Tally Practical Assignment with Solutions PDF

Tally Practical Assignment including GST with Solutions PDF for free download. Super Success Institute Tally computer training coaching classes day by day task. Notes is very useful for learn and practice the tally ERP 9 with GST. We found that student face problem to find the practice assignment of Tally. The Training Faculty of Super Success Institute compiled the practice task in this PDF for self study of students.

Our Tally Coaching Class Assignment / task includes following:-

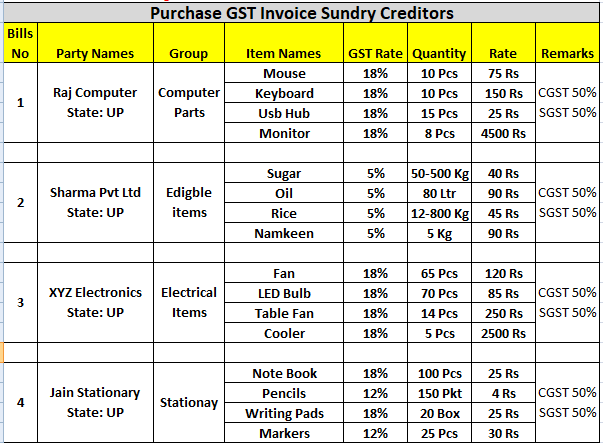

Purchase Invoice Bills Sundry Creditors Sales Invoice Bills Sundry Debtors Purchase Invoice Bills Batch Wise Details

Brief of GST Business For Purchase & Sales Of Goods Business for Service providing Who are Compulsory For GST Registration Document Required For GST Registration GST What is GSTIN Number Types of GST Rates GST Rates How GST Apply in Tally How GST Apply in Invoice SGST (State Tax) & CGST (Central Tax) IGST (Interstate Tax) – Purchase GST Invoice Sundry Creditors Sale GST Invoice Sundry Debtors

Purchase Entry

Purchase Invoice with GST (Sundry Creditors)

Sales Invoice with GST Sundry Debtors

Entry of 25 Sundry Debater bills are given in the PDF

Download Tally Practice Assignment PDF

Document Name : Tally Practice Assignment with solution

Publisher : S uper Success Institute Muzaffarnagar and https://onlinestudytest.com Author : Super Computer Muzaffarnagar Number of Pdf Pages : 28 Quality Very good

Note : The Tally Practical Assignment with Solutions notes PDF are property of Super Success Institute Muzaffarnagar. We are sharing the google drive download link with due consent of Computer Coaching Institute.

Tally Prime Notes

- Fundamental of Accounting and Tally Prime Notes

- Introduction of Tally Prime Notes

- Groups and Ledgers in Tally Prime Notes

- Voucher Entry in Tally Prime Notes

- Create Stock Item in Tally Prime Notes for Practice

- Bill wise entry in Tally Prime

- Batch wise Details in Tally Prime Notes

- Cost Center in Tally Prime Notes

- Export Import Ledger in Tally Prime

More Tally PDF may be found – Tally Notes PDF Archives – SSC STUDY

Tally Prime Book PDF Free Download – SSC STUDY

Tally ERP9 Question Paper in Hindi – Online Study Test

Related Posts

O level computer course book pdf download, tally computer course notes pdf download, computer book pdf for competitive exams in hindi, computer questions pdf for competitive exams.

dVIDYA : e-learning | CA/CS/CMA Foundation | CBSE/ISCE/Boards- Class 11-12 | Competitive Exams

Practical Assignments : GST Accounts–Tally

The Practical Assignments-Tax Accounts- covers Basic tasks of Maintaining GST Accounts, from set up, Data Entry to GST Reports, in Tally Prime Rel 3.x.

This assignment is in continuation to Practical Assignments of Basic Financial Accounting & Basic Invoicing & Inventory Accounts. Maintain GST Accounts in the same Company in which Basic Financial Accounts and Basic Invoicing & Inventory Accounts Practical Assignments data were entered.

Perform the operations for each Assignment as explained. Capture the screenshots (Prtscr) and paste it in MS Word file in 1×1 cell. Write the number and Name of screen shot as indicated. Explain the options and operational step.

This way, capture the screenshots and place in MS Word file, in sequence. Don’t repeat same screenshot.

After completing all assignments, take Back up of the data files. Now email to [email protected], attaching the Data Back Up file and screenshot zip file.

GST Accounting – Practical Assignments

Continue in same Company after previous assignments

01-1 Company GST Features

[At Company >Click F11. At Company Features , under section Taxation , set Yes at Enable Goods & Services Tax (GST) . Next, At GST Details screen , under GST Registration Details section, enter the relevant details.]

Capture Screenshot 1-1A : Company Features . 1-1B : Company GST Details set up

For more details, visit

https://dvidya.com/goods-service-tax-gst/ https://dvidya.com/goods-services-tax-gst-set-up-composition-dealers-tally/ https://dvidya.com/goods-services-tax-gst-set-up-regular-dealers-tally/ https://youtu.be/STv3wbduT8A https://youtu.be/RwJJIYC6msE https://youtu.be/VSS48c_LZXY https://youtu.be/OjSvFYUJ_bI https://youtu.be/mLrLyOeDX78 https://youtu.be/7wlTsturfks

02 GST Masters

02-1 Create SGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter SGST; at Under , select Duties & Taxes ; at Tax Type , select SGST/UTGST ; At Inventory Values are affected , set No .

Capture Screenshot 1-2 : SGST Ledger Account Creation.

https://dvidya.com/gst-set-up-accounts-inventory-masters-tally/ https://youtu.be/x8VZLjVEeug https://youtu.be/XVZbi0-ufDY https://youtu.be/Uzsise4yZXg

02-2 Create CGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter CGST; at Under , select Duties & Taxes ; at Tax Type. At Inventory Values are affected , set No . Capture Screenshot 2-2 : CGST Ledger Account Creation.

02-3 Create IGST Ledger Account Master

[Select GoT>Create> Ledger. At Ledger Account creation , at Name , enter IGST; at Under , select Duties & Taxes ; at Tax Type select I GST ; At Inventory Values are affected , set No .

Capture Screenshot 2-3 : CGST Ledger Account Creation.

https://youtu.be/XVZbi0-ufDY

02-4 UQC set up in UoM Master

Set UQC in UoM – Kilograms [Select GoT>Alter> Unit. Select Kilogram. At Unit Alteration , at Unit Quantity Code (UQC) , select KGS-Kilograms from the UQC list. Press Ctrl+A to save].

Capture Screenshot 2-4 : UoM-UQC set up.

https://youtu.be/KAKto78n9fQ

02-5 GST details set up in Stock Item Master

Set GST details in Stock Item Wheat, Select GoT>Alter> Item. Select Wheat, At Stock Item Alteration, Under HSN/SAC & Related Details, at HSN/SAC Details , select Specify Details Here. At HSN Description – Food grains, HSN Code- 1234, At Description of Goods, select Specify Details Here , Under GST Rate and related Details, At GST Rate details, select Specify Details Here . At Taxability Type, select Taxable . At GST Rate, enter the GST Rate applicable for the Item. At Type of Supply, select Goods .

2-5 : Capture Screenshot UoM-UQC set up.

https://youtu.be/U7fuonC9dkI https://youtu.be/LK-df_Oh6Vk

02-6 Set GST details in Supplier Master

At Supplier Ledger Account, enter Tax related details [Select GoT>Alter>Ledger, select ABC & Co. At Ledger Alteration, click F12:Configure. At Ledger Master Configuration screen, under Party Tax Registration details , set Yes at Provide GST Registration details . At Tax Registration details of Ledger Account Master, Enter Registration Type- Regular, GSTIN 19AAAC1234K1ZV. At Set Alter Additional Details, set Yes and then Place of Supply, select the State of the Party.

Capture Screenshot : 2-6A: Ledger Account Master, 2-6B: Ledger Master Configuration screen,

https://youtu.be/1_jlZD8mXkI https://youtu.be/B6jEPMw26Tg

03 GST Invoicing

3-1 Create GST Sales Invoice .

Create Sales Invoice for 10 kg of Wheat @25 per kg sold to ABC & Co on 1-5-21. [Select GoT>Vouchers. Click F8:Sales (or press F8). Select Sales Voucher type from List. Click Ctrl+H and select Item Invoice . Enter Voucher Date 1-5-21 . At Party A/c Name , select ABC & Co . At Sales Ledger, select Sales . At Name of Item , select Wheat , At Quantity , enter 10 kg. at Rate , enter 25/kg. The amount 250 would be shown. In next line, select End of List . Next select SGST, the SGST amount (15.00) would be auto calculated. Next select CGST. the CGST amount (15.00) would be auto calculated. The total Invoice amount (250.00+15.00+15.00 = 280.00) is displayed. Press Ctrl+A to save the Voucher].

Capture Screenshot : 3-1 GST Sales Invoice Entry ,

https://youtu.be/L57aR4Zb7GM https://youtu.be/S0y56oS7r1U

3-2 Print the Sales Voucher

Voucher dated 1-5-23 on ABC Co [Select GoT>Day Book . At Day Book display, press F2 and Date 1-5-23. Select the Sales Voucher from the list to get the Voucher Alteration. Press Ctrl+P to get the Print screen. Click I:Preview to View the Print form of the Invoice on screen]

Capture Screenshot : 3-2 GST Sales Invoice in Print ,

https://youtu.be/L57aR4Zb7GM https://youtu.be/S0y56oS7r1U

03-03 GST Reports

- Display GSTR-1 for 1-4-23 to 31-7-23

[Select GoT>Display more reports>GST Reports>GSTR-1. Click F2:Period (or press F2) and enter Period from 1-4-23 to 31-7-23 to display GSTR-1 Report

Capture Screenshot : 3-3 GSTR-1 Display, https://dvidya.com/gsrt-1-return-filing-tally/

Dvidya: Hello Student, How can I help you!

Ask Question, Get Answer

This will close in 0 seconds

टैली सीखें – हिन्दी में (Learn Tally in Hindi)

Complete Practical Accounting

Questions for Practice – Tally and Accounts – (टैली के अभ्यास प्रश्न)

टैली व अकाउंट्स के अभ्यास प्रश्न (questions for practice – tally and accounts).

