- GK for competitive exams

- General Awareness for Bank Exams

- Current Affairs

- Govt Schemes

- Financial Awareness

- Computer GK

- Social Issues

- General Knowledge for Kids

Application for ATM Card

- Unified Mobile Application

- Real Life Applications of Microcontroller

- Software Testing - Bank Domain Application Testing

- Important Computer Abbreviations for Bank Exams

- Blockchain - Electronic Cash

- Mini Banking Application in Java

- What is Application Service Provider (ASP) ?

- C++ Program to Implement Trading Application

- Java Application to Implement Bank Functionality

- Multifactor Authentication

- Online Chat Application Project in Software Development

- Applications of Augmented Reality in Retail Automation

- Works Applications Interview Experience | Set 3

- UPSC Admit Card

- How to Create a Credit Card Form in Android?

- How to Send Money by Cash App?

- Journal Entry for Capital

- Multi Factor authentication Card using Tailwind CSS

- How to Apply for IPO in Zerodha?

An ATM (Automated Teller Machine) card is an essential banking tool that provides convenient access to your financial accounts. It allows you to withdraw cash, check account balances, transfer funds, and perform other transactions without having to visit a bank branch during business hours. The application letter serves as the primary means of communicating your ATM card requirements to the bank.

In this article, we will look into the format of an ATM application letter. Let’s start.

Writing an Application for ATM Card – Things to Remember

When applying for an ATM (Automated Teller Machine) card, there are a few essential things to keep in mind. Firstly, you must have an active bank account with the financial institution you’re applying to. Secondly, gather all the required documents, such as a valid ID proof and address proof. Thirdly, ensure you understand the terms and conditions, fees, and charges associated with the ATM card.

Format of ATM Card Application Letter

Here is a format and explanation for writing an ATM card application letter:

Your Name Your Address City, State, Zip Date The Manager Name of Bank Bank Branch Address City, State, Zip Subject: Application for New ATM/Debit Card Dear Sir/Madam, I am writing this letter to request for issuance of a new ATM/Debit card for my following bank account(s): Account Number(s): [Mention your account number(s)] Account Type(s): [Savings/Current/etc.] I would like to apply for a new ATM card, as [mention reason – my previous card has expired/damaged/lost/stolen]. Please issue me a new ATM card and send it to my current mailing address mentioned above. I request you to link all my above-mentioned accounts with the new ATM card for easy access and operations. In case you need any other details or documents from me, please let me know. I will be glad to provide the same. Thank you for your assistance in this matter. Sincerely, [Your Name]

Important Things to Remember:

1) Start with your full name and current mailing address where you want the new ATM card delivered.

2) Address it properly to the bank manager with bank’s branch address.

3) Mention the subject line clearly as “Application for New ATM/Debit Card”.

4) In the first paragraph, state your request for issuance of a new ATM card.

5) Provide your bank account number(s) and account type(s) to be linked to the new card.

6) Give a brief reason for applying for a new card – previous expired, damaged, lost or stolen.

7) Confirm your current mailing address and request to link all mentioned accounts to the new card.

8 ) Optionally, you can add a line about providing any other required details/documents.

9) Thank the bank for their assistance and end with a polite closing salutation.

Sample Application for ATM Card in English

Date: June 1, 2023 To, The Branch Manager ABC Bank 123 Main Street Cityville, State 12345 Subject: Application for Issuance of a New ATM Card Dear Sir/Madam, I am writing to request the issuance of a new ATM card for my savings account number 987654321 with your bank. My account details are as follows: Account Number: 987654321 Account Holder’s Name: John Doe Contact Number: 555-0123 I have enclosed copies of my driver’s license and recent utility bill as proof of identity and address, respectively. Kindly process my request for a new ATM card at your earliest convenience. I will be happy to provide any additional information or documentation required. Thank you for your assistance. Sincerely, John Doe

Sample Letter for New ATM Card Issue Application

Date: [Current Date] To, The Branch Manager [Bank Name and Address] Subject: Application for Issuance of a New ATM Card Dear Sir/Madam, I am writing to request the issuance of a new ATM card for my savings account with your bank. My account details are as follows: Account Number: [Your Account Number] Account Holder’s Name: [Your Full Name] Contact Number: [Your Mobile Number] I have enclosed copies of my [ID Proof] and [Address Proof] for your reference. Kindly process my request for a new ATM card at your earliest convenience. I will be happy to provide any additional information or documentation required. Thank you for your assistance. Sincerely, [Your Name]

Sample Letter for ATM Card Renewal/Replacement

Date: [Current Date] To, The Branch Manager [Bank Name and Address] Subject: Request for ATM Card Renewal/Replacement Dear Sir/Madam, I am writing to request the renewal/replacement of my existing ATM card for my savings account with your bank. My account details are as follows: Account Number: [Your Account Number] Account Holder’s Name: [Your Full Name] Contact Number: [Your Mobile Number] Existing ATM Card Number: [Your Current ATM Card Number] The reason for this request is [state the reason, e.g., card expired, lost, damaged, etc.]. I have enclosed copies of my [ID Proof] and [Address Proof] for your reference. Kindly process my request for a new ATM card at your earliest convenience. I will be happy to provide any additional information or documentation required. Thank you for your assistance. Sincerely, [Your Name]

Sample ATM Card Application Letter

Date: [Today’s Date] To, The Bank Manager [Name of Bank and Address] Subject: Asking for a New ATM Card Dear Sir/Madam, I am writing to you to ask for a new ATM card for my bank account with your bank. My account details are: Account Number: [Your Account Number] Name: [Your Full Name] Phone Number: [Your Mobile Number] I am giving copies of my [ID Proof] and [Address Proof] with this letter. Please give me a new ATM card as soon as possible. I will give any other information or documents needed. Thank you for your help. Sincerely, [Your Name]

Remember, these are sample letters and may need to be modified based on your specific requirements and the bank’s guidelines.

Applying for an ATM card is a straightforward process that requires submitting a formal application letter along with the necessary documents to your bank. By following the proper format and providing the required information, you can ensure a smooth and efficient process for obtaining or renewing your ATM card. Maintaining a polite and professional tone in your application letter can also help facilitate a positive experience with your bank

People Also View:

- How to Write Job Application Letter? (with Samples)

- Casual Leave Application: Check Format & Samples

- Letter to Principal, Format And Samples

FAQs on Application for ATM Card

How can i write an application for an atm card.

To apply for a new ATM card, write a letter addressed to the bank manager or customer service department. Mention your full name, account number, and type of account. State that you want to apply for a new ATM/Debit card for your account. If it’s to replace an expired/damaged card, mention that. Provide your current mailing address to receive the new card. Request them to link your existing accounts to the new card. Thank them for their assistance.

How do I write an application letter for ATM card block and reissue?

Address the letter to the bank manager. Clearly state that you want to block your existing ATM card number and mention the card number. Explain the reason, such as the card being lost, stolen, or compromised. Request them to reissue a new ATM card linked to your accounts. Provide your updated mailing address to receive the new card. Thank them for their cooperation.

How do I write a request for an ATM card?

To request an ATM card, write a letter to the bank. Mention your full name, account number, and type of account. State that you want to apply for a new ATM/Debit card for your account. If it’s to replace an expired/damaged card, mention that. Provide your current mailing address to receive the new card. Request them to link your existing accounts to the new card. Thank them for their assistance.

How to apply for an ATM card?

To apply for an ATM card, write an application letter addressed to the bank manager or customer service department. Mention your full name, account number, and type of account. State that you want to apply for a new ATM/Debit card for your account. If it’s to replace an expired/damaged card, mention that. Provide your current mailing address to receive the new card. Request them to link your existing accounts to the new card.

How to write a letter for lost passbook and ATM card?

Address the letter to the bank manager. State that you have lost both your passbook and ATM card. Request them to block the lost ATM card number immediately. Apply for a replacement passbook and ATM card. Provide your account details like account number and type. Confirm your current mailing address. Thank them for their assistance.

Please Login to comment...

Similar reads.

- General Knowledge

- SSC/Banking

Improve your Coding Skills with Practice

What kind of Experience do you want to share?

Application for New ATM Card – 7+ Samples, Formatting Tips, and FAQs

Are you tired of waiting in long queues for cash withdrawals? Do you want to have hassle-free access to your money 24/7?

An ATM card is the solution you’re looking for!

In today’s cashless society, an ATM card has become a necessity. It gives us access to our bank account anytime and anywhere. However, sometimes we may need to replace our existing ATM card due to various reasons like damage, loss, or expiry. In such situations, the first step is to apply for a new ATM card.

But how do you apply for a new ATM card? What are the necessary documents and formats required to do so? And how do you ensure that your application is successful? This article aims to answer all of these questions and guide you through the process of applying for a new ATM card in India.

Whether you’re living in a rural area or an urban city, our samples and formats will help you write a compelling application that increases your chances of success. Keep reading to learn more!

