School of Graduate Studies

Mathematical finance, program overview.

In the 12-month Master of Mathematical Finance (MMF) program , students’ superior math skills are focused on the tools of financial mathematics for an initial four-month period. Students then move immediately into an internship with a firm. Afterwards, students will continue their coursework for the remainder of the school year.

Quick Facts

Master of mathematical finance, program description.

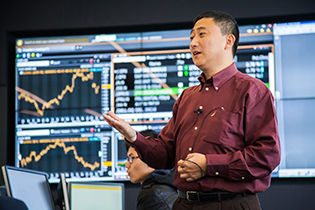

In the MMF program, students reshape their existing analytical abilities with the help of senior academics in mathematics, computer science, statistics, and engineering who have experience with the tools of mathematical finance. This cross-disciplinary approach develops graduates with a richer, more innovative approach to applied mathematics in real-world situations. Some of the faculty are seasoned practitioners from the financial industry while others are from leading firms in the financial software industry, developing applications around requirements like risk management, portfolio analysis, and the pricing of advanced derivatives.

The heart of the program is the four-month internship or campus project. Working on real financial projects, students learn to integrate and apply theoretical knowledge gained earlier in the program. In the internship, students team up with employees of the sponsoring firm to experience how financial mathematics impacts the decision-making processes of a financial services organization.

Minimum Admission Requirements

Applicants are admitted under the General Regulations of the School of Graduate Studies. Applicants must also satisfy the graduate unit's additional admission requirements stated below.

Applicants must have an appropriate bachelor's degree in a quantitative, technical discipline with a minimum of a mid-B standing in the final two years.

Applicants whose primary language is not English and who graduated from a university where the language of instruction was not English must demonstrate proficiency in the English language through the successful completion of the Test of English as a Foreign Language (TOEFL) with minimum scores as follows:

paper-based TOEFL exam: 580 and 5 on the Test of Written English (TWE)

Internet-based TOEFL exam: 93/120 and 22/30 on the writing and speaking sections

Applicants must also show evidence of strong mathematical ability. Appropriate workplace experience will be considered in lieu of formal education.

Admission to the program is competitive. Those accepted into the program will normally have achieved a standing considerably higher than the minimum mid-B standing or have demonstrated exceptional ability through appropriate workplace experience.

Applicants must satisfy the Admissions Committee of their ability to do rigorous quantitative analysis at an advanced level. The broad background required for this program makes it likely that many strong applicants will not possess all the background requirements. It is expected that applicants will have extra depth in certain areas and need to do additional work in others. Admission may be conditional upon the applicant's satisfactory completion of the required background material.

Applicants should submit a written statement of approximately 300 words outlining their objectives for entering the program. Applicants should also explain how their background is appropriate. An interview may be required.

Inquiries about part-time options for the program should be addressed to the Program Director.

Program Requirements

The program of study begins in mid-August and includes a four-month internship during the second session. Students will be responsible for obtaining their own internship. In cases where the student is taking a leave of absence from an appropriate job, it is expected that the student will return to this job for the internship. In all cases, the Director must approve the placement.

Students will proceed through the program as a group, following a common course of study. The course of study will be fully integrated and computer-laboratory intensive. Course projects and assignments will be designed to integrate the material learned from a variety of the courses and to utilize it in a practical context. Excellent communication and presentation skills will be emphasized in both the oral and written components of the projects.

Students must complete all required courses listed below.

Program Length

3 sessions full-time (typical registration sequence: F/W/S)

3 years full-time

Main navigation

- Undergraduate Programs

- Bachelor of Commerce

- MBA Programs

- MM in Analytics

- MM in Finance

- MM in Retailing

- Global Manufacturing and Supply Chain Management

- Graduate Certificate in Healthcare Management

- Graduate Certificate in Professional Accounting

- McGill-HEC Montréal Executive MBA

- McGill Executive Institute

- International Masters for Health Leadership

- International Masters Program for Managers

- PhD in Management

- McGill Personal Finance Essentials

- McGill Dobson Centre for Entrepreneurship

- Career Management

- Marcel Desautels Institute for Integrated Management (MDIIM)

- Equity, Diversity and Inclusion (EDI)

- Laidley Centre for Business Ethics and Equity (LCBEE)

- Sustainability

- Sustainable Growth Initiative (SGI)

- Entrepreneurship & Innovation Initiative (E&I)

- Managing Disruption: Analytics, Advanced Digital Technologies and AI (AAAI)

- Information Systems

- Operations Management

- Organizational Behaviour

- Retail Management

- Strategy & Organization

- Our Students

Addressing current issues confronting organizations and investors operating in today’s rapidly changing financial environment.

The PhD specialization in Finance at McGill prepares students for research-oriented academic careers. While students from all backgrounds are encouraged to apply, the typical student holds an undergraduate or a master's degree in economics, finance, mathematics, statistics, computer science, engineering or physics.

The program is normally completed in five years. The first two years in the program are devoted primarily to taking courses in finance, as well as supporting disciplines (economics, mathematics and econometrics/statistics). After the first two years, students enter the dissertation phase of the program. For details on the Finance Area, research domains, publications and working papers, visit the Desmarais Global Finance Research Centre website.

Numerous required and elective doctoral courses are offered by the McGill Finance Faculty, including:

- Financial Economics

- Corporate Finance

- Empirical Methods in Finance

- Continuous-Time Finance

- International Finance

- Fixed Income Securities Theory

- Corporate Governance

Faculty and Research

The McGill Finance area includes fourteen faculty members who regularly publish in the top finance journals. The moderate size of the program (currently we have 13 Ph.D. students in residence) make it possible for the students to closely interact with the faculty and to benefit from personalized attention and support. Because the faculty's interests span a wide spectrum of specialized fields in finance, students enjoy a lot of freedom in the choice of their dissertation topic.

Related Content

Insightful research for visionary management.

See the PhD Program Finance Postcard

Finance members

Department and university information, desautels faculty of management mcgill university.

- Bachelor of Commerce (BCom)

- Master of Management in Analytics (MMA)

- Master of Management in Finance (MMF)

- Master of Management in Retailing (MMR)

- Global Manufacturing and Supply Chain Management Program (GMSCM)

- Graduate Certificate in Healthcare Management (GCHM)

- Graduate Certificate in Professional Accounting (GCPA Program)

- Executive MBA

- McGill Executive Institute (MEI)

- International Masters for Health Leadership (IMHL)

- International Masters Program for Managers (IMPM)

- Desautels at a Glance

- Marcel Desautels

- Administration & Governance

- Desautels Strategic Plan 2025

- Equity, Diversity and Inclusion

- Academic Integrity

- International Advisory Board

- Desautels Global Experts

- Delve Thought Leadership

- Search the Desautels directory

- Areas of specialization

- Desautels 22: Top-tier Publications

- Research publications

- Research centres

- McGill Centre for the Convergence of Health and Economics (MCCHE)

- Desautels alumni

- Get involved

- Support Desautels

- News and social

- Desautels Stories

- DesautelsConnect on 10KC

- Working at Desautels

- Student Hub

- Casual payroll

Study and Work in Mathematical Finance in Canada

Graduate Mathematical Finance Admission Requirements The prequisites required to become accepted in an graduate and/or post-graduate PhD program in Mathematical Finance.

What Mathematical Finance Students Learn Topics and concepts that are covered and the overall approach or focus taken in studying Mathematical Finance.

Research in Mathematical Finance Research areas, topics, interests projects in Mathematical Finance.

Career and Employment Opportunities in Mathematical Finance Professions or occupations available to graduates in Mathematical Finance and links to employment resources.

