Research & Insights

Sharper vision for your decisions. Driven by our scale, people and innovation.

Global Research

Through the breadth of our coverage, the depth of our expertise and commitment to client service, we are a trusted advisor for clients across the world.

Leveraging cutting-edge technologies and innovative tools to bring clients industry-leading analysis and investment advice.

Our award-winning analysts set the industry standard for delivering the most comprehensive and impactful research to clients by employing big data analysis, machine learning and other techniques—combined with their macro, asset class, sector and company expertise.

Key Benefits

Capabilities.

- J.P. Morgan Markets platform

- Research data tools

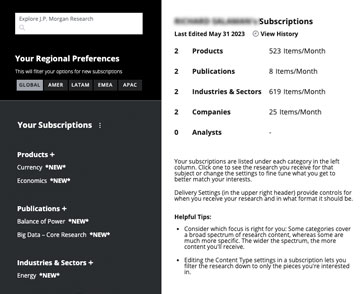

- My research subscriptions

- Mobile first

J.P. Morgan Markets Platform

Access our research across asset classes and utilize our data products and tools.

Additionally, discover our interactive forecasts and calendars, updated in real time, to view forward-looking and historical data.

Research Data Tools

Explore our data tools including DataQuery, InvestableAI, Banks Analyzer and ESG Discovery.

My Research Subscriptions

Manage the transparency and control over the research you receive. Access the research through a personalized subscription dashboard displaying your subscribed research content.

Mobile-First

Mobile first.

Consume research where you are, through the newly designed J.P. Morgan Markets app found on the App Store, or through J.P. Morgan’s Research Podcast Channels, Global Data Pod , At Any Rate and All into Account available on Apple and Spotify.

FOR INSTITUTIONAL & PROFESSIONAL CLIENTS ONLY – NOT INTENDED FOR RETAIL CUSTOMER USE

Global research disclaimer.

This communication is provided for information purposes only. Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy except with respect to any disclosures relative to J.P. Morgan and/or its affiliates and an analyst's involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, J.P. Morgan may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J.P. Morgan. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of J.P. Morgan.

Copyright 2023 JPMorgan Chase & Co. All rights reserved.

© 2023 JPMorgan Chase & Co. All rights reserved.

Request Access

Please select from the options below to request access.

- Asia Pacific

- Latin America

- Middle East & Africa

- North America

- Australia & New Zealand

Mainland China

- Hong Kong SAR, China

- Philippines

- Taiwan, China

- Channel Islands

- Netherlands

- Switzerland

- United Kingdom

- Saudi Arabia

- South Africa

- United Arab Emirates

- United States

From startups to legacy brands, you're making your mark. We're here to help.

- Innovation Economy Fueling the success of early-stage startups, venture-backed and high-growth companies.

- Midsize Businesses Keep your company growing with custom banking solutions for middle market businesses and specialized industries.

- Large Corporations Innovative banking solutions tailored to corporations and specialized industries.

- Commercial Real Estate Capitalize on opportunities and prepare for challenges throughout the real estate cycle.

- Community Impact Banking When our communities succeed, we all succeed. Local businesses, organizations and community institutions need capital, expertise and connections to thrive.

- International Banking Power your business' global growth and operations at every stage.

- Client Stories

Prepare for future growth with customized loan services, succession planning and capital for business equipment.

- Asset Based Lending Enhance your liquidity and gain the flexibility to capitalize on growth opportunities.

- Equipment Financing Maximize working capital with flexible equipment and technology financing.

- Trade & Working Capital Experience our market-leading supply chain finance solutions that help buyers and suppliers meet their working capital, risk mitigation and cash flow objectives.

- Syndicated Financing Leverage customized loan syndication services from a dedicated resource.

- Employee Stock Ownership Plans Plan for your business’s future—and your employees’ futures too—with objective advice and financing.

Institutional Investing

Serving the world's largest corporate clients and institutional investors, we support the entire investment cycle with market-leading research, analytics, execution and investor services.

- Institutional Investors We put our long-tenured investment teams on the line to earn the trust of institutional investors.

- Markets Direct access to market leading liquidity harnessed through world-class research, tools, data and analytics.

- Prime Services Helping hedge funds, asset managers and institutional investors meet the demands of a rapidly evolving market.

- Global Research Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

- Securities Services Helping institutional investors, traditional and alternative asset and fund managers, broker dealers and equity issuers meet the demands of changing markets.

- Financial Professionals

- Liquidity Investors

Providing investment banking solutions, including mergers and acquisitions, capital raising and risk management, for a broad range of corporations, institutions and governments.

- Center for Carbon Transition J.P. Morgan’s center of excellence that provides clients the data and firmwide expertise needed to navigate the challenges of transitioning to a low-carbon future.

- Corporate Finance Advisory Corporate Finance Advisory (“CFA”) is a global, multi-disciplinary solutions team specializing in structured M&A and capital markets. Learn more.

- Development Finance Institution Financing opportunities with anticipated development impact in emerging economies.

- Sustainable Solutions Offering ESG-related advisory and coordinating the firm's EMEA coverage of clients in emerging green economy sectors.

- Mergers and Acquisitions Bespoke M&A solutions on a global scale.

- Capital Markets Holistic coverage across capital markets.

- Capital Connect

- In Context Newsletter from J.P. Morgan

- Director Advisory Services

Accept Payments

Explore Blockchain

Client Service

Process Payments

Manage Funds

Safeguard Information

Banking-as-a-service

Send Payments

- Partner Network

A uniquely elevated private banking experience shaped around you.

- Banking We have extensive personal and business banking resources that are fine-tuned to your specific needs.

- Investing We deliver tailored investing guidance and access to unique investment opportunities from world-class specialists.

- Lending We take a strategic approach to lending, working with you to craft the fight financing solutions matched to your goals.

- Planning No matter where you are in your life, or how complex your needs might be, we’re ready to provide a tailored approach to helping your reach your goals.

Whether you want to invest on your own or work with an advisor to design a personalized investment strategy, we have opportunities for every investor.

- Invest on your own Unlimited $0 commission-free online stock, ETF and options trades with access to powerful tools to research, trade and manage your investments.

- Work with our advisors When you work with our advisors, you'll get a personalized financial strategy and investment portfolio built around your unique goals-backed by our industry-leading expertise.

- Expertise for Substantial Wealth Our Wealth Advisors & Wealth Partners leverage their experience and robust firm resources to deliver highly-personalized, comprehensive solutions across Banking, Lending, Investing, and Wealth Planning.

- Why Wealth Management?

- Retirement Calculators

- Market Commentary

Who We Serve

Explore a variety of insights.

Global Research

- Newsletters

Insights by Topic

Explore a variety of insights organized by different topics.

Insights by Type

Explore a variety of insights organized by different types of content and media.

- All Insights

We aim to be the most respected financial services firm in the world, serving corporations and individuals in more than 100 countries.

Key takeaways

- J.P. Morgan Research sees only a modest risk the global economy slides into recession in the near term but is forecasting an end to the global expansion by mid-2025.

- Stubborn inflation, above central bank comfort zones, is expected to keep rates higher-for-longer. Current market expectations for an early start to developed market (DM) easing cycles are likely to be disappointed.

- A more challenging macro backdrop is anticipated for equity markets in 2024. Lackluster earnings growth and geopolitical risks are set to weigh on the outlook for stocks. J.P. Morgan analysts estimate S&P 500 earnings growth of 2–3% and a price target of 4,200, with a downside bias.

“As we approach 2024, we expect both inflation data and economic demand to soften, as the tailwinds for growth and risk markets are fading. Overall, we are cautious on the performance of risky assets and the broader macro outlook over the next 12 months, due to building monetary headwinds, geopolitical risks and expensive asset valuations.”

