That's 'Interest'ing May 2022 - A Primer on Interest Rate Caps

When the interest rate on a mortgage financing is not fixed, the amount that a borrower may be required to pay may fluctuate depending on changes in the underlying index to which the “margin” or “spread” is tied. While a lender may be comfortable with its underwriting of a financing and the ability of its borrower to service its debt at closing, if the underlying index of a floating rate loan changes over time, the lender’s comfort and the ability of its borrower to service its debt will obviously change. To combat against interest rate volatility, borrowers and lenders usually agree to hedge the interest rate against the uncertainty in the market for floating rate loans. The most common form of such hedging is an “interest rate cap.”

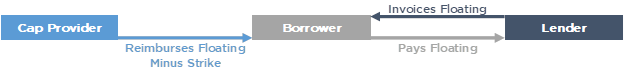

An interest rate cap is a derivative whereby the interest rate cap provider (the “counterparty”) agrees to pay the interest which would be payable by the borrower over a strike price (the “strike”) on the notional amount (the principal amount) of the loan. Consequently, if the index of the loan rises above the strike, the counterparty, and not the borrower, is liable for the excess interest payment obligation. In this way, the borrower’s liability for payment of interest on the loan in question is always “capped” at an amount equal to the strike plus the spread.

As additional collateral for a loan, the borrower will purchase an interest rate cap and pledge it to the lender. Simply put, the interest rate cap is an insurance policy on a floating rate loan, which protects the borrower and the lender if the interest rate index rises above the strike during a specified period of time (the “term”). The term of the cap is usually coterminous with the initial term of the loan. If the loan is extended, extensions are usually conditioned on the purchase of a new interest rate cap for the extended period.

Caps are purchased upfront with a single payment at the closing of a loan. After the premium is paid, the borrower has no further payment obligations. Most lenders will require borrowers to purchase the interest rate cap as a condition to closing the loan. Lenders also require that the cap provider have a minimum credit rating from Moody’s, S&P, Fitch or another rating agency. The interest rate cap is usually auctioned to a number of creditworthy financial institutions to secure the most favorable terms at the lowest premium price. Lenders will require the counterparty to maintain a certain rating level during the term. In the event that the counterparty does not maintain its rating, the borrower will typically be required to (i) replace the counterparty with a new counterparty that meets the qualifications and execute a new interest rate protection agreement, (ii) require the counterparty to supply a guaranty from a party meeting the ratings default, or (iii) cause the counterparty to deliver collateral to secure its exposure to the borrower in an amount acceptable to the lender and the rating agencies. In most cases, borrowers will choose either option (i) or (ii).

Since most caps are purchased through an auction process, a bid package is usually assembled for the bidders, which includes the agreed-upon terms of the interest rate cap, the timeline for which the auction must be completed, the assignment of interest rate cap protection agreement, and the form of confirmation. The confirmation describes the particulars of the transaction, such as the loan amount, payment dates, accrual periods and other pertinent dates, the rates, and other material items necessary to understand the parameters of the interest rate cap. It is important to review the confirmation and the bid package to ensure all terms are correct, and accurately reflect the terms of the transaction. At closing, the borrower will collaterally assign the interest rate cap agreement, which is additional collateral for the loan, and ensures the lender’s right to receive payments under the agreement.

While interest rate hedging takes many forms, interest rate caps are the most common derivative in mortgage financing. As we understand the process, we expect the market and traditional requirements to make implementation of this aspect of mortgage financing a smoother and simpler endeavor.

Related Posts

- ABCD ... ROFR and SLL June 2022 - Sustainability-Linked Loans Series, Part 2 – The Sustainability-Linked Loans Principles

Latest Posts

- The Biden Administration’s “Extensive Review of Interlocking Directorates Across the Entire Economy” May Put Your Board Representation At Risk

- In the UCC We Trust May 2024 - It Looks Like We Have Trust Issues

- DOL Issues Final Rule Regarding Fiduciary Investment Advice

- These Are Junk Fees

See more »

DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

Refine your interests »

Written by:

Published In:

Cadwalader, wickersham & taft llp on:.

"My best business intelligence, in one easy email…"

What Is An Interest Rate Cap?

An interest rate cap, a.k.a “cap”, is essentially an insurance policy, purchased by a borrower, that protects them against undesirable movements in a floating interest rate, most commonly 1-month LIBOR or SOFR. Caps have three primary economic terms:

- Notional: the dollar amount covered by the cap, typically equating to the loan amount

- Term: the duration of the cap, typically two or three years, commonly shorter than the loan term.

- Strike Rate: the interest rate level, above which the cap will provide a financial benefit to the borrower.

The concept is best explained via an example: Let’s assume that the 1-month LIBOR Strike Rate in the cap is 2.00% and 1-month LIBOR rises to 2.25%. The cap provider – typically a bank – would pay the borrower 0.25%. While the borrower still pays the LIBOR-driven market interest rate of 2.25%, the cap allows them to “buy down” their effective interest rate to the 2.00% Strike Rate.

Why Do Borrowers Buy A Cap?

The cap creates a ceiling on the borrower’s floating interest rate. Should the floating interest rate rise above the Strike Rate during any month over the life of the cap, the cap’s insurance feature serves to limit the cap owner’s exposure to a move higher in the floating rate; if the floating rate moves higher than the Strike Rate, the Cap serves to limit the financial damage.

To buy a cap, the borrower makes a single, upfront payment to the cap provider, typically a bank.

Interest rate caps are one of the most efficient ways to hedge against an increase in a floating interest rate and are most commonly used to hedge short term, “bridge” financings. Caps offer many advantages over other types of interest rate hedges, like swaps, such as:

- A defined cost, paid when the cap is purchased

- No prepayment penalty or termination cost

- Cap owner retains exposure to the floating rate, should it move lower

- Greatly reduced transaction cost

- Totally customizable, to achieve the perfect balance of protection and cost

- Can be bid out between multiple bank providers to achieve to lowest available cost

- Can be transferred to other floating rate debt

What Determines The Cost Of A Cap?

To explain how the cost of a cap is determined, Let’s drill down on a few key variables mentioned earlier. The cost is driven by the mix of:

- Notional: Often referred to as the “size” of the rate cap, the Notional typically equals the loan amount that it’s being used to hedge. In general, the larger the Notional, the higher the cap’s cost.

- Term: The amount of time the cap is providing protection to the borrower. The longer the Term, the more expensive the cap. Each additional month of protection is typically more expensive than the previous month; said another way, a cap with a 3-year Term is much more expensive than a cap with a 2-year Term.

- Strike Rate: The level of the floating rate above which triggers payments from the cap provider (a bank) to the cap owner (a borrower). The lower the Strike, the more expensive the cap.

For a defined mix of Notional, Term and Strike Rate, the cost of the rate cap will fluctuate over time based upon movements in the “underlying” floating interest rate, e.g. 1-month LIBOR or SOFR. The lower the underlying rate is relative to the Strike Rate the cheaper the cost of the cap and vice-versa.

In fact, how the financial markets expect the underlying interest rate to change in the future also has a big impact on the cap’s cost. If markets expect the underlying rate to increase over the Term of the cap, the greater the likelihood of a payout to the borrower increases, hence the more expensive the cap.

