English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- TESLA, INC.

- AMD (ADVANCED MICRO DEVICES)

- NIPPON ACTIVE VALUE FUND PLC

- NVIDIA CORPORATION

- AMAZON.COM, INC.

- TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Trend-Following Stocks

- Undervalued stocks

- Quality stocks at a reasonable price

- Dividend Kings

- Solar energy

- E-Commerce & Logistics

- Artificial Intelligence

- Cloud Computing

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- The genomic revolution

- Financial Data

- Space Exploration

- Europe's family businesses

- Millennials

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

The Gym Group plc

Gb00bzbx0p70, leisure & recreation.

- The Gym Group plc Reports Earnings Results for the Full Year Ended December 31, 2023

The Gym Group plc reported earnings results for the full year ended December 31, 2023. For the full year, the company reported sales was GBP 204 million compared to GBP 172.9 million a year ago. Net loss was GBP 8.4 million compared to GBP 19.3 million a year ago.

Basic loss per share from continuing operations was GBP 0.047 compared to GBP 0.109 a year ago.

Latest news about The Gym Group plc

Chart the gym group plc.

Company Profile

Income statement evolution, ratings for the gym group plc, analysts' consensus, eps revisions, annual profits - rate of surprise, sector gyms, fitness and spa centers.

- Stock Market

- News The Gym Group plc

- Markets Data

GYM Group PLC

Select symbol.

- United Kingdom

- GYM:LSE London Stock Exchange

- 4GY:STU Stuttgart Stock Exchange

- 4GY:BER Berlin Stock Exchange

- 4GY:MUN Munich Stock Exchange

- 4GY:DEU German Composite

- 4GY:FRA Frankfurt Stock Exchange

- 4GY:DUS Dusseldorf Stock Exchange

- United States

- GYYMF:PKC OTC Pink - Current Information

- Add to watchlist

- Add to portfolio

- Add an alert

- Price (GBX) 116.05

- Today's Change 0.05 / 0.04%

- Shares traded 29.49k

- 1 Year change +14.45%

- Beta 2.3198

Apply Cancel Actions

Your alerts done, apply cancel comparisons, suggested comparisons.

- Hollywood Bowl Group PLC

- Facilities By ADF PLC

- FT News FT News

- Announcements Announcements

- Events & Activity Events & Activity

Athleisure shares appear out of shape

Sales have recovered from the pandemic, but valuations are sluggish

Russian elections and St Patrick’s Day celebrations

Vladimir Putin expected to win fifth term in office, while much of the world toasts Ireland’s patron saint

Investors, don’t waste an economic crisis

Turn market or economic turbulence to your advantage

Taiwan goes to the polls

Also, a bulge of Wall Street banks report and the Australian Open gains a day of tennis matches

Crunch time at the Nato summit

Plus, UK chancellor and Bank of England governor address City businesses, and US bank earnings

Hôtel Dame des Arts: a chic arrival on the Rive Gauche

A former Holiday Inn has metamorphosed into a Raphael Navot-designed beauty that oozes Left Bank cool

- Holding(s) in Company May 13 2024

- Result of AGM May 09 2024

- Total Voting Rights May 02 2024

- Savills appointed to advise on expansion plans Apr 26 2024

- Notice of AGM Apr 11 2024

- Annual Financial Report Mar 15 2024

- The Gym Group PLC 2023 Full Year Results Mar 13 2024

- Pre-close trading update Jan 10 2024

- Notice of Pre-close Trading Update Jan 02 2024

- Director/PDMR Shareholding Dec 08 2023

- GYM:LSE trading volume exceeds daily average by +77.87% May 14 2024

- GYM:LSE price moved over -1.22% to 113.80 May 13 2024

- GYM:LSE price falls below 50-day moving average to 113.00 at 09:00 BST May 14 2024

- GYM:LSE price falls below 50-day moving average to 112.60 at 09:01 BST May 13 2024

Key statistics

Investors chronicle view.

- Sports & Recreation ›

Sports & Fitness

Industry-specific and extensively researched technical data (partially from exclusive partnerships). A paid subscription is required for full access.

Revenue of The Gym Group in the UK 2020

Revenue of the gym group health clubs in the united kingdom (uk) in 2019 and 2020 (in million u.s. dollars).

- Immediate access to 1m+ statistics

- Incl. source references

- Download as PNG, PDF, XLS, PPT

Additional Information

Show sources information Show publisher information Use Ask Statista Research Service

United Kingdom

2019 and 2020

Other statistics on the topic

COVID-19: estimate time for return to gym/exercise classes in the U.S. 2020

COVID-19: Share of people who would return to gym/exercise classes in the U.S. 2020

Impact of COVID on the U.S. fitness industry 2020

To download this statistic in XLS format you need a Statista Account

To download this statistic in PNG format you need a Statista Account

To download this statistic in PDF format you need a Statista Account

To download this statistic in PPT format you need a Statista Account

As a Premium user you get access to the detailed source references and background information about this statistic.

As a Premium user you get access to background information and details about the release of this statistic.

As soon as this statistic is updated, you will immediately be notified via e-mail.