Copyright 2021 - Hecterra Publishing Inc. - Privacy Statement - Terms of Service

- My UCalgary

- Class Schedule

- UCalgary Directory

- Continuing Education

- Active Living

- Academic Calendar

- UCalgary Maps

- Close Faculty Websites List Viewing: Faculty Websites

- Cumming School of Medicine

- Faculty of Arts

- Faculty of Graduate Studies

- Faculty of Kinesiology

- Faculty of Law

- Faculty of Nursing

- Faculty of Nursing (Qatar)

- Faculty of Science

- Faculty of Social Work

- Faculty of Veterinary Medicine

- Haskayne School of Business

- School of Architecture, Planning and Landscape

- School of Public Policy

- Schulich School of Engineering

- Werklund School of Education

- Future Students

- Combined Degrees

- Change of Program

- Concentrations

- Fees and Finances

- Program Advising

- New to U of C?

- Incoming Students

- Testimonials

- Master of Management

- Is MMgmt right for you?

- Career development

- Experiential learning

- Dual degrees

- Tuition and scholarships

- MBA programs

- Daytime MBA

- Is the Daytime MBA right for you?

- Specialization options

- Career outcomes

- Information for international students

- Tuition and funding

- Evening MBA

- Is the Evening MBA right for you?

- Accelerated MBA

- Is the Accelerated MBA right for you?

- Combined MBA

- Executive MBA

- Is the Haskayne EMBA right for you?

- Tuition and Funding

- Specialized Programs

- MSc Sustainable Energy Development

- Diploma in Data Science and Analytics

- Program Information

- Academic Curriculum

- Business Analytics Faculty

- Embedded Certificates

- Entrepreneurial Thinking

- Leadership Studies

- Post-Graduate Certificates

- Business Intelligence and Data Analytics

- Management Analytics

- Doctoral Programs

- PhD Supervisors

- PhD Students by area

- Professional Programs

- Executive Education

- Programs for Individuals

- Programs for Organizations

- Programs for Board Directors

- Real Estate Programs

- Pre-Licensing Courses

- Real Estate Development Leadership Certificate

- UCalgary NoCode Professional Education Program

- Programs for researchers

- Staff Directory

- Registration FAQs

- Current Students

- Undergraduate

- Academic Information

- Registration

- BComm Honours Program

- Deferral of Term Work and Exams

- Letter of Permission

- Grade Reappraisals and Appeals

- External Links

- Final Exams

- Important Dates

- Wellness Resources

- Dean's List

- Student Resources

- Business Library

- Scholarships Awards

- Tuition Information

- Academic Turnaround

- Syndicate Room Bookings

- Student Experience

- Co-operative Education

- Student Experience Fund

- Marker/Proctor opportunities

- Case Competitions

- Student Clubs

- International Exchange

- Outgoing Students

- Semester at Sea

- International Exchange Development Partners

- Convocation

- Specialization

Specializations

- Candidacy Requirements

- International exchange

- Mitacs Business Strategy Internship (MBSI) - Partner information

- Career Development Centre

- Student Services

- Employer Services

- Faculty/Staff Services

- Myths vs Facts & FAQs

- Haskayne Connects

- Research and Faculty

- Academic Areas

Business Technology Management

Entrepreneurship and innovation, operations and supply chain management.

- Organizational Behaviour and Human Resources

Risk Management and Insurance

- Strategy and Global Management

- Academic Tools & Support

- Research Info Centre on D2L

- Qualtrics Online Survey

- Teaching and Learning

- Teaching and Learning Fellowships

- Teaching Development and Initiatives

- Staff and faculty recognition

- Dean's Awards

- Golden Bull Award

- Canadian Centre for Advanced Leadership in Business (CCAL)

- Centre for Corporate Sustainability (CCS)

- Centre for Entrepreneurship and Innovation

- Centre for Excellence in Professional Accounting (CEPA)

- Creative Destruction Lab - Rockies

- Global Business Futures Initiative (GBFI)

- Informatics Research Centre (iRC)

- Trico Foundation Social Entrepreneurship Centre

- Westman Centre for Real Estate Studies

- Communities & Networks

- Alumni Benefits & Services

- Haskayne Alumni Awards

- Grow Your Career

- Get Involved

- Mathison Hall

- Work-integrated learning

- Scholarships

- Ways to Give

- Haskayne Founders' Circle

- Signature Events

- Inspiring Business Leader Award

- 2024 Recipient

- Previous Recipients

- Sponsorship

- Nominations

- Scholarship

- Next Up: The W. David Duckett Speaker Series

- PETRONAS International Energy Speaker Series

- Support student career development

- Get student consulting

- Hire a student

- Become a mentor

- Become a panel member

- At a Glance

- Richard F. Haskayne

- Publications

- Strategic Vision

- Haskayne 2025 Strategic Plan

- Learning Goals and Objectives

- Principles for Responsible Management Education (PRME)

- Leadership Team

- Senior Leadership Team

- Advisory Councils

- Equity, Diversity, Inclusion and Indigenization

- Strategy - Goals & Progress

- Haskayne Directory

- Location and Spaces

- Scurfield Hall

- Nu West Commons TV Screens

- Student Club Event Planning

- Haskayne Room Bookings

- Faculty & Staff Room Booking

- Student Club Room Booking

- External Room Booking

- Mathison Hall Event Centre Booking

Haskayne PhD

Generous Funding Package

Our funding package is one the most generous among the Canadian business schools. We pay full tuition to all students admitted. We provide in excess of $120,000 over four years plus partial funding in year 5 to all incoming PhD students. We also support each student’s participation and attendance at academic conferences (subject to approval) to encourage presenting research and building networks.

The main mission of the PhD program in Accounting at the Haskayne School of Business, University of Calgary, is to prepare prospective faculty members for positions at reputable business schools in Canada and around the world. Our graduates teach and research in schools such as American University of Cairo, Concordia University, Mount Royal University, University of Ottawa, Royal Roads University. University of Texas-Pan American and York University.

Some of the factors that make our graduates successful include a rigorous admission process, training in core business, accounting, and statistics. In addition to five core seminars in business and research methodology, our students are required to complete four seminars in accounting research, one seminar in a minor area (Corporate Sustainability and Finance are popular choices) and two statistics courses. For their seminar courses students are required to take Managerial Accounting Seminar, Financial Accounting Seminar, and Paradigms, Issues, and Methods. They may choose from other optional courses including Evaluating Environmental Performance, Tax, Advanced Financial, and Advanced Managerial or other Special Topics (as a directed study). Additionally, the Accounting Area holds a regular series of research presentations by our faculty members and well-known researchers from other universities, as part of or independently of these courses. With help from their professors, PhD students undertake their own research project through a summer research program at the end of their first year, which may be further developed for conference presentation and/or expanded into dissertation research. PhD students are frequently provided with opportunities to work with professors on accounting research projects.

Financial aid is available to some of our students through the Chartered Accountants Education Foundation, and the Certified Management Accountants. Please view their websites for specific requirements for applying. PhD students, along with professors, can apply for small amounts of funding to support research projects through the Certified Management Accountants and Certified General Accountants internal research competitions. Other competitive awards that may be of interest to support research are the Peter Valentine Corporate Governance Award and the Enbridge Corporate Sustainability Award Doctoral Scholarship, if doing research on these topics.

When ready, students are encouraged to attend and present papers at the Canadian Academic Accounting Association (CAAA), the American Accounting Association (AAA), the European Accounting Association (EAA), and the Administrative Sciences Association of Canada (ASAC). Students can also attend the Contemporary Accounting Research (CAR) conference as a PhD participant. Other conferences of regional or special interest, depending on the student’s area of research, may also be encouraged. There are also a number of PhD doctoral consortiums that can be attended.

