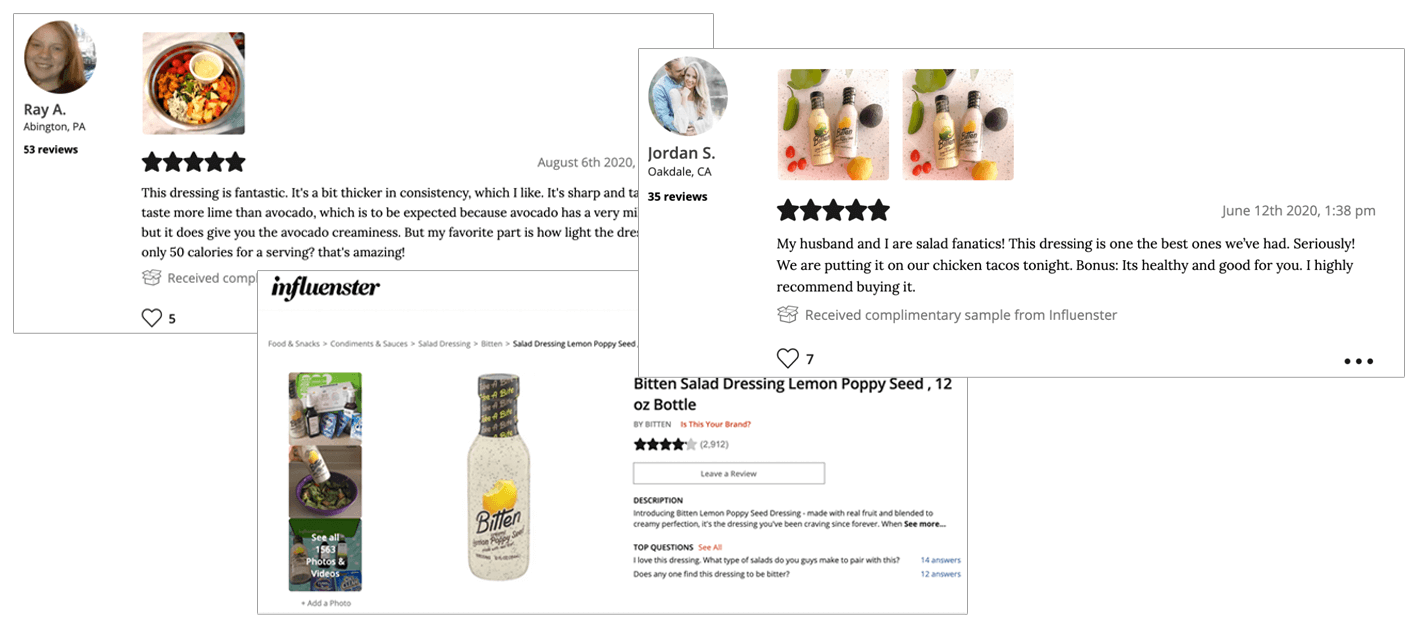

Kraft Heinz earns 39 million impressions from the Influenster community

The global food company fuels product launch success by getting new Kraft Dressings Vinaigrettes, Twisted Ranch, and Bitten dressings into the hands of hyper-targeted consumers and empowering them to generate high-quality UGC and social advocacy.

At a Glance

Launch eight new products and lock in immediate sales success.

Activate key consumers with sampling campaigns to generate reviews, visual content, and social buzz by tapping into Bazaarvoice’s Influenster community.

20,000 new reviews and 39 million impressions from 369,000 social posts, shares, likes, and comments from consumers.

Impressions

The three sampling campaigns resulted in 39 million impressions from 369,000 social posts, shares, likes, and comments from consumers.

Kraft Heinz brands drives targeted trial and awareness for new products leveraging Bazaarvoice’s Influenster community

Grocery shoppers are always hungry for new flavors from familiar food brands, which is why Kraft Heinz regularly launches new products. When the global company recently created eight new flavors of salad dressings, it knew getting customers talking about the dressings would be critical to launch success.