- 1 Sample Application for New ATM Card

- 2 ATM Card Apply Letter Format

- 3 New ATM Card Request Letter Format SBI Example

- 4 Sample Application to Bank Manager for ATM Card Format

- 5 Formal Request Letter for ATM Card Sample

- 6 New ATM Card Issue Application Format

- 7 Sample Application Letter to Bank Manager for New ATM Card

- 8 Sample Application for New ATM Card in Hindi

- 9.1 Components of a Proper Application

- 9.2 Structuring the Application

- 10 FAQs on Application for a New ATM Card

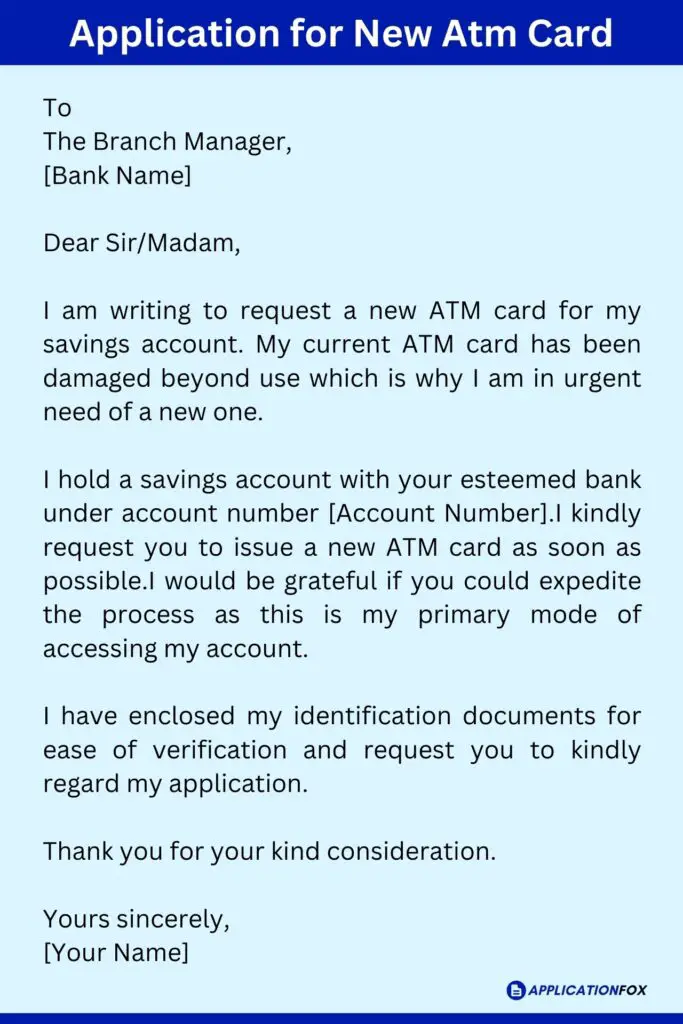

Sample Application for New ATM Card

To The Branch Manager, [Bank Name]

Dear Sir/Madam,

I am writing to request a new ATM card for my savings account. My current ATM card has been damaged beyond use which is why I am in urgent need of a new one.

I hold a savings account with your esteemed bank under account number [Account Number].I kindly request you to issue a new ATM card as soon as possible. I would be grateful if you could expedite the process as this is my primary mode of accessing my account.

I have enclosed my identification documents for ease of verification and request you to kindly regard my application.

Thank you for your kind consideration.

Yours sincerely, [Your Name]

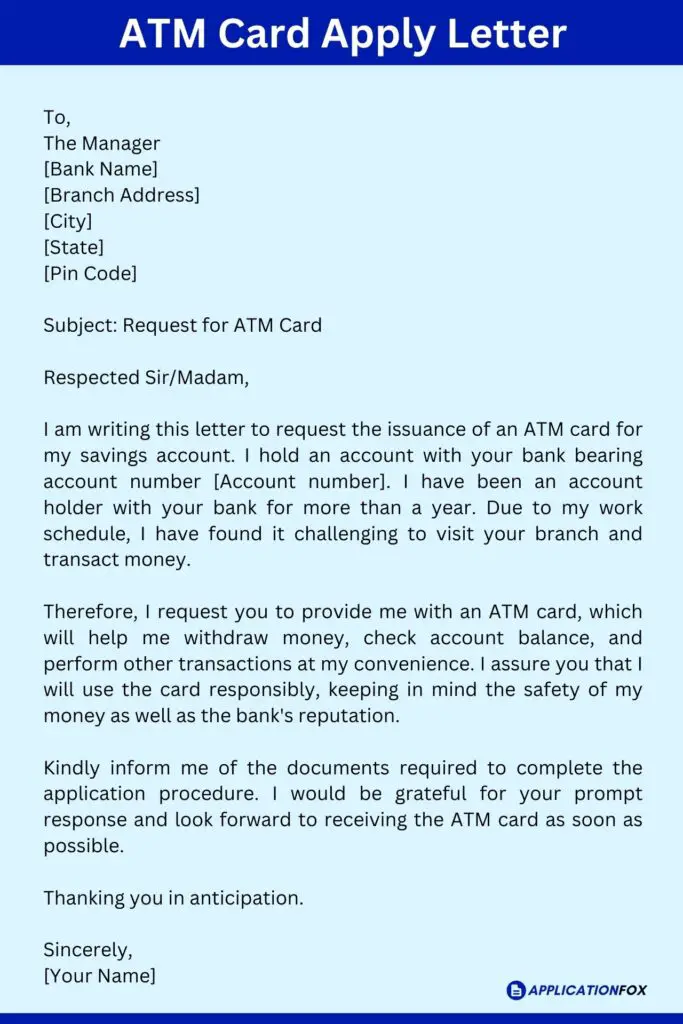

ATM Card Apply Letter Format

To, The Manager [Bank Name] [Branch Address] [City] [State] [Pin Code]

Subject: Request for ATM Card

Respected Sir/Madam,

I am writing this letter to request the issuance of an ATM card for my savings account. I hold an account with your bank bearing account number [Account number]. I have been an account holder with your bank for more than a year. Due to my work schedule, I have found it challenging to visit your branch and transact money.

Therefore, I request you to provide me with an ATM card, which will help me withdraw money, check account balance, and perform other transactions at my convenience. I assure you that I will use the card responsibly, keeping in mind the safety of my money as well as the bank’s reputation.

Kindly inform me of the documents required to complete the application procedure. I would be grateful for your prompt response and look forward to receiving the ATM card as soon as possible.

Thanking you in anticipation.

Sincerely, [Your Name]

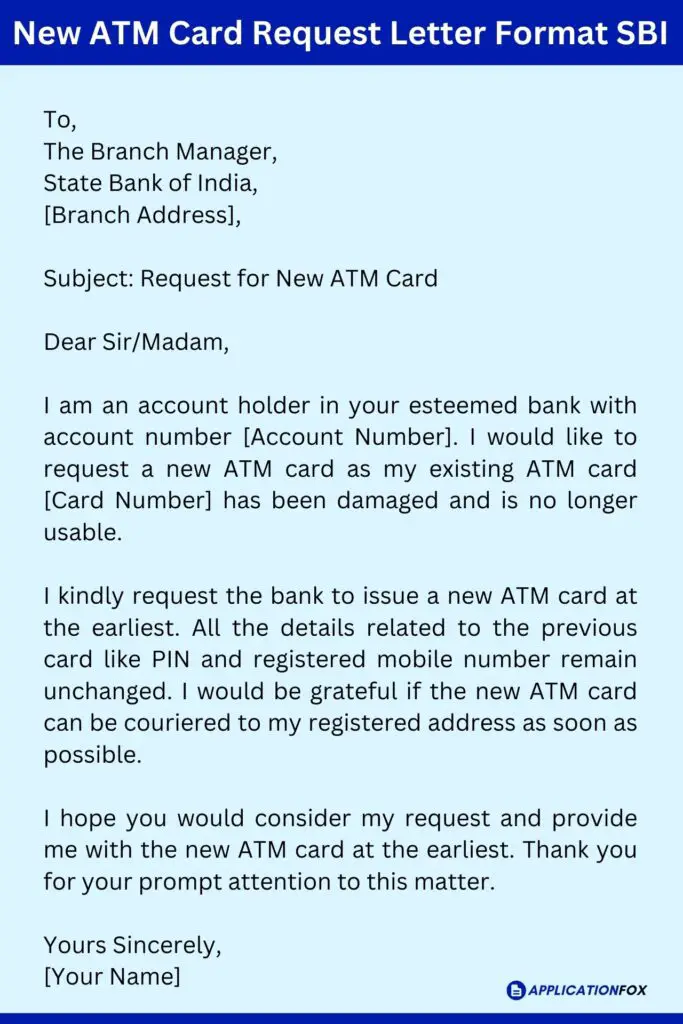

New ATM Card Request Letter Format SBI Example

To, The Branch Manager, State Bank of India, [Branch Address],

Subject: Request for New ATM Card

I am an account holder in your esteemed bank with account number [Account Number]. I would like to request a new ATM card as my existing ATM card [Card Number] has been damaged and is no longer usable.

I kindly request the bank to issue a new ATM card at the earliest. All the details related to the previous card like PIN and registered mobile number remain unchanged. I would be grateful if the new ATM card can be couriered to my registered address as soon as possible.

I hope you would consider my request and provide me with the new ATM card at the earliest. Thank you for your prompt attention to this matter.

Yours Sincerely, [Your Name]

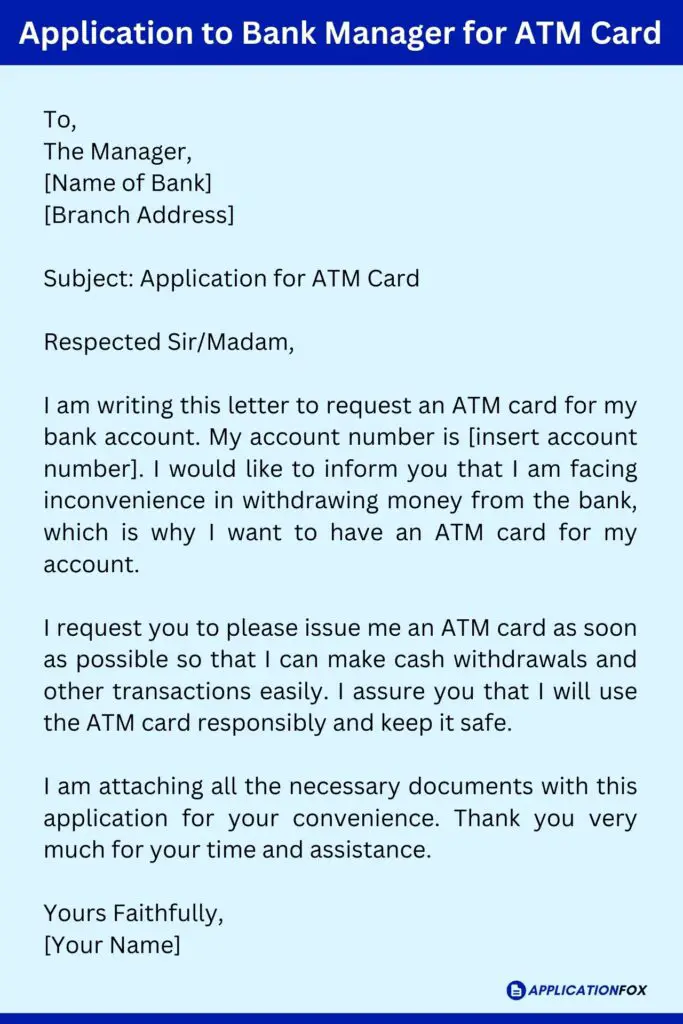

Sample Application to Bank Manager for ATM Card Format

To, The Manager, [Name of Bank] [Branch Address]

Subject: Application for ATM Card

I am writing this letter to request an ATM card for my bank account. My account number is [insert account number]. I would like to inform you that I am facing inconvenience in withdrawing money from the bank, which is why I want to have an ATM card for my account.