PhD students are free to select their own topic of interest for their dissertation research; however, most students choose a topic of interest they may share with one of the accounting professors. Some topics that have been investigated in the past include international accounting, capital markets, intellectual capital, public sector accounting, managerial performance systems, and corporate sustainability. Methods include experimental, events studies using archival data, case studies, empirical analysis, and others. Both qualitative and quantitative methods are used as well. Our graduates publish in such quality journals as Journal of Accounting Research (JAR), Contemporary Accounting Research (CAR), Accounting, Organization and Society (AOS), and Journal of Business Ethics. Many of our graduates serve as associate editors or in the editorial boards of reputable journals.

Area chair: Dr. Mark Anderson , Associate Professor

The Ph.D. Program in Management Information Systems (MIS), which also goes under the name Business Technology Management (BTM), at the Haskayne School of Business (HSB) is a research-based program designed to prepare candidates to become strong scholars at universities and other research-based institutions.

The focus of the Ph.D. program in MIS/BTM at HSB is on the economics of information systems, otherwise known as the “econ of IS”, and related areas. The course work, which covers about two years, is designed to prepare the candidates in economics, econometrics, research methods, quantitative methods, and state-of-the-art research in the econ of IS.

Active participation in research with one or more faculty members begins no later than the first summer. All research faculty in MIS/BTM have one or more publications in the field’s top journals, and this provides a strong basis for guidance and future prospects.

Recent research areas include:

- Productivity impacts of Information technology (IT)

- E-commerce and channels of distribution

- Electronic retailing

- Platform-mediated networks

- Online data and reputations

- Economics of user-generated content

- Business process reengineering

- IT outsourcing

- Adaptive control in scheduling

- Price quotation in supply chains

- IT and organizational design

- IT applications in healthcare

Area chair: Dr. Raymond A. Patterson , Professor

Researchers:

- Dr. Barrie R. Nault

- Dr. Ray Patterson

- Dr. Hooman Hidaji

- Dr. Duy Dao

- Dr. Jian (Ray) Zhang

The Haskayne PhD in Entrepreneurship and Innovation offers students an opportunity to work with faculty who are committed to excellence in theoretical foundations and a variety of research methodologies, preparing them for academic careers.

Entrepreneurship and Innovation (ENTI) is an interdisciplinary domain that focuses on the activities, people and context involved in initiating, developing, and maintaining an enterprise or innovation. Among topics of interest are new venture opportunities, strategies, and resources; entrepreneurship ecosystems; the owner-manager; the relationship between entrepreneurship and economic development; family business; crowdfunding; start-up governance; social entrepreneurship; intrapreneurship; and international entrepreneurship and policy.

In addition, because entrepreneurship often involves technological innovations, the specialization includes scholarship and dialogue on the management of innovation and technological change, technology strategy, technology-based entrepreneurship, and the commercialization of scientific research.

We encourage students to examine the questions of the field from multiple perspectives and draw upon a wide range of foundational disciplines, including economics, mathematics, philosophy, psychology, and sociology.

Area chair: Dr. Olga Petricevic , Associate Professor

The PhD program in Finance at the Haskayne School of Business is a technical, rigorous, academic program designed to prepare you for a career as a researcher and scholar. You will get a solid education in the mainstreams of finance research and be trained in the professional skills that are necessary to pursue a successful career in academia. The program is intense and requires a lot of dedication and a positive work attitude. Our faculty will work with students in all major areas of finance research including: corporate finance, asset pricing, banking, corporate governance, mathematical finance, and entrepreneurship. You will work with your advisor to select finance courses that will optimally prepare you for your chosen field of study. To augment the finance courses, students are often encouraged to take classes from mathematics and/or economics. Please visit our University of Calgary Calendar for a description of available courses and prerequisites.

Area chair: Dr. Kyoung Jin Choi , Associate Professor

Organizational Behaviour and Human Resources | Strategy & Global Management

The doctoral programs in SGMA and OBHR are closely aligned, and encourage students to adopt multi-disciplinary and multi-methodology approaches in their research.

The key question to be answered in any SGMA or OBHR thesis is always: how to increase the effectiveness and/or efficiency of a managerial practice with a view to contribute to the firm’s competitive advantage?

There is considerable flexibility in choosing the thesis subject, i.e., the selected managerial practice’s nature and scope. Such practice may be observable at the level of the individual decision-maker, a team, a sub-unit within the firm, the firm, a strategic alliance or even an industry.

Answering the key question in a SGMA or OBHR dissertation must build on solid conceptual foundations and take advantage of state-of-the-art empirical methodologies, both in the quantitative and qualitative sphere.

Students are encouraged to adopt an integrative approach, drawing conceptual insight from foundational disciplines such as applied psychology, micro-economics (especially the law, economics and organization branch of micro-economics) and other complementary disciplines with proven potential to answer in a rigorous fashion the key question considered.

The focus should be on gaining an in-depth understanding of the practice at hand in terms of its strengths (or benefits) and weaknesses (or costs), and on developing or evaluating a set of actionable paths towards improving the practice.

For example, work on non-market strategies of firms may require delving into political science, the institutional-theory strand of sociology, and law. As another example, work on designing effective human resources management practices in multinational enterprises may require a serious grounding in conceptual frameworks related to societal culture and organizational behaviour, and deep knowledge of the modern economics-based theory of the multinational enterprise.

All SGMA and OBHR students will be expected to master advanced statistics as used in the leading management journals (such as the Academy of Management Journal), and have an equivalent command of qualitative research methods .

The SGMA and OBHR doctoral programs will provide the PhD students with the multi-disciplinary and multi-methodology training required to examine issues of managerial effectiveness and efficiency in a large variety of organizational settings.

Students will be supervised by a select group of Haskayne faculty members, who have published in leading academic journals and whose expectation is that each thesis will consist of a set of high quality essays publishable in refereed journals. These faculty members have a history of co-publishing with their students on a wide variety of topics, ranging from the determinants of job satisfaction, to meta-analyses on a wide variety of organizational phenomena, and the strategy and structure of the world’s largest companies. Take a look at the SGMA and OBHR faculty members’ research records to see if there is an overlap in interests.

OBHR Area chair: Dr. Nick Turner , Professor, Distinguished Research Chair, ABL

SGMA Area chair: Dr. Pengfei Li , Associate Professor

The Haskayne School of Business (HSB) doctoral degree in Marketing is a rigorous, research-based academic program designed to prepare you for a career as a marketing scholar. This program is intensive and the expectations are high. At graduation, you will have developed a solid theoretical foundation and strong analytical skills to prepare you for a career in university teaching and research.

All HSB doctoral students are paired with a supervisor from the first day, and you will have opportunities very early in your program to develop close working relationships with faculty members as you become involved in faculty-led research projects (generally toward the end of your first year). These research projects reflect our faculty’s research interests, which are varied and include:

- Consumer Behaviour

- Decision Making

- Product Management/New Product Development

- Relationship Marketing

- Ethics/Social Responsibility

- Sustainability

- International & Global Marketing

- Services Marketing

- Cross-Cultural Marketing Research

- Methodological Issues

Marketing is an interdisciplinary field that draws theories and methodologies from a number of founding disciplines, including economics, psychology, sociology, strategy, and statistics. Depending on your research interests, you will be encouraged to take courses in the foundational disciplines to complement your marketing training. You will also be encouraged to take several courses in statistics and quantitative methods. Please visit our University of Calgary Calendar for a description of available courses and prerequisites.

Area chair: Dr. Scott Radford , Associate Professor

As a doctoral student in the Operations and Supply Chain Management (OSCM) area, you will have the opportunity to work closely with faculty members who are dedicated to excellence in both research and teaching. Two particular research strengths of our faculty are:

- Health care operations management, specifically health care delivery optimization through addressing problems of access to care and quality/safety, employing quantitative tools as well as qualitative and empirical studies of health services, and

- Supply chain management, encompassing all aspects, from operations strategy – maximizing responsiveness through flexibility, collaboration and logistics – through supply chain network design, including facility layout and location.

