An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- v.9(8); 2023 Aug

- PMC10457530

Effects of automated teller machine service quality on customer satisfaction: Evidence from commercial bank of Ethiopia

Abibual getachew nigatu.

a Department of Accounting and Finance, Samara University, Semera, Ethiopia

Atinkugn Assefa Belete

b Department of Economics, Samara University, Semera, Ethiopia

Getnet Mamo Habtie

c Department of Statistics, Samara University, Semera, Ethiopia

Associated Data

Data will be made available on request.

The banking industry has seen the emergence of numerous service delivery channels, automated teller machines (ATMs), telephone banking, and online banking. Global financial systems and mature competition have been compelled to research the importance of consumer satisfaction. Thus, this study aimed to examine the effects of automated teller machine service quality on customer satisfaction in commercial banks of Ethiopia in the Afar regional state, Northeast Ethiopia. To this end, cross-sectional data were collected through a questionnaire from a sample of three hundred forty-six (346) ATM users selected from Semera-logia City, Asyaita, and Awash Town. To identify the dimensions of automated teller machine service quality and their relationship with customer satisfaction, confirmatory factor analysis and structural equation modeling (SEM)) through SPSS and AMOS 23.0 data analysis software were used. The findings indicate that convenience, reliability, ease of use, fulfillment, and security/privacy of ATM service quality dimensions are positively and significantly associated with customer satisfaction. The results of this study can help banks' management improve the quality of their ATM services to increase overall customer satisfaction. To ensure continued customer satisfaction, banks are encouraged to make the ATM service more convenient, reliable, user-friendly, secure, and fulfilling. They should also constantly update and differentiate their ATM service quality aspects to build a competitive advantage and boost their profitability.

1. Introduction

Effective and cost-effective methods are needed to survive and generate profits in today's fast-paced, fiercely competitive global market. These revenues can then be used to fuel the organization's expansion. It is evident that customers are more significant stakeholders in many firms, and marketing management places a high focus on ensuring their pleasure. In many service sectors, technology is one of the most important forces behind increased client attraction, improved service delivery, and improved transaction execution [ 1 ]. The banking industry is regarded as the heart of global business in the era of advanced technologies. To expand the competitive market share, technological innovation improves the efficiency of banking operations and systems. The use of technology is helping the banking sector expand quickly. Information technology has revolutionized the banking sector over the past few decades and given banks a way to serve their consumers with products and services of high quality [ 2 ].

A banking company can only set itself apart from rivals by offering top-notch services. As a result of technological advancements, businesses may now offer improved services that satisfy clients [ 3 ]. Conventional banking systems are being replaced by electronic-based business models, and most banks are reevaluating their business process designs and customer relationship management strategies. Due to the low cost of comparing options in online contexts, researchers have suggested that electronic service quality is a major factor in differentiating service offers and creating a competitive advantage [ 4 ].

To be competitive, banks are expanding their electronic service options, such as SMS, mobile banking, internet banking, and ATMs. The trend in the banking industry changed from a cash economy to a cheque economy, which then shifted to a plastic card economy [ 5 ]. Clients primarily used automated teller machines out of all of these, which are self-service technology devices, and are the most commonly used electronic banking product. Using their cards in public places, customers of banks can access financial transactions like cash withdrawals, prepaid mobile phone credits, fund transfers between accounts, and checking account balances without the assistance of a bank teller [ 6 ].

The Ethiopian banking sector is also adopting this ICT-based service to clients to improve operational efficiency by lowering operating costs, which would ultimately boost client satisfaction and profitability. The state-owned Commercial Bank of Ethiopia (CBE) is the first bank in Ethiopia to introduce ATM service for a long time ago as part of ensuring service excellence by reducing waiting time, errors, and costs, thereby improving client satisfaction. Even though ATM service has a great significance in improving customer satisfaction, the services in Ethiopia are challenged by inappropriate infrastructure, unavailability of competent and skilled employees in the banks, and related problems. To encourage further ATM service expansion in the country, a better understanding of ATM service quality dimensions and client satisfaction is critical [ 7 ]. Customer impressions of ATM service quality are gauged by the ATM's ability to perform these tasks to their satisfaction. Researchers and corporations have been interested in the relationship between customer satisfaction and service quality because certain studies have shown that it exists [ 8 ].

Researchers such as [ [9] , [10] , [11] , [12] , [13] , [14] , [15] , [16] ] conducted on ATM service quality in different parts of the world. In Ethiopia, previously scant research has been done on ATM service quality and its effects on customer satisfaction in Ethiopia, such as Embiale [ 17 ] conducted a study on the effect of automatic teller machine service quality on customer satisfaction: the case of the Commercial Bank of Ethiopia in Hawassa city, and conclude that aspects of ATM service quality, such as reliability, convenience, user-friendliness, security, and responsiveness, positively and significantly affect customers' satisfaction. Tewodros and Debela [ 18 ] studied Factors affecting customers' satisfaction towards the use of automated teller machines (ATMs): A case in a commercial bank of Ethiopia, Chiro town, responsiveness, efficiency, appearance, reliability, and convenience of ATMs have a significant and positive influence on customers’ satisfaction. Tadesse and Bakala [ 19 ] also conducted a study on the effects of automated teller machine service on client satisfaction in the Commercial Bank of Ethiopia and found a positive relationship between tangibles, reliability, responsiveness, empathy and assurance, and client satisfaction.

However, those studies were complicated by some issues. The selection of quality dimensions in previous studies often lacked a strong theoretical foundation. As a result, the dimensions for Automated Teller Machine (ATM) quality were chosen from existing literature on electronic quality without considering the unique attributes and aspects of ATM service quality. The studies have also neglected a crucial aspect of ATM quality such as fulfillment which has been suggested as a major ATM service quality dimension [ 9 , 20 ]. Also, the convenience sampling methodology adopted in prior studies and the limited geographic scope of those studies could affect the generalizability of the results which requires the need for a more comprehensive study. Overall, the existing literature falls short of providing a comprehensive understanding of the effect of ATM service quality on customer satisfaction, as it fails to consider the unique attributes of ATM services, and explores the holistic nature of ATM services.

An investigation into the dimensions of ATM service quality and their relationship with customer satisfaction is crucial due to the rising popularity of ATMs in retail banking, and this study is intended to address the identified gaps and enhance understanding of the unique characteristics of ATM services, shed light on the dimensions of service quality that customers value, and provide valuable insights for banks to improve customer satisfaction in the specific context of banking through ATM. The survey will give bank management a thorough understanding of how to manage client expectations and raise ATM user satisfaction. The objectives of this study are therefore to examine the dimensions of perceived ATM service quality evaluate the relative importance of these dimensions in predicting customer satisfaction based on the perceptions of customers and provide insight into ATM service quality in a region often understudied in academic discourse and inquiry.

2. Literature review

2.1. atm service quality and customer satisfaction.

ATMs are technological tools that enable users to deposit, withdraw, and transfer money, pay bills, and carry out other financial activities without a branch employee or teller's assistance [ 13 ]. From the aforementioned, it is claimed that an ATM is the electronic equivalent of a traditional banking hall. Customers visit an ATM to conduct financial transactions, such as withdrawals, deposits, or balance checks, just as they would have done in a traditional banking hall.

Service quality is an important factor that influences how attractive a service provider is to customers [ 21 ]. If a company provides high-quality products that fulfill customer needs, it initially ensures customer satisfaction. Therefore, to enhance customer satisfaction, service providers should enhance the quality of their services. In simpler terms, service quality and customer satisfaction have a positive relationship, where the quality of service is the primary factor that determines customer satisfaction [ [22] , [23] , [24] ]. Providing high-quality customer service is crucial for establishing and maintaining a positive rapport with customers in the traditional banking industry [ 22 ]. In this sector, delivering exceptional customer service plays a vital role in fostering positive relationships with clients [ 25 ]. Specifically, concerning ATM services, service quality refers to the customer's general evaluation and judgment of the quality of services received through the ATM channel [ 26 ].