इस पेज पर टैली व अकाउंट्स की प्रैक्टिस के लिए कई अभ्यास प्रश्न (Questions for Practice – Tally and Accounts) दिए गए हैं।

टैली के विडिओ ट्यूटोरियल (Tally – Video Tutorial)

सभी प्रश्नों के हल (Solutions) प्रत्येक प्रश्न वाले पेज पर प्रश्न के नीचे दिए गए हैं। प्रश्नों (Practice Questions) को हल करने के बाद प्रश्न के नीचे दिए solution से अपने answers का मिलान कर लें। कृपया सुझाव कमेंट्स में लिखें। आपके बहुमूल्य सुझावों का स्वागत है।

Tally Questions for Practice – Maintain Accounts only, Accounts with Inventory and Tally Accounting with GST

टैली अभ्यास प्रश्न – 1 (Tally practice exercise for beginners)

टैली अभ्यास प्रश्न – 2 (Tally practice exercise for beginners)

टैली अभ्यास प्रश्न – 3 (Tally practice exercise for beginners) with Maintain Bill-wise details for beginners

टैली अभ्यास प्रश्न – 4 (Tally practice test – Accounts with Inventory in Tally Prime & Tally.erp9)

टैली अभ्यास प्रश्न – 5 (Tally Practical Question for Learn Tally in Hindi) Practice Test with Trade discount and Cash Discount

टैली अभ्यास प्रश्न – 6 (Tally practice test for beginners with Previous Year’s Opening Balances)

टैली अभ्यास प्रश्न – 7 (Tally practice test – Accounts with Inventory in Tally Prime & Tally.erp9)

टैली अभ्यास प्रश्न – 8 (Tally Practice Question with Previous Year’s Opening Balances)

टैली अभ्यास प्रश्न – 9 (Tally Practice Test with Previous Year’s Balance Sheet)

टैली अभ्यास प्रश्न – 10

टैली अभ्यास प्रश्न – 11 (Tally Prime Practice Test with Previous year Balance Sheet & Inventory with multiple units for stock items)

टैली अभ्यास प्रश्न – 12

टैली अभ्यास प्रश्न – 13

टैली अभ्यास प्रश्न – 14 (आय व खर्चों को प्रतिमाह ड्यू करने की एंट्रीज़ हेतु बहुत ही महत्वपूर्ण प्रश्न)

टैली अभ्यास प्रश्न – 15

टैली अभ्यास प्रश्न – 16 (Partnership Practice Question for Tally erp9 and Tally Prime)

टैली अभ्यास प्रश्न – 17

टैली अभ्यास प्रश्न – 18 (GST)

टैली अभ्यास प्रश्न – 19 (GST)

टैली अभ्यास प्रश्न – 20 (GST)

हिन्दी में टैली सीखने के विडिओ ट्यूटोरियल (Learn Tally in Hindi – Video Tutorial)

Tally Prime व Tally.ERP9 के Tally Practice Questions या Tally Practice Test के किसी भी अभ्यास प्रश्न के संबंध में कोई भी संदेह या सुझाव हों तो कमेंट जरूर करें।

One thought on “ Questions for Practice – Tally and Accounts – (टैली के अभ्यास प्रश्न) ”

tally practice questions very nice sir contact number plese sir

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Our Visitor

How To Easily Learn Tally Online With Practical Assignments

Every business needs accounting since it’s essential for everything from tracking expenses to choosing investments to calculating profits. we can say that learning tally is a terrific skill to have in the job market. even there’s no need to be physically present in the class to learn tally. nowadays, thanks to the internet you can learn tally online. this article has included how to learn tally online and everything you need to know about tally. there are so many institutes that provide tally courses online. so, let’s get started..

What is Tally?

- Tally stands for Transaction Allowed in Linear Line Yards.

- It is an accounting and inventory management application software.

- It which can record daily business transactions or accounting works like sales, purchases, payments received, banking or taxation, etc.

- The most popular way we can say that Tally is an Accounting Software.

- It is designed and developed by Tally Solutions which is a Bangalore-based IT Solution Company.

- In 1986, S.S Goenka was the founding chairperson of Tally Solutions Private Limited.

- Developed based on Accounting principles and Mercantile Law.

- It is simple yet powerful software.

- It is a window-based software.

- It is a stand-alone application.

- It is developed using the Tally Definition Language (TDL).

- It supports,

-Bookkeeping

-MIS report

Versions of Tally Software

Other features of tally software.

- User-friendly accounting software

- Multi-lingual

- Excellent backup provisions

- Easy exit to an operating system

- Tally can maintain books of account either with inventory or without inventory.

- It can work with multiple company accounts simultaneously.

- Tally can get offline and online support.

- It can be installed on any version of Windows OS like NT, 2000, ME, 95, 98, XP, 7 Ultimate, Vista, and Windows 8. Etc.

- Many computerized accounting software requires numeric codes to maintain the account. But Tally pioneered that no accounting codes were needed.

Skills required in Tally

Career and scope in tally.

Having the skill set of Tally software may help you land your chosen job path quickly if you are someone wishing to start a futuristic career in the accounting field. It is because Tally is extensively used across all business sizes, from small to large across all sectors.

90% of companies and businesses are said to use Tally software for their daily accounting tasks.

Additionally, the top MNCs and Retail businesses of all kinds, financial institutions, financial organizations (NGOs), hospitals, BPO and KPO sectors, and chartered accountant companies are among the many different industries that use Tally software.

You can have so many career choices in Tally. Such as-

- Inventory Manager

- Data Entry Operator

- Billing Executive

- Tally freelancers

- Tally Course Benefits

- Scope of Tally Courses in India

Job Profiles and Salary in Tally

The common job profiles offered in the organizations for accountants with Tally skill sets are-

Many students who are looking for Diploma Courses after 10th/12th or after graduation and planning to look for career opportunities in computer accounting can learn tally.

The purpose of the tally training course is to teach students the fundamentals of accounting and how to integrate such concepts with the tally platform. Although it’s easy to learn, for ways of operation one must grasp how the software works as well as be familiar with its applications.

Tally Jobs in India

Requirements for Learning Tally Online.

- Any student who wants to learn tally software online should have a computer or laptop with an internet connection.

- Nowadays it has become very easy to learn any software or anything from home.

- There are so many courses with certification and placement assistance in Tally you can opt for.

- Here we have listed some of the best Tally courses you can learn online.

- All of these courses are completely online, so there’s no need to show up to a classroom in person.

- You can access your lectures, readings, and assignments from reputable institutes anytime and anywhere via the web or your mobile device.

More Professional Courses from IIM SKILLS

- Digital Marketing Course

- Technical Writing Course

- Content Writing Course

- Investment Banking Course

- Business Accounting And Taxation Course

- CAT Coaching

Learn Tally Online: IIM SKILLS

IIM SKILLS is one of the global leading institutes that provides professional courses in various subjects including writing, marketing, accounting, etc.

The tally master course by IIM SKILLS is one of the best for getting hands-on experience. It is a comprehensive training program that covers all of Tally’s topics and features. Students learn precisely how to manage and maintain accounts, inventory, GST, and payroll at Tally in the course modules. The training module is particularly informative because it starts from the basics, providing a foundation for your understanding of Tally. Also, a variety of practical assignments and tasks are included to ensure that students grasp the subject well. IIM SKILL’s professional guidance allows one to interact, clear doubts and learn more effectively.

Course Name: Tally Course

Duration of the Course: 18 Hours of Self Learning, 20 Hours of Lecture

Mode of the Course: Online

Fees: Rs.2, 900 + 18% GST

Course Syllabus:

Course offerings:.

- Access to Learning Management System (LMS)

- Self-Paced Learning

- Software Tools

- 60+ Hours Practical Assignment

- Internship Opportunities

- Dedicated Placement Cell

- Govt. of India Recognized Certification

Certificate Availability: Yes

Contact Information:

Email ID: [email protected]

Phone Number: +91 9580 740 740

Learn Tally Online: Tally Training

In-depth information is covered in the Tally ERP9 online course with GST to match the industry’s accounting standards. With the use of real-world examples and tally entries, Tally Training not only explain the principles but also show you how to practically apply them in your day-to-day accounting process.

Course Name: Tally ERP9 Expert Course

Duration of the Course: 1 or 2 Months

Fees: Rs.1800

Couse Syllabus:

- Learning in Hing-lish language

- DVD(Videos + eBook PDF)

Contact Information

Phone Number: +91 9081211174

Learn Tally Online: Vskills

Intelligent Communication Systems India Limited (ICSIL), a department of the Indian government, manages the skills certification programs.

Their certification programs help students measure and exhibit the skills that have high demand and business value. Vskills Tally ERP9 course provides students with a clear understanding of accounting as well as the necessary practical aspects. Thanks to their self-paced training, even newbies can gain from the course’s worthwhile teaching.

Course Name: Certificate in Tally ERP9

Duration of the Course: 19 Hours

Fees: Rs.3, 499

Couse Syllabus:

- Introduction to Tally ERP9

- Stock and Godwon in Tally

- Groups, Ledgers, Vouchers and, others

- Reports in Tally ERP9

- Back and Restore in Tally ERP9

- Tally.NET in Tally ERP9

- Government Certification

- Lifelong e-learning access

Phone Number: +011 4734 4723

Recommend Read,

- Advanced Tally Courses

- Tally ERP 9 Certificate

- Learn Online Tally

- Tally Training Benefit

- Tally Courses Uses

- Tally Course Eligibility

Learn Tally Online: LearnVern

LearnVern teaches students in the user’s native language. You can learn their Tally courses in Hindi.

Their method of instruction encourages critical thinking, learning by doing, and teaching by example. To help students in remembering the subject better, their Tally course material is enhanced with graphics, animations and, photos. LearnVern also gives practical training through assignments and tests.

