- Dermatology

- Anesthesiology

- Cardiology and CTVS

- Critical Care

- Diabetes and Endocrinology

- Gastroenterology

- Obstretics-Gynaecology

- Ophthalmology

- Orthopaedics

- Pediatrics-Neonatology

- Pulmonology

- Laboratory Medicine

- Paramedical

- Physiotherapy

- Doctor News

- Government Policies

- Hospital & Diagnostics

- International Health News

- Medical Organization News

- Medico Legal News

- Ayurveda Giuidelines

- Ayurveda News

- Homeopathy Guidelines

- Homeopathy News

- Siddha Guidelines

- Siddha News

- Unani Guidelines

- Yoga Guidelines

- Andaman and Nicobar Islands

- Andhra Pradesh

- Arunachal Pradesh

- Chattisgarh

- Dadra and Nagar Haveli

- Daman and Diu

- Himachal Pradesh

- Jammu & Kashmir

- Lakshadweep

- Madhya Pradesh

- Maharashtra

- Uttar Pradesh

- West Bengal

- Ayush Education News

- Dentistry Education News

- Medical Admission News

- Medical Colleges News

- Medical Courses News

- Medical Universities News

- Nursing education News

- Paramedical Education News

- Study Aborad

- Health Investment News

- Health Startup News

- Medical Devices News

- CDSCO (Central Drugs Standard Control Organisation) News

- Pharmacy Education News

- Industry Perspective

ICMR Invites Joint Call Proposal For Investigator-Initiated Research Initiative 2023

Delhi: Indian Council of Medical Research (ICMR) has invited a joint call for proposals for Investigator Initiated Research (IIR) Initiative 2023. Detailed schedule – 1. Closing dates for expression of interest (EOI) - 30th April 2023 2. Closing dates for full proposal – 15th July 2023 3. Final selection – September 2023 The Indian Council of Medical Research (ICMR), under...

Delhi: Indian Council of Medical Research (ICMR) has invited a joint call for proposals for Investigator Initiated Research (IIR) Initiative 2023.

Detailed schedule –

1. Closing dates for expression of interest (EOI) - 30th April 2023

2. Closing dates for full proposal – 15th July 2023

3. Final selection – September 2023

The Indian Council of Medical Research (ICMR), under the Department of Health Research, Government of India, is the apex body in India for the formulation, coordination, and promotion of biomedical research and continues to nurture ecosystems for enabling medical innovations and their introduction into the health systems across the country. Throughout this journey, ICMR has established several regional and international collaborations to accelerate health research in India, leveraging complementary strengths and synergies. This includes the successful partnership with IAVI towards the joint mandate of developing scientifically robust practical solutions to public health problems.

IAVI, a global non-profit product development partner (PDP) organization generously supported by U.S. Agency for International Development (USAID), is dedicated to building and strengthening capacity and capability in India and Africa towards accelerated efforts to develop a safe, effective, affordable, and globally accessible HIV biomedical prevention tool to serve the unmet global health needs tailored to the most relevant populations.

ICMR and IAVI had undertaken a joint initiative to launch the first Investigator-Initiated Research (IIR) Call in 2021, inviting research proposals from young investigators across Indian and African partner institutes on HIV and HIV-COVID-19 research.

To continue the efforts and further strengthen South-South collaboration, ICMR, and IAVI are now launching the Second Investigator-Initiated Research (IIR) Call 2023, inviting applications from young investigators across India and Africa on HIV research under various priority areas towards enhancing the indigenous scientific capacity of young investigators and promoting regional collaborations between India and Africa.

The IIR Call 2023 will grant Regional Collaboration Awards to support joint collaborative projects between young Indian and young African investigators towards advancing scientific research and leadership across both regions. Each regional collaboration award will be for an approximate consolidated budget of 400,000 – 500,000 USD for a maximum period of 30 months for all partners across the two regions (at least 1 Indian and 1 African partner). IIR call 2023 will aim to support 3-4 Regional Collaboration Awards through a competitive selection process.

ICMR will fund the Indian PIs, whereas IAVI will fund the African PIs in a joint project. Certain activities, such as interactive workshops/review meetings, etc., shall be funded jointly by ICMR and IAVI.

Eligibility –

1. Researchers who have an advanced degree (PhD in life sciences/social sciences or equivalent Medical degree), have some experience working in the field of HIV, or want to pursue research in the field of HIV and are under 45 years of age will be considered eligible to apply for this call.

2. For India: All primary applicants (PI) should be permanent employees of the Institute. The current PhD students can be included as Co-PIs in the proposal. All applicants should preferably have a senior mentor as Co-PI in the proposal.

3. For Africa: All primary applicants (including current PhD students) should be affiliated with the institute OR be permanent employees of that institute and must have a senior mentor as Co-PI who is a permanent employee.

Scope of the projects –

Scientifically robust comprehensive proposals are invited in HIV/AIDS prevention research. The proposals for 2023 may be in any of the disciplines of epidemiology, socio-behavioral research, community engagement, immunology, virology, and discovery research toward informing vaccine/product development in the field of HIV. The proposals should align with at least one or more of the following four D's for impactful outcomes –

1. Discovery research (aimed at finding novel interventions (basic research))

2. Development research (aimed at developing innovative interventions related to HIV screening, detection, prevention, awareness, and behavior change)

3. Delivery or implementation research (aimed at learning how to overcome barriers in delivering effective interventions to the people who need them)

4. Descriptive Research (aimed at generating evidence to enable/facilitate developmental science)

The scope of this call will include the following research areas in the field of HIV –

Immunology, Virology, and Discovery Research –

1. Study viral factors and their role in HIV replication dynamics /pathogenesis/transmission - genotypic (sequencing and phylogenetics), phenotypic (sensitivity & resistance to bNAbs) characterization, diversity, and impact on susceptibility to neutralization

2. Predictive analysis for identification of new and recent infections and use of bioinformatics to study viral evolutionary patterns in Indian and African populations

3. Use of functional genomic approaches to dissect effective immune responses and host responses to HIV-1 acquisition and pathogenesis (in adults, adolescents, and pediatric populations)

4. Study B-cell repertoire (diversity/frequency) and T-cell receptor diversity in healthy individuals to inform HIV vaccine design

5. Isolation, functional characterization, and suitability assessment of broadly neutralizing antibodies relevant to circulating HIV-1 strains (in adult, adolescent & pediatric populations) in India and Africa and preclinical evaluation of novel antibodies

6. Understanding emerging trends of drug resistance in circulating HIV strains and their functional assessment

7. Design and characterization of immunogens that can elicit potent and broadly neutralizing antibodies for HIV-1

Epidemiology -

1. Identifying most relevant target populations and emerging pockets of risk towards informing targeted intervention development – With a focus on physical and virtual network dynamics in diverse (including hard-to-reach) populations (including at-risk key populations, adolescents, and young adults) across India and Africa

2. Studying diversity and evolution of circulating viruses across different risk groups (including high-risk key populations, adolescents and young adults, pregnant mothers and children below 2 years) and geographical regions (including urban/ rural) in India and Africa

3. Understanding cost-effective approaches to identify acute/early HIV infections towards sustainable surveillance

4. Identifying the unmet needs and translational gaps in the prevention of mother-to-child transmission and addressing ways to address them in India and Africa

Socio-behavioral research and Community Engagement -

1. Understanding population needs and factors (individual, social, and structural) influencing a)uptake of preventive health services; and b) research participation (recruitment, retention, care) and innovative interventions and strategies to ensure participant-centric engagement;

2. Understanding the social, contextual, and behavioral needs of adolescents and young adults (girls and boys), particularly related to their sexual and reproductive health, and identifying adolescent-responsive strategies to engage them in HIV prevention research and product uptake;

3. Developing and piloting innovative interventions/behavior change strategies among at-risk populations (including at-risk key populations, adolescents and young adults, pregnant women, and children) towards improving prevention outcomes and ensuring meaningful engagement in India and Africa

4. End-user acceptability & health system feasibility studies for HIV prevention products in the pipeline to inform their development, introduction, and uptake in India and Africa

The proposed work may also include research questions utilizing data and samples from ongoing and prior trials and other studies available to applying investigators.

Structure and selection process of the Applications -

The application submission will be in 2 stages -

Expression of Interest (EOI) -

1. The applicant must submit a concise Expression of Interest (EOI) which should briefly describe the scientific rationale, objectives, study plan, and intended impact (detailed format for EOI attached as annexure 1). The EOI submitted will be evaluated based on defined selection criteria (evaluation criteria for the EOI provided in the section below).

2. The shortlisted EOIs will be invited for an in-person pre-submission workshop to enable robust proposals and facilitate alignment among the identified collaborating partners.

Full proposal -

The shortlisted EOI applicants must submit detailed proposals, which will be evaluated and again scored (evaluation criteria for the full proposals are provided in the section below).