Customer satisfaction is of utmost importance for both customers and banks. It pertains to evaluating how well a bank's products and services meet or exceed customer expectations [ 27 ]. Customer satisfaction refers to the state in which customers feel adequately rewarded or compensated in a buying situation in exchange for a particular cost [ 28 ]. Farris, Bendle [ 29 ] also described that customer satisfaction refers to the extent to which customers are happy with the products and/or services provided by a business. According to Habte and Mesfin [ 30 ], customer satisfaction refers to a response that is specific to a particular focus and time. It is closely associated with meeting the needs of clients and is recognized as a significant factor in influencing their future purchasing decisions [ 31 ]. When discussing client satisfaction, it can be described as an individual's level of pleasure or discontentment derived from comparing the perceived performance of a product with their expectations [ 32 ]. Customer perceptions of ATM service quality are determined by how effectively the ATM meets its expectations and fulfills its desired tasks.

According to the literature, ATM service quality dimensions are multidimensional [ 15 , [33] , [34] , [35] ]. Several aspects of ATM service quality, including reliability, convenience, security and privacy, ease of use, and fulfillment, were recognized by Ref. [ 33 ]. This study tried to examine the ATM's service quality dimensions such as reliability, convenience, security and privacy, ease of use, and fulfillment. A review of these dimensions and their alleged connection to customer satisfaction is given in the next section.

Convenience is the state of having work simple and hassle-free [ 36 ]. Narteh [ 33 ] described convenience as the location of the ATM and involves the availability of services to clients around the clock. ATMs are conveniently positioned at bank branches and other locations, like malls and colleges. Customers can withdraw money from other ATMs for a minimal price because the bank's ATM card is compatible with systems used by other banks. It reduces the hassle of utilizing ATMs and has been found to positively correlate with client satisfaction. It is less inconvenient to conduct financial transactions when ATMs are nearby, as this eliminates the need to travel far [ 12 ]. According to Olusanya and Fadiya [ 11 ], customer satisfaction has been found to positively correlate with convenience, which is the most frequently used factor of ATM service quality.

Convenience of ATM service has a significant positive relationship with customer satisfaction.

Reliability is the ability to perform the desired service exactly and dependably [ 37 ]. Wolfinbarger and Gilly [ 38 ] claimed that reliability is a good predictor of client satisfaction in electronic channels. According to Ennew, Waite [ 39 ], reliability can be viewed as the degree to which customers can rely on the service that the company has promised. The reliability dimension is essential because it incorporates the active competency to carry out all the contracted services consistently and precisely. Reliability in the context of an ATM setting refers to the capacity of the device to operate continuously and deliver services that are constant and error-free. According to Ogbeide [ 10 ], reliability is a crucial ATM service quality dimension that affects client satisfaction. The literature that is currently available has also demonstrated that in the banking industry, reliability and customer satisfaction are positively correlated [ [40] , [41] , [42] , [43] ].

Reliability of ATM service has a significant positive relationship with customer satisfaction.

Ease of Use: Since some customers may feel threatened by technology, one would anticipate that ATMs would be designed to speed up the transactional process for users [ 44 ]. Ease of use is the extent to which the prospective user anticipates the target system to be free of effort, according to Davis, Bagozzi [ 44 ]. Chong, Ooi [ 45 ] argued that people are more inclined to use an electronic banking system if they think it's easy and stress-free. The term "concept" in this study refers to the extent to which an ATM service provides a hassle-free transaction for the user. An important factor in determining the acceptance and utilization of different corporate information technologies, such as online banking, is the ease of use [ 46 ]. The ease of use was identified by Refs. [ 9 , 47 , 48 ] as an essential ATM quality dimension.

Easy use of ATM service has a significant positive relationship with customer satisfaction.

Fulfillment: The extent to which the website's guarantees about order delivery and item readiness are upheld is what matters [ 20 ]. Wolfinbarger and Gilly [ 38 ] stated that the fulfillment of websites has a significant effect on overall quality, satisfaction, and loyalty goals. In the ATM context, the study employed fulfillment quality to gauge how well the ATM delivers results that live up to client expectations One could also indicate the amount given to clients per transaction, the transactional fees charged by the ATM, and the validity of the notes handed by the ATM (to eliminate counterfeits). Fulfillment was found to be the primary determinant of customer satisfaction for ATM service quality [ 13 ].

Fulfillment of ATM service has a significant positive relationship with customer satisfaction.

Security and Privacy: Customers should receive protection and privacy from an ATM. While privacy is the defense of personal information, security includes protecting clients against fraud and financial loss [ 49 ]. Security was described by Casaló, Flavián [ 50 ] as the technical guarantee that the legal requirement and practices protecting privacy will be properly met. The adoption of Internet banking in Vietnam was found to be influenced by security and privacy [ 45 ]. Every client expects their banks to protect their personal information and money. Khan [ 15 ] concluded that security and privacy were important aspects of the ATM service quality.

Security and privacy of ATM service have a significant negative relationship with customer satisfaction.

Based on the previously studied literature that is already in existence, the current study predicts that the key aspects of ATM service quality that will affect customer satisfaction are reliability, convenience, security and privacy, ease of use, and fulfillment. Based on the previous discussions, the study suggests a framework that directs the ongoing research, as shown in Fig. 1 .

Conceptual model of ATM service quality and customer satisfaction.

3. Research methods

3.1. study area.

This study was conducted in Samara-Logia city, Asayita, and Awash town located in Afar regional state, eastern Ethiopia. Currently, the region is growing into a place of considerable social, economic, and political activities with the establishment of colleges, a lot of commercial banks, a university, factories, modern shops, investment projects, and other significant financial institutions.

3.2. Research design

A research design is an overall strategy for the study that outlines the precise steps a researcher should take to answer the study's questions and accomplish its objective [ 51 ]. The study's research design strategy is designed based on the objectives of the study. To achieve the objectives of the study, both descriptive and explanatory research methods are employed to describe and evaluate how automated teller machine service quality affects customer satisfaction. In addition, this study collected data over a specific period to look into the effect of ATM service quality on customer satisfaction in addition to its descriptive and explanatory nature. As a result, our study used the cross-sectional data type for this investigation based on the time horizon dimension of research design classification.

3.3. Sampling techniques and sampling size

A multi-stage sampling technique was used in this study. In the first stage, from the regional state of Afar, two towns (Awash and Asayita) and one city administration (Samara-logia) were selected purposively because there are large numbers of ATM users in those areas. In the Second stage, the sample size from each selected area was determined proportionally to the number of registered ATM users in the Commercial Bank of Ethiopia operated in each town and city. Finally, 386 ATM users were selected based on the simple random sampling method. To derive the sample size, the study used a [ 52 ] simplified formula by considering a sample error of 5%.

3.4. Data source and collection procedure

The sources of data for this study are both primary and secondary data sources for the achievement of the objectives. The primary data were obtained from ATM users of commercial banks of Ethiopia (CBE) in selected towns and a city through structured questionnaires. The data were collected from October 2022 to December 2022. The secondary sources were obtained from published and unpublished materials and annual reports of the bank.

3.5. Measurement of instruments

The survey questionnaire for the study consists of demographic variables and five constructs in the research model. Demographic variables for acquiring information about participants consisted of gender, age, marital status, educational background, and occupation. Other than that, to identify respondents who have experience in using conventional banking services and ATMs a screening question was included in demographic questions. The survey items were assessed based on a five-point Likert-type scale, where 1 indicates strongly disagree and 5 indicates strongly agree. The construct, reliability, convenience, security and privacy, ease of use, and fulfillment were assessed by 3 items, and lastly, customer satisfaction was assessed by 4 items, adopted from Refs. [ 13 , 15 , 34 , 53 ] with some modification.