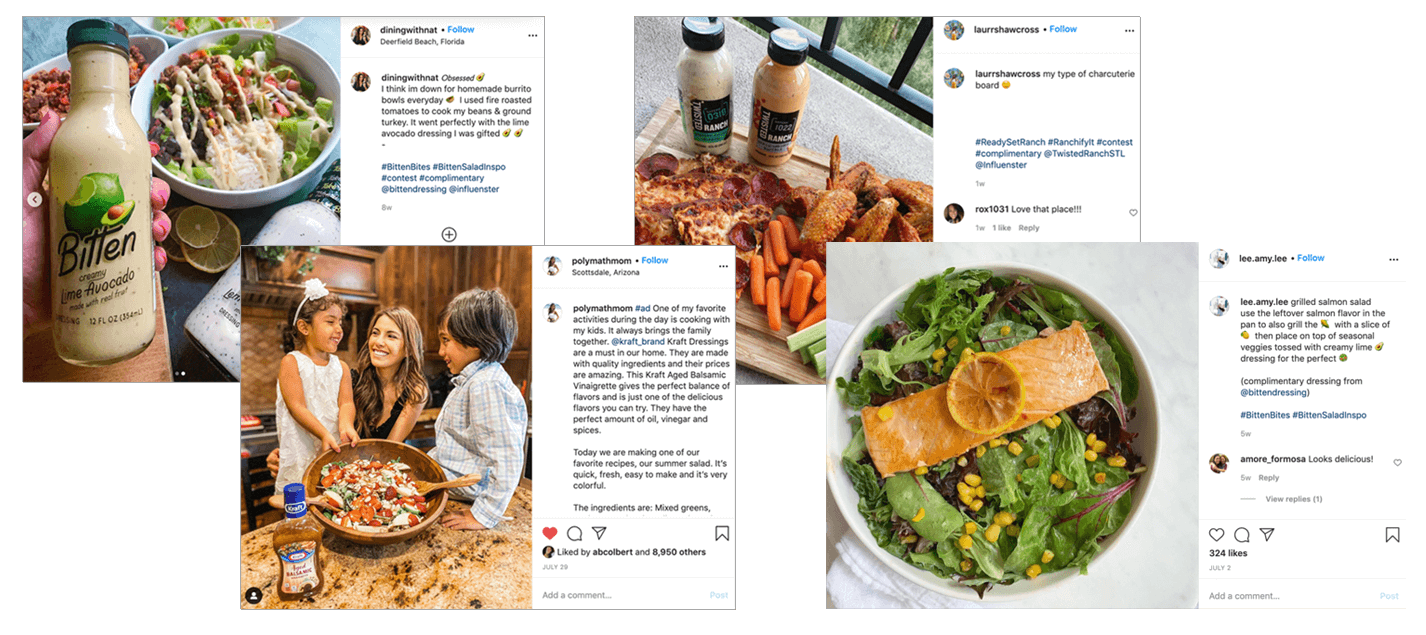

Kraft Dressings Vinaigrettes, Twisted Ranch, and Bitten sent samples to a select group of ideal consumers in Bazaarvoice’s Influenster community of 6 million+ members and encouraged them to share their experiences with a broad audience through reviews and social posts. This let the brands collect authentic content and generate social advocacy that sparked trial and increased awareness.

The three sampling campaigns exceeded the company’s goals and expectations, resulting in 98,000 pieces of user-generated content (UGC) on the Influenster site, 20,000 reviews, and 39 million impressions from 369,000 social posts, shares, likes, and comments from consumers.

“The campaigns for Kraft Dressings Vinaigrettes, Twisted Ranch and Bitten over-delivered on our targets for the program, delivering 2x the product reviews we expected, and the earned media was over 5x our program investment,” said Elizabeth Northrup, Associate Brand Manager for the three brands.

Spicing up meals with VoxBox sampling

Bazaarvoice curated and sent exclusive, branded sampling assortment packages (Custom VoxBoxes) to 13,500 consumers within Bazaarvoice’s Influenster community. These engaged, everyday consumers actively participate in product discussions and create content about the products they discover.

Bazaarvoice developed three segments of members based on thousands of data points, including demographics, psychographics, shopping preferences and behaviors, and social activity.

“The ability to hyper-target consumers based on behaviors and other characteristics beyond typical demographics was a key benefit in choosing Influenster,” said Northrup. “It ensured we didn’t just send products to a large group of people and instead to consumers who are interested in getting to know and love the brand long-term.”

Custom VoxBoxes with four new flavors of the brand’s Kraft Vinaigrettes line (Raspberry, Lemon Herb, and Balsamic) went to 6,500 consumers between the ages of 18-35 who use vinaigrette salad dressings and have previously tried other brands. Meanwhile, 3,500 members between the ages of 18-45 who enjoy creamy dressings and consider themselves somewhat healthy received two new flavors of the brand’s Bitten line (Creamy Lime Avocado and Lemon Poppy Seed). Finally, 3,500 members between the ages of 18-44 who frequently buy ranch dressing received two new flavors of the brand’s Twisted Ranch line (Garlic Smashed Buffalo and Cheddar Popped Jalapeno).

Savoring actionable, impactful insights

Matching the right products with the right consumers means the brand is collecting high quality social content, reviews, and photos that satiates the appetite of other shoppers on Influenster, Kraft Heinz’s My Food and Family Recipes site, retail sites, and across social media platforms.

“The quality of UGC from Influenster members was one of the biggest advantages,” said Northrup. “They were especially creative with their photos and gave us and other consumers a new way to see how the products can be used.”

UGC is also a scalable way for the brands to listen to consumers in real-time and glean insights straight from the most important source.

“Hearing directly from consumers about their experiences is a powerful way for us to identify specific attributes that people enjoy about our products and to make changes and improvements based on their feedback.”

Earning a spot at the table

Activating key consumers at-scale to create thousands of ratings, reviews, and visual content is the secret ingredient to any successful product launch. Getting new dressings into the hands of targeted consumers allowed the brands to leverage advocates early in the launch process to help introduce the products to a broader audience and compel other shoppers to try the new flavors.

“The VoxBox is a nice compliment to other marketing initiatives like media and in-store programs and is helpful for building trust and credibility over e-commerce where many consumers search for product reviews before trying something new. It has helped achieve our brand goals of driving trial with thousands of reviews and awareness with millions of impressions,” said Northrup. “We would definitely work with Influenster for sampling programs to support launches in the future.”

Request a demo

About the company

We are driving transformation at The Kraft Heinz Company (Nasdaq: KHC), inspired by our Purpose, Let’s Make Life Delicious. Consumers are at the center of everything we do. With 2019 net sales of approximately $25 billion, we are committed to growing our iconic and emerging food and beverage brands on a global scale. We leverage our scale and agility to unleash the full power of Kraft Heinz across a portfolio of six consumer-driven product platforms. As global citizens, we’re dedicated to making a sustainable, ethical impact while helping feed the world in healthy, responsible ways. Learn more about our journey by visiting www.kraftheinzcompany.com or following us on LinkedIn and Twitter.

Visit website

The campaigns for Kraft Dressings Vinaigrettes, Twisted Ranch and Bitten over-delivered on our targets for the program, delivering 2x the product reviews we expected, and the earned media was over 5x our program investment.

Elizabeth Northrup

Associate Brand Manager

More in this industry

Hardys gathers over 1,700 reviews with in-store customer activation

The UK’s number one wine brand drove a significant volume of reviews and an increase in ratings by adopting an alternative review collection strategy.

T2 sees a 75% conversion increase from user-generated content

T2 brews up a user-generated content strategy to boost review volume and drive international online success.

Nestlé Canada improves products with Questions & Answers

UGC plays a critical role in Nestlé Canada’s relentless effort to serve customers and deliver continued growth.

Become a success story.

Let Bazaarvoice help you command your goals and catapult your business.

Want to answer questions at retailer websites?

Respond to consumer questions in real-time.

Looking to sample and review products?

Receive products from your favorite brands in exchange for honest reviews.

Get started

Tell us a little about yourself, and our sales team will be in touch shortly.