The applicants must also submit the following –

1. CVs of all collaborators (at the time of EOI submission)

2. Detailed Budget (at the time of Full proposal submission)

The onus is on the applicants to find their research collaborator(s) in the partner country(ies). Only a joint proposal with at least 1 Indian and 1 African partner will be considered.

Evaluation criteria -

Expression of Interest (EOI) -

Scientific Relevance -

1. Does the project align with the call's objective?

2. Is the proposed project relevant to and important for the HIV prevention landscape, including vaccine and/or antibody design/development?

3. Is there a strong scientific rationale for the project?

4. How significant is the impact that the proposed work will bring about in the field?

Innovation & Approach -

1. Are the concepts, approaches or methodologies, instrumentation, or interventions novel to the field of research?

2. Are the overall strategy and methodology well-reasoned and appropriate to accomplish the specific aims of the project?

3. Are the exchange visits, training, knowledge, and tech transfer plans well-articulated and planned?

Investigators/Collaborations -

1. Are the investigators well-suited to achieve the aims of the proposal?

2. Do the applications leverage complementary expertise across partners to deliver impactful outcomes?

Funding under this mechanism is only to support the realization of not-for-profit scientific work towards acquiring new knowledge, promoting scientific exchange within and across regions, and fostering the development of integration and cooperation between scientific organizations in India and Africa. Proposals will undergo a quality evaluation taking into account the following criteria -

1. Scientific Merit - Does the project align with the call's objective? Is the proposed project relevant to and important for the HIV prevention landscape, including vaccine and/or antibody design/development? Is there a strong scientific rationale for the project? What is the state of readiness for the proposed work based on the background information and scientific work in the relevant field? How significant is the impact that the proposed work will bring about in the field? How well does the project align with in-country programmatic priorities? Does it support or provide additional value to programmatic needs? How relevant are the proposed outcomes of the project to the needs and constraints of the country(ies)/regions and target groups/final beneficiaries, and does it have any policy impact?

2. Implementation Plan - Are the objectives and endpoints/outcomes clear? Does the proposal have a justified study design, appropriate methodology, and detailed analysis plan to achieve the objectives within a feasible timeline? Is the implementation work plan adequately detailed and realistic? Is there clear metrics for monitoring project progress, including milestones and outputs' expected timelines?

3. Investigator - Is the investigator and other researchers well suited to the project? Do they have appropriate experience and training? Will the project allow career development for a young investigator? If appropriate, is a suitable mentor identified? Is the investigator likely to significantly contribute to scientific capacity at the institute over time?

4. Operational Feasibility - Does the applicant have access to adequate resources (samples, data, local linkages with relevant partners, infrastructure) to conduct the proposed work? Does the researcher consider/integrate other national collaborators, expertise, and other ongoing work to strengthen the value or impact of this work? Has the applicant anticipated difficulties/risks that may be encountered? Have alternative tactics and mitigation plans been considered in case of failure?

5. Cost Effectiveness and Sustainability - Is the ratio between the estimated costs and expected results satisfactory? Have the budgets required over time been comprehensively mapped to highlight justified needs towards the proposed objectives? Are sustainability plans (based on results from the current study) identified, and are linkages to broader national/international programs/sustainable funding mentioned?

6. Value of Partnership - Does this collaboration add significant value to the work proposed? Do the investigators have complementary and integrated expertise? Is there any additional future work expected through this partnership? Are the plans for capacity building (cross-learning, knowledge sharing, and tech transfer) between the collaborators across the two regions well-articulated and planned? Are the team roles and responsibilities (including project management and coordination, governance, and organizational structure) clearly defined?

Application Procedure -

The EOI should be a straightforward concept of the proposed idea. The complete proposal should be a detailed description of the intended research, including the scientific principles upon which it is founded. The EOI and full proposal should be written to consider each review criteria outlined above.

We recommend that all co-investigators and collaborators mentioned in the proposal be aware of the proposed work at the time of EOI submission and have granted written permission at the time of full proposal submission.

The EOI and full application formats are attached as Annexures 1 & 2, respectively, in the notice attached below. The EOIs with relevant attachments should be uploaded on the ICMR portal (http://iircall.icmr.org.in/home.php) per the deadline below. Subsequently, the shortlisted EOI applicants will need to submit full proposals post the pre-submission workshop again on the ICMR portal as per the above dates.

To view the notice, click on the link below –

https://medicaldialogues.in/pdf_upload/calliir-207016.pdf

Debmitra has completed her certified course in content writing from ETC Delhi in 2020. She has 3 years of experience into content writing. She joined Medical Dialogues in 2021 and covers educational news.

ICMR: CALL FOR INVESTIGATOR-INITIATED RESEARCH PROPOSALS FOR SMALL EXTRAMURAL GRANTS

Overview and purpose

Indian Council of Medical Research (ICMR) provides financial assistance for Indian scientists working outside ICMR institutes to conduct research in the fields of medicine, public health, and allied disciplines aimed at improving health of Indians under its Extramural Research Programme.

The proposed research in response to Call for Proposals should be well circumscribed, and time bound. It should achieve specific and measurable objectives and should be in line with ICMR priorities. Multidisciplinary projects which aim to find solutions to priority disease and conditions (see table 1) will receive preference for funding. Research proposals that take forward leads from previous ICMR grants to fruition will also be given preference.

The following types of research proposals will be considered. Some indicative examples of each category are given below.

1. Discovery research aimed at finding novel interventions (basic research). Some examples are pre-clinical and phase-I studies including phytopharmaceuticals and traditional medicines and genomic methods/algorithms/tools for personalized medicine etc.

2. Development research aimed at developing interventions for screening, diagnosis, prevention, treatment of diseases/conditions or make existing interventions simpler, safer, more efficacious, or more affordable. Examples of such research includes development of Point of care tests, molecular diagnostic tests, animal models for diseases appropriate dosage and formulations, artificial intelligence and machine learning predictive tools/models, phase 2/3 (or equivalent phase) clinical trials of vaccine and therapeutics etc.

3. Delivery research or implementation research aimed at learning how to overcome barriers in delivering effective interventions to the people who need them. This will include health system-based interventions to increase access, and to successfully implement national health programme or schemes, reducing inequity and improve quality of health care.

4. Descriptive Research aimed to understand the disease or condition including its burden, risk factors and determinants and pathogenesis mechanism will not be prioritized; will be funded only if deemed by ICMR to be critical to move towards finding solutions.

Priority diseases or conditions Research proposals that are aimed at finding solutions for prevention, screening, diagnosis, treatment or rehabilitation of the following diseases or conditions will receive preference for funding:

Duration of project and funding

Current budgetary ceiling is 1.5 crores per project. The project duration will be up to a maximum period of three years. An additional period of up to 6 months for preparatory activities (with no additional costs) can be incorporated in the project proposal.

How to apply

A proposal can be submitted for financial support through ONLINE MODE ONLY by Indian scientists/ professionals who have a regular employment in Medical Institutes/ Research Institutes/ Universities/ Colleges/ recognized Research & Development laboratories/ Government and semi-government organizations and NGOs (documentary evidence of their recognition including DSIR certificate should be enclosed with every proposal). ICMR scientists are not eligible to apply in this call. ICMR scientists may be named as co-investigators in these projects, but no funds will be given for ICMR institutions or scientists in these cases.

For any queries related to the call, please contact

Dr. Lokesh Sharma

Scientist E Division of BMI,

ICMR Headquarters,

V Ramalingaswami Bhawan,

Ansari Nagar, New Delhi-110029

Email: [email protected]

Deadline for submission of complete proposal: 28 April 2023

Deadline for submission of concept note/expression of interest to R&D Department – 3 April 2023, EoD. The project proposal in prescribed format or the concept note as the case may be, should be sent to Dean R&D ([email protected]), with CC to Associate Dean (R&D) ([email protected]) well in time.

- ← Science Technology Innovation (STI) based livelihood centric development

- Indo-French Visiting/Mobility Programme for Women in Science (PROWIS-II) →

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

Cancer Research North East (CaRes NER) Programme Call for Proposals, 2023 Theme: Early diagnosis of cancers

I. background, ii. scope of the call.

Provide intervention models to address the problem through the identification of determinants, barriers and facilitators towards early cancer detection

Broad proposed study areas

- Early detection in the form of screening and early diagnosis: community-based strategies, scaling up of existing interventions, strategies to address health-seeking behaviour for early detection, overcoming barriers to early detection.

- Access to care-diagnosis and treatment: Interventions to improve access to diagnosis and treatment, scaling up of existing interventions, overcoming barriers to accessing cancer care

- Studies on cancer epidemiology, aetiology and risk factor of cancers alone

- Basic science (Cellular and molecular biology, immunology, genetics and genomics, physiology studies) related to cancer.

