The benefits of a cashless society

We're shifting toward a cashless society, with potential for enormous socio-economic benefits for both developed and developing countries. Image: Jonas Leupe/Unsplash

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Mehul Desai

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} The Digital Economy is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, the digital economy.

The first recognisable coins were produced in China more than 3,000 years ago.

If you visit China today, however, there’s a strong chance you’ll see people paying for things using facial recognition on their phones.

This is a radical shift, but it’s just the beginning of the cash revolution.

Have you read?

Africa should follow in india's footsteps towards a cashless economy. this is why, these are the countries that would benefit most from a cashless world.

The new global payments ecosystem, including both physical cash as well as mobile wallets, is the result of the convergence of three large and powerful industries: telecommunications, banking and retail.

And if the private and public sector can work together to harness the latest technology and realise the full potential of a cashless society, there will be enormous benefits.

It’s important to first reflect upon where we are on the journey toward a cashless society.

Thus far, the shift is basically a move from physical cash to cash-replacements. With private companies involved in processing those transactions, there is inevitably a cost. And that means there is a loss of value when the transfer occurs.

This is my vision of a true cashless society. There is an exchange of value in its entirety – just like cash. And it requires a national government – rather than banks or the like – to act as the payment provider, effectively becoming a state-backed utility.

The savings from avoiding the processing costs could then be used to benefit those in need, such as by being transferred to a fund to rejuvenate economically depressed areas, as one example.

This might sound counterintuitive, but I would argue just about everyone has access to capital. However, for the poorer members of society, there’s often a prohibitively high cost to accessing it. If you have a great business idea but can’t afford start-up capital, then your venture is unlikely to get off the ground.

A cashless society – along with the transformation of the last mile of money transfers, payments and banking services – will help to close the financial inclusion gap.

Cashless technologies could be some of our greatest assets in the fight against corruption and organised crime, too.

And, once again, the people who stand to benefit most are those who are most in need.

There are 1.4 billion people in the world who have to make do with less than $1.25 a day. At the same time, around $1.26 trillion is effectively stolen from developing countries , due to corruption, bribery, theft and tax evasion. If we could reclaim that money for those countries, we could lift those 1.4 billion people above the poverty threshold and keep them there for at least six years.

If everyone were connected to an end-to-end e-payment infrastructure – a cashless environment – there would be transparency in money flows. Whether it’s international aid or private investment, if everyone in the chain were connected digitally, you could see where the money went and how it was spent.

Any sums appearing outside of that framework could immediately be flagged and investigated. This would narrow the focus for law enforcement and forensic accountants, making it easier to target and recoup hidden money.

There are, of course, many challenges to overcome as we embrace this level of disruption. And governments will need to take preemptive and proactive action in areas such as identity management and the protection of security and privacy.

However, the underlying support structures to make it all possible – the building blocks, or e-plumbing – are already in place. We already have secure, enabled ecosystems and the next generation of infrastructure.

At Finablr, we have four decades of experience in regulatory alignment and cross-border compliance, with a network spanning 170 countries. We also have proprietary technology, which enabled 150 million transactions at a total value of $115 billion in 2018 alone.

There’s no going back – which means we need to face the risks and deal with some of the difficulties of going cashless in order to unlock the benefits.

In developed countries, a cashless society will deliver transactions that are seamless, frictionless and low-cost. And in developing nations, it could deliver life-changing socio-economic benefits.

This easily accessible exchange of value will create a more equal world, and strengthen the bond between people, regardless of where they live.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Forum Institutional .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

Reflections from MENA at the #SpecialMeeting24

Maroun Kairouz

May 3, 2024

Day 2 #SpecialMeeting24: Key insights and what to know

Gayle Markovitz

April 28, 2024

Day 1 #SpecialMeeting24: Key insights and what just happened

April 27, 2024

#SpecialMeeting24: What to know about the programme and who's coming

Mirek Dušek and Maroun Kairouz

Climate finance: What are debt-for-nature swaps and how can they help countries?

Kate Whiting

April 26, 2024

What to expect at the Special Meeting on Global Collaboration, Growth and Energy for Development

Spencer Feingold and Gayle Markovitz

April 19, 2024

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

The past five years for cash converters international (asx:ccv) investors has not been profitable.

The main aim of stock picking is to find the market-beating stocks. But even the best stock picker will only win with some selections. So we wouldn't blame long term Cash Converters International Limited ( ASX:CCV ) shareholders for doubting their decision to hold, with the stock down 34% over a half decade.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

View our latest analysis for Cash Converters International

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Cash Converters International became profitable within the last five years. On the other hand, it reported a trailing twelve months loss, suggesting it isn't reliably profitable. Other metrics may better explain the share price move.

The steady dividend doesn't really explain why the share price is down. It's not immediately clear to us why the stock price is down but further research might provide some answers.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Cash Converters International in this interactive graph of future profit estimates .

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return . The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Cash Converters International the TSR over the last 5 years was -15%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Cash Converters International shareholders are down 2.2% for the year (even including dividends), but the market itself is up 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 3% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Cash Converters International (1 is a bit unpleasant) that you should be aware of.

Cash Converters International is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

- Share full article

Advertisement

Supported by

Guest Essay

Cash Will Soon Be Obsolete. Will America Be Ready?

By Eswar Prasad

Dr. Prasad is a professor of trade policy at Cornell University and the author of a forthcoming book on digital currencies.

When was the last time you made a payment with dollar bills?

Some people still prefer to use cash, perhaps because they like the tactile nature of physical currency or because it provides confidentiality in transactions. But digital payments, made with the swipe of a card or a few taps on a cellphone, are fast becoming the norm .

To keep their money relevant, many central banks are experimenting with digital versions of their currencies. These currencies are virtual, like Bitcoin; but unlike Bitcoin, which is a private enterprise, they are issued by the state and function much like traditional currencies. The idea is for central banks to introduce these digital currencies in limited circulation — to exist alongside cash as just another monetary option — and then to broaden their circulation over time, as they gain in popularity and cash fades away.

China , Japan and Sweden have begun trials of central bank digital currency. The Bank of England and the European Central Bank are preparing their own trials. The Bahamas has already rolled out the world’s first official digital currency.

The U.S. Federal Reserve, by contrast, has largely stayed on the sidelines. This could be a lost opportunity. The United States should develop a digital dollar, not because of what other countries are doing, but because the benefits of a digital currency far outweigh the costs.

One benefit is security. Cash is vulnerable to loss and theft, a problem for both individuals and businesses, whereas digital currencies are relatively secure. Electronic hacking does pose a risk, but one that can be managed with new technologies. (As it happens, offshoots of Bitcoin’s technology could prove helpful in increasing security.)

Digital currencies also benefit the poor and the “unbanked.” It is hard to get a credit card if you don’t have much money, and banks charge fees for low-balance accounts that can make them prohibitively expensive. But a digital dollar would give everyone, including the poor, access to a digital payment system and a portal for basic banking services. Each individual or household could have a fee-free, noninterest-bearing account with the Federal Reserve, linked to a cellphone app for making payments. (About 97 percent of American adults have a cellphone or a smartphone .)