Thank you for your interest in Bazaarvoice. A member of our team will be in touch shortly to talk about how Bazaarvoice can help you reach your business goals.

- Utility Menu

logo-03.png

- Analysis of Heinz Company’s Acquisition of Kraft Foods Group Inc.

Publisher's Version

Recent Publications

- Contextual Limitations of Goal-Setting Theory

- VALUATION OF THREE MAJOR OIL COMPANIES: EXXONMOBIL, ROYAL DUTCH SHELL, AND CHEVRON

- FLAT CORPORATIONS: FEASIBILITY OF SELF-MANAGED WORKPLACES

- Viral Investments Linked to Social Media Analysis of Viral Investments Among Inexperienced Investors

- The Fear Factor: Understanding Fear in the Workplace

- Harvard Business School →

- Faculty & Research →

- April 2019 (Revised October 2020)

- HBS Case Collection

Kraft Heinz: The $8 Billion Brand Write-Down

- Format: Print

- | Language: English

- | Pages: 30

About The Author

Jill J. Avery

Related work.

- Faculty Research

- Kraft Heinz: The $8 Billion Brand Write-Down By: Jill Avery

The Kraft Heinz Company migrated its SAP® Business Warehouse application to the SAP HANA® platform—shortening its nightly reporting batches substantially even as data volumes explode.

With challenging system performance due to growing data volumes, how could The Kraft Heinz Company deliver more detailed reports without affecting the performance of its critical SAP business systems?

The Kraft Heinz Company migrated its SAP Business Warehouse application to the SAP HANA platform—shortening its nightly reporting batches substantially even as data volumes explode.

For enterprises in the fast-moving consumer goods (FMCG) industry, lean operations have never been more crucial for success. As an uncertain global economy continues to exert downward pressure on consumer spending at the checkout, businesses must constantly identify and implement operational efficiencies to protect their margins. The Kraft Heinz Company, one of the world’s leading manufacturers of food and beverage products, aimed to tackle this challenge head-on by streamlining the supply chain that supports its brands in North America. This wide-ranging program would enable the digital transformation of many business processes, integrating data flows across the enterprise for greater efficiency and advanced analytics. Rowie Torres, Head – Global SAP Center of Excellence at The Kraft Heinz Company, explains: “Managing a supply chain as large as Kraft’s is a complex process that demands accurate, timely data on sales forecasts, manufacturing plans, logistics and more. Collating data from multiple sources is vital, as it enables us to manufacture the optimal quantities of each of our products, and deliver them to retailers at the best time to capitalize on consumer demand. “In recent years, the volume of supply-chain data we collect has grown rapidly. We knew that incorporating this additional data into our reporting process would enable our decision-makers to drill down and uncover valuable opportunities to improve efficiency, but building fine-grained reports posed tough technical challenges.” Like many leading enterprises in the FMCG space, The Kraft Heinz Company relies on a suite of integrated SAP applications to drive its business processes from end to end. Rowie Torres continues: “For many years, we have used SAP Business Warehouse software to support our business analytics processes. However, growing data volumes and demand for analytics meant that our nightly batch processes were almost exceeding the strict 12-hour window. Moreover, the complexity of our data model meant that building new reports was a time-consuming process that could take up to six months to complete. To offer more frequent and more granular reports to the business, we looked for a way to boost the performance of our SAP Business Warehouse platform.”

After a thorough review of its existing analytics landscape, The Kraft Heinz Company determined that migrating its SAP Business Warehouse application to the SAP HANA database would deliver the in-memory performance boost it needed to satisfy business demand for rapid, in-depth reporting. “We use SAP solutions to support the majority of our business processes, and we realized that adopting SAP HANA as our analytics platform would enable us to obtain even greater value from our SAP investments,” explains Rowie Torres. “As well as offering tight integration with the SAP ERP (link resides outside of ibm.com) applications we have used to drive our day-to-day business operations for more than 12 years, SAP HANA supports a range of new solutions that align with our long-term strategic objectives. For that reason, we aimed to use SAP HANA to integrate our manufacturing processes with near-real-time forecasting data.” To realize the value as quickly as possible, and to reduce its risk exposure throughout the migration process, The Kraft Heinz Company searched for an experienced partner to drive the project. After a rigorous vendor-selection process, the company engaged an expert team of consultants from IBM Services . “One of the main reasons we chose the IBM Services team was their proven record of successful SAP HANA deployments at other large enterprises,” recalls Rowie Torres. “Another important factor was the IBM team’s deep familiarity with the analytics platform at The Kraft Heinz Company. IBM has been a valued partner since The Kraft Heinz Company first deployed SAP solutions, and the IBM team’s knowledge of our SAP Business Warehouse environment is second to none. And because of the close strategic relationship between IBM and SAP, we felt IBM was the ideal choice to deliver our new SAP HANA database rapidly.” As a first step, The Kraft Heinz Company worked with IBM Services to cleanse its existing analytics databases. This work helped shrink the databases from a total of 18 TB to just 9 TB—a reduction of 50 percent that helped pave the way for a seamless migration to the new analytics platform. Next, the company worked with consultants from IBM and SAP to migrate its SAP Business Warehouse reports to the new SAP HANA platform for data warehousing and analytics. Following its proven, best-practice methodology, IBM Services provisioned development, quality-assurance, regression and production environments for the SAP HANA platform. Utilizing its deep expertise of The Kraft Heinz Company’s SAP Business Warehouse environment, IBM helped The Kraft Heinz Company to re-architect reports for all new projects—including the supply-chain transformation—to the SAP Business Warehouse LSA++ model. The aim was to offer the benefits of the in-memory analytics platform to the largest possible number of business users in the shortest possible time, and IBM Services mobilized resources from across IBM to achieve the goal within a tight timeframe. “Working with IBM on our SAP HANA migration was a very positive experience,” says Rowie Torres. “IBM brought together all of the resources we needed to keep the project running smoothly, and the team reacted quickly to solve issues whenever they arose—this strong leadership from the IBM team became all the more important as we neared our go-live date. In fact, IBM helped us to complete our migration in just eight months—a very short timeline for a project of this size.”