Marko Kolanovic

Chief Global Markets Strategist and Global Co-Head of Research, J.P. Morgan

Global market outlook

2023 started with low and declining expectations for global growth and heightened fears of a recession. however, china’s reopening, large fiscal stimulus in the u.s. and europe, and the residual strength of u.s. consumers stabilized growth. additional market optimism was related to chatgpt , luxury goods , weight-loss drugs , the expectation of federal reserve (fed) rate cuts and the bitcoin rally, resulting in a broadly positive performance for risk markets. that was despite the largest increase in interest rates in decades, major wars, an energy crisis, a regional banking crisis, recession in parts of the eurozone and emerging signs of credit and consumer deterioration in the u.s., contemporaneous positive economic data was enough to lift risk markets, which could be seen as complacency against a backdrop of declining consumer strength and increased credit stress (e.g. rising credit card and auto loan delinquencies). household liquidity trends indicate that for 80% of consumers, excess savings from the covid era are already gone, and by mid-2024 it is likely that only the top 1% of consumers by income will be better off than before the pandemic. , “we expect both inflation data and economic demand to soften in 2024. should investors and risky assets welcome an inflation decline and bid up bonds and stocks, or will the fall in inflation indicate the economy is sliding toward a recession we think the decline in inflation and economic activity we forecast for 2024 will at some point make investors worry or perhaps even panic,” said marko kolanovic, chief global markets strategist and global co-head of research at j.p. morgan. , “overall, we are not positive on the performance of risky assets and the broader macro outlook over the next 12 months. the primary reason is the interest rate shock (over the past 18 months) will negatively impact economic activity. geopolitical developments are an additional challenge as they impact commodity prices, inflation, global trade in goods and services and financial flows. at the same time, valuations of risky assets are expensive on average,” kolanovic added., it is hard to see an acceleration of the economy or a lasting risk rally without a significant reduction in interest rates and reversal of quantitative tightening. this is a catch-22 situation, in which risk assets can’t have a sustainable rally at this level of monetary restriction, and there will likely be no decisive easing unless risky assets correct (or inflation declines due to, for example, weaker demand, thus hurting corporate profits). this would imply that some market declines and volatility would need to take place first during 2024 before easing of monetary conditions and a more sustainable rally., avoiding recession has now become consensus thinking but looking at the relatively small number of recessions throughout history as a reference point, yield curve inversion signals indicate recession risk is highest between 14 and 24 months after the onset of inversion. , “that time period will cover most of 2024 and should make it another challenging year for market participants,” kolanovic said., equity market outlook , in 2022, the s&p 500 slid close to 20% in the wake of the fed’s decision to rapidly hike interest rates. however, equity markets advanced in 2023, recovering some lost ground. , while stocks have remained positive year to date, the outlook for earnings growth has not been as strong as investors hoped. equity concentration in the s&p 500 is now at levels not seen since the 1970s, meaning the rise in stocks this year has been driven by a cluster of tech mega-cap stocks. this dynamic, which has been seen ahead of previous economic slowdowns — along with an end to a period of record pricing power as 40-year high inflation begins to soften — suggests corporate margins are set to face major headwinds in 2024. .

S&P 500 outlook 2024

In 2024, J.P. Morgan Research estimates 2–3% earnings growth for the S&P 500 and a price target of 4,200.

“Absent rapid Fed easing, we expect a more challenging macro backdrop for stocks next year, with softening consumer trends at a time when investor positioning and sentiment have mostly reversed. Equities are now richly valued with volatility near the historical low, while geopolitical and political risks remain elevated. We expect lackluster global earnings growth with downside for equities from current levels,” said Dubravko Lakos-Bujas, Global Head of U.S. Equity and Quantitative Strategy at J.P. Morgan.

For the S&P 500, J.P. Morgan Research estimates earnings growth of 2–3% next year with earnings per share (EPS) of $225 and a price target of 4,200, with a downside bias.

J.P. Morgan economists expect U.S. and global growth to slow by the end of 2024. At the same time, liquidity continues to contract as major central banks shrink balance sheets at an unprecedented pace and borrowing rates remain restrictive across consumer and corporate segments.

Among U.S. households, excess liquidity and cash-like assets have fallen from a peak of $3.4 trillion (T) to $1T and should largely be exhausted by the second quarter of 2024, based on J.P. Morgan Research estimates.

“While it is difficult to pin down the start date and depth of a recession ahead of time, we think it is a live risk for next year, even though investors are not pricing in this uncertainty consistently across geographies, styles and sectors yet.”

Dubravko Lakos-Bujas

Chief Global Equity Strategist, J.P. Morgan

Stay current

Sign up for the bi-weekly In Context newsletter, bringing market views and industry news straight to your inbox.

Geopolitical risks also remain high, with two major conflicts currently ongoing and national elections soon taking place in 40 countries, including the U.S. As such, equity volatility is expected to generally trade higher in 2024 than in 2023, and the extent of the increase depends on the timing and severity of an eventual recession.

“While it is difficult to pin down the start date and depth of a recession ahead of time, we think it is a live risk for next year, even though investors are not pricing in this uncertainty consistently across geographies, styles and sectors yet,” Lakos-Bujas added.

From a regional perspective, the U.S. continues to command a quality premium over other markets, given its sector composition and cash-rich mega-cap stocks.

Outside the U.S. and within international developed markets (DM), the outlook for U.K. equities is optimistic, given significant valuation support and favorable sector compositions.

“Despite cheap valuation, we expect European equities to have a V-shaped path, ending the year relatively flat. On the other hand, Japan remains attractive with a potential pick-up in retail participation, strong balance sheets, improving shareholder focus, better consumer real income growth and a still supportive policy backdrop,” said Mislav Matejka, Head of Global Equity Strategy at J.P. Morgan.

A bumpy start to the year is expected for emerging markets (EM) given high rates, geopolitical developments and lasting U.S. dollar strength. However, EM should become more attractive through 2024 on EM-DM growth divergence, demand for diversification away from the U.S. and low investor positioning.

For China, which has lagged meaningfully this year, there is the prospect of better performance if the growth momentum delivers on the upside and geopolitical risks stay contained.

“2024 can likely provide a tactical entry point for strategic allocations, with bond yields peaking ahead of rate cutting, and stocks likely to correct due to the disconnect between a slowing economy and unrealistic consensus earnings expectations.”

Thomas Salopek

Global Head of Cross-Asset Strategy, J.P. Morgan

Global economic forecast

Global growth exceeded expectations in 2023. despite synchronized monetary tightening from central banks around the world, the private sector proved to be resilient and positive fiscal and commodity price shocks also provided relief. , j.p. morgan economists expect the global economy to avoid a near-term recession, but an end to the global expansion by mid-2025 remains the most likely scenario., in this scenario, inflation remains sufficiently sticky at around 3%, meaning central banks will maintain higher-for-longer policy stances. this will ultimately lead to an earlier end to the expansion than currently anticipated by many. , but at the same time, with a healthy private sector that has weathered the monetary tightening cycle surprisingly well and some disinflationary signs emerging, soft-landing optimism is on the rise..

“Our top-down views have become more open to a soft-landing scenario (to 40%) but remain biased toward an end to the global expansion by mid-2025.”

Bruce Kasman

Chief Global Economist, J.P. Morgan

On balance, the global outlook calls for the following:

- Growth is poised to slow as positive shocks fade, while rising yields and tighter credit bite.

- Inflation moderation is expected to be limited by lingering damage to supply and a shift in inflation psychology.

