Persistence and Sneakers 2013 Case Study

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

Relevant cash flows for Sneaker 2013 are those that are directly associated with the project. Among such cash flows are sales of Sneaker 2013, variable costs, an increase in inventory, an increase in accounts payable, the cost of equipment that needs to be purchased and its installation, the cost of building a factory in Vietnam, the interest cost on debt which needs to be employed to finance the project, and the advertising and promotion costs. Tax expense is also a relevant cash flow as it concerns Sneaker 2013 project. The reduction in sales of existing New Balance shoes should be regarded as the lost revenue, which is also incremental cash flow. Even though the cost of equipment and its installation and the cost of real estate are depreciated, depreciation is not a cash flow. $2 million spent on research and development on Sneaker 2013 is a sunk cost that should be ignored.

Relevant cash flows for Persistence include revenue generated from sales, an increase in the working capital, the cost of equipment, the cost of the design technology and manufacturing specifications for a new hiking shoe, interest expense on debt, taxes, and net income after tax. The allocation of overheads associated with the use of the company’s factories is a sunk cost and not a component of relevant cash flows. There is no opportunity cost as the introduction of the product is not expected to impact the existing sales. Depreciation is a non-cash item, which is why it is not a relevant cash flow.

The net present value of a project can be calculated as the difference between the present value of future cash flows and the initial cost of investment. The initial cost of investment includes the cost of equipment and its installation (15 million in total), the cost of building a factory in Vietnam (150 million), and an increase in the working capital, which is equal to the difference between an increase in current assets and an increase in current liabilities. The initial cost of investment for Sneaker 2013 can be calculated as:

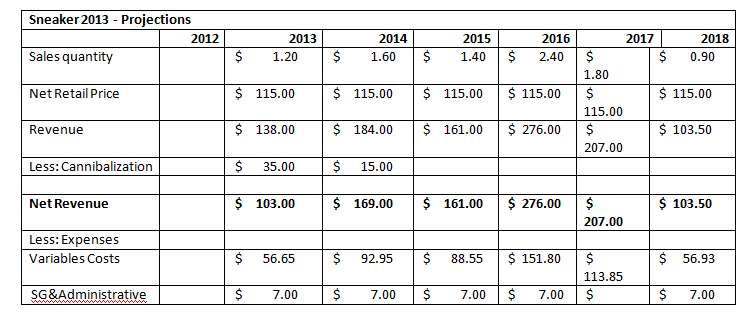

Tables 1 and 2 show total cash flows and discounted cash flows for Sneaker 2013 for 2013-2018. Revenue was calculated by multiplying sales volume by net price. Gross profit was calculated by subtracting variable costs from revenue. Tax expense was calculated by multiplying the tax rate by income before taxes. Discounted cash flows were calculated using the following formula:

Table 1. Cash Flows for Sneaker 2013.

Table 2. Discounted Cash Flows for Sneaker 2013.

At the end of the project, the company will gain an additional 115,000,000 million if it sells the equipment and the factory and recovers the working capital. Thus, the NPV of the project is:

The lost revenue (or opportunity cost) is equal to the lost sales multiplied by the gross margin:

The IRR can be calculated by solving the following equation for R:

Using What-If analysis in Excel, the value of R is equal to 48.35%, which is the internal rate of return for Sneaker 2013.

The payback period is calculated by subtracting each individual annual cash inflow from the cost of investment until a positive amount is achieved. The payback period for Sneaker 2013 is equal to five years (see Table 3).

Table 3. Cumulative Cash Flows for Sneaker 2013.

The discounted payback period is calculated similarly to the payback period, yet the annual cash flows are discounted. The discounted payback period for Sneaker 2013 is equal to six years (see Table 4).

Table 4. Cumulative Discounted Cash Flows for Sneaker 2013.

Profitability index for Sneaker 2013 is equal to:

The initial cost of investment for Persistence includes the cost of manufacturing equipment (8 million) and an increase in the working capital (15 million). The initial cost of investment for Persistence is equal to:

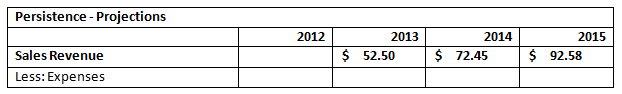

Tables 5 and 6 show total cash flows and discounted cash flows for Persistence for 2013-2015. Total sales were calculated by multiplying the total sales for the athletic footwear market by the market share projections for Persistence with consideration of the annual growth rate. The gross profit was calculated by subtracting variable costs from total sales. Purchase of intangible assets is recognized as an immediate expense, which is why it is not amortized. The tax expense was equal to zero in 2013 since the company did not generate any income.

Table 5. Cash Flows for Persistence.

Table 6. Discounted Cash Flows for Persistence.

At the end of the project, the company will gain an additional 17,320,000 if it sells the equipment and recovers the working capital. Thus, the NPV of the project is:

Using What-If analysis in Excel, the value of R is equal to 42%, which is the internal rate of return for Persistence.

The payback period for Persistence is equal to three years (see Table 7).

Table 7. Cumulative Cash Flows for Persistence.

The discounted payback period is equal to three years (see Table 8).

Table 8. Discounted Cumulative Cash Flows for Persistence.

Profitability index for Persistence is equal to:

Tables 9 and 10 show the capital budgeting cash flow statements for Sneaker 2013 and Persistence, respectively.

Table 9. Projected Capital Budgeting Cash Flow Statement for Sneaker 2013 for 2013-2018.

Table 10. Projected Capital Budgeting Cash Flow Statement for Persistence for 2013-2015.

Sneaker 2013 can be considered a more attractive choice for New Balance shareholders because it offers a higher return on the initial investment and has a greater net present value. Even though the implementation of Sneaker 2013 entails the revenue loss, which is equal to 20 million, this project is expected to generate more positive cash flows, compared to Persistence. On the other hand, Persistence is a good option, too, because its profitability index is slightly higher and its net present value is positive. However, the main reason why Persistence is worse than Sneaker 2013 is that it has a too high cost of intangible assets that should be purchased immediately.

Based on all the above-said, Rodriguez may be recommended to undertake Sneaker 2013. Despite the fact that this project is slightly less profitable, its internal rate of return and net present value are much higher. If the company found a way to minimize costs associated with the purchase of the design technology or the project had a longer life cycle, Persistence could be a more feasible choice. As for now, however, shareholders will gain more from Sneaker 2013 than from Persistence.

- Summary Business Plan of KenSpo

- Ladies’ Sneakers Retail at Walmart and Kohl’s

- Ford Motors Company's New Product Development

- BMW and Cadillac Corporation Financial Accounting Standards

- Tesco Plc.’s Audit Risks and Plan

- Gary Automobile Clinic's Business & Financial Plan

- Specialized Accounting: Cash Flow Statement Indirect Method

- Managerial Accounting in Healthcare Services

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2021, July 28). Persistence and Sneakers 2013 Case Study. https://ivypanda.com/essays/sneaker-2013-and-persistence-case-analysis/

"Persistence and Sneakers 2013 Case Study." IvyPanda , 28 July 2021, ivypanda.com/essays/sneaker-2013-and-persistence-case-analysis/.

IvyPanda . (2021) 'Persistence and Sneakers 2013 Case Study'. 28 July.

IvyPanda . 2021. "Persistence and Sneakers 2013 Case Study." July 28, 2021. https://ivypanda.com/essays/sneaker-2013-and-persistence-case-analysis/.

1. IvyPanda . "Persistence and Sneakers 2013 Case Study." July 28, 2021. https://ivypanda.com/essays/sneaker-2013-and-persistence-case-analysis/.

