- Business Planning

Business Plan Financial Projections

Written by Dave Lavinsky

Financial projections are forecasted analyses of your business’ future that include income statements, balance sheets and cash flow statements. We have found them to be an crucial part of your business plan for the following reasons:

- They can help prove or disprove the viability of your business idea. For example, if your initial projections show your company will never make a sizable profit, your venture might not be feasible. Or, in such a case, you might figure out ways to raise prices, enter new markets, or streamline operations to make it profitable.

- Financial projections give investors and lenders an idea of how well your business is likely to do in the future. They can give lenders the confidence that you’ll be able to comfortably repay their loan with interest. And for equity investors, your projections can give them faith that you’ll earn them a solid return on investment. In both cases, your projections can help you secure the funding you need to launch or grow your business.

- Financial projections help you track your progress over time and ensure your business is on track to meet its goals. For example, if your financial projections show you should generate $500,000 in sales during the year, but you are not on track to accomplish that, you’ll know you need to take corrective action to achieve your goal.

Below you’ll learn more about the key components of financial projections and how to complete and include them in your business plan.

What Are Business Plan Financial Projections?

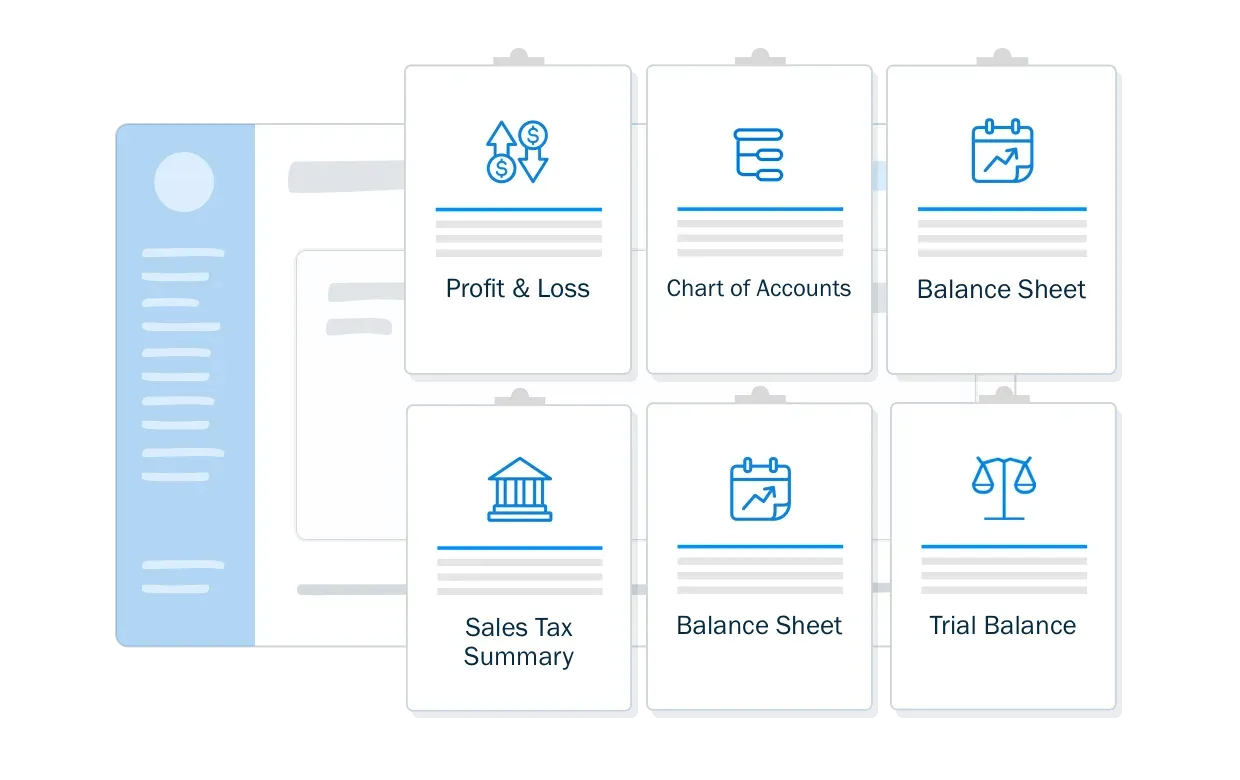

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

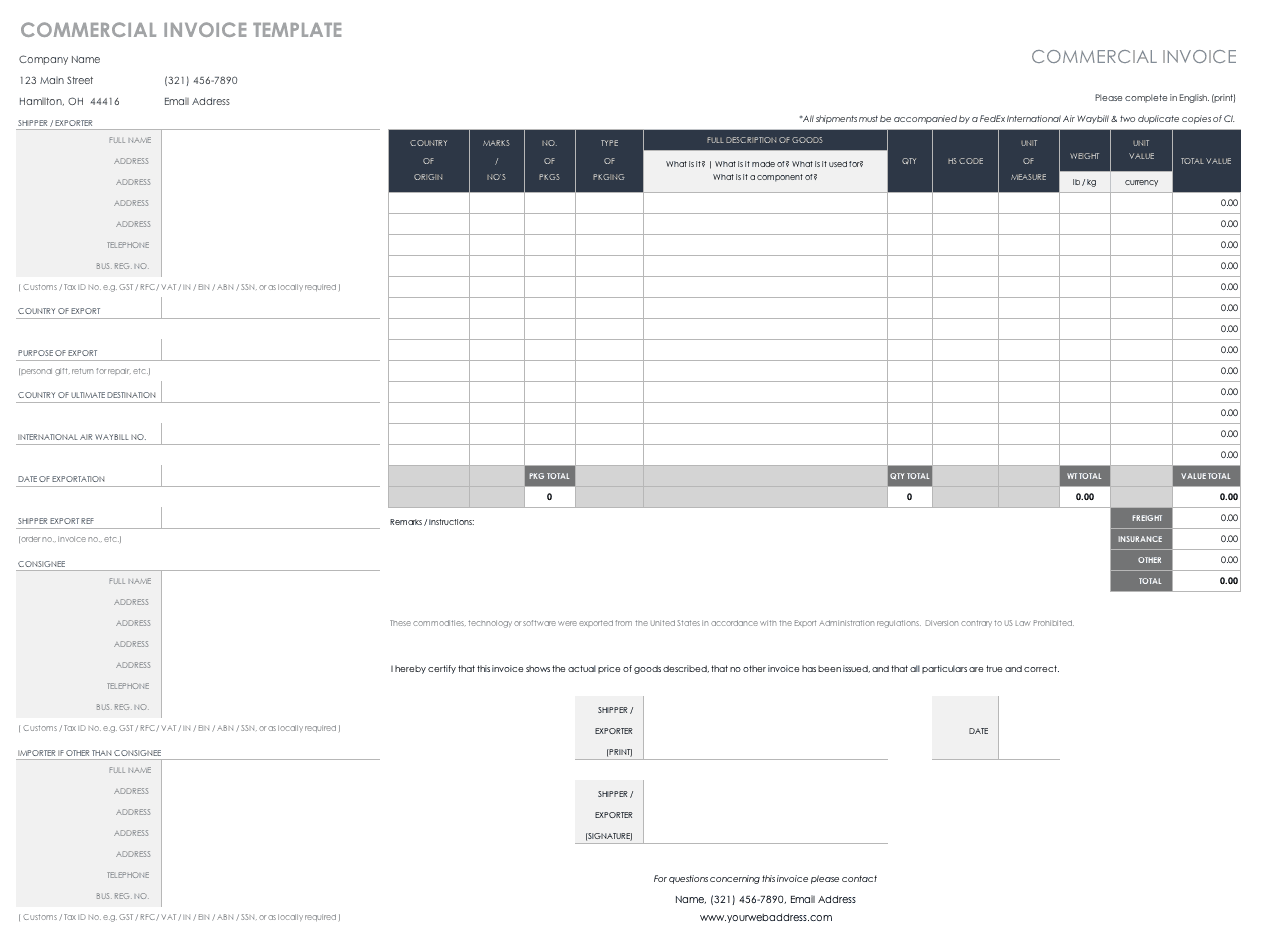

Sample Income Statement

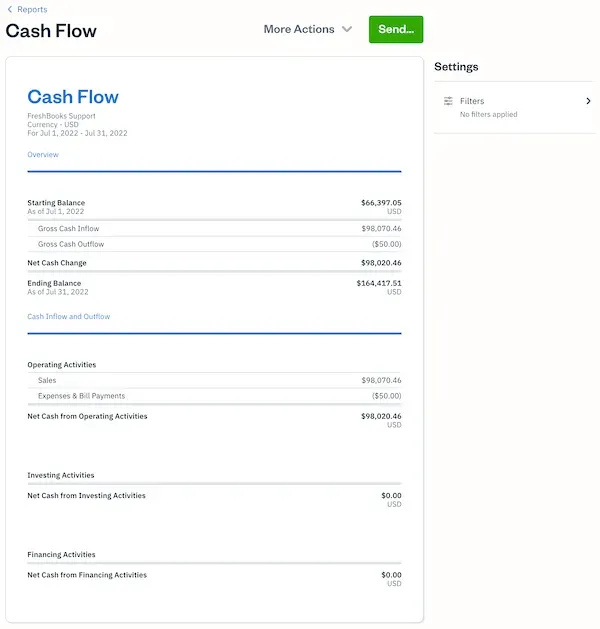

2. cash flow statement & projection.

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

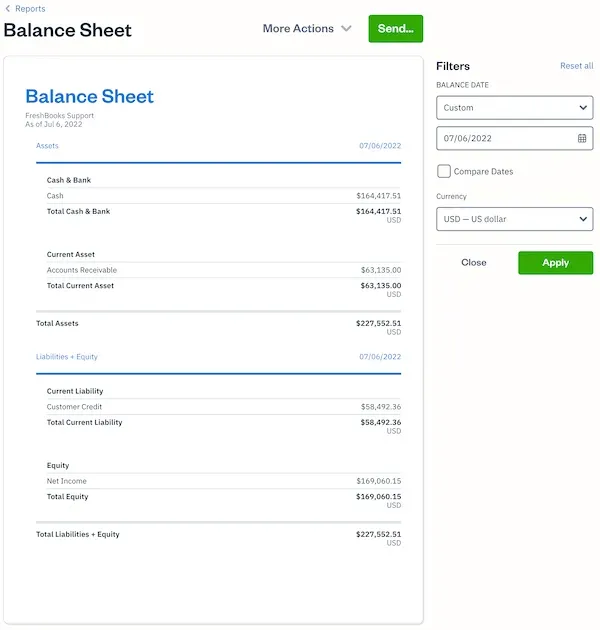

3. balance sheet projection.

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

How to create financial projections.

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic

When creating your financial projections, it is important to be realistic. Your projections should be based on your list of assumptions and should reflect your best estimate of what your company’s future financial performance will be. This includes projected operating income, a projected income statement, and a profit and loss statement.

Your goal should be to create a realistic set of financial projections that can be used to guide your company’s future decision-making.

Sales Forecast

One of the most important aspects of your financial projections is your sales forecast. Your sales forecast should be based on your list of assumptions and should reflect your best estimate of what your company’s future sales will be.

Your sales forecast should be realistic and achievable. Do not try to “game” the system by creating an overly optimistic or pessimistic forecast. Your goal should be to create a realistic sales forecast that can be used to guide your company’s future decision-making.

Creating a sales forecast is not an exact science, but there are a number of methods that can be used to generate realistic estimates. Some common methods include market analysis, competitor analysis, and customer surveys.

Create Multi-Year Financial Projections

When creating financial projections, it is important to generate projections for multiple years. This will give you a better sense of how your company’s financial performance is likely to change over time.

It is also important to remember that your financial projections are just that: projections. They are based on a number of assumptions and are not guaranteed to be accurate. As such, you should review and update your projections on a regular basis to ensure that they remain relevant.

Creating financial projections is an important part of any business plan. However, it’s important to remember that these projections are just estimates. They are not guarantees of future success.

Business Plan Financial Projections FAQs

What is a business plan financial projection.

A business plan financial projection is a forecast of your company's future financial performance. It should include line items for each type of asset and liability, as well as a total at the end.

What are annual income statements?

The Annual income statement is a financial document and a financial model that summarize a company's revenues and expenses over the course of a fiscal year. They provide a snapshot of a company's financial health and performance and can be used to track trends and make comparisons with other businesses.

What are the necessary financial statements?

The necessary financial statements for a business plan are an income statement, cash flow statement, and balance sheet.

How do I create financial projections?

You can create financial projections by making a list of assumptions, creating two scenarios (best case and worst case), conducting a ratio analysis, and being realistic.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing a Business Plan—Financial Projections

Spell out your financial forecast in dollars and sense

Creating financial projections for your startup is both an art and a science. Although investors want to see cold, hard numbers, it can be difficult to predict your financial performance three years down the road, especially if you are still raising seed money. Regardless, short- and medium-term financial projections are a required part of your business plan if you want serious attention from investors.

The financial section of your business plan should include a sales forecast , expenses budget , cash flow statement , balance sheet , and a profit and loss statement . Be sure to follow the generally accepted accounting principles (GAAP) set forth by the Financial Accounting Standards Board , a private-sector organization responsible for setting financial accounting and reporting standards in the U.S. If financial reporting is new territory for you, have an accountant review your projections.

Sales Forecast

As a startup business, you do not have past results to review, which can make forecasting sales difficult. It can be done, though, if you have a good understanding of the market you are entering and industry trends as a whole. In fact, sales forecasts based on a solid understanding of industry and market trends will show potential investors that you've done your homework and your forecast is more than just guesswork.

In practical terms, your forecast should be broken down by monthly sales with entries showing which units are being sold, their price points, and how many you expect to sell. When getting into the second year of your business plan and beyond, it's acceptable to reduce the forecast to quarterly sales. In fact, that's the case for most items in your business plan.

Expenses Budget

What you're selling has to cost something, and this budget is where you need to show your expenses. These include the cost to your business of the units being sold in addition to overhead. It's a good idea to break down your expenses by fixed costs and variable costs. For example, certain expenses will be the same or close to the same every month, including rent, insurance, and others. Some costs likely will vary month by month such as advertising or seasonal sales help.