To see how this might help, consider the payments that the U.S. government made to households as part of the coronavirus stimulus packages. Millions of low-income households without bank accounts or direct deposit information on file with the Internal Revenue Service experienced complications or delays in getting those payments. Checks and debit cards mailed to many of them were delayed or lost, and scammers found ways to intercept payments. Central-bank accounts could have reduced fraud and made administering stimulus payments easier, faster and more secure.

A central-bank digital currency can also be a useful policy tool. Typically, if the Federal Reserve wants to stimulate consumption and investment, it can cut interest rates and make cheap credit available. But if the economy is cratering and the Fed has already cut the short-term interest rate it controls to near zero, its options are limited. If cash were replaced with a digital dollar, however, the Fed could impose a negative interest rate by gradually shrinking the electronic balances in everyone’s digital currency accounts, creating an incentive for consumers to spend and for companies to invest.

A digital dollar would also hinder illegal activities that rely on anonymous cash transactions, such as drug dealing, money laundering and terrorism financing. It would bring “off the books” economic activity out of the shadows and into the formal economy, increasing tax revenues. Small businesses would benefit from lower transaction costs, since people would use credit cards less often, and they would avoid the hassles of handling cash.

To be sure, there are potential risks to central-bank digital currencies, and any responsible plan should prepare for them. For example, a digital dollar would pose a danger to the banking system. What if households were to move their money out of regular bank accounts and into central-bank accounts, perceiving them as safer, even if they pay no interest? The central bank could find itself in the undesirable position of having to allocate credit, deciding which sectors and businesses deserve loans.

But this risk can be managed. Commercial banks could vet customers and maintain the central-bank digital currency accounts along with their own interest-bearing deposit accounts. The digital currency accounts might not directly help banks earn profits, but they would attract customers who could then be offered savings or loan products. (To help protect commercial banks, limits can also be placed on the amount of money stored in central-bank accounts, as the Bahamas has done .) A central-bank digital currency could be designed for use across different payment platforms, promoting private sector competition and encouraging innovations that make electronic payments cheaper, quicker and more secure.

Another concern is the loss of privacy that central-bank digital currencies entail. Even with protections in place to ensure confidentiality, no central bank would forgo the ability to audit and trace transactions. A digital dollar could threaten what remains of anonymity and privacy in commercial transactions — a reminder that adopting a digital dollar is not just an economic but also a social decision.

The end of cash is on the horizon, and it will have far-reaching effects on the economy, finance and society more broadly. With proper preparation and open discussion, we should embrace the advent of a digital dollar.

Eswar Prasad ( @EswarSPrasad ) is a professor of trade policy at Cornell University, a senior fellow at the Brookings Institution and the author of the forthcoming book “ The Future of Money : How the Digital Revolution Is Transforming Currencies and Finance.”

The Times is committed to publishing a diversity of letters to the editor. We’d like to hear what you think about this or any of our articles. Here are some tips . And here’s our email: [email protected] .

Follow The New York Times Opinion section on Facebook , Twitter (@NYTopinion) and Instagram .

Essay on Exchange Rates | Foreign Exchange | International Economics

Here is an essay on ‘Exchange Rates’ for class 11 and 12. Find paragraphs, long and short essays on ‘Exchange Rates’ especially written for school and college students.

Essay # 1. Meaning of Exchange Rate:

The rate of exchange is the rate at which the currency of one country is exchanged for the currency of another country. It is the price paid for a unit of foreign currency in terms of the home currency.

The exchange rate existing between two currencies can be expressed in two alternative ways:

Firstly, it is a ratio of one unit of foreign currency to a certain number of units of the home currency.

ADVERTISEMENTS:

Secondly, it is a ratio of certain number of units of the foreign currency to one unit of the home currency.

For instance, if one U.S. dollar can be exchanged with Rs. 60, then the rate of exchange between these two currencies can be expressed as:

(i) 1 U.S. dollar = Rs. 60 or

(ii) 1 Re. = 1.67 Cents

At a particular point of time, there does not exist in the foreign exchange market a single or unique rate of exchange between two currencies. There is rather a large spectrum of exchange rates as per the credit instruments employed for the transfer function. There is a sight rate in case of foreign bills of exchange, a T.T. or cable rate in case of telegraphic transfers. It is also called as a spot rate. There may be a usance rate or long rate.

It may be applicable to foreign exchange transactions over one month to 3 months period. There is also forward exchange rate which applies to future exchange contracts. It is, therefore, clear that there is the existence of a large structure of exchange rates in a foreign exchange market at a specified point of time.

Suppose the rate of exchange between rupee and dollar is – 1 U.S. dollar = Rs. 60. This rate of exchange may not hold itself. There are possibilities of variations in it. In case the exchange rate becomes 1 U.S. dollar = Rs. 58, it signifies that dollar has depreciated relative to rupee.

Previously 1 U.S. dollar could buy Rs. 60. Now it can have in exchange only Rs. 58. At the same time, it means the rupee has appreciated against dollar. On the opposite, if the exchange rate becomes- 1 U.S. dollar = Rs. 62, it means dollar has appreciated relative to rupee and one dollar can now buy Rs. 62. The rupee, on the other hand, has undergone depreciation.

The rate of exchange between dollar and rupee can be maintained at the level -1 U.S. dollar = Rs. 60 through arbitrage. Arbitrage means the purchase of foreign currency in the market where its price is low and its sale in a market where its price is relatively high. Suppose in Mumbai, the exchange rate is – 1 U.S. dollar = Rs. 60 and it is – 1 U.S. dollar = Rs. 56 in New York.

The speculators or arbitrageurs will start buying dollars in New York and sell it in Mumbai, thereby making a profit of Rs. 4 per dollar. Such transactions will result in a fall in the price of dollar in Mumbai and a rise in New York. Ultimately, the price of dollar in terms of rupees will become equal in both the markets and arbitrage will come to an end.

Essay # 2. Determination of Equilibrium Exchange R ate:

Since the rate of exchange is the price of one currency expressed in terms of another, it is determined, like every other price by the forces of demand and supply. The demand for and supply of foreign exchange together determine the equilibrium rate of exchange. The equilibrium rate of exchange is defined as the rate at which the demand for foreign exchange equals the supply of foreign exchange.

It can be viewed also as a rate at which the par value of the home currency with foreign currency is exactly maintained. The rate of exchange not only has no tendency to change, there is also neither under-valuation nor over-valuation of the home currency (or foreign currency).

In the words of Scammel, an equilibrium rate is “that rate at which over a standard period during which full employment is maintained and there is no change in the amount of restriction on trade or on currency transfer, causes no net change in the holding of gold and currency reserves of the country concerned.”

R. Nurkse has defined the equilibrium rate of exchange from a different viewpoint. According to him, the equilibrium rate of exchange is the “rate which over a certain period of time, keeps the balance of payments in equilibrium.”