- Interventions that comprise the development of diagnostic tools, devices or pharmacological agents

III. Applicant Eligibility

- Applicants from multidisciplinary backgrounds are eligible to apply. The Principal Investigator (PI) should be holding a regular faculty/scientific position in a medical college, research institute, or university, including government, semi-government and NGOs'/ private institutes registered with DSIR SIRO Scheme, from any of the eight states in the Northeast Region. Investigators from other parts of the country will not be eligible to be a PI.

Collaborations

- The applicant can choose collaborators in any institution outside the NER from any part of India (no international investigators will be eligible).

- Collaborations involving institutions/health systems within NER are encouraged. The collaboration could be purely academic or in the form of lending technical support or mentorship for undertaking the proposed research. The collaborators could be listed as co-investigators with their roles defined.

- No direct funding will be provided to institutions outside NER from ICMR-NCDIR, Bengaluru. However, the NER PI can submit an appropriate budget for the collaborator outside NER with due justifications for transferring funds as per her/his institutional norms.

IV. Funding amount

A pragmatic budget commensurate with the project's goals and objectives should be framed. A maximum limit of INR 1,00,00,000 for the total duration of the project

V. Study duration

The study could be for a maximum duration of three years

VI. How to apply

Interested applicants should first register on the submission portal https://proposals.ncdirindia.org/default.aspx and submit a full proposal in the prescribed format, latest by 28 th February 2023 . An early registration is encouraged so that registered applicants could avail of the benefit of attending a grant writing webinar organized by ICMR-NCDIR, tentatively during mid February 2023. Please send a hard copy of the proposal (generated by the portal), original copies of the declaration and attestation forms and Institutional Ethics Committee approval for the proposed study, latest by 20 th March 2023 to: ICMR-National Centre for Disease Informatics and Research II Floor of Nirmal Bhawan, ICMR Complex Poojanhalli Road, Off NH-7, Adjacent to Trumpet Flyover of KIAL Kannamangala Post Bengaluru - 562 110. India. For any queries, please write to [email protected]

VII. Process of selection

An expert committee shall review the proposals as per norms of ICMR/MoHFW/GoI revised from time to time. Shortlisted applicants may be invited to revise the proposals given any recommendations from the committee before final approval for funding. In case proposals with similar objectives are received, these would be considered for merging them into a larger proposal in consultation with applicants. Please note that proposals that were submitted in response to earlier calls will not be considered again.

Cancer Research North East (CaRes NER) Programme Call for Proposals, 2023

Copyright © NCDIR, Bengaluru 2024

ICM Graduate Reading Group Call for Proposals 2024-2025

The Institute for Comparative Modernities seeks to provide greater opportunities for graduate students from across the campus to engage each other through interdisciplinary and collaborative research working groups. To that end, the Institute provides a meeting space as well as seed money for the establishment and the maintenance of a small number of graduate student research working groups each year. More information about current and past groups is available here .

Proposal Guidelines

The Institute for Comparative Modernities invites proposals that include a 500-word statement of intent, a bibliography, and a list of the names and departmental affiliations of the proposed group members, along with the curriculum vitae of each participant. Cross-disciplinarity must be an integral part of both the design of the research proposal and the composition of the group; applications from groups composed of members from a single department will not be approved. We imagine most groups will consist of three to eight members. This program, which is announced annually, now provides a subvention of $2000 for groups of 3-5 people and $2500 for groups of 6-8 people. The funds can be used for books, materials, and/or bringing outside speakers to the campus community. We also offer a comfortable, congenial meeting space at the ICM, housed in Toboggan Lodge. We expect the sustained collaboration to culminate in a public presentation (oral or written) at the end of the award year. The subvention covers one year, but renewal may be possible under certain circumstances. It is likely that academic year 2024–2025 will see four to six awards.

Proposal Submissions

Please include all the following as part of a single PDF document: • 500-word statement of intent • Bibliography • List of the names, departmental affiliations, and e-mail addresses of the proposed group members, along with the curriculum vitae of each participant

Submit proposals to Ashley Stockstill, ICM program coordinator: [email protected] DEADLINE : Saturday, May 25, 2024

Salah M. Hassan curates "Gavin Jantjes: To Be Free! A Retrospective 1970–2023" at the Sharjah Art Foundation

Art and Architecture of Migration and Discrimination by Esra Akcan and Iftikhar Dadi

Beshara Doumani, "A Modern History of the Palestinians Through the Social Life of Stone" 5.6

Naeem Mohaiemen, Jole Dobe Na / Those Who Do Not Drown 3.28

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

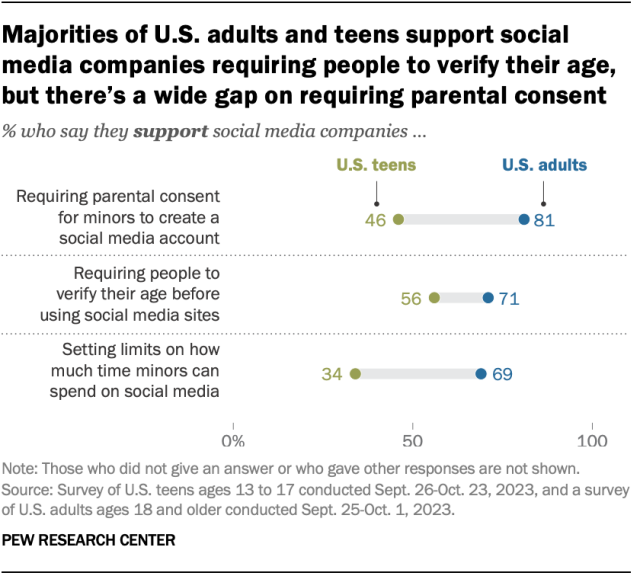

81% of U.S. adults – versus 46% of teens – favor parental consent for minors to use social media

More than 40 states and the District of Columbia are suing Meta , the parent company of Facebook and Instagram, alleging its platforms purposefully use addictive features that harm children’s mental health.

Amid this news, U.S. adults and teens are more likely to support than oppose requiring parental consent for minors to create a social media account and requiring people to verify their age before using these platforms, according to a pair of new Pew Research Center surveys. But adults are far more supportive than teens of these measures, as well as limiting how much time minors can spend on social media.

Pew Research Center conducted this study to understand American adults’ and teens’ views on ways social media companies could limit minors’ use of their platforms. This analysis uses data from two separate surveys, allowing us to compare the views of U.S. teens ages 13 to 17 with U.S. adults ages 18 and older.

For the analysis of teens, the Center conducted an online survey of 1,453 U.S. teens from Sept. 26 to Oct. 23, 2023, via Ipsos. Ipsos recruited the teens via their parents who were a part of its KnowledgePanel , a probability-based web panel recruited primarily through national, random sampling of residential addresses. The survey is weighted to be representative of U.S. teens ages 13 to 17 who live with parents by age, gender, race and ethnicity, household income and other categories. This research was reviewed and approved by an external institutional review board (IRB), Advarra, an independent committee of experts specializing in helping to protect the rights of research participants.

For the separate analysis of adults, the Center surveyed 8,842 U.S. adults from Sept. 25 to Oct. 1, 2023. Everyone who took part in the survey is a member of the Center’s American Trends Panel (ATP). This online survey panel is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race and ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology .

Here are the questions used for this analysis, along with responses, and its methodology .

Here’s a closer look at the findings from the two new surveys – one of adults and one of teens – which we conducted in late September through October, before the states’ lawsuit against Meta.

Adults’ views on social media policies aimed at minors

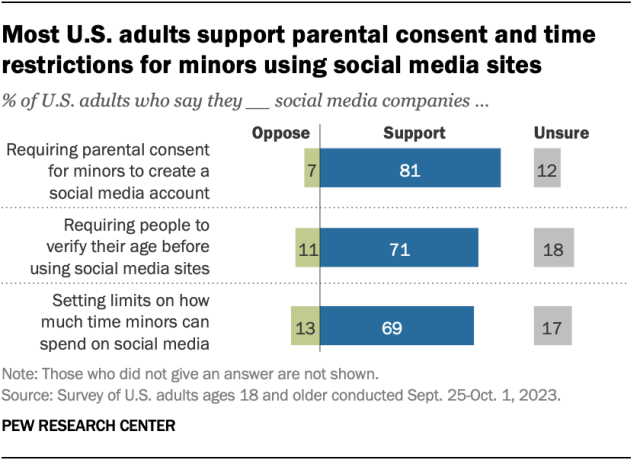

Most U.S. adults (81%) say they support social media companies requiring parental consent for minors to create a social media account. About seven-in-ten favor requiring people to verify their age before using social media sites (71%) and setting limits on how much time minors can spend on these platforms (69%). Only about one-in-ten adults oppose each of these three measures.

Still, some adults are uncertain. For example, roughly one-in-five adults are unsure if companies should require age verification (18%) or set time limits for minors (17%).

