Seeking Alpha - Stock Market Analysis & Tools for Investors

- Commodities

Latest News

- - U.S. hikes royalty fees for drilling on federal lands for first time in a century

- - Israel says Iran has launched drones, U.S. says operation 'likely to unfold' over hours

- - Most ‘buy now, pay later’ users have come across issues, survey shows

- - J&J cough syrup recall classified as most serious in South Africa

- - Fundstrat's Tom Lee sees S&P 500 potentially ending the year at 5,700 points

- - Coinbase appeals key point in SEC lawsuit

U.S. hikes royalty fees for drilling on federal lands for first time in a century

Israel says iran has launched drones, u.s. says operation 'likely to unfold' over hours, most ‘buy now, pay later’ users have come across issues, survey shows, j&j cough syrup recall classified as most serious in south africa, fundstrat's tom lee sees s&p 500 potentially ending the year at 5,700 points, coinbase appeals key point in sec lawsuit, trending analysis.

Bristol Myers Squibb: Seriously Undervalued At Peak Pessimism (Rating Upgrade)

10 Dividend Aristocrat Bargain Buys Yielding As Much As 9.4%

Rivian: Accelerating Into The Big Leagues

Broadcom: Cash Out Now

Apple: Why I Sold All My Shares

S&P 500: The Momentum And Fundamentals Point To The Downturn - I'm Going Short

Don't Touch Trump Media & Technology Group Stock With A 10-Foot Pole

Earn Up To 8% While Living The American Dream

How To Invest $100,000 Today With Peace Of Mind

Enterprise Products: SPOT Is A Game Changer

Alibaba: I Was Fooled By The Valuation (Downgrade)

AI Hardware Stocks At A Peak: 2024 Growth May Not Translate To Returns

Trending news, catalyst watch: boeing hearing, bitcoin halving event and new eyes on reddit, nasdaq, s&p, dow end deep in the red as stocks suffer worst session since late january, ftc leaning toward lawsuit to block tapestry's $8.5b purchase of capri - report, s&p 500 notches worst weekly performance since october on sticky inflation woes, intel's foundry is 'fully dependent' on its design team. that's a red flag, bofa says., abbvie keeps humira market share near 100% despite biosimilars: report, real estate stocks continue to dip as earnings season kicks off, former treasury secretary larry summers says june rate cut could be a mistake by fed, editors' picks, notable calls & insights, top gainers, in the news, most active, cryptocurrencies, latest articles, stock ideas, dividend investing, trending dividend stocks, upcoming exdates, dividends & income, etfs & portfolio strategy, investing strategy, manage email newsletters, u.s. equity markets, learn about investing, about seeking alpha.

Our mission: Power to Investors. We empower investors to make the absolute best investing decisions by leveraging our independent and balanced stock research, fundamental analysis tools, crowdsourced debate, reliable news, and actionable market data.

Our research is created by investors, for investors. It is carefully vetted by in-house editors, then read and debated by millions of people. Our stock coverage is wider and deeper than any other. We provide diverse opinions on each stock so that investors can weigh the bull and bear case and make an informed decision.

Our news enables investors to understand why the market and the stocks in their portfolio are moving or are about to move. Investors read our financial news to gain insight into stocks’ future earnings and price trajectory, and to find new and exciting opportunities.

Our data places professional-caliber tools in the hands of every investor. Our factor grades and quant rating summarize each stock’s characteristics, and SA analyst ratings provide a snapshot of our Analysts’ qualitative opinions.

Our community includes everyone from new investors to fund managers. By helping them to invest successfully, we help them to achieve life goals such as buying their first house, sending their children to college, and securing their retirement.

Become a Seeking Alpha Analyst

Seeking Alpha publishes research from thousands of analysts. Investors contribute articles to Seeking Alpha because they receive payment, exposure, fame, the opportunity to get feedback on their ideas, and the ability to run their own subscription research business in our Investing Groups.

Our analysts include professional investors and individual investors. We believe that individual investors are often underestimated, when many individual investors have better investment track records than professionals and possess valuable insights that can help other investors.

To become a Seeking Alpha Analyst, you must be accepted by our editors, who ensure our Analysts and articles meet our quality and compliance standards.

To become a Seeking Alpha Analyst, submit an article here.

Ever heard of Finviz*Elite?

Our premium service offers you real-time quotes, advanced visualizations, technical studies, and much more. Become Elite and make informed financial decisions.

Upgrade your FINVIZ experience

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Make Smarter, Data-Driven Investment Decisions

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

New to Zacks? Get started here.

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

- Equity Research

Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Research Wizard

- Personal Finance

- Money Managing

- Real Estate

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Don't Miss the Latest Market News

Get daily market news and analysis from Zacks Investment Research.

WELCOME TO ZACKS.COM

Zacks' 7 strongest buys for april, 2024.

Our experts just released their predictions for 7 stocks likely to climb the highest in the next 30-90 days. Hand-picked from 220 new Strong Buys, these "best of the best" stocks are spring-loaded and ready to soar. Recent picks have climbed as much as +67.5% within 30 days.

Our experts just released their predictions for 7 stocks likely to climb the highest in the next 30-90 days. Hand-picked from 220 new Strong Buys, these "best of the best" stocks are spring-loaded and ready to soar. Today's dip gives you a chance to snag these stocks at attractive prices. Recent picks have climbed as much as +67.5% within 30 days.

No cost. No credit card. No obligation to buy anything ever. Past performance is no guarantee of future results. We respect your privacy. Zacks Ultimate Member? Click here .

3 Secrets to Quick Profits This Earnings Season

Nothing can move a stock faster, up or down, than an earnings announcement. So with the season about to heat up, Dave Bartosiak has a few ideas to help align your portfolio for the weeks ahead.

Stocks To Buy BEFORE Earnings Reports

"ESP" formula predicts positive earnings surprises with unthinkable 80% accuracy.

Q1 Earnings Season Kicks Off Positively

We see the Q1 results from the major banks as good enough; not great, but definitely not bad either. Next week, the cycle picks up notable steam, with 41 S&P 500 companies on the reporting docket. How will the market react?

What Stocks Should You Buy Right Now?

A discussion about the economy, and where you should look to put your money in 2024: big caps or small?

What's Ahead for Nvidia ETFs?

Chip giant Nvidia (NVDA) has already entered correction territory this week. Although it recovered some of its strength later on, is there only limited upside potential?

Top Stock Reports for PepsiCo, Canadian Pacific Kansas City & MercadoLibre

Today's Research Daily features new research reports on 16 major stocks, including PepsiCo, Inc. (PEP), Canadian Pacific Kansas City Ltd. (CP) and MercadoLibre, Inc. (MELI).

3 Giant Tech Stocks to Buy in April and Hold Forever

Now the market turns its attention to Q1 earnings season. Some of the first big names in tech to report are the three stocks we dig into today.

AWS 4/12: Import/Exports Send Pre-Markets Lower; Big Banks Beat

Import Prices came in hotter than expected, while Exports came down considerably.

PFP 4/12: Nasdaq Up for the Week So Far, S&P Close By

While interest rate cuts have been pushed out by another couple of months, the economy remains resilient.

Volatility Spikes as Inflation Resurfaces: Stocks to Watch

Several stocks are bucking the recent selling pressure amid a hot inflation print.

More Commentary

Featured Zacks Rank Stocks

Learn to Profit from the Zacks Rank

Investment Ideas

3 Buy Rated Stocks to Consider as Earnings Approach

by Shaun Pruitt

Low Beta Tech Stocks to Consider for a Rebound Amid Heightened Market Volatility

by Tracey Ryniec

3 Railroad Stocks to Watch From the Challenging Industry

Googl, msft, amzn & meta pose threat to nvda with in-house chips, 4 stocks to buy from the booming water supply industry, 3 top-ranked value stocks to buy from the energy space, 4 ai stocks with ample growth potential to buy in 2024, 2 auto replacement stocks holding steady despite industry woes, sticky inflation delays rate cut expectations: 5 low-beta picks, 5 mid-cap stocks to buy in a volatile april, 5 top dividend growth stocks to counter volatility.

More Stock Commentary

Inverse ETFs to Play Now on Middle East Tension & Rising Rates?

Wall Street wavered this week on high inflation data which lowered chances of an imminent Fed rate cut. Plus, geopolitical tension in Middle East has weighed on stocks.

What's Ahead for Nvidia ETFs?

5 etfs leading the tech rebound: will the rally continue, 5 etfs to tap amazon's growth story.

More ETF Commentary

3 Balanced Mutual Funds to Buy as Inflation Stays Elevated

Invest in balanced mutual funds like STFBX, FBALX and HADAX to secure your portfolio against uncertain market conditions.

3 Large-Cap Value Funds to Buy as Inflation Resumes Climb

5 fidelity mutual funds to build a solid portfolio, 2 harbor mutual funds for superior returns.

More Mutual Fund Commentary

Retired? You Can Still Collect a Weekly Paycheck

Despite these problematic market conditions, this strategy has produced above-average returns with relatively low risk.

A Low-Risk FedEx Options Play into Earnings

Trading options qqq for a near-term bounce, profit regardless of market direction, earnings analysis.

The Q1 Earnings Season Kicks off Positively

Earnings preview.

by Sheraz Mian

We see the Q1 results from the major banks as good enough; not great, but definitely not bad either. Next week, the cycle picks up notable steam, with 41 S&P 500 companies on the reporting docket. How will the market react?

The 2024 Q1 Earnings Season Gets Underway

Earnings headlines, wells fargo (wfc) q1 earnings surpass estimates, costs rise, lovesac (love) q4 earnings & net sales miss estimates, up y/y, lakeland's (lake) earnings & revenues miss estimates in q4, progressive's (pgr) q1 earnings, revenues top, premiums rise y/y.

Get the First Calendar Made for Traders. Visit the Zacks Earnings Calendar

Reported Earnings Surprises

EPS Positive Surprises for Apr 12, 2024

EPS Negative Surprises for Apr 12, 2024

Upcoming Earnings ESP

This file is used for Yahoo remarketing pixel add

Due to inactivity, you will be signed out in approximately:

5 Best Free Stock Analysis Tools for Investors

A tremendous amount of free stock research and analysis tools are available online.

