- Screen Reader

- Skip to main content

- Text Size A

- Language: English

Case Studies

- EXIM Procedure

Media & Events

- Image Gallery

- Media Coverage

Other Links

- GI of India

- Experience India

- Indian Trend Fair 2022

India Organic Biofach 2022

Gulfood dubai 2023, banking sector in india, as of 2022, more than 80% of the indian population has a bank account in comparison to 17% in 2009., advantage india, robust demand.

* Indian Fintech industry is estimated to be at US$ 150 billion by 2025. India has the 3rd largest FinTech ecosystem globally.

* BCG predicts that the proportion of digital payments will grow to 65% by 2026.

* That demand seems particularly strong when it comes to the critical need of protecting consumer data, where incumbent banks have a trust advantage. Some super apps may also turn to banks for access to banking licenses and to meet other regulatory requirements.

Innovation in Services

* In the recent period, technological innovations have led to marked improvements in efficiency, productivity, quality, inclusion and competitiveness in the extension of financial services, especially in the area of digital lending.

* Digitalization of Agri-finance was conceptualized jointly by the Reserve Bank and the Reserve Bank Innovation Hub (RBIH). This will enable delivery of Kisan Credit Card (KCC) loans in a fully digital and hassle-free manner.

* In Union Budget 2023, the KYC process will be streamlined by using a 'risk-based' strategy rather than a 'one size fits all' approach.

* In September 2023, Hitachi Payment Services launched India's first-ever UPI-ATM with NPCI.

Business Fundamentals

* The Indian banking industry has been on an upward trajectory aided by strong economic growth, rising disposable incomes, increasing consumerism and easier access to credit.

* Digital modes of payments have grown by leaps and bounds over the last few years.

* As on January 2024, there were 560 banks actively using UPI. The total number of digital transactions during this period amounted to 15.08 billion, with a total value of US$ 25.27 billion (Rs. 2.1 trillion).

Policy Support

* The RBI has launched a pilot to digitalize KCC lending in a bid for efficiency, higher cost savings, and reduction of TAT. This is expected to transform the flow of credit in the rural economy.

* In November 2022, RBI launched a pilot project on central bank digital currency (CBDC).

* In Union Budget 2023, a national financial information registry would be constructed to serve as the central repository for financial and ancillary data

* In March 2023, India Post Payments Bank (IPPB), in collaboration with Airtel, announced the launch of WhatsApp Banking Services for IPPB customers in Delhi.

Banking Industry Report

Introduction.

As per the Reserve Bank of India (RBI), India’s banking sector is sufficiently capitalised and well-regulated. The financial and economic conditions in the country are far superior to any other country in the world. Credit, market and liquidity risk studies suggest that Indian banks are generally resilient and have withstood the global downturn well.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years India has also focused on increasing its banking sector reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. Schemes like these coupled with major banking sector reforms like digital payments, neo-banking, a rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

Indian Fintech industry is estimated to be at US$ 150 billion by 2025. India has the 3rd largest FinTech ecosystem globally. India is one of the fastest-growing Fintech markets in the world. There are currently more than 2,000 DPIIT-recognized Financial Technology (FinTech) businesses in India, and this number is rapidly increasing.

The digital payments system in India has evolved the most among 25 countries with India’s Immediate Payment Service (IMPS) being the only system at level five in the Faster Payments Innovation Index (FPII). India’s Unified Payments Interface (UPI) has also revolutionized real-time payments and strived to increase its global reach in recent years.

Market Size

The Indian banking system consists of 12 public sector banks, 21 private sector banks, 44 foreign banks, 12 Small finance banks. As of December 2023, the total number of micro-ATMs in India reached 16,88,558. Moreover, there are 1,26,205 on-site ATMs and Cash Recycling Machines (CRMs) and 93,671 off-site ATMs and CRMs.

Banks added 2,796 ATMs in the first four months of FY23, against 1,486 in FY22 and 2,815 in FY21. 100% of new bank account openings in rural India are being done digitally. BCG predicts that the proportion of digital payments will grow to 65% by 2026.

In 2023, total assets in the public and private banking sectors were US$ 1686.70 billion and US$ 1016.39 billion, respectively. In 2023, assets of public sector banks accounted for 58.31% of the total banking assets (including public, private sector and foreign banks).

The interest income of public banks reached US$ 102.4 billion in 2023. In 2023, interest income in the private banking sector reached US$ 70 billion.

India's digital lending market witnessed a growth of CAGR 39.5% over a span of 10 years. The Indian digital consumer lending market is projected to surpass US$ 720 billion by 2030, representing nearly 55% of the total US$ 1.3 trillion digital lending market opportunity in the country.

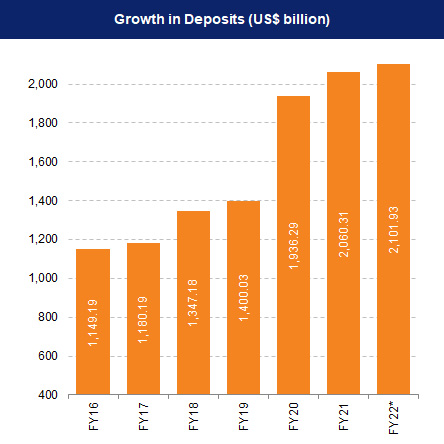

According to RBI’s Scheduled Banks’ Statement, deposits of all scheduled banks collectively surged by a whopping Rs. 200.6 lakh crore (US$ 2,414.15 billion) as of January 26th, 2024.

Investments/Developments

Key investments and developments in India’s banking industry include:

- Google India Digital Services (P) Limited and NPCI International Payments Ltd (NIPL), have signed a Memorandum of Understanding (MoU) to expand the transformative impact of UPI to countries beyond India.

- Warehousing Development Regulatory Authority and Punjab & Sind Bank signed Memorandum of Understanding to facilitate low interest rate loans to farmers.

- Fincare Small Finance Bank Limited (Fincare) and AU Small Finance Bank Limited (AU) has merged, with AU being the surviving entity (merged entity).

- In December 2023, ICICI Prudential Life Insurance and Ujjivan Small Finance Bank forged the Bancassurance Partnership.

- In October 2023, AU Small Finance Bank announced the acquisition of Fincare Small Finance Bank in an all-share deal and to merge it with itself.

- According to data released by the National Payments Corporation of India (NPCI), UPI transactions reached 10.241 billion until August 30th, 2023.

- In September 2023, Hitachi Payment Services launched India's first-ever UPI-ATM with NPCI.

- In September 2023, the Reserve Bank of India is likely to bring in CBDC in the call money market.

- In July 2023, Mahindra and Mahindra acquires minority stake in RBL Bank.

- In July 2023, State Bank of India to acquire 100% stake of SBI Capital in SBICAP Ventures for US$ 85.25 million (Rs. 708 crore).

- In June 2023, State Bank of India to acquire entire 20% stake of SBI Capital Markets in SBI Pension Funds.

- In April 2023, HDFC Bank to acquire 20% or more in Griha Pte subsidiary of HDFC Investments.

- M&A activity with an India angle hit a record US$ 171 billion in 2022.

- In April 2022, IDFC to sell Mutual Fund Business to Bandhan-Financial Holdings led Consortium for US$ 550.23 million (Rs. 4,500 crore).

- In March 2022, aggressive Axis Bank acquired Citi's India consumer business for US$ 1.6 billion.

- In December 2022, HDFC Bank to buy 7.75% stake in fintech start-up Mintoak.

- As per report by Refinitiv, Domestic M&A activity saw record levels of activity in 2022 at US$ 119.2 billion, up 156.3% from 2021. Companies like HDFC Bank, HDFC, Ambuja Cements, ACC, Adani Group Biocon, Mindtree, L&T Infotech, AM/NS, Essar Ports were involved in M&A deals in 2022.

- On June 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totalled Rs. 1.68 trillion (US$ 21.56 billion).

- In April 2022, India’s largest private bank HDFC Bank announced a transformational merger with HDFC Limited.

- On November 09, 2021, RBI announced the launch of its first global hackathon 'HARBINGER 2021 – Innovation for Transformation' with the theme ‘Smarter Digital Payments’.

- In November 2021, Kotak Mahindra Bank announced that it has completed the acquisition of a 9.98% stake in KFin Technologies for Rs. 310 crore (US$ 41.62 million).

- In October 2021, Indian Bank announced that it has acquired a 13.27% stake in the proposed National Asset Reconstruction Company Ltd. (NARCL).