It is mentioned that the equilibrium rate of exchange is determined by equality between the demand for and supply of foreign exchange. The relevant question is whether the demand and supply forces pertain to the home currency or foreign currency. In this connection, it must be pointed out that the rate of exchange can be determined either by the demand for and supply of foreign currency or the home currency.

In either of the two cases, the equilibrium rate of exchange will be exactly the same. In the present analysis, the demand for and supply of foreign currency (the U.S. dollars) will be considered for determining the equilibrium rate of exchange between dollar and rupee.

Demand for Foreign Exchange:

The demand for foreign exchange is the derived demand. The demand for U.S. dollars in India arises because of the demand for American goods and services from India. If exchange rate of dollar with rupee is relatively lower, the Indian importers will have a strong inducement to import goods and services from the U.S.A.

It will signify a larger demand for dollars. On the opposite, the relatively higher exchange rate of dollar with rupee will act as a disincentive and lesser quantities of goods and services will be imported from the U.S.A.

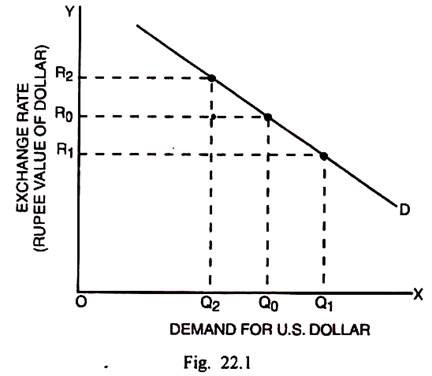

As a consequence, there will be a less demand for dollars by this country at a higher exchange rate of dollar. This inverse relation between the exchange rate and demand for foreign exchange (dollars), the demand function for dollars slopes negatively. It may be shown through Fig. 22.1.

The Importance of Saving Money

- Categories: Money and Class in America Personal Growth and Development

About this sample

Words: 893 |

Published: Mar 16, 2024

Words: 893 | Pages: 2 | 5 min read

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Dr. Heisenberg

Verified writer

- Expert in: Literature Life

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

2 pages / 887 words

3.5 pages / 2123 words

7 pages / 3276 words

3.5 pages / 1676 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Money and Class in America

Money is often considered the key to happiness, and we all have at some point in our lives desired more of it. However, many research studies have shown that money is not a straightforward path to happiness. In this essay, I [...]

Barbara Ehrenreich's book "Nickel and Dimed: On (Not) Getting By in America" is a powerful exploration of the challenges faced by low-wage workers in the United States. In "Serving In Florida," Ehrenreich focuses specifically on [...]

Money is often seen as the key to happiness, but is this really the case? While it is true that money can provide us with the things we need to survive and can make life more comfortable, research has shown that there is a point [...]

This paper examines the trend and causes of income inequality in the United States over time and explains how Universal Basic Income can be used as an effective policy for solving income inequality. It compares the [...]

The title year of George Orwell's most famous novel is nineteen years past, but the dystopian vision it draws has retained its ability to grip readers with a haunting sense of foreboding about the future. At the heart of many of [...]

In the novel Nineteen Eighty-Four, Orwell uses several literary techniques to develop the theme that totalitarianism is destructive. He does so by using extensive imagery, focusing on the deterioration of the Victory Mansions, [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

We use cookies to enhance our website for you. Proceed if you agree to this policy or learn more about it.

- Essay Database >

- Essay Examples >

- Essays Topics >

- Essay on Finance

Cash Conversion Essay Example

Type of paper: Essay

Topic: Finance , Company , Money , Accounting , Time , Conversation , Inventory , Bicycle

Published: 02/26/2020

ORDER PAPER LIKE THIS

Introduction

Most of the people regarded accounting and finance as similar things; however the ideas and concepts behind both of these things are totally different with each other. There are number of concepts which specifically stride under the ambit of accounting and finance and among these concepts, the name of Cash Conversation is one of them, which has its own significance and importance in a broad nutshell (Towers-Clark, 2011). Cash Conversation is a concept, used by the organizations to assess the time in which the cash would be converted for the company and then transform or reflect in their financial statements. This is one of the most important concepts that come under the umbrella of organizational productivity. Cash Conversion Cycle (CCC), also known as Cash Operating Cycle (COC) is basically an important thing used by the companies. CCC is basically referred to a metric that expresses the length of time in days which takes a company to convert its resources into the cash inflows. It is one of the most effective methods for the companies. The formula of the same is mentioned below,

Analysis and Findings

Analysis and findings are some of the major things which used to cover up this particular thing in total. The first thing which needed to be analyzed in this particular scenario is days to outstanding inventory. The computation of days to inventory outstanding is mentioned below in particular.

Beginning Inventory and ending inventory computation mentioned below. Days have been selected on the level of 360 days

Now, we are going to analyze the days to sales outstanding Now we are analyzing the days to payable After analyzing all of the three things mentioned in the formula, we are all set to analyze the cash operating cycle of MNQ Company. The CCC is mentioned below

As conclusion, it could be said that, the cash operating cycle of the selected company is very high, which means that it requires 300 to 360 days for the company to generate cash for their business which is not at all effective for a company from any viewpoint. Such type of companies has been regarded as ineffective companies. The average Cash Conversation Cycle of the company is 310 days, which is extremely high and the company has to decrease the same in total, otherwise, the company may be in the sigh of economic hardship in future terms.

Towers-Clark, J. (2011). Accounting: A Smart Approach. London: Oxford University Press.

Cite this page

Share with friends using:

Removal Request

Finished papers: 631

This paper is created by writer with

If you want your paper to be:

Well-researched, fact-checked, and accurate

Original, fresh, based on current data

Eloquently written and immaculately formatted

275 words = 1 page double-spaced

Get your papers done by pros!

Other Pages

Example of psychological disorders essay, example of the death of the author term paper, example of essay on postmodernism in literature and culture, free research paper on jonathan earle john browns raid on harpers ferry a brief history with documents, example of essay on slavery in the usa, critical thinking on the crusades, research paper on ethnicity and police corruption, example of designing a new information system course work, example of essay on criminal behaviour profiling, technology article review example, good example of norm violation research paper, good essay on hr issues, w5a1 essays examples, promotional pricing and advertising strategies in the automobile industry research paper, buying coffee shop in piazzale lotto milano essay examples, critical analysis critical thinking 2, public servant essays, aldosterone essays, alchemy essays, ideation essays, refraction essays, polio essays, crucifix essays, paternalism essays, airing essays, incentive program essays, home rule essays, governess essays, clausal essays, devaluing essays, photosynthesis reports, chicago reports, lake reports, general motors reports, chapels college essays, dpi college essays, dosages college essays, devoting college essays, conquests college essays, countee college essays, dwellings college essays, coastlines college essays.

Password recovery email has been sent to [email protected]

Use your new password to log in

You are not register!

By clicking Register, you agree to our Terms of Service and that you have read our Privacy Policy .

Now you can download documents directly to your device!

Check your email! An email with your password has already been sent to you! Now you can download documents directly to your device.

or Use the QR code to Save this Paper to Your Phone

The sample is NOT original!

Short on a deadline?