Coursework will be tailored to individual interests but will include a series of seminars to provide in-depth knowledge of research in operations management and exposure to a variety of management science techniques.

Area chair: Dr. Osman Alp , Professor

The Haskayne School of Business (HSB) doctoral degree in Risk Management and Insurance is a rigorous, research-based academic program. This program is intensive and the expectations are high. At graduation, you will have developed a solid theoretical foundation and strong analytical skills to prepare you for a career in university teaching and research.

- Enterprise risk management

- Corporate governance

- Disaster resilience

- Distribution systems in insurance

- Merger and acquisition activity in the insurance industry

- Competitiveness and efficiency of the insurance industry

- Tort versus no-fault liability systems

- Public policy issues surrounding social insurance systems and pensions

- Risk communication

Risk management and insurance are interdisciplinary fields that draw theory and methodologies from a number of founding disciplines, including economics, law, psychology, and statistics. Depending on your research interests, you will be encouraged to take courses in the foundational disciplines to complement your marketing training. You will also be encouraged to take courses in both qualitative and quantitative methods. Please visit our University of Calgary Calendar for a description of available courses and prerequisites.

Please note: Applicants interested in financial risk management should visit the page for FINANCE.

Area chair: Dr. Anne Kleffner , Professor

Cross-Disciplinary Programs

The business school supports the efforts of students wishing to combine a doctoral program in management with doctoral studies in another discipline. These joint programs are individually tailored to meet student interests and needs. Students in cross-disciplinary programs must be highly qualified because it is difficult to meet the standards of two specializations.

Interested in learning more?

If you are interested in learning more about the Haskayne PhD program, application requirements and deadlines, please contact us.

- Doctor of Philosophy in Mathematics (PhD)

- Graduate School

- Prospective Students

- Graduate Degree Programs

Canadian Immigration Updates

Applicants to Master’s and Doctoral degrees are not affected by the recently announced cap on study permits. Review more details

Go to programs search

Mathematicians use theoretical and computational methods to solve a wide range of problems from the most abstract to the very applied. UBC's mathematics graduate students work in many branches of pure and applied mathematics. The PhD program trains students to operate as research mathematicians. The focus of the program is on substantial mathematical research leading to the PhD dissertation. Students also develop their skills in presenting and teaching mathematics and its applications.

For specific program requirements, please refer to the departmental program website

What makes the program unique?

UBC has one of the largest and most vigorous departments of mathematics in Canada. Our faculty routinely win national and international awards for their research and teaching achievements. We have an engaged and sociable cohort of graduate students who are essential members of a broad selection of active research groups. Each group holds a variety of seminars and events that allow graduate students, postdoctoral fellows, visitors and faculty to enjoy regular interaction.

UBC is the headquarters for the Pacific Institute of Mathematical Sciences (PIMS). PIMS hosts a plethora of mathematical events such as conferences and summer schools, greatly enriching the scientific environment in the quantitative sciences at UBC. Our mathematics students are also regular participants at the nearby Banff International Research Station for Mathematical Innovation and Discovery. Finally, our Institute for Applied Mathematics provides options for interdisciplinary studies for PhD students who wish to work in applied and computational mathematics.

I chose UBC because of the reputation of the university and mathematics department, the alignment of my research interests with my advisor’s expertise, and my love for Canada!

Ethan White

Quick Facts

Program enquiries, admission information & requirements, 1) check eligibility, minimum academic requirements.

The Faculty of Graduate and Postdoctoral Studies establishes the minimum admission requirements common to all applicants, usually a minimum overall average in the B+ range (76% at UBC). The graduate program that you are applying to may have additional requirements. Please review the specific requirements for applicants with credentials from institutions in:

- Canada or the United States

- International countries other than the United States

Each program may set higher academic minimum requirements. Please review the program website carefully to understand the program requirements. Meeting the minimum requirements does not guarantee admission as it is a competitive process.

English Language Test

Applicants from a university outside Canada in which English is not the primary language of instruction must provide results of an English language proficiency examination as part of their application. Tests must have been taken within the last 24 months at the time of submission of your application.

Minimum requirements for the two most common English language proficiency tests to apply to this program are listed below:

TOEFL: Test of English as a Foreign Language - internet-based

Overall score requirement : 100

IELTS: International English Language Testing System

Overall score requirement : 7.0

Other Test Scores

Some programs require additional test scores such as the Graduate Record Examination (GRE) or the Graduate Management Test (GMAT). The requirements for this program are:

The GRE is not required.

2) Meet Deadlines

3) prepare application, transcripts.

All applicants have to submit transcripts from all past post-secondary study. Document submission requirements depend on whether your institution of study is within Canada or outside of Canada.

Letters of Reference

A minimum of three references are required for application to graduate programs at UBC. References should be requested from individuals who are prepared to provide a report on your academic ability and qualifications.

Statement of Interest

Many programs require a statement of interest , sometimes called a "statement of intent", "description of research interests" or something similar.

Supervision

Students in research-based programs usually require a faculty member to function as their thesis supervisor. Please follow the instructions provided by each program whether applicants should contact faculty members.

Instructions regarding thesis supervisor contact for Doctor of Philosophy in Mathematics (PhD)

Citizenship verification.

Permanent Residents of Canada must provide a clear photocopy of both sides of the Permanent Resident card.

4) Apply Online

All applicants must complete an online application form and pay the application fee to be considered for admission to UBC.

Tuition & Financial Support

Financial support.

Applicants to UBC have access to a variety of funding options, including merit-based (i.e. based on your academic performance) and need-based (i.e. based on your financial situation) opportunities.

Program Funding Packages

All full-time students who begin a UBC-Vancouver PhD Mathematics program in September 2018 or later will be provided with a funding package of at least $24,256 for each of the first four years of their PhD. The funding package may consist of any combination of internal or external awards, teaching-related work, research assistantships, and graduate academic assistantships.

Average Funding

- 52 students received Teaching Assistantships. Average TA funding based on 52 students was $13,784.

- 48 students received Research Assistantships. Average RA funding based on 48 students was $11,580.

- 3 students received Academic Assistantships. Average AA funding based on 3 students was $1,814.

- 54 students received internal awards. Average internal award funding based on 54 students was $13,279.

- 4 students received external awards. Average external award funding based on 4 students was $27,083.

Scholarships & awards (merit-based funding)

All applicants are encouraged to review the awards listing to identify potential opportunities to fund their graduate education. The database lists merit-based scholarships and awards and allows for filtering by various criteria, such as domestic vs. international or degree level.

Graduate Research Assistantships (GRA)

Many professors are able to provide Research Assistantships (GRA) from their research grants to support full-time graduate students studying under their supervision. The duties constitute part of the student's graduate degree requirements. A Graduate Research Assistantship is considered a form of fellowship for a period of graduate study and is therefore not covered by a collective agreement. Stipends vary widely, and are dependent on the field of study and the type of research grant from which the assistantship is being funded.

Graduate Teaching Assistantships (GTA)

Graduate programs may have Teaching Assistantships available for registered full-time graduate students. Full teaching assistantships involve 12 hours work per week in preparation, lecturing, or laboratory instruction although many graduate programs offer partial TA appointments at less than 12 hours per week. Teaching assistantship rates are set by collective bargaining between the University and the Teaching Assistants' Union .

Graduate Academic Assistantships (GAA)

Academic Assistantships are employment opportunities to perform work that is relevant to the university or to an individual faculty member, but not to support the student’s graduate research and thesis. Wages are considered regular earnings and when paid monthly, include vacation pay.

Financial aid (need-based funding)

Canadian and US applicants may qualify for governmental loans to finance their studies. Please review eligibility and types of loans .

