Personal Financial Planning Doctorate

- K-State home

- K-State Online

- Explore Programs

Develop the knowledge, skills and tools necessary to achieve success as a university faculty, director of research or practitioner of financial planning.

The personal financial planning doctorate is the first in the nation to be conducted largely online and is one of only three doctoral programs to be registered with the CFP® Board. It is designed for professionals, like you, who already have busy careers and substantial roots where they live.

March 5 Personal Financial Planning Doctorate Webinar Personal financial planning doctorate webinar with Morgan Graham at 7 p.m. (CST) on March 5, 2024.

*This estimate includes online tuition and College of Health and Human Sciences fees and is for illustrative purposes only. Your hours and costs will differ depending on your transfer hours, course choices and your academic progress. See more about tuition and financial aid.

New Tuition and Fees Structure for 2021-22 Academic Year To better assist students with understanding the cost of attendance, K-State has simplified the tuition and fees structure for students enrolled in online programs.

Hybrid Format

The personal financial planning doctorate is a hybrid program in which you will take online courses during the fall and spring semesters and participate in intensive 10-day summer experiences. During three consecutive summer residency sessions on the K-State campus in Manhattan, Kansas, you will build connections with faculty, peers and the university.

For the final summer session, you will travel abroad with your classmates to see up-close how global markets work and how they affect financial planning in the United States and worldwide.

Career Prospect Highlights

Graduation Rate

Median salary.

Nationwide Median Salary

Jobs Nationwide

5-Year Nationwide Job Growth

Admission Requirements

All students are required to meet the general university admission requirements.

Additional Requirements

- An undergraduate and graduate GPA of 3.0 (B) or better. In some cases, a 2.75 will be permissible if the last 60 hours of study were at least a 3.0.

- GRE/GMAT scores from within the last five years

Program-Specific Application Deadline

- Summer semester (begins in late May): Dec. 1

Additional Documentation View detailed information about the documentation required to complete your application.

The personal financial planning doctorate will prepare you for a career as a:

- finanical planning professional

- researcher in financial planning

- college or university faculty

If you have not taken a graduate-level statistics course in the recent past, you may be required to take STAT 703 or another introductory research and statistics course prior to your first session on campus.

A maximum of 30 credit hours may be transferred into the doctoral program. If you are interested in teaching in an AASCB-accredited business program, we recommend taking 15 or more credits in finance.

Research Courses (minimum 46 credit hours) Grades of B or better are required for PFP 805, 806, 888, 889, 890 and 906.

- STAT 705 - Regression and Analysis of Variance (3 credits)

- PFP 805 - Statistical Software Application in PFP (3 credits)*

- PFP 806 - Statistical Methods in PFP I (3 credits)*

- PFP 808 - Research Application in Personal Financial Planning (3 credits; must repeat for 6 credits) *

- PFP 888 - Research Methods in Personal Financial Planning I (3 credits) *

- PFP 889 - Theories and Models in PFP (3 credits)*

- PFP 890 - Research Methods in Personal Financial Planning II (3 credits) *

- PFP 906 - Statistical Methods in PFP II (3 credits)*

- PFP 990 - Dissertation Proposal Seminar (1 credit)*

- PFP 999 - Dissertation Research (18 credits)

Professional Courses (minimum 14 credit hours)

- PFP 825 - Survey of PFP Research and Theory (3 credits)*

- PFP 894 - Professional Issues in PFP (1 credit; must repeat for 3 credits)*

- PFP 900 - Research Seminar (1 credit; must repeat for 2 credits)*

- PFP 956 - Clinical Research and Applications in Financial Counseling and Planning (3 credits)*

- PFP 979 - Global Issues in PFP (3 credits)*

Supporting (Core Content) Courses (minimum 18 credit hours) A maximum of 18 transfer hours may be applied for supporting (core content) courses.

- PFP 760 - Retirement Planning for Families (3 credits)

- PFP 762 - Investing for the Family’s Future I (3 credits)

- PFP 764 - Estate Planning for Families (3 credits)

- PFP 766 - Insurance Planning for Families (3 credits)

- PFP 772 - Personal Income Taxation (3 credits)

- PFP 836 - Financial Planning Case Studies (3 credits)

Electives (minimum 12 credit hours) A maximum of 12 transfer hours may be applied for elective courses.

- PFP 768 - Introduction to Financial Therapy (3 credits)

- PFP 769 - Money and Relationships (3 credits)

- PFP 770 - Applied Behavioral Finance (3 credits)

- PFP 771 - Financial Therapy Theory and Research (3 credits)

- PFP 835 - Professional Practices Management in Personal Financial Planning (3 credits)

- PFP 860 - Advanced Retirement Planning Issues (3 credits)

- PFP 864 - Advanced Estate Planning Issues (3 credits)

- PFP 909 - Financial Ethics and Mediation (3 credits)

- Other elective as agreed upon by the committee

*Indicates courses must be taken at K-State unless prior approval is received from committee.

Related Programs

Ph.D. in Financial Planning

UGA’s Ph.D. program in financial planning provides students with the opportunity to focus on research and statistical analysis in the field of Financial Planning to expand your expertise in theory, research methods, analytical thinking, and statistical analysis. Upon completion of this concentration, graduates will be prepared to enter academia or a post-doctoral research position.

What the degree offers students:

- A focused approach to theory and research-based methodology needed to help advance the financial planning profession.

- The opportunity to explore the financial planning profession in depth from a theoretical and research basis with tenure-track and published UGA faculty.

- A research-intensive experience that prepares students for academic, policy, and business positions.

- Find a variety of career opportunities .

Time to Completion

Students typically complete the Ph.D. program in 3 to 4 years, depending on the research topic and student background.

Admission Requirements

In order to be admitted into the UGA professional master's program in financial planning, you must first be admitted by the University of Georgia Graduate school. See how to apply to the graduate school here .

Certifications & Opportunities

UGA’s Financial Planning Program is registered with the Certified Financial Planner Board of Standards, Inc ., and the Association of Financial Counseling and Planning Education . Graduates are eligible to sit for the Certified Financial Planner (CFP®), the Accredited Financial Counselor (AFC®), and the Certified Retirement Counselor (CRC®) examinations upon completion of the program. The Behavioral Financial Planning/Financial Therapy option allows students to sit for the Certified Financial Therapist-I™ (CFT-I) examination.

While in the program, students can have the opportunity to participate in a variety of experiential learning research including the ASPIRE Clinic and Volunteer Income Tax Assistance (VITA) .

Degree Requirements

The button below will provide the Financial Planning course sequencing required for the Ph.D. program. Please contact Melissa McBride at 706-542-4856 or [email protected] with any questions.

Ph.D. Financial Planning Degree Requirements

Key Faculty

John Grable

Athletic Association Endowed Professor of Family and Consumer Sciences

Lance Palmer

Swarn Chatterjee

Department Head and Bluerock Professor of Financial Planning

706-542-4877

Kristy Archuleta

Joan Koonce

Professor & Extension Financial Planning Specialist

706-542-4865

Joseph Goetz

Assistant Professor

Effie Antonoudi

Assistant Professor and Undergraduate Coordinator

770-229-3322

Travis Mountain

Assistant Professor of Extension in Financial Planning

James Pasztor

303-990-3883

Michael Thomas

Kimberly Watkins

Melissa McBride

- Technology Services

- Website Support

- Faculty and Staff Resources

- FACS Openings

- Extension Agent Openings

Address/Map

Dawson Hall 305 Sanford Dr Athens, GA 30602

SSAC 706-542-4847

Administration, Alumni, Communications 706-542-6402

15 Best Online PhD in Finance Programs [2024 Guide]

Looking for Online PhD in Finance Programs? Some schools have no GRE and offer accelerated courses to help you finish faster.