Don't waste time. Get help with 11% off using code - GETWOWED

No, thanks! I'm fine with missing my deadline

Don't have an account? Sign up now

Already have an account login, get 10% off on your next order.

Subscribe now to get your discount coupon *Only correct email will be accepted

(Approximately ~ 0.0 Page)

Total Price

Thank you for your email subscription. Check your email to get Coupon Code.

Cash Converters International PESTEL & Environment Analysis

Posted by Freddie Murphy on May-12-2018

PESTEL Analysis & Environment Analysis

The PESTEL analysis is a tool devised by Harvard professor Francis Aguilar to conduct a thorough external analysis of the business environment of any industry for which data is available. This is an important step for eventually devising a strategy that can effectively manoeuvre the competition to maximize a firm's chances of sustainability and profitability. PESTEL is an amalgam of initials of various factors that not only affect but the entire industry as a whole- these factors are namely Political, Economic, Social, Technological, Environmental and Legal.

PESTEL analysis provides valuable insight into the operating challenges that any company in the industry appears to face, and so the company in question may face as well. An understanding of the overall competitive landscape will prevent investors and entrepreneurs from partaking in any risky ventures if the risk arises out of, say, an unstable political regime or a sudden economic recession. This may be best exemplified by the recent exit of the United Kingdom from the European Union. The sudden fallout was political and caused many investors to pull out of new ventures and halt their expansions, as the future became uncertain in the wake of this decision.

Political Factors that Impact

The political factors that may impact the profitability or chances of survival of the company are quite diverse. The political risks vary from sudden changes in existing political regimes to civil unrest to major decisions taken by the government. In cases of possible multinationals, one may also include political factors that take place/ affect not only the host country but also all countries that contain business operations, or that may engage in trade with

To properly appraise the extent of the overall systematic political risk that may be exposed to, the following factors should be considered before taking part in any investments:

- The level of political stability that the country has in recent years.

- The integrity of the politicians and their likelihood to take part in acts of corruption, as the resulting repercussions may lead to possible impeachments or resignations of high level government employees.

- The laws that the country enforces, especially with regards to business, such as contract law, as they dictate what is and is not allowed to do. Some countries, for example, prohibit alcohol or have certain conditions that must be fulfilled, while some government systems have inefficient amounts of red tape that discourage business.

- Whether or not a company’s intellectual property (IP) is protected. For example, a country that has no policies for IP protection would mean that entrepreneurs may find it too risky to invest in

- The trade barriers that the host country has would protect ; however, trade barriers that countries with potential trade partners would harm companies by preventing potential exports.

- A high level of taxation would demotivate companies like from maximizing their profits.

- The risk of military invasion by hostile countries may cause divestment from ventures.

- A low minimum wage would mean higher profits and, thus, higher chances of survival for

Economic Factors that Impact

Economic factors are all those that pertain to the economy of the country that , such as changes in the inflation rate, the foreign exchange rate, the interest rate, the gross domestic product, and the current stage of the economic cycle. These factors, and their resulting impact on aggregate demand, aggregate investment and the business climate, in general, have the potential to make a company highly profitable, or extremely likely to incur a loss. The economic factors in the PESTEL analysis are macroeconomic.

The economic factors that may be sensitive to, and in turn should consider before investing may include the following:

- The economic system that is currently operational in the sector in question- whether it is a monopoly, an oligopoly, or something similar to a perfect competition economic system.

- The rate of GDP growth in the country will affect how fast is expected to grow in the near future.

- The interest rates in the country would affect how much individuals are willing to borrow and invest. Higher rates would result in greater investments that would mean more growth for

- However efficiently the financial markets operate also impact how well can raise capital at a fair price, keeping in mind the demand and supply.

- The exchange rate of the country operates in would impact the profitability of , particularly if engages in international trade. The stability of the currency is also important- an unstable currency discourages international investors.

- A high level of unemployment in the country would mean there is a greater supply of jobs than demand, meaning people would be willing to work for a lower wage, which would lower the costs of

Social Factors that Impact

The social factors that impact are a direct reflection of the society that operates in, and encompasses culture, belief, attitudes and values that the majority of the population may hold as a community. The impact of social factors is not only important for the operational aspect of , but also on the marketing aspect of the organization. A thorough understanding of the customers, their lifestyle, level of education and beliefs in a society, or segment of society, would help design both the products and marketing messages that would lead to a venture becoming a success.

The social factors that affect and should be included in the social aspect of the PESTEL analysis include the following:

- The demographics of the population, meaning their respective ages and genders, vastly impact whether or not a certain product may be marketed to them. Makeup is mostly catered to women, so targeting a majority male population would be less population than targeting a population that is mostly female.

- The class distribution among the population is of paramount importance: would be unable to promote a premium product to the general public if the majority of the population was a lower class; rather, they would have to rely on very niche marketing.

- To some extent, the differences in educational background between the marketers and the target market may make it difficult to relate to and draw in the target market effectively. should be very careful not to lose the connection to the target market's interests and priorities.

- needs to be fully aware of what level of health standards, reactions to harassment claims and importance of environmental protection prevail in the industry as a whole, and thus are expected from any company as they are seen as the norm.

Technological Factors that Impact

Technology can rapidly dismantle the price structure and competitive landscape of an industry in a very short amount of time. It thus becomes extremely important to constantly and consistently innovate, not only for the sake of maximizing possible profits and becoming a market leader, but also to prevent obsolescence in the near future. There are multiple instances of innovative products completely redesigning the norm for an entire industry: Uber and Lyft dominate the taxi cab industry; smartphones have left other phones an unviable option for most et cetera.

The technological factors that may influence may include the following:

- The recent technological developments and breakthroughs made by competitors, as mentioned above. If encounters a new technology that is gaining popularity in the industry in question, it is important to monitor the level of popularity and how quickly it is growing and disrupting its competitors’ revenues. This would translate to the level of urgency required to adequately respond to the innovation, either by matching the technology or finding an innovative alternative.

- How easy, and thus quickly, will the technology be diffused to other firms in the industry, leading to other firms copying the technological processes/ features of

- How much an improvement of technology would improve/ transform what the product initially offers. If this improvement is drastic, then other firms in the industry suffer more heavily.

- The impact of the technology on the costs that most companies in the industry are subject to have the potential to increase or reduce the resulting profits greatly. If these profits are great in number, they may be reinvested into the research and development department, where future technological innovations would further raise the level of profits, and so on, ensuring sustainable profits over a long period of time.

Environmental Factors that Impact

Different industries hold different standards of environmental protection in their head as the norm. This norm then dictates what every company should aim for, in the least, to prevent becoming the target of pressure groups and boycotts due to a lack of environmental conscientiousness. A company in the textile industry, for example, is not expected to incur the same level of pollution and environmental degradation as an oil company. The new consumer, armed with the interest and the knowledge it carries, prefers to give its business to companies it views as more ethical, particularly about the environment in the wake of global warming.

The environmental factors that may significantly impact include:

- The current weather conditions may significantly impact the ability of to manage the transportation of both the resources and the finished product. This, in turn, would affect the delivery dates of the final product in the case of, say, an unexpected monsoon.

