- Coaching Team

- Investor Tools

- Student Success

- Real Estate Investing Strategies

Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

What Is A Micro Business? Examples & FAQs

What is a micro business? | Micro business vs. small business | Pros and cons of micro businesses | How to start a micro business | Challenges of micro businesses |

In the age of the side hustle , most people can name at least one or two business owners in their social circles. Platforms like Etsy, eBay, Upwork, and more have made it easier than ever to monetize skills and hobbies, and these platforms are only the beginning. Many entrepreneurs have their own websites and social media profiles selling goods and services. Did you know each of these gigs could be classified as its own micro business ?

Micro businesses are an increasingly common way for people to break out of traditional work environments. Running a micro business is no easy feat, but the benefits can make this an attractive opportunity for those with the time and the drive to succeed. If you are interested in becoming your own boss , selling your own products or services, or even supplementing your regular income: it may be time to consider starting a business. Continue reading to learn what a micro business is and how you can start one today.

What Is A Micro Business?

A micro business is a type of small business that employs less than ten people and earns less than $250,000 annually. It is common for micro businesses to operate as sole proprietorships, which consist only of the business owner. The Small Business Administration (SBA) also defines micro businesses as those requiring less than $50,000 to start. A few examples of micro businesses include freelance writers, Etsy shop owners, consultants, and many other self-employed workers. The business structure typically revolves around a smaller consumer market and allows owners to have a close relationship with their clientele.

Types Of Micro Businesses

Micro businesses can operate in any sector of the economy, though they are particularly common in retail, creative work, food service, and real estate. For example, someone operating an Airbnb may be considered a micro business owner. Similarly, your local bakery owner could also be considered a micro business. Many states have their own set of classifications for what makes a micro business, though they generally follow the same guidelines.

Micro Business Vs. Small Business

Micro businesses fall under the small business designation, though they are even smaller in structure. A small business can refer to any company with 500 employers or fewer, or $6 million or less in annual revenue (depending on the industry). There is a lot of room between micro vs. small businesses in terms of startup costs, revenue, and legal structure. These designations are important to consider as they directly impact how businesses are taxed.

Micro businesses are typically operated as sole proprietorships, while small businesses generally register as LLCs or corporations. Sole proprietors are taxed according to the owner’s tax rate, and business-related expenses can be deducted on a personal tax return. Single-member LLCs are taxed similarly; however, things get different with larger LLCs and corporate tax rates. Understanding these differences can help micro business owners choose the best legal designation when starting their own business.

Advantages Of A Micro Business

Many aspiring entrepreneurs are drawn to the idea of a micro business because they can provide supplemental income; in some cases, they can even replace your full-time job. There are some other advantages of a micro businesses to consider:

Flexibility: Micro businesses can offer owners a degree of flexibility that is not typically associated with an office job. Owners can set their working hours and decide how many projects or clients to take on.

Independence: Do you prefer to work alone? Starting your own business is a perfect opportunity to create the company of your dreams. Many people enjoy the foundational steps of starting a business as they have full creative control over the direction of the company.

Market Opportunity: Many micro businesses offer a specialized product or skill, such as graphic design work or even homemade bread. By offering a unique service, you can build a consistent network of clients. Eventually, this can help you expand your business and increase your overall profits.

Low Business Costs: Micro business owners also enjoy lower overhead expenses when compared to larger business structures. There is often not a designated office space to pay for (as many micro business owners work from home), and there are fewer employees on the payroll.

Disadvantages Of A Micro Business

There are a few disadvantages of micro businesses to consider before starting your own. Most notably, micro businesses require a high level of involvement from owners. Here are a few things to think about before starting a micro business:

High Risk: Your success as a micro business owner will depend entirely on your ability to market yourself and your product to clients over time. This could result in busy spells or periods without a lot of work. It can be risky to quit your full-time job to start a micro business for this reason.

Lack Of Support: The work of a micro business often demands diverse skill sets from everyone involved. If you are the sole employee, you will be directly responsible for marketing, financing, selling, and managing any other aspects of the business.

High Level Of Involvement: There is a lot of responsibility necessary to be a successful micro business owner. Oftentimes, you will be the only person holding yourself accountable for work and time management. Micro business owners need to be self-starters.

Difficult To Attract Talent: After you spend time building your micro business the way you want, it can be challenging to find the right employees to help with the job. Some business owners may struggle to attract talented workers who fit the hiring budget, while others struggle with relinquishing control over certain responsibilities.

How To Start A Micro Business In 6 Steps

Do you have a product or service in mind that you think you could effectively market? If you are interested in creating your own micro business, here are a few steps you can follow to get started:

Create Your Mission & Vision Statement

Plan Business Operations

Assess Financials

Create A Marketing Plan

Research & Test Your Product

File Your LLC

1. Create Your Mission & Vision Statement

With your product or service in mind, you first need to establish your business’ purpose. What are your core values and business goals? Think through your intentions when starting this business and document them appropriately. Not only can this help you get focused, but later on can help you attract investors and clientele.

2. Plan Business Operations

The next thing you need to work on is planning business operations. What services will you provide, and how much will they cost? Write out your products and a general business model you want to follow. Identify what type of resources you need to get started and set a schedule for yourself. This is also a great time to get organized. Consider the following resources as you plan out business operations:

Project Management Software: Look up software that will help you track your projects and business progress. Examples include Asana, Trello, and Kissflow Project.

Online Calendars: Organization is key, especially in the early stages of starting a business. Consider using Google Calendars, Doodle, or Calendly.

Accounting Programs: Before you fully plan out your finances, research a few programs that might help you with a business budget. A few popular options are Scoro, QuickBooks, or BillQuick.

3. Assess Financials

Before you begin searching for your first customer, it is important to establish a baseline for your business finances. Look at how much money you need to cover upstart costs and plan out a budget with your ideal revenue numbers. This will help you identify how many projects you need to take on to begin turning a profit. Assessing your finances is also crucial if you want to apply for a micro business loan, as lenders will request this information upfront.

4. Create A Marketing Plan

Now it’s time to develop a marketing strategy and begin planning how you will attract customers. This step will look different depending on your industry, but it is crucial to seek low-cost options when starting out. Research similar businesses for ideas to help you get started and write out your target audience. Again, marketing will vary from industry to industry, but here are a few places to help you get started:

Build a Business Website: Almost every micro business owner could benefit from a dedicated website. This will help clients gather information about your services and brand. Several platforms offer templates and monthly plans for small business owners. Review these options and customize a website based on your business.

Start Networking: Networking is also crucial for small business owners. Reach out to people in your area and let them know what services you provide. You can also join local business groups, Facebook pages, and more to build connections with other business owners. Word-of-mouth marketing is key for micro businesses, so always remember the importance of networking.