I request you to please issue me an ATM card as soon as possible so that I can make cash withdrawals and other transactions easily. I assure you that I will use the ATM card responsibly and keep it safe.

I am attaching all the necessary documents with this application for your convenience. Thank you very much for your time and assistance.

Yours Faithfully, [Your Name]

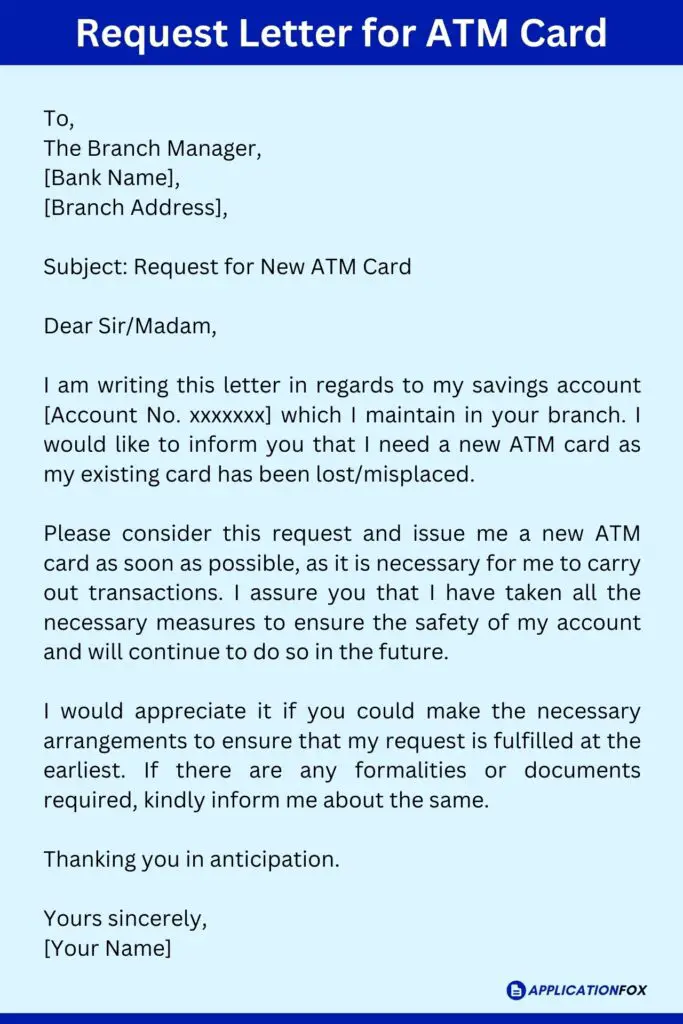

Formal Request Letter for ATM Card Sample

To, The Branch Manager, [Bank Name], [Branch Address],

I am writing this letter in regards to my savings account [Account No. xxxxxxx] which I maintain in your branch. I would like to inform you that I need a new ATM card as my existing card has been lost/misplaced.

Please consider this request and issue me a new ATM card as soon as possible, as it is necessary for me to carry out transactions. I assure you that I have taken all the necessary measures to ensure the safety of my account and will continue to do so in the future.

I would appreciate it if you could make the necessary arrangements to ensure that my request is fulfilled at the earliest. If there are any formalities or documents required, kindly inform me about the same.

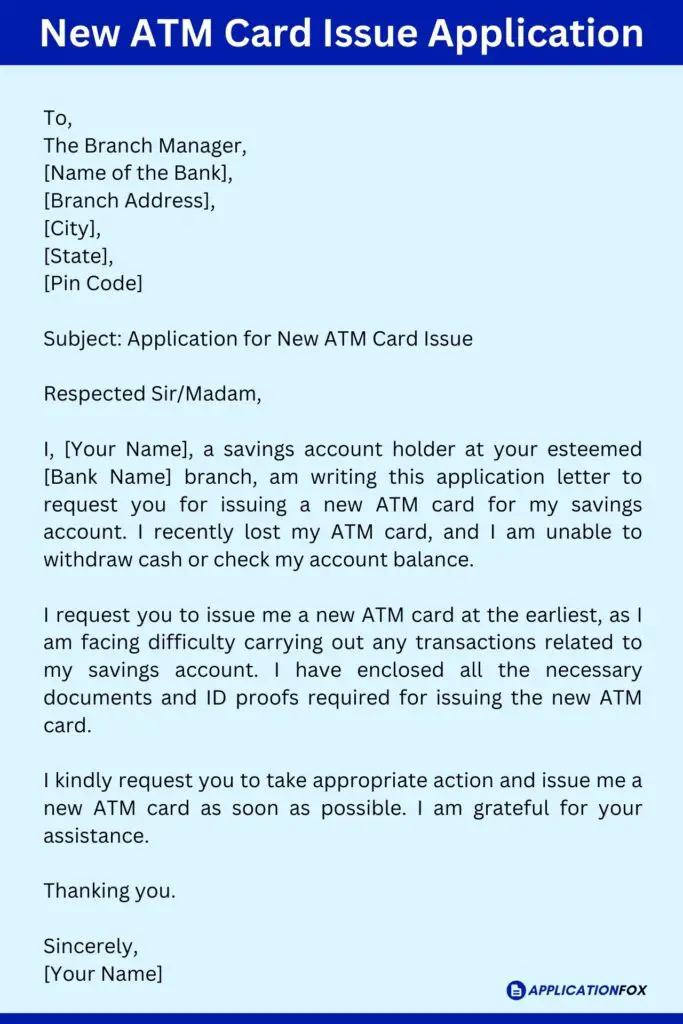

New ATM Card Issue Application Format

To, The Branch Manager, [Name of the Bank], [Branch Address], [City], [State], [Pin Code]

Subject: Application for New ATM Card Issue

I, [Your Name], a savings account holder at your esteemed [Bank Name] branch, am writing this application letter to request you for issuing a new ATM card for my savings account. I recently lost my ATM card, and I am unable to withdraw cash or check my account balance.

I request you to issue me a new ATM card at the earliest, as I am facing difficulty carrying out any transactions related to my savings account. I have enclosed all the necessary documents and ID proofs required for issuing the new ATM card.

I kindly request you to take appropriate action and issue me a new ATM card as soon as possible. I am grateful for your assistance.

Thanking you.

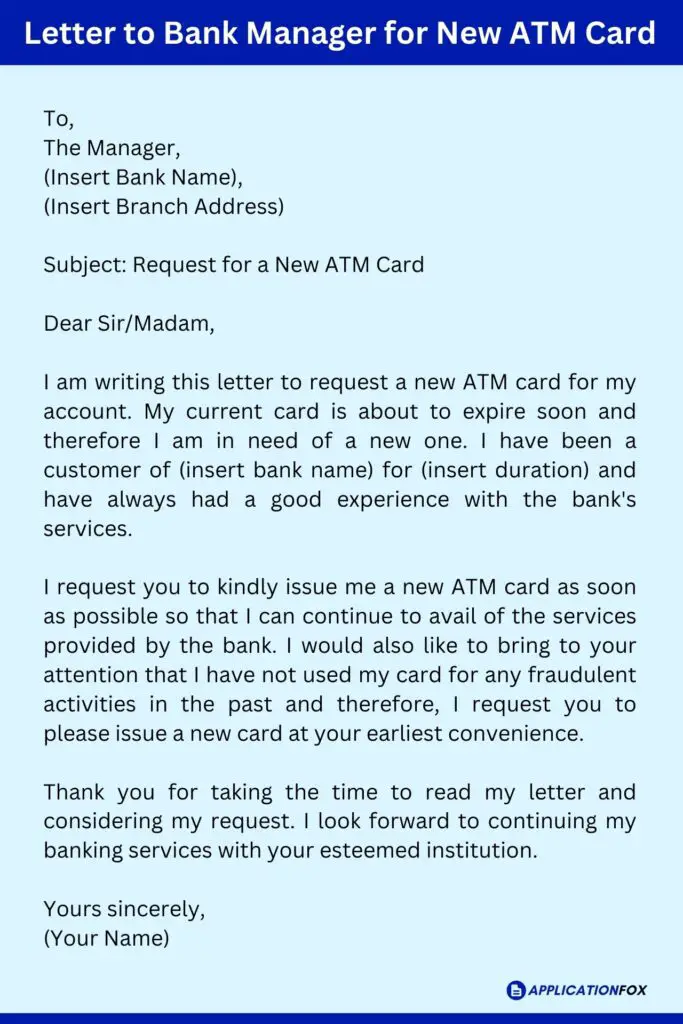

Sample Application Letter to Bank Manager for New ATM Card

To, The Manager, (Insert Bank Name), (Insert Branch Address)

Subject: Request for a New ATM Card

I am writing this letter to request a new ATM card for my account. My current card is about to expire soon and therefore I am in need of a new one. I have been a customer of (insert bank name) for (insert duration) and have always had a good experience with the bank’s services.

I request you to kindly issue me a new ATM card as soon as possible so that I can continue to avail of the services provided by the bank. I would also like to bring to your attention that I have not used my card for any fraudulent activities in the past and therefore, I request you to please issue a new card at your earliest convenience.