The hidden drivers of cap cost: Interest rate volatility. The more the underlying rate, e.g. 1-month LIBOR, moves around, the greater the likelihood that the underlying rate will spike higher than the Strike Rate. The greater the volatility in interest rates, the more expensive a cap becomes.

Finally, yet another factor that has a big impact on the cost of a cap: The Lender’s rating requirements. Most bridge lenders that require caps of their borrowers also require that the borrower buy the rate cap from a credit worthy financial institution. They manifest this requirement via verbiage in the loan agreement which defines “Initial Ratings” and “Downgrade Triggers”:

- An “Initial Rating” is a requirement by the Lender that the borrower purchase the cap from a bank that has a minimum credit rating – from the likes of S&P, Moody’s or Fitch – at the time the cap is purchased.

- A “Downgrade Trigger” is a requirement by the Lender that the Bank the borrower purchased the cap from maintain a defined minimum credit rating – again, from the likes of S&P, Moody’s or Fitch – over the Term of the rate cap. Should the Bank’s credit rating fall below the Downgrade Trigger, the Borrower must remedy the breach via the purchase of another cap from a Bank that meets the credit requirements.

In general, the higher the credit rating requirement, e.g. A+ S&P versus A- S&P, the more expensive the cap.

Can Any bank Sell A Cap?

No. While most of the large banks have the capability to sell the borrower a cap, most have limited interest, and thus are not competitive on price. There are only a handful of banks that specialize in caps and make a real business of it, having efficiencies in process and competitiveness in pricing. Further, even fewer of this handful of banks will participate in a bidding auction.

How much Lead Time Is Needed Before Starting The Cap Purchasing Process?

There are several steps involved in getting the ball rolling on the rate cap. While Derivative Logic can routinely orchestrate and help pull the trigger on the cap purchase in as little as 24 hours, we recommend engaging with us at least one week prior to the planned cap purchase or loan close. Pro tip: Don’t put yourself in a position where delays in the cap process also delay the loan close. Get us involved as early as possible.

What Documentation Is Needed To Buy A Cap?

Planning to purchase a cap requires documentation at several points in the process, specifically:

- Bid Package

- Dodd-Frank related, “Know Your Customer” disclosures

- Incumbency Certificate

- Collateral Assignment

- Derivative Logic’s Transaction Summary

- Legal Opinion

- Confirmation

Lender’s that mandate borrowers buy caps are very familiar with what documentation is needed. Derivative Logic facilitates the generation, circulation and execution of all required documentation as you travel down the road toward your cap purchase and loan close.

Why do I need help with my interest rate cap?

Interest rate caps pricing is not transparent – you don’t realize how much the bank is making off you. Structuring alternatives are never fully presented – the cap depends on variables you need to understand to get a fair price.

How do I calculate my cap cost?

The short answer – WITH HELP! The rates quoted on Bloomberg or in the Wall Street Journal may not be best for your specific situation. They are general indications. Knowing the appropriate details insures you are offered a fair rate.

Why would I enter into an interest rate cap?

You want to limit the impact of a rise in floating interest rates. In fact, your loan agreement may likely require you to enter into a cap for this reason. You’re more likely to be able to pay off your loan if you’re not overly squeezed by a higher market rate. But there are considerations! Let’s talk about your unique situation before you pull the trigger so you are assured you’re getting a fair market price.

What does CAP stand for?

Nothing! It’s not an abbreviation, it’s literally a cap on the interest rate you effectively pay on your loan. However, caps are financially important enough for your company to think about with CAPITALIZED emphasis, so give us a call to discuss your deal!

What are the risks of interest rate caps?

A cap can be thought of as similar to buying insurance against a future risk, in this case, the risk that the interest rate your loan is based on increases so much that your project is financially damaged. You want to buy the right policy at a fair price. The full value of expert advice on your side often develops after a cap transaction has closed.

- Knowledge Center

- Training Academy

- Privacy Policy

- Legal Notices

Exhibit 10.39

COLLATERAL ASSIGNMENT OF INTEREST RATE CAP AGREEMENT

COLLATERAL ASSIGNMENT OF INTEREST RATE CAP AGREEMENT , dated as of November 29, 2006 (this “ Assignment ”), made by PH FEE OWNER LLC , a Delaware limited liability company, and OPBIZ, L.L.C. , a Nevada limited liability company, each having its principal place of business at c/o OpBiz, L.L.C., 3667 Las Vegas Boulevard South, Las Vegas, Nevada 89109 (collectively, “ Assignor ”), in favor of COLUMN FINANCIAL, INC. , a Delaware corporation having an address at 11 Madison Avenue, New York, New York 10010 (“ Assignee ”). Capitalized terms used but not defined herein shall have the meanings assigned such terms in that certain Loan Agreement, dated as of the date hereof, between Assignor, as borrower, and Assignee, as lender (as amended, restated, replaced, supplemented or otherwise modified from time to time, the “ Loan Agreement ”).

1. For good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged by Assignor, Assignor hereby assigns, grants, delivers and transfers to Assignee, as collateral, all of its interest, whether now owned or hereafter acquired, now existing or hereafter arising, wherever located, in, to and under that certain Confirmation (Reference Number DPA609207), dated November 29, 2006, between Assignor and SMBC Derivative Products Limited, as the counterparty thereunder (the “ Counterparty ”) (together with that certain ISDA Master Agreement (Multicurrency-Cross Border) form deemed to have been executed by Assignor and the Counterparty concurrently with the Confirmation pursuant to the terms of such Confirmation , the “ Interest Rate Cap Agreement ”), including, but not limited to, any and all rights that such Assignor may now or hereafter have to any and all payments, disbursements, distributions or proceeds (collectively, the “ Payments ”) owing, payable or required to be delivered to Assignor on account of the Interest Rate Cap Agreement with respect to the period commencing on the date hereof and ending on the date on which Assignor shall have repaid the Loan in its entirety, and all proceeds of any or all of the foregoing (collectively, the “ Cap Collateral ”). Assignor hereby grants to Assignee a security interest in and to the Interest Rate Cap Agreement, the Cap Collateral and all Proceeds (as defined in the Uniform Commercial Code adopted in the State of New York (the “ UCC ”)) thereof, to have and to hold the same, unto Assignee, its successors and assigns, and Assignor covenants and agrees to cause all Payments to be made directly to Assignee. This Assignment constitutes additional security for the obligations of Assignor governed by the Loan Agreement and secured or evidenced by the other Loan Documents.