- Pressure will likely be concentrated in the business sector where margins should compress, prompting a slowdown in hiring and spending.

- Vulnerability is likely to build gradually: We see a 25% chance of recession by the first half of 2024, 45% by the second half of 2024 and 60% by the first half of 2025.

- Inflation will not fall to target on a sustained expansion path, but recent developments soften our skepticism.

- U.S. supply-side performance has been impressive this year, easing labor markets despite strong growth.

- Domestic demand shortfalls in China and Europe point to a potential ongoing disinflationary impulse.

- A soft landing is dependent on an inflation decline that allows monetary easing to begin by about mid-year.

- A mild recession is not a mild event and would generate a much worse outcome than a sluggish-growth soft landing.

Since mid-2022, J.P. Morgan Research’s global outlook has moved away from focusing on a single narrative and has instead rested on recognizing a range of outcomes that each have a material likelihood.

“It is no surprise that a tide of soft-landing optimism is now on the rise, boosting asset prices and expectations for early policy ease. Our top-down views have become more open to a soft-landing scenario (to 40%) but remain biased toward an end to the global expansion by mid-2025,” said Bruce Kasman, Chief Global Economist at J.P. Morgan.

“We continue to put the most weight on a ‘boiling the frog’ scenario, whereby elevated interest rates eventually drive the global economy into recession. We put a 60% chance on this occurrence,” Kasman added.

Global real GDP

In both 1H and 2H 2024, real GDP growth is expected to be higher in EM than in DM.

Rates forecast

The reversal of the fastest and most synchronized dm central bank tightening cycle of 2022–23 will start in the second half of 2024, against a backdrop of muted growth and falling inflation. , on the monetary policy side, the global tightening cycle across dm central banks will be most likely completed by the end of 2023. central banks will be patient in holding policy rates if confidence around the convergence of inflation to target holds, but some will be under pressure to make additional hikes if the decline is too slow..

“We look for lower yields and steeper curves in 2024, with the largest moves expected to occur from spring onward. We forecast 10-year yields at 4.25% by mid-year and 3.75% by the end of 2024.”

Co-Head of U.S. Rates Strategy, J.P. Morgan

Inflation in 2024 is expected to continue its downtrend trend on fading energy pressure and weaker labor markets, as the delivered tightening starts weighing on the growth outlook.

Headline inflation for DM countries

By the end of 4Q24, inflation in developed markets is expected to be close to the target set by central banks.

Potential stickiness on the way down will put pressure on central banks to stay higher-for-longer and push back on premature expectations of cuts. On the other hand, downward pressure on inflation will give confidence to DM central banks that the delivered tightening has been effective in taking inflation back toward target.

“We expect a steady and gradual easing cycle toward a neutral level of rates across DMs if our macro baseline of soft landing unfolds, with differentiation across jurisdictions in terms of start date, pace and terminal. However, risks are tilted toward faster cuts in a recession scenario where the macro outlook warrants easy monetary policy,” said Fabio Bassi, Head of European Rates Strategy at J.P. Morgan.

In the U.S., the Federal Open Market Committee (FOMC) will likely start cutting rates in the third quarter of 2024 at a pace of 25 bp per meeting, while quantitative tightening (QT) will continue through 2024.

“We look for lower yields and steeper curves in 2024, with the largest moves expected to occur from spring onward. We forecast 10-year yields at 4.25% by mid-year and 3.75% by the end of 2024,” said Jay Barry, Co-Head of U.S. Rates Strategy at J.P. Morgan.

Commodity markets outlook

After falling in 2023, j.p. morgan research expects brent oil prices to remain largely flat in 2024 and edge down a further 10% in 2025. , “our brent forecast has not changed since june and is expected to average $83 per barrel (bbl) in 2024,” said natasha kaneva, head of global commodities strategy at j.p. morgan. , this will be buttressed by solid supply-demand fundamentals. “despite sustained economic headwinds, we see oil demand rising by 1.6 million barrels per day (mbd) in 2024, underpinned by robust emerging markets, a resilient u.s. and a weak but stable europe,” kaneva said. .

“Despite sustained economic headwinds, we see oil demand rising by 1.6 million barrels per day (mbd) in 2024, underpinned by robust emerging markets, a resilient U.S. and a weak but stable Europe.”

Natasha Kaneva

Head of Global Commodities Strategy, J.P. Morgan

To keep the oil market balanced however, the OPEC+ (Organization of the Petroleum Exporting Countries) alliance will likely need to continue to constrain production. J.P. Morgan Research expects Saudi Arabia and Russia to extend their voluntary production/export cuts through the first quarter of 2024. Assuming Saudi Arabia pumps additional oil and Russia increases exports, global oil inventories will likely stay flat in 2024.

Over in U.S. gas markets, an overhang of supply will likely limit upside risks for U.S. gas prices in 2024. “We believe there are two stories that will dictate the year. The first narrative is one of oversupply and depressed pricing that is likely to linger through the first half of 2024 and, potentially, the entirety of the summer injection season,” said Shikha Chaturvedi, Head of Global Natural Gas and Natural Gas Liquids Strategy at J.P. Morgan. “The second is the ability for feed gas demand to not only offset but also outpace regional supply growth.”

Global commodity price forecasts

In 2024, Brent crude is expected to average $83/bbl, natural gas $3.34/MMBtu, gold $2,175/oz, silver $30/oz and wheat $6.33/bu.

Turning to metals, gold and silver are forecasted to outshine the rest of the sector. The Fed cutting cycle and falling U.S. real yields are expected to push gold prices to new nominal highs in the middle of 2024, reaching an average of $2,175/oz by the fourth quarter. In the same vein, silver prices will likely follow gold, averaging around $30/oz in the fourth quarter.

“Across all metals, we have the highest conviction on a bullish medium-term forecast for both gold and silver over the course of 2024 and into the first half of 2025, though timing an entry will continue to be critical,” said Gregory Shearer, Head of Base and Precious Metals Strategy at J.P. Morgan.

In the agriculture markets, price risk is skewed to the upside off current spot levels, particularly through the first half of 2024. “Our price forecasts call for a bullish outlook across sugar and modest gains across grain, oilseeds and the cotton markets through 2024,” said Tracey Allen, Agricultural Commodities Strategist at J.P. Morgan. Sugar prices are projected to average $0.30/lb in 2024, while wheat prices are expected to average $6.33 per bushel.

Against an uncertain macro backdrop, how will FX perform in 2024?

“foreign exchange (fx) market participants’ view on the macro outlook remains wide, spanning from a soft landing and additional fed hikes to recession. needless to say, they will need to navigate the transition among these scenarios tactically as these would imply different outcomes for the u.s. dollar,” said meera chandan, co-head of global fx strategy at j.p. morgan. , while the road ahead for the u.s. dollar (usd) looks bumpy, the greenback is expected to remain at elevated levels, with potential for new highs. “if rate cuts are realized, the dollar would still yield more than 56% of global currencies on a real basis in 2024,” chandan said. .

Forecasts for major currency pairs

By December 2024, EUR/USD is expected to reach 1.13, GBP/USD 1.26, USD/JPY 146, AUD/USD 0.68, CAD/USD 1.33 and NZD/USD 0.60.

Looking at the euro, prospects for a convincing rebound in 2024 appear dim as the region is flirting with recession amid restrictive rates. A recovery in the single currency would require not only Fed easing, but also improved prospects of regional growth.

“Euro underperformance versus the dollar may be a longer-term phenomenon,” Chandan said, with J.P. Morgan Research forecasting the euro/dollar pair to hover between parity and 1.05 for the first half of 2024.

