What Does a Business Planning Manager Do?

Find out what a Business Planning Manager does, how to get this job, salary information, and what it takes to succeed as a Business Planning Manager.

The Business Planning Manager plays a strategic role in steering the company’s direction through comprehensive market analysis, forecasting, and resource allocation. This position involves synthesizing complex data into actionable strategies that align with the company’s long-term goals and financial objectives. By closely monitoring industry trends and evaluating business performance, the Business Planning Manager ensures that the organization remains agile and responsive to changing market demands. Collaboration with various departments to develop and implement plans that enhance operational efficiency and profitability is also a significant aspect of the role. Through a balanced approach to risk management and opportunity identification, the Business Planning Manager supports the company in maintaining a competitive edge and achieving sustainable growth.

Business Planning Manager Job Duties

- Develop and implement comprehensive business plans to facilitate achievement by planning cost-effective operations and market development activities.

- Analyze and forecast financial, economic, and other data to provide accurate and timely information for strategic and operational decisions.

- Coordinate cross-functional teams to develop business strategies and objectives, ensuring alignment with corporate goals.

- Evaluate competitive market strategies through analysis of related product, market, or share trends.

- Identify and drive initiatives to improve operational efficiency, including process improvements, cost reduction, and systems enhancements.

- Facilitate communication and collaboration among departments to ensure that business planning and strategies are aligned with company-wide goals.

- Oversee the preparation of operational and risk reports for management analysis.

- Spearhead the development of new business opportunities, including expansion, mergers, acquisitions, and partnerships.

Business Planning Manager Salary & Outlook

Factors affecting a Business Planning Manager’s salary include industry sector, company size, years of experience, and specific skills in strategic planning, financial modeling, and market analysis. Performance outcomes and the ability to influence business growth also significantly impact compensation.

- Median Annual Salary: $110,250 ($53/hour)

- Top 10% Annual Salary: $152,000 ($73.08/hour)

The employment of business planning managers is expected to grow faster than average over the next decade.

This growth is driven by the increasing complexity of global markets, the need for strategic planning in competitive environments, and the demand for innovation in product and service development. Business Planning Managers are pivotal in navigating these challenges, making their role more critical than ever.

Business Planning Manager Job Requirements

Education: A Business Planning Manager typically holds a Bachelor’s Degree in Business Administration, Finance, or a related field. Coursework often includes strategic management, financial analysis, market research, and organizational behavior. Advanced degrees like an MBA can enhance prospects, focusing on leadership, advanced strategic planning, and international business. Specialized courses in data analysis, project management, and economics are also beneficial, equipping candidates with the necessary skills to excel in developing and implementing business strategies.

Experience: Business Planning Managers typically come from diverse experience backgrounds, with a significant portion having substantial experience in strategic planning, financial analysis, and project management. Many have progressed through roles that required increasing responsibility in business strategy and operations. On-the-job training is common, often through mentorship or rotational programs within a company, allowing for hands-on experience in different business units. Training programs focusing on leadership, data analysis, and market research are also valuable, equipping candidates with the skills to lead cross-functional teams and drive business growth. Successful candidates often demonstrate a blend of practical experience in business planning and strategic initiatives, coupled with formal training programs that enhance their analytical and leadership capabilities.

Certifications & Licenses: Certifications and licenses are not typically required for the role of Business Planning Manager.

Business Planning Manager Skills

Strategic Forecasting: Leveraging data-driven insights, a Business Planning Manager predicts market trends to develop strategies that align with organizational goals. This involves synthesizing diverse information sources to anticipate challenges and opportunities, keeping the company agile and competitive.

Market Analysis: Through the meticulous examination of trends, customer behaviors, and competitor activities, Business Planning Managers can forecast market demands and pinpoint opportunities or threats. This skill hinges on thorough data collection and interpretation to inform strategic decisions.

Financial Modeling: Business Planning Managers create detailed, predictive models of a company’s financial future to forecast revenue, assess risk, and efficiently allocate resources. This requires a solid grasp of accounting principles, spreadsheet software proficiency, and the ability to interpret market trends for data-driven strategic planning.

Risk Management: By identifying potential threats and developing strategies to mitigate them, Business Planning Managers protect the organization’s interests and ensure its long-term sustainability. Analyzing market trends, financial forecasts, and operational vulnerabilities is crucial for preemptively addressing challenges.

Stakeholder Engagement: Building and maintaining strong relationships with investors, partners, and internal teams is critical for aligning business strategies and meeting project milestones. This skill ensures smoother project execution and fosters an environment of trust and mutual respect.

Performance Optimization: Data-driven insights and lean methodologies are used to streamline operations, reduce waste, and boost business efficiency. Analyzing performance metrics, identifying bottlenecks, and implementing strategic interventions are key for sustained organizational improvement.

Business Planning Manager Work Environment

A Business Planning Manager typically operates within a structured office environment, where the workspace is designed to foster both concentration and collaboration. The setup usually includes personal computers, advanced planning software, and access to data analytics tools, essential for strategic decision-making and forecasting.

Work hours might extend beyond the traditional 9-to-5, especially during critical planning phases, though many organizations offer flexibility to accommodate work-life balance. The dress code tends to align with corporate standards, leaning towards business casual or formal, depending on the company’s culture and external meeting requirements.

The role demands frequent interaction with team members, stakeholders, and departments, necessitating strong communication channels and a cooperative atmosphere. Travel may be required for industry events or company-wide meetings, adding variety to the routine.

Professional development opportunities are often available, encouraging continuous learning and advancement in strategic planning methodologies and leadership skills. This role thrives in a setting that values analytical thinking, adaptability, and collaborative problem-solving.

Advancement Prospects

A Business Planning Manager can ascend to higher strategic roles within an organization, such as Director of Strategy or Chief Operations Officer (COO), by demonstrating exceptional analytical, leadership, and decision-making skills. Success in this career path hinges on the ability to drive business growth and efficiency through innovative planning and execution.

To achieve these advancements, a Business Planning Manager should focus on spearheading high-impact projects and initiatives that align with the company’s long-term goals. Gaining experience in cross-functional team leadership and developing a deep understanding of the industry’s competitive landscape are crucial.

Building a track record of successful business plans and strategies that have significantly contributed to the company’s profitability and market position will set a solid foundation for moving into top executive roles. Engaging in high-level decision-making processes and demonstrating a keen insight into market trends and business opportunities are essential steps toward career progression in this field.

What Does a Rental Car Manager Do?

What does a radiology coordinator do, you may also be interested in..., what does an employee engagement specialist do, what does an energy technician do, 16 dairy farmer skills for your career and resume, 16 sales coordinator skills for your career and resume.