Phone Number: +91 88490 04643

Learn Tally Online: UDEMY

Udemy is one of the best online platforms that provide various Tally certification courses. All of these courses are accessible from anywhere at affordable prices. Here we’ve listed three courses among others with the highest rating. You will learn how to use the tally program for payroll, audit, TDS, and GST accounting of any organization. Their tally course provides students the chance to work on real-time projects in addition to assignments.

- Assignments

- Access on Mobile and TV

- Full Lifetime Access

Please, go to their official website for further details.

Learn Tally Online: Coursera

Students who want to build a career in bookkeeping or want to learn how to manage their account books, Coursera offers the best Tally Bookkeeper professional certificate course.

In their unique 4-month Tally Book Keeper Professional Certificate program, three separate Tally software-related courses are offered. It comprises most of the theoretical and instructional modules. You have to take the course in the specific order listed because the content builds on the previous session.

Program Name: Tally Bookkeeper Professional Certificate

Fees: You can enroll for free.

- Interview Prep

Learn Tally Online: InternShala Trainings

InternShala is an Ed-tech company that provides live, interactive learning in digital format.

Their Online Tally course has covered all the accounting-related concepts. They also provide quizzes and assignments after completing every module to revise your knowledge.

Duration of the Course: 6 Weeks, 1hr/day (Flexible Schedule)

Fees: Rs.4499

- Basic Concepts of Accounting

- The world of Tally

- Accounting process in Tally

- Bank reconciliation statement

- Tax Deducted at source (TDS) & Collected at Source (TCS) accounting in Tally

- Payroll in Tally

- Goods and Service Tax (GST) accounting in Tally

- Data extraction from Tally

- Some extra topics

- Final training project

- Placement Assistance

- Learn in Hindi

- 1:1 Doubt Solving

- Hands-On-Practice

Learn Tally Online: FITA Academy

Tally Online courses at FITA Academy offer comprehensive instruction in the tally ERP9 software from Journal Entries to finalizing accounts, including managing GST and other taxation.

You will learn the ins and outs of accounting and finance-related Tally. The modules are covered from both basic and advanced standpoints to help student comprehension of the subject better. Their online Tally course also includes real-world assignments to meet industry standards.

Course Name: Online Tally Course

Duration of the Course:

- Tally-Advanced accounting professional-basics in financial accounting

- Introduction to Tally

- Configuring Tally ERP9

- Company Management

- Master- Ledgers and Groups

- Understanding Vouchers in Tally

- Tally ERP9 reports

- Inventory configuration in Tally ERP9

- Managing inventory using Tally ERP9

- Goods and Service Tax (GST)

- Purchase and Sales reports

- GST reports and returns

- Using tally to manage point of sales (POS)

- Bank reconciliation

- Tally-expert accounting professional

- Payroll accounting

- More advanced topic

- Live Projects

- Instructor-led Live Class

- Flexibility

- Placement Support

Phone Number: 93450 45466

Learn Tally Online: Frequently Asked Questions

Q. can i learn to tally online through a laptop.

Answer: Yes, Students who wish to study tally software online should have access to a computer or laptop with an internet connection.

Q. Which Tally is best for beginners?

Answer: The latest version of Tally Prime is easy to learn. There is no longer a need for prior expertise or specialized training in Tally. You can easily use Tally Prime for your regular accounting tasks with only a simple installation and setup.

Q. Can learning Tally online is difficult?

Answer: Beginners have the choice of enrolling in expert courses provided by reputable institutions or learning the program on their own with the help of blogs and videos that are easily available online.

Q. Where can I practice Tally?

Answer: The Tally Software Education version is available on www.tallysolution.com website. You may practice it by downloading it for free.

Q. Which industries can one enter after completing the Tally course?

Answer: The private and public sectors provide a ton of options. Banking, finance, business manufacturing, IT industries, and so on. You can also work in sales, marketing, insurance, and HR.

Learn Tally Online: Conclusion

That’s all about how to learn tally online. In this article, we have focused on tally software, its feature, also the scope and career opportunities in tally. And institutions that provide tally training online. We hope this might have helped to get some insights about tally. If you plan to learn tally online, you can get in touch with the experts of this institute that will provide you with the information and exposure you need in this area.

Author: Swati Varli

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Request For A Call Back

- Email This field is for validation purposes and should be left unchanged.

You May Also Like To Read

What is mobile marketing 10 key elements of mobile marketing, best seo tricks in 2024: increase website traffic, 13 tips for writing engaging social media posts, investment banking fresher jobs – a comprehensive detail, top 4 tally courses in delhi with practical learning, top 8 python courses in hyderabad with placement, 5 benefits of having an effective blogging strategy, how to craft an effective e-mail best practices of email writing, 25 small business ideas for entrepreneurs in 2024.

- 100% assured internships

- Placement Assured Program

- 500+ Hiring Partners

- 100% Money Return Policy

Sunday Batch - 26th May 2024

Sunday 10:00 AM - 2:00 PM (IST)

Share Your Contact Details

- Name This field is for validation purposes and should be left unchanged.

- Comments This field is for validation purposes and should be left unchanged.

Weekdays Batch - 21st May 2024

Tues & Thur- 8:00 PM - 9:30 PM (IST)

Saturday Batch - 18th May 2024

Saturday 10:00 AM - 1:00 PM (IST)

- Phone This field is for validation purposes and should be left unchanged.

Download Course Brochure

- Hidden Unique ID

Weekdays Batch - 28th May 2024

Every Tue, Wed & Thur - 8:00 PM - 10:00 PM (IST)

Weekend Batch - 19th May 2024

Every Sat & Sun - 10:00 AM - 1:00 PM (IST)

Download Hiring Partners List

Download tools list, weekend batch - 25th may 2024.

Every Sat & Sun - 10:00 AM - 12:00 PM

Request for Online DEMO

Weekend batch - 18th may 2024.

Every Sat & Sun - 10:00 AM - 12:00 PM (IST)

- Learn From An Expert

- Steroids To Crack CAT Exam

- Flip The Classroom Concept

- Technology Driven

Request to Speak with MBA ADVISOR

- Select Course * * Select Course Advanced Search Engine Optimization Business Accounting & Taxation Course Business Analytics Master Course Content Writing Master Course Digital Marketing Master Course Data Analytics Master Course Data Science Master Course Financial Modeling Course Investment Banking Course GST Practitioner Certification Course Technical Writing Master Course Tally Advanced Course Other Course

- ADDITIONAL COMMENT

Download Our Student's Success Report

Watch our module 1 recording live for free, get realtime experience of training quality & process we follow during the course delivery.

Tally ERP 9 Mock Test

Report this question.

Tally Practical Questions and Answer PDF (Free Download)

Through today’s post, we are going to share Tally Practical Questions and Answer PDF with you, which you can download for free using direct download link given below in this post.

If you are studying Tally, then today’s notes can be very important for you, because in today’s notes, some important questions of Tally have been given along with their answers, with the help of which you can practice.

Tally Practical Questions and Answer PDF

Practical questions and answers of tally pdf.

If you are preparing for competitive exam of banking then study of tally becomes very important, because questions related to tally are also asked in the recruitment exam of banking.

Along with this, practical questions have also been given in this notes with their solutions, by solving which you can practice tally.

This PDF Notes can be very beneficial for you to practice Tally, that’s why must download it for free.

Download Tally Practical Questions and Answer PDF

To download the practical questions and answers of tally in pdf format, just follow the below mentioned download button.

Through this post, we have shared Practical Questions and Answers of Tally PDF with you, I think, you liked the information shared in this post, if you liked, please do share with your friends as well.

Related Post-

- A to Z Shortcut Keys in MS Word PDF

- Internet Notes in Hindi PDF

- Generation of Computer Notes in Hindi PDF

- Computer Awareness in Hindi PDF

- Python Notes in Hindi PDF

Important Posts

RRB ALP Notification 2024 PDF Free Download

Kedareswara Vratham Vrat Katha Telugu PDF Free Download

Kalnirnay 2024 Marathi Calendar (कालनिर्णय मराठी कैलेंडर) PDF Free Download

Kalnirnay January 2024 Calendar Marathi PDF Free Download

UP Board Class 10 Exam Time Table 2024 PDF Download

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

404 Not Found

Tally practical assignment with solution pdf download.

Table of Contents

Tally Practical Assignment with Solution PDF Download:- Welcome to our website. Here we are happy to provide you with Tally Solutions . At gurujistudy.com you can easily get Tally Prime Notes PDF, Tally Practical Assignment in PDF, Tally Notes in Hindi and English in PDF, PDF Notes Tally Prime, Download Tally PDF Notes in English & Hindi, Tally Books Notes in Hindi PDF Download, Tally Books Notes in English PDF Download, Tally all study materials and notes in pdf for free. If you are preparing for Banking and RRB then there is a single-stop destination as far as preparation of all of these examinations is concerned. Here in this post, we are happy to provide Chapter Wise & Topic Wise Tally Practical Assignment PDF download.

Brief of GST

Business For Purchase & Sales Of Goods Business for Service providing Who is Compulsory For GST Registration Document Required For GST Registration GST What is GSTIN Number Types of GST Rates GST Rates How GST Apply in Tally How GST Apply to Invoice SGST (State Tax) & CGST (Central Tax) IGST (Interstate Tax) – Purchase GST Invoice, Sundry Creditors Sale GST Invoice Sundry Debtors

Download Tally Practical Assignment in PDF

Download tally books & notes in hindi & english pdf, download tally books notes in pdf.

Tally Practical Assignment in PDF Download

See Also:- “ Click Here ”

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

TALLY-9 PRACTICAL QUESTIONS(SAMPLE

Related Papers

Soniya Angel

अंबिका सिंह

SEERAAPU KALYAN KUMAR

Megha Sharma

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

500+ Tally Exam Questions and Answers 2020-21 - 1

- computer-quiz

- tally-quiz11

- tally quiz1

- tally quiz2

- tally quiz3

- tally quiz4

- tally quiz5

- tally quiz6

- tally quiz7

- tally quiz8

- tally quiz9

- tally quiz10

- tally quiz11

- tally quiz12

- tally quiz13

- tally quiz14

- computer organisation

Question: 1

A Debit note is a statement sent to the _____ by the _____

(A) Buyer, seller

(B) Seller, buyer

(C) Creditor, seller

(D) Customer, seller

Seller, buyer

Question: 2

_____ is the shortcut for sales order in Tally.

Question: 3

In taxation, TCS stands for

(A) Tariff Collected at Station

(B) Tax Combined at Source

(C) Tax Collected at Source

(D) Tax Creation at Source

Tax Collected at Source

Question: 4

_____ is the shortcut to rejection in from inventory Vouchers in Tally.

Question: 5

Can we allow Expenses/Fixed Assets in Purchase vouchers?