Cash Flow Statement

As with your sales forecast, cash flow statements for a startup require doing some homework since you do not have historical data to use as a reference. This statement, in short, breaks down how much cash is coming into your business on a monthly basis vs. how much is going out. By using your sales forecasts and your expenses budget, you can estimate your cash flow intelligently.

Keep in mind that revenue often will trail sales, depending on the type of business you are operating. For example, if you have contracts with clients, they may not be paying for items they purchase until the month following delivery. Some clients may carry balances 60 or 90 days beyond delivery. You need to account for this lag when calculating exactly when you expect to see your revenue.

Profit and Loss Statement

Your P&L statement should take the information from your sales projections, expenses budget, and cash flow statement to project how much you expect in profits or losses through the three years included in your business plan. You should have a figure for each individual year as well as a figure for the full three-year period.

Balance Sheet

You provide a breakdown of all of your assets and liabilities in the balances sheet. Many of these assets and liabilities are items that go beyond monthly sales and expenses. For example, any property, equipment, or unsold inventory you own is an asset with a value that can be assigned to it. The same goes for outstanding invoices owed to you that have not been paid. Even though you don't have the cash in hand, you can count those invoices as assets. The amount you owe on a business loan or the amount you owe others on invoices you've not paid would count as liabilities. The balance is the difference between the value of everything you own vs. the value of everything you owe.

Break-Even Projection

If you've done a good job projecting your sales and expenses and inputting the numbers into a spreadsheet, you should be able to identify a date when your business breaks even—in other words, the date when you become profitable, with more money coming in than going out. As a startup business, this is not expected to happen overnight, but potential investors want to see that you have a date in mind and that you can support that projection with the numbers you've supplied in the financial section of your business plan.

Additional Tips

When putting together your financial projections, keep some general tips in mind:

- Get comfortable with spreadsheet software if you aren't already. It is the starting point for all financial projections and offers flexibility, allowing you to quickly change assumptions or weigh alternative scenarios. Microsoft Excel is the most common, and chances are you already have it on your computer. You can also buy special software packages to help with financial projections.

- Prepare a five-year projection . Don’t include this one in the business plan, since the further into the future you project, the harder it is to predict. However, have the projection available in case an investor asks for it.

- Offer two scenarios only . Investors will want to see a best-case and worst-case scenario, but don’t inundate your business plan with myriad medium-case scenarios. They likely will just cause confusion.

- Be reasonable and clear . As mentioned before, financial forecasting is as much art as science. You’ll have to assume certain things, such as your revenue growth, how your raw material and administrative costs will grow, and how effective you’ll be at collecting on accounts receivable. It’s best to be realistic in your projections as you try to recruit investors. If your industry is going through a contraction period and you’re projecting revenue growth of 20 percent a month, expect investors to see red flags.

Free Financial Projection and Forecasting Templates

By Andy Marker | January 3, 2024

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve collected the top free financial projection and forecasting templates. These templates enable business owners, CFOs, accountants, and financial analysts to plan future growth, manage cash flow, attract investors, and make informed decisions. On this page, you'll find many helpful, free, customizable financial projection and forecasting templates, including a 1 2-month financial projection template , a startup financial projection template , a 3-year financial projection template , and a small business financial forecast template , among others. You’ll also find details on the elements in a financial projection template , types of financial projection and forecasting templates , and related financial templates .

Simple Financial Projection Template

Download a Sample Simple Financial Projection Template for

Excel | Google Sheets

Download a Blank Simple Financial Projection Template for

Excel | Google Sheets

Small business owners and new entrepreneurs are the ideal users for this simple financial projection template. Just input your expected revenues and expenses. This template stands out due to its ease of use and focus on basic, straightforward financial planning, making it perfect for small-scale or early-stage businesses. Available with or without sample text, this tool offers clear financial oversight, better budget management, and informed decision-making regarding future business growth.

Looking for help with your business plan? Check out these free financial templates for a business plan to streamline the process of organizing your business's financial information and presenting it effectively to stakeholders.

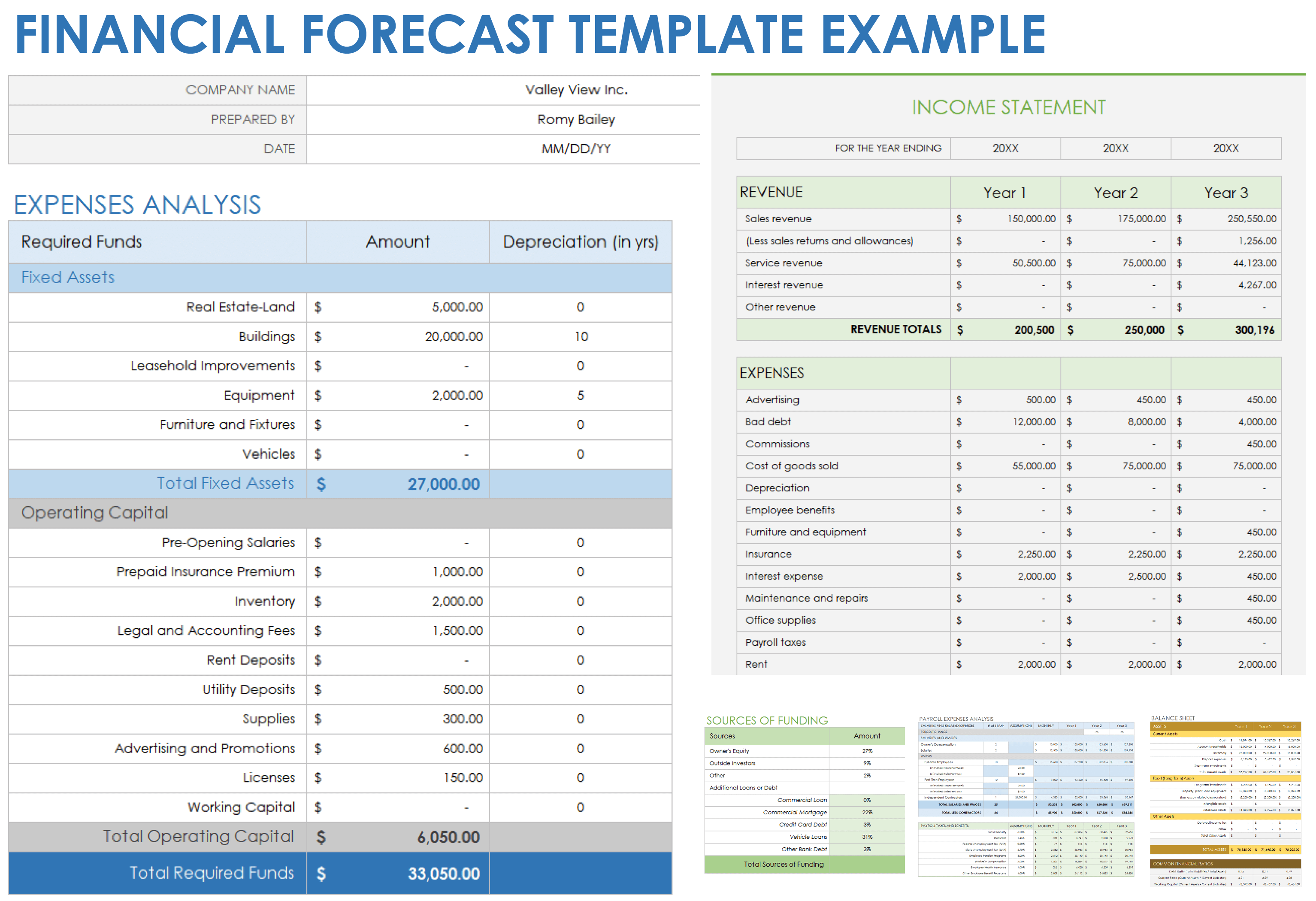

Financial Forecast Template

Download a Sample Financial Forecast Template for

Download a Blank Financial Forecast Template for

This template is perfect for businesses that require a detailed and all-encompassing forecast. Users can input various financial data, such as projected revenues, costs, and market trends, to generate a complete financial outlook. Available with or without example text, this template gives you a deeper understanding of your business's financial trajectory, aiding in strategic decision-making and long-term financial stability.

These free cash-flow forecast templates help you predict your business’s future cash inflows and outflows, allowing you to manage liquidity and optimize financial planning.

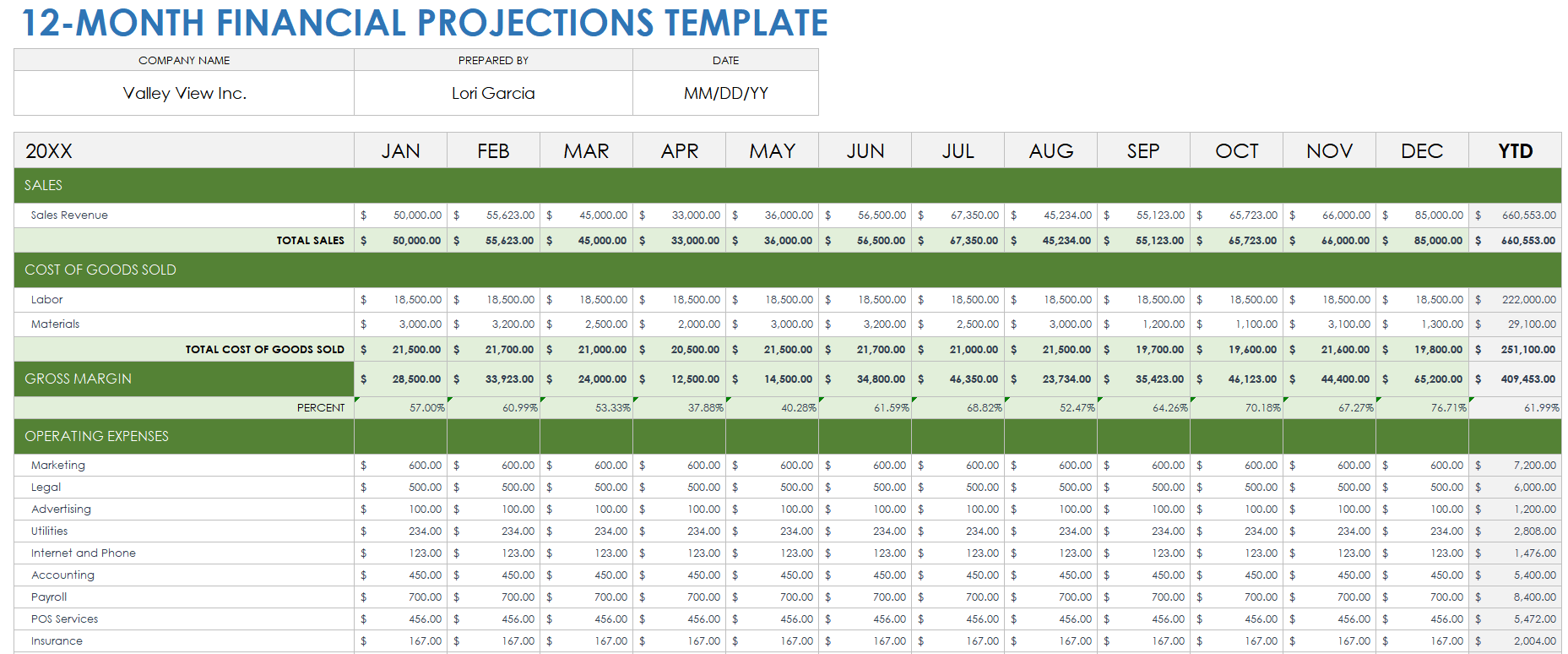

12-Month Financial Projection Template

Download a Sample 12-Month Financial Projection Template for

Download a Blank 12-Month Financial Projection Template for

Use this 12-month financial projection template for better cash-flow management, more accurate budgeting, and enhanced readiness for short-term financial challenges and opportunities. Input estimated monthly revenues and expenses, tracking financial performance over the course of a year. Available with or without sample text, this template is ideal for business owners who need to focus on short-term financial planning. This tool allows you to respond quickly to market shifts and plan effectively for the business's crucial first year.

Download free sales forecasting templates to help your business predict future sales, enabling better inventory management, resource planning, and decision-making.