A doctoral degree in finance may be your ticket to the career you’ve always wanted.

Editorial Listing ShortCode:

This online finance degree can help you pursue an executive role or a teaching job related to accounting, banking, asset management, or financial policymaking.

Universities Offering Online PhD in Finance Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

1. Capella University

With Capella University in Minnesota, students can study online to earn a DBA with a concentration in Accounting or a PhD in Business Management with a concentration in Accounting.

These programs are designed to help students learn about theories, methods, rules and ethical issues that influence accounting practice and consider the implications of practicing accounting within a global marketplace.

Before graduation, DBA students are expected to complete two residencies and submit a major research project. PhD students are expected to do three residencies and complete a dissertation.

Both programs use Capella’s GuidedPath format with weekly discussions and specific deadlines for submitting assignments.

- PhD in Accounting

- DBA in Accounting

Capella University is accredited by the Higher Learning Commission.

2. City University of Seattle

When you study with City University of Seattle, you’ll have the opportunity to choose your own area of specialty for your DBA program.

Students who choose the Specialized Study concentration can submit a proposal for the graduate-level courses they would like to take as part of their studies.

If you’re interested in finance, you may be able to request courses on the topics of finance and accounting. During online classes, you’ll have opportunities to engage in live conversations with faculty.

You’ll be expected to submit a dissertation during your doctoral studies and complete three different residencies.

- DBA in Business Administration (Finance concentration)

The City University of Seattle is Accredited by the Northwest Commission on Colleges and Universities.

3. George Fox University

As you pursue a DBA with a concentration in Accounting from George Fox University, you may take classes like Advanced Applications of Ethical Reasoning and Compliance in Accounting and Advanced Topics in Accounting.

In addition, you’ll need to complete both a dissertation and a practicum for the program. During the practicum, you’ll have opportunities to try your hand at teaching or consulting.

Most of the work for this hybrid DBA program is online, but you’ll need to report to the school’s campus in Oregon a few times a year.

George Fox University is accredited by the Northwest Commission on Colleges and Universities.

4. Hampton University

If you’re interested in a PhD in Business Administration, check out Hampton University in Virginia. The program students to pursue a concentration in Accounting and Finance by taking multiple credit hours of elective courses.

These electives include classes like Financial Accounting and Reporting Research, Accounting Theory, Corporate and Financial Institutions, and Behavior Finance.

Students at this university take online courses during the traditional school year and come to campus for two summer residencies. This PhD program is appropriate for current professionals and for those straight out of a master’s program.

- PhD in Business Administration

Hampton U is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

5. Kansas State University

Do you believe that it is critical for individuals and families to have a solid financial plan for their future? If so, you may be interested in the PhD in Personal Financial Planning from Kansas State University.

You may choose to use this degree in the business world or spread your knowledge to others by working in an academic setting.

During the online doctoral program, you’ll need to come to the school’s Kansas campus for a few intensive sessions and go overseas to expand your knowledge about global markets. A dissertation is required for this program.

- Hybrid PhD in Personal Financial Planning

Kansas State University is accredited by the Higher Learning Commission.

6. Liberty University

For those interested in numbers and money, Liberty University’s online DBA offers two concentration options: Accounting and Finance.

Both programs begin with the same core courses, but Accounting students take specialized classes like Accounting for Decision Making and Advanced Auditing while Finance students focus on classes like Managerial Finance and Advanced Financial Statement Analysis.

Whichever track you choose, you will need to take a comprehensive exam and complete a dissertation before graduation from this Virginia university. Accounting graduates often work as auditors or budget supervisors, and Finance graduates may choose to become treasurers or financial managers.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

7. National University

You can pursue a DBA or a PhD in Business Administration from National University. NU is a network of nonprofit institutions headquartered in San Diego, CA.

The school encourages students of either program to pursue high-level leadership positions, but the PhD program is research-based, and the DBA involves the application of research findings that are already available.

Specialization options for both PhD and DBA students include Financial Management and Advanced Accounting. All faculty hold doctoral degrees, and many tracks can be completed fully online. Dissertations are required for PhD programs.

- PhD in Business Administration – Advanced Accounting

- DBA in Financial Management

- DBA in Advanced Accounting

National University is accredited by the WASC Senior College and University Commission.

8. Rutgers University

This university offers a PhD in Management; concentrations include Finance, Accounting or Accounting Information Systems. The concentration in finance offers courses like Investments, Corporate Finance, Theory of Corporate Disclosures, Control and Governance, and Econometrics.

The concentration in accounting offers courses like Current Topics in Auditing and Empirical Analysis of Financial Reporting. Students are expected to take a qualifying exam and defend a dissertation before graduating from these programs. The school recommends that students have master’s level education in mathematics, economics or computer science before applying for enrollment.

Rutgers University is accredited by the Middle States Commission on Higher Education.

9. Sacred Heart University

Although Sacred Heart University does require DBA in Finance students to come to its Connecticut campus, the program is described as “low-residency,” and it is structured to fit the schedules of people who are already in the workforce.

Each student is part of a cohort that provides opportunities for networking and group projects. During the course of the program, students study topics like mathematics and global markets and choose electives like Fixed Income Securities or Portfolio Management.

Students are also required to submit a dissertation before graduation. The school’s DBA graduates often find work in government, academia, and corporations.

- DBA in Finance

SHU is accredited by the New England Commission of Higher Education.

10. Saint Leo University

You can get an online DBA from Saint Leo University in Florida. The program offers classes like Analytics for Decision Making, Organizational Behavior and Social Responsibility, and A History of Applied Management Theory. It can help you acquire research skills and learn how to apply your findings to real-world business applications.

Before graduation, you will be expected to take a comprehensive exam, defend a dissertation and complete a practicum. This DBA course of study is particularly well-suited for students who want to go into consulting, but the school’s graduates also teach, work as CFOs, manage organizations and become investment analysts.

- Doctor of Business Administration

Saint Leo University is accredited by the Southern Association of Colleges and Schools.

11. Trident University

Whether you want to earn an online DBA or a PhD in Business Administration, you can pursue your degree from Trident University in California.

One available concentration for the PhD program is Accounting and Finance; students on that track study topics like auditing, global markets, corporation finance, and taxation.

The DBA is a generalist degree that doesn’t include specialization. If you go the PhD route, you’ll need to complete a dissertation, and if you choose a DBA, you will be expected to complete a doctoral study. To help you move through the online program, the university offers its Doctoral Positioning System tracker.

- PhD in Business Administration – Accounting

Trident University is accredited by the WASC Senior College and University Commission.

12. University of Dallas

Students at the University of Dallas can earn a DBA through a mix of online classes and time on the school’s Texas campus.

This program is designed for those who already hold leadership positions in the business world and desire increased advancement, and its flexible nature helps working professionals earn their doctoral degrees while remaining in their current jobs.

This generalist program includes classes like Agile Organizations and Emerging Technologies. If you choose this university, you will be expected to join a colloquium and defend a dissertation and will have the option to complete a teaching practicum.

The University of Dallas is accredited by the Southern Association of Colleges and Schools.

13. University of South Carolina

The Darla Moore School of Business at the University of South Carolina offers an on-campus program through which you can earn a PhD in Business Administration.

One available concentration for this program is Finance, and classes include Current Issues in Finance, Empirical Methods in Financial Research and Theory of Finance.