3.6. Statistical technique

The structural equation modeling (SEM) approach using Amos was employed for data analysis. This study consists of 15 latent variables, which can be deemed complex; therefore, SEM is considered appropriate for dealing with complex research models with larger numbers of latent variables [ 54 ]. The reliability, convenience, security and privacy, ease of use, and fulfillment of ATM service quality were the exogenous variables, and customer satisfaction was the endogenous variable.

3.7. Normality test

After gathering data, the participants' answers were organized, stored, and examined using SPSS, the statistical software. To determine whether the data followed a normal distribution, the kurtosis and skewness were assessed using two tests called the Shapiro-Wilk and Kolmogorov-Smirnov tests. The findings of the normality tests showed that they were not significant, meaning that the p-values obtained were greater than 0.05. This suggests that the distribution of the data was indeed normal. Given that our null hypothesis assumes a normal distribution, we do not reject the hypothesis when the p-value is greater than 0.05.

3.8. Common method variance

According to Aslam, Arif [ 36 ], common method variance (CMV) presence in the study has to be detected first before examining the measurement model to prevent any bias. To detect any bias, this study used Harman's single factor test, which stated that if the variance is less than 50%, then it indicated no CMV issue. In this study, it is indicated that the percentage of variance is 45.39%, which indicates no presence of data bias in this study.

3.9. Ethical consideration and consent to participate

The College of Business and Economics at Samara University provided ethical clearance. The confidentiality of the data was protected by removing respondents' identifiers, such as names, from the data collection format.

Finally, those who were willing to engage in the study and were in the sampled city and towns provided verbal informed consent. Moreover, the results were recommended to be disseminated by the responsible bodies who were involved in the Commercial Bank of Ethiopia.

Out of the 386 questionnaires distributed to selected ATM users, 26 questionnaires were not returned for various reasons. In addition, 14 questionnaires were not appropriately completed by the respondents. Therefore, 346 questionnaires were analyzed, which accounted for a response rate of 89.6%.

4.1. Demographic profile of respondents

Table 1 presents the background profile of the users of ATM services provided by the Commercial Bank of Ethiopia in Awash and Asayita Towns and Samara-logia city administration. Out of the total completed ATM user survey in the study area, about 73.4% were male and the remaining 26.5% were female customers. Among the total samples, the majority age group of ATM users (50.3%) was 27–35 years, 19.9% were 36–50 years age group, whereas, 10.1% were 18–26 and 19.7% of them were over 51 years. Concerning marital status, the dominant 70.8% of samples are single, followed by married 19.7%, divorced 6.9%, and widowed 2.6% ( Table 1 ).

Background of Respondents (ATM users).

Regarding their levels of education, the majority of the total sample respondents 72.6% of them had completed a diploma and above or higher qualifications, with 26.9% having secondary education, and 0.6% of them were illiterate. Of the total sample respondents, 39.6% were salaried individuals, 28% were unemployed individuals, and 17.9% and 14.5% of the sample of ATM users were businessmen and students respectively ( Table 1 ).

Regarding customer's experience in using the conventional banking service, from the total ATM users, 41.6% of them have 5–6 years of experience, 27.7% of them have over 6 years of experience, 12.4% of them have 1–2 years of experience, 9.8% of them have an experience of below one year, and 8.4% of them have 3–4 years of experience in the bank. Concerning using ATM service, out of the total sample respondents, about 37% of them have 5–6 years of experience, 32.7 of them have over 6 years of experience, 14.5% of them have 3–4 years of experience, 13.3% of them have 1–2 years of experience, and 3.7% of them have an experience of below one year in using ATM service from the bank according to Table 1 . This indicates that, on average, most of the ATM banking users in the study area have an experience of more than three years. The longer period of the users of the ATM service served contributes to evaluating better how the ATM service of the bank is effective and efficient. Besides that, it helps the researcher to gain responses, which are most likely expected to be reliable information as a customer rating their level of satisfaction or dissatisfaction concerning services received from the bank in the study area.

4.2. Customer satisfaction with ATM banking services

Table 2 shows the status of customer satisfaction with using ATM banking services within the Commercial Bank of Ethiopia. The table shows that the highest mean score of all the customer satisfaction items is obtained and ranges from 3.83 to 4.11. According to Alhakimi and Alhariryb [ 55 ], the interpretations of the Likert scale results are: the mean score value of 1–2.32 indicates a low level, scores of 2.33–3.65 indicate a medium level, and scores of 3.66–5 indicate high level. In addition, the higher mean values (>3) refer to the customers are agreed on the item, and vice-versa. So, this result revealed that ATM users are more delighted with the ATM services they receive from the bank.

Client Satisfaction with the ATM service quality of commercial bank of Ethiopia.

This signifies that the users of ATMs concur that ATM banking services offer higher satisfaction than conventional banking systems, have met customer expectations, offer adequate guidance on how to use and secure the ATM banking service, and, as a whole, have a more positive effect on banking practices than ordinary banking services. Overall, the grand mean for the overall satisfaction level is (3.9913) implying their satisfaction has reached a high level implying that the majority of users are satisfied with the provided ATM service of the Commercial Bank of Ethiopia in the study area and is evaluated as very good, though it needs an improvement on the different dimensions.

4.3. Effects of ATM service quality on customer satisfaction

The perception of the customer was analyzed based on the convenience, reliability, ease of use, fulfillment, and security dimension of ATM service quality offered by the Commercial Bank of Ethiopia. Table 3 , shows the summary of customer perception of ATM services quality and the overall mean for the dimension of convenience, reliability, easiness, fulfillment, and security. As a result, the mean values of all dimensions vary from 2.37 to 4.18, showing that customers perceived that the ATM service is moderately convenient that there are enough ATMs, that offer 24/7 service, and that ATM waiting time for a given transaction is acceptable; reliable service that performs the service exactly as promised and completes the service correctly the first time; easy to use service that the ATM service is user friendly and uses simple and clear language; fulfillment that the service contains full banking service, provides information that exactly fits needs and the daily cash withdrawal limit of ATM is adequate; and finally, making transactions through ATM is safe, protects users privacy and transaction information and also has clear transaction safety policies regarding ATM followed by the bank. Moreover, the result established that the overall mean of all the ATM service quality dimensions from 2.41 to 3.98 referring that the ATM service their bank provides is convenient, reliable, easy to use, fulfilled, and secured in Commercial Bank of Ethiopia operated in the regional state of Afar.

Customer perception of ATM service.

4.4. Measurement model assessment

Each latent construct was measured with multiple indicators to reach a high level of validity. The psychometric properties of the survey instrument were tested using CFA employing structural equation modeling (SEM) analysis with SPSS Amos version 23 to assess the quality of the measures. The measurement scales are provided in Table 4 .

Confirmatory factor analysis (CFA) and Convergent validity.

Tests of sampling adequacy were initially carried out before the analysis. Kaiser-Meyer-Olkin (KMO) statistic is 0.84, which is appropriately higher than the suggested cut cut-off of 0.60 [ 56 ]. Additionally, the Bartlett test of Sphericity (approximately: χ2 = 5264.913, df = 171, significance 0.000) was significant, at the 1% level.