Best Free Stock Analysis and Research

Getty Images | iStockphoto

It's best to do your homework before you pull the trigger on a stock option.

The U.S. stock market is off to a great start in 2024. Through Feb. 23, both the S&P 500 and the Nasdaq-100 are up more than 7% year to date (YTD). The Dow Jones Industrial Average is up nicely as well, though not as dramatically. That well-known index has gained just over 3% YTD.

You may be thinking about taking money off the sidelines and investing in this red-hot market. If you have a long-term time horizon, that's probably a good idea. The equities markets go up and down, but historically, good quality stocks tend to appreciate over time.

Before you pull the trigger on that stock you've got your eye on, you need to do a little homework first. It's smart to review past performance, become familiar with company fundamentals , learn about management and get an independent, third-party opinion before you place a buy order.

The problem is, high-quality stock analysis tools and professional research can be very expensive. Where can a retail investor go for high-level stock research and helpful analysis tools without breaking the bank?

Thankfully, there are plenty of investing resources that any investor can access for free. Here are some of the best places to conduct your equity research at no cost to you:

- Your online broker.

- TradingView.

- Morningstar at the public library.

- S&P Global Market Intelligence.

Your Online Broker

Most brokerage platforms provide their clients with reasonable access to their proprietary equity research as well as valuable analysis tools such as charting and backtesting utilities. Generally, the larger and more established the broker, the better the research. You can expect excellent quality research, tools and advice to be included on platforms like E*Trade, which is owned by Morgan Stanley (ticker: MS ), TD Ameritrade, owned by Charles Schwab Corp. ( SCHW ) and Merrill Edge, owned by Bank of America Corp. ( BAC ), and the online brokerage of Charles Schwab Corp. ( SCHW ), which includes features from the recently acquired TD Ameritrade. Popular online and app-based brokers like Interactive Brokers Group Inc. ( IBKR ) and Robinhood Markets Inc. ( HOOD ) get high marks in this department as well.

Broker-provided research reports are usually only one or two pages long and are well worth reading. You'll also find easy-to-access tools like stock screeners and news feeds as well.

Just log on to your account and look for a tab or button that says "research." Most systems are designed to be highly intuitive and user-friendly. If you run into difficulty accessing their tools or research, just contact customer service via chat, email or phone.

Did you know that a public company's financial filings and virtually all other government-mandated reports are public information and can be accessed by anyone, at any time free of charge? It's true. And it makes the Securities and Exchange Commission (SEC) an excellent free resources for stock research.

The SEC doesn't publish research reports or give opinions on stocks, but through its Electronic Data Gathering, Analysis and Retrieval System, called EDGAR for short, it does catalog and provide free access to every document a public company files with that regulatory agency.

Want to know a stock's revenue, profit, expenses or cash flow for the latest quarter or for the last few decades? Are you curious about the CEO's compensation? It's all on EDGAR for you to download and view, and it's very easy to find. Just navigate over to the SEC's website and click on the "filings" tab. From there, page down to the EDGAR - Search and Access . There you can navigate to a search that works for you, and an incredible wealth of information is available with a few clicks of your mouse.

TradingView

There is a category of investment analysis websites broadly called charting platforms. That name, however, is insufficient in light of all they offer and all the free investing tools they provide. With more than 50 million users, TradingView is among the most popular charting and investing platforms on the internet.

TradingView is a comprehensive combination of charting, analysis and research tools. All members have access to breaking news, historical investment data and the site's social network. It offers premium subscriptions for a reasonable fee, but investors can conduct a surprising amount of in-depth research with basic access which is available for free.

You can view customizable charts with multiple layers of pricing, volume and trend data , you can screen stocks by market capitalization, stock market sector and other criteria, and you can develop your own strategies and ideas and test them in various hypothetical situations. Beyond the research capabilities, TradingView offers an opportunity to communicate and learn from other investors on the platform.

It will ask you to open an account by registering with an email and password, but access isn't temporary or on a trial basis. You can use the many free tools for as long as you want and upgrade to premium only when you're ready.

Morningstar at the Public Library

A standard library card can be your key to an incredible amount of free market research. Many public libraries around the country maintain a premium subscription to Morningstar as well as other professional investment research outlets. Like almost all public library resources, Morningstar equity research is free to registered members.

Check with your local or state library system to see if it has Morningstar. While you're at it, look for other subscription-based research companies like CFRA or Zacks. Chances are they will have one or more. Once you've confirmed it has what you're looking for, dust off your old library card – or apply for a new one for free – and start browsing the catalog of investment resources.

In most cases, you won't even have to visit a physical library branch. Modern libraries offer members access to Morningstar online at no additional cost. You can download detailed financial and analyst reports, use the available portfolio and stock screening tools, and benefit from the educational resources Morningstar produces, all for free.

S&P Global Market Intelligence

S&P Global is one of the most respected research firms in the world. Institutional investors pay tens of thousands of dollars a year for premium access to its S&P Capital IQ research and trading platform. Those exorbitant price levels are out of reach for most retail investors but, thankfully, S&P offers many market insights and research online for free.

The Research & Insights page of S&P's website is loaded with articles, posts, notes and news that can be an invaluable resource to the small investor. Some information requires you have an account, but you can create one for free to access those reports. The site is updated several times a week so the data and information is always current.

You'll find sophisticated but accessible market intelligence on sectors from tech to health care and everything in between. The page has a search bar in the upper right corner so you can quickly find exactly what you're looking for.

Click on the "subscribe now" button and you'll be directed to the S&P newsletter subscription hub. There you can sign up for any of dozens of professional quality investment industry newsletters on a wide variety of subjects. Free research will be delivered to your email inbox on a monthly basis at no cost and with no obligation.

Best Long-Term Stocks to Buy Now

Glenn Fydenkevez Feb. 12, 2024

Tags: investing , stock market , money , financial literacy , Morgan Stanley , TD Ameritrade , Charles Schwab , Bank of America , Interactive Brokers Group

The Best Financial Tools for You

Credit Cards

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

See a newsletter example .

You May Also Like

10 best value stocks to buy now.

Ian Bezek April 12, 2024

Water Stocks and ETFs

Matt Whittaker April 12, 2024

7 Stocks Jeff Bezos Is Buying

Jeff Reeves April 12, 2024

Is It Time to Invest Internationally?

Kate Stalter April 11, 2024

Cheap Dividend Stocks to Buy Under $10

Wayne Duggan April 11, 2024

5 Best Large-Cap Growth Stocks

Glenn Fydenkevez April 11, 2024

7 Dividend Kings to Buy and Hold Forever

Tony Dong April 11, 2024

5 Socially Responsible Investing Apps

Coryanne Hicks April 10, 2024

7 Diabetes and Weight Loss Drug Stocks

Brian O'Connell April 10, 2024

7 Best Socially Responsible Funds

Jeff Reeves April 10, 2024

Fidelity Mutual Funds to Buy and Hold

Tony Dong April 10, 2024

Dividend Stocks to Buy and Hold

Wayne Duggan April 9, 2024

What Is a Stock Market Correction?

Marc Guberti April 9, 2024

If You Invested $10,000 in SMCI IPO

6 of the Best AI ETFs to Buy Now

Tony Dong April 9, 2024

7 Best Cybersecurity Stocks to Buy

Glenn Fydenkevez April 8, 2024

How Bitcoin Mining Is Evolving

Matt Whittaker April 8, 2024

9 of the Best Bond ETFs to Buy Now

Tony Dong April 8, 2024

10 Best Tech Stocks to Buy for 2024

Wayne Duggan April 8, 2024

About the Methodology

U.S. News Staff April 8, 2024

Better Charting. Smarter Investing.

Whether you're an active trader, diligent investor or simply managing your retirement accounts, StockCharts has everything you need to plan, organize and execute any investing system.

From advanced financial charting to customizable market screens and automatic real-time alerts, StockCharts brings you a complete analysis and portfolio management toolkit.

WHY STOCKCHARTS

We believe that process drives profits, and it's our mission to power every part of yours..

Everything you see on StockCharts is designed with one goal in mind: to help you succeed in the markets.

Our charting and analysis tools, portfolio management resources and comprehensive data coverage deliver a complete package that can be uniquely tailored to fit any approach. That's why millions of investors around the globe have made StockCharts their trusted financial analysis platform for more than two decades.

From simple candlesticks to advanced technical visualizations, our award-winning charting tools help you see the markets clearly. Compare symbols over multiple timeframes, choose from dozens of powerful indicators, and customize your charts to suit your personal trading or investing style.

Whether you're looking for stocks making new highs or searching for complex setups that combine multiple technical indicators, our advanced market scanning tools give you the power find promising new trade targets or investment opportunities faster than ever before.

Stay ahead of the markets and on top of your portfolio with custom, automatic alerts for all of the symbols you're following. From simple price alerts to advanced combinations of specific technical and fundamental criteria, our custom alert features will help make sure you never miss a thing.

And that's just the tip of the iceberg. Our rich feature set provides comprehensive coverage for every step of your investing journey, from trading tools like Scheduled Scans to portfolio management resources like ChartList Reports.

Advanced Charting Platform

The web's most advanced, interactive financial charting platform, designed to transform the way you see the markets..

Ultra Dynamic

ACP is designed to redefine the way that you chart and analyze the financial markets, with more technical tools and capabilities than ever before.

Highly Interactive

Engage with the markets and your portfolio in entirely new ways with a highly-interactive charting experience that knows no bounds.

Insanely Flexible

Every investor has different needs and ACP is designed to support them all, with a wide array of technical indicators and overlays, customizable multi-chart layouts, additional data views and much more.

Remarkably Powerful

ACP brings you the web's most advanced technical charting platform, seamlessly integrated with the rest of the StockCharts feature set to create an unrivaled analysis and portfolio management toolkit.

Over 1.9 million investors trust StockCharts.com to deliver the tools and resources they need to invest with confidence .

Great financial tools shouldn't break the bank..

With affordable pricing, flexible renewal options and multiple service levels to choose from, it's easy to find the account that's just right for you. Plus, our hassle-free account management makes it simple to cancel at any time - no games, no tricks, no runaround. You deserve to stay focused on the charts without worrying about your bill.

$19.95 / month

$18.42 / month, $239.40 / year usd + 1 free month.