- In July 2021, Google Pay for Business has enabled small merchants to access credit through tie-up with the digital lending platform for MSMEs—FlexiLoans.

- In February 2021, Axis Bank acquired a 9.9% share in the Max Bupa Health Insurance Company for Rs. 90.8 crore (US$ 12.32 million).

- In December 2020, in response to the RBI’s cautionary message, the Digital Lenders’ Association issued a revised code of conduct for digital lending.

- On November 6, 2020, WhatsApp started UPI payments service in India on receiving the National Payments Corporation of India (NPCI) approval to ‘Go Live’ on UPI in a graded manner.

- In October 2020, HDFC Bank and Apollo Hospitals partnered to launch the ‘HealthyLife Programme’, a holistic healthcare solution that makes healthy living accessible and affordable on Apollo’s digital platform.

- In 2019, banking and financial services witnessed 32 M&A (merger and acquisition) activities worth US$ 1.72 billion.

- In April 2020, Axis Bank acquired additional 29% stake in Max Life Insurance.

- In March 2020, State Bank of India (SBI), India’s largest lender, raised US$ 100 million in green bonds through private placement.

- In February 2020, the Cabinet Committee on Economic Affairs gave its approval for continuation of the process of recapitalization of Regional Rural Banks (RRBs) by providing minimum regulatory capital to RRBs for another year beyond 2019-20 - till 2020-21 to those RRBs which are unable to maintain minimum Capital to Risk weighted Assets Ratio (CRAR) of 9% as per the regulatory norms prescribed by RBI.

Government Initiatives

- Bank accounts opened under GoI Pradhan Mantri Jan Dhan Yojana have deposits of over ~US$ 25.13 billion in beneficiary accounts. 51.11 crore beneficiaries banked till December 15th, 2023.

- In September 2023, IREDA partners with banks to boost renewable energy projects in India.

- In March 2023, India Post Payments Bank (IPPB), in collaboration with Airtel, announced the launch of WhatsApp Banking Services for IPPB customers in Delhi.

- In October 2022, Prime Minister Mr. Narendra Modi inaugurated 75 Digital Banking Units (DBUs) across 75 districts in India.

- In Union Budget 2023, a national financial information registry would be constructed to serve as the central repository for financial and ancillary data.

- In Union Budget 2023, the KYC process will be streamlined by using a 'risk-based' strategy rather than a 'one size fits all' approach.

- National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crore (US$ 6.70 billion) from the banks.

- National payments corporation India (NPCI) has plans to launch UPI lite which will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

- In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly known as Digital Rupee.

- In November 2021, RBI launched the ‘RBI Retail Direct Scheme’ for retail investors to increase retail participation in government securities.

- The RBI introduced new auto debit rules with a mandatory additional factor of authentication (AFA), effective from October 01, 2021, to improve the safety and security of card transactions, as part of its risk mitigation measures.

- In September 2021, Central Banks of India and Singapore announced to link their digital payment systems by July 2022 to initiate instant and low-cost fund transfers.

- In August 2021, Prime Minister Mr. Narendra Modi launched e-RUPI, a person and purpose-specific digital payment solution. e-RUPI is a QR code or SMS string-based e-voucher that is sent to the beneficiary’s cell phone. Users of this one-time payment mechanism will be able to redeem the voucher at the service provider without the usage of a card, digital payments app, or internet banking access.

- As per Union Budget 2021-22, the government will disinvest IDBI Bank and privatise two public sector banks.

- Government smoothly carried out consolidation, reducing the number of Public Sector Banks by eight.

- In May 2022, Unified Payments Interface (UPI) recorded 5.95 billion transactions worth Rs. 10.41 trillion (US$ 133.46 billion).

- According to the RBI, India’s foreign exchange reserves reached US$ 630.19 billion as of February 18, 2022.

- The number of transactions through immediate payment service (IMPS) reached 430.67 million and amounted to Rs. 3.70 trillion (US$ 49.75 billion) in October 2021.

- The RBI has launched a pilot to digitalize KCC lending in a bid for efficiency, higher cost savings, and reduction of TAT. This is expected to transform the flow of credit in the rural economy.

- As per the Union Budget 2023-24, the RBI has launched a pilot to digitalize Kisan Credit Card (KCC) lending in a bid for efficiency, higher cost savings, and reduction of TAT. This is expected to transform the flow of credit in the rural economy.

- As per the Union Budget 2023-24, digital banking, digital payments and fintech innovations have grown at a rapid pace in the country. Taking forward this agenda, and to mark 75 years of our independence, it is proposed to set up 75 Digital Banking Units in 75 districts of the country by Scheduled Commercial Banks.

- Additionally, the government proposed to introduce a digital rupee or a Central Bank Digital Currency (CBDC) which would be issued by the RBI using blockchain and other technologies.

- The government also proposed to bring all the 150,000 post offices under the digital banking core business to enable financial inclusion.

- As per the economic survey 2022-23, the permission by RBI to lending institutions to grant a total moratorium of 6 (3+3) months in case of payment failure due between 1st March 2020 to 31st August 2020, infusion of US$ 9.1 billion (Rs. 75,000 crore) for Non-Banking Financial Corporations (NBFCs), Housing Finance Companies (HFCs) and Micro Finance Institutions (MFIs), among others, have also contributed to the revival of the real estate sector. The permission by RBI to lending institutions to grant a total moratorium of 6 (3+3) months in case of payment failure due between 1st March 2020 to 31st August 2020, infusion of US$ 9.1 billion (Rs. 75,000 crore) for Non-Banking Financial Corporations (NBFCs), Housing Finance Companies (HFCs) and Micro Finance Institutions (MFIs), among others, have also contributed to the revival of the real estate sector.

- According to the Economic Survey 2022-23, Over the last few years, the number of neo banking platforms and global investments in the neo-banking segment has also risen consistently. Neo-banks operate under mainstream finance's umbrella but empower specific services long associated with traditional institutions such as banks, payment providers, etc.

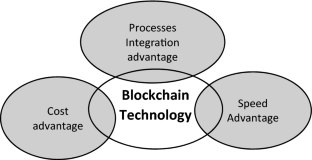

Enhanced spending on infrastructure, speedy implementation of projects and continuation of reforms are expected to provide further impetus to growth in the banking sector. All these factors suggest that India’s banking sector is poised for robust growth as rapidly growing businesses will turn to banks for their credit needs. The advancement in technology has brought mobile and internet banking services to the fore. AI and automation are demonstrating unprecedented value while Blockchain has sparked innovation throughout the business landscape and is poised to continue in doing so. The banking sector is laying greater emphasis on providing improved services to their clients and upgrading their technology infrastructure to enhance customer’s overall experience as well as give banks a competitive edge.

In recent years India has experienced a rise in fintech and microfinancing. India’s digital lending stood at US$ 75 billion in FY18 and is estimated to reach US$ 1 trillion by FY23 driven by the five-fold increase in digital disbursements. The Indian fintech market has attracted US$ 29 billion in funding over 2,084 deals so far (January 2017-July 2022), accounting for 14% of global funding and ranking second in terms of deal volume. By 2025, India's fintech market is expected to reach Rs. 6.2 trillion (US$ 83.48 billion).

References: Media Reports, press releases, Reserve Bank of India, Press Information Bureau, www.pmjdy.gov.in , Union Budget 2023-24, Economic Survey 2023-24

Note: Conversion rate used in February 2024, Rs. 1 = US$ 0.012, * - according to an FIS report, # - Microfinances Institution Network

Related News

The Reserve Bank of India highlights India's robust GDP growth fuelled by solid investment demand, aided by healthy financial institutions and government policies.

India's top banks set to enhance asset quality with record net incomes, strengthening balance sheets, and underwriting standards, per S&P Global.

India's External Affairs Minister, Mr. S Jaishankar, highlights India's digital prowess with 10-12 billion monthly cashless transactions, positioning India as a global economic powerhouse poised for a top-three ranking despite COVID-19 challenges.

India's Minister of Finance, Ms. Nirmala Sitharaman, highlights the nation's exponential growth in digital payments, reaching 131 billion UPI transactions worth US$ 2.39 trillion (Rs. 200 trillion) in FY24, underscoring the government's commitment to combat corruption and drive economic development.

Outward remittances from India reached a record high of US$ 29 billion under the liberalised remittance scheme, showing a 21.7% increase compared to the previous year, with significant allocations towards international travel and education.