2. counterparty hereby consents to the assignment contained in paragraph 1 hereof and agrees that it will make any payments that become payable under or pursuant to the interest rate cap agreement directly into the cash management account until such time as this assignment is terminated or otherwise canceled, at which time the counterparty will be instructed to make payments to or on behalf of assignor., 3. prior to the occurrence of an event of default, payments received by assignee shall be deposited into the cash management account and applied to payments becoming due under the note, as and when such payments are due. upon the occurrence of an event of default (a) payments received by assignee may be applied by assignee to any principal, interest and other amounts owing by borrower under the note and the other loan, documents in such order and priority as assignee shall determine in its sole and absolute discretion and (b) assignee shall be entitled to exercise all remedies provided in the ucc with respect to the security interest being granted herein., 4. assignor hereby covenants and agrees that assignor shall not, without first obtaining assignee’s or its successor’s or assign’s written consent, convey, assign, sell, mortgage, encumber, pledge, hypothecate, grant a security interest in, grant an option or options with respect to, or otherwise dispose of (directly or indirectly, voluntarily or involuntarily, by operation of law or otherwise, and whether or not for consideration) the interest rate cap agreement. assignor and counterparty hereby covenant and agree that neither assignor nor counterparty shall, without first obtaining assignee’s or its successor’s or assign’s written consent, amend, modify, cancel or terminate the interest rate cap agreement. assignee agrees to be bound by all of the terms, covenants and conditions of the interest rate cap agreement., 5. in the event that for any reason the interest rate cap agreement ever expires, or is terminated, rescinded or revoked and, as a result thereof, a termination fee or such similar payment is owing to assignor by counterparty, such sum is and shall be considered a payment and a part of the cap collateral and shall be held and disbursed by assignee in accordance with the terms hereof; provided , that so long as no event of default has occurred and is continuing, assignee will (a) make such termination fee or similar payment available to assignor to be applied to the reasonable and customary costs and expenses payable by assignor in connection with assignor’s replacement of the interest rate cap agreement and (b) disburse the balance of such termination fee or similar payment to assignor if assignor has replaced the interest rate cap agreement in accordance with the terms and provisions of this assignment and the other loan documents, and such replacement interest rate cap agreement is in fact in full force and effect., 6. assignor represents and warrants that: (a) it has the full power, right and authority to assign its interest in the cap collateral, (b) assignor owns the cap collateral free and clear of all liens and claims of others and assignor has not transferred, assigned, granted a security interest in or otherwise encumbered its interest in and to the cap collateral other than in favor of assignee, (c) no security agreement, financing statement or other document is on file or of record in any public office with respect to the cap collateral, other than in favor of assignee, (d) the obligation of the counterparty under the interest rate cap agreement to make payments is not subject to any defense or counterclaim arising from any act or omission of assignor or any affiliate of assignor, (e) the location of its chief executive office is the address set forth in the caption to this assignment and (f) upon the filing of ucc financing statements naming assignor as debtor and assignee as secured party in the office of the delaware secretary of state and the office of the nevada secretary of state, assignee will have a first priority perfected lien on the cap collateral., 7. assignor covenants and agrees with assignee as follows (a) it will comply with all terms of the interest rate cap agreement, (b) it will not waive any provision of the interest rate cap agreement, fail to deliver a copy of any notice received from counterparty to assignee or, without the prior written consent of assignee, fail to exercise any right thereunder and (c) it will not change the location of its state of organization from the location specified in the caption to this assignment unless, in conjunction therewith, assignor executes and delivers, to assignee such additional ucc financing statements as assignee shall reasonably request to allow for assignee’s continued prior and perfected lien on the cap collateral., 8. assignor further covenants and agrees with assignee that it will at any time and from time to time, upon the written request of assignee, and at the sole expense of assignor, promptly and duly execute and deliver such further instruments and documents and take such further action as assignee may reasonably request for the purpose of obtaining or preserving the full benefits of this assignment and of the rights and powers herein granted, including, without limitation, the filing of any financing or continuation statements under the ucc. assignor also hereby authorizes assignee to file any such financing or continuation statement without the signature of assignor to the extent permitted by applicable law. a carbon, photographic or other reproduction of this assignment shall be sufficient as a financing statement for filing in any jurisdiction., 9. this assignment does not include the delegation to assignee of any of assignor’s duties, responsibilities or obligations under the interest rate cap agreement, assignor remaining liable to perform all duties, responsibilities and obligations to be performed by assignor thereunder, and assignee shall not have any obligation or liability under the interest rate cap agreement or by reason of or arising out of this assignment or the receipt by assignee of any payment and assignor specifically agrees to indemnify and forever hold assignee harmless from any claim or liability on account thereof, including, without limitation, attorneys’ fees incurred., 10. assignee shall only be accountable for payments actually received by it hereunder. assignee’s sole duty with respect to the custody, safekeeping and physical preservation of the cap collateral in its possession, under section 9-207 of the ucc or otherwise, shall be to deal with it in the same manner as assignee deals with similar property for its own account. neither assignee nor any of its directors, officers, employees or agents shall be liable for failure to demand, collect or realize upon all or any part of the cap collateral or for any delay in doing so or shall be under any obligation to sell or otherwise dispose of any cap collateral upon the request of assignor or any other person or to take any other action whatsoever with regard to the cap collateral or any part thereof. the powers conferred on assignee hereunder are solely to protect assignee’s interests in the cap collateral and shall not impose any duty upon assignee to exercise any such powers. assignee shall be accountable only for amounts that they actually receive as a result of the exercise of such powers, and neither it nor any of its officers, directors, employees or agents shall be responsible to assignor for any act or failure to act hereunder, except for their own gross negligence or willful misconduct., 11. any notices required to be given under this assignment shall be given in the manner provided in the loan agreement., 12. this assignment may not be modified, amended or terminated except by a written agreement executed by all of the parties hereto., 13. any provision of this assignment which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition, or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction., 14. assignee shall not by any act (except by a written instrument), delay, indulgence, omission or otherwise be deemed to have waived any right or remedy hereunder or to have acquiesced in any event of default or in any breach of any of the terms and conditions hereof. no failure to exercise, nor any delay in exercising, on the part of assignee any right, power or privilege hereunder shall operate as a waiver thereof. no single or partial exercise of any right, power or privilege hereunder shall preclude any other or further exercise thereof or the exercise of any other right, power or privilege. a waiver by assignee of any right or remedy hereunder on any one occasion shall not be construed as a bar to any right or remedy which assignee otherwise have on any future occasion. the rights and remedies herein provided are cumulative, may be exercised singularly or concurrently and are not exclusive of any rights or remedies provided by law., 15. the parties hereto hereby notify counterparty of this assignment and the security interests granted to assignee hereunder and instruct counterparty to make all payments to be made under or pursuant to the terms of the interest rate cap agreement, without set-off, defense or counterclaim, to assignee in accordance with written instructions (subject to the terms hereof) delivered by assignee, its successors or assigns, to counterparty at the address set forth under its signature hereto., 16. this assignment shall be governed by and construed in accordance with the laws of the state of new york, without reference to choice of law doctrine., 17. this assignment shall terminate upon the earlier to occur of (a) the termination or expiration of the interest rate cap agreement and (b) the payment in full of the loan., 18. this assignment shall be binding upon and shall inure to the benefit of assignor and assignee and their respective successors and assigns., 19. this assignment may be executed in any number of counterparts each of which shall be an original, but all of which shall constitute one instrument., 20. assignee shall have the right to assign this assignment and the obligations hereunder in connection with the assignment of the loan. the parties hereto acknowledge that following the execution and delivery of this assignment, assignee may sell, transfer and assign this assignment, the loan and the other loan documents. all references to “ assignee ” hereunder shall be deemed to include the assigns of assignee and the parties hereto acknowledge that actions taken by assignee hereunder may be taken by assignee’s agents and by the agents of the assigns of assignee., 21. the provisions of section 9.4 of the loan agreement are hereby incorporated by reference as if fully set forth herein., 22. in consideration of the foregoing agreement by the counterparty, assignor and assignee agree that (a) counterparty shall be entitled to conclusively rely (without any independent investigation) on any notice or instructions from assignee in respect of the interest rate cap agreement and (b) counterparty shall be held harmless and shall be fully indemnified by assignor, from and against any and all claims, other than those arising out of the gross negligence or willful misconduct of counterparty, and from and against any damages, penalties, judgments, liabilities, losses or expenses (including attorney’s fees and disbursements) reasonably incurred by counterparty as a result of the assertion of any claim, by any person or entity, arising out of, or otherwise related to, any actions taken or omitted to be taken by counterparty in reliance upon any such instructions or notice provided by assignee..