- Save Charts & Settings

- 25 Technical Indicators per Chart

- 25 Technical Overlays per Chart

- Intraday Charting

- Available Real-Time Data

- Larger Charts

- Auto-Refreshed Charts

- Save Annotations

- ChartList Reports

- Access to ACP Plug-Ins

- Trade Directly From StockCharts

- StockCharts Mobile App (iOS+Android)

- 1 Saved Multi-Chart Layout

- 1 ChartList

- 1 Custom Scan

- 2 Price Alerts

- 1 Advanced Technical Alert

- 6 Price Datasets per Chart

- Historical Price Data Back to 1980

- Custom ChartStyles

- Customizable RRG Charts

- Members-Only Commentary

$29.95 / month

$27.65 / month, $359.40 / year usd + 1 free month.

- 25 Saved Multi-Chart Layouts

- 250 ChartLists

- Access to ChartPacks

- 200 Custom Scans

- 10 Scheduled Scans

- 200 Price Alerts

- 100 Advanced Technical Alerts

$49.95 / month

$46.11 / month, $599.40 / year usd + 1 free month.

- Huge, Full-Screen Charts

- Faster Auto Refresh

- Quarterly & Yearly Charts

- 500 ChartLists

- Even More Access to ChartPacks

- 500 Custom Scans

- 25 Scheduled Scans

- 500 Price Alerts

- 250 Advanced Technical Alerts

- 10 Price Datasets per Chart

- Historical Price Data Back to 1900

Smarter investing is just one click away.

Upgrade your toolkit with our premium features now in less than 60 seconds, frequently asked questions, still have questions we're here to help, visit our support center or contact our support team for answers and assistance, attention: your browser does not have javascript enabled.

In order to use StockCharts.com successfully, you must enable JavaScript in your browser. Click Here to learn how to enable JavaScript.

The revolution for long term stock investors

Built on long term investing principles to help individuals at every stage of their investment journey.

Investing in stocks is the most powerful way to build long term wealth

Successful investors follow 3 principles.

- 1 Think in decades not months

- 2 Be objective & independent

- 3 Continuously learn & improve

Take control of your investing and build a portfolio that you’re proud of. Simply Wall St equips every individual investor with the processes and tools to stick to the principles and succeed.

Level up your whole investing process

Understand any business quickly.

Get the complete story with visual insights and unbiased analysis you can trust

Discover & watch hidden gems

Curated collections and screener to find your kind of gems

Nurture and protect your portfolio

Make the most informed moves every time with powerful analysis

Stay informed without the noise

Receive weekly global insights and intelligent alerts on impactful changes

Stock Reports

Identify wonderful companies determine a fair price.

Comprehensive visual analysis on any stock covering all aspects of the business in a consistent and unbiased format.

Past Performance

Key benchmarks of the company's profitability or revenue over the years

Risks & Rewards

A snapshot of critical red-flags and opportunities with key insights extracted daily

Valuation & Comparison

Estimated stock fair value based on future expected cash flows

Growth Forecast

Forecast growth of a company based on the consensus of professional analysts

Financial Health

Understand the balance sheet. From assets and liabilities to debt, equity and current cash runway

Dividend Quality

Historical, current and projected shareholder payments and how it compares to the market and industry

Management Profile

Assess if the right people are steering the ship with management and board profiles and analysis

Insider Transactions

Which individuals or institutions have been backing the company with their financial decisions?

Which stock are you currently researching?

Evaluate them easily with our stock reports that cover risks and rewards

Stock Notes

All your insights together in one place.

Remember every move, set your alerts and make better decisions. Use notes alongside our watchlist and portfolio to take your investing strategy to the next level.

Find opportunities and invest in all market cycles

Investing Ideas

Fresh investing ideas for you.

Get inspired with over 100 stock collections across many investing strategies and industry themes. Don't miss out on the new weekly market trend collections with analysts’ commentary.

Stock Screener

Find your next quality investment.

Quickly narrow down your favourite type of stocks with our easy and powerful screener. You can start from top level characteristics to specific key metrics as your strategy develops.

Portfolio Tracker & Analysis

Make progress toward your goals.

Use our bespoke analysis to get a top level view of your diversification, weighting, risks and overall performance. Keep track of your capital gains, dividends across your holdings.

Intelligent Updates

Stay up to date on important changes that could impact fair value.

Skip the noise and get only the impactful updates that matter to the business and long term valuation. Our curated set of alerts helps you stay focused on fundamentals and pay attention only when necessary.

Weekly Market Insights

Global market analysis to help you cut through the noise.

The Big Trends - Part 12: Nuclear Energy

The Big Trends - Part 11: Nanotechnology

.jpg)

The Big Trends - Part 10: Gaming, AR and VR

Trusted by over 6 million individual investors worldwide

As someone just finding their way in stocks and shares this app has been invaluable. The fact I can upload my portfolio to the app and get a feel for performance is fab. I honestly feel this app is useful to novice and experienced investors alike and I highly recommend it to you.

Incredible, simply brilliant. The info this site finds and presents is unreal. you couldn’t obtain this info without wasting weeks doing intensive research. Setting an incredibly high standard, good luck to their competitors - there’s some magic minds in this team.

For those that are truly interested in stock trading, look for the “simply wall st.” app. It will display performance and other in depth info about a company you wish to invest in, thus making you a better investor. 🙂 You are welcome

After a 30 year career as an Investment Adviser I retired to manage my own portfolio. I use a number of tools for this purpose. Simply Wall St. has a unique pictorial approach to quickly and effectively cut through the massive amounts of data to narrow to a select few candidates. It is very easy to track your holdings. They are also very transaparent in presenting how their results are obtained. After two week trail I have parted with my hard earned money. I expect that they will help in making better investment choices in the year ahead. WES

Great customer service ! I sent a couple of emails prior to committing to a subscription and received a prompt answer. Subscribed & fully satisfied my money is well spent & very informative & visually pleasing site. So far I am a big fan & has already helped me to weed out some of my future non performing stocks, probably paid for my subscription fee already.

Level 5, 320 Pitt Street, Sydney

Financial Data provided by S&P Global Market Intelligence LLC, analysis provided by Simply Wall Street Pty Ltd. Copyright © 2023 , S&P Global Market Intelligence LLC. All rights reserved.

Popular Exchanges

Trending Industries

Discover Stocks

Simply Wall St

Simply Wall Street Pty Ltd (ACN 600 056 611), is a Corporate Authorised Representative (Authorised Representative Number: 467183) of Sanlam Private Wealth Pty Ltd (AFSL No. 337927). Any advice contained in this website is general advice only and has been prepared without considering your objectives, financial situation or needs. You should not rely on any advice and/or information contained in this website and before making any investment decision we recommend that you consider whether it is appropriate for your situation and seek appropriate financial, taxation and legal advice. Please read our Financial Services Guide before deciding whether to obtain financial services from us.

© 2023 Simply Wall Street Pty Ltd, US Design Patent #29/544/281, Community and European Design Registration #2845206.

- Robo Advisors

- Betterment Review

- Wealthfront Review

- Personal Capital Review

- Wealthsimple Review

- View All Robo Advisors

- TD Ameritrade Review

- Motif Investing Review

- Interactive Brokers Review

- TradeKing Review

- View All Brokerage Platforms Best Roth IRA Account Providers

- Best Investment Apps

- Robinhood Review

- Stash Invest Review

- Acorns Review

- View Best Investment Apps

- Calculators

- 401k Calculator

- Comparisons

- Acorns vs Betterment

- Betterment vs Wealthfront

- Betterment vs Vanguard

- Lending Club vs Prosper

- Personal Capital vs Mint

- Index Investing

- Peer to Peer Investing

- Alternative Investments

- View All Investing Content

- Real Estate Investing

- Is Buying a House a Good Investment? How to Start in Rental Properties How to Start Flipping Houses How to Invest in Real Estate Remotely

- How To Get a Mortgage

- Mortgage Basics

- Types of Mortgage Loans

- How To Get The Best Mortgage Rate

- Mortgage Application Process

- Mortgage Guide Table of Contents

- Real Estate Crowdfunding

- Fundrise Review

- RealtyShares Review

- RealtyMogul Review

- Patch of Land Review

- View Real Estate Crowdfunding Platforms

- Real Estate Calculators

- Early Mortgage Payoff Calculator

- FHA Loan Calculator

- Home Ownership

- Paying Off Mortgage

- View All Real Estate Content

- Best Business Credit Cards

- American Express Gold Card Review

- View All Business Credit Cards

- Best Balance Transfer Cards

- Chase Slate Credit Card Review

- View All Balance Transfer Cards

- Best Travel Credit Cards

- Capital One Venture Credit Card Review

- View All Travel Credit Cards

- Best Cash Back Credit Cards

- Amex Blue Cash Preferred Review

- View All Cash Back Credit Cards

- Best Student Credit Cards

- Capital One Journey Student Rewards Review

- View All Student Credit Cards

- Credit Calculators

- Debt Snowball Calculator

- Improve Your Credit Score In 30 Days

- Use Personal Loans to Pay Off Credit Cards

- Why Credit Cards Are Not Evil

- View All Credit Card Content

- Personal Loans

- SoFi Review

- Earnest Review

- LightStream Review

- View All Personal Loans

- Small Business Loans

- Kabbage Review

- OnDeck Review

- Funding Circle Review

- View All Small Business Loans

- Lending Club Review

- Prosper Review

- Upstart Review

- View All P2P Lending Platforms

- Paying Off Debt

- Student Loans

- View All Loan Content

- Cashback Websites

- Ebates Review

- BeFrugal Review

- Ibotta Review

- Swagbucks Review

- View All Cashback Websites

- How To Save Money

- Are You Missing Opportunities To Save Thousands In Order To Save Pennies?

- I Have Every Dollar I've Earned In My 10 Year Career

- How To Get Rich Without A Fancy 6 Figure Job

- View All Saving Money Content

- How Much Should I Have Saved For Retirement At My Age?

- Here's Why You Need To Have Multiple Streams Of Income

- How To Live Your Dream Life Through Mini-Retirement

- How A Million Dollars Bought Me Happiness

- Early Retirement Calculators

- View All Early Retirement Content

How Much Should I Have In My 401k At My Age?