(C) Wrong Question

(D) Both a and b

Error Report!

- sap abbreviations

- Top 500+ Tally Quiz

- Tally ERP 9 Questions and Answers Pdf

- Tally ERP 9 Multiple Choice Questions and Answers

- Tally Quiz Online Test

- Tally GST Questions and Answers

- Tally ERP 9 Quiz Questions with Answers

- Tally Fill in the Blanks Questions with Answers

- Top 100+ Tally ERP 9 Objective Questions and Answers

- 100+ Tally ERP 9 Interview Questions & Answers Pdf

- Tally Question Paper with Answer Pdf in Hindi

- 100+ Tally Practical Questions & Answers Pdf Free Download

- 500+ Tally Exam Questions and Answers 2020-21

- Top 250+ Tally Practice Questions with Answers

- Top 1000+ Tally Online Test/Mock Test

- 1000+ Tally ERP 10 Questions and Answers

REGISTER TO GET FREE UPDATES

2024 © MeritNotes

Accountancy - Practical problem on accounting software - Tally | 12th Accountancy : Chapter 10 : Computerised Accounting System- Tally

Chapter: 12th accountancy : chapter 10 : computerised accounting system- tally, practical problem on accounting software - tally.

Practical problem 1

Record the following transactions in Tally.

1. Robert commenced a transport business with a capital of ₹ 1,00,000

2. An account was opened with State Bank of India and deposited ₹ 30,000

3. Purchased furniture by paying cash ₹ 10,000

4. Goods purchased on credit from Mohaideen for ₹ 20,000

5. Cash sales made for ₹ 8,000

6. Goods purchased from Rathinam for ₹ 5,000 and money deposited in CDM

7. Goods sold to Rony on credit for ₹ 60,000

8. Money withdrawn from bank for office use ₹ 9,000

9. Part payment of ₹ 10,000 made to Mohaideen by cheque

10. Rony made part payment of ₹ 5,000 by cash

11. Salaries paid to staff through ECS ₹ 6,000

12. Wages of ₹ 3,000 paid by cash

13. Purchased stationery from Pandian Ltd. on credit ₹ 4,000

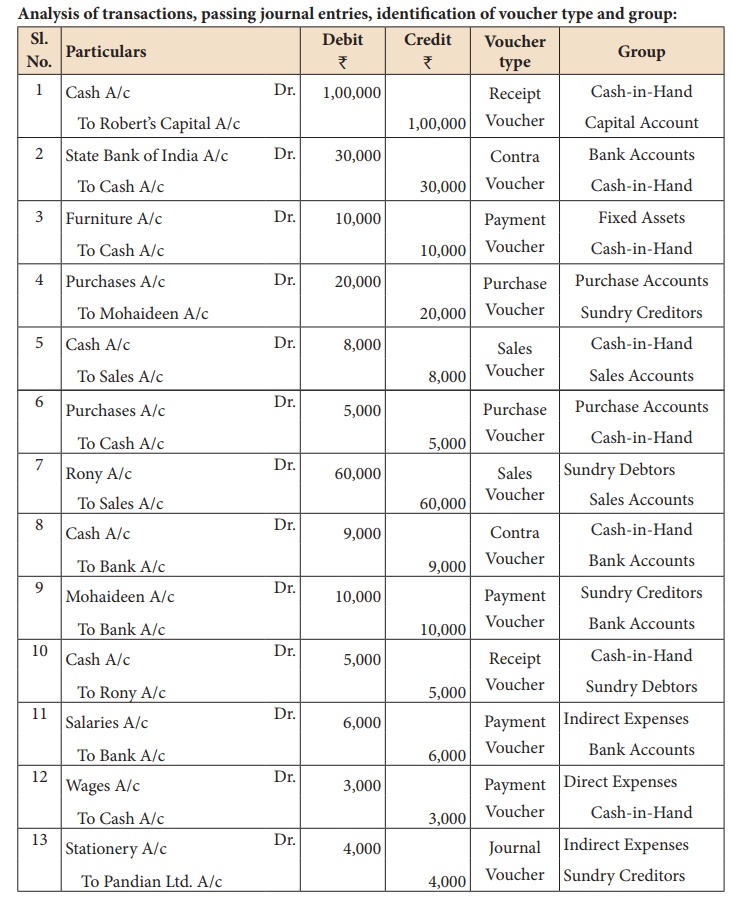

Analysis of transactions, passing journal entries, identification of voucher type and group:

Following steps are to be followed to enter the transactions in Tally.ERP 9

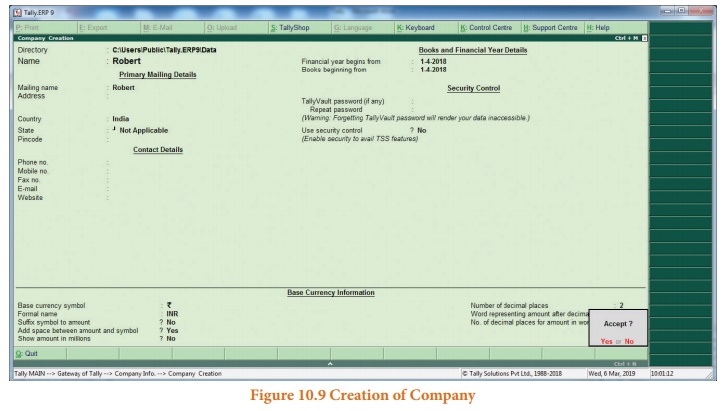

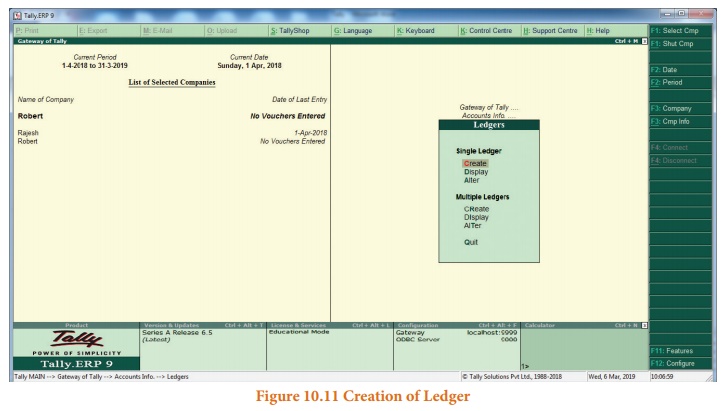

1. To create company

Company Info > Create Company

Type the Name as Robert and keep all other fields as they are and choose ‘Yes’ to accept.

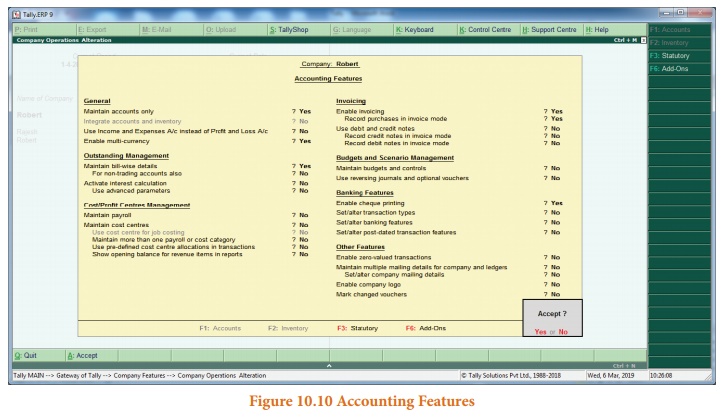

2. To maintain accounts only

Gateway of Tally > F11 Accounting Features > General > Maintain accounts only: Yes > Accept Yes

3. To create ledger accounts

Gateway of Tally > Masters > Accounts Info > Ledgers > Single Ledger > Create

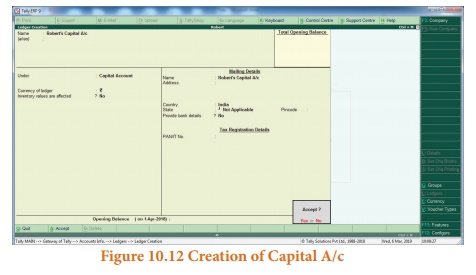

(i) To create Robert’s Capital A/c

Name: Robert’s Capital A/c

Under: Capital Account

Accept: Yes:

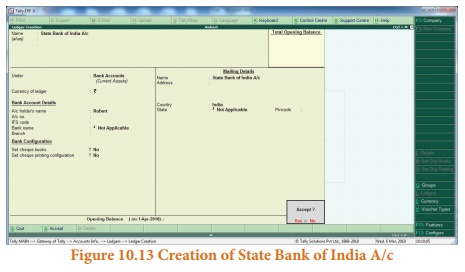

(ii) To create State Bank of India A/c

Name: State Bank of India A/c

Under: Bank Accounts

Accept: Yes

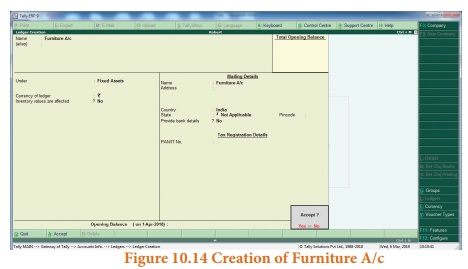

(iii) To create Furniture A/c

Name: Furniture A/c

Under: Fixed Assets

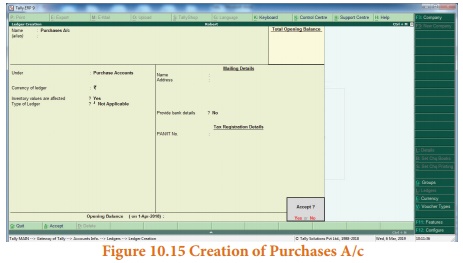

(iv) To create Purchases A/c

Name: Purchases A/c

Under: Purchase

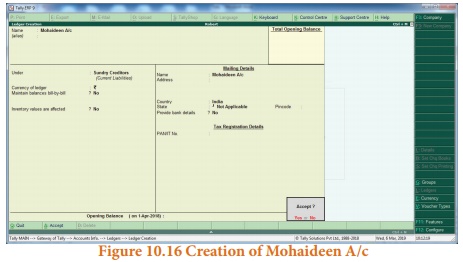

(v) To create Mohaideen A/c

Name: Mohaideen A/c

Under: Sundry Creditors

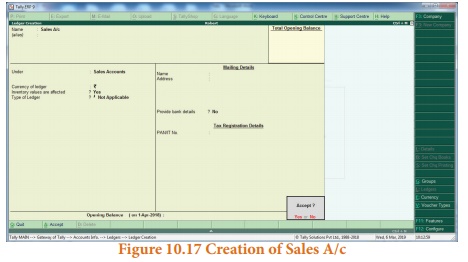

(vi) To create Sales A/c

Name: Sales A/c

Under: Sales Accounts

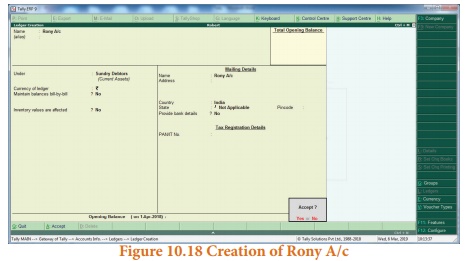

(vii) To create Rony A/c

Name: Rony A/c

Under: Sundry Debtors

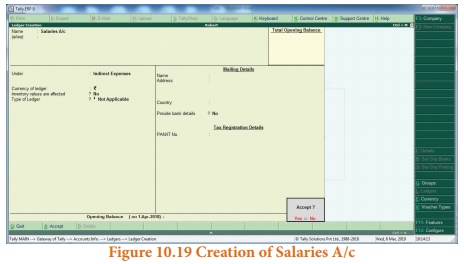

(viii) To create Salaries A/c

Name: Salaries A/c

Under: Indirect Expenses

(ix) To create Wages A/c

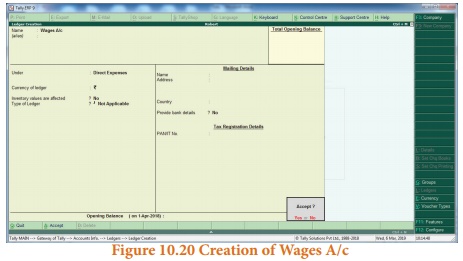

Name: Wages A/c

Under: Direct Expenses

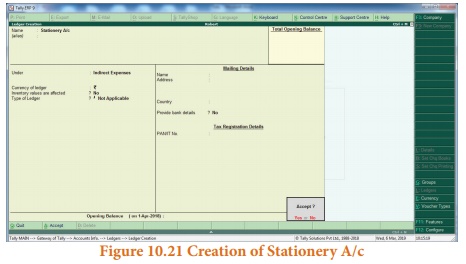

(x) To create Stationery A/c

Name: Stationery A/c

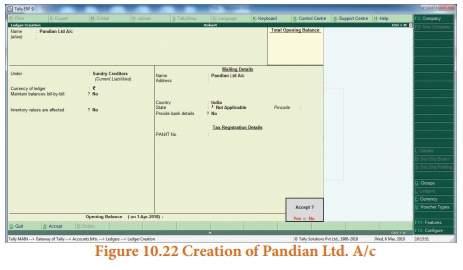

(xi) To create Pandian Ltd. A/c

Name: Pandian Ltd. A/c

Under:Sundry Creditors

4. To enter transactions through vouchers

Gateway of Tally > Transactions > Accounting Vouchers

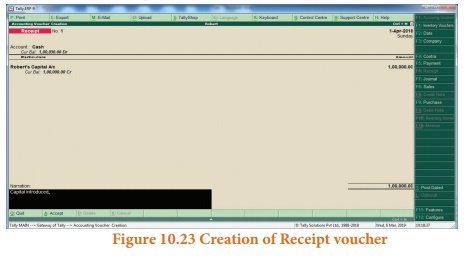

(1) Robert commenced a transport business with a capital of ₹ 1,00,000

F6: Receipt voucher

Account: Cash

Particulars: Robert’s Capital A/c (Choose from List of Ledger Accounts)

Enter the amount of capital: ₹ 1,00,000

Narration: Capital introduced

Accept Yes.