… to incorporate the statistic into your presentation at any time.

You need at least a Starter Account to use this feature.

- Immediate access to statistics, forecasts & reports

- Usage and publication rights

- Download in various formats

You only have access to basic statistics. This statistic is not included in your account.

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

Business Solutions including all features.

Other statistics that may interest you

- Health/Fitness club companies - Atlantic Club Inc. revenue 2012-2019

- Health/Fitness club companies - The Bay Club Company revenue 2012-2019

- Health/Fitness club companies - Fitness Formula Clubs revenue 2016-2019

- Health/Fitness club companies - Anytime Fitness revenue 2012-2017

- Health/Fitness club companies - Fitness First UK revenue 2012-2015

- U.S. fitness center / health club memberships 2000-2019

- Personal training market size in the United Kingdom (UK) 2011-2022

- U.S. health club industry revenue 2000-2020

- Yoga and pilates products & services market share in the U.S. 2015

- Operating expenses of Life Time Fitness 2009-2014, by segment

- Number of gym members in the UK 2019-2021

- Number of personal trainers in the United Kingdom (UK) 2011-2022

- Gym, health & fitness club industry market size in the United Kingdom (UK) 2012-2022

- Number of gyms in the United Kingdom (UK) 2011-2022

- UK: number of gyms in the largest low-cost health and fitness groups 2013-2019

- UK: sales revenues in the low-cost fitness group sector 2013-2018

- UK: share of the low cost fitness market in 2018, by fitness group

- UK: number of clubs in largest health and fitness groups in 2015, by fitness group

- Health/Fitness club companies -Virgin Active revenue 2012-2014

- Health/Fitness club companies - Fusion Lifestyle UK revenue 2012-2014

- Participants in wrestling in the U.S. from 2006 to 2017

- Number of U.S. health clubs & fitness centers 2008-2022

- Brazil: people who practice sports 2015, by sports type

- Health/fitness clubs members in Europe 2010-2022

- Smart Fit: clubs in Latin America 2022, by country

- Distribution of gym memberships in Germany 2016

- Revenue of gym and fitness centers in Australia 2004-2019

- Total revenue of beauty farms in China until 2015

- Health/Fitness club companies - Groupe DG / Keep Cool revenue 2014-2019

- Health/Fitness club companies - World Gym Taiwan revenue 2012-2015

- Health/Fitness club companies - Talwalkars Better Value Fitness revenue 2012-2016

- Number of Life Time Fitness memberships 2009-2014

- Number of visits to Life Time Fitness centers 2009-2014

- Value of the European health and fitness industry 2017-2022

- Fitness club employment in the United States 2012-2023

- Market share of global health and fitness club industry 2021-2030

- Gym, health & fitness club industry revenue in the United States 2010-2023

- Fitness industry enterprises in the United States 2023

- Health and fitness clubs in European countries 2020

- Gym membership increase in the U.S. 2010-2019, by gender

- Number of health club visits in the U.S. 2019

Other statistics that may interest you Statistics on

About the industry

- Premium Statistic Health/Fitness club companies - Atlantic Club Inc. revenue 2012-2019

- Premium Statistic Health/Fitness club companies - The Bay Club Company revenue 2012-2019

- Basic Statistic Health/Fitness club companies - Fitness Formula Clubs revenue 2016-2019

- Premium Statistic Health/Fitness club companies - Anytime Fitness revenue 2012-2017

- Basic Statistic Health/Fitness club companies - Fitness First UK revenue 2012-2015

- Premium Statistic U.S. fitness center / health club memberships 2000-2019

- Basic Statistic Personal training market size in the United Kingdom (UK) 2011-2022

- Premium Statistic U.S. health club industry revenue 2000-2020

- Premium Statistic Yoga and pilates products & services market share in the U.S. 2015

- Premium Statistic Operating expenses of Life Time Fitness 2009-2014, by segment

About the region

- Premium Statistic Number of gym members in the UK 2019-2021

- Premium Statistic Number of personal trainers in the United Kingdom (UK) 2011-2022

- Premium Statistic Gym, health & fitness club industry market size in the United Kingdom (UK) 2012-2022

- Premium Statistic Number of gyms in the United Kingdom (UK) 2011-2022

- Premium Statistic UK: number of gyms in the largest low-cost health and fitness groups 2013-2019

- Premium Statistic UK: sales revenues in the low-cost fitness group sector 2013-2018

- Basic Statistic UK: share of the low cost fitness market in 2018, by fitness group

- Premium Statistic UK: number of clubs in largest health and fitness groups in 2015, by fitness group

- Basic Statistic Health/Fitness club companies -Virgin Active revenue 2012-2014

- Premium Statistic Health/Fitness club companies - Fusion Lifestyle UK revenue 2012-2014