How To Invest In Real Estate Without Owning Real Estate

How To Use Warren Buffett’s “Moat” Strategy In Real Estate

How I Learned To Stop Stock Picking And Love Index Funds

I Have Every Dollar I’ve Earned In My 10 Year Career

10 best stock research websites & tools – rating the best stock market websites in 2024.

What are the best stock research websites and stock market analysis tools for investors in 2022? Read on to find out!

Financial writer

The internet is full of websites and stock research tools that analyze equity markets and help investors choose the best stocks out there.

Investors need to understand the product that is most suited to their investing style, risk tolerance and budget. Some investors are pure numbers-players, others connect dots around the world to come to a decision, while many are on the lookout for the next big idea.

Individual stock picking requires considerable analysis. Early investors who are starting out their journey are better off considering passive investments and low-cost index funds, rather than researching and buying stocks on their own.

We have put together a list of some of the best stock research sites where you can get news and data on companies, the economy and the market.

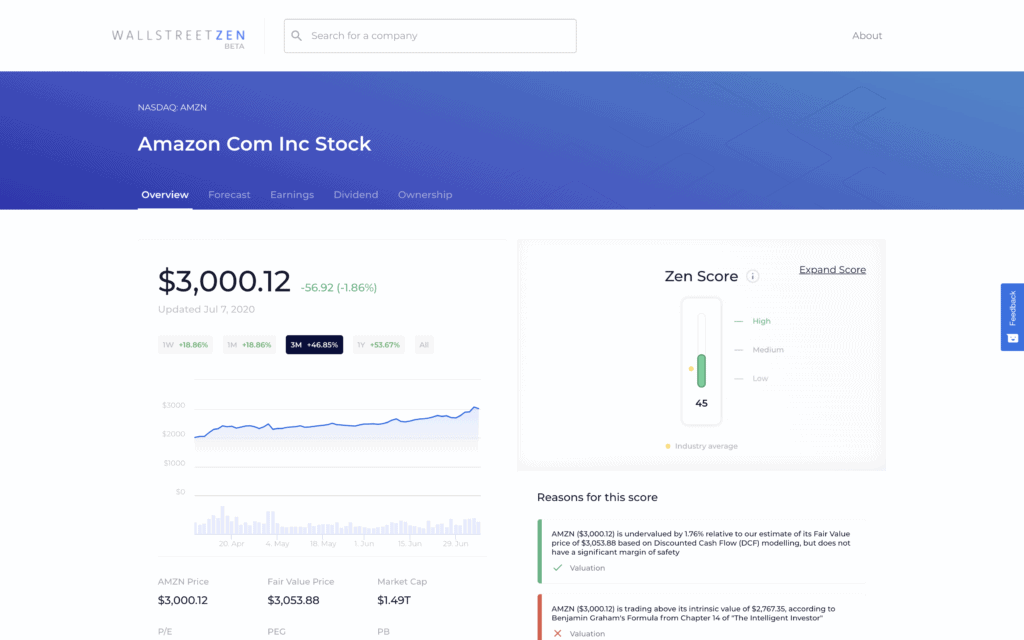

1. WallStreetZen (Best Stock Research Website In 2024)

WallStreetZen was created when its founders were frustrated with existing stock research websites, so they set out on a mission of creating a better stock analysis experience for investors who are serious about deeply understanding the stocks they invest in, but aren’t financial professionals themselves.

The idea behind this stock research website is simple – most stock research sites are created by finance professionals, for finance professionals. As a result, they tend to be cluttered with dense tables filled with financial ratios and numbers, but they don’t give you the context you need to easily understand the data.

WallStreetZen takes a different approach – they don’t just show you financial data, they also help you interpret the data and understand the context.

How, you might ask? Their Zen Score and automated due diligence checks run key financial checks that experienced investors would run (usually using spreadsheets), and they present the results in easy to understand, one line explanations.

See the Zen Score in action for yourself by looking up a stock here

And instead of packing every page to the point of data overload, they’ve carefully selected important metrics that every investor should pay attention to and they help you visualize the historical and industry context behind the numbers.

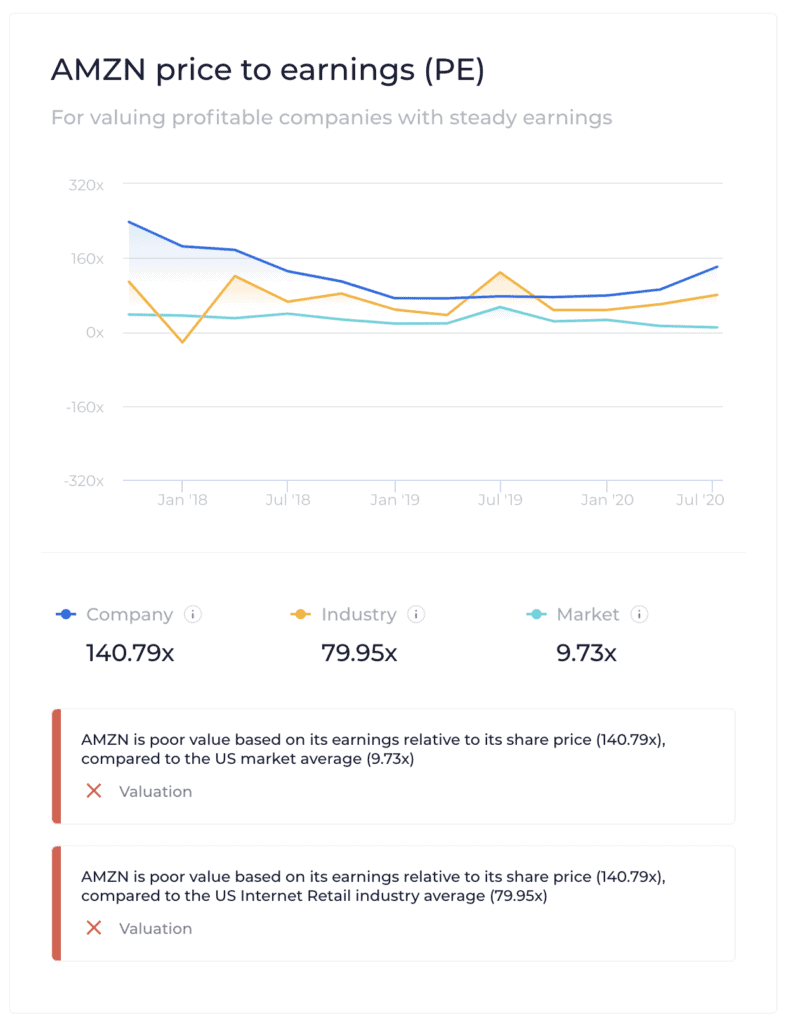

For example, here is how Yahoo Finance shows you the P/E ratio for AMZN:

Source: Yahoo Finance

Here is how WallStreetZen shows you the P/E ratio for AMZN :

Source: WallStreetZen

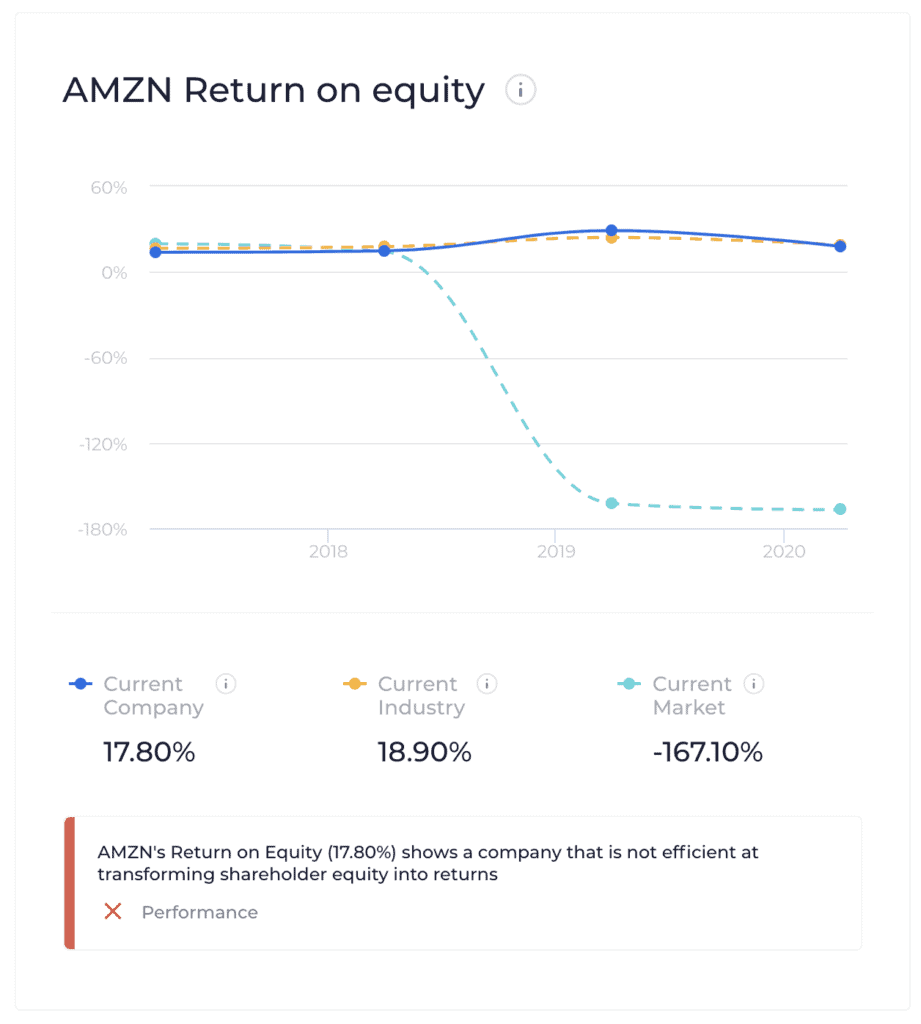

Here is how Yahoo Finance shows you Return on Equity for AMZN:

Here is how WallStreetZen shows you Return on Equity for AMZN :

Lastly, it’s obvious that WallStreetZen cares deeply about creating a great user experience.