Faculty in this department have earned multiple recognitions, including the Alfred G. Smith, Jr. Excellence in Teaching Award and the Mortar Board Excellence in Teaching Award. A master’s degree is recommended before admission to the program, but it is not a requirement.

- Hybrid DBA in Business Administration – Finance

The University of South Carolina is accredited by the Southern Association of Colleges and Schools.

14. University of the Cumberlands

The PhD in Business program at the University of the Cumberlands takes business courses ranging from comparative economic and corporate finance to managerial ethics and responsibility. Students can choose one of their specialty areas like accounting, entrepreneurship, finance, etc. The Curriculum of this program will engage students in the theories, strategies, and tactics that they need to.

- PhD in Business (Finance concentration)

The University of the Cumberlands is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

15. Walden University

Whether you’re interested in DBA or a PhD, you can earn it from Walden University. The DBA program offers concentrations like Accounting and Finance. On the path to earning a DBA, you can complete a doctoral study, assemble a portfolio or take part in a consultation program in which you work with a local organization or company.

If you would prefer to earn a PhD in Management, you can select a 21st Century Finance concentration, which requires the completion of a dissertation. Both the DBA and PhD tracks can be completed through online study.

Walden University is accredited by the Higher Learning Commission.

Online PhD in Finance Programs

If you have a particular area of interest within the world of finance, then you may want to select a corresponding degree concentration.

PhD in Finance

Phd in financial management, phd in financial planning.

A concentration can give you opportunities to take an array of courses designed to hone your knowledge on that particular topic.

If you are a numbers person, there’s a good chance that you like accounting just as much as you enjoy general financial topics. This concentration can allow you to explore both of these areas of study.

You might put this degree to work in corporate or academic settings. You may also be interested in an Online PhD in Accounting program .

Being in charge of a company’s financial resources requires a special set of managerial leadership skills. A concentration in financial management can help you gain those skills.

This concentration is designed to teach topics like building a solid financial strategy and navigating international markets.

Helping individuals do their best with their money is the goal behind a concentration in financial management.

This concentration can help train you to guide wise financial choices as you learn not only about asset management and investment growth but also about how to influence smart decision-making through relational know-how.

With a PhD Financial Planning degree, you may help others manage their money, lead a financial advisement company, or teach future finance students.

Doctorate in Finance Salary

Earning your doctoral degree in finance may open many career paths to you. Once you graduate with this degree, you may work in an academic setting, a nonprofit organization, the corporate world, or the public sector.

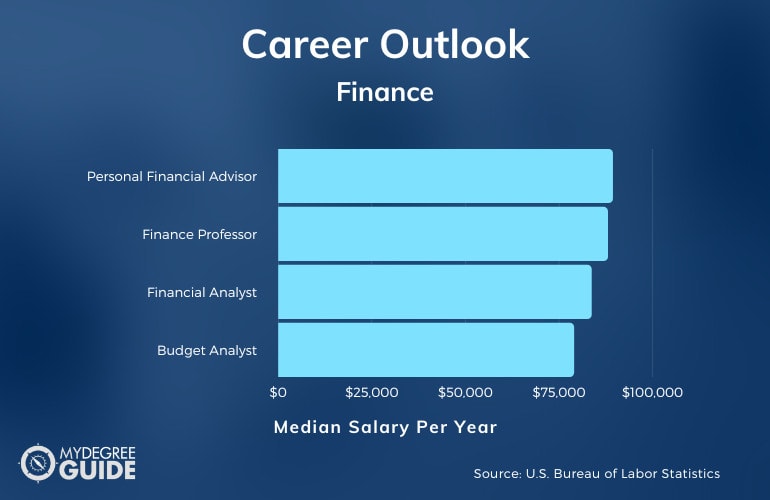

Here are a few jobs you may be able to look forward to, along with the U.S. Bureau of Labor Statistics job outlook and average salary information.

Budget Analyst

Budget analysts are responsible for setting an organization’s budget and helping the company stick to it.

- Outlook for job growth: 5% increase

- Median salary per year: $78,970

This may be an enjoyable career path for those who want to understand all facets of a company – tracking and justifying where each penny goes. Budget analysts make recommendations for investment and expenditure to boost their company’s profitability.

Financial Analyst

Financial analysts are responsible for paying attention to the market in order to make recommendations on how people or businesses should invest their resources.

- Outlook for job growth: 6% increase

- Median salary per year: $83,660

Rather than monitoring their business or organization, they monitor the economy as a whole. This career may be ideal for those who find financial markets interesting and have a deep understanding of investments.

Personal Financial Advisor

Consider this career path if you want the satisfaction of knowing that you’re helping others plan for their futures.

- Median salary per year: $89,330

You might also need to have a knack for marketing and sales as you attract and welcome new clients to your firm. In this role, you might work for a successful money management company or start your own practice.

Finance Professor

You may be able to pass your knowledge onto others by teaching students at the university level.

- Outlook for job growth: 7% increase

- Median salary per year: $88,010

Like many careers, you’ll need more than knowledge of the financial sector to be successful in this position. You’ll need organization and communication skills to be able to teach effectively. You’ll also need to be willing to prove your teaching effectiveness to your department via annual reviews.

If you enjoy teaching, researching, and discussing business, you may find yourself quite at home among the faculty of a business college.

Curriculum for Finance PhD Programs

Similar to a MBA in finance or online master’s in finance , when pursuing an advanced degree in finance, you’ll likely take a variety of courses designed to equip you with a thorough understanding of financial matters and how they relate to decision-making for individuals and businesses.

Your classes may include:

- Accounting and Control for Nonprofit Organizations

- Business Ethics

- Business Valuation

- Data Analysis for Investments

- Financial Management for International Business

- Human Resource Development

- Investment Portfolio Analysis

- Managerial Finance

- Mathematical Foundations for Finance

- Mergers & Acquisitions

- Money, Capital Markets & Economic Growth

- Quantitative Research Design & Methodology

- Real Estate Finance

- Real Option Valuation

- Risk Management

- Strategic Thinking for Decision-Making

- Stochastic Foundations of Finance

Since your program will likely encourage you to take a mix of both foundational classes and specialized electives, the coursework listed above includes both core classes and electives. Your PhD in finance requirements may also include a dissertation or capstone project. A growing number of doctorate programs have no dissertation required , but these tend to be professional doctorates, not PhDs.

Choose programs with a capstone project if you’d like to finish your degree faster. Dissertations can often take 2-3 years more to complete after you finish your coursework.

DBA in Finance vs. PhD in Finance

When you have your sights set on a finance degree, there are two different doctoral routes you can take. You could earn a doctorate of business administration (DBA) in finance or pursue a Doctor of Philosophy (PhD) in finance.

Although you can learn a great deal about numbers, money, and economics either way, the two different degrees will likely set you on divergent career tracks.

People often choose a professional doctorate, such as a DBA in Finance, if they want to put their education to work in the field — for example, working on Wall Street or in a Fortune 500 company.

A DBA in Finance:

- Is typically pursued by those who want to stay with their current company or work for another corporation.

- May involve drawing from others’ data and research for the culminating project.

- Is often pursued by those with several years of professional experience.

A PhD in finance is often pursued by people who want to work in an academic setting. You may find that a PhD program focuses more on the theoretical aspects of finance than the practical ones.

A PhD in Finance:

- Is typically pursued by people who want to conduct research, get published or teach.

- Typically requires conducting original research.

- May be good for those straight out of school, such as recent graduates of a master’s in finance or master of accounting program.