Bibliography

IvyPanda . "Persistence and Sneakers 2013 Case Study." July 28, 2021. https://ivypanda.com/essays/sneaker-2013-and-persistence-case-analysis/.

The marketplace for case solutions.

Sneaker 2013 – Case Solution

The case study Sneaker 2013 introduces the basics of capital budgeting. It allows the computation of a project’s initial investment outlay, the project’s annual net operating cash flows, and the project’s terminal net cash flow. This case study likewise discusses the valuation of both the Sneaker 2013 and the Persistence project. To determine which project is likely to be profitable and accept that project, it is important to calculate and consider some financial determinants such as WACC, NPV, IRR, and payback period. It also looks into other factors affecting New Balance's decision whether to invest in the Sneaker 2013 running shoe or the Persistence hiking shoe by delving into an in-depth analysis of both projects’ cash flows and financial metrics and looking into a few nonfinancial factors relevant to the project.

Richard Bliss and Mark Potter Harvard Business Review ( BAB166-PDF-ENG ) March 01, 2015

Case questions answered:

Case study questions answered in the first and second solutions:

- Produce a projected capital budgeting cash flow statement for the Persistence project by answering the following: (a) What is the project’s initial (year 0) investment outlay? (b) What are the project’s annual net operating cash flows? (c) What is the project’s terminal (2018) net cash flow?

- Which project do you think is riskier? How do you think you should incorporate differences in risk into your analysis?

- Based on the calculated payback period, net present value (NPV), and internal rate of return (IRR) for each project, which project looks better for New Balance shareholders? Why?

- Should Rodriguez be more or less critical of cash flow forecasts for Persistence than of cash flow forecasts for Sneaker 2013? Why?

- What is your final recommendation for Rodriguez?

Case study questions answered in the third solution:

- Which cash flows should be incorporated into the project’s forecast? Why or why not?

- Produce a projected capital budgeting cash flow statement for the Persistence project by answering the following: a.) What is the project’s initial (year 0) investment outlay? b.) What are the project’s annual net operating cash flows? c.) What is the project’s terminal (2018) net cash flow? d.) Does Persistence appear attractive from a quantitative standpoint? To answer this question, estimate the project’s payback, net present value, and internal rate of return.

Not the questions you were looking for? Submit your own questions & get answers .

Sneaker 2013 Case Answers

This case solution includes an Excel file with calculations.

You will receive access to three case study solutions! The second and third solutions are not yet visible in the preview.

New Balance, a shoe manufacturing company, is located in Brighton, United States. The company is well known globally due to the high quality and wide variety of shoes provided to customers. The company saw an opportunity in the 12-18-year-old male segment of the market while other competitors had ignored it.

Due to the lack of resources or star power, the company can’t compete in this segment. However, the company saw an opportunity to target younger customers if effective marketing and advertising were used. Thus, Sneaker 2013 was initiated in response to this opportunity.

Although the target of this project was between 12 and 18 years old, the market trend was expected to be 27 years and older as the population ages. So, the company began to review another hiking shoe proposal called Persistence. Even though the company had not yet entered this market, this market was considered one of the fastest-growing in the footwear industry.

This report provides an analysis and valuation of both the Sneaker 2013 and the Persistence project. To determine which project is likely to be profitable and accept that project, it is important to calculate and consider some financial determinants such as WACC, NPV, IRR, and payback period.

Moreover, this report consists of the project sensitivity analysis of some financial determinants, the comparison between both projects and some recommendations for the company in order to decide which project is better.

Finally, with careful and thorough consideration, the company is recommended to go ahead with the Sneaker 2013 project and use Kirani James as their newest athlete endorser.

Introduction

In consideration of market share to compare with the competitors of New Balance, the major competitors are as follows:

source: The Statistics Portal, Share of the athletic footwear market

High-quality athlete shoes are purchased at a reasonable price by baby boomers, who are the primary target market of sneakers.

The company demands to renovate the products created with new ideas and designs that will stimulate sales and profitability. The market share would be larger in this competitive industry.

Presenting 2 projects, Sneaker 2013 and Persistence in the athletic footwear industry, the first project (Sneaker 2013), with a 6-year venture life from 2013 to 2018, contains customary cash flow.

This cash flow also includes uncertainty(risk) of endorsing the market product for promotion. With the small size of investment in a competitive market, the second project evaluates a new hiking shoe venture.

Sneaker 2013

Capital budget projection..

The capital budgeting of Sneaker 2013 depends on new equipment installation to make progress. The initial cost for investment is usually integrated into the Net Present Value (NPV) calculation and is mostly in a negative value. The valuation is to determine whether to…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster! Michael MBA student, Boston

How do I get access?

Upon purchase, you are forwarded to the full solution and also receive access via email.

Is it safe to pay?

Yes! We use Paypal and Stripe as our secure payment providers of choice.

What is Casehero?

We are the marketplace for case solutions - created by students, for students.

Brought to you by:

Sneaker 2013

By: Richard Bliss, Mark Potter

This case provides a comprehensive introduction to the basics of capital budgeting. It presents students with two distinct capital budgeting exercises revolving around the athletic footwear industry.…

- Length: 5 page(s)

- Publication Date: Mar 1, 2015

- Discipline: Finance

- Product #: BAB166-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

This case provides a comprehensive introduction to the basics of capital budgeting. It presents students with two distinct capital budgeting exercises revolving around the athletic footwear industry. The first exercise is about a running sneaker with a large capital outlay and a six-year project life. It contains many traditional project cash flows as well as a significant endorsement risk. The second exercise involves evaluating a hiking shoe project with a smaller initial investment in a more rapidly growing but unfamiliar market segment. The authors have used this case with audiences including sophomore undergraduates, MBAs, and seasoned executives. In the first two audiences, students build spreadsheet solutions from the assumptions provided; for executives, we often give them the completed analysis and focus more on interpretation of financial metrics and on qualitative discussion. We have also used one or both of the exercises as exam questions.

Learning Objectives

The case was developed with the following objectives: Introduce the basic concepts of capital budgeting, including cash flow calculation and decision metrics. Determine the cash flows appropriate to consider for a potential project. Forecast a project's cash flows. Evaluate a project using payback period, net present value (NPV), and internal rate of return (IRR). Raise the issue of how to compare projects with unequal lives. Introduce different types of risk inherent in capital budgeting and how they are incorporated into the analysis. Providing two exercises gives students the opportunity to practice basic capital budgeting techniques and instructors the flexibility to design a class around one or both projects.

Mar 1, 2015

Discipline:

Babson College

BAB166-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Sneaker 2013

- Harvard Case Studies

Sneaker 2013 Case Study Solution & Analysis

In most courses studied at Harvard Business schools, students are provided with a case study. Major HBR cases concerns on a whole industry, a whole organization or some part of organization; profitable or non-profitable organizations. Student’s role is to analyze the case and diagnose the situation, identify the problem and then give appropriate recommendations and steps to be taken.

To make a detailed case analysis, student should follow these steps:

STEP 1: Reading Up Harvard Case Study Method Guide:

Case study method guide is provided to students which determine the aspects of problem needed to be considered while analyzing a case study. It is very important to have a thorough reading and understanding of guidelines provided. However, poor guide reading will lead to misunderstanding of case and failure of analyses. It is recommended to read guidelines before and after reading the case to understand what is asked and how the questions are to be answered. Therefore, in-depth understanding f case guidelines is very important.