Views among adults by age, party and parental status

Many social media companies do not allow those under 13 to use their sites. Still, there’s a growing movement to develop stricter age verification measures , such as requiring users to provide government-issued identification. Legislators have pushed for mandatory parental consent and time restrictions for those under 18, arguing this will help parents better monitor what their children do on social media.

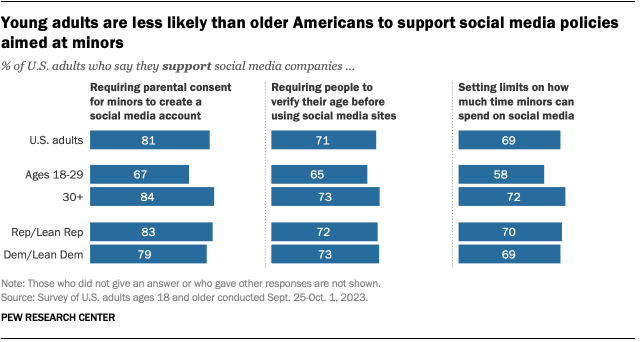

Our survey finds there is strong bipartisan support for these types of policies. Clear majorities of Republicans and Democrats – including independents who lean to either party – support parental consent, time limits for minors and age verification.

Majorities of adults across age groups support social media companies introducing these measures. But young adults are less supportive than their older counterparts. For example, 67% of those ages 18 to 29 say social media sites should require parental consent for minors to create an account, but this share rises to 84% among those ages 30 and older.

Additionally, majorities of parents and those without children back each of these measures, though support is somewhat higher among parents.

Teens’ views on social media policies for minors

Building on the Center’s previous studies of youth and social media, we asked U.S. teens ages 13 to 17 about their views on these measures.

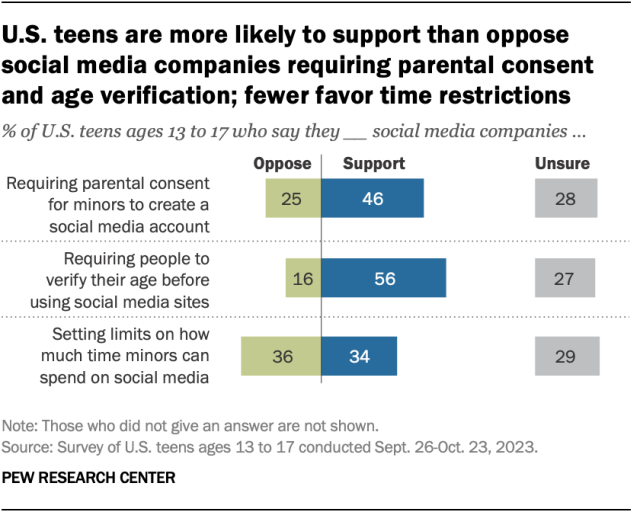

Teens are more likely to support than oppose social media companies requiring parental consent for minors to create an account (46% vs. 25%). There’s even more support for requiring people to verify their age before using these sites – 56% of teens favor this, while 16% oppose it.

But their views are more divided when it comes to setting limits on how long minors can use these sites. Similar shares of teens support and oppose this (34% vs. 36%).

For each of these policies, about three-in-ten teens report being unsure if this is something social media companies should do.

How adults’ and teens’ views on social media policies differ

Adults are considerably more supportive of all three measures we asked about than are teens.

While 81% of U.S. adults support social media companies requiring parental consent for minors to create an account, that share drops to 46% among U.S. teens.

Adults are also about twice as likely as teens to support setting limits on how much time minors can spend on social media sites (69% vs. 34%).

But majorities of adults and teens alike support requiring people to verify their age before using social media sites. But on this, too, adults are more supportive than teens (71% vs. 56%).

Note: Here are the questions used for this analysis, along with responses, and its methodology .

- Social Media

- Technology Policy Issues

- Teens & Tech

6 facts about Americans and TikTok

Whatsapp and facebook dominate the social media landscape in middle-income nations, how teens and parents approach screen time, germans stand out for their comparatively light use of social media, majorities in most countries surveyed say social media is good for democracy, most popular.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Age & Generations

- Coronavirus (COVID-19)

- Economy & Work

- Family & Relationships

- Gender & LGBTQ

- Immigration & Migration

- International Affairs

- Internet & Technology

- Methodological Research

- News Habits & Media

- Non-U.S. Governments

- Other Topics

- Politics & Policy

- Race & Ethnicity

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

Terms & Conditions

Privacy Policy

Cookie Settings

Reprints, Permissions & Use Policy

Language selection

- Français fr

Chapter 4: Economic Growth for Every Generation

On this page:, 4.1 boosting research, innovation, and productivity, 4.2 attracting investment for a net-zero economy, 4.3 growing businesses to create more jobs.

- 4.4 A Strong Workforce for a Strong Economy

To ensure every Canadian succeeds in the 21 st century, we must grow our economy to be more innovative and productive. One where every Canadian can reach their full potential, where every entrepreneur has the tools they need to grow their business, and where hard work pays off. Building the economy of the future is about creating jobs: jobs in the knowledge economy, jobs in manufacturing, jobs in mining and forestry, jobs in the trades, jobs in clean energy, and jobs across the economy, in all regions of the country.

To do this, the government's economic plan is investing in the technologies, incentives, and supports critical to increasing productivity, fostering innovation, and attracting more private investment to Canada. This is how we'll build an economy that unlocks new pathways for every generation to earn their fair share.

The government is targeting investments to make sure Canada continues to lead in the economy of the future, and these are already generating stronger growth and meaningful new job opportunities for Canadians. New jobs—from construction to manufacturing to engineering—in clean technology, in clean energy, and in innovation, are just the start. All of this, helping to attract further investment to create more opportunities, will raise Canada's productivity and competitiveness. This will create more good jobs, and in turn, raise the living standards of all Canadians.

We are at a pivotal moment where we can choose to renew and redouble our investments in the economy of the future, to build an economy that is more productive and more competitive—or risk leaving an entire generation behind. We will not make that mistake. We owe it to our businesses, to our innovators, and most of all, to the upcoming generations of workers, to make sure that the Canadian economy is positioned to thrive in a changing world.

Canada has the best-educated workforce in the world. We are making investments to ensure every generation of workers has the skills the job market, and the global economy, are looking for—and this will help us attract private investment to grow the economy (Chart 4.1). Building on our talented workforce, we are delivering, on a priority basis, our $93 billion suite of major economic investment tax credits to drive growth, secure the future of Canadian businesses in Canada, and create good jobs for generations to come.

In the first three quarters of 2023, Canada had the highest level of foreign direct investment (FDI) on a per capita basis among G7 countries, and ranked third globally in total FDI, after the U.S. and Brazil (Chart 4.2).