Selected statistics

- Premium Statistic Participants in wrestling in the U.S. from 2006 to 2017

Other regions

- Premium Statistic Number of U.S. health clubs & fitness centers 2008-2022

- Premium Statistic Brazil: people who practice sports 2015, by sports type

- Premium Statistic Health/fitness clubs members in Europe 2010-2022

- Premium Statistic Smart Fit: clubs in Latin America 2022, by country

- Premium Statistic Distribution of gym memberships in Germany 2016

- Premium Statistic Revenue of gym and fitness centers in Australia 2004-2019

- Premium Statistic Total revenue of beauty farms in China until 2015

- Premium Statistic Health/Fitness club companies - Groupe DG / Keep Cool revenue 2014-2019

- Basic Statistic Health/Fitness club companies - World Gym Taiwan revenue 2012-2015

- Basic Statistic Health/Fitness club companies - Talwalkars Better Value Fitness revenue 2012-2016

Related statistics

- Premium Statistic Number of Life Time Fitness memberships 2009-2014

- Premium Statistic Number of visits to Life Time Fitness centers 2009-2014

- Premium Statistic Value of the European health and fitness industry 2017-2022

- Basic Statistic Fitness club employment in the United States 2012-2023

- Premium Statistic Market share of global health and fitness club industry 2021-2030

- Basic Statistic Gym, health & fitness club industry revenue in the United States 2010-2023

- Premium Statistic Fitness industry enterprises in the United States 2023

- Basic Statistic Health and fitness clubs in European countries 2020

- Basic Statistic Gym membership increase in the U.S. 2010-2019, by gender

- Basic Statistic Number of health club visits in the U.S. 2019

Further related statistics

- Basic Statistic Overweight prevalence in England 2000-2021, by gender

Further Content: You might find this interesting as well

- Overweight prevalence in England 2000-2021, by gender

Investor Dialogue: Basic Fit, The Gym Group, & Discount Gyms

Inpractise.com/articles/ investor-dialogue-basic-fit-the-gym-group-and-discount-gyms, why is this interview interesting.

Investor Dialogues is a new format at In Practise. We invite 3-5 professional investors from our audience to participate in a recorded discussion on a specific company. Each participant is anonymised and named analyst 1-X in the transcript.

If you're interested in participating, please ensure your company watchlist is updated on your settings page and directly reach out to us if you're particularly interested in joining discussions on specific companies.

Disclaimer: This interview is for informational purposes only and should not be relied upon as a basis for investment decisions. In Practise is an independent publisher and all opinions expressed by guests are solely their own opinions and do not reflect the opinion of In Practise.

The first thing we could discuss is the addressable market. Clearly, part of the bull case is that it’s huge. What is your sense of the potential limitations in that market size?

Analyst 1: From my understanding, the core markets for Basic-Fit is Benelux and France, where they are highly penetrated, at least way more penetrated than in other markets. If you compare the penetration of the European market, in terms of low-cost gyms and overall gym penetration, versus the US and probably the UK market, penetration is lower. I don’t want to base the whole thesis around the penetration of the low-cost gym market, but I would like to better understand the advantages that Basic-Fit has against other players in the market and if the market and tailwinds are enough to support more growth.

That was my sense. The fitness penetration in the US is around 20%. Part of the bull case of Basic-Fit is Europe getting there. Do you think there are any limitations why Europe, France and these different cultures in fitness, will get there?

Analyst 2: Comparing Gym and Basic-Fit, the growth runways are clearly different. I think the unit economics are, actually, very similar but the membership growth rates and the duration of growth are likely superior for Basic-Fit than Gym. There are a couple of things there and one is the obvious point about lower starting penetration levels; in aggregate, probably 12% versus 15% of Basic-Fit versus Gym’s markets. Then there is this opportunity to be the dominant market leader, versus the UK’s duopolistic structure which makes Planet Fitness-type market shares potentially more achievable in Europe.

You’ve had Planet, essentially, single-handedly driving the US’s penetration, whereas you have a number of players in the UK. In some markets, like the Netherlands, you have got more duopolistic structures. The third element that lends itself to thinking about these growth runways is, essentially, an attitude, favoring geographic expansion for businesses like PureGym and Basic-Fit and not so much Gym Group.

When I’ve tried to think about the valuation premium of Basic-Fit versus Gym, it largely has to be judged in that context. It does strike me that expanding into new markets is more valuable and lower cost when the portion of new joiners that are expanding the TAM is very high. They’re not prizing them away from competitors.

Is that also because, in the UK, you’ve basically got the Gym Group and PureGym aggressively expanding. It’s almost like a land grab, with these two, it seems?

Analyst 2: Yes, I think it’s a land grab but, obviously, Gym Group is confined, really, to the UK and being a duopolistic participant in the UK. I do think that you have clearly seen the top one or two pulling away in many, many markets and there is this real difficulty in getting beyond 50 sites and these smaller, low-cost players just seem to crumble. Meanwhile, the market leaders start to press this very hard to replicate lever, which is multi-site membership premiums and just reinvesting that entirely back into the cost proposition, so the distance just widens and widens.

Are there numbers on how many people use multiple gyms?

Analyst 3: About a quarter.

Analyst 4: I think it’s a little higher now. In 2016, it was 25%.

Analyst 2: I think it’s 27% in the UK and it’s £7 on a £20 membership and it’s 100% margin. It’s pretty meaningful.