A better way to drive your business

Managing the availability of supply to meet volatile demand has never been easy. Even before the unprecedented challenges created by the COVID-19 pandemic and the war in Ukraine, synchronizing supply and demand was a perennial struggle for most businesses. In a survey of 54 senior executives, only about one in four believed that the processes of their companies balanced cross-functional trade-offs effectively or facilitated decision making to help the P&L of the full business.

That’s not because of a lack of effort. Most companies have made strides to strengthen their planning capabilities in recent years. Many have replaced their processes for sales and operations planning (S&OP) with the more sophisticated approach of integrated business planning (IBP), which shows great promise, a conclusion based on an in-depth view of the processes used by many leading companies around the world (see sidebar “Understanding IBP”). Assessments of more than 170 companies, collected over five years, provide insights into the value created by IBP implementations that work well—and the reasons many IBP implementations don’t.

Understanding IBP

Integrated business planning is a powerful process that could become central to how a company runs its business. It is one generation beyond sales and operations planning. Three essential differentiators add up to a unique business-steering capability:

- Full business scope. Beyond balancing sales and operations planning, integrated business planning (IBP) synchronizes all of a company’s mid- and long-term plans, including the management of revenues, product pipelines and portfolios, strategic projects and capital investments, inventory policies and deployment, procurement strategies, and joint capacity plans with external partners. It does this in all relevant parts of the organization, from the site level through regions and business units and often up to a corporate-level plan for the full business.

- Risk management, alongside strategy and performance reviews. Best-practice IBP uses scenario planning to drive decisions. In every stage of the process, there are varying degrees of confidence about how the future will play out—how much revenue is reasonably certain as a result of consistent consumption patterns, how much additional demand might emerge if certain events happen, and how much unusual or extreme occurrences might affect that additional demand. These layers are assessed against business targets, and options for mitigating actions and potential gap closures are evaluated and chosen.

- Real-time financials. To ensure consistency between volume-based planning and financial projections (that is, value-based planning), IBP promotes strong links between operational and financial planning. This helps to eliminate surprises that may otherwise become apparent only in quarterly or year-end reviews.

An effective IBP process consists of five essential building blocks: a business-backed design; high-quality process management, including inputs and outputs; accountability and performance management; the effective use of data, analytics, and technology; and specialized organizational roles and capabilities (Exhibit 1). Our research finds that mature IBP processes can significantly improve coordination and reduce the number of surprises. Compared with companies that lack a well-functioning IBP process, the average mature IBP practitioner realizes one or two additional percentage points in EBIT. Service levels are five to 20 percentage points higher. Freight costs and capital intensity are 10 to 15 percent lower—and customer delivery penalties and missed sales are 40 to 50 percent lower. IBP technology and process discipline can also make planners 10 to 20 percent more productive.

When IBP processes are set up correctly, they help companies to make and execute plans and to monitor, simulate, and adapt their strategic assumptions and choices to succeed in their markets. However, leaders must treat IBP not just as a planning-process upgrade but also as a company-wide business initiative (see sidebar “IBP in action” for a best-in-class example).

IBP in action

One global manufacturer set up its integrated business planning (IBP) system as the sole way it ran its entire business, creating a standardized, integrated process for strategic, tactical, and operational planning. Although the company had previously had a sales and operations planning (S&OP) process, it had been owned and led solely by the supply chain function. Beyond S&OP, the sales function forecast demand in aggregate dollar value at the category level and over short time horizons. Finance did its own projections of the quarterly P&L, and data from day-by-day execution fed back into S&OP only at the start of a new monthly cycle.

The CEO endorsed a new way of running regional P&Ls and rolling up plans to the global level. The company designed its IBP process so that all regional general managers owned the regional IBP by sponsoring the integrated decision cycles (following a global design) and by ensuring functional ownership of the decision meetings. At the global level, the COO served as tiebreaker whenever decisions—such as procurement strategies for global commodities, investments in new facilities for global product launches, or the reconfiguration of a product’s supply chain—cut across regional interests.

To enable IBP to deliver its impact, the company conducted a structured process assessment to evaluate the maturity of all inputs into IBP. It then set out to redesign, in detail, its processes for planning demand and supply, inventory strategies, parametrization, and target setting, so that IBP would work with best-practice inputs. To encourage collaboration, leaders also started to redefine the performance management system so that it included clear accountability for not only the metrics that each function controlled but also shared metrics. Finally, digital dashboards were developed to track and monitor the realization of benefits for individual functions, regional leaders, and the global IBP team.

A critical component of the IBP rollout was creating a company-wide awareness of its benefits and the leaders’ expectations for the quality of managers’ contributions and decision-making discipline. To educate and show commitment from the CEO down, this information was rolled out in a campaign of town halls and media communications to all employees. The company also set up a formal capability-building program for the leaders and participants in the IBP decision cycle.

Rolled out in every region, the new training helps people learn how to run an effective IBP cycle, to recognize the signs of good process management, and to internalize decision authority, thresholds, and escalation paths. Within a few months, the new process, led by a confident and motivated leadership team, enabled closer company-wide collaboration during tumultuous market conditions. That offset price inflation for materials (which adversely affected peers) and maintained the company’s EBITDA performance.

Our research shows that these high-maturity IBP examples are in the minority. In practice, few companies use the IBP process to support effective decision making (Exhibit 2). For two-thirds of the organizations in our data set, IBP meetings are periodic business reviews rather than an integral part of the continuous cycle of decisions and adjustments needed to keep organizations aligned with their strategic and tactical goals. Some companies delegate IBP to junior staff. The frequency of meetings averages one a month. That can make these processes especially ineffective—lacking either the senior-level participation for making consequential strategic decisions or the frequency for timely operational reactions.

Finally, most companies struggle to turn their plans into effective actions: critical metrics and responsibilities are not aligned across functions, so it’s hard to steer the business in a collaborative way. Who is responsible for the accuracy of forecasts? What steps will be taken to improve it? How about adherence to the plan? Are functions incentivized to hold excess inventory? Less than 10 percent of all companies have a performance management system that encourages the right behavior across the organization.

By contrast, at the most effective organizations, IBP meetings are all about decisions and their impact on the P&L—an impact enabled by focused metrics and incentives for collaboration. Relevant inputs (data, insights, and decision scenarios) are diligently prepared and syndicated before meetings to help decision makers make the right choices quickly and effectively. These companies support IBP by managing their short-term planning decisions prescriptively, specifying thresholds to distinguish changes immediately integrated into existing plans from day-to-day noise. Within such boundaries, real-time daily decisions are made in accordance with the objectives of the entire business, not siloed frontline functions. This responsive execution is tightly linked with the IBP process, so that the fact base is always up-to-date for the next planning iteration.