Confirmatory factor analysis (CFA) was used to evaluate the measurement model. Based on the criteria of Cronbach's alpha and factor loading, the reliability of each construct was tested. For reliability to be considered acceptable, the Cronbach alpha and factor loading must surpass 0.70 and 0.50, respectively [ 57 ]. Table 4 presents the findings of the assessment of the measurement model and demonstrates that each variable's factor loading is greater than 0.6, and Cronbach alpha is greater than 0.70. Reliability has been determined to be at an acceptable level in this study. Opponents of Cronbach's α argue that while it is a straightforward reliability indicator based on internal consistency, it is ineffective for estimating mistakes brought on by variables outside of an instrument, such as variations in testing conditions or respondent characteristics over time [ 56 ]. Because they are more parsimonious than Cronbach's, composite reliability (CR) and average variance extracted (AVE) are suitable options for SEM [ 58 ]. As a result, a validity test consisting of convergent and discriminant validity was conducted to assess the reliability of the constructs and the items . Hair, Ringle [ 59 ] noted that the index of composite reliability (CR) should exceed 0.70 whereas the index of average variance extracted (AVE) should exceed 0.50 while examining convergent validity. According to Table 4 , which lists the results for convergent validity, the values of CR, which range from 0.863 to 0.978, are greater than the 0.70 suggested threshold value. The findings based on factor loadings, Cronbach's alpha, and CR confirmed the five-factor structure as the dimensions of ATM service quality.

Convergent and discriminant validity were used to evaluate the measuring scale's validity. The degree to which latent variables have a significant amount of variance in common is measured by convergent validity [ 60 ]. The AVE in items by their respective constructs must be bigger than the variance unexplained for convergence validity to be attained (i.e. AVE >0.50). The findings in Table 4 showed that the constructs match the standards outlined by Ref. [ 57 ], with an AVE between 0.551 and 0.722 (>0.50). The study's convergent validity is therefore verified.

4.5. Structural model estimation

In this model, there were five exogenous variables (convenience, reliability, ease of use, fulfillment, and security/privacy), and one endogenous variable (satisfaction with service quality). The model was tested for good fit using various model fit indices and it was determined that the fit was adequate by the following standards: Chi-square (CMIN/DF) = 1.68; Goodness-of-Fit Index (GFI) = 0.90; Adjusted Goodness-of-Fit Index (AGFI) = 0.88; Incremental fit index (IFI) = 0.94; Tucker-Lewis Index (TLI) = 0.93; Comparative Fit Index (CFI) = 0.94; and Root Mean Square Error of Approximation (RMSEA) = 0.04. The findings of all goodness of fit indices met the specified levels from the literature (See Table 5 ), indicating that our data matched our model quite well.

Model fit indices.

The relation was developed and examined by the suggested model after the SEM model fit was determined . Fig. 2 depicts the predicted association. Out of the five ATM service quality aspects, all were found to be statistically significant, supporting four out of the five relationship hypotheses. The findings show that reliability, ease of use, fulfillment convenience, and security/privacy are the main predictors of customer satisfaction with ATM service quality. According to the path coefficients of the SEM results shown in Table 6 , the reliability of the ATM service is the most predictor of customers' satisfaction (standardized beta = 0.636), followed by ease of use (standardized beta = 0.44), fulfillment (standardized beta = 0.40), convenience (standardized beta = 0.25), and security/privacy (standardized beta = 0.14), the factor that has the least contribution to the service quality of the ATM and customer satisfaction.

Path diagram of structural model.

Hypothesis testing.

5. Discussions

The purpose of the study was to identify the dimensions of ATM service quality and investigate the relationship between customer satisfaction and ATM service quality constructs. In this study, a five-factor structure was developed and tested, and the results showed that ATM quality is multidimensional, in line with recently published literature on ATM service quality [ 13 , 15 , 34 ]. The SEM approach discovered that reliability, ease of use, fulfillment, convenience, and security/privacy predicted customer satisfaction.

The study has confirmed that reliability is the major determinant of customer satisfaction with ATMs. The result of this study indicates that the dimension of reliability has a positive and significant association with customer satisfaction. This implies that ATM services are reliable enough that users don't need to carry cash wherever they go, deliver the service exactly as promised, and complete the service right the first time client will be more satisfied with ATM banking services. This finding is in line with the findings [ 3 , 10 , 17 , 19 ], which suggested that ATM service quality is an antecedent of customer satisfaction with a significant and positive influence on it.

The finding of this study also shows that the ease of use of ATM service quality dimension is an important contributor to customer satisfaction. Clients expect the ATM to be straightforward because even the most tech-savvy customers occasionally find technologies to be a little daunting. Easy-to-understand language, services adapted to the needs of people with disabilities, and user-friendly instructions were all deemed essential for enhancing the customer experience with ATMs. These results are consistent with the findings of other empirical studies such as [ 17 , 47 , 48 , 63 ].

In addition, this study further indicates that fulfillment of the ATM service is a good predictor of customer satisfaction. The outcome also implies that, if the ATM banking service daily cash withdrawal limit of ATM is adequate provides information that exactly fits needs, and contains full banking service the level of customer satisfaction could be improved. This finding is in tandem with the finding of [ 13 , 33 ].

Similarly, the convenience of ATM service quality is another significant dimension of ATM service quality in predicting customer satisfaction. This denoted that if the banks install other ATMs at different locations like shopping areas, hotels, hospitals, college campuses, etc., enabling customers can carry out their banking activities whenever they want in a 24/7 h service, ATM banking service would be more convenient, and higher the customer satisfaction is likely to be. This finding is concurrent with the findings of [ 10 , 17 , 47 , 63 ].

Finally, the finding of this study indicates that the security or privacy of the ATM banking service to the customer has a positive and significant influence on customer satisfaction. This suggested that as the service secures the privacy of the customer, protects the customer's banking information, and has clear transaction safety policies will significantly improve customer satisfaction with the bank service. The result of the study is consistent with the works of [ 10 , 63 , 64 ]. Thus, to summarize the findings of the study reveal that convenience, reliability, ease of use, fulfillment, and security dimensions of ATM service, have a positive and significant effect on overall ATM service quality in Commercial Bank of Ethiopia in the Afar regional state.

6. Conclusion, theoretical and practical implications of the study

The purpose of the study was to examine the effect of ATM service quality on customer satisfaction in the case of the Commercial Bank of Ethiopia. The study used primary data for analysis, which were obtained from 346 ATM users in the region selected area, to achieve this purpose. The required data are collected in person through a structured questionnaire. After data collection, the study employed descriptive and econometric data analysis methods. The findings of this study obtained from the descriptive analysis showed that the majority of current ATM users are youth between the ages of 18–35, gender-wise the males are the dominant users, occupationally salaried and unemployed are the majority users, and businessmen/women and students are not an active participant in using the service, educational level diploma and first-degree holders are the majority users, as indicated by the overall mean of all ATM service quality dimensions, which runs from 3.21 to 3.63 that the customers agreed that the ATM service is more reliable, easy to use, fulfilled, convenient, and secured provided by the bank in the study area.

Moreover, the results obtained from the SEM revealed that reliability, ease of use, fulfillment, convenience, and security of ATM service quality dimensions have a positive and significant contribution to customer satisfaction. Out of this reliability has been identified as the key factor in predicting customer satisfaction.

6.1. Theoretical implication

The study contributes to the existing literature by identifying five dimensions of ATM service quality (reliability, ease of use, fulfillment, convenience, and security/privacy). This helps researchers and practitioners to have a comprehensive understanding of the key factors that influence customers' perception of ATM services. The research findings in the study contribute to the current understanding of the topic by establishing the connection between the quality of ATM services and customer satisfaction. The study emphasizes the importance of these aspects in determining overall customer satisfaction. It presents arguments on why and how the quality of ATM services influences customer satisfaction, thereby adding to the existing literature on this relationship. Through the use of structural equation modeling (SEM), the study ensures the reliability and validity of the developed five-factor structure. This finding contributes to the methodological aspect of assessing service quality dimensions.