How do you look at post-Covid normalization of home workouts potentially eating into market share or changing that consumer behavior, that could reduce or impact the TAM?

Analyst 3: I think there are a couple of things. I think that home workouts are, generically, not as much of a threat in Europe as they are in the US. If you look at the footage of an average home in the UK and Europe, versus the US, there is just not as much space to do a home workout. The second thing is, if you look at GYM and joining behavior, over the last two years, every time the lockdowns ended, you’ve seen a huge increase in membership.

I think, probably, what ends up happening is that working out at home and working out at the gym are complementary. There are a lot of things you can do at the gym that you can’t do at home. I don’t think it is a replacement experience.

Analyst 4: I would add two things to that. The first thing is, in the US, the average household only spends $150 on sports equipment so this idea that everyone is going to have a Peloton or buy all the weights, is kind of crazy. Secondly, these low-cost gyms are, basically, on-premise fitness equipment rental businesses. You have access to all the cardio and weight equipment, for €20 a month. If you were to recreate that experience at home, firstly, you need the space and, secondly, it would cost you tens of thousands of dollars.

If you are working out 10 times a month, for €20 a month, that’s effectively €2 per workout; you’re never going to be able to recreate that experience, at that cost, within your home. The spend is not there, for a household, to get the content within your home and the space is not there. I don’t really see it being a threat, over the long term, unless everyone works out in the metaverse.

In your mind, five years forward, Basic-Fit new unit growth has plummeted, much more than you expected. What do you think the main reasons would be?

Analyst 4: Maybe the pandemic continuing. The problem with that analysis is that it assumes consumer behavior changes and that takes a long time. I don’t think that happens in five years. For it to happen, there would have to be some sort of macro catastrophe or another pandemic or worsening of Covid. Other than that, for some reason, capital markets dry up, Basic-Fit stock plummets, it takes a long time for members to come back and they won’t have the capital to reinvest into new store growth. But I don’t see that happening.

It would either be just a really bad recession or some external pandemic that would affect their ability to open stores.

How reliant are they on capital markets? Obviously, they’ve got some debt out and need the leases, but is that a potential limitation if we see the cycle turn and they can’t finance that?

Analyst 3: They’re going to rely on the capital markets until the end of 2023 and, after that, they should be self-funding, unless they take the pace of growth up another level.

Related Content

The Gym Group: Clustering Units & Post-Covid Customer Behaviour

Founder of the gym group, the gym group: risk from anytime fitness, ènergie, & franchise chains, basic fit france: gym market challenges, former managing director at fitness park, basic-fit, the gym group & discount gym economics, copyright notice.

This document may not be reproduced, distributed, or transmitted in any form or by any means including resale of any part, unauthorised distribution to a third party or other electronic methods, without the prior written permission of IP 1 Ltd.

IP 1 Ltd, trading as In Practise (herein referred to as "IP") is a company registered in England and Wales and is not a registered investment advisor or broker-dealer, and is not licensed nor qualified to provide investment advice.

In Practise reserves all copyright, intellectual and other property rights in the Content. The information published in this transcript (“Content”) is for information purposes only and should not be used as the sole basis for making any investment decision. Information provided by IP is to be used as an educational tool and nothing in this Content shall be construed as an offer, recommendation or solicitation regarding any financial product, service or management of investments or securities.

© 2024 IP 1 Ltd. All rights reserved.