Harvard Case Study Solutions

STEP 2: Reading The Sneaker 2013 Harvard Case Study:

To have a complete understanding of the case, one should focus on case reading. It is said that case should be read two times. Initially, fast reading without taking notes and underlines should be done. Initial reading is to get a rough idea of what information is provided for the analyses. Then, a very careful reading should be done at second time reading of the case. This time, highlighting the important point and mark the necessary information provided in the case. In addition, the quantitative data in case, and its relations with other quantitative or qualitative variables should be given more importance. Also, manipulating different data and combining with other information available will give a new insight. However, all of the information provided is not reliable and relevant.

When having a fast reading, following points should be noted:

- Nature of organization

- Nature if industry in which organization operates.

- External environment that is effecting organization

- Problems being faced by management

- Identification of communication strategies.

- Any relevant strategy that can be added.

- Control and out-of-control situations.

When reading the case for second time, following points should be considered:

- Decisions needed to be made and the responsible Person to make decision.

- Objectives of the organization and key players in this case.

- The compatibility of objectives. if not, their reconciliations and necessary redefinition.

- Sources and constraints of organization from meeting its objectives.

After reading the case and guidelines thoroughly, reader should go forward and start the analyses of the case.

STEP 3: Doing The Case Analysis Of Sneaker 2013:

To make an appropriate case analyses, firstly, reader should mark the important problems that are happening in the organization. There may be multiple problems that can be faced by any organization. Secondly, after identifying problems in the company, identify the most concerned and important problem that needed to be focused.

Firstly, the introduction is written. After having a clear idea of what is defined in the case, we deliver it to the reader. It is better to start the introduction from any historical or social context. The challenging diagnosis for Sneaker 2013 and the management of information is needed to be provided. However, introduction should not be longer than 6-7 lines in a paragraph. As the most important objective is to convey the most important message for to the reader.

After introduction, problem statement is defined. In the problem statement, the company’s most important problem and constraints to solve these problems should be define clearly. However, the problem should be concisely define in no more than a paragraph. After defining the problems and constraints, analysis of the case study is begin.

STEP 4: SWOT Analysis of the Sneaker 2013 HBR Case Solution:

SWOT analysis helps the business to identify its strengths and weaknesses, as well as understanding of opportunity that can be availed and the threat that the company is facing. SWOT for Sneaker 2013 is a powerful tool of analysis as it provide a thought to uncover and exploit the opportunities that can be used to increase and enhance company’s operations. In addition, it also identifies the weaknesses of the organization that will help to be eliminated and manage the threats that would catch the attention of the management.

This strategy helps the company to make any strategy that would differentiate the company from competitors, so that the organization can compete successfully in the industry. The strengths and weaknesses are obtained from internal organization. Whereas, the opportunities and threats are generally related from external environment of organization. Moreover, it is also called Internal-External Analysis.

In the strengths, management should identify the following points exists in the organization:

- Advantages of the organization

- Activities of the company better than competitors.

- Unique resources and low cost resources company have.

- Activities and resources market sees as the company’s strength.

- Unique selling proposition of the company.

WEAKNESSES:

- Improvement that could be done.

- Activities that can be avoided for Sneaker 2013.

- Activities that can be determined as your weakness in the market.

- Factors that can reduce the sales.

- Competitor’s activities that can be seen as your weakness.

OPPORTUNITIES:

- Good opportunities that can be spotted.

- Interesting trends of industry.

- Change in technology and market strategies

- Government policy changes that is related to the company’s field

- Changes in social patterns and lifestyles.

- Local events.

Following points can be identified as a threat to company:

- Company’s facing obstacles.

- Activities of competitors.

- Product and services quality standards

- Threat from changing technologies

- Financial/cash flow problems

- Weakness that threaten the business.

Following points should be considered when applying SWOT to the analysis:

- Precise and verifiable phrases should be sued.

- Prioritize the points under each head, so that management can identify which step has to be taken first.

- Apply the analyses at proposed level. Clear yourself first that on what basis you have to apply SWOT matrix.

- Make sure that points identified should carry itself with strategy formulation process.

- Use particular terms (like USP, Core Competencies Analyses etc.) to get a comprehensive picture of analyses.

STEP 5: PESTEL/ PEST Analysis of Sneaker 2013 Case Solution:

Pest analyses is a widely used tool to analyze the Political, Economic, Socio-cultural, Technological, Environmental and legal situations which can provide great and new opportunities to the company as well as these factors can also threat the company, to be dangerous in future.

Pest analysis is very important and informative. It is used for the purpose of identifying business opportunities and advance threat warning. Moreover, it also helps to the extent to which change is useful for the company and also guide the direction for the change. In addition, it also helps to avoid activities and actions that will be harmful for the company in future, including projects and strategies.

To analyze the business objective and its opportunities and threats, following steps should be followed:

- Brainstorm and assumption the changes that should be made to organization. Answer the necessary questions that are related to specific needs of organization

- Analyze the opportunities that would be happen due to the change.

- Analyze the threats and issues that would be caused due to change.

- Perform cost benefit analyses and take the appropriate action.

Pest analysis

PEST FACTORS:

- Next political elections and changes that will happen in the country due to these elections

- Strong and powerful political person, his point of view on business policies and their effect on the organization.

- Strength of property rights and law rules. And its ratio with corruption and organized crimes. Changes in these situation and its effects.

- Change in Legislation and taxation effects on the company

- Trend of regulations and deregulations. Effects of change in business regulations

- Timescale of legislative change.

- Other political factors likely to change for Sneaker 2013.

ECONOMICAL:

- Position and current economy trend i.e. growing, stagnant or declining.

- Exchange rates fluctuations and its relation with company.

- Change in Level of customer’s disposable income and its effect.

- Fluctuation in unemployment rate and its effect on hiring of skilled employees

- Access to credit and loans. And its effects on company

- Effect of globalization on economic environment

- Considerations on other economic factors

SOCIO-CULTURAL:

- Change in population growth rate and age factors, and its impacts on organization.

- Effect on organization due to Change in attitudes and generational shifts.

- Standards of health, education and social mobility levels. Its changes and effects on company.

- Employment patterns, job market trend and attitude towards work according to different age groups.

case study solutions

- Social attitudes and social trends, change in socio culture an dits effects.

- Religious believers and life styles and its effects on organization

- Other socio culture factors and its impacts.

TECHNOLOGICAL:

- Any new technology that company is using

- Any new technology in market that could affect the work, organization or industry

- Access of competitors to the new technologies and its impact on their product development/better services.

- Research areas of government and education institutes in which the company can make any efforts

- Changes in infra-structure and its effects on work flow

- Existing technology that can facilitate the company

- Other technological factors and their impacts on company and industry

These headings and analyses would help the company to consider these factors and make a “big picture” of company’s characteristics. This will help the manager to take the decision and drawing conclusion about the forces that would create a big impact on company and its resources.

STEP 6: Porter’s Five Forces/ Strategic Analysis Of The Sneaker 2013 Case Study:

To analyze the structure of a company and its corporate strategy, Porter’s five forces model is used. In this model, five forces have been identified which play an important part in shaping the market and industry. These forces are used to measure competition intensity and profitability of an industry and market.

porter’s five forces model

These forces refers to micro environment and the company ability to serve its customers and make a profit. These five forces includes three forces from horizontal competition and two forces from vertical competition. The five forces are discussed below:

- THREAT OF NEW ENTRANTS:

- as the industry have high profits, many new entrants will try to enter into the market. However, the new entrants will eventually cause decrease in overall industry profits. Therefore, it is necessary to block the new entrants in the industry. following factors is describing the level of threat to new entrants:

- Barriers to entry that includes copy rights and patents.