All students may be able to access private sector or bank loans.

Foreign government scholarships

Many foreign governments provide support to their citizens in pursuing education abroad. International applicants should check the various governmental resources in their home country, such as the Department of Education, for available scholarships.

Working while studying

The possibility to pursue work to supplement income may depend on the demands the program has on students. It should be carefully weighed if work leads to prolonged program durations or whether work placements can be meaningfully embedded into a program.

International students enrolled as full-time students with a valid study permit can work on campus for unlimited hours and work off-campus for no more than 20 hours a week.

A good starting point to explore student jobs is the UBC Work Learn program or a Co-Op placement .

Tax credits and RRSP withdrawals

Students with taxable income in Canada may be able to claim federal or provincial tax credits.

Canadian residents with RRSP accounts may be able to use the Lifelong Learning Plan (LLP) which allows students to withdraw amounts from their registered retirement savings plan (RRSPs) to finance full-time training or education for themselves or their partner.

Please review Filing taxes in Canada on the student services website for more information.

Cost Estimator

Applicants have access to the cost estimator to develop a financial plan that takes into account various income sources and expenses.

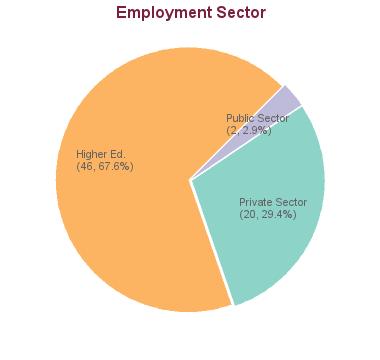

Career Outcomes

88 students graduated between 2005 and 2013: 1 is in a non-salaried situation; for 19 we have no data (based on research conducted between Feb-May 2016). For the remaining 68 graduates:

Sample Employers in Higher Education

Sample employers outside higher education, sample job titles outside higher education, phd career outcome survey, career options.

A great majority of our PhD graduates move on to postdoctoral fellowships and faculty positions at universities and research institutes in North America and around the world. However, a significant fraction of students move into careers in industry. Students considering non-academic careers are encouraged to complete an industrial internship (for instance through the Mitacs Accelerate program - headquartered at UBC) during their studies.

Enrolment, Duration & Other Stats

These statistics show data for the Doctor of Philosophy in Mathematics (PhD). Data are separated for each degree program combination. You may view data for other degree options in the respective program profile.

ENROLMENT DATA

Completion rates & times, upcoming doctoral exams, monday, 27 may 2024 - 12:30pm - room 203, thursday, 30 may 2024 - 10:00am - 203, mathematics building, 1984 mathematics road, friday, 5 july 2024 - 9:00am - room 200.

- Research Supervisors

Advice and insights from UBC Faculty on reaching out to supervisors

These videos contain some general advice from faculty across UBC on finding and reaching out to a supervisor. They are not program specific.

This list shows faculty members with full supervisory privileges who are affiliated with this program. It is not a comprehensive list of all potential supervisors as faculty from other programs or faculty members without full supervisory privileges can request approvals to supervise graduate students in this program.

- Adem, Alejandro (Cohomology of finite groups, orbifolds, stringy topology, algebra, sporadic simple group, group actions, arithmetic groups, K-theory, homotopy theory, spaces of homomorphisms)

- Angel, Omer (Probability theory, percolation, random graphs, random walks, particle processes, scaling limits)

- Bachmann, Sven (Mathematics and statistics; Mathematical Analysis; quantum phenomena; Mathematical physics; Quantum statistical physics; Topological states of matter)

- Balmforth, Neil (Fluid mechanics, nonlinear dynamics and applied partial differential equations)

- Behrend, Kai (Moduli spaces, Gromov-Witten invariants, string theory, Donaldson-Thomas invariants, Euler characteristics, categorification)

- Bennett, Michael (Number Theory, Diophantine Approximation and Classical Analysis)

- Bryan, Jim (Algebraic and differential geometry; Algebraic geometry, moduli spaces, enumerative invariants related to theoretical physics.)

- Cautis, Sabin (Mathematics and statistics; Geometry)

- Chau, Albert (Differential Geometry and Partial Differential Equations)

- Chen, Jingyi (Algebraic and differential geometry; Differential Geometry, Partial Differential Equations)

- Colliander, James (hamiltonian dynamical systems; partial differential equations; harmonic analysis)

- Coombs, Daniel (Mathematical biology; Cellular immunology; Complex physical systems; Epidemiology (except nutritional and veterinary epidemiology); Cell Signaling and Infectious and Immune Diseases; Cell biophysics; Disease models; Epidemiology; Immune cell signalling; Mathematics)

- Cytrynbaum, Eric (Bacterial cell division, Microtubule and cellular organization, Wave propagation in excitable media)

- Dao Duc, Khanh (Genomics; Mathematical biology; Neurocognitive patterns and neural networks; Agricultural spatial analysis and modelling; combine mathematical,computational and statistical tools to study fundamental biological processes; regulation and determinants of gene expression and translation; Machine Learning for Biological Imaging and Microscopy; Database development and management; Biological and Artificial Neural Networks for geometric representation)

- Doebeli, Michael Walter (Mathematical ecology and evolution, evolution of diversity, adaptive speciation, evolution of cooperation, game theory, experimental evolution in microorganisms)

- Feng, James (Chemical engineering; Mathematics and statistics; Biophysics; Complex fluids; Fluid mechanics; Mathematical biology)

- Fraser, Ailana (Differential Geometry, Geometric Analysis)

- Friedlander, Michael (numerical optimization, numerical linear algebra, scientific computing, Scientific computing)

- Frigaard, Ian (Fluid mechanics (visco-plastic fluids))

- Ghioca, Dragos (Drinfeld modules, isotrivial semiabelian varieties, Lehmer inequality)

- Gordon, Julia Yulia (Representation theory of p-adic groups and motivic integration; Trace Formula and its applications)

- Gustafson, Stephen James (Mathematics and statistics; Mathematical Analysis; Differential Equation; Global and Non-Linear Analysis; Mathematical physics; Nonlinear partial differential equations; Nonlinear waves; Topological solitons)

- Hauert, Christoph (Mathematics and statistics; Modelization and Simulation; Evolution and Phylogenesis; Biological Behavior; dynamical systems; evolution; game theory; social dilemmas; stochastic processes)

- Hermon, Jonathan (probability theory; Markov chains and the cutoff phenomenon; particle systems; percolation)

- Holmes-Cerfon, Miranda (Mathematical modelling and simulation; Computational methods in statistics; Numerical analysis; Thermodynamics and statistical physics)

Doctoral Citations

Sample thesis submissions.

- Free boundary minimal submanifolds in geodesic balls of simply connected space forms

- On a completion of cohomological functors generalizing Tate cohomology

- Distribution of integral points on varieties

- Effective and explicit S-unit equations with many terms

- Classifying space for commutativity and unordered flag manifolds

- Finite-size scaling of a few statistical physics models in high dimensions

- Residual supersingular Iwasawa theory and μ-invariants for Zₚ²-extensions

- Numerical methods for biological flows laden with deformable capsules and solid particles

- The construction of blow-up solutions for some evolution equations

- Topics in discrete analysis

- Inviscid damping phenomena in some fluid models

- Gibbs measures and factor codes in symbolic dynamics

- Deep reinforcement learning agents for industrial control system design

- Structure-preserving numerical schemes for phase field models

- Enumerative geometry problems for Calabi-Yau manifolds with an action

Related Programs

Same specialization.

- Master of Science in Mathematics (MSc)

At the UBC Okanagan Campus

Further information, specialization.