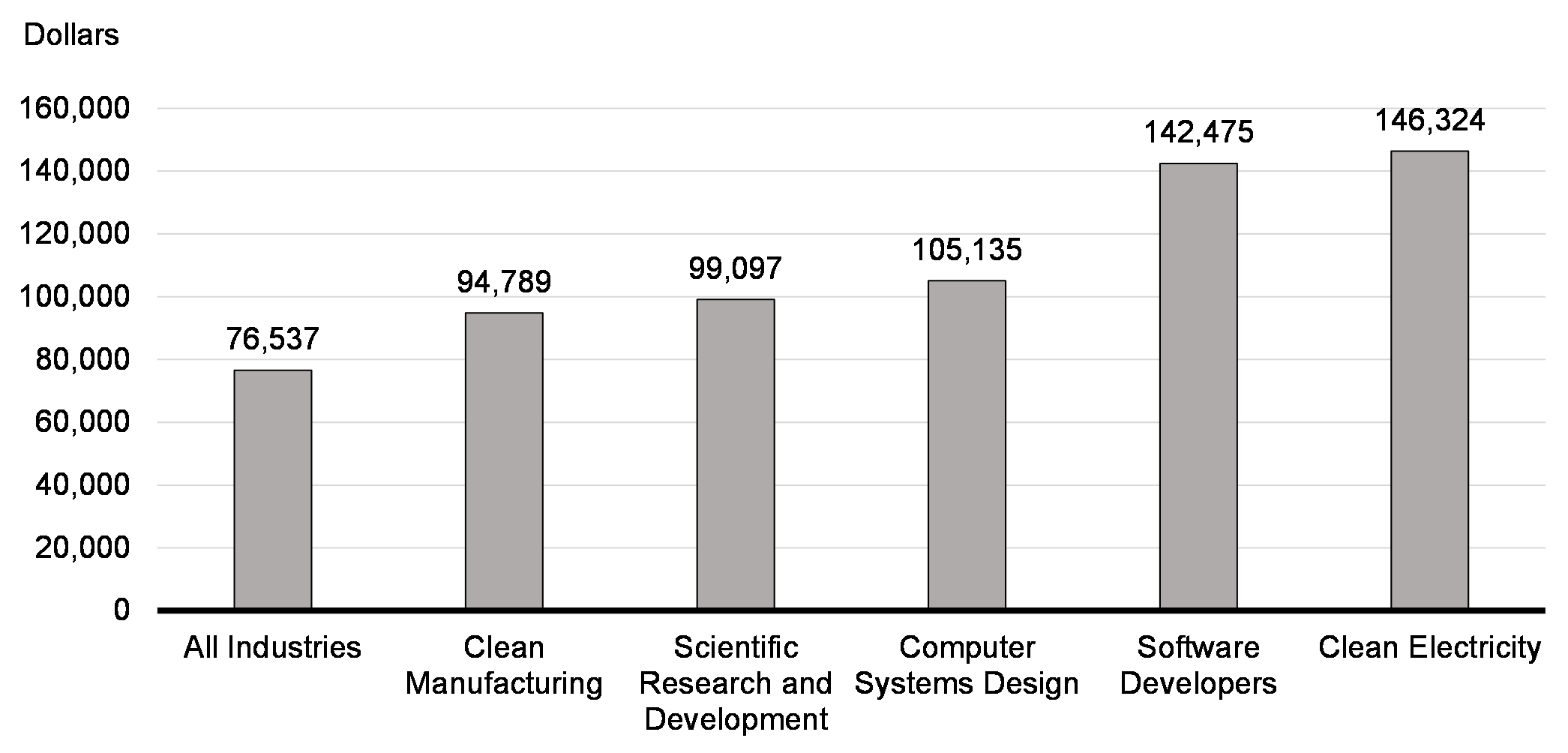

The Canadian economy is adding new, high-paying jobs, in high-growth sectors, like clean tech, clean electricity, and scientific research and development (Chart 4.4). Budget 2024 will continue this momentum by making strategic investments that create opportunities for workers today—driving productivity and economic growth for generations to come.

Impacts report

Find out more about the expected gender and diversity impacts for each measure in section 4.1 Boosting Research, Innovation, and Productivity

Canada's skilled hands and brilliant minds are our greatest resource. Capitalizing on their ideas, innovations, and hard work is an essential way to keep our place at the forefront of the world's advanced economies. Our world-class innovators, entrepreneurs, scientists, and researchers are solving the most pressing challenges of today, and their discoveries help launch the businesses of tomorrow.

Canadian researchers, entrepreneurs, and companies are the driving force of this progress—from scientific discovery to bringing new solutions to market. They also train and hire younger Canadians who will become the next generation of innovators. New investments to boost research and innovation, including enhancing support for graduate students and post-doctoral fellows, will ensure Canada remains a world leader in science and new technologies, like artificial intelligence.

By making strategic investments today in innovation and research, and supporting the recruitment and development of talent in Canada, we can ensure Canada is a world leader in new technologies for the next generation. In turn, this will drive innovation, growth, and productivity across the economy.

Key Ongoing Actions

- Supporting scientific discovery, developing Canadian research talent, and attracting top researchers from around the planet to make Canada their home base for their important work with more than $16 billion committed since 2016.

- Supporting critical emerging sectors, through initiatives like the Pan-Canadian Artificial Intelligence Strategy, the National Quantum Strategy, the Pan-Canadian Genomics Strategy, and the Biomanufacturing and Life Sciences Strategy.

- Nearly $2 billion to fuel Canada's Global Innovation Clusters to grow these innovation ecosystems, promote commercialization, support intellectual property creation and retention, and scale Canadian businesses.

- Investing $3.5 billion in the Sustainable Canadian Agricultural Partnership to strengthen the innovation, competitiveness, and resiliency of the agriculture and agri-food sector.

- Flowing up to $333 million over the next decade to support dairy sector investments in research, product and market development, and processing capacity for solids non-fat, thus increasing its competitiveness and productivity.

Strengthening Canada's AI Advantage

Canada's artificial intelligence (AI) ecosystem is among the best in the world. Since 2017, the government has invested over $2 billion towards AI in Canada. Fuelled by those investments, Canada is globally recognized for strong AI talent, research, and its AI sector.

Today, Canada's AI sector is ranked first in the world for growth of women in AI, and first in the G7 for year-over-year growth of AI talent. Every year since 2019, Canada has published the most AI-related papers, per capita, in the G7. Our AI firms are filing patents at three times the average rate in the G7, and they are attracting nearly a third of all venture capital in Canada. In 2022-23, there were over 140,000 actively engaged AI professionals in Canada, an increase of 29 per cent compared to the previous year. These are just a few of Canada's competitive advantages in AI and we are aiming even higher.

To secure Canada's AI advantage, the government has already:

- Established the first national AI strategy in the world through the Pan-Canadian Artificial Intelligence Strategy;

- Supported access to advanced computing capacity, including through the recent signing of a letter of intent with NVIDIA and a Memorandum of Understanding with the U.K. government; and,

- Scaled-up Canadian AI firms through the Strategic Innovation Fund and Global Innovation Clusters program.

AI is a transformative economic opportunity for Canada and the government is committed to doing more to support our world-class research community, launch Canadian AI businesses, and help them scale-up to meet the demands of the global economy. The processing capacity required by AI is accelerating a global push for the latest technology, for the latest computing infrastructure.

Currently, most compute capacity is located in other countries. Challenges accessing compute power slows down AI research and innovation, and also exposes Canadian firms to a reliance on privately-owned computing, outside of Canada. This comes with dependencies and security risks. And, it is a barrier holding back our AI firms and researchers.

We need to break those barriers to stay competitive in the global AI race and ensure workers benefit from the higher wages of AI transformations; we must secure Canada's AI advantage. We also need to ensure workers who fear their jobs may be negatively impacted by AI have the tools and skills training needed in a changing economy.

To secure Canada's AI advantage Budget 2024 announces a monumental increase in targeted AI support of $2.4 billion, including:

- $2 billion over five years, starting in 2024-25, to launch a new AI Compute Access Fund and Canadian AI Sovereign Compute Strategy, to help Canadian researchers, start-ups, and scale-up businesses access the computational power they need to compete and help catalyze the development of Canadian-owned and located AI infrastructure.

- $200 million over five years, starting in 2024-25, to boost AI start-ups to bring new technologies to market, and accelerate AI adoption in critical sectors, such as agriculture, clean technology, health care, and manufacturing. This support will be delivered through Canada's Regional Development Agencies.

- $100 million over five years, starting in 2024-25, for the National Research Council's AI Assist Program to help Canadian small- and medium-sized businesses and innovators build and deploy new AI solutions, potentially in coordination with major firms, to increase productivity across the country.

- $50 million over four years, starting in 2025-26, to support workers who may be impacted by AI, such as creative industries. This support will be delivered through the Sectoral Workforce Solutions Program, which will provide new skills training for workers in potentially disrupted sectors and communities.

The government will engage with industry partners and research institutes to swiftly implement AI investment initiatives, fostering collaboration and innovation across sectors for accelerated technological advancement.

Safe and Responsible Use of AI

AI has tremendous economic potential, but as with all technology, it presents important considerations to ensure its safe development and implementation. Canada is a global leader in responsible AI and is supporting an AI ecosystem that promotes responsible use of technology. From development through to implementation and beyond, the government is taking action to protect Canadians from the potentially harmful impacts of AI.

The government is committed to guiding AI innovation in a positive direction, and to encouraging the responsible adoption of AI technologies by Canadians and Canadian businesses. To bolster efforts to ensure the responsible use of AI:

- Budget 2024 proposes to provide $50 million over five years, starting in 2024-25, to create an AI Safety Institute of Canada to ensure the safe development and deployment of AI. The AI Safety Institute will help Canada better understand and protect against the risks of advanced and generative AI systems. The government will engage with stakeholders and international partners with competitive AI policies to inform the final design and stand-up of the AI Safety Institute.

- Budget 2024 also proposes to provide $5.1 million in 2025-26 to equip the AI and Data Commissioner Office with the necessary resources to begin enforcing the proposed Artificial Intelligence and Data Act .

- Budget 2024 proposes $3.5 million over two years, starting in 2024-25, to advance Canada's leadership role with the Global Partnership on Artificial Intelligence, securing Canada's leadership on the global stage when it comes to advancing the responsible development, governance, and use of AI technologies internationally.

Using AI to Keep Canadians Safe

AI has shown incredible potential to toughen up security systems, including screening protocols for air cargo. Since 2012, Transport Canada has been testing innovative approaches to ensure that air cargo coming into Canada is safe, protecting against terrorist attacks. This included launching a pilot project to screen 10 to 15 per cent of air cargo bound for Canada and developing an artificial intelligence system for air cargo screening.