Think about what you want to do for your career, then choose the degree that best fits those goals.

Online vs. Traditional Finance Degree

When it comes to online versus traditional finance doctoral programs, the main difference is the format through which the material is presented. The content should remain about the same, and the rigors of the program likely will as well.

You may choose a fully online program, an on-campus one, or a hybrid mix.

Accreditation for a Doctorate in Finance Online

Universities receive accreditation as proof that their programs provide a thorough educational experience for students. Therefore, when you’re looking for a doctor of finance program, the school’s accreditation should be the first thing that you consider.

Reputable universities receive accreditation from a regional accrediting agency . These organizations give a broad stamp of approval to the entire school rather than to its individual programs. It is essential that you enroll in a school with regional accreditation.

In addition, there are several national and international organizations that provide accreditation specifically for business programs. Although this type of accreditation may not be absolutely essential, it’s certainly a valuable sign that the program is thorough, reputable, and excellent in quality.

A finance program may be accredited by:

- Accreditation Council for Business Schools and Programs (ACBSP)

- Association to Advance Collegiate Schools of Business International (AACSB)

- International Assembly for Collegiate Business Education (IACBE)

The top finance PhD programs are accredited both regionally and programmatically by one of these specialty boards. You can find your chosen university’s accreditation by searching the US Department of Education’s accreditation database .

Financial Aid for a Finance Degree

As you begin looking into finance PhD programs, don’t forget to also look into financial aid opportunities. At the doctorate level, you may still be eligible for federal financial aid as well as fellowships and scholarships from universities and scholarships from private organizations.

Your employer might even have tuition assistance programs available.

Can I Get My PhD Online?

Yes, many universities offer online PhD and professional doctorate programs. This includes doctoral degrees in finance, public health, education, nursing, and organizational leadership.

This approach can help you earn your advanced degree in a format that fits your schedule.

Is an Online PhD Respected and Credible?

In an online program, you should have to work just as hard as you do in an on-campus program. Additionally, your official records are unlikely to specify how you earned your degree.

The important thing is not the format in which you completed your coursework but whether you attended an accredited university.

Are There Any Online PhD In Finance Programs?

Earning a doctoral degree in finance doesn’t have to require moving onto campus or uprooting your whole life. Rather, there are programs for a DBA or PhD in finance online.

In these programs, you can engage in a computer-based educational experience as you work toward your degree.

Getting Your PhD in Finance Online

To take your finance education to the highest level, you may want to pursue a doctoral degree in this field, whether a PhD or a DBA.

Completing your coursework online can help you receive a solid education in a format that fits your lifestyle and prepare you for the next step on your career path.

Use the above list of schools to narrow down the finance PhD programs for you.

Related Guides:

- Best Online Masters in Finance No GMAT

- Finance vs. Accounting – What’s the Difference?

Best Online Doctorates in Finance

Staff Writers

Contributing Writer

Learn about our editorial process .

Updated October 17, 2023

TheBestSchools.org is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

Are you ready to discover your college program?

Whether your career interests lie in academia or business, graduating with a doctoral degree in finance opens doors to advanced job opportunities and earning potential. The U.S. Bureau of Labor Statistics (BLS) projects that popular finance careers like finance managers and personal finance advisors may grow by 15%-19% between 2016 and 2026. These occupations boast median incomes of $125,080 and $90,640, respectively. Doctors in finance also frequently find employment as college professors, educating students and conducting research for scholarly publications. With a variety of online degree options available from top schools around the country, it has never been easier to earn your doctorate in finance.

For more degree and career info, jump to:

- Choosing a Doctorate in Finance Program

- What Else Can I Expect From an Online Doctorate in Finance Program?

Careers with a Doctorate in Finance

The best online doctorate in finance programs.

Online Doctorate in Finance Ranking Guidelines: We selected the degree programs based on the quality of program and range of courses provided, as well as school awards, rankings, and reputation.

Our Methodology

Here at TheBestSchools.org, we take the trust and welfare of our readers very seriously. When making our school and program rankings, our top priority is ensuring that our readers get accurate, unbiased information that can help them make informed decisions about online education. That's why we've developed a rigorous ranking methodology that keeps the needs of our readers front and center.

Our proprietary, multi-criteria ranking algorithm analyzes key data indicators — as collected by the federal government — for each school or program. What data we use depends on the focus of each specific ranking, but in all cases, our ranking methodology is impartial: Schools cannot buy better rankings at TBS.

While specific criteria under consideration can vary by ranking, there are a few data points that we value most highly. They are affordability, academic quality, and online enrollment. Below, we break down our algorithm to help you understand what you're getting when you use one of our rankings.

- Affordability

- Online Enrollment

Data Sources

The data used in TBS rankings comes primarily from the federal government, and much of it is provided by the schools themselves. We aggregate and analyze this data to build our rankings.

The Integrated Postsecondary Education Data System (IPEDS) is our primary source. Its data comes from annual surveys conducted by the U.S. Department of Education's National Center for Education Statistics (NCES). Every college, university, or technical school with access to federal financial aid must participate in these surveys, which include questions about enrollment, graduation rates, finances, and faculty qualifications. This is publicly available data, which you can access yourself through the College Navigator .

Additionally, because we value a personal touch and the professional experience of our staff and Academic Advisory Board, we vet all results and adjust rankings as necessary based on our collected knowledge of schools and degree programs. Depending on the ranking, we may obtain additional input from AcademicInfluence.com , subject matter experts, prior TBS ranking lists, or other sources we deem relevant to a particular ranking.

Breakdown of Our Rankings Methodology

About our ranking factors.

Here at TBS, we value what you value: quality education, affordability, and the accessibility of online education. These factors guide all of our program rankings.

Each of these factors are further broken down into weighted subfactors. For example, retention rates are weighted more heavily than availability of program options because they are a better indicator of student success.

We chose the following factors for our rankings because of their influence on learning experiences and graduate outcomes. However, students should always balance our rankings against their personal priorities. For instance, a learner who needs a fully online program may prioritize online flexibility more than our rankings do. Our rankings are designed to help you make a decision — not to make a decision for you.

- Collapse All

Academics - 75%

Affordability - 15%, online enrollment - 10%.

In all our school rankings and recommendations, we work for objectivity and balance. We carefully research and compile each ranking list, and as stated in our advertising disclosure, we do NOT permit financial incentives to influence rankings. Our articles never promote or disregard a school for financial gain.

If you have questions about our ranking methodology, please feel free to connect with our staff through contact page .

We thank you for your readership and trust.

Finance PhD Programs for You

The best online doctorate in finance degree programs.

We use trusted sources like Peterson's Data and the National Center for Education Statistics to inform the data for these schools. TheBestSchools.org is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site. from our partners appear among these rankings and are indicated as such.

#1 Best Online Doctorates in Finance

Liberty University

- Lynchburg, VA

- Online + Campus

The doctor of business administration in finance program at Liberty University offers a flexible route to a doctorate. The private university provides flexible enrollment options to meet the needs of diverse degree-seekers. Doctoral students receive research support throughout the program.

In the online program, learners complete doctoral coursework and strengthen advanced skills. After passing comprehensive examinations, doctoral candidates complete an original dissertation that contributes to the field. With a doctorate, professionals may work in academia, research, and leadership roles.

Doctoral students attending the accredited institution online qualify for several forms of financial aid. Contact the finance program to learn about the enrollment process and start dates.