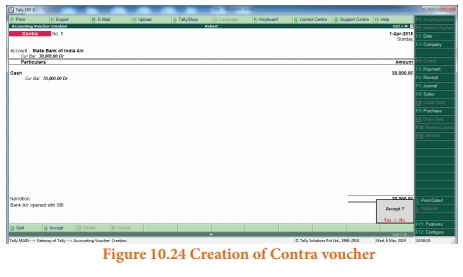

(2) An account was opened with State Bank of India and deposited ₹ 30,000

F4: Contra voucher

Account: State Bank of India

Particulars: Cash

Amount: ₹ 30,000

Narration: Opened bank account in SBI

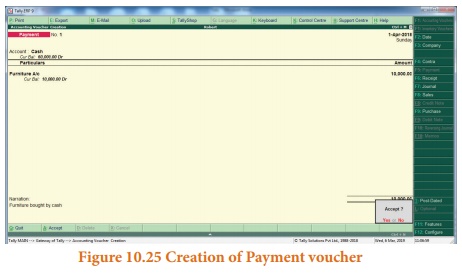

(3) Purchased furniture by paying cash ₹ 10,000

F5: Payment voucher

Particulars: Furniture A/c

Amount: ₹ 10,000

Narration: Furniture bought by cash

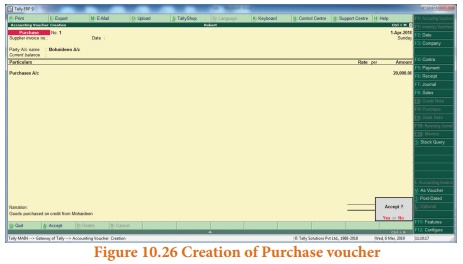

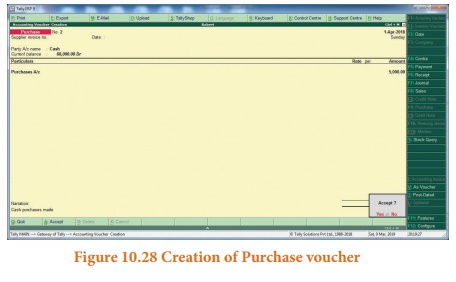

(4) Goods purchased on credit from Mohaideen for ₹ 20,000

F9: Purchase voucher

Party A/c name: Mohaideen A/c

Particulars: Purchases A/c

Amount: ₹ 20,000

Narration: Goods purchased on credit from Mohaideen

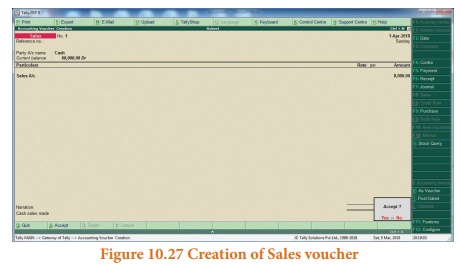

(5) Cash sales made for ₹ 8,000

F8: Sales voucher

Particulars: Sales A/c

Amount: ₹ 8,000

Narration: Cash sales made

(6) Goods purchased from Rathinam for ₹ 5,000 and money deposited in CDM

Amount: ₹ 5,000

Narration: Cash purchases made

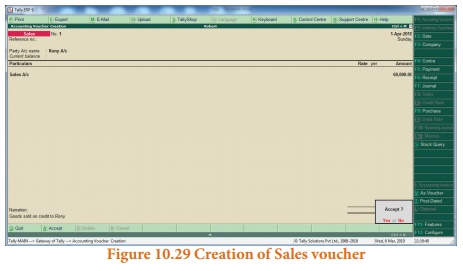

(7) Goods sold to Rony on credit for ₹ 60,000

Party A/c name: Rony A/c

Amount: ₹ 60,000

Narration: Goods sold on credit to Rony

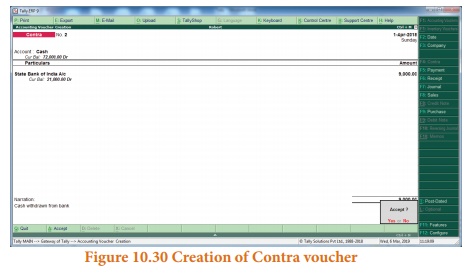

(8) Money withdrawn from bank for office use ₹ 9,000

Particulars: State Bank of India A/c

Amount: ₹ 9,000

Narration: Cash withdrawn from bank

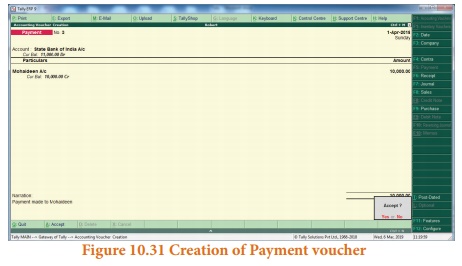

(9) Part payment of ₹ 10,000 made to Mohaideen by cheque

Particulars: Mohaideen A/c

Narration: Payment made to Mohaideen by cheque

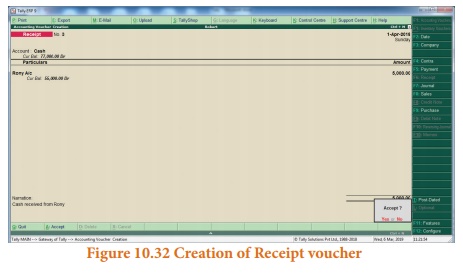

(10) Rony made part payment of ₹ 5,000 by cash

Particulars: Rony A/c

Narration: Cash received from Rony

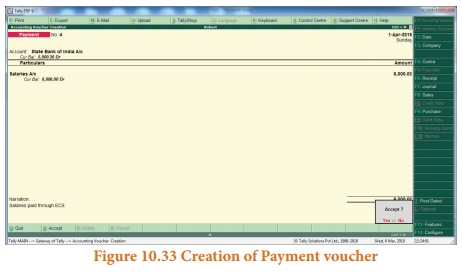

(11) Salaries paid to staff through ECS ₹ 6,000

Particulars: Salaries A/c

Amount: ₹ 6,000

Narration: Salaries paid through

ECS Accept Yes

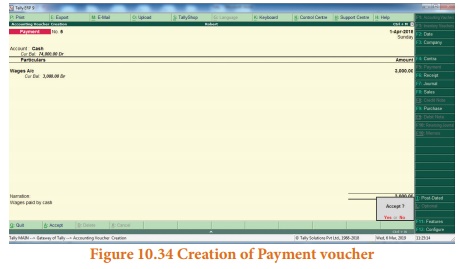

(12) Wages of ₹ 3,000 paid by cash

Particulars: Wages A/c

Amount: ₹ 3,000

Narration: Wages paid by cash

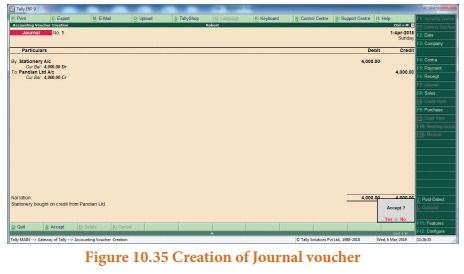

(13) Purchased stationery from Pandian Ltd. on credit ₹ 4,000

F7: Journal voucher

Particulars: Stationery

Amount: ₹ 4,000

To Pandian Ltd.

Narration: Stationery bought on credit from Pandian Ltd.

5. To view reports

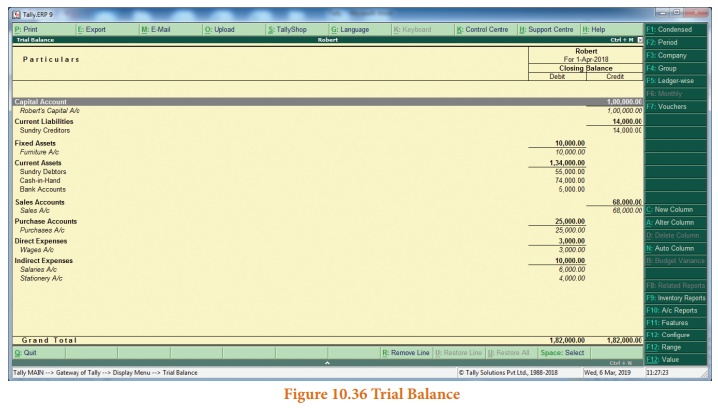

(i) To view Trial Balance

Gateway of Tally > Reports > Display > Trial Balance > AltF1 (detailed)

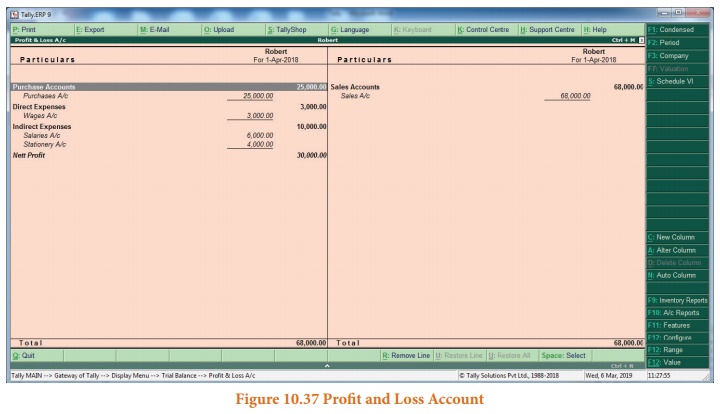

(ii) To view Profit and Loss Account

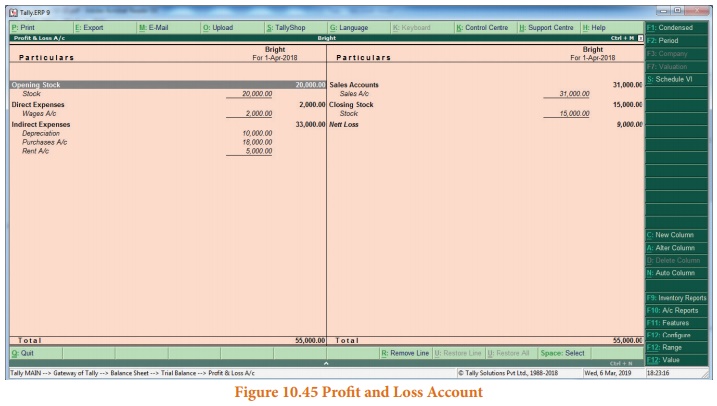

F10: A/c Reports > Profit & Loss A/c > AltF1 (detailed)

Gateway of Tally > Reports > Profit & Loss A/c > AltF1 (detailed)

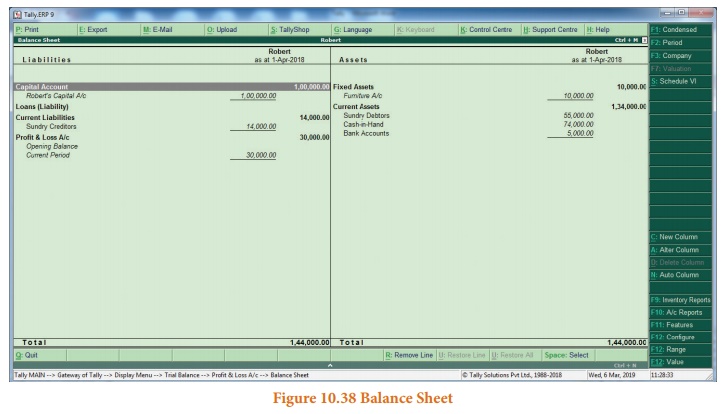

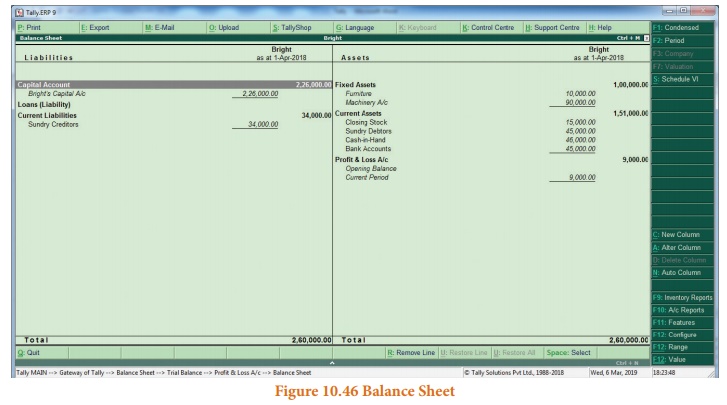

(iii) To view Balance Sheet

F10: A/c Reports > Balance Sheet > AltF1 (detailed)

Gateway of Tally > Reports > Balance Sheet > AltF1 (detailed)

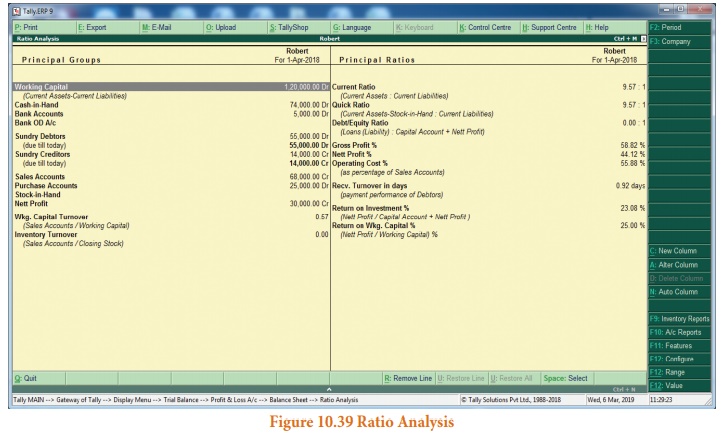

(iv) To view Ratio Analysis

F10: A/c Reports > Ratio Analysis

Gateway of Tally > Reports > Ratio Analysis

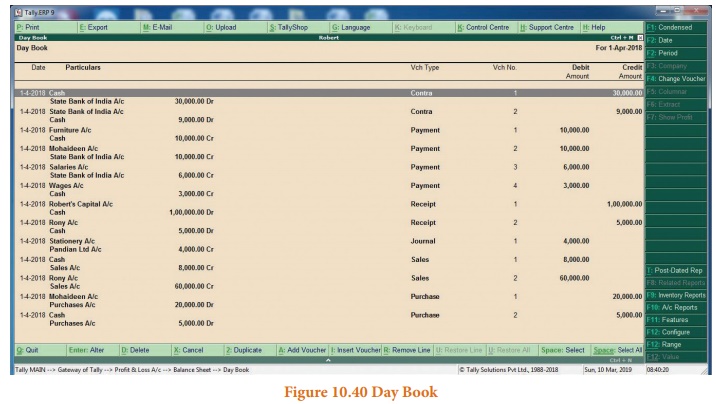

(v) To view Day Book

F10: A/c Reports > Day Book > AltF1 (detailed)

Gateway of Tally > Reports > Display> Day Book > AltF1 (detailed)

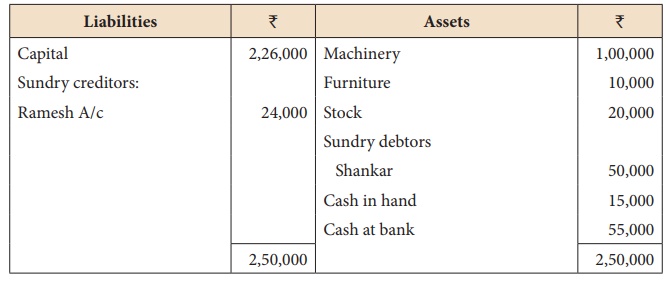

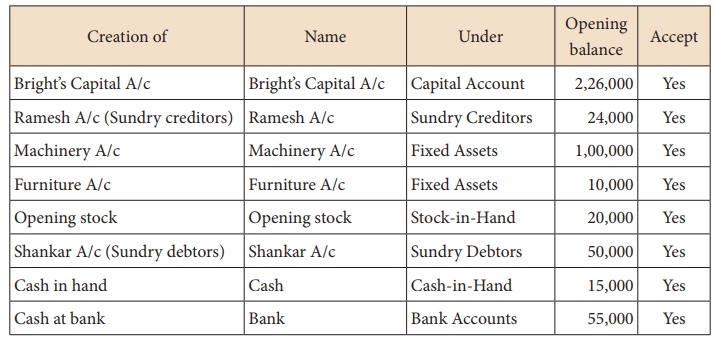

Practical problem 2

The following balance sheet has been prepared from the books of Bright on 1-4-2018.