Establish Social Media Accounts: Create a social media page on every platform that might be relevant to your business. In today’s world, social media is often the first place prospective clients go to learn more about a business. It’s okay if you don’t have a regular posting schedule yet, but make sure your contact information and business services are clear.

5. Research & Test Your Product

While you already have a good idea of your product or service, there is no harm in extra market research. Fine-tune your offerings by researching similar businesses. Also, don’t be afraid to ask for feedback from early customers about your website or marketing strategies. These insights could be gathered in a quick online survey or through an exit phone call after you are done working with them. Use this information to improve your offerings, and don’t be afraid to test out new ideas.

6. File Your LLC

After establishing the foundation of your micro business, formalize your hard work and file for an LLC in your state. This process will look a little different depending on where you live. Still, for the most part, it will involve filing articles of organization along with an application fee to your state’s corporate filing office. If you are interested in learning more about the benefits of an LLC , be sure to read this guide.

What Challenges Do Micro Businesses Face?

While micro businesses enjoy many unique advantages, they also face some challenges. Here are the top three challenges to be aware of before you launch your micro business.

Securing Financing

Because micro businesses operate on a small financial scale, securing business financing can be tricky. Lenders often view small operations as unstable and unable to handle debt.

If you own a micro business and require funding, look to online lenders. While you may not qualify for a traditional small business loan, you can find working capital through micro loans, even if you have a low credit score .

Attracting Customers

Because you’re working with a smaller budget, you may have a harder time attracting potential customers. Small businesses often have a budget dedicated to marketing, advertising, and networking, while micro businesses don’t.

Luckily, there are plenty of digital marketing tools that are free or inexpensive to implement. In this digital age, commit to building a presence on at least one social media platform. Instagram and Facebook are great places to start. YOu may also consider expanding to Twitter, Pinterest, YouTube, TikTok, or LinkedIn, depending on your bandwidth and target market.

Don’t forget to tap into your personal and local networks. Word-of-mouth marketing is crucial for micro businesses. Send emails from your business email account to your contacts to announce your business and the products or services you offer. Encourage supporters to follow your business’s social media accounts and subscribe to your newsletter.

Multitasking

Although a business made up of 10 employees is still considered a micro business, most are owned and operated by one person. A solopreneur either cannot or will not hire employees, meaning that they wear many hats. They are on their own when it comes to marketing, taxes, operations, and sales.

Some of these tasks can be outsourced to subcontractors, while others can be streamlined using digital tools. Expect to spend a significant amount of time “on” your business rather than “in” your business.

Examples of Micro Businesses

Here are some examples of common micro businesses:

Freelancers: Are you a writer, editor, merchandiser, or consultant? You can build your career as a freelancer or independent contractor. You would take on clients as a micro business rather than as an employee of a company. This means that you would work independently and be in charge of your own business operations.

Event Specialists: Event designers, wedding florists, makeup artists, and musicians are a few examples of independent contractors that work in the event industry. These are micro businesses that market themselves independently to clients for their event needs.

Food truck owners: Food vendors using a food truck or cart typically employ just one or two employees to take food orders, prepare food, and handle point-of-sale transactions.

General Labor: Plumbers, carpenters, and independent mechanics are all examples of micro businesses in the general labor industry. These independent contractors may work with one or two employees who handle the administrative aspect of their micro businesses.

Coaches: The coaching industry is booming right now. You can find a coach for anything, such as relationships, health and wellness, or business. The majority of coaches are solopreneurs who spend just as much time marketing themselves as they do coaching.

How To Get A Microloan For Your Business

As you walk through the steps of creating a micro business, you may notice you need extra capital to get started. There are two main ways to get a microloan for your business. First, you can apply for a loan with a traditional financial institution. Research which banks in your area offer micro loans for small business owners. Look up loan amounts and interest rates before meeting with a potential lender. Be aware that not all banks provide loans in such small amounts, and you may need to seek out multiple options.

The other main option for receiving a microloan is to apply with the Small Business Administration (SBA). The SBA works with intermediary lenders to provide loans up to $50,000 for micro business owners. Find out if there is an SBA office in your area by searching online, or go ahead and research a list of potential intermediary lenders to work with. This will provide you with more information on the application process and potential loan details.

Microlending In Certain Areas

Small businesses are crucial to many local economies, and because of this, private lenders are often available to help micro business owners get started. Private lenders may be able to accommodate special circumstances for business owners in traditionally underserved communities. The U.S. Chamber of Commerce website has an excellent list of resources available for private microloans. These loans could help cover payroll costs, marketing campaigns, seasonal expenses, and supplies.

Micro Businesses Help From Your State

In addition to federal help, there are also state-specific programs that may be available to you. These could provide loans for upstart costs, inventory, and more as you create your micro business. For example, the California Infrastructure and Economic Development Bank offers both jump-start loans and financial relief programs for micro business owners. Look up micro loans in your state online to see what programs you may be eligible for, then compare interest rates and loan terms to find the right lender for your needs.

Starting your own business can be extremely rewarding. Not only can this accomplishment give you a sense of pride, but it can also help you establish financial security. That being said, owning a successful business will take time and dedication on your part. Research the numerous resources available to help you get started and begin marketing your unique product or service today. You may find that owning your own micro business turns into a fulfilling, lifelong career.

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

NAR Settlement: What It Means For Buyers And Sellers

What is the assessed value of a property, what is bright mls a guide for agents and investors, how to pass a 4 point home inspection, defeasance clause in real estate explained, what is the federal funds rate a guide for real estate investors.

Be Stress Free and Tax Ready 🙌 70% Off for 4 Months. BUY NOW & SAVE

70% Off for 4 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

What is a micro business & how to start one.

Micro businesses are hugely popular these days and they ’ re pretty easy to start!

Onto today’s topic: micro businesses. What exactly is a micro business or “micro enterprise” and how do you start one ? Contrary to what you might hope, a micro business is not a tiny storefront run by caterpillars. It’s a business that employs less than 10 people and makes less than $250,000 in annual sales. Statistically though, micro businesses are usually operated by one person, the owner.

Think of all those life coaches on Instagram. The Etsy shop owners, independent freelancers…these are all examples of micro businesses.

Here’s What We’ll Cover:

Micro Business vs. Small Business

How to start a micro business, key takeaways.

The definition of a “micro business” can vary, especially from state to state. However, there are some commonalities on what defines a business to be “micro”. These commonalities include: employs less than 10 people (so maximum 9), produces less than $250,000 in annual sales , was started up with less than $50,000.

Similarly to micro businesses, the definition of a small business can vary depending on what state you are in. According to the U.S. Small Business Administration, a small business employs less than 1500 people and makes less than 38.5 million in annual sales. In some industries that number goes all the way down to 6 million. Still not a bad year, but a big difference when it comes to business type!