Liberty University at a Glance:

Online Student Enrollment: 78,511

Online Master's Programs: 67

Online Doctoral Programs: 9

Student-to-Faculty Ratio: 17-to-1

Graduate Tuition Rate: $7,980

Accepts Transfer Credits: Accepted

#2 Best Online Doctorates in Finance

Kansas State University

- Manhattan, KS

The personal financial planning doctorate at Kansas State University offers an online option for doctoral students. Thanks to a flexible format, the public institution makes it easier to complete a doctorate. Doctoral students benefit from support services like career advising.

Doctoral candidates move through the program by passing exams and researching a dissertation project. With a doctorate, professionals may work in academia, research, and leadership roles.

Doctoral students attending the accredited institution online qualify for several forms of financial aid. Contact the program to learn about admission requirements.

Kansas State University at a Glance:

Online Student Enrollment: 5,850

Online Master's Programs: 26

Online Doctoral Programs: 4

Student-to-Faculty Ratio: 18-to-1

Graduate Tuition Rate: $10,212

Accepts Transfer Credits: Data not available

#3 Best Online Doctorates in Finance

National University

- San Diego, CA

National University offers an online Ph.D. in financial management. At the private institution, degree-seekers complete a doctorate in a flexible environment. Doctoral students receive research support and participate in scholarly events.

In the online program, learners take advanced doctoral coursework. After passing comprehensive examinations, doctoral candidates conduct research for their dissertation. As the terminal degree in finance, the program leads to career opportunities in academia, research, and industry.

At the accredited institution, online doctoral students qualify for scholarships, federal loans, and other forms of financial aid. Contact the program for more information about research support and financial aid.

National University at a Glance:

Online Student Enrollment: Data not available

Online Doctoral Programs: 15

Student-to-Faculty Ratio: 3-to-1

Graduate Tuition Rate: $16,983

#4 Best Online Doctorates in Finance

Walden University

- Minneapolis, MN

The online doctor of business administration in finance program at Walden University ranks as one of the best degrees in the finance field. At the private university, degree-seekers engage in online classes to earn a doctorate. Doctoral students participate in career counseling and benefit from research support.

During the online program, learners complete at least 49 credits of advanced coursework. After passing comprehensive examinations, doctoral candidates choose a dissertation topic and conduct research in their specialty area. As the highest degree in finance, the doctorate trains graduates for academic, research, and leadership careers.

Doctoral students attending the accredited institution online qualify for several forms of financial aid. Prospective applicants can contact the program for more about financial aid and admission requirements.

Walden University at a Glance:

Online Master's Programs: 39

Online Doctoral Programs: 20

Graduate Tuition Rate: $12,039

Choosing an Online Doctorate in Finance Program

50 Best Online Colleges & Universities Two main avenues exist for earning an online doctorate in finance: an academic route and an industry route. Students who want to apply their finance expertise to an industry job should consider earning a doctorate of business administration (DBA) in finance. Students looking to enter the academic profession as faculty should consider a Ph.D. finance program. While they may seem similar on the surface, these two finance doctorate pathways require different coursework and produce different learning outcomes. Carefully consider which path works best for your own goals.

An industry-focused program provides you with a firm foundation of quantitative financial skills and trains you to apply theory to real-world business scenarios. Additional concentrations may also let you further tailor your focus. Academic-focused programs require more intensive study of research and theory but offer fewer opportunities to hone mathematical finance skills. These programs also require dissertations, while industry-focused programs more commonly require a thesis. Finally, getting into an academic Ph.D. finance program may prove more difficult than a DBA program. While DBA programs often allow for cohorts of about 10 students, Ph.D. programs may only offer enrollment to one or two students per year.

What Else Can I Expect from an Online Doctorate in Finance Program?

The information below intends to provide a representative look at the potential curriculum content of a doctorate of finance. The specifics can vary, depending on the school and program you select. Different programs align with different career goals, in industry or academia, and offer courses according to these specific learning outcomes.

Concentrations Offered for an Online Doctoral Degree in Finance

- Careers this concentration prepares for: College Professor, Accountant, Auditor

- Careers this concentration prepares for: Finance Manager, Executive

- Careers this concentration prepares for: Personal Financial Advisor, College Professor

Curriculum for an Online Doctoral Degree in Finance

- Introduction to Empirical Methods: These introductory courses develop a foundational knowledge of academic and theoretical research methods by exploring a range of techniques and quantitative tools used for finance and economic analysis.

- Topics in Macroeconomics: Macroeconomics topics courses typically focus on two or three main areas of modern research, such as economic growth or wage inequality. Students read literature on the course topics and participate in discussions.

- Finance Theory: Expect to complete a few finance theory courses for your doctorate in finance online. From introductory levels to advanced courses, students develop an understanding of single period and dynamic models.

- Economic Analysis: Typically part of a sequence of multiple microeconomics theory courses, economic analysis courses focus on topics including consumer and producer choice and the nature of equilibrium in competitive markets.

- Applied Behavioral Finance: Through lectures, active discussion, and written assignments students learn to apply current behavioral finance theory and research to real-world scenarios like financial planning and business practice.

Earning an online doctorate in finance prepares an individual to work either inside or outside of the finance industry. Graduates' analytical skills and advanced knowledge of financial principles allow them to hold high-level positions in major companies, in the government, or in academia.

- Median Annual Salary: $76,000

- Projected Growth Rate: 15%

- Median Annual Salary: $125,080

- Projected Growth Rate: 19%

- Median Annual Salary: $90,640

Source: Bureau of Labor Statistics

Featured Image Credit: Nitat Termmee | Moment | Getty Images

Popular with our students.

Highly informative resources to keep your education journey on track.

Take the next step toward your future with online learning.

Discover schools with the programs and courses you’re interested in, and start learning today.

School Finder

Online phd finance, are you wondering if an online ph.d. in finance is right for you looking for the best online ph.d. in finance programs this article features the top finance ph.d. programs available..

A Ph.D. in finance is the highest level of education you can complete in the field of finance. By pursuing an online PhD in finance, you’ll be prepared for some of the highest-level careers in the financial sector.

You may also like: IS A MASTER’S IN FINANCE RIGHT FOR ME?

Featured Programs

Students will be exposed to advanced concepts in these programs. Some of the skills you can learn in an online Ph.D. in finance program include:

Data Analysis

Predicting and detecting changes in financial events is an essential skill for online PhD in finance students to have. They will need to organize huge amounts of information and explore vast amounts of data. Therefore, understanding data analysis is critical for staying up-to-date in the finance industry.

Communication Skills

Ph.D. in finance students need to learn to communicate effectively. Conveying complicated concepts or interacting with other professionals make such skills essential. In addition, they help people make thoughtful word choices and play a role in how knowledge is presented.

Critical Thinking Skills

Those with an online Ph.D. in finance are some of the top thinkers in the finance industry. Critical thinking skills are a big part of that. It’s essential to know how to sort through complex information.

And it is equally important to understand how to find practical solutions to problems. Many classes in advanced online PhD in finance programs teach critical thinking and research skills.

Analytical Software Skills

It’s more important than ever that finance PhDs understand today’s financial software.

Software in this industry is geared toward e-business, education, statistics, and more. Having strong knowledge of these programs will ensure you stay on top of things in the world of finance. And an online PhD in finance program can give you those skills.

Economics and Accounting Skills

During an online PhD in finance program, students learn advanced economics and accounting skills. These programs cover accounting processes in all areas of finance. That includes everything from executive-level roles to research positions.

Courses may cover topics in both global economics and the U.S. marketplace. And you will learn high-level skills like advanced financial statement analysis.