23. If Assignor consists of more than one Person, the obligations and liabilities of each such Person shall be joint and several.

[NO FURTHER TEXT ON THIS PAGE]

IN WITNESS WHEREOF, Assignor and Assignee have duly executed this Assignment on the day and year first written above.

THE UNDERSIGNED HEREBY ACKNOWLEDGES RECEIPT OF NOTICE OF THE FOREGOING ASSIGNMENT AND CONSENTS THERETO AND AGREES THAT THE UNDERSIGNED SHALL HEREAFTER CAUSE ALL PAYMENTS REQUIRED TO BE MADE BY THE UNDERSIGNED PURSUANT TO THE TERMS OF THE INTEREST RATE CAP AGREEMENT TO BE MADE DIRECTLY TO ASSIGNEE, ITS SUCCESSORS OR ASSIGNS, IN ACCORDANCE WITH WRITTEN INSTRUCTIONS (BUT SUBJECT TO THE TERMS OF THE ASSIGNMENT) TO BE DELIVERED BY ASSIGNEE, ITS SUCCESSORS OR ASSIGNS, TO THE UNDERSIGNED AT THE ADDRESS SET FORTH BELOW. THE UNDERSIGNED FURTHER AGREES THAT ALL SUCH PAYMENTS SHALL BE MADE TO ASSIGNEE WITHOUT SET-OFF, DEFENSE OR COUNTERCLAIM. THE UNDERSIGNED AGREES THAT IT SHALL NOT AMEND OR MODIFY THE INTEREST RATE CAP AGREEMENT WITHOUT THE PRIOR WRITTEN CONSENT OF ASSIGNEE, ITS SUCCESSORS OR ASSIGNS.

COUNTERPARTY:

Address for notice:

SMBC Derivative Products Limited

Eighth Floor, Temple Court

11 Queen Victoria Street

London EC4N 4TA United Kingdom

Attention: Swaps Administration

Facsimile No.: (44 207) 786 1419

Telephone No.: (44 207) 786 1400

with a copy to:

SMBC Capital Markets, Inc.

277 Park Avenue, Fifth Floor

New York, NY 10172 USA

Attention: President

Facsimile No.: (212) 224-4948

(212) 224-5111 (for payment and reset notices)

Telephone No.: (212) 224-5021

When the interest rate on a mortgage financing is not fixed, the amount that a borrower may be required to pay may fluctuate depending on changes in the underlying index to which the “margin” or “spread” is tied. While a lender may be comfortable with its underwriting of a financing and the ability of its borrower to service its debt at closing, if the underlying index of a floating rate loan changes over time, the lender’s comfort and the ability of its borrower to service its debt will obviously change. To combat against interest rate volatility, borrowers and lenders usually agree to hedge the interest rate against the uncertainty in the market for floating rate loans. The most common form of such hedging is an “interest rate cap.”

An interest rate cap is a derivative whereby the interest rate cap provider (the “counterparty”) agrees to pay the interest which would be payable by the borrower over a strike price (the “strike”) on the notional amount (the principal amount) of the loan. Consequently, if the index of the loan rises above the strike, the counterparty, and not the borrower, is liable for the excess interest payment obligation. In this way, the borrower’s liability for payment of interest on the loan in question is always “capped” at an amount equal to the strike plus the spread.

As additional collateral for a loan, the borrower will purchase an interest rate cap and pledge it to the lender. Simply put, the interest rate cap is an insurance policy on a floating rate loan, which protects the borrower and the lender if the interest rate index rises above the strike during a specified period of time (the “term”). The term of the cap is usually coterminous with the initial term of the loan. If the loan is extended, extensions are usually conditioned on the purchase of a new interest rate cap for the extended period.

Caps are purchased upfront with a single payment at the closing of a loan. After the premium is paid, the borrower has no further payment obligations. Most lenders will require borrowers to purchase the interest rate cap as a condition to closing the loan. Lenders also require that the cap provider have a minimum credit rating from Moody’s, S&P, Fitch or another rating agency. The interest rate cap is usually auctioned to a number of creditworthy financial institutions to secure the most favorable terms at the lowest premium price. Lenders will require the counterparty to maintain a certain rating level during the term. In the event that the counterparty does not maintain its rating, the borrower will typically be required to (i) replace the counterparty with a new counterparty that meets the qualifications and execute a new interest rate protection agreement, (ii) require the counterparty to supply a guaranty from a party meeting the ratings default, or (iii) cause the counterparty to deliver collateral to secure its exposure to the borrower in an amount acceptable to the lender and the rating agencies. In most cases, borrowers will choose either option (i) or (ii).

Since most caps are purchased through an auction process, a bid package is usually assembled for the bidders, which includes the agreed-upon terms of the interest rate cap, the timeline for which the auction must be completed, the assignment of interest rate cap protection agreement, and the form of confirmation. The confirmation describes the particulars of the transaction, such as the loan amount, payment dates, accrual periods and other pertinent dates, the rates, and other material items necessary to understand the parameters of the interest rate cap. It is important to review the confirmation and the bid package to ensure all terms are correct, and accurately reflect the terms of the transaction. At closing, the borrower will collaterally assign the interest rate cap agreement, which is additional collateral for the loan, and ensures the lender’s right to receive payments under the agreement.

While interest rate hedging takes many forms, interest rate caps are the most common derivative in mortgage financing. As we understand the process, we expect the market and traditional requirements to make implementation of this aspect of mortgage financing a smoother and simpler endeavor.

United States: A Primer On Interest Rate Caps

When the interest rate on a mortgage financing is not fixed, the amount that a borrower may be required to pay may fluctuate depending on changes in the underlying index to which the "margin" or "spread" is tied. While a lender may be comfortable with its underwriting of a financing and the ability of its borrower to service its debt at closing, if the underlying index of a floating rate loan changes over time, the lender's comfort and the ability of its borrower to service its debt will obviously change. To combat against interest rate volatility, borrowers and lenders usually agree to hedge the interest rate against the uncertainty in the market for floating rate loans. The most common form of such hedging is an "interest rate cap."