When it comes to taxes, both small businesses and micro businesses can function the same, depending on how they are registered. As the owner of a micro business, you have two options. You can register your business as a separate entity, or be the sole proprietor and include your micro business as part of your personal tax form.

Registering your micro business as a separate entity (LLC or corporation) will give you a few benefits. These benefits include: a break on your taxes and “personal liability protection”. Having personal liability protection means that if things go south, the bank cannot go after your personal assets (home, car, savings account) but may take over your business account and property. A micro business doesn’t bring in enough revenue for registration to make sense. This is why the majority of micro business owners choose to be the sole proprietor.

Now onto the good stuff. How do you actually start one of these things? Here’s the breakdown:

Step 1 – Write out your mission statement: Before you do anything, you’ll need to figure out what sort of micro business you want to launch! All good businesses start with a solid mission statement, so grab a piece of paper and write down your goals. Really think about what will make your business stand out from the rest. Whatever you would include on your “about us” page would be a good start.

Step 2 – Take stock of what you need to get started: Now it’s time to get into the nitty-gritty. Where will you source your supplies from? What are your business expenses ? Who is your target audience and what will they expect from you? Will you offer your product/service locally? Or internationally? Write all of this down and do your research. It’s always a good idea to talk to a fellow business owner in your space, to get a read on what to watch out for when you begin to put your micro business plan into action.

Step 3 – Consider asking for a micro – loan: Keep your eyes open for programs and grants geared towards micro businesses. Some of these programs also offer workshops, coaching and other resources to help with business funding.

Step 4 – Come up with a marketing plan: There’s no point in having a micro business unless people actually know about it! Most micro businesses rely heavily on social media and email marketing as it’s low-cost, effective and easy for one person to execute. Figure out which platforms will best suit your brand and start getting the word out.

You don’t need to have gone to business school in order to launch your own micro business. All you need is a bit of money and the drive to get it started. To reiterate, here are the four steps to help get you started:

- Write out your mission statement

- Take stock of what you need

- Consider asking for a loan

- Come up with a marketing strategies

It looks like when it comes to businesses, size really doesn’t matter!

Read more about micro businesses on our resource hub .

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, micro businesses : what are they and how do you start one.

Discover the differences between small and micro businesses, and explore practical tips for starting and running a successful compact business.

Small businesses versus micro businesses: What’s the difference, you may ask. While all micro businesses are small businesses, making up 99.9% of all U.S. organizations, not all small businesses are micro businesses. However, these compact operations are instrumental in driving the economy, delivering specialized services to niche markets, and opening doors for budding entrepreneurs.

What are micro businesses?

Micro businesses are found nationwide, ranging from freelance professionals to mom-and-pop shops. Defined by the U.S. Small Business Administration as any company with nine or fewer employees, these small-scale operations typically provide specialized services or cater to specific market segments. Micro businesses generate less than $250,000 in annual revenue and require little startup capital to establish, making them accessible for those just entering the industry.

The advantages of having a micro business

Operating within specific niches, micro businesses offer unique services or products, serving as a significant differentiator for those aiming to establish a market presence. Plus, their low overhead costs result in reduced expenses for things like office space, staffing, and business operations.

The small scale of micro businesses also allows for easier management without needing external intervention. For example, if a business needs to adjust its operations due to underperformance, there's no need for a lengthy approval process through an internal hierarchy; businesses can make adjustments promptly. This flexibility can be freeing for employees, who can typically set their own schedules and working conditions.

[Read more: Why Hot Startups Like Pura Vida and Cure Hydration Are Getting Big Results From Micro-Influencers ]

The challenges

Despite needing less capital than larger enterprises, micro businesses often struggle to secure funding due to their limited history or brand recognition, with entrepreneurs frequently resorting to risky self-financing. Funding problems can impact consumers too, as smaller entities often struggle to set competitive prices and adapt to fluctuating demand.

Another hurdle for micro businesses is attracting customers due to brand recognition issues. While carving out a niche can appeal to consumers, micro businesses often operate with limited resources, potentially leaving them with too few staff members or needing more technological expertise to attract new customers as effectively as their larger counterparts.

Types of micro businesses

Micro businesses are prevalent across the country and vary widely, ranging from e-commerce storefronts and startups to independent contractors, retailers, and street vendors. These businesses can function from a commercial location, a retail storefront, or be home-based.

Qualifying as a micro business largely depends on staff size, encompassing many private practices including doctors' offices, financial professionals, and law firms. Local small businesses also qualify, as do retail businesses operating on online platforms with low overhead and few employees.

Operating within specific niches, micro businesses offer unique services or products, serving as a significant differentiator for those aiming to establish a market presence.

How to start a micro business

While starting a micro business is a much smaller undertaking than establishing a larger corporation, it still requires ample planning to be successful. Here are some tips to get you started.

Choose an industry

Begin developing your business idea by considering the areas you excel in. If you possess specialized skills or have a profitable hobby, it can steer you toward an industry where you're likely to thrive. Research the industry to confirm the need for your business, as well as a potential customer base, and ensure it suits your lifestyle.

Develop a business plan

Draft a business plan that encompasses details ranging from your business model to financial projections to your intended hiring strategies. Include information about your target market and define your marketing plan, along with goals you’d like to achieve and a corresponding timeline.

[Read more: Writing a Business Plan? Here’s How to Do It, Step by Step ]

Register your business

For most businesses, registering with local and state authorities is essential in order to obtain a state tax ID and Employer Identification Number (EIN). An EIN is necessary for various operations, including opening business bank accounts, filing taxes, or processing employee payroll.

Research and test your product

Conduct studies to test your product or service in your target market and determine areas of improvement. Gather feedback, whether it's from a small sampling of people during a soft launch or a wide range encompassing family and friends, focus groups, and other local vendors and businesses, to refine your product to be market-ready.

Secure financing

A financial plan is essential to getting your business off the ground. Secure capital through microloans and credit from banks, or explore funding options from external lenders or investors who believe in and support your business idea.

Attract customers

Micro businesses need a comprehensive marketing strategy to attract customers. Investigate your target market and competitors to guarantee that your business effectively communicates its value proposition. Employ marketing techniques, such as social media promotion and paid advertisements, and develop a website that reflects your business's core values to reach your audience.

[Read more: A New Selling Strategy? How to Create Virtual Micro-Experiences ]

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Join us for our Small Business Day event!

Join us at our next event on Wednesday, May 1, at 12:00 p.m., where we’ll be kicking off Small Business Month alongside business experts and entrepreneurs. Register to attend in person at our Washington, D.C., headquarters, or join us virtually!

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more startup tips

How to change your ein, or how to fix an incorrect ein, micro-business vs. startup: what’s the difference, micro businesses: what are they and how do you start one.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

- Search Search Please fill out this field.

- Building Your Business

What Is a Microbusiness?