Much like the Robinhood app provided a cleaner, sleeker user experience for investors who weren’t satisfied with the clunky interfaces of traditional brokerages, WallStreetZen does the same for stock research and analysis websites.

Unlike most stock research websites that are cluttered and packed with too much data in every pixel, WallStreetZen’s design is minimalist and clean while still focusing your attention on the information you need to make good investing decisions.

WallStreetZen is currently in beta mode, but its unique features and focus on user experience already make it one of the most indispensable stock research sites for investors who want the best stock analysis software with more insights, and less noise.

You’ll definitely want to experience it for yourself, just click here to give it a try (it’s free).

Just a little disclaimer: WallStreetZen was started by one of the founders of InvestmentZen, so while we can’t claim to be unbiased, you can check out the product and decide for yourself .

2. Motley Fool Stock Advisor

The Motley Fool is one of the most well known and best stock research sites in the world.

It is one of the most popular stock advisor platforms out there when it comes to investment news and advice. Founded in 1993 by brothers David and Tom Gardner, The Motley Fool offers a combination of free news and paid financial advice and research.

Motley Fool launched its Stock Advisor product in 2002. The product is priced at $99 for an annual subscription or $19 for a monthly subscription.

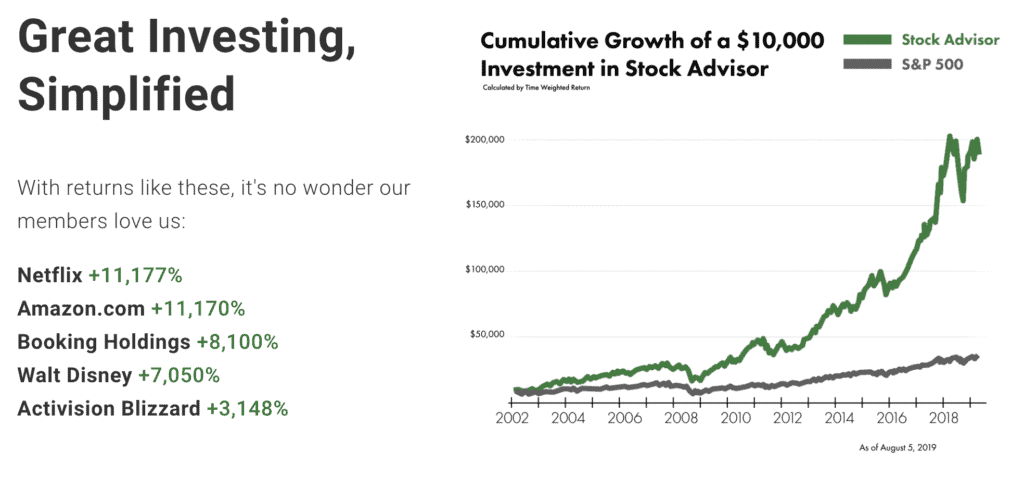

What this product does is simple: Both brothers recommend stocks (after extensive research) that aim to beat the market. Since inception, Stock Advisor picks have delivered 333% returns compared to 77% by the S&P 500.

The dynamic duo at the Motley Fool give out two monthly recommendations of stocks that they believe will beat the broader markets in the long-term.

Similar to most investors, David and Tom are not concerned about short-term volatility and expect the company’s strong fundamentals to outperform the S&P 500 over a period of time.

While it is not possible to buy every single recommendation, you need to buy a good number of recommended stocks to be successful and outpace overall market returns.

Apart from the Stock Advisor ( read our full Stock Advisor review here ) report, investors also get:

- Starter Stocks : This a curated list of 10 of the best stocks every month by Motley Fool experts for the investor who is just starting out in the market. These are rock-solid stocks that can build the foundations of a great portfolio (What’s a portfolio? Learn more and see an example of a stock portfolio .).

- Best Buys Now : David and Tom Gardner regularly give you a list of the best opportunities in the market at that moment.

- S.A. Knowledge Base : Provides 24/7 access to the full Stock Advisor library of proprietary reports and research compiled over eighteen years – ideal for all levels of investors with a desire to learn.

- Market News Coverage : This is a pitstop where you can any investment worthy news from across the world.

- The Motley Fool Community : Here every month investors can connect with fellow members and the actual analysts behind the Stock Advisor team. It promotes the exchange of investment ideas and a robust platform where investors can learn from each other.

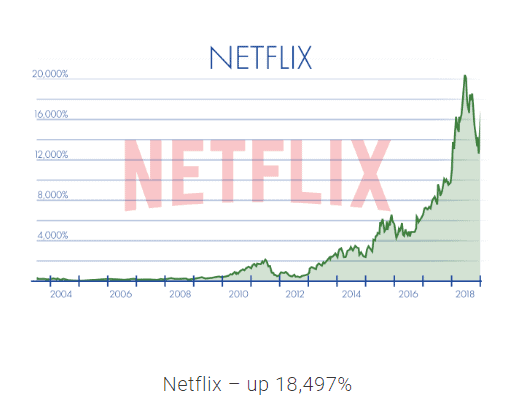

Stock Advisor’s biggest successes since launch include Booking.com that is up 5,561%, Marvel (later acquired by Disney ) which is up 5,464%, Amazon.com that is up 15,107% and Netflix stock that is up 18,497%.

Stock Advisor members who invested $1,000 in each of those stocks on the day Stock Advisor came out with their recommendations are sitting on over $450,285 today . You can try Motley Fool Advisor with a 30 day membership fee refund guarantee by signing up here .

You can also check out this Motley Fool Stock Advisor review if you want to learn more.

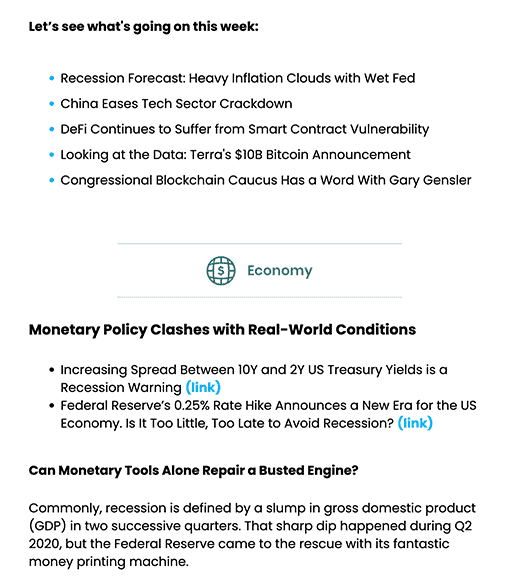

3. Tokenist’s Newsletter: Five Minute Finance

The Tokenist is a financial media publication which produces world-class educational content on all aspects of investing and personal finance.

Led by Timothy Fries, partner at Protective Technologies Capital, The Tokenist received a 100/100 rating from NewsGuard , an independent agency which evaluates media publications for journalistic integrity.

The Tokenist has a few different content offerings—and all of them are quite impressive.

First, the publication has a news desk, which specifically focuses on the integration of finance and technology, maintaining a macro-economic outlook. Coverage can include in-depth analysis on anything from digital assets, to meme stocks and Robinhood’s payment for order flow (PFOF), to the ways in which U.S. monetary policy is anticipated to impact certain asset classes.

The Tokenist’s editorial vision largely focuses on the ways in which emerging technology is becoming increasingly integrated into capital markets—which makes it quite unique.

The publication also routinely publishes extensive guides written by financial experts which aim to help readers optimize the wealth creation process. The Tokenist’s well-rounded, insightful library of guides will help individuals learn about all aspects from investing, to include choosing the right broker, trading stocks, options, forex, and more—for beginners and veteran traders alike. If this piques your interest, check out the best options trading platform .

The Tokenist also offers a free newsletter, called Five Minute Finance (5MF). Published each Friday, the newsletter captures five of the week’s biggest events in the realm of finance and technology—and provides additional context to illustrate ongoing trends.

And honestly, it’s clear to see that Five Minute Finance produces signal, among an overly crowded sea of noise. Five Minute Finance is largely why The Tokenist takes the number three spot in our list of the best stock research websites.

Here’s an inside view of a previous edition of 5MF:

5MF boasts over 111k subscribers – so while it does not provide actionable investing advice, it helps investors maintain a pulse on the market environment—explaining where things are now, and where they’re going.

There’s a lot of noise out there – but 5MF aims to deliver valuable insights by illustrating trends, keeping investors in the know about the most important events to impact financial markets.

In summary:

- Published once per week, each Friday

- Maintains a big picture view of financial markets, identifying larger trends to keep investors in the know

- Focuses on the integration of finance and technology, covering FinTech and digital assets

If you don’t want to miss out on the next big thing to hit the world of finance, be sure to sign up for Five Minute Finance —it’s free.

4. Morningstar

Morningstar is one of the world’s most widely respected equity research firms.

This is not a website for investors who trade using charts, this is for the value or fundamental investor.

There is no charting and technical analysis on this site and there is no talk of buy and sell indicators here, making it one of the best stock websites for long-term investors.

You come to Morningstar to understand and start allocating your budget into assets and investments that suit your investing style. The Morningstar premium membership costs $199 annually and is well worth it.

It changes the way you look at investments because you start relying on hard data and sound analysis. You will find yourself making better decisions as you continue to use this tool. Numbers start to make sense and you feel like you are in constant touch with a financial advisor from the comfort of your home (and sans the expensive fees).

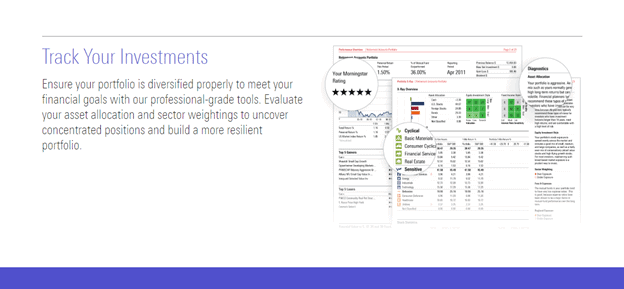

While Morningstar (see our Morningstar Premium review ) rates and analyses securities like stocks and bonds, its primary focus is mutual funds. This membership is perfect for investors who want to buy and hold for a long time.

Investors of every kind can tailor Morningstar research and tools according to their specifications. Premium members can:

- Find new investment ideas using the most popular screeners for research.