Subscribe now

Subscribe to access hundreds of interviews and primary research

- Market data

- Connectivity

- News and events

- Investor Relations

Presentations

- Financial statements

- Annual reports

- Reporting and presentations

- 4Q 2023 Earnings presentation

- 3Q 2023 Earnings presentation

- MOEX Strategy 2028 webcast transcript

- Webcast recording on MOEX Strategy 2028

- 2Q 2023 Earnings presentation

- 1Q 2023 Earnings presentation

- 4Q 2022 Earnings presentation

- 3Q 2022 Earnings presentation

- 2Q 2022 Earnings presentation

- Investor presentation, March 2022

- Investor presentation, February 2022

- Investor presentation, January 2022

- Investor presentation, December 2021

- Investor presentation, November 2021

- Investor presentation, October 2021

- Investor presentation, September 2021

- MOEX Global Business: Equities Breakthrough

- Investor presentation, August 2021

- Investor presentation, July 2021

- Investor presentation, June 2021

- Investor presentation, May 2021

- Investor presentation, April 2021

- Investor presentation, March 2021

- Investor presentation, February 2021

- Marketplace (Finuslugi.ru) update

- Investor presentation, January 2021

- Investor presentation, December 2020

- Investor presentation, November 2020

- Investor presentation, October 2020

- Investor presentation, September 2020

- Investor presentation, August 2020

- Investor presentation, July 2020

- Investor presentation, June 2020

- Investor presentation, May 2020

- Investor presentation, April 2020

- Investor presentation, March 2020

- Investor presentation, February 2020

- Investor presentation, January 2020

- Investor presentation, December 2019

- Investor presentation, November 2019

- Moscow Exchange Group’s Strategy 2024

- Investor presentation, October 2019

- Investor presentation, September 2019

- Investor presentation, August 2019

- Investor presentation, July 2019

- Investor presentation, June 2019

- Investor presentation, May 2019

- Investor presentation, April 2019

- Investor presentation, March 2019

- Investor presentation, February 2019

- Investor presentation, January 2019

- Investor presentation, December 2018

- Investor presentation, November 2018

- Investor presentation, October 2018

- Investor presentation, September 2018

- Investor presentation, August 2018

- Investor presentation, July 2018

- Investor presentation, June 2018

- Investor presentation, May 2018

- Investor presentation, April 2018

- Investor presentation, March 2018

- Investor presentation, February 2018

- Investor presentation, January 2018

- Investor presentation, December 2017

- Investor presentation, November 2017

- Investor presentation, October 2017

- Investor presentation, September 2017

- Investor presentation, August 2017

- Investor presentation, July 2017

- Investor presentation, June 2017

- Investor presentation, May 2017

- Investor presentation, April 2017

- Investor presentation, March 2017

- Investor presentation, February 2017

- Investor presentation, January 2017

- Investor presentation, December 2016

- Investor presentation, November 2016

- Investor presentation, October 2016

- Investor presentation, September 2016

- Investor presentation, August 2016

- Investor presentation, July 2016

- Investor presentation, June 2016

- Investor presentation, May 2016

- Investor presentation, April 2016

- Investor presentation, March 2016

- Investor presentation, February 2016

- Investor presentation, January 2016

- Investor presentation, December 2015

- Investor presentation, November 2015

- Investor presentation, October 2015

- Investor presentation, September 2015

- Investor presentation, August 2015

- Investor presentation, July 2015

- Investor presentation, June 2015

- Investor presentation, May 2015

- Investor presentation, April 2015

- Investor presentation, March 2015

- Deutsche Bank dbAccess CEEMEA Conference (Jan 21-23)

- Investor presentation, December 2014 (pdf, 1 Mb)

- Investor presentation, November 2014 (pdf, 1 Mb)

- Investor presentation, October 2014 (pdf, 1 Mb)

- Investor presentation, August 2014 (pdf, 1 Mb)

- Investor presentation, July 2014 (pdf, 1 Mb)

- Investor conference Renaissance Capital, 23-25 June (pdf, 930 Kb)

- Investor presentation (May) (pdf, 1 Mb)

- Business breakfast: Analyst day, April 2014 (pdf, 1 Mb)

- Non-deal road-show presentation, March 31-April 9, 2014 (pdf, 1 Mb)

- Investor presentation, February 2014 (pdf, 739 Kb)

- Investor presentation, December 2013 (pdf, 750 Kb)

- Investor presentation, November 2013 (pdf, 800 Kb)

- Non-deal road show presentation, September 24-30, 2013 (pdf, 690 Kb)

- Investor presentation, August 2013 (pdf, 1 Mb)

- Investor presentation, July 2013 (pdf, 970 Kb)

- Investor presentation, June 2013 (pdf, 1 Mb)

- Investor presentation, April 2013 (pdf, 900 Kb)

- Investor presentation, December 2018 (pdf, 1 Mb)

- Investor presentation, November 2018 (pdf, 1 Mb)

- Investor presentation, October 2018 (pdf, 1 Mb)

- Investor presentation, September 2018 (pdf, 1 Mb)

- Investor presentation, August 2018 (pdf, 1 Mb)

- Investor presentation, July 2018 (pdf, 1 Mb)

- Investor presentation, June 2018 (pdf, 1 Mb)

- Investor presentation, May 2018 (pdf, 1 Mb)

- Investor presentation, April 2018 (pdf, 1 Mb)

- Investor presentation, March 2018 (pdf, 1 Mb)

- Investor presentation, February 2018 (pdf, 1 Mb)

- Investor presentation, January 2018 (pdf, 1 Mb)

- Investor presentation, December 2017 (pdf, 1 Mb)

- Investor presentation, November 2017 (pdf, 1 Mb)

- Investor presentation, October 2017 (pdf, 1 Mb)

- Investor presentation, September 2017 (pdf, 1 Mb)

- Investor presentation, August 2017 (pdf, 1 Mb)

- Investor presentation, July 2017 (pdf, 1 Mb)

- Investor presentation, June 2017 (pdf, 1 Mb)

- Investor presentation, May 2017 (pdf, 1 Mb)

- Investor presentation, April 2017 (pdf, 1 Mb)

- Investor presentation, March 2017 (pdf, 1 Mb)

- Investor presentation, February 2017 (pdf, 1 Mb)

- Investor presentation, January 2017 (pdf, 1 Mb)

- Investor presentation, December 2016 (pdf, 1 Mb)

- Investor presentation, November 2016 (pdf, 1 Mb)

- Investor presentation, October 2016 (pdf, 1 Mb)

- Investor presentation, September 2016 (pdf, 1 Mb)

- Investor presentation, August 2016 (pdf, 1 Mb)

- Investor presentation, July 2016 (pdf, 1 Mb)

- Investor presentation, June 2016 (pdf, 930 Kb)

- Investor presentation, May 2016 (pdf, 1 Mb)