:max_bytes(150000):strip_icc():format(webp)/ScreenShot2020-03-26at1.24.14PM-16d178cb2ee74d71946d658ab027e210.png)

Definition and Examples of Microbusiness

- How a Microbusiness Works

State Aid for Microbusinesses

jacoblund / Getty Images

A microbusiness is a subcategory of a small business, defined specifically by its small number of employees, annual revenue, and startup costs.

Key Takeaways

- A microbusiness is a type of small business that has under 10 employees (according to the SBA), meets specific annual revenue criteria set by state authorities, and has small startup needs.

- Identifying an organization as a microbusiness is key to sustaining growth and applying for resources and loans particular to microbusiness owners.

Loans from the microloan program can be used to fund working capital, inventory or supplies, furniture or fixtures, or lastly, machinery and equipment.

A microbusiness is an entity defined by its small number of employees, annual revenue, and startup costs . The U.S. Census Bureau and the Small Business Administration (SBA) define microbusinesses as companies with fewer than 10 employees. However, there is technically no universal definition, and each state tends to set its own standards for the size and scope of a microbusiness.

Examples of state regulation include Connecticut, which further identifies microbusinesses as making under $500,000 in annual revenue. California, on the other hand, defines a microbusiness as one with annual gross revenue of $2.5 million or less over the three previous years, or a business with 25 or fewer employees.

You can think of a microbusiness as a subset of a small business, though it operates and has very different challenges than a small business does. A microbusiness owner needs to create operations, capital needs, and scaling measures that are specific to a microbusiness entity.

A microbusiness is often run by a sole proprietor , meaning the owner must spread themselves across various roles or departments to keep the business functioning. Further, dollars to invest in marketing and growing a customer base are more limited with a microbusiness, pushing an owner to get creative when it comes to building an active clientele.

Microbusinesses often fall within the industries of retail, construction, and health care. Many independently owned creative shops fall within this scope too, such as businesses on Etsy. According to 2017 data, microbusiness employers account for 74.8% of all private-sector employers.

Supporting microbusinesses in local economies is crucial to creating employment opportunities and building a sense of community in local neighborhoods. Selecting a solopreneur owned cafe over a big-brand coffee shop can make a difference for economic and employment diversity.

- Alternate name: Microenterprise

How a Microbusiness Works

A microbusiness is one of the smallest business entities, categorized as having much lesser annual revenue and employees than the average small business.

To maintain status as a microbusiness according to the SBA, a company must:

- Employ one to nine employees, including the owner

- Make below specific annual revenue numbers set by state and local governments, such as Vermont’s regulation of $25,000 in annual revenue

- Have small startup costs and capital needs, aligned with the small scale operations necessary to keep the business running

As mentioned, microbusinesses often operate with a small team and slim resources. Keeping a business operational could mean a need for expansion, and expansion takes additional capital to ensure success. To lump microbusinesses into the same category as small businesses would create unfair challenges and competition for microbusiness owners seeking funding opportunities.

Just like a small business has specific loan programs available to help them thrive, so do microbusinesses. The SBA offers a microloan program that provides loans of up to $50,000 to help businesses and certain nonprofit child care centers startup and grow. The average microloan, though, is generally about $13,000.

The SBA provides funds to specifically chosen intermediary lenders, such as nonprofit organizations with lending experience, that then distribute the loans to eligible borrowers. Each lender has its own credit and lending requirements, and they generally require collateral and a personal guarantee of the business owner.

It can be very competitive for small businesses, including microbusinesses, to receive small business grants from the SBA. As a result, there are many state and local programs that provide aid for microbusinesses too.

Vermont, for example, offers a Micro Business Development Program to companies that have less than five employees and generate less than $25,000 in annual revenue. Through this program and others like it, microbusiness owners have the opportunity to:

- Network with other entrepreneurs

- Take relevant courses on topics like building your credit score and record-keeping

- Gain access to technology resources

- Work one-on-one with an experienced business counselor

Also keep in mind that many microbusinesses operate as sole proprietorships, not going as far to register as an LLC or corporation as many small businesses do. As a result, a microbusiness owner is taxed according to the tax rate on their personal tax return , as opposed to filing business taxes separately.

U.S. Small Business Administration Office of Advocacy. " Small Business Facts: The Role of Microbusiness Employers in the Economy ." Accessed Nov. 19, 2021.

Connecticut General Assembly. " Statutory Definitions of Small Businesses and Microenterprises. " Accessed Nov. 19, 2021.

California State Legislature. " Government Code - GOV Title 2. Government of the State of California [8000 - 22980] (Title 2 Enacted by Stats. 1943, Ch. 134.) Division 3. Executive Department [11000 - 15986] (Division 3 Added by Stats. 1945, Ch. 111.) Part 5.5. Department of General Services [14600 - 14985.11] (Part 5.5 added by Stats. 1965, Ch. 371.) Chapter 6.5. Small Business Procurement and Contract Act [14835 - 14847] (Chapter 6.5 Added by Stats. 1973, Ch. 1198.) Article 1. General Provisions [14835 - 14843] (Article 1 Heading Added by Stats. 1998, Ch. 917, Sec. 1.) 14837 ." Accessed Nov. 19, 2021.

Vermont Agency for Human Services. " Micro Business Development Program ." Accessed Nov. 19, 2021.

U.S. Small Business Administration. " Loans and Grants Microloan Program ." Accessed Nov. 19, 2021.

Vermont Agency of Human Services Department for Children and Families. " Micro Business Development Program (MBDP) ." Accessed Nov. 19, 2021.

- How It Works

- Resource Center

- Form an LLC

- Form a C Corporation

- Form an S Corporation

- Form a Non Profit

- Company Name Change

- Registered Agent

- Virtual Address

- Certificate of Good Standing

- ‘Doing Business As’ Name (DBA)

- Foreign Qualifcation

- Change of Registered Agent

- Business License or Permit

- Submit an Annual Report

- Get a Free Tax Consultation

- Get a Trademark

- Order a Corporate / LLC Kit

- Finances and Accounting

- Dissolve Your Company

- Get Reinstated

- Compare Business Entities

- Business Name Generator

- Business Industry Guides

- Business Name Search Tool

- Business Startup Guide

- What is an LLC?

- LLC Information By State

- Corporation Information By State

- State Filing Times

- Do I Need a Business License?

- Free Business Tools

- What To Do After Forming Your LLC

- Financial Management

- Growth Tips

- Get Bizee Podcast

- Why Choose Us

- Testimonials

- Incfile is now Bizee

- Bizee vs. ZenBusiness

- Bizee vs. LegalZoom

- Visit the Blog

- New Clients

Small Business Not for You? Here's How to Create a Micro Business Plan

Please note: This post contains affiliate links and we may receive a commission if you make a purchase using these links.

