Resume Worded | Proven Resume Examples

- Resume Examples

- Engineering Resumes

8 Auditor Resume Examples - Here's What Works In 2024

While getting audited can sound like a terrifying ordeal, auditors’ work is actually vital for the health and long-term success of a company. auditors will help a company cross their ts and dot their i’s when it comes to their financial documents. they ensure that everything is done correctly and that everything adds up. this guide will highlight auditor titles, give strong resume samples of each, and provide suggestions on how you can craft your own successful auditor resume. let’s get started..

An auditor's role is multifaceted. Your tasks will include analyzing financial documents to spot errors, interrogating a company’s accounting system to give suggestions on how to improve it, assessing a company’s financial risk, etc. The role requires a strong analytical mind, a diligent and thorough approach, and a certain level of healthy skepticism. It is your job to see the discrepancies that everybody missed.

Beyond the skills and approaches needed to thrive, an auditor's educational background is of great importance. To become a practicing auditor, you will at the very least need an undergraduate in accounting or a very similar field. Most recruiters would prefer more qualifications, in the form of a master’s degree or industry certification like a CIA (Certified Internal Auditor) designation.

Here are some auditor titles and resume samples for each.

Auditor Resume Templates

Jump to a template:

- Senior Auditor

- Staff Auditor

- External Auditor

- Night Auditor

- Government Auditor

Jump to a resource:

- Keywords for Auditor Resumes

Auditor Resume Tips

- Action Verbs to Use

- Related Finance Resumes

Get advice on each section of your resume:

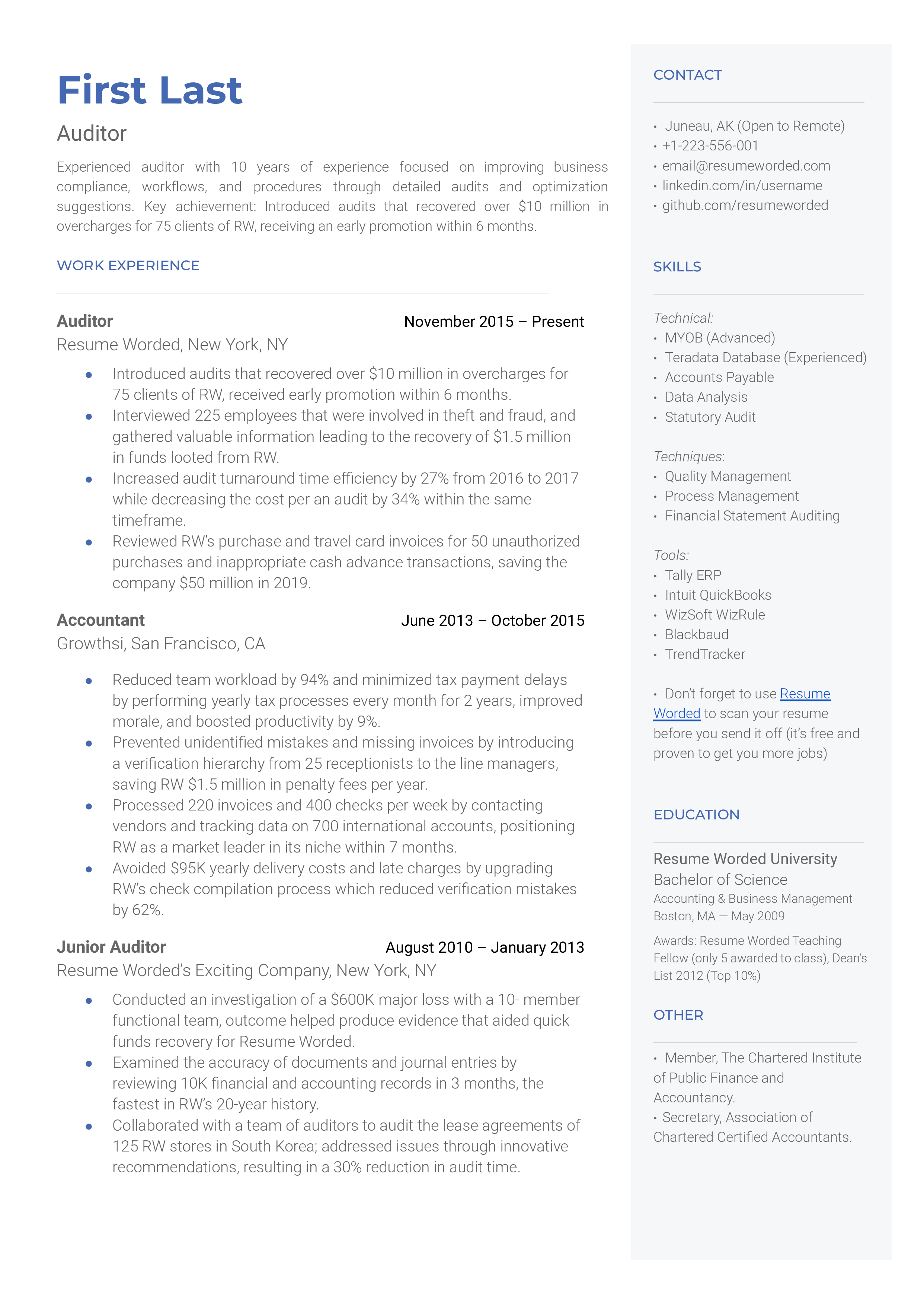

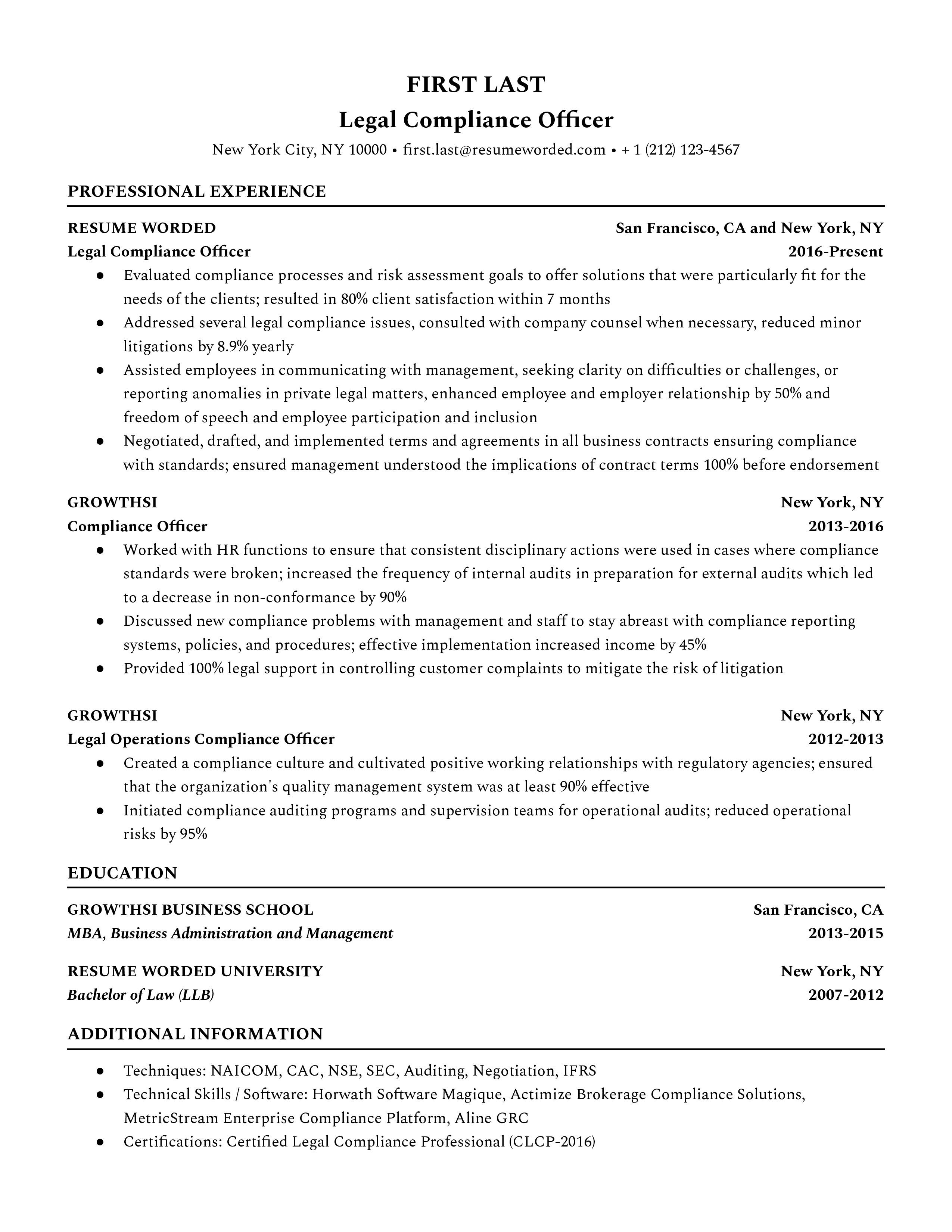

Template 1 of 8: Auditor Resume Example

An auditor interrogates a company’s financial documents and processes to make recommendations on what can be improved upon. You can work as an internal auditor and work for one company as an employee, or you can work as an external auditor who may work for multiple companies in a consultant capacity. When creating a general auditor’s resume, you want to show the breadth of your experience. You will want to show a range of the skills you offer as well as the success you’ve had with each one. You will also want to show your range in terms of the variety of industries you have worked in. This resume is an example of a strong auditor’s resume.

We're just getting the template ready for you, just a second left.

Tips to help you write your Auditor resume in 2024

quantify how much your auditing has saved your previous employers..

The biggest use of an auditor is to find any discrepancies or occasions of fraud. It helps companies identify employees and processes that are losing them money. It is therefore beneficial to be able to mention how much money you have saved or recovered for a company or how many convictions your work has helped accomplish.

Tweak your resume depending on the potential job.

Are you applying to audit a gaming company that has a really weak accounting system? Or are you auditing an NGO where there are suspicions of fraud? Make sure your experience emphasizes your ability to analyze systems or investigate fraud. and give good demonstrable cases of success.