Mathematicians use theoretical and computational methods to solve a wide range of problems from the most abstract to the very applied. UBC's mathematics graduate students work in many branches of pure and applied mathematics.

UBC Calendar

Program website, faculty overview, academic unit, program identifier, classification, social media channels, supervisor search.

Departments/Programs may update graduate degree program details through the Faculty & Staff portal. To update contact details for application inquiries, please use this form .

Nicholas Richardson

Having grown up outside of Toronto and completed my undergrad and master's degree at the University of Waterloo, I was ready to change the scenery and go study somewhere else. I joke that is it the farthest I could move without leaving Canada, but more truthfully it was the campus that felt "right...

Gabriel Currier

I quite like the kind of math that people do here, and enjoy working with my supervisors. The campus is also a beautiful place and the graduate student community is pretty laid back and friendly.

Nathan Lawrence

Many factors contributed to my choice of UBC for graduate school. I was attracted to Vancouver’s geographical similarities to Portland in the pacific northwest. Also, I have family in the area. However, most importantly, I was intrigued and inspired by my professors and advisors to take on the...

Start calling Vancouver “Home”

The metropolitan area is known for its diversity and UBC is one of the most international universities in Canada. This multicultural community means we have a wide range of restaurants, grocery stores, and events to provide a sense of belonging.

- Why Grad School at UBC?

- Application & Admission

- Info Sessions

- Research Projects

- Indigenous Students

- International Students

- Tuition, Fees & Cost of Living

- Newly Admitted

- Student Status & Classification

- Student Responsibilities

- Supervision & Advising

- Managing your Program

- Health, Wellbeing and Safety

- Professional Development

- Dissertation & Thesis Preparation

- Final Doctoral Exam

- Final Dissertation & Thesis Submission

- Life in Vancouver

- Vancouver Campus

- Graduate Student Spaces

- Graduate Life Centre

- Life as a Grad Student

- Graduate Student Ambassadors

- Meet our Students

- Award Opportunities

- Award Guidelines

- Minimum Funding Policy for PhD Students

- Killam Awards & Fellowships

- Policies & Procedures

- Information for Supervisors

- Dean's Message

- Leadership Team

- Strategic Plan & Priorities

- Vision & Mission

- Equity, Diversity & Inclusion

- Initiatives, Plans & Reports

- Graduate Education Analysis & Research

- Media Enquiries

- Newsletters

- Giving to Graduate Studies

Strategic Priorities

- Strategic Plan 2019-2024

- Improving Student Funding

- Promoting Excellence in Graduate Programs

- Enhancing Graduate Supervision

- Advancing Indigenous Inclusion

- Supporting Student Development and Success

- Reimagining Graduate Education

- Enriching the Student Experience

Initiatives

- Public Scholars Initiative

- 3 Minute Thesis (3MT)

- PhD Career Outcomes

- Great Supervisor Week

Universal Navigation

Universal navigation2.

- U of T's Statistical Sciences Rankings

- Collaborate With Us

Search form

- Research Areas

Mathematical Finance

- Our Research

- Publication Highlights

- Request new password

Main Content

Rotman Finance offers top-tier training from some of the world’s leading experts in fields such as risk management, corporate governance, delegated asset management, and behavioural finance. The PhD Program in Finance at the Rotman School trains prospective scholars to become highly skilled and innovative researchers and teachers, and to prepare them for careers as faculty members at premier academic institutions throughout the world.

Strengths of the Program

Rotman Finance offers top-tier training from some of the world's leading experts in fields such as risk management, corporate governance, delegated asset management, and behavioural finance. Students are assigned faculty mentors upon admission and work closely with faculty throughout the program. We train prospective scholars to become highly skilled and innovative researchers and teachers.

Admission to the Program

The PhD Program in Finance is looking for accomplished graduate and undergraduate students, with strong backgrounds in economics, finance, quantitative methods or related fields. Our admission is highly competitive. We encourage you to explore our website to discover what makes a successful candidate.

PhD Courses

Rotman PhD courses in finance stream provide a strong base in finance theory, economics and empirical methods. Preview course offerings here.

Program Structure and Requirements

The PhD program in Finance is an intense academic exercise providing effective training for an academic career. Our program includes required courses, comprehensive examinations, research paper presentations as well as the final dissertation.

Current PhD Students

The doctoral students in the Finance stream are a key strength of the Rotman School. After graduation, these students will go on to work at some of the world's top universities, helping to extend the reputation of Rotman and of the University of Toronto.

Meet the Rotman Finance faculty.

Faculty by Research Focus

As a PhD student you will work closely with faculty that share your research interests, are working on similar areas, or can provide a new perspective. Find out what our faculty members are currently working on here.

Risk Management Research Team

Exciting research opportunities at Rotman abound. Learn about a new research team in Risk Management.

ICPM Grant on Corporate Governance

Exciting research opportunities at Rotman abound. Learn about a new research project on Governance.

- APPLY TO MMF

- HIRE A QUANT

- CURRENT STUDENTS

- MMF E-LEARNING

MMF Applications Open October 1 2024

Applications for Fall 2025 entry will open on October 1 2024.

If you are interested in joining the MMF Program in the future, click here for more information on MMF’s application criteria, and be sure to follow MMF on LinkedIn , YouTube , Instagram , Twitter , Facebook , and Spotify for more updates throughout the year.

MMF Blog: 2023-24 Squarepoint Scholars

Last fall, the Squarepoint Foundation awarded scholarships to six Master of Mathematical Finance (MMF) grads from the class of 2024. They share what it means to be recognized.

MMF Ranked A Top-25 Quant Program By Risk.net

This year’s Risk.net annual ranking of the top Quant Finance Master’s programs has been released. MMF has moved up five places to 13th, and it’s still the only Canadian university to be in the top 25 programs listed.

Established in 1998 MMF remains at the forefront of training in quantitative finance. MMF is a boutique Program admitting a select number of students each year who will move through the Program as one cohort. The boutique nature of our Program means that students will learn in smaller class sizes, have the opportunity to build lasting bonds with their classmates and work in industry-like teams to complete projects and presentations.

If you have advanced math, statistics and programming skills you may be a great fit for Quantitative Finance. After 12 months of training your Master of Mathematical Finance degree prepares you to join a dynamic and growing industry

Financial Mathematics is one of the fastest growing areas of applied mathematics. Institutions that employ financial mathematicians are among the wealthiest and most sophisticated corporations in the world. A career in financial mathematics provides you with an invigorating combination of intellectual challenge and accelerated professional growth.

A fast-track Program

During your 12 months of training in MMF your superior quantitative skills are focused on the tools of financial mathematics for the initial 4 months of course work. You then move into a full-time 4 month internship with one of our industry partners. Finally, you will complete course work during the last 4 months of the Program.

Applied mathematics in business is as demanding and interesting as it is in the sciences, engineering or technology

You may join an institution (hedge fund, bank, government or pension plan) with multibillion-dollar investment portfolios. You may manage sophisticated hedge funds, complex derivatives, assess the risk in a bank’s commercial loans portfolio or develop original software applications for financial markets. There have been Nobel Prizes awarded for work in financial mathematics.