An interest rate cap is a derivative whereby the interest rate cap provider (the "counterparty") agrees to pay the interest which would be payable by the borrower over a strike price (the "strike") on the notional amount (the principal amount) of the loan. Consequently, if the index of the loan rises above the strike, the counterparty, and not the borrower, is liable for the excess interest payment obligation. In this way, the borrower's liability for payment of interest on the loan in question is always "capped" at an amount equal to the strike plus the spread.

As additional collateral for a loan, the borrower will purchase an interest rate cap and pledge it to the lender. Simply put, the interest rate cap is an insurance policy on a floating rate loan, which protects the borrower and the lender if the interest rate index rises above the strike during a specified period of time (the "term"). The term of the cap is usually coterminous with the initial term of the loan. If the loan is extended, extensions are usually conditioned on the purchase of a new interest rate cap for the extended period.

Caps are purchased upfront with a single payment at the closing of a loan. After the premium is paid, the borrower has no further payment obligations. Most lenders will require borrowers to purchase the interest rate cap as a condition to closing the loan. Lenders also require that the cap provider have a minimum credit rating from Moody's, S&P, Fitch or another rating agency. The interest rate cap is usually auctioned to a number of creditworthy financial institutions to secure the most favorable terms at the lowest premium price. Lenders will require the counterparty to maintain a certain rating level during the term. In the event that the counterparty does not maintain its rating, the borrower will typically be required to (i) replace the counterparty with a new counterparty that meets the qualifications and execute a new interest rate protection agreement, (ii) require the counterparty to supply a guaranty from a party meeting the ratings default, or (iii) cause the counterparty to deliver collateral to secure its exposure to the borrower in an amount acceptable to the lender and the rating agencies. In most cases, borrowers will choose either option (i) or (ii).

Since most caps are purchased through an auction process, a bid package is usually assembled for the bidders, which includes the agreed-upon terms of the interest rate cap, the timeline for which the auction must be completed, the assignment of interest rate cap protection agreement, and the form of confirmation. The confirmation describes the particulars of the transaction, such as the loan amount, payment dates, accrual periods and other pertinent dates, the rates, and other material items necessary to understand the parameters of the interest rate cap. It is important to review the confirmation and the bid package to ensure all terms are correct, and accurately reflect the terms of the transaction. At closing, the borrower will collaterally assign the interest rate cap agreement, which is additional collateral for the loan, and ensures the lender's right to receive payments under the agreement.

While interest rate hedging takes many forms, interest rate caps are the most common derivative in mortgage financing. As we understand the process, we expect the market and traditional requirements to make implementation of this aspect of mortgage financing a smoother and simpler endeavor.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

© Mondaq® Ltd 1994 - 2024. All Rights Reserved .

Login to Mondaq.com

Password Passwords are Case Sensitive

Forgot your password?

Why Register with Mondaq

Free, unlimited access to more than half a million articles (one-article limit removed) from the diverse perspectives of 5,000 leading law, accountancy and advisory firms

Articles tailored to your interests and optional alerts about important changes

Receive priority invitations to relevant webinars and events

You’ll only need to do it once, and readership information is just for authors and is never sold to third parties.

Your Organisation

We need this to enable us to match you with other users from the same organisation. It is also part of the information that we share to our content providers ("Contributors") who contribute Content for free for your use.

- Search Search Please fill out this field.

- Credit & Debt

- Definitions N - Z

Interest Rate Cap Structure: Definition, Uses, and Examples

:max_bytes(150000):strip_icc():format(webp)/me_jpeg__chris_murphy-5bfc262746e0fb0051bcea2f.jpg)

What Is an Interest Rate Cap Structure?

An interest rate cap structure refers to the provisions governing interest rate increases on variable-rate credit products. An interest rate cap is a limit on how high an interest rate can rise on variable-rate debt. Interest rate caps can be instituted across all types of variable rate products.

However, interest rate caps are commonly used in variable-rate mortgages and specifically adjustable-rate mortgage (ARM) loans.

Key Takeaways

- An interest rate cap is a limit on how high an interest rate can rise on variable rate debt. Interest rate caps are commonly used in variable-rate mortgages and specifically adjustable-rate mortgage (ARM) loans.

- Interest rate caps can have an overall limit on the interest for the loan and also be structured to limit incremental increases in the rate of a loan.

Interest rate caps can give borrowers protection against dramatic rate increases and also provide a ceiling for maximum interest rate costs.

How Interest Rate Caps Work

Interest rate cap structures serve to benefit the borrower in a rising interest rate environment. The caps can also make variable rate interest products more attractive and financially viable for customers.

Variable Rate Interest

Lenders can offer a wide range of variable rate interest products. These products are most profitable for lenders when rates are rising and most attractive for borrowers when rates are falling.

Variable-rate interest products are designed to fluctuate with the changing market environment. Investors in a variable rate interest product will pay an interest rate that is based on an underlying indexed rate plus a margin added to the index rate.

The combination of these two components results in the borrower’s fully indexed rate. Lenders can index the underlying indexed rate to various benchmarks with the most common being their prime rate or a U.S. Treasury rate.

Lenders also set a margin in the underwriting process based on the borrower’s credit profile. A borrower’s fully indexed interest rate will change as the underlying indexed rate fluctuates.

How Interest Rate Caps Can Be Structured

Interest rate caps can take various forms. Lenders have some flexibility in customizing how an interest rate cap might be structured. There can be an overall limit on the interest for the loan. The limit is an interest rate that your loan can never exceed, meaning that no matter how much interest rates rise over the life of the loan, the loan rate will never exceed the predetermined rate limit.

Interest rate caps can also be structured to limit incremental increases in the rate of a loan. An adjustable-rate mortgage (ARM) has a period in which the rate can readjust and increase if mortgage rates rise.

The ARM rate might be set to an index rate plus a few percentage points added by the lender. The interest rate cap structure limits how much a borrower's rate can readjust or move higher during the adjustment period. In other words, the product limits the number of interest rate percentage points the ARM can move higher.

Example of an Interest Rate Cap Structure

Adjustable-rate mortgages have many variations of interest rate cap structures. For example, let's say a borrower is considering a 5-1 ARM, which requires a fixed interest rate for five years followed by a variable interest rate afterward, which resets every 12 months.

With this mortgage product, the borrower is offered a 2-2-5 interest rate cap structure. The interest rate cap structure is broken down as follows:

- The first number refers to the initial incremental increase cap after the fixed-rate period expires. In other words, 2% is the maximum the rate can increase after the fixed-rate period ends in five years. If the fixed-rate was set at 3.5%, the cap on the rate would be 5.5% after the end of the five-year period.

- The second number is a periodic 12-month incremental increase cap meaning that after the five year period has expired, the rate will adjust to current market rates once per year. In this example, the ARM would have a 2% limit for that adjustment. It's quite common that the periodic cap can be identical to the initial cap.

- The third number is the lifetime cap, setting the maximum interest rate ceiling . In this example, the five represents the maximum interest rate increases on the mortgage.

So let's say the fixed rate was 3.5% and the rate was adjusted higher by 2% during the initial incremental increase to a rate of 5.5%. After 12 months, mortgage rates rose to 8%, the loan rate would be adjusted to 7.5% because of the 2% cap for the annual adjustment.