TABLE OF CONTENTS

Get the guide: How to Start a Micro Business

Do good things really come in small packages? If micro businesses are anything to judge by, then the answer is "no — they come in tiny ones." With a micro business, you can sidestep many of the headaches that come with small business ownership while still pursuing your entrepreneurial goals and running your own business.

So if you're ready to join the micro side, stick around to find out how to create a micro business plan.

Put your brilliant business ideas into action with Bizee’s Free DIY Course

What is a micro business.

By now, you've probably guessed that a micro business is even smaller than a small business. But what is a micro business exactly ?

In truth, it depends on who you ask. Some of the various definitions include:

- Businesses started with less than $50,000. While this makes sense at first glance, consider that Hewlett-Packard was founded with just $538 in 1939 or about $10,000 in today's money. The tech giant now employs over 50,000 people and earns tens of billions of dollars per year, and you'd be hard-pressed to find anyone who considers it a micro business. So, this definition has too much room for error.

- Businesses that earn less than $250,000 per year. Again, this definition seems sound at first. But when you remember that heavily investor-funded companies like Uber sometimes exist for many years before finally turning a profit , its practical use becomes much murkier.

- Business with less than 10 employees. OK, now we're getting somewhere. Even on Forbes ' annual Small Giants roundup , a list of 25 outstanding small businesses, it's difficult to find companies with less than 20 employees, let alone 10. As such, this is one of the most solid definitions so far, and it also happens to be the one used by the U.S. Small Business Administration (SBA) .

So which definition is the best one? There is no single agreed-upon answer, but for the sake of simplicity, we'll use the same one as the SBA and say that a micro business is any with less than 10 employees . If the business was started with less than $50,000 and/or earns less than $250,000 per year, that just contributes to its micro business status.

What are examples of micro businesses? In short, the sky's the limit. That's because any and every business with less than 10 employees can be considered a micro business, including:

- A brick-and-mortar retail shop with one owner and three sales associates

- A tax consultation company owned by two people who occasionally meet with clients

- A freelance writing business consisting of one person who works exclusively from home

- A real estate company with one owner and five employees who all work out of the same office

Those are just a few of many possible examples, but suffice it to say that there are myriad micro businesses across every industry and niche.

Micro Businesses by the Numbers

You've probably heard that small businesses are the backbone of the economy, and that's certainly accurate. But if we're getting really specific, the truth is that micro businesses form the foundation of the U.S.'s wealth.

As the SBA explained, they're the most common type of employer firm. And in 2016, the country's 3.8 million micro business employers made up nearly 75 percent of all private-sector employers:

And remember, those statistics don't even account for micro businesses that don't have any employees, i.e., those consisting only of one person. The U.S. Census Bureau pointed out that in that same year, only about 24 percent of the country's establishments had paid employees, meaning that 75 percent don't have any employees at all.

In other words, the majority of the U.S.'s businesses are micro businesses whose only employee is their owner. So if you're more interested in starting a micro business than you are in starting a small business destined for growth, you're far from being the only one.

How to Create a Micro Business Plan

So you want to start your own micro business, you're brimming with entrepreneurial energy and you're ready to go. Now, it's time to start planning. But what is a micro business plan?

In many regards, a micro business plan is very similar to a small business plan in that it:

- Provides a roadmap for starting and managing your business

- Plans for up to five years in the future

- Details what your business will do, how it will earn money and who it will sell to

Where micro business plans differ from other business plans, however, is in their scope. For example, all of these elements can be included in standard business plans but may be unnecessary in micro business plans:

- Overview of management structure/corporate hierarchy: Since most micro businesses only employ their owner, there's no need to dedicate a section to detailing the business's leaders and key staff members. And even if a micro business does have employees, it will have so few that this section can remain short and sweet.

- Funding requests: Larger businesses may need to include funding requests or investor information in their business plan. But with a micro business, your startup costs can likely be covered by your own funds (seriously — there are many businesses you can start for under $1,000 ).

- Growth goals and scalability: For businesses whose ultimate goal is to achieve as much growth as possible, it's important to detail how much they want to grow, when they want to achieve that growth and how their business will scale. But for micro businesses that are more focused on self-sufficiency than scalability, this isn't typically a concern.

But the question still remains, how do you write a mini business plan of your own? While there is no one right way to create a business plan, your micro business plan could look something like this:

- Business overview: A brief description of what your business will do, as well as your broader vision and goal.

- Market summary: A breakdown of your target audience, the value you're offering to them, your main competitors and your competitive edge.

- Marketing strategy: An outline of the marketing channels you'll use to find and connect with customers (this can include social media, content marketing, email marketing and the like), as well as the strategies you'll use to make the most of those channels (such as by posting one new blog post per week and one new Facebook post per day).

- Expected costs: An estimation of your business's costs, including those that you'll only have to pay once (such as state fees for filing an LLC ) and those that you'll have to pay on a regular basis (such as software subscriptions).

- Expected revenue: An estimation of how much money your business will earn from each sale and how frequently you expect sales to occur. Also note how many sales you'll need to make (and how often) in order to generate a profit.

- Key objectives: A summary of your next steps and when you want them to be completed. For instance, form an LLC within one month, make five sales within three months and break-even within six months.

In the end, what's most important is that your micro business plan helps you form a clearer idea of what you want your business to do and how you plan to do it. You don't need a 10-page essay in order to succeed — just as with micro businesses themselves, bigger isn't necessarily better.

Creating a business plan is just one piece of the puzzle, though. If you want a guide that walks you through every step of starting a micro business on your own, Bizee's DIY Business Course can help.

Carrie Buchholz-Powers

Carrie Buchholz-Powers is a Colorado-based writer who’s been creating content since 2013. From digital marketing to ecommerce to land conservation, she has experience in a wide range of fields and loves learning about them all. Carrie is fond of history, animals and beauty in equal measure. In her free time, she enjoys knitting, playing video games and exploring Colorado's prairies and mountains with her husband.

like what you’re reading?

Get Fresh Monthly Tips to Start & Grow Your LLC

Related Articles

Follow Bizee on:

VIEW BY TOPIC

- Budgeting and Financial

- Finding and Retaining Employees

- How to close more sales

- Keys to Business Success

- Latest News

Marketing Your Business

- Recession Proof Your Business

- Results and Case Studies

- Testimonials

- Time Management Strategies

- Trending Business Growth Article

- Finding Customers

- Business Systems

- Managing Employees

- Managing Money

Get Weekly Coaching Tip

Related posts, the benefits of ai transcription for content marketing, the benefits of using ai for email management, what is equipment maintenance and how it helps your business, how a business rules management system revolutionizes, how can you set up an australia based company, stay connected: essential esim tips for small businesses, business expansion: 5 tips for conquering international markets, a complete guide to local seo for gyms and fitness studios, successfully sourcing packaging materials for your business, the role of the metaverse in your 2024 brand plan, top 10 effective techniques to improve digital marketing, ready to grow your business fast.