- My UCalgary

- Class Schedule

- UCalgary Directory

- Continuing Education

- Active Living

- Academic Calendar

- UCalgary Maps

- Close Faculty Websites List Viewing: Faculty Websites

- Cumming School of Medicine

- Faculty of Arts

- Faculty of Graduate Studies

- Faculty of Kinesiology

- Faculty of Law

- Faculty of Nursing

- Faculty of Nursing (Qatar)

Faculty of Science

- Faculty of Social Work

- Faculty of Veterinary Medicine

- Haskayne School of Business

- School of Architecture, Planning and Landscape

- School of Public Policy

- Schulich School of Engineering

- Werklund School of Education

- Future Students

- Explore programs

- How to apply

- Understanding graduate studies

- Indigenous graduate students

- Financing grad school

- International students

- Graduate Student life

- Current Students

- Indigenous Graduate Students

- Newly Admitted

- Graduate Orientation

- Pre-arrival

- Registration

- Annual Registration

- Concurrent Registration

- Flexible Grading Option (CG Grade)

- Confirmation of registration

- Course registration

- Leave of absence

- Registration status

- Studying at another university

- Updating personal information (included preferred name)

- Thesis-based students

Fees and funding

- Understanding your fees

- Paying your fees

- Funding options

- Payment plan

- Supervision

- Best practices and guidelines

- Conflict of interest

- Changing supervision

- Academic integrity

- Annual progress report

- Intellectual property

- Building a thesis

- Submit your thesis

- Conducting oral exams remotely

- Thesis defence

- Course-based Students

- Academic Integrity

- Sources of funding

- Payment Plan

- NEW: Term-Based Registration

- Completing my degree

- Important dates and resources

- Forms and documents

- Service Requests and eForms

- News, updates and events

- Find your Graduate Program Administrator

- Calendar Archives

- Award Opportunities

- Graduate Awards Database

- Award opportunities

- Doctoral Recruitment Scholarships

- Award Guide

- Step 1: Applying

- Looking for awards

- Eligibility

- Preparing your application

- Step 2: Receiving

- Accept/Decline your award

- Getting paid

- Step 3: Managing your award

- Renewing your award

- Award interruption

- Award Termination

- Policies and Regulations

- Regulations

- Contact the Scholarship Office

- My GradSkills

- Academic Success

- My GradSkills Partners

- Communication Skills

- Research Communications Feedback Sessions

- Oral communication

- Visual communication

- Written communication

- Experiential Learning

- Internships

- For employers

- For graduate students

- Finding an internship

- Making your internship a TTI

- Applying for a TTI

- For graduate supervisors

- Images of Research

- Three Minute Thesis

- 2024 UCalgary 3MT Finalists

- 2024 3MT Finals' Hosts and Judges

- Past Three Minute Thesis Videos

- Workshops and Resources

- Career planning and professional development resources

- My GradSkills Calendar

- My GradSkills Workshop Matrix

- Online/Virtual Training

- UCalgary Alumni Mentorship Program

- Exceptional scholars

- What I wish I knew

- FGS Services

- Supervisory Renewal

- Supports for graduate students

- Graduate Academic and International Specialists

- Graduate supervisors

- Thesis and candidacy exams

- Supervisor resources

- Maintaining your supervisor profile

- Supervisory privileges

- Leadership team

- FGS Council

- Committees of Council

- Minutes and meetings

- Website Feedback

Mathematics and Statistics

Doctor of Philosophy (PhD)

Thesis-based program

Program overview.

Doctoral students in mathematics and statistics contribute original thought to a discipline that has developed in richness and complexity from antiquity to the present day. Students will choose to focus on a pure mathematical area such as combinatorics, discrete mathematics, geometry, logic, number theory and cryptography, analysis or even mathematical physics; or on theoretical research in probability or statistics. Or you may choose to work in industrial mathematics and operations research, with application in biology and medicine, biomedical statistics, energy or financial markets, mathematical finance, actuarial science, geoscience, medical imaging, software and computer applications, and big data analysis.

Completing this program

- Mathematics Courses: Topics may include measure and integration, analysis, algebraic geometry, number theory, scientific modelling and more.

- Statistics Courses: Topics may include probability, estimation, hypothesis testing and more.

- Seminars: In addition to required courses, students register in a research seminar in either actuarial science, biostatistics, mathematics, or statistics (depending on student's specialization).

- Presentations: Students are required to give three invited or contributed presentations during the degree program.

- Preliminary Examinations: Doctoral students must pass written Preliminary Examinations no later than 18 months from the beginning of their program and before completing Candidacy.

- Candidacy: Students will complete both oral and written candidacy exams.

- Thesis: Students will be required to submit and defend an original research thesis.

Specializations

- Mathematics

- Biostatistics (Interdisciplinary)

- Actuarial Science

- Mathematical Finance

Universities and colleges, Government of Canada (Canadian citizens only), banking and finance, information technology and cybersecurity, energy, risk management and insurance, health, pharmaceuticals, environmental management, quantum computing, data analytics, medical imaging.

A PhD in math and statistics is usually considered a final degree.

Students are required to prepare a thesis and successfully defend in an open oral defense.

Eight courses

Learn more about program requirements in the Academic Calendar

Classroom delivery

Time commitment.

Four years full-time; six years maximum

A supervisor is required, but is not required prior to the start of the program

See the Graduate Calendar for information on fees and fee regulations, and for information on awards and financial assistance .

Virtual Tour

Explore the University of Calgary (UCalgary) from anywhere. Experience all that UCalgary has to offer for your graduate student journey without physically being on campus. Discover the buildings, student services and available programs all from your preferred device.

Supervisors

Learn about faculty available to supervise this degree. Please note: additional supervisors may be available. Contact the program for more information.

Tracey Balehowsky

Kristine Bauer

Karoly Bezdek

Elena Braverman

Thierry Chekouo

Clifton Cunningham

Rob Deardon

Wenjun Jiang

Wenyuan Liao

Admission Requirements

A minimum of 3.0 GPA on a 4.0 point system, over the past two years of full-time study (a minimum of 10 full-course equivalents or 60 units) of the undergraduate degree.

Minimum education

A master’s degree or equivalent in the subject of the specialization.

Work samples

Reference letters, test scores, english language proficiency.

An applicant whose primary language is not English may fulfill the English language proficiency requirement in one of the following ways:

- Test of English as a Foreign Language (TOEFL ibt) score of 97 (Internet-based, with no section less than 20).

- International English Language Testing System (IELTS) score of 7.0 (minimum of 6.0 in each section).

- Pearson Test of English (PTE) score of 68, or higher (Academic version).

- Canadian Academic English Language test (CAEL) score of 70 (70 in some sections – up to the program, 60 in all other).

- Academic Communication Certificate (ACC) score of A- in one or two courses (up to the program), “B+” on all other courses.

- Cambridge C1 Advanced or Cambridge C2 Proficiency minimum score of 191.

*Please contact your program of interest if you have any questions about ELP requirements.

For admission on September 1:

- Canadians and permanent residents: Jan. 15 application deadline

- International students: Jan. 15 application deadline

If you're not a Canadian or permanent resident, or if you have international credentials, make sure to learn about international requirements

Are you ready to apply?

Learn more about this program, department of mathematics and statistics.

Mathematical Science Room 462 612 Campus Place NW Calgary, AB T2N 4V8 403.220-6299

Contact the Graduate Program Administrator

Visit the departmental website

Biological Sciences, Room 540 2500 University Drive NW Calgary, AB T2N 1N4 403.220.8600

Visit the Faculty of Science website

Learn more about UCalgary by taking a virtual tour

Related programs

If you're interested in this program, you might want to explore other UCalgary programs.

Course-based MSc

Thesis-based MSc

Community Health Sciences

Computer science.

Thesis-based MA

Course-based MA

Electrical and Software Engineering

Course-based MEng

Course-based MEng (Software)

Thesis-based MEng

Thesis-based MSc

Medical Science

Physics and astronomy, veterinary medicine, curious about the university of calgary.

Located in the nation's most enterprising city, we are a living, growing and youthful institution that embraces change and opportunity with a can-do attitude.

Mathematical Finance

“I really like the culture at Waterloo. It’s so inclusive — you get to meet a lot of students from different backgrounds and a lot of other people who are passionate about math. Interacting with them on a daily basis is really exciting.”

What is Mathematical Finance?