The outlook is similar for the British pound, with the market oscillating between sticky inflation and weaker growth in 2024. The decisive issue for sterling in 2024 is largely about how far this year’s policy tightening can slow growth and the labor market, such that the Bank of England (BoE) is comfortable enough with the inflation outlook to cut the bank rate.

“We take a bearish stance on sterling going into 2024, but are mindful that the economy is more resilient to policy tightening than we thought,” Chandan added. J.P. Morgan Research forecasts the sterling/dollar pair to sink to 1.18 in the first quarter of 2024, before rising to 1.26 by December.

In Asia, structural pressures will continue to weigh on the Japanese yen in 2024. “We forecast yen appreciation in the second half of 2024 driven by shorter-term factors, namely relative policy rate changes. However, this appreciation may be shallow because of the underlying long-run downtrend,” said Katsuhiro Oshima, Head of Japan FX Research at J.P. Morgan.

Emerging markets outlook

“A key focus for us through 2024 is the U.S. economy and how it resolves cyclical uncertainty.”

Luis Oganes

Head of Global Macro Research, J.P. Morgan

Overall, the EM outlook will largely be dominated by U.S. growth and monetary policy cycles. These are the three key themes that will be at play in EM during 2024:

The US cycle will be a major EM driver

The focus will be on the U.S. cycle as a soft-landing scenario or recession emerges. “For EM assets, there is likely hundreds of basis points’ difference between the two scenarios in terms of risk premia,” said Luis Oganes, Head of Global Macro Research at J.P. Morgan. “A key focus for us through 2024 is the U.S. economy and how it resolves cyclical uncertainty.” Near term, there is space for smaller cycles to be the primary drivers. “In the meantime, EM monetary policy and default cycles should be the focus of investment opportunities until the big cycle dominates again,” Oganes said.

EM growth is set to moderate

EM growth is expected to moderate from 4.1% to a slightly below-trend 3.8% in 2024. China’s growth will edge lower to 4.9%, though a slew of targeted policy supports will put growth above 5% (ar) in the first half of the year. Regionally, Asia EM growth will accelerate, outweighing steady growth in EMEA and further slowing in Latin America.

Inflation will return to central bank comfort zones for most

J.P. Morgan Research forecasts headline and core inflation in EM ex-China and Türkiye to fall around 100 bp, converging near 3.5% yoy by the end of 2024. Monetary policy will stay restrictive as rate cuts will likely remain measured.

“As you navigate increasingly complex markets, J.P. Morgan Global Research is looking forward to continuing our partnership, providing investment insights and ideas in 2024 and beyond.”

Hussein Malik

Global Co-Head of Research, J.P. Morgan

Related insights

Leveraging cutting-edge technology and innovative tools to bring clients industry-leading analysis and investment advice.

The increase in appetite for obesity drugs

November 29, 2023

What does the growing popularity of GLP-1s mean for sectors ranging from biotech to insurance and food?

Energy supercycle: Will oil prices keep rising?

November 02, 2023

Discover the outlook for oil prices and energy stocks against a difficult geopolitical backdrop. Could Brent hit $150/bbl in 2026?

This communication is provided for information purposes only. Please read J.P. Morgan research reports related to its contents for more information, including important disclosures. JPMorgan Chase & Co. or its affiliates and/or subsidiaries (collectively, J.P. Morgan) normally make a market and trade as principal in securities, other financial products and other asset classes that may be discussed in this communication.

This communication has been prepared based upon information, including market prices, data and other information, from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy except with respect to any disclosures relative to J.P. Morgan and/or its affiliates and an analyst's involvement with any company (or security, other financial product or other asset class) that may be the subject of this communication. Any opinions and estimates constitute our judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This communication is not intended as an offer or solicitation for the purchase or sale of any financial instrument. J.P. Morgan Research does not provide individually tailored investment advice. Any opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. You must make your own independent decisions regarding any securities, financial instruments or strategies mentioned or related to the information herein. Periodic updates may be provided on companies, issuers or industries based on specific developments or announcements, market conditions or any other publicly available information. However, J.P. Morgan may be restricted from updating information contained in this communication for regulatory or other reasons. Clients should contact analysts and execute transactions through a J.P. Morgan subsidiary or affiliate in their home jurisdiction unless governing law permits otherwise.

This communication may not be redistributed or retransmitted, in whole or in part, or in any form or manner, without the express written consent of J.P. Morgan. Any unauthorized use or disclosure is prohibited. Receipt and review of this information constitutes your agreement not to redistribute or retransmit the contents and information contained in this communication without first obtaining express permission from an authorized officer of J.P. Morgan.

You're now leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.

JP Morgan Research

- What is J.P. Morgan Research?

Support Center Articles

Product access & information.

- Additional Language Resources

- ProQuest Support Center

- Platform Status Page

- Upcoming Webinars

J.P. Morgan Research includes a ccess to quality market research is essential for business school students as it teaches real-world business research skills and helps students develop analytical capabilities. J.P. Morgan Research allows business students to perform in-depth company and industry research through the most highly regarded analysis available. Through this collection, students can access all of J.P. Morgan’s analyst and economics reports from 2011 forward, covering over 3,000 global companies across all industries with just a seven-day embargo.

For more information about J.P. Morgan Research , navigate to the Content Page.

J.P. Morgan Research database is also part of the Business Premium Collection and ProQuest One Business. J.P. Morgan Research resides on the ProQuest Platform. For more information, see the ProQuest Platform LibGuide .

- ProQuest Business Databases Content Updates

- Next: Content >>

- Last Updated: Jul 28, 2023 1:27 PM

- URL: https://proquest.libguides.com/jpmorgan

- Mutual Funds

- SmartRetirement Funds

- 529 Portfolios

- Alternatives

- Separately Managed Accounts

- Money Market Funds

- Commingled Funds

- Featured Funds

Asset Class Capabilities

- Fixed Income

- Multi-Asset Solutions

- Global Liquidity

Investment Approach

- ETF Investing

- Model Portfolios

- Sustainable Investing

- Commingled Pension Trust Funds

Education Savings

- 529 Plan Solutions

- College Planning Essentials

Defined Contribution

- Target Date Strategies

- Startup and Micro 401(k) Plan Solutions

- Small to Mid-market 401(k) Plan Solutions

Market Insights

- Market Insights Overview

Guide to the Markets

- Quarterly Economic & Market Update

- Guide to Alternatives

- Market Updates

On the Minds of Investors

- Principles for Successful Long-Term Investing

- Weekly Market Recap

Portfolio Insights

- Portfolio Insights Overview

- Asset Class Views

Long-Term Capital Market Assumptions

- Multi-Asset Solutions Strategy Report

- Strategic Investment Advisory Group

Retirement Insights

- Retirement Insights Overview

Guide to Retirement

- Principles for a Successful Retirement

Portfolio Construction

- Portfolio Construction Tools Overview

- Portfolio Analysis

- Investment Comparison

- Heatmap Analysis

- Bond Ladder Illustrator

- Retirement Plan Tools & Resources Overview

- Target Date Compass®

- Core Menu Evaluator℠

- Price Smart℠

- Account Service Forms

- News & Fund Announcements

- Insights App

- Market Response Center

- Artificial Intelligence

- Diversity, Equity, & Inclusion

- How we invest

- Media Resources

- Our Leadership Team

- LinkedIn Twitter Facebook

Insights to empower better decisions

Tools and resources necessary to help make informed investment decisions and build stronger portfolios

Our flagship Insights

The J.P. Morgan Guide to the Markets illustrates a comprehensive array of market and economic histories, trends and statistics through clear charts and graphs.