- Climate change would also render some products useless. For example, in the case of textiles, in countries where the winter has become very mild due to Global Warming, warm winter clothes have much less of a market.

- Those companies that produce extremely large amounts of waste may be required by law to manage their environmental habits. This may include pollution fines and quotas, which may place a financial strain on

- If should (knowingly or unknowingly) contribute to the further endangerment of an already endangered species may face not only the consequences from the law but also face a backlash from the general public who may then boycott in retaliation.

- While relying, in any percentage, on renewable energy may be expensive, it often receives support not only from the government but also from its customer base, who may be willing to pay a premium price for the products that may produce.

Legal Factors that Impact

The government institutions and frameworks in a country, while technically also political and thus subject to whichever political party holds the majority in a government body, are also legal and thus should be considered in a PESTEL analysis. Often policies on their own are not enough to efficiently protect and its workers, making appear an undesirable place of employment that may repel skilled, talented workers.

The legal factors that deserve consideration include the following:

- Intellectual property laws and other data protection laws are, as mentioned earlier, in place to protect the ideas and patents of companies who are only profiting because of that information. If there is a likelihood that the data is stolen, then will lose its competitive edge and have a high chance of failure.

- Discrimination laws are placed by the government to protect the employees and ensure that everyone in is treated fairly and given the same opportunities, regardless of gender, age, disability, ethnicity, religion or sexual orientation.

- Health and safety laws were created after witnessing the horrible conditions that employees were forced to work in during and directly after the industrial revolution. Implementing the proper regulations may be expensive, but has to engage in it, not only due to the law but also out of 's personal feeling of ethical and social responsibility to other human beings.

- Laws are also placed to ensure a certain level of quality or reasonable price for certain products to keep the customer safe and prevent them for being provided. The industries this applies to find often their costs elevated.

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here .

Related Articles

- Corporate Social Responsibility of Cash Converters International

- Cash Converters International 5C Marketing Analysis

- The vision statement of Cash Converters International

- Organizational Culture of Cash Converters International

- Cash Converters International Generic and Intensive Growth Strategies

- Marketing Mix Cash Converters International

- Cash Converters International Porter Five Forces Analysis

- Cash Converters International SWOT Analysis / SWOT Matrix

- Value Chain Analysis Of Cash Converters International

- Marketing Strategy Of Cash Converters International

- Cash Converters International Case Solution

- Ansoff Matrix of Cash Converters International

- Blue Ocean Strategy of Cash Converters International

- Hofstede Cultural Model of Cash Converters International

- Porters Diamond Model of Cash Converters International

- Mckinsey 7s Framework Of Cash Converters International

- Resource Based View Of The Firm - Cash Converters International

- VRIN/VRIO Analysis Of Cash Converters International

- Net Present Value (NPV) Analysis of Cash Converters International

- WACC for Cash Converters International

9414 Students can’t be wrong

PhD Experts

Muniza Zutaib

When I used to imagine college life, mind became overwhelmed with the idea of hundreds of assignments as a result of which I didn't want to join college. Yet parents forced me, I got admission to college and am taking help from this service for dozens of assignments.

Kimberley Patrick

Currently, I need a service that can compose the assignment under the tight deadline and this one appeared on the scene with numberless advantages.

Elia Gabriel

The paper was transferred to me without missing the deadline. Thank you!

Clem Alfred

The writer paid full attention to the project that is why the CGPA was improved. Thanks for the fine paper!

The work was delivered on time and it was as I wanted it. This service is perfect and I submitted the paper on time. Thanks a lot!

Olie Fredie

The design of the website impressed me and I want to say that the team of writers will originate your paper excellently. Much thanks!

Calculate the Price

(approx ~ 0.0 page), total price $0, next articles.

- 1899-Delecta-Limited-Pestel-Analysis

- 1900-Ensogo-Limited-Pestel-Analysis

- 1901-Funtastic-Limited-Pestel-Analysis

- 1902-Godfreys-Group-Limited-Pestel-Analysis

- 1903-Greencross-Limited-Pestel-Analysis

- 1904-Harris-Technology-Group-Limited-Pestel-Analysis

- 1905-Harvey-Norman-Holdings-Limited-Pestel-Analysis

- 1906-Jatenergy-Limited-Pestel-Analysis

- 1907-Jb-Hi-Fi-Limited-Pestel-Analysis

- 1908-Joyce-Corporation-Ltd-Pestel-Analysis

Previous Articles

- 1897-Byte-Power-Group-Limited-Pestel-Analysis

- 1896-Breville-Group-Limited-Pestel-Analysis

- 1895-Bod-Australia-Limited-Pestel-Analysis

- 1894-Birch-And-Prestige-Investment-Group-Limited-Pestel-Analysis

- 1893-Beacon-Lighting-Group-Limited-Pestel-Analysis

- 1892-Bapcor-Limited-Pestel-Analysis

- 1891-Baby-Bunting-Group-Limited-Pestel-Analysis

- 1890-Autosports-Group-Limited-Pestel-Analysis

- 1889-Automotive-Holdings-Group-Limited-Pestel-Analysis

- 1888-Ap-Eagers-Limited-Pestel-Analysis

Be a Great Writer or Hire a Greater One!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Essay48 with BIG enough reputation.

Our Guarantees

Zero plagiarism, best quality, qualified writers, absolute privacy, timely delivery.

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!

Allow Our Skilled Essay Writers to Proficiently Finish Your Paper.

We are here to help. Chat with us on WhatsApp for any queries.

Customer Representative

Writing: Get your essay and assignment written from scratch by PhD expert

Rewriting: Paraphrase or rewrite your friend's essay with similar meaning at reduced cost

Editing: Proofread your work by experts and improve grade at Lowest cost

Enter phone no. to receive critical updates and urgent messages !

Error goes here

Please upload all relevant files for quick & complete assistance.

New User? Start here.

Essay On Unethical Lending Practices: Cash Converters' Accounting And Auditing Research.

1,853 Words Published On: 22-05-2018

Analysis of the issue, faced by Cash Converters under the relevant ethical theories, and code of ethics for professional accountants.

Discuss about the Accounting and Auditing Research for Tools and Strategies.

Cash Converters International Limited is a company registered in Australia which provides services of pawnbroking as well as providing small loans to needy customers. It also operates in US, UK and South Africa etc. the Company began its operations in 1984 from Perth, Western Australia and soon spread its wing to many other cities. The services are generally limited to retail buying and selling, pawnbroking and providing small scale financial loans.

The Cash Converter Limited also engaged in Buyback agreements. However, this was only made available in its UK operations. Under this service, a customer would sell an item which has monetary value at a cash converter outlet and then would be eligible to buyback the same item by paying the amount borrowed plus a fee. At present, it is estimated that the fee is approximately 32.5% and the same is considered quite high.

A payday loan is a kind of loan which is given to an individual who wants to avail the same like a salary loan or a cash advance. In most cases the loan is linked to the borrower’s payment day. These loans are unsecured and thus has great amount of risk to the lender. Cash converter company is one of the biggest payday lenders in Australia. In Australia, the regulations prevent any lender to charge in excess of 48% APR on such short duration loans. However, in general the prevailing rates vary between 36% to 40% (Hargovan, 2014).