Banking India

- Public Sector

- Private Sector

- Foreign Bank

Industry Contacts

- Indian Banks Association

- Reserve Bank of India

- Institute for Development and Research in Banking Technology

NEW INDIA DIGITAL INDIA

India will contribute 2.2% to the world's digital payments market by 2023, while the value of such transaction is expected to reach US$ 12.4 trillion globally by 2025.

IBEF Campaigns

APEDA India Pavilion Gulfood February 20th-26th, 2022 | World Trade Centre,...

Ibef Organic Indian Pavilion BIOFACH2022 July 26th-29th, 2022 | Nuremberg, ...

Spiritual Tourism in India: Analysing Economic Impact and Growth Potential

India, the country where millions of travellers come to seek spiritual fulfilment as part of their tourism journey, makes it an integral part of India...

Financial Resurgence: A Comprehensive Exploration of the Recent Boom in Mutual Fund Investments in India

Mutual funds play an indispensable role in capital markets, serving as a gateway for individuals and institutions to access a diverse range of securit...

Transforming India's Logistics Sector: Challenges and Opportunities

The logistics industry plays a vital role in the dynamic economic landscape of India by enabling the efficient movement of goods and services througho...

Digital India: Advancements in E-Governance Services

Digital India was launched in India in 2015 with the aim of transitioning I...

Air Travel Trends: India's Rising Importance in the Global Passenger Market

The Indian aviation sector has been experiencing great growth over the past...

Transforming the Toll Payment Infrastructure in India

India's booming roads and cars are paving the way for smart traffic man...

Not a member

- Finance & Insurance ›

- Financial Institutions

Banking industry in India - statistics & facts

Indian banking landscape, banking outreach, key insights.

Detailed statistics

Number of banks in India 2023, by type

Value of bank assets in India FY 2013-2023

Number of ATMs in India 2019-2022

Editor’s Picks Current statistics on this topic

Leading public sector banks in India 2023, by market cap

Leading private sector banks in India 2023, by market cap

Fintech (Mobile/online banking)

Status of online banking in India 2020

Further recommended statistics

- Premium Statistic Number of banks in India 2023, by type

- Premium Statistic Value of bank assets in India FY 2013-2023

- Premium Statistic Reserves to debt ratio in India FY 2015-2023

- Premium Statistic Gross non-performing loan ratio SCBs India FY 2008-2023, with estimates for FY 2024

- Premium Statistic Value of foreign exchange reserves in India FY 2010-2023

- Premium Statistic Financial conditions index India Q2 FY 2023, by category

Number of banks across India as of November 2023, by type

Total assets of banks in India from financial year 2013 to 2023 (in trillion U.S. dollars)

Reserves to debt ratio in India FY 2015-2023

Reserves to debt ratio in India from financial year 2015 to 2022, with an estimate for 2023

Gross non-performing loan ratio SCBs India FY 2008-2023, with estimates for FY 2024

Gross non-performing loan ratio of scheduled commercial banks across India from financial year 2008 to 2023, with estimates until September 2024

Value of foreign exchange reserves in India FY 2010-2023

Value of foreign exchange reserves across India from financial year 2010 to 2023 (in billion U.S. dollars)

Financial conditions index India Q2 FY 2023, by category

Financial conditions index in India in 2nd quarter of financial year 2023, by category of banks and financial institutions

- Premium Statistic Distribution of number of banks in India FY 2021, by sector

- Basic Statistic Public sector bank assets in India FY 2013-2023

- Basic Statistic Private sector bank assets in India FY 2013-2023

- Basic Statistic Assets of foreign banks in India FY 2013-2023

- Basic Statistic Loan to deposit ratio of public sector banks in India FY 2012-2023

- Premium Statistic Loan to deposit ratio of private sector banks in India FY 2017-2023

- Premium Statistic Loan to deposit ratio of foreign sector banks in India FY 2019-2023

Distribution of number of banks in India FY 2021, by sector

Distribution of the banking market in India in financial year 2021, by sector

Public sector bank assets in India FY 2013-2023

Public sector bank assets in India from financial year 2013 to 2023 (in trillion U.S. dollars)

Private sector bank assets in India FY 2013-2023

Value of private sector bank assets in India from financial year 2013 to 2023 (in billion U.S. dollars)

Assets of foreign banks in India FY 2013-2023

Foreign banks assets in India from financial year 2013 to 2023 (in billion U.S. dollars)

Loan to deposit ratio of public sector banks in India FY 2012-2023

Credit to deposit ratio of public sector banks across India from financial year 2012 to 2023

Loan to deposit ratio of private sector banks in India FY 2017-2023

Credit to deposit ratio of private sector banks across India from financial year 2017 to 2023

Loan to deposit ratio of foreign sector banks in India FY 2019-2023

Credit to deposit ratio of foreign sector banks across India from financial year 2019 to 2023

Key players

- Premium Statistic Leading public sector banks in India 2023, by market cap

- Premium Statistic Leading private sector banks in India 2023, by market cap

- Premium Statistic State Bank of India's brand value 2016-2023

- Premium Statistic Value of deposits at Punjab National Bank FY 2017-2023

- Premium Statistic Value of deposits at HDFC Bank FY 2017-2023

- Premium Statistic ICICI Bank's total advances FY 2016-2023

Leading public sector banks in India as of December 2023, based on market capitalization (in billion Indian rupees)

Leading private sector banks across India as of 2023, based on market capitalization (in billion Indian rupees)

State Bank of India's brand value 2016-2023

Brand value of State Bank of India from 2016 to 2023 (in billion U.S. dollars)

Value of deposits at Punjab National Bank FY 2017-2023

Value of deposits at Punjab National Bank between financial year 2017 and 2023 (in trillion Indian rupees)

Value of deposits at HDFC Bank FY 2017-2023

Value of deposits at HDFC Bank Limited between financial year 2017 and 2023 (in trillion Indian rupees)

ICICI Bank's total advances FY 2016-2023

Total advances of ICICI Bank Limited from financial year 2016 to 2023 (in billion Indian rupees)

Digital banking

- Premium Statistic Penetration rate of online banking in India 2014-2029

- Premium Statistic UPI usage in India in Q4 2023, by platform

- Premium Statistic Number of NETC partner banks India 2016-2022

- Premium Statistic Partner banks for IMPS India 2013-2023

- Premium Statistic Number of member banks affiliated to NFS India 2018-2023

- Premium Statistic Online banking frauds reported in India 2022, by state

Penetration rate of online banking in India 2014-2029

Penetration rate of online banking in India from 2014 to 2029

UPI usage in India in Q4 2023, by platform

Unified Payment Interface (UPI) usage across India in fourth quarter of 2023, by platform

Number of NETC partner banks India 2016-2022

Number of NETC partner banks in India from November 2016 to January 2022

Partner banks for IMPS India 2013-2023

Number of partner banks for IMPS in India from September 2013 to June 2023

Number of member banks affiliated to NFS India 2018-2023

Number of member banks affiliated to NFS in India from August 2018 to June 2023

Online banking frauds reported in India 2022, by state

Number of online banking frauds reported across India in 2022, by state

Government initiatives

- Premium Statistic Number of rural and urban PMJDY recipients in India 2023, by sector

- Premium Statistic Value of PMJDY deposits in India 2023, by sector

- Premium Statistic Number of PMJDY recipients in India 2023, by public sector bank

- Premium Statistic Value of PMJDY deposits in India 2023, by public sector bank

- Premium Statistic Number of PMJDY recipients in India 2023, by major private bank

- Premium Statistic Value of PMJDY deposits in India 2023, by major private bank

- Premium Statistic Number of loan accounts under PMMY scheme India FY 2021, by category

- Premium Statistic Value of sanctioned loans under PMMY scheme India FY 2022, by financial institution

Number of rural and urban PMJDY recipients in India 2023, by sector

Number of Pradhan Mantri Jan-Dhan Yojana recipients in India as of August 2023, by type and sector (in millions)

Value of PMJDY deposits in India 2023, by sector

Value of Pradhan Mantri Jan-Dhan Yojana deposits in India as of August 2023, by sector (in billion Indian rupees)

Number of PMJDY recipients in India 2023, by public sector bank

Number of Pradhan Mantri Jan-Dhan Yojana recipients in India as of August 2023, by public sector bank (in millions)

Value of PMJDY deposits in India 2023, by public sector bank

Value of Pradhan Mantri Jan-Dhan Yojana deposits in India as of August 2023, by public sector bank (in billion Indian rupees)

Number of PMJDY recipients in India 2023, by major private bank

Number of Pradhan Mantri Jan-Dhan Yojana recipients in India as of August 2023, by major private bank (in millions)

Value of PMJDY deposits in India 2023, by major private bank

Value of Pradhan Mantri Jan-Dhan Yojana deposits in India as of August 2023, by major private bank (in million Indian rupees)

Number of loan accounts under PMMY scheme India FY 2021, by category

Number of loan accounts under Pradhan Mantri Mudra Yojana (PMMY) in India in financial year 2021, by category (in 1,000s)

Value of sanctioned loans under PMMY scheme India FY 2022, by financial institution

Value of sanctioned loans under Pradhan Mantri Mudra Yojana (PMMY) in India in financial year 2022, by financial institution (in billion Indian rupees)

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

- fdi policy ,

- taxation in india ,

- major investors

BFSI - Banking

India is set to have the third-largest domestic banking sector by 2050. .