A better plan for IBP

In our experience, integrated business planning can help a business succeed in a sustainable way if three conditions are met. First, the process must be designed for the P&L owner, not individual functions in the business. Second, processes are built for purpose, not from generic best-practice templates. Finally, the people involved in the process have the authority, skills, and confidence to make relevant, consequential decisions.

Design for the P&L owner

IBP gives leaders a systematic opportunity to unlock P&L performance by coordinating strategies and tactics across traditional business functions. This doesn’t mean that IBP won’t function as a business review process, but it is more effective when focused on decisions in the interest of the whole business. An IBP process designed to help P&L owners make effective decisions as they run the company creates requirements different from those of a process owned by individual functions, such as supply chain or manufacturing.

One fundamental requirement is senior-level participation from all stakeholder functions and business areas, so that decisions can be made in every meeting. The design of the IBP cycle, including preparatory work preceding decision-making meetings, should help leaders make general decisions or resolve minor issues outside of formal milestone meetings. It should also focus the attention of P&L leaders on the most important and pressing issues. These goals can be achieved with disciplined approaches to evaluating the impact of decisions and with financial thresholds that determine what is brought to the attention of the P&L leader.

The aggregated output of the IBP process would be a full, risk-evaluated business plan covering a midterm planning horizon. This plan then becomes the only accepted and executed plan across the organization. The objective isn’t a single hard number. It is an accepted, unified view of which new products will come online and when, and how they will affect the performance of the overall portfolio. The plan will also take into account the variabilities and uncertainties of the business: demand expectations, how the company will respond to supply constraints, and so on. Layered risks and opportunities and aligned actions across stakeholders indicate how to execute the plan.

Would you like to learn more about our Operations Practice ?

Trade-offs arising from risks and opportunities in realizing revenues, margins, or cost objectives are determined by the P&L owner at the level where those trade-offs arise—local for local, global for global. To make this possible, data visible in real time and support for decision making in meetings are essential. This approach works best in companies with strong data governance processes and tools, which increase confidence in the objectivity of the IBP process and support for implementing the resulting decisions. In addition, senior leaders can demonstrate their commitment to the value and the standards of IBP by participating in the process, sponsoring capability-building efforts for the teams that contribute inputs to the IBP, and owning decisions and outcomes.

Fit-for-purpose process design and frequency

To make IBP a value-adding capability, the business will probably need to redesign its planning processes from a clean sheet.

First, clean sheeting IBP means that it should be considered and designed from the decision maker’s perspective. What information does a P&L owner need to make a decision on a given topic? What possible scenarios should that leader consider, and what would be their monetary and nonmonetary impact? The IBP process can standardize this information—for example, by summarizing it in templates so that the responsible parties know, up front, which data, analytics, and impact information to provide.

Second, essential inputs into IBP determine its quality. These inputs include consistency in the way planners use data, methods, and systems to make accurate forecasts, manage constraints, simulate scenarios, and close the loop from planning to the production shopfloor by optimizing schedules, monitoring adherence, and using incentives to manufacture according to plan.

Determining the frequency of the IBP cycle, and its timely integration with tactical execution processes, would also be part of this redesign. Big items—such as capacity investments and divestments, new-product introductions, and line extensions—should be reviewed regularly. Monthly reviews are typical, but a quarterly cadence may also be appropriate in situations with less frequent changes. Weekly iterations then optimize the plan in response to confirmed orders, short-term capacity constraints, or other unpredictable events. The bidirectional link between planning and execution must be strong, and investments in technology may be required to better connect them, so that they use the same data repository and have continuous-feedback loops.

Authorize consequential decision making

Finally, every IBP process step needs autonomous decision making for the problems in its scope, as well as a clear path to escalate, if necessary. The design of the process must therefore include decision-type authority, decision thresholds, and escalation paths. Capability-building interventions should support teams to ensure disciplined and effective decision making—and that means enforcing participation discipline, as well. The failure of a few key stakeholders to prioritize participation can undermine the whole process.

Decision-making autonomy is also relevant for short-term planning and execution. Success in tactical execution depends on how early a problem is identified and how quickly and effectively it is resolved. A good execution framework includes, for example, a classification of possible events, along with resolution guidelines based on root cause methodology. It should also specify the thresholds, in scope and scale of impact, for operational decision making and the escalation path if those thresholds are met.

Transforming supply chains: Do you have the skills to accelerate your capabilities?

In addition to guidelines for decision making, the cross-functional team in charge of executing the plan needs autonomy to decide on a course of action for events outside the original plan, as well as the authority to see those actions implemented. Clear integration points between tactical execution and the IBP process protect the latter’s focus on midterm decision making and help tactical teams execute in response to immediate market needs.

An opportunity, but no ‘silver bullet’

With all the elements described above, IBP has a solid foundation to create value for a business. But IBP is no silver bullet. To achieve a top-performing supply chain combining timely and complete customer service with optimal cost and capital expenditures, companies also need mature planning and fulfillment processes using advanced systems and tools. That would include robust planning discipline and a collaboration culture covering all time horizons with appropriate processes while integrating commercial, planning, manufacturing, logistics, and sourcing organizations at all relevant levels.

As more companies implement advanced planning systems and nerve centers , the typical monthly IBP frequency might no longer be appropriate. Some companies may need to spend more time on short-term execution by increasing the frequency of planning and replanning. Others may be able to retain a quarterly IBP process, along with a robust autonomous-planning or exception engine. Already, advanced planning systems not only direct the valuable time of experts to the most critical demand and supply imbalances but also aggregate and disaggregate large volumes of data on the back end. These targeted reactions are part of a critical learning mechanism for the supply chain.

Over time, with root cause analyses and cross-functional collaboration on systemic fixes, the supply chain’s nerve center can get smarter at executing plans, separating noise from real issues, and proactively managing deviations. All this can eventually shorten IBP cycles, without the risk of overreacting to noise, and give P&L owners real-time transparency into how their decisions might affect performance.

P&L owners thinking about upgrading their S&OP or IBP processes can’t rely on textbook checklists. Instead, they can assume leadership of IBP and help their organizations turn strategies and plans into effective actions. To do so, they must sponsor IBP as a cross-functional driver of business decisions, fed by thoughtfully designed processes and aligned decision rights, as well as a performance management and capability-building system that encourages the right behavior and learning mechanisms across the organization. As integrated planning matures, supported by appropriate technology and maturing supply chain–management practices, it could shorten decision times and accelerate its impact on the business.

Elena Dumitrescu is a senior knowledge expert in McKinsey’s Toronto office, Matt Jochim is a partner in the London office, and Ali Sankur is a senior expert and associate partner in the Chicago office, where Ketan Shah is a partner.

Explore a career with us

Related articles.