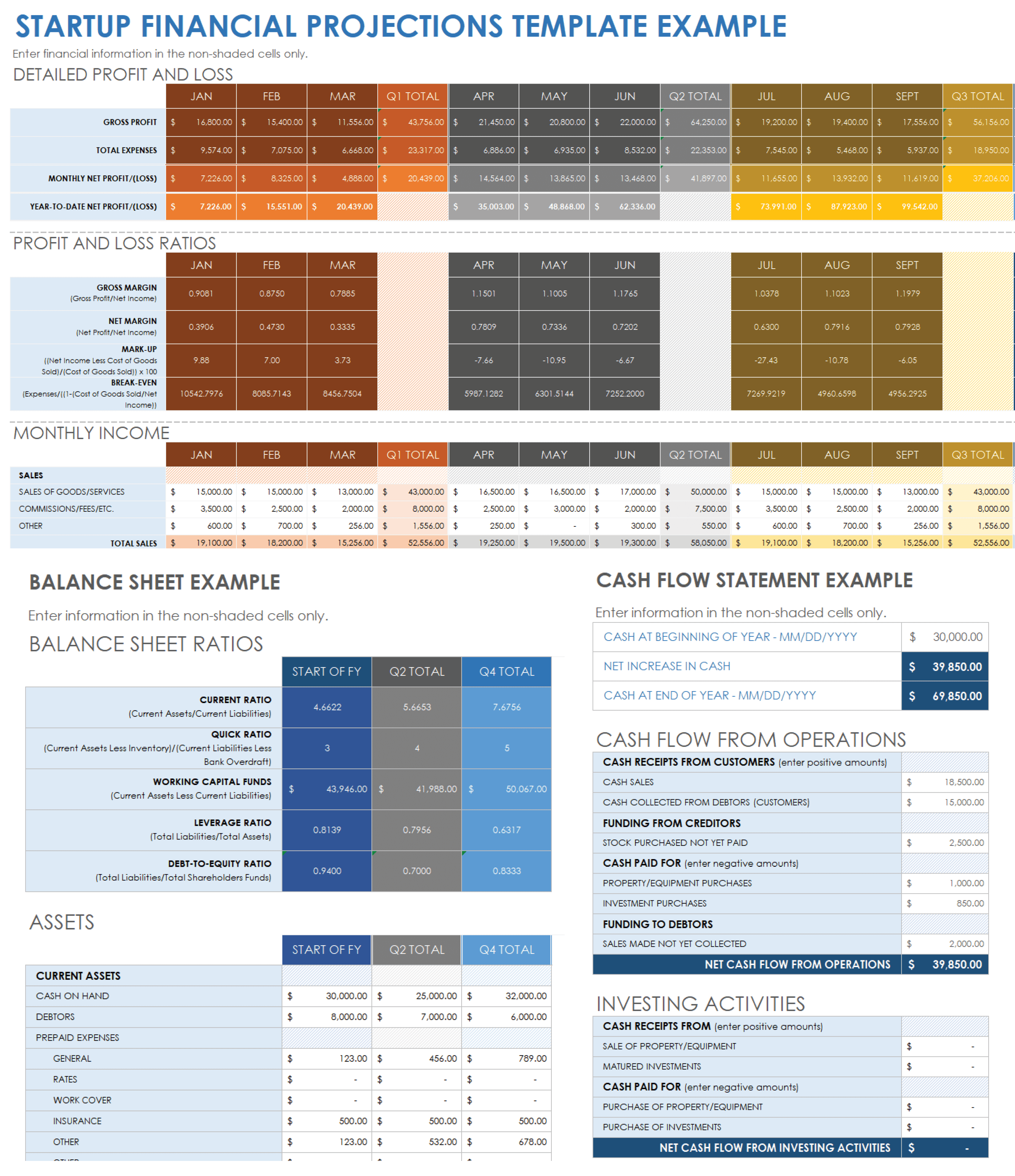

Startup Financial Projection Template

Download a Sample Startup Financial Projection Template for

Download a Blank Startup Financial Projection Template for

This dynamic startup financial projection template is ideal for startup founders and entrepreneurs, as it's designed specifically for the unique needs of startups. Available with or without example text, this template focuses on clearly outlining a startup's initial financial trajectory, an essential component for attracting investors. Users can input projected revenues, startup costs, and funding sources to create a comprehensive financial forecast.

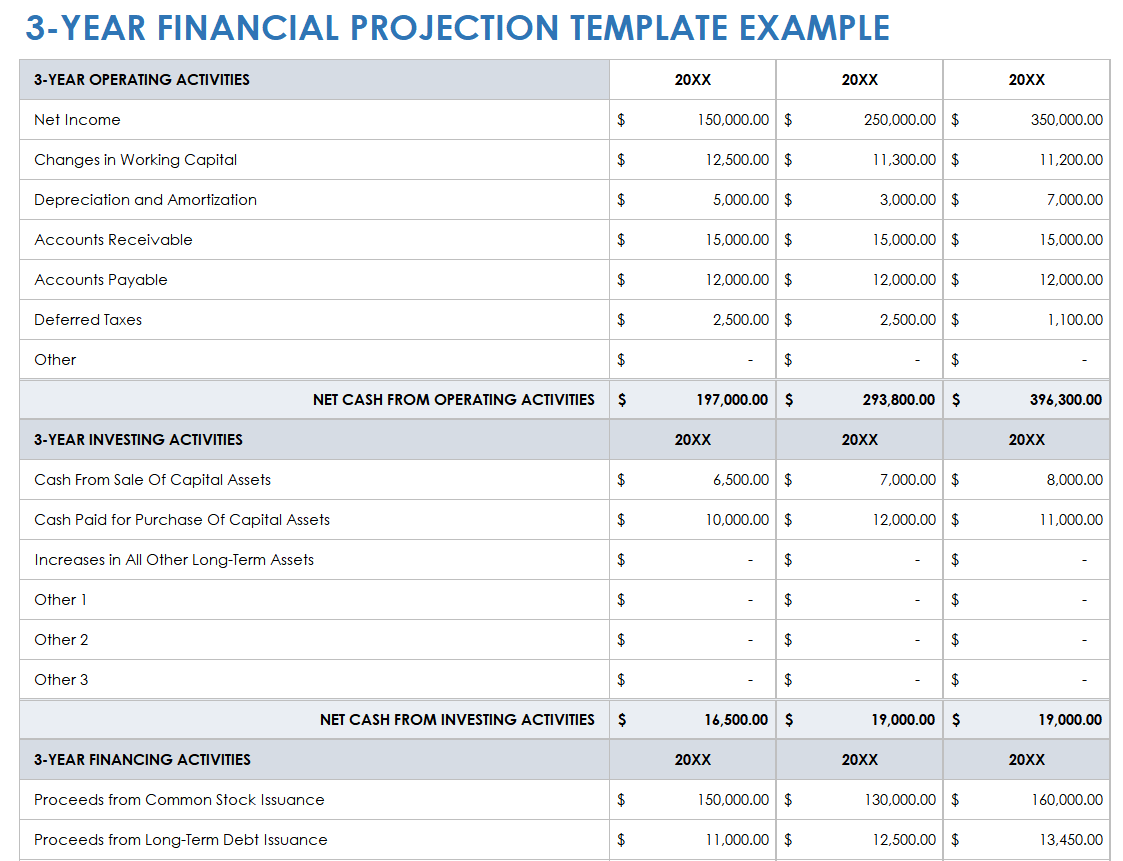

3-Year Financial Projection Template

Download a Sample 3-Year Financial Projection Template for

Download a Blank 3-Year Financial Projection Template for

This three-year financial projection template is particularly useful for business strategists and financial planners who are looking for a medium-term financial planning tool. Input data such as projected revenues, expenses, and growth rates for the next three years. Available with or without sample text, this template lets you anticipate financial challenges and opportunities in the medium term, aiding in strategic decision-making and ensuring sustained business growth.

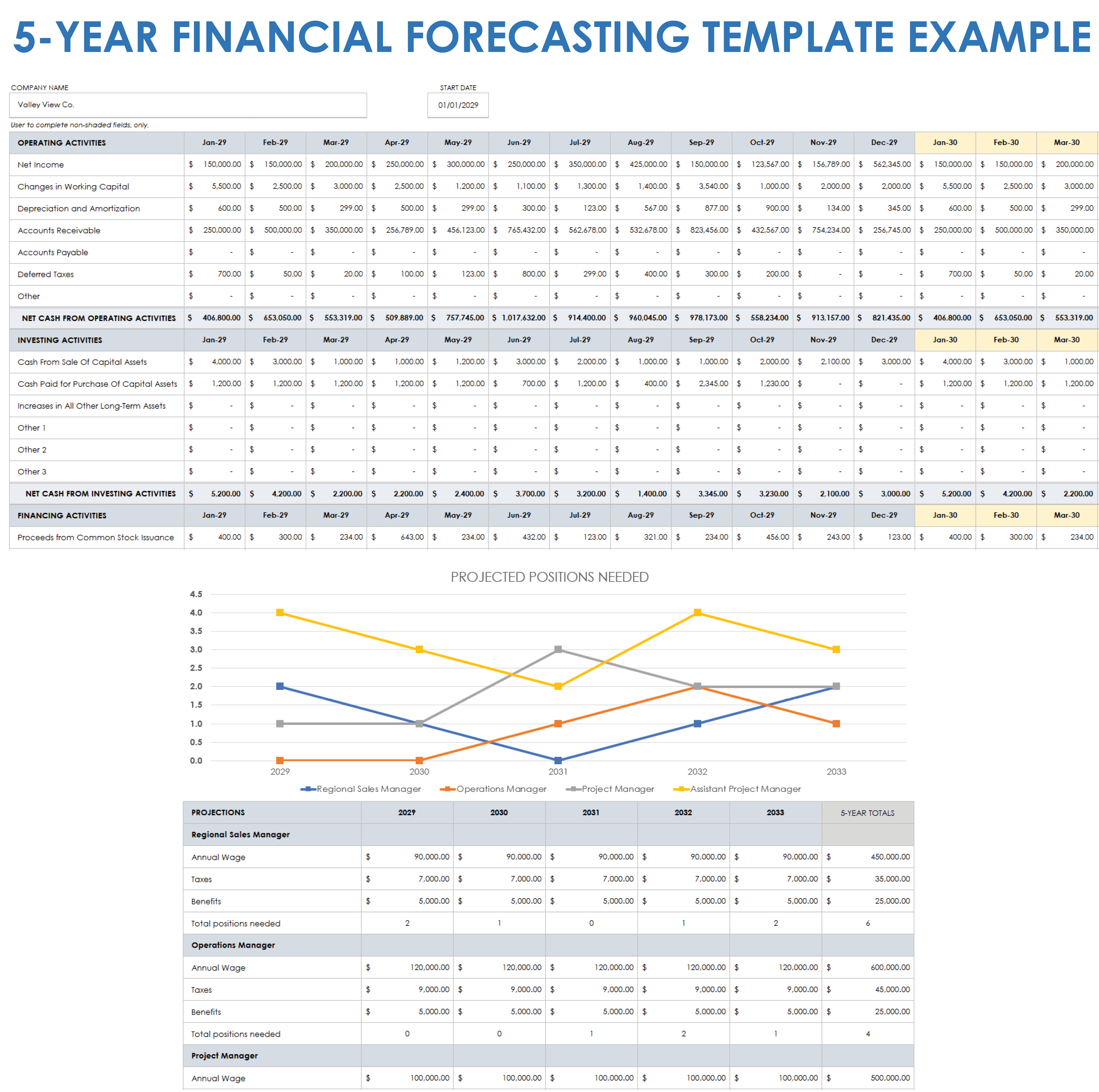

5-Year Financial Forecasting Template

Download a Sample 5-Year Financial Forecasting Template for

Download a Blank 5-Year Financial Forecasting Template for

CFOs and long-term business planners can use this five-year financial forecasting template to get a clear, long-range financial vision. Available with or without example text, this template allows you to plan strategically and invest wisely, preparing your business for future market developments and opportunities. This unique tool offers an extensive outlook for your business’s financial strategy. Simply input detailed financial data spanning five years, including revenue projections, investment plans, and expected market growth. Visually engaging bar charts of key metrics help turn data into engaging narratives.

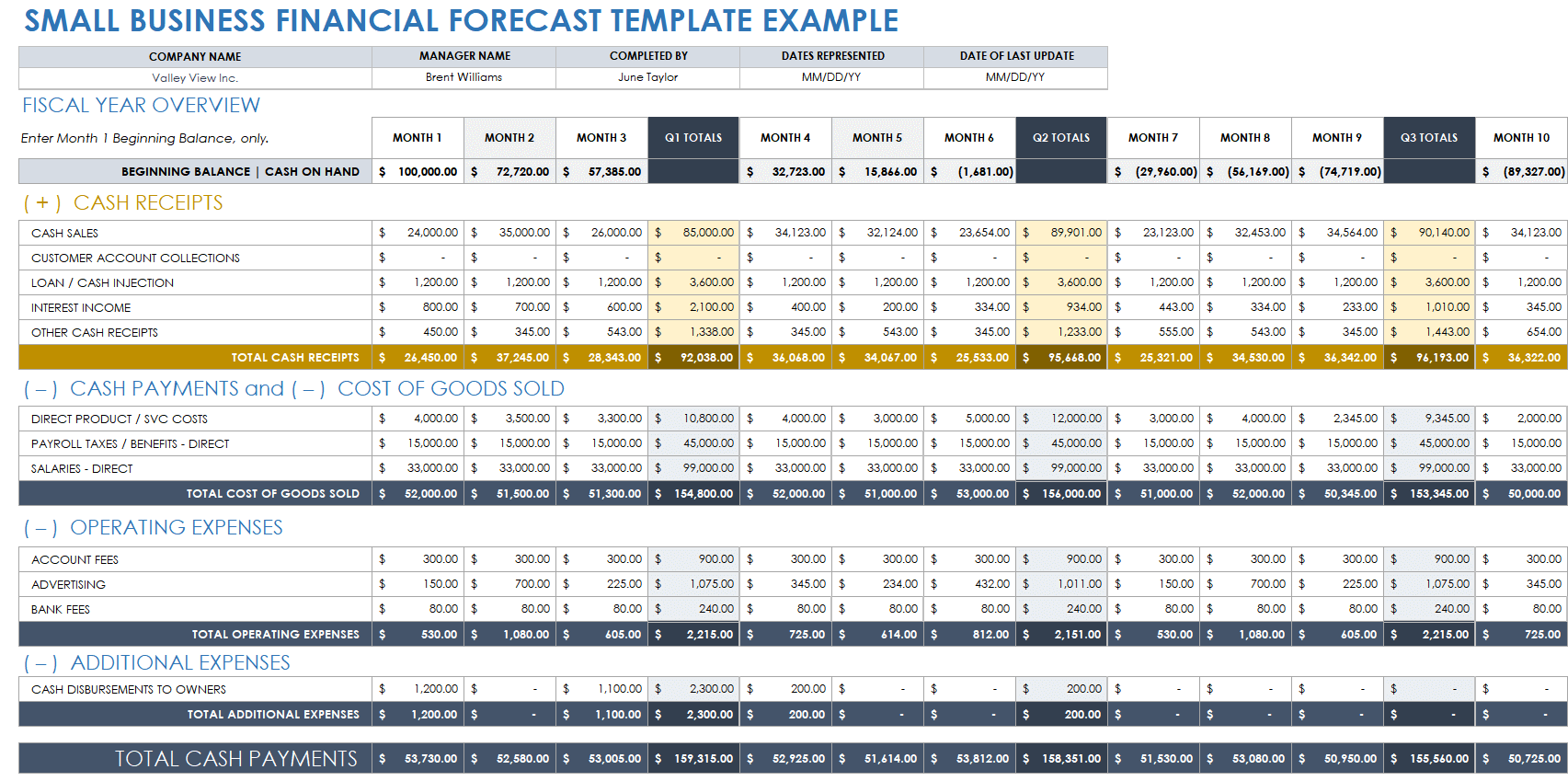

Small Business Financial Forecast Template

Download a Sample Small Business Financial Forecast Template for

Download a Blank Small Business Financial Forecast Template for

Excel | Google Sheets

The small business financial forecast template is tailored specifically for the scale and specific requirements of small enterprises. Business owners and financial managers can simply input data such as projected sales or expenses. Available with or without sample text, this tool offers the ability to do the following: envision straightforward financial planning; anticipate future financial needs and challenges; make informed decisions; and steer the business toward steady growth.