- High capital requirement

- Government restricted policies

- Switching cost

- Access to suppliers and distributions

- Customer loyalty to established brands.

- THREAT OF SUBSTITUTES:

- this describes the threat to company. If the goods and services are not up to the standard, consumers can use substitutes and alternatives that do not need any extra effort and do not make a major difference. For example, using Aquafina in substitution of tap water, Pepsi in alternative of Coca Cola. The potential factors that made customer shift to substitutes are as follows:

- Price performance of substitute

- Switching costs of buyer

- Products substitute available in the market

- Reduction of quality

- Close substitution are available

- DEGREE OF INDUSTRY RIVALRY:

- the lesser money and resources are required to enter into any industry, the higher there will be new competitors and be an effective competitor. It will also weaken the company’s position. Following are the potential factors that will influence the company’s competition:

- Competitive advantage

- Continuous innovation

- Sustainable position in competitive advantage

- Level of advertising

- Competitive strategy

- BARGAINING POWER OF BUYERS:

- it deals with the ability of customers to take down the prices. It mainly consists the importance of a customer and the level of cost if a customer will switch from one product to another. The buyer power is high if there are too many alternatives available. And the buyer power is low if there are lesser options of alternatives and switching. Following factors will influence the buying power of customers:

- Bargaining leverage

- Switching cost of a buyer

- Buyer price sensitivity

- Competitive advantage of company’s product

- BARGAINING POWER OF SUPPLIERS:

- this refers to the supplier’s ability of increasing and decreasing prices. If there are few alternatives o supplier available, this will threat the company and it would have to purchase its raw material in supplier’s terms. However, if there are many suppliers alternative, suppliers have low bargaining power and company do not have to face high switching cost. The potential factors that effects bargaining power of suppliers are the following:

- Input differentiation

- Impact of cost on differentiation

- Strength of distribution centers

- Input substitute’s availability.

STEP 7: VRIO Analysis of Sneaker 2013:

Vrio analysis for Sneaker 2013 case study identified the four main attributes which helps the organization to gain a competitive advantages. The author of this theory suggests that firm must be valuable, rare, imperfectly imitable and perfectly non sustainable. Therefore there must be some resources and capabilities in an organization that can facilitate the competitive advantage to company. The four components of VRIO analysis are described below: VALUABLE: the company must have some resources or strategies that can exploit opportunities and defend the company from major threats. If the company holds some value then answer is yes. Resources are also valuable if they provide customer satisfaction and increase customer value. This value may create by increasing differentiation in existing product or decrease its price. Is these conditions are not met, company may lead to competitive disadvantage. Therefore, it is necessary to continually review the Sneaker 2013 company’s activities and resources values. RARE: the resources of the Sneaker 2013 company that are not used by any other company are known as rare. Rare and valuable resources grant much competitive advantages to the firm. However, when more than one few companies uses the same resources and provide competitive parity are also known as rare resources. Even, the competitive parity is not desired position, but the company should not lose its valuable resources, even they are common. COSTLY TO IMITATE : the resources are costly to imitate, if other organizations cannot imitate it. However, imitation is done in two ways. One is duplicating that is direct imitation and the other one is substituting that is indirect imitation. Any firm who has valuable and rare resources, and these resources are costly to imitate, have achieved their competitive advantage. However, resources should also be perfectly non sustainable. The reasons that resource imitation is costly are historical conditions, casual ambiguity and social complexity. ORGANIZED TO CAPTURE VALUE : resources, itself, cannot provide advantages to organization until it is organized and exploit to do so. A firm (like Sneaker 2013) must organize its management systems, processes, policies and strategies to fully utilize the resource’s potential to be valuable, rare and costly to imitate.

STEP 8: Generating Alternatives For Sneaker 2013 Case Solution:

After completing the analyses of the company, its opportunities and threats, it is important to generate a solution of the problem and the alternatives a company can apply in order to solve its problems. To generate the alternative of problem, following things must to be kept in mind:

- Realistic solution should be identified that can be operated in the company, with all its constraints and opportunities.

- as the problem and its solution cannot occur at the same time, it should be described as mutually exclusive

- it is not possible for a company to not to take any action, therefore, the alternative of doing nothing is not viable.

- Student should provide more than one decent solution. Providing two undesirable alternatives to make the other one attractive is not acceptable.

Once the alternatives have been generated, student should evaluate the options and select the appropriate and viable solution for the company.

STEP 9: Selection Of Alternatives For Sneaker 2013 Case Solution:

It is very important to select the alternatives and then evaluate the best one as the company have limited choices and constraints. Therefore to select the best alternative, there are many factors that is needed to be kept in mind. The criteria’s on which business decisions are to be selected areas under:

- Improve profitability

- Increase sales, market shares, return on investments

- Customer satisfaction

- Brand image

- Corporate mission, vision and strategy

- Resources and capabilities

Alternatives should be measures that which alternative will perform better than other one and the valid reasons. In addition, alternatives should be related to the problem statements and issues described in the case study.

STEP 10: Evaluation Of Alternatives For Sneaker 2013 Case Solution:

If the selected alternative is fulfilling the above criteria, the decision should be taken straightforwardly. Best alternative should be selected must be the best when evaluating it on the decision criteria. Another method used to evaluate the alternatives are the list of pros and cons of each alternative and one who has more pros than cons and can be workable under organizational constraints.

STEP 11: Recommendations For Sneaker 2013 Case Study (Solution):

There should be only one recommendation to enhance the company’s operations and its growth or solving its problems. The decision that is being taken should be justified and viable for solving the problems.

- Order Status

- Testimonials

- What Makes Us Different

SNEAKERS 2013 Harvard Case Solution & Analysis

Home >> Harvard Case Study Analysis Solutions >> SNEAKERS 2013

SNEAKERS 2013 Case Study Analysis

Introduction.

This case is about a company named New Balance located in Brighton, Massachusetts. The company has implemented a new policy for the employee's work-life balance. New Balance has an opportunity in a segment ignored by the firm’s large competitors, such as:the 18 years old male age group. New Balance can target them with an effective and efficient marketing strategy. There is a steady growth in the Athletic footwear industry, even the economy is facing crises.

So Michelle Rodriguez has to provide a position report on one of the New Balance’s most promising new athletic shoes. Data should be taken from all the departments, such as: marketing, finance, sales, technology and manufacturing. She has to perform an analysis and recommend whether to proceed or not.

Persistence Project

The costs related to the factory will not be included in the capital budgeting, because the factory costs are fixed and it would not change if the company takes the project or not. Purchase of the equipment will be included in the capital budgeting, because the company is incurring these costs solely for the Persistence project. Cannibalization of other sneaker sales will not be adjusted in the cash flows, because the Persistence project does not impact the sales of the existing product line. Interest costs are specifically related to the project’s financing, so these will be included.

Changes in current assets and current liabilities are mainly occurring due to the adoption of the Persistence project, so a change in working capital costs will also be included. Taxes will be included in the capital budgeting decision process, as the business must pay taxes on the generated earnings. To determine the project’s profitability and cash flows; the cost of goods sold, depreciation charges advertising and promotion expenses must be added.

The Persistence project has an initial cash outlay of $53 million at year 0, i.e. 2012,and the project’s annual cash flows are $14.59 million in 2013, $22.43 million in 2014 and $46.72 million in 2015. (See Appendix 2)

As per the quantitative analysis of the Persistence Project; the project appears to be viable, as the project generates a positive net present value of $7.54 million. The project generates an IRR of 22%, which is greater than the cost of capital of 14%, and its initial cost can be recovered by the company in 2.34 years, as the payback period is 2.34.