6.2. Practical implications

The findings of this study provide valuable insights for ATM service providers and managers in identifying areas that need improvement. By focusing on improving the identified dimensions of ATM service quality (reliability, convenience, ease of use, fulfillment, and security/privacy), ATM service providers can enhance customer satisfaction. This may involve enhancing system reliability, simplifying the user interface, ensuring prompt transaction processing, increasing convenience through additional functionalities, and prioritizing security and privacy measures. Implementing findings from this study enables organizations to align their strategies with customer expectations and requirements. Understanding the dimensions that drive customer satisfaction empowers service providers to develop targeted initiatives, such as training programs for employees, technological advancements, and personalized customer experiences, to improve overall service quality. Differentiating ATM services based on the identified dimensions can provide a competitive advantage for banks. By excelling in reliability, ease of use, fulfillment, convenience, and security/privacy of ATM services, institutions can attract and retain satisfied customers who perceive their ATM services as superior to competitors'. This can ultimately lead to increased market share and customer satisfaction.

Overall, this study provides theoretical insights into the dimensions of ATM service quality and its relationship with customer satisfaction. It also offers practical implications for banks, financial institutions, and ATM manufacturers to enhance service quality, and improve customer satisfaction in the ATM domain.

6.3. Limitations and future research directions

Although the research paper has greatly enhanced our comprehension and assessment of ATM service quality, it is crucial to recognize its inherent limitations. One major limitation is that the study was conducted specifically in one city and two towns of the Afar region, focusing on ATM users of the Commercial Bank of Ethiopia. The attitudes and experiences of customers from different provinces or banks may vary, and therefore, the results may only provide limited insights into customer attitudes toward ATM service quality and its impact on customer satisfaction. To address this limitation, additional research should be conducted to investigate the behavior of customers located in different regions.

Furthermore, since this study solely relied on quantitative methods for data collection through surveys, it is important to acknowledge the limitations associated with this approach. Future research should consider employing mixed methodology and qualitative approaches to gain a more comprehensive understanding of the topic. Additionally, it is recommended that future studies explore the relationship between other dimensions of service quality and customer satisfaction, loyalty, and retention in various other self-service technologies such as Internet banking and mobile banking. Comparing the cross-cultural service quality of conventional commercial banks would also be of interest in future research.

Author contribution statement

Abibual Getachew Nigatu; Atinkugn Assefa Belete; Getnet Mamo Habtie: Conceived and designed the experiments; Performed the experiments; Analyzed and interpreted the data; Contributed reagents, materials, analysis tools or data; Wrote the paper.

Funding statement

During this investigation, there was no financial support.

Data availability statement

Declaration of interest's statement.

The authors declare no conflict of interest.

Declaration of competing interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Appendix A Supplementary data to this article can be found online at https://doi.org/10.1016/j.heliyon.2023.e19132 .

Appendix A. Supplementary data

The following is the Supplementary data to this article:

Factors influencing customer preference of cardless technology over the card for cash withdrawals: an extended technology acceptance model

- Original Article

- Open access

- Published: 27 January 2022

- Volume 28 , pages 58–73, ( 2023 )

Cite this article

You have full access to this open access article

- Bindu K. Nambiar 1 &

- Kartikeya Bolar ORCID: orcid.org/0000-0003-2277-3357 2

9361 Accesses

6 Citations

Explore all metrics

It can seem paradoxical that someone who evades the use of a debit card still wants access to cash and is willing to use their mobile device at an ATM. The cardless cash technology delivers a solution that is an improvement over the traditional form of cash delivery. This study explores the influential factors that affect the preference of cardless cash over cards. A cross-sectional survey was utilised to collect both data through a self-administered questionnaire. A total of 521 bank customers from one of the largest banks in India participated in the study employing a convenience sampling technique. The responses were analysed using a predictive analytics approach with various statistical and data mining techniques. Customers preferred cardless cash because of its usefulness over the Card rather than perceived ease of use, customer trust, or perceived security. This paper contributes to the banking world's ways of pre-stage access to cash, reducing customer contact at ATMs. It highlights the main factors that influence customer's preference towards using cardless cash technology at ATMs, helping banks spread the newest technology used to provide a financial instrument that has been here for centuries—cash.

Similar content being viewed by others

Determinants of the Cashless Payment Systems Acceptance in Developing Countries: Evidence from Jordanian Public Sector Employees

Exploring usage of mobile banking apps in the UAE: a categorical regression analysis

Factors affecting consumer acceptance of electronic cash in China: an empirical study

Avoid common mistakes on your manuscript.

Introduction

Banking services are undergoing significant shifts due to a wide variety of factors. How the banks adapt to these changes is the key to staying relevant and stimulating growth. The imperative here is to facilitate the customers' desire for financial independence through innovative and imaginative products and processes, appealing to the customers' dreams and aspirations. Banks have witnessed headwinds accentuated by the ever-evolving market dynamics. However, they were also hugely supported by tailwinds like digitisation and digitalisation. These continuous upheavals, amplified by the domestic and global scenarios, have pushed the banks to provide a robust platform and multiple channels to deliver the best customer experience.

Customer experience and satisfaction have a considerable impact on the bank's financial performance (Mbama & Ezepue, 2018 ), and bracing innovations in enhancing customer experience will genuinely shape the future of banking. The forces that reshape the banking landscape begin with the rapid evolution of customer demands (Kumar & Balaramachandran, 2018 ) that elevate the benchmark for exceptional customer experience. Secondly, emerging fintech and digital platforms drive the disruptive innovative solutions compelling the traditional banks into the most incredible opportunity (Gomber et al., 2018 ). Banking has been identified as one of the business sectors that has been most impacted by the internet's spread (Flavian et al., 2006 ). However, it is also a window of unfulfilled opportunities to define a point of difference concerning their fintech competitors, leverage their channel, and deliver and meet the unique customer needs in an emotionally significant way (Zachariadis & Ozcan, 2017 ). Additionally, the entry of multiple players is also questioning the hegemony of brick-and-mortar banks unravelling new paths and pushing banks to align their approach with the current evolution of customer expectations.

Along with the banking system, the customer domain has also undergone a sea change. Today's customers are very different from their counterparts of the past decades. They have become highly tech-savvy and more demanding. They have an enhanced understanding of the various advances in technology. They tend to adopt those technologies early on, some of which are disruptive to the hitherto seen banking landscape. They probe the full spectrum of banking channels to see what suits them better. They visit bank branches less frequently due to the rapid rise of information and communication technologies, wireless technologies, and mobile devices and do most of their banking online (Singh & Srivastava, 2020 ).

With such a high level of technology adoption, banks need to account for the fact that customers have a high degree of anxiety (Shen et al., 2010 ). Traditionally, banking is positioned to instil trust (Yousefi & Nasiripour, 2015 ). However, considering customers' growing needs through the banker's lens of service and experience, alleviating customer anxieties may be a significant vulnerability for technology-based high anxiety settings like banks (Shell & Buell, 2019 ).

The present-era customers may have a substantial amount of discretionary income and are probably in their wealth creation phase in their lives. Hence, it offers an excellent opportunity for banks to capitalise and build profitable long-term relationships. Nevertheless, banking relationships are involved in transactions-based activities more (Arnoud et al. 2011 ). Financial providers need to concentrate on spinning up and removing the friction points in the buyer's journey (KPMG, 2018 ). Banks need to provide a high degree of convenience and access to financial products (Yiu et al. 2007 ). Thus, the critical priorities for banks need to be building relationships and removing friction points in the customer journey. Innovations are happening across the globe to address these priorities. One such innovation is the application of cardless cash technology to withdraw money from ATMs without card use. One reason that prompted cardless cash technology is the rising number of ATM frauds (Agidi, 2018 ; Ali et al., 2021 ).

