- Browse All Articles

- Newsletter Sign-Up

Marketing →

- 07 May 2024

- Cold Call Podcast

Lessons in Business Innovation from Legendary Restaurant elBulli

Ferran Adrià, chef at legendary Barcelona-based restaurant elBulli, was facing two related decisions. First, he and his team must continue to develop new and different dishes for elBulli to guarantee a continuous stream of innovation, the cornerstone of the restaurant's success. But they also need to focus on growing the restaurant’s business. Can the team balance both objectives? Professor Michael I. Norton discusses the connections between creativity, emotions, rituals, and innovation – and how they can be applied to other domains – in the case, “elBulli: The Taste of Innovation,” and his new book, The Ritual Effect.

- 29 Feb 2024

Beyond Goals: David Beckham's Playbook for Mobilizing Star Talent

Reach soccer's pinnacle. Become a global brand. Buy a team. Sign Lionel Messi. David Beckham makes success look as easy as his epic free kicks. But leveraging world-class talent takes discipline and deft decision-making, as case studies by Anita Elberse reveal. What could other businesses learn from his ascent?

- 17 Jan 2024

Psychological Pricing Tactics to Fight the Inflation Blues

Inflation has slowed from the epic rates of 2021 and 2022, but many consumers still feel pinched. What will it take to encourage them to spend? Thoughtful pricing strategies that empower customers as they make purchasing decisions, says research by Elie Ofek.

- 05 Dec 2023

What Founders Get Wrong about Sales and Marketing

Which sales candidate is a startup’s ideal first hire? What marketing channels are best to invest in? How aggressively should an executive team align sales with customer success? Senior Lecturer Mark Roberge discusses how early-stage founders, sales leaders, and marketing executives can address these challenges as they grow their ventures in the case, “Entrepreneurial Sales and Marketing Vignettes.”

Tommy Hilfiger’s Adaptive Clothing Line: Making Fashion Inclusive

In 2017, Tommy Hilfiger launched its adaptive fashion line to provide fashion apparel that aims to make dressing easier. By 2020, it was still a relatively unknown line in the U.S. and the Tommy Hilfiger team was continuing to learn more about how to serve these new customers. Should the team make adaptive clothing available beyond the U.S., or is a global expansion premature? Assistant Professor Elizabeth Keenan discusses the opportunities and challenges that accompanied the introduction of a new product line that effectively serves an entirely new customer while simultaneously starting a movement to provide fashion for all in the case, “Tommy Hilfiger Adaptive: Fashion for All.”

- Research & Ideas

Are Virtual Tours Still Worth It in Real Estate? Evidence from 75,000 Home Sales

Many real estate listings still feature videos and interactive tools that simulate the experience of walking through properties. But do they help homes sell faster? Research by Isamar Troncoso probes the post-pandemic value of virtual home tours.

- 17 Oct 2023

With Subscription Fatigue Setting In, Companies Need to Think Hard About Fees

Subscriptions are available for everything from dental floss to dog toys, but are consumers tiring of monthly fees? Elie Ofek says that subscription revenue can provide stability, but companies need to tread carefully or risk alienating customers.

- 29 Aug 2023

As Social Networks Get More Competitive, Which Ones Will Survive?

In early 2023, TikTok reached close to 1 billion users globally, placing it fourth behind the leading social networks: Facebook, YouTube, and Instagram. Meanwhile, competition in the market for videos had intensified. Can all four networks continue to attract audiences and creators? Felix Oberholzer-Gee discusses competition and imitation among social networks in his case “Hey, Insta & YouTube, Are You Watching TikTok?”

- 26 Jun 2023

Want to Leave a Lasting Impression on Customers? Don't Forget the (Proverbial) Fireworks

Some of the most successful customer experiences end with a bang. Julian De Freitas provides three tips to help businesses invest in the kind of memorable moments that will keep customers coming back.

- 31 May 2023

With Predictive Analytics, Companies Can Tap the Ultimate Opportunity: Customers’ Routines

Armed with more data than ever, many companies know what key customers need. But how many know exactly when they need it? An analysis of 2,000 ridesharing commuters by Eva Ascarza and colleagues shows what's possible for companies that can anticipate a customer's routine.

- 30 May 2023

Can AI Predict Whether Shoppers Would Pick Crest Over Colgate?

Is it the end of customer surveys? Definitely not, but research by Ayelet Israeli sheds light on the potential for generative AI to improve market research. But first, businesses will need to learn to harness the technology.

- 24 Apr 2023

What Does It Take to Build as Much Buzz as Booze? Inside the Epic Challenge of Cannabis-Infused Drinks

The market for cannabis products has exploded as more states legalize marijuana. But the path to success is rife with complexity as a case study about the beverage company Cann by Ayelet Israeli illustrates.

- 07 Apr 2023

When Celebrity ‘Crypto-Influencers’ Rake in Cash, Investors Lose Big

Kim Kardashian, Lindsay Lohan, and other entertainers have been accused of promoting crypto products on social media without disclosing conflicts. Research by Joseph Pacelli shows what can happen to eager investors who follow them.

- 10 Feb 2023

COVID-19 Lessons: Social Media Can Nudge More People to Get Vaccinated

Social networks have been criticized for spreading COVID-19 misinformation, but the platforms have also helped public health agencies spread the word on vaccines, says research by Michael Luca and colleagues. What does this mean for the next pandemic?

- 02 Feb 2023

Why We Still Need Twitter: How Social Media Holds Companies Accountable

Remember the viral video of the United passenger being removed from a plane? An analysis of Twitter activity and corporate misconduct by Jonas Heese and Joseph Pacelli reveals the power of social media to uncover questionable situations at companies.

- 06 Dec 2022

Latest Isn’t Always Greatest: Why Product Updates Capture Consumers

Consumers can't pass up a product update—even if there's no improvement. Research by Leslie John, Michael Norton, and Ximena Garcia-Rada illustrates the powerful allure of change. Are we really that naïve?

- 29 Nov 2022

How Much More Would Holiday Shoppers Pay to Wear Something Rare?

Economic worries will make pricing strategy even more critical this holiday season. Research by Chiara Farronato reveals the value that hip consumers see in hard-to-find products. Are companies simply making too many goods?

- 26 Oct 2022

How Paid Promos Take the Shine Off YouTube Stars (and Tips for Better Influencer Marketing)

Influencers aspire to turn "likes" into dollars through brand sponsorships, but these deals can erode their reputations, says research by Shunyuan Zhang. Marketers should seek out authentic voices on YouTube, not necessarily those with the most followers.

- 25 Oct 2022

Is Baseball Ready to Compete for the Next Generation of Fans?

With its slower pace and limited on-field action, major league baseball trails football in the US, basketball, and European soccer in revenue and popularity. Stephen Greyser discusses the state of "America's pastime."

- 18 Oct 2022

When Bias Creeps into AI, Managers Can Stop It by Asking the Right Questions

Even when companies actively try to prevent it, bias can sway algorithms and skew decision-making. Ayelet Israeli and Eva Ascarza offer a new approach to make artificial intelligence more accurate.

- Free Resources

14 Market Research Examples

This article was originally published in the MarketingSherpa email newsletter .

Example #1: National bank’s A/B testing

You can learn what customers want by conducting experiments on real-life customer decisions using A/B testing. When you ensure your tests do not have any validity threats, the information you garner can offer very reliable insights into customer behavior.

Here’s an example from Flint McGlaughlin, CEO of MarketingSherpa and MECLABS Institute, and the creator of its online marketing course .

A national bank was working with MECLABS to discover how to increase the number of sign-ups for new checking accounts.

Customers who were interested in checking accounts could click on an “Open in Minutes” link on the bank’s homepage.

Creative Sample #1: Anonymized bank homepage

After clicking on the homepage link, visitors were taken to a four-question checking account selector tool.

Creative Sample #2: Original checking account landing page — account recommendation selector tool

After filling out the selector tool, visitors were taken to a results page that included a suggested package (“Best Choice”) along with a secondary option (“Second Choice”). The results page had several calls to action (CTAs). Website visitors were able to select an account and begin pre-registration (“Open Now”) or find out more information about the account (“Learn More”), go back and change their answers (“Go back and change answers”), or manually browse other checking options (“Other Checking Options”).

Creative Sample #3: Original checking account landing page — account recommendation selector tool results page

After going through the experience, the MECLABS team hypothesized that the selector tool wasn’t really delivering on the expectation the customer had after clicking on the “Open in Minutes” CTA. They created two treatments (new versions) and tested them against the control experience.

In the first treatment, the checking selector tool was removed, and instead, customers were directly presented with three account options in tabs from which customers could select.

Creative Sample #4: Checking account landing page Treatment #1

The second treatment’s landing page focused on a single product and had only one CTA. The call-to-action was similar to the CTA customers clicked on the homepage to get to this page — “Open Now.”

Creative Sample #5: Checking account landing page Treatment #2

Both treatments increased account applications compared to the control landing page experience, with Treatment #2 generating 65% more applicants at a 98% level of confidence.

Creative Sample #6: Results of bank experiment that used A/B testing

You’ll note the Level of Confidence in the results. With any research tactic or tool you use to learn about customers, you have to consider whether the information you’re getting really represents most customers, or if you’re just seeing outliers or random chance.

With a high Level of Confidence like this, it is more likely the results actually represent a true difference between the control and treatment landing pages and that the results aren’t just a random event.

The other factor to consider is — testing in and of itself will not produce results. You have to use testing as research to actually learn about the customer and then make changes to better serve the customer.

In the video How to Discover Exactly What the Customer Wants to See on the Next Click: 3 critical skills every marketer must master , McGlaughlin discussed this national bank experiment and explained how to use prioritization, identification and deduction to discover what your customers want.

This example was originally published in Marketing Research: 5 examples of discovering what customers want .

Example #2: Consumer Reports’ market intelligence research from third-party sources

The first example covers A/B testing. But keep in mind, ill-informed A/B testing isn’t market research, it’s just hoping for insights from random guesses.

In other words, A/B testing in a vacuum does not provide valuable information about customers. What you are testing is crucial, and then A/B testing is a means to help better understand whether insights you have about the customer are either validated or refuted by actual customer behavior. So it’s important to start with some research into potential customers and competitors to inform your A/B tests.

For example, when MECLABS and MarketingExperiments (sister publisher to MarketingSherpa) worked with Consumer Reports on a public, crowdsourced A/B test, we provided a market intelligence report to our audience to help inform their test suggestions.

Every successful marketing test should confirm or deny an assumption about the customer. You need enough knowledge about the customer to create marketing messages you think will be effective.

For this public experiment to help marketers improve their split testing abilities, we had a real customer to work with — donors to Consumer Reports.

To help our audience better understand the customer, the MECLABS Marketing Intelligence team created the 26-page ConsumerReports Market Intelligence Research document (which you can see for yourself at that link).

This example was originally published in Calling All Writers and Marketers: Write the most effective copy for this Consumer Reports email and win a MarketingSherpa Summit package and Consumer Reports Value Proposition Test: What you can learn from a 29% drop in clickthrough .

Example #3: Virtual event company’s conversation

What if you don’t have the budget for A/B testing? Or any of the other tactics in this article?

Well, if you’re like most people you likely have some relationships with other human beings. A significant other, friends, family, neighbors, co-workers, customers, a nemesis (“Newman!”). While conducting market research by talking to these people has several validity threats, it at least helps you get out of your own head and identify some of your blind spots.

WebBabyShower.com’s lead magnet is a PDF download of a baby shower thank you card ‘swipe file’ plus some extras. “Women want to print it out and have it where they are writing cards, not have a laptop open constantly,” said Kurt Perschke, owner, WebBabyShower.com.

That is not a throwaway quote from Perschke. That is a brilliant insight, so I want to make sure we don’t overlook it. By better understanding customer behavior, you can better serve customers and increase results.

However, you are not your customer. So you must bridge the gap between you and them.

Often you hear marketers or business leaders review an ad or discuss a marketing campaign and say, “Well, I would never read that entire ad” or “I would not be interested in that promotion.” To which I say … who cares? Who cares what you would do? If you are not in the ideal customer set, sorry to dent your ego, but you really don’t matter. Only the customer does.

Perschke is one step ahead of many marketers and business leaders because he readily understands this. “Owning a business whose customers are 95% women has been a great education for me,” he said.

So I had to ask him, how did he get this insight into his customers’ behavior? Frankly, it didn’t take complex market research. He was just aware of this disconnect he had with the customer, and he was alert for ways to bridge the gap. “To be honest, I first saw that with my wife. Then we asked a few customers, and they confirmed it’s what they did also. Writing notes by hand is viewed as a ‘non-digital’ activity and reading from a laptop kinda spoils the mood apparently,” he said.

Back to WebBabyShower. “We've seen a [more than] 100% increase in email signups using this method, which was both inexpensive and evergreen,” Perschke said.

This example was originally published in Digital Marketing: Six specific examples of incentives that worked .

Example #4: Spiceworks Ziff Davis’ research-informed content marketing

Marketing research isn’t just to inform products and advertising messages. Market research can also give your brand a leg up in another highly competitive space – content marketing.

Don’t just jump in and create content expecting it to be successful just because it’s “free.” Conducting research beforehand can help you understand what your potential audience already receives and where they might need help but are currently being served.

When Spiceworks Ziff Davis (SWZD) published its annual State of IT report, it invested months in conducting primary market research, analyzing year-over-year trends, and finally producing the actual report.

“Before getting into the nuts and bolts of writing an asset, look at market shifts and gaps that complement your business and marketing objectives. Then, you can begin to plan, research, write, review and finalize an asset,” said Priscilla Meisel, Content Marketing Director, SWZD.

This example was originally published in Marketing Writing: 3 simple tips that can help any marketer improve results (even if you’re not a copywriter) .

Example #5: Business travel company’s guerilla research

There are many established, expensive tactics you can use to better understand customers.

But if you don’t have the budget for those tactics, and don’t know any potential customers, you might want to brainstorm creative ways you can get valuable information from the right customer target set.

Here’s an example from a former client of Mitch McCasland, Founding Partner and Director, Brand Inquiry Partners. The company sold a product related to frequent business flyers and was interested in finding out information on people who travel for a living. They needed consumer feedback right away.

“I suggested that they go out to the airport with a bunch of 20-dollar bills and wait outside a gate for passengers to come off their flight,” McCasland said. When people came off the flight, they were politely asked if they would answer a few questions in exchange for the incentive (the $20). By targeting the first people off the flight they had a high likelihood of reaching the first-class passengers.

This example was originally published in Guerrilla Market Research Expert Mitch McCasland Tells How You Can Conduct Quick (and Cheap) Research .

Example #6: Intel’s market research database

When conducting market research, it is crucial to organize your data in a way that allows you to easily and quickly report on it. This is especially important for qualitative studies where you are trying to do more than just quantify the data, but need to manage it so it is easier to analyze.

Anne McClard, Senior Researcher, Doxus worked with Shauna Pettit-Brown of Intel on a research project to understand the needs of mobile application developers throughout the world.

Intel needed to be able to analyze the data from several different angles, including segment and geography, a daunting task complicated by the number of interviews, interviewers, and world languages.

“The interviews were about an hour long, and pretty substantial,” McClard says. So, she needed to build a database to organize the transcripts in a way that made sense.

Different types of data are useful for different departments within a company; once your database is organized you can sort it by various threads.

The Intel study had three different internal sponsors. "When it came to doing the analysis, we ended up creating multiple versions of the presentation targeted to individual audiences," Pettit-Brown says.

The organized database enabled her to go back into the data set to answer questions specific to the interests of the three different groups.

This example was originally published in 4 Steps to Building a Qualitative Market Research Database That Works Better .

Example #7: National security survey’s priming

When conducting market research surveys, the way you word your questions can affect customers’ response. Even the way you word previous questions can put customers in a certain mindset that will skew their answers.

For example, when people were asked if they thought the U.S. government should spend money on an anti-missile shield, the results appeared fairly conclusive. Sixty-four percent of those surveyed thought the country should and only six percent were unsure, according to Opinion Makers: An Insider Exposes the Truth Behind the Polls .

But when pollsters added the option, "...or are you unsure?" the level of uncertainty leaped from six percent to 33 percent. When they asked whether respondents would be upset if the government took the opposite course of action from their selection, 59 percent either didn’t have an opinion or didn’t mind if the government did something differently.

This is an example of how the way you word questions can change a survey’s results. You want survey answers to reflect customer’s actual sentiments that are as free of your company’s previously held biases as possible.

This example was originally published in Are Surveys Misleading? 7 Questions for Better Market Research .

Example #8: Visa USA’s approach to getting an accurate answer

As mentioned in the previous example, the way you ask customers questions can skew their responses with your own biases.

However, the way you ask questions to potential customers can also illuminate your understanding of them. Which is why companies field surveys to begin with.

“One thing you learn over time is how to structure questions so you have a greater likelihood of getting an accurate answer. For example, when we want to find out if people are paying off their bills, we'll ask them to think about the card they use most often. We then ask what the balance was on their last bill after they paid it,” said Michael Marx, VP Research Services, Visa USA.

This example was originally published in Tips from Visa USA's Market Research Expert Michael Marx .

Example #9: Hallmark’s private members-only community

Online communities are a way to interact with and learn from customers. Hallmark created a private members-only community called Idea Exchange (an idea you could replicate with a Facebook or LinkedIn Group).

The community helped the greeting cards company learn the customer’s language.

“Communities…let consumers describe issues in their own terms,” explained Tom Brailsford, Manager of Advancing Capabilities, Hallmark Cards. “Lots of times companies use jargon internally.”

At Hallmark they used to talk internally about “channels” of distribution. But consumers talk about stores, not channels. It is much clearer to ask consumers about the stores they shop in than what channels they shop.

For example, Brailsford clarified, “We say we want to nurture, inspire, and lift one’s spirits. We use those terms, and the communities have defined those terms for us. So we have learned how those things play out in their lives. It gives us a much richer vocabulary to talk about these things.”

This example was originally published in Third Year Results from Hallmark's Online Market Research Experiment .

Example #10: L'Oréal’s social media listening

If you don’t want the long-term responsibility that comes with creating an online community, you can use social media listening to understand how customers talking about your products and industry in their own language.

In 2019, L'Oréal felt the need to upgrade one of its top makeup products – L'Oréal Paris Alliance Perfect foundation. Both the formula and the product communication were outdated – multiple ingredients had emerged on the market along with competitive products made from those ingredients.

These new ingredients and products were overwhelming consumers. After implementing new formulas, the competitor brands would advertise their ingredients as the best on the market, providing almost magical results.

So the team at L'Oréal decided to research their consumers’ expectations instead of simply crafting a new formula on their own. The idea was to understand not only which active ingredients are credible among the audience, but also which particular words they use while speaking about foundations in general.

The marketing team decided to combine two research methods: social media listening and traditional questionnaires.

“For the most part, we conduct social media listening research when we need to find out what our customers say about our brand/product/topic and which words they use to do it. We do conduct traditional research as well and ask questions directly. These surveys are different because we provide a variety of readymade answers that respondents choose from. Thus, we limit them in terms of statements and their wording,” says Marina Tarandiuk, marketing research specialist, L'Oréal Ukraine.

“The key value of social media listening (SML) for us is the opportunity to collect people’s opinions that are as ‘natural’ as possible. When someone leaves a review online, they are in a comfortable environment, they use their ‘own’ language to express themselves, there is no interviewer standing next to them and potentially causing shame for their answer. The analytics of ‘natural’ and honest opinions of our customers enables us to implement the results in our communication and use the same language as them,” Tarandiuk said.

The team worked with a social media listening tool vendor to identify the most popular, in-demand ingredients discussed online and detect the most commonly used words and phrases to create a “consumer glossary.”

Questionnaires had to confirm all the hypotheses and insights found while monitoring social media. This part was performed in-house with the dedicated team. They created custom questionnaires aiming to narrow down all the data to a maximum of three variants that could become the base for the whole product line.

“One of our recent studies had a goal to find out which words our clients used to describe positive and negative qualities of [the] foundation. Due to a change in [the] product’s formula, we also decided to change its communication. Based on the opinions of our customers, we can consolidate the existing positive ideas that our clients have about the product,” Tarandiuk said.

To find the related mentions, the team monitored not only the products made by L'Oréal but also the overall category. “The search query contained both brand names and general words like foundation, texture, smell, skin, pores, etc. The problem was that this approach ended up collecting thousands of mentions, not all of which were relevant to the topic,” said Elena Teselko, content marketing manager, YouScan (L'Oréal’s social media listening tool).

So the team used artificial intelligence-based tagging that divided mentions according to the category, features, or product type.

This approach helped the team discover that customers valued such foundation features as not clogging pores, a light texture, and not spreading. Meanwhile, the most discussed and appreciated cosmetics component was hyaluronic acid.

These exact phrases, found with the help of social media monitoring, were later used for marketing communication.

Creative Sample #7: Marketing communicating for personal care company with messaging based on discoveries from market research

“Doing research and detecting audience’s interests BEFORE starting a campaign is an approach that dramatically lowers any risks and increases chances that the campaign would be appreciated by customers,” Teselko said.

This example was originally published in B2C Branding: 3 quick case studies of enhancing the brand with a better customer experience .

Example #11: Levi’s ethnographic research

In a focus group or survey, you are asking customers to explain something they may not even truly understand. Could be why they bought a product. Or what they think of your competitor.

Ethnographic research is a type of anthropology in which you go into customers’ homes or places of business and observe their actual behavior, behavior they may not understand well enough to explain to you.

While cost prohibitive to many brands, and simply unfeasible for others, it can elicit new insights into your customers.

Michael Perman, Senior Director Cultural Insights, Levi Strauss & Co. uses both quantitative and qualitative research on a broad spectrum, but when it comes to gathering consumer insight, he focuses on in-depth ethnographic research provided by partners who specialize in getting deep into the “nooks and crannies of consumer life in America and around the world.” For example, his team spends time in consumers’ homes and in their closets. They shop with consumers, looking for the reality of a consumer’s life and identifying themes that will enable designers and merchandisers to better understand and anticipate consumer needs.

Perman then puts together multi-sensory presentations that illustrate the findings of research. For example, “we might recreate a teenager’s bedroom and show what a teenage girl might have on her dresser.”

This example was originally published in How to Get Your Company to Pay Attention to Market Research Results: Tips from Levi Strauss .

Example #12: eBags’ ethnographic research

Ethnographic research isn’t confined to a physical goods brand like Levi’s. Digital brands can engage in this form of anthropology as well.

While usability testing in a lab is useful, it does miss some of the real-world environmental factors that play a part in the success of a website. Usability testing alone didn’t create a clear enough picture for Gregory Casey, User Experience Designer and Architect, eBags.

“After we had designed our mobile and tablet experience, I wanted to run some contextual user research, which basically meant seeing how people used it in the wild, seeing how people are using it in their homes. So that’s exactly what I did,” Gregory said.

He found consumers willing to open their home to him and be tested in their normal environment. This meant factors like the television, phone calls and other family members played a part in how they experienced the eBags mobile site.

“During these interview sessions, a lot of times we were interrupted by, say, a child coming over and the mother having to do something for the kid … The experience isn’t sovereign. It’s not something where they just sit down, work through a particular user flow and complete their interaction,” Gregory said.

By watching users work through the site as they would in their everyday life, Gregory got to see what parts of the site they actually use.

This example was originally published in Mobile Marketing: 4 takeaways on how to improve your mobile shopping experience beyond just responsive design .

Example #13: John Deere’s shift from product-centric market research to consumer-centric research

One of the major benefits of market research is to overcome company blind spots. However, if you start with your blind spots – i.e., a product focus – you will blunt the effectiveness of your market research.

In the past, “they’d say, Here’s the product, find out how people feel about it,” explained David van Nostrand, Manager, John Deere's Global Market Research. “A lot of companies do that.” Instead, they should be saying, “Let's start with the customers: what do they want, what do they need?”

The solution? A new in-house program called “Category Experts” brings the product-group employees over as full team members working on specific research projects with van Nostrand’s team.

These staffers handle items that don’t require a research background: scheduling, meetings, logistics, communication and vendor management. The actual task they handle is less important than the fact that they serve as human cross-pollinators, bringing consumer-centric sensibility back to their product- focused groups.

For example, if van Nostrand’s team is doing research about a vehicle, they bring in staffers from the Vehicles product groups. “The information about vehicle consumers needs to be out there in the vehicle marketing groups, not locked in here in the heads of the researchers.”

This example was originally published in How John Deere Increased Mass Consumer Market Share by Revamping its Market Research Tactics .

Example #14: LeapFrog’s market research involvement throughout product development (not just at the beginning and the end)

Market research is sometimes thought of as a practice that can either inform the development of a product, or research consumer attitudes about developed products. But what about the middle?

Once the creative people begin working on product designs, the LeapFrog research department stays involved.

They have a lab onsite where they bring moms and kids from the San Francisco Bay area to test preliminary versions of the products. “We do a lot of hands-on, informal qualitative work with kids,” said Craig Spitzer, VP Marketing Research, LeapFrog. “Can they do what they need to do to work the product? Do they go from step A to B to C, or do they go from A to C to B?”

When designing the LeapPad Learning System, for example, the prototype went through the lab “a dozen times or so,” he says.

A key challenge for the research department is keeping and building the list of thousands of families who have agreed to be on call for testing. “We've done everything from recruiting on the Internet to putting out fliers in local schools, working through employees whose kids are in schools, and milking every connection we have,” Spitzer says.

Kids who test products at the lab are compensated with a free, existing product rather than a promise of the getting the product they're testing when it is released in the future.

This example was originally published in How LeapFrog Uses Marketing Research to Launch New Products .

Related resources

The Marketer’s Blind Spot: 3 ways to overcome the marketer’s greatest obstacle to effective messaging

Get Your Free Test Discovery Tool to Help Log all the Results and Discoveries from Your Company’s Marketing Tests

Marketing Research: 5 examples of discovering what customers want

Online Marketing Tests: How do you know you’re really learning anything?

Improve Your Marketing

Join our thousands of weekly case study readers.

Enter your email below to receive MarketingSherpa news, updates, and promotions:

Note: Already a subscriber? Want to add a subscription? Click Here to Manage Subscriptions

Get Better Business Results With a Skillfully Applied Customer-first Marketing Strategy

The customer-first approach of MarketingSherpa’s agency services can help you build the most effective strategy to serve customers and improve results, and then implement it across every customer touchpoint.

Get headlines, value prop, competitive analysis, and more.

Marketer Vs Machine

Marketer Vs Machine: We need to train the marketer to train the machine.

Free Marketing Course

Become a Marketer-Philosopher: Create and optimize high-converting webpages (with this free online marketing course)

Project and Ideas Pitch Template

A free template to help you win approval for your proposed projects and campaigns

Six Quick CTA checklists

These CTA checklists are specifically designed for your team — something practical to hold up against your CTAs to help the time-pressed marketer quickly consider the customer psychology of your “asks” and how you can improve them.

Infographic: How to Create a Model of Your Customer’s Mind

You need a repeatable methodology focused on building your organization’s customer wisdom throughout your campaigns and websites. This infographic can get you started.

Infographic: 21 Psychological Elements that Power Effective Web Design

To build an effective page from scratch, you need to begin with the psychology of your customer. This infographic can get you started.

Receive the latest case studies and data on email, lead gen, and social media along with MarketingSherpa updates and promotions.

- Your Email Account

- Customer Service Q&A

- Search Library

- Content Directory:

Questions? Contact Customer Service at [email protected]

© 2000-2024 MarketingSherpa LLC, ISSN 1559-5137 Editorial HQ: MarketingSherpa LLC, PO Box 50032, Jacksonville Beach, FL 32240

The views and opinions expressed in the articles of this website are strictly those of the author and do not necessarily reflect in any way the views of MarketingSherpa, its affiliates, or its employees.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Market research

- Sales and marketing

- Business management

How People Really Use Mobile

- Harvard Business Review

- From the January–February 2013 Issue

What Customers Want from the Collaborative Economy

- Alexandra Samuel

- October 08, 2015

Marketing Meets Mission

- Myriam Sidibe

- From the May–June 2020 Issue

Building an Insights Engine

- Frank van den Driest

- Stan Sthanunathan

- From the September 2016 Issue

What Stops Managers from Looking to Other Industries for Inspiration

- Graham Kenny

- March 11, 2022

It's Not Necessarily Best to Be First

- Elena Reutskaja

- Barbara Fasolo

Why Algorithm-Generated Recommendations Fall Short

- Carey K Morewedge

- January 09, 2024

Riding the Marketing Information Wave

- From the September–October 1993 Issue

What? Me, Worry?

- Gardiner Morse

- From the November 2005 Issue

How Companies Can Meet the Needs of a Changing Workforce

- Avivah Wittenberg-Cox

- December 18, 2020

Use Inclusive Marketing to Reach New Customers

- Simone Ahuja

- May 31, 2012

Northwestern Mutual's Ed Zore on Staying Relevant to Customers

- Thomas A. Stewart

- From the December 2007 Issue

What Men Think They Know About Executive Women

- Dawn S. Carlson

- K. Michele Kacmar

- Dwayne Whitten

- From the September 2006 Issue

Case of the Profitless PC (HBR Case Study and Commentary)

- Andy Blackburn

- Matt Halprin

- Ruth Veloria

- Donna Dubinsky

- Larry Keeley

- George Quesnelle

- Philip Pifer

- Geoff Moore

- From the November-December 1998 Issue

How to Market in a Downturn

- John A. Quelch

- Katherine E. Jocz

- From the April 2009 Issue

Customer Loyalty Is Overrated

- A.G. Lafley

- Roger Martin

- From the January–February 2017 Issue

A 3-Step Strategy to Support the New U.S. Mask Mandate

- Devabhaktuni Srikrishna

- Joseph Buccina

- Dan Hanfling

- Monica Gandhi

- Donald Milton

- January 26, 2021

Research: How Cultural Differences Can Impact Global Teams

- Vasyl Taras

- Alfredo Jiménez

- Fabian Froese

- June 09, 2021

Creativity in Advertising: When It Works and When It Doesn't

- Werner Reinartz

- Peter Saffert

- From the June 2013 Issue

How Brand Building and Performance Marketing Can Work Together

- Jim Stengel

- Cait Lamberton

- From the May–June 2023 Issue

Discovering What Has Already Been Discovered: Why Did Your Customers Hire Your Product?

- Clayton M. Christensen

- April 20, 1999

The London 2012 Olympic Games

- John T. Gourville

- Marco Bertini

- September 02, 2009

Starbucks: Delivering Customer Service

- Youngme Moon

- July 31, 2003

Showrooming at Best Buy

- Thales S. Teixeira

- Elizabeth Anne Watkins

- August 14, 2014

Booking.com

- Stefan Thomke

- Daniela Beyersdorfer

- October 15, 2018

Away: Scaling a DTC Travel Brand

- Joseph B. Fuller

- November 11, 2019

Intelliseek

- Luc Wathieu

- Allan Friedman

- March 15, 2005

Kraft Heinz: The $8 Billion Brand Write-Down

- April 04, 2019

- David E. Bell

- Natalie Kindred

- December 06, 2020

Ethnic Consumers Consulting

- S. Ramesh Kumar

- Nitya Guruvayurappan

- Madhurjya Banerjee

- January 20, 2011

Tomographic Equipment, Inc. (TEQ)

- David J. Collis

- Eric Van Den Steen

- Ashley Hartman

- December 22, 2016

Freemark Abbey Winery

- William S. Krasker

- August 01, 1980

Aspire Food Group: Marketing a Cricket Protein Brand

- Miranda Goode

- Emily Moscato

- August 24, 2020

Hugging Face: Serving AI on a Platform

- Shane Greenstein

- Kerry Herman

- Sarah Gulick

- November 04, 2022

Taj Hotels, Resorts and Palaces

- Rohit Deshpande

- September 28, 2010

Nestle Refrigerated Foods: Contadina Pasta & Pizza (B)

- V. Kasturi Rangan

- October 13, 1995

Montreaux Chocolate USA: Are Americans Ready for Healthy Dark Chocolate?

- Diane Badame

- August 05, 2013

Hubble Contact Lenses: Data Driven Direct-to-Consumer Marketing

- Ayelet Israeli

- August 01, 2018

Rocket Fuel: Measuring the Effectiveness of Online Advertising

- Zsolt Katona

- July 01, 2017

Lifting the Vail: Largest U.S. Snow Sports Resort Operator Takes on Climate Change

- Christopher I. Rider

- Joni Betrand

- July 19, 2023

Reversing the AMD Fusion Launch, Teaching Plan

- Ryan Johnson

- June 28, 2011

Popular Topics

Partner center.

Marketing case study 101 (plus tips, examples, and templates)

Summary/Overview

If you’re familiar with content lines like, “See how our fancy new app saved Sarah 10 hours a week doing payroll,” you’ve encountered a marketing case study. That’s because case studies are one of the most powerful marketing tools, showcasing real-world applications and customer success stories that help build trust with potential customers.

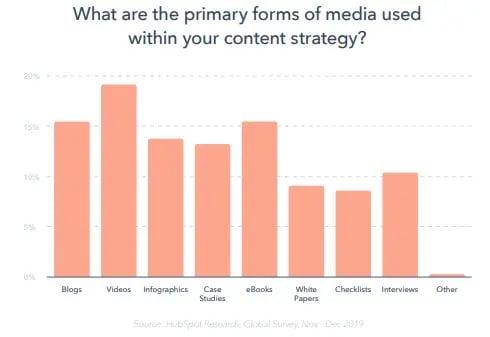

More than 42% of marketers use case studies in their marketing strategy. Let’s face it — we love testimonials and reviews. People love hearing customer stories and experiences firsthand. In fact, 88% of consumers view reviews before making a purchase decision. Case studies work similarly by providing prospective customers with real-life stories demonstrating the brand’s success.

Case studies provide a more in-depth view of how your product solves an existing problem — something potential buyers can relate to and learn from.

In this article, we take a closer look at what marketing case studies are, why they’re important, and how you can use them to improve your content marketing efforts. You’ll also learn the key elements of a successful case study and how to turn a good case study into a great case study.

What is a marketing case study?

A case study is a narrative that documents a real-world situation or example. A marketing case study is a detailed examination and analysis of a specific strategy, initiative, or marketing campaign that a business has implemented. It’s intended to serve as an all-inclusive narrative that documents a real-world business situation and its outcome.

Marketing case studies are tools businesses use to showcase the effectiveness of a particular tool, technique, or service by using a real-world example. Companies often use case studies as sales collateral on websites, email marketing, social media , and other marketing materials. They provide readers with a firsthand look into how your product or service has helped someone else and demonstrate the value of your offering while building trust with potential customers.

Some common key components of a marketing case study include:

- Context: A case study begins by describing the business’s situation or problem. This often includes challenges, opportunities, or objectives.

- Strategy: An outline of the tactics or strategy utilized to address the business’s situation. This includes details such as the target audience, messaging, channels used, and other unique aspects of the approach.

- Implementation: Provide information about how the strategy was implemented, including timeline, resources, and budget.

- Results: This is arguably the most crucial part of a marketing case study. Present the results through data, metrics, and key performance indicators (KPIs) to demonstrate the impact of the strategy. The results section should highlight both qualitative and quantitative data.

- Challenges and Solutions: A great case study not only focuses on the successes but addresses any obstacles faced during the campaign. Make sure to address any challenges and how they were overcome or mitigated.

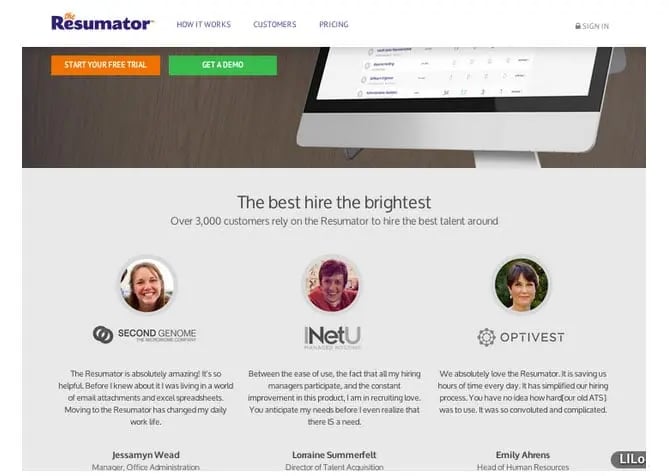

- Customer Feedback: Including testimonials or quotes from satisfied clients is a great way to add credibility and authenticity to a case study. Choose customer feedback that reinforces the positive outcomes of the strategy taken.

- Visuals: Compelling case studies include visuals such as graphs, charts, images, videos, and infographics to make the information presented more engaging and easier to understand.

- Analysis: An optional way to conclude a case study includes discussing key takeaways, insights, and lessons learned from a campaign.

Case studies can help you connect your product to the customer’s needs by providing a real world examples of success and encouraging conversions.

Benefits of marketing case studies

Some of the key benefits of using case studies in your marketing efforts include the following:

- Building trust and credibility. You build trust and credibility with potential clients or customers by demonstrating real world success stories. In-depth looks at how your products or services have helped other businesses or people achieve success can increase customer loyalty and encourage repeat business.

- Learn best practices. Learn from strategies employed in successful case studies and apply similar approaches to future campaigns.

- Enhancing sales and conversions. By highlighting the real world results your products or services have delivered, case studies can be a powerful tool for boosting sales. They can help demonstrate the value of your offering and persuade your target audience to make a purchase.

- Explain how your business generates results. Case studies are a compelling way to share key takeaways with your target audience and showcase your brand.

- Use them as content marketing material. Use case studies as content for marketing purposes on websites, social media, and beyond.

Case studies can help your business stand out and achieve success. By highlighting the real world results you’ve delivered, you can use case studies to boost sales, build customer loyalty, and compellingly showcase your business.

Tips on how to write an effective marketing case study

Are you ready to write a compelling case study? Get started with these tips.

Develop a clear and compelling headline

You have about 10 seconds to communicate your value proposition to keep customer attention. Whether you’re designing a new landing page or making a long-term plan for your brand’s content marketing strategy , the headline is the most crucial part.

A compelling title should capture readers’ attention and make them want to read more. To craft a compelling headline:

- Understand your audience: Before crafting a headline, ensure you know your target audience — what are their pain points, interests, and needs?

- Highlight the most significant result: Focus on the most impactful result achieved in the case study. What was the primary outcome of the strategy implemented?

- Keep it brief: Keep your headline concise and to the point. Try to keep your headline under 12 words.

- Use action words: Incorporate action verbs such as “achieved,” “transformed,” or “boosted” to convey a sense of accomplishment.

- Include data: Numbers make your headline more credible. For example, if the case study achieved a 75% increase in sales, include that in the headline.

- Emphasize benefits: Focus on the positive changes or advantages the implemented strategy brought to the client or business. Use these as selling points in your headline.

- Make it unique and memorable: Avoid generic phrases to make your headline stand out from the competition.

- Use keywords wisely: Incorporate relevant keywords that align with the case study and your target audience’s search interest to improve search engine visibility through search engine optimization (SEO).

- Consider subheadings: If you cannot fit all the necessary information in a headline, consider adding a subheading to provide additional context or details.

Here are some examples of clear and convincing case study headlines:

- “Achieving a 150% ROI: How [XYZ] Strategy Transformed a Startup”

- “How Optimized SEO Tactics Skyrocketed Sales by 80%”

- “Mastering Social Media: How [ABC] Brand Increased Engagement by 50%”

- “The Power of Personalization: How Tailored Content Quadrupled Conversions”

Write relatable content

Almost 90% of Gen Z and millennial shoppers prefer influencers who they consider relatable. Relatability is part of building trust and connection with your target audience.

When writing your case study, make content that resonates with readers and speaks to their pain points. The best marketing doesn’t just increase conversion rates — it also serves your customers’ needs. To write content that really resonates with your target audience, make sure to:

- Understand your audience: To successfully write relatable content, you first need to understand your target audience — their interests, pain points, and challenges. The more you know about your target audience, the better you can tailor your content to their needs.

- Identify pain points: As mentioned above, identify challenges your target audience may face. Make sure to highlight how the product or service in the case study can effectively address these pain points.

- Tell a story: Create a narrative that follows a standard story arc. Start with a relatable struggle that the customer or business faced and describe its associated emotions.

- Use real customer feedback: Incorporate quotes or testimonials from actual customers or clients. Including authentic voices makes the content more relatable to readers because they can see real people expressing their experiences.

- Use relatable language: Write in a tone to which your audience can relate. Only include overly technical terms if your target audience solely consists of experts who would understand them.

- Use social proof: Mention any recognitions, awards, or industry acknowledgments that may have been received by the customer or business in the case study.

- Encourage engagement: Urge readers to share their own challenges or experiences related to the subject matter of the case study. This is a great way to foster a sense of community.

Outline your strategies with corresponding statistics

Whether you’re showing off the results your marketing team achieved with a new strategy or explaining how your product has helped customers, data and research make it easier to back up claims.

Include relevant statistics in your case study to provide evidence of the effectiveness of your strategies, such as:

- Quantitative data: Use numerical data to quantify results.

- Qualitative data: Use qualitative data, such as customer testimonials, to back up numerical results.

- Comparisons: Compare the post-campaign results with the pre-campaign benchmarks to provide context for the data.

- Case study metrics: Include specific metrics relevant to your industry or campaign if applicable. For example, in e-commerce, common metrics could include customer acquisition cost, average order value, or cart abandonment rate.

By incorporating relatable outcomes — such as cost savings from new automation or customer responsiveness from your new social media marketing campaign — you can provide concrete evidence of how your product or service has helped others in similar situations.

Use multiple formats of representation

People love visuals . It doesn’t matter if it’s an infographic for digital marketing or a graph chart in print materials — we love to see our data and results represented in visuals that are easy to understand. Additionally, including multiple representation formats is a great way to increase accessibility and enhance clarity.

When making a case study, consider including various forms of representation, such as:

- Infographics: Use infographics to condense critical information into a visually appealing, easy-to-understand graphic. Infographics are highly sharable and can be used across marketing channels.

- Charts: Use charts (bar charts, pie charts, line graphs, etc.) to illustrate statistical information such as data trends or comparisons. Make sure to include clear labels and titles for each chart.

- Images: Include relevant photos to enhance the storytelling aspect of your case study. Consider including “before and after” pictures if relevant to your case study.

- Videos: Short videos summarizing a case study’s main points are great for sharing across social media or embedding into your case study.

- Tables: Use tables to help organize data and make it easier for readers to digest.

- Data visualizations: Include data visualizations such as flowcharts or heatmaps to illustrate user journeys or specific processes.

- Screenshots: If your case study involves digital products, include screenshots to provide a visual walkthrough of how the product or service works.

- Diagrams: Use diagrams, such as a flowchart, to explain complex processes, decision trees, or workflows to simplify complicated information.

- Timelines: If your case study involves a timeline of specific events, present it using a timeline graphic.

Use a consistent design style and color scheme to maintain cohesion when incorporating multiple formats. Remember that each format you use should serve a specific purpose in engaging the reader and conveying information.

Get your case study in front of your intended audience

What good is a compelling case study and a killer call to action (CTA) if no one sees it? Once you’ve completed your case study, share it across the appropriate channels and networks your target audience frequents and incorporate it into your content strategy to increase visibility and reach. To get your case study noticed:

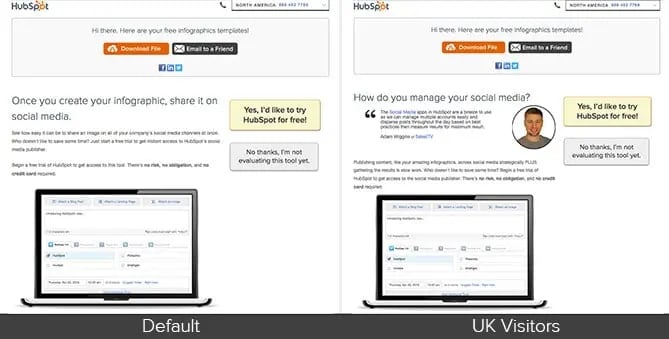

- Take advantage of your website. Create a dedicated section or landing page on your website for your case study. If your website has a blog section, consider including it here. Optimize the page for search engines (SEO) by including relevant keywords and optimizing the meta description and headers. Make sure to feature your case study on your homepage and relevant product or service pages.

- Launch email marketing campaigns. Send out the case study to your email subscriber list. Be specific and target groups that would most likely be interested in the case study.

- Launch social media campaigns. Share your case study on your social media platforms. Use eye-catching graphics and engaging captions to draw in potential readers. Consider creating teaser videos or graphics to generate interest.

- Utilize paid promotions. Use targeted social media and search engine ads to reach specific demographics or interests. Consider retargeting ads to re-engage visitors who have previously interacted with your website.

- Issue a press release. If your case study results in a significant industry impact, consider issuing a press release to share the exciting news with relevant media outlets or publications.

- Utilize influencer outreach. Collaborate with influencers who can share your case study with their followers to increase credibility and expand your reach.

- Host webinars and presentations. Discuss the case study findings and insights through webinars or presentations. Promote these events through your various marketing channels and make sure to encourage participation.

- Utilize networking events and conferences. Present your case study at industry-related conferences, trade shows, or networking events. Consider distributing printed or digital copies of the case study to attendees.

- Utilize online communities. Share the case study in relevant online forums and discussion groups where your target audience congregates.

- Practice search engine optimization (SEO). Optimize the SEO elements of your case study to improve organic search ranking and visibility.

Remember, the key to successfully promoting your case study is to tailor your approach to your specific target audience and their preferences. Consistently promoting your case study across multiple channels increases your chances of it reaching your intended audience.

Marketing case study examples

Let’s look at some successful marketing case studies for inspiration.

“How Handled Scaled from Zero to 121 Locations with HubSpot”

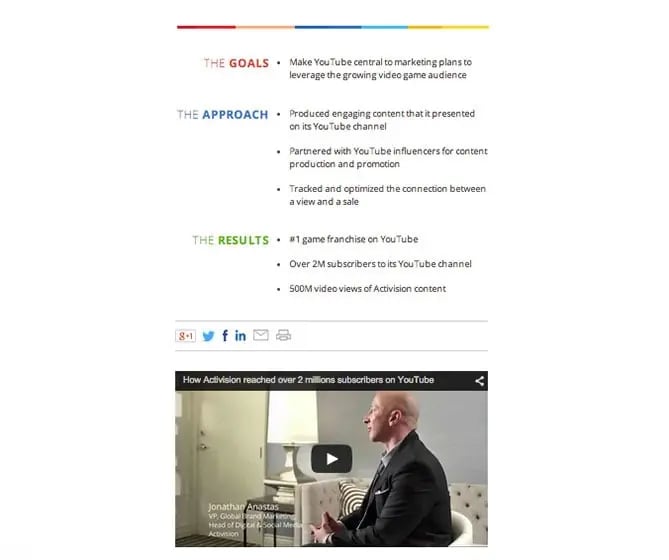

Right away, they lead with compelling metrics — the numbers don’t lie. They use two different formats: a well-made video accompanied by well-written text.

The study also addresses customer pain points, like meeting a higher demand during the pandemic.

“How AppSumo grew organic traffic 843% and revenue from organic traffic 340%”

This case study from Omniscient Digital leads with motivating stats, a glowing review sharing a real user experience, and a video review from the AppSumo Head of Content.

The case study information is broken down into clearly marked sections, explaining the benefits to their target audience (startups) and providing plenty of visuals, charts, and metrics to back it up.

“How One Ecommerce Business Solved the Omnichannel Challenge with Bitly Campaigns”

Download this Bitly case study from their site to see the details of how this company made an impact.

Not only is it well designed, but it also tackles customer challenges right away. The most compelling types of case studies serve their audience by showing how the product or service solves their problems.

Bitly nails it by listing obstacles and jumping right into how the brand can help.

Marketing case study template

Use this basic template to better understand the typical structure of a business case study and use it as a starting place to create your own:

Case Study Title

Date: [Date]

Client or Company Profile:

- Client/Company Name: [Client/Company Name]

- Industry: [Industry]

- Location: [Location]

- Client/Company Background: [Brief client or company background information.]

Introduction:

- Briefly introduce the client or company and any necessary context for the campaign or initiative.

- Problem statement: Describe the specific challenge or problem faced by the client or company before implementing the campaign or initiative.

- Strategy: Explain the strategy that was implemented to address the challenge. Include details such as target audience, objectives, goals, and tactics.

- Implementation: Provide a timeline of the strategy’s implementation, including key milestones and other notable considerations taken during execution.

- Outcomes: Present the qualitative and quantitative results achieved through the implemented strategy. Include relevant metrics, statistics, and key performance indicators (KPIs).

- Comparative data: Compare the post-campaign results to pre-campaign benchmarks or industry standards.

Analysis and Insights:

- Key insights: Summarize insights and lessons learned from the campaign and discuss the campaign's impact on the client or company’s goals.

- Challenges faced: Address any obstacles encountered during the campaign and how they were mitigated or overcome.

Conclusion:

- Conclusion: Summarize the campaign’s overall impact on the client or company. Highlight the value that was delivered by the implemented strategy and the success it achieved.

- Next Steps: Discuss potential follow-up actions, recommendations, or future strategies.

Testimonials:

- Include quotes or testimonials from the clients or customers who benefitted from the campaign.

- Incorporate relevant visuals to illustrate key points, findings, and results.

The above template is a great way to get started gathering your ideas and findings for a marketing case study. Feel free to add additional sections or customize the template to match your requirements.

Craft a compelling marketing case study for your business

Are you ready to make your marketing case study shine? With Adobe Express, you can make high-quality infographics and presentations that take your case studies to the next level.

Choose from our library of designed templates, or make it yourself with powerful tools and a library of ready-to-use graphic elements.

Get started with Adobe Express today to make compelling marketing case studies that engage your audience and drive conversions.

Try Adobe Express today

Ready to create standout content?

Start for free

Explore Related Posts

https://www.adobe.com/express/learn/blog/brand-strategy

https://www.adobe.com/express/learn/blog/marketing-plan

https://www.adobe.com/express/learn/blog/types-of-marketing

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.