To improve your supply chain, modernize your supply-chain IT

Supply-chain resilience: Is there a holy grail?

Business Planning

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Get Any Financial Question Answered

Table of contents, what is business planning.

Business planning is a crucial process that involves creating a roadmap for an organization to achieve its long-term objectives. It is the foundation of every successful business and provides a framework for decision-making, resource allocation, and measuring progress towards goals.

Business planning involves identifying the current state of the organization, determining where it wants to go, and developing a strategy to get there.

It includes analyzing the market, identifying target customers, determining a competitive advantage, setting financial goals, and establishing operational plans.

The business plan serves as a reference point for all stakeholders , including investors, employees, and partners, and helps to ensure that everyone is aligned and working towards the same objectives.

Importance of Business Planning

Business planning plays a critical role in the success of any organization, as it helps to establish a clear direction and purpose for the business. It allows the organization to identify its goals and objectives, develop strategies and tactics to achieve them, and establish a framework of necessary resources and operational procedures to ensure success.

Additionally, a well-crafted business plan can serve as a reference point for decision-making, ensuring that all actions taken by the organization are aligned with its long-term objectives.

It can also facilitate communication and collaboration among team members, ensuring that everyone is working towards a common goal.

Furthermore, a business plan is often required when seeking funding or investment from external sources, as it demonstrates the organization's potential for growth and profitability. Overall, business planning is essential for any organization looking to succeed and thrive in a competitive market.

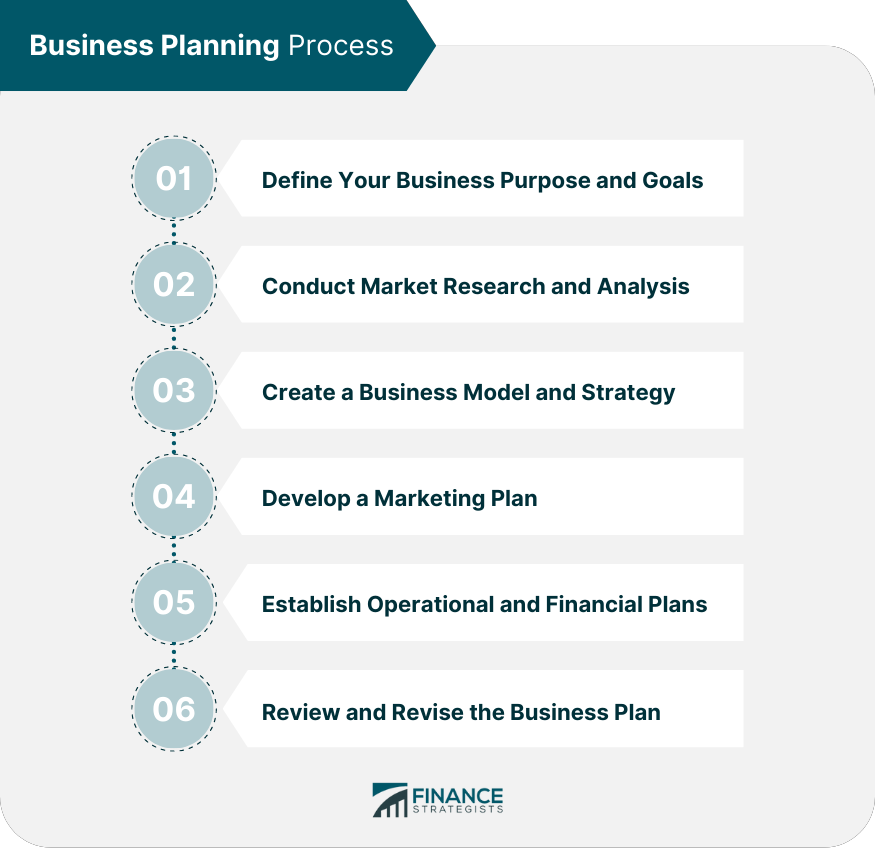

Business Planning Process

Step 1: defining your business purpose and goals.

Begin by clarifying your business's purpose, mission, and long-term goals. These elements should align with the organization's core values and guide every aspect of the planning process.

Step 2: Conducting Market Research and Analysis

Thorough market research and analysis are crucial to understanding the industry landscape, identifying target customers, and gauging the competition. This information will inform your business strategy and help you find your niche in the market.

Step 3: Creating a Business Model and Strategy

Based on the insights from your market research, develop a business model that outlines how your organization will create, deliver, and capture value. This will inform the overall business strategy, including identifying target markets, value propositions, and competitive advantages.

Step 4: Developing a Marketing Plan

A marketing plan details how your organization will promote its products or services to target customers. This includes defining marketing objectives, tactics, channels, budgets, and performance metrics to measure success.

Step 5: Establishing Operational and Financial Plans

The operational plan outlines the day-to-day activities, resources, and processes required to run your business. The financial plan projects revenue, expenses, and cash flow, providing a basis for assessing the organization's financial health and long-term viability.

Step 6: Reviewing and Revising the Business Plan

Regularly review and update your business plan to ensure it remains relevant and reflects the organization's current situation and goals. This iterative process enables proactive adjustments to strategies and tactics in response to changing market conditions and business realities.