Sector Expert Raghav Dhanuka

- ALL SECTORS

- BFSI - BANKING

Industry Scenario

Major investors, data on map.

- Gallery/Latest News

Latest In BFSI - Banking

- FAQs/Market Research

Invest India closely works with

Quick links, resilient and well capitalised banking system, the banking industry in india has historically been one of the most stable systems globally, despite global upheavals..

Historically Indian banking has benefited from high savings rates and growth in savings as well as disposable income growth.

- Number of offline and online ATMs – 252,000 (as on Mar 2022)

- Total bank branches: ~123,000

- Total Deposits – $2 Tn

The Banking industry in India has historically been one of the most stable systems globally, despite global upheavals. The health of the Indian banking system is robust, fortified by a multi-year low non-performing loans and adequate level of capital and liquidity buffers.

The population covered with bank accounts increased from 53% in FY 16 to 78% in FY 21. For the first time, the Gross Non-Performing Asset (GNPA) of SCBs has decreased to a 7-year low of 5% in Sept 2022, and the Net NPA has declined to a 10-year low of 1.3%. The continuous improvement in asset quality is seen in the declining GNPA ratio of NBFCs from the peak of 7.2% recorded during the second wave of the pandemic (Jun 2021) to 5.9% in Sept 2022, reaching close to the pre-pandemic level.

There are more than 1.6 Lakh bank branches translating to approximately 15 branches per 1 Lakh of population. This is further complemented by a network of 2.17 lakh ATMs, out of which 47% are in rural and semi-urban areas. Banking services have been made accessible to every village within a 5 km radius in 25 states and 7 Union Territories covering 99.94% of villages.

Key Budget 2023 announcements

- Simplification of KYC process: The KYC process will be simplified adopting a ‘risk-based’ instead of ‘one size fits all’ approach

- Entity Digilocker: to be set up for use by MSMEs, large business and charitable trusts. This will be towards storing and sharing documents online securely, with various authorities, regulators, banks and other business entities

- Credit Guarantee for MSMEs: the revamped credit guarantee scheme will take effect from 1st Apr 2023 through infusion of INR 9,000 Cr in the corpus

- National Financial Information Registry: Proposed to serve as the central repository of financial and ancillary information

- GIFT-IFSC: Permitting acquisition financing by IFSC Banking Units of foreign banks; Establishing a subsidiary of EXIM Bank for trade re-financing

- Improving Governance and Investor Protection in Banking Sector

- Azadi Ka Amrit Mahotsav Mahila Samman Bachat Patra: One-time new small savings scheme, Mahila Samman Savings Certificate, to be made available for a 2 year period up to Mar 2025

- Senior Citizen Savings Scheme

For further information, please refer the FDI policy

Number of ATMs (including Micro ATMs)

Total Deposits (Approx)

No. of Schedule Commercial Banks

Bank Credit SCBs (FY 23)

Tele density has reached up to 93%, over a Bn people have a digital ID document, more than 80% have bank accounts, and as of 2022, over 6 Bn of digital payment transactions are completed per month.

Number of PMJDY accounts has grown more than three-fold from 147.2 Mn in Mar 2015 to over 500 Mn in Aug 2023

- FOREIGN INVESTMENT

- INDUSTRY TRENDS

- POLICIES & SCHEMES

The consolidated balance sheet of SCBs registered double digit growth in FY 22, after a gap of 7 years

- The credit growth to the MSME sector has been remarkably high, over 30.6% (on avg. during Jan-Nov 2022) supported by the extended Emergency Credit Linked Guarantee Scheme (ECLGS) of the Union government

- The share of MSMEs in gross credit offtake to the industry rose from 17.7 % (Jan 2020) to 23.7% (Nov 2022)

- At the end of FY23, the banking sector reported deposits of ~$2.2 Tn and loans of ~$1.67 Tn, leading to a credit-deposit ratio of 75.8% (highest in the past three years)

- Scheduled commercial banks (SCBs) reported a robust credit growth of 15.4% in FY23 (11 year high) compared to 9.7% in FY22. The growth was powered by personal loans, loans to the services sector, and agriculture and allied activities. Personal loans registered a growth of 20.6% in FY23 as compared to 12.6% in the year-ago period, primarily driven by housing loans.

- New bank branches opened by SCBs increased by 4.6% during FY 22. The growth was led by new branches opened in Tier 4, Tier 5 and Tier 6 centres

- The growing importance of the NBFC sector in the Indian financial system is reflected in the consistent rise of NBFCs’ credit as a proportion to GDP

- NBFCs continued to deploy the largest quantum of credit from their balance sheets to the industrial sector, followed by retail, services, and agriculture

- The continuous improvement in asset quality is seen in the declining GNPA ratio of NBFCs from the peak of 7.2% in June 2021 to 5.9% in Sept 2022. The personal loans portfolio of NBFCs grew the most during the last four-year period {compound annual growth rate (CAGR) being more than 30 per cent} resulting in increase of its share in total loan portfolio to 31.2% in Mar 2023

- Credit extended by NBFCs has picked up momentum, with the aggregate outstanding amount at INR 31.5 Lakh Cr as of September 2022. NBFCs continued to deploy the largest quantum of credit from their balance sheets to the industrial sector, followed by retail, services, and agriculture.

Key Government & Regulatory Initiatives

- Pradhan Mantri Jan Dhan Yojana: The world’s largest financial inclusion initiative, “Jan Dhan Yojna”, has helped in new bank account enrolment of 486+ Mn beneficiaries, with 265+ Mn being women

- Scheme for Setting up of Wholly Owned Subsidiaries (WOS) by foreign banks in India: In 2013, the RBI published guidelines for setting up of WOS by foreign banks in India to promote foreign investments into the sector

- Introduction of Kisan Credit Card (KCC) loans in a fully digital and hassle-free manner

- Aadhaar e-KYC authentication for NBFC/Non-Banking entities: All NBFCs, payment system providers and payment system participants can now obtain Aadhaar Authentication Licence (KUA/sub-KUA)

- Establishment of Digital Banking units: In 2022, 75 DBUs were announced in 75 districts of the country to commemorate 75 years of India’s independence

GROWTH DRIVERS

Large consumption market.

India will become the 3rd largest consumer economy by 2030, driven by a young population comprising 65% population below the age of 35 years

Rural Digitization

Digital adoption continues to be propelled by rural India – clocking an 8% YoY growth to 333 Mn internet users (37% of rural population). Rural consumption accounts for 45% of all data consumption in India. Now there are 7 Rural Internet Subscriber, for every 10 Urban Internet Subscribers.

Number of Smartphone Users

India already has the 2nd highest number of smartphone users globally, and is the 2nd largest Internet user market

Digital Push

Mobile banking internet banking, neo-banking and rise in digital products and solutions by private and Government of India support: 93% digital payments (by volume) done via mobile (2021) and over 1 Bn cards are in circulation

Industrial Land Bank Portal

Gis - based map displaying available infrastructure for setting up business operations in the state..