Sneaker 2013 Project

In the capital budgeting cost of equipment; purchase & installation and the cost of building the factory would be included, as this cost would solely be incurred for the Sneakers’ 2013 project. Research and development costs are carried out, to determine the project's feasibility, so these costs will also be included. Cannibalization of other sneaker’s sales will be adjusted in cash flows because this refers to the opportunity cost for the company’s existing product sales. Interest costs are specifically related to the project’s financing, so these will be included. Changes in current assets and current liabilities are mainly occurring due to the adoption of the Sneakers’ 2013 project, so the change in working capital costs will also be included.

Taxes will be included in the capital budgeting decision process, as the business must pay taxes on the generated earnings. For determining the profitability as well as FCF (Free cash flows) of the sneakers’ 2013 project; the cost of goods sold, advertising expense and promotion expense will be included. Depreciation charges are also included, to determine the project’s profitability and free cash flows.

The Sneakers 2013 project has an initial cash outlay of $182 million at year 0 i.e. 2012. The project’s annual cash flows in 2013 are $9.50 million, $29.70 million in 2014, $37.27 million in 2015, $41.82 million in 2016, in 2017 its $46.37 million and its $143.68 million in 2018. (See Appendix 1).

As per quantitative analysis; Sneaker’s 2013 project appears to be viable, because it generates positive NPV, i.e.$8.82 million net present value, as well as a greater internal rate of return than the cost of capital. The IRR is 12%.On the other hand, the cost of capital is 11%. The payback period of the project is 5.1 years, so the initial investment cost will be recovered in 5.1 years.

Additional Information

The Sneaker’s 2013 project seems to be riskier as compared to the Persistence project, as its IRR is very low as compared to other projects, and the difference between the Sneakers’ IRR and cost of capital is very less. Further, the Sneakers’ 2013 project requires a high capital investment, regardless of which, it is generating a lower IRR and the payback period is also higher.

In terms of NPV; the Sneakers’ 2013 project generates a higher NPV as compared to the Persistence project. In terms of IRR, the Persistence project is a better option as it generates a quite higher IRR of 22% as compared to an IRR of 12% in the Sneakers’ 2013 project. In terms of the payback period; it takes a longer period for the company to cover the initial cost over layin Sneakers’ 2013 project. So, the Persistence Project seems to be a better option taking under consideration the payback period’s perspective.

From the capital budgeting perspective; NPV should be given a priority, and Sneakers’ 2013 project generates a higher NPV as compared to the Persistence project. So, to the New Balance Company is recommended to adopt the Sneakers 2013 Project.

Appendix 1: Sneakers 2013 Project

Appendix 2: Persistence Project

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.

Related Case Solutions & Analyses:

Hire us for Originally Written Case Solution/ Analysis

Like us and get updates:.

Harvard Case Solutions

Search Case Solutions

- Accounting Case Solutions

- Auditing Case Studies

- Business Case Studies

- Economics Case Solutions

- Finance Case Studies Analysis

- Harvard Case Study Analysis Solutions

- Human Resource Cases

- Ivey Case Solutions

- Management Case Studies

- Marketing HBS Case Solutions

- Operations Management Case Studies

- Supply Chain Management Cases

- Taxation Case Studies

More From Harvard Case Study Analysis Solutions

- TopCoder (A): Developing Software through Crowdsourcing

- Targeting college students on Facebook How to stop wasting your money

- Marketing Plan

- A 30-Year Cross-Border Alliance in China-Chongqing Jianshe Motorcycle Co. and Yamaha Motor Co.

- State Farm Insurance: Taking the Reins (B)

- Fortis industries

Contact us:

Check Order Status

How Does it Work?

Why TheCaseSolutions.com?

SNEAKER 2013 CAPITAL BUDGETING Case Solution & Answer

Home » Case Study Analysis Solutions » SNEAKER 2013 CAPITAL BUDGETING

SNEAKER 2013 CAPITAL BUDGETINGÂ Case Study Solution

Following are the items that will and will not be included in the capital budgeting process of calculating NPV, IRR and payback period of the company which will provide the financial projections for the projects that the company needs to implement in its business for the expansion of its production line.

- Building a factory and purchase or installation of the equipment will be added in the estimating the projections of the company through NPV, IRR and payback period. It is a project outflow or investments which a company will invest to undertake the project.

- Research and development cost will also be reflected in the financial projections of the projects which the company will undertake to expand its business. These are called the floatation cost which are added in the project cash outflow or initial investment and not adjusted in to the discount rate of the company which is used for the discounting of future cash flow of the company.

- Cannibalization will not be included in the capital budgeting cash flow projection for the projects that will be undertaken by the company. The reason for not including cannibalization is these are the cost which are related to other products of the company. Although the introduction of a new product will affect the sales of the previous product line which will be reflected in the financial statements of the company. Moreover, the cash flows projected through capital budgeting process will only involve cash inflows and outflow that are related to the project’s production line which will provide the value of that particular project and its impact on overall financials of the company.

- Interest costs are also related in estimating the financial projection through capital budgeting process. The cash flows which are used in the projections through capital budgeting operating cash flows after tax and interest expense. Therefore the interest cost will be deducted and after interest cost amount will be added as a future projected cash flows by the project.

- In estimating operating cash flows, the change in working capital account is deducted from the cash flow after interest and tax expense. Hence changes in current asset and current liabilities account will be subtracted in arriving to the cash flow generated by the company. Therefore the impact of change in current asset and current liability account will be reflected in the projections of cash flows generated by the projects.

- The cash flows which are undertaken for the financial projections of the company includes cash flow after taxes. Taxes will be deducted and the final available after tax cash flows will be used in arriving at the future financial projections of the company. Hence taxes will create impact in estimating future financial projections.

- Cost of goods sold is the amount that will be deducted from the revenue in arriving at the gross profit margin for the company. Hence cost of goods sold will be deducted and net cash flows will used in the financial projection through capital budgeting process.

- Advertising and promotion expense are related to the operating expense of that particular project and hence will be deducted from the gross profit of the company in arriving at net profit margin of the company. Therefore the deduction of advertising and promotion expense will be reflected in the future projection of cash flows estimated through capital budgeting process.

In the following table the NPV, IRR and payback period of the project is provided.

Following are the cash flows which will either be added in the cash flow projection of the persistence project or not. Below are the nature of cash flows and the reason are discussed as to whether the cash flow will impact the persistence project or not.

- Building and factory cost will not be added in the cash outflow projection incorporated by the company because the company already possess the area in the factory which could be used to implement the persistence project. Although the purchase and installation cost will be incorporated by the company in estimating the final projection through capital budgeting process which will be reflected in the cash flows generated by the capital budgeting method. The equipment cost will be added as the cash outflow in the initial investment of the project.

- Research and development cost will also be incorporated in calculating the financial projection of the persistence project as it is the part of this particular project and should be incorporated by the company in estimating future cash flows generated by this particular project.

- The cannibalization effect which will occur when the company will undertake the other project for the expansion of its product line. Due to cannibalization the company’s revenue will decline because of the effect of cannibalization which will reduce the sales of the company’s existing products. This effect should not be reflected in the persistence project because the cost occurred through cannibalization effect is not the part of persistence project instead it is an effect of undertaking the persistence project.

- Interest cost will cause the impact in the future projected cash flows of financial projection using capital budgeting method. The net cash flows which are calculated in estimating financial projections of the company through capital budgeting method are after interest and tax basis i.e. interest cost will be deducted and the cash after interest expense will be taken in account by the company in financial projection of the project.