If rates increased by another 2%, the loan would only increase by 1% to 8.5%, because the lifetime cap is five percentage points above the original fixed rate.

Periodic Interest Rate Cap

A periodic interest rate cap refers to the maximum interest rate adjustment allowed during a particular period of an adjustable-rate loan or mortgage.

The periodic rate cap protects the borrower by limiting how much an adjustable-rate mortgage (ARM) product may change or adjust during any single interval. The periodic interest rate cap is just one component of the overall interest rate cap structure.

Limitations of an Interest Rate Cap

The limitations of an interest rate cap structure can depend on the product that a borrower chooses when entering into a mortgage or loan. If interest rates are rising, the rate will adjust higher, and the borrower might have been better off originally entering into a fixed-rate loan.

Although the cap limits the percentage increase, the rates on the loan still increase in a rising rate environment. In other words, borrowers must be able to afford the worst-case scenario rate on the loan if rates rise significantly.

What Are the Disadvantages of an Adjustable-Rate Mortgage?

The disadvantages of an adjustable-rate mortgage include the fact if interest rates rise that your monthly payments could increase to a point where you may not be able to afford them. If you cannot make your mortgage payments, your home is at risk of foreclosure.

Can You Pay Off an ARM Early?

Whether you can pay off an adjustable rate mortgage (ARM) early will depend on the terms of your mortgages. Some lenders allow early payoffs with no penalties, while other will charge a fee if you pay off the loan before the terms ends.

Can You Refi Out of an ARM?

You can refinance an adjustable rate mortgage just as you would a traditional mortgage. You will essentially take out a new loan to pay off the original loan so you will have new terms.

The Bottom Line

Understanding how interest rates caps work with different types of mortgages can help determine with mortgage can best fit your needs. For more specific guidance on your options, consider consulting a professional financial advisor.

Consumer Financial Protection Bureau. " What Are Rates Caps? "

The Federal Reserve Board. " Consumer Handbook on Adjustable Rate Mortgages ."

Freddie Mac. " Considering an Adjustable Rate Mortgage? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1086308604-c14d500b40574ab4b32e8cefd32c020c.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Calculators

- Industry News

- Interest Rate Risk Management

- ISDA Negotiation

- Regulatory Compliance

- Yield Maintenance

Where To Send Your Cap Payouts

With floating rates already climbing above 0.50% this quarter and markets projecting a continued increase all the way up to 3.40% by this time next year, many interest rate caps are about to start paying out. This has left many borrowers, and some lenders, asking the question: where do the cap payouts go?

The answer is “it depends.” Because most interest rate caps are a prerequisite for a loan closing, the borrower will usually be required to assign the hedge to the lender as collateral. Most of the time, that Collateral Assignment will also stipulate to which account cap payouts are to be sent. There are generally a couple ways those payouts can be processed:

Cap payouts go directly to the borrower .

The payout is sent from the cap provider to the borrower’s account, who then nets that amount against the floating rate invoice from their lender.

Cap payouts go directly to the lender .

The payout is sent from the cap provider to the lender’s account.

The lender subtracts the cap payout from the floating rate interest, and invoices for the net amount.

Or, the lender invoices the floating rate amount and reimburses the cap payout.

That reimbursement could potentially be applied to the next payment, which would create a one-period lag on when the borrower receives those funds.

The below graphically illustrates how approach #1, which is far more common, works.

If your interest rate cap wasn’t a lender requirement and also wasn’t assigned to the lender as collateral following execution, you should be free to direct the cap payouts to the account of your choosing. Most borrowers in this scenario will have the payouts sent to an operating account or the account from which the loan payments are sent for that deal.

If your interest rate cap was a lender requirement and you’re not sure where the payouts will go, a good first step would be to take a look at the Collateral Assignment and see if it’s specified there. If it’s not, it may be worth checking with your lender to ensure that they’re indifferent to the account before providing wiring instructions for your cap provider.

If you have any questions or need assistance identifying where you interest rate cap payouts should go, please don’t hesitate to reach out to the Pensford team at [email protected] or (704) 887-9880.

Related articles

Recent newsletter.

Updated Daily. Last Update: 4/29/2024

A slightly irreverent take on interest rate markets and the economy.

Collateral Assignment

Jump to Section

A collateral assignment involves granting a security interest in the asset or property to a lender. It is a lawful arrangement where the borrower promises an asset or property to the lender to guarantee the debt repayment or meet a financial obligation. Moreover, in a collateral assignment, the borrower maintains asset ownership, the lender holds the security interest, and the lender has the right to seize and sell the asset in event of default. This blog post will discuss a collateral assignment, its purpose, essential considerations, and more.

Key Purposes of a Collateral Assignment

Collateral assignment concerns allocating a property's ownership privileges, or a specific interest, to a lender as loan collateral. The lender retains a security interest in the asset until the borrower entirely settles the loan. If the borrower defaults on loan settlement, the lender can seize and market the collateral to recover the unpaid debt. Below are the key purposes of a collateral assignment.

- Enhanced Lender Protection: The primary purpose of the collateral assignment is to provide lenders with an added layer of security and assurance. Also, by maintaining a claim on the borrower's properties, lenders lower their risk and improve the probability of loan settlement. In case of default, the lender can sell the collateral to recover the unpaid balance. This security authorizes lenders to offer loans with lower interest rates, as the threat associated with the loan is reduced.

- Favorable Loan Terms: Collateral assignment allows borrowers to access financing on more favorable terms than unsecured loans . However, the terms of the loan will vary depending on the borrower’s creditworthiness and the value of the collateral. Generally, lenders are more willing to extend larger loan amounts and lower interest rates when they have collateral to fall back on. The presence of collateral reassures lenders that they have a viable means of recouping their investment, even in case of default. This increased confidence often leads to more competitive loan offers for borrowers.

- Unlocking Asset Value: Collateral assignment enables borrowers to leverage the value of their assets, even if those assets are not readily convertible into cash. For instance, a business owner with valuable machinery can assign it as collateral to secure a business loan. This arrangement allows the borrower to continue utilizing the asset for operational purposes while accessing the necessary funds for expansion or working capital. Collateral assignment, thus, enables the efficient allocation of resources. However, the collateral will still be considered in determining the loan amount and terms.

- Access to Higher Loan Amounts: When borrowers promise collateral against a loan, lenders can present greater loan amounts than for other unsecured loans. The worth of the collateral serves as a reassurance to lenders that they can recover their investment even if the borrower fails to settle the loan. Therefore, borrowers can obtain higher loans to finance important endeavors such as purchasing property, starting a business, or funding major projects.

- Diversification of Collateral: Collateral assignment offers flexibility for borrowers by allowing them to diversify their collateral base. While real estate is commonly used as collateral, borrowers can utilize other valuable assets such as investment portfolios, life insurance policies, or valuable personal belongings. This diversification allows borrowers to access financing without limiting themselves to a single asset, thereby preserving their financial flexibility.