With SAP HANA at the heart of its analytics processes, The Kraft Heinz Company is well positioned to deliver fine-grained reports to its decision-makers—empowering them to identify and implement new efficiencies in the supply chain and beyond. “In the past, our analytics platform was stretched to the limit, and it simply wasn’t feasible to add additional dimensions to our reports—but today, that’s all changed,” says Rowie Torres. “The SAP HANA platform delivered by IBM Services is a key component of our digital transformation initiative. For example, we have shortened our nightly reporting batches substantially. This offers us the all-important headroom we need to accommodate ever-growing volumes of data into our reports. “Better still, the flexibility of the SAP HANA platform makes it far easier to make changes to our data model, which means that we can roll out new reports to the business in weeks, not months.” Rowie Torres concludes: “SAP HANA is The Kraft Heinz Company’s answer to the challenges of today’s data-driven consumer products marketplace, and we see SAP as our long-term strategic platform. By continuing our close collaboration with IBM and SAP, we are confident that we can find new ways to streamline our operations and control our costs as part of our strategic digital transformation.”

The Kraft Heinz Company is the third-largest food and beverage company in North America, and the fifth-largest food and beverage company in the world. With operations in more than 45 countries and eight billion-dollar brands, the company generated revenues of USD 29.1 billion in 2014.

To learn more about solutions from IBM and SAP, please contact your IBM representative or IBM Business Partner, or visit the following website: ibm.com/consulting/sap

© Copyright IBM Corporation 2016. IBM Deutschland GmbH D-71137 Ehningen ibm.com/consulting/sap

Produced in Germany. February 2016.

IBM, the IBM logo, and ibm.com are trademarks of International Business Machines Corp., registered in many jurisdictions worldwide. Other product and service names might be trademarks of IBM or other companies. A current list of IBM trademarks is available on the web at “Copyright and trademark information” at ibm.com/legal/copyright-trademark .

Other company, product or service names may be trademarks, or service marks of others. This document is current as of the initial date of publication and may be changed by IBM at any time. Not all offerings are available in every country in which IBM operates.

This case study illustrates how one IBM customer uses IBM and/or IBM Business Partner technologies/services. Many factors have contributed to the results and benefits described. IBM does not guarantee comparable results. All information contained herein was provided by the featured customer and/or IBM Business Partner. IBM does not attest to its accuracy. All customer examples cited represent how some customers have used IBM products and the results they may have achieved. Actual environmental costs and performance characteristics will vary depending on individual customer configurations and conditions. This publication is for general guidance only. Photographs may show design models.

THE INFORMATION IN THIS DOCUMENT IS PROVIDED “AS IS” WITHOUT ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING WITHOUT ANY WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND ANY WARRANTY OR CONDITION OF NON-INFRINGEMENT. IBM products are warranted according to the terms and conditions of the agreements under which they are provided. © 2016 SAP SE. All rights reserved. SAP, R/3, SAP NetWeaver, Duet, PartnerEdge, ByDesign, SAP BusinessObjects Explorer, StreamWork, SAP HANA, and other SAP products and services mentioned herein as well as their respective logos are trademarks or registered trademarks of SAP SE in Germany and other countries. These materials are provided by SAP SE or an SAP affiliate company for informational purposes only, without representation or warranty of any kind, and SAP SE or its affiliated companies shall not be liable for errors or omissions with respect to the materials.

This document, or any related presentation, and SAP SE’s or its affiliated companies’ strategy and possible future developments, products, and/or platform directions and functionality are all subject to change and may be changed by SAP SE or its affiliated companies at any time for any reason without notice.

Product details

Prevedere's forecast accuracy resulted in millions in cost savings and revenue growth.

The kraft heinz company partnered with prevedere to modernize its forecasting, planning processes, and culture to respond to shifts in consumer behavior and significant market volatility due to covid and increasing external disruption..

- View the Testimonial

Schedule a Demo

01 The Cliff's Notes

Kraft heinz has transformed its go to market strategy..

By working with Prevedere's global data, Advanced Predictive Planning platform, and expert in-house economists—the Kraft Heinz Company (KHC) is realizing both tactical and strategic advantages, including:

- Forecast accuracy , where a 1% improvement results in millions of dollars of cost savings or revenue growth.

- A new layer of understanding, with data driven predictions, to help drive supply chain decisions .

- Ability to attain insights and discover new and impactful consumer-level drivers .

- Ability to attain CAGRs, market size projections, and other financial metrics that were previously difficult to produce.

- No more surprises or market blind spots, with a new confidence and ability to plan for future opportunity and risk.

- Download the Case Study

All retailers and CPGs should consider macroeconomic factors to improve their business planning.

Not only will forecasting accuracy improve, but go to-market planners will be fully educated as to what external factors are important to their markets.

Bernardo Fiaux

Global Head of Excellence and Capabilities Kraft Heinz Global

Start considering macroeconomic factors in your business planning.

Add Prevedere's Advanced Predictive Planning platform to your FP&A stack.

02 The Kraft Heinz Story

Operating in volatile global markets.

The Kraft Heinz Company (KHC) is one of the largest CPG organizations in the world with over $26 billion in annual revenue. They manufacture and sell products worldwide within 80 food and beverage categories, and has a consumer penetration rate of 97% in the US.

Forecasting and planning is a critical function, performed on a monthly, quarterly, and annual basis by teams around the world. Budgets and resources are constantly re-assessed.

In 2020 KHC reorganized and regrouped its categories into 6 new product platforms, based around consumer behavior, supporting a transformational new growth strategy.

COVID rocked even their most stable categories, and triggered a new initiative to commence all planning with macro economic views and predictions within each of their key markets.

03 Opportunities & Goals

Opportunity 1, shifts in consumer behavior, gain predictive insight.

In 2019 KHC saw that consumer behavior in their markets was shifting, even before COVID. An increase in eCommerce, a desire for greater convenience, more snacking and mini-meals and a willingness to experiment with taste. KHC saw a real opportunity to reorganize and focus on a new growth strategy.