- Investor presentation, April 2016 (pdf, 1 Mb)

- Investor presentation, March 2016 (pdf, 1 Mb)

- Investor presentation, February 2016 (pdf, 1 Mb)

- Investor presentation, January 2016 (pdf, 1 Mb)

- Investor presentation, December 2015 (pdf, 1 Mb)

- Investor presentation, November 2015 (pdf, 1 Mb)

- Investor presentation, October 2015 (pdf, 1 Mb)

- Investor presentation, September 2015 (pdf, 1 Mb)

- Investor presentation, August 2015 (pdf, 1 Mb)

- Investor presentation, July 2015 (pdf, 1 Mb)

- Investor presentation, June 2015 (pdf, 1 Mb)

- Investor presentation, May 2015 (pdf, 1 Mb)

- Investor presentation, April 2015 (pdf, 1 Mb)

- Investor presentation, March 2015 (pdf, 1 Mb)

- Deutsche Bank dbAccess CEEMEA Conference (Jan 21-23) (pdf, 739 Kb)

- Presentation

- Weekend Reading

Management Team

- LinkedIn Group

- Facebook Group

Join Our Club

What They Say About Us

"The wonderful thing about entrepreneurs is that their passion for starting new companies transcends languages and geographic boundaries."

Ron Conway, Founder and Managing Partner of the Angel Investors LP funds, early stage investor in Google and PayPal

"Networking is very important for start-ups. The challenge for them is often not money: it is mentoring and finding people who can give good advice from experience."

Esther Dyson, Founder, EDventure Holdings

"This conference is clearly a labor of love for a group of dedicated professionals who care deeply about the Eastern European entrepreneurs. From the value-packed educational panels, to the star-studded key note speakers' line up, to an amazing quantity of venture capitalists – this is a not to be missed event for any high tech entrepreneur,"

Richard Guha, President of the Marketing Executives Network and Managing Partner at MaxBrandEquity

"As Stanford MBA students, we were exposed to a lot of VC firms both from the Valley and abroad. It is at Stanford that we met Anna Dvornikova, an absolutely amazing business leader and (by our big luck) our friend, who was the center of the Russian Silicon Valley professional community, and was doing a huge work to connect Russia and the Valley. Anna helped us a lot with kick-starting Wikimart, put us to our first-ever conference, introduced us to most of Russian VCs. And all that happened in a very short time span! It was the beginning of a six-month journey that despite the particularly tough times resulted in an extraordinarily group of investors backing our start-up."