Thank you for taking the time to read my letter and considering my request. I look forward to continuing my banking services with your esteemed institution.

Yours sincerely, (Your Name)

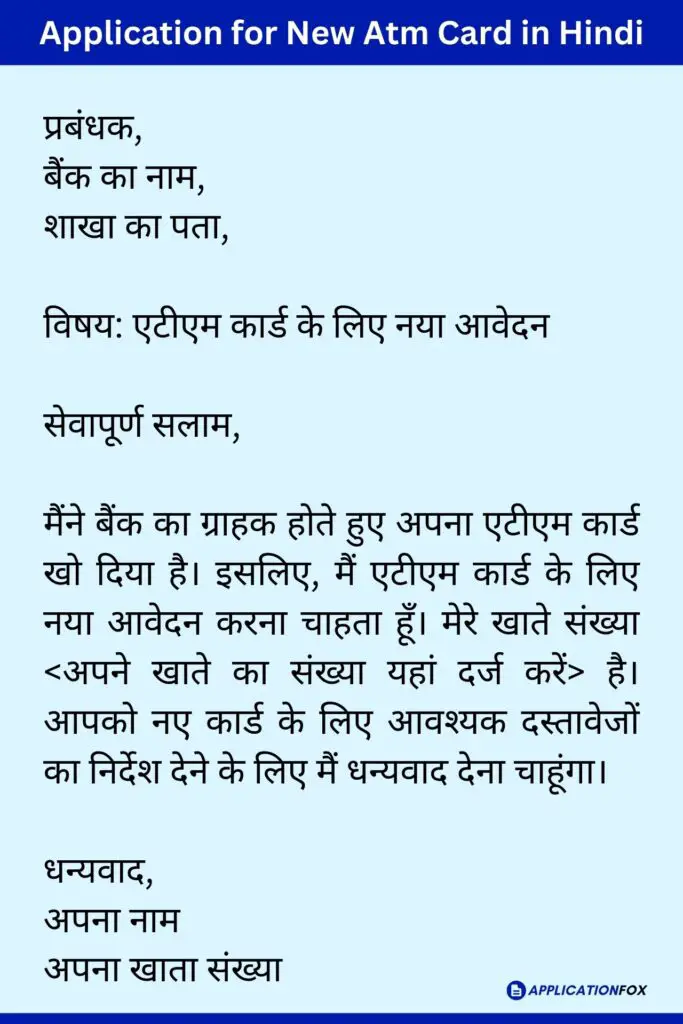

Sample Application for New ATM Card in Hindi

प्रबंधक, बैंक का नाम, शाखा का पता,

विषय: एटीएम कार्ड के लिए नया आवेदन

सेवापूर्ण सलाम,

मैंने बैंक का ग्राहक होते हुए अपना एटीएम कार्ड खो दिया है। इसलिए, मैं एटीएम कार्ड के लिए नया आवेदन करना चाहता हूँ। मेरे खाते संख्या <अपने खाते का संख्या यहां दर्ज करें> है। आपको नए कार्ड के लिए आवश्यक दस्तावेजों का निर्देश देने के लिए मैं धन्यवाद देना चाहूंगा।

धन्यवाद, अपना नाम अपना खाता संख्या

Application for New ATM Card: Things to Consider

When it comes to applying for a new ATM card, a proper application is necessary to ensure its approval. Your application should include all the necessary information and details that the bank requires. In this section, we’ll explore the essential components of a proper application, and how to structure it effectively.

Components of a Proper Application

- Purpose of Application: A brief introduction to your intent for applying for a new ATM card, such as a lost or stolen card, expiration, damage, or upgrading to a better card.

- Account Details: Important information about your account, such as account number, type of account, and branch name.

- Personal Information: Contact information like name, address, phone number, and email ID.

- Reason for Requesting a New ATM Card: A clear explanation for requesting a new ATM card and why replacing the existing card is necessary.

- Supporting Documents: Any necessary documents, such as photo identity proofs, address proofs, and other forms that the bank might require.

Structuring the Application

Writing a structured and well-formatted application is vital for getting a quick approval. Even minor discrepancies or lack of required information could lead to rejection or delays in processing. Therefore, you should follow the correct format while drafting your application letter. Here are some tips for structuring the application:

- Start with a proper heading containing the subject matter, reference number, and date.

- Address the letter formally to the bank manager or the concerned authority with proper salutations.

- Inform the bank about the reason for requesting a new ATM card and the account details.

- Elaborate the reason for requesting the new card and provide supporting documents if necessary.

- In conclusion, thank the bank manager or appropriate authority for considering the application and for their services.

By following the above tips, you can create a clear, concise, and well-structured application that increases your chances for the quicker process and faster approval of your new ATM card. Remember, preparing a structured and comprehensive application can pave the way to your cashless payment journey.

FAQs on Application for a New ATM Card

How can I apply for a new ATM card?

You can apply for a new ATM card by visiting your bank’s nearest branch or by applying through their online banking portal.

What documents are required to apply for a new ATM card?

You will need to submit a valid ID proof (such as Aadhaar card, driving license, passport), proof of address (such as utility bills), and your bank’s account details.

How long does it take to get a new ATM card?

The processing time may vary from bank to bank, but generally, it takes 7-10 working days to get a new ATM card.

Is there any fee for a new ATM card application?

Yes, most banks charge a nominal fee for a new ATM card . The fee may differ for different types of accounts.

Related posts:

- Application for Bank Statement – 11+ Samples, Formatting Tips, and FAQs

- Bank Passbook Missing Letter – 8+ Samples, Formatting Tips, and FAQs

- Application for Mobile Number Registration in Bank – 6+ Samples, Formatting Tips, and FAQs

- Application for Changing Signature in Bank – 5+ Samples, Formatting Tips, and FAQs

- Application for Name Change in Bank Account – 11+ Samples, Formatting Tips, and FAQs

- Application for Unblock Atm Card – 3+ Samples, Formatting Tips, and FAQs

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Application for New ATM Card (5+ Updated Samples)

If you have a bank account and have not received an ATM card while opening the account or you already have an ATM card that is lost or expired and now you need a new ATM card. So in order to issue a new ATM card, you have to write a request letter for an ATM card to the branch manager of your respective bank. In this post, I will share samples of applications requesting a new ATM card from the branch manager.

An ATM card is one of the easiest ways through which one can withdraw money from any ATM machine at any time. An ATM card is also known as a debit card and a debit card is used for many purposes.

Those of you who have used the facility of internet banking are eligible to apply for an ATM card through online mode, many banks provide online facilities for issuing new ATM cards. Otherwise, you can submit an application to the branch of the bank for a new ATM.

1. ATM Card Apply Letter

2. new atm card request letter sbi, 3. application to bank manager for atm card, 4. request letter for atm card, 5. application for atm card issue, 6. letter to bank manager for new atm card.

To, The Branch Manager, Canara Bank, A Block XYZ Road, Mumbai.

Date:- Date/Month/Year

Subject:- Request letter for new ATM card.

Requested Sir/Madam, I would like to inform you that I am “your name” an account holder in your branch. My account holder name is _________ and my account number is **********. I request you kindly issue me an ATM card as I do not have an ATM card. Also when I opened my bank account in your branch still I did not get the ATM card. Now, I need an ATM card for my work.

Therefore, kindly issue me an ATM card as soon as possible.

Thanking You, Yours Faithfully Signature

To, The Branch Manager, State Bank of India, B Block XYZ Road, Delhi.

Subject:- ATM card request letter.

Requested Sir/Madam, I am “your name” maintaining a savings bank account in your branch for the last 4 years. My account number is ********** and I live in _______. My ATM card having the number XXXXXXXXXXXX has been lost 3 days ago in “mention the area where your ATM is lost”. Now, I request you block my ATM card at the earliest and issue me a new ATM card. Documents required for the issue of a new ATM card to me are also attached to this letter.

Thank you in Advance, Yours Obediently Signature

To, The Branch Manager, Punjab National Bank, C Block XYZ Road, Bangalore.

Subject:- Application to issue new ATM card.

Requested Sir/Madam, I have lost my ATM card which was issued through your bank when I opened my bank account at your branch. My account holder name is ________ and my account number is **********. Now I request you cancel/block my ATM card and issue me a new ATM card.

I will be forever grateful to you if you do this in less time.

To, The Branch Manager, Union Bank, D Block XYZ Road, Hyderabad.

Subject:- Letter for ATM card issue.

Requested Sir/Madam, I am “mention your name” and I have a current account having account number **********. I request you please issue me a new ATM card because my current ATM card has been lost. Now I do not have an ATM card and due to this, I am not able to withdraw money.

Therefore, please accept my letter and do the needful.

Thanking You, Yours Truly Signature

To, The Branch Manager, Central Bank of India, E Block XYZ Road, Ahmadabad.

Subject:- New ATM card request application.

Requested Sir/Madam, With due respect, I request you to please issue me a new ATM card because my old ATM is broken into pieces and now it’s of no use. My account holder name is _____ and my account number is **********. I have attached the Xerox copy of my aadhaar card and PAN card in this application.

Therefore, please accept my application and start the process of issuing me a new ATM.

Thank you in Advance, Your Trusty Signature

To, The Branch Manager, Bank of India, F Block XYZ Road, Chennai.

Subject:- Issuing of ATM card for my account number **********.

Sir/Madam, With utmost respect, I would like to draw your attention that my ATM card which was issued at the time of opening a savings account with your branch is not working. Till now I have faced a lot of difficulties in withdrawing money from ATMs. My account details are as follows:

Account Holder Name:- _____________ Account Number:- _____________ Pan Number:- _____________ Aadhaar Number:- _____________ Mobile Number:- _____________

Hence, I request you please deactivate my current ATM card (mention the card number) and issue me a new ATM card as soon as possible.

Thanking You, Regards Signature

Related Read

- Cheque Book Request Letter

- Bank Account Address Change Letter for Bank

- Application for Change Mobile Number in Bank

- Bank Account Closing Letter

Frequently Asked Questions (FAQs)

What are the documents to apply for an atm card.