During the year the following transactions took place:

a) Wages paid by cash ₹ 2,000

b) Rent paid by cheque ₹ 5,000

c) Cash purchases made for ₹ 3,000

d) Good purchased on credit from Senthamarai ₹ 15,000

e) Goods sold on credit to Pushparaj ₹ 25,000

f) Payment made to Senthamarai by cheque ₹ 5,000

g) Cash received from Shankar ₹ 30,000

h) Cash sales made for ₹ 6,000

i) Depreciate machinery at 10%

j) Closing stock on 31.03.2019 ₹ 15,000

You are required to prepare trading and profit and loss account for the year ended 31-03-2019 and a balance sheet as on that date using Tally.

Type the Name as Bright and keep all other fields as they are and choose ‘Yes’ to accept.

3. To create ledger accounts with opening balances

Cash account need not be created as it is a default ledger. Only the opening balance has to be recorded by altering the cash account.

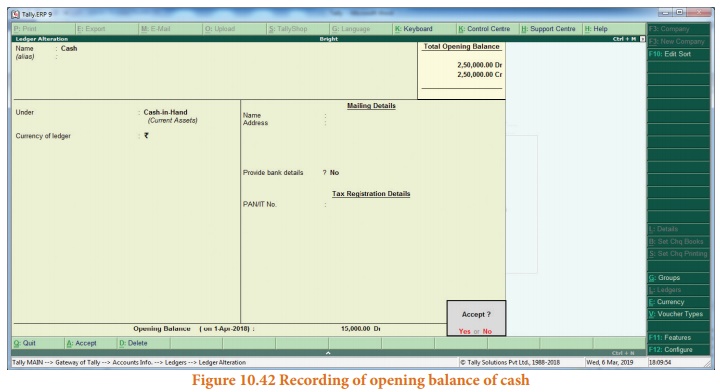

To record the opening balance of cash:

Gateway of Tally > Masters > Accounts Info > Ledgers > Single Ledger > Alter

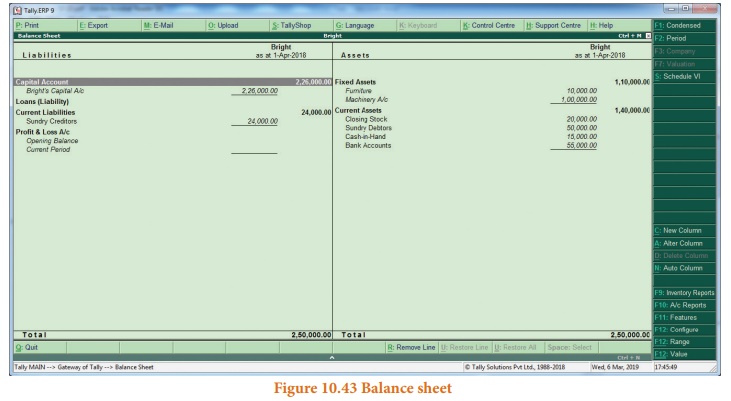

After creating the ledgers and recording the opening balances of ledger accounts the balance sheet of Bright is shown as in the following figure:

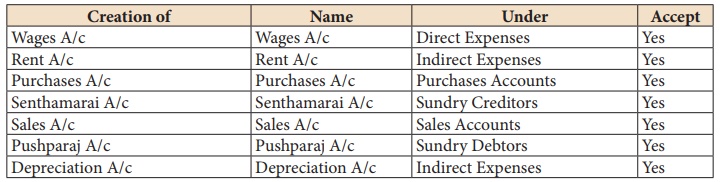

3. To create ledger accounts for transactions

Example: Wages of ₹ 2,000 paid by cash

Amount: ₹ 2,000

In the similar way, record the other transactions. Use Payment Voucher for rent paid and payment to Senthamarai.

Use Purchase Voucher for credit purchases from Senthamarai and cash purchases.

Use Sales Voucher for credit sales to Pushparaj and cash sales.

Use Receipt Voucher for cash received from Shankar.

Use Journal Voucher for depreciation.

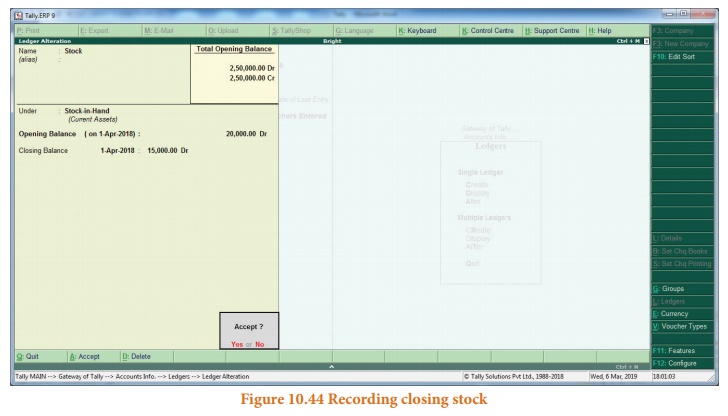

To record closing stock

Since maintain accounts only is set to ‘Yes’ and integrate accounts and inventory is set to ‘No’ under accounting features, stock has to be recorded manually. Hence, the closing stock has to be recorded by altering the stock account and while entering the date of closing stock, the date of opening stock has to be entered. The following procedure is to be followed:

Gateway of Tally > Masters > Accounts Info > Ledgers > Single Ledger > Alter > Stock > Closing balance > Date (opening date) > Amount > Accept Yes

6. To view reports

(i) To view Profit and Loss Account

(ii) To view Balance Sheet

Related Topics

Privacy Policy , Terms and Conditions , DMCA Policy and Compliant

Copyright © 2018-2024 BrainKart.com; All Rights Reserved. Developed by Therithal info, Chennai.

Tally Brains

Tally Brains – Dhamtari

Near Church, Jagdalpur Roard, Dhamtari

Coming Soon…

Address : in front of govt. maharaja college, 1st floor, swaraj tractor agency, chhatarpur 471001 (m.p.), contact: mr sushil raikwar, address : cinema line, shankar ward, bhatapara, dist – baloda bazar 493118, contact: ms namita agrawal, address : sindhi colony, new bus stand, baloda bazar 493332, contact: mr prem prakash patel, address : in front of bhaiya ji biryani, maharaja chowk, adarsh nagar, durg ( c.g) 491001, contact: mrs. neha pashine, address : subhash chowk, sadar road, nawapara, rajim 493885 (c.g.) 493881, contact: mr. balram dewangan, address : manav mandir chowk, gurudwara road, infront of anapurna restaurant, rajnandgaon, 491441 chhattisgarh, contact: mr. imran khan, address : tamrit colony, angul, odisha – 759122, contact: mr. gyanendra kumar sahu, address : 3rd floor, swarn mayukh complex, 9 to 9, kankarbagh, patna, bihar 800016 088188 00904, contact: bhagwan khetan, address : 2nd floor, above samsung smart care, opp. govt. ayurvedic hospital, bilaspur 495001, contact: mr. sourabh sahu, technobrains education pvt ltd, address : 309, 2nd floor, shyam square, near lic building, pandri, raipur-492004, mats university, address : mats university, pandri, raipur, kruti group of institutions, address : nardaha, raipur, c.g, contact: bhojesh maskare, blue tree skills (ln), address : tally brains, main road, lakhe nagar, purani basti, raipur, chhattigarh – 492001, tally brains tatibandh, address : 1st floor, lalwani heights, tatibandh, raipur – 492099, contact: rekha devi, address : pratapganjpara, near a to z sale, jagdalpur – 494001, contact: ms arshiya meer, address : shop no.4, near prithvi electronics, supela phatak, bhilai, 490023, contact: vikram khetan.

Form submitted successfully.

Our support team will contact you in few minutes.

- Class 6 Maths

- Class 6 Science

- Class 6 Social Science

- Class 6 English

- Class 7 Maths

- Class 7 Science

- Class 7 Social Science

- Class 7 English

- Class 8 Maths

- Class 8 Science

- Class 8 Social Science

- Class 8 English

- Class 9 Maths

- Class 9 Science

- Class 9 Social Science

- Class 9 English

- Class 10 Maths

- Class 10 Science

- Class 10 Social Science

- Class 10 English

- Class 11 Maths

- Class 11 Computer Science (Python)

- Class 11 English

- Class 12 Maths

- Class 12 English

- Class 12 Economics

- Class 12 Accountancy

- Class 12 Physics

- Class 12 Chemistry

- Class 12 Biology

- Class 12 Computer Science (Python)

- Class 12 Physical Education

- GST and Accounting Course

- Excel Course

- Tally Course

- Finance and CMA Data Course

- Payroll Course

Interesting

- Learn English

- Learn Excel

- Learn Tally

- Learn GST (Goods and Services Tax)

- Learn Accounting and Finance

- GST Tax Invoice Format

- Accounts Tax Practical

- Tally Ledger List

- GSTR 2A - JSON to Excel

Are you in school ? Do you love Teachoo?