In one instance a low-income woman form Victoria was issued 23 payday loans and also granted 76 pawnbroking agreements by the company in between 2013-2015 and under those agreements the low-income woman as required to pay interest which ranged from 360% APR to 420% APR. in general many payday and pawnbroking loans issued by Cash Converters were found to be violating responsible regulations of lending and inflicted uncalled for hardship on unsuspecting borrowers in Australia and elsewhere (Weirich, 2013).

There were concerns amid reports that despite widespread reporting and an investigation by the ASIC into the matter the unethical practice of charging exorbitant interest and other fees continued by the Cash converter company.

Issued loans without verifying the customers’ ability to pay.

The loans were issued again and again against existing norms.

Unethical practices:

The company followed its own internal norms and ditched the regulatory requirements.

This advocated a practice of over-indebtedness.

As per reports of the NCA or the National Credit Act the issuance of loans to those who can’t afford to pay amounts to reckless lending by the payday lenders including Cash Converters(Kane, 2015).

Professional accountants are needed to be straight forward and full of integrity in communicating with the consumers and clients. Integrity in general implies being truthful to the client and indulge in fair dealing. A professional accountant is mandated to not indulge in communications which are believed to be or he / she has reasons to believe that such communication includes false information and hides required and material information. The professional accountants are also required to report information which they believe if omitted to be communicated would surely amount to misleading information. However, in the case of the cash converters pawnbroking and payday loans the integrity of the company’s accountants were clearly breached and they failed to communicate the terms of the same to their clients and the regulators (Picker, 2015).

Explain how this unethical practice was portrayed in the annual report of Cash Converters, and how the company’s share price, was affected?

After being subjected to an investigation regarding unethical practices adopted in lending to small scale borrowers by ASIC and settling for paying the class action suit by a payment of over $23 m the Lender company cash converter has decided to amortize an amount of $13m in the year 2015-2016. The amortization of the amount was provisioned to make way for any fines resulting from compliance issues.

However, the ASIC investigation was criticized to be half baked as refunds of extra fees collected form borrowers were settled for those borrowers who borrowed form cash converter through online means and no refunds were issued to those who borrowed form their sores by physical means (Eisen, 2013).

After investigations by the ASIC and payouts to more than 118,000 borrowers in a $11m approx. settlement and a further fine of $1.35m, the Cash converter company took steps to reduce unethical business practices in all lending’s. This has reduced the company’s profits in the first half of the 2016-2017 FY by 27% as against the previous years and profits form the personal loan segment fell by over 20% in the same period. However, during the previous years, the company registered considerable amount of growth in these segments. The company has attributed the lowering of the margins to lowering of the lending volumes possibly because more consumers are now aware of the higher interest charges and hidden fees in these short-term borrowings (Luenberger, 2012).

Explain how this unethical practice was portrayed in the annual report of Cash Converters, and how the company’s share price was affected?

The profits were higher on the back higher fees and interest charged by the company and this helped the company’s stock prices to zoom in the past. Profits in the personal short term loan segment were much higher than what could possibly be earned through responsible lending and this impacted investor in the market. However, the stock prices in the last 6 months have shown considerable amount of decline. The stock prices of the company were higher at $1.30 as on 01-Sep-2013 but the same declined consistently in the last 4 years to reach a lower level of $.32 as of March 1, 2017. The volume of trading the company’s stocks have declined as well. This shows that the company’s capability to survive the crisis is being questioned by the investors (Kane, 2015).

Discuss the social responsibility and sustainability of a financial institutions, in general and of Cash Converters, in particular.

Payday lending in Australia was found to be a business model under which the borrowers and the consumers were not benefitted form the expansion of the market at all. Since July 2013, the payday lending has been capped under cost (48% maximum APR) but the same has not been able to deter the cash lenders or payday lenders form charging exorbitant fees form the unscrupulous borrowers. The research made by the Consumer Action Law Centre found that only 10% of the borrowers of cash as payday etc. are borrowing considering the charges and fees to be paid whereas the majority of the borrowers borrowed from a particular borrower because they found their location nearer to their homes and 17% approx. borrowed from the same lender from whom they have borrowed before. These data clearly demonstrate the fact that the borrowers on the street was unaware of the legal stipulations and the same was fully exploited by the lenders and charged as per their own policies and clearly violating all forms of regulatory requirements (Consumer Action Law Centre , 2014).

Consumer Action Law Centre also found in its research that with a rapid increase in the no of payday lenders in the Australian Market the borrowing rates were suppled to lower on the long term. However, from 1998 onwards it was found that despite a market increase in the no of lenders in the market the rates did not fall at all which was a sharp contrast to the market economics and the same was actually seen to have increased because of hidden charges and greed of the lenders like Cash Converter etc. Financial experts and consumer rights experts have argued in the recent past that the Cash Converters knowingly targeted those borrowers who had very little income and those who has very little knowledge of finance. These issuances of loans often indulge in aggressive marketing, blatant loan terms and creates a form of vicious loan and debt cycles which becomes very difficult to break by the borrowers in many case. The loan collection policies followed by Cash Converter was quite coercive as well. These behaviors practiced by cash converter was against not only unethical but also anti-social behavior and not desirable. It has also come to light during ASIC investigation that the terms of the loans was deliberately not told to the borrower until the loan terms becomes due (Hargovan, 2014).

Discuss the social responsibility and sustainability of a financial institution, in general, and of Cash Converters, in particular.

Consumer Action Law Centre also found in its research that with a rapid increase in the no of payday lenders in the Australian Market the borrowing rates were suppled to lower on the long term. However, from 1998 onwards it was found that despite a market increase in the no of lenders in the market the rates did not fall at all which was a sharp contrast to the market economics and the same was actually seen to have increased because of hidden charges and greed of the lenders like Cash Converter etc (Lekakis, 2017).

Cash Converter management have categorically stated in recent months that they have changed their model of doing business and adhered to regulatory principles. As a result, the no borrowers have increased online while the number of customers availing the services in stores have declined. However, those who are involved with investigation and litigation like the Consumer center for research have been skeptical of the commitment of the cash lending industry in adhering to and adopting a more responsible lending approach and not supporting over indebtedness (Atrill & Eddie, 2012). While it is estimated that cash lending volumes exceed $1bn in a single financial year in Australia, the capacity and the willingness of the industry undertaking change of approach is still questionable and remains to be seen.

Atrill, P. & Eddie, M., 2012. Accounting and Finance. 5th ed. LONDON: Prentice Hall Financial Times.

Banister, J. D. &. P., 2015. Austrlaian Financial Planning Handbook. Sydney : Thomson Reuters.

Brearly, M. &. A., 2012. Corporate finance. 9th ed. Chicago: McGraw Hill Irwin.

Butler, C. M., 2015. Can CORPORATE Social RESPONSIBILITY Save Payday Lenders?. Rutgers University Journal of Law and Urban Policy, 1(3), pp. 119-133.