- Evaluate investment ideas by unveiling buying opportunities across sectors thanks to the unlocked data and ratings.

- Monitor their investments using Portfolio X-Ray that shows how your asset allocation is holding up, enabling premium members to rebalance their portfolios.

Morningstar has pre-sorted their current top mutual fund, stock, and ETF picks using proprietary data points and featured them by type and investing goal making it easy for premium members to pick the best.

Morningstar premium has planning tools for tax planning, personal finance, and retirement and education investing.

The Instant X-Ray tool, in particular, is one of the best out there, and it ensures that you are not over-invested in a particular country, sector or stock. The tool takes a mutual fund’s quarterly SEC reporting of its individual stock allocation and helps determine your investment spread.

Basically, this tool does take a look at your asset allocation and then helps you determine if you are overinvested in a particular company. The report divides your portfolio into Cyclical, Sensitive and Defensive. For example, housing is a cyclical sector while electricity is defensive. Tech stocks and oil stocks could be sensitive.

If you are not sure about going in for the premium membership, there is an option of a 14-day trial period, making it one of the most flexible and best stock analysis websites for investors.

Morningstar analyst reports provide in-depth, continuous analyses from over 150+ independent analysts. This enables investors make decisions with confidence knowing the data and research that has gone into every single one of the ratings.

A lot of free investing apps use Morningstar ratings to make it easier for investors to choose the right investment. That should give you an idea of how highly Morningstar is rated. Of course, you only get access to the detailed analysis and reports on the premium membership.

Here’s a helpful comparison of Morningstar vs Motley Fool (our 2nd pick), if you want to learn more.

5. Seeking Alpha

Seeking Alpha is a website for advanced investors . This is a rather different kind of website in the sense that it is crowdsourced, giving it exceptional coverage of smaller cap stocks that receive little or no attention from Wall Street analysts.

The site offers a lot of articles and blogs for stocks and financial markets. The writers include amateur as well as professional investors, a lot of whom have backgrounds in buy and sell-side research.

If you are someone who understands advanced jargon and day-to-day terminology used in Wall Street, you’ll love following other finance professionals on Seeking Alpha. It is one of the best stock websites for people who want to access top-quality research for public equities.

As you get used to the style at Seeking Alpha, it could very easily turn into a one-stop-shop for you for all things related to investing in stocks, market analysis and insights.

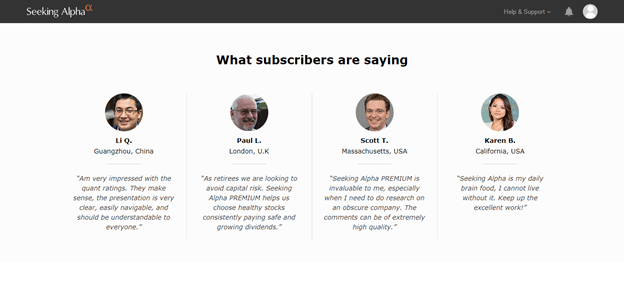

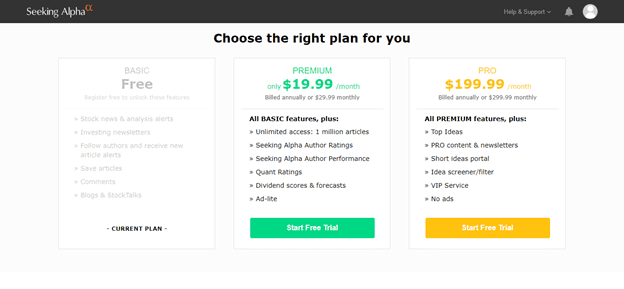

Most articles on Seeking Alpha are free for a limited period of time for registered users. Sometimes articles as young as 10 days go behind a paywall. Seeking Alpha Premium is the basic premium product from the company that charges subscribers $29.99 monthly or $19.99 (if paid annually).

Apart from basic news and articles, Premium offers unlimited access to Seeking Alpha archives. That’s over 1 million articles. You get to view author performance and ratings, along with quant ratings, dividend forecasts and scores. Check out this review of Seeking Alpha Premium for more details.

(What’s due diligence? Read: What Does DD Mean in Stocks? )

The Pro service provides charts, research, analysis, newsletters, emails and personalized service to all content on Seeking Alpha. For example: Members can create specific tickers tailored to the securities they want to analyze and invest in.

Seeking Alpha has priced at its Pro subscription at $299.99 a month or $2,399 (which is about $199.99 a month) for the entire year. Pro subscribers get the following benefits:

- Unlimited Analysis : Access to all the research and analysis on the website.

- Top Ideas : Pro members get exclusive access to timely and well thought out expert long and short ideas. These actionable strategies help investors analyze new opportunities early on.

- Weekly Digest : The best stock calls, ideas, exclusive interviews and newsletters are emailed to members.

- VIP Customer Service : Personalized priority support through Seeking Alpha’s phone and email service.

- Powerful Screeners : Smart screening and filtering tools that enable members to surf Pro author content and search for investment ideas on different parameters. You can save time with more focused research and create investment opportunities for yourself according to your investing style and financial goals.

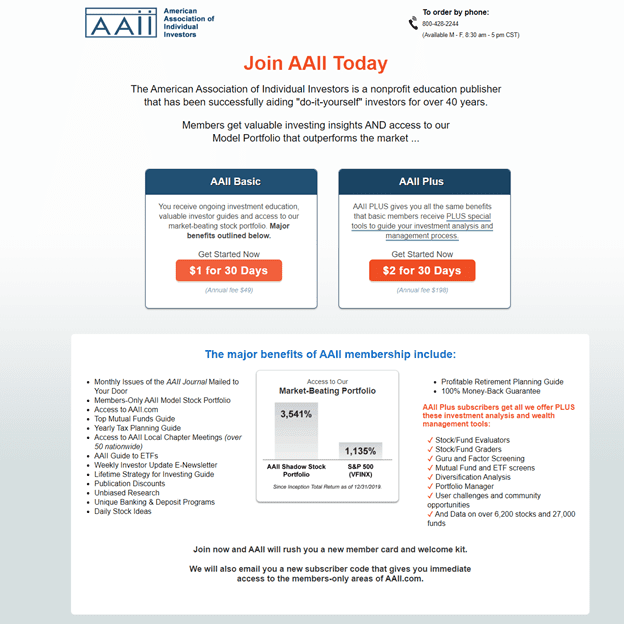

6. AAII (American Association of Individual Investors)

You can add AAII to the list of best stock research websites. This is the only non-profit website that is on this list. Launched in 1978 by Dr. James B Cloonan the American Association of Individual Investors (AAII) has a simple mission. It wants to make individuals responsible for their own investment journeys by educating them, informing them and providing research to them, particularly in the mutual fund space.

And it wants them to beat the average S&P 500 returns while taking on lower-than-average levels on risk. The premise is simple. An unbiased platform can provide the best investment advice.

Sounds far-fetched? Well, it isn’t. AAII runs on a freemium model like most sites.

While some information is available to everyone, only paying members get access to a monthly journal, mutual fund analysis, stock screeners and model portfolios. The Better Business Bureau gives AAII a rating of A+.

The membership fees at the AAII are a paltry $29 per year. You can also opt for a 30-day trial at just $1.

The most popular paid resources that the AAII provides are:

- The AAII Journal : This journal is published, ad-free, every month.

- Asset Allocation Models : Here members can view the performance of popular investment benchmarks.

- Stock Ideas : Members get to explore a wide range of strategies and investment ideas best suited to their investing style.

- AAII Model Shadow Stock Portfolios : This is our favorite product from the AAII stable. It provides investors guidance for investing in the micro-cap sector. The focus of this model portfolio is on reducing risk and portfolio formation.

It shows when you take multiple risky stocks into your portfolio but if your portfolio is well-diversified, the risk of individual stocks is reduced by 70%.

The model encourages you to invest in at least 10 stocks to maintain a diversified portfolio. AAII manages this portfolio by simply reviewing earnings on a quarterly basis.

You can utilize the resources on AAII’s Stock Ideas to get a list of potential Shadow Stocks. This list is updated daily. The Ideas list shows all companies that meet the criteria for the Shadow Stock screen. However, this doesn’t mean that stocks that appear on the list will be added to the model portfolio.

The Model Stock Portfolio is a great tool that shows the investor how to develop a value-oriented approach towards investing. Considering that you will be investing in companies with great volatility, you will need to be extra careful here.

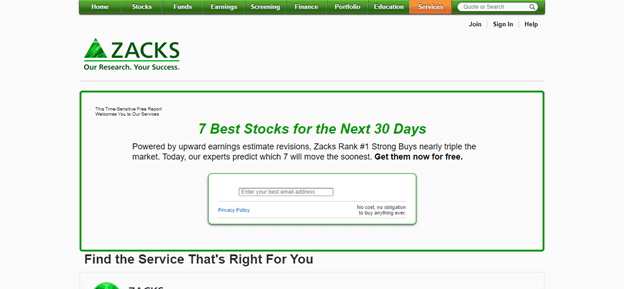

7. Zacks Investment Research

Zacks Investment Research is a well-known research website and stock picking service that often comes out with contrarian views. The website has a large archive of free content – the same as most websites — to hook readers and potential investors on to their research and information. Zacks goes beyond the usual articles with video commentary and podcasts in multiple topics, making it a comprehensive stock research website.

Over 500,000 ‘Zacks Profit from the Pros’ members receive a free newsletter every morning ( ranked among WallStreetZen’s 3 best investment newsletters ) where they are briefed on key market developments. Along with this, they also get the Bull Stock of the Day from the Zacks Rank system. Zacks claims that this delivers more than doubles the market with an average gain of +24.13% per year.

One of the best things about Zacks is that they have their own mutual fund ranking system that helps its members evaluate the funds that will give them the most profit. That is all that Zacks focuses on- the bottom-line. In April 2020, approximately 19,000 mutual funds have been tracked and evaluated by Zacks.

Zacks’ rating system for mutual funds is simple. A 1 implies a great mutual fund while a ranking of 5 indicates a horrible one. Zacks’ research relies on quantitative data more than fundamental analysis which is not necessarily a bad thing depending on your investing style.

