How to Write a Successful Fundraising Plan

Why You Need a Fundraising Plan

Many non-profits, particularly smaller charities and start-ups, operate without a fundraising plan. When someone has an idea for an event or a campaign, these organizations simply put together a host committee or volunteer group and go for it. They may send out a letter here and there, and do some donor meetings, and when the bank account seems to be low, they often go into “panic mode” and race around trying to find cash to keep the doors open.

This is definitely not the best way to run your development program. Even if your non-profit is flush with cash, running an un-organized and un-planned fundraising operation is a recipe for stress, headaches, and ultimately… financial ruin.

So, how do you avoid this fate? The best way is by having a written fundraising plan. No matter how small your church, school, or charity is, or how far along you are into your operations, your group needs a comprehensive, well-written fundraising plan. A written plan will allow you to focus your efforts, plan out your yearly fundraising calendar , and give you guidance on strategy and tactics when you are in the thick of events, mailings, and calls. In short, your fundraising plan will keep you sane in the insane day-to-day world of the development office.

Your Plan: Who and When

The first questions you need to answer are: who should write your plan, and when should they write it? I’ll answer the second question first… When should you write your plan? How about now! Seriously – if you are operating without a plan, it is worth your time to sit down for a week and write your plan. Ideally, you’ll write a plan every year, or will write a 2, 3 or 5 year plan and tweak it at the beginning of every year.

As for who should write your plan, if you’ve got a development staff (like a development director), they should write the plan, in consultation with your charity’s CEO or Executive Director (E.D.) as well as the board. If you don’t have a development staff, then it is probably best for the E.D. or head person to write the plan, again, in consultation with the non-profit’s board of directors. You can also seek help from a qualified development consultant, many of whom specialize in writing fundraising plans.

The Anatomy of a Fundraising Plan

O.k., you know you need to write a plan, you know who is going to write it, and that person has consulted with all of the appropriate stakeholders and is ready to write. What needs to be part of the plan?

1. The Goal

The best starting point for your plan is with the end point in mind: what is your overall fundraising goal? (Even better: what is your overall fundraising goal for this year, and for each of the next four years?). This number should not be drawn out of thin air. It should be based on the needs of the organization. How much money will your group need to raise in order to carry out the activities that you want to carry out?

2. The Mission / Your Message

If the goal answers the question, “How much money do you need?” then the mission answers the question, “Why do you need it?” What is your organization’s mission? What do you plan to do with the money you raise? What is your operating budget, and why is it the amount it is?

3. The Tactics

Once you know how much you need to raise and why you need to raise it, you need to figure out how you are going to raise the full amount. What tactics will you use to raise your goal amount this year? Next year? The year after? Go into detail here, and figure out a goal for each of the tactics that adds up to your total goal. (For example, if you need to raise $5,000 you may say that you will raise $3,000 through a major donor group and $2,000 through an event). Some common tactics include:

- Individual Giving – Asking major donors to make gifts to your organization.

- Major Donor Groups – May include board giving, a finance or development committee, etc.

- Events – Both large and small.

- Direct Mail

- Telemarketing

- Online and E-Giving

- Grants – Foundations, Corporate, Government

- Corporate Giving Programs

- United Way Fundraising

- Minor Donor Groups – Yes, they do exist!

- Participatory Fundraising – Like walk-a-thons and chili cook-offs

- Annual Giving and Multi-Year Giving Campaign

When it comes to tactics, there are no shortage of ways to raise money, only a limited amount of staff and volunteer resources to implement your ideas. Try to include a good mix of fundraising tactics, and be willing to nix ideas that end up not working, and make up the lost revenue elsewhere.