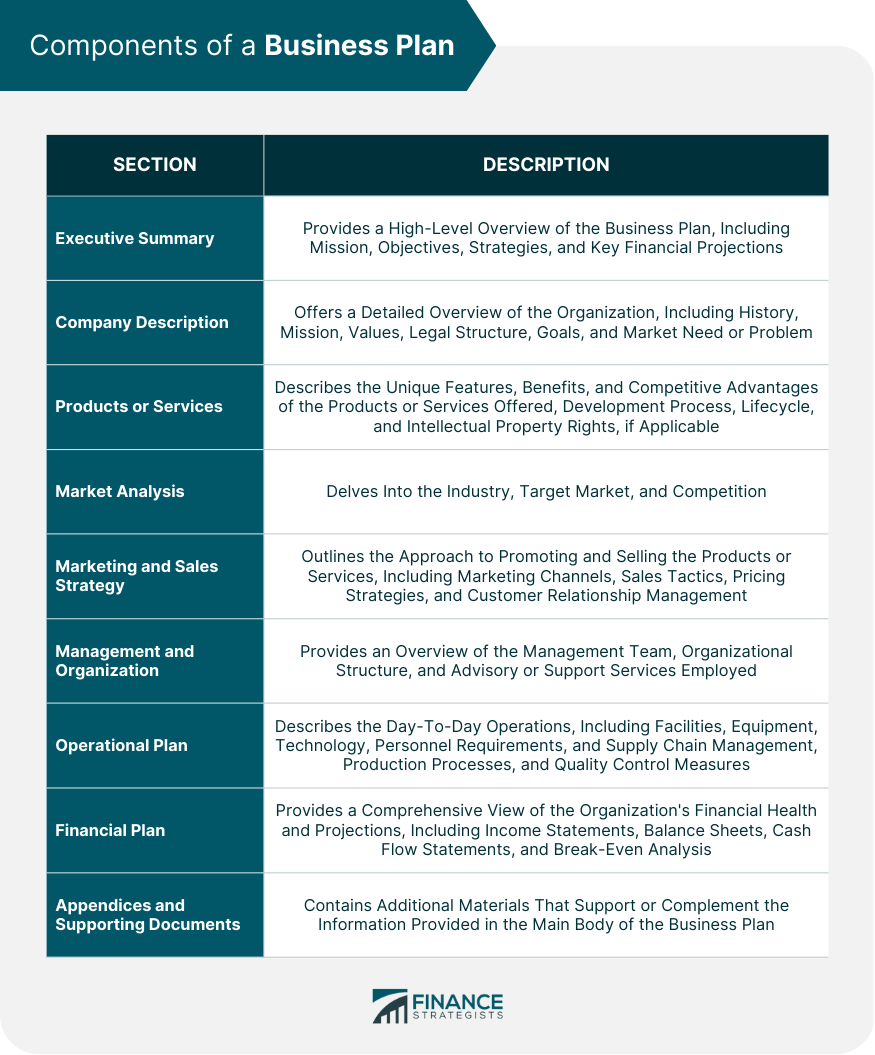

Components of a Business Plan

Executive summary.

The executive summary provides a high-level overview of your business plan, touching on the company's mission, objectives, strategies, and key financial projections.

It is critical to make this section concise and engaging, as it is often the first section that potential investors or partners will read.

Company Description

The company description offers a detailed overview of your organization, including its history, mission, values, and legal structure. It also outlines the company's goals and objectives and explains how the business addresses a market need or problem.

Products or Services

Describe the products or services your company offers, emphasizing their unique features, benefits, and competitive advantages. Detail the development process, lifecycle, and intellectual property rights, if applicable.

Market Analysis

The market analysis section delves into the industry, target market, and competition. It should demonstrate a thorough understanding of market trends, growth potential, customer demographics, and competitive landscape.

Marketing and Sales Strategy

Outline your organization's approach to promoting and selling its products or services. This includes marketing channels, sales tactics, pricing strategies, and customer relationship management .

Management and Organization

This section provides an overview of your company's management team, including their backgrounds, roles, and responsibilities. It also outlines the organizational structure and any advisory or support services employed by the company.

Operational Plan

The operational plan describes the day-to-day operations of your business, including facilities, equipment, technology, and personnel requirements. It also covers supply chain management, production processes, and quality control measures.

Financial Plan

The financial plan is a crucial component of your business plan, providing a comprehensive view of your organization's financial health and projections.

This section should include income statements , balance sheets , cash flow statements , and break-even analysis for at least three to five years. Be sure to provide clear assumptions and justifications for your projections.

Appendices and Supporting Documents

The appendices and supporting documents section contains any additional materials that support or complement the information provided in the main body of the business plan. This may include resumes of key team members, patents , licenses, contracts, or market research data.

Benefits of Business Planning

Helps secure funding and investment.

A well-crafted business plan demonstrates to potential investors and lenders that your organization is well-organized, has a clear vision, and is financially viable. It increases your chances of securing the funding needed for growth and expansion.

Provides a Roadmap for Growth and Success

A business plan serves as a roadmap that guides your organization's growth and development. It helps you set realistic goals, identify opportunities, and anticipate challenges, enabling you to make informed decisions and allocate resources effectively.

Enables Effective Decision-Making

Having a comprehensive business plan enables you and your management team to make well-informed decisions, based on a clear understanding of the organization's goals, strategies, and financial situation.

Facilitates Communication and Collaboration

A business plan serves as a communication tool that fosters collaboration and alignment among team members, ensuring that everyone is working towards the same objectives and understands the organization's strategic direction.

Business planning should not be a one-time activity; instead, it should be an ongoing process that is continually reviewed and updated to reflect changing market conditions, business realities, and organizational goals.

This dynamic approach to planning ensures that your organization remains agile, responsive, and primed for success.

As the business landscape continues to evolve, organizations must embrace new technologies, methodologies, and tools to stay competitive.

The future of business planning will involve leveraging data-driven insights, artificial intelligence, and predictive analytics to create more accurate and adaptive plans that can quickly respond to a rapidly changing environment.

By staying ahead of the curve, businesses can not only survive but thrive in the coming years.

Business Planning FAQs

What is business planning, and why is it important.

Business planning is the process of setting goals, outlining strategies, and creating a roadmap for your company's future. It's important because it helps you identify opportunities and risks, allocate resources effectively, and stay on track to achieve your goals.

What are the key components of a business plan?

A business plan typically includes an executive summary, company description, market analysis, organization and management structure, product or service line, marketing and sales strategies, and financial projections.

How often should I update my business plan?

It is a good idea to review and update your business plan annually, or whenever there's a significant change in your industry or market conditions.

What are the benefits of business planning?

Effective business planning can help you anticipate challenges, identify opportunities for growth, improve decision-making, secure financing, and stay ahead of competitors.

Do I need a business plan if I am not seeking funding?

Yes, even if you're not seeking funding, a business plan can be a valuable tool for setting goals, developing strategies, and keeping your team aligned and focused on achieving your objectives.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Business Continuity Planning (BCP)

- Business Exit Strategies

- Buy-Sell Agreements

- Capital Planning

- Change-In-Control Agreements

- Cross-Purchase Agreements

- Decision Analysis (DA)

- Employee Retention and Compensation Planning

- Endorsement & Sponsorship Management

- Enterprise Resource Planning (ERP)

- Entity-Purchase Agreements

- Family Business Continuity

- Family Business Governance

- Family Limited Partnerships (FLPs) and Buy-Sell Agreements

- Human Resource Planning (HRP)

- Manufacturing Resource Planning (MRP II)

- Plan Restatement

Ask a Financial Professional Any Question

Find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

To Ensure One Vote Per Person, Please Include the Following Info

Great thank you for voting..

What is a business planning manager and how to become one

A business planning manager is a professional who oversees the process of business management. They are responsible for ensuring that staff meets productivity goals and targets, recruiting and training new staff, handling budgets for projects, and identifying opportunities to increase revenue resources and profits. They also coordinate with clients for updates and adjust business plans as needed. Business planning managers use various skills, such as demand planning, financial analysis, and market research, to design processes, provide strategic recommendations, and drive new and incremental sales. They also manage teams, provide executive directors with suggestions, and work towards meeting company objectives.