Skills you can include on your Auditor resume

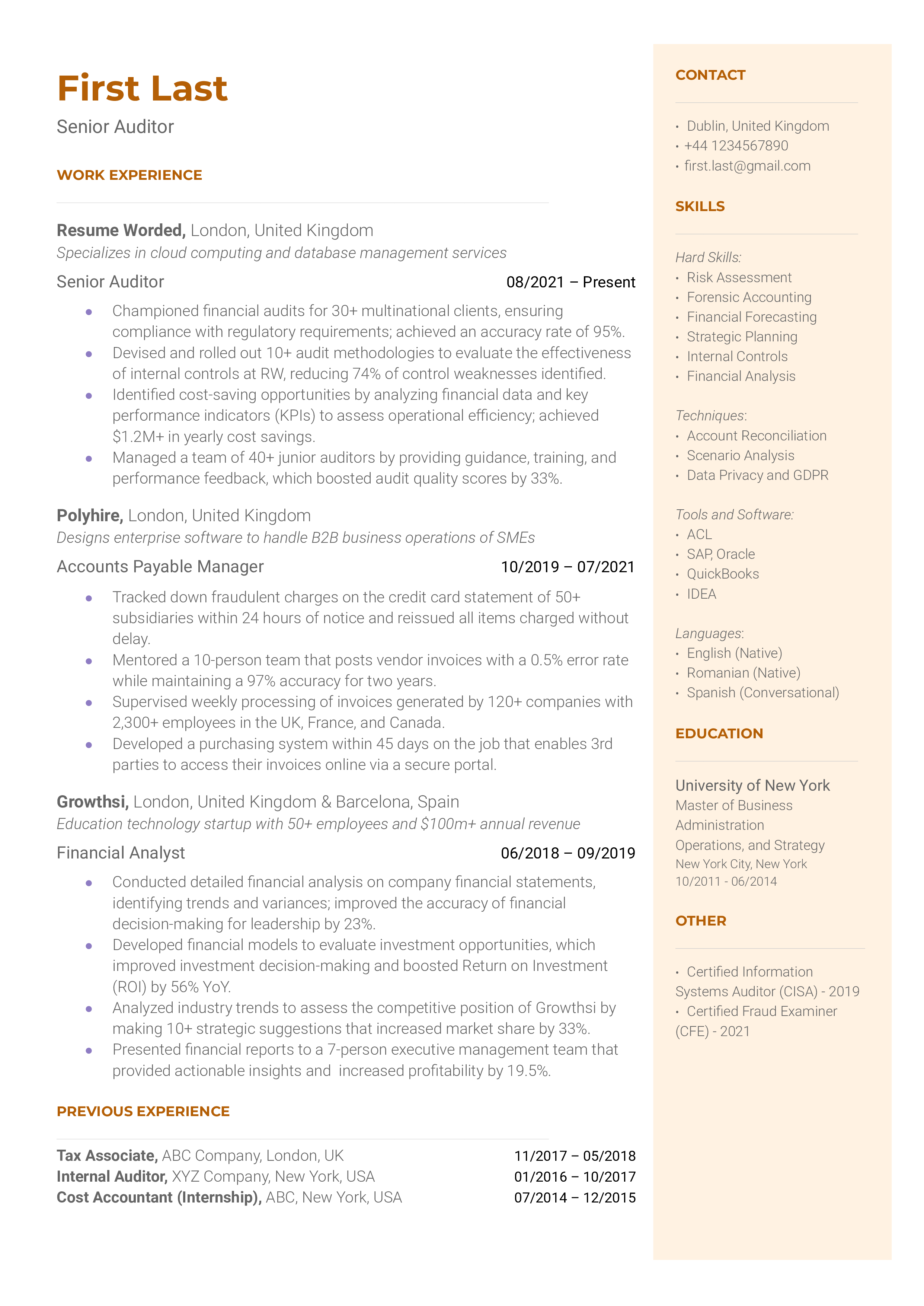

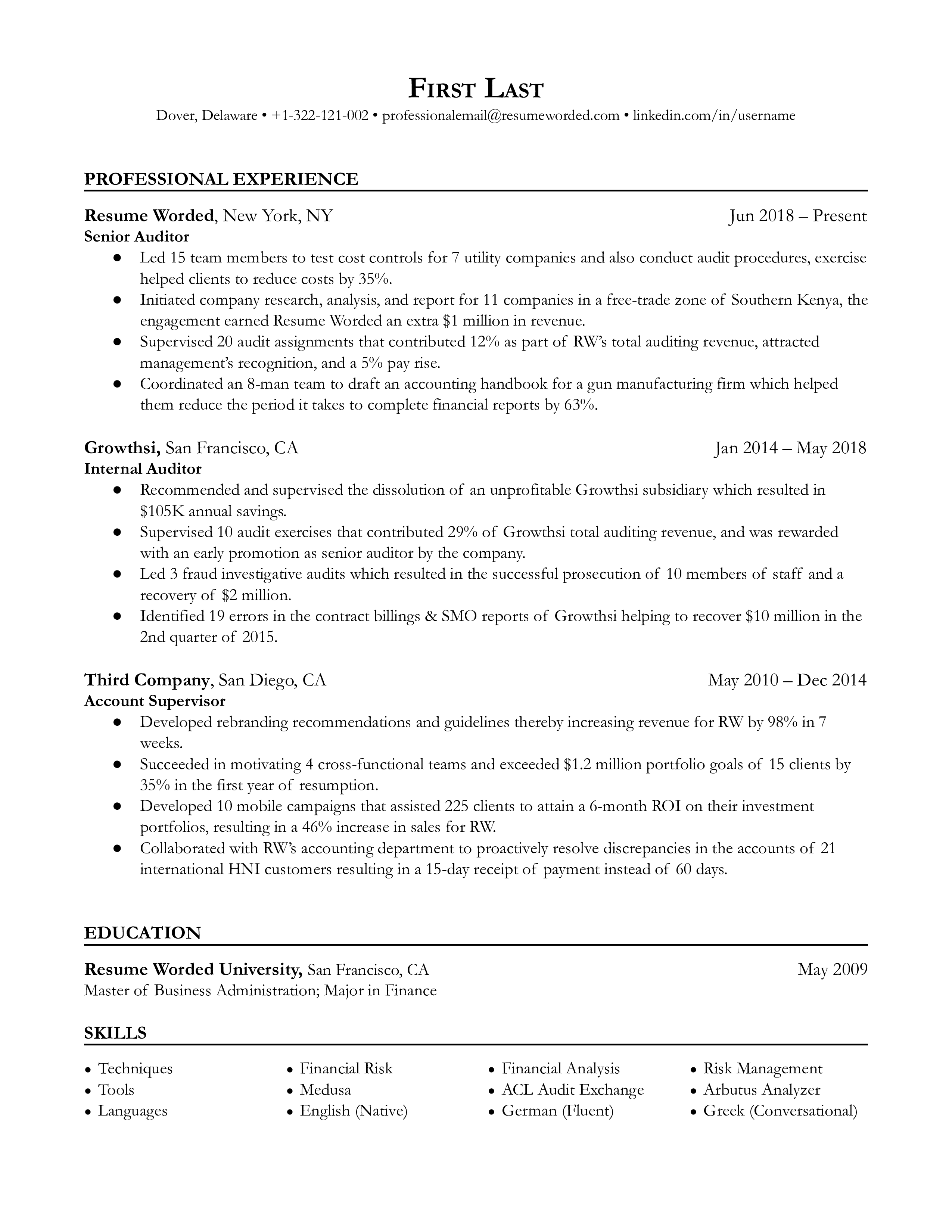

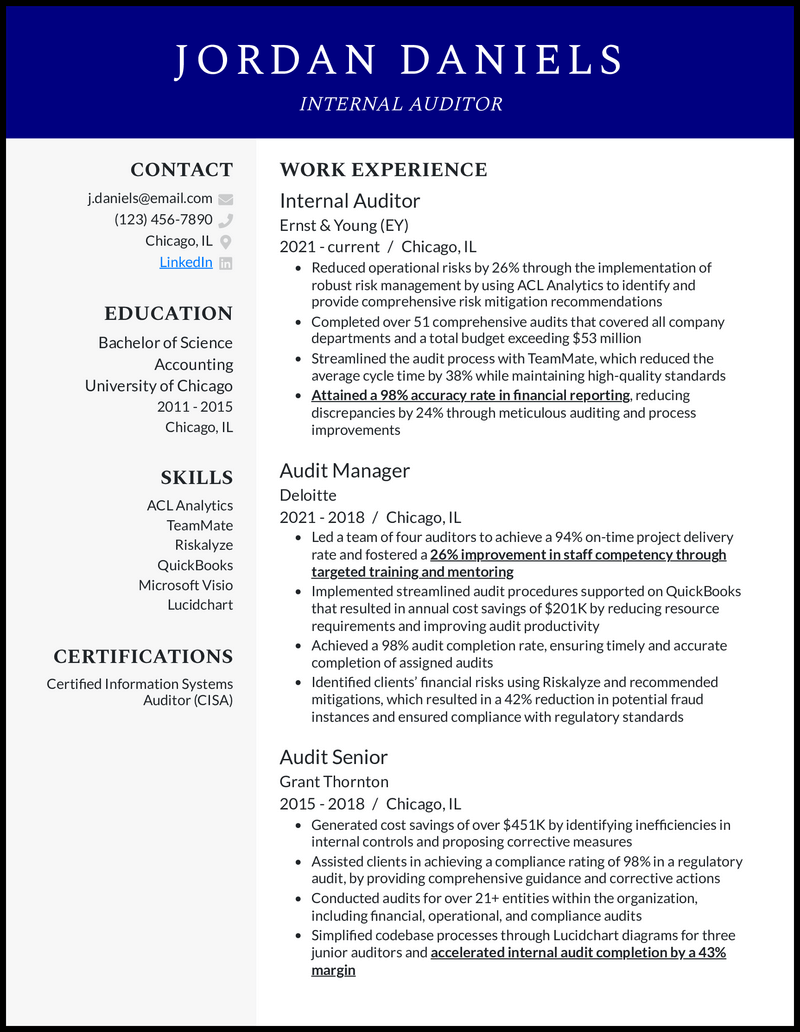

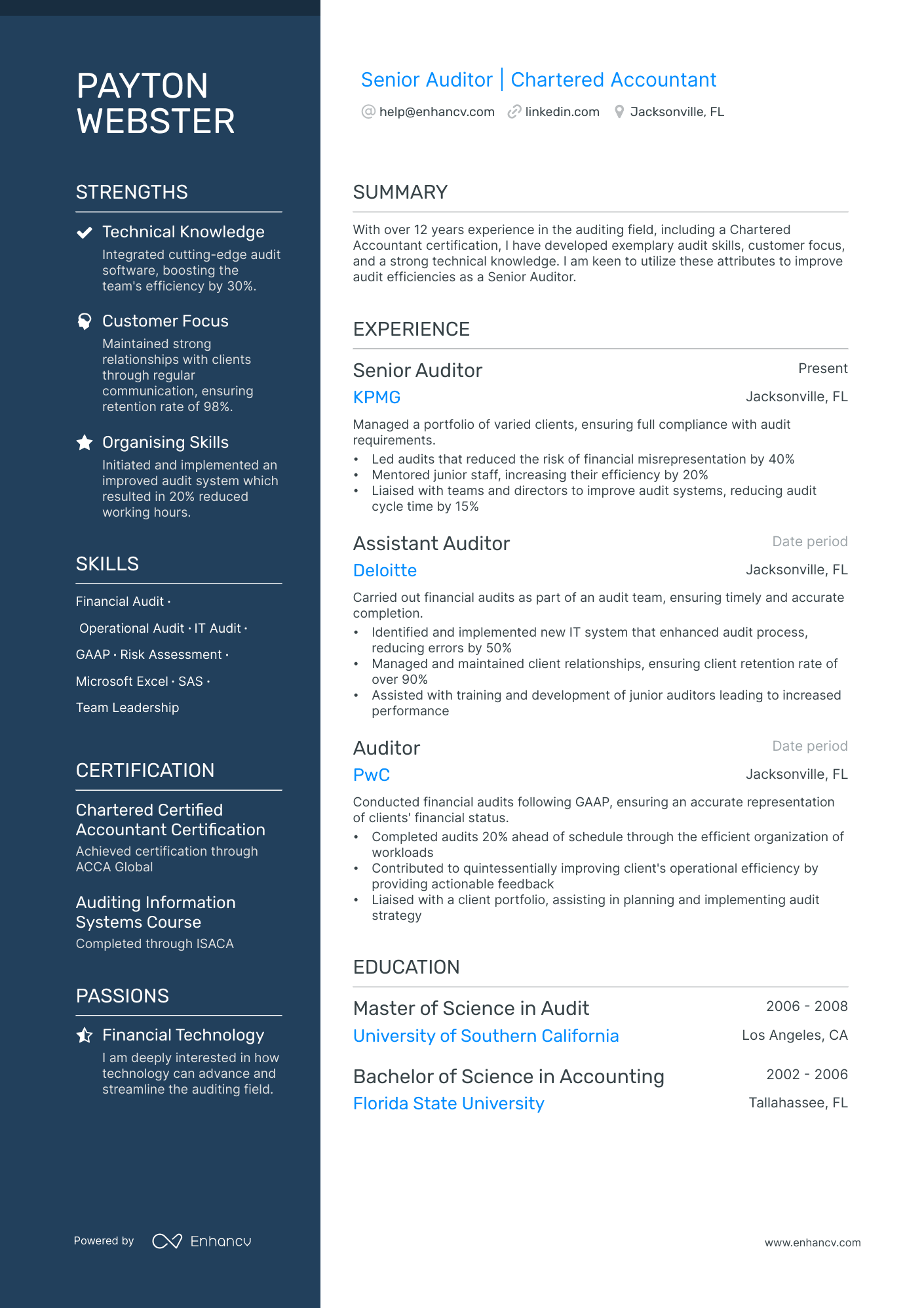

Template 2 of 8: senior auditor resume example.

Senior auditors are the watchdogs of financial propriety within organizations. This is a role that calls for an individual with a keen eye for detail, a firm grasp of financial controls and regulations, and strong analytical skills. With the increasing focus on transparency and accountability in business operations, the demand for seasoned auditors is on the rise. When you're writing your resume for a senior auditor position, remember, this isn't your run-of-the-mill finance job. Your prospective employer is looking for proof that you can sniff out financial irregularities with the precision of a bloodhound. Therefore, your resume should tell a compelling story of your auditing experience, showcasing the concrete impact you've made and the challenges you've navigated. Tailor your resume to reflect the specific needs of the role in the context of the industry and company you're applying to.

Tips to help you write your Senior Auditor resume in 2024

highlight key achievements in auditing.

Don't just list your tasks from previous roles. Highlight your achievements, specifically those that demonstrate your skills in identifying and rectifying financial discrepancies. Include quantifiable results, such as the amount of money saved due to your audits.

Showcase Expertise in Regulatory Compliance

As a senior auditor, your knowledge of financial regulations and standards is crucial. Use your resume to demonstrate your expertise in regulatory compliance. Describe instances where your understanding of these regulations led to improved processes or avoided penalties.

Skills you can include on your Senior Auditor resume

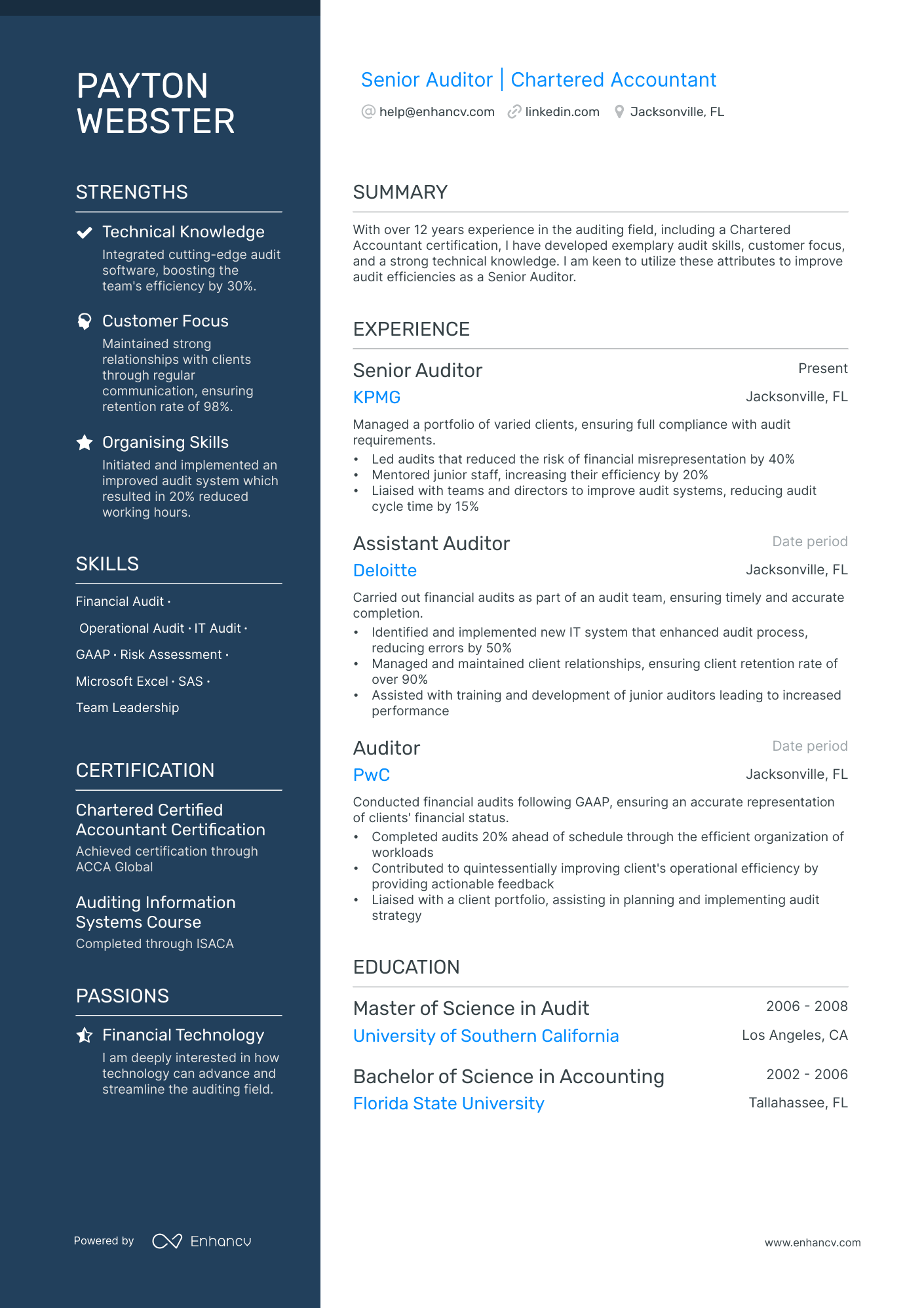

Template 3 of 8: senior auditor resume example.

A senior auditor works as a leader of a team of auditors. Though they will perform all the main functions of an editor, they will also be tasked with delegating tasks to their team and ensuring their quality of work is up to par. This position, therefore, requires the analytical skills to perform the auditing task as well as managerial skills to lead a team of auditors. Most recruiters will be looking for an applicant with a bachelor’s degree in finance, accounting, or a similar field. They will also be looking for a CPA certification and years of experience as an auditor. Any managerial experience will be a huge plus. Take a look at this successful senior auditor's resume.

Mention if you are particularly knowledgeable of financial regulation in a region.

Financial regulation differs across regions. To accomplish your tasks successfully, you need to be an expert in the financial regulation in your region of practice. So be sure to include which region’s financial regulation you are particularly familiar with.

Mention the size of the teams you have managed/led.

Half of your job as a senior auditor is to manage and lead a team of auditors. So as you list the accomplishments of your team, make sure to mention the size of the team you have been leading/managing. Leading a successful large team would be very attractive to recruiters.

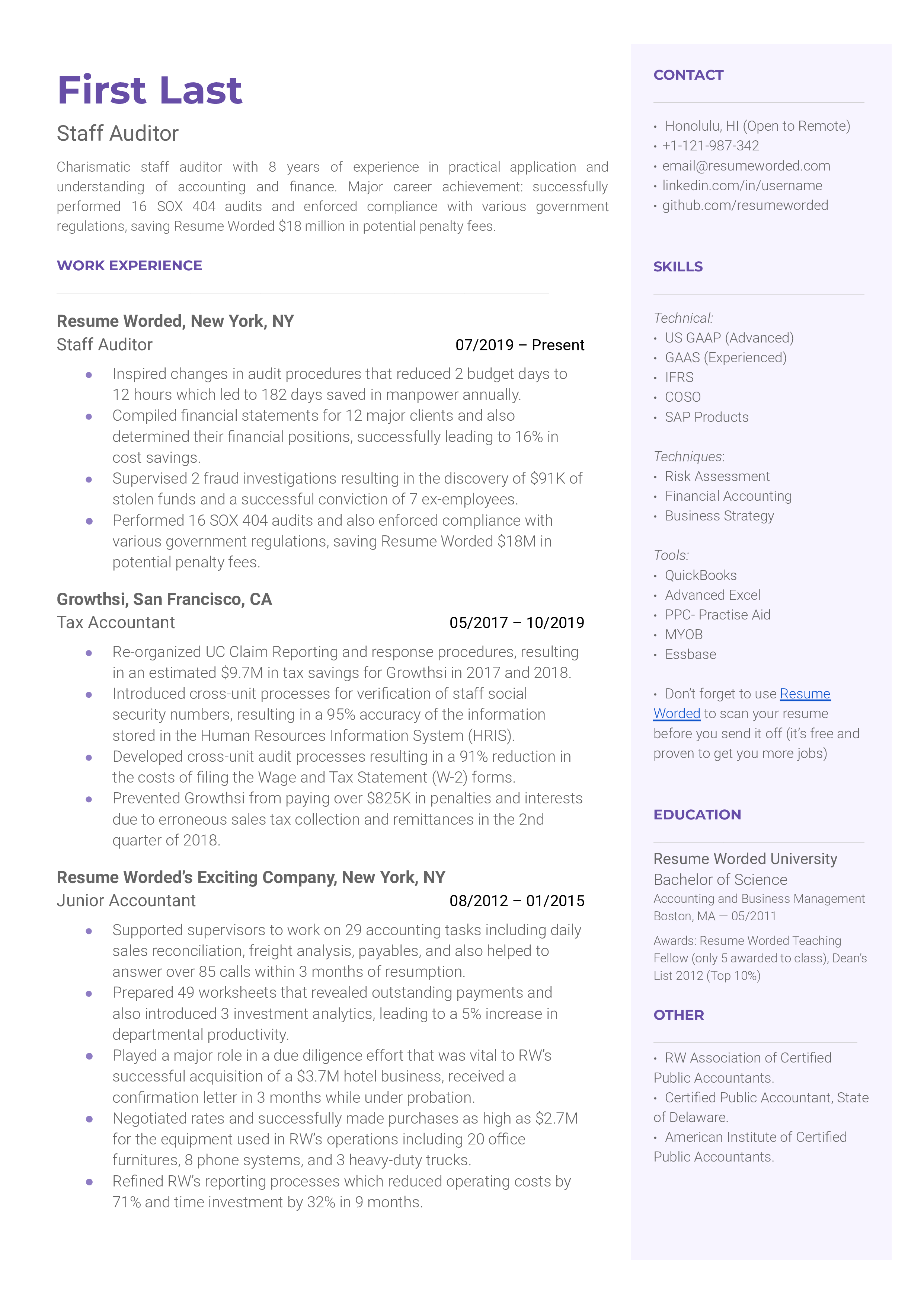

Template 4 of 8: Staff Auditor Resume Example

A staff auditor, also sometimes referred to as an internal auditor, is responsible for identifying fraud and mismanagement within a company, analyzing its financial processes to find points of inefficiency, and writing a report with recommendations on how to rectify any issues identified. Accomplishing this will require you to go through financial documents, interview staff, and may even include you going through communications like emails and letters. Staff auditors are almost always employees of the company they are auditing. As with any auditor position, analytical skills are key. For this position, communication skills are also essential, as you will be trying to get as much delicate and sensitive information from the staff as possible.

Tips to help you write your Staff Auditor resume in 2024

list which industries you specialize in..

Because different industries have different regulations, companies will generally want to hire auditors who specialize in audit work for their industry. So if you work primarily with NGOs or with education institutions, mention that in your introduction section.

Quantify your interview numbers.

As a staff auditor, you will need to be especially skilled at interviewing colleagues. This requires a very strong and specific communication skill set. It requires tact, confidentiality, and maturity for colleagues to feel comfortable speaking with you. Listing how many colleagues you have interviewed will tell employees how seasoned you are in performing this very delicate task.

Skills you can include on your Staff Auditor resume

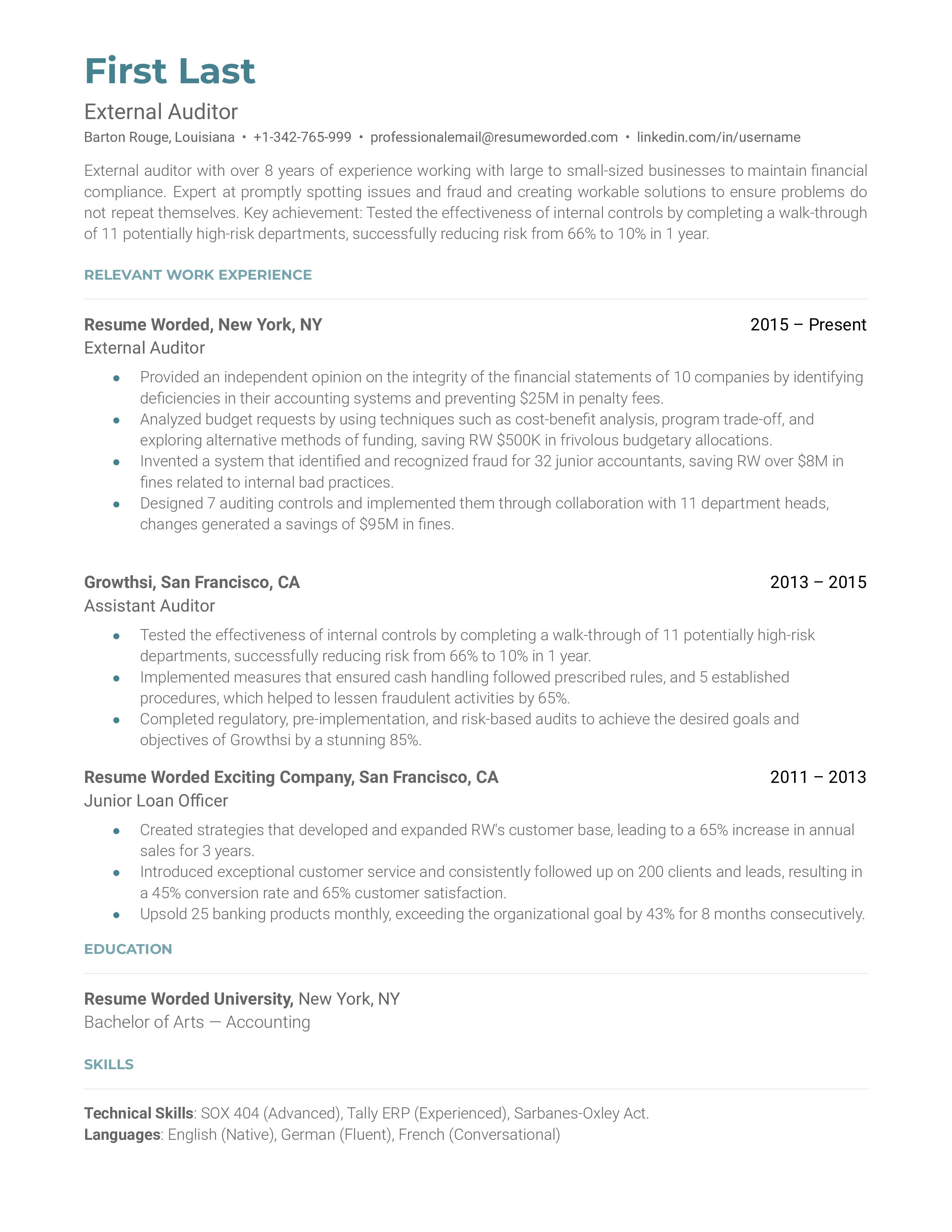

Template 5 of 8: external auditor resume example.

External auditors are not employees of the companies that they audit and are instead independent contractors. They will analyze and interrogate a company's financial information to look for evidence of fraud or irregularities and produce a report with their findings. External auditors will be expected to be a member of a recognized professional accountancy and will usually present their findings to a company’s shareholders. You will be expected to have a bachelor's degree in accounting or a similar field will be expected to be a certified accountant, and will be expected to have years of experience as an auditor.

Tips to help you write your External Auditor resume in 2024

list noticeable clients you have worked with..

As an external auditor, you will need to constantly sell yourself to companies looking for your services. An easy way to impress potential clients is to list big or noticeable clients that you have successfully worked with in the past.

List your specializations.

Because you are an external auditor, you will be working with companies on a short-term basis. To have a steady flow of companies, you should highlight your specializations. So if you are particularly skilled at interviewing clients, or going through financial documents, make sure you mention that. It’s an easy way to attract the right client to you.