Steps to Execute a Collateral Assignment

A collateral assignment is a financial procedure that involves utilizing an asset as security for a loan or other responsibilities. Below are the essential steps involved in the collateral assignment process.

- Assess the Need for Collateral Assignment. The initial step in collateral assignment is determining whether collateral is necessary. Lenders or creditors may require collateral to mitigate the risk of default or ensure repayment. Evaluating the value and marketability of the proposed collateral is crucial to ascertain if it meets the lender's requirements.

- Select Appropriate Collateral. The next step involves choosing a suitable asset for collateral assignment. Common classifications of collateral comprise stocks, real estate, bonds, cash deposits, and other valuable assets. The collateral's value should be sufficient to cover the loan amount or the obligation being secured.

- Understand Lawful and Regulatory Requirements. Before proceeding with collateral assignment, it is essential to comprehend the lawful and regulatory provisions specific to the jurisdiction where the transaction happens. Collateral assignment laws can vary, so seeking advice from legal professionals experienced in this area is advisable to ensure compliance.

- Negotiate Provisions. Once the collateral is recognized, the collateral assignment provisions must be negotiated among the concerned parties. It includes specifying the loan amount, interest rates, repayment terms, and any further duties or limitations associated with the collateral assignment.

- Prepare the Collateral Assignment Agreement. The collateral assignment agreement is a lawful document that typically includes details about the collateral, the loan or obligation being secured, and the rights and responsibilities of both parties. It is highly advised to engage the services of a legal specialist to prepare or review the contract.

- Enforce the Collateral Assignment Agreement. After completing the collateral assignment agreement, it must be executed by all involved parties. This step ensures that all necessary signatures are obtained and copies of the agreement are distributed to each individual for record-keeping objectives.

- Notify Relevant Parties. To ensure proper recognition and recording of the collateral assignment, it is important to notify all relevant parties. It may involve informing the lender or creditor, the custodian or holder of the collateral, and any other pertinent stakeholders. Sufficient documentation and communication will help prevent potential disputes or misunderstandings.

- Record the Collateral Assignment. Depending on the nature of the collateral, it may be necessary to record the collateral assignment with the appropriate government authority or registry. This step provides public notice of the assignment and establishes priority rights in case of multiple claims on the same collateral. Seeking guidance from legal professionals or relevant authorities can determine if recording the collateral assignment is required.

- Monitor and Maintain the Collateral. Throughout the collateral assignment term, it is crucial to monitor and maintain the value and condition of the collateral. This includes ensuring insurance coverage, property maintenance, and compliance with any ongoing obligations associated with the collateral. Regular communication between all parties involved is essential to address concerns or issues promptly.

- Terminate the Collateral Assignment. Once the loan or obligation secured by the collateral is fully satisfied, the collateral assignment can be terminated. This involves releasing the collateral from the assignment, updating relevant records, and notifying all parties involved. It is important to follow proper procedures to ensure the appropriate handling of the legal and financial aspects of the termination.

Key Terms for Collateral Assignments

- Security Interest: It is the legal right granted to a lender over the assigned collateral to protect their interests in case of borrower default.

- Collateral Valuation: The process of determining the worth or market value of the assigned collateral to assess its adequacy in securing the loan.

- Release of Collateral: The action taken by a lender to relinquish its claim over the assigned collateral after the borrower has fulfilled the loan obligations.

- Subordination Agreement : A legal document that establishes the priority of multiple creditors' claims over the same collateral, typically in the case of refinancing or additional loans.

- Lien : A legal claim or encumbrance on a property or asset, typically created through a collateral assignment, that allows a lender to seize and sell the collateral to recover the loan amount.

Final Thoughts on Collateral Assignments

A collateral assignment is a valuable instrument for borrowers and lenders in securing loans or obligations. It offers borrowers access to profitable terms and more extensive loan amounts while reducing the risk for lenders. Nevertheless, it is essential for borrowers to thoughtfully assess the terms and threats associated with collateral assignment before proceeding. Seeking professional guidance and understanding the contract can help ensure a successful and beneficial financial arrangement for all parties involved.

If you want free pricing proposals from vetted lawyers that are 60% less than typical law firms, click here to get started. By comparing multiple proposals for free, you can save the time and stress of finding a quality lawyer for your business needs.

Meet some of our Collateral Assignment Lawyers

I opened Hestia Legal when I was 6 months pregnant with the focus on educating and assisting families in my community. While the majority of my practice revolves around Estate Planning, I have a history of experience with contract and general business agreement drafting, discovery drafting, and general litigation document drafting.

I am a licensed attorney in Illinois, I am currently a Regulatory Compliance Analyst.

Torrey Livenick, Esq. is a fourth generation Colorado lawyer. Although she was born in California and raised in Nevada, she spent every summer in Colorado and knew she planned to make Denver her home. After graduating from Bryn Mawr College with a degree in Classical Culture and Society, she returned to Las Vegas to work as a paralegal. Once she spent five years building her skills and confirming her interest, she attended Emory University School of Law. Torrey’s interests include trivia (she even was a contestant on Jeopardy! during her law school days), video games, playing with her cats, and the arts. She is active in pro bono organizations including Metro Volunteer Lawyers.

Haber Law Firm, APC, is a transactional business law firm with a focus on small/mid-market business purchases and sales, outside general counsel, and start-up assistance for businesses in their early stages. Peter Haber started Haber Law Firm, APC after several years as a legal executive at Popcornopolis, a gourmet popcorn brand sold at groceries and stadiums nationwide. In this role, Peter served as the company’s sole in-house legal advisor as it related to all functions of the company’s operations, including dispute resolution, compliance, and employment law, to name a few. With his help and guidance, the company relocated its entire corporate and manufacturing operation, developed a new factory and warehouse, and was successfully acquired by private equity. Prior to this, Peter was a litigator and business attorney with distinguished Los Angeles litigation boutiques. Such matters included the representation of numerous businesses in litigation and in the resolution of pre-litigation disputes as well as the representation of professionals in liability defense matters, including hospitals, physicians, and brokers.

Obtained J.D. in December 2021, admitted to the Indiana Bar in November 2022. Began working as a clerk for civil defense firm in March 2022 and have been the same firm to the present, currently working as an Associate Attorney.

Credible history in navigating complex legal landscapes to deliver strategic solutions that optimize employee benefits programs and healthcare compliance. Demonstrated mastery in interpreting and applying ERISA, HIPAA, and ACA regulations, safeguarding client interests, and minimizing legal risks. Remarkable background in advising diverse clientele, ranging from corporations to healthcare providers, on intricate regulatory frameworks, compliance strategies, and litigation support. Adept at crafting innovative strategies, providing expert guidance, and driving compliance with unwavering precision. Skilled in leveraging unique skill set that combines medical knowledge and technological proficiency to address multifaceted challenges at intersection of healthcare and technology. Exceptional project management skills with track record of contributing to high-impact initiatives. Accomplished in drafting and negotiating contracts, mitigating legal risks, and streamlining processes.