Consumer Action Law Centre , 2014. Competition Policy Review Issues Paper, Melbourne: Competition Policy Review Secretariat.

Eisen, P. J., 2013. Accounting (Business Review Series). 6th edition ed. NewYork : Barron's Educational Series Inc.,U.S.

Hargovan, J. H. &. A., 2014. Australian Corporate Law. Melbourne: Lexis Nexis.

Kane, Z. B. &. A., 2015. Investments. 10th ed. NewYork: McGrawhill Education .

Lekakis, G., 2017. Payday lender Cash Converters running low on cash, s.l.: https://thenewdaily.com.au/money/finance-news/2016/08/31/cash-converters-loss/.

Luenberger, D. G., 2012. Investment Science. 1st ed. London: Oxford University Press.

Picker, R., 2015. Australian Accounting Standards. 1st ed. Melbourne: Earnst and Young Publications.

Weirich, T., 2013. Accounting and Auditing Research: Tools and Strategies. 8th Revised edition ed. London: John Wiley & Sons;.

To export a reference to this article please select a referencing stye below:

My Assignment Help. (2018). Essay On Unethical Lending Practices: Cash Converters' Accounting And Auditing Research. . Retrieved from https://myassignmenthelp.com/free-samples/accounting-and-auditing-research-tools-and-strategies .

"Essay On Unethical Lending Practices: Cash Converters' Accounting And Auditing Research.." My Assignment Help, 2018, https://myassignmenthelp.com/free-samples/accounting-and-auditing-research-tools-and-strategies .

My Assignment Help (2018) Essay On Unethical Lending Practices: Cash Converters' Accounting And Auditing Research. [Online]. Available from: https://myassignmenthelp.com/free-samples/accounting-and-auditing-research-tools-and-strategies [Accessed 08 May 2024].

My Assignment Help. 'Essay On Unethical Lending Practices: Cash Converters' Accounting And Auditing Research.' (My Assignment Help, 2018) https://myassignmenthelp.com/free-samples/accounting-and-auditing-research-tools-and-strategies > accessed 08 May 2024.

My Assignment Help. Essay On Unethical Lending Practices: Cash Converters' Accounting And Auditing Research. [Internet]. My Assignment Help. 2018 [cited 08 May 2024]. Available from: https://myassignmenthelp.com/free-samples/accounting-and-auditing-research-tools-and-strategies .

JOIN US! before it’s too late.

That's our welcome gift for first time visitors

Sign up now and Get The Exclusive offer* Limited Time Only

- Free Samples

- Premium Essays

- Editing Services Editing Proofreading Rewriting

- Extra Tools Essay Topic Generator Thesis Generator Citation Generator GPA Calculator Study Guides Donate Paper

- Essay Writing Help

- About Us About Us Testimonials FAQ

- Studentshare

- Finance & Accounting

- Calculating the cash conversion

Calculating the cash conversion - Essay Example

- Subject: Finance & Accounting

- Type: Essay

- Level: Masters

- Pages: 1 (250 words)

- Downloads: 4

- Author: giuseppe12

Extract of sample "Calculating the cash conversion"

Cash conversion cycle Cash conversion cycle Cash conversion cycle is the total number of days that a company needs to convert its resources into cash flows. It calculates the period of time during which every dollar input is devoted to the process of sales and production prior to its conversion to cash via the process of receivable accounts. The primary purpose of the process of cash conversion is to provide insight into the company’s financial stability because it indicates the period of time during which assets are committed to business (Brigham & Ehrhardt, 2008).

Therefore, the cash is not available for investment to obtain greater returns. This is why a shorter conversion cycle is better.From the excerpt, it is evident that money is held in the stock up to the time when it is sold. It infers that invested cash, or money that was used to purchase this stock is not available, and cannot be used for any other purpose (Brigham & Houston, 2012). Therefore, business must maintain short cash conversion cycle in order to reduce costs associated with inventory storage and depreciation and maintain business liquidity at a higher point.

In a nut shell, the cash conversion cycle measure the time in days that the company takes to convert its input resources into cash flows. That is, it reflects the period of time in days that the company takes to sell its stock, collect all cash receivables, and settle its bills (Whittington, 2012). It is conventionally agreed that a company that takes the shortest time is at its bets operations. This is because the cash becomes free as the cash conversion cycle shortens, and the company can invest it, use it for other activities such as purchasing new equipment, infrastructure to boost the returns.

Cash conversion cycle is also significant in assessing the efficiency of the management and competitor comparison (Graham & Smart, 2012).ReferencesBrigham, E. F., & Ehrhardt, M. C. (2008). Financial management: Theory & practice. Mason, Ohio: Thomson Business and Economics.Brigham, E. F., & Houston, J. F. (2012). Fundamentals of financial management. Mason, Ohio: South-Western Cengage Learning.Graham, J. & Smart, S. (2012). Introduction to corporate finance. Mason, Ohio: South-Western Cengage Learning.

http://smallbusiness.chron.com/difference-between-operating-cash-conversion-cycles-24738.htmlWhittington, O. R. (2012). Wiley CPA Exam Review 2013, Business Environment and Concepts. Hoboken: Wiley.

- Cited: 0 times

- Copy Citation Citation is copied Copy Citation Citation is copied Copy Citation Citation is copied

CHECK THESE SAMPLES OF Calculating the cash conversion

Working capital case study: target corporation, medicare funding and reibursement, prepaids and deferrals in working capital, market analysis of choice-based-conjoint study, callbration of air sampling pump, electric cart performance analysis, simple and compound interest, the gradual transformation of computers and the technical aspect of the development.

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

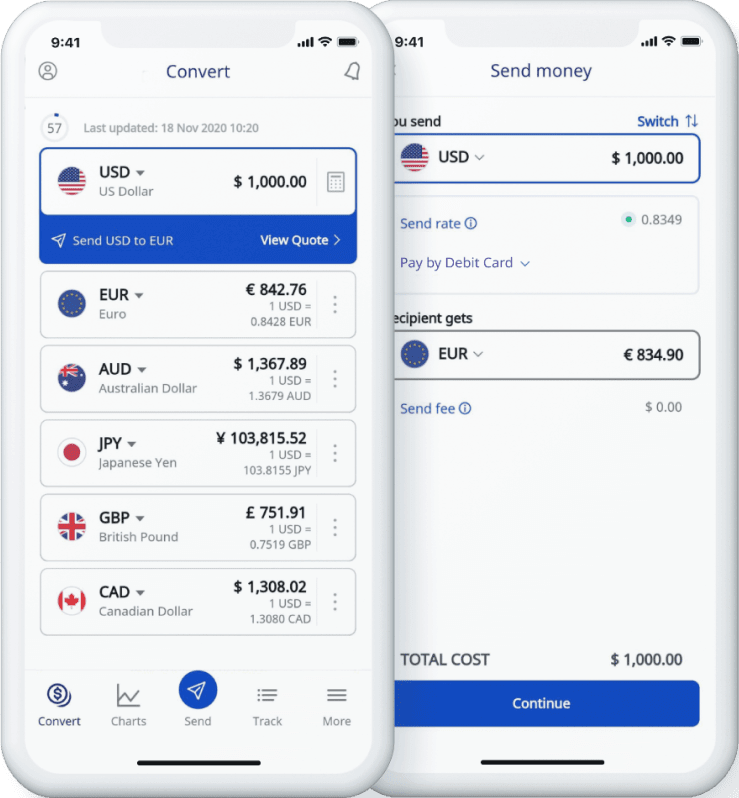

- Transferencia de dinero

- Alertas de tipos

Convierta 1 Dólar estadounidense a Peso colombiano - USD a COP

Conversor de divisas XE

1.00 Dólar estadounidense =

3,893.46 37 Colombian Pesos

1 COP = 0.000256841 USD

Convertir Dólar estadounidense a Peso colombiano

Convertir peso colombiano a dólar estadounidense, gráfico de usd a cop.