- The cash flow which are used in estimating the financial projection through capital budgeting method are adjusted for the change in the working capital account. Therefore the change in the current assets and current liabilities account will be incorporated in estimating the financial projections of cash flow generated by the project. This change in working capital account will be deducted which will help us to arrive at cash flows which will be used for estimating NPY, IRR and payback period

- Taxes which are the integral part in estimating the net cash flows which are available to the company. The net operating cash flows are after tax cash flows which are used by the company in calculating the financial projection through capital budgeting method.

- Cost of goods sold are deducted from the revenue to arrive at the gross profit margin earned by the company. Therefore the cost of goods sold will show impact in the financial projection estimated by the company because final cash flow after deducting all the expenses are used by the company in the projection of future cash flow that will be acquired by the particular project.

- Similarly the advertising and promotion expense will also be incorporated in arriving at the net operating cash flows available to the companies. The advertising and promotion expense will reduce the cash generated by the implementation of the particular project therefore it will impact the final cash flows which will be used in the financial projections by the company through capital budgeting method………….

This is just a sample partical work. Please place the order on the website to get your own originally done case solution.

Related Case Solutions:

LOOK FOR A FREE CASE STUDY SOLUTION

Don't have an account? Sign up now

Already have an account login, get 10% off on your next order.

Subscribe now to get your discount coupon *Only correct email will be accepted

(Approximately ~ 0.0 Page)

Total Price

Thank you for your email subscription. Check your email to get Coupon Code.

Sneaker 2013 Case Analysis and Case Solution

Posted by Peter Williams on Aug-09-2018

Introduction of Sneaker 2013 Case Solution

The Sneaker 2013 case study is a Harvard Business Review case study, which presents a simulated practical experience to the reader allowing them to learn about real life problems in the business world. The Sneaker 2013 case consisted of a central issue to the organization, which had to be identified, analysed and creative solutions had to be drawn to tackle the issue. This paper presents the solved Sneaker 2013 case analysis and case solution. The method through which the analysis is done is mentioned, followed by the relevant tools used in finding the solution.

The case solution first identifies the central issue to the Sneaker 2013 case study, and the relevant stakeholders affected by this issue. This is known as the problem identification stage. After this, the relevant tools and models are used, which help in the case study analysis and case study solution. The tools used in identifying the solution consist of the SWOT Analysis, Porter Five Forces Analysis, PESTEL Analysis, VRIO analysis, Value Chain Analysis, BCG Matrix analysis, Ansoff Matrix analysis, and the Marketing Mix analysis. The solution consists of recommended strategies to overcome this central issue. It is a good idea to also propose alternative case study solutions, because if the main solution is not found feasible, then the alternative solutions could be implemented. Lastly, a good case study solution also includes an implementation plan for the recommendation strategies. This shows how through a step-by-step procedure as to how the central issue can be resolved.

Problem Identification of Sneaker 2013 Case Solution

Harvard Business Review cases involve a central problem that is being faced by the organization and these problems affect a number of stakeholders. In the problem identification stage, the problem faced by Sneaker 2013 is identified through reading of the case. This could be mentioned at the start of the reading, the middle or the end. At times in a case analysis, the problem may be clearly evident in the reading of the HBR case. At other times, finding the issue is the job of the person analysing the case. It is also important to understand what stakeholders are affected by the problem and how. The goals of the stakeholders and are the organization are also identified to ensure that the case study analysis are consistent with these.

Analysis of the Sneaker 2013 HBR Case Study

The objective of the case should be focused on. This is doing the Sneaker 2013 Case Solution. This analysis can be proceeded in a step-by-step procedure to ensure that effective solutions are found.

- In the first step, a growth path of the company can be formulated that lays down its vision, mission and strategic aims. These can usually be developed using the company history is provided in the case. Company history is helpful in a Business Case study as it helps one understand what the scope of the solutions will be for the case study.

- The next step is of understanding the company; its people, their priorities and the overall culture. This can be done by using company history. It can also be done by looking at anecdotal instances of managers or employees that are usually included in an HBR case study description to give the reader a real feel of the situation.

- Lastly, a timeline of the issues and events in the case needs to be made. Arranging events in a timeline allows one to predict the next few events that are likely to take place. It also helps one in developing the case study solutions. The timeline also helps in understanding the continuous challenges that are being faced by the organisation.

SWOT analysis of Sneaker 2013

An important tool that helps in addressing the central issue of the case and coming up with Sneaker 2013 HBR case solution is the SWOT analysis.

- The SWOT analysis is a strategic management tool that lists down in the form of a matrix, an organisation's internal strengths and weaknesses, and external opportunities and threats. It helps in the strategic analysis of Sneaker 2013.

- Once this listing has been done, a clearer picture can be developed in regards to how strategies will be formed to address the main problem. For example, strengths will be used as an advantage in solving the issue.

Therefore, the SWOT analysis is a helpful tool in coming up with the Sneaker 2013 Case Study answers. One does not need to remain restricted to using the traditional SWOT analysis, but the advanced TOWS matrix or weighted average SWOT analysis can also be used.

Porter Five Forces Analysis for Sneaker 2013

Another helpful tool in finding the case solutions is of Porter's Five Forces analysis. This is also a strategic tool that is used to analyse the competitive environment of the industry in which Sneaker 2013 operates in. Analysis of the industry is important as businesses do not work in isolation in real life, but are affected by the business environment of the industry that they operate in. Harvard Business case studies represent real-life situations, and therefore, an analysis of the industry's competitive environment needs to be carried out to come up with more holistic case study solutions. In Porter's Five Forces analysis, the industry is analysed along 5 dimensions.

- These are the threats that the industry faces due to new entrants.

- It includes the threat of substitute products.

- It includes the bargaining power of buyers in the industry.

- It includes the bargaining power of suppliers in an industry.

- Lastly, the overall rivalry or competition within the industry is analysed.

This tool helps one understand the relative powers of the major players in the industry and its overall competitive dynamics. Actionable and practical solutions can then be developed by keeping these factors into perspective.

PESTEL Analysis of Sneaker 2013

Another helpful tool that should be used in finding the case study solutions is the PESTEL analysis. This also looks at the external business environment of the organisation helps in finding case study Analysis to real-life business issues as in HBR cases.

- The PESTEL analysis particularly looks at the macro environmental factors that affect the industry. These are the political, environmental, social, technological, environmental and legal (regulatory) factors affecting the industry.

- Factors within each of these 6 should be listed down, and analysis should be made as to how these affect the organisation under question.

- These factors are also responsible for the future growth and challenges within the industry. Hence, they should be taken into consideration when coming up with the Sneaker 2013 case solution.

VRIO Analysis of Sneaker 2013

This is an analysis carried out to know about the internal strengths and capabilities of Sneaker 2013. Under the VRIO analysis, the following steps are carried out:

- The internal resources of Sneaker 2013 are listed down.

- Each of these resources are assessed in terms of the value it brings to the organization.

- Each resource is assessed in terms of how rare it is. A rare resource is one that is not commonly used by competitors.

- Each resource is assessed whether it could be imitated by competition easily or not.

- Lastly, each resource is assessed in terms of whether the organization can use it to an advantage or not.

The analysis done on the 4 dimensions; Value, Rareness, Imitability, and Organization. If a resource is high on all of these 4, then it brings long-term competitive advantage. If a resource is high on Value, Rareness, and Imitability, then it brings an unused competitive advantage. If a resource is high on Value and Rareness, then it only brings temporary competitive advantage. If a resource is only valuable, then it’s a competitive parity. If it’s none, then it can be regarded as a competitive disadvantage.