Latest News

Chennai-headquartered bank, Indian Overseas Bank plans to open 88 new…

Insurance major, Tata AIG General Insurance partners Aurm, an asset p…

Banking major, Kotak Mahindra Bank plans to hire 400 engineers to ram…

Public sector UCO Bank to invest INR 1000 Cr for digitisation drive a…

International Finance Corporation (IFC) to more than triple its inves…

RBI Financial Stability Report June 2023

Framework for acceptance of Green Deposits

Master Circular - Bank Finance to Non-Banking Financial Companies (NBFCs)

RBI framework for invoicing and payments for international trade in Indian Rupee

Guidelines on Digital Lending

External Commercial Borrowings (ECB) Policy – Liberalisation Measures

Extension of timeline for implementation of certain provisions of Master Direction – Credit Card and Debit…

Branches of Indian Banks operating in GIFT-IFSC

Establishment of Digital Banking Units (DBUs)

Enhancement in Individual Housing Loan limits and credit to Commercial Real Estate - Residential Housing

Guidelines for Doorstep Banking

Interoperable Card-less Cash Withdrawal (ICCW) at ATMs

Framework for FinTech Entity in the International Financial Services Centres (IFSCs)

Governor Monetary Policy 2022

Inter-operable platform to enhance investor experience in Mutual Funds

Constitution of an Expert Committee on Longevity Finance

Joint Statement on the 1st India-UK Financial Markets Dialogue

Statement on Developmental and Regulatory Policies | 7 April 2021

RBI releases the Financial Stability Report, January 2021

Statement by Shri Shaktikanta Das, Governor, Reserve Bank of India | 4 December 2020

Co-Lending by Banks and NBFCs to Priority Sector

'Technology Vision for Cyber Security' for Urban Co-operative Banks – 2020-2023

Master Circular - Bank Finance to Non…

Press release

RBI framework for invoicing and payments for…

External Commercial Borrowings (ECB) Policy …

Extension of timeline for implementation of…

Branches of Indian Banks operating in GIFT…

Establishment of Digital Banking Units (DBUs…

Enhancement in Individual Housing Loan…

Interoperable Card-less Cash Withdrawal …

Framework for FinTech Entity in the…

Press Release

Inter-operable platform to enhance investor…

Constitution of an Expert Committee on…

Joint Statement on the 1st India-UK…

Statement on Developmental and Regulatory…

RBI releases the Financial Stability Report,…

Statement by Shri Shaktikanta Das, Governor,…

Co-Lending by Banks and NBFCs to Priority…

'Technology Vision for Cyber Security' for…

Frequently Asked Questions

Some of the important Government initiatives undertaken in the banking sector in India are: • Pradhan Mantri Jan Dhan Yojana (PMJDY) • Pradhan Mantri Suraksha Bima Yojana (PMSBY) • Pradhan Mantri Mudra Yojana • Atal Pension Yojana (APY) • Stand-Up India Scheme • Pradhan Mantri Vaya Vandana Yojana • Public Provident Fund • Senior Citizens Sacings Scheme • Sukanya Samriddhi Account

Was it helpful?

Any entity desiring to carry on banking business in India are required to obtain a licence from the Reserve Bank of India. 'Banking business', as per Section 6 of the Banking Regulation Act, refers to acceptance of public deposits for the purpose of lending or investment, which would be repayable and capable of withdrawal, and includes guarantee and indemnity business, discounting, dealing in negotiable instruments, underwriting, participating or managing of any issue, and other incidental activities.

For more information, please visit the RBI website here .

Yes, a banking entity (both Indian and Foreign banks) can operate as IFSC Banking Unit (IBU) after getting a license from IFSCA.

For more information, please read the IFSCA (Banking) Regulations 2020 available here .

Information related to the banking sector of India (rules, regulations, guidelines, statistics etc) are available on the RBI website here and on the Department of Financial Services, Government of India website here .

Banks in India can be broadly categorised in 2 categories: commercial banks and cooperative banks.

Commercial banks include: government-owned banks or public-sector banks (PSBs), private banks, branches or subsidiaries of foreign banks, small finance banks (scheduled commercial banks), and regional rural banks, which provide credit facilities for agricultural purposes to rural areas.

Cooperative banks are divided into 2 categories: urban cooperative banks; and state cooperative banks that provide financing services to small borrowers. The RBI has recently introduced payments banks to provide basic banking and remittance related facilities and accept small deposits.

Since there are different categories of banks set up for different purposes, there are various statutes and regulations made under these statutes that govern and regulate banks set up for specific purposes. For more information, please visit the RBI website here .

Market Research

Report summary of the 15th finance commission for 2021-26, report on currency and finance 2022-23, msme financing market in india 2023 (part-ii), msme financing market in india 2023 (part-i), union budget 2023-24: analysis report, government ministry/ department.

- Ministry of Finance

Industry Associations

- Department of Economic Affairs, Ministry of finance

- Department of Financial Services, Ministry of Finance

- Department for Promotion of Industry and Internal Trade, Ministry of Commerce

- Doing Business in India

- Team India News

Mastering the new realities of India’s banking sector

India’s banking sector is a study in contrasts: it supports the world’s fastest-growing large economy but is grappling with challenges that test its strength and resilience.

Stay current on your favorite topics

Primary among them is the burden of distressed loans. According to Reserve Bank of India (RBI) data, the value of banks’ gross nonperforming assets (GNPA) and restructured assets reached $150 billion in April 2016 and has been growing by almost 25 percent year on year since 2013. State-owned banks account for more than three-fourths of the stressed-asset load, which is now far higher than their net worth. Provision levels are inadequate because these banks hold only 28 percent of GNPAs and restructured assets as provisions. There is a gap of close to $110 billion between the system’s stressed assets and the provisions made. These problems are considerably less severe for private banks.

Yet headline numbers do not tell the entire story, and there are many layers to the changing face of banking and finance in the world’s second most populous country. Even as legacy banks continue to be under pressure from stressed assets and stagnant loan growth, the sector as a whole represents one of the world’s biggest opportunities to create value in banking. Macroeconomic fundamentals continue to be strong, the country is in the midst of a digital revolution , and the ongoing disruptive changes (including momentum on the regulatory front) point to possibilities for both new entrants and incumbent banks.

The Indian government’s twin thrusts—to encourage digital identification and cashless transactions—are driving change throughout the economy . These measures picked up steam after the Unique Identification Authority of India (UIDAI), a statutory body responsible for providing the country’s residents with a biometric identity and a digital platform to authenticate it, was set up in 2016. The UIDAI has issued more than a billion unique identity (Aadhaar) cards, covering most of the country’s adult population. The government is pushing the whole financial system to use this unified identification system, and that has major implications for the sector. The system, which can be used not only for verifying customers but also for loans, direct transfers of subsidies, and a host of other financial transactions, could change the contours of formal and informal business in India.

In addition to the push for digitization, new policies favor financial inclusion and promote competition by allowing new domestic players to set up payments banks (which can only accept deposits and cannot issue loans or credit cards) and small-finance banks (which provide basic banking services to underserved sections of the economy). The further easing of norms, such as permission to set up wholly owned subsidiaries, makes it easier for foreign banks to enter India’s banking sector. Although processes are evolving, regulatory interventions point to the emergence of a digital, inclusive, and interoperable financial-services market in India.

A difficult legacy for Indian banking

Public-sector banks are more exposed to industry sectors with a higher share of nonperforming loans than their private-sector counterparts are. These state-owned institutions have deep networks and control 70 percent of banking’s asset base. From 2009 to 2016, the government made capital infusions of $15 billion into them. But over the years, value has steadily shifted toward private-sector institutions, whose share of the sector’s assets has grown to 25 percent, from 21 percent, in the past decade. 1 1. Reserve Bank of India (RBI) data and annual reports of banks. (Foreign banks account for the remaining 5 percent.) The division is more apparent in the value banks created from 2006 to 2016: private banks have grown faster and generated far more value for their shareholders, with their share of market cap increasing from about 40 percent to nearly 70 percent in the same period.

Loan growth in fiscal year 2017 has remained anemic—the banks’ credit books shrank by 4 percent in the past quarter (Exhibit 1). With the balance sheets of major Indian companies continuing to be under stress, the volume of corporate loans fell by 3 percent from April to December 2016. Roughly 40 percent of the outstanding debt is to companies whose interest-coverage ratio is less than one, 2 2. Analysis of data from Prowess, RBI, and company reports. making debt repayment difficult. Overall, the recovery of wholesale-banking loans seems difficult in the medium term.

The Indian government’s decision to demonetize the currency—about 85 percent of it ceased to be legal tender on November 8, 2016—led to a surge in the current and savings-account (CASA) deposits of the country’s banks. Slow loan growth, combined with the higher CASA, has pushed down the banks’ credit-deposit ratios, a standard measure of loans to deposits. If credit offtake fails to pick up, these factors could affect the banks’ net interest income.