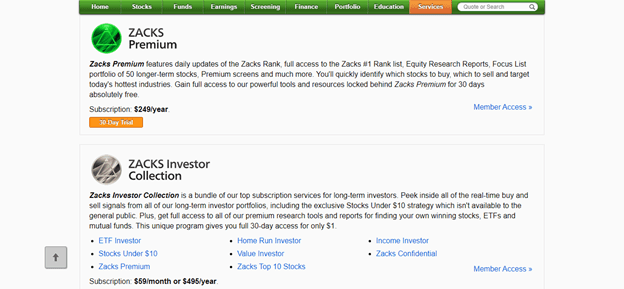

Investors who want more than the free stuff can opt for Zacks Premium which gives them the following:

- Zacks #1 Rank List : This is a collection of the top stocks that have more than doubled returns compared to the S&P 500 since 1998.

- Industry Rank List : This is an extension of the #1 Rank List. Here, Zacks ranks industries by evaluating them on the Zacks Rank. The Zacks Industry Rank is calculated by considering the average Zacks Rank for all relevant stocks in a particular industry. The algorithm then assigns an ordinal rank to it.

Here, an industry with a lower average Zacks rank is better than an industry with a higher average Zacks Rank.

- Premium Screens : Zacks Premium Screens lets you evaluate and choose from over 45 predefined screens according to your investing style. You can choose to browse through Zacks’ bear market strategies. Considering the next couple of quarters don’t look great, this is a solid feature to exploit.

- Focus List : This is a collection of 50 top long-term performing stocks based on earnings momentum.

- ESP List : The Earnings Expected Surprise Prediction or ESP is a great way to make some quick profits as you can use this filter to predict what stocks will have a great earnings season and pick them up before announcements.

- Equity Research Reports : This is simple enough. Members get access to equity research reports for more than 1,000 stocks.

There’s a lot of data on Zacks. It can get overwhelming at times, especially when it comes to options contracts. If you’re interested in using Zacks Options Trader, head over to what is vega in options to start learning.

Zacks Premium costs members $299 per year but you can also avail of a 30-day free trial period.

8. Yahoo! Finance

Yahoo! Finance is the most popular finance website in the US with 70 unique million users visiting it every month.

It is considered to be among the best stock market websites out there.

The amount of information available on this site is simply unmatched . A lot of websites on this list including Motley Fool, Seeking Alpha and Zacks ( read our review of Motley Fool vs Seeking Alpha vs Morningstar vs Zacks here ) derive a large amount of their traffic through Yahoo Finance. Its portfolio of stock research tools make it an ideal pick for the experienced investor.

Yahoo! Finance is popular as a starting point beginners who are interested in investing.

The site has a basic set of tools that it provides investors to get started on their journey.

- Stock Screeners : Yahoo Finance has predefined, ready-to-use stock screeners that you can use to search stocks by industry, index membership and more.

Yahoo Finance has one of the best free stock screeners on the market.

Examples of screeners include Fair Value Screener (Undervalued stocks with a strong & consistent history of earnings and revenue growth), Undervalued Growth Stocks (Stocks with earnings growth rates better than 25% and relatively low PE and PEG ratios), Growth Technology Stocks (Technology stocks with revenue and earnings growth in excess of 25%), Undervalued Large Caps, Aggressive Small Caps and a lot more.

You will need a Yahoo account to get started on Stock Screeners.

- My Portfolio : This is our favorite Yahoo Finance tool. In case you haven’t spotted a trend, we like portfolio tools. They are a one-stop-shop to track our investments, and they show us all the data we need.

This Yahoo Finance tool lets you track portfolios (stocks, mutual funds, ETFs), you can customize the screen view, decide the parameters you want to input like valuation metrics and price movements.

You can manage your holdings efficiently and create custom views using over 60 data points. You can also key in the purchase prices of the shares you have invested in and calculate profits or losses. All the data is available in real-time. A Yahoo account is required to start building your portfolio.

- Markets : The market data section on Yahoo Finance is another great place to start for the young investor. You just have to click on the Markets link on the home page and you can choose the category you want to take a look at. Everything from mutual funds, to cryptocurrencies to futures to US bonds and Treasuries is available in this section.

Yahoo launched its premium service in August 2019. Subscription costs $34.99 per month or $349.99 annually. The service is integrated into Yahoo Finance’s existing desktop and app products. Key features of the product include:

- Premium Data and Charting : This is great for ‘charters’ and day traders who can identify, evaluate and trade on new opportunities based on automated pattern recognition for technical analysis . If day trading is your thing, here’s the best trading platform for day trading .

- Advanced Portfolio Analytics : The tool measure portfolio performance and you can analyze and manage risk and volatility.

- Research Reports and Investment Ideas : One of the largest repositories of third-party research reports created by analysts across the world. You can also get reports through an algorithm best suited to you. Stay updated on companies that you follow regularly and action ideas according to the current environment.

- Company Profiles : Go beyond fundamentals as you get better insights into the hiring, innovation and patent updates for various companies.

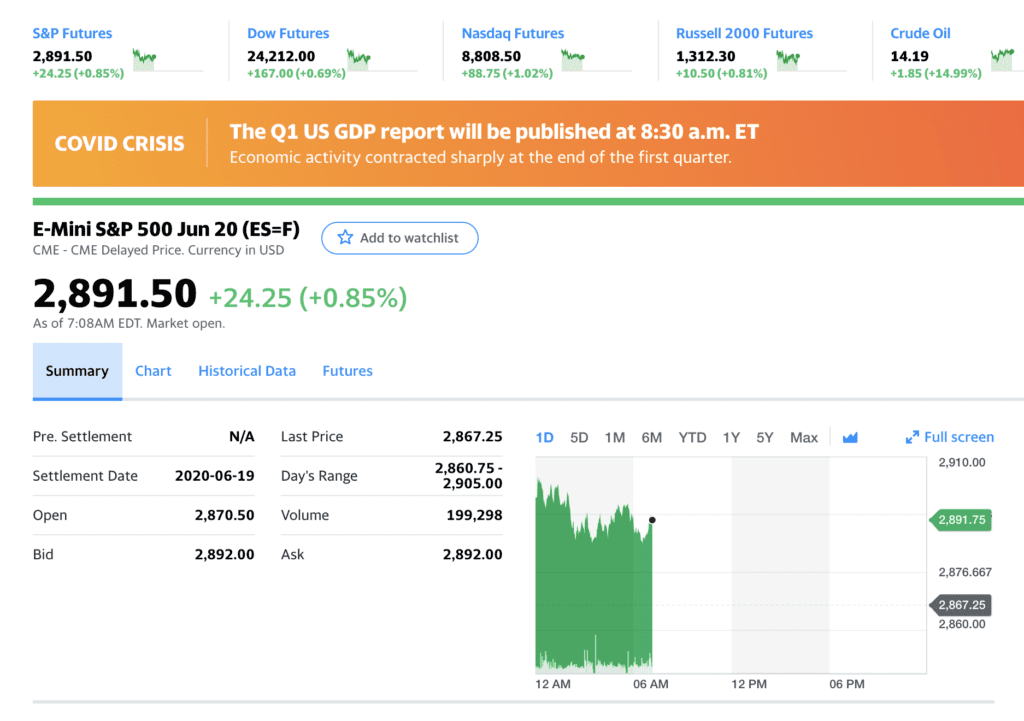

9. Google Finance

Google is trying to compete with other financial websites in the best way it knows. By going completely free.

Google Finance is a tool that budding investors should use as they try to get their feet wet in the financial markets today.

It’s a solid site to go and analyze a large amount of financial data , including stock quotes and financial news before you decide where you want to invest your money. It’s very similar to Yahoo! Finance in the sense that it is a repository of real-time data and offers a lot of similar services.

You have a world markets section where you can see how stock indices around the world are performing. The currency section does the same when it comes to world currencies. You can also view bond yields.

The website used to have a stock portfolio tool and a stock screener that was pretty good but it has since been discontinued. However, there is a Watchlist section on the page where you can add securities that you want to track and it does a pretty good job of it. If you’re looking to dive into more complex data, take a look at the features in our Benzinga Pro review .

This is a simpler website to use than the others. One thing that works in its favor is that we use so much of Google in our daily lives that navigating on this site is very intuitive. That said, think of Google Finance as your foundation building site before you move on to the big boys.

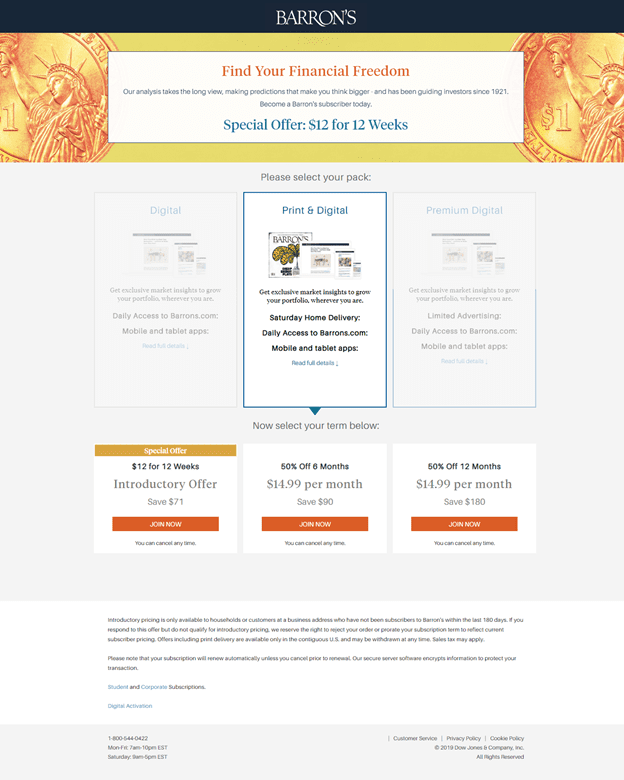

10. Barron’s

When it comes to compiling a list of best stock research websites, it is difficult to drop Barron’s from the list.

Barron’s is well known for its magazines that help people out with their investments. Investors are expected to already have an idea about financial basics and terminology. Barron’s comes out with a cover story every week that analyzes an industry or a business in great detail.