Skills you can include on your External Auditor resume

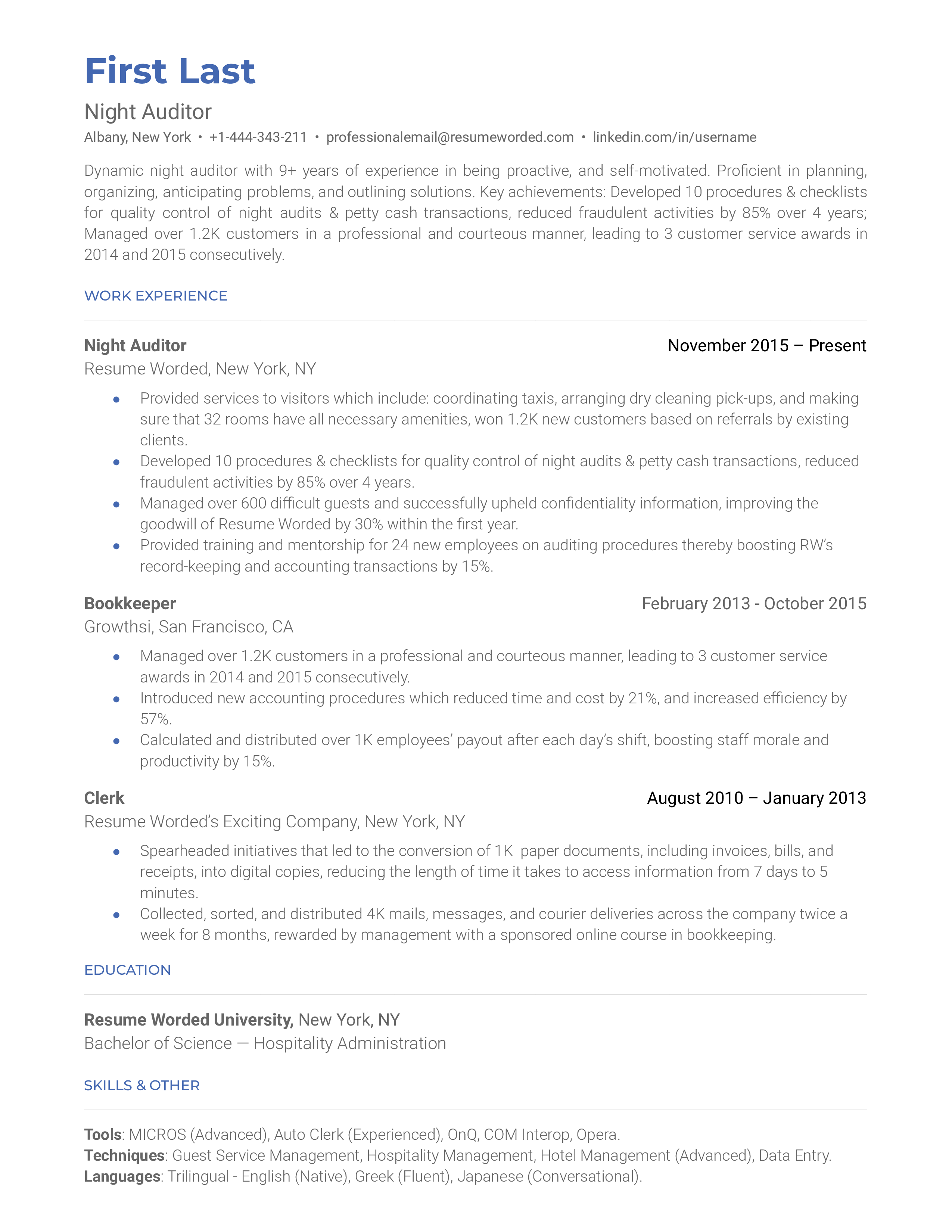

Template 6 of 8: night auditor resume example.

A night auditor balances the books at the end of each day and also serves as a resource of support for clients overnight. Night auditors work for businesses that operate 24/7 and are mainly found in hotels and other kinds of lodgings. Your auditing tasks will include analyzing the transactions of the day to find any mistakes or errors, processing paychecks, and creating invoices. Your hospitality tasks include assisting clients with services such as check-ins, scheduling early morning wake-up calls, assisting with bookings, etc. While you will need to have the analytical skills of an auditor you will also need to have very strong communication and hospitality skills for your interaction with clients. Because of the dualistic nature of the position, history in both hospitality and auditing is crucial. Take a look at this strong night auditor resume.

Tips to help you write your Night Auditor resume in 2024

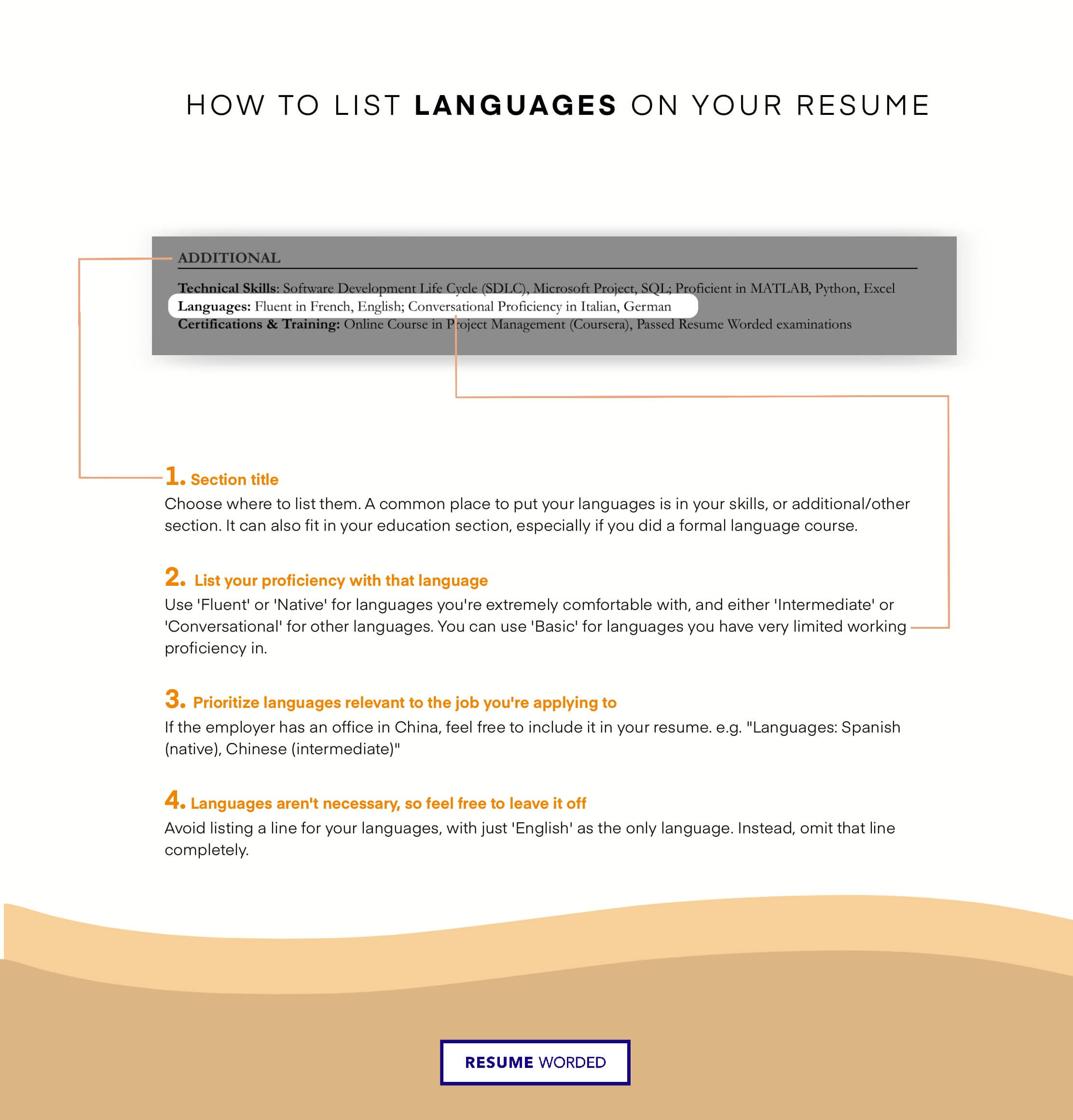

list all the languages you speak..

Working at a hotel means you will be in contact with people from a variety of different countries. Because of this, being able to speak multiple languages is extremely beneficial. So make sure you list all your spoken languages on your resume.

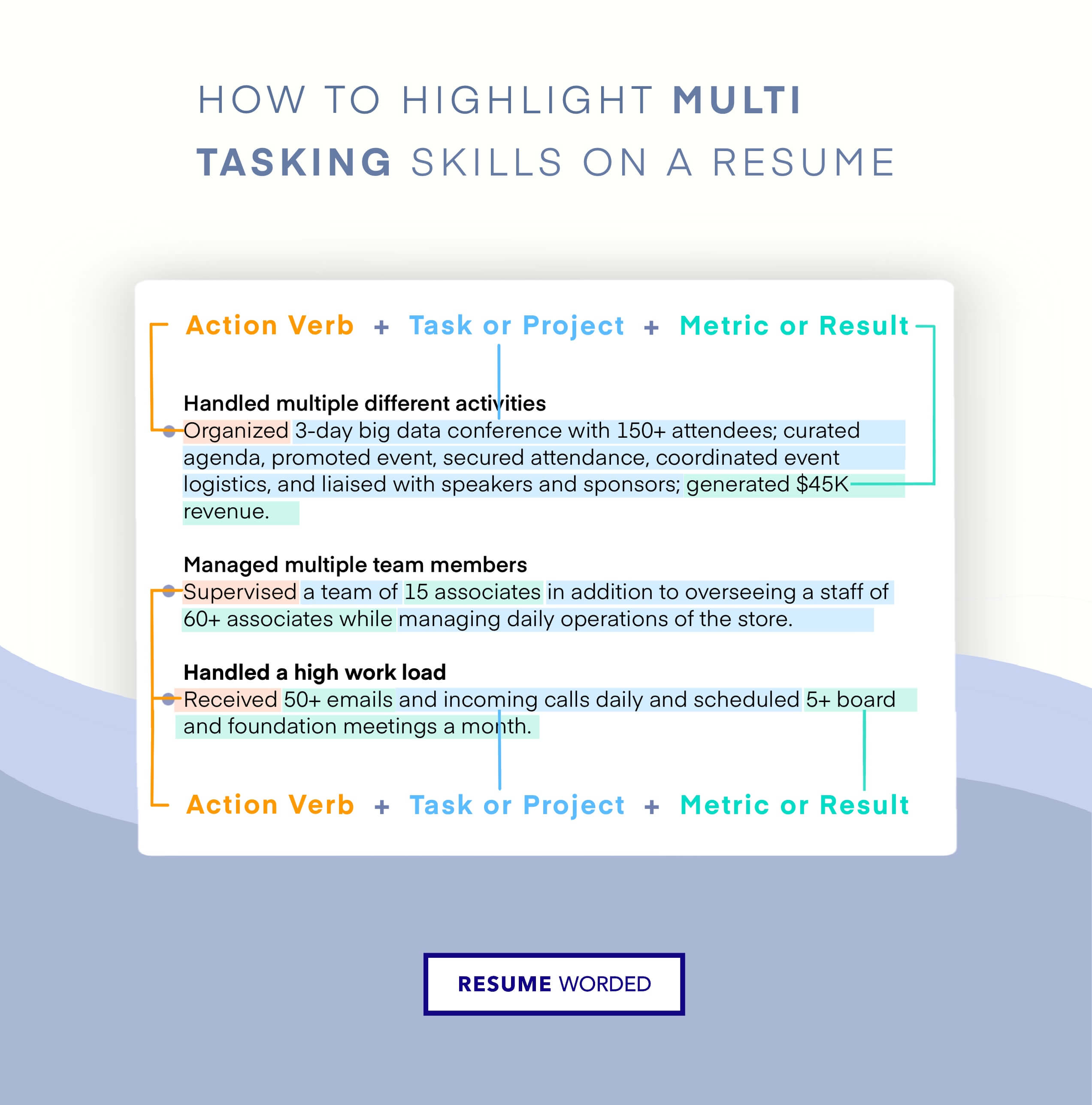

Highlight multi-tasking capabilities.

A night auditor has quite a number of different tasks. You could be balancing the books for the day in one moment, and scheduling a wake-up call for a customer the next. You need to show recruiters that you can successfully complete all the tasks. You can prove this by making sure the experience section of your resume reflects the variety of tasks you will need to complete as a night auditor. You could also ensure that your skills section includes a variety of skills that cater to the different tasks.

Skills you can include on your Night Auditor resume

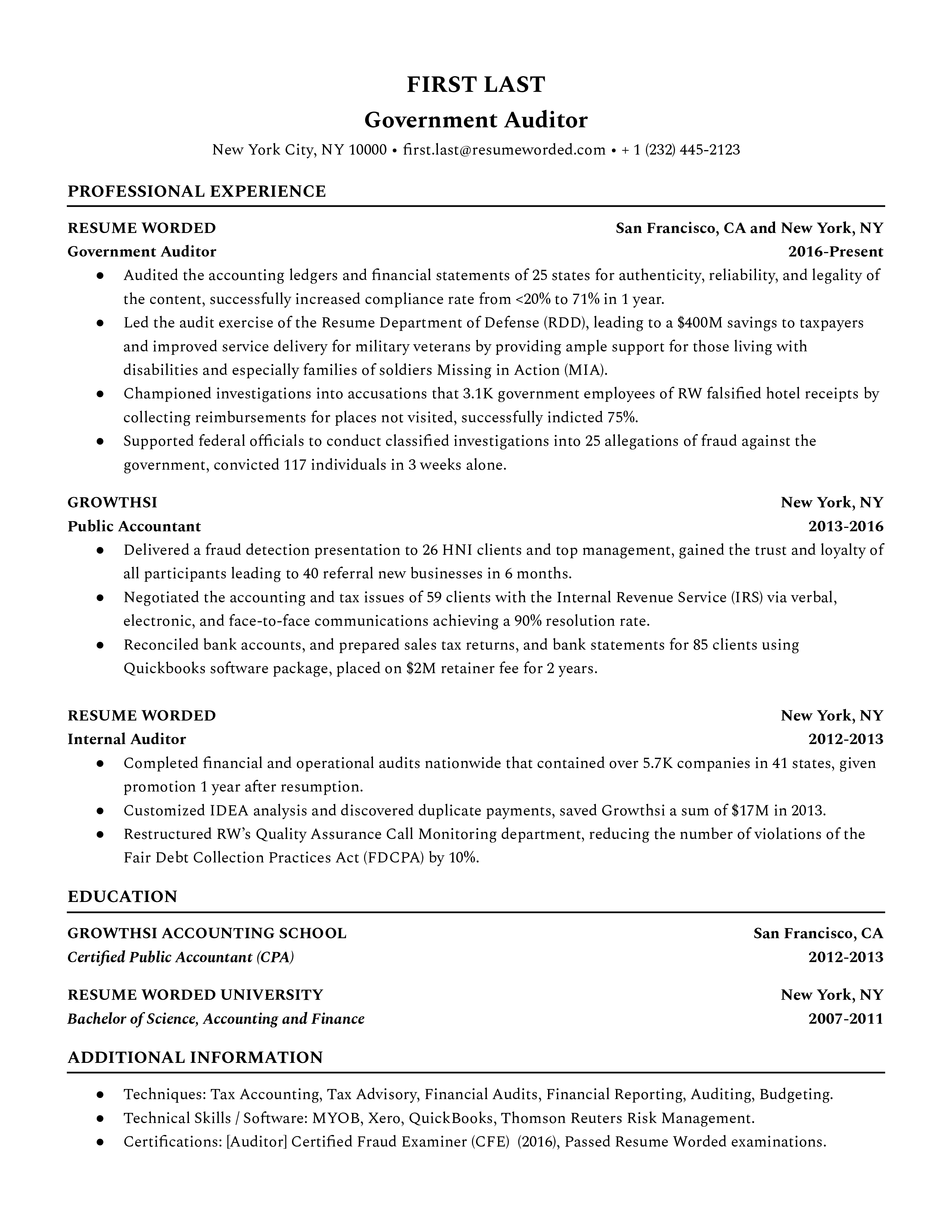

Template 7 of 8: government auditor resume example.

Government Auditors hold a unique role in public service, sifting through financial data, evaluating compliance with regulations, and identifying opportunities for cost efficiencies. Just like any other job, writing a resume for this role requires specific attention to detail. In recent times, there's an increased demand for auditors who not only understand financial controls but can also harness the power of data analytics. When crafting your resume, differentiate yourself by showcasing your ability to navigate both the financial and data-driven aspects of the role. Beware that government positions often have stringent application protocols, so pay attention to formatting requirements and supplementary document requests. Tailor your resume to highlight your scrutiny skills, understanding of governmental regulations and financial controls, but don't forget your data analytics skills to fit into the evolving landscape of this job.

Tips to help you write your Government Auditor resume in 2024

emphasize compliance and regulation acumen.

In your resume, you should strategically illustrate your understanding and interpretation of government regulations and compliance standards. Any experience of holding responsible positions in compliance will make you come across as a valuable asset.

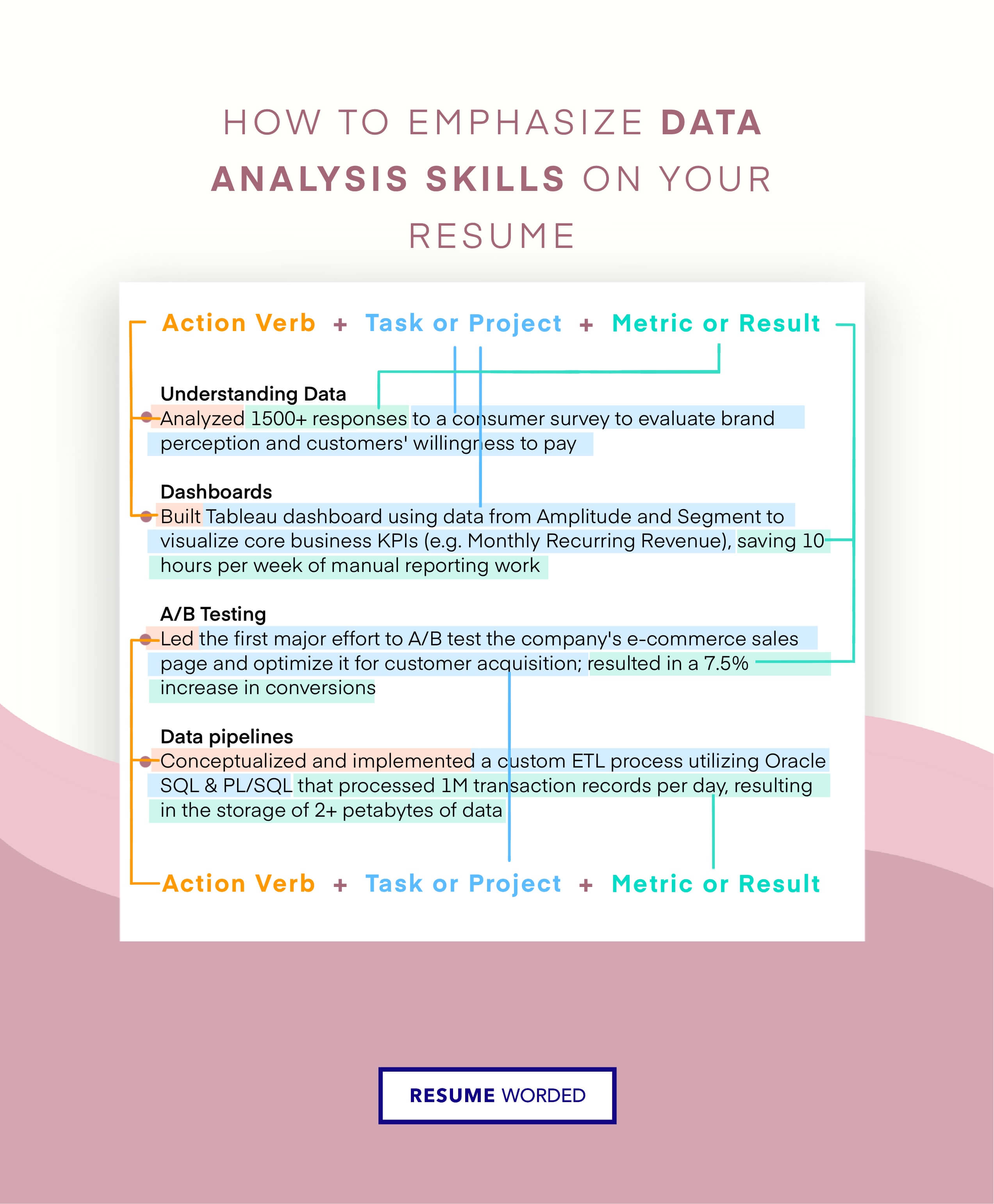

Showcase proficiency in data analytics

Don't shy away from clearly stating your ability to use data analytics for auditing. Consider mentioning specific tools you are familiar with, or projects you've worked on that actively utilized data analytics. It's a skill that's soaring in demand for government auditors.