Discover J.P. Morgan's Long-Term Capital Market Assumptions, drawing on the best thinking of our experienced investment professionals worldwide.

The Guide to Retirement is here. This guide provides a powerful framework to support advisors’ retirement planning conversations with clients by using data, exhibits and analysis to explain complex retirement issues in a clear and concise manner.

Insights Now

Our thought leaders sit down for a conversational breakdown of big ideas, future trends, emerging topics and their investment implications complete with key takeaways to help inform building stronger investment plans and portfolios for the long-term.

- Market Insights: China data update

- Maximizing your retirement nest egg

- Fine-tuning portfolios with active ETFs

Trending Topics

Impact of missing the best 10 days in the market

Losses hurt more than gains feel good. During periods of market declines, a natural emotional reaction is to sell out of the market and seek safety in cash. However, keep in mind, the best days in the market are likely to occur close to the worst days. Staying the course with a diversified long-term investment strategy may produce a better retirement outcome.

Learn more in our Guide to Retirement >

Market Commentary

Where are mortgage rates headed.

While we don’t expect home prices to decline materially from here given structural dynamics, Americans that have been sidelined from being able to purchase a home over the past couple of years are perhaps hoping and waiting for at least one area of reprieve: lower mortgage rates.

Can investment management harness the power of AI?

If 2023 was the year for AI excitement, this year may be the year for deployment. In first quarter earnings calls, approximately 45% of S&P 500 companies mentioned AI, marking a fresh high by our measures, and their collective investments continue to climb.

What’s going on with auto insurance costs?

Within that “super core” index, one small category (only 3% of the overall CPI basket) has been making outsized contributions: auto insurance.

Is investing in Asia about more than just China?

2023 marked a third consecutive year of double-digit declines for Chinese equity markets. Investors are now reconsidering how to invest in that market and whether investing in Asia is about more than just China.

Is the growth in private credit cannibalizing the high yield market?

To understand these shifting dynamics and determine how to embrace this growing asset class, investors should consider: What’s driving the growth of private credit and the decline in high yield and, if private credit deserves a strategic allocation in a broader credit portfolio?

Why is home ownership unattainable for so many young Americans?

Following the pandemic, median home prices surged by double digits until peaking at the end of 2022. While prices are down roughly 12% since then, home affordability still sits at multi-decade lows.

1Q24 Earnings: Off to a solid start

During the first quarter, U.S. equities shrugged off ever-changing expectations for monetary policy with relative ease, climbing 10.6% despite a sharp hawkish repricing in policy expectations.

Will the Federal Reserve (Fed) cut rates this year?

At its May meeting, the Federal Open Market Committee (FOMC) voted to leave the Federal funds rate unchanged at a target range of 5.25%-5.50%.

Is inflation reaccelerating?

Sticky price pressures pose a challenge for the data-dependent Fed, casting doubt on the possibility of any rate cuts this year.

Which overseas markets are particularly attractive?

Investors should consider trimming decade-long international equity underweights – and Asia is the key place to look for opportunities.

Will exit activity improve in private equity?

Private equity has been surprisingly resilient throughout the Fed hiking cycle. In 2022, PE only declined by 2%, but is now 3.2% higher than the end of 2021, compared to U.S. small cap stocks, which were 7% lower.

Will the U.S. consumer keep economic growth afloat?

It’s well understood that consumption is the largest contributor to economic growth in the United States accounting for just under 70% of GDP. Therefore, to a large extent, any outlook on the economy hinges on the health of the consumer.

Does conflict escalation in the Middle East change the investment outlook?

Investors should recognize that while geopolitical headlines have the ability to capture market attention, the shocks to sentiment are often short-lived.

Does AI have the power to enhance our health?

Well-positioned investors could take advantage of the new era unfolding in healthcare transformation.

Should investors be constructive given yields or cautious given spreads in corporate bonds?

We expect yields to stabilize in the near term and for spreads to remain tight given still healthy credit fundamentals and strong economic activity.

The quarter in review: what happened in the first three months of 2024?

2023’s so-called “everything rally” was confusing to many market watchers, given the pessimistic macro outlook at the beginning of last year. Now, a quarter into 2024, the rally has clearly continued.

Can multiples still support the equity rally?

The S&P 500 notched 24 new all-time highs in Q1, up 10.6%, with 2.7%-points from earnings, 7.4% from multiple expansion, and 0.4% from dividends.

Has the housing market turned a corner?

While we don’t expect a recession this year, whenever one occurs, the lack of private sector imbalances suggest that it is unlikely to be a severe one.

Would Fed rate cuts benefit EM equities?

Investors should focus on EM regions and sectors that benefit from structural, as well cyclical, tailwinds.

When will the Federal Reserve start cutting interest rates?

As widely anticipated, the Federal Open Market Committee (FOMC) voted to leave the Federal funds rate unchanged at a target range of 5.25%-5.50% at its March meeting.

Does it make sense to buy bitcoin?

Cryptocurrency investments should be made cautiously, and only as part of a much larger diversified portfolio of stocks and bonds. For investors with a long time horizon, traditional asset allocation remains an effective strategy.

Could AI adoption be the catalyst for Asia tech?

For investors looking to diversify concentration to U.S. tech names or to lean into underappreciated AI opportunities, Asian high-quality technology stocks could provide an attractive opportunity set.

Will Japanese Yen strength derail the Japanese equity rally?

Despite causing some short-term profit taking, gradual Yen strength can be digested by equities. Japan finally deserves to retake its place as a strategic allocation in global equity portfolios.

What’s behind the surge in working women?

The financial future for women looks promising, but for individual investors, a strong financial plan will be key in seizing the opportunity.

Is commercial real estate finding a floor?

After a significant pricing reset, private real estate could be on the verge of a rebound due to a few key drivers.

What has the Fed done in election years?

With monetary policy still at the forefront of the macro landscape in 2024, investors are left wondering how the election might influence Fed policymakers.

Can harvesting tax losses improve investor outcomes?

Investors should recognize that the challenging backdrop presents an opportunity for alpha generation, both through traditional security selection and through active tax management

Are there opportunities outside the “Magnificent 7” and outside the U.S.?

For over a year, investors have been hyper-focused on the performance of just seven U.S. companies, nicknamed the “Magnificent 7”*, and rightfully so, given their outsized returns, earnings growth, and long-term tailwinds.

How can investors avoid falling into the “Cash Trap”?

Over the last 30 years, cash has been unable to keep up with the creep of inflation. By contrast, other investments have been much better places to park capital.

What does the election mean for taxes?

Presidential candidates will be campaigning on various policy proposals throughout the year, but one policy item that must be addressed during the next administration is whether to sunset or extend tax cuts from the 2017 Tax Cuts and Jobs Act.

Market cap or equal weight?

The S&P 500 has reached a new milestone: crossing 5000. It is up 5.4% year-to-date, compared to the equal weight S&P 500, up just 0.7%.

Should investors be bullish or bearish on US equities?

While recession risks in the US have receded, geopolitical risk, election risk and restrictive monetary policy all threaten the current rally.

Are Chinese equities cheap enough?

As the Year of the Dragon is about to begin in China, investors wonder: Are Chinese equity valuations cheap enough to bring good fortune ahead? What will turn investor sentiment around? Equity valuations already reflect a lot of uncertainty about the short-term and long-term path, suggesting a tactical rebound may be in the cards.

How soon will the Federal Reserve (Fed) start cutting rates?

At the first Federal Open Market Committee (FOMC) meeting of the year, the FOMC voted to leave the Federal funds rate unchanged at a target range of 5.25%-5.50%.