The magazine itself is full of investment ideas where the authors go very deep into researching the articles and businesses they write on. The five picks they give out every week are based on business or fundamental analyses and not technicals. These are stocks you want to hold on for a long period.

Barron’s is one of the top online media platforms in the United States. Magazine readers get well researched weekly articles that equip them with investing ideas, recent market trends and trading concepts.

The Data section of Barron’s is split up into Stocks, Bonds, Currencies, Funds and ETFs, and Commodities. Barron’s target audience is made up of experienced financial professionals, money managers, hardcore individual investors and senior management.

It has a Market Week section that focuses on trading strategies ranging from options trades to ETF trades. If you’re looking into complex derivatives like options, do some research on the safest options strategies first.

The pricing is expensive at $179 for the whole year or $99 for 30 weeks.

But Barron’s is running an offer right now where you can get 12 weeks for $12. It’s not a bad investment to check it out for a quarter and decide if this one is for you.

Honourable Mention

Here’s an honourable mention to StocksTelegraph.com which didn’t make the list but is another helpful stock research website.

For even more ideas, take a look at the top Bloomberg Terminal alternatives .

The Best Stock Research Websites – What’s The Bottom Line?

The above list is just a selection of the best stock market websites and the most popular investing resources out there for the avid investor. However if you have a specific style of investing, you may want to look at different sites (here is a list of fundamental analysis tools )

The best stock sites look to engage self-directed investors who aim to create and manage their own portfolio. The internet is full of websites and stock research tools that analyze equity markets and help investors choose the best stocks to buy now .

These platforms are vast oceans of knowledge and we know that knowledge is power. However, if you don’t have the time or expertise to pick individual stocks, you can opt to leverage passive investing instead.

Headline image used under creative commons attribution license InvestmentZen Images

Aditya Ragunath

Aditya Raghunath is a financial writer who writes about business, public equities and personal finance. His work has been published on several digital platforms in the U.S. and Canada, including The Motley Fool and Market Realist. With a post-graduate degree in finance, Aditya has close to 8 years of work experience in financial services. If you are considering investing in the stock market, he recommends reading The Intelligent Investor by Benjamin Graham before taking the plunge.

Related Posts

Seeking Alpha Review: Your Complete Guide To This Daily Market Blog

Who Has The Best Stock Picking Record?

Google Finance – Stock Screener Or Search Tool?

A Write-Up On Zacks Investment Research: A Zacks.com Review

Finviz Review: Is The Finviz Stock Screener Really The Best?

9 Best Stock Screeners (Free & Paid) In 2024

How To Invest A Million Dollars In 2024

How To Invest Money Wisely With Little Money

Related questions.

What Are My Best 401(k) Investment Options?

How To Buy Stocks Online Without A Broker

How Does 401(k) Matching Work?

Which Self-Employed Retirement Account Is Right For You? Choosing Between A SIMPLE IRA vs SEP IRA vs Solo 401(k)

What is a 457 Plan?

What Are The Pros And Cons Of A Roth IRA?

What Is A Good Return On Investment?

What Are The Differences Between A 401(k) And A 403(b)?

How Does 401(k) Vesting Work?

What’s the Difference Between Roth and Traditional IRA?

Most popular.

How To Manage Your Money By Automating Your Finances

Why Compound Interest Isn’t As Powerful As You Think

What is a Good PE Ratio for a Stock? Is a High P/E Ratio Good or Bad?

How I Built My Nest Egg Flipping Houses

How 27 Financial Experts Made Their First Investments

5 Ways To Find Time To Side Hustle (Even If You’re Super Busy)

More in investing.

With all the sources of free and premium daily investment commentary out there, you may be wondering if Seeking Alpha is...

There’s no shortage of hot stock tips these days. The question is: Who has the best stock picking record? And what...

Once a go-to place for investors looking to carry out equity research, the Google Finance stock screener had a multitude of...

There are a few investment services available that have a claim to fame, and Zacks.com is one of them. Zacks was...

It’s definitely up there as one of the best! Based on my experience, Finviz is one of the most informative stock...

Looking for the best stock screener? Read on to get our detailed analysis and find out which stock screener comes out...

What is a good PE ratio for a stock? Is a high PE ratio good or bad? We'll dive into the...

How do you evaluate a stock and calculate its intrinsic value? Keep reading to learn about the stock valuation methods used...

How much should you have in your 401(k) at your age? The answer is simple, yet complicated. Confused yet? Let's dive...

- Get 7 Days Free

Stock Investing

Watch 3 Dividend Stocks for April 2024 The dividend prospects of three firms with wide or narrow Morningstar Economic Moat Ratings. David Harrell

Top 50 Most Viewed Stocks

Technology stocks.

- Apple (AAPL)

- Microsoft (MSFT)

- Nvidia (NVDA)

- Salesforce.com (CRM)

- Intel Corp (INTC)

- Adobe (ADBE)

- Palantir Technologies (PLTR)

- Advanced Micro Devices (AMD)

- DocuSign Inc (DOCU)

- Block Inc (SQ)

- ASML Holding (ASML)

- Taiwan Semiconductor(TSM)

Financial Services Stocks

- PayPal (PYPL)

- Berkshire Hathaway (BRK.B)

- JPMorgan Chase & Co (JPM)

- Citigroup (C)

- Bank of America Corp (BAC)

- Wells Fargo & Co (WFC)

- U.S. Bancorp (USB)

- Charles Schwab Corp (SCHW)

- Blackstone Inc (BX)

Communication Services Stocks

- Meta (META)

- AT&T (T)

- Disney (DIS)

- Alphabet Class A (GOOGL)

- Netflix (NFLX)

- Verizon (VZ)

- Alphabet Class C (GOOG)

- Comcast Corp Class A (CMCSA)

Consumer Defense Stocks

- Coca Cola Co (KO)

- Costco Wholesale (COST)

- Procter & Gamble Co (PG)

- Anheuser-Busch InBev SA/NV ADR (BUD)

- Altria Group (MO)

- Walmart Inc (WMT)

- PepsiCo Inc (PEP)

- Kellogg Co (K)

Healthcare Stocks

- Pfizer Inc (PFE)

- Merck & Co (MRK)

- Johnson & Johnson (JNJ)

- AbbVie Inc (ABBV)

- Zimmer Biomet Holdings (ZBH)

- Medtronic PLC (MDT)

- CVS Health Corp (CVS)

- UnitedHealth Group (UNH)

- GSK PLC ADR (GSK)

- Eli Lilly and Co (LLY)

- Moderna Inc (MRNA)

- Gilead Sciences Inc (GILD)

Stock Analysis

4 Undervalued Stocks That Just Raised Dividends Mosaic and First Energy are among the cheap stocks with notable dividend increases in March. Tom Lauricella

The Best Stock to Buy Now in a Growing Industry This 20% undervalued wide-moat stock is our top pick in software today. Dan Romanoff

Our Investment Picks

Best Financial-Services Companies to Own What drives these firms’ competitive advantages varies by industry. Katherine Lynch

20 Best Healthcare Companies to Invest In These companies largely earn their competitive advantage from intangible assets, and their stocks are great choices for an investor’s watchlist. Emelia Fredlick

Morningstar Investor

Five star stocks, core stock funds, small-cap funds, moats on sale, mid-cap funds, growth funds, emerging markets funds, core foreign funds, foreign index funds, sector funds, all stocks by morningstar ratings, morningstar rating for stocks, economic moat, stewardship grade, fair value uncertainty, stocks by classification, stock style.

- Large-Cap Value

- Large-Cap Core

- Large-Cap Growth

- Mid-Cap Value

- Mid-Cap Core

- Mid-Cap Growth

- Small-Cap Value

- Small-Cap Core

- Small-Cap Growth

Stock Sector

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Real Estate

World Region

- North America

- Latin America

- United Kingdom

- Europe Developed

- Europe Emerging

- Africa and Middle East

- Australasia

- Asia Developed

- Asia Emerging

Explore More Research & Tools

.png)

Uncover New Stock Investment Opportunities

Is the Market Cheap or Expensive?

Morningstar StockInvestor

Morningstar DividendInvestor

Learn how to invest in stocks at morningstar.

The Best Companies to Own: 2023 Edition

Rating Methodology

Morningstar Fair Value Estimate

Investing Definitions and Financial Terms

How to Read a Morningstar Stock Analyst Report

Morningstar Economic Moat Rating

More articles and videos about stock investing.

Sponsor Center

/ The best trades require research, then commitment.

Where the world does markets.

Join 50 million traders and investors taking the future into their own hands.

Market summary

Editors' picks.

See all editors' picks ideas

Indian stocks

Trade ideas.

See all stocks ideas

Community trends

Highest volume stocks, most volatile stocks, stock gainers, stock losers, indian stocks news, world stocks.

See all world ideas

World biggest companies

World largest employers, world stocks news.

See all ETF ideas

Most traded

Highest aum growth, highest returns, highest dividend yields.

See all crypto ideas

Crypto market cap ranking

Tvl ranking, crypto gainers, crypto losers, crypto news, forex and currencies.

See all forex ideas

Currency indices

Futures and commodities.

See all futures ideas

Energy futures

Metals futures, futures news.

See all bonds ideas

Indian bonds

See all trade ideas

Pine scripts

See all scripts

Educational ideas

See all educational ideas

Video ideas

See all video ideas

Trading and brokers

See all brokers

More From Forbes

A disappointing trump media stock (djt) analysis.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

A reminder that risk accompanies return

The March and April SEC filings provide the information needed to analyze the Trump Media merger. Unfortunately for the new shareholders coming from Digital Acquisition, the result is disappointing.

What happened? Four negative developments

First , after an enthusiastic 2021-22 market environment, conditions turned negative in 2023. The delay decreased interest, so the merger actions slowed, and the Digital Acquisition stock stagnated.

Digital Acquisition stock chart through Trump Media merger

Second , Digital Acquisition expenses remained high, made worse by a misleading SEC filing that ended up costing an $18M settlement. That amount, along with the expenses, ate into the money that would transfer over to Trump Media in the case of a merger.

Third , Trump Media was running negative earnings, with moderate revenues and large expenses. As a result, they turned to private loans to keep the firm afloat, meaning the company's shareholder (equity) balance was getting more negative.