We would love to talk to you! Please fill this form so that we can contact you

Passing Entry in Tally

- Basics of Tally

- Ledger Creation and Alteration

- Important Tally Features

- Important Tally Reports

- Common Errors in Tally

Mixed Entries Practice

Last updated at April 16, 2024 by Teachoo

We know that there are 6 types of Accounting Vouchers in tally

For every entry we have to think which type of entry

Assignment/Examples

Pass the following entries in Tally

Maintenance Charges Bill Received from SK Associates Rs 2500,Amt paid by Cheque of SBI Bank

Maintenance Exp Dr 2500

To SK Associates 2500

SK Associates 2500

To SBI Bank 2500

(First Entry is Journal,Second is Payment

SK Associates is a Sundry Creditor,Maintenance Exp is Indirect Expense,SBI Bank Under Bank Account)

Furniture purchased from DK Furnishers Rs 10000,Amt paid by Cash

Fur Dr 10000

To DK Furnishers 10000

DK Furnishers 10000

To Cash 10000

SK Associates is a Sundry Creditor,Furniture is Fixed Assets,Cash Account is already created)

Security Service Bill Received from Ravi Security Agency, Amt not yet paid

Security Exp Dr 2500

To Ravi Security Agency 2500

(It is a Journal Entry

Security Exp is Indirect Expense and Ravi Security Agency is Sundry Creditors )

Professional Service Bill received from CA Amit Gupta Rs 40000

Professional Exp 40000

To CA Amit Gupta 40000

Professional Exp is Indirect Expense and CA Amit Gupta is Sundry Creditors )

Salary paid to employees A,B,C,D and E Rs 15000 eac h by cash

Salary Expense Dr 75000

To Cash 75000

(It is a Payment Entry)

Salary Expense is Indirect Expense ,Employee names are normally not recorded )

The company entered into contract with Alex and Co to provide Consultancy service of Rs 20000 on 20 Jan. As per terms, Rs 4000 was paid in advance by cheque of SBI Bank ON 22 Jan. Maxwell completed its work and sent its bill for technical service of Rs 20000 on 28 Jan and Balance 16000 was paid on 29 Ja n by cash

No Entry for Agreement Entered

Alex and Co 4000

To SBI Bank 40000

28 jan

Consultancy Exp Dr 20000

To Alex and Co 20000

29 Jan

Alex and Co Dr 16000

To Cash 16000

(The three Enries are Payment,Journal and payment

Consultancy Exp is Indirect Expense and Alex and Co is Sundry Creditors )

Loan taken from Director Ajay Patel Rs 200000 by cheque @12% p.a for 1 month

SBI Bank A/c Dr 200000

To Ajay Patel Loan A/c 200000

Entry for Interest due

Int on Loan A/c Dr 1000

To Ajay Patel Loan A/C 201000

(Interest for the month= 200000*12%*1/12 =1000)

Entry for Amount paid including interest

Ajay Patel Loan A/C A/c Dr 201000 To SBI Bank A/C 201000

(Ajay Patel Loan A/C is Loans Liabilities,Int on Loan is Indirect Expense and SBI Bank is Bank Account)

Learn GST, TDS, Excel (with certification)

CA Maninder Singh

CA Maninder Singh is a Chartered Accountant for the past 14 years. He also provides Accounts Tax GST Training in Delhi, Kerala and online.

Get E-filing Return Practice

Watch videos and do assignments

Add more skills to your resume

Get Professional Certification in Accounts and Taxation

Hi, it looks like you're using AdBlock :(

Please login to view more pages. it's free :), solve all your doubts with teachoo black.

COMMENTS

Company Creation: You can create a Company profile by using the following procedure : 1. Press Alt+K > Create. Alternatively, at the Gateway of Tally, press F3 > Company > Create Company. A Self-Study Practical Assignment on TallyPrime-Rel.4. TallyPrime-4 [Practical Assignment]Page: 7Visit us:www.tallyprimebook.com.

Tally Practical Assignment including GST with Solutions PDF for free download. Super Success Institute Tally computer training coaching classes day by day task. Notes is very useful for learn and practice the tally ERP 9 with GST. We found that student face problem to find the practice assignment of Tally. ... Tally ERP9 Question Paper in Hindi ...

The Practical Assignments-Tax Accounts- covers Basic tasks of Maintaining GST Accounts, from set up, Data Entry to GST Reports, in Tally Prime Rel 3.x. This assignment is in continuation to Practical Assignments of Basic Financial Accounting & Basic Invoicing & Inventory Accounts. Maintain GST Accounts in the same Company in which Basic ...

टैली अभ्यास प्रश्न - 3 (Tally practice exercise for beginners) with Maintain Bill-wise details for beginners. टैली अभ्यास प्रश्न - 4 (Tally practice test - Accounts with Inventory in Tally Prime & Tally.erp9) टैली अभ्यास प्रश्न - 5 (Tally ...

IIM SKILL's professional guidance allows one to interact, clear doubts and learn more effectively. Course Name: Tally Course. Duration of the Course: 18 Hours of Self Learning, 20 Hours of Lecture. Mode of the Course: Online. Fees: Rs.2, 900 + 18% GST.

100+ Tally Practical Questions & Answers Pdf Free Download; 500+ Tally Exam Questions and Answers 2020-21; Top 250+ Tally Practice Questions with Answers; Top 1000+ Tally Online Test/Mock Test; 1000+ Tally ERP 10 Questions and Answers ; tally-erp9-questions.pdf. tally-gst-questions-answers.pdf.

You will learn to use Tally with complete project work. This practical work book is based on sales/purchase accounting in a Computer Shop. This practical work book Including: Financial Accounting, Inventory Management, and Sales/Purchase Order Processing in Tally.ERP 9 with GST. Each and every step is described with help of screenshots.

QUESTION 7 Topic: Tally Features Questions. ________________ amongst the following is not a Default Ledger in Tally. Cash in Hand. Capital Account. Profit and Loss. None of these. Report This Question. QUESTION 8 Topic: Tally Managing multiple bank accounts. What is the purpose of the "Cash/Bank Books" option in Tally ERP when managing multiple ...

Prepare for the Tally certification exam with Finprov Learning, the best online platform for learning Tally Prime. Find the top 20 Tally questions and answers and practice with quizzes on various topics.

Practical Assignment for Trading & Manufacturing Business in Tally - Free download as PDF File (.pdf), Text File (.txt) or read online for free. practical assignment for tally erp 9

Tally Prime Assignment 2 | Tally Practical Exercise | Practice For Beginners students Download Free Assignment : https://bit.ly/3piOXmOor https://www.comput...

Premium Notes. Join Telegram. Through today's post, we are going to share Tally Practical Questions and Answer PDF with you, which you can download for free using direct download link given below in this post. If you are studying Tally, then today's notes can be very important for you, because in today's notes, some important questions of ...

In this Playlist we covers basic concepts of accountancy.its a practical assignment that will help the students.

We found that student faces problem in finding practice assignments for Tally. The training faculty of Super Success Institute has compiled practice tasks in this PDF for self-study of students. Brief of GST. Purchase Entry. Tally Prime Practical Assignment With Solutions PDF Free Download. Computer Networking PDF. Class 8 Computer Book PDF.

Voucher Entry & Practical Problem - Tally - Free download as PDF File (.pdf), Text File (.txt) or read online for free. The document describes different types of vouchers used for accounting purposes in Tally. It discusses contra vouchers, payment vouchers, receipt vouchers, journal vouchers, sales vouchers, and purchase vouchers. It also provides examples of transactions that can be recorded ...

Basic questions for tally prime. Practice set for Tally Prime. tally practice questions ledgers in tally ques.1) Skip to document. University; High School; Books; Discovery. ... Assignment-2 (Part-2) Ledgers in T all y. Ques.1) Explain the concept of Creation, Alteration and Display of single and multiple .

Tally Payroll Notes in PDF. Download. Tally Practice Set in PDF. Download. Tally Practice Set 2 in PDF. Download. Tally Practical Assignment in PDF Download. See Also:- " Click Here ". Tally Practical Assignment in PDF Download.

Practical questions on Tally for Financial Accounting Practical. tallyprime with dr. kumar assignment: (with inventory transactions multiple gst) the company. ... Mechanics assignment - info; Tally - inventory - GST - These are some question based on the newest syllabus of Delhi University. Kanak Jain BCP Sem 3 22-198;

View PDF. TALLY-9 PRACTICAL QUESTIONS (SAMPLE) 1. Create a Company as "Sagar Industries Ltd." in Tally with inventory management. 2. Pass the following Entries : (i) Sagar started "Sagar Industries Ltd." by bringing Capital Rs.3,00,000/- Cash. (ii) He deposited Rs.1,00,000/- cash at ICICI bank.

100+ Tally Practical Questions & Answers Pdf Free Download; 500+ Tally Exam Questions and Answers 2020-21; Top 250+ Tally Practice Questions with Answers; Top 1000+ Tally Online Test/Mock Test; 1000+ Tally ERP 10 Questions and Answers ; tally-erp9-questions.pdf. tally-gst-questions-answers.pdf.

Practical problem 1. Record the following transactions in Tally. 1. Robert commenced a transport business with a capital of ₹ 1,00,000. 2. An account was opened with State Bank of India and deposited ₹ 30,000. 3. Purchased furniture by paying cash ₹ 10,000. 4.

S. No. Test Syllabus Action 01 Tally Prime Basic - Masters Intro, Download, Company Creation, Masters etc. Give Test 02 Tally Prime Basic - Entries Voucher Entries Give Test 03 Tally Prime Basic - Reports Reports with Tally Prime Give Test 04 Tally Prime Basic - Overall Complete Tally Basic Prime Book Give Test 05

No commitment, cancel anytime. We know that there are 6 types of Accounting Vouchers in tally. For every entry we have to think which type of entry. Assignment/Examples. Pass the following entries in Tally. Maintenance Charges Bill Received from SK Associates Rs 2500,Amt paid by Cheque of SBI Bank. View Answer.