Skills you can include on your Government Auditor resume

Template 8 of 8: government auditor resume example.

As the name suggests, government auditors work with and for the government to ensure public funds are appropriately used. Internal government auditors analyze government agencies’ financial records to make sure they are in line with financial regulations and tax obligations. External government auditors analyze the financial records of third-party entities that have entered agreements with government agencies to ensure the funds shared are used appropriately and in line with the agreement. A government auditor will need to be an expert on the financial regulations and operations of the government. You will also be expected to have, at least, a bachelor’s degree in accounting or a similar field, and preferably accounting certification and years of experience specializing in auditing for government entities.

Specify which government agencies you have worked for previously.

Government agencies vary in size and policy. It’s therefore important to note which agencies you have had experience with. A potential employer is likely to hire you if you have worked with the agency before or a similar agency with similar policies.

Include your skills with taxes.

It is especially important for government agencies, their employees, and their third-party partners, to be tax compliant. So ensure that you have listed any skills you may have in analyzing tax records.

As a hiring manager who has recruited for top accounting firms like Deloitte, KPMG, and PwC, I've reviewed countless auditor resumes. The best ones always stand out by showcasing the candidate's specific skills, experience, and impact in the field. In this article, we'll share some tips to help you create a compelling auditor resume that will catch the attention of hiring managers and increase your chances of landing an interview.

Highlight your auditing expertise and certifications

Emphasize your auditing skills and any relevant certifications you have earned, such as Certified Public Accountant (CPA) or Certified Internal Auditor (CIA). These credentials demonstrate your expertise and commitment to the field.

Compare the following examples:

- Experienced in auditing

- Skilled in accounting principles

Instead, be specific and highlight your certifications:

- CPA with 5+ years of experience in external auditing

- CIA certified with expertise in risk assessment and internal controls

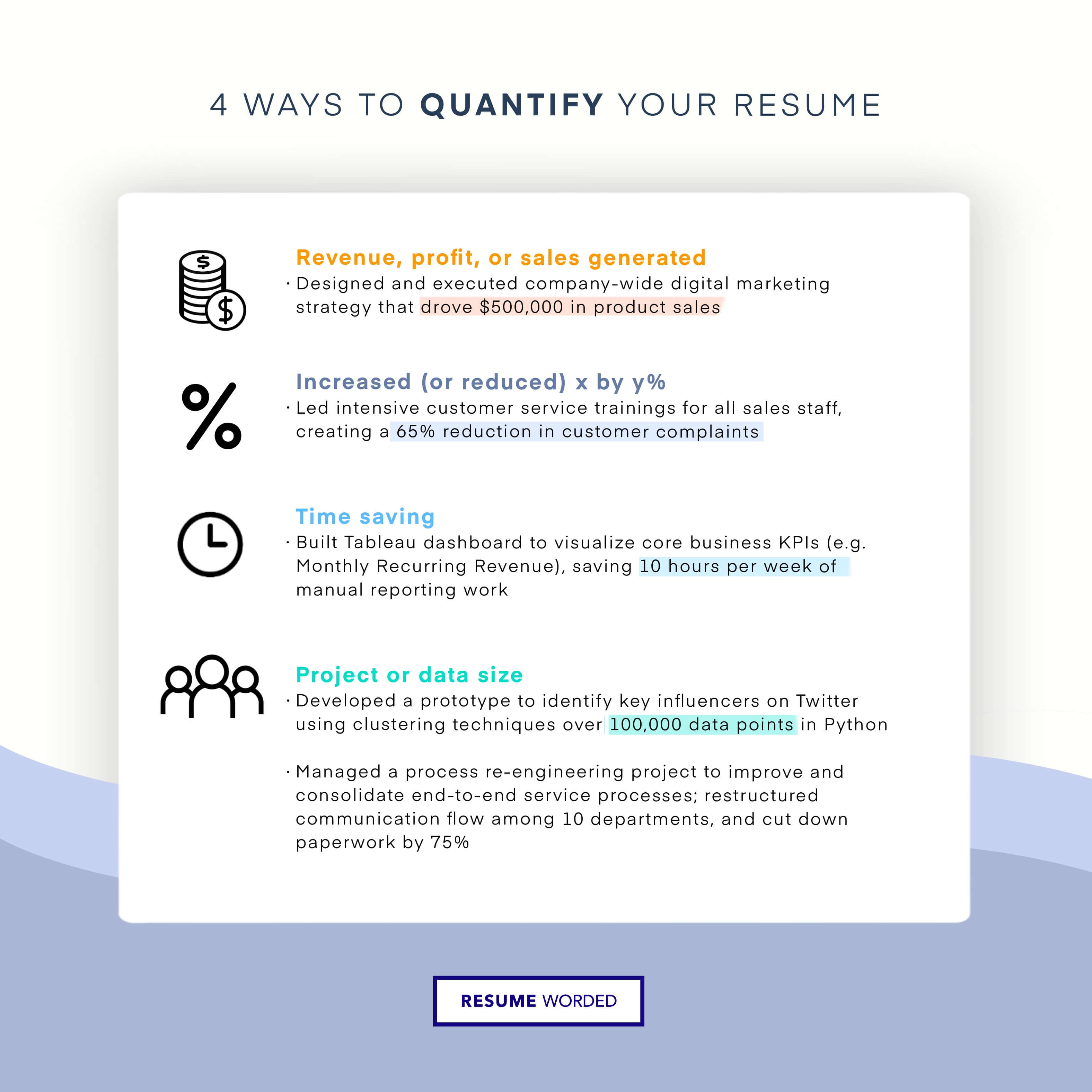

Quantify your impact with metrics

Use numbers and metrics to quantify your accomplishments and demonstrate the impact you've made in your previous roles. This helps hiring managers understand the scope of your work and the value you can bring to their organization.

Here are some examples:

- Conducted 20+ audits annually, ensuring compliance with GAAP and IFRS

- Identified and resolved 15 major internal control weaknesses, saving the company $500K in potential losses

- Led a team of 5 auditors in completing a complex SOX compliance audit within tight deadlines

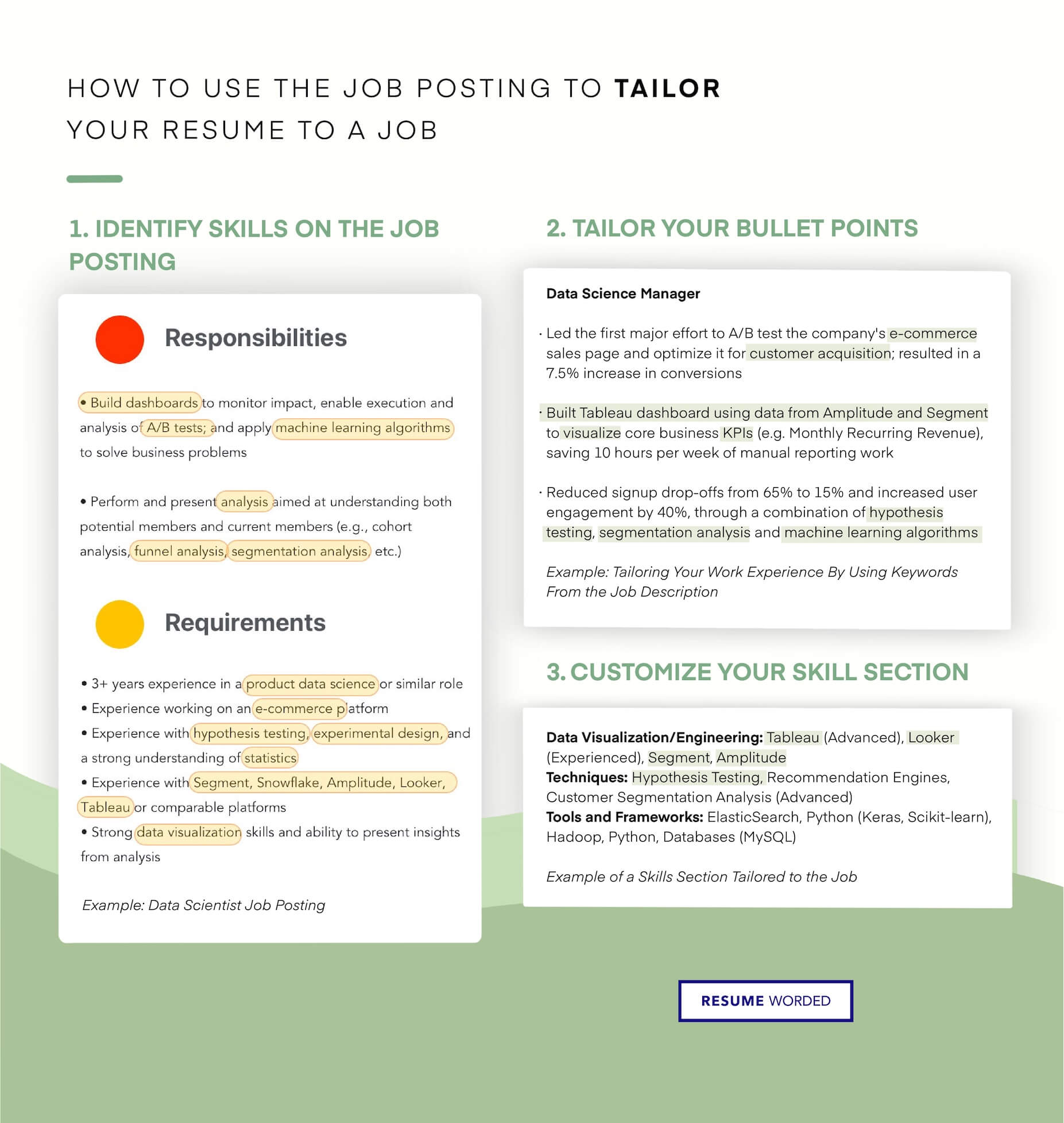

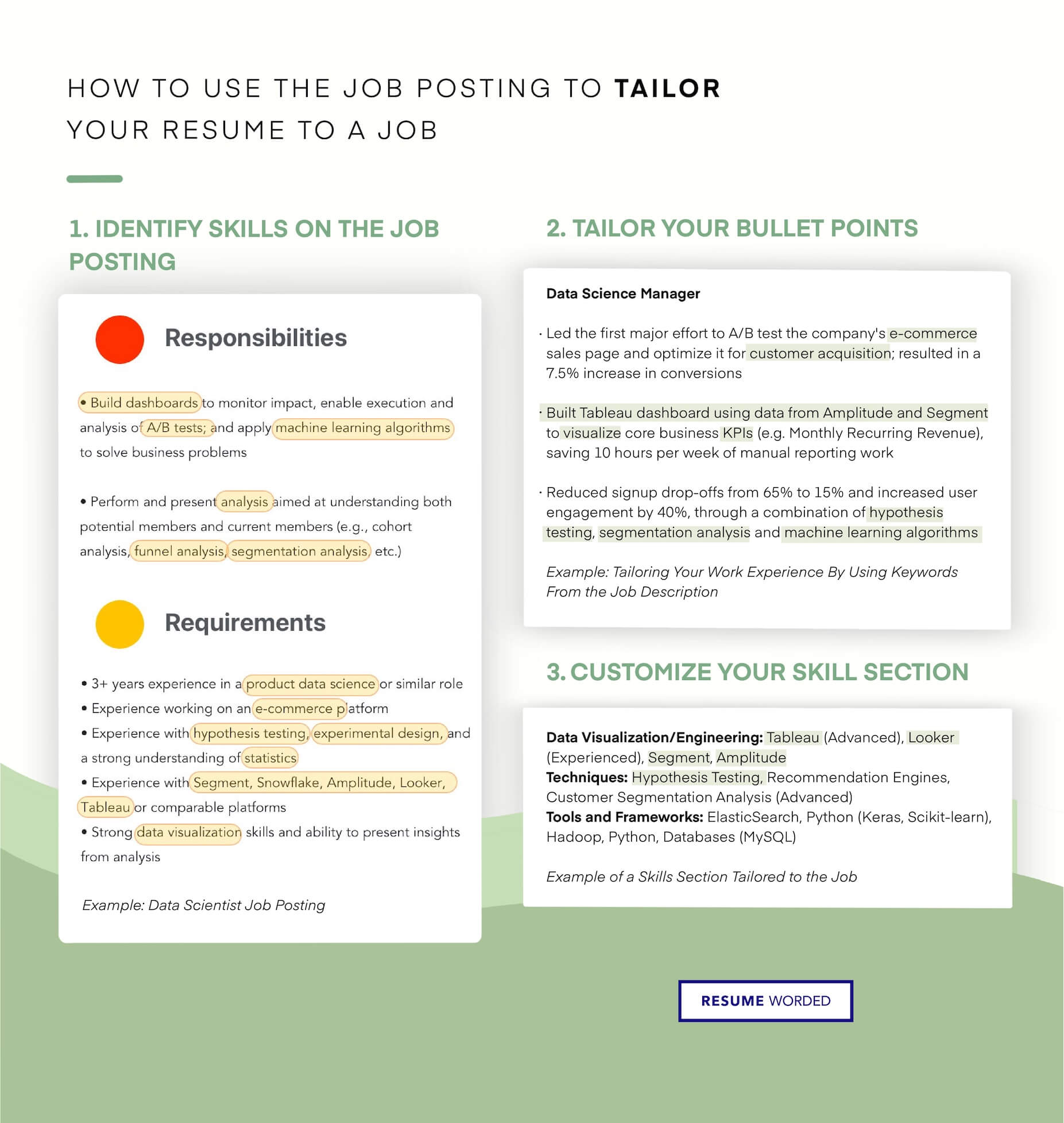

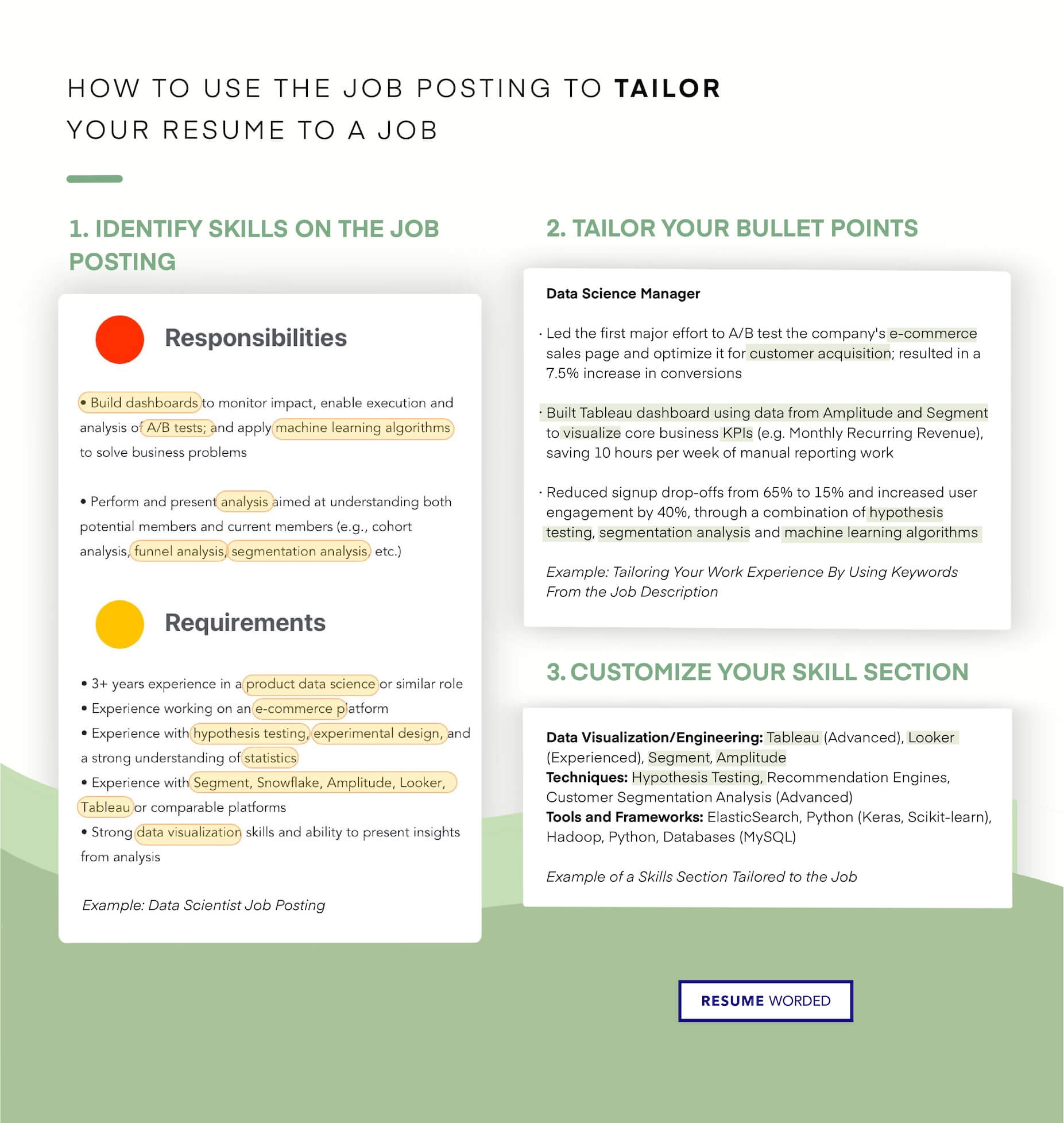

Tailor your resume to the specific job requirements

Customize your resume to match the requirements of the auditor position you're applying for. Review the job description carefully and highlight the skills and experiences that align with the company's needs.