KHC decided to regroup its categories into consumer behavior-based platforms, and to develop objectives, plans, and marketing around these new trends. They really needed visibility and intelligence around these go to market platforms, especially regarding CAGR predictions, in order to optimize forecasts, budgets and resources.

In order to be able to optimize resources for growth, KHC needed to gain predictive insight into the new consumer-behavior based platforms.

Opportunity 2

Covid + volatility, embrace volatility.

And then COVID struck...

In 2020 the business world was shaken by the pandemic as every industry was impacted in varying ways. KHC experienced a surge in demand and their teams adjusted the best they could. It was clear that forecasting based on historical performance and internal projections was not going to cut it anymore.

This was the realization that strategic planning and ongoing forecasting needed to incorporate external market dynamics, and to quantify the unique set of market drivers for each platform and market.

KHC needed to incorporate market volatility into their planning and forecasting processes , and create top-down macro views of the markets in which they operate.

04 The Prevedere Solution

Proof of concept.

KHC discussed with Prevedere their desire to incorporate macroeconomic views into forecasting and planning.

An initial project that targeted one of its key consumer platforms was executed.

The goal was to identify contributing market drivers, then create economic-based forecasts and industry outlooks from econometric predictive models.

Order of Operations

- Prevedere's team leveraged its Global Intelligence Cloud and modeling engine to identify the leading indicators and create platform forecasts and scenarios.

- These were presented to the KHC team, along with back tested forecasts. Prevedere was able to review the identified economic drivers and validate their potential impact on KHC's business.

- Forecasts were compared to internally generated forecasts, which were then adjusted based on Prevedere's input.

The Kraft Heinz team now had a platform forecast validated by correlated economic data and macro predictions.

Prevedere's global roll-out.

After a successful pilot resulting in a much higher degree of forecast accuracy and market visibility, KHC dramatically expanded the number of predictive models, driven by Prevedere's Advanced Predictive Planning platform, across the organization—including Canada and 80 other international territories.

Senior financial leadership at KHC realized that they needed to supplement each planner's own internal knowledge with a better understanding of established and emerging market drivers.

Increased standardization

KHC teams across the world do not all use the same practices for forecasting, so adding a macro-based first step creates a common foundation for planning.

A Culture of Planning

Planners are now enabled with macro data and views that relate to their own businesses. Their knowledge has greatly increased into the real drivers of their markets.

05 The Outcome

Forecast accuracy.

Kraft Heinz forecast accuracy improved and global market planning confidence skyrocketed with Prevedere economic forecasts and scenarios.

Guard Rails

Economic baseline forecasts and scenarios combined with market assessments by Prevedere's economists provide critical intelligence and the ultimate safety net for KHC planners.

Market Savvy

Planners and leaders at Kraft Heinz now understand what really drives their business units, and are far more knowiedgeable about the economic impact on supply and demand.

Prevedere helped Kraft Heinz enable transformation and growth, manage volatility and risk in uncertain times.

Want to protect your business in these uncertain times?

Plan and forecast more accurately with Prevedere.

Add Advanced Predictive Planning to your business.

Request a Demo

Download the Kraft Heinz Case Study

Learn how The Kraft Heinz team partnered with Prevedere to develop a platform forecast validated by correlated economic data and macro predictions.

Want to protect your business in these uncertain times? Add Prevedere's Advanced Predictive Planning platform to your FP&A stack.

Navigating Economic Uncertainty with Jesse Weaver

What do you think about us?

The Kraft-Cadbury Acquisition: A Case Study in Corporate Mergers and Acquisitions

Concept map.

The Kraft Heinz Company's formation through the merger of Kraft Foods Group and HJ Heinz, and its strategic vision, is a key focus. The text delves into Cadbury's rich heritage and Kraft Foods' hostile takeover in 2010, analyzing the merger's impact on the industry, post-takeover challenges, and long-term effects on Cadbury's brand and practices.

The Kraft Heinz Company

Formation and history.

The Kraft Heinz Company was formed in 2015 through the merger of Kraft Foods Group and HJ Heinz Holding Corporation

Brands and Revenue

Prominent Brands

Kraft Heinz is home to numerous brands, many of which generate over $1 billion in annual revenue

Revenue Generation

The company's brands generate significant revenue, making it the third-largest food and beverage company in North America and the fifth-largest in the world

Mission and Strategy

Kraft Heinz's mission is to become the best food company, driving its strategic decisions, including mergers and acquisitions, to achieve its goals

History and Growth

Cadbury is a storied British confectionery company founded in 1824 that has grown into a multinational brand famous for its chocolate products

International Presence

Major Markets

Cadbury's major markets include the United Kingdom, the United States, Australia, and India

Influence of International Investors

Cadbury's ownership and strategic direction have been significantly influenced by international investors, including those from the United States

Resistance to Acquisition

In 2009, Kraft Foods launched a hostile takeover bid for Cadbury, which was initially resisted by Cadbury's leadership and the UK government

The Kraft-Cadbury Acquisition

Strategic motivations.

Kraft's pursuit of Cadbury was part of a larger strategic plan to restructure the company and strengthen its global snacks division

Successful Acquisition

Despite initial resistance, Kraft's final offer of 840 pence per share was accepted by the majority of Cadbury shareholders, leading to a successful acquisition

Expected Benefits

The merger promised cost synergies and a stronger competitive position for Kraft, while offering potential benefits for Cadbury through access to new markets and synergistic potential

Challenges and Controversies

Increased Debt and Job Cuts

The acquisition led to increased debt for Kraft and concerns about job cuts, which were realized when Kraft began to lay off workers and close some of Cadbury's UK factories

Criticism and Tension

The takeover faced criticism from unions and the British government, highlighting the tension between corporate expansion and the preservation of a company's heritage

Impact and Outcome

The Kraft-Cadbury acquisition marked a significant event in the food and beverage industry, with Kraft becoming a leading confectionery business and Cadbury now part of Mondelēz International

Want to create maps from your material?

Enter text, upload a photo, or audio to Algor. In a few seconds, Algorino will transform it into a conceptual map, summary, and much more!

Learn with Algor Education flashcards

Click on each card to learn more about the topic.