Value Chain Analysis of Sneaker 2013

The Value chain analysis of Sneaker 2013 helps in identifying the activities of an organization, and how these add value in terms of cost reduction and differentiation. This tool is used in the case study analysis as follows:

- The firm’s primary and support activities are listed down.

- Identifying the importance of these activities in the cost of the product and the differentiation they produce.

- Lastly, differentiation or cost reduction strategies are to be used for each of these activities to increase the overall value provided by these activities.

Recognizing value creating activities and enhancing the value that they create allow Sneaker 2013 to increase its competitive advantage.

BCG Matrix of Sneaker 2013

The BCG Matrix is an important tool in deciding whether an organization should invest or divest in its strategic business units. The matrix involves placing the strategic business units of a business in one of four categories; question marks, stars, dogs and cash cows. The placement in these categories depends on the relative market share of the organization and the market growth of these strategic business units. The steps to be followed in this analysis is as follows:

- Identify the relative market share of each strategic business unit.

- Identify the market growth of each strategic business unit.

- Place these strategic business units in one of four categories. Question Marks are those strategic business units with high market share and low market growth rate. Stars are those strategic business units with high market share and high market growth rate. Cash Cows are those strategic business units with high market share and low market growth rate. Dogs are those strategic business units with low market share and low growth rate.

- Relevant strategies should be implemented for each strategic business unit depending on its position in the matrix.

The strategies identified from the Sneaker 2013 BCG matrix and included in the case pdf. These are either to further develop the product, penetrate the market, develop the market, diversification, investing or divesting.

Ansoff Matrix of Sneaker 2013

Ansoff Matrix is an important strategic tool to come up with future strategies for Sneaker 2013 in the case solution. It helps decide whether an organization should pursue future expansion in new markets and products or should it focus on existing markets and products.

- The organization can penetrate into existing markets with its existing products. This is known as market penetration strategy.

- The organization can develop new products for the existing market. This is known as product development strategy.

- The organization can enter new markets with its existing products. This is known as market development strategy.

- The organization can enter into new markets with new products. This is known as a diversification strategy.

The choice of strategy depends on the analysis of the previous tools used and the level of risk the organization is willing to take.

Marketing Mix of Sneaker 2013

Sneaker 2013 needs to bring out certain responses from the market that it targets. To do so, it will need to use the marketing mix, which serves as a tool in helping bring out responses from the market. The 4 elements of the marketing mix are Product, Price, Place and Promotions. The following steps are required to carry out a marketing mix analysis and include this in the case study analysis.

- Analyse the company’s products and devise strategies to improve the product offering of the company.

- Analyse the company’s price points and devise strategies that could be based on competition, value or cost.

- Analyse the company’s promotion mix. This includes the advertisement, public relations, personal selling, sales promotion, and direct marketing. Strategies will be devised which makes use of a few or all of these elements.

- Analyse the company’s distribution and reach. Strategies can be devised to improve the availability of the company’s products.

Sneaker 2013 Blue Ocean Strategy

The strategies devised and included in the Sneaker 2013 case memo should have a blue ocean strategy. A blue ocean strategy is a strategy that involves firms seeking uncontested market spaces, which makes the competition of the company irrelevant. It involves coming up with new and unique products or ideas through innovation. This gives the organization a competitive advantage over other firms, unlike a red ocean strategy.

Competitors analysis of Sneaker 2013

The PESTEL analysis discussed previously looked at the macro environmental factors affecting business, but not the microenvironmental factors. One of the microenvironmental factors are competitors, which are addressed by a competitor analysis. The Competitors analysis of Sneaker 2013 looks at the direct and indirect competitors within the industry that it operates in.

- This involves a detailed analysis of their actions and how these would affect the future strategies of Sneaker 2013.

- It involves looking at the current market share of the company and its competitors.

- It should compare the marketing mix elements of competitors, their supply chain, human resources, financial strength etc.

- It also should look at the potential opportunities and threats that these competitors pose on the company.

Organisation of the Analysis into Sneaker 2013 Case Study Solution

Once various tools have been used to analyse the case, the findings of this analysis need to be incorporated into practical and actionable solutions. These solutions will also be the Sneaker 2013 case answers. These are usually in the form of strategies that the organisation can adopt. The following step-by-step procedure can be used to organise the Harvard Business case solution and recommendations:

- The first step of the solution is to come up with a corporate level strategy for the organisation. This part consists of solutions that address issues faced by the organisation on a strategic level. This could include suggestions, changes or recommendations to the company's vision, mission and its strategic objectives. It can include recommendations on how the organisation can work towards achieving these strategic objectives. Furthermore, it needs to be explained how the stated recommendations will help in solving the main issue mentioned in the case and where the company will stand in the future as a result of these.

- The second step of the solution is to come up with a business level strategy. The HBR case studies may present issues faced by a part of the organisation. For example, the issues may be stated for marketing and the role of a marketing manager needs to be assumed. So, recommendations and suggestions need to address the strategy of the marketing department in this case. Therefore, the strategic objectives of this business unit (Marketing) will be laid down in the solutions and recommendations will be made as to how to achieve these objectives. Similar would be the case for any other business unit or department such as human resources, finance, IT etc. The important thing to note here is that the business level strategy needs to be aligned with the overall corporate strategy of the organisation. For example, if one suggests the organisation to focus on differentiation for competitive advantage as a corporate level strategy, then it can't be recommended for the Sneaker 2013 Case Study Solution that the business unit should focus on costs.

- The third step is not compulsory but depends from case to case. In some HBR case studies, one may be required to analyse an issue at a department. This issue may be analysed for a manager or employee as well. In these cases, recommendations need to be made for these people. The solution may state that objectives that these people need to achieve and how these objectives would be achieved.

The case study analysis and solution, and Sneaker 2013 case answers should be written down in the Sneaker 2013 case memo, clearly identifying which part shows what. The Sneaker 2013 case should be in a professional format, presenting points clearly that are well understood by the reader.

Alternate solution to the Sneaker 2013 HBR case study

It is important to have more than one solution to the case study. This is the alternate solution that would be implemented if the original proposed solution is found infeasible or impossible due to a change in circumstances. The alternate solution for Sneaker 2013 is presented in the same way as the original solution, where it consists of a corporate level strategy, business level strategy and other recommendations.

Implementation of Sneaker 2013 Case Solution

The case study does not end at just providing recommendations to the issues at hand. One is also required to provide how these recommendations would be implemented. This is shown through a proper implementation framework. A detailed implementation framework helps in distinguishing between an average and an above average case study answer. A good implementation framework shows the proposed plan and how the organisations' resources would be used to achieve the objectives. It also lays down the changes needed to be made as well as the assumptions in the process.

- A proper implementation framework shows that one has clearly understood the case study and the main issue within it.

- It shows that one has been clarified with the HBR fundamentals on the topic.

- It shows that the details provided in the case have been properly analysed.

- It shows that one has developed an ability to prioritise recommendations and how these could be successfully implemented.

- The implementation framework also helps by removing out any recommendations that are not practical or actionable as these could not be implemented. Therefore, the implementation framework ensures that the solution to the Sneaker 2013 Harvard case is complete and properly answered.

Recommendations and Action Plan for Sneaker 2013 case analysis

For Sneaker 2013, based on the SWOT Analysis, Porter Five Forces Analysis, PESTEL Analysis, VRIO analysis, Value Chain Analysis, BCG Matrix analysis, Ansoff Matrix analysis, and the Marketing Mix analysis, the recommendations and action plan are as follows:

- Sneaker 2013 should focus on making use of its strengths identified from the VRIO analysis to make the most of the opportunities identified from the PESTEL.