Maxim Faldin and Kamil Kurmakayev, co-CEOs, Wikimart

Leading vertically integrated aluminium and power producer

Select the topics of interest to you

You have subscribed to the newsletter

Correct the data and try again

Shareholder center

- Shareholder Structure

- General meetings

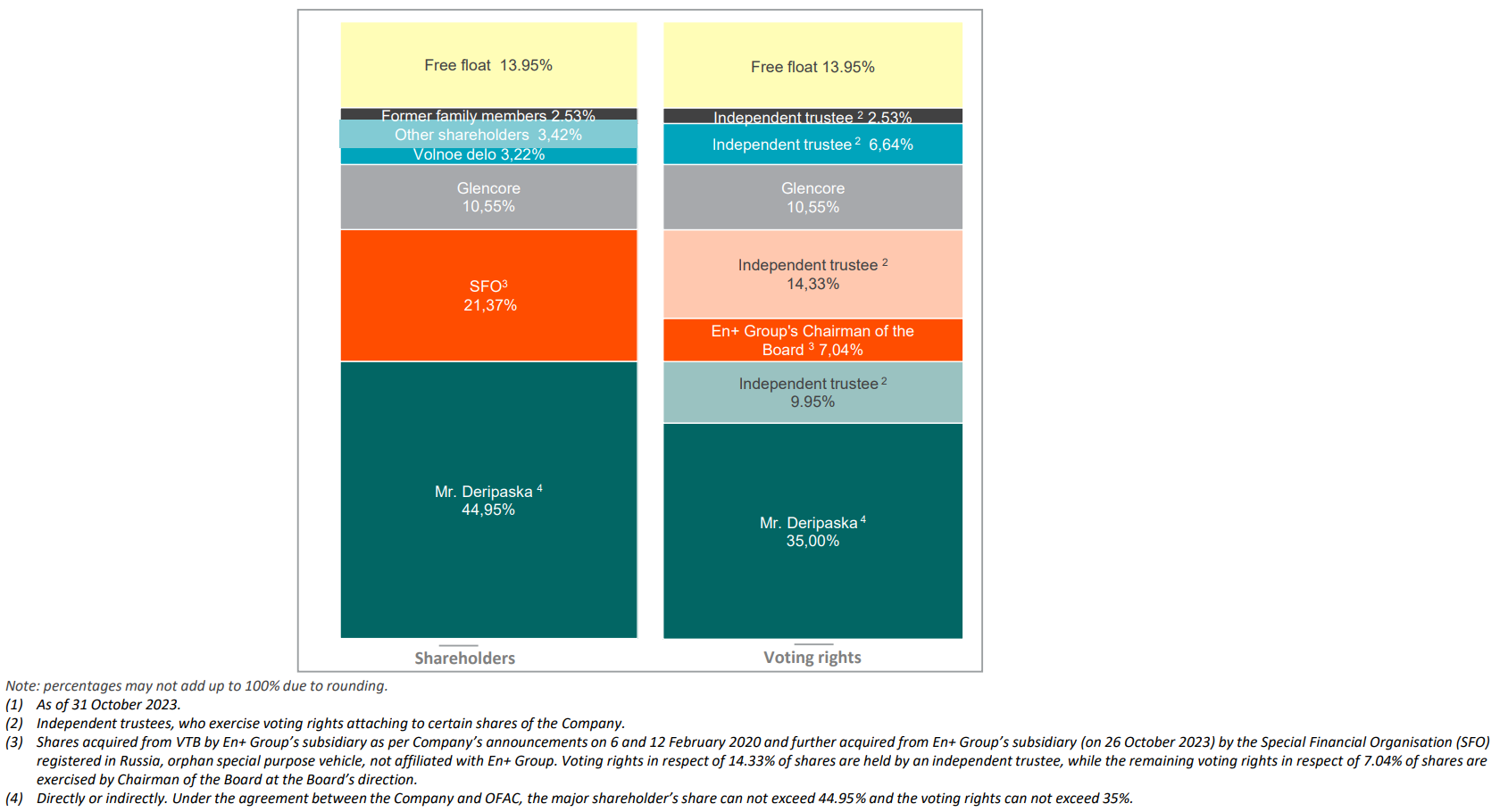

Voting and shareholders structure 1

Depository Bank

Citibank, N.A.

388 Greenwich Street, New York, NY, USA 10013

Stock Exchanges

London stock exchange, moscow stock exchange, related assets, key figures, results and disclosure.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Premium News

- Biden Economy

- EV Deep Dive

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Personal Loans

- Student Loans

- Car Insurance

- Morning Brief

- Market Domination

- Market Domination Overtime

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Gogl – invitation to presentation of q1 2024 results.

Golden Ocean Group Limited (the “Company) will publish its financial results for the first quarter of 2024 on Wednesday May 22, 2024.

In connection with the release, a conference call and webcast will be held as described below:

Conference call and webcast A conference call will be held at 3:00 P.M. CET (9:00 A.M. New York Time) on Wednesday February 28, 2024. The presentation will be available for download from the Investor Relations section at www.goldenocean.bm (under "Presentations") prior to the conference call/webcast.

In order to listen to the presentation, you may do one of the following:

a. Webcast Visit the Investor Relations section of the Company’s website at www.goldenocean.bm and click on the link to “Webcast”, or access directly via the webcast link below.

GOGL Q1 2024 Webcast

b. Conference Call Participants will need to register online prior to the conference call via the link below. Dial-in details will be available when registered.

GOGL Q1 2024 Conference Call

A Q&A session will be held after the conference call/webcast. Information on how to submit questions will be given at the beginning of the session.

May 13, 2024 Hamilton, Bermuda

This information is subject to the disclosure requirements of section 5-12 of the Norwegian Securities Trading Act.

Cookie policy

The Gym Group website uses cookies. By continuing to browse you are agreeing to our use of cookies. Click here for more information

- At a Glance

- Investment Proposition

- Business Model and Strategy

- Board of Directors

- Executive Committee

- Our Journey

- Investors Overview

- Key Performance Indicators

- Principal Risks

- RNS Alerts Signup

Results, Reports & Presentations

- IPO Information

- Share Price

- Financial Calendar

- Board Responsibilities

- Board Committees

- Placing 2021

- Placing 2020

- Investor & Advisor Contacts

- Press Releases

- Email Alerts Sign Up

- Media Contact

- Policy Statements

You are using an outdated browser. Upgrade your browser today or install Google Chrome Frame to better experience this site.

IMAGES

VIDEO

COMMENTS

Date. Presentations Report Webcast. The Gym Group Annual Report and Accounts 2023 15/03/2024. Full Year Results for the year ended 31 December 2023 13/03/2024. Pre-Close Trading Update 10/01/2024.

Date. Presentations Report Webcast. Trading Update 09/11/2022. Interim Results for the six month period ended 30 June 2022 04/08/2022. Notice of Half Year Results 08/07/2022. Capital Markets Day 2022 19/05/2022. The Gym Group Annual Report and Accounts 2021 16/03/2022. Prev.

The Gym Group was a pioneer of the low cost gym model, and now operates 233 high quality sites across the UK. These gyms offer 24/7 opening and flexible, no contract membership. As at 31 December 2023, there were 850,000 members nationwide.

1,308.00. +2.19%. Find the latest The Gym Group plc (GYM.L) stock quote, history, news and other vital information to help you with your stock trading and investing.

115.00 / 13 May 2024. Volume. 279,062. Turnover (on book) £113,999.07. 52 week range. 88.10 / 124.80. Display price followed by previous trading day date.