Kraft Heinz formation through merger

Formed by merging Kraft Foods Group and HJ Heinz in 2015.

Kraft Heinz market ranking in North America

Third-largest food and beverage company in North America.

Kraft Heinz global market position

Fifth-largest food and beverage company in the world.

The renowned ______ brand, known for treats like ______ and ______, was established by ______ in ______.

Cadbury Cadbury Eggs Dairy Milk John Cadbury 1824

Year Kraft launched hostile bid for Cadbury

2009, not 2019

Cadbury's preferred partners over Kraft

Nestlé, Ferrero, Hershey

UK government's concern about Kraft's takeover

Potential disregard for Cadbury's heritage and stakeholder interests

Kraft aimed to split into two entities, one for ______ snacks and confectionery, and another for ______ grocery items.

global North American

Kraft-Cadbury merger year

Kraft's post-merger industry status

Became leading confectionery business

Cadbury's post-merger distribution advantage

Gained access to Kraft's extensive distribution network

The acquisition of ______ by Kraft resulted in increased debt and subsequent worries about potential ______.

Cadbury cost-cutting measures

Role of shareholders in corporate acquisitions

Shareholders, including hedge funds, influence acquisitions focusing on short-term financial gains.

Post-takeover challenges for Cadbury

Cadbury faced increased debt and job cuts but continued brand growth post-Kraft takeover.

Cadbury's transition to Mondelēz International

Cadbury became part of Mondelēz International, a global snacks leader, after Kraft's 2012 spin-off.

The ______-______ acquisition serves as an instructive example in the realm of corporate mergers and acquisitions.

Kraft Cadbury

The result of the ______-______ deal underscores the conflict between the growth of a corporation and the maintenance of its legacy.

Here's a list of frequently asked questions on this topic

When was the kraft heinz company established, and what is its corporate mission, what is the origin and global reach of cadbury, what was cadbury's response to kraft foods' initial takeover bid, why did kraft aim to acquire cadbury, and what was the final offer, what were the anticipated benefits of the kraft-cadbury merger, what were the negative outcomes following the kraft-cadbury merger, how did the kraft-cadbury takeover affect the company's ownership and practices, what are the key takeaways from the kraft-cadbury acquisition, similar contents, explore other maps on similar topics.

Cadbury's Strategic Positioning

Zara's Business Practices

Porter's Five Forces Analysis of Apple Inc

Starbucks' Marketing Strategy

Organizational Structure and Culture of McDonald's Corporation

The Enron Scandal and its Impact on Corporate Governance

IKEA's Global Expansion Strategy

Can't find what you were looking for?

Search for a topic by entering a phrase or keyword

The Formation and Vision of Kraft Heinz Company

Cadbury's Rich Heritage in Confectionery

Kraft foods' hostile takeover attempt of cadbury, kraft's strategic goals in acquiring cadbury, analyzing the kraft-cadbury merger's impact, post-takeover challenges and controversies, long-term effects of the kraft-cadbury takeover, lessons from the kraft-cadbury acquisition.

Edit available

Revolutionizing the Food Industry: HEINZ REMIX™

Watch the HEINZ REMIX™ launch on The TODAY Show

A Mission to Redefine the Industry

“We’ve been on this journey to make innovation the number one growth driver across our business. To do that, we knew we needed to operate differently than we had in the past, to think bigger, to be more consumer-centric.”

-Alan Kleinerman, VP & Head of Disruption at Kraft Heinz

Read the full press release by Kraft Heinz.

Sauce Combinations

Hours Saved in Development

Results Delivered

Kraft Heinz achieved its goals to immerse itself into the equipment space with an innovative, connected product resulting in:

Working Prototype with a Global Debut

The HEINZ REMIX™ prototype was created in 6 months, from ideation to production, with its debut on The TODAY Show on NBC.

Supporting New Growth Segment

In the first quarter of 2023, Kraft Heinz’s North American food service division had sales growth of more than 25%, and new products such as the HEINZ REMIX™ are poised to sustain and propel growth even further.

Actionable Market Research

Get in touch today..

Accelerate your connected product journey.

Talk to an IoT Expert

Schedule time to meet with a Mesh Systems team member.

- Customer Stories

- About Mesh Systems

- MeshMate Culture

The marketplace for case solutions.

H. J. Heinz: Estimating the Cost of Capital in Uncertain Times – Case Solution

With the ever-changing status of the market conditions and the doubt about where it will lead, H. J. Heinz's internal financial analyst found the need to come up with an estimate of the company's weighted average cost of capital (WACC). This case study analysis provides information not only for Heinz but also for other comparable firms. The study connects the practice of calculating the WACC and at the same time looks into the economic meaning of inputs to the calculation.

Marc Lipson Harvard Business Review ( UV5147-PDF-ENG ) November 08, 2010

Case questions answered:

We have uploaded two case solutions, which both answer the following questions:

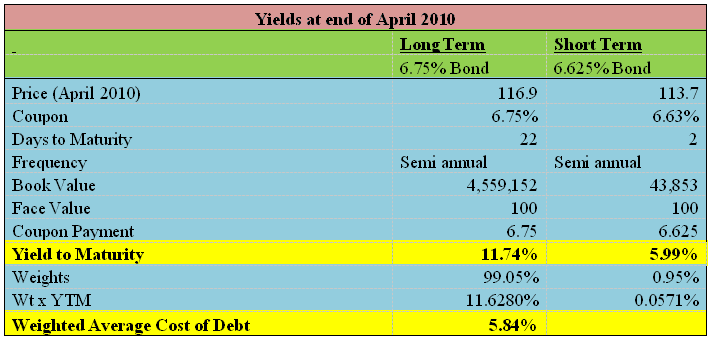

- What were the yields on the two representative outstanding H.J. Heinz debt issues as of the end of April 2010? What were they one year earlier?

- What was the WACC for Heinz at the start of the fiscal year 2010? What was the WACC one year earlier?

- What is your best estimate of the WACC for Kraft Foods, Campbell Soup Company, and Del Monte Foods? How do these WACCs influence your thinking about the WACC for Heinz?

Not the questions you were looking for? Submit your own questions & get answers .