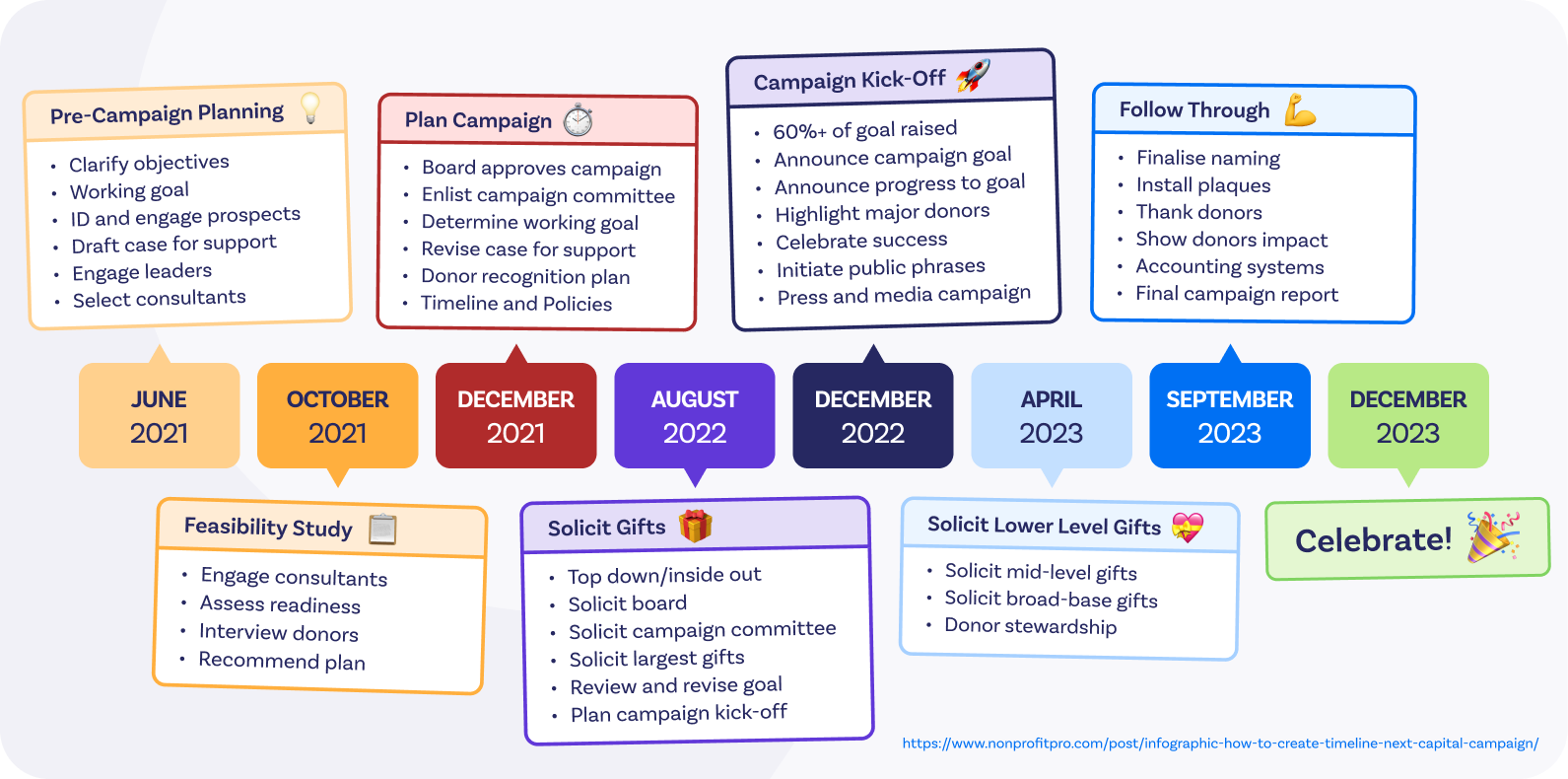

4. The Timeline

Many organizations stumble here – they come up with a solid budget, have a great mission, and draw up a plan that includes a solid group of fundraising tactics, but fail to set timelines, and thus never seem to get things done.

Some development pros like plans that have only basic timelines: Hold an event in April, send out a mailing in September, run a board giving campaign in November. I actually prefer far more detailed timelines that list not only big picture goals, but also all of the small goals that go into making that big goal a reality (a management consultant might call this a “critical path.”) For example, instead of just listing that we’re having an event in April, I would also list when decisions on venue and entertainment need to be made, when sponsors will be solicited, when invitations will go out, etc.

Whichever type of timeline you include, include one… it will force you to think critically through your fundraising decisions, and provide invaluable guidance on your activities as the year progresses.

Want a step-by-step guide for writing a fundraising plan that works? Check out our webinar How to Write a Successful Nonprofit Fundraising Plan .

Copyright © The Fundraising Authority 2023

Login with your site account

Remember Me

Not a member yet? Register now

Register a new account

I accept the Terms of Service

Are you a member? Login now

Business Plan Template for Fundraising Campaigns

- Great for beginners

- Ready-to-use, fully customizable Subcategory

- Get started in seconds

Are you an entrepreneur or startup founder in search of funding for your brilliant business idea? Look no further than ClickUp's Business Plan Template for Fundraising Campaigns! This template is your secret weapon in impressing potential investors and securing the funds you need to bring your vision to life.