Mathematical Finance is an elite program designed for students with outstanding mathematical skills who want a career in high-level quantitative finance. In one of the most advanced undergraduate finance programs in the world, you’ll take courses in corporate finance, real analysis, asset liability management and forecasting. The program delivers solid mathematical training and a modern understanding of the financial market to prepare you for the broad field of banking and finance after graduation

- Available as a co-op or regular program

- There are 40 courses for this degree

- Graduate with a Bachelor of Mathematics, major in Mathematical Finance

First-year courses

- MATH 135/145 - Classical Algebra

- MATH 137/147 - Calculus 1

- CS 115/135/145 - Computer Science

- A communications course

- One non-math elective

See full courses in our undergraduate calendar .

Upper-year courses

- ACTSC 372 - Corporate Finance

- PMATH 351 - Real Analysis

- STAT 443 - Forecasting

- ACTSC 445 - Quantitative Enterprise Risk Management

Sample co-op jobs

- Quantitative Analyst, BMO

- Product Manager Assistant, AVIVA — COFCO Life Insurance

- Portfolio Analyst — GCM — Derivatives, CPP Investment Board

- Audit Co-op Student — Market Risk, Scotiabank

- Quantitative Analyst, Manulife Financial

Sample careers

- Derivatives Analyst, Canada Pension Plan Investment Board

- Director, International Strategy and Banks Research, China Construction Bank International

- Finance Operation Analyst, GE Canada Inc.

- Investment Analyst, Dancap Global Asset Management

- Treasury Manager, Avolon

Student stories

Nidhi is double major in Mathematical Finance and Statistics. She is from United Arab Emirates and was attracted to study at the University of Waterloo because of the institution's international reputation in math and co-op. She's worked as an Accounting Analyst, Financial Analyst and Actuarial Analyst and hopes to hone these experiences to work in finance-related careers. She's a member of the UW Finance Club and UW Ballroom Club and enjoys rock climbing, crocheting ,art and reading.

Meet Sabrina

While at the University of Waterloo, Sabrina has taken advantage of the global opportunities that the school has to offer - including a co-op term in Switzerland. When on-campus in Waterloo, she is part of the Archery Club and in her spare time she likes to practice and play the piano.

Similar programs

If you're interested in Mathematical Finance, you may also be interested in these programs that offer similar courses or career opportunities:

- Actuarial Science with a Finance Option

- Mathematics/Business Administration

- Mathematics/Financial Analysis and Risk Management

- Pure Mathematics

How to apply

Apply to Mathematics for admissions consideration. If admitted, speak with an academic advisor after first year to declare Mathematical Finance as a major.

Find out more information on the steps to apply .

Explore more mathematics and computer science programs .

U of T Home | Graduate Faculty Members A-Z | A-Z Index

SGS Home

School of Graduate Studies (SGS) Calendar

Mathematical finance, mathematical finance: introduction, faculty affiliation.

Arts and Science

Degree Programs

Financial engineering is one of the fastest-growing areas of applied mathematics.

Contact and Address

Web: www.mmf.utoronto.ca Email: [email protected] Telephone: (416) 946-5206

Mathematical Finance Program University of Toronto Suite 17030, 700 University Avenue Toronto, Ontario M5G 1Z5 Canada

Mathematical Finance: Graduate Faculty

Full members, associate members, mathematical finance: mathematical finance mmf, master of mathematical finance, program description.

In the MMF program, students reshape their existing analytical abilities with the help of senior academics in mathematics, computer science, statistics, and engineering who have experience with the tools of mathematical finance. This cross-disciplinary approach develops graduates with a richer, more innovative approach to applied mathematics in real-world situations. Some of the faculty are seasoned practitioners from the financial industry while others are from leading firms in the financial software industry, developing applications around requirements like risk management, portfolio analysis, and the pricing of advanced derivatives.

The heart of the program is the four-month internship or campus project. Working on real financial projects, students learn to integrate and apply theoretical knowledge gained earlier in the program. In the internship, students team up with employees of the sponsoring firm to experience how financial mathematics impacts the decision-making processes of a financial services organization.

Minimum Admission Requirements

Applicants are admitted under the General Regulations of the School of Graduate Studies. Applicants must also satisfy the graduate unit's additional admission requirements stated below.

Applicants must have an appropriate bachelor's degree in a quantitative, technical discipline with a minimum of a mid-B standing in the final two years.

Applicants whose primary language is not English and who graduated from a university where the language of instruction was not English must demonstrate proficiency in the English language through the successful completion of the Test of English as a Foreign Language (TOEFL) with minimum scores as follows:

paper-based TOEFL exam: 580 and 5 on the Test of Written English (TWE)

Internet-based TOEFL exam: 93/120 and 22/30 on the writing and speaking sections

Applicants must also show evidence of strong mathematical ability. Appropriate workplace experience will be considered in lieu of formal education.

Admission to the program is competitive. Those accepted into the program will normally have achieved a standing considerably higher than the minimum mid-B standing or have demonstrated exceptional ability through appropriate workplace experience.

Applicants must satisfy the Admissions Committee of their ability to do rigorous quantitative analysis at an advanced level. The broad background required for this program makes it likely that many strong applicants will not possess all the background requirements. It is expected that applicants will have extra depth in certain areas and need to do additional work in others. Admission may be conditional upon the applicant's satisfactory completion of the required background material.

Applicants should submit a written statement of approximately 300 words outlining their objectives for entering the program. Applicants should also explain how their background is appropriate. An interview may be required.

Inquiries about part-time options for the program should be addressed to the Program Director.

Program Requirements

The program of study begins in mid-August and includes a four-month internship during the second session. Students will be responsible for obtaining their own internship. In cases where the student is taking a leave of absence from an appropriate job, it is expected that the student will return to this job for the internship. In all cases, the Director must approve the placement.

Students will proceed through the program as a group, following a common course of study. The course of study will be fully integrated and computer-laboratory intensive. Course projects and assignments will be designed to integrate the material learned from a variety of the courses and to utilize it in a practical context. Excellent communication and presentation skills will be emphasized in both the oral and written components of the projects.

Students must complete all required courses listed below.

Program Length

3 sessions full-time (typical registration sequence: F/W/S)

3 years full-time

Mathematical Finance: Mathematical Finance MMF Courses

Courses are offered in modules. A module will consist of a four-week unit with a minimum of three contact hours per week, or its equivalent. A large portion of the learning for the module will take place outside of class through carefully designed computer projects and group study. The courses have been packaged in units of one, two, three, four, or five modules, and the course weight will be equal to the number of modules; for example, a course with three modules will have a weight of three credit hours. Six modules will be considered the equivalent of one full-course equivalent in a standard format. The third digit of the four-digit course number determines the course weight.

Third Digit Notation

1 = one-third of a half course 2 = two-thirds of a half course 3 = one half course 4 = two-thirds of a full course 5 = one full course

Required Courses

Additional courses.

0 Course that may continue over a program. The course is graded when completed.

- Programs at a Glance

- Programs by Graduate Unit

- Programs by SGS Division

- Search Collaborative Specializations

- Search Combined Degree Programs

- Search Graduate Faculty Members

- Glossary of Degrees and Honorifics

- Sessional Dates

- Important Notices

- General Regulations

- Degree Regulations

- Fee Regulations

- Financial Support

- Dean's Welcome

- Mission Statement

- Graduate Studies at the University of Toronto

- PDF Calendar and Archives

- My UCalgary

- Class Schedule

- UCalgary Directory

- Continuing Education

- Active Living

- Academic Calendar

- UCalgary Maps

- Close Faculty Websites List Viewing: Faculty Websites

- Cumming School of Medicine

- Faculty of Arts

Faculty of Graduate Studies

- Faculty of Kinesiology

- Faculty of Law

- Faculty of Nursing