H. J. Heinz: Estimating the Cost of Capital in Uncertain Times Case Answers

This case solution includes an Excel file with calculations.

You will receive access to two case study solutions! The second is not yet visible in the preview.

Executive Summary

The central problem, in this case, was the calculation of the weighted average cost of capital for the Heinz Company. There are three main reasons why it was becoming problematic to compute the weighted average cost of capital for the H. J. Heinz Company.

The first reason was the rapid fluctuation of the stock price of the company over the past 2 years. The price had touched the same high level of $ 47 per share in 2010, and there was a huge debate about whether the WACC needs to be updated or not.

Secondly, the interest rates were highly low. The lower interest rates would also reduce the WACC for Heinz Company, and a large number of projects could be then accepted by H. J. Heinz.

Finally, the third issue was that the company was not certain how the consumers would react to this, as the chances of the consumers taking the risks changed because of the changing economic conditions.

Furthermore, the company is also facing stiff competition from three other competitors in the industry which are Kraft Foods, Campbell Soup, and Del Monte Foods. In this case analysis, we have attempted to compute the yields of the short-term and long-term bond issues of the company.

It could be seen that the yields have declined significantly in 2010 from 2009. After this, the weighted average cost of capital has been computed for 2010 and 2009 based on a number of input variables.

It could be seen that the WACC has declined significantly in 2010 as compared to 2009. Finally, the WACCs of all three comparable companies have also been calculated, all of which have higher WACCS than H. J. Heinz.

What were the yields on the two representative outstanding Heinz debt issues as of the end of April 2010? What were they one year earlier?

The yields of the two representative outstanding H. J. Heinz debt issues at the end of April 2010 are as follows:

The debt with 22 years to maturity is long-term debt, and the debt with just a maturity period of 2 years is short-term debt. The YTL approximation formulas have been used to compute the yields of the two debt issues at the end of April 2010. The formula used is shown in the Excel spreadsheet.

Similarly, the yields on both of these two representative bonds one year earlier based on the maturity and the book values of short-term and long-term debts in 2009 were as follows…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster! Michael MBA student, Boston

How do I get access?

Upon purchase, you are forwarded to the full solution and also receive access via email.

Is it safe to pay?

Yes! We use Paypal and Stripe as our secure payment providers of choice.

What is Casehero?

We are the marketplace for case solutions - created by students, for students.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Back to Yahoo Finance classic

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Investors heavily search kraft heinz company (khc): here is what you need to know.

Kraft Heinz (KHC) has recently been on Zacks.com's list of the most searched stocks. Therefore, you might want to consider some of the key factors that could influence the stock's performance in the near future.

Shares of this the processed food company with dual headquarters in Pittsburgh and Chicago have returned -4.7% over the past month versus the Zacks S&P 500 composite's +5.8% change. The Zacks Food - Miscellaneous industry, to which Kraft Heinz belongs, has gained 5.7% over this period. Now the key question is: Where could the stock be headed in the near term?

Although media reports or rumors about a significant change in a company's business prospects usually cause its stock to trend and lead to an immediate price change, there are always certain fundamental factors that ultimately drive the buy-and-hold decision.

Earnings Estimate Revisions

Rather than focusing on anything else, we at Zacks prioritize evaluating the change in a company's earnings projection. This is because we believe the fair value for its stock is determined by the present value of its future stream of earnings.

We essentially look at how sell-side analysts covering the stock are revising their earnings estimates to reflect the impact of the latest business trends. And if earnings estimates go up for a company, the fair value for its stock goes up. A higher fair value than the current market price drives investors' interest in buying the stock, leading to its price moving higher. This is why empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

For the current quarter, Kraft Heinz is expected to post earnings of $0.74 per share, indicating a change of -6.3% from the year-ago quarter. The Zacks Consensus Estimate has changed -1.6% over the last 30 days.

The consensus earnings estimate of $3.02 for the current fiscal year indicates a year-over-year change of +1.3%. This estimate has changed -0.2% over the last 30 days.

For the next fiscal year, the consensus earnings estimate of $3.18 indicates a change of +5.4% from what Kraft Heinz is expected to report a year ago. Over the past month, the estimate has changed -0.3%.

With an impressive externally audited track record, our proprietary stock rating tool -- the Zacks Rank -- is a more conclusive indicator of a stock's near-term price performance, as it effectively harnesses the power of earnings estimate revisions. The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #3 (Hold) for Kraft Heinz.

The chart below shows the evolution of the company's forward 12-month consensus EPS estimate:

12 Month EPS

Revenue Growth Forecast

While earnings growth is arguably the most superior indicator of a company's financial health, nothing happens as such if a business isn't able to grow its revenues. After all, it's nearly impossible for a company to increase its earnings for an extended period without increasing its revenues. So, it's important to know a company's potential revenue growth.

In the case of Kraft Heinz, the consensus sales estimate of $6.63 billion for the current quarter points to a year-over-year change of -1.4%. The $26.67 billion and $27.12 billion estimates for the current and next fiscal years indicate changes of +0.1% and +1.7%, respectively.

Last Reported Results and Surprise History

Kraft Heinz reported revenues of $6.41 billion in the last reported quarter, representing a year-over-year change of -1.2%. EPS of $0.69 for the same period compares with $0.68 a year ago.

Compared to the Zacks Consensus Estimate of $6.42 billion, the reported revenues represent a surprise of -0.13%. The EPS surprise was +1.47%.

The company beat consensus EPS estimates in each of the trailing four quarters. The company could not beat consensus revenue estimates in any of the last four quarters.

No investment decision can be efficient without considering a stock's valuation. Whether a stock's current price rightly reflects the intrinsic value of the underlying business and the company's growth prospects is an essential determinant of its future price performance.

While comparing the current values of a company's valuation multiples, such as price-to-earnings (P/E), price-to-sales (P/S) and price-to-cash flow (P/CF), with its own historical values helps determine whether its stock is fairly valued, overvalued, or undervalued, comparing the company relative to its peers on these parameters gives a good sense of the reasonability of the stock's price.