Here’s How I Grew Five Businesses, and Eventually Sold One to a Fortune 500 Company.

MICRO BUSINESSES

Micro businesses operate similarly to small businesses but with some differences in terms of funding and expansion. However, they can be a profitable venture to pursue. In this article, we will look at microbusinesses and all the details required to start and run one. So, let’s get started.

What Is a Micro business?

A micro business is a small enterprise that typically has fewer than five employees. It is usually owned and operated by a single person or family with limited capital investment. Micro businesses provide goods and services that meet the needs of their local communities and often specialize in niche markets. They are frequently based in home offices or storefronts, using innovative technologies and methods to deliver quality products and services.

Micro businesses are commonly powered by entrepreneurs who would rather take their own path than work in a large corporation. Having these small business owners, drives creativity and new ideas while bringing helpful products and services to smaller areas. By staying flexible and agile, micro businesses are able to adapt to changing market conditions and customer needs quickly. They also offer consumers greater choice, as well as the opportunity to shop locally and support their own community.

The success of a micro business depends on its owner’s ability to identify potential opportunities within the local market, build relationships with customers, manage cash flow effectively, and develop long-term strategies for growth and sustainability.

With careful planning, hard work, and determination, a micro business can be an effective way to create financial stability and pursue personal passions.

In today’s digital world, it is also possible to launch a successful online micro business with relatively low startup costs. By utilizing various digital platforms and tools , entrepreneurs can create robust ecommerce operations that have the potential to reach a global customer base. This is an attractive option for many people who wish to maintain a certain degree of flexibility and autonomy in their business endeavors.

No matter what type of micro business you start, it is important to remember that success does not happen overnight. It requires hard work, dedication, and resilience. With the right plan in place and a positive attitude, you can create a successful small business that will bring financial stability and personal satisfaction.

How Does a Microbusiness Work?

A micro business is a small-scale business that typically consists of one to five employees or less. It usually requires minimal upfront investment, such as office space, equipment and supplies.

Micro businesses operate in a similar fashion to much larger businesses with regards to:

- Deciding on a legal business structure, e.g., LLC, corporation, or partnership

- Structuring financial, management, marketing, and operations

- Getting business permits and licenses

Taxes for micro businesses largely depend on the formal business legal structure used – sole proprietorship, corporation, partnership, or LLC. These taxes may include:

- Income taxes

- Payroll taxes

- Sales taxes

- Property taxes etc.

Here are the main components of how a micro business works:

– Establishing the Business : This involves researching the target market, developing a business plan , registering the business, obtaining any necessary permits and licenses, and choosing the appropriate legal structure.

– Financing : Microbusinesses typically rely on personal funds or small loans to cover start-up expenses.

– Supplies & Equipment : Different types of businesses require different supplies and equipment. Research into what is required to run the business should be conducted prior to purchasing anything.

– Marketing : This is a key component of any successful microbusiness. It involves strategizing and implementing an effective plan to reach potential customers.

– Operations : Operations are the day-to-day activities that maintain the business, such as accounting and record keeping, customer service, and employee management.

– Expansion : Once the business is established and running smoothly, it may be time to consider expansion options. This could include additional locations or products/services.

Entrepreneurs can create a successful small business by understanding how a micro business works and applying the necessary steps. With hard work and dedication, microbusinesses can become the backbone of the economy.

Micro Businesses vs. Small Businesses

Small businesses and micro businesses might appear to be interchangeable, but they actually aren’t. Micro businesses can more accurately be defined as a small subset of the term “small business.”

Small businesses, like micro businesses, don’t have a standard definition across the board, as the definition varies among different industries. For example, in the manufacturing industry, a small business includes less than or equal to 500 employees. Simultaneously, in the retail and service domain, the average annual revenue should be less than or equal to $6 million. SBA standards allow for small businesses to have easier access to loans and government contracts than micro businesses.

State Intervention Programs for Micro businesses

Like small businesses, micro businesses may benefit from intervention (aid) programs from the government; the degree of such intervention may vary from region to region.

For example, there is a Micro Business Development Program for low-to-moderate-income start-ups to help such micro businesses start and grow in Vermont. This aid covers networking, seminars and workshops, counseling, and networking for the micro business.

Mecklenburg County, Pennsylvania also has a micro businesses aid structure set up with financial support of up to $10,000 to help qualifying businesses navigate through an economic slump.

Consult with your local government structure for specific loan and aid programs for micro businesses.

Types of Micro Businesses

Micro businesses are typically small-scale operations that can be run by a single person or a group of people. Some common types of micro businesses include home-based businesses, freelance services, and consulting firms.

Home-based businesses offer convenience as they enable entrepreneurs to work from the comfort of their own homes. This type of business usually involves products or services that do not require a lot of overhead expenses and can be managed with minimal resources. Examples of home-based businesses include online stores, pet sitting services, and tutoring.

Freelance services are another type of micro business. Freelancers typically work on a contract basis for different clients and provide specialized services such as writing, graphic design, web development, and data entry.

This type of business is ideal for those who want to work on their own terms and have the flexibility to choose the projects they want to work on.

Consulting firms are also considered micro businesses. They provide advice and guidance to companies on a variety of different topics, such as marketing, finance, and operations. Consulting firms can also help businesses develop strategies for growth and success.

No matter what type of micro business you choose to pursue, it is important to understand the basics of running a business and know how to effectively manage your time , resources, and finances. With the right skills and dedication, any micro business can be successful.

These are just a few of the many types of micro businesses available to entrepreneurs. There are countless options, so it is important to do research and find the right fit for you. With dedication and hard work, any micro business can be successful.

Pros and Cons of a Micro business

Like any other venture, micro businesses have advantages and disadvantages.

Let’s explore some of the most significant advantages of running a micro business.

1. There is room for specialization in a specific niche

It is a common trend for businesses to start out trying to supply various goods and services. They start out with extensive teams and anticipate and invest hefty sums of money. Only with time do they start realizing which specific aspects of the business are sustainable and which should be suspended. The end result to this a trimming of the unnecessary workforce and more efficient operations

Some other companies take a different route to those mentioned earlier, starting out with a niche and quickly expanding the business to a more significant market only to end up with very little interest in the specific goods/services rendered. Of course, such start-ups could have been better served with a smaller area focus like a community.

Now, these are two polar ends of common business scenarios, and micro businesses can allow you to have the best of both worlds. A Micro business allows for a great deal of specialization in the market and remains profitable as the market expands. A niche allows for a greater degree of focus and dominance over the competition concerning the specific goods and services rendered.

2. Greater adaptability and flexibility to change

When it comes to start-ups, it is common to have start-ups pivoting business ideas to accommodate changing tastes. To do this, considerable changes must be made to the organization and the nature of the company’s products and services. This was the situation with well-known social media platforms like Instagram and Twitter, which underwent pivots and are now unmistakably on a soaring trend.