Documents required to apply ATM card are an Aadhar card, PAN card, Bank passbook, Voter ID card, and DOB proof.

How can I renew my ATM card?

You can renew your ATM card either through your respective bank ATM or by visiting your respective bank branch.

Can we apply for an ATM card from home?

Yes, some banks offer this facility through net banking. Whereas some banks only provide ATM card after visiting the respective bank.

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on Twitter (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to print (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Tumblr (Opens in new window)

- Click to share on Pocket (Opens in new window)

- Click to email a link to a friend (Opens in new window)

Related Post

1 thought on “application for new atm card (5+ updated samples)”.

New ATM card

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Letter Formats and Sample Letters

Searching for letter formats? We howtoletter realized your need and thus come up with several types of sample letters and format of letters. Dig into the website and grab what you want.

Saturday, July 15, 2017

How to write a letter for new atm card.

Sample letter format to get new ATM card for your existing account

Related articles.

30 comments

Is the use of "have+used to" correct?

I want to write an application to issue net banking, how to write?

https://www.howtoletter.com/2017/08/sample-letter-format-to-bank-activating-internet-banking.html you can use this link

Very very helpful

Very helpful, thanks again

Emoticon Emoticon

20+ New ATM Card Request Letter Format SBI – How to Start, Examples

- Letter Format

- February 27, 2024

- Bank Letters , Legal Letters , Request Letters

New ATM Card Request Letter Format SBI: A new ATM card request letter is a formal communication that is sent to a bank to request for a new ATM card. The State Bank of India (SBI) is one of the largest banks in India , and they offer a variety of banking services to their customers, including ATM cards. If you are an SBI account holder and you need to request a new ATM card, it is important to follow the correct letter format to ensure that your request is processed in a timely manner . In this article, we will discuss the New ATM Card Request Letter Format SBI.

Also Check:

- 18+ KYC Update Letter To Bank – Samples, Email Format, Tips

- 20+ NOC Letter For Employee Format | How To Write & Samples

- 30+ Requesting For Catalogue Letter – Check Format, Phrases, Examples

Tips for New ATM Card Request Letter Format SBI

Content in this article

Here we have given some tips for New ATM Card Request Letter Format SBI:

- Heading and Date: The first step in writing a New ATM Card Request Letter Format SBI is to include your name and address on the top right corner of the letter. Below your address, include the date that you are writing the letter.

- Salutation: Next, address the Bank letter to the appropriate person or department at SBI. If you are unsure who to address the letter to, you can simply write “To Whom It May Concern”.

- Opening Paragraph: In the opening paragraph of the New ATM Card Request Letter Format SBI, state the purpose of the letter. This should be a clear and concise statement that informs the bank that you are requesting a new ATM card.

- Body Paragraph: In the body paragraph of the letter, provide your account details, including your account number and your name as it appears on your account. You should also mention the reason why you need a new ATM card. This could be because your previous card was lost, stolen, or damaged.

- Closing Paragraph: In the closing paragraph, thank the bank for their assistance and request that they send the new ATM card to your address as soon as possible. Be sure to include your current address so that the bank can send the card to the correct location.

- Closing and Signature: Finally, close the New ATM Card Request Letter Format SBI with a polite and professional sign-off, such as “Sincerely” or “Thank you”. Below your sign-off, include your full name and signature.

New ATM Card Request Letter Format SBI – Sample Format

This Sample format of letter is a formal request to the bank manager of the State Bank of India for a new ATM card due to loss or damage, expressing the need for prompt replacement.

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

[Bank Manager’s Name] [Bank Name] [Branch Address] [City, State, ZIP Code]

Subject: Request for New ATM Card

Dear [Bank Manager’s Name],

I hope this letter finds you well. I am writing to request a new ATM card for my account with [Bank Name]. My current ATM card is [lost/damaged], and I am unable to use it for transactions.

Account Details: Account Holder Name: [Your Full Name] Account Number: [Your Account Number] Existing ATM Card Number (if available): [Current ATM Card Number]

I kindly request you to issue a new ATM card for my account at the earliest convenience. I understand the importance of securing my banking information, and I assure you that I will follow all necessary procedures to safeguard the new card.

If there are any forms or documentation required to process this request, please let me know, and I will promptly provide the necessary information.

I would appreciate it if you could expedite the process to minimize any inconvenience caused by the unavailability of my ATM card.

Thank you for your prompt attention to this matter. I look forward to receiving the new ATM card and continuing to benefit from the services provided by [Bank Name].

[Your Name] [Your Signature – if sending a hard copy]

New ATM Card Request Letter Format SBI – Example

This is an example of letter to the SBI Bank Manager requests a replacement ATM card due to misplacement, providing account details and expressing gratitude for prompt assistance.

[Bank Manager’s Name] [State Bank of India] [Branch Address] [City, State, ZIP Code]

I am writing to request a new ATM card for my account. Unfortunately, my current card has been misplaced, and I am unable to locate it despite thorough searching. Therefore, I kindly request your assistance in issuing a replacement ATM card for my account as soon as possible.

Please find the necessary details of my account attached to this letter for your reference. If any additional information is required, please do not hesitate to contact me at the provided contact details.

Thank you for your attention to this matter, and I appreciate your prompt assistance in resolving this issue.

[Your Name] [Your Account Number] [Your Contact Information]

SBI ATM card replacement letter format

This letter to the SBI Bank Manager seeks a replacement for a lost ATM card, expressing gratitude for prompt assistance and providing necessary account details.

I am writing to request a replacement for my State Bank of India (SBI) ATM card. Unfortunately, my current card has been lost, and I am unable to locate it.

Details of my account are as follows:

Account Holder Name: [Your Full Name] Account Number: [Your Account Number] Previous ATM Card Number (if available): [Card Number] I kindly request your assistance in issuing a new ATM card at your earliest convenience. I understand the importance of securing my account and appreciate your prompt attention to this matter.

If any further documentation or information is required, please do not hesitate to contact me at the provided phone number or email address.

Thank you for your understanding and prompt assistance in resolving this issue.

SBI ATM Card Replacement Letter Format

Application for reissuing ATM card SBI

This application to the SBI Bank Manager requests the reissuance of an ATM card, citing loss or damage and expressing gratitude for prompt attention.

I hope this letter finds you well. I am writing to request the reissuance of my State Bank of India (SBI) ATM card. Unfortunately, my current card [was lost / is damaged], and I am unable to use it.

Account Holder Name: [Your Full Name] Account Number: [Your Account Number] Previous ATM Card Number (if available): [Card Number] I kindly request your assistance in reissuing a new ATM card at your earliest convenience. I understand the importance of securing my account and appreciate your prompt attention to this matter.

Application for Reissuing ATM Card SBI

New ATM Card Request Letter Format SBI – Template

This template facilitates a formal request for a new SBI ATM card, providing details and emphasizing the need for prompt attention.

I hope this letter finds you well. I am writing to formally request a new ATM card for my State Bank of India (SBI) account.

Account Holder Name: [Your Full Name] Account Number: [Your Account Number] Previous ATM Card Number (if available): [Card Number] [Specify the reason for the new card: e.g., My current card is lost/damaged.]

I kindly request your assistance in issuing a new ATM card at your earliest convenience. Ensuring the security of my account is crucial, and I appreciate your prompt attention to this matter.

Thank you for your understanding and assistance in advance.

SBI ATM card issue request letter

This letter to the SBI Bank Manager requests a new ATM card due to loss or damage, underscoring the urgency for prompt attention to maintain account security.

I trust this letter finds you well. I am writing to formally request the issuance of a new ATM card for my State Bank of India (SBI) account.

Account Holder Name: [Your Full Name] Account Number: [Your Account Number] I am in need of a new ATM card due to [loss/damage], and I would be grateful if you could assist me in expediting the issuance process. Ensuring the security of my account is of utmost importance, and I appreciate your prompt attention to this matter.

If any additional documentation or information is required, please do not hesitate to contact me at the provided phone number or email address.

SBI ATM card not working letter format

This letter informs the SBI Bank Manager about the malfunctioning ATM card, emphasizing the need for prompt resolution and full card functionality restoration.

I trust this letter finds you well. I am writing to bring to your attention that my State Bank of India (SBI) ATM card is not functioning properly.

Account Holder Name: [Your Full Name] Account Number: [Your Account Number] ATM Card Number: [Card Number] The issues I am facing with the card include [mention the specific problems, such as inability to withdraw cash or perform transactions]. I have attempted to use the card at multiple ATMs, and the problem persists.

I kindly request your prompt assistance in resolving this matter and ensuring the restoration of full functionality to my ATM card. If any further documentation or information is required, please do not hesitate to contact me at the provided phone number or email address.

SBI ATM card Issue Request Letter

a letter to SBI manager for lost ATM card

This letter informs the SBI Bank Manager about a lost ATM card, emphasizing the need for prompt action to secure the account.

I hope this letter finds you well. I am writing to inform you about the unfortunate loss of my State Bank of India (SBI) ATM card.

Account Holder Name: [Your Full Name] Account Number: [Your Account Number] Lost ATM Card Number: [Card Number] I kindly request you to take immediate action to block the lost ATM card to prevent any unauthorized transactions. Additionally, I seek your guidance on the process for obtaining a replacement card.

If any further documentation or information is required from my end, please let me know. I appreciate your prompt attention to this matter and your assistance in ensuring the security of my account.

Thank you for your understanding and cooperation.

A Letter to SBI Manager for Lost ATM Card

Email format – New ATM Card Request Letter to SBI

Initiating an email to request a new ATM card from SBI necessitates a polite and concise introduction. Start with a greeting and a brief acknowledgment of the purpose of your email. Here’s an Email format of New ATM Card Request Letter Format SBI:

Subject: Request for a New ATM Card

Dear Sir/Madam,

I am writing this email to request a new ATM card for my account with your bank. My account number is XXXXXXXXXX, and my name is [Your Name].

Unfortunately, my current ATM card has been lost/stolen/damaged, and I am unable to access my funds. I kindly request you to issue a new ATM card as soon as possible so that I can continue to manage my finances.