Empays, India's authorised payment system, teamed with Mastercard to launch 40,000 ATMs that accept this payment scheme (Mastercard press release, 2020 ). It employs SMS technology to allow cash withdrawals from participating ATMs without the need for a card. State Bank piloted the concept in India with YONO Cash, and almost all their ATMs are configured for cardless withdrawals. According to TRAI's most recent survey, India has 1.16 billion wireless or mobile telecom users, out of a population of 1.3–1.4 billion people. Since all Debit/Credit/ATM cardholders will be having a mobile number tagged to the Card, this makes the potential for a cardless payment system unbelievably vast.

Cardless ATM is a technological innovation that allows customers to make cash transactions from their accounts using a simple mobile application rather than a physical card at the ATMs. When a customer wants to withdraw money from a cardless ATM, the app produces an authentication key in a numeric code. By entering the PIN and password correctly, the ATM will process the transaction and disburse cash without a physical card. Cardless ATMs can enhance customer service by allowing customers to withdraw cash more quickly and effectively while lowering transaction costs and also not charged a fee for the cash withdrawals from the bank's ATMs.

Furthermore, there will no longer be a concern of losing the Card or missing their PIN (Phothikitti, 2020 ). Banks face the critical risks of credibility and reputation when hackers tear into the machines in different ways (Lim et al., 2017 ). Physical cards get cloned by professionals, and replacing magnetic strip cards with chip-based cards has not reduced card-related fraud. Such actions lead to repercussions from the regulator and numerous fraud-related RTI queries and litigations. Accordingly, cardless withdrawals avoid the risk of fraud unless the cardholder is complicit.

However, despite intensive social media and direct campaigns, cardless cash technology is yet to get the required momentum. Customers hesitate to use this technology because of the associated risks and the lack of knowledge of the benefits of cardless cash technology. The perceived risks may be overwhelming compared to the traditional method of banking. Customer's judgements about the capabilities (such as required knowledge, skill, and self-efficacy) to use the technology may impact their intentions since cardless cash technology may appear as a form of complicated technology (Ali et al., 2021 ).

Based on the above premise, an empirical study of customers' preference for cardless cash withdrawals at the ATMs over cards was attempted, considering the importance of ATMs in providing customer delight and the role that mobile phones play in their lives. There are many customer complaints about ATM fraud, and the entire system spends a significant amount of resources to address and resolve these issues. These critical factors spurred a study to see if increased perceived security, trust, ease of use, and usefulness of cardless cash technology led to a higher likelihood of preferring cardless cash technology over card transactions.

This paper's coverage is as follows: Sect. “ Literature review ” provides a literature review, which leads to the development of the hypothesis and research model in Sect. “ Research model and hypotheses ”. We describe data collection and research methodology in Sect. “ Data collection and methodology ”. We provide data analysis and interpretations in Sect. “ Data analysis and interpretation ”, which are further discussed in Sect. “ Discussion ”. Section “ Conclusion ” presents conclusions and some implications for practitioners and researchers.

Literature review

Can we claim cash could become obsolete (Mercadante, 2020 ) when 500 billion banknotes circulating globally and physical cash accounted for 9.6% of GDP in 2018, up from 8.1 per cent in 2011 (World Cash Report, 2018 )? However, India's currency circulation fell to 13.35 trillion rupees after the demonetisation of 500 and 1000 rupee notes in 2016. Nonetheless, it swiftly recovered to a level of 28 trillion rupees (Statista, 2021). Similarly, progress towards a cashless society has been gradual in other geographies, such as Europe (Auer et al. 2020 ). In 2015, the Eurozone's economy accounted for 9% of global GDP, while the US' economy accounted for 7%. Banknotes and coins account for up 3% of the Swedish economy, despite the country's near-cashless status (Batiz-Lazo et al. 2016 ). As a result, despite massive efforts to digitise data and transactions, cash, the complicated currency, appears to reign supreme.

Emergence of electronic modes of payment

Technological advancements and the ever-increasing mobile density have increased manifold the scope of digital payment in the mobile commerce industry (Au & Kauffman, 2008 ). Digital payment is a transaction made on digital platforms. Here, the sender and the recipient both use digital modes for paying and accepting payments. It is also called payment by electronic means. In India, digital payments have been growing at an exponential rate, and with the country's increasing internet and mobile penetration, the government is prepared to see a massive surge in digital payment use in the coming years (Singh & Rana, 2017 ). The different digital/electronic payment modes include credit card/debit card payments, mobile wallets, Unstructured Supplementary Service Data (USSD) channel, Aadhar Enabled Payment System (AEPS), United Payments Interface (UPI), internet banking, mobile banking, and Micro ATMs.

One of the electronic payment methods is the use of cards has increased during the last two decades. The government invested in strengthening the infrastructure for accepting cards at various merchant locations as part of demonetisation. Several programmes were available, including cash back, no transaction costs up to a specific amount, to further assist with digital transactions (Bhakta, 2017 ). With over 3.5 million ATMs worldwide thus, cards became one of the most popular ways for customers to interact physically and remotely with their bank. Customers could go up to an ATM and do a variety of financial transactions. This way, customers recognised that technology was capable of far more than simply dispensing cash.

The ever-evolving technological innovations enabled the payment landscape to expand beyond cash and ATMs quickly. The introduction of initiatives like the electronic payment system allowed customers greater leverage over managing cash (Deloitte, 2015 ). This move also considerably reduced banks' time spent on manual processing (Bahillo et al. 2016 ) and reconciling transactions (Guo & Liang, 2016 ), saving considerable costs (Gomber et al. 2016 ). More importantly, the technological platforms made payment processes easy and convenient for customers and provided real-time information for analysis to the banks on an ongoing basis (Capgemini, 2013 ). Furthermore, a boom in Fintech firms (KPMG & NASSCOM, 2016 ) and government digitisation programmes (Kaka et al., 2019 ) also acted as catalysts.

Additionally, through technology-led payment platforms, payment happens intuitively in the background at the end of every purchase. Customers, therefore, are prompted to use these platforms more frequently as recurring payments lead to higher rewards and savings. Consequently, a deeply integrated technology-based and easy-to-operate platform are needed to help banks grow in value, recovering all lending money while providing free payments. Nonetheless, each bank also needs to ensure that the investment in technology-based payment infrastructure is recovered as soon as possible (Ngumi, 2014 ). This infusion of technology should delight customers (Bitner et al. 2000 ), increasing their willingness and ability to adapt and use technology more (Shaw, 2014 ), thereby validating the organisation's investment.

Cash versus electronic mode of payment

While there appears to be no reliable calculation for cash consumption, the Reserve Bank of India ( 2020 ) has listed two indicators to measure. They are the Currency value in Circulation (CIC) relative to Gross Domestic Product (GDP) and ATM withdrawals. CIC grew at a compounded annual growth rate of 10.2 per cent between 2014–15 and 2018–19, implying cash preference. During those years, the second measure, cash withdrawals from ATMs, has also increased, and the proportion of cash withdrawals to GDP has been consistent at 17%. However, the ATMs experienced slower growth, with a CAGR of 4% over those years and the increase in cash usage also slowed down compared to digital payment transactions. Cash usage grew at a CAGR of 9% in volume and 10% in value, whereas digital payments grew at a CAGR of 61% in volume and 19% in value (RBI, 2020 ). While this comparison points to a positive shift towards digitisation, cash remains a convenient transaction mode for citizens living in semi-urban and rural areas (Mohite et al., 2021 ).