For example, if the job requires experience in IT audits, emphasize your relevant projects:

- Performed IT audits on the company's ERP system, ensuring data integrity and security

- Collaborated with IT teams to develop and implement access control policies

Avoid generic statements that could apply to any auditor role, such as:

- Experienced in various types of audits

- Knowledgeable in accounting standards

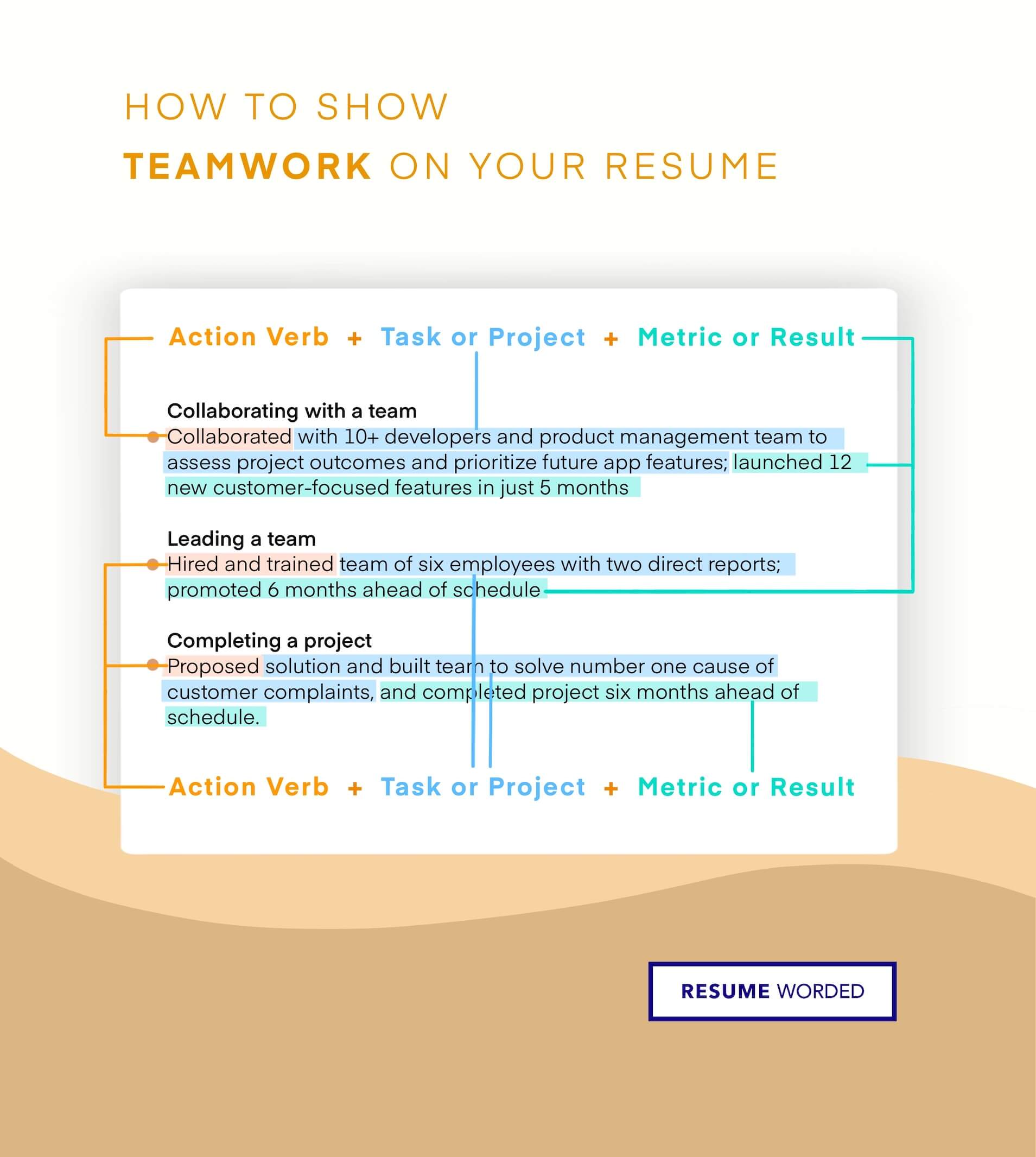

Showcase your communication and leadership skills

Auditors often work in teams and communicate with various stakeholders, so it's essential to highlight your communication and leadership abilities. Provide examples of how you've collaborated with others, presented findings, or led projects.

Accomplished auditor with strong communication and leadership skills. Collaborated with cross-functional teams to identify and mitigate financial risks. Presented audit findings and recommendations to senior management and the audit committee.

Compare this to a generic statement:

- Good communication and teamwork skills

Include relevant industry experience

If you have auditing experience in specific industries, such as healthcare, financial services, or manufacturing, make sure to highlight this on your resume. Many companies prefer candidates with industry-specific knowledge and expertise.

For example:

- Conducted audits for a portfolio of 10 healthcare clients, ensuring compliance with HIPAA regulations

- Specialized in auditing manufacturing companies, focusing on inventory management and cost accounting

Avoid broad statements like:

- Experience in various industries

- Knowledgeable in different sectors

Emphasize your analytical and problem-solving skills

Auditors need strong analytical and problem-solving skills to identify risks, analyze data, and recommend solutions. Showcase examples of how you've used these skills to drive improvements or resolve complex issues.

- Analyzed large datasets using Excel and ACL to identify potential fraud, resulting in a 20% reduction in financial losses

- Conducted root cause analysis on audit findings and developed targeted action plans to address control weaknesses

Avoid generic phrases like:

- Strong analytical skills

- Problem-solver

By following these tips and showcasing your unique skills and experiences, you'll create a compelling auditor resume that stands out to hiring managers and increases your chances of landing your dream job.

Writing Your Auditor Resume: Section By Section

header, 1. put your name front and center.

Your name should be the most prominent element in your resume header. It's best to put it on its own line, in a larger font size than the rest of your contact details.

Here's an example of a well-formatted name in a resume header:

- John Smith, CPA

Avoid formatting your name in a way that makes it hard to read or detracts from its prominence, such as:

- JOHN SMITH, CPA (all caps can come across as aggressive)

- John Smith, CPA, CIA, CISA, CFE (too many certifications can clutter your header)

2. Include key contact details

In addition to your name, your resume header should include your:

- Phone number

- Professional email address

- Location (city and state)

- LinkedIn profile URL

Make sure your email address is professional - avoid using casual handles like ' [email protected] '. Stick to a variation of your name, such as:

- [email protected]

You can include these details on one line, separated by vertical lines or bullet points to keep your header compact. For example:

John Smith, CPA | 555-123-4567 | [email protected] | New York, NY | linkedin.com/in/johnsmith

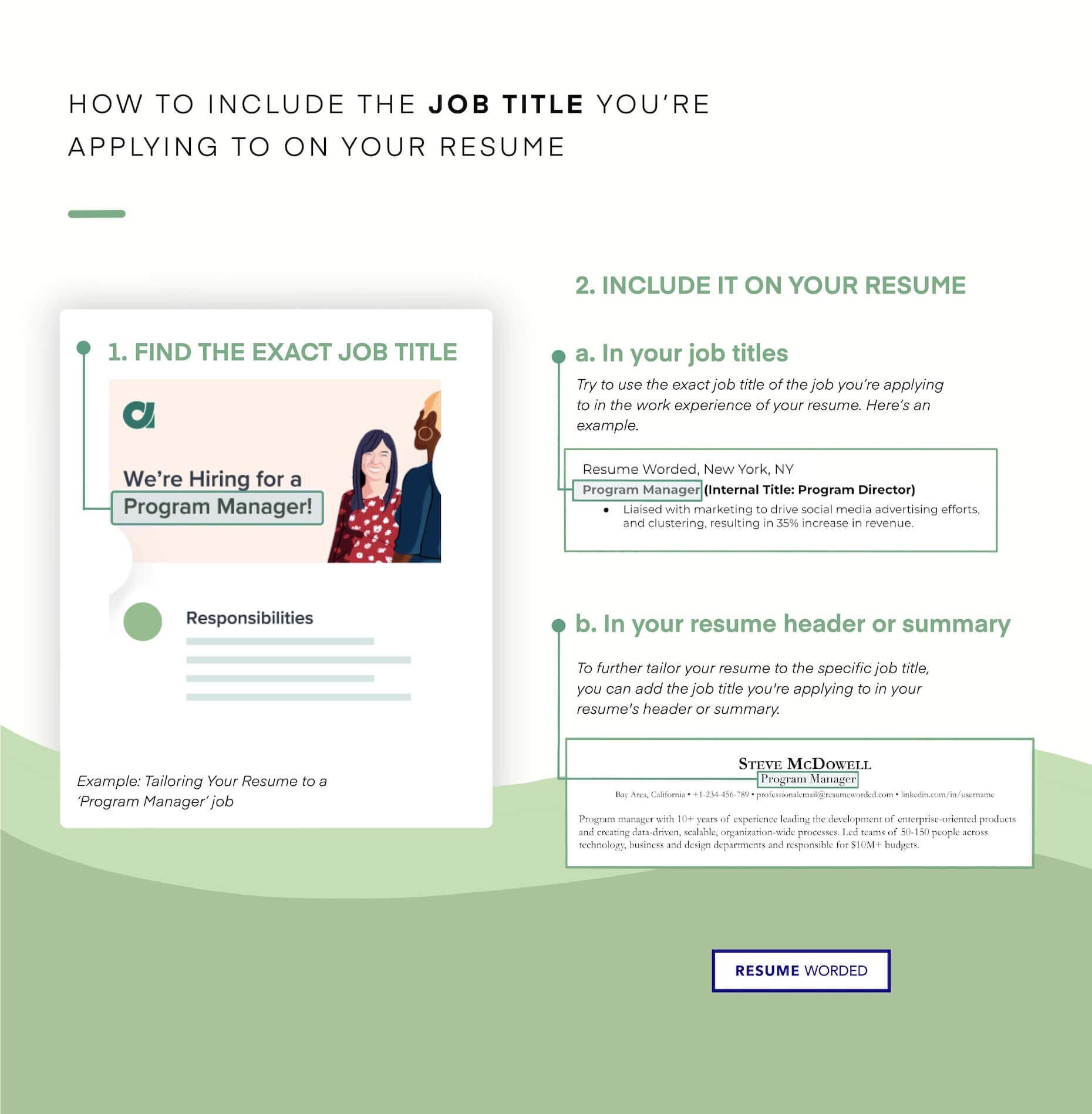

3. Consider including your target job title

If you're targeting a specific auditor job title, such as Senior Internal Auditor or IT Auditor, you may want to include that in your resume header. This immediately communicates to the employer the type of role you're seeking.

You can include your target job title below your name. For example:

- John Smith, CPA Senior Internal Auditor

However, avoid cramming too many keywords or variations of the job title, as that can come across as over-eager or spammy. A simple, direct title works best. For example:

- John Smith, CPA Senior Auditor | Internal Auditor | IT Auditor | Financial Auditor

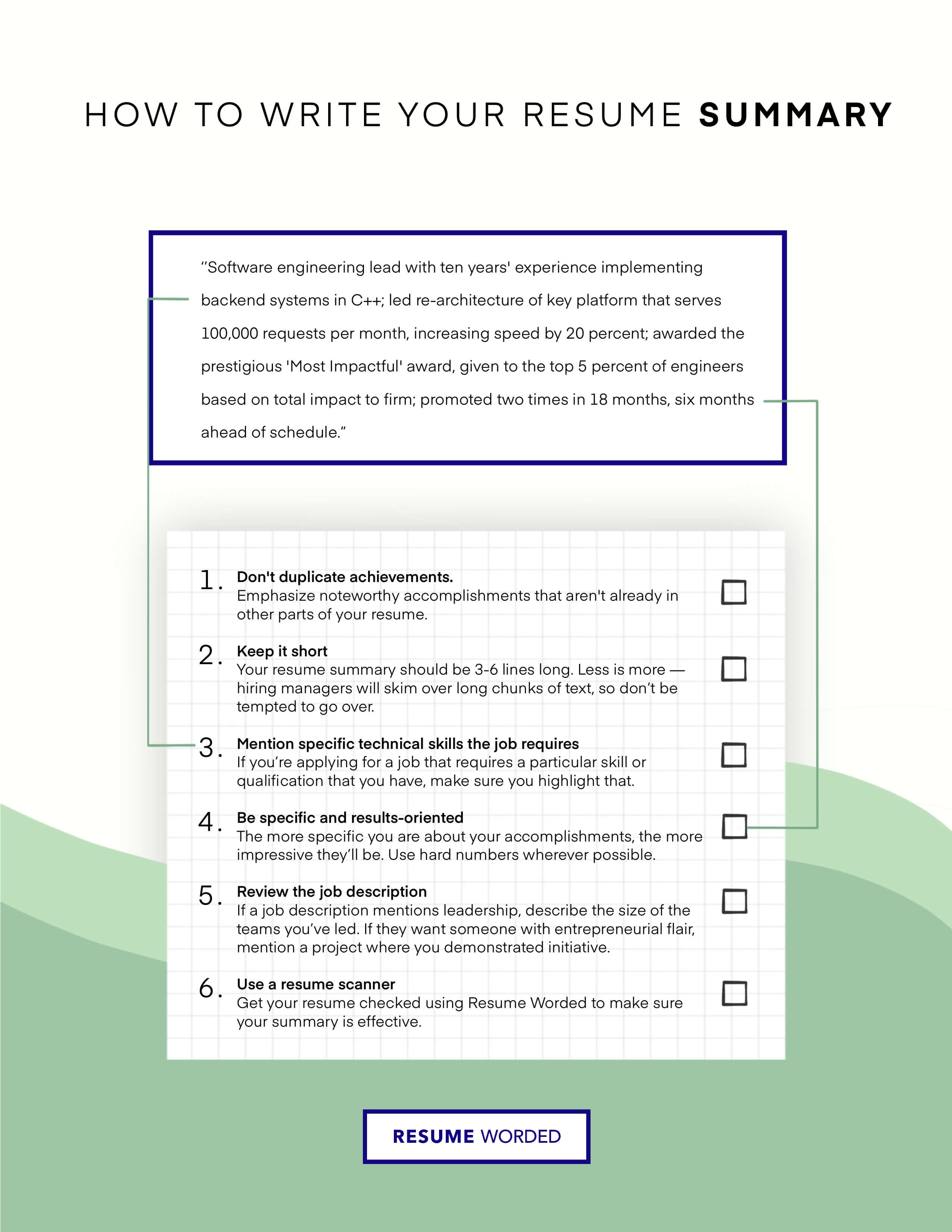

Summary

A resume summary for an auditor role is optional, but it can be a strategic way to introduce yourself and provide context for your experience. While your resume should already be a concise summary of your qualifications, a summary can help highlight your most relevant skills and experiences, especially if you're changing careers or have a diverse background. Remember, an objective statement is outdated and should never be used.

When writing your auditor resume summary, focus on your unique value proposition and the specific skills and experiences that make you a strong candidate for the role. Use objective language and quantify your achievements with metrics whenever possible. Keep it concise, ideally no more than a few sentences or a short paragraph.

To learn how to write an effective resume summary for your Auditor resume, or figure out if you need one, please read Auditor Resume Summary Examples , or Auditor Resume Objective Examples .

1. Tailor your summary to the specific auditor role

While it may be tempting to use a generic summary that could apply to any auditor position, it's important to customize your summary to the specific role and company you're applying to. Research the company and the job description to identify the key skills and experiences they're looking for.

For example, if the job description emphasizes experience with a particular type of audit or industry, make sure to highlight your relevant experience in your summary.

- Financial auditor with 5+ years of experience conducting audits for publicly traded companies in the technology industry. Proven track record of identifying and mitigating financial risks.

- Internal auditor specializing in operational audits for manufacturing companies. Skilled at developing and implementing audit plans to improve efficiency and compliance.

2. Highlight your most impressive achievements

Your summary is the perfect place to showcase your most impressive achievements and the value you can bring to the role. Use specific examples and metrics to quantify your impact whenever possible.

However, be careful not to simply duplicate achievements that are already listed in other sections of your resume. Your summary should provide a high-level overview and entice the reader to learn more.

- Experienced auditor with a proven track record of success.

- Skilled at conducting audits and identifying areas for improvement.

Instead, focus on specific, quantifiable achievements that demonstrate your skills and impact:

- Identified and recovered $500K in overpayments through a comprehensive audit of vendor contracts.

- Led a team of 5 auditors to complete a complex SOX compliance audit 20% ahead of schedule.

3. Demonstrate your industry expertise and specializations

As an auditor, you may have experience working in specific industries or with particular types of audits. Highlighting this expertise in your summary can help you stand out from other candidates and demonstrate your unique value proposition.

Certified Internal Auditor (CIA) with 7+ years of experience leading operational and financial audits in the healthcare industry. Expertise in risk assessment, internal controls, and compliance with HIPAA and other healthcare regulations. Proven ability to identify and mitigate risks, streamline processes, and improve overall organizational performance.

If you have any relevant certifications, such as Certified Public Accountant (CPA) or Certified Information Systems Auditor (CISA), make sure to include them in your summary as well. These certifications demonstrate your expertise and commitment to the field.