I have attached a scanned copy of my ID proof and account statement for your reference. Please let me know if any other documents are needed to process my request.

I would appreciate it if you could provide me with the necessary information on how to collect the new ATM card. Also, please let me know if any charges are applicable for the same.

Thank you for your prompt assistance.

[Your Name]

Email Format – New ATM Card Request Letter to SBI

SBI ATM card unblock request letter format

This letter requests the unblocking of an SBI ATM card, providing the reason and expressing gratitude for prompt resolution.

I hope this letter finds you well. I am writing to request the unblocking of my State Bank of India (SBI) ATM card.

Account Holder Name: [Your Full Name] Account Number: [Your Account Number] ATM Card Number: [Card Number] My ATM card was blocked due to [mention the reason, e.g., multiple incorrect PIN attempts]. I understand the importance of security measures, and I assure you that I will take necessary precautions to prevent any such incidents in the future.

I kindly request your assistance in unblocking my ATM card at your earliest convenience. If any further documentation or information is required, please do not hesitate to contact me at the provided phone number or email address.

Thank you for your understanding and prompt assistance in resolving this matter.

SBI ATM Card Unblock Request Letter Format

Application letter for ATM card activation in SBI

This letter seeks the activation of an SBI ATM card, expressing eagerness for transactions and gratitude for prompt attention.

I am writing to request the activation of my State Bank of India (SBI) ATM card associated with my account. The details are as follows:

Account Holder Name: [Your Full Name] Account Number: [Your Account Number] ATM Card Number: [Card Number] I recently received my ATM card [mention if it’s a new card or a replacement]. I kindly request your assistance in activating it so that I can begin using the card for transactions.

If any further documentation or information is required from my end, please let me know. I appreciate your prompt attention to this matter.

Thank you for your assistance in advance.

Application Letter for ATM Card Activation in SBI

FAQS About New ATM Card Request Letter Format SBI – How to Start, Examples

How should i start a new atm card request letter format sbi.

Begin with a polite salutation, addressing the bank manager by name if possible. Clearly state the purpose of the New ATM Card Request Letter Format SBI, such as a request for a new ATM card.

What information should be included in the New ATM Card Request Letter Format SBI?

This New ATM Card Request Letter Format SBI include your personal details, account information, reason for requesting a new card (lost, damaged, etc.), and any relevant details such as the previous card number.

Should I mention the reason for needing a new ATM card?

Absolutely. Using a template provides a structured format of New ATM Card Request Letter Format SBI. Ensure to customize it with your specific details, such as account information and the reason for the request.

How long should the New ATM Card Request Letter Format SBI be?

Keep the New ATM Card Request Letter Format SBI concise and to the point. Typically, one page is sufficient. Include all necessary details without unnecessary elaboration.

Should I provide contact information in the New ATM Card Request Letter Format SBI?

Yes, This New ATM Card Request Letter Format SBI, always include your contact information. This allows the bank to reach out to you if any additional details or clarifications are required during the process.

Requesting a new ATM card from SBI is a simple process that requires a formal request letter . By following the correct letter format of New ATM Card Request Letter Format SBI and providing all the necessary information , you can ensure that your request is processed quickly and efficiently .

Related Posts

25+ Complaint Letter Format Class 11 – Email Template, Tips, Samples

24+ Car Parking Letter Format – How to Write, Email Templates

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

21+ Black Money Complaint Letter Format, How to Write, Examples

11+ Authorized Signatory Letter Format – Templates, Writing Tips

20+ Authorization Letter Format for ICEGATE Registration – Examples

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

[10+] Application For ATM Card [New Card/ Lost Card]

Application For ATM Card : Nowadays it is the era of cashless, so everyone needs an ATM card. Therefore, after opening a bank account or losing an ATM card, we have to apply to the bank manager for a new ATM card.

Keeping this in mind, we have written various types of applications for the bank account holder to get a new ATM.

Table of Contents

Application For New Atm Card

To The Manager HDFC Bank Bagar

4th September 2022

Sub- Application for issuing ATM card.

With this letter, I want to inform you that I am Shikha Kataria, account holder in your bank. Till now, I was doing all my transactions and cash withdrawal by visiting the bank regularly. But now, due to shortage of time I can not access the bank for cash withdrawal. So, I want the facility of an ATM card for this account so that I can easily debit money from the account.

I request you to kindly issue my ATM card as soon as possible. I would be very thankful to you for this kind act & please do the needful.

My bank account details are given below-

Account holder name- Shikha Kataria Account number- 8590 Contact number- 7588

Thanks again

Yours truly Shikha Kataria

ATM Card Missing Letter

To The Manager AXIS Bank Sikar

9th November 2022

Sub- Application for missing ATM card.

This is to state that I am Vipin Goyal, I holds a account in your bank with account number- * 0490 in your bank. My mistake: I lost my ATM card for this account and still can’t find that. Recently, I am facing many inconveniences in transactions without ATM service.

I am requesting you to please block that ATM card and kindly issue a new ATM card for this account. I will be forever thankful to you if you do it in time.

Thanks a lot

Yours obediently Vipin Goyal Contact number- 0504

New ATM Card Request Letter

To The Manager SBI Bank Vaishali Nagar Jaipur

18th November 2022

Sub- Application to issue ATM card.

I am Anuj Pareek, account holder in your bank having account number- 0599 in your branch office. By mistake I have damaged my ATM card which is not usable at all. I am having difficulties withdrawing cash when required.

I am enclosing all my required bank documents. Kindly issue me a new ATM card immediately. Hope you will help me.

Thanking you

Yours truly Anuj Pareek

Application For New Debit Card

To The Manager AXIS Bank Jhunjhunu

9th October 2022

Sub- Application to issue new Debit card.

With due regards, I want to inform you that I urgently need a new Debit Card linked with my account, with account number- 9778 in this branch office. I don’t have any debit card till now.

Nowadays I require a debit card for regular transactions to make my work easier. I request you to issue a debit card of my account and do the needful. I Hope you will make it possible.

My account details are:

Account holder name- Akshita Saini Account number- 94950 Contact number- *0479

Yours obediently Akshita Saini

New ATM Card Request Letter In English

To The Manager P.N.B. Bank Alwar

29th November 2022

Sub- Application to issue new ATM card.

Through this letter I would like to request you to issue a new ATM card linked with my account number- 58869 in your bank. I already have an ATM card but because of my carelessness my nephew found it in my trouser and broke it into pieces mistakenly.

I am sending you that damaged ATM card as proof. I am enclosing all my required bank documents. I am requesting you to kindly issue a new ATM card linked with this account.

Yours obediently Aman Suthar

Atm Card Missing Letter Format In English

To The Manager (Name of bank) (Address of branch) (Date)

Sub- Application to issue ATM Card

I beg to state that, I am (your name), holds an account with account number- (your account number) in your bank. Few, days ago by mistake I lost my ATM card of this account on the train. I have also complained about it to the railway officer but still I can’t find my ATM card.

I am enclosing all my account details. Please issue me a new ATM card and block the previous one. Hope you will make it possible the earliest.

Yours sincerely (Your Name) (Contact number )

ATM Card Apply Letter Format In English

To The Manager (Name of bank) (Address of branch)

With humble submission this is to state that I am (your name), holds a saving account in your bank with account number (your account number). I want an ATM card because I still have no ATM card for this account and this makes my transactions inconvenient. Please issue the ATM card for my account, I would also like to know the duration to obtain the card, once applied.

I will be grateful to you if you provide me with all the procedure and necessary information to apply for an ATM card.

Yours truly (Your name)

Application To Bank Manager For Atm Card

To The Manager SBI Bank Sikar

Sir, With deepest request, it is to state that I am Sachin Tiwari, I holds a current account with account number- 6579 in your branch office. As a student I often need cash from my account. It is a bit inconvenient for me to have transactions in the bank.

I want to apply for an ATM card to get better and instant service. Please help me to issue an ATM card as soon as possible.

Yours faithfully Sachin Tiwari Contact number- 0490

How To Write A Letter To Bank Manager For Request A New ATM Card

To The Manager Canara Bank Jaipur

6th October 2022

I am Shankar Kumar, I hold an account in your branch office. Mistakenly I didn’t apply for the ATM card while opening my bank account. I have to go to the bank to do my transactions and this is quite an uncomfortable and time taking process for me.

It is hard for me to go to the bank for transactions. So, I urgently need an ATM card for my account. Kindly start the procedure to apply for an ATM card the earliest. I hope you will do it in time.

My account details are mentioned below-

Account holder name- Shankar Kumar Account number- 1670 Contact number- 9495

Yours obediently Shankar Kumar

Application For Lost ATM Card And Issue New ATM Card In English

To The Manager HDFC Bank Jodhpur

15th November 2022

Sub- Application for applying for a new ATM card.

With due regards, this is to inform you that I am Riya Tiwari, having account of account number- * 2435 in your branch. Recently, I lost my ATM card while going to the office and still I couldn’t find it.

I already deactivated that previous ATM card by the help of customer service. Hereby, I am requesting you to issue a new ATM card and do the needful. All the required documents of my bank account are attached with this letter.

Yours obediently Riya Tiwari

Also Read Other Application :-

[10+] Bank Account Close Application Format

[10+] Cheque Book Request Letter

[10+] Bank Account Transfer Application for SBI/ICICI & PNB

[10+] Application for Change Mobile Number in Bank

If you like the application written by us, then do not forget to share this “ Application For ATM Card ” article with your friends and relatives through WhatsApp, Facebook, Instagram etc. to support us. If you find any error in any application or want to write any other thing, then tell us by commenting below.

1 thought on “[10+] Application For ATM Card [New Card/ Lost Card]”

Application for ATM card

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

ATM Block Application

Online shopping has become so easy in today’s time that every individual has an ATM card. By just linking the card with the application, you can purchase anything online very easily. Even when you need to buy something manually from the store, you can purchase it just by swiping your card on the machine available with the seller. But with such a kind of ease comes the risk. The risk of being cheated or maybe if you lose your card and someone else uses it to withdraw money. In such a case, you may have to write an ATM block application to the bank manager as soon as possible to block your ATM card and prevent any misuse of your hard-earned money.