Now, the challenge with achieving a pivot in the midst of changing tastes and preferences in consumers is the team’s size. In the above example, teams constituted behemoths of friends and relatives who pursued their dreams and aspirations in doing what they loved. For such small teams, pivotal changes were a lot easier. With a team of over 40 members, however, not so much. It would take months to achieve a pivot.

This is where micro businesses shine. Their small teams allow adaptive changes within small time gaps. It also means whenever there is a shift in industry standards or consumer preferences, they can easily band together ideas and take advantage of new opportunities. Think of it regarding warfare: a small unit of elite warriors is better suited for hazardous or unchartered terrain than a large battalion of soldiers with diverse skills.

3. Lower overhead costs and fewer expenses

Increased business size means higher operational costs. Even with a shift from traditional to remote working setups, there is still the matter of comprehensive HR oversight and payroll management. It is an irrefutable fact that many businesses can’t fully operate remotely, necessitating the need for office spaces and other facilities.

In this dilemma, micro businesses present another advantage – the small team sizes allow for lower overhead costs as modern automation systems can be leveraged efficiently without the need for larger team sizes. There is also less need for oversight, especially with side-hustle start-ups like freelance marketing. It’s as simple as putting up campaigns, setting them in motion, and reviewing them seasonally.

Training and workshops are important for company success, but they can be costly. Company-wide sessions should be implemented rather than departmental or per-team sessions to save money. This will reduce costs while still allowing the company to reinvest in things like employee wages, advertisement campaigns, and better infrastructure–all of which help the micro business grow.

4. Independence for the Non-Committed

There is great liberty to choose a business path with micro businesses and determine the future you want as an entrepreneur. This freedom not only applies to the business owner but sips to the employees as well.

Having looked at some of the most significant advantages of running a micro business, let’s look at some of the disadvantages to running micro businesses. Here are a few to consider:

1. More significant workload on fewer employees.

There is the prevalence of more responsibilities for fewer people to manage .

Running a business is hard enough, but you have to contend with content marketing and reputation management in the modern age. A single negative review on social media can be disastrous, and you must constantly generate new content to keep up a healthy online presence.

Now, outsourcing some tasks can be a really decent and yet inexpensive way to get things done. However, it will still require time to outline the tasks, energy to manage communications and ensure deadlines are met in delivering results. Handling everything in-house could be the way to go, but it brings up another problem – the few members on the team means there may not be available the necessary skill needed at the time.

One of the main reasons more prominent companies hire new employees regularly is to stock up enough skills to get things done efficiently. For example, they may hire a graphic designer to aid in branding and publicity adverts, thus improving the company’s overall productivity. With micro businesses, the fewer employees mean much is left to the charge of fewer individuals. Though it may be fun at first, it can quickly degenerate into a grievous and strenuous venture.

2. Higher risk of failure and funding challenges

Surely you’ve heard the phrase, “Too big to fail”, often associated with financial institutions that have had a hand in major financial crises. But since they are heavily relied upon to the point that the collateral damage upon their dissolution would be irreparable, the government instead chooses to encourage and promote them.

So, what’s the point of all this? Well, size sometimes does matter, and a company can survive through some hardship and challenges simply because of its size. The larger the company, the stronger its brand, the greater its turnover, the more recognition it accrues. In the event of a challenge or difficulty, they can fall back to savings, downscale, or even relinquish some assets to ensure survival. Also, more prominent companies would have a lot less of a hassle getting loans or investments since they’d have more significant financial records.

In contrast, micro businesses are much smaller and face difficulties when getting loans or appealing to outside investors. Even if they try to attract investments, their lack of size makes them seem risky, and potential investors will only see a few opportunities for profit if the business puts in the effort.

3. Limited access to valuable resources

Companies that are widely recognized usually have an easier time getting favors and discounts because other industry leaders want to support them. Most of the time, companies give each other bigger discounts when trying to attract a profitable contract.

Micro businesses have neither the considerable name recognition nor the size to attract such bonuses and discounts. Since they usually won’t be able to pay for large contracts, concessions on their rates would hardly be made in their favor. As such, it holds that the bigger the business, the better the prices you’d get for goods and services from other service providers. Additionally it will be easier to convince others to value a potential business relationship. Such leverage is hard to deny and is indeed farfetched for many micro businesses.

How to Start a Micro Business in 6 Steps

So, are you interested in starting a micro business? The advantages are, no doubt, significant and, like any other type of business, there are challenges to it. But I dare say those with the will to succeed can surely set up and succeed with a micro business. Here’s a step-by-step approach to starting a micro business.

Step 1: Establish a mission, vision and values statement.

It is essential to develop and clearly state the intents and purpose of the business. This is the foundation of the business and surmounts the mission and vision statement. When there isn’t a clear vision, mission and values statement, growth will be hindered as the path to realizing the business’s more detailed plans will be blurred.

Well-structured vision, values and mission statements also reveal what the business stands for and will attract customers and investors who are interested in the business’s core values.

Step 2: Draw up a good business plan

Your business plan is a document that explains and outlines the goals, estimated costs, and strategies for running your micro business. If you want to attract investors or acquire loans, then you need a formal business plan.

Research shows that people who write up great business plans are more likely to start up the business. Writing up a business plan also triggers critical question for the success of the business like:

- What market is available for my product or service, and what is its current outlook?

- Who would be my market competition, and how would I stand out from the crowd?

- Who are my potential customers?

- How will I reach them?

- What will it cost me to survive my first year in the micro business?

- Where will the needed money come from?

A business plan would typically include financial details—projections of sales, expenses, assets, and cash flow. The financial documents needed for a formal business plan include:

- Balance sheet, showing what you own and what you owe

- Profit and loss (or income) statement summarizing revenues and expenses every three months (quarterly) and annually (each year).

- Cash flow statement (or forecast), showing working capital for better expenditure predictions.

Step 3: Decide micro business structure

Setting up a successful business is essential to establish the business structure – legal entity –to run the business.

Sole proprietorships (which are single-owner businesses) and partnerships (having two or more owners of the business) are the least costly business structures. In these setups, owners have all the power in business decisions. They also are obliged to make reports detailing income and losses and are, thus, personally liable for any and all business-related debts. In the event of business failure, they may file for bankruptcy, which may allow them to abandon debts, but damage personal credit history in the process.

A corporation is a legal business structure that is legally separate from the people who own it under state or federal law. Like people, corporations can also own property, incur debt, sue, and be sued. Most corporations exclude members from personal liability with corporation dealings or lawsuits.

A Limited Liability Company (LLC) is a business structure that combines a corporation’s features and those of a sole proprietorship or partnership. An LLC offers some protection of personal assets and from personal liability and is a suitable option for both one-owner or multi-owner micro businesses.