4Q23 Earnings: Rounding the corner

Markets achieved a trifecta of good news in 2023: an economy that not only avoided recession but reaccelerated, meaningful progress on disinflation, and the Fed pivot markets had been trying to manifest for over a year.

What’s happened so far in 2024?

Geopolitical uncertainty and an impending U.S. presidential election, coupled with the divergence in performance across assets in January, help to underline the importance of diversification in a fundamentally uncertain world.

Can the Magnificent 7 retain its magnificence?

Much has been said about the “Magnificent 7” stocks that dominated market returns last year, ending 2023 up 107% and accounting for around two-thirds of the S&P 500’s performance.

Large caps, mid-caps, or small caps?

After an impressive equity rally in 2023 and new all-time highs to start 2024, investors are evaluating their equity allocations, which includes where to position along the market cap spectrum.

What will drive international equity performance this year?

International equities are likely to benefit this year from positive structural changes, a weaker dollar, and exciting governance changes.

Investing in an election year

Presidential elections always add an extra element of uncertainty to investing, and after a halcyon 2023 in equity markets, could come as a shock to investors. On top of assessing the path of the Federal Reserve, the stability of profits and the consumer, and navigating economic resilience vs. recession, investors will have to grapple with the barrage of headlines about the 2024 election.

How might geopolitical risks impact markets in 2024?

A spike in oil prices could lead to higher prices at the pump, further disrupting the broad disinflationary trend.

Does the December CPI report signal an inflation resurgence?

The December CPI report showed an unexpected bounce in inflation with headline CPI rising 0.3% m/m (consensus 0.2%) and the year-over-year rate rising to 3.4% (consensus 3.2%).

How much does policy influence sector performance?

Although investors may be tempted to invest based on who they think will win the election and how certain policies may be implemented, macro forces often dwarf policy agendas when it comes to sector performance.

Are markets too optimistic about rate cuts in 2024?

For investors, should fundamentals remain solid we would expect the Fed to begin gradually reducing rates by the middle of this year and for long-term rates to stabilize at current levels, before grinding lower over the balance of the year.

How sectors perform under Republicans vs. Democrats

Many investors wonder if they can tweak their existing exposures to be either more defensive against volatility or more opportunistic if certain sectors face future policy tailwinds.

What themes will drive the market in 2024?

We cannot predict what theme will dominate the markets in 2024, but we can control how we react to positive and negative surprises by having a measured approach to portfolios.

Will surging deficits contribute to higher interest rates in 2024?

Deficits are financed through Treasury issuance, and it is likely this significant increase in Treasury bond supply relative to estimates contributed to the move higher in bond yields this year.

Is the Federal Reserve finished raising interest rates?

At its final meeting of 2023, the Federal Open Market Committee (FOMC) voted to leave the Federal funds rate unchanged at a target range of 5.25%-5.50% and strongly hinted it is finished hiking interest rates this cycle.

What is the outlook for 2024?

In many ways, 2023 can be used as evidence that asset allocators must learn to “expect the unexpected”: the U.S. economy avoided a recession, the Federal Reserve pushed interest rates higher, growth equity continued to outperform relative to value and the international recovery was largely lackluster.

How can alternative assets drive portfolio outcomes in 2024?

The macro landscape has shifted dramatically over the last three years, and in 2024 uncertainty lingers as to whether the economy will experience resilience or recession.

Is the recent enthusiasm about Japanese equities justified?

Japan has long been a disappointing market for global investors, with annualized 15-year returns of 6.4% (in U.S. dollars) versus 13.7% in the U.S. Slow growth, negative interest rates, lack of focus on shareholders, and better opportunities elsewhere in Asia kept investment dollars away from Japan.

When will higher rates start hurting companies?

For investors, large caps may be better insulated from higher rates than small caps, and falling net interest costs can assist decelerating input costs and wages in supporting stabilizing margins.

Have other equity market returns been as concentrated as those in the U.S.?

The big story for U.S. equity markets this year has been the remarkable performance of the largest seven technology stocks or the “magnificent 7.” These handful of stocks account for nearly 100% of S&P 500 YTD returns and are up over 72% this year.

Does technical analysis matter?

Many investors are comfortable with the concept of fundamental analysis but are less confident in the technical aspects of market forecasting. As a result, they may wonder: does technical analysis matter?

Have equity valuations adjusted to higher rates?

Active stock selection remains of the utmost importance, as investors should look toward attractively priced companies with strong balance sheets and resilient profits.

What are the implications of cooling inflation?

For markets, disinflation could pose an earnings headwind for certain industries like autos, hotels and airlines while the Fed’s “higher for longer” mantra could instill continued volatility in bond markets.

Where can investors find sources of diversification?

While many of the traditional sources of diversification have been challenged by market conditions, alternative investments can enhance diversification.

How to position fixed income under different economic and interest rate scenarios?

Coming into 2023, the rallying cry from the asset management community was “Bonds are Back! ”. There were several reasonable assumptions behind this call.

After two consecutive pauses, what is next for the Federal Reserve?

While a reacceleration in growth and/or inflation could prompt another rate hike either in December or early next year, short-term bumps in a downward trending economy likely keep the Fed on hold well into 2024.

Can China turn its economy around?

Historically, Chinese market recoveries can be fast and furious, highlighting the risk of being too underweight China when pessimism is already elevated.

3Q23 earnings: Here today, what about tomorrow?

At the start of the year, investors and economists were confident that 2023 would be a challenging year for the economy, markets and corporate profits. In the event, however, growth has been better than expected, equity markets are higher, and earnings have surprised to the upside.

What is the opportunity in the secondary market?

The secondary market can often relieve liquidity issues for investors in private equity by offering the opportunity to sell existing investments to another buyer.

What is your outlook for the energy sector?

At first glance, the jump in energy equities may seem like a temporary phenomenon, but a variety of economic factors could support the sector’s performance over the longer-term.

Should investors embrace active or passive in fixed income?

Given the shifting characteristics in the bond market and uncertainty around the path of rates from here, investors should engage in an active approach with proven managers in their fixed income allocations.

Which measure of earnings should I look at?

The question for investors, however, is which measure of earnings has the highest correlation with stock market returns.

Does incoming data signal another rate increase by year end?

With two FOMC meetings before year end, investors and policymakers are closely monitoring the totality of incoming data to determine whether the committee will lift rates again or go on an extended pause.

What is the outlook for 3Q23 earnings season?

Despite many looming threats to the economy, 3Q23 earnings season should hopefully represent a relative bright spot in the landscape.

Is good news bad news?

As rates have moved higher risk assets have found themselves under pressure, with the S&P 500 down more than 7% from its July 31st high of 4,589. To an extent, this price action has been driven by a shift in investor psychology whereby “good news” is now “bad news.”

Will the U.S. economy avoid a recession next year?

It is still a close call on whether the economy will enter a recession or not, but we do believe slow growth is the most likely outcome, while risks for a mild recession remain.

How will the auto worker strike impact the U.S. economy?

If automobile production decreases, prices for vehicles, particularly used ones, may increase once more, unwinding some of recent disinflation and putting renewed upward pressure on “super-core” CPI.

What happens if the U.S. government shuts down?

After well over a year of anxiously anticipating an economic recession, the U.S. economy continues to look sound. However, as we enter the “fall of worry” there are several risks on the horizon this autumn: impacts from the UAW strike, rising oil prices, the resumption of student loan payments, and the potential for a government shutdown.

What are the investment implications of the September FOMC meeting?

As widely anticipated, the Federal Open Market Committee (FOMC) voted to leave the Federal funds rate unchanged at a target range of 5.25%-5.50% at its September meeting.