ATMs are a vital touchpoint that serves as an extension of the bank branch, facilitating financial inclusion and providing easy access to cash for withdrawals supporting the government's economic relief initiatives to the less privileged. Most government payments are through DBT (Direct Benefit Transfer), which entails the usage of cards, and optimally pushes for enhanced financial literacy and inclusion. Unfortunately, ATM penetration in India in terms of population is among the lowest among emerging markets (RBI, 2019 ), with less than one-fifth of ATMs deployed in rural areas (Irani, 2021 ). However, there is visible engagement by the government, regulators, and banks to increase ATM installation in remote areas. One of such decisions by the Reserve Bank of India to hike the interchange fees will increase ATMs' penetration, making it attractive for banks to install more ATMs in more geographies.

Conception of cardless cash technology

With the growth of the ATM network, banks and customers alike were forced to deal with new problems they did not cause, such as skimming, hacking, cloning, and phishing of their cards. As a result of such instances, the notion of cardless ATMs was conceived. ATMs incorporated advanced technologies such as cardless and contactless cash withdrawals, biometric fingerprint, or iris-based access. This cardless option enabled customers to access cash until a lost, stolen, or infringed Card is replaced, potentially reducing the need for express delivery of the replacement card. Cardless cash technology is mobile-driven access to cash, without a card, a significant step towards anywhere and anytime money. Customers also appear comfortable when they need not carry cards for withdrawals. Hence, cardless solutions most appropriately address the customers' desire for convenience. Yet, customers are also concerned with security (Singh & Srivastava, 2020 ), so tokenisation is included as an additional layer of protection for ATM access (Finserv, 2016 ). As a result, cardless cash technology provides an excellent option for providing customers with increased security.

Characteristics of cardless technology

Cardless technology enables banked, under-banked, or unbanked customers to transfer and withdraw funds using electronic devices over a wireless network (Karthikeyan, 2012 ). It allows account holders to withdraw money from their accounts without using a card (Istrate, 2014 ). Besides that, this feature also offers access to banking facilities, such as transferring funds, to individuals who do not have an account with the bank (Moodley, 2011 ; Kinsman, 2019 ), allowing them to withdraw cash without a card (Innova, 2015). All these transactions are carried out using customer's personal information.

Benefits of cardless cash technology

ATMs using cards currently do not provide adequate protection. If a person secures a debit card and its PIN, the account can be misused. However, cardless ATMs offer a more robust verification procedure to guarantee that the correct person accesses an account. Yet again, the cardless cash technology improves protection by removing the risk of 'shoulder surfing' and card-skimming. This feature eliminates amount details inserted into ATMs and guarantees the non-storage of a customer's data on the mobile device and all the other critical financial credentials with which the customer carries out a transaction (Bhosale & Sawant, 2012 ). As customers retain familiar mobile user interfaces, it simplifies how users can perform a cardless cash technology (Asfour & Haddad, 2014 ). Its ability to carry out transactions without a branch or waiting in the queue makes the cardless cash technology convenient for customers (Johnson, 2014 ). In addition to customer convenience, self-service electronic platforms such as ATMs also minimise the costs of services and operations (David-West, 2006 ). The transaction costs associated with cardless cash technology are comparatively lower than those associated with card transactions due to lower ATM withdrawal, recurring payment fees, and transfers fees . Banks can avoid, in this way, grievance related to cards (Bhosale & Sawant, 2012 ). Again, the cardless cash technology has additional security measures, such as computer-generated codes sent via a short message service (SMS) on a secure network as part of a two-code authentication system (Istrate, 2014 ).

Digital/mobile/E-wallet versus cardless cash

Digital wallets facilitate online shopping (PayPal), transferring funds between friends (Venmo), or paying at the gas station (Apple Pay) by phone. A mobile wallet is one that customers access via an app on a mobile device (usually a phone or wearable) using "tap to pay" in a store while checking out. It is a simple alternative to paying with cash or carrying around a bevvy of physical cards. Customers have store boarding passes and concert tickets in mobile wallets. They are safe to use because payment information is over NFC waves. The systems encrypt data in the form of a "token". The token does not expose details of the actual account that might otherwise be compromised. Since a mobile wallet requires a passcode, fingerprint, or a face scan before the customer makes a payment, it is safer than credit cards or cash, which anyone can use if stolen. Therefore, the distinction between digital wallets and mobile wallets is that the customer can have a mobile wallet on a mobile device in an app, and a digital wallet is accessed through a desktop.

The difference between an E-wallet and a Digital Wallet/Mobile Wallet is that before any transaction (online or offline), E-Wallet enables the user to move and load currency into them, whereas digital wallet merely saves the user's card information for simple future transactions, with the funds remaining in the user's bank or card account.

Conversely, cardless technology helps users withdraw cash safely and efficiently at ATMs for daily use without using any card. For using cardless technology, the customer has to download the respective bank's application on the mobile. For instance, for ICICI Bank, customers need to download the mobile app on their smartphone from Play Store or App Store. After that, they select the 'services' option and select the cardless cash withdrawal option. After entering the amount, the customer generates a 4-digit temporary PIN, specifies an account number to debit the amount, and selects the submit button after confirming the details. The bank then sends an SMS with a unique code on the registered mobile phone, which the customer must save for future uses. Subsequently, the customer visits the specified bank ATM and makes a cardless withdrawal.

The advantage of using cardless cash technology is that the recipient need not have any bank account and still withdraw cash from any ATM across India without using the Card, using the details received through an SMS on a mobile device. Drawing money without a card can provide customers privacy and comfort as the technology is remote access and does not allow skimming or stealing of physical cards. Customers who have their mobile phones arrive at the ATM and withdraws money by keying the saved PIN sent via SMS. With this facility, a customer can transfer money instantly anywhere to anyone. All they need to do is to add a beneficiary's mobile number, name, and address.

Research model and hypotheses

The Technology Acceptance Model (TAM) proposed by Davis ( 1989 ) has been extensively used to measure the adoption of various technologies and technology-enabled services . According to Davis ( 1989 ), multiple factors influence the customer's decision to adopt or reject technology. Previous research reveals two significant determinants. First, "people are more likely to use or not use an application if they believe it would help them accomplish their work better " (Davis, 1989 ). This variable is referred to as "perceived usefulness" (P.U.) (Davis, 1989 ). Second, "people believe that if a technology is too difficult to use, they are less likely to embrace and use it, even if they think it is functional". This second measure is referred to as "perceived ease of use" (PEOU) ( Davis, 1989 ).

The viability and robustness of TAM have been established and validated in different technology-based services domains decades ago since Davis ( 1989 ) introduced the model. As Poong et al. ( 2017 ) stated, the available literature significantly demonstrates the viability and robustness of TAM in technology adoption. Again, individuals and firms in both developed and developing economies around the globe have used TAM to predict the adoption and use of the latest technologies (Glavee-Geo et al., 2017 ). Legris et al. ( 2003 ) has also confirmed that TAM is the most significantly utilised model to predict the extent of technology adoption. However, Lee and Jun ( 2007 ) alleged that the TAM must have the ability to examine more factors affecting use intentions further than the usual two factors. Various research studies have also extended TAM on different technologies, especially in service industries (Hanafizadeh et al., 2014 ; Mehrad & Mohammadi, 2016 ; Chitungo & Munongo, 2013 ; Lee et al. 2011 ). Moreover, Shaikh & Karjaluoto's ( 2015 ) findings reveal that existing literature on adopting technology in banking generally relies on TAM and its relevant modifications. These studies have modified and extended TAM to enhance its power of prediction and explanation in the arena of technology acceptance (Jayasingh et al. 2009 ). Again, Brown & Venkatesh ( 2005 ) have termed TAM incomplete as it excludes economic, demographic, and external factors (Mehrad& Mohammadi, 2016 ). Hence, existing studies have suggested supplementing TAM with additional variables to understand better and predict technology adoption (Liébana-Cabanillas et al. 2017 ).