Guidelines to Write an ATM Block Application Letter

- Mention the date on which your card was lost or stolen.

- Inform the bank authorities as soon as possible by writing a letter to the bank manager.

- Mention all your bank details and ask for a block of the ATM card.

- Ask the bank manager to issue a new ATM card against the block card as you may need one.

- Mention if your account has an unauthorized transaction by your ATM card and the amount that was deducted.

- Remember, you are requesting the manager of the bank with your letter, so the tone of the letter should be very polite and respectful.

Format of ATM Block Application Letter

The ATM block application is written to the manager of the bank in which you have a savings account. The format of the ATM block application letter is just like other formal letters.

Your address

Bank Manager

The bank’s name

The bank’s address

Sub- Application to block my ATM card.

Respected/Dear Sir/Ma’am,

Write the main body of the letter. Request for blocking of ATM card. Give all card and account details to the manager. Explain why your ATM was blocked. Request them to issue a new ATM card for you.

Express gratitude towards the bank manager.

Thank you/Thank you in anticipation.

Yours truly/faithfully/sincerely

(Signature)

Contact no-

A Sample of an ATM Block Application Letter

If you are still thinking about how to write an ATM block application. Have a look at the sample letters given below to correctly write ATM block applications.

Sample Letter 1. Request to Block ATM Card because of Theft

Roman Reigns

Francis Apartment

Hyderabad – 301011

Date – 9 August 2022

Hyderabad – 310021

Sub: Request to block my ATM card because of theft

I am Roman Reigns, a resident of Hyderabad. I have had a bank account with your bank for the last five years. I would like to request that you please block my ATM card as my wallet has been stolen and all my cards were present in the wallet.

My account number is 34561234 and my ATM card number is 1234 4567 ****. I would humbly request you to block this ATM card at the earliest to prevent any misuse of my hard-earned money. I would also request that you please allot me a new ATM card which I may use for my future transactions.

I would greatly appreciate the efforts taken by IDBI bank.

Yours faithfully,

Phone number: 0909090909

Explore More Sample Letters

- Leave Letter

- Letter to Uncle Thanking him for Birthday Gift

- Joining Letter After Leave

- Invitation Letter for Chief Guest

- Letter to Editor Format

- Consent Letter

- Complaint Letter Format

- Authorization Letter

- Application for Bank Statement

- Apology Letter Format

- Paternity Leave Application

- Salary Increment Letter

- Permission Letter Format

- Enquiry Letter

- Cheque Book Request Letter

- Application For Character Certificate

- Name Change Request Letter Sample

- Internship Request Letter

- Application For Migration Certificate

- NOC Application Format

- Application For ATM Card

- DD Cancellation Letter

Sample Letter 2. Request to Block ATM Card due to Unknown Transaction

Juna Mondal Society.

Road High Street

Kolkata – 301415

Date – 8 June 2022

State Bank of Kolkata

Kolkata-301416

Sub: Request to block my ATM card due to an unknown transaction

I am Maria Vaz, who has had a bank account with your bank for the last eight years. I have never faced any issues with your bank in the span of the last eight years. But today I got a message that my account had a debit of 10,000 rupees. It was done using my ATM card details.

I would first request that you block my ATM card immediately to avoid any further misuse of my money. Secondly, I would request that you please have a look into the matter and help me get a refund of my hard-earned money. Lastly, I would also request that you issue me a new ATM card to replace my old one.

I beg you to please make sure the ATM card is blocked and my money is refunded to me at the earliest.

Thank you in advance.

Yours truly,

Contact no-787878****

Sample Letter 3. Request to Block ATM Card

Ramesh Goswami

Gada Society No. 12

Dhan Daulat Nagar

Dholakpur-561789

Date – 18 December 2022

Dholakpur-561345

Sub: Request to block my ATM card

Respected Sir,

I am Ramesh Goswami, a resident of Dholakpur. I would like to inform you that while I was traveling from Mumbai to Dholakpur yesterday, I lost my card case in which I store all my debit and credit cards.

My account number is 56413257 and my ATM card number is 4566 1378 ****.

I would beg you to kindly block the abovementioned ATM card as I do not want any sort of unknown transactions using my ATM card. I would also request that you please issue me a new ATM card with the same account number mentioned above.

I would be highly obliged if you blocked my ATM card at the earliest.

Thank you in anticipation.

Yours sincerely,

Contact number – 995678****

FAQs on ATM Block Application

Question 1. How many days does it take to block the ATM card?

Answer: As soon as you inform the bank manager, he will take immediate action and block your ATM card with your approval. You can block your ATM card immediately by visiting the bank’s website or application.

Question 2: Will I have to apply for a new ATM card if I enter the wrong pin three times and my card is blocked?

Answer. When you enter the wrong pin on your ATM card three times, your card gets temporarily blocked. However, the card gets blocked for the next 24 hours only. You need not apply for a new card as after 24 hours you can again use the card by entering the correct pin.

Customize your course in 30 seconds

Which class are you in.

Letter Writing

- Letter to School Principal from Parent

- ATM Card Missing Letter Format

- Application for Quarter Allotment

- Change of Address Letter to Bank

- Name Change Letter to Bank

- Application for School Teacher Job

- Parents Teacher Meeting Format

- Application to Branch Manager

- Request Letter for School Admission

- No Due Certificate From Bank

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

- Letter Writing

- Formal Letter Writing In English

- Atm Block Application

Application to Block ATM Card | Format and Samples

If your ATM card is lost or misplaced, you can write a letter to the branch manager asking them to block your ATM card. With the advancements in technology, other ways to block the ATM card have been developed. However, some banks might advise you to provide a letter as well for documentation purposes. Learn how to write a letter expressing this concern in this article.

Table of Contents

How to write an application to block atm card, letter to bank manager to block your atm card.

- Frequently Asked Questions on Application to Block ATM Card

An application for an ATM card block is written to the respective banks in case the ATM card is misplaced, lost, damaged, etc. While writing an ATM card block application in English, keep in mind the format to use, mentioning the reason for blocking and issuing a new ATM card. Writing an application doesn’t specifically have any strict format like other formal letters but the general format can be followed to write an application to block an ATM card.

In order to write an ATM card block application in English, refer to the below-provided samples and follow the same format for it. While writing the application, use your own language for a clear and better understanding of the urgent need to block the ATM card.

Sample Applications to Block ATM Card

Before you write an application to block the ATM card, do refer to the below-provided samples and keep the bank details with you.

#77, Sector-B, Lake View Road

Himachal Pradesh

The Branch Manager

Side View Branch

#65 Himachal Pradesh

Sub: Application to block my ATM card

Dear Sir/Madam,

I, Sukanya Meher, would like to bring to your kind attention that my ATM card was lost in the flight yesterday while travelling back to Himachal Pradesh from Bangalore. Owing to this situation, I think it would be best to block my ATM card at the earliest to avoid any sort of mishap. I have provided my account details for your reference.

I request you to kindly understand the seriousness of the situation and do the needful.

Thanking you in advance.

Yours sincerely,

Sukanya Meher

Contact No. 12345

Template for Application to Block ATM Card

Sender’s address

Receiver’s address

(The Branch Manager

Bank’s name

I, _____, am writing to request you to block my ATM card because it was _______ (reason). I am running a____ account (current/savings) in your branch for ___ years with account number _______.

I understand that it is best to block the ATM card as soon as possible in order to avoid any sort of mishap that can happen with my account. I hope I have justified the reasons for my concern, and am expecting an early response from you.

Hope the actions will be taken.

Contact details

Frequently Asked Questions on ATM Block Application

Do i write an application to block my atm card if my card has expired.

Generally, your bank will send you the ATM card before your card has expired and issue a new card. If your old card has expired, then you can write an application to the bank stating that your ATM card has expired, and request them to issue a new card. You need not request them to block your ATM card in this case.

How can I write an application to block my ATM card?

You can write an application to block your ATM card if you have all your bank details with you. You will have to address the letter to your branch manager, stating the reason behind your request to block the ATM card.

Do I visit the bank for ATM block application submission?

Yes, if the application is hand-written, then the person will have to visit the bank to submit the application. If the application is submitted online, then there is no need to visit the bank.

Leave a Comment Cancel reply

Your Mobile number and Email id will not be published. Required fields are marked *

Request OTP on Voice Call

Post My Comment

Register with BYJU'S & Download Free PDFs

Register with byju's & watch live videos.

Please update your browser.

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

Update your browser

We don't support this browser version anymore. Using an updated version will help protect your accounts and provide a better experience.

We’ve signed you out of your account.

You’ve successfully signed out

We’ve enhanced our platform for chase.com. For a better experience, download the Chase app for your iPhone or Android. Or, go to System Requirements from your laptop or desktop.

Chase debit/ATM card FAQs

Please turn on javascript in your browser.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Frequently Asked Questions

When will my debit/atm card arrive.

Your card will arrive in about a week after opening your new account.

If you don’t receive your card within two weeks, you can request a new card online .

You can also do this on the Chase Mobile ® app by selecting your account and then choosing the “Replace a lost or damaged card” icon in the “Account services” section.

How do I activate a debit card or ATM card?

You can activate a debit card online , by calling 1-800-290-3935 or by completing a transaction at any Chase ATM using your PIN. You can begin using an ATM card immediately. Learn more about activating and managing a new debit card here .

How can I lock/unlock my debit card if it’s lost or misplaced?

After signing in online or in the app, choose the account you want to lock or unlock. Then scroll to the “Account services” section and select “Lock & unlock card.”

Chase Survey

Your feedback is important to us. Will you take a few moments to answer some quick questions?

You're now leaving Chase

Chase's website and/or mobile terms, privacy and security policies don't apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name.

- Sign in

Bank of America Advantage Banking

Get the flexibility you deserve. Choose a checking account to meet you where you are in your journey.