The transformative power of generative AI

Last quarter, 40% of S&P 500 companies mentioned artificial intelligence (AI) in their earnings calls – more than double from a year earlier – and their collective investments in AI are exploding.

What do financial conditions tell us about future growth?

With the possibility of tighter financial conditions going forward, investors may be well served by looking for any signs that tighter conditions are beginning to weigh on activity.

What is the outlook for the relationship between stocks and bonds?

Over the long run, duration will be an investor’s friend for both asset classes: not only will lower rates push bond prices higher, but a lower opportunity cost of owning equities and easy monetary policy should allow valuations and earnings expectations to move higher.

Have the rest of EM been faring as badly as China?

While what happens in China will continue to influence growth, sentiment, and performance in the broader EM universe, powerful structural and cyclical themes can lead to differentiated performance.

How might the outlook for real yields impact market performance?

We expect a slower growth and cooling inflation environment will allow the Fed to gradually reduce rates next year, thus stabilizing real yields and potentially biasing them lower.

What do I need to know after summer vacation?

With many parents (and investors!) taking the end of summer to be with their families and go to the beach one last time, kids are not the only ones who need a refresher before they head back to the classroom; in today’s blog, we try to help parents get ready to go “back to school.”

What is really going on with real assets?

2023 has seen more office conversion activity – while sometimes this can be easier said than done, it does suggest that there is an evolving opportunity in the office space for investors who can deploy additional capital.

Is the excitement toward Indian equities justified?

India’s smaller share in global manufacturing exports and its lower dependence on the China reopening story helps to explain its strength versus other export-oriented Asian economies’ struggles.

What is ‘up’ with rates?

While the probability of a soft landing has risen given the generally strong incoming data, the concern is that most leading indicators continue to point to recession.

Will U.S. investment grade credit spreads remain tight amid economic uncertainty?

The rally in corporate credit may have caught some investors by surprise given the consensus that a recession would materialize this year, a historically bad environment for credit spreads.

Is it true that when the U.S. sneezes the rest of the world catches a cold?

Looking back at the past six U.S. stock market declines greater than 10%, international has not always sold off more. In some instances, it has performed in line or even better.

2Q23 earnings: Resilient

This combination of resilient growth, better than expected profits and enthusiasm around artificial intelligence has led to a strong rally in U.S. equities so far this year.

What is the outlook for oil prices?

The likely cause for declining oil prices is increased U.S. production, which is expected to reach an all-time high in 2023.

Will the Federal Reserve hike rates again?

While the Fed may need some more convincing over the next two meetings, it seems reasonable to expect this tightening cycle will end this year.

What is the outlook for private equity?

It would not be surprising to see a more notable re-rating in valuations later this year or in early 2024; this, in turn, will create opportunity for both primary and secondary market investors.

Have U.S. equities rallied too much?

Beneath the surface are two market dynamics: the megacap tech stocks, which account for the lion’s share of positive market performance year-to-date, and everything else.

What is the outlook for capital spending?

The combination of slower economic growth, higher interest rates and tightening credit conditions are likely to weigh on CapEx and could be the thing that tips the U.S. economy into a mild recession.

What trends are persisting across alternative investments?

Fundamentals differ significantly at the sector level. For example, office remains the weakest sector, as vacancy rates remain elevated, and firms struggle to fully exit remote working.

Was the June FOMC meeting a Fed pause or hawkish skip?

Today’s announcement made it clear that the committee still needs more compelling evidence that inflation is under control and could very well tighten at least once more this summer.

Is the Fed getting inflation wrong?

While labor market conditions may have had some effect on pushing up services prices, we think its impact is overstated. Over the last 4 months, more than half of the year-over-year gain in core services ex-shelter inflation has come from transportation services alone.

How can private infrastructure fit in my portfolio?

Core infrastructure continues to represent a way to generate income without taking on more equity risk, while proactively hedging portfolios from the chance that inflation is harder to tame than many currently expect.

Will the debt ceiling aftermath push up interest rates?

Although rates have risen across the curve in recent weeks due to debt ceiling uncertainty, more hawkish Fed expectations, and resilient economic data, the overall macro landscape is one of slowing growth and receding inflation.

Inflation: A Somewhat Sticky Situation

As we emerge from this pandemic with inflation now rising at its fastest pace since the 1980s, the biggest question for investors is whether some of this inflation will prove “sticky”.

Featured Portfolio Insights

Global asset allocation views 2q 2024.

We expect moderating growth, cooling inflation and policy rate cuts in 2024. We overweight equities and credit and are neutral on duration. In equities we favor U.S. cyclicals, Japan and emerging markets ex-China. In fixed income, we prefer shorter-dated U.S. high yield and securitized credit.

Global Fixed Income Views 2Q 2024

Recent years remind us that significant central bank tightening does not automatically lead to recession. Sub Trend Growth is still our base case at 70% probability; we’ve raised Above Trend Growth’s likelihood to 15% and lowered Recession to 10%. Crisis is unchanged at 5%.

Global Equity Views 2Q 2024

Our portfolio managers are a little more cautious on the outlook. Many prefer quality stocks and find less expensive names in the more cyclical, industrial areas of the market. Fundamentals of corporate profits still look good.

Factor Views 2Q 2024

Factors had a strong first quarter, particularly equity factors. Equity value rose in nearly every region and remains inexpensive. Prospects remain attractive for a range of factors, including equity value and quality in the U.S., and macro carry

Make the most of the economic recovery

See the potential impact that various recovery scenarios may have on client portfolios.

At Morgan Stanley, we lead with exceptional ideas. Across all our businesses, we offer keen insight on today's most critical issues.

Personal Finance

Learn from our industry leaders about how to manage your wealth and help meet your personal financial goals.

Market Trends

From volatility and geopolitics to economic trends and investment outlooks, stay informed on the key developments shaping today's markets.

Technology & Disruption

Whether it’s hardware, software or age-old businesses, everything today is ripe for disruption. Stay abreast of the latest trends and developments.

Sustainability

Our insightful research, advisory and investing capabilities give us unique and broad perspective on sustainability topics.

Diversity & Inclusion

Multicultural and women entrepreneurs are the cutting-edge leaders of businesses that power markets. Hear their stories and learn about how they are redefining the terms of success.

Wealth Management

Investment Banking & Capital Markets

Sales & Trading

Investment Management

Morgan Stanley at Work

Sustainable Investing

Inclusive Ventures Group

Morgan Stanley helps people, institutions and governments raise, manage and distribute the capital they need to achieve their goals.

We help people, businesses and institutions build, preserve and manage wealth so they can pursue their financial goals.

We have global expertise in market analysis and in advisory and capital-raising services for corporations, institutions and governments.

Global institutions, leading hedge funds and industry innovators turn to Morgan Stanley for sales, trading and market-making services.

We offer timely, integrated analysis of companies, sectors, markets and economies, helping clients with their most critical decisions.

We deliver active investment strategies across public and private markets and custom solutions to institutional and individual investors.

We provide comprehensive workplace financial solutions for organizations and their employees, combining personalized advice with modern technology.

We offer scalable investment products, foster innovative solutions and provide actionable insights across sustainability issues.

From our startup lab to our cutting-edge research, we broaden access to capital for diverse entrepreneurs and spotlight their success.

Core Values

Giving Back

Sponsorships

Since our founding in 1935, Morgan Stanley has consistently delivered first-class business in a first-class way. Underpinning all that we do are five core values.

Everything we do at Morgan Stanley is guided by our five core values: Do the right thing, put clients first, lead with exceptional ideas, commit to diversity and inclusion, and give back.