Management and Leadership Skills

Students in an online Ph.D. in finance program may also cover management skills. These skills will be necessary for leadership roles when managing personnel. No matter what position you fill, these “people” skills can help with communication in the professional world.

You may also like: Best Online Graduate Schools

What’s the difference between a Ph.D. in Finance and a DBA in Finance?

You can pursue two different doctoral routes if you aim for an online Ph.D. in finance. A doctor of business administration (DBA) or a doctor of philosophy (Ph.D.) in finance are both options. Which one should you choose? It depends on your academic and career goals. Both are respected degrees that represent the highest level of academic achievement you can pursue. So what’s the difference?

Ph.D. in Finance

A Ph.D. in finance is an academic doctorate. For example, if you want to work in research or education, you would probably choose an online Ph.D. in finance. These programs tend to concentrate more on finance theories rather than practical applications. An online Ph.D. in finance is also focused on contributing to the field of finance with knowledge. PhDs in finance typically work in research centers or universities.

Doctorate in Business Administration in Finance

With a doctor of business administration degree in finance, you focus more on real-world finance and business topics. Unlike the online Ph.D. in finance, This degree is for those looking for a career in finance or consulting. Some DBAs do work in education. However, if you aspire to work with a Fortune 500 company or on Wall Street, for example, you would choose the Doctorate in Business Administration in Finance.

Related: TOP CAREERS FOR MASTER’S IN FINANCE DEGREES

Online PhD in Finance Methodology

For students who want to pursue an online PhD in finance, we have compiled a list of the top programs available. These programs have been selected for this ranking based upon a scoring system that considers the cost of tuition and length of the program. They are ordered from highest to lowest score.

All of the online PhD in finance programs are from nonprofit colleges. And each is accredited by a nationally recognized board. The listed tuition is from the school’s published prices and is based on yearly costs.

See also: For Profit vs. Non Profit Colleges: What’s the Difference? (nonprofitcollegesonline.com)

Best Online PhD in Finance: Students Before Profits

#1. liberty university.

Online Doctor of Business Administration – Finance

Lynchburg, virginia.

The first online PhD in finance program on our list is a 100 percent online Doctor of Business Administration–Finance degree. It is offered through Liberty University. Students in this program of study will work to expand their knowledge of business finance. Some of the topics in the program include:

- Managerial Finance

- Mergers & Acquisitions

- Investments & Derivatives

- Business Valuation

- Financial Management

Liberty has been ranked among the top online colleges in the nation by various publications. And this program is accredited by ACBSP. The Accreditation Council for Business Schools and Programs is an elite organization. Only three percent of business schools in the world have earned this accreditation. We find this is one of the best online PhD programs in finance.

You’ll need 60 credit hours to complete the program. Doctorate in Business Administration students can finish online in as little as three years, and tuition is quite reasonable. The school has frozen tuition rates for the past several years. The cost per credit hour for this online doctor of business administration program is only $595 for full-time students.

Online students can take full advantage of many online resources while pursuing the program. These include technical support, an online writing center, online tutoring, and more. Students are also encouraged to visit any of Liberty’s campuses and participate in the school’s clubs, activities, and events. Some of these include:

- The LaHaye Ice Center

- Equestrian Center

- Montview Bowling Alley

- The Gun Club

- Liberty Mountain Snowflex Centre

Accreditation: Southern Association of Colleges and Schools Commission on Colleges

Tuition: $7,847

#2. University of Maryland

Online Doctorate in Business Administration

College park, maryland.

The University of Maryland offers an online doctor of business administration designed for working professionals. To complete this degree program, students must earn a total of 48 credits. UMGC is an excellent option for students who want to further their careers in finance. Students will study topics ranging from investment banking to econometrics and more. Topics include:

- Interpreting and Translating Management Theory in Practice

- Evidence-Based Research Methods

- Data Analytics in Practice

- Designing Evidence-Based Management Solutions

- Producing Original Management Ideas that Influence: Publishing and Conferencing

Students are expected to have demonstrated leadership skills and management experience. There is a lot of writing involved in this program, so the school’s Graduate Writing Skills (ASC 601) is recommended. Applicants should be motivated and intellectually curious. Online students at UMGC can also take advantage of a wide range of services. These include:

- Academic advisors and success coaches

- Military & veteran support

- The UMGC Library

- Technical support Help Center

- Writing center

- Lifetime career support

- One-on-one career planning and tools

- Global Campus student organizations

The University of Maryland has a wide range of grants, scholarships, and other financial assistance programs. Additionally, the school offers an interest-free monthly payment plan. UMCG is the second most affordable online PhD programs on our list.

Accreditation: Middle States Commission on Higher Education

Tuition: $9,072

Score: 99.75

#3. Kansas State University

Online Doctorate in Personal Financial Planning

Manhattan, kansas.

Kansas State University offers an online Doctorate in Personal Financial Planning. This program is designed to be completed in a hybrid format. While many of the courses are offered online, students must take some of them at the Kansas State University campus. These on-campus experiences consist of three consecutive summer residency sessions in Manhattan, Kansas. During these residencies, students in the personal financial planning program will build connections with their peers and instructors.

This is one of the only PhD in financial planning online programs in the country. A total of 90 credit hours are needed to complete the doctorate in personal financial planning. And the cost at Kansas State University is $635.60 per credit hour. Students can transfer up to 30 credit hours into the doctoral program. Some of the courses include:

- Estate Planning for Families

- Insurance Planning for Families

- Personal Income Taxation

- Financial Planning Case Studies

- Introduction to Financial Therapy

- Money and Relationships

- Applied Behavioral Finance

- Financial Therapy Theory and Research

- Financial Ethics and Mediation

K-State uses Canvas for its online learning management system. Whether online or on-campus, you’ll get the same high-quality instruction. Students can complete this flexible personal financial planning degree program on their own schedule. You’ll do your weekly readings, discussions, and assignments at a time that is convenient for you.

Online PhD financial planning students are invited to participate in commencement activities on campus. However, if you can’t make it to the University, a remote commencement ceremony is offered. In addition, online students can take advantage of all the services Kansas State University offers, including:

- Academic Advising

- Academic Coaching

- Student Access Center

- Writing Center

- Library Services

Accreditation: Higher Learning Commission

Tuition: $10,294

Score: 99.50

#4. City University of Seattle

Doctorate in Business Administration with Specialized Study Concentration

River forest, illinois.

The City University of Seattle offers an online doctor of business administration with a specialized study concentration. The concentration consists of 12 credits taken in a specific area of focus. Students can propose a particular industry to the program director. In this case, a student could transfer finance courses from another institution. They could also choose to do an independent study or choose from existing course offerings. Some of the courses include:

- Financial Decision Making

- Industry Analysis and Market Innovation

- Business Process Analysis and Strategic Management

- Quantitative Research Methods

- Qualitative Research Methods

- Research Fundamentals

- Organizational Development Theories and Trends

- Technology Implementation and Change Management

- Organizational Identity and Culture

This program consists of 91 credit hours and has no residency requirements. This is a very affordable Ph.D. in finance online at $765 per credit. City University students can expect to complete the program in three to four years. All of the school’s degree programs qualify for scholarships and financial aid. As a result, it is one of the top online finance PhD programs on our list. Additionally, the school offers many opportunities to connect with faculty members. These instructors are already working professionally in the field.