LLCs also require more legal documentation than much simpler sole proprietorships or partnerships, but the legal requirements are fewer than corporations.

Step 4: Establish detailed operation plans for the business

The next step is to outline plans of operation for the business clearly. There are numerous moving parts in a company, but it all simplifies well-structured goals and milestones with timelines to organize day-to-day activities. And to make things easier, there are diverse technological tools today like business model canvases or one-pagers to address any potential issues that may arise in the running of the business

To achieve an effective plan of action , you should ask yourself the following questions:

- Who are my key partners and suppliers?

- Where does my micro business function?

- What facilities do I need, and how much do they cost?

- What is my business structure?

- Who are my target customers?

- What ways can I possibly use to meet the needs of my target customers?

- What is my cost structure/revenue stream?

Step 5: Anticipate financial needs

Creating a financial plan is the best way to pitch your business to potential investors and lenders. A well-researched and comprehensive plan will give you the best chance of success.

Many businesses fail primarily because of lack of funding, and it is imperative to assess financial needs before setting up a micro business carefully.

Such funding anticipations should include operating costs for at least a year. Having reliable predictions of the micro business’s running cost will enable you to prepare a reasonable budget better to accommodate your business plan.

The estimates should include:

- Your salary needs: This is the money from the micro business you’ll live on if you’re quitting a salaried job.

- Initial (start-up) costs: This will include the cost of equipment, installations, remodeling, professional and legal fees, licenses, etc.

- Direct costs : This will cover the cost of raw materials or inventory

- Overhead Cost: This will include rent, office supplies, utilities, and maintenance

- Recurring costs: This will include salary payments, tax payments, advertising and promotion costs, as well as micro business insurance costs .

In many cases, micro businesses start with the founder’s savings, so it follows that having a saving will bail you out of tight corners in your micro business. However, even without saving to start up with, you could still borrow the needed capital. Taking loans requires a good credit history, a means of repaying the debt, and, in the case of larger loans, collateral.

Here are some familiar sources of people use to start micro businesses:

- Use money from savings

- Form a partnership

- Applying for a Small Business Administration loan.

- Tapping individual life insurance.

- Leasing equipment, rather than buying it.

- Bartering—or exchanging—property or services directly

Step 6: Organize a marketing strategy

Marketing strategy is an indispensable requirement for a successful micro business and is especially important seeing the small team sizes with micro businesses. You must understand your customers and develop ways on how to reach them, backed by proper research. Such information will enable you to launch online campaigns like Google ads, social media ads, email marketing, and content marketing/SEO.

Step 7: Research and test your product

Prototyping is an excellent strategy to better your micro business from consumers’ viewpoints. Some research examples for microbusinesses include:

- Surveys

- A templated, pre-launched, or preview website

- Offers to build an email list

- Calling vendors and potential customers

When there is resistance or opposition from people to test your product or service, jump on it as an opportunity to request feedback on how to improve your product or customer service.

Step 8: File your micro business and Start

After establishing an operational mission and vision statement, operation plans, financial plans, marketing plans, legal framework, and adequate research on the product you’re marketing, it’s time to officially file your micro business with the government for the legal backup to operate.

With the above steps, you’re sure to start up a micro business effectively .

So, there you have it, folks! Check out these blogs on 51 Best Start-up Ideas and a Business Startup Checklist !

© 2024 Small Business Coach All rights reserved.

- Terms of Use

- Entrepreneurship

10 Examples of Successful Micro Businesses

Idea To Income

How to start a company and turn your entrepreneurial dreams into reality, in this article, what is a micro business, micro business vs side hustle: what’s the difference, … micro businesses are better, 10 micro businesses examples & ideas , lawn care year-round , micro business additional resources.

What is a micro business?

Do you want to make more money? No, you don’t have to ask for a raise or change jobs.

You can start a micro business from an idea that either you're passionate about or a void you see in the marketplace.

How much work does a micro business take? How much money can you earn from a micro business? Is it similar to a “ side hustle ”?

In this article, we will explain everything you need to know about micro businesses, including:

- What a micro business is, what a side hustle is, and the differences between each

- Micro business examples and micro business ideas

- Additional micro business & entrepreneurship resources

If you’re ready to boost your income with a micro business, let’s get started!

A micro business is a type of small business that has a small number of employees and minimal startup costs.

According to the Small Business Association (SBA), a micro business employs fewer than 10 people.

Why should you start a micro business?

Let’s look at it like this.

In early morning hours of a Wednesday in May, drivers on an Indiana highway experienced something incredible: hundreds of thousands of dollars blowing across the road.

The backdoor of an armored Brinks truck malfunctioned and opened in transit, spewing bags of cash all over the road.

Police quickly arrived to blockade the area, but those who experienced it later admitted how tempting it was to grab cash off the ground.

It’s easy to imagine why it was so tempting. Few people would turn down the opportunity to make more money.

Only 19% of workers in the U.S. feel comfortable with how much they're making.

So how can you make more money?

With a micro business — or a side hustle.

Instead of finding cash on the side of a highway or winning on a game show, 44 million Americans have turned to “ side hustles ”, extra work in addition to a full time job.

Most side hustlers make an additional $100-$1,000 per month.

People start a side hustle for a variety of reasons:

- paying off debt

- Saving for a big event, like a wedding

- saving for a holiday splurge

- Some have an unquenchable entrepreneurial spirit

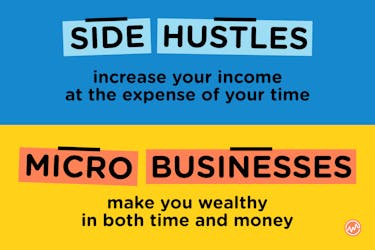

Side Hustles Are Great ...

Side hustles are an effective and easy way to generate more income by providing a service in your free time.

Side hustlers usually have full time jobs and side hustle to supplement their income.

Here are a few common side hustles:

- Driving with Uber or Lyft

- Delivering take out orders with UberEATS or DoorDash

- Renting your Home with Airbnb

- Child Care with SitterCity, Care, or UrbanSitter

- Teaching courses online

- Complete chores using Task Rabbit

- Coaching sports at local universities, schools, and leagues

- Start a mobile car wash and detailing

- Graphic design

According to the Association for Enterprise Opportunity 86% of side hustlers do it at least once a month. More than a third of side hustlers earn more than $500 per month .

Side hustles are common because there is such a low barrier to entry.

You can start a side hustle easily. You don’t need much money or other people to start.

For example, to become an Uber driver all you need is a driver's license, a car, a smartphone, and enough common sense to pass a simple online test.

Side hustles are great, but the problem with side hustles is you’re trading time for money . Your time is limited, so your income is too.

The main difference between a side hustle and what we’ll discuss next — a micro business — is short-term gains or lasting wealth .