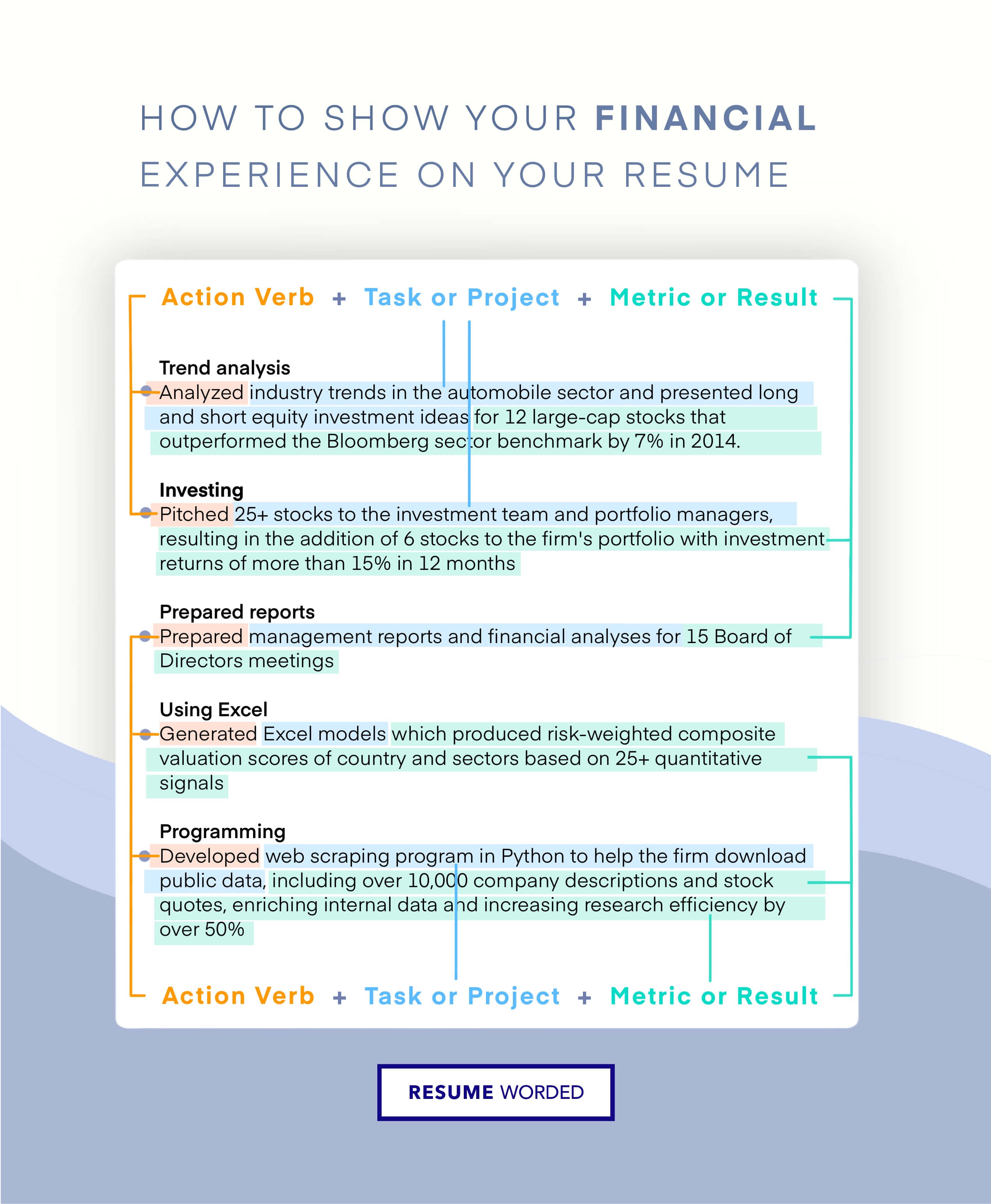

Experience

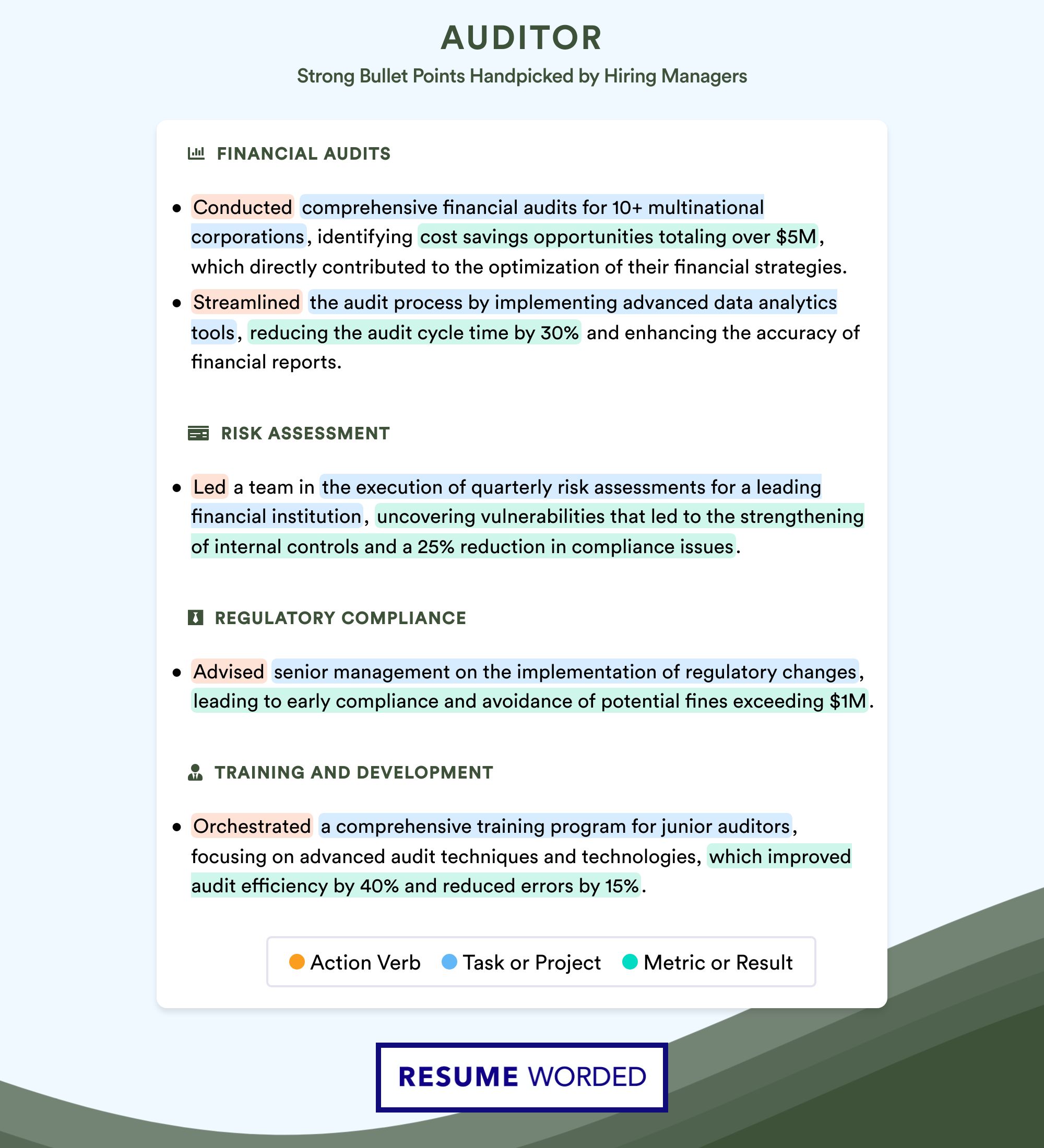

The work experience section is the heart of your resume. It's where you show hiring managers how you've applied your skills to make an impact for previous employers. For auditors, this section is especially critical, as it's your chance to highlight your expertise in areas like financial analysis, risk assessment, and compliance.

As you write your work experience section, keep the following tips in mind to make sure you're showcasing your qualifications in the best possible light.

1. Highlight your achievements with metrics

When describing your previous roles, don't just list your responsibilities. Instead, focus on your key accomplishments and the impact you made. And whenever possible, quantify your achievements with metrics.

For example, instead of saying:

- Conducted internal audits to ensure compliance with financial regulations

You could say:

- Conducted 25+ internal audits per quarter, ensuring 100% compliance with SOX, GAAP, and other financial regulations

- Identified and resolved an average of 5 major compliance issues per audit, reducing financial risk by 30%

By using numbers and percentages to describe your accomplishments, you give hiring managers a clear picture of the value you can bring to their organization.

Not sure if your bullet points are specific enough? Try running your resume through Score My Resume . It will analyze your resume and provide feedback on areas like achievement-oriented language and use of metrics.

2. Showcase your expertise with industry keywords

Auditing roles can vary significantly depending on the industry and type of organization. So as you describe your experience, be sure to include relevant keywords that showcase your specific expertise.

For example, if you're applying for an internal auditor position at a publicly traded company, you might mention:

- SOX compliance

- Internal controls testing

- Financial reporting

On the other hand, if you're targeting a role in IT auditing, you'd want to highlight keywords like:

- System and network security

- Access controls

- Change management processes

By tailoring your language to the specific role and industry, you'll show hiring managers that you have the highly relevant skills they're looking for.

To make sure you're hitting the right keywords, try pasting the job description into our Targeted Resume tool. It will scan the posting and identify the most important skills and qualifications to include in your resume.

3. Demonstrate career progression

Hiring managers love to see candidates who have steadily progressed in their careers. If you've earned promotions or taken on increasing levels of responsibility, make that clear in your work experience section.

For example, you might have bullet points like:

- Promoted to Senior Auditor after just 2 years, in recognition of strong performance and leadership skills

- Managed a team of 5 junior auditors, overseeing all aspects of the audit process from planning to reporting

- Selected to lead high-profile audits of key business units, including finance, operations, and IT

Progressed from Staff Auditor to Audit Manager over 6 years, taking on increasing responsibility for leading audit engagements, managing client relationships, and developing junior talent. Managed a portfolio of 15+ clients with annual audit fees exceeding $2M.

By highlighting your career progression through promotions, leadership roles, and high-profile assignments, you'll demonstrate your ability to take on advanced responsibilities and drive value for your next employer.

When describing your promotions, be sure to include the full job titles. This will make your career advancement even clearer to recruiters who may be quickly scanning your resume.

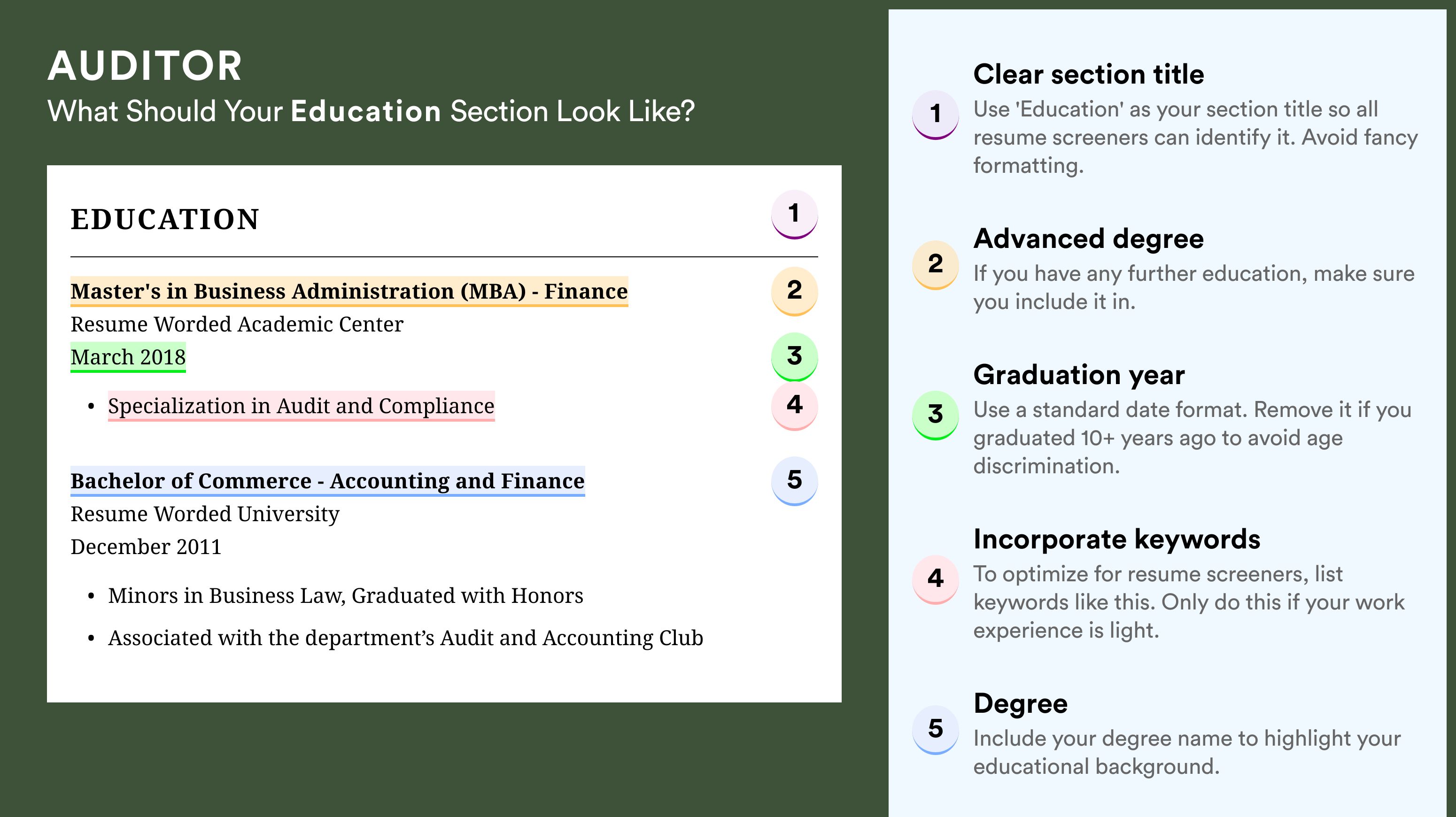

Education

Your education section is a crucial part of your auditor resume. It shows hiring managers that you have the necessary knowledge and qualifications to excel in the role. In this section, we'll break down the key steps to crafting an effective education section that will catch the eye of potential employers.

1. List your degrees in reverse chronological order

Start with your most recent degree and work backwards. This format helps employers quickly identify your highest level of education and see your academic progression.

Here's an example of how to list your degrees:

- Master of Business Administration (MBA), XYZ University, 2018-2020

- Bachelor of Science in Accounting, ABC College, 2014-2018

Avoid listing your degrees like this:

2. Include relevant coursework and honors

If you're a recent graduate or have limited work experience, highlighting relevant coursework and academic achievements can help demonstrate your qualifications for an auditor position.

Bachelor of Science in Accounting, ABC College, 2014-2018 Relevant Coursework: Auditing, Financial Accounting, Managerial Accounting, Taxation Honors: Dean's List (6 semesters), Graduated Summa Cum Laude

However, avoid listing irrelevant or outdated coursework:

Bachelor of Science in Accounting, ABC College, 2014-2018 Coursework: Introduction to Psychology, World History, Creative Writing

3. Keep it concise for senior-level positions

If you're a senior-level auditor with extensive work experience, your education section should be brief and to the point. Employers will be more interested in your professional accomplishments than your academic background.

Here's an example of a concise education section for a senior auditor:

- MBA, XYZ University

- B.S. in Accounting, ABC College

Avoid including unnecessary details or outdated information:

- Master of Business Administration (MBA), XYZ University, 2000-2002

- Bachelor of Science in Accounting, ABC College, 1996-2000

- Relevant Coursework: Auditing, Financial Accounting, Managerial Accounting, Taxation

- Honors: Dean's List (6 semesters), Graduated Summa Cum Laude

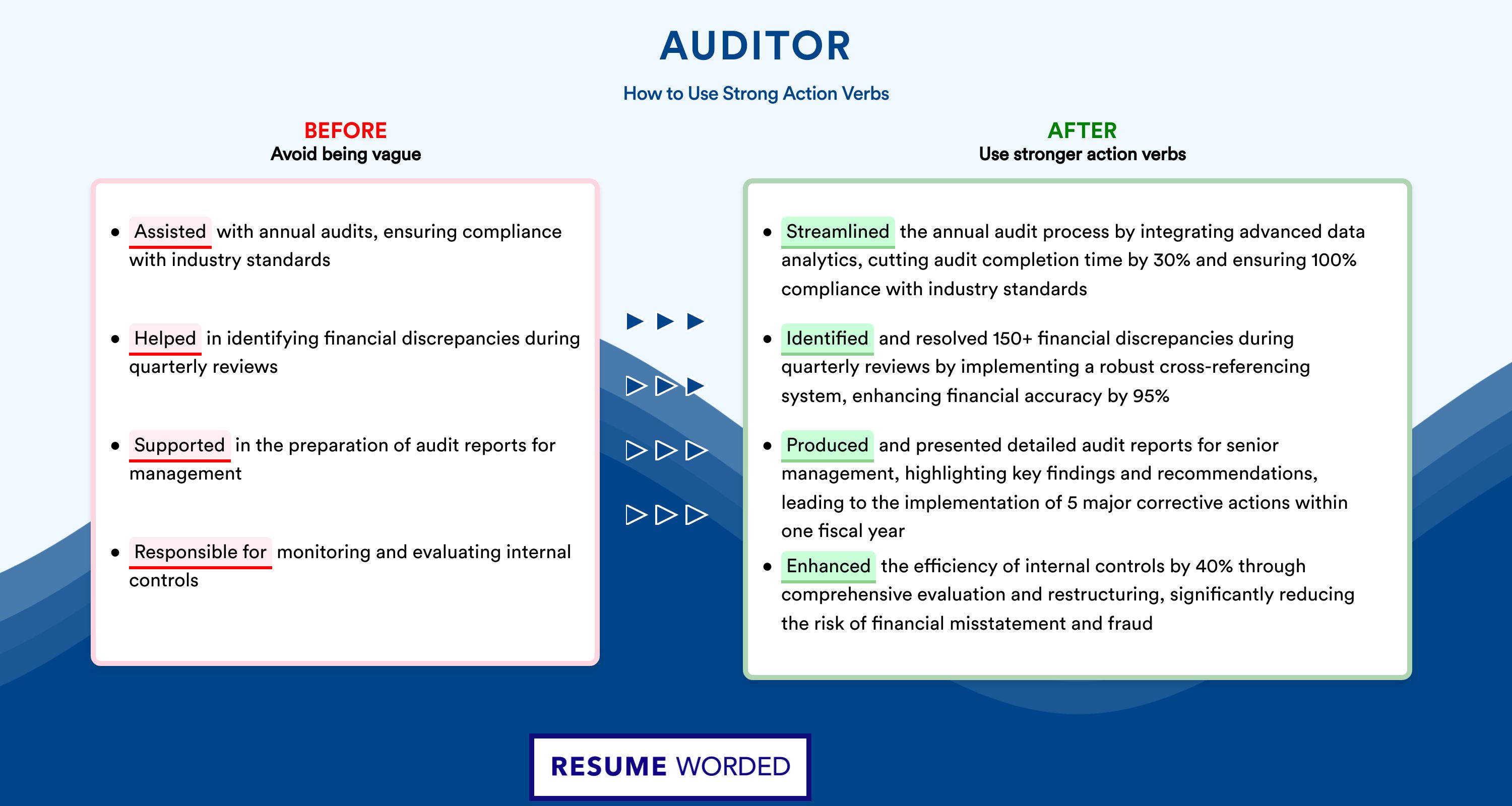

Action Verbs For Auditor Resumes

Strong action verbs help recruiters understand your role in specific tasks. An auditor’s resume should use action verbs that are relevant to the auditing process. Action verbs like "Audited", "Interviewed" or “Compiled" are examples of strong action verbs for this profession.

- Investigated

- Interviewed

- Implemented

For a full list of effective resume action verbs, visit Resume Action Verbs .