Simple banking with an easy-to-use experience

- Digital banking — no paper check writing

- A great start for students and young adults — no monthly fee if under age 25 Personal Schedule of Fees for more information." data-footnote="fiduciaryAccounts" href="#ftn_fiduciaryAccounts_content" aria-label="Footnote 1"> Footnote [1]

- Helps prevent overspending — no Overdraft Item Fees Footnote [2]

Flexible banking with more features and options

- Digital banking with a variety of payment options

- Multiple ways to waive your monthly maintenance fee, including direct deposit

Offers Balance Connect ® for overdraft protection Deposit Agreement and Disclosures for more information about eligibility and how Balance Connect® transfers work." data-footnote="balanceConnectOverDraftProtection" href="#ftn_balanceConnectOverDraftProtection_content" aria-label="Footnote 3"> Footnote [3]

Comprehensive banking that unlocks additional benefits

Earns interest

- $0 monthly maintenance fee on up to 7 eligible accounts when you link Footnote [4] them to your primary Relationship Banking account

No fees on select banking services Personal Schedule of Fees for details." data-footnote="bankingServiceNoFees" href="#ftn_bankingServiceNoFees_content" aria-label="Footnote 5"> Footnote [5]

Monthly maintenance fee

Advantage SafeBalance Banking

$4.95 or $0

$0 for each statement cycle that:

You maintain a minimum daily balance of $500 or more in your account

An account owner is under age 25 [1]

An account owner is a member of the Preferred Rewards program. [2]

- Fiduciary accounts, including trust and estate accounts, do not qualify for the under the age of 25 requirement to waive the monthly maintenance fee. Additionally, accounts do not qualify for the under 25 qualifier to waive the monthly fee based on the age of the Payable on Death beneficiary. Please refer to the Personal Schedule of Fees for more information

- For Preferred Rewards members in the Gold, Platinum, or Platinum Honors tiers, the monthly maintenance fee waiver applies to the first 4 checking and 4 savings accounts. The monthly maintenance fee waiver is unlimited for clients in the Diamond or Diamond Honors tiers. For Preferred Rewards program eligibility requirements, go to Preferred Rewards .

Advantage Plus Banking

You maintain a minimum daily balance of $1,500 or more in your account

You have at least 1 qualifying direct deposit of $250 or more made to your account

An account owner is a member of the Preferred Rewards program [1]

Advantage Relationship Banking

You maintain a minimum daily balance of $20,000 or more in your account

Advantage SafeBalance Banking

Advantage Plus Banking

- Offers Balance Connect® for overdraft protection Deposit Agreement and Disclosures for more information about eligibility and how Balance Connect® transfers work." data-footnote="balanceConnectOverDraftProtection" href="#ftn_balanceConnectOverDraftProtection_content" aria-label="Footnote 3" tabindex="-1"> Footnote [3]

Advantage Relationship Banking

- No fees on select banking services Personal Schedule of Fees for details." data-footnote="bankingServiceNoFees" href="#ftn_bankingServiceNoFees_content" aria-label="Footnote 5" tabindex="-1"> Footnote [5]

Bank of America Advantage SafeBalance Banking ®

Bank On certified

SafeBalance ® is certified as meeting Bank On National Account Standards for safe and affordable bank accounts.

Bank of America Advantage Plus Banking ®

Bank of America Advantage Relationship Banking ®

Advantage Safebalance Banking

An account owner is under age 25 Personal Schedule of Fees for more information." data-footnote="fiduciaryAccounts" href="#ftn_fiduciaryAccounts_content" aria-label="Footnote 1"> Footnote [1]

An account owner is a member of the Preferred Rewards program Preferred Rewards . For SafeBalance Banking® for Family Banking accounts, the parent owner can participate in the Preferred Rewards program but their child using the account cannot." data-footnote="advantagePreferredRewards" href="#ftn_advantagePreferredRewards_content" aria-label="Footnote 10"> Footnote [10]

Age 16 or older

Under age 16 must co-own with adult

Schedule an appointment at a financial center to open an account with someone under age 13

Age 18 or older

Under age 18 must co-own with an adult

This account is set to the Decline All overdraft setting. Transactions are declined or returned unpaid when they exceed your available balance. We won’t charge you an overdraft fee, but the payee may charge fees. Footnote [12]

Option to enroll in: Balance Connect ® for overdraft protection popup Deposit Agreement and Disclosures for more information about eligibility and how Balance Connect® transfers work." data-footnote="balanceConnectOverDraftProtection" href="#ftn_balanceConnectOverDraftProtection_content" aria-label="Footnote 3"> Footnote [3]

And choice of overdraft setting Deposit Agreement and Disclosures as well as the Personal Schedule of Fees provide details about transaction processing and posting. They also explain how and when overdrafts may be paid, and how and when overdraft fees are assessed." data-footnote="depositAgreement" href="#ftn_depositAgreement_content" aria-label="Footnote 13"> Footnote [13] : Standard or Decline All popup

Parental controls

As the parent owner, you can set limits on your child's spending for amounts and certain categories.

Limitations on parent deposits

As the parent, you can add money to this account by:

- Transfer from your Bank of America checking or savings accounts

- Mobile check deposit

This account does not offer external money transfers into the account, including direct deposit, wires, ACH transactions and transfers from other banks.

Child login at age 6 or older with limitations

This account provides a limited online experience for your child.

Children age 6 or older can have their own Online Banking login and can:

- View account balances

- Monitor transactions

Here are some things they can't do:

- See or access your other Bank of America accounts

- Deposit money

- Lock or unlock their debit card

For a full list of what your child can do with this account, refer to the Personal Schedule of Fees .

Direct deposit

When you set up direct deposit, your paycheck or other recurring deposits are sent to your account automatically.

APY (Annual Percentage Yield)

Balance: Less than $50,000

Balance: $50,000 and over

Select banking services

Select banking services include:

- Standard checks

- Incoming domestic wires

- Stop payments

- Outgoing wires sent in foreign currency

- Statement paper copies

See the Personal Schedule of Fees for details

A fast and easy way to send and receive money online with friends and family.

Eligible Bank of America account and login

To open a SafeBalance for Family Banking account, you must already have a personal Bank of America checking or savings account. Small business and Merrill Lynch accounts do not qualify.

You must also have an Online Banking login.

Balance Connect® for overdraft protection

You can link up to 5 eligible Bank of America accounts to this checking account to cover transactions. When there isn't enough money in your checking account to pay for an item, available funds are automatically transferred from the linked backup accounts to your checking account. There’s no transfer fee, but other charges may apply. For example, transfers from a linked credit card or HELOC may result in interest charges.

Overdraft settings: Standard or Decline All

Choose how you want us to handle checks and scheduled payments when there isn’t enough money in your checking account to cover transactions.

We won't authorize ATM withdrawals or debit card purchases when there’s not enough money in your account to cover the transactions. For other payments, at our discretion, we may authorize and pay the item and overdraw your account (an overdraft item), or decline or return the item unpaid (a returned item). Review the Deposit Agreement and Disclosures and Personal Schedule of Fees for details.

Standard setting

Your checks and scheduled payments may be paid and cause an overdraft. There’s a $10 fee [1] when we make the payment and overdraw your account. We won’t charge a fee for the returned items, but the payee may.

Decline All setting

Your checks and scheduled payments will be declined or returned unpaid. We won’t charge a fee for returned items, but the payee may.

1. We’ll charge an Overdraft Item Fee for each item that we authorize and pay, including recurring debit card payments. We will not charge a fee to your account when we decline or return an item unpaid; however, you may be charged a fee by the payee. Please see the Personal Schedule of Fees for your account for more details.

To view all fees and additional information on how to link eligible accounts, see the Personal Schedule of Fees .

Helping keep your account secure

$0 liability guarantee fraud protection.

Promptly tell us if your debit card is lost or stolen, and we'll credit unauthorized transactions back to your account. You could see credits as soon as the next business day Footnote [6] .

Fast, secure sign-in

Log in to our mobile app with Touch ID®, Face ID® or your fingerprint. ® , Face ID ® or fingerprint login. If eligible, you will have the option to enroll by following the prompts within the Mobile Banking app. If you store multiple fingerprints on your device including those of additional persons, those persons will also be able to access your Bank of America Mobile Banking app via fingerprint, including the ability to access a call center, when Touch ID ® or fingerprint is enabled. Data connection required. Wireless carrier fees may apply." data-footnote="fingerPrintScannerEnrollment" href="#ftn_fingerPrintScannerEnrollment_content" aria-label="Footnote 14"> Footnote [14]

Custom alerts

Set alerts Footnote [7] for account changes, like unusual activity, payments and more.

Debit card controls

Lock a debit card Footnote [15] to prevent unauthorized use, request a digital card Footnote [16] and more.

Digital tools to help you in your day-to-day

Better budgeting

Track your spending with our interactive Spending and Budgeting tool. Footnote [17]

Mobile deposits

Deposit checks with the camera on your device and our mobile app. Help > Browse More Topics > Mobile Check Deposit for details and other terms and conditions. Message and data rates may apply. For SafeBalance Banking® for Family Banking accounts, the parent owner can make mobile check deposits but their child using the account cannot." data-footnote="mobileDeposits" href="#ftn_mobileDeposits_content" aria-label="Footnote 18"> Footnote [18]

Erica ® virtual financial assistant

Erica Footnote [8] makes it easy for you to stay on top of your finances.

Manage your account on the go with our mobile app Footnote [19]

Earn rewards and save with Bank of America

Keep the change ®.

Build your savings with Keep the Change. We’ll round up your Bank of America debit card purchases to the nearest dollar and transfer the difference to your Bank of America savings. ® or Visa ® debit card purchases to the nearest dollar and transfer the difference from your checking account to your Bank of America ® savings account. If your savings account enrolled in Keep the Change ® is converted to a checking account, Keep the Change transfers will continue to be made into that account. We may cancel or modify the Keep the Change service at any time without prior notice. Keep the Change is not available for small business debit cards." data-footnote="keepTheChange" href="#ftn_keepTheChange_content" aria-label="Footnote 20"> Footnote [20]

BankAmeriDeals ®