With this Ph.D. in finance online, students utilize Blackboard Collaborate Ultra. This allows for an interactive experience. You’ll interact together online with your classmates and instructors every other week. Other online services at City University of Seattle include:

- Library website

- Writing Center

- Unlimited free tutoring through Smarthinking

- Technical help via Brightspace Help Desk and the Student Help Center

- Career counseling

- Mental health counseling

Accreditation: Northwest Commission on Colleges and Universities

Tuition: $11,812

Score: 99.25

#5. California Baptist University

Online Doctor of Business Administration

Riverside, california.

California Baptist University has an Online Doctor of Business Administration program. Students can expect to complete this 56-credit-hour program in about three years. The courses in this program are delivered in an eight-week format. So students will study one course every eight weeks. This concentrated format ensures that students can devote all of their energies to learning one topic at a time. Some of the courses in this program include:

- Foundations of Organization and Management

- Ethics in Organizations and Management

- Financial Analysis for Decision Making

- Applying Economic Theory to Business

- International Finance

- Strategic Marketing

- Topics in Human Resource Management

- Research Design

- Data Analysis and Interpretation

- Quantitative Research

- Qualitative Research

Students at California Baptist University can take advantage of many exclusive services:

- Dedicated Personal Enrollment Counselor

- One-Stop Student Service Advisor

- Academic Success Center

- Smarthinking 24/7 Online Tutoring Support

Online Career Services

CBU uses the Blackboard 9.1 learning platform. And they aim to employ the latest technologies in remote education. As a result, they have also been named one of the top online colleges by U.S. News and World Report.

Accreditation: Western Association of Schools and Colleges

Tuition: $13,590

Score: 99.00

#6. George Fox University

Online Doctor of Business Administration

Newberg, oregon.

This next program is one of the best finance Ph.D. programs available. George Fox University offers a hybrid Doctorate in Business Administration with two concentrations. Students can choose management or business analytics. Both programs introduce students to advanced finance concepts. So your choice will depend on your specific goals. George Fox has one of the best finance PhD programs on our list.

This online Ph.D. in finance requires two in-person sessions per year. So you’ll want to be sure your schedule allows for this. George Fox University estimates that students can complete this rigorous degree program in four to five years. The cost is $980 per credit hour before financial aid.

This program is ideal for working professionals. In addition, it’s beneficial for those who want to develop their financial knowledge further to advance their careers. The program itself is accredited by the ACBSP . Some of the courses you may take include:

- Leading in Organizations

- Foundations of Marketing

- Conceptual Foundations of Economics

- Conceptual Foundations of Finance

- International Business

- Business Analytics: Analytic Thinking and Decisions

- Seminar in Accounting

- Business Analytics: Descriptive Analytics and Forecasting

- Business Analytics: Applied Analytics and Predictions

- Business Analytics: Prescriptive Analytics and Modeling

This finance Ph.D. program functions around a cohort model. This model allows students to interact and network with their instructor and peers. This gives them a way to connect with other professionals across the country and even across the world. Online students have a variety of services at their disposal, including:

- Writing circles

- Academic Resource Center (ARC)

- Career Services (IDEA Center)

- Student Jobs on Campus (Handshake)

- Athletics

- Clubs

- Spiritual Life Groups

- Music Ensembles

- Student Publications

- Theatre Performances

- Bruin Community Pantry

- Diversity Initiatives & Programs

- Health & Counseling Center

- Intercultural Resource Center

- Student Support Network

Tuition: $14,158

Score: 98.75

#7. Johnson & Wales University

Providence, Rhode Island

Johnson & Wales University online Doctor of Business Administration degree program is one of the best finance programs on this list. Students enrolled in the program will develop the financial acumen for high-paying careers in finance. And they will be prepared for roles such as:

- Executive-level organizational leaders

- Industry innovators

- Consultants

- Policymakers

Additionally, for those pursuing a career in education, the Doctorate in Business Administration is recognized as a terminal degree.

A total of 60 credit hours are needed to complete the program. It takes approximately three years to finish. Courses are offered in eight-week formats, which means students focus on only one topic at a time. That allows you to fully understand the material before moving on to the next learning area. This degree has definitely earned its spot among our top finance Ph.D. rankings. Courses in the program include:

- Contemporary Issues in Finance and Accounting

- Advanced Strategies in Organization Development

- Problems and Methods in Marketing Management

- Business Analytics and Intelligence

- Organizational Behavior

- Innovation and Change

- Contemporary Leadership Issues

- Leadership and Managing Large Scale Transformation

The program is offered in collaboration with JWU’s College of Business. It is entirely online with no residency requirements.

Accreditation: New England Commission on Higher Education

Tuition: $14,706

Score: 98.50

#8. Franklin University

Online Doctor of Business Administration – Accounting

Columbus, ohio.

Franklin University offers a 100 percent online Doctorate in Business Administration-Accounting degree. The program is designed to teach students to become problem-solving business leaders. While not a Ph.D. in Finance, you can customize this degree with several electives. This allows students to advance their knowledge of finance topics such as:

- Advanced Accounting

- Federal Income Tax

- Accounting Research and Analysis

- Financial Planning

- Enterprise Resource Planning

- Financial & Managerial Accounting

- Management Control Processes & Systems

- Introduction to Tax Research

- C-Corporation Taxation

- Enterprise Risk Analysis & Management

The program requires a total of 58 credit hours, and students can complete it in as little as three years. The cost per credit is $748. However, Franklin University offers many financial aid resources . These include scholarships, grants, and other forms of assistance. They also have installment payment plans and deferred tuition reimbursement.

Franklin has a generous transfer program as well. Doctoral students can transfer up to 24 credits. And the school will work diligently to ensure you maximize all the credits you can.

Students studying finance online at Franklin have plenty of support services, too. All students have a personal advisor to help them one-on-one with questions or concerns. In addition, tutoring, writing help, research help, library services, and more are also available.

Tuition: $16,080

Score: 98.25

#9. Cambridge College

Online Doctor of Business Administration – Quality Systems Management

Boston, massachusetts.

This next program is offered through the New England Institute of Business at Cambridge College. It’s an online DBA Administration Quality Systems Management degree. This online Ph.D. in finance is ideal for students who want to gain the knowledge and expertise to build a career in certain finance professions.

A total of 60 credit hours are needed to complete this program, and the cost is $658 per credit hour. Military members, first responders, and veterans are entitled to a discount. The school anticipates that students can complete the program in three years. Some of the courses related to finance in this program include:

- Financial Management and Fiscal Leadership

- Benchmarking, Reengineering, and Cost of Quality

- Business Analytics and Strategic Decision Making

- Innovation, Strategic Technologies, and Sustainability

- Business Operations and Supply Chain Management

- Strategic Management and Globalization

The online Doctorate in Business Administration has two required residency courses. Students must attend each of these in full. There is one four-day residency and one three-day residency. If you have special circumstances, you must notify the school in advance.

Students pursuing finance online are entitled to the same services as their peers on campus, including:

- Academic Support

- Center for Career and Professional Development

Accreditation: New England Commission of Higher Education

Tuition: $16,409

Score: 98.00

#10. Northcentral University

Doctor of Business Administration with a Specialization in Financial Management

San diego, california.

Northcentral University offers an Online Doctorate in Business Administration with several specializations. The one we’re discussing here is the financial management specialization. It’s a 48-credit-hour program designed to be completed entirely online.

This finance degree is a great option for students looking for an affordable Ph.D. in finance online. It is staffed by a 100 percent doctorate faculty. And you can complete the program in approximately 34 months. The entire program is asynchronous and starts every Monday. There are no residency or GRE/GMAT requirements. Topics in the financial management specialization include:

- Advanced skills in fiscal analysis, budgeting, and spending for public and private organizations

- Domestic and international finance

- Causes of fluctuations in interest and monetary exchange rates

- Advanced business financial decision models

- Investment selection techniques

- How financial institutions generate earnings and manage risk

- Corporate Finance

At NCU, students can interact one-to-one with their professors. And they will receive personalized mentoring. The school has a Virtual Education Support Center where you can access plenty of resources. Plus, students studying finance online can take advantage of a Virtual Center for Health and Wellness.