Action Verbs for Auditor Resumes

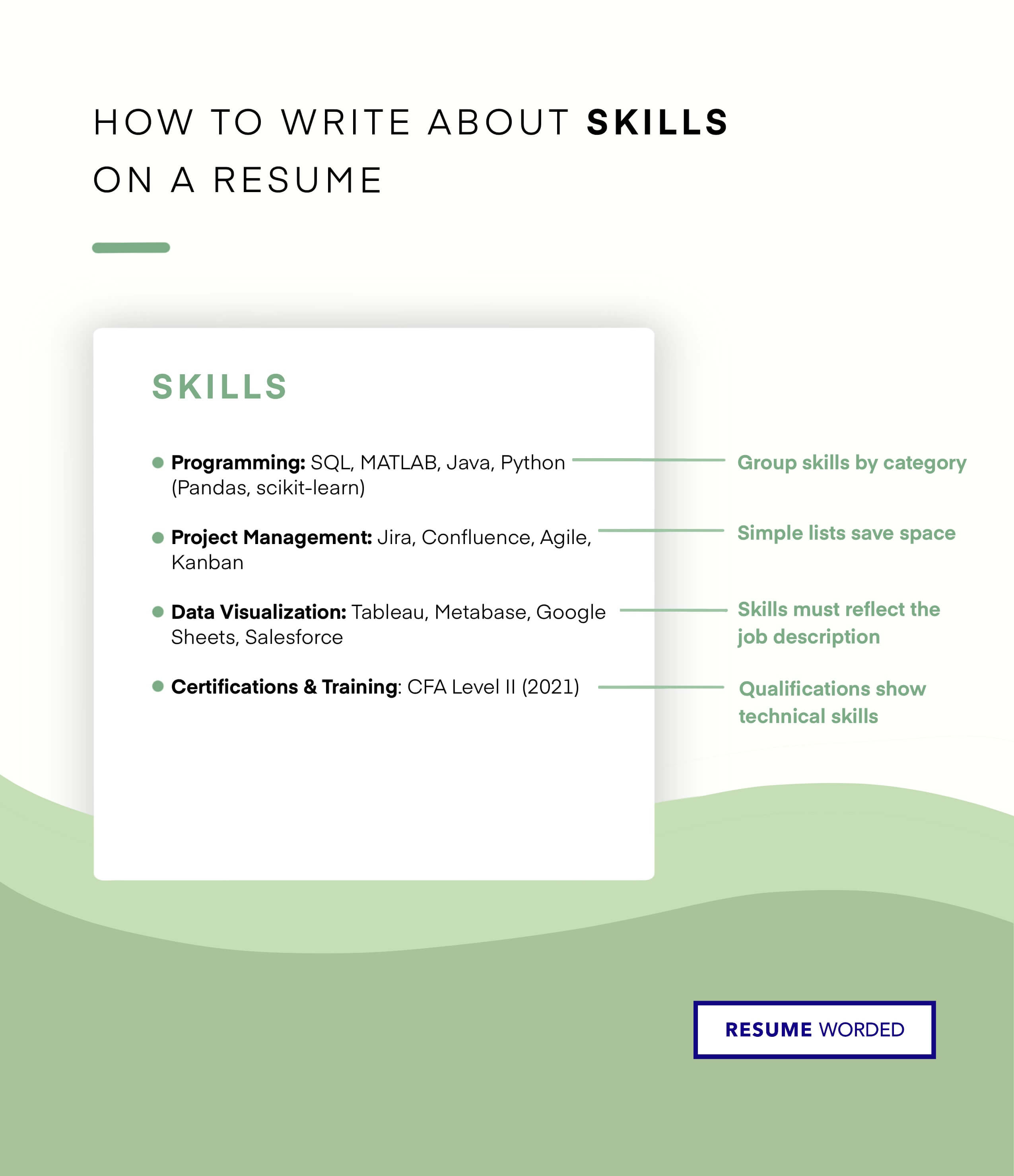

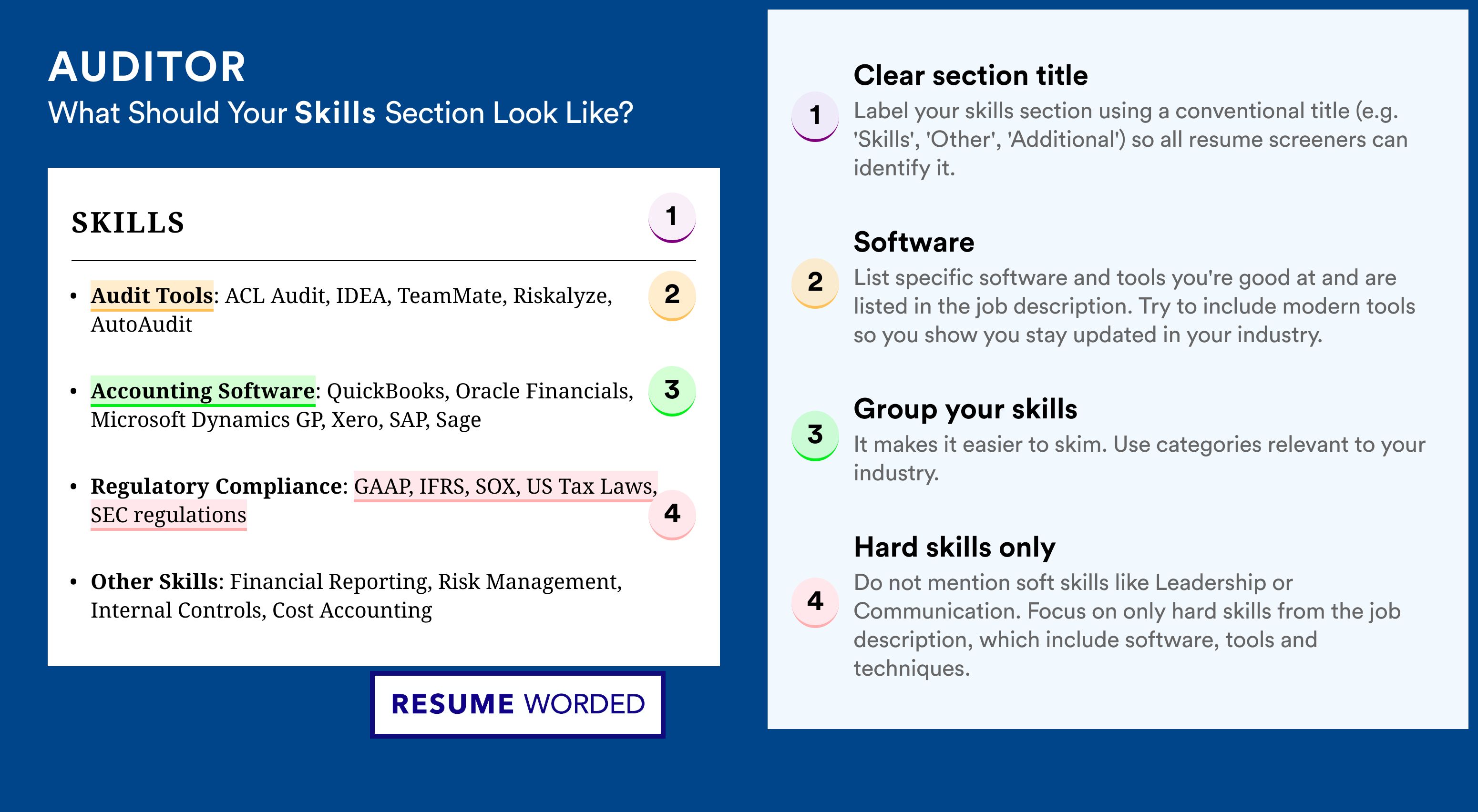

Skills for auditor resumes.

When you speak of skills for an auditor, you will want to list the technical and soft skills used in the auditing process.

Here is a list of skills you would expect to see in an auditor’s resume. Add those that you are experienced with to your resume to impress recruiters.

- External Audit

- Financial Reporting

- Financial Accounting

- Internal Controls

- Financial Analysis

- Internal Audit

- Financial Audits

- International Financial Reporting Standards (IFRS)

- Financial Statements

- Microsoft Access

- Account Reconciliation

- Business Strategy

- Corporate Finance

- Strategic Planning

How To Write Your Skills Section On an Auditor Resumes

You can include the above skills in a dedicated Skills section on your resume, or weave them in your experience. Here's how you might create your dedicated skills section:

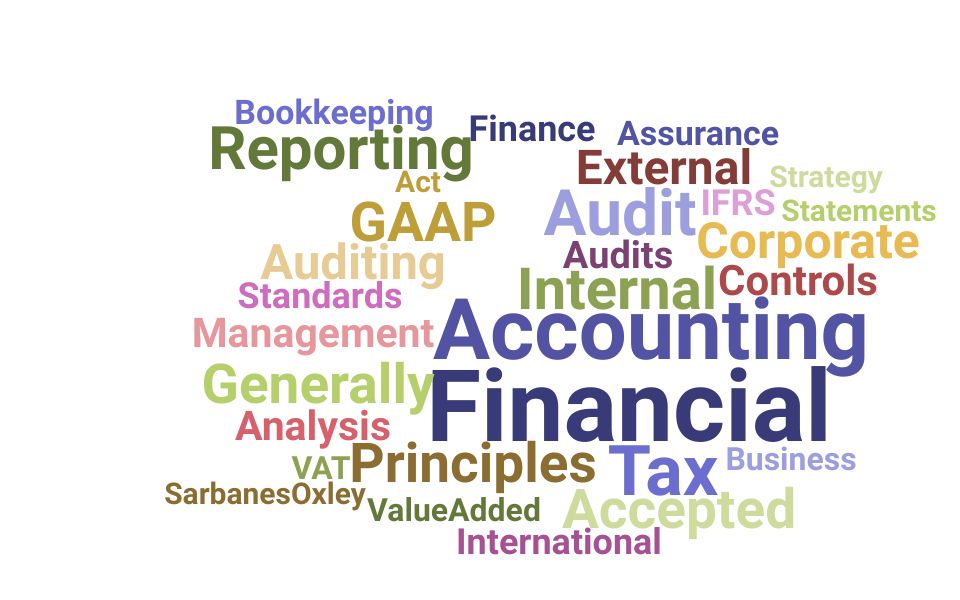

Skills Word Cloud For Auditor Resumes

This word cloud highlights the important keywords that appear on Auditor job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more 'important' it is.

How to use these skills?

Other finance resumes.

- Bookkeeper Resume Guide

- Investment Banking Resume Guide

- Financial Analyst Resume Guide

- Accountant Resume Guide

- Equity Research Resume Guide

- C-Level and Executive Resume Guide

- Financial Advisor Resume Guide

- Procurement Resume Guide

Auditor Resume Guide

- Financial Controller Resume Guide

- Risk Management Resume Guide

- Accounts Payable Resume Guide

- Internal Audit Resume Guide

- Purchasing Manager Resume Guide

- Loan Processor Resume Guide

- Finance Director Resume Guide

- Credit Analyst Resume Guide

- Collections Specialist Resume Guide

- Finance Executive Resume Guide

- VP of Finance Resume Guide

- Claims Adjuster Resume Guide

- Payroll Specialist Resume Guide

- Cost Analyst Resume Guide

- M&A Resume Guide

- Auditor Resume Example

- Senior Auditor Resume Example

- Staff Auditor Resume Example

- External Auditor Resume Example

- Night Auditor Resume Example

- Government Auditor Resume Example

- Tips for Auditor Resumes

- Skills and Keywords to Add

- All Resume Examples

- Auditor CV Examples

- Auditor Cover Letter

- Auditor Interview Guide

- Explore Alternative and Similar Careers

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 7 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 7 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Auditor Resume Examples That Earned the Job in 2024

Auditor Resume

- Auditor Resumes by Experience

- Auditor Resumes by Role

- Write Your Auditor Resume

As an auditor, you’re the guardian of financial integrity, ensuring accuracy and compliance. Your meticulous scrutiny uncovers discrepancies and prevents financial missteps, all while your analytical skills provide insights into improving processes.

Whether it’s scrutinizing financial records, detecting fraud, or assessing risk, you’re a master at maintaining fiscal accountability. Crafting a resume that showcases your diverse talents, however, can sometimes be just as complicated as conducting an audit.

No reason to fret, though. You don’t need years of training and experience to master resume writing—pull up one of our auditor resume examples and handy resume tips to help you stand out and land jobs.

or download as PDF

Why this resume works

- So, it is thoughtful to include your team collaboration efforts in your auditor resume to highlight the impact of reducing time spent on audits and instead used to perform other core functions.

Big 4 Auditor Resume

- Talk about the total budget, significant transactions, or projects you oversaw. It’s about demonstrating your ability to operate on a higher level of responsibility, where your capacity to nurture teams, make informed decisions, and execute improvements is critical.

Night Auditor Resume

- For example, you could talk about using Xero for processing payments and managing accounts, reducing discrepancies by a certain percentage. Or perhaps using BambooHR for employee scheduling and payroll management, cutting time spent on administrative tasks by four hours per month.

Internal Auditor Resume

- Ensure that your internal auditor resume emphasizes your role in identifying financial risks and recommending the most effective solutions to avoid losses.

IT Auditor Resume

- Consequently, your IT auditor resume must accompany your achievements with metrics on thwarted insecurity incidences and the reinforcement of systems and training of human resources to identify and report breaches.

Related resume examples

- Cyber Security

- Data Analyst

- Computer Science

- Business Analyst

Tailor Your Auditor Resume to Impress Recruiters

Your auditor resume is a testament to your ability to ensure financial accuracy and compliance, but recruiters only give it a brief look and move on if it’s not what they’re after. This means that tailoring your skills section to match the job requirements is essential.

Rather than vague terms, focus on precision. Emphasize expertise in financial analysis, risk assessment, and knowledge of accounting software. Detail your proficiency in industry regulations, data analysis, and internal control evaluation.

While technical skills take the spotlight, you can include a sprinkling of relevant soft skills , like communication and attention to detail, especially for less technical roles. However, it’s often best to leave this for later, be it the work experience section or when creating a cover letter .

Seeking inspiration?

15 top auditor skills

- Financial Analysis

- Microsoft Excel

- Audit Planning

- Internal Controls

- ACL Analytics

- Oracle Financials

- Cognos

- Visual Audit Xpress

- CaseWare IDEA

Your auditor work experience bullet points

You’re immersed in a world of financial scrutiny, risk assessment, and compliance assurance. While conducting complex audits is part of your routine, it’s better not to focus on your daily tasks too much. Instead, try to put your greatest achievements front and center.

Your job is a lot more impressive than you might think. After all, your hard work directly influences the financial well-being and regulatory compliance of your company, which means that you’ll have a lot to talk about here.

Showcase accomplishments such as identifying process improvements, uncovering financial irregularities, or enhancing operational efficiency. Give those statements more weight by adding useful metrics that show off what you’ve achieved in terms of risk reduction, financial accuracy, or cost savings.

- Show that you’re good at preventing problems before they arise by mentioning the percentage of risk reduction you were able to achieve.

- Emphasize your skill in meeting rules and regulations by showing the percentage of audit checks that resulted in proper compliance.

- Demonstrate your effectiveness in uncovering illegal activities by citing the percentage of detected fraud instances out of the total audits conducted.

- Show your effect on improving procedures by stating how much time or resources were saved due to your audit suggestions.

See what we mean?

- Worked with teams from different departments to simplify audit procedures and enhance effectiveness, which reduced total time spent on audits by 26%

- Completed over 51 comprehensive audits that covered all company departments and a total budget exceeding $53 million

- Upgraded Intrusion Detection Systems, which flagged and reported 99% of malicious activities for timely interventions

- Implemented automated tools and processes, reducing audit time and resources by 39%

9 active verbs to start your auditor work experience bullet points

- Implemented

- Collaborated

- Recommended

- Generated

- Investigated

3 Tips for Writing an Auditor Resume Without Experience

- If you have limited professional experience , zoning in on your education and relevant coursework can strengthen your auditor resume. Talk about things like leading a team project that analyzed financial statements to identify discrepancies or collaborating on a risk assessment simulation.

- You may not have worked as an auditor before, but many jobs rely on skills that translate well to the role, so make sure to zone in on those. Feature around 10 key skills that reflect your strengths as an auditor, such as data analysis, internal control assessment, or compliance knowledge.

- It’s not all just high school and college—extra certifications can be great, too. Mention credentials like Certified Internal Auditor (CIA), Certified Information Systems Auditor (CISA), or other relevant industry certifications.

3 Tips for Writing an Auditor Resume Once You’re Experienced

- If you possess specialized skills as an auditor, like forensic accounting, risk assessment, or compliance auditing, make sure to include them in your skills list. Tailor your bullet points to show off your expertise in these specific areas, even if they’re not strictly related to the job.

- Staying up to date with current industry standards is part of what makes you a successful auditor. To express that, discuss your involvement in professional auditing associations, or attendance at relevant conferences.

- Detail instances of successful cross-functional collaboration by highlighting situations where you collaborated with colleagues from diverse departments like finance, legal, or operations. Emphasize tangible outcomes resulting from these partnerships, such as streamlined processes, enhanced controls, or improved compliance measures.

Including a resume summary or objective can be beneficial, especially when tailored to the specific auditor role you’re targeting. Highlight your key skills, such as financial analysis, risk assessment, or compliance knowledge, and align them with the company’s needs.

Make sure that your resume includes relevant keywords from the job description , such as “financial analysis,” “risk assessment,” and specific auditing software names. If you tailor your resume with job-specific skills and experiences, you’re more likely to pass the automatic check and have an actual recruiter look at your resume.

Absolutely. Incorporate a separate section to detail significant audit projects you’ve undertaken, showcasing your hands-on experience. Describe the scope of the projects, your role, the methodologies employed, and the outcomes achieved.

- Knowledge Base

- Free Resume Templates

- Resume Builder

- Resume Examples

- Free Resume Review

Click here to directly go to the internal auditor resume sample.

Looking for an auditor resume in 2023?

If yes, then your search is over as you have landed at the right platform!

Here, you will get complete guidance and auditor resume examples to build an impeccable resume for your job-search.

The auditor profile is an indispensable part of every business, because of which, this career option has never faced scarcity.

According to a report by Statista , there were 1.28 million accountants and auditors placed in the United States as of 2012. Since then, this graph has never gone below 1.17 million professionals.

Looking at the eployment stability, we can consider it as a great employment niche for financial graduates. However, You must remember the fact that your degree will only make you eligible for an auditor job, and you need a job-winning auditor resume to apply for it.

Here, we have tried to elaborate on every aspect of auditor resume building. Take a look at the summary points of this intuitive guide:

- Get all the details related to your targeted auditor job and its recruitment process

- Pick industry-specific keywords from the job description and use them in your auditor resume

- Use reverse chronological resume format if you do not have a career gap

- Use one-liner bullet points to mention details in your resume except for summary

- Add your education details with grades, important dates, and institute name with location.

Apart from this, we have also answered some fundamental questions related to an auditor profile here:

- What does an auditor do?

- What are the responsibilities of an auditor?

- Do auditors make good money?

- What is the education required to become an auditor?

- What are the certifications required for an auditor job?

You can take a look at Hiration’s Online Resume Builder to build your auditor resume. It is powered by Artificial Intelligence technology and is potent enough to give you a smooth and hassle-free resume-building experience.

Account Manager Resume Sample

Please take a look at the below given Account Manager Resume sample to get resume-building insights. You can use this resume hierarchy to build your audit associate resume.

Auditor Resume Points

It is a fact that the competition for any job is very high these days. Hence, you can not expect the recruiter to spend much time on your audit associate resume.

However, you can represent your information in bullet points for easy understanding so that the recruiter would spend more than a few seconds on your auditor resume.

To make your auditor resume points appealing, you can follow these guidelines while framing them:

- Start every point with a power verb

- Write every point in STAR (Situation, Task, Action, Result) format

- Quantify your information wherever possible

- Highlight important keywords and metrics

You can feel relaxed as we are supporting you in every possible manner to grab your targeted job. We have crafted one-liner bullet points for more than 250 profiles that can be used in your resume to improve readability.

Here you can see the resume points of similar profiles to an auditor:

- Night Auditor Resume Points

- Staff Accountant Resume Points

- Senior Accountant Resume Points

- Financial Analyst Resume Points

- Finance Manager Resume Points

- Senior Financial Analyst Resume Points

Job Description of an Auditor

An auditor is the authorized person to review the financial records of companies and ensure the money flow complies with applicable tax laws. Auditors prevent companies from fraud and help them improve their financial decisions to achieve organizational goals.

Here you can see an example of an auditor job description for better understanding:

We are looking for internal auditors to develop plans and support our internal partners in maintaining strong internal controls. A perfect fit must be an expert in reducing risk, increasing operational efficiency, and protecting our shareholders, customers, and employees.

As an auditor of our company, you must understand the importance of keeping the lines of communication across all levels to earn trust. Moreover, a suitable match must also have the experience to dig into details and develop recommendations that hugely impact business growth.

Auditor Roles & Responsibilities

Let us see some real-time fundamental roles and responsibilities of an internal auditor:

- Contributes as a team member working on risk-based audits and advisory engagements (including research, evaluation and analysis, and testing) to identify issues related to risk, governance, processes, technology, controls, and operating practices of assigned engagements.

- Attends team and client discussions throughout the engagement to assist the team with executing audit methodology, assessing risk, and testing effectiveness of controls.

- Learn the business flow and audit methodology to improve discussion making related to audit scope, testing approach, and data analysis.

- Contributes to research and writing high-quality internal work papers and client-facing deliverables such as process/control narratives, flowcharts, testing documentation, conclusions, recommendations, and audit report findings to be shared with the audit team and clients.

Also Read: How to draft the perfect personal banker resume

Salary of an Auditor

According to a popular employment website named Indeed , the average base salary of an Auditor in the United States is USD 60,878.

The pay scale of an auditor also varies according to the job location. Here we have added some of the United States cities with average auditor salaries:

Highest Paying Companies in the United States For Auditors

Company size and virtical also play a vital role in ditermining the salary of a professional. Here you can see the list of companies offering highest Auditor Salaries in the United States. You can apply accordingly to get a better renumeration in 2023:

Auditor Resume Format

To create a magnificent senior auditor resume, you must start by opting for the correct resume format . People usually do not pay attention while outlining their internal audit resumes as there are numerous resume formats available online that confuse them.

As a result, they end up adding all the sections and details unimpressively. Hence, we recommend you select a suitable resume format based on your skillset and experience.

We have listed three predominantly used resume formats that will help you in building a better auditor resume compared to the other mediocre auditing resumes of your competitors:

- Chronological Resume Format

It is the best resume format for professionals with no career gaps. It starts with demonstrating your current status and goes down the line with descending dates and details of your career & academic achievements.