1 USD = 0 COP

Estadísticas de 1 Dólar estadounidense a Peso colombiano

Información de divisas, usd - dólar estadounidense.

Nuestras clasificaciones de divisas muestran que la tarifa de cambio de Dólar estadounidense más popular es de USD a USD. El código de la divisa Dólares estadounidenses es USD. El símbolo de esta divisa es $.

COP - Peso colombiano

Nuestras clasificaciones de divisas muestran que la tarifa de cambio de Peso colombiano más popular es de COP a USD. El código de la divisa Colombian Pesos es COP. El símbolo de esta divisa es $.

Pares de divisas más comunes que contienen Dólar estadounidense (USD)

Las herramientas de divisas más populares del mundo, transferencias de dinero internacionales xe.

Envíe dinero en línea de forma rápida, segura y fácil. Ofrecemos seguimiento y notificaciones en tiempo real, además de opciones flexibles de entrega y pago.

Gráficos de Xe Currency

Cree un gráfico para cualquier pareja de divisas del mundo para ver su historial de divisa. Estos gráficos de divisas utilizan tarifas de mercado medio en tiempo real, son fáciles de usar y muy fiables.

Alertas de tipos XE

¿Necesita saber cuándo una moneda alcanza una tarifa específica? Las alertas de tarifas de Xe le permitirán saber cuándo la tarifa que necesita se encuentra disponible en los pares de divisas seleccionados.

API de XE Currency Data ►

Apoyamos tarifas a nivel comercial en más de 300 compañías en todo el mundo

Descargue la aplicación de Xe

Verifique tarifas en vivo, envíe dinero de forma segura, establezca alertas de tarifas, reciba notificaciones y mucho más.

Más de 70 millones de descargas en todo el mundo

IMAGES

COMMENTS

Cash Converters was founded in Perth, Western Australia, in 1984 by Brian Cumins and a group of partners. Within four years, the network had opened a further six outlets across Perth. The Company commenced its international expansion in the mid-1990s establishing operations in New Zealand, the United Kingdom (UK), France, Belgium, South Africa ...

It's important to first reflect upon where we are on the journey toward a cashless society. Thus far, the shift is basically a move from physical cash to cash-replacements. With private companies involved in processing those transactions, there is inevitably a cost. And that means there is a loss of value when the transfer occurs.

View our latest analysis for Cash Converters International . In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the ...

Cash is vulnerable to loss and theft, a problem for both individuals and businesses, whereas digital currencies are relatively secure. Electronic hacking does pose a risk, but one that can be ...

A SWOT analysis is a framework that is used to analyze a company's competitive positioning in its business environment. This can be used by Cash Converters International, and will involve the identification of its internal Strengths (S) and Weaknesses (W) followed by the identification of the Opportunities (O) and Threats (T) it faces in its extensivelyrnal business environment.

Here is an essay on 'Exchange Rates' for class 11 and 12. Find paragraphs, long and short essays on 'Exchange Rates' especially written for school and college students. Essay # 1. Meaning of Exchange Rate: The rate of exchange is the rate at which the currency of one country is exchanged for the currency of another country. It is the price paid for a unit of foreign currency in terms ...

The mission statement of Cash Converters International has identified its target customer groups, and also identified their needs and demands. The mission statement reflects on how its products and services work towards increasing customer satisfaction for its target customers. 2.2.2. Based on core competencies.

The development of Cash Converters International Marketing Strategy requires identifying segmentation basis to understand the specific buying behaviour of customers. The needs, expectations and buying behaviour of customers are heterogeneous and depend on multifaceted factors- like: Age. Gender.

DIGIT AL CURRENCY AND ITS. IMPLICA TIONS FOR INDIA. T he demonetization of currency in year 2016. by Modi government revolutionized the. movement towards usage of digital payment. methods in India ...

According to a Federal Reserve Board report in 2019, cash is still extensively used for small-value purchases, representing nearly half of all payments under $10 dollars and 42 percent of payments ...

3053 Words. 13 Pages. 7 Works Cited. Open Document. The Canadian Exchange Rate. The Canadian Dollar has undergone a significant depreciation over the past 10 years. The drop in relative value of our currency has caused a great deal of consternation not only among economists but also in the media and consequently the general public has well.

Currency Hedging at Aifs Essay. Q1. What gives rise to the currency exposure at AIFS? * Currency exposure is the extent to which the future cash flows of an enterprise, arising from domestic and foreign currency denominated transactions involving assets and liabilities, and generating revenues and expenses, are susceptible to variations in ...

The currency of the future will be brought about by the powerful economies of the future. According to the IMF, of the top ten fastest developing economies, six are in Africa. Focusing our ...

Regardless of what currency converter that the people are using, they will always find ways to get the highest possible profits out of the exchanges. It is totally up to the company to put up their own conversion fees. There are some exchange transactions that may merit more extravagant fees, while there are those that offer the same with much ...

This lack of savings can hinder individuals from pursuing their aspirations and lead to financial stress. By saving money consistently, individuals can build the financial resources necessary to achieve their goals and secure their future. Debt Reduction. Saving money can also help individuals reduce and avoid debt.

CCC is basically referred to a metric that expresses the length of time in days which takes a company to convert its resources into the cash inflows. It is one of the most effective methods for the companies. The formula of the same is mentioned below, ... "Cash Conversion Essay Example," Free Essay Examples - WowEssays.com, 26-Feb-2020 ...

2.2.1 Cash Conversion Cycle Theory. Cash conversion theory was propounded by Blinder and Maccini (2001), cash conversion cycle theory is the time it takes a company to convert its resource inputs into cash. It evaluates how effectively a firm is managing its working capital. In most cases, a company acquires inventory on credit, which results ...

Whether you need to check the latest exchange rates, compare historical trends, or send money abroad, Xe Currency Converter is the ultimate tool for you. You can easily convert between any of the world's major currencies, including crypto and precious metals, and get the most accurate and up-to-date rates. Xe Currency Converter is free, fast, and simple to use.

Need Help with Cash Converters International Pestel & Environment Analysis? Political, Economic, Social, Technological, Environment & Legal Factors.