Investor Presentation 24 May 20224. 745 778 5434. Q4 2019 Q1 2021Q1 2022. Q1 2022 Group results vs 2019 & 2021. Closing members Gyms in estate Revenue Q1 new sites. Notes: 2019 includes the results of Fitness World on a proforma basis, except for available liquidity and Q1 cash flow which are based on PureGym UK only.

About the company. The Gym Group plc is a United Kingdom-based provider of gym facilities. The Company's activities consist solely of the provision of low cost, 24/7, no contract gyms within the United Kingdom, traded through 233 sites. The Company offers a carbon-neutral chain of gyms. These gyms offer 24/7 opening and flexible, no contract ...

It provides multi-gym access, fitness tracking, on-demand fitness classes, and refillable Yanga sports water, all available for an added charge. It has approximately 850,000 members. The Companyâ s subsidiaries include The Gym Group Midco1 Limited, The Gym Group Midco2 Limited, The Gym Group Operations Limited, and The Gym Limited.

He floated the company in 1997, and in 2000 he and his investors sold it on. He then spent time lending his expertise to premium gym chain Esporta, before concentrating on the launch of The Gym Group. 2008. Our first Gym opened in Hounslow in 2008. It was a roaring success, and was swiftly followed by Guildford and Vauxhall. Within the first ...

It provides multi-gym access, fitness tracking, on-demand fitness classes, and refillable Yanga sports water, all available for an added charge. It has approximately 850,000 members. The Company's subsidiaries include The Gym Group Midco1 Limited, The Gym Group Midco2 Limited, The Gym Group Operations Limited, and The Gym Limited.

s28.q4cdn.com

Oct 27, 2022. Founded in 2007, The Gym Group is a chain of 24/7 fitness clubs with locations across the United Kingdom. The company reported revenue of 103 million U.S. dollars in 2020, a decrease ...

Investor Presentation

Analyst 1: From my understanding, the core markets for Basic-Fit is Benelux and France, where they are highly penetrated, at least way more penetrated than in other markets. If you compare the penetration of the European market, in terms of low-cost gyms and overall gym penetration, versus the US and probably the UK market, penetration is lower.

4Q 2023 Earnings presentation 3Q 2023 Earnings presentation MOEX Strategy 2028 webcast transcript Webcast recording on MOEX Strategy 2028 2Q 2023 Earnings presentation 1Q 2023 Earnings presentation 4Q 2022 Earnings presentation 3Q 2022 Earnings presentation 2Q 2022 Earnings presentation Investor presentation, March 2022 Investor presentation, February 2022 Investor presentation, January 2022 ...

Mr.Khirman is a founder of "TEC - The Entrepreneur Club" - an international multi-ethnic network of several thousand high-tech entrepreneurs, executives and other professionals started in 2003. Mr. Khirman is a serial entrepreneur and co-founder of three Silicon Valley Startup. He currently serves as a CTO of ChooChee Inc - leader of ...

Presentations Report Webcast. Trading Update 16/12/2021. Interim Results for the six month period ended 30 June 2021 02/09/2021. Trading Update 26/05/2021. The Gym Group Annual Report and Accounts 2020 18/03/2021. Full Year Results for the year ended 31 December 2020 18/03/2021. Prev.

One GDR represents one share. Until 17 April 2020 inclusive, En+ Group's GDRs were listed on the Moscow Exchange (ticker: ENPL), and were included in the Level One Quotation List. The GDRs were subsequently delisted from the Moscow Exchange on 20 April 2020. During the two-month transition period prior to this date, when the two equity ...

Visit the Investor Relations section of the Company's website at www.goldenocean.bm and click on the link to "Webcast", or access directly via the webcast link below. GOGL Q1 2024 Webcast b.

The following slide deck was published by GEA Group Aktiengesellschaft in conjunction with their 2024 Q1 earnings call.

of a gym prior to COVID. This growth was led by the low cost gym sector which was introducing new people to gym memberships for the first time every year. Whilst having a short term impact on the health and fitness sector, COVID-19 is likely to increase gym usage and headroom for significant growth remains with the number of low cost gyms in the UK

Investors. RUSAL is a public company, listed on the Moscow and Hong Kong stock exchanges. The company has a strong position as the world's leading vertically integrated producer of low carbon aluminium. This section contains RUSAL's annual reports, financial statements, as well as investor presentations and operational results.

The Gym Group plc, the fast growing, nationwide operator of 1861 low-cost, no-contract gyms, announces its full year results for the year ended 31 December 2020. The results reflect a year of significant disruption in which the Company's ... A live audio webcast of the analyst presentation will be available at 08.30am today via the following ...

Q1: 2024-05-14 Earnings Summary. EPS of $0.07 beats by $0.14 | Revenue of $37.62M (-23.03% Y/Y) beats by $2.53M. The following slide deck was published by Broadwind, Inc. in conjunction with their ...

Date. Presentations Report Webcast. Interim Results for the six month period ended 30 June 2019 29/08/2019. Pre-Close Trading Update 12/07/2019. KPIs and reporting under IFRS16 - presentation to analysts 02/07/2019. The Gym Group Annual Report and Accounts 2018 19/03/2019. Full Year Results for the year ended 31 December 2018 19/03/2019.