- Budget 2024 proposes to provide $6.7 million over five years, starting in 2024-25, to Transport Canada to establish the Pre-Load Air Cargo Targeting Program to screen 100 per cent of air cargo bound for Canada. This program, powered by cutting-edge artificial intelligence, will increase security and efficiency, and align Canada's air security regime with those of its international partners.

Incentivizing More Innovation and Productivity

Businesses that invest in cutting-edge technologies are a key driver of Canada's economic growth. When businesses make investments in technology—from developing new patents to implementing new IT systems—it helps ensure Canadian workers put their skills and knowledge to use, improves workplaces, and maximizes our workers' potential and Canada's economic growth.

The government wants to encourage Canadian businesses to invest in the capital—both tangible and intangible—that will help them boost productivity and compete productively in the economy of tomorrow.

- To incentivize investment in innovation-enabling and productivity-enhancing assets, Budget 2024 proposes to allow businesses to immediately write off the full cost of investments in patents, data network infrastructure equipment, computers, and other data processing equipment. Eligible investments, as specified in the relevant capital cost allowance classes, must be acquired and put in use on or after Budget Day and before January 1, 2027. The cost of this measure is estimated at $725 million over five years, starting in 2024-25.

Boosting R&D and Intellectual Property Retention

Research and development (R&D) is a key driver of productivity and growth. Made-in-Canada innovations meaningfully increase our gross domestic product (GDP) per capita, create good-paying jobs, and secure Canada's position as a world-leading advanced economy.

To modernize and improve the Scientific Research and Experimental Development (SR&ED) tax incentives, the federal government launched consultations on January 31, 2024, to explore cost-neutral ways to enhance the program to better support innovative businesses and drive economic growth. In these consultations, which closed on April 15, 2024, the government asked Canadian researchers and innovators for ways to better deliver SR&ED support to small- and medium-sized Canadian businesses and enable the next generation of innovators to scale-up, create jobs, and grow the economy.

- Budget 2024 announces the government is launching a second phase of consultations on more specific policy parameters, to hear further views from businesses and industry on specific and technical reforms. This includes exploring how Canadian public companies could be made eligible for the enhanced credit. Further details on the consultation process will be released shortly on the Department of Finance Canada website.

- Budget 2024 proposes to provide $600 million over four years, starting in 2025-26, with $150 million per year ongoing for future enhancements to the SR&ED program. The second phase of consultations will inform how this funding could be targeted to boost research and innovation.

On January 31, 2024, the government also launched consultations on creating a patent box regime to encourage the development and retention of intellectual property in Canada. The patent box consultation closed on April 15, 2024. Submissions received through this process, which are still under review, will help inform future government decisions with respect to a patent box regime.

Enhancing Research Support

Since 2016, the federal government has committed more than $16 billion in research, including funding for the federal granting councils—the Natural Sciences and Engineering Research Council (NSERC), the Canadian Institutes of Health Research (CIHR), and the Social Sciences and Humanities Research Council (SSHRC).

This research support enables groundbreaking discoveries in areas such as climate change, health emergencies, artificial intelligence, and psychological health. This plays a critical role in solving the world's greatest challenges, those that will have impacts for generations.

Canada's granting councils already do excellent work within their areas of expertise, but more needs to be done to maximize their effect. The improvements we are making today, following extensive consultations including with the Advisory Panel on the Federal Research Support System, will strengthen and modernize Canada's federal research support.

- To increase core research grant funding and support Canadian researchers, Budget 2024 proposes to provide $1.8 billion over five years, starting in 2024-25, with $748.3 million per year ongoing to SSHRC, NSERC, and CIHR.

- To provide better coordination across the federally funded research ecosystem, Budget 2024 announces the government will create a new capstone research funding organization. The granting councils will continue to exist within this new organization, and continue supporting excellence in investigator-driven research, including linkages with the Health portfolio. This new organization and structure will also help to advance internationally collaborative, multi-disciplinary, and mission-driven research. The government is delivering on the Advisory Panel's observation that more coordination is needed to maximize the impact of federal research support across Canada's research ecosystem.

- To help guide research priorities moving forward, Budget 2024 also announces the government will create an advisory Council on Science and Innovation. This Council will be made up of leaders from the academic, industry, and not-for-profit sectors, and be responsible for a national science and innovation strategy to guide priority setting and increase the impact of these significant federal investments.

- Budget 2024 also proposes to provide a further $26.9 million over five years, starting in 2024-25, with $26.6 million in remaining amortization and $6.6 million ongoing, to the granting councils to establish an improved and harmonized grant management system.

The government will also work with other key players in the research funding system—the provinces, territories, and Canadian industry—to ensure stronger alignment, and greater co-funding to address important challenges, notably Canada's relatively low level of business R&D investment.

More details on these important modernization efforts will be announced in the 2024 Fall Economic Statement.

World-Leading Research Infrastructure

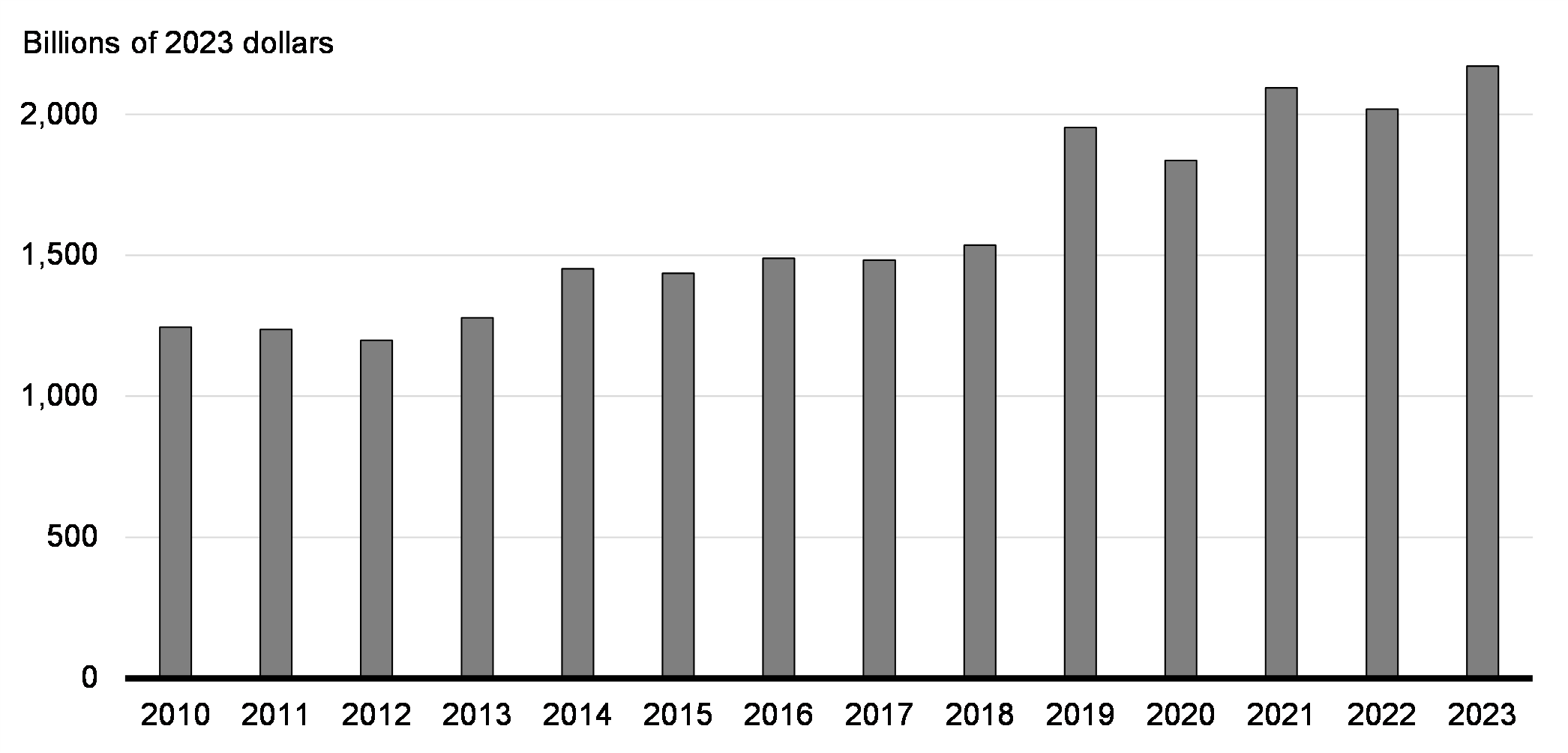

Modern, high-quality research facilities and infrastructure are essential for breakthroughs in Canadian research and science. These laboratories and research centres are where medical and other scientific breakthroughs are born, helping to solve real-world problems and create the economic opportunities of the future. World-leading research facilities will attract and train the next generation of scientific talent. That's why, since 2015, the federal government has made unprecedented investments in science and technology, at an average of $13.6 billion per year, compared to the average from 2009-10 to 2015-16 of just $10.8 billion per year. But we can't stop here.