How long does it takes to become a business planning manager?

It typically takes 9-11 years to become a business planning manager:

- Years 1-4: Obtaining a Bachelor's degree in a relevant field, such as business administration, finance, or economics.

- Years 5-6: Accumulating the necessary work experience in roles such as financial analyst or management trainee.

- Years 7-9: Continuing to gain experience in roles such as senior financial analyst or assistant business planning manager.

- Year 10-11: Completing 1-3 months of on-the-job training in business planning and management.

- Salary $115,251

- Growth Rate 10%

- Jobs Number 133,931

- Most Common Skill Business Planning

- Most Common Degree Bachelor's degree

- Best State Washington

Business Planning Manager career paths

A business planning manager's career path can take various directions. They may progress to become finance directors, vice presidents, or directors of sales. They may also pursue roles in business development, marketing, or sales management. Some may even become managers of stores or products. Finally, they may become senior managers or directors in areas like strategic alliances, product management, or customer support.

Key steps to become a business planning manager

Explore business planning manager education requirements.

The educational requirements for a business planning manager typically involve a bachelor's degree. In fact, 55.76% of business planning managers hold a bachelor's degree. According to Dr. Mark Harvey , Associate Professor at the University of Saint Mary, critical and creative thinking are crucial soft skills for business planning managers. He states, "Employers value problem solvers. A Business Development Manager's problem usually is finding growth opportunities. Candidates need to learn to take the initiative to figure out how to solve problems like those." Additionally, writing, speaking, and social skills are also important for success in this role.

Most common business planning manager degrees

Bachelor's

Master's

Start to develop specific business planning manager skills

A business planning manager's important skills include demand planning, financial analysis, competitive analysis, market research, and supply chain management. They must be able to analyze data and track achievement of project metrics, costs incurred, and resource allocation processes. They also must be able to create, communicate, and coordinate quarterly adjustments to the annual plan as dictated by corporate business planning and operational requirements.

Complete relevant business planning manager training and internships

Research business planning manager duties and responsibilities.

A business planning manager's responsibilities include demand planning for various product lines, identifying sales opportunities, managing customer service, and analyzing budgets and capital expenditures. They also track and analyze retail consumer price elasticity, coordinate supply chain planning activities, and serve as information storage supplies organization marketing business development managers. Additionally, they monitor financial results, analyze data, and manage the development of tools and templates to increase the effectiveness of business analysis. They also direct periodic risk calibration meetings, create compensation transactions, and utilize DOE and 6 Sigma techniques to resolve recurring issues.

- Lead central team summarizing and prioritizing all DOD opportunities, enabling more efficient and effective resource allocation across several program departments.

- Create and implement new product BOM's.

- Verify WIP movement transactions are complete and with the latest BOM changes.

- Provide management with managerial reporting, variances explanations, and KPIs for decision making.

Prepare your business planning manager resume

When your background is strong enough, you can start writing your business planning manager resume.

You can use Zippia's AI resume builder to make the resume writing process easier while also making sure that you include key information that hiring managers expect to see on a business planning manager resume. You'll find resume tips and examples of skills, responsibilities, and summaries, all provided by Zippi, your career sidekick.

Choose From 10+ Customizable Business Planning Manager Resume templates

Apply for business planning manager jobs

Now it's time to start searching for a business planning manager job. Consider the tips below for a successful job search:

- Browse job boards for relevant postings

- Consult your professional network

- Reach out to companies you're interested in working for directly

- Watch out for job scams

Are you a Business Planning Manager?

Share your story for a free salary report.

Average business planning manager salary

The average Business Planning Manager salary in the United States is $115,251 per year or $55 per hour. Business planning manager salaries range between $87,000 and $151,000 per year.

What Am I Worth?

How do business planning managers rate their job?

Updated April 25, 2024

Editorial Staff

The Zippia Research Team has spent countless hours reviewing resumes, job postings, and government data to determine what goes into getting a job in each phase of life. Professional writers and data scientists comprise the Zippia Research Team.

Business Planning Manager Related Careers

- Brand Manager

- Business Development And Marketing Manager

- Business Development Manager

- Business Director

- Business Leader

- Business Manager

- Business Operations Manager

- Business Partner

- Business Unit Manager

- Manager Finance Planning And Analysis

- Manager, Strategy

- Market Manager

- Media Manager

- Planning Director

- Planning Manager

Business Planning Manager Related Jobs

- Brand Manager Jobs

- Business Development And Marketing Manager Jobs

- Business Development Manager Jobs

- Business Director Jobs

- Business Leader Jobs

- Business Manager Jobs

- Business Operations Manager Jobs

- Business Partner Jobs

- Business Unit Manager Jobs

- Manager Finance Planning And Analysis Jobs

- Manager, Strategy Jobs

- Market Manager Jobs

- Media Manager Jobs

- Planning Director Jobs

- Planning Manager Jobs

What Similar Roles Do

- What Does a Brand Manager Do

- What Does a Business Development And Marketing Manager Do

- What Does a Business Development Manager Do

- What Does a Business Director Do

- What Does a Business Leader Do

- What Does a Business Manager Do

- What Does a Business Operations Manager Do

- What Does a Business Partner Do

- What Does a Business Unit Manager Do

- What Does a Manager Finance Planning And Analysis Do

- What Does a Manager, Strategy Do

- What Does a Market Manager Do

- What Does a Media Manager Do

- What Does a Planning Director Do

- What Does a Planning Manager Do

Resume For Related Jobs

- Brand Manager Resume

- Business Development And Marketing Manager Resume

- Business Development Manager Resume

- Business Director Resume

- Business Leader Resume

- Business Manager Resume

- Business Operations Manager Resume

- Business Partner Resume

- Business Unit Manager Resume

- Manager Finance Planning And Analysis Resume

- Manager, Strategy Resume

- Market Manager Resume

- Media Manager Resume

- Planning Director Resume

- Planning Manager Resume

- Zippia Careers

- Executive Management Industry

- Business Planning Manager

Browse executive management jobs

Table of Contents

What is a business plan, the advantages of having a business plan, the types of business plans, the key elements of a business plan, best business plan software, common challenges of writing a business plan, become an expert business planner, business planning: it’s importance, types and key elements.

Every year, thousands of new businesses see the light of the day. One look at the World Bank's Entrepreneurship Survey and database shows the mind-boggling rate of new business registrations. However, sadly, only a tiny percentage of them have a chance of survival.

According to the Bureau of Labor Statistics, about 20% of small businesses fail in their first year, about 50% in their fifth year.

Research from the University of Tennessee found that 44% of businesses fail within the first three years. Among those that operate within specific sectors, like information (which includes most tech firms), 63% shut shop within three years.