As part of the Zacks Style Scores system, the Zacks Value Style Score (which evaluates both traditional and unconventional valuation metrics) organizes stocks into five groups ranging from A to F (A is better than B; B is better than C; and so on), making it helpful in identifying whether a stock is overvalued, rightly valued, or temporarily undervalued.

Kraft Heinz is graded B on this front, indicating that it is trading at a discount to its peers. Click here to see the values of some of the valuation metrics that have driven this grade.

Bottom Line

The facts discussed here and much other information on Zacks.com might help determine whether or not it's worthwhile paying attention to the market buzz about Kraft Heinz. However, its Zacks Rank #3 does suggest that it may perform in line with the broader market in the near term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Recommended Stories

Got $1,000 3 stocks to buy now while they're on sale.

Alibaba, Vici Properties, and Kraft Heinz are still great value plays.

Veeva Systems Inc. (VEEV) is Attracting Investor Attention: Here is What You Should Know

Veeva (VEEV) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

Investors Heavily Search Hologic, Inc. (HOLX): Here is What You Need to Know

Hologic (HOLX) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Reasons to Hold Verisk Analytics (VRSK) in Your Portfolio

Verisk Analytics' (VRSK) robust growth strategy focuses on organic growth, product development and acquisitions. However, the risk of being confined to a single service offering remains a concern.

Energy Fuels Inc (UUUU) Is a Trending Stock: Facts to Know Before Betting on It

Energy Fuels (UUUU) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

Investors Heavily Search Lantheus Holdings, Inc. (LNTH): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Lantheus Holdings (LNTH). This makes it worthwhile to examine what the stock has in store.

Arbor Realty Trust (ABR) Is a Trending Stock: Facts to Know Before Betting on It

Recently, Zacks.com users have been paying close attention to Arbor Realty Trust (ABR). This makes it worthwhile to examine what the stock has in store.

StoneCo Ltd. (STNE) is Attracting Investor Attention: Here is What You Should Know

StoneCo (STNE) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

- The Kraft Heinz Company-stock

- News for The Kraft Heinz Company

Kraft Heinz Strategy and Oscar Mayer Sale Impact: A Hold Rating Analysis

J.P. Morgan analyst Kenneth Goldman has maintained their neutral stance on KHC stock, giving a Hold rating on May 14.

Kenneth Goldman has given his Hold rating due to a combination of factors related to Kraft Heinz’s strategic direction and financial details surrounding the potential sale of its Oscar Mayer brand. Firstly, the proposed divestiture of Oscar Mayer aligns with the company’s strategy to refocus on key growth areas, which could improve long-term growth prospects. However, the estimated earnings dilution from the sale is relatively modest, and Goldman suggests that any positive impact on the stock might be tempered by this dilution being largely balanced by a slight increase in valuation multiples. The report also acknowledges that while the sale would fit into management’s broader strategy, the immediate financial implications may not significantly change the stock’s outlook. Additionally, Goldman considers the potential impact of health initiatives, such as reducing sodium in products, on revenue. This could support the decision to sell Oscar Mayer as it may align with shifting consumer preferences towards healthier options. The uncertainty regarding the inclusion of Lunchables in the sale adds complexity to the situation, as does the potential difficulty in finding a suitable buyer who could navigate regulatory challenges. The valuation range for Oscar Mayer, as reported, is broad, and while Goldman provides a detailed analysis of revenue, EBITDA, and a possible takeout multiple, he concludes that the high end of the valuation range may be optimistic. These financial analyses and strategic considerations underpin Goldman’s Hold rating, reflecting a cautious optimism tempered by the recognition of various uncertainties and the limited immediate financial benefit of the proposed sale.

Goldman covers the Consumer Defensive sector, focusing on stocks such as Campbell Soup, The Hershey Company, and Tyson Foods. According to TipRanks , Goldman has an average return of 10.9% and a 61.29% success rate on recommended stocks.

In another report released on May 14, Wells Fargo also maintained a Hold rating on the stock with a $37.00 price target.

TipRanks tracks over 100,000 company insiders, identifying the select few who excel in timing their transactions. By upgrading to TipRanks Premium, you will gain access to this exclusive data and discover crucial insights to guide your investment decisions. Begin your TipRanks Premium journey today.

Kraft Heinz (KHC) Company Description:

The Kraft Heinz Company is one of the world’s leading consumer packaged food and beverage companies. The company engages in manufacturing and marketing food and beverage products including condiments and sauces, dairy, meats, meals, refreshment beverages, coffee, and other grocery products.

Read More on KHC:

- Kraft Heinz Plans to Offload Oscar Mayer Business

- Kraft rallies 1% to $36.55 after WSJ report of Oscar Mayer sale process

- Kraft hires advisers to gauge interest in Oscar Mayer, WSJ reports

- Kraft Heinz exploring sale of Oscar Mayer business, WSJ reports

- Sprout Social Stock (NASDAQ:SPT): Is the 40% Plunge a Buying Opportunity?

The Kraft Heinz Company News MORE

Related stocks.

Kraft Heinz exploring sale of Oscar Mayer brand that could be worth up to $5 billion: Wall Street Journal

K raft Heinz Co. has hired financial advisers to help explore a possible sale of its Oscar Mayer unit, which makes hot dogs, cold cuts and bacon, the Wall Street Journal reported Monday, citing people familiar with the matter.

The business could be worth $3 billion to $5 billion, the people said. The company has hired Bank of America and Centerview Partners to work on the process, with potential buyers including private-equity firms or other food companies.

Kraft — which has a new chief executive in Carlos Abrams-Rivera, who took on the role on Jan. 1 — is working to overhaul its portfolio as consumers become more health- and budget-conscious.

Abrams-Rivera is also under pressure to boost the company’s stock price, which has been little changed for the last five years.

The company is seeking to make supermarket staples like its ketchup and fruit drinks more nutritious amid a pushback on processed foods and as increasing levels of obesity and other chronic illnesses are linked to diet.

The parent to brands including Lunchables, Maxwell House, Jell-O and Velveeta announced Abrams-Rivera as CEO last summer. He had previously run its North America operations.