Attorney admitted to the New York State Bar. Hispanic. Eager to meet client's needs and provide legal assistance.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Collateral Assignment lawyers by city

- Austin Collateral Assignment Lawyers

- Boston Collateral Assignment Lawyers

- Chicago Collateral Assignment Lawyers

- Dallas Collateral Assignment Lawyers

- Denver Collateral Assignment Lawyers

- Houston Collateral Assignment Lawyers

- Los Angeles Collateral Assignment Lawyers

- New York Collateral Assignment Lawyers

- Phoenix Collateral Assignment Lawyers

- San Diego Collateral Assignment Lawyers

- Tampa Collateral Assignment Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

IMAGES

VIDEO

COMMENTS

An interest rate cap has three primary economic terms: the loan amount covered by the cap (the notional), the duration of the cap (the term), and the level of rates (the strike rate) above which the cap will pay out. As an example, a $100M, 3-year, 3% strike cap will pay out if SOFR exceeds 3% over the next 3 years.

At closing, the borrower will collaterally assign the interest rate cap agreement, which is additional collateral for the loan, and ensures the lender's right to receive payments under the ...

Rate cap agreements are typically entered into at closing, and all right, title and interest to receive payments under the agreement are assigned by borrower to lender as additional collateral for the loan, until the expiration of the agreement or the loan is repaid in full.

Examples of Collateral Assignment of Interest Rate Cap in a sentence. Borrower shall collaterally assign to Lender, pursuant to the Collateral Assignment of Interest Rate Cap Agreement, all of its right, title and interest to receive any and all payments under the Interest Rate Cap Agreement, and shall deliver to Lender an executed counterpart of such Interest Rate Cap Agreement (which shall ...

An interest rate cap, a.k.a "cap", is essentially an insurance policy, purchased by a borrower, that protects them against undesirable movements in a floating interest rate, most commonly 1-month LIBOR or SOFR. Caps have three primary economic terms: Term: the duration of the cap, typically two or three years, commonly shorter than the loan ...

Exhibit 10.39. COLLATERAL ASSIGNMENT OF INTEREST RATE CAP AGREEMENT. COLLATERAL ASSIGNMENT OF INTEREST RATE CAP AGREEMENT, dated as of November 29, 2006 (this "Assignment"), made by PH FEE OWNER LLC, a Delaware limited liability company, and OPBIZ, L.L.C., a Nevada limited liability company, each having its principal place of business at c/o OpBiz, L.L.C., 3667 Las Vegas Boulevard South ...

rate cap, the meline for which the aucon must be completed, the assignment of interest rate cap protecon agreement, and the form of confirmaon. The confirmaon describes the parculars of the transacon, such as the loan amoun t, payment dates, accrual periods and other pernen t dates, the rates, and other material items necessar y to understand ...

At closing, the borrower will collaterally assign the interest rate cap agreement, which is additional collateral for the loan, and ensures the lender's right to receive payments under the agreement. While interest rate hedging takes many forms, interest rate caps are the most common derivative in mortgage financing.

At closing, the borrower will collaterally assign the interest rate cap agreement, which is additional collateral for the loan, and ensures the lender's right to receive payments under the agreement. While interest rate hedging takes many forms, interest rate caps are the most common derivative in mortgage financing.

Interest Rate Cap Structure: Limits to the interest rate on an adjustable-rate loan - frequently associated with a mortgage. There are several different types of interest rate cap structures ...

Rate cap agreements are typically entered into at closing, and all right, title and interest to receive payments under the agreement are assigned by borrower to lender as additional collateral for ...

Related to Collateral Assignment of Interest Rate Cap Agreement. Interest Rate Cap Agreement (a) The Interest Rate Cap Agreement in effect on the Closing Date has a LIBOR strike price equal to the Strike Price and a scheduled termination date of the Initial Maturity Date. The Interest Rate Cap Agreement (i) is in a form and substance reasonably acceptable to Lender, (ii) is with an Acceptable ...

A rate cap agreement sets a limit on how much a lender can charge a borrower for a specific loan product. ... Reference: Security Exchange Commission - Edgar Database, EX-99.3 4 m799exhibit993.htm INTEREST RATE CAP AGREEMENT, Viewed April 22, 2022, View Source on SEC. ... Collateral Assignment; Commercial Loan; Convertible Bonds; Convertible Note;

Examples of Collateral Assignment of Interest Rate Cap Agreement in a sentence. Borrower shall collaterally assign to Lender, pursuant to the Collateral Assignment of Interest Rate Cap Agreement, all of its right, title and interest to receive any and all payments under the Interest Rate Cap Agreement, and shall deliver to Lender an executed counterpart of such Interest Rate Cap Agreement ...

The answer is "it depends." Because most interest rate caps are a prerequisite for a loan closing, the borrower will usually be required to assign the hedge to the lender as collateral. Most of the time, that Collateral Assignment will also stipulate to which account cap payouts are to be sent.

ty agrees to "cap" floating-rate interest at a certain strike price. At the same time, Borrower agrees that if the floating rate drops below a "floor," then Borrower will keep paying the "floor" interest rate to Counter-party. Hedges of this type raise the same Borrower credit issues as swaps, with smaller exposures. Security

LOAN DOCUMENTS AND SECURITY AGREEMENTS THIS COLLATERAL ASSIGNMENT OF MORTGAGES, LOAN DOCUMENTS AND SECURITY AGREEMENTS (this Assignment) is made and entered into as of the [DATE] day of ... interest in and to the Collateral as more specifically set forth herein. NOW, THEREFORE, for Ten and No/100 Dollars ($10.00), and other good and valuable ...

Assignment of Interest Rate Cap that certain Collateral Assignment of Interest Rate Cap Agreement made by Borrower to Lender dated as of the date hereof required by this Agreement as security for the Loan, consented to by the Counterparty, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

As interest rates change over time, the swap will begin to take on value, whether positive or negative. The value generally becomes negative to your borrower when rates fall and positive when rates rise. The Bank has credit exposure when rates fall and the value of the swap relative to the borrower is negative (e.g., it is an asset to the Bank).

Rate Protection Agreement means, collectively, any interest rate swap, cap, collar or similar agreement entered into by the Borrower or any of its Subsidiaries under which the counterparty of such agreement is (or at the time such agreement was entered into, was) a Lender or an Affiliate of a Lender. Collateral Assignment Agreement has the ...

A collateral assignment involves granting a security interest in the asset or property to a lender. It is a lawful arrangement where the borrower promises an asset or property to the lender to guarantee the debt repayment or meet a financial obligation. Moreover, in a collateral assignment, the borrower maintains asset ownership, the lender ...

Related to Pledge and Collateral Assignment of Interest Rate Cap Agreement. Interest Rate Cap Agreement (a) The Interest Rate Cap Agreement in effect on the Closing Date has a LIBOR strike price equal to the Strike Price and a scheduled termination date of the Initial Maturity Date. The Interest Rate Cap Agreement (i) is in a form and substance reasonably acceptable to Lender, (ii) is with an ...

Collateral Assignment means, with respect to any Contracts, the original instrument of collateral assignment of such Contracts by the Company, as Seller, to the Collateral Agent, substantially in the form included in Exhibit A hereto. Interest Rate Cap Payment (a) With respect to the Class A-2, Class A-3 and Class A-4 Certificates, beginning on ...