Promising developments in India

Notwithstanding the sectoral doom and gloom, India’s macroeconomic fundamentals continue to be strong . GDP has increased at 6.6 to 7.0 percent over the past four years, and International Monetary Fund projections show an upward trend—growth could reach 7.7 percent by 2020. Wholesale and retail inflation have been trending downward over the past three years.

Would you like to learn more about our Financial Services Practice ?

The expansion and upward mobility of the middle class have transformed retail banking in India over the past decade. We expect these changes to continue as about 89 million households join this social segment by 2025. 3 3. India’s ascent: Five opportunities for growth and transformation , McKinsey Global Institute, August 2016. Upwardly mobile customers are more discerning, which is reflected in loyalty levels. Compared with their predecessors a decade ago, such consumers are half as likely to recommend a financial institution to an acquaintance and 15 percent more likely to shop around. They also have nearly 20 percent more banking relationships, on average.

These new customers, who represent the opening up of the banking marketplace, are more likely than yesterday’s to be attracted by one or another emerging value proposition. Most of them are rapid technology adopters, whose use of the Internet and mobile phones is growing (Exhibit 2). The falling cost of Internet access has facilitated the adoption of digital technologies. By December 2016, mobile data rates in India had fallen to almost 50 percent of their 2013 levels. 4 4. Airtel and Idea annual reports. Digital demand has shot up in consequence—exponential growth in the number of users and Internet use. More consumers rely on the Internet and mobile phones to meet their banking needs. The Indian Banks’ Association’s 2016 survey shows that almost 80 percent of transactions in the newer banks are made through digital channels.

At the same time, a regulatory push by the government and the RBI over the past few years is encouraging more competition and the emergence of digital business models. New categories of banking licenses have been launched—such as payments banks and small-finance banks. It’s also become easier for foreign players to enter the market, since they can now set up wholly owned subsidiaries in the country. This means that they can operate much as Indian-owned banks do, without restrictions on their branch footprints or their efforts to raise domestic capital.

Meanwhile, the government has launched what it calls the Jan Dhan (People’s Money) program, opening bank accounts for millions of previously unbanked customers to promote financial inclusion. About 280 million such accounts have been set up as of March 2017, 5 5. Pradhan Mantri Jan Dhan Yojana, pmjdy.gov.in. allowing users to receive government subsidies and to access remittances, credit, insurance, and so on. Low-cost Indian platforms have been launched to promote digital payments—for example, RuPay, a cheaper, domestic alternative to international credit- or debit-card gateways such as MasterCard and Visa; the Unified Payment Interface (UPI), a system to facilitate the transfer of funds between bank accounts on the mobile platform; and the Bharat Interface for Money (BHIM), a mobile app based on UPI.

The availability of data in India has become more democratic, and with IndiaStack and open application programming interfaces (APIs) banks can now access customer information from a single source. Many of these digital-finance initiatives use the national unique identification number (Aadhaar) to authenticate customers. The recently launched DigiLocker, for example, is a cloud-based document-repository system that enables the sharing of digitized identity documents and certificates.

These developments give financial players opportunities to build innovative business models serving millions of new consumers. Both new entrants, free of legacy issues and with much lower infrastructure costs, and innovative incumbents have an advantage in reaching and serving customers. Since many existing banks have balance-sheet limitations, relatively unconstrained ones also have an opportunity to take over some wholesale loans on their own terms. In addition, disruptions, both in technology and policy, could help new banks create value and increase their efficiency.

Moving the banking sector forward

Despite the tremendous potential and opportunity, incumbents and new entrants alike could use a few boosts to overcome traditional roadblocks.

Leverage the ‘data tsunami’ for customer insights

Reliable, diverse data sources are emerging in India, and these could be used to make smarter and faster decisions in financial services (Exhibit 3). In addition to the traditional sources, such as financial-transaction records and credit bureaus, banks can now tap into information from e-commerce purchases, utility payments, and social media.

With Aadhaar identifying individual customers, financial-services players can also serve them more intelligently, with faster approvals, more customized products, and better underwriting decisions. Combining traditional and nontraditional sources of data on customers allows players to get a more comprehensive picture of them. Many fintechs are already encroaching on the traditional banking space by using the “data tsunami” to come up with disruptive business models that address unmet financing needs.

Cultivate partnership-driven digital ecosystems

Some of the most significant opportunities in Indian banking over the next three to five years will accrue to partnerships, a strategy that will require banks to embed themselves in the daily lives of customers to meet their financing needs. A payments bank, for example, can allow customers to cash in or cash out through local retailer outlets, bypassing the need for traditional (and more expensive) branches and ATMs.

This approach will require banks to build close relationships with partners, creating integrated digital infrastructures that span their individual platforms. This mechanism of being able to embed into another ecosystem and build an entirely digital model, relies on the physical networks of the partners to access customers. It has the potential to change the economics and the ability to serve underserved segments.

India’s ascent: Five opportunities for growth and transformation

Tap growing credit demand from small and midsize enterprises.

With corporate loan books continuing to shrink, the next growth opportunity will be serving India’s vast number of small and medium enterprises (SMEs). Currently, most of them look to the informal sector and nonbanking financial companies for their financing needs. With the push from the informal to the formal economy, an estimated 50 million SMEs could enter the formal banking space by 2020. 6 6. McKinsey Small and Medium Enterprises Survey, 2014.

Traditional banks will face challenges to serve these customers in the face of stiff competition from nonbanking financial companies and fintechs. Small businesses that turn to informal financing channels do so because they cannot raise the collateral banks require. High interest rates, indebtedness, and processing demands are frequently cited reasons for bypassing formal lenders. To address these issues, banks will need to review their traditional lending mechanisms, which are not suitable for SMEs or micro, small, and medium enterprises. To assess the creditworthiness of SMEs, price risk, and set appropriate loan limits, banks will need to use unstructured data—such as prior transaction details and data from the Goods and Services Tax (GST) platform and even from social media.

As we said at the outset, India’s banking sector is at a crossroads. Traditional players face huge disruptions, while digital growth is propelling changes in technology and customer mind-sets. This period of disruption presents tremendous growth opportunities. Old banks will need to make bold moves and initiate major transformations to take advantage of them. The path for new players, which are not saddled with the problems of the past, and for existing but relatively unconstrained banks is considerably easier. Those that master these new realities could build truly world-class banking businesses at scale.

To request a copy of the full report, see “ Mastering new realities: A blueprint to transform Indian banking .”

Aditya Sharma is an associate partner in McKinsey’s Bangalore office, and Renny Thomas is a senior partner in the Mumbai office.

Explore a career with us

Related articles.

India’s ascent: Five opportunities for growth and transformation

Private equity and India’s economic development

Changing lives through technology

We use cookies to deliver the best possible experience on our website. To learn more, visit our cookie policy . By continuing to use this site, or closing this box, you consent to our use of cookies.

- CRISIL Ratings

- Coalition Greenwich

- Explore our world

- Life @ CRISIL

- Tech @ CRISIL

- Find your place

Log In To Your Account

Forgot Password

Thank you! If email exists, we'll send password reset link

Sorry !! The password change operation failed.

user does not exist

Captcha validation failed. Please try again.

- Step 1 Login Credentials

- Step 2 Personal Information

- Step 3 Company Information

Sucess Dialog

You are successfully Registered. A success message has been sent to your registred email id

Error Dialog

User already exists. Please sign-up with a different email id.

Error while creating the user. Please try again later.

- Corporate Sector

- Financial Sector

- Structured Finance

- New Rating Products

- Risk Solutions

- Data & Analytics

- CRISIL 1Academy

- Bridge To India

- Fundamental Research

- Quantitative Services

- Traded Risk

- Credit & Lending Solutions

- Non Financial Risk

- Data and Analytics

- Independent Credit Evaluation

- Insurance Hybrids

- REITs/InvITs

- CRISIL Coalition Index

- Intelligent Credit Origination

- Credit One View

- Model Infinity

- CRISIL AIF Benchmarks

- Sustainability Solutions

- Consumption Products

- Infrastructure

- IT, Media & Telecom

- Travel, Health, Retail and Others

- Views & Commentaries

- Publications

- Premium Research

- CRISIL Blogs

- CRISIL Podcasts

- ESG Research

- Bond Market Seminar

- India Outlook

- Infra Intelligence

- Fin Insights

- Home >

- Our Analysis >

- Reports >

Our recommendations

Greenwich associates llc.