Several other statistics expose the abysmal rates of business failure. But why are so many businesses bound to fail? Most studies mention "lack of business planning" as one of the reasons.

This isn’t surprising at all.

Running a business without a plan is like riding a motorcycle up a craggy cliff blindfolded. Yet, way too many firms ( a whopping 67%) don't have a formal business plan in place.

It doesn't matter if you're a startup with a great idea or a business with an excellent product. You can only go so far without a roadmap — a business plan. Only, a business plan is so much more than just a roadmap. A solid plan allows a business to weather market challenges and pivot quickly in the face of crisis, like the one global businesses are struggling with right now, in the post-pandemic world.

But before you can go ahead and develop a great business plan, you need to know the basics. In this article, we'll discuss the fundamentals of business planning to help you plan effectively for 2021.

Now before we begin with the details of business planning, let us understand what it is.

No two businesses have an identical business plan, even if they operate within the same industry. So one business plan can look entirely different from another one. Still, for the sake of simplicity, a business plan can be defined as a guide for a company to operate and achieve its goals.

More specifically, it's a document in writing that outlines the goals, objectives, and purpose of a business while laying out the blueprint for its day-to-day operations and key functions such as marketing, finance, and expansion.

A good business plan can be a game-changer for startups that are looking to raise funds to grow and scale. It convinces prospective investors that the venture will be profitable and provides a realistic outlook on how much profit is on the cards and by when it will be attained.

However, it's not only new businesses that greatly benefit from a business plan. Well-established companies and large conglomerates also need to tweak their business plans to adapt to new business environments and unpredictable market changes.

Before getting into learning more about business planning, let us learn the advantages of having one.

Since a detailed business plan offers a birds-eye view of the entire framework of an establishment, it has several benefits that make it an important part of any organization. Here are few ways a business plan can offer significant competitive edge.

- Sets objectives and benchmarks: Proper planning helps a business set realistic objectives and assign stipulated time for those goals to be met. This results in long-term profitability. It also lets a company set benchmarks and Key Performance Indicators (KPIs) necessary to reach its goals.

- Maximizes resource allocation: A good business plan helps to effectively organize and allocate the company’s resources. It provides an understanding of the result of actions, such as, opening new offices, recruiting fresh staff, change in production, and so on. It also helps the business estimate the financial impact of such actions.

- Enhances viability: A plan greatly contributes towards turning concepts into reality. Though business plans vary from company to company, the blueprints of successful companies often serve as an excellent guide for nascent-stage start-ups and new entrepreneurs. It also helps existing firms to market, advertise, and promote new products and services into the market.

- Aids in decision making: Running a business involves a lot of decision making: where to pitch, where to locate, what to sell, what to charge — the list goes on. A well thought-out business plan provides an organization the ability to anticipate the curveballs that the future could throw at them. It allows them to come up with answers and solutions to these issues well in advance.

- Fix past mistakes: When businesses create plans keeping in mind the flaws and failures of the past and what worked for them and what didn’t, it can help them save time, money, and resources. Such plans that reflects the lessons learnt from the past offers businesses an opportunity to avoid future pitfalls.

- Attracts investors: A business plan gives investors an in-depth idea about the objectives, structure, and validity of a firm. It helps to secure their confidence and encourages them to invest.

Now let's look at the various types involved in business planning.

Become a Business and Leadership Professional

- Top 10 skills in demand Business Analysis As A Skill In 2020

- 14% Growth in Jobs Of Business Analysis Profile By 2028

Business Analyst

- Industry-recognized certifications from IBM and Simplilearn

- Masterclasses from IBM experts

Post Graduate Program in Business Analysis

- Certificate from Simplilearn in collaboration with Purdue University

- Become eligible to be part of the Purdue University Alumni Association

Here's what learners are saying regarding our programs:

Assistant Consultant at Tata Consultancy Services , Tata Consultancy Services

My experience with Simplilearn has been great till now. They have good materials to start with, and a wide range of courses. I have signed up for two courses with Simplilearn over the past 6 months, Data Scientist and Agile and Scrum. My experience with both is good. One unique feature I liked about Simplilearn is that they give pre-requisites that you should complete, before a live class, so that you go there fully prepared. Secondly, there support staff is superb. I believe there are two teams, to cater to the Indian and US time zones. Simplilearn gives you the most methodical and easy way to up-skill yourself. Also, when you compare the data analytics courses across the market that offer web-based tutorials, Simplilearn, scores over the rest in my opinion. Great job, Simplilearn!

I was keenly looking for a change in my domain from business consultancy to IT(Business Analytics). This Post Graduate Program in Business Analysis course helped me achieve the same. I am proficient in business analysis now and am looking for job profiles that suit my skill set.

Business plans are formulated according to the needs of a business. It can be a simple one-page document or an elaborate 40-page affair, or anything in between. While there’s no rule set in stone as to what exactly a business plan can or can’t contain, there are a few common types of business plan that nearly all businesses in existence use.

Here’s an overview of a few fundamental types of business plans.

- Start-up plan: As the name suggests, this is a documentation of the plans, structure, and objections of a new business establishments. It describes the products and services that are to be produced by the firm, the staff management, and market analysis of their production. Often, a detailed finance spreadsheet is also attached to this document for investors to determine the viability of the new business set-up.

- Feasibility plan: A feasibility plan evaluates the prospective customers of the products or services that are to be produced by a company. It also estimates the possibility of a profit or a loss of a venture. It helps to forecast how well a product will sell at the market, the duration it will require to yield results, and the profit margin that it will secure on investments.

- Expansion Plan: This kind of plan is primarily framed when a company decided to expand in terms of production or structure. It lays down the fundamental steps and guidelines with regards to internal or external growth. It helps the firm to analyze the activities like resource allocation for increased production, financial investments, employment of extra staff, and much more.

- Operations Plan: An operational plan is also called an annual plan. This details the day-to-day activities and strategies that a business needs to follow in order to materialize its targets. It outlines the roles and responsibilities of the managing body, the various departments, and the company’s employees for the holistic success of the firm.

- Strategic Plan: This document caters to the internal strategies of the company and is a part of the foundational grounds of the establishments. It can be accurately drafted with the help of a SWOT analysis through which the strengths, weaknesses, opportunities, and threats can be categorized and evaluated so that to develop means for optimizing profits.

There is some preliminary work that’s required before you actually sit down to write a plan for your business. Knowing what goes into a business plan is one of them.

Here are the key elements of a good business plan:

- Executive Summary: An executive summary gives a clear picture of the strategies and goals of your business right at the outset. Though its value is often understated, it can be extremely helpful in creating the readers’ first impression of your business. As such, it could define the opinions of customers and investors from the get-go.