Morgan Stanley leadership is dedicated to conducting first-class business in a first-class way. Our board of directors and senior executives hold the belief that capital can and should benefit all of society.

From our origins as a small Wall Street partnership to becoming a global firm of more than 80,000 employees today, Morgan Stanley has been committed to clients and communities for 87 years.

The global presence that Morgan Stanley maintains is key to our clients' success, giving us keen insight across regions and markets, and allowing us to make a difference around the world.

Morgan Stanley is differentiated by the caliber of our diverse team. Our culture of access and inclusion has built our legacy and shapes our future, helping to strengthen our business and bring value to clients.

Our firm's commitment to sustainability informs our operations, governance, risk management, diversity efforts, philanthropy and research.

At Morgan Stanley, giving back is a core value—a central part of our culture globally. We live that commitment through long-lasting partnerships, community-based delivery and engaging our best asset—Morgan Stanley employees.

As a global financial services firm, Morgan Stanley is committed to technological innovation. We rely on our technologists around the world to create leading-edge, secure platforms for all our businesses.

At Morgan Stanley, we believe creating a more equitable society begins with investing in access, knowledge and resources to foster potential for all. We are committed to supporting the next generation of leaders and ensuring that they reflect the diversity of the world they inherit.

Why Morgan Stanley

How We Can Help

Building a Future We Believe In

Get Started

Stay in the Know

For 88 years, we’ve had a passion for what’s possible. We leverage the full resources of our firm to help individuals, families and institutions reach their financial goals.

At Morgan Stanley, we focus the expertise of the entire firm—our advice, data, strategies and insights—on creating solutions for our clients, large and small.

We have the experience and agility to partner with clients from individual investors to global CEOs. See how we can help you work toward your goals—even as they evolve over years or generations.

At Morgan Stanley, we put our beliefs to work. We lead with exceptional ideas, prioritize diversity and inclusion and find meaningful ways to give back—all to contribute to a future that benefits our clients and communities.

Meet one of our Financial Advisors and see how we can help you.

Get the latest insights, analyses and market trends in our newsletter, podcasts and videos.

- Opportunities

- Technology Professionals

Experienced Financial Advisors

We believe our greatest asset is our people. We value our commitment to diverse perspectives and a culture of inclusion across the firm. Discover who we are and the right opportunity for you.

Students & Graduates

A career at Morgan Stanley means belonging to an ideas-driven culture that embraces new perspectives to solve complex problems. See how you can make meaningful contributions as a student or recent graduate at Morgan Stanley.

Experienced Professionals

At Morgan Stanley, you’ll find trusted colleagues, committed mentors and a culture that values diverse perspectives, individual intellect and cross-collaboration. See how you can continue your career journey at Morgan Stanley.

At Morgan Stanley, our premier brand, robust resources and market leadership can offer you a new opportunity to grow your practice and continue to fulfill on your commitment to deliver tailored wealth management advice that helps your clients reach their financial goals.

Through timely, in-depth analysis of companies, industries, markets and world economies, Morgan Stanley has earned its reputation as a leader in the field of investment research.

The New Technologies for Longer, Healthier Lives

Revolutionary ways to prevent and treat disease can add decades to people’s lives. Here’s what investors should know about the opportunities in the longevity theme.

The Dollar Is Poised to Keep Its Crown

Why the dollar is likely to hold onto its status as the reserve currency of the world, despite some cyclical weaknesses.

Watch for a September Rate Cut

Summer data should begin to show that inflation is finally under control, prompting the Fed to make the first of three interest rate cuts this year.

Scaling Up the Impact of Obesity Drugs

The global market for the blockbuster drugs could increase by more than 15-fold over the next five years as their benefits expand beyond weight loss, with expected implications for consumer goods and longevity.

What Could Keep India's Bull Market Going?

As India votes, the election’s outcome and other key factors could help determine whether its stock market maintains its trajectory.

Where Will Older Adults Live?

Investors should watch how a growing 65-plus demographic in the U.S. is creating opportunities for providers of senior living and targeted healthcare solutions.

Next-Day Disruption

E-commerce is upending package delivery as retailers restructure their supply chains to focus on short-haul, regionalized models.

Election 2024: Inflation Outlook

It's too early to predict the results of the election on inflation and the broader economy, but there are three areas investors should watch.

K-Pop's Investment Potential

The pop music genre out of South Korea is set to broaden its horizons, with the $130 billion global music industry in its sights.

Japan Offers Lessons in Longevity

Japan's approach to the fastest-aging population may provide a guide for other nations in navigating the challenges of longevity.

Why 2024 Could Be a Hot year For M&A

Morgan Stanley Research predicts a 50% increase in deal volumes compared with 2023, thanks to growing corporate confidence and positive news on the global economy.

Aging Consumers Shop for Wellness

As the population grows older and wealthier, expected growth in health-enhancing products and services in Europe could offer lessons for the world on this demographic’s consumption preferences.

Exceptional Leaders/Exceptional Ideas

Morgan Stanley’s James Gorman: Seizing the Moment

James Gorman, Morgan Stanley’s Executive Chairman, reflects on his 14-year tenure as CEO, leading the firm during periods of unprecedented disruption and opportunity.

Van Hauwermeiren: 'Everyone Can Innovate'

Tim Van Hauwermeiren, co-founder and CEO of argenx, talks about how the biotech develops novel treatments for autoimmune conditions, why the line between success and failure is “razor thin” for fledgling companies and why innovation should happen in all corners of an organization.

Delta's Ed Bastian: Making Travel Magical

Delta Air Lines CEO Ed Bastian talks about how the COVID-19 pandemic helped build brand loyalty, his conviction to take tough stands and how he sees sustainability shaping the future of air travel.

Astrazeneca: Creating a Culture of Innovation

Pascal Soriot, the CEO of AstraZeneca, talks about how AI is changing drug development, the significance of ‘smart chemo’ and why real innovation requires taking risks.

The Home Depot: 'Our Culture is our Differentiator'

Ted Decker, CEO of The Home Depot, talks about the outlook for home improvement after its pandemic-driven boom, why technology makes DIY more accessible, and how he plans to lead The Home Depot through the next phase of growth.

Bill Gates: Big Ideas on Digitalization and Clean Energy

Bill Gates has spent a lifetime chasing what he calls “wild ideas.” Now he’s focused on breakthroughs in clean energy and digitalization as a tool to tackle global poverty.

Harley-Davidson: Revamping an Iconic Brand

Morgan Stanley sits down with Harley-Davidson CEO Jochen Zeitz to talk about what might be the biggest challenge of his career: making sure the iconic brand stays relevant without losing its authenticity.

How Digitalization is Transforming India

Morgan Stanley sits down with Nandan Nilekani, one of the visionaries behind India’s digital transformation, to discuss how India’s digitalization is transforming healthcare, education and banking in India.

Northrop Grumman: Redefining What's Possible

Morgan Stanley sits down with Northrop Grumman President and CEO Kathy Warden to talk about how one of the world’s largest aerospace companies thinks about innovation and exploration.

RWE: A Major Coal Producer Makes a Big Bet On Clean Energy

CEO of Germany’s RWE talks about how the company has transformed from one of the world’s largest brown coal producers to a leader in the global transition to clean energy.

Palo Alto Networks: Staying Ahead of Cyber Threats

Morgan Stanley sits down with Nikesh Arora, Chairman & CEO of Palo Alto Networks, to talk about how the pandemic changed the cybersecurity landscape.

Amgen: How Biotechnology is Transforming Medicine

Chairman and CEO of one of the world’s leading biotechnology companies, Bob Bradway, talks about how this one-niche segment is driving some of the biggest breakthroughs in medicine.