A Flight to Safety as Indian Banks Navigate Tumultuous Times

CRISIL Global Research and Risk Solutions

Modelling short-term bank deposits

Risk culture and bank runs

Press Release

Bank GNPAs may touch decadal low of ~4% next fiscal

NBFCs enroute to double-digit, 4-fiscal high AUM growth

- CRISIL Research

- Financial Institutions

Sector Report: Banking

This is added to your favourites.

Warning Dialog

This is already added to your favourites.

sorry something went wrong.

This report is available to users in India. Please get in touch with us for a customized pricing.

Table of contents.

- Sector and player wise credit

- Capital adequacy

- NPA resolution schemes

- Profitability

Bank credit growth to decline to ~0-2% over fiscal 2021

Given the increasing intensity, spread, and duration of the pandemic, economic recovery is expected to be weak in fiscal 2021. hence, we estimate banking credit growth to slow to 0-2% in the fiscal 2021., retail which used to drive overall banking growth in the past, which in turn was driven by housing and personal loans, will be impacted given sluggish economic activity and vulnerable customer income source. banking credit growth to be supported by government schemes and increased working capital demand from msmes and corportes amid economic slowdown in fiscal 2021., inorder to ease finanical stress and improve sentiments, rbi permiited 6-month moratorium which ended on august 2020 and restructuring which is to implemented in fiscal 2021 and will extend for a period upto 2 years. approx 19-20% of the book is expected to be under moratorium by august 2020 and ~30% of moratorium book i.e.. 5-6% of overall book is expected to be restructured. restructuring to delay recognition of npas and mask asset quality for fiscals 2021 and 2022. gnpa is expectedto improve from 8.5% as on fiscal 2020 to 8.3% in fiscal 2021 on the back of lower slippages and resolutions. it is expected to increase to 8.9% to fiscal 2022 becuase of increased slippages given some of the slippages from the restructured book but will still not be reflective of the overall stress as restructured assets is expected to be 4-5% by fiscal 2022., moratorium and restructuring led lower fresh slippages and lower write-offs to reduce credit costs and improve profitability for the sector optically for the fiscals 2021 and 2022..

Subscribe to our reports

Thanks for subscribing

Mail not delivered

Please enter valid email id

Related links

- Access premium CRISIL reports on India

- Know more about customised industry research

- Learn about our capital market research offerings

What's popular

Indian banking sector: blockchain implementation, challenges and way forward

- Original Article

- Published: 11 May 2020

- Volume 4 , pages 65–73, ( 2020 )

Cite this article

- Aarti Patki ORCID: orcid.org/0000-0001-8400-6984 1 &

- Vinod Sople 2

800 Accesses

23 Citations

1 Altmetric

Explore all metrics

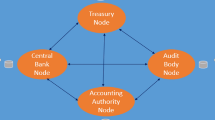

This study is aimed at covering the application of blockchain technology (BCT) in the Indian banking sector and its benefits in banking operations. This paper covers the challenges it faces in implementing blockchain technology. The paper highlights how BCT is addressing key issues such as speedily and securely transmission of data, value to and from various transaction partners, cost of processing payments, new products, and services creation. The paper also covers various advantages brought out by BCT such as automate verification process and eliminating the need for multiple parties to confirm manual validity of transactions. With the advent of BCT, India’s banking and financial systems can be expected to transform the banking process to a new level. This study covers the field investigation as to how existing BCT is helping banks to effectively and efficiently monitor and control the banking process. The respondents were leading banking institutions and FinTech firms in the country. The study result shows that some of the Indian banks have already started their journey in using BCT and they got the benefits. However, they are facing certain challenges in the adaptation and implementation of this new technology. The legal and standardization issues need to be looked into with regards to jurisdictions in cross border transactions and interoperability between different BCT systems. Banks are currently using permission based BCT solutions for very defined (small) eco-system because of the data security reasons. It is like but not exactly the ‘WhatsApp’ group system wherein an administrator decides on membership of the group. However, for each bank, the considerations will differ for the ecosystem required to deploy the BCT solution. The study covers only leading banks and FinTech companies in the country and smaller players in the banking sector. In India financial institutions are at various stages of BCT adoption. They have already seen the benefits of BCT in some processes where BCT is put into use. With time to come with full implementation, BCT will change the picture of banking in India. With BCT the banking processes will be more transparent, faster and cost-effective with elimination of intermediaries. The key benefits will be decentralisation, trust, and security in transactions.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Online Economy on the Move: The Future of Blockchain in the Modern Banking System

Feasibility of Adoption of Blockchain Technology in Banking and Financial Sector of India

Transforming Government banking by leveraging the potential of blockchain technology

Know Your Customer is the process of a business verifying the identity of its clients and assessing their suitability, along with the potential risks of illegal intentions towards the business relationship. The term is referred to as financial institution’s regulations. Banks and other financial institutions are increasingly demanding that customers provide detailed due diligence information. For example; KYC requirements for opening a bank account are to submit an Aadhaar and PAN as proof of identity, address and registered income-tax payer receptively together with a recent photograph. KYC policies framework of a bank, in general, incorporate the following four elements such as; Customer Acceptance Policy; Customer Identification Procedures; Monitoring of Transactions; and Risk management.

Bitcoin is a cryptocurrency. In other words it is a decentralized digital currency without a central bank or single administrator that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. Each bitcoin is a computer file that is stored in a 'digital wallet' app on a smart device (phone/computer). People can exchange/transact bitcoins and every single transaction is recorded in the blockchain.

Blockchain application and outlook in the banking industry. https://www.researchgate.net/publication/311549710_Blockchain_application_and_outlook_in_the_banking_industry . Accessed 29 Oct 2018

Varghese JJ, Sharma D, Singh NK (2019) Analysing the impact of blockchain technology in India’s digital economy. Glob J Enterp Inf Syst 11(1):98

Google Scholar

Swan M (2015) Blockchain: blueprint for a new economy. O’Reilly Media Inc, New York (ISBN 1491920491)

Li Z, Bewaji S (2019) How cross-border payments are evolving. https://www.payments.ca/industry-info/our-research/payments-perspectives/how-cross-border-payments-are-evolving . Accessed 11 Apr 2020

Guo Y, Liang C (2016) Blockchain application and outlook in the banking industry. Financ Innov 2(1):1

Article Google Scholar

http://www.livemint.com/Companies/BcqXQgey9fieFps9xVZxrK/How-Bajaj-Electricals-uses-blockchain-to-pay-suppliers.html

https://www.icicibank.com/aboutus/article.page?identifier=news-icici-bank-executes-indias-first-banking-transactions-on-blockchain-in-partnership-withemiratesnbd-20161210162515562

Pilkington M (2016) Blockchain technology: principles and applications. In: Xavier Olleros F, Zhegu M (eds) Research handbook on digital transformations. Edward Elgar. https://ssrn.com/abstract=2662660

Nakamoto S (2009) Bitcoin: a peer-to-peer electronic cash system. http://bitcoin.org/bitcoin.pdf

Swan M (2015) Blockchain: blueprint for a new economy. O’Reilly, New York

Ølnes S (2015) Beyond bitcoin—public sector innovation, using the bitcoin blockchain technology. http://ojs.bibsys.no/index.php/Nokobit/article/view/264

Yli-Huumo J, Ko D, Sujin Choi S, Park S, Smolander K (2016) Where is current research on blockchain technology? A systematic review. PLoS One. https://doi.org/10.1371/journal.pone.0163477

RBI White Paper (2017) Application of blockchain technology to banking and financial sector in India. https://monetago.com/wp-content/uploads/2017/01/BCT.pdf

http://www.forbes.com/sites/suparnadutt/2017/09/01/blockchain-is-slowly-changing-digital-banking-in-india-thanks-to-these-startups/#516e12404a17

Yoo S (2017) Blockchain based financial case analysis and its implications. Asia Pac J Innov Entrep 11(3):312–321

Hwa CS (2016) Legal issues for the introduction of distributed ledger based on blockchain technology-focused on the financial industry. Korea Financ Law Assoc 13(2):107–138

Guo Y, Liang C (2016) Blockchain application and outlook in the banking industry. Financ Innov 2: 24. https://doi.org/10.1186/s40854-016-0034-9 . https://www.researchgate.net/publication/311549710_Blockchain_application_and_outlook_in_the_banking_industry . Accessed Oct 29 2018

Robleh A, Barrdear J, Clews R, Southgate J (2014) Innovations in payment technologies and the emergence of digital currencies, bank of England quarterly bulletin 2014 Q3. https://ssrn.com/abstract=2499397

Mougayar W (2016) The business blockchain: promise, practice, and application of the next internet technology. Wiley, New York

https://www2.deloitte.com/content/dam/Deloitte/in/Documents/strategy/in-strategy-innovation-blockchain-technology-india-opportunities-challenges-noexp.pdf .