- Business Description: A thorough business description removes room for any ambiguity from your processes. An excellent business description will explain the size and structure of the firm as well as its position in the market. It also describes the kind of products and services that the company offers. It even states as to whether the company is old and established or new and aspiring. Most importantly, it highlights the USP of the products or services as compared to your competitors in the market.

- Market Analysis: A systematic market analysis helps to determine the current position of a business and analyzes its scope for future expansions. This can help in evaluating investments, promotions, marketing, and distribution of products. In-depth market understanding also helps a business combat competition and make plans for long-term success.

- Operations and Management: Much like a statement of purpose, this allows an enterprise to explain its uniqueness to its readers and customers. It showcases the ways in which the firm can deliver greater and superior products at cheaper rates and in relatively less time.

- Financial Plan: This is the most important element of a business plan and is primarily addressed to investors and sponsors. It requires a firm to reveal its financial policies and market analysis. At times, a 5-year financial report is also required to be included to show past performances and profits. The financial plan draws out the current business strategies, future projections, and the total estimated worth of the firm.

The importance of business planning is it simplifies the planning of your company's finances to present this information to a bank or investors. Here are the best business plan software providers available right now:

- Business Sorter

The importance of business planning cannot be emphasized enough, but it can be challenging to write a business plan. Here are a few issues to consider before you start your business planning:

- Create a business plan to determine your company's direction, obtain financing, and attract investors.

- Identifying financial, demographic, and achievable goals is a common challenge when writing a business plan.

- Some entrepreneurs struggle to write a business plan that is concise, interesting, and informative enough to demonstrate the viability of their business idea.

- You can streamline your business planning process by conducting research, speaking with experts and peers, and working with a business consultant.

Whether you’re running your own business or in-charge of ensuring strategic performance and growth for your employer or clients, knowing the ins and outs of business planning can set you up for success.

Be it the launch of a new and exciting product or an expansion of operations, business planning is the necessity of all large and small companies. Which is why the need for professionals with superior business planning skills will never die out. In fact, their demand is on the rise with global firms putting emphasis on business analysis and planning to cope with cut-throat competition and market uncertainties.

While some are natural-born planners, most people have to work to develop this important skill. Plus, business planning requires you to understand the fundamentals of business management and be familiar with business analysis techniques . It also requires you to have a working knowledge of data visualization, project management, and monitoring tools commonly used by businesses today.

Simpliearn’s Executive Certificate Program in General Management will help you develop and hone the required skills to become an extraordinary business planner. This comprehensive general management program by IIM Indore can serve as a career catalyst, equipping professionals with a competitive edge in the ever-evolving business environment.

What Is Meant by Business Planning?

Business planning is developing a company's mission or goals and defining the strategies you will use to achieve those goals or tasks. The process can be extensive, encompassing all aspects of the operation, or it can be concrete, focusing on specific functions within the overall corporate structure.

What Are the 4 Types of Business Plans?

The following are the four types of business plans:

Operational Planning

This type of planning typically describes the company's day-to-day operations. Single-use plans are developed for events and activities that occur only once (such as a single marketing campaign). Ongoing plans include problem-solving policies, rules for specific regulations, and procedures for a step-by-step process for achieving particular goals.

Strategic Planning

Strategic plans are all about why things must occur. A high-level overview of the entire business is included in strategic planning. It is the organization's foundation and will dictate long-term decisions.

Tactical Planning

Tactical plans are about what will happen. Strategic planning is aided by tactical planning. It outlines the tactics the organization intends to employ to achieve the goals outlined in the strategic plan.

Contingency Planning

When something unexpected occurs or something needs to be changed, contingency plans are created. In situations where a change is required, contingency planning can be beneficial.

What Are the 7 Steps of a Business Plan?

The following are the seven steps required for a business plan:

Conduct Research

If your company is to run a viable business plan and attract investors, your information must be of the highest quality.

Have a Goal

The goal must be unambiguous. You will waste your time if you don't know why you're writing a business plan. Knowing also implies having a target audience for when the plan is expected to get completed.

Create a Company Profile

Some refer to it as a company profile, while others refer to it as a snapshot. It's designed to be mentally quick and digestible because it needs to stick in the reader's mind quickly since more information is provided later in the plan.

Describe the Company in Detail

Explain the company's current situation, both good and bad. Details should also include patents, licenses, copyrights, and unique strengths that no one else has.

Create a marketing plan ahead of time.

A strategic marketing plan is required because it outlines how your product or service will be communicated, delivered, and sold to customers.

Be Willing to Change Your Plan for the Sake of Your Audience

Another standard error is that people only write one business plan. Startups have several versions, just as candidates have numerous resumes for various potential employers.

Incorporate Your Motivation

Your motivation must be a compelling reason for people to believe your company will succeed in all circumstances. A mission should drive a business, not just selling, to make money. That mission is defined by your motivation as specified in your business plan.

What Are the Basic Steps in Business Planning?

These are the basic steps in business planning:

Summary and Objectives

Briefly describe your company, its objectives, and your plan to keep it running.

Services and Products

Add specifics to your detailed description of the product or service you intend to offer. Where, why, and how much you plan to sell your product or service and any special offers.

Conduct research on your industry and the ideal customers to whom you want to sell. Identify the issues you want to solve for your customers.

Operations are the process of running your business, including the people, skills, and experience required to make it successful.

How are you going to reach your target audience? How you intend to sell to them may include positioning, pricing, promotion, and distribution.

Consider funding costs, operating expenses, and projected income. Include your financial objectives and a breakdown of what it takes to make your company profitable. With proper business planning through the help of support, system, and mentorship, it is easy to start a business.

Our Business And Leadership Courses Duration And Fees

Business And Leadership Courses typically range from a few weeks to several months, with fees varying based on program and institution.

Get Free Certifications with free video courses

Business and Leadership

Business Analysis Basics

Data Science & Business Analytics

Business Intelligence Fundamentals

Learn from Industry Experts with free Masterclasses

The Modern Day Business Analyst Role: AI Tools and Techniques for Success

Product Manager Role Breakdown: Skills, Career Paths, and Salaries

Career Information Session: Find Out How to Become a Business Analyst with IIT Roorkee

Recommended Reads

Business Intelligence Career Guide: Your Complete Guide to Becoming a Business Analyst

Corporate Succession Planning: How to Create Leaders According to the Business Need

Top Business Analyst Skills

Business Analytics Basics: A Beginner’s Guide

Financial Planning for Businesses Across the Globe

How to Become a Business Analyst

Get Affiliated Certifications with Live Class programs

- PMP, PMI, PMBOK, CAPM, PgMP, PfMP, ACP, PBA, RMP, SP, and OPM3 are registered marks of the Project Management Institute, Inc.

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..