Elements in a Financial Projection Template

The elements in a financial projection template include future sales, costs, profits, and cash flow. This template illustrates expected receivables, payables, and break-even dates. This tool helps you plan for your business's financial future and growth.

Here are the standard elements in a financial projection template:

- Revenue Projection: This estimates future income from various sources over a specific period.

- Expense Forecast: This predicts future costs, including both fixed and variable expenses.

- Profit and Loss Forecast: This projects the profit or loss by subtracting projected expenses from projected revenues.

- Cash-Flow Projection: This assesses the inflows and outflows of cash, indicating liquidity over time.

- Balance Sheet Projection: This predicts the future financial position, showing assets, liabilities, and equity.

- Break-Even Analysis: This calculates the point at which total revenues equal total costs.

- Capital Expenditure Forecast: This estimates future spending on fixed assets such as equipment or property.

- Debt Repayment Plan: This outlines the schedule for paying back any borrowed funds.

- Sales Forecast: This predicts future sales volume, often broken down by product or service.

- Gross Margin Analysis: This looks at the difference between revenue and cost of goods sold.

Types of Financial Projection and Forecasting Templates

There are many types of financial projection and forecasting templates: basic templates for small businesses; detailed ones for big companies; special ones for startup businesses; and others. There are also sales forecasts, cash-flow estimates, and profit and loss projections.

In addition, financial projection and forecasting templates include long-term planning templates, break-even analyses, budget forecasts, and templates made for specific industries such as retail or manufacturing.

Each template serves different financial planning needs. Determine which one best suits your requirements based on the scale of your business, the complexity of its financial structure, and the specific department that you want to analyze.

Here's a list of the top types of financial projection and forecasting templates:

- Basic Financial Projection Template: Ideal for small businesses or startups, this template provides a straightforward approach to forecasting revenue, expenses, and cash flow.

- Detailed Financial Projection Template: Best for larger businesses or those with complex financial structures, this template offers in-depth projections, including balance sheets, income statements, and cash-flow statements.

- Startup Financial Projection Template: Tailored for startups, this template focuses on funding requirements and early-stage revenue forecasts, both crucial for attracting investors and planning initial operations.

- Sales Forecasting Template: Used by sales and marketing teams to predict future sales, this template helps you set targets and plan marketing strategies.

- Cash-Flow Forecast Template: Essential for financial managers who need to monitor the liquidity of the business, this template projects cash inflows and outflows over a period.

- Profit and Loss Forecast Template (P&L): Useful for business owners and financial officers who need to anticipate profit margins, this template enables you to forecast revenues and expenses.

- Three-Year / Five-Year Financial Projection Template: Suitable for long-term business planning, these templates provide a broader view of your company’s financial future, improving your development strategy and investor presentations.

- Break-Even Analysis Template: Used by business strategists and financial analysts, this template helps you determine when your business will become profitable.

- Budget Forecasting Template: Designed for budget managers, this template uses historical financial data to help you plan your future spending.

- Sector-Specific Financial Projection Template: Designed for specific industries (such as retail or manufacturing), these templates take into account industry-specific factors and benchmarks.

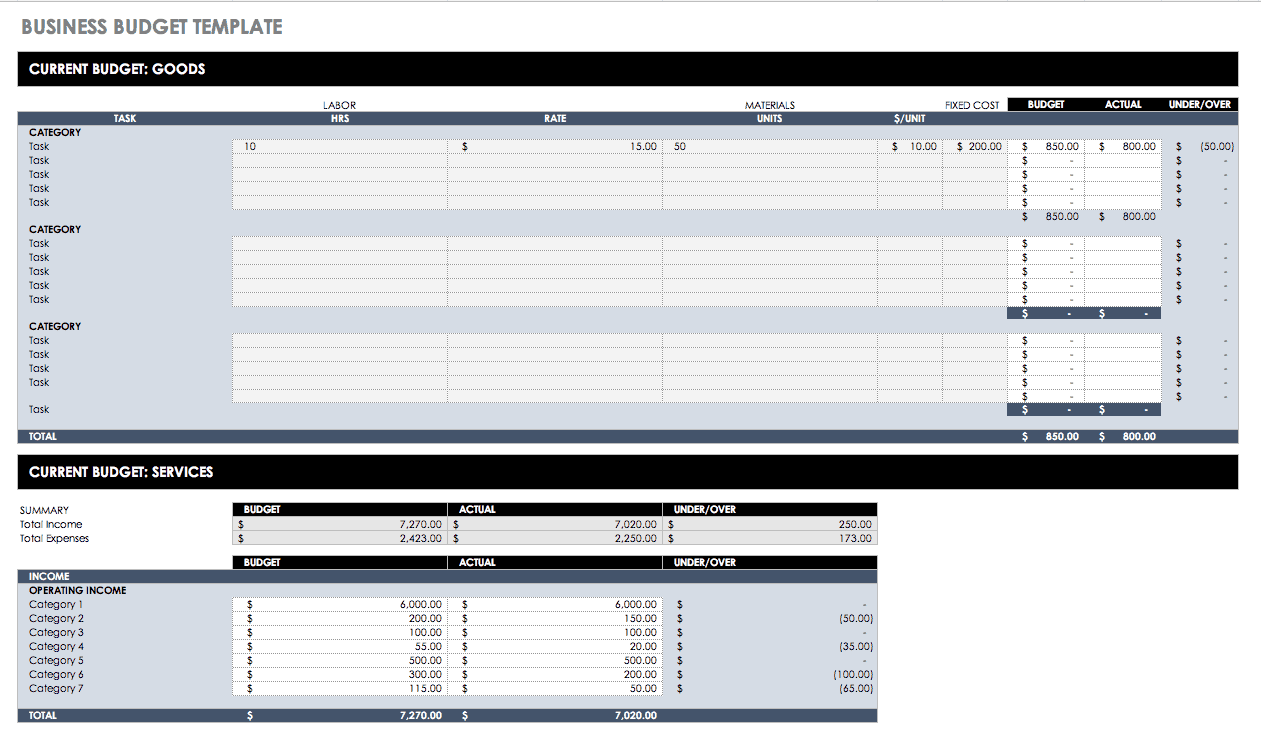

Related Financial Templates

Check out this list of free financial templates related to financial projections and forecasting. You'll find templates for budgeting, tracking profits and losses, planning your finances, and more. These tools help keep your company’s money matters organized and clear.

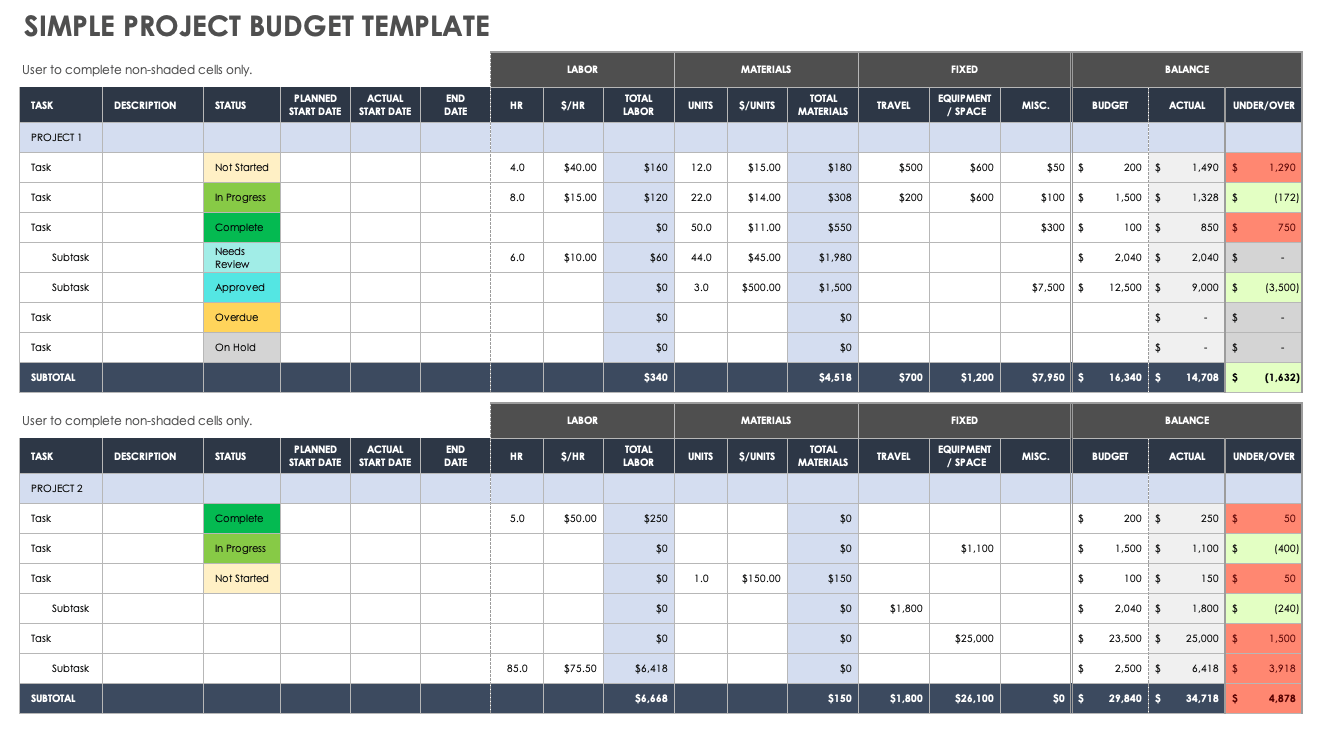

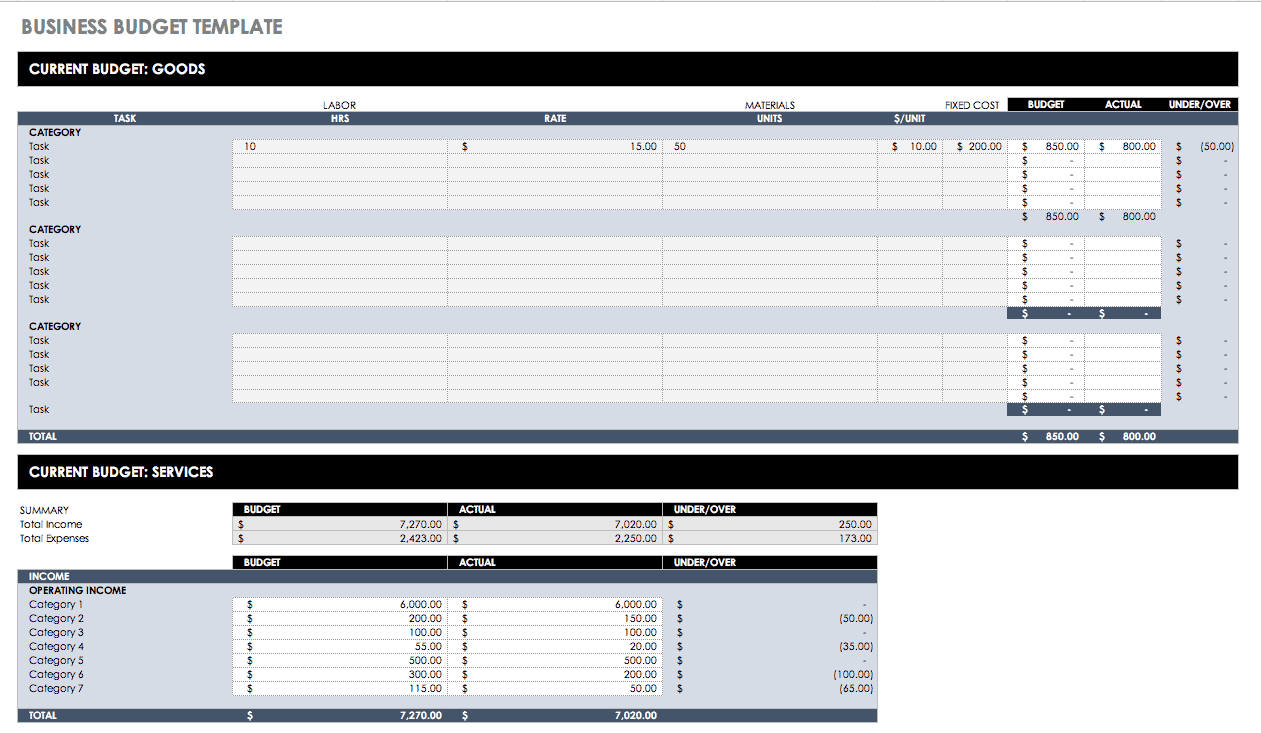

Free Project Budget Templates

Use one of these project budget templates to maintain control over project finances, ensuring costs stay aligned with the allocated budget and improving overall financial management.

Free Monthly Budget Templates

Use one of these monthly budget templates to effectively track and manage your business’s income and expenses, helping you plan financially and save money.

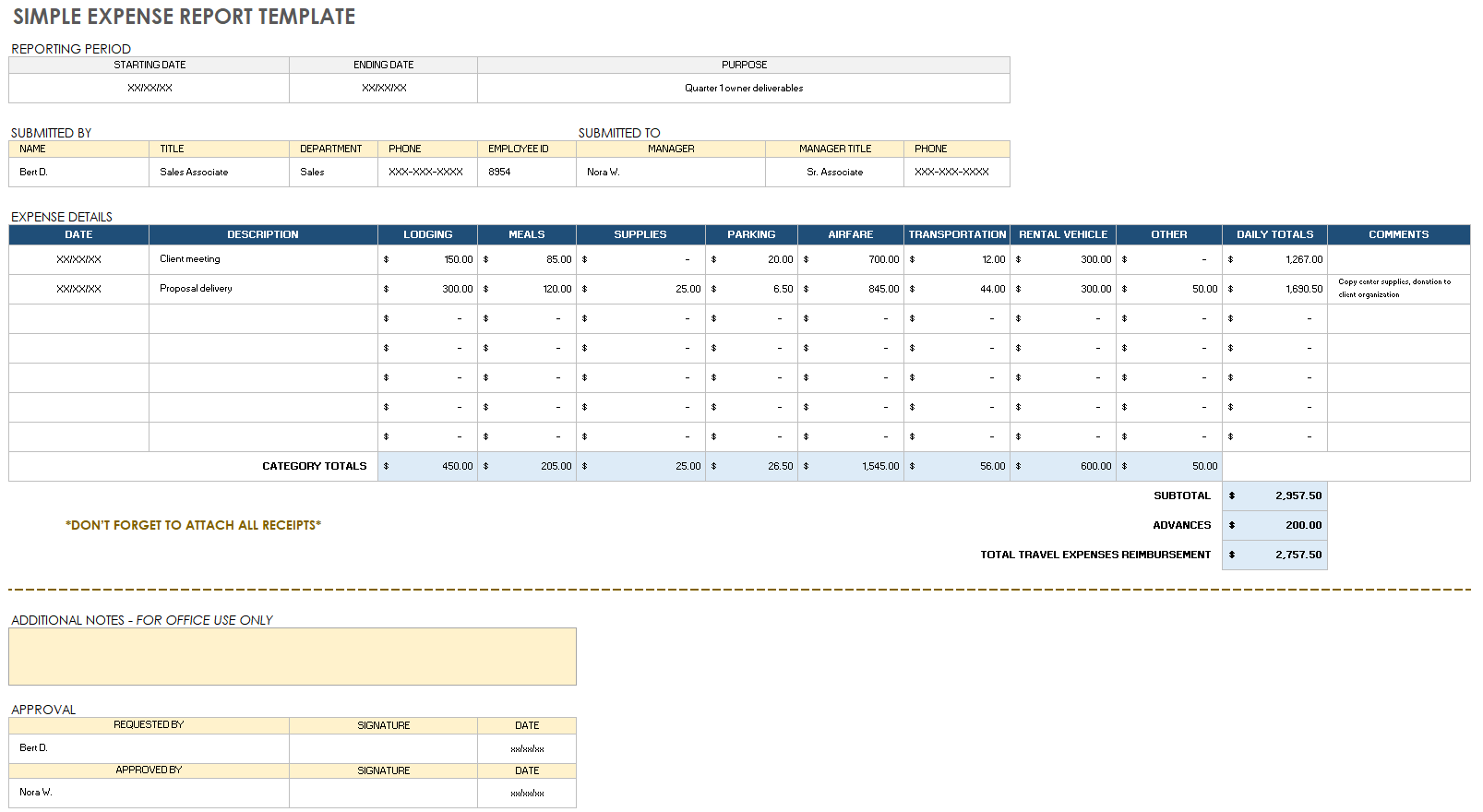

Free Expense Report Templates

Use one of these expense report templates to systematically track and document all business-related expenditures, ensuring accurate reimbursement and efficient financial record-keeping.

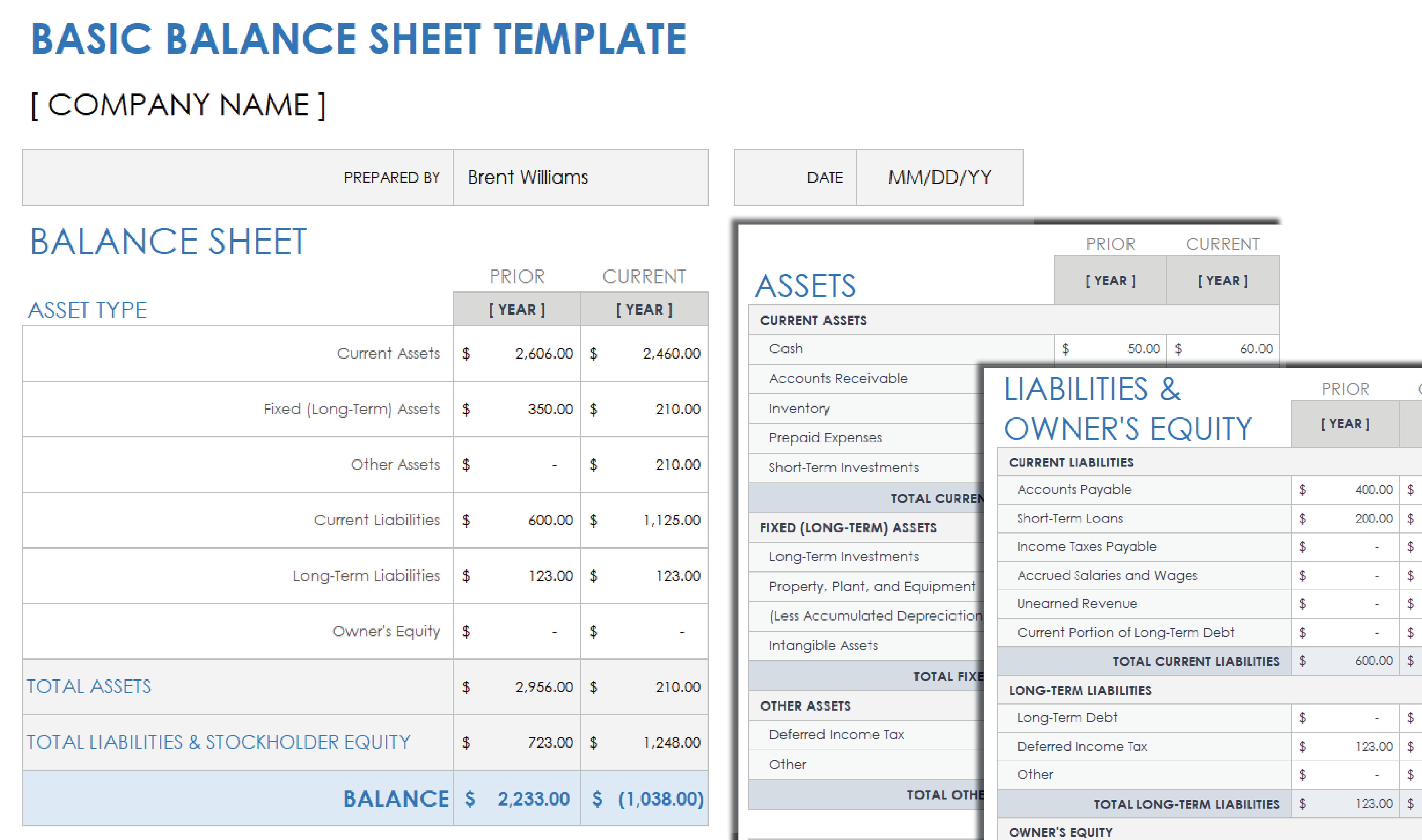

Free Balance Sheet Templates

Use one of these balance sheet templates to summarize your company's financial position at a given time.

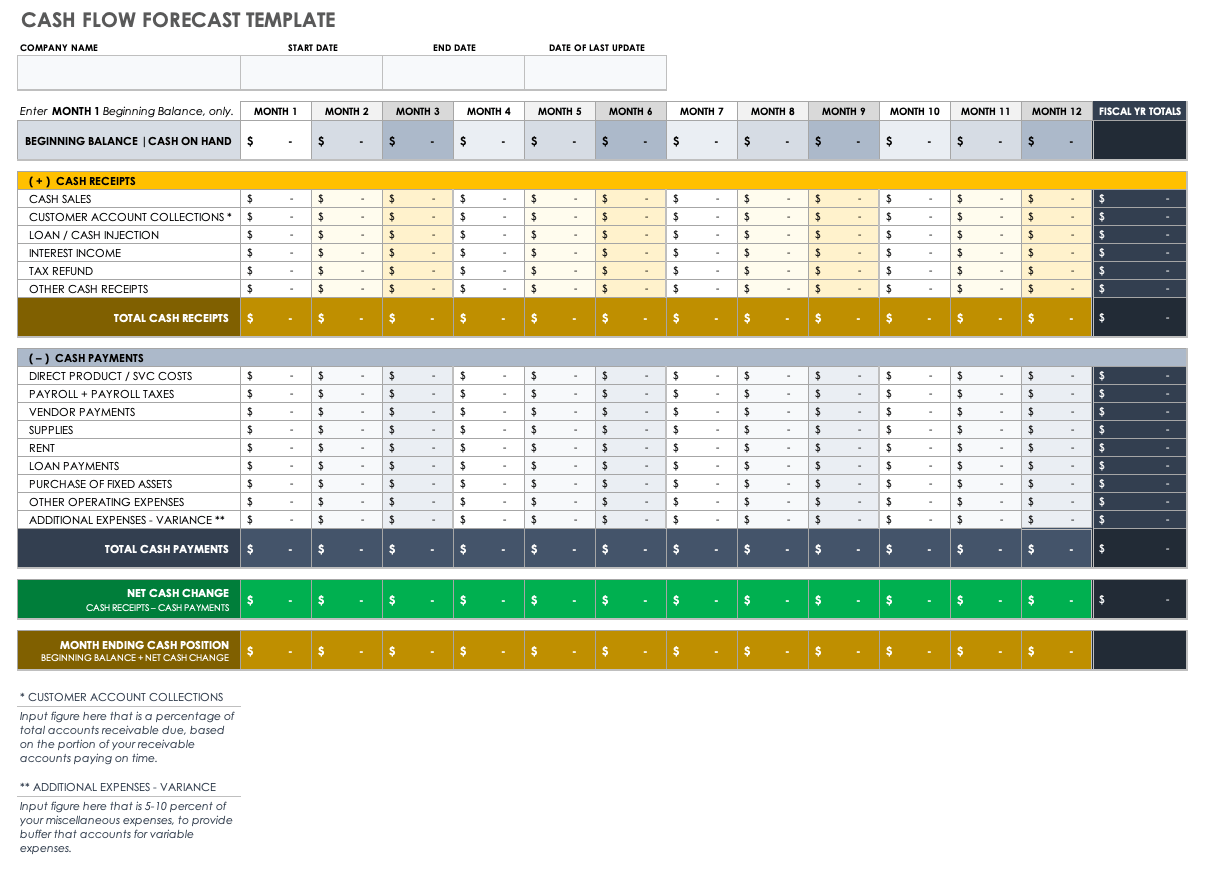

Free Cash-Flow Forecast Templates

Use one of these cash-flow forecast templates to predict future cash inflows and outflows, helping you manage liquidity and make informed financial decisions.

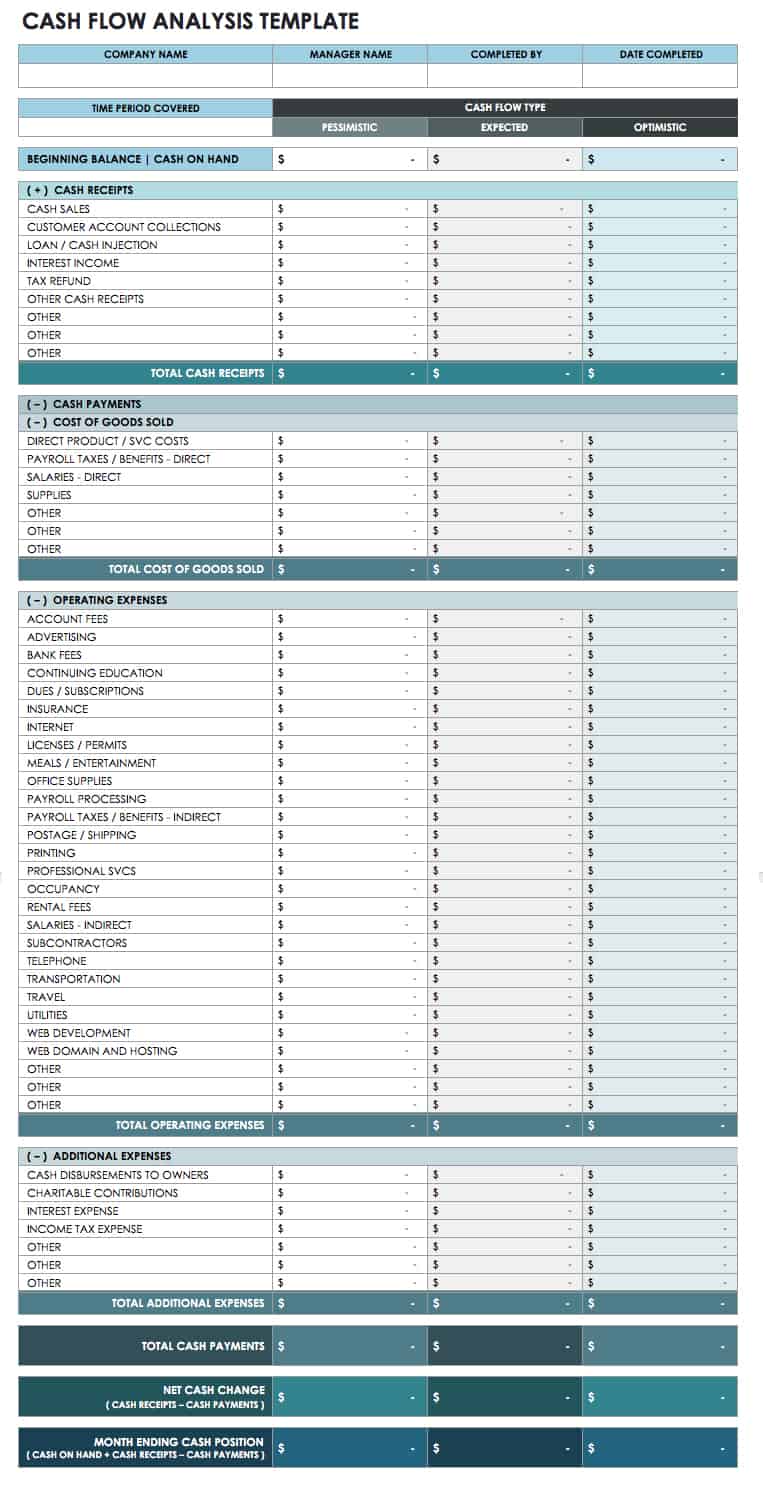

Free Cash-Flow Statement Templates

Use one of these cash-flow statement templates to track the movement of cash in and out of your business, so you can assess your company’s level of liquidity and financial stability.

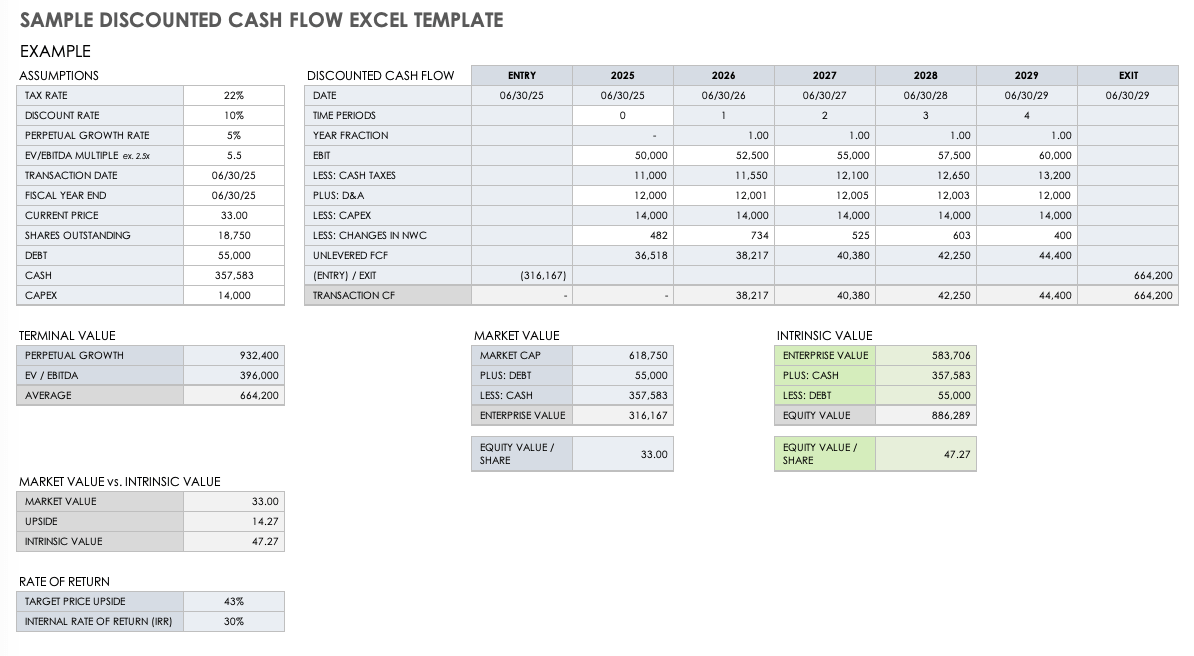

Free Discounted Cash-Flow (DCF) Templates

Use one of these discounted cash-flow (DCF) templates to evaluate the profitability of investments or projects by calculating their present value based on future cash flows.

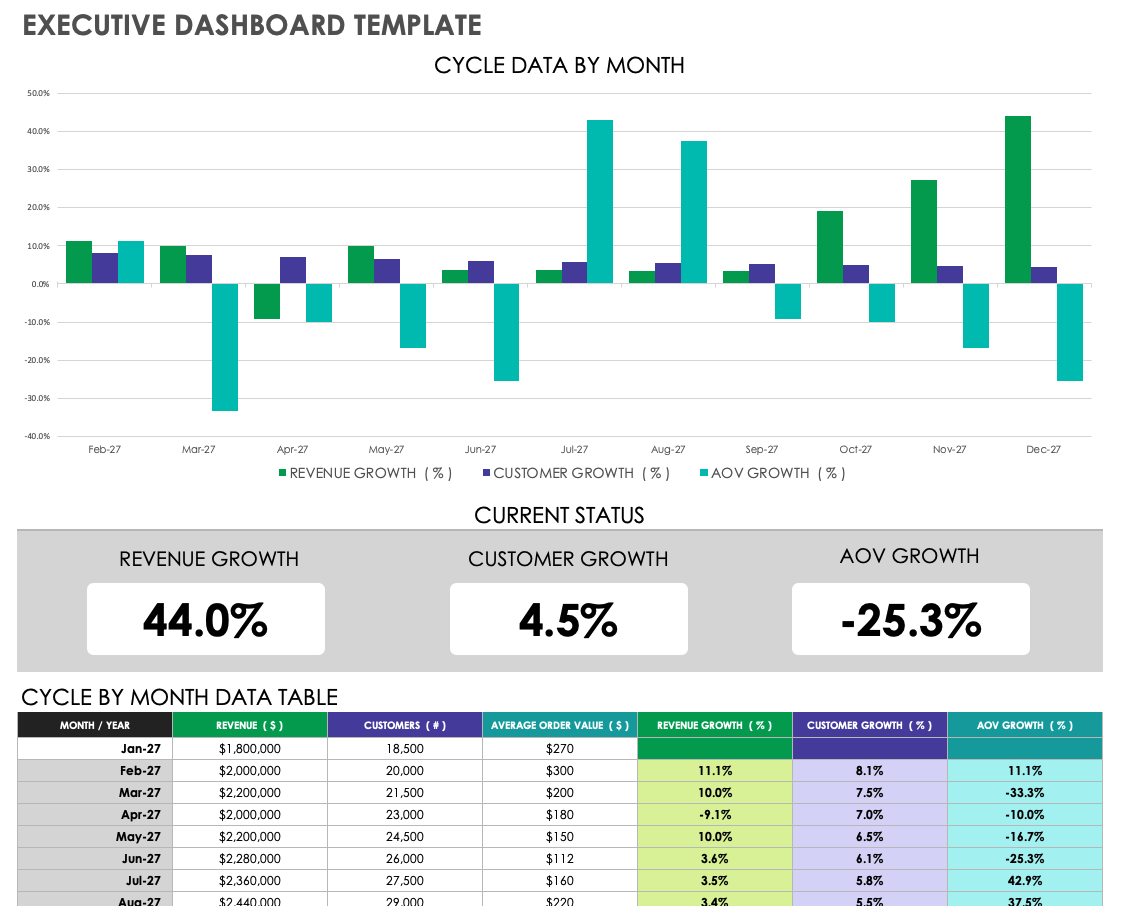

Free Financial Dashboard Templates

Use one of these financial dashboard templates to get an at-a-glance view of key financial metrics, so you can make decisions quickly and manage finances effectively.

Related Customer Stories

Free financial planning templates.

Use one of these financial planning templates to strategically organize and forecast future finances, helping you set realistic financial goals and ensure long-term business growth.

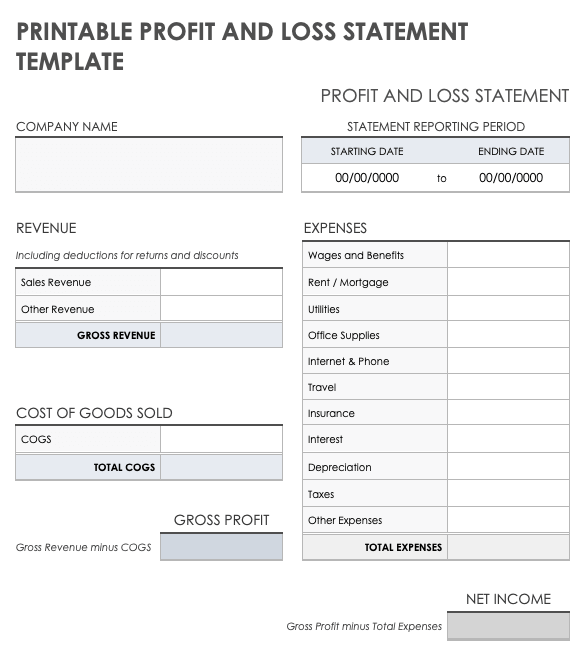

Free Profit and Loss (P&L) Templates

Use one of these profit and loss (P&L) templates to systematically track income and expenses, giving you a clear picture of your company's profitability over a specific period.

Free Billing and Invoice Templates

Use one of these billing and invoice templates to streamline the invoicing process and ensure that you bill clients accurately and professionally for services or products.

Plan and Manage Your Company’s Financial Future with Financial Projection and Forecasting Templates from Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

How to Write a Small Business Financial Plan

Noah Parsons

4 min. read

Updated April 22, 2024

Creating a financial plan is often the most intimidating part of writing a business plan.

It’s also one of the most vital. Businesses with well-structured and accurate financial statements are more prepared to pitch to investors, receive funding, and achieve long-term success.

Thankfully, you don’t need an accounting degree to successfully create your budget and forecasts.

Here is everything you need to include in your financial plan, along with optional performance metrics, funding specifics, mistakes to avoid , and free templates.

- Key components of a financial plan

A sound financial plan is made up of six key components that help you easily track and forecast your business financials. They include your:

Sales forecast

What do you expect to sell in a given period? Segment and organize your sales projections with a personalized sales forecast based on your business type.

Subscription sales forecast

While not too different from traditional sales forecasts—there are a few specific terms and calculations you’ll need to know when forecasting sales for a subscription-based business.

Expense budget

Create, review, and revise your expense budget to keep your business on track and more easily predict future expenses.

How to forecast personnel costs

How much do your current, and future, employees’ pay, taxes, and benefits cost your business? Find out by forecasting your personnel costs.

Profit and loss forecast

Track how you make money and how much you spend by listing all of your revenue streams and expenses in your profit and loss statement.

Cash flow forecast

Manage and create projections for the inflow and outflow of cash by building a cash flow statement and forecast.

Balance sheet

Need a snapshot of your business’s financial position? Keep an eye on your assets, liabilities, and equity within the balance sheet.

What to include if you plan to pursue funding

Do you plan to pursue any form of funding or financing? If the answer is yes, then there are a few additional pieces of information that you’ll need to include as part of your financial plan.

Highlight any risks and assumptions

Every entrepreneur takes risks with the biggest being assumptions and guesses about the future. Just be sure to track and address these unknowns in your plan early on.

Plan your exit strategy

Investors will want to know your long-term plans as a business owner. While you don’t need to have all the details, it’s worth taking the time to think through how you eventually plan to leave your business.

- Financial ratios and metrics

With your financial statements and forecasts in place, you have all the numbers needed to calculate insightful financial ratios.

While including these metrics in your plan is entirely optional, having them easily accessible can be valuable for tracking your performance and overall financial situation.

Key financial terms you should know

It’s not hard. Anybody who can run a business can understand these key financial terms. And every business owner and entrepreneur should know them.

Common business ratios

Unsure of which business ratios you should be using? Check out this list of key financial ratios that bankers, financial analysts, and investors will want to see.

Break-even analysis

Do you want to know when you’ll become profitable? Find out how much you need to sell to offset your production costs by conducting a break-even analysis.

How to calculate ROI

How much could a business decision be worth? Evaluate the efficiency or profitability by calculating the potential return on investment (ROI).

- How to improve your financial plan

Your financial statements are the core part of your business plan that you’ll revisit most often. Instead of worrying about getting it perfect the first time, check out the following resources to learn how to improve your projections over time.

Common mistakes with business forecasts

I was glad to be asked about common mistakes with startup financial projections. I read about 100 business plans per year, and I have this list of mistakes.

How to improve your financial projections

Learn how to improve your business financial projections by following these five basic guidelines.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Financial plan templates and tools

Download and use these free financial templates and calculators to easily create your own financial plan.

Sales forecast template

Download a free detailed sales forecast spreadsheet, with built-in formulas, to easily estimate your first full year of monthly sales.

Download Template

Accurate and easy financial forecasting

Get a full financial picture of your business with LivePlan's simple financial management tools.

Get Started

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

- What to include for funding

Related Articles

10 Min. Read

How to Write a Competitive Analysis for Your Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

How to Set and Use Milestones in Your Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

SMALL BUSINESS MONTH. 50% Off for 6 Months. BUY NOW & SAVE

50% Off for 6 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- Reports Library

- FreshBooks vs QuickBooks

- FreshBooks vs HoneyBook

- FreshBooks vs Harvest

- FreshBooks vs Wave

- FreshBooks vs Xero

- Free Invoice Generator

- Invoice Templates

- Accounting Templates

- Business Name Generator

- Estimate Templates

- Help Center

- Business Loan Calculator

- Mark Up Calculator

Call Toll Free: 1.866.303.6061

1-888-674-3175

- All Articles

- Productivity

- Project Management

- Bookkeeping

Resources for Your Growing Business

How to make financial projections for business.

Writing a solid business plan should be the first step for any business owner looking to create a successful business.

As a small business owner, you will want to get the attention of investors, partners, or potential highly skilled employees. It is, therefore, important to have a realistic financial forecast incorporated into your business plan.

We’ll break down a financial projection and how to utilize it to give your business the best start possible.

Key Takeaways

Accurate financial projections are essential for businesses to succeed. In this article, we’ll explain everything you need to know about creating financial projections for your business. Here’s what you need to know about financial projections:

- A financial projection is a group of financial statements that are used to forecast future performance

- Creating financial projections can break down into 5 simple steps: sales projections, expense projections, balance sheet projections, income statement projections, and cash flow projections

- Financial projections can offer huge benefits to your business, including helping with forecasting future performance, ensuring steady cash flow, and planning key moves around the growth of the business

Here’s What We’ll Cover:

What Is a Financial Projection?

How to Create a Financial Projection

What goes into a financial projection, what are financial projections used for.

Financial Projections Advantages

Frequently Asked Questions

What Is Financial Projection?

A financial projection is essentially a set of financial statements . These statements will forecast future revenues and expenses.

Any projection includes your cash inflows and outlays, your general income, and your balance sheet.

They are perfect for showing bankers and investors how you plan to repay business loans. They also show what you intend to do with your money and how you expect your business to grow.

Most projections are for the first 3-5 years of business, but some include a 10-year forecast too.

Either way, you will need to develop a short and mid-term projection broken down month by month.

As you are just starting out with your business, you won’t be expected to provide exact details. Most financial projections are rough guesses. But they should also be educated guesses based on market trends, research, and looking at similar businesses.

It’s incredibly important for financial statements to be realistic. Most investors will be able to spot a fanciful projection from a mile away.

In general, most people would prefer to be given realistic projections, even if they’re not as impressive.

Financial projections are created to help business owners gain insight into the future of their company’s financials.

The question is, how to create financial projections? For business plan purposes, it’s important that you follow the best practices of financial projection closely. This will ensure you get accurate insight, which is vital for existing businesses and new business startups alike.

Here are the steps for creating accurate financial projections for your business.

1. Start With A Sales Projection

For starters, you’ll need to project how much your business will make in sales. If you’re creating a sales forecast for an existing business, you’ll have past performance records to project your next period. Past data can provide useful information for your financial projection, such as if your sales do better in one season than another.

Be sure also to consider external factors, such as the economy at large, the potential for added tariffs and taxes in the future, supply chain issues, or industry downturns.

The process is almost the same for new businesses, only without past data to refer to. Business startups will need to do more research on their industry to gain insight into potential future sales.

2. Create Your Expense Projection

Next, create an expense projection for your business. In a sense, this is an easier task than a sales projection since it seems simpler to predict your own behaviors than your customers. However, it’s vital that you expect the unexpected.

Optimism is great, but the worst-case scenario must be considered and accounted for in your expense projection. From accidents in the workplace to natural disasters, rising trade prices, to unexpected supply disruptions, you need to consider these large expenses in your projection.

Something always comes up, so we suggest you add a 10-15% margin on your expense projection.

3. Create Your Balance Sheet Projection

A balance sheet projection is used to get a clear look at your business’s financial position related to assets, liabilities , and equity, giving you a more holistic view of the company’s overall financial health.

For startup businesses, this can prove to be a lot of work since you won’t have existing records of past performance to pull from. This will need to be factored into your industry research to create an accurate financial projection.

For existing businesses, it will be more straightforward. Use your past and current balance sheets to predict your business’s position in the next 1-3 years. If you use a cloud-based, online accounting software with the feature to generate balance sheets, such as the one offered by FreshBooks, you’ll be able to quickly create balance sheets for your financial projection within the app.

Click here to learn more about the features of FreshBooks accounting software.

4. Make Your Income Statement Projection

Next up, create an income statement projection. An income statement is used to declare the net income of a business after all expenses have been made. In other words, it states the profits of a business.

For currently operating businesses, you can use your past income statements and the changes between them to create accurate predictions for the next 1-3 years. You can also use accounting software to generate your income statements automatically.

You’ll need to work on rough estimates for new businesses or those still in the planning phase. It’s vital that you stay realistic and do your utmost to create an accurate, good-faith projection of future income.

5. Finally, Create Your Cash Flow Projection

Last but not least is to generate your projected cash flow statement. A cash flow projection forecasts the movement of all money to and from your business. It’s intertwined with a business’s balance sheet and income statement, which is no different when creating projections.

If your business has been operating for six months or more, you can create a fairly accurate cash flow projection with your past cash flow financial statements. For new businesses, you’ll need to factor in this step of creating a financial forecast when doing your industry research.

It needs to include five elements to ensure an accurate, useful financial forecast for your business. These financial statements come together to provide greater insight into the projected future of a business’s financial health. These include:

Income Statement

A standard income statement summarizes your company’s revenues and expenses over a period. This is normally done either quarterly or annually.

The income statement is where you will do the bulk of your forecasting.

On any income statement, you’re likely to find the following:

- Revenue: Your revenue earned through sales.

- Expenses: The amount you’ve spent, including your product costs and your overheads.

- Pre-Tax Earnings: This is your income before you’ve paid tax.

- Net Income: The total revenues minus your total expenses.

Net income is the most important number. If the number is positive, then you’re earning a profit, if it’s negative, it means your expenses outweigh your revenue and you’re making a loss.

Cash Flow Statement

Your cash flow statement will show any potential investor whether you are a good credit risk. It also shows them if you can successfully repay any loans you are granted.

You can break a cash flow statement into three parts:

- Cash Revenues: An overview of your calculated cash sales for a given time period.

- Cash Disbursements: You list all the cash expenditures you expect to pay.

- Net Cash Revenue: Take the cash revenues minus your cash disbursements.

Balance Sheet

Your balance sheet will show your business’s net worth at a given time.

A balance sheet is split up into three different sections:

- Assets: An asset is a tangible object of value that your company owns. It could be things like stock or property such as warehouses or offices.

- Liabilities: These are any debts your business owes.

- Equity: Your equity is the summary of your assets minus your liabilities.

Looking for an easy-to-use yet capable online accounting software? FreshBooks accounting software is a cloud-based solution that makes financial projections simple. With countless financial reporting features and detailed guides on creating accurate financial forecasts, FreshBooks can help you gain the insight you need to let your business thrive. Click here to give FreshBooks a try for free.

Financial projections have many uses for current business owners and startup entrepreneurs. Provided your financial forecasting follows the best practices for an accurate projection, your data will be used for:

- Internal planning and budgeting – Your finances will be the main factor in whether or not you’ll be able to execute your business plan to completion. Financial projections allow you to make it happen.

- Attracting investors and securing funding – Whether you’re receiving financing from bank loans, investors, or both, an accurate projection will be essential in receiving the funds you need.

- Evaluating business performance and identifying areas for improvement – Financial projections help you keep track of your business’s financial health, allowing you to plan ahead and avoid unwelcome surprises.

- Making strategic business decisions – Timing is important in business, especially when it comes to major expenditures (new product rollouts, large-scale marketing, expansion, etc.). Financial projections allow you to make an informed strategy for these big decisions.

Financial Projections Advantages

Creating clear financial projections for your business startup or existing company has countless benefits. Focusing on creating (and maintaining) good financial forecasting for your business will:

- Help you make vital financial decisions for the business in the future

- Help you plan and strategize for growth and expansion

- Demonstrate to bankers how you will repay your loans

- Demonstrate to investors how you will repay financing

- Identify your most essential financing needs in the future

- Assist in fine-tuning your pricing

- Be helpful when strategizing your production plan

- Be a useful tool for planning your major expenditures strategically

- Help you keep an eye on your cash flow for the future

Your financial forecast is an essential part of your business plan, whether you’re still in the early startup phases or already running an established business. However, it’s vital that you follow the best practices laid out above to ensure you receive the full benefits of comprehensive financial forecasting.

If you’re looking for a useful tool to save time on the administrative tasks of financial forecasting, FreshBooks can help. With the ability to instantly generate the reports you need and get a birds-eye-view of your business’s past performance and overall financial help, it will be easier to create useful financial projections that provide insight into your financial future.

FAQs on Financial Projections

More questions about financial forecasting, projections, and how these processes fit into your business plan? Here are some frequently asked questions by business owners.

Why are financial projections important?

Financial projections allow you to gain insight into your business’s economic trajectory. This helps business owners make financial decisions, secure funding, and more. Additionally, financial projections provide early warning of roadblocks and challenges that may lay ahead for the company, making it easier to plan for a clear course of action.

What is an example of a financial projection?

A projection is an overall look at a business’s forecasted performance. It’s made up of several different statements and reports, such as a cash flow statement, income statement, profit and loss statement, and sales statement. You can find free templates and examples of many of these reports via FreshBooks. Click here to view our selection of accounting templates.

Are financial forecasts and financial projections the same?

Technically, there is a difference between forecasting and projections, though many use the terms interchangeably. Financial forecasting often refers to shorter-term (<1 year) predictions of financial performance, while financial projections usually focus on a larger time scale (2-3 years).

What is the most widely used method for financial forecasting?

The most common method of accurate forecasting is the straight-line forecasting method. It’s most often used for projecting the growth of a business’s revenue growth over a set period. If you notice that your records indicate a 4% growth of revenue per year for five years running, it would be reasonable to assume that this will continue year-over-year.

What is the purpose of a financial projection?

Projection aims to get deeper, more nuanced insight into a business’s financial health and viability. It allows business owners to anticipate expenses and profit growth, giving them the tools to secure funding and loans and strategize major business decisions. It’s an essential accounting process that all business owners should prioritize in their business plans.

Michelle Alexander, CPA

About the author

Michelle Alexander is a CPA and implementation consultant for Artificial Intelligence-powered financial risk discovery technology. She has a Master's of Professional Accounting from the University of Saskatchewan, and has worked in external audit compliance and various finance roles for Government and Big 4. In her spare time you’ll find her traveling the world, shopping for antique jewelry, and painting watercolour floral arrangements.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

👋 Welcome to FreshBooks

To see our product designed specifically for your country, please visit the United States site.

What's Planergy?

Modern Spend Management and Accounts Payable software.

Helping organizations spend smarter and more efficiently by automating purchasing and invoice processing.

We saved more than $1 million on our spend in the first year and just recently identified an opportunity to save about $10,000 every month on recurring expenses with Planergy.

Cristian Maradiaga

Download a free copy of "preparing your ap department for the future", to learn:.

- How to transition from paper and excel to eInvoicing.

- How AP can improve relationships with your key suppliers.

- How to capture early payment discounts and avoid late payment penalties.

- How better management in AP can give you better flexibility for cash flow management.

Business Plan Financial Projections: How To Create Accurate Targets

- Written by Keith Murphy

- 16 min read

Small businesses and startups have a lot riding on their ability to create effective and accurate financial projections as part of their business plan. Solid financials are a strong enticement for investors, after all, and can help new businesses chart a course that will take them beyond the legendendarily difficult first year and into a productive and profitable future.

But the need for business owners to look ahead in order to secure funding, increase profits, and make intelligent financial decisions doesn’t end when startups become full-fledged businesses—and business plan financial projections aren’t just for startups. Existing businesses can also put them to good use by harvesting insights from their existing financial statements and creating sales projections and other financial forecasts that guide and improve their ongoing business planning.

What Are Business Plan Financial Projections?

Successful companies plan ahead, looking as best they can into the near and distant future to chart a course to growth, innovation, and competitive strength. Financial projections, both as part of an initial business plan and as part of ongoing business planning, use a company’s financial statements to help business owners forecast their upcoming expenses and revenue in a strategically useful way.

Most businesses use two types of financial projections:

- Short-term projections are broken down by month and generally cover the coming 12 months. They provide a guide companies can use to monitor and adjust their financial activity to set and hit targets for the financial year. In the first year, short-term projections will be entirely estimated, but in subsequent years, historical data can be used to help fine-tune them for greater accuracy and strategic utility.

- Long-term projections are focused on the coming three to five years and are generally used to secure investment (both initial and ongoing), provide a strategic roadmap for the company’s growth, or both.

For startups, creating financial projections is part of their initial business plan. Providing financial forecasts banks and potential investors can use to determine the financial viability of a business is key to obtaining financing and investments needed to get the business off the ground.

For existing businesses—for whom an initial business plan has evolved into business planning—financial projections are useful in attracting investors who want to see clear estimates for upcoming revenue, expenses, and potential growth. They’re also helpful in securing loans and lines of credit from financial institutions for the same reason. And even if you’re not trying to get funding or investments, financial projections provide a useful framework for building budgets focused on growth and competitive advantage.

So whether you’re a small business owner, an aspiring tycoon starting a new business, or part of the financial team at a well-established corporation, what matters most is viewing financial projections as a living, breathing reference tool that can help you plan and budget for growth in a realistic way while still setting aspirational goals for your business.

Financial projections, both as part of an initial business plan and as part of ongoing business planning, use a company’s financial statements to help business owners forecast their upcoming expenses and revenue in a strategically useful way.

Financial Projections: Core Components

Whether you’re preparing them as part of your business plan or to enhance your business planning, you’ll need the same financial statements to prepare financial projections: an income statement, a cash-flow statement, and a balance sheet.

- Income statements , sometimes called profit and loss statements , provide detailed information on your company’s revenue and expenses for a given period (e.g., a quarter, year, or multi-year period).

- Cash flow statements provide a comprehensive view of cash flowing into and out of a business. They record all cash flow from operations, investment, and financing activities.

- Balance sheets are used to showcase a company’s assets, liabilities, and owner’s equity for a specific period.

How to Create Financial Projections

The process of creating financial projections is the same whether you’re drafting a business plan or creating forecasts for an existing business. The primary difference is whether you’ll draw on your own research and expertise (a new business or startup business) or use historical data (existing businesses).

Keep in mind that while you’ll create the necessary documents separately, you’ll most likely finish them by consulting each of them as needed. For example, your sales forecast might change once you prepare your cash-flow statement. The best approach is to view each document as both its own piece of the financial projection puzzle and a reference for the others; this will help ensure you can assemble comprehensive and clear financial projections.

1. Start with a Sales Projection

A sales forecast is the first step in creating your income statement. You can start with a one, three, or five-year projection, but keep in mind that, without historical financial data, accuracy may decrease over time. It’s best to start with monthly income statements until you reach your projected break-even , which is the point at which revenue exceeds total operating expenses and you show a profit. Once you hit the break-even, you can transition to annual income statements.

Also, keep in mind factors outside of sales; market conditions, global environmental, political, and health concerns, sourcing challenges (including pricing changes and increased variable costs) and other business disruptors can put the kibosh on your carefully constructed forecasts if you leave them out of your considerations.

Start with a reasonable estimate of the units sold for the forecast period, and multiply them by the price per unit. This value is your total sales for the period.

Next, estimate the total cost of producing these units (i.e., the cost of goods sold , or COGS; sometimes called cost of sales ) by multiplying the per-unit cost by the number of units produced.

Deducting your COGS from your estimated sales yields your gross profit margin.

From the gross margin, subtract expenses such as wages, marketing costs, rent, and other operating expenses. The result is your projected operating income , or net income .

Using these figures, you can create an income statement:

2. Cash Flow Statement

Tracking your estimated cash inflows and outflows from investment and financing, combined with the cash generated by business operations, is the purpose of a cash flow projection .

Investment activities might include, for example, purchasing real estate or investing in research and development outside of daily operations.

Financing activities include cash inflows from investor funding or business loans, as well as cash outflows to repay debts or pay dividends to shareholders.

A reliable and accurate cash flow projection is essential to managing your working capital effectively and ensuring you have all the cash you need to cover your ongoing obligations while still having enough left to invest in growth and innovation or cover emergencies.

Drawing from our income statement, we can create a basic cash flow statement:

3. The Balance Sheet

Providing a “snapshot” of your businesses’ financial performance for a given period of time, the balance sheet contains your company’s assets, liabilities, and owner’s equity.

Assets include inventory, real estate, and capital, while liabilities represent financial obligations and include accounts payable, bank loans, and other debt.

Owner’s equity represents the amount remaining once liabilities have been paid.

Ideally, over time your company’s balance sheet will reflect your growth through a reduction of liabilities and an increase in owner’s equity.

We can complete our triumvirate of financial statements with a basic balance sheet:

Best Practices for Effective Financial Projections

Like a lot of other business processes, financial planning can be complex, time-consuming, and even frustrating if you’re still using manual workflows and paper documents or basic spreadsheet-style applications such as Microsoft Excel. You can get free templates for basic financial projections from the Service Corps of Retired Executives (SCORE), but even templates can only take you so far.

Without a doubt, the best advantage you can give yourself in creating effective and accurate financial projections—whether they’re for the financial section of your business plan or simply part of your ongoing business planning—is to invest in comprehensive procure-to-pay (P2P) software such as Planergy.

In addition to helpful templates, best-in-class P2P software also provides a rich array of real-time data analysis, reporting, and forecasting tools that make it easy to transform historical data (or market research) into accurate forecasts. In addition, artificial intelligence and process automation make it easy to collect, organize, manage and share your data with all internal stakeholders, so everyone has the information they need to create the most useful and complete forecasts and projections possible.

Beyond investing in P2P software, you can also improve the quality and accuracy of your financial projections by:

- Doing your homework. Invest in financial statement analysis and ratio analysis, with a focus not just on your own company, but your industry and the market in general. Learn the current ratios used for liquidity analysis, profitability, and debt and compare them to your own to get a more nuanced and useful understanding of how your company performs internally and within the context of the marketplace.

- Keeping it real. It can be all too easy to get carried away with pie-in-the-sky optimism when forecasting the future of your business. Rose-colored glasses aren’t exclusive to startups and small businesses; over-inflated estimates can hobble even veteran organizations if they don’t practice good data discipline and temper their hopes with practical considerations. Focus on creating realistic, but positive, projections, and you won’t have to worry about investors or lenders glancing askance at your hard work.

- Hoping for the best, but planning for the worst. Run two scenarios when performing your financial projections: the best-case scenario where everything goes perfectly to plan, and a worse-case scenario where Murphy’s Law holds sway. While actual performance will undoubtedly fall somewhere in between the two, having an upper and lower boundary appeals to investors and lenders who are assessing your company’s financial viability.

Financial Projections Help You Reach Your Goals for Growth

From startups to global corporations, every business needs reliable tools for financial forecasting. Take the time to create well-researched, data-driven financial projections, and you’ll be well-equipped to attract investors, secure funding, and chart a course for greater profits, growth, and performance in today’s competitive marketplace.

What’s your goal today?

1. use planergy to manage purchasing and accounts payable.

- Read our case studies, client success stories, and testimonials.

- Visit our “Solutions” page to see the areas of your business we can help improve to see if we’re a good fit for each other.

- Learn about us, and our long history of helping companies just like yours.

2. Download our guide “Preparing Your AP Department For The Future”

3. learn best practices for purchasing, finance, and more.

Browse hundreds of articles , containing an amazing number of useful tools, techniques, and best practices. Many readers tell us they would have paid consultants for the advice in these articles.

Related Posts

The Future of FP&A: How The Role Is Evolving With The Use Of Real-Time Data

- 17 min read

Days Sales Outstanding: What Is It and How To Calculate It

- 19 min read

Budgeting In UK Schools: MAT, Academy Budgeting Challenges and Best Practices

Procurement.

- Purchasing Software

- Purchase Order Software

- Procurement Solutions

- Procure-to-Pay Software

- E-Procurement Software

- PO System For Small Business

- Spend Analysis Software

- Vendor Management Software

- Inventory Management Software

AP & FINANCE

- Accounts Payable Software

- AP Automation Software

- Compliance Management Software

- Business Budgeting Software

- Workflow Automation Software

- Integrations

- Reseller Partner Program

Business is Our Business

Stay up-to-date with news sent straight to your inbox

Sign up with your email to receive updates from our blog

This website uses cookies

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services.

Read our privacy statement here .

ZenBusinessPlans

Home » Business Plans

How to Write a Business Plan Financial Projection [Sample Template]

How do you prepare a business plan financial statement? Do you need help developing business plan financial projections? Do you need a business plan projections template? Then i advice you read on because this article is for you.

What is a Business Plan Financial Statement?

The financial statement is a distinct section of your business plan because it outlines your financial projections. A business lives and dies based on its financial feasibility and most importantly its profitability. Regardless of how hard you work or how much you have invested of your time and money, people, at the end of the day, only want to support something that can return their investments with profits.

Your executive summary may be brilliantly crafted, and your market or industry analysis may be the bomb. But your business plan isn’t just complete without a financial statement to justify it with good figures on the bottom line.

Your financial statement is what makes or mars your chances of obtaining a bank loan or attracting investors to your business. Even if you don’t need financing from a third party, compiling a financial statement will help you steer your business to success. So, before we dig further into how to prepare a financial statement, you need to understand what a financial statement is not.

What’s the Difference Between a Financial Projection Statement and Accounting Statement?

However, you need to keep in mind that the financial statement is not the same as an accounting statement. Granted, a financial statement includes financial projections such as profit and loss, balance sheets, and cash flow, all of which makes it look similar to an accounting statement.

But the major difference between them is that an accounting statement deals with the past, while the financial projections statement of your business plan outlines your future spending and earnings. Having made this point clear, let’s now look at the steps involved on preparing a financial statement for your business plan.

So what exactly do you have to include in this section? You will need to include three statements:

- Income Statement

- Balance Sheet

- Cash-Flow Statement

Now, let’s briefly discuss each.

Components of a Business Plan Financial Statement

Income statement.

This beautiful composition of numbers tells the reader what exactly your sources of revenue are and which expenses you spent your money on to arrive at the bottom line. Essentially, for a given time period, the income statement states the profit or loss ( revenue-expenses ) that you made.

Balance sheet

The key word here is “ balance, ” but you are probably wondering what exactly needs to be weighed, right? On one side you should list all your assets ( what you own ) and on the other side, all your liabilities ( what you owe ), thereby giving a snapshot of your net worth ( assets – liabilities = equity ).

Cash flow statement

This statement is similar to your income statement with one important difference; it takes into account just when revenues are actually collected and when expenses are paid. When the cash you have coming in ( collected revenue ) is greater than the cash you have going out ( disbursements ), your cash flow is said to be positive.

And when the opposite scenario is true, your cash flow is negative. Ideally, your cash flow statement will allow you to recognize where cash is low, when you might have a surplus, and how to be on top of your game when operating in an uncertain environment.

How to Prepare a Business Plan Financial Projections Statement

1. Start by preparing a revenue forecast and a forecast profit and loss statement

Also, prepare supporting schedules with detailed information about your projected personnel and marketing costs. If your business has few fixed assets or it’s just a cash business without significant receivables, you don’t need a forecast balance sheet.

2. Using your planned revenue model, prepare a spreadsheet

Set the key variables in such a way that they can be easily changed as your calculations chain through. To ensure that your projected revenues are realistic and attainable, run your draft through a number of iterations. For each year covered in your business plan, prepare a monthly forecast of revenues and spending.

3. If you plan to sell any goods, then include a forecast of goods sold

This applies the most to manufacturing businesses. Give a reasonable estimate for this cost. And be of the assumption that the efficiency of your products would increase with time and the cost of goods sold as a percentage of sales will decline.

4. Quantify your marketing plan

Look at each marketing strategy you outlined in the business plan and attach specific costs to each of them. That is, if you are looking at billboard advertising, TV advertising, and online marketing methods such as pay-per-click advertising and so on; then you should estimate the cost of each medium and have it documented.

5. Forecast the cost of running the business, including general and administrative costs

Also, forecast the cost of utilities, rents, and other recurring costs. Don’t leave out any category of expenses that is required to run your business. And don’t forget the cost of professional services such as accounting and legal services.

6. In the form of a spreadsheet, forecast the payroll

This outlines each individual that you plan to hire, the month they will start work, and their salary. Also include the percentage salary increases (due to increased cost of living and as reward for exemplary performance) that will come in the second and subsequent years of the forecast.

Additional tips for Writing a Business Plan Financial Statement

- Don’t stuff your pages with lots of information, and avoid large chunks of text. Also, use a font size that is large enough. Even if these would spread out your statement into more pages, don’t hesitate to spread it out. Legibility matters!

- After completing the spreadsheets in the financial statement, you should summarize the figures in the narrative section of your business plan.

- Put a table near the front of your financial statement that shows projected figures, pre-tax profit, and expenses. These are the figures you want the reader to remember. You can help the reader retain these figures in memory by including a bar chart of these figures, too.

As a final note, you should keep in mind that a financial statement is just an informed guess of what will likely happen in the future. In reality, the actual results you will achieve will vary. In fact, this difference may be very far from what you have forecast.

So, if your business is a start-up, prepare more capital than your projections show that you will need. Entrepreneurs have a natural tendency to project a faster revenue growth than what is realistic. So, don’t let this instinct fool you.

More on Business Plans

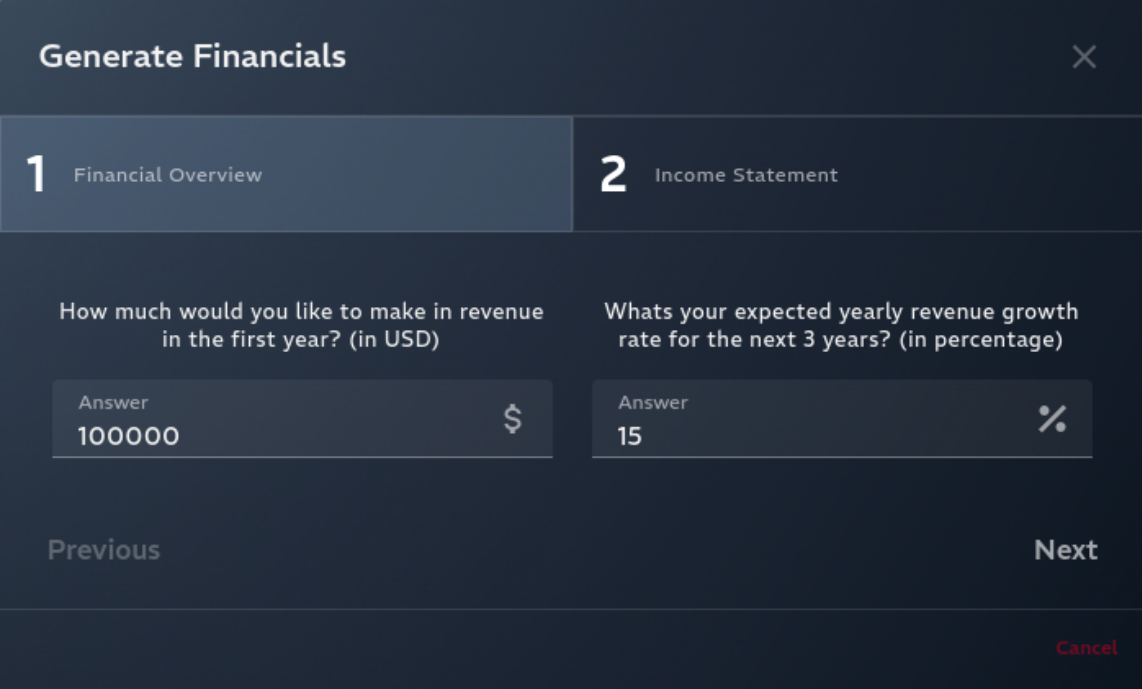

Plannit Financial Projections

Take Your Business Plan to the Next Level

Financial projections are a crucial part of any business plan. Plannit AI’s financial projections and income statement generator simplifies the process, allowing entrepreneurs to create accurate, detailed financial forecasts with ease. This feature streamlines the process of generating your initial financial information.

Comprehensive Financial Overview

Our algorithms merge seamlessly with the GPT-4 engine to learn from your revenue model, business information and financial inputs, to automatically generate a comprehensive financial overview for your business plan. This includes an in-depth look at the projected growth rate of the company, the expected revenue, and the anticipated expenses.

10x More Powerful AI

We utilize the GPT-4 engine at our own expense to ensure that you have access to the most powerful AI in the industry. This allows us to provide you with the most accurate and detailed financial overview possible.

Simplified User Experience

Answer a few additional questions to allow us to calculate your financial projections and generate an income statement for your business plan. All in under 30 seconds.

Detailed 3-Year Income Statement

Based on your revenue model, your business information and your financial inputs, we generate a detailed 3-year income statement for your business plan, formatting your vision into dollars.

Simple, Accurate, and Detailed

Plannit only requires a few additional inputs to generate your detailed financial overview and income statement. It also learns from your revenue model and takes industry standards into account.

Increase Your Chances of Getting Funded

Accurate financial projections.

Plannit AI’s financial projections and income statement generator ensures that your business plan is backed by accurate, detailed financial forecasts. This increases your chances of securing funding and support from investors and lenders.

Professional Income Statement