Earlier studies of Amin et al. (2012), Anderson and Gerbing ( 1988 ), Bankole et al. ( 2011 ), Ramayah & Suki ( 2006 ), and Venkatesh & Morris ( 2000 ) have ascertained the prime factors of TAM (P.U. and PEOU)to be the most constructive elements in predicting adoption of information systems in different settings as indicated in Table 1

Yet again, Davis ( 1989 ) stated that TAM could be further supplemented and customised with external variables, which is the prime reason for its wider acceptance. Various research studies have extended TAM on different technological aspects, which have been adaptive to service industries, especially in banking (Moser, 2015 ). To add credence, King & He ( 2006 ) conducted a meta-analysis of TAM, including 88 studies that utilised TAM in different settings. They termed the model as possibly the most powerful, versatile, and robust with highly reliable predictive capabilities in various contexts.

- Customer preference

Customer preference refers to the predisposition of customers to choose (Howard & Sheth, 1969 ), and customers who perceive that specific offerings are customised to satisfy their tastes are likely to use more (Moon & Lee, 2014 ). Also, customised products based on customer preferences are considerably more likely to receive favourable responses (Franke et al., 2009 ). A series of recent studies emphasised that there should be a focus on customer preferences rather than on technology adoption to become customer-centric (Fogliatto et al., 2012 ). If there is a close fit between customer preferences and product/service features, it will lead to higher adoption (Simonson, 2005 ). Hence, determining how individuals perceive the fit between a product/service features and their personal preferences is critical (Franke et al., 2009 ).

In banking nowadays, customers pay for transactions with an increasing variety of payment methods. Past several decades, there has been a rising emergence of electronic payment mechanisms like credit cards, charge cards, and debit cards, in addition to traditional forms such as cash and cheques. A new wave of payment systems such as smart cards, memory cards, and online payments rose that eventually constituted a large proportion of all customer purchases (Marlin, 1998 ). Apart from strategic reasons such as maximising the transaction's perceived attractiveness, the choice of payment is also motivated by more straightforward considerations such as convenience, retailer acceptability, accessibility, and fee for usage (Loewenstein & Prelec, 1998). Nonetheless, there is not much research on the proliferating spectrum of payment mechanisms' influence on customers' preferences or vice versa. Though some studies have compared conventional cash-based and card-based transactions, these studies found that cash-based payment is very significant in both physical form and amount. The implication is that how customers respond to cash-based and card-based payment mechanisms is different. This difference may affect customer's perceptions and choices (Soman, 2003 ). As discussed in the earlier sections, the cardless cash feature is revolutionary for its advantages. This feature results in the reduction of transaction time to half and minimisation of ATM system downtime. Moreover, studies from Lewin ( 1951 ) and Festinger ( 1957 ) indicate that choices between desirable yet completely contradictory alternatives would conflict as the options become similar. The exact inference may be plausible while comparing Card and cardless cash withdrawals.

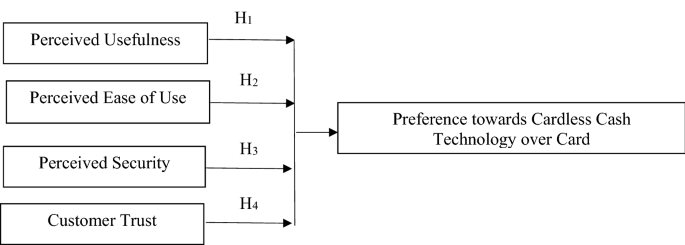

The following research model (Fig. 1 ) is built on understanding the interrelationships between perceived ease of use, perceived usefulness, perceived security, and customer trust with a preference for a card or cardless technology for cash withdrawals.

Theoretical framework

Perceived usefulness

Davis introduced perceived usefulness as one of the TAM components ( 1989 ). It relates to how much a person believes that employing technology would help them perform better (Doll et al., 1998 ). A few researchers have examined the usefulness of technology-driven banking (Eriksson et al., 2005 ; Wang et al., 2003 ) and confirm that perceived usefulness substantially impacts technology-led banking (Amin et al., 2007 ; Tang et al. 2004 ). As a result, the following hypothesis is proposed:

Perceived usefulness has a significant positive influence on the preference of cardless cash technology over the Card to withdraw cash.

Perceived ease of use

As defined by Davis ( 1989 ) and Venkatesh & Davis ( 2000 ), perceived ease of use refers to how easy it is to use technology-led banking. Perceived ease of use is a person's judgement of the effort expended due to technology use (Davis, 1989 ). People's perceptions about technology usage may also be described as their belief that it will be free of mental stress and that they will not have to devote much of their time and effort (Raza et al. 2017 ). Applications that are clear and simple interfaces will encourage customers to try out technology-led banking channels (Singh & Srivastava, 2020 ). Hence, the following hypothesis is proposed:

Perceived ease of use has a significant positive influence on the preference of cardless cash technology over the Card to withdraw cash.

Perceived security

Offering banking services in the virtual environment is challenging (Mann & Sahni, 2013 ). One of the most significant impediments to the adoption of technological innovation is security, and many studies suggest that firms that operate on the internet must first convince their customers about security (Mattila & Mattila, 2005 ).

According to Chen and Zahedi ( 2016 ), security assures authentication, non-denial confidentiality, and data integrity when using technology-led banking. Generally, such transactions stand up susceptible to various attacks like phishing, viruses, and malware that prohibit customers' online operations. As Bansal and Zahedi ( 2014 ) stated, security concerns do get translated to the failure of the technology to safeguard transaction information. Hence, the hypothesis is formulated as:

Perceived security has a significant positive influence on the preference of cardless cash technology over the Card to withdraw cash.

Customer trust

According to Dwyer et al. ( 1987 ), trust is essential for successful economic transactions. This aspect has since been integrated into customer relationship-building models by experts on customer decision-making. Rempel et al.'s ( 1985 ) seminal research describe trust as a generalised expectancy a customer bestows on the business's word, promise, or statement. For a customer, trust is particularly significant when the situation involves risk and uncertainty (Mayer et al., 1995 ). The nature of internet banking raises the value of trust, as there is no direct physical interaction between customer and banker (Yap et al., 2009 ). Trust is instrumental in generating goodness or profit. Banks with the increasing adoption of technology require a high level of trust over their security and privacy (Yauzafzai et al., 2007 ). More so, Reichheld and Schefter ( 2000 ) found that trust is an antecedent for technology adoption in internet-based services. Hence, the hypothesis is formulated as follows:

Perceived trust has a significant positive influence on the preference of cardless cash technology over the Card to withdraw cash.

Data collection and methodology

We captured the responses from the customers of one of the largest public sector banks in India through a structured questionnaire after seeking permission from the bank and consent of the customer at the branch itself. Convenience sampling was used in this regard. This public sector bank has been one of the earliest banks to introduce cardless technology and therefore choosing this bank was appropriate. The questionnaire consists of the adapted scale items for the constructs, namely Perceived Usefulness (P.U.), Perceived Ease of Use (EOU), Customer Trust (TR.) and Perceived Security (SEC.). We also asked an additional question regarding the preference of cardless cash transactions over the Card. Table 2 below summarises the demographic profile of the respondents.

The questionnaire was developed by adapting the established scales to measure the Extended TAM constructs from (Davis, 1989 ), (Bansal and Zahedi, 2014 ) and (Chatterjee and Bolar, 2019 ). All the constructs considered in the study were measured on a five-point Likert scale (1 = "strongly disagree," and 5 "strongly agree"). A summary of items operationalising all the constructs is shown in Table 3 .

We first carried out principal component analysis followed by the confirmatory factor analysis for the four constructs Perceived Ease of Use, Perceived Usefulness, Security, and Trust.