To advance the next generation of cutting-edge research, Budget 2024 proposes major research and science infrastructure investments, including:

- $399.8 million over five years, starting in 2025-26, to support TRIUMF, Canada's sub-atomic physics research laboratory, located on the University of British Columbia's Vancouver campus. This investment will upgrade infrastructure at the world's largest cyclotron particle accelerator, positioning TRIUMF, and the partnering Canadian research universities, at the forefront of physics research and enabling new medical breakthroughs and treatments, from drug development to cancer therapy.

- $176 million over five years, starting in 2025‑26, to CANARIE, a national not-for-profit organization that manages Canada's ultra high-speed network to connect researchers, educators, and innovators, including through eduroam. With network speeds hundreds of times faster, and more secure, than conventional home and office networks, this investment will ensure this critical infrastructure can connect researchers across Canada's world-leading post-secondary institutions.

- $83.5 million over three years, starting in 2026-27 to extend support to Canadian Light Source in Saskatoon. Funding will continue the important work at the only facility of its kind in Canada. A synchrotron light source allows scientists and researchers to examine the microscopic nature of matter. This specialized infrastructure contributes to breakthroughs in areas ranging from climate-resistant crop development to green mining processes.

- $45.5 million over five years, starting in 2024-25, to support the Arthur B. McDonald Canadian Astroparticle Physics Research Institute, a network of universities and institutes that coordinate astroparticle physics expertise. Headquartered at Queen's University in Kingston, Ontario, the institute builds on the legacy of Dr. McDonald's 2015 Nobel Prize for his work on neutrino physics. These expert engineers, technicians, and scientists design, construct, and operate the experiments conducted in Canada's underground and underwater research infrastructure, where research into dark matter and other mysterious particles thrives. This supports innovation in areas like clean technology and medical imaging, and educates and inspires the next wave of Canadian talent.

- $30 million over three years, starting in 2024-25, to support the completion of the University of Saskatchewan's Centre for Pandemic Research at the Vaccine and Infectious Disease Organization in Saskatoon. This investment will enable the study of high-risk pathogens to support vaccine and therapeutic development, a key pillar in Canada's Biomanufacturing and Life Sciences Strategy. Of this amount, $3 million would be sourced from the existing resources of Prairies Economic Development Canada.

These new investments build on existing federal research support:

- The Strategic Science Fund, which announced the results of its first competition in December 2023, providing support to 24 third-party science and research organizations starting in 2024-25;

- Canada recently concluded negotiations to be an associate member of Horizon Europe, which would enable Canadians to access a broader range of research opportunities under the European program starting this year; and,

- The steady increase in federal funding for extramural and intramural science and technology by the government which was 44 per cent higher in 2023 relative to 2015.

Investing in Homegrown Research Talent

Canada's student and postgraduate researchers are tackling some of the world's biggest challenges. The solutions they come up with have the potential to make the world a better place and drive Canadian prosperity. They are the future Canadian academic and scientific excellence, who will create new innovative businesses, develop new ways to boost productivity, and create jobs as they scale-up companies—if they get the support they need.

To build a world-leading, innovative economy, and improve our productive capacity, the hard work of top talent must pay off; we must incentivize our top talent to stay here.

Federal support for master's, doctoral, and post-doctoral students and fellows has created new research opportunities for the next generation of scientific talent. Opportunities to conduct world-leading research are critical for growing our economy. In the knowledge economy, the global market for these ideas is highly competitive and we need to make sure talented people have the right incentives to do their groundbreaking research here in Canada.

- To foster the next generation of research talent, Budget 2024 proposes to provide $825 million over five years, starting in 2024-25, with $199.8 million per year ongoing, to increase the annual value of master's and doctoral student scholarships to $27,000 and $40,000, respectively, and post-doctoral fellowships to $70,000. This will also increase the number of research scholarships and fellowships provided, building to approximately 1,720 more graduate students or fellows benefiting each year. To make it easier for students and fellows to access support, the enhanced suite of scholarships and fellowship programs will be streamlined into one talent program.

- To support Indigenous researchers and their communities, Budget 2024 also proposes to provide $30 million over three years, starting in 2024-25, to support Indigenous participation in research, with $10 million each for First Nation, Métis, and Inuit partners.

Boosting Talent for Innovation

Advanced technology development is a highly competitive industry and there is a global race to attract talent and innovative businesses. Canada must compete to ensure our economy is at the forefront of global innovation.

To spur rapid growth in innovation across Canada's economy, the government is partnering with organizations whose mission it is to train the next generation of innovators. This will ensure innovative businesses have the talent they need to grow, create jobs at home, and drive Canada's economic growth.

- Budget 2024 announces the government's intention to work with Talent for Innovation Canada to develop a pilot initiative to build an exceptional research and development workforce in Canada. This industry-led pilot will focus on attracting, training, and deploying top talent across four key sectors: bio-manufacturing; clean technology; electric vehicle manufacturing; and microelectronics, including semiconductors.

Advancing Space Research and Exploration

Canada is a leader in cutting-edge innovation and technologies for space research and exploration. Our astronauts make great contributions to international space exploration missions. The government is investing in Canada's space research and exploration activities.

- Budget 2024 proposes to provide $8.6 million in 2024-25 to the Canadian Space Agency for the Lunar Exploration Accelerator Program to support Canada's world-class space industry and help accelerate the development of new technologies. This initiative empowers Canada to leverage space to solve everyday challenges, such as enhancing remote health care services and improving access to healthy food in remote communities, while also supporting Canada's human space flight program.

- Budget 2024 announces the establishment of a new whole-of-government approach to space exploration, technology development, and research. The new National Space Council will enable the level of collaboration required to secure Canada's future as a leader in the global space race, addressing cross-cutting issues that span commercial, civil, and defence domains. This will also enable the government to leverage Canada's space industrial base with its world-class capabilities, workforce, and track record of innovation and delivery.

Accelerating Clean Tech Intellectual Property Creation and Retention

Canadian clean technology companies are turning their ideas into the solutions that the world is looking for as it races towards net-zero. Encouraging these innovative companies to maintain operations in Canada and retain ownership of their intellectual property secures the future of their workforce in Canada, helping the clean economy to thrive in Canada.

As part of the government's National Intellectual Property Strategy, the not-for-profit organization Innovation Asset Collective launched the patent collective pilot program in 2020. This pilot program is helping innovative small- and medium-sized enterprises in the clean tech sector with the creation and retention of intellectual property.

- To ensure that small- and medium-sized clean tech businesses benefit from specialized intellectual property support to grow their businesses and leverage intellectual property, Budget 2024 proposes to provide $14.5 million over two years, starting in 2024-25, to Innovation, Science and Economic Development Canada for the Innovation Asset Collective.

Find out more about the expected gender and diversity impacts for each measure in section 4.2 Attracting Investment for a Net-Zero Economy

In the 21 st century, a competitive economy is a clean economy. There is no greater proof than the $2.4 trillion worth of investment made around the world, last year, in net-zero economies. Canada is at the forefront of the global race to attract investment and seize the opportunities of the clean economy, with the government announcing a net-zero economic plan that will invest over $160 billion. This includes an unprecedented suite of major economic investment tax credits, which will help attract investment through $93 billion in incentives by 2034-35.

All told, the government's investments will crowd in more private investment, securing Canadian leadership in clean electricity and innovation, creating economic growth and more good-paying jobs across the country.

Investors at home and around the world are taking notice of Canada's plan. In defiance of global economic headwinds, last year public markets and private equity capital flows into Canada's net-zero economy grew—reaching $14 billion in 2023, according to RBC. Proof that Canada's investments are working—driving new businesses to take shape, creating good jobs, and making sure that we have clean air and clean water for our kids, grandkids, and for generations to come.

Earlier this year, BloombergNEF ranked Canada's attractiveness to build electric vehicle (EV) battery supply chains first in the world, surpassing China which has held the top spot since the ranking began. From resource workers mining the critical minerals for car batteries, to union workers on auto assembly lines, to the truckers that get cars to dealerships, Canada's advantage in the supply chain is creating high-skilled, good-paying jobs across the country, for workers of all ages.

This first place ranking of Canada's EV supply chains is underpinned by our abundant clean energy, high labour standards, and rigorous standards for consultation and engagement with Indigenous communities. That's what Canada's major economic investment tax credits are doing—seizing Canada's full potential, and doing it right.

By 2050, clean energy GDP could grow fivefold—up to $500 billion, while keeping Canada on track to reach net-zero by 2050. Proof, once again, that good climate policy is good economic policy.

Helping innovative Canadian firms scale-up is essential to increasing the pace of economic growth in Canada. Already, the Cleantech Group's 2023 list of the 100 most innovative global clean technology companies featured 12 Canadian companies, the second highest number of any country, behind only the U.S. The government is investing in clean technology companies to ensure their full capabilities are unlocked.