Graduates of this program will be ready for a variety of careers. A few of those include:

- Financial Research Specialist

- Statistician

- Financial Analyst

- Budget Analyst

- Loan Officer

- Financial Manager

- Financial Planner

- Investment Banker

Accreditation: Western Association of Schools and Colleges

Tuition: $16,881

Score: 97.75

#11. Rutgers University

Online PhD in Management – Finance Concentration

Newark, new jersey.

Students at Rutgers University can enroll in the school’s Online Ph.D. in Management and choose a finance concentration. This program is one of the top finance Ph.D. programs on our list. And it’s ideal for working professionals who want to further their careers in finance. You’ll need to earn a total of 72 credits to complete the program. Courses include:

- Microeconomic Theory

- Optimization Models in Finance

- Math Methods in Economics

- Introduction to Probability

- Stochastic Processes

- Game Theory

- Macroeconomics

- Modern Statistics

- Investments

- Accounting Theory I: Theory of Corporate Disclosures, Control, and Governance

- Floating Finance Seminar

- Econometrics

This finance degree program is via the Department of Finance & Economics of Rutgers Business School. The business school is a member of AACSB International—The Association to Advance Collegiate Schools of Business. There are five research centers associated with this department:

- Blanche and Irwin Lerner Center for Pharmaceutical Management

- Center for Real Estate

- Center for Research in Regulated Industries

- Rutgers Financial Institutions Center

- Whitcomb Center for Research in Financial Services

Although not required, it’s a plus if you have a master’s in computer science, economics, or mathematics. However, if your background in finance or economics is limited, the school suggests taking an additional course. This would be the Master of Quantitative Finance course. While this doesn’t guarantee admission, it can benefit you in your studies.

Tuition: $18,168

Score: 97.50

Related: Largest Nonprofit Online Universities

Why Should You Pursue an Online PhD in Finance?

A doctoral degree in finance represents the highest academic level you can reach in college. And it puts you in an elite group of students. Only around 181,000 students earn a Ph.D. each year. You might think that is a lot. But over 800,000 students get their master’s degrees. And nearly two million students graduate with a bachelor’s degree every year.

When you graduate with a Ph.D. in Finance online, you are considered an expert in the field of finance. Your credentials open up many possibilities for careers others can only dream about. You can also reach more of your personal and financial goals.

Are Online PhD in Finance Programs Legit?

When looking for the best school for PhD finance programs, one of your main concerns should be credibility. There are a few for-profit schools offering these degrees, but many of them have some shady practices . You should avoid these “diploma mills” at all costs. Many are not even accredited.

You’ll want to look for programs offered at reputable nonprofit colleges and universities. Nonprofits can be public or private. And they invest all their earnings back into educational programs. Nonprofits do not exist to make money. At Nonprofit Colleges Online, we only feature universities and colleges that are not for profit.

We also look for accreditation. Each of the schools we review is accredited by a national or regional accrediting body. Accreditation is crucial when looking for the best online Ph.D. in finance. When a school is accredited, it meets certain academic standards for rigor, quality, and other factors. In fact, some employers won’t even consider hiring a candidate who has not attended an accredited program.

See Also: BEST ONLINE MASTERS IN FINANCE: STUDENTS BEFORE PROFITS AWARD

On-Campus vs. Online PhD in Finance Programs

Online PhD in Finance programs are getting more and more popular each year. But are they really as good as the on-campus versions? First, let’s look at a few things that are not different about pursuing an online degree program.

1. Online degree programs are just as academically rigorous as their on-campus counterparts.

You’ll focus on the same curriculum when studying online. You will take the same exams and quizzes. And you will complete the same research and assignments.

2. Online PhD in Finance programs have the same esteemed instructors.

The online version of a Ph.D. program will almost always have the same faculty members. You can expect to meet the same respected professors and instructors that teach in the classroom.

3. Online PhD in Finance degrees look no different than those earned on campus.

Your degree will not specify that you earned it online. Instead, you will have the same diploma as students who attended an on-campus program. And only you will know you earned your degree online.

You may also enjoy: TOP PODCASTS FOR BUSINESS STUDENTS

What Is Different About Online Ph.D. in Finance Programs?

Online and on-campus Ph.D. programs have two significant differences—pace and schedule. When students attend on-campus programs, there are a specified number of courses to finish. Class begins and ends at a particular time, and assignments all need to be completed by a specific date. You usually can’t go at a faster pace since everyone is taking the course at once. And if you lag behind, you may fail the course or have to complete it again.

With online programs, there is much more flexibility. For example, you’ll have the same number of courses and the same assignments, lectures, readings, etc. But you can usually progress at your own pace. When taking online courses, you don’t need to show up to class at a specific time. You can log in and complete your assignments whenever it is convenient.

Related: BEST ONLINE BACHELOR’S IN FINANCE/ECONOMICS: STUDENTS BEFORE PROFITS AWARD

How Many Years Does It Take to Earn a Ph.D. in Finance?

The credit hours needed for earning an online Ph.D. in finance can vary significantly. Often, it depends on the school you choose and how rigorous the program is. The number of credits can be between 50 to 90, with 60 being about average. For full-time students, most online doctoral programs can be finished in three to four years.

This concludes our ranking of the top online PhD in finance degree programs.

- 10 Best Online Doctorates at Nonprofit Colleges

- Top 10 Nonprofit Online Colleges in Georgia

- Online Bachelor’s in Computer Science

- Top 10 Nonprofit Online Colleges in Virginia

- DIFFERENT TYPES OF LEGAL STUDIES DEGREES

- 15 Best Paying Jobs in Energy

- 10 Top Organizational Leadership Jobs by Salary

- Top 10 Affordable Online Colleges in NYC

Infographics

- How To Focus Despite Distractions

- Online College Enrollment: By the Numbers

- Most Profitable Non-Profit Organizations

- College Tuition Around the World

Financial Planning Graduate Programs in America

1-24 of 24 results

Bentley University McCallum Graduate School of Business

Waltham, MA •

Graduate School

- • Rating 4.71 out of 5 21 reviews

Master's Student: I have had a fantastic experience at Bentley. The hybrid and fully online courses make it possible for me to have a full time job, take care of my young family, and complete my degrees in a reasonable amount of time. The professors are incredibly knowledgable in their fields and bring so much real world experience to the table. I've learned so much about leadership in my MBA courses that I've actively used in my job. ... Read 21 reviews

Blue checkmark.

Graduate School ,

WALTHAM, MA ,

21 Niche users give it an average review of 4.7 stars.

Featured Review: Master's Student says I have had a fantastic experience at Bentley. The hybrid and fully online courses make it possible for me to have a full time job, take care of my young family, and complete my degrees in a... .

Read 21 reviews.

Kansas State University College of Business Administration

Manhattan, KS •

Kansas State University •

- • Rating 1 out of 5 1 review

Kansas State University ,

MANHATTAN, KS ,

1 Niche users give it an average review of 1 stars.

Read 1 reviews.

University of San Francisco School of Management

San Francisco, CA •

University of San Francisco •

University of San Francisco ,

SAN FRANCISCO, CA ,

Jerry S. Rawls College of Business Administration