Guo Y, Liang C (2016) Blockchain application and outlook in the banking industry. Financ Innov 2:24. https://doi.org/10.1186/s40854-016-0034-9

Wyman O (2016) Blockchain in capital markets: the prize and the journey

Study (2016) Blockchain rewires financial markets: trailblazers take the lead. https://www-01.ibm.com/common/ssi/cgibin/ssialias?htmlfid=GBP03469 . USEN

Kim EJ (2016) Korea’s first block-chain payment settlement, verification of customer authentication technology completed. Hana Financial, Korea Economic Daily

Lewis R, McPartland J, Ranjan R (2017) Blockchain and financial market innovation. Federal Reserve Bank of Chicago. [Google Scholar]

Zhao JL, Fan S, Yan J (2016) Overview of business innovations and research opportunities in blockchain and introduction to the special issue. Financ Innov. https://doi.org/10.1186/s40854-016-0049-2

http://www.moneycontrol.com/news/business/economy/rbi-bullishblockchain-embracesideadigital-rupee-940737.html

Bhattacharyya B, Pradhan S (2017) Digital revolution in the Indian banking sector. http://www.forbesindia.com/article/weschool/digital-revolution-in-the-indian-banking-sector/47811/1 . Accessed 10 Apr 2020

http://www.mahindra.com/news-room/press-release/Mahindra-and-IBM-to-Develop-Blockchain-Solution-for-Supply-Chain-Finance

Mundra SS (2015) Indian banking sector: emerging challenges and way forward. In: Lecture by Mr. S S Mundra, Deputy Governor of the Reserve Bank of India, as part of the Memorial Lecture series launched by State Bank of Mysore Bangalore, 29 April 2015

Prusty N (2018) Blockchain for enterprise: build scalable blockchain applications with privacy, interoperability, and permissioned features. Packt Publishing Ltd, Birmingham, p 28 (ISBN 1788477138, 9781788477130)

Download references

Author information

Authors and affiliations.

Accounting & Finance, NMIMS, Kharghar, Navi Mumbai, India

Aarti Patki

ITM Business School, Kharghar, Navi Mumbai, India

Vinod Sople

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Aarti Patki .

Rights and permissions

Reprints and permissions

About this article

Patki, A., Sople, V. Indian banking sector: blockchain implementation, challenges and way forward. J BANK FINANC TECHNOL 4 , 65–73 (2020). https://doi.org/10.1007/s42786-020-00019-w

Download citation

Received : 06 November 2019

Accepted : 24 April 2020

Published : 11 May 2020

Issue Date : April 2020

DOI : https://doi.org/10.1007/s42786-020-00019-w

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Distributed ledger

- Banking industry

- Smart contract

- Find a journal

- Publish with us

- Track your research

Welcome to Finextra. We use cookies to help us to deliver our services. We'll assume you're ok with this, but you may change your preferences at our Cookie Centre . Please read our Privacy Policy .

/ regulation & compliance

See headlines ».

News in your inbox

For Finextra's free daily newsletter, breaking news and flashes and weekly job board.

Related Companies

Lead channel.

RBI encourages fintech self-regulation with new framework

The Reserve Bank of India (RBI) has finalised its Framework for Recognising Self-Regulatory Organisations for the Fintech Sector (SRO-FT), after inviting feedback for a draft framework in January thus year.

RBI will begin the initiation process of recognising SROs that meet the SRO-FT framework requirements. SROs seeking recognition can apply and those found eligible will be published on RBI’s website.

The move aims to encourage self-regulation of the fintech sector in India, and ensure that there is regulatory infrastructure in place to manage upcoming technologies being introduced to the industry and newcomers to the space.

In 2023, RBI announced a credit tech program to boost credit transactions on a public tech platform and establish a digital payments infrastructure.

Bharat Dhawan, managing partner, Mazars in India commented on the framework: "This forward-thinking approach will not only enhance regulatory compliance and ethical standards but also reinforce market integrity and transparency. As an advisory firm, we are confident that these industry-led SROs will create a more robust and trustworthy fintech ecosystem, benefiting all stakeholders."

Yashoraj Tyagi, CEO, CASHe added: “This initiative marks a significant step towards ensuring customer protection, data privacy, cyber security, grievance handling, internal governance, and the overall integrity of the financial system within our rapidly evolving industry."

Sponsored: [On-Demand Webinar] Embedded Finance: Valuable Partnerships and Opportunities for Payments

Comments: (0)

Write a blog post about this story (membership required)

ABN Amro on alert as supplier hit by ransomware attack

28 May 0 2 5

Pay.UK hails fraud detection pilot results

30 May 0 3 8

Gnosis Pay partners Visa to connect Web3 ecosystems with traditional payments

/regulation

Jp morgan to pay $100m for client order monitoring failures.

27 May 0 1 3

Related News

Google Wallet launches in India

09 May 2024 0 1 2

Namibia signs on for India's UPI tech

03 May 2024 0 2 5

10x to build Centres of Excellence in the UK, US and India with Deloitte

PayPal builds advertising platform

See all reports ».

Fraud and AML Case Management: How to Operate at the Speed of Risk

181 downloads

The Future of UK Fintech - 2015-2035

499 downloads

Definitive Differentiators - Forging a future-proof payments model

569 downloads

Morning Bid: China PMIs, Tokyo CPI Eyed; Month-End Mood Dims

A visitor using his smartphone takes photos of an electronic screen displaying Japan's Nikkei share average, which surged past an all-time record high scaled in December 1989, inside a building in Tokyo, Japan February 22, 2024. REUTERS/Issei Kato/File Photo

By Jamie McGeever

(Reuters) - A look at the day ahead in Asian markets.

An Asian economic calendar on Friday overflowing with top-tier indicators awaits investors, who look set to close out the week and the month on a downbeat note as worries grow over the strength of the U.S. and global economies.

Investors often cheer 'bad news' on the U.S. economy by bidding up risk assets on the view that the Fed will be forced to ease policy. Equally, 'good news' often drags stocks and bonds lower because rates may have to stay higher for longer.

Investors' reaction to revised U.S. GDP figures on Thursday followed neither play book - bad news was bad news. Slower GDP growth in Q1 pushed stocks, the dollar and bond yields lower, and relatively dovish comments from New York Fed president John Williams failed to provide much comfort.

The MSCI World, MSCI Asia ex-Japan, MSCI emerging market and Japan's Nikkei 225 indexes are all poised for their second weekly loss in a row. Rising bond yields, and now U.S. growth concerns, are taking their toll.

And could the U.S. tech fairy tale be starting to fade too?

Financial conditions certainly seem to be biting. According to Goldman Sachs, emerging market, Chinese and global financial conditions are the tightest in a month. Little wonder, perhaps, that investors are taking some chips off the table as the month end approaches.

It may be month-end on Friday, but there will be no rest for Asian markets. Not if the economic calendar is anything to go by.

China's official purchasing managers' index reports for May, a raft of top-tier indicators from Japan including retail sales, industrial production and Tokyo inflation, and first quarter GDP from India and Taiwan are all on tap.

China's PMIs are expected to show that manufacturing activity in May grew at a similar pace to the previous month when it barely managed to stay expansionary, reinforcing the fragile nature of the recovery in the world's No.2 economy.

China's economy blew past expectations to post growth of 5.3% in the first quarter, and a string of April indicators including factory output, trade and consumer prices suggest it has successfully navigated some near-term downside risks.

But the crisis-hit property sector remains a major drag, deflationary pressures persist, and capital is just as liable to be flowing out of the country than in.

Core inflation in Japan's capital, meanwhile, is expected to have picked up in May to 1.9% from a two-year low of 1.6% in April, and India's economy likely grew at a 6.5% rate in the January-March quarter - its slowest pace in a year - due to weak demand.

Here are key developments that could provide more direction to markets on Friday:

- China official PMIs (May)

- Tokyo inflation (May)

- India GDP (Q1)

(Reporting by Jamie McGeever; Editing by Josie Kao)

Copyright 2024 Thomson Reuters .

Tags: United States , India , Asia , Japan

The Best Financial Tools for You

Credit Cards