Budget 2024 announces the next steps in the government's plan to attract even more investment to Canada to create good-paying jobs and accelerate the development and deployment of clean energy and clean technology.

- Carbon Capture, Utilization, and Storage investment tax credit;

- Clean Technology investment tax credit;

- Clean Hydrogen investment tax credit;

- Clean Technology Manufacturing investment tax credit; and

- Clean Electricity investment tax credit.

- Since the federal government launched the Canada Growth Fund last year, $1.34 billion of capital has been committed to a world-leading geothermal energy technology company, the world's first of its kind carbon contract for difference; and to clean tech entrepreneurs and innovators through a leading Canadian-based climate fund.

- Working with industry, provinces, and Indigenous partners to build an end-to-end electric vehicle battery supply chain, including by securing major investments in 2023.

- Building major clean electricity and clean growth infrastructure projects with investments of at least $20 billion from the Canada Infrastructure Bank.

- $3.8 billion for Canada's Critical Minerals Strategy, to secure our position as the world's supplier of choice for critical minerals and the clean technologies they enable.

- $3 billion to recapitalize the Smart Renewables and Electrification Pathways Program, which builds more clean, affordable, and reliable power, and to support innovation in electricity grids and spur more investments in Canadian offshore wind.

A New EV Supply Chain Investment Tax Credit

The automotive industry is undergoing a major transformation. As more and more electric vehicles are being produced worldwide, it is essential that Canada's automotive industry has the support it needs to retool its assembly lines and build new factories to seize the opportunities of the global switch to electric vehicles. With our world-class natural resource base, talented workforce, and attractive investment climate, Canada will be an electric vehicle supply chain hub for all steps along the manufacturing process. This is an opportunity for Canada to secure its position today at the forefront of this growing global supply chain and secure high-quality jobs for Canadian workers for a generation to come.

Businesses that manufacture electric vehicles and their precursors would already be able to claim the 30 per cent Clean Technology Manufacturing investment tax credit on the cost of their investments in new machinery and equipment, as announced in Budget 2023. Providing additional support to these businesses so they choose Canada for more than one stage in the manufacturing process would secure more jobs for Canadians and help cement Canada's position as a leader in this sector.

- electric vehicle assembly;

- electric vehicle battery production; and,

- cathode active material production.

For a taxpayer's building costs in any of the specified segments to qualify for the tax credit, the taxpayer (or a member of a group of related taxpayers) must claim the Clean Technology Manufacturing investment tax credit in all three of the specified segments, or two of the three specified segments and hold at least a qualifying minority interest in an unrelated corporation that claims the Clean Technology Manufacturing tax credit in the third segment. The building costs of the unrelated corporation would also qualify for the new investment tax credit.

The EV Supply Chain investment tax credit would apply to property that is acquired and becomes available for use on or after January 1, 2024. The credit would be reduced to 5 per cent for 2033 and 2034, and would no longer be in effect after 2034.

The EV Supply Chain investment tax credit is expected to cost $80 million over five years, starting in 2024-25, and an additional $1.02 billion from 2029-30 to 2034-35.

The design and implementation details of the EV Supply Chain investment tax credit will be provided in the 2024 Fall Economic Statement . Its design would incorporate elements of the Clean Technology Manufacturing investment tax credit, where applicable.

Delivering Major Economic Investment Tax Credits

To seize the investment opportunities of the global clean economy, we are delivering our six major economic investment tax credits. These will provide businesses and other investors with the certainty they need to invest and build in Canada. And they are already attracting major, job-creating projects, ensuring we remain globally competitive.

From new clean electricity projects that will provide clean and affordable energy to Canadian homes and businesses, to carbon capture projects that will decarbonize heavy industry, our major economic investment tax credits are moving Canada forward on its track to achieve a net-zero economy by 2050.

In November 2023, the government introduced Bill C-59 to deliver the first two investment tax credits and provide businesses with the certainty they need to make investment decisions in Canada today. Bill C-59 also includes labour requirements to ensure workers are paid prevailing union wages and apprentices have opportunities to gain experience and succeed in the workforce. With the support and collaboration of Parliamentarians, the government anticipates Bill C-59 receiving Royal Assent before June 1, 2024.

- Carbon Capture, Utilization, and Storage investment tax credit: would be available as of January 1, 2022;

- Clean Technology investment tax credit: would be available as of March 28, 2023; and,

- Clean Hydrogen investment tax credit; and,

The government will soon introduce legislation to deliver the next two investment tax credits:

- Clean Hydrogen investment tax credit: available as of March 28, 2023; and,

- Clean Technology Manufacturing investment tax credit: available as of January 1, 2024.

As a priority, the government will work on introducing legislation for the remaining investment tax credits, including the new EV Supply Chain investment tax credit, as well as proposed expansions and enhancements:

- Clean Electricity investment tax credit: would be available as of the day of Budget 2024, for projects that did not begin construction before March 28, 2023;

- The expansion of the Clean Technology investment tax credit would be available as of November 21, 2023; and,

- The expansion of the Clean Electricity investment tax credit would be available from the day of Budget 2024, for projects that did not begin construction before March 28, 2023.

- Clean Technology Manufacturing investment tax credit enhancements to provide new clarity and improve access for critical minerals projects. Draft legislation will be released for consultation in summer 2024 and the government targets introducing legislation in fall 2024.

- The EV Supply Chain investment tax credit : would be available as of January 1, 2024.

Given that the major economic investment tax credits will be available, including retroactively, from their respective coming into force dates, businesses are already taking action to break ground on projects that will reduce emissions, create jobs, and grow the economy. Passing the major economic investment tax credits into law will secure a cleaner, more prosperous future for Canadians today, and tomorrow.

Implementing the Clean Electricity Investment Tax Credit

As the economy grows, Canada's electricity demand is expected to double by 2050 (Chart 4.7). To meet this increased demand with a clean, reliable, and affordable grid, our electricity capacity must increase by 1.7 to 2.2 times compared to current levels (Chart 4.8). Investing in clean electricity today will reduce Canadians' monthly energy costs by 12 per cent (Chart 4.9) and create approximately 250,000 good jobs by 2050 (Chart 4.10).

Canada already has one of the cleanest electricity grids in the world, with 84 per cent of electricity produced by non-emitting sources of generation. Quebec, British Columbia, Manitoba, Newfoundland and Labrador, and Yukon are already clean electricity leaders and generate nearly all of their electricity from non-emitting hydropower—and have more untapped clean electricity potential. Other regions of Canada will require major investments to ensure clean, reliable electricity grids, and the federal government is stepping up to support provinces and territories with these investments.

In Budget 2023, the government announced the new Clean Electricity investment tax credit to deliver broad-based support to implement clean electricity technologies and accelerate progress towards a Canada-wide net-zero electricity grid.

- Low-emitting electricity generation systems using energy from wind, solar, water, geothermal, waste biomass, nuclear, or natural gas with carbon capture and storage.

- Stationary electricity storage systems that do not use fossil fuels in operation, such as batteries and pumped hydroelectric storage.

- Transmission of electricity between provinces and territories.

- The Clean Electricity investment tax credit would be available to certain taxable and non-taxable corporations, including corporations owned by municipalities or Indigenous communities, and pension investment corporations.

- Provided that a provincial and territorial government satisfies additional conditions, outlined below, the tax credit would also be available to provincial and territorial Crown corporations investing in that province or territory.

- Robust labour requirements to pay prevailing union wages and create apprenticeship opportunities will need to be met to receive the full 15 per cent tax credit.

The Clean Electricity investment tax credit is expected to cost $7.2 billion over five years starting in 2024-25, and an additional $25 billion from 2029-30 to 2034-35.

The Clean Electricity investment tax credit would apply to property that is acquired and becomes available for use on or after the day of Budget 2024 for projects that did not begin construction before March 28, 2023. The credit would no longer be in effect after 2034. Similar rules would apply for provincial and territorial Crown corporations, with modifications outlined below.

Provincial and Territorial Crown Corporations

The federal government is proposing that, for provincial and territorial Crown corporations to access to the Clean Electricity investment tax credit within a jurisdiction, the government of that province or territory would need to:

- Work towards a net-zero electricity grid by 2035; and,

- Provincial and territorial Crown corporations passing through the value of the Clean Electricity investment tax credit to electricity ratepayers in their province or territory to reduce ratepayers' bills.

- Direct provincial and territorial Crown corporations claiming the credit to publicly report, on an annual basis, on how the tax credit has improved ratepayers' bills.

If a provincial or territorial government satisfies all the conditions by March 31, 2025, then provincial or territorial Crown corporations investing in that jurisdiction would be able to access the Clean Electricity investment tax credit for property that is acquired and becomes available for use on or after the day of Budget 2024 for projects that did not begin construction before March 28, 2023.