- Combination Resume Format

This resume format is similar to the chronological resume format, with a slight change in the professional experience section . The resume points in this format are grouped based on skills.

- Functional Resume Format

It is completely different from the other two resume formats. The work details in this resume format are entered under the skills section instead of the professional experience section. A functional resume format is suitable for professionals having a career gap.

Internal Auditor Resume Sample

Here is an example of a refined internal audit resume. Unlike other internal auditor resumes available online, it has all the elements at the right place with the best possible presentation.

- Conducting financial audits with 100% accuracy every year as part of tax saving and cost optimization

- Preparing audit reports based on the international standards to improve business decisions and get maximum benefits

- Coordinating with 5+ associates to evaluate audit procedures for saving ~USD 10mn. annually

- Collaborating with a team of 10+ auditors to track banking activities and monthly investments

- Performing monthly analysis of company's financial reports as part of mitigating risks by up to 40%

- Upgrading finance management methodologies to reduce business complexities by 50% and improve security by 25%

- Analyzed business trends and internal operations to reduce costs and improve productivity by 45%

- Assisted senior accountant in preparation of 50+ error free financial statements and budget reports

- Developed 20+ tax saving strategies for small businesses and individuals under the supervision of account manager

- Collaborated with 15+ associate accountants to perform audit testing for 50+ financial accounts

- Created and analyzed monthly financial reports for 10+ clients with individual net worth of USD 50mn.

- CGPA: 3.6/4.0

- Certified Internal Auditor (CIA) | Institute of Internal Auditors (IIA) | July '19

- Certified Public Accountant | Association of International Certified Professional Accountants | May '17

- Languages: English (native), Spanish (fluent), and French (working proficiency)

Education Required for an Auditor Job

It would be best to have a degree in Business Administration with Accounting as the major subject to be an auditor.

The knowledge of finance is the primary requirement for this job profile. Hence, even finance diplomas with suitable certifications can help you in becoming a successful auditor.

You can contemplate following these steps while writing educational details in your auditor resume for a professional appearance:

- Write your university name

- Add the name of your degree

- Mention location of the college

- State your CGPA gained

- Show your enrollment and graduation dates

You can also mention your major subjecst to showcase your knowledge and expertise in the Auditor Resume.

Top Auditor Course Offering Universities in the United States

You can enroll at any of these United States universities to kickstart your auditor career in 2023:

- DePaul University | Chicago, IL

- University of Missouri | Columbia, MO

- Temple University | Philadelphia, PA

- Virginia Tech | Blacksburg, VA

- The University of New Orleans | New Orleans, LA

- Suffolk University | Boston, MA

- Universiy of North Texas | Denton, TX

- Southern New Hampshire University | Manchester, NH

- University of Missouri- St. Louis | St. Louis, MO

- University of California | Riverside, CA

- University of Nebraska | Omaha, NE

- Southern Illinois University | Carbondale, IL

Auditor Certifications

A competent financial certificate can boost your shortlisting chances in the recruitment process. Most of your competitors will have similar financial degrees like you. Hence, you need a financial certification to stand out from the crowd.

You can check out these certifications given below with the name of affiliated institutions to bag an auditor job without any complications:

You can follow the format given beneath while addressing the certification details in your auditor resume:

Certification Name | Name of the Affiliated Institute | Date of Completion

All of these certifications are credible enough to benefit you a lot in your professional auditor journey. You can opt for any of them to start your career as an auditor and reach up to new heights.

Also Read: How to List Certifications on Resume

Auditor Skills

A degree in finance and suitable certifications might make you eligible for an auditor’s job. Still, an auditor resume without the latest auditing skills will not help you to bag the job.

Hence, we recommend you add all the latest auditor skills to strengthen your senior auditor resume. It is also important to make separate sections for your technical auditing skills and key auditor skills to highlight them effectively.

We have curated some auditing skills here that you can use while making an auditor resume:

You can get more advanced skills by referring to the Auditor job descriptions available at different job portals like indeed and Glassdoor. Strong modern skillset will help you grow better as an auditor.

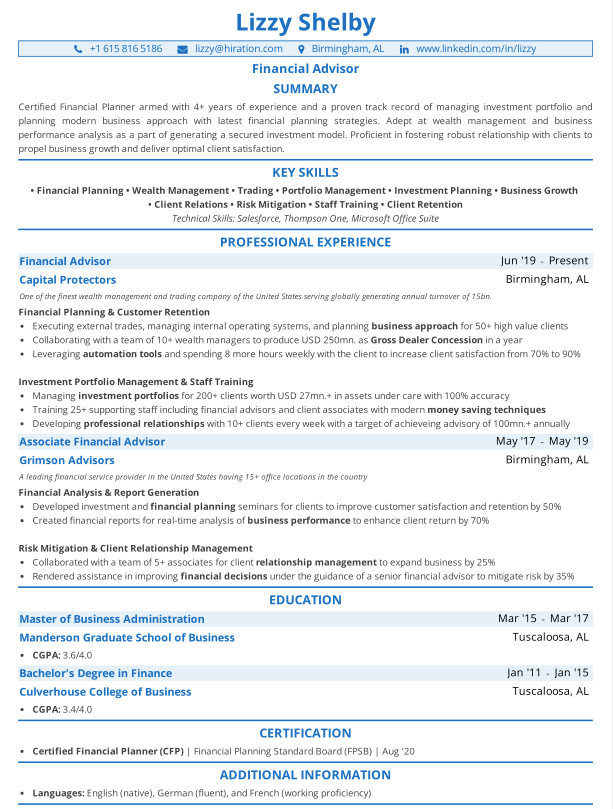

Financial Advisor Resume Sample

Similar to the aforementioned auditors resume sample, you can consider this Financial Advisor Resume sample to frame an attractive auditor resume:

Auditor Job Assistance at Hiration

Job hunting is not a piece of cake for entry-level and even experienced professionals. It requires heavy brainstorming tasks like resume building, cover letter building, interview preparation, etc.

Hiration works as the panacea for all of these tasks.

Hiration has a team of expert resume builders who help people to create flawless auditing resumes. At hiration, we have built an AI-powered Online Resume Builder that is effective enough to ease your audit associate resume-building process. Moreover, it comes with 24/7 chat support that will help you expernece a smooth operating experience while using this resume-building application.

Additional smart career-framing tools under the roof of Hiration are:

- LinkedIn Profile Review

- Digital Portfolio Builder

- Interview Preparation

- Cover Letter Builder

Key Takeaways

Take a look at the key takeaways of this reference guide:

- Choose the suitable resume format according to your experience and skills

- Mention your academic and professional details in one-liner points to enhance the effectiveness

- Write your technical auditor skills and soft skills in a separate section to highlight them properly

- Add your certification details with the affiliated institution name and completion date

We have mentioned you can get some executable guidelines and important information about an auditor’s profile here to build your auditor resume.

You can also contact us anytime at [email protected] .

Share this blog

Subscribe to Free Resume Writing Blog by Hiration

Get the latest posts delivered right to your inbox

Stay up to date! Get all the latest & greatest posts delivered straight to your inbox

Is Your Resume ATS Friendly To Get Shortlisted?

Upload your resume for a free expert review.

Resume Builder

- Resume Experts

- Search Jobs

- Search for Talent

- Employer Branding

- Outplacement

- Resume Samples

Auditor Resume Samples

The guide to resume tailoring.

Guide the recruiter to the conclusion that you are the best candidate for the auditor job. It’s actually very simple. Tailor your resume by picking relevant responsibilities from the examples below and then add your accomplishments. This way, you can position yourself in the best way to get hired.

Craft your perfect resume by picking job responsibilities written by professional recruiters

Pick from the thousands of curated job responsibilities used by the leading companies, tailor your resume & cover letter with wording that best fits for each job you apply.

Create a Resume in Minutes with Professional Resume Templates

- Develop accurate and complete audit workpapers that adequately support audit observations and documents work performed

- Provide team support by reviewing audit work, providing technical knowledge and guiding and assisting the direction of various audit procedures

- Opportunity to lead others, delegating the work, provide guidance / coaching, reviewing workpapers and providing feedback

- Performs program procedures and documents work performed, test results and conclusions using work paper preparation guidelines

- Develop effective working relationships with technology and business management of the area being audited

- Assists with the analysis of risk and controls for assigned audits and provides input to Audit management or senior staff on routine audit reporting

- Provides assistance in developing and administering department administrative guidelines

- Evaluates staff performance; performs management review of work performed by assistant auditors, prior to Senior Auditor/Section Chief's review

- Evaluates staff performance; performs management review of work performed by assistant auditors, prior to Senior Auditor/Section Chief’s review

- Evaluates staff performance; performs management reviews of work performed by assistant auditors prior to the Senior Auditor/Section Chief’s review

- Evaluates staff performance; performs management review of work performed by assistant auditors, prior to Senior Auditor's/Section Chief’s review

- Working with management to develop ways to better manage risk

- Works closely with the Audit Team Leader to perform/develop the audit planning, scoping, and fieldwork execution strategy

- Assists and/or supervises audit team members in the performance of internal audit fieldwork for audit areas assigned by audit management

- Strong analytical skills: including ability to understand quickly the critical steps in a process and understand the related risks of various nature

- Excellent team working capabilities and an ability to build strong business and team relationships

- Strong analytical skills with the ability to break down complex situations into manageable components, and to reach appropriate conclusions

- Demonstrates strong interpersonal skills and ability to develop solid working relationships with others

- Strong analytical skills: including ability to learn (be able to understand the critical steps in a process and understand the related risks of various nature)

- Ability to apply strong understanding of risk recognition in financial and operational processes with solid core analytical and problem solving skills

- Excellent working knowledge of MS Office and proficient in Computer Assisted Auditing Techniques (CAATs), e.g. SAS, ACL and/or IDEA

- Highly organized, detail oriented and capable of managing multiple tasks

- Participate on audit engagements from planning to reporting and produce quality deliverables to both department and professional standards

- Ability to learn quickly, work independently, and maintain professional skepticism

15 Auditor resume templates

Read our complete resume writing guides

How to tailor your resume, how to make a resume, how to mention achievements, work experience in resume, 50+ skills to put on a resume, how and why put hobbies, top 22 fonts for your resume, 50 best resume tips, 200+ action words to use, internship resume, killer resume summary, write a resume objective, what to put on a resume, how long should a resume be, the best resume format, how to list education, cv vs. resume: the difference, include contact information, resume format pdf vs word, how to write a student resume, auditor resume examples & samples.

- Performs tests of operational effectiveness to validate controls

- May assist with the preparation and may assist with communicating recommendations for strengthening controls in assigned business processes

- Provides assistance to external auditors and regulators as required

- Fundamental concepts of financial markets and products

- Planning, organizing and conducting audits

- Identifying and documenting risk management issues

- Preparing written reports and delivering oral presentations

- Work independently, demonstrating initiative and problem solving skills

- Bachelor's Degree in Business Administration, Accounting, and Finance or related field

- Partner with colleagues, clients and control community members to evaluate, test and report on the adequacy and effectiveness of management controls. This is conducted in accordance with department and professional standards and will require the presentation of root cause issues to senior client management

- Identify and follow up on specific audit issues and ensure appropriate involvement with significant development efforts or projects. In this capacity members of the team are often asked to join the steering or program control committee's of major projects to provide continuous feedback on control issues or compliance with best practice standards

- A minimum of 5 + years of working experience with exposure to asset management and the financial services industry including related processes/controls

- Strong knowledge of investment products along with a good knowledge of the end to end transaction cycles and systems in asset management business will be a plus

- Ability to understand potentially complex processes to identify and test key controls

- Flexible to set individual goals and objectives to be consistent with those of the Audit department

- A good understanding of the local/regional regulatory requirements is a plus

- At least 3 - 5 year's internal/external auditing experience, with at least 1-2 years specifically covering Consumer Banking products, services, or operational functions preferred

- Strong knowledge of key Consumer regulations

- Ability and desire to learn quickly, be flexible and think strategically

- 6 years of audit and/or Mortgage Banking Originations experience, including roles as a project lead

- Enthusiastic, self motivated, effective under pressure

- JPMorgan Chase is an equal opportunity and affirmative action employer M/F/Disability/VeteranBe prepared to travel to business locations domestically (15 - 25%)

- Be the established “point-person” for Chief Auditor support and lead both central and Chief Auditor defined initiatives

- Build and support the analytical processes to enhance the reporting and assessment of the annual audit plan for the Citi Chief Auditor and the members of the IA Executive Committee

- Establishment and provision of Committee-level reports to the Chief Auditors for local country and business control committees

- Support the design and build of MIS to address all of the IA reporting requirements to all Audit Committees within the Group (per alignment of the role)

- Design and continually streamline the process whereby data owners (Chief Auditors) sign off the data accuracy and completeness of the central audit data

- Establish and implement data methodology to provide a central repository for all reporting

- Work with other control functions to ensure data is leveraged across the Group to ensure a higher level of data intelligence

- Highly proficient in data analytic tools and MIS reporting tools. Essential technical skills include intermediate SQL (including writing scripts for data extraction), VBA, advanced Microsoft Excel and Access, and high proficiency across the MS Office suite

- Have specific experience with data cleansing and validation within imperfect and disparate data environments. Experience with a diverse range of databases would be highly beneficial

- Excellent interpersonal and organizational skills

- Significant, diversified experience in providing MIS on a global basis, working across several related, but not necessarily directly linked, information sources, and providing aggregated, coherent outputs

- The candidate will have experience in utilising mainstream Business Intelligence tools (for example, Tableau, Qlikview). Additionally, will be required to have experience within ETL (Extract, Transform, Load), real time transactional systems, data cleansing and validation within imperfect and manual data environments

- Independently contributes to the development of audit processes improvements

- Good analytical skills and critical thinking

- Fluent in English and Spanish

- Able to travel 50% of the time

- 3 years of experience in the banking/financial industry

- Effectively execute and complete assigned projects on the department’s risk-based Internal Audit Plan

- Assist in creating / updating process narratives or flows, audit programs, and test procedures for assigned projects

- Work on various ad hoc projects for Internal Audit leadership and business partners as assigned

- Ensure all workpapers and deliverables are in accordance with the Institute of Internal Auditors (IIA) and department’s quality standards

- Research and report on significant accounting, auditing and internal control related topics

- Plans, assigns, schedules, reviews and directs the work of others

- Develops operational audit programs, including determining audit objectives and scope, procedures and internal control reviews to ensure compliance with policies and procedures

- Identifies, analyzes and recommends changes to core business processes to minimize risk, increase service levels and improve process efficiency and prepares follow plans to ensure recommendations are addressed

- Makes recommendations for improving assigned business processes and internal controls

- Identifies potential process improvements to assigned to increase the effectiveness and efficiency of operations

- Serves as a technical resource to other auditors

- Identifies, reviews, assesses and documents risk management and control issues

- Tests or reviews testing of key controls to provide due diligence in compliance with organizational policies for risk management

- Maintains currency in operational audit processes and procedures

- Advanced concepts, practices and procedures of operational auditing

- Advanced investment concepts, practices and procedures used in the securities industry

- Planning, organizing and conducting operational audits

- Work independently as well as collaboratively or in a leadership role in a team environment

- Basic to intermediate level bank or audit experience in a Consumer banking role, with demonstrated execution capabilities according to strict timetables

- Excellent knowledge of product management/operations/compliance in corporate and/or retail banking

- Good Mandarin and English language skills (both written and spoken) with Chinese / English translation working experience will be a plus point

- Bachelor's degree, or equivalent work experience

- Thorough knowledge of applicable laws, regulations, financial services, and regulatory trends that impact their assigned line of business

- Thorough knowledge of Risk/Compliance/Audit competencies

- Presents recommendations that are feasible always bearing in mind the cost/benefit relationship where applicable

- Demonstrate sufficient knowledge of required auditing standards, accounting policies, computer application standards, applicable laws and regulations, etc

- Written communications should be clear and concise

- Proficiency with Word and Excel required

- Leads multiple and concurrent projects in accordance with department standards for quality

- Communicates audit progress and results to both department and business unit management, both verbally and in writing

- Effectively identifies and evaluates the risks/impacts associated with identified processes

- Focuses on Internal Audit’s impact on Transamerica’s Four Must Win Battles

- 2-5 years of audit (internal, external, combination)

- Oil and gas experience preferred

- CPA and / or CIA is a plus

- Ability to travel domestically and internationally 20% - 30%

- Knowledge of auditing in the financial services industry and basic accounting principles and 2+ years of related work experience

- Knowledge of regulatory and financial reporting, capital markets, treasury, capital adequacy, and/or enterprise risk management is a plus

- Background in finance, law, business economics, and/or credit and market risk management is a plus

- Professional certifications (e.g. FRM, CPA, CIA, CFA, ACA, ICAS, ACCA, CIMA) and/or an MBA along with demonstrated technical abilities in select areas (e.g. accounting, regulatory compliance, etc.) are preferred

- Strong report writing and workpaper documentation skills is preferred

- A College or University degree is required

- Relevant auditing experience in a financial institution or similar public accounting/consulting experience in the financial services industry is preferred

- Execute control testing through the examination and verification of business records

- Build business process & risk knowledge for areas of responsibility

- Keep comprehensive workpapers for planning, risk assessments, and audit testing

- Thought Leadership – Understands business objectives and balances big picture concerns with day to day activities. Demonstrates initiative and critical thinking to analyze problems logically, improve efficiency of work and generate innovative solutions. Open-minded and curious to non-traditional ways of providing risk assurance

- People Leadership – Encourages an effective and productive team environment. Develops positive relationships and communicates effectively in meetings. Appropriately involves others in decisions and plans that impact them. Effectively shares experience, providing honest opinions and feedback across the team

- Bachelor’s degree (Accounting or Finance preferred) and a minimum 4+ years of accounting, finance or audit experience

- Ability to quickly analyze and synthesize data

- Strong interpersonal skills and the ability to effectively work on virtual teams with people at all levels of the organization

- Willingness to travel (expected to be less than 10% initially)

- Bachelor’s degree (B.A.) from four year college or university in Accounting, Finance, or other relevant area of study

- Up to two years related working experience

- Possess or in pursuit of a relevant professional certification (e.g., CPA, CIA, CFSA, or other relevant certification)

- Strong analytical skills, attention to detail as well as strong written and verbal communication

- Demonstrate good judgment in evaluating test results and presenting remediation solutions where weaknesses have been identified

- Proficient with the Microsoft Office Suite and prior experience with audit management software a plus

- Performance of audit activities including inquiry, testing and observation towards completion of audit projects

- Contributes to the planning of audit projects through the effective assessment of inherent and residual risks

- Responsible for researching laws, rules and regulations impacting designated audit projects and partnering with Risk Management to ensure the business risks are properly identified and mitigated within the business lines, and ensuring that the changes are incorporated into the independent assessment process performed by Corporate Audit Services

- Support the completion of audits through effective co-sourcing of outsourced audit activities to ensure appropriate and timely coverage of business line risks. This includes performing the research and training to enable the auditor to become a subject matter expert

- Primary contact with officers and staff within the assigned business lines regarding audit activities. Through inquiry and testing, analyze and discuss with the business line the effectiveness of risk management practices. Works in collaboration with the Audit Manager in the preparation of written communications with the business lines including Points for Discussion (proper identification of root cause and exposure), development of recommendations, and drafting audit reports and other correspondence

- Develop and communicate the annual risk based assessment of the audit projects within the designated portion of the audit universe. Coach and mentor peers in the documentation and analysis of key business controls, risk identification and mitigation

- Develop work program, in consultation with Director or Senior Auditor, for efficient tests of key controls

- Document test results in work papers ready for Director or Senior Auditor review