- Sneaker 2013 should enhance the value creating activities within its value chain.

- Sneaker 2013 should invest in its stars and cash cows, while getting rid of the dogs identified from the BCG Matrix analysis.

- To achieve its overall corporate and business level objectives, it should make use of the marketing mix tools to obtain desired results from its target market.

Baron, E. (2015). How They Teach the Case Method At Harvard Business School. Retrieved from https://poetsandquants.com/2015/09/29/how-they-teach-the-case-method-at-harvard-business-school/

Bartol. K, & Martin, D. (1998). Management, 3rd edition. Boston: Irwin McGrawHill.

Free Management E-Books. (2013a). PESTLE Analysis. Retrieved from http://www.free-management-ebooks.com/dldebk-pdf/fme-pestle-analysis.pdf

Gupta, A. (2013). Environment & PEST analysis: an approach to the external business environment. International Journal of Modern Social Sciences, 2(1), 34-43.

Hambrick, D. C., MacMillan, I. C., & Day, D. L. (1982). Strategic attributes and performance in the BCG matrix—A PIMS-based analysis of industrial product businesses. Academy of Management Journal, 25(3), 510-531.

Hill, C., & Jones, G. (2010). Strategic Management Theory: An Integrated Approach, Ninth Ed. Mason, OH: South-Western, Cengage Learning.

Hussain, S., Khattak, J., Rizwan, A., & Latif, M. A. (2013). ANSOFF matrix, environment, and growth-an interactive triangle. Management and Administrative Sciences Review, 2(2), 196-206.

IIBMS. (2015). 7 Effective Steps to Solve Case Study. Retrieved from http://www.iibms.org/c-7-effective-steps-to-solve-case-study/

Kim, W. C., & Mauborgne, R. (2004). Blue ocean strategy. If you read nothing else on strategy, read thesebest-selling articles., 71.

Kotler, P., & Armstrong, G. (2010). Principles of marketing. Pearson education.

Kulkarni, N. (2018). 8 Tips to Help You Prepare for the Case Method. Retrieved from https://www.hbs.edu/mba/blog/post/8-tips-to-help-you-prepare-for-the-case-method

Lin, C., Tsai, H. L., Wu, Y. J., & Kiang, M. (2012). A fuzzy quantitative VRIO-based framework for evaluating organizational activities. Management Decision, 50(8), 1396-1411.

Nixon, J., & Helms, M. M. (2010). Exploring SWOT analysis – where are we now?: A review of academic research from the last decade. Journal of Strategy and Management, 3(3), 215-251.

Panagiotou, G. (2003). Bringing SWOT into Focus. Business Strategy Review, 14(2), 8-10.

Pickton, D. W., & Wright, S. (1998). What's swot in strategic analysis? Strategic Change, 7(2), 101-109.

Porter, M. E. (2001). The value chain and competitive advantage. Understanding Business Processes, 50-66.

Porter, M. E. (1985). Competitive advantage: creating and sustaining superior performance (Vol. 2). New York: Free Press.

Porter, M.E. (1979, March). Harvard Business Review: Strategic Planning, How Competitive Forces Shape Strategy. Retrieved July 7, 2016, from https://hbr.org/1979/03/how-competitive-forces-shape-strategy

Rastogi, N., & Trivedi, M. K. (2016). PESTLE Technique–a Tool to Identify External Risks in Construction Projects. International Research Journal of Engineering and Technology (IRJET), 3(1), 384-388.

Rauch, P. (2007). SWOT analyses and SWOT strategy formulation for forest owner cooperations in Austria. European Journal of Forest Research, 126(3), 413-420.

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here .

9416 Students can’t be wrong

PhD Experts

The support team promised me for the good grades and the specified content. Thus, I placed an order on this website and got the work that really improved the CGPA.

Emilia Samuel

My fate brought me on this service that forms the paper rightly. Thanks!

Frankie Tayler

Once the support guy said to me, he will call me within 10 minutes but he didn't. Actually, he is a nice personality and I would like to have communication with him. Thank you so much!

The writer was very good to interact with and provided me with great help. I really can’t thank you guys enough.

Calculate the Price

(approx ~ 0.0 page), total price $0, next articles.

- Fernandez Vega Eye Institute Case Analysis

- Governance Challenge At An International Humanitarian Organization: The Case Of The IFRC Case Analysis

- The Affordable Care Act (F): Regaining Momentum Case Analysis

- The Affordable Care Act (G): The Final Votes Case Analysis

- CLP: Powering Asia Case Analysis

- The Affordable Care Act (J): Healthcare.gov Case Analysis

- The Affordable Care Act (B): Industry Negotiations Case Analysis

- The Affordable Care Act (H): Implementation Begins Case Analysis

- The Affordable Care Act (E): The August 2009 Recess Case Analysis

- The Affordable Care Act (I): The Supreme Court Case Analysis

Previous Articles

- Fiat Mio: The Project That Embraced Open Innovation, Crowdsourcing And Creative Commons In The Automotive Industry, Spanish Version Case Analysis

- How A One Time Incentive Can Induce Long Term Commitment To Training Case Analysis

- Global Clusters Of Innovation: Lessons From Silicon Valley Case Analysis

- BP And Contingent Liabilities Case Analysis

- Improving Private Sector Impact On Poverty Alleviation: A Cost Based Taxonomy Case Analysis

- Coffee Wars In India: Café Coffee Day 2015 Case Analysis

- Cheryl Dorsey And Lara Galinsky, In Class Comments, March 21, 2012, Video Case Analysis

- Tsinghua Science Park Source Of Chinese Entrepreneurial Innovation Case Analysis

- SimpliFlying (B): Making A Great Idea Take Flight Case Analysis

- A Note On A Standardized Approach To Hiring Decisions Case Analysis

Be a great writer or hire a greater one!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Case48 with BIG enough reputation.

Our Guarantees

Zero plagiarism, best quality, qualified writers, absolute privacy, timely delivery.

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!

Allow Our Skilled Essay Writers to Proficiently Finish Your Paper.

We are here to help. Chat with us on WhatsApp for any queries.

Customer Representative

SNEAKER 2013 Case Study Help

Sneaker 2013 case solution.

Produce the cash flow statement for Sneaker 2013 project clearly showing all the assumptions and supporting calculations including the initial investment outlay and the net cash flows during each year of the project. Note that for Sneaker 2013 project, “revenue” means “net revenue.” Net revenue is equal to the gross margin minus any cannibalization. (50 points)

The cash flow statement for the Sneaker 2013 project has been prepared in the excel spreadsheet. The project will have a life of 6 years from 2013 to 2018. The cash flow statement is shown below:

The research and development costs have not been incorporated in the above cash flow calculations because these are sunk costs. The annual interest costs have also not been considered in the above cash flow calculations because the cost of capital has the built in effect of cost of debt. The endorsement fees and the 2016 bonus have been incorporated in the above cash flows. The net revenues are equal to gross margins less the cannibalized sales.

Does Sneaker 2013 appear viable from a quantitative standpoint? To answer this question, estimate the project’s payback period, net present value and internal rate of return. (6 points)

The payback period for the Sneaker 2013 project is 4.53 years. Its internal rate of return is 12% which is higher than the 11% cost of capital and thus the project has a positive net present value of $ 8.17 million. Therefore, the project is viable from the quantitative standpoint. If Michelle Rodriguez invests in this project then it would increase the wealth of all the shareholders of New Balance Company. The computations have been performed in excel spreadsheet. The outputs are shown in the table below: