An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- J Adv Pract Oncol

- v.6(2); Mar-Apr 2015

Understanding and Evaluating Survey Research

A variety of methodologic approaches exist for individuals interested in conducting research. Selection of a research approach depends on a number of factors, including the purpose of the research, the type of research questions to be answered, and the availability of resources. The purpose of this article is to describe survey research as one approach to the conduct of research so that the reader can critically evaluate the appropriateness of the conclusions from studies employing survey research.

SURVEY RESEARCH

Survey research is defined as "the collection of information from a sample of individuals through their responses to questions" ( Check & Schutt, 2012, p. 160 ). This type of research allows for a variety of methods to recruit participants, collect data, and utilize various methods of instrumentation. Survey research can use quantitative research strategies (e.g., using questionnaires with numerically rated items), qualitative research strategies (e.g., using open-ended questions), or both strategies (i.e., mixed methods). As it is often used to describe and explore human behavior, surveys are therefore frequently used in social and psychological research ( Singleton & Straits, 2009 ).

Information has been obtained from individuals and groups through the use of survey research for decades. It can range from asking a few targeted questions of individuals on a street corner to obtain information related to behaviors and preferences, to a more rigorous study using multiple valid and reliable instruments. Common examples of less rigorous surveys include marketing or political surveys of consumer patterns and public opinion polls.

Survey research has historically included large population-based data collection. The primary purpose of this type of survey research was to obtain information describing characteristics of a large sample of individuals of interest relatively quickly. Large census surveys obtaining information reflecting demographic and personal characteristics and consumer feedback surveys are prime examples. These surveys were often provided through the mail and were intended to describe demographic characteristics of individuals or obtain opinions on which to base programs or products for a population or group.

More recently, survey research has developed into a rigorous approach to research, with scientifically tested strategies detailing who to include (representative sample), what and how to distribute (survey method), and when to initiate the survey and follow up with nonresponders (reducing nonresponse error), in order to ensure a high-quality research process and outcome. Currently, the term "survey" can reflect a range of research aims, sampling and recruitment strategies, data collection instruments, and methods of survey administration.

Given this range of options in the conduct of survey research, it is imperative for the consumer/reader of survey research to understand the potential for bias in survey research as well as the tested techniques for reducing bias, in order to draw appropriate conclusions about the information reported in this manner. Common types of error in research, along with the sources of error and strategies for reducing error as described throughout this article, are summarized in the Table .

Sources of Error in Survey Research and Strategies to Reduce Error

The goal of sampling strategies in survey research is to obtain a sufficient sample that is representative of the population of interest. It is often not feasible to collect data from an entire population of interest (e.g., all individuals with lung cancer); therefore, a subset of the population or sample is used to estimate the population responses (e.g., individuals with lung cancer currently receiving treatment). A large random sample increases the likelihood that the responses from the sample will accurately reflect the entire population. In order to accurately draw conclusions about the population, the sample must include individuals with characteristics similar to the population.

It is therefore necessary to correctly identify the population of interest (e.g., individuals with lung cancer currently receiving treatment vs. all individuals with lung cancer). The sample will ideally include individuals who reflect the intended population in terms of all characteristics of the population (e.g., sex, socioeconomic characteristics, symptom experience) and contain a similar distribution of individuals with those characteristics. As discussed by Mady Stovall beginning on page 162, Fujimori et al. ( 2014 ), for example, were interested in the population of oncologists. The authors obtained a sample of oncologists from two hospitals in Japan. These participants may or may not have similar characteristics to all oncologists in Japan.

Participant recruitment strategies can affect the adequacy and representativeness of the sample obtained. Using diverse recruitment strategies can help improve the size of the sample and help ensure adequate coverage of the intended population. For example, if a survey researcher intends to obtain a sample of individuals with breast cancer representative of all individuals with breast cancer in the United States, the researcher would want to use recruitment strategies that would recruit both women and men, individuals from rural and urban settings, individuals receiving and not receiving active treatment, and so on. Because of the difficulty in obtaining samples representative of a large population, researchers may focus the population of interest to a subset of individuals (e.g., women with stage III or IV breast cancer). Large census surveys require extremely large samples to adequately represent the characteristics of the population because they are intended to represent the entire population.

DATA COLLECTION METHODS

Survey research may use a variety of data collection methods with the most common being questionnaires and interviews. Questionnaires may be self-administered or administered by a professional, may be administered individually or in a group, and typically include a series of items reflecting the research aims. Questionnaires may include demographic questions in addition to valid and reliable research instruments ( Costanzo, Stawski, Ryff, Coe, & Almeida, 2012 ; DuBenske et al., 2014 ; Ponto, Ellington, Mellon, & Beck, 2010 ). It is helpful to the reader when authors describe the contents of the survey questionnaire so that the reader can interpret and evaluate the potential for errors of validity (e.g., items or instruments that do not measure what they are intended to measure) and reliability (e.g., items or instruments that do not measure a construct consistently). Helpful examples of articles that describe the survey instruments exist in the literature ( Buerhaus et al., 2012 ).

Questionnaires may be in paper form and mailed to participants, delivered in an electronic format via email or an Internet-based program such as SurveyMonkey, or a combination of both, giving the participant the option to choose which method is preferred ( Ponto et al., 2010 ). Using a combination of methods of survey administration can help to ensure better sample coverage (i.e., all individuals in the population having a chance of inclusion in the sample) therefore reducing coverage error ( Dillman, Smyth, & Christian, 2014 ; Singleton & Straits, 2009 ). For example, if a researcher were to only use an Internet-delivered questionnaire, individuals without access to a computer would be excluded from participation. Self-administered mailed, group, or Internet-based questionnaires are relatively low cost and practical for a large sample ( Check & Schutt, 2012 ).

Dillman et al. ( 2014 ) have described and tested a tailored design method for survey research. Improving the visual appeal and graphics of surveys by using a font size appropriate for the respondents, ordering items logically without creating unintended response bias, and arranging items clearly on each page can increase the response rate to electronic questionnaires. Attending to these and other issues in electronic questionnaires can help reduce measurement error (i.e., lack of validity or reliability) and help ensure a better response rate.

Conducting interviews is another approach to data collection used in survey research. Interviews may be conducted by phone, computer, or in person and have the benefit of visually identifying the nonverbal response(s) of the interviewee and subsequently being able to clarify the intended question. An interviewer can use probing comments to obtain more information about a question or topic and can request clarification of an unclear response ( Singleton & Straits, 2009 ). Interviews can be costly and time intensive, and therefore are relatively impractical for large samples.

Some authors advocate for using mixed methods for survey research when no one method is adequate to address the planned research aims, to reduce the potential for measurement and non-response error, and to better tailor the study methods to the intended sample ( Dillman et al., 2014 ; Singleton & Straits, 2009 ). For example, a mixed methods survey research approach may begin with distributing a questionnaire and following up with telephone interviews to clarify unclear survey responses ( Singleton & Straits, 2009 ). Mixed methods might also be used when visual or auditory deficits preclude an individual from completing a questionnaire or participating in an interview.

FUJIMORI ET AL.: SURVEY RESEARCH

Fujimori et al. ( 2014 ) described the use of survey research in a study of the effect of communication skills training for oncologists on oncologist and patient outcomes (e.g., oncologist’s performance and confidence and patient’s distress, satisfaction, and trust). A sample of 30 oncologists from two hospitals was obtained and though the authors provided a power analysis concluding an adequate number of oncologist participants to detect differences between baseline and follow-up scores, the conclusions of the study may not be generalizable to a broader population of oncologists. Oncologists were randomized to either an intervention group (i.e., communication skills training) or a control group (i.e., no training).

Fujimori et al. ( 2014 ) chose a quantitative approach to collect data from oncologist and patient participants regarding the study outcome variables. Self-report numeric ratings were used to measure oncologist confidence and patient distress, satisfaction, and trust. Oncologist confidence was measured using two instruments each using 10-point Likert rating scales. The Hospital Anxiety and Depression Scale (HADS) was used to measure patient distress and has demonstrated validity and reliability in a number of populations including individuals with cancer ( Bjelland, Dahl, Haug, & Neckelmann, 2002 ). Patient satisfaction and trust were measured using 0 to 10 numeric rating scales. Numeric observer ratings were used to measure oncologist performance of communication skills based on a videotaped interaction with a standardized patient. Participants completed the same questionnaires at baseline and follow-up.

The authors clearly describe what data were collected from all participants. Providing additional information about the manner in which questionnaires were distributed (i.e., electronic, mail), the setting in which data were collected (e.g., home, clinic), and the design of the survey instruments (e.g., visual appeal, format, content, arrangement of items) would assist the reader in drawing conclusions about the potential for measurement and nonresponse error. The authors describe conducting a follow-up phone call or mail inquiry for nonresponders, using the Dillman et al. ( 2014 ) tailored design for survey research follow-up may have reduced nonresponse error.

CONCLUSIONS

Survey research is a useful and legitimate approach to research that has clear benefits in helping to describe and explore variables and constructs of interest. Survey research, like all research, has the potential for a variety of sources of error, but several strategies exist to reduce the potential for error. Advanced practitioners aware of the potential sources of error and strategies to improve survey research can better determine how and whether the conclusions from a survey research study apply to practice.

The author has no potential conflicts of interest to disclose.

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, automatically generate references for free.

- Knowledge Base

- Methodology

- Doing Survey Research | A Step-by-Step Guide & Examples

Doing Survey Research | A Step-by-Step Guide & Examples

Published on 6 May 2022 by Shona McCombes . Revised on 10 October 2022.

Survey research means collecting information about a group of people by asking them questions and analysing the results. To conduct an effective survey, follow these six steps:

- Determine who will participate in the survey

- Decide the type of survey (mail, online, or in-person)

- Design the survey questions and layout

- Distribute the survey

- Analyse the responses

- Write up the results

Surveys are a flexible method of data collection that can be used in many different types of research .

Table of contents

What are surveys used for, step 1: define the population and sample, step 2: decide on the type of survey, step 3: design the survey questions, step 4: distribute the survey and collect responses, step 5: analyse the survey results, step 6: write up the survey results, frequently asked questions about surveys.

Surveys are used as a method of gathering data in many different fields. They are a good choice when you want to find out about the characteristics, preferences, opinions, or beliefs of a group of people.

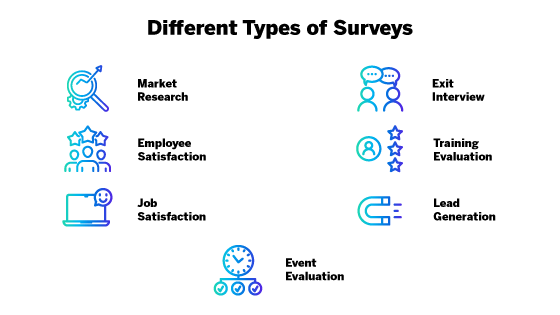

Common uses of survey research include:

- Social research: Investigating the experiences and characteristics of different social groups

- Market research: Finding out what customers think about products, services, and companies

- Health research: Collecting data from patients about symptoms and treatments

- Politics: Measuring public opinion about parties and policies

- Psychology: Researching personality traits, preferences, and behaviours

Surveys can be used in both cross-sectional studies , where you collect data just once, and longitudinal studies , where you survey the same sample several times over an extended period.

Prevent plagiarism, run a free check.

Before you start conducting survey research, you should already have a clear research question that defines what you want to find out. Based on this question, you need to determine exactly who you will target to participate in the survey.

Populations

The target population is the specific group of people that you want to find out about. This group can be very broad or relatively narrow. For example:

- The population of Brazil

- University students in the UK

- Second-generation immigrants in the Netherlands

- Customers of a specific company aged 18 to 24

- British transgender women over the age of 50

Your survey should aim to produce results that can be generalised to the whole population. That means you need to carefully define exactly who you want to draw conclusions about.

It’s rarely possible to survey the entire population of your research – it would be very difficult to get a response from every person in Brazil or every university student in the UK. Instead, you will usually survey a sample from the population.

The sample size depends on how big the population is. You can use an online sample calculator to work out how many responses you need.

There are many sampling methods that allow you to generalise to broad populations. In general, though, the sample should aim to be representative of the population as a whole. The larger and more representative your sample, the more valid your conclusions.

There are two main types of survey:

- A questionnaire , where a list of questions is distributed by post, online, or in person, and respondents fill it out themselves

- An interview , where the researcher asks a set of questions by phone or in person and records the responses

Which type you choose depends on the sample size and location, as well as the focus of the research.

Questionnaires

Sending out a paper survey by post is a common method of gathering demographic information (for example, in a government census of the population).

- You can easily access a large sample.

- You have some control over who is included in the sample (e.g., residents of a specific region).

- The response rate is often low.

Online surveys are a popular choice for students doing dissertation research , due to the low cost and flexibility of this method. There are many online tools available for constructing surveys, such as SurveyMonkey and Google Forms .

- You can quickly access a large sample without constraints on time or location.

- The data is easy to process and analyse.

- The anonymity and accessibility of online surveys mean you have less control over who responds.

If your research focuses on a specific location, you can distribute a written questionnaire to be completed by respondents on the spot. For example, you could approach the customers of a shopping centre or ask all students to complete a questionnaire at the end of a class.

- You can screen respondents to make sure only people in the target population are included in the sample.

- You can collect time- and location-specific data (e.g., the opinions of a shop’s weekday customers).

- The sample size will be smaller, so this method is less suitable for collecting data on broad populations.

Oral interviews are a useful method for smaller sample sizes. They allow you to gather more in-depth information on people’s opinions and preferences. You can conduct interviews by phone or in person.

- You have personal contact with respondents, so you know exactly who will be included in the sample in advance.

- You can clarify questions and ask for follow-up information when necessary.

- The lack of anonymity may cause respondents to answer less honestly, and there is more risk of researcher bias.

Like questionnaires, interviews can be used to collect quantitative data : the researcher records each response as a category or rating and statistically analyses the results. But they are more commonly used to collect qualitative data : the interviewees’ full responses are transcribed and analysed individually to gain a richer understanding of their opinions and feelings.

Next, you need to decide which questions you will ask and how you will ask them. It’s important to consider:

- The type of questions

- The content of the questions

- The phrasing of the questions

- The ordering and layout of the survey

Open-ended vs closed-ended questions

There are two main forms of survey questions: open-ended and closed-ended. Many surveys use a combination of both.

Closed-ended questions give the respondent a predetermined set of answers to choose from. A closed-ended question can include:

- A binary answer (e.g., yes/no or agree/disagree )

- A scale (e.g., a Likert scale with five points ranging from strongly agree to strongly disagree )

- A list of options with a single answer possible (e.g., age categories)

- A list of options with multiple answers possible (e.g., leisure interests)

Closed-ended questions are best for quantitative research . They provide you with numerical data that can be statistically analysed to find patterns, trends, and correlations .

Open-ended questions are best for qualitative research. This type of question has no predetermined answers to choose from. Instead, the respondent answers in their own words.

Open questions are most common in interviews, but you can also use them in questionnaires. They are often useful as follow-up questions to ask for more detailed explanations of responses to the closed questions.

The content of the survey questions

To ensure the validity and reliability of your results, you need to carefully consider each question in the survey. All questions should be narrowly focused with enough context for the respondent to answer accurately. Avoid questions that are not directly relevant to the survey’s purpose.

When constructing closed-ended questions, ensure that the options cover all possibilities. If you include a list of options that isn’t exhaustive, you can add an ‘other’ field.

Phrasing the survey questions

In terms of language, the survey questions should be as clear and precise as possible. Tailor the questions to your target population, keeping in mind their level of knowledge of the topic.

Use language that respondents will easily understand, and avoid words with vague or ambiguous meanings. Make sure your questions are phrased neutrally, with no bias towards one answer or another.

Ordering the survey questions

The questions should be arranged in a logical order. Start with easy, non-sensitive, closed-ended questions that will encourage the respondent to continue.

If the survey covers several different topics or themes, group together related questions. You can divide a questionnaire into sections to help respondents understand what is being asked in each part.

If a question refers back to or depends on the answer to a previous question, they should be placed directly next to one another.

Before you start, create a clear plan for where, when, how, and with whom you will conduct the survey. Determine in advance how many responses you require and how you will gain access to the sample.

When you are satisfied that you have created a strong research design suitable for answering your research questions, you can conduct the survey through your method of choice – by post, online, or in person.

There are many methods of analysing the results of your survey. First you have to process the data, usually with the help of a computer program to sort all the responses. You should also cleanse the data by removing incomplete or incorrectly completed responses.

If you asked open-ended questions, you will have to code the responses by assigning labels to each response and organising them into categories or themes. You can also use more qualitative methods, such as thematic analysis , which is especially suitable for analysing interviews.

Statistical analysis is usually conducted using programs like SPSS or Stata. The same set of survey data can be subject to many analyses.

Finally, when you have collected and analysed all the necessary data, you will write it up as part of your thesis, dissertation , or research paper .

In the methodology section, you describe exactly how you conducted the survey. You should explain the types of questions you used, the sampling method, when and where the survey took place, and the response rate. You can include the full questionnaire as an appendix and refer to it in the text if relevant.

Then introduce the analysis by describing how you prepared the data and the statistical methods you used to analyse it. In the results section, you summarise the key results from your analysis.

A Likert scale is a rating scale that quantitatively assesses opinions, attitudes, or behaviours. It is made up of four or more questions that measure a single attitude or trait when response scores are combined.

To use a Likert scale in a survey , you present participants with Likert-type questions or statements, and a continuum of items, usually with five or seven possible responses, to capture their degree of agreement.

Individual Likert-type questions are generally considered ordinal data , because the items have clear rank order, but don’t have an even distribution.

Overall Likert scale scores are sometimes treated as interval data. These scores are considered to have directionality and even spacing between them.

The type of data determines what statistical tests you should use to analyse your data.

A questionnaire is a data collection tool or instrument, while a survey is an overarching research method that involves collecting and analysing data from people using questionnaires.

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the ‘Cite this Scribbr article’ button to automatically add the citation to our free Reference Generator.

McCombes, S. (2022, October 10). Doing Survey Research | A Step-by-Step Guide & Examples. Scribbr. Retrieved 15 April 2024, from https://www.scribbr.co.uk/research-methods/surveys/

Is this article helpful?

Shona McCombes

Other students also liked, qualitative vs quantitative research | examples & methods, construct validity | definition, types, & examples, what is a likert scale | guide & examples.

- Survey & Questionnaire Introduction: Examples + [5 Types]

Whether online or offline, you need to politely approach survey respondents and get them excited to fill your questionnaire when carrying out a research survey. Therefore, before going into the questions you want to ask, you need to kickstart your data collection process with a compelling survey or questionnaire introduction.

Generally, only a few people would even listen to you if you shoved your survey in their faces without a simple introduction first. Survey introductions in online questionnaires help you prepare the minds of your respondents ahead of time and gather the best responses.

What is a Survey Introduction?

A survey introduction is a concise description with relevant information about a survey. It is the first part of the survey that prospective respondents interact with and it helps them decide whether to fill your questionnaire or not.

Think of survey introductions as abstracts that communicate the entire essence of the data collection process. Without a good abstract, your thesis gets delayed or unapproved.

Following through with this thought means that the more exciting your survey introduction is, the higher your chances of collecting the right number of quality survey responses.

Features of a Survey Introduction

A good survey introduction must answer these 5 questions:

- Who is conducting the survey?

Here, you should include the name of the person or organization that is carrying out the research.

- What is the research about?

Survey respondents need to understand the aims and objectives of your research. This shows them why your survey is important and why they need to be part of it.

- How long will the survey take?

Prepare their minds ahead of time by adding an estimated survey-completion time. While shorter surveys are likely to have more respondents, don’t give a false estimation to bait people to fill your survey.

- Is my data safe?

Data privacy and protection is a huge concern for everyone. Since you plan to collect data from respondents, you need to tell them how you will use this information. You can include a link to your company’s privacy policy.

- How will I fill the survey?

Include instructions on how to fill the survey. Include information about relevant documents for the survey too.

Your survey should be written in simple language your audience understands. It should be friendly, human and show the respondents how much impact they’ll make by taking part in the survey. Always include a nice “thank you” note in your survey introduction.

Types of Survey Introduction

Market survey introduction.

If you’re conducting market research using a survey , then you need a market survey introduction. To get more information about your customers/ target market, you need to conduct a market research survey. A market survey introduction gives your target audience a clear picture of what you want to achieve and how their participation is an important part of it.

Market research serves multiple purposes—sometimes, it is all about getting real-time data to inform product launches. Other times, it is for business expansion or product improvement. With a market survey introduction, you can get your audience on the same page and let them know the exact information you need from them.

A market survey introduction should answer all the questions we looked at when we discussed the features of a survey introduction. After naming your organization, you should also introduce your product or product idea for brand awareness.

Because of the type of information, market surveys are longer than other types of surveys ; sometimes, they have multiple sections. So, in your market survey introduction, give respondents a heads-up and let them know completing your survey will take more time than the average. You can add a nice reward they can claim after filling the survey.

Example of Market Survey Introduction

At Formplus, we are working to improve online data collection for you. We’d really like to know what you feel about online data gathering tools . Take this 20-minute survey and win a free 1-month Formplus premium subscription. Your data will be collected anonymously and only used for this research. Thank You!

Student Survey Introduction

A student survey is a method of sampling students’ opinions about the school, teachers, and overall learning experiences. From measuring student satisfaction to evaluating courses, student surveys help you to make the right changes to your school.

A student survey introduction is the first step in getting the best responses from your students. Encourage students to provide objective feedback and let them know how the information will be used.

In the survey introduction, indicate that all responses will be recorded anonymously. Students need to be sure that they can provide honest feedback in the survey without getting harassed or victimized.

Example of Student Survey Introduction

Thank you for being one of our students at Salthill College. Please complete this short 3-minutes survey to let us know how satisfied you are with your overall student experience at our college. All responses are recorded anonymously so feel free to provide honest feedback. Your responses will help us improve our teaching and learning environment.

Research Questionnaire Introduction

You need a good research questionnaire introduction during the data-collection phase of your research. People are more likely to fill your questionnaire when they clearly understand what you want to achieve and why your research is important.

In the research questionnaire introduction, you can include facts, data, or statistics about the research problem. Then, show how the data collected via the questionnaire will contribute to solving the problem. The introduction should also address data privacy, data protection, and participant’s consent.

Even if you plan to share the questionnaire physically, a good research questionnaire introduction will help collect responses faster and save time.

Example of Research Questionnaire Introduction

Hello, I am a postgraduate researcher at the London School of Tropical Medicine. I am conducting a study on effective treatment options for communicable diseases in West Africa and I would like to know your experiences with the signs, symptoms, and treatment of communicable diseases. Please complete this 30-minute survey. Your responses are anonymous and you can skip any questions you are not comfortable with. Thank you for your participation.

Customer Satisfaction Survey Introduction

Your customer satisfaction survey introduction should communicate 2 things—appreciation and brevity. First, you should let your customers know how much you love their patronage. Next, tell them that the survey will take just a few minutes.

Throw in an honorary mention of your brand and then, go through some of the information you’ll need from them in the survey. To increase response rates, you can reward respondents with a gift, discount, or special offer.

Example of Customer Satisfaction Survey Introduction

Thank you for shopping at Wreaths and Flowers! We’ll like to ask you a few questions about your shopping experience. Your responses will help us make shopping more enjoyable for you. This will only take 1 minute and you get 30% off your next order when you complete the survey!

Importance of Survey Introduction

- It outlines the most important information about your survey

People need to know what they are getting into before filling your survey or questionnaire, and that’s exactly why you need a great survey introduction.

- It’s a great way to welcome respondents

You wouldn’t just walk up to someone to ask for something without a proper introduction so why would you want to do this with your survey or questionnaire ? A questionnaire welcome page sets the mood for requesting responses from your respondents.

- Quality survey introductions help you gain respondents’ trust

Many people are not excited about filling surveys and questionnaires, which is why they need a push. A survey or questionnaire introduction helps respondents to trust you and heightens their interest in filling your survey.

A survey introduction answers all the questions participants may have about the questionnaire. Think of it as some sort of FAQs that allows respondents to have a full grasp of your data collection process.

A questionnaire welcome page boosts survey participation and reduces survey dropout rates.

It helps survey participants to feel like an important part of the overall data gathering process. Survey introductions show participants that you value their opinions.

Survey introductions build the participants’ interest in your survey or questionnaire.

Why Use Formplus to Create Surveys?

- Pre and Post Submission Page

Formplus allows you to add exciting survey introductions to your questionnaire. On the form’s intro page, you can provide a brief description of your survey, information on data privacy, and any other thing they need to know before filling the form.

You can also customize the form’s post-submission page and include a nice “thank you” note for respondents after they complete the survey or questionnaire. Learn more about our intro and post-submission pages here:

- Intuitive Easy to Use Survey Maker

The Formplus builder is easy to use and you can build surveys and questionnaires from scratch in no time without writing a single line of code. It has a drag-and-drop feature that allows you to add more than 30 different fields to your form seamlessly.

- Conditional Logic

Survey participants do not have to see or fill out all the fields in your form. With conditional logic, you can show or hide form fields and pages based on answers provided by respondents. This means survey respondents only have to fill the fields that are relevant to them.

Conditional logic helps you collect the right type of information from different survey participants. This way, you can avoid extra clutter and collect as much data as you want.

- Offline Surveys

Formplus supports offline data collection and this means you can collect data in areas with poor or no internet access. Survey participants can fill and submit your questionnaire when they are offline. The data they provide will be automatically synced with our servers or your preferred cloud storage when internet access is restored.

- Customized Surveys and Questionnaires

Formplus allows you to create beautiful and unique surveys with zero design experience. With the flexible design options, you can change the questionnaire’s background, colors, fonts, and create visually appealing designs. You can also add images and your organization’s logo.

- Share Forms Easily

With multiple form-sharing options, you can send out your survey and collect responses in many ways. Apart from adding your questionnaire to your website, you can also share it using the social media direct sharing buttons and via email invitations.

- Google Sheets Integration

With Google sheets integration, you can automatically update form responses in your spreadsheet and keep all form collaborators up to date. This makes it easy for you to import and export data, and collaborate with multiple people at the same time.

- Custom Subdomain

Sharing your questionnaire via a custom subdomain adds an air of professionalism to your overall data collection process. When creating your custom URL, you can include the name of your organization as a means of promoting your brand.

Custom subdomains are simple and easy to remember too. Hosting your survey on a custom subdomain also serves as an extra layer of security; especially when you share the link via email.

- Autoresponder Emails

After receiving a new response to your questionnaire, you can send out an automated automatic confirmation email to the survey participant in the form of autoresponder messages. In your autoresponder email, you should include a thank you message and any links to special offers and rewards.

- Mobile-Friendly Forms

Many people fill out surveys and questionnaires on their mobile devices and this is why all Formplus forms are mobile-friendly. Participants can complete the survey right on their mobile devices without having to bother about pinching out or zooming in on your form. Formplus forms can be viewed and filled out on any smartphone, tablet, or internet-enabled mobile device.

In this article, we’ve looked at different survey introductions for different types of questionnaires and surveys including customer satisfaction surveys and research questionnaires. Whether you are collecting data online or offline, the right survey introduction will boost participants’ interest in completing your survey.

With Formplus, you can add unique survey introductions to your form before sharing it with respondents. On the post-submission page, you can include a beautiful “thank you” note for respondents who complete your survey. Try out the pre and post-submission page option as well as other exciting features when you sign up for a free Formplus account.

Connect to Formplus, Get Started Now - It's Free!

- accuracy surveys

- age survey questions

- brand survey examples

- compatibility questionnaires

- survey methods

- survey question types

- survey questionnaire

- survey research

- survey types

- busayo.longe

You may also like:

25 Training Survey Questions + Free Form Templates

Asking the right training survey questions before, during, and after a training session is an effective way to gather valuabl

Survey Methods: Definition, Types, and Examples

Data gathering is a flexible and exciting process; especially when you use surveys. There are different survey methods that a

33 Event Survey Questions + [Template Examples]

Read this article to learn how to create an event survey with Formplus

Pilot Survey: Definition, Importance + [ Question Examples]

Before launching a new product or feature into the market, it is a good idea to find out what you

Formplus - For Seamless Data Collection

Collect data the right way with a versatile data collection tool. try formplus and transform your work productivity today..

- Privacy Policy

Buy Me a Coffee

Home » Descriptive Research Design – Types, Methods and Examples

Descriptive Research Design – Types, Methods and Examples

Table of Contents

Descriptive Research Design

Definition:

Descriptive research design is a type of research methodology that aims to describe or document the characteristics, behaviors, attitudes, opinions, or perceptions of a group or population being studied.

Descriptive research design does not attempt to establish cause-and-effect relationships between variables or make predictions about future outcomes. Instead, it focuses on providing a detailed and accurate representation of the data collected, which can be useful for generating hypotheses, exploring trends, and identifying patterns in the data.

Types of Descriptive Research Design

Types of Descriptive Research Design are as follows:

Cross-sectional Study

This involves collecting data at a single point in time from a sample or population to describe their characteristics or behaviors. For example, a researcher may conduct a cross-sectional study to investigate the prevalence of certain health conditions among a population, or to describe the attitudes and beliefs of a particular group.

Longitudinal Study

This involves collecting data over an extended period of time, often through repeated observations or surveys of the same group or population. Longitudinal studies can be used to track changes in attitudes, behaviors, or outcomes over time, or to investigate the effects of interventions or treatments.

This involves an in-depth examination of a single individual, group, or situation to gain a detailed understanding of its characteristics or dynamics. Case studies are often used in psychology, sociology, and business to explore complex phenomena or to generate hypotheses for further research.

Survey Research

This involves collecting data from a sample or population through standardized questionnaires or interviews. Surveys can be used to describe attitudes, opinions, behaviors, or demographic characteristics of a group, and can be conducted in person, by phone, or online.

Observational Research

This involves observing and documenting the behavior or interactions of individuals or groups in a natural or controlled setting. Observational studies can be used to describe social, cultural, or environmental phenomena, or to investigate the effects of interventions or treatments.

Correlational Research

This involves examining the relationships between two or more variables to describe their patterns or associations. Correlational studies can be used to identify potential causal relationships or to explore the strength and direction of relationships between variables.

Data Analysis Methods

Descriptive research design data analysis methods depend on the type of data collected and the research question being addressed. Here are some common methods of data analysis for descriptive research:

Descriptive Statistics

This method involves analyzing data to summarize and describe the key features of a sample or population. Descriptive statistics can include measures of central tendency (e.g., mean, median, mode) and measures of variability (e.g., range, standard deviation).

Cross-tabulation

This method involves analyzing data by creating a table that shows the frequency of two or more variables together. Cross-tabulation can help identify patterns or relationships between variables.

Content Analysis

This method involves analyzing qualitative data (e.g., text, images, audio) to identify themes, patterns, or trends. Content analysis can be used to describe the characteristics of a sample or population, or to identify factors that influence attitudes or behaviors.

Qualitative Coding

This method involves analyzing qualitative data by assigning codes to segments of data based on their meaning or content. Qualitative coding can be used to identify common themes, patterns, or categories within the data.

Visualization

This method involves creating graphs or charts to represent data visually. Visualization can help identify patterns or relationships between variables and make it easier to communicate findings to others.

Comparative Analysis

This method involves comparing data across different groups or time periods to identify similarities and differences. Comparative analysis can help describe changes in attitudes or behaviors over time or differences between subgroups within a population.

Applications of Descriptive Research Design

Descriptive research design has numerous applications in various fields. Some of the common applications of descriptive research design are:

- Market research: Descriptive research design is widely used in market research to understand consumer preferences, behavior, and attitudes. This helps companies to develop new products and services, improve marketing strategies, and increase customer satisfaction.

- Health research: Descriptive research design is used in health research to describe the prevalence and distribution of a disease or health condition in a population. This helps healthcare providers to develop prevention and treatment strategies.

- Educational research: Descriptive research design is used in educational research to describe the performance of students, schools, or educational programs. This helps educators to improve teaching methods and develop effective educational programs.

- Social science research: Descriptive research design is used in social science research to describe social phenomena such as cultural norms, values, and beliefs. This helps researchers to understand social behavior and develop effective policies.

- Public opinion research: Descriptive research design is used in public opinion research to understand the opinions and attitudes of the general public on various issues. This helps policymakers to develop effective policies that are aligned with public opinion.

- Environmental research: Descriptive research design is used in environmental research to describe the environmental conditions of a particular region or ecosystem. This helps policymakers and environmentalists to develop effective conservation and preservation strategies.

Descriptive Research Design Examples

Here are some real-time examples of descriptive research designs:

- A restaurant chain wants to understand the demographics and attitudes of its customers. They conduct a survey asking customers about their age, gender, income, frequency of visits, favorite menu items, and overall satisfaction. The survey data is analyzed using descriptive statistics and cross-tabulation to describe the characteristics of their customer base.

- A medical researcher wants to describe the prevalence and risk factors of a particular disease in a population. They conduct a cross-sectional study in which they collect data from a sample of individuals using a standardized questionnaire. The data is analyzed using descriptive statistics and cross-tabulation to identify patterns in the prevalence and risk factors of the disease.

- An education researcher wants to describe the learning outcomes of students in a particular school district. They collect test scores from a representative sample of students in the district and use descriptive statistics to calculate the mean, median, and standard deviation of the scores. They also create visualizations such as histograms and box plots to show the distribution of scores.

- A marketing team wants to understand the attitudes and behaviors of consumers towards a new product. They conduct a series of focus groups and use qualitative coding to identify common themes and patterns in the data. They also create visualizations such as word clouds to show the most frequently mentioned topics.

- An environmental scientist wants to describe the biodiversity of a particular ecosystem. They conduct an observational study in which they collect data on the species and abundance of plants and animals in the ecosystem. The data is analyzed using descriptive statistics to describe the diversity and richness of the ecosystem.

How to Conduct Descriptive Research Design

To conduct a descriptive research design, you can follow these general steps:

- Define your research question: Clearly define the research question or problem that you want to address. Your research question should be specific and focused to guide your data collection and analysis.

- Choose your research method: Select the most appropriate research method for your research question. As discussed earlier, common research methods for descriptive research include surveys, case studies, observational studies, cross-sectional studies, and longitudinal studies.

- Design your study: Plan the details of your study, including the sampling strategy, data collection methods, and data analysis plan. Determine the sample size and sampling method, decide on the data collection tools (such as questionnaires, interviews, or observations), and outline your data analysis plan.

- Collect data: Collect data from your sample or population using the data collection tools you have chosen. Ensure that you follow ethical guidelines for research and obtain informed consent from participants.

- Analyze data: Use appropriate statistical or qualitative analysis methods to analyze your data. As discussed earlier, common data analysis methods for descriptive research include descriptive statistics, cross-tabulation, content analysis, qualitative coding, visualization, and comparative analysis.

- I nterpret results: Interpret your findings in light of your research question and objectives. Identify patterns, trends, and relationships in the data, and describe the characteristics of your sample or population.

- Draw conclusions and report results: Draw conclusions based on your analysis and interpretation of the data. Report your results in a clear and concise manner, using appropriate tables, graphs, or figures to present your findings. Ensure that your report follows accepted research standards and guidelines.

When to Use Descriptive Research Design

Descriptive research design is used in situations where the researcher wants to describe a population or phenomenon in detail. It is used to gather information about the current status or condition of a group or phenomenon without making any causal inferences. Descriptive research design is useful in the following situations:

- Exploratory research: Descriptive research design is often used in exploratory research to gain an initial understanding of a phenomenon or population.

- Identifying trends: Descriptive research design can be used to identify trends or patterns in a population, such as changes in consumer behavior or attitudes over time.

- Market research: Descriptive research design is commonly used in market research to understand consumer preferences, behavior, and attitudes.

- Health research: Descriptive research design is useful in health research to describe the prevalence and distribution of a disease or health condition in a population.

- Social science research: Descriptive research design is used in social science research to describe social phenomena such as cultural norms, values, and beliefs.

- Educational research: Descriptive research design is used in educational research to describe the performance of students, schools, or educational programs.

Purpose of Descriptive Research Design

The main purpose of descriptive research design is to describe and measure the characteristics of a population or phenomenon in a systematic and objective manner. It involves collecting data that describe the current status or condition of the population or phenomenon of interest, without manipulating or altering any variables.

The purpose of descriptive research design can be summarized as follows:

- To provide an accurate description of a population or phenomenon: Descriptive research design aims to provide a comprehensive and accurate description of a population or phenomenon of interest. This can help researchers to develop a better understanding of the characteristics of the population or phenomenon.

- To identify trends and patterns: Descriptive research design can help researchers to identify trends and patterns in the data, such as changes in behavior or attitudes over time. This can be useful for making predictions and developing strategies.

- To generate hypotheses: Descriptive research design can be used to generate hypotheses or research questions that can be tested in future studies. For example, if a descriptive study finds a correlation between two variables, this could lead to the development of a hypothesis about the causal relationship between the variables.

- To establish a baseline: Descriptive research design can establish a baseline or starting point for future research. This can be useful for comparing data from different time periods or populations.

Characteristics of Descriptive Research Design

Descriptive research design has several key characteristics that distinguish it from other research designs. Some of the main characteristics of descriptive research design are:

- Objective : Descriptive research design is objective in nature, which means that it focuses on collecting factual and accurate data without any personal bias. The researcher aims to report the data objectively without any personal interpretation.

- Non-experimental: Descriptive research design is non-experimental, which means that the researcher does not manipulate any variables. The researcher simply observes and records the behavior or characteristics of the population or phenomenon of interest.

- Quantitative : Descriptive research design is quantitative in nature, which means that it involves collecting numerical data that can be analyzed using statistical techniques. This helps to provide a more precise and accurate description of the population or phenomenon.

- Cross-sectional: Descriptive research design is often cross-sectional, which means that the data is collected at a single point in time. This can be useful for understanding the current state of the population or phenomenon, but it may not provide information about changes over time.

- Large sample size: Descriptive research design typically involves a large sample size, which helps to ensure that the data is representative of the population of interest. A large sample size also helps to increase the reliability and validity of the data.

- Systematic and structured: Descriptive research design involves a systematic and structured approach to data collection, which helps to ensure that the data is accurate and reliable. This involves using standardized procedures for data collection, such as surveys, questionnaires, or observation checklists.

Advantages of Descriptive Research Design

Descriptive research design has several advantages that make it a popular choice for researchers. Some of the main advantages of descriptive research design are:

- Provides an accurate description: Descriptive research design is focused on accurately describing the characteristics of a population or phenomenon. This can help researchers to develop a better understanding of the subject of interest.

- Easy to conduct: Descriptive research design is relatively easy to conduct and requires minimal resources compared to other research designs. It can be conducted quickly and efficiently, and data can be collected through surveys, questionnaires, or observations.

- Useful for generating hypotheses: Descriptive research design can be used to generate hypotheses or research questions that can be tested in future studies. For example, if a descriptive study finds a correlation between two variables, this could lead to the development of a hypothesis about the causal relationship between the variables.

- Large sample size : Descriptive research design typically involves a large sample size, which helps to ensure that the data is representative of the population of interest. A large sample size also helps to increase the reliability and validity of the data.

- Can be used to monitor changes : Descriptive research design can be used to monitor changes over time in a population or phenomenon. This can be useful for identifying trends and patterns, and for making predictions about future behavior or attitudes.

- Can be used in a variety of fields : Descriptive research design can be used in a variety of fields, including social sciences, healthcare, business, and education.

Limitation of Descriptive Research Design

Descriptive research design also has some limitations that researchers should consider before using this design. Some of the main limitations of descriptive research design are:

- Cannot establish cause and effect: Descriptive research design cannot establish cause and effect relationships between variables. It only provides a description of the characteristics of the population or phenomenon of interest.

- Limited generalizability: The results of a descriptive study may not be generalizable to other populations or situations. This is because descriptive research design often involves a specific sample or situation, which may not be representative of the broader population.

- Potential for bias: Descriptive research design can be subject to bias, particularly if the researcher is not objective in their data collection or interpretation. This can lead to inaccurate or incomplete descriptions of the population or phenomenon of interest.

- Limited depth: Descriptive research design may provide a superficial description of the population or phenomenon of interest. It does not delve into the underlying causes or mechanisms behind the observed behavior or characteristics.

- Limited utility for theory development: Descriptive research design may not be useful for developing theories about the relationship between variables. It only provides a description of the variables themselves.

- Relies on self-report data: Descriptive research design often relies on self-report data, such as surveys or questionnaires. This type of data may be subject to biases, such as social desirability bias or recall bias.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Questionnaire – Definition, Types, and Examples

Case Study – Methods, Examples and Guide

Observational Research – Methods and Guide

Quantitative Research – Methods, Types and...

Qualitative Research Methods

Explanatory Research – Types, Methods, Guide

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Descriptive Research: Definition, Characteristics, Methods + Examples

Suppose an apparel brand wants to understand the fashion purchasing trends among New York’s buyers, then it must conduct a demographic survey of the specific region, gather population data, and then conduct descriptive research on this demographic segment.

The study will then uncover details on “what is the purchasing pattern of New York buyers,” but will not cover any investigative information about “ why ” the patterns exist. Because for the apparel brand trying to break into this market, understanding the nature of their market is the study’s main goal. Let’s talk about it.

What is descriptive research?

Descriptive research is a research method describing the characteristics of the population or phenomenon studied. This descriptive methodology focuses more on the “what” of the research subject than the “why” of the research subject.

The method primarily focuses on describing the nature of a demographic segment without focusing on “why” a particular phenomenon occurs. In other words, it “describes” the research subject without covering “why” it happens.

Characteristics of descriptive research

The term descriptive research then refers to research questions, the design of the study, and data analysis conducted on that topic. We call it an observational research method because none of the research study variables are influenced in any capacity.

Some distinctive characteristics of descriptive research are:

- Quantitative research: It is a quantitative research method that attempts to collect quantifiable information for statistical analysis of the population sample. It is a popular market research tool that allows us to collect and describe the demographic segment’s nature.

- Uncontrolled variables: In it, none of the variables are influenced in any way. This uses observational methods to conduct the research. Hence, the nature of the variables or their behavior is not in the hands of the researcher.

- Cross-sectional studies: It is generally a cross-sectional study where different sections belonging to the same group are studied.

- The basis for further research: Researchers further research the data collected and analyzed from descriptive research using different research techniques. The data can also help point towards the types of research methods used for the subsequent research.

Applications of descriptive research with examples

A descriptive research method can be used in multiple ways and for various reasons. Before getting into any survey , though, the survey goals and survey design are crucial. Despite following these steps, there is no way to know if one will meet the research outcome. How to use descriptive research? To understand the end objective of research goals, below are some ways organizations currently use descriptive research today:

- Define respondent characteristics: The aim of using close-ended questions is to draw concrete conclusions about the respondents. This could be the need to derive patterns, traits, and behaviors of the respondents. It could also be to understand from a respondent their attitude, or opinion about the phenomenon. For example, understand millennials and the hours per week they spend browsing the internet. All this information helps the organization researching to make informed business decisions.

- Measure data trends: Researchers measure data trends over time with a descriptive research design’s statistical capabilities. Consider if an apparel company researches different demographics like age groups from 24-35 and 36-45 on a new range launch of autumn wear. If one of those groups doesn’t take too well to the new launch, it provides insight into what clothes are like and what is not. The brand drops the clothes and apparel that customers don’t like.

- Conduct comparisons: Organizations also use a descriptive research design to understand how different groups respond to a specific product or service. For example, an apparel brand creates a survey asking general questions that measure the brand’s image. The same study also asks demographic questions like age, income, gender, geographical location, geographic segmentation , etc. This consumer research helps the organization understand what aspects of the brand appeal to the population and what aspects do not. It also helps make product or marketing fixes or even create a new product line to cater to high-growth potential groups.

- Validate existing conditions: Researchers widely use descriptive research to help ascertain the research object’s prevailing conditions and underlying patterns. Due to the non-invasive research method and the use of quantitative observation and some aspects of qualitative observation , researchers observe each variable and conduct an in-depth analysis . Researchers also use it to validate any existing conditions that may be prevalent in a population.

- Conduct research at different times: The analysis can be conducted at different periods to ascertain any similarities or differences. This also allows any number of variables to be evaluated. For verification, studies on prevailing conditions can also be repeated to draw trends.

Advantages of descriptive research

Some of the significant advantages of descriptive research are:

- Data collection: A researcher can conduct descriptive research using specific methods like observational method, case study method, and survey method. Between these three, all primary data collection methods are covered, which provides a lot of information. This can be used for future research or even for developing a hypothesis for your research object.

- Varied: Since the data collected is qualitative and quantitative, it gives a holistic understanding of a research topic. The information is varied, diverse, and thorough.

- Natural environment: Descriptive research allows for the research to be conducted in the respondent’s natural environment, which ensures that high-quality and honest data is collected.

- Quick to perform and cheap: As the sample size is generally large in descriptive research, the data collection is quick to conduct and is inexpensive.

Descriptive research methods

There are three distinctive methods to conduct descriptive research. They are:

Observational method

The observational method is the most effective method to conduct this research, and researchers make use of both quantitative and qualitative observations.

A quantitative observation is the objective collection of data primarily focused on numbers and values. It suggests “associated with, of or depicted in terms of a quantity.” Results of quantitative observation are derived using statistical and numerical analysis methods. It implies observation of any entity associated with a numeric value such as age, shape, weight, volume, scale, etc. For example, the researcher can track if current customers will refer the brand using a simple Net Promoter Score question .

Qualitative observation doesn’t involve measurements or numbers but instead just monitoring characteristics. In this case, the researcher observes the respondents from a distance. Since the respondents are in a comfortable environment, the characteristics observed are natural and effective. In a descriptive research design, the researcher can choose to be either a complete observer, an observer as a participant, a participant as an observer, or a full participant. For example, in a supermarket, a researcher can from afar monitor and track the customers’ selection and purchasing trends. This offers a more in-depth insight into the purchasing experience of the customer.

Case study method

Case studies involve in-depth research and study of individuals or groups. Case studies lead to a hypothesis and widen a further scope of studying a phenomenon. However, case studies should not be used to determine cause and effect as they can’t make accurate predictions because there could be a bias on the researcher’s part. The other reason why case studies are not a reliable way of conducting descriptive research is that there could be an atypical respondent in the survey. Describing them leads to weak generalizations and moving away from external validity.

Survey research

In survey research, respondents answer through surveys or questionnaires or polls . They are a popular market research tool to collect feedback from respondents. A study to gather useful data should have the right survey questions. It should be a balanced mix of open-ended questions and close ended-questions . The survey method can be conducted online or offline, making it the go-to option for descriptive research where the sample size is enormous.

Examples of descriptive research

Some examples of descriptive research are:

- A specialty food group launching a new range of barbecue rubs would like to understand what flavors of rubs are favored by different people. To understand the preferred flavor palette, they conduct this type of research study using various methods like observational methods in supermarkets. By also surveying while collecting in-depth demographic information, offers insights about the preference of different markets. This can also help tailor make the rubs and spreads to various preferred meats in that demographic. Conducting this type of research helps the organization tweak their business model and amplify marketing in core markets.

- Another example of where this research can be used is if a school district wishes to evaluate teachers’ attitudes about using technology in the classroom. By conducting surveys and observing their comfortableness using technology through observational methods, the researcher can gauge what they can help understand if a full-fledged implementation can face an issue. This also helps in understanding if the students are impacted in any way with this change.

Some other research problems and research questions that can lead to descriptive research are:

- Market researchers want to observe the habits of consumers.

- A company wants to evaluate the morale of its staff.

- A school district wants to understand if students will access online lessons rather than textbooks.

- To understand if its wellness questionnaire programs enhance the overall health of the employees.

FREE TRIAL LEARN MORE

MORE LIKE THIS

21 Best Customer Advocacy Software for Customers in 2024

Apr 19, 2024

10 Quantitative Data Analysis Software for Every Data Scientist

Apr 18, 2024

11 Best Enterprise Feedback Management Software in 2024

17 Best Online Reputation Management Software in 2024

Apr 17, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

How to Write a Survey Introduction [+Examples]

Published: August 25, 2021

Writing a survey introduction probably isn't something you think about very often. That is until you're looking at the first screen of your almost finalized survey thinking "I should put something here. But what?"

While a potentially overlooked piece of the survey creation process, a good survey introduction is critical to improving survey completion rates and ensuring that the responses you receive are accurate. Taking the time to think about what information to include in your introduction can have a big impact on the success of your survey.

![description for research survey → Free Download: 5 Customer Survey Templates [Access Now]](https://no-cache.hubspot.com/cta/default/53/9d36416b-3b0d-470c-a707-269296bb8683.png)

What is a Survey Introduction?

A survey introduction is the block of text that precedes the questions of your survey. It might be included at the top of an email requesting feedback or be the first slide in a series of questions. The survey introduction serves to set the stage for what the survey is, why the recipient should take the time to complete it, and what you're going to do with the information you collect. It should be compelling, informative, and reassuring.

.webp)

5 Free Customer Satisfaction Survey Templates

Easily measure customer satisfaction and begin to improve your customer experience.

- Net Promoter Score

- Customer Effort Score

You're all set!

Click this link to access this resource at any time.

How to Write a Survey Introduction

Start by thinking about the purpose of this survey. Who will be taking the survey? What information do you need for the project to be successful? Distill this information down into a sentence or two for your audience. Some examples may include:

- We're looking for feedback on our new product line for men.

- Tell us about your recent customer service experience.

- We're revamping our spring menu! What do you want for dinner?

Secondly, follow up with any logistical information they need to know about the survey. How many questions is it? When does the survey end? Who should they contact if they have additional questions? This might sound something like:

- This 5 question survey will take around 10 minutes to complete.

- Click below to access the short, two-question survey. For further information or feedback, please contact our support team at [email protected].

- This survey will be open until April 24th, 2022. Please take 5 minutes to provide your feedback before that time.

Finally, reassure the survey participants that their data is safe, and offer any information about how the survey data will be used:

- Your answers are anonymous and will be used to improve our future customer service strategy.

- Responses will be anonymized and analyzed for our upcoming report on consumer perception of insurance companies in the US. Please leave your email address if you'd like to receive a copy of the finished report.

- We read every response to our customer happiness surveys, and follow-up to make sure you're left with a positive experience.

No matter what you include in your survey introduction, make sure to keep it concise and as short as possible. Too long, and you risk readers dropping off and not completing your survey. It's also important to keep your survey messaging on-brand. If you typically use a brand voice that's quite corporate, switching to a conversational tone in your survey introduction will feel out of place. It might even make some readers question if the survey is truly coming from your company - causing distrust in its authenticity.

Finally, thank your respondents for their time. Even if their responses are negative, the fact that they're engaging with your survey is a great indicator of their loyalty . Customers will not take the time to provide feedback to companies they don't care about. Here are some phrases you can use to show your appreciation:

- This feedback is very helpful for our team in developing new features. Thank you so much for taking the time to complete this survey.

- We read every comment you leave on these surveys, so thank you for your feedback!

- We truly appreciate your insight and your time.

Want to make sure you've got it all covered? Save this checklist of the most important aspects to include in the survey introduction:

- How long will it take? (Minutes or number of questions)

- Why are you doing this survey?

- Why should they fill it out? Is there a giveaway for respondents (such as a draw for a $50 Amazon card) or another incentive to complete it?

- What are you going to do with the results? Are they anonymous?

- When does the survey close? What is the overall timeline?

- Are there any definitions or things they need to know before filling out the survey?

- Where should they go if they have questions or more feedback?

- Thank your participants for their time and feedback.

- Any additional information they need to fill out the survey with good, accurate data

Good Survey Introduction Examples

These survey introductions hit all the right notes. Read on for inspiration and additional tricks on how to write your own!

1. Squamish Off-Road Cycling Association (SORCA)

Don't forget to share this post!

Related articles.

Nonresponse Bias: What to Avoid When Creating Surveys

How to Make a Survey with a QR Code

50 Catchy Referral Slogans & How to Write Your Own

![description for research survey How Automated Phone Surveys Work [+Tips and Examples]](https://blog.hubspot.com/hubfs/phone-survey.webp)

How Automated Phone Surveys Work [+Tips and Examples]

Online Panels: What They Are & How to Use Them Effectively

The Complete Guide to Survey Logic (+Expert Tips)

Focus Group vs. Survey: Which One Should You Use?

![description for research survey Leading Questions: What They Are & Why They Matter [+ Examples]](https://blog.hubspot.com/hubfs/leading-questions-hero.webp)

Leading Questions: What They Are & Why They Matter [+ Examples]

What are Survey Sample Sizes & How to Find Your Sample Size

28 Questionnaire Examples, Questions, & Templates to Survey Your Clients

5 free templates for learning more about your customers and respondents.

Service Hub provides everything you need to delight and retain customers while supporting the success of your whole front office

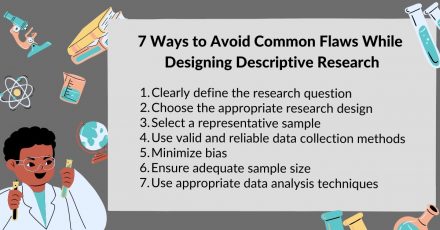

Bridging the Gap: Overcome these 7 flaws in descriptive research design

Descriptive research design is a powerful tool used by scientists and researchers to gather information about a particular group or phenomenon. This type of research provides a detailed and accurate picture of the characteristics and behaviors of a particular population or subject. By observing and collecting data on a given topic, descriptive research helps researchers gain a deeper understanding of a specific issue and provides valuable insights that can inform future studies.