With ClickUp's Business Plan Template, you can:

- Clearly outline your business model, market analysis, and growth strategies for a comprehensive and compelling pitch

- Present financial projections that demonstrate the potential return on investment, giving investors confidence in your venture

- Streamline the process of creating a professional and polished business plan, saving you time and effort

Don't miss out on the funding you deserve. Use ClickUp's Business Plan Template for Fundraising Campaigns and make your business dreams a reality!

Business Plan Template for Fundraising Campaigns Benefits

When it comes to fundraising campaigns, a solid business plan template is a must-have for entrepreneurs and startup founders. Here are the key benefits of using a business plan template for fundraising campaigns:

- Streamline your fundraising efforts by providing a comprehensive overview of your business model and growth strategies

- Impress potential investors with a well-structured plan that showcases your market analysis and competitive advantage

- Clearly communicate your financial projections and potential return on investment, increasing your chances of securing funding

- Save time and effort by utilizing a pre-designed template that ensures you cover all the essential elements of a successful business plan.

Main Elements of Fundraising Campaigns Business Plan Template

ClickUp's Business Plan Template for Fundraising Campaigns is the perfect tool for entrepreneurs and startup founders looking to secure funding and attract investors. Here are the main elements of this template:

- Custom Statuses: Keep track of the progress of each section of your business plan with statuses like Complete, In Progress, Needs Revision, and To Do.

- Custom Fields: Use custom fields like Reference, Approved, and Section to add important details and streamline your fundraising campaign.

- Custom Views: Access different views to visualize your business plan from various angles, including Topics, Status, Timeline, Business Plan, and Getting Started Guide.

- Collaboration and Organization: Utilize features like task assignments, comments, due dates, and notifications to collaborate with team members and stay organized throughout the fundraising campaign.

- Document Management: Create and store your business plan in ClickUp's Docs feature for easy access and editing.

With ClickUp's Business Plan Template for Fundraising Campaigns, you'll have all the tools you need to create a comprehensive and convincing business plan that will attract investors and help you secure funding for your startup.

How To Use Business Plan Template for Fundraising Campaigns

If you're looking to create a business plan for fundraising campaigns, follow these steps using the Business Plan Template in ClickUp:

1. Define your campaign goals and objectives

Before diving into the details, it's crucial to clearly define your goals and objectives for the fundraising campaign. Are you aiming to raise a specific amount of money? Do you have a target audience in mind? Clarifying your goals will help guide your strategy and ensure that your business plan is aligned with your campaign objectives.

Use Goals in ClickUp to set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals for your fundraising campaign.

2. Identify your target audience

Understanding your target audience is essential for effective fundraising. Determine who your ideal donors or supporters are and create buyer personas to gain insights into their demographics, interests, and motivations. This information will help you tailor your messaging and outreach efforts to resonate with your target audience.

Use a Doc in ClickUp to create and document your buyer personas, including their characteristics and preferred communication channels.

3. Develop your campaign strategy and tactics

With your goals and target audience in mind, develop a comprehensive strategy for your fundraising campaign. Outline the key tactics you will use to reach your audience and inspire them to donate or get involved. This could include social media marketing, email campaigns, events, partnerships, or any other relevant tactics that align with your campaign objectives.

Use the Board view in ClickUp to create cards for each tactic and track their progress throughout the campaign.

4. Determine your budget and resources

To ensure a successful fundraising campaign, it's important to allocate appropriate resources and budget. Consider all the costs involved, such as marketing materials, technology platforms, staff or volunteer support, and any other expenses. Determine how much funding you need to raise to cover these costs and support your campaign goals.

Use custom fields in ClickUp to track your budget and allocate resources to different areas of your campaign.

5. Monitor, evaluate, and adjust

Once your fundraising campaign is in motion, it's crucial to monitor its progress, evaluate the effectiveness of your strategies and tactics, and make adjustments as needed. Track key performance metrics, such as donation amounts, engagement rates, and conversion rates, to assess the success of your campaign. Based on these insights, make data-driven decisions to optimize your efforts and increase your fundraising results.

Use Dashboards in ClickUp to create visual representations of your campaign data and regularly review and analyze the metrics to inform your decision-making process.

Get Started with ClickUp’s Business Plan Template for Fundraising Campaigns

Entrepreneurs and startup founders looking to attract investors and secure funding can use the ClickUp Business Plan Template for Fundraising Campaigns to effectively present their ideas and potential return on investment.

First, hit “Add Template” to sign up for ClickUp and add the template to your Workspace. Make sure you designate which Space or location in your Workspace you’d like this template applied.

Next, invite relevant members or guests to your Workspace to start collaborating.

Now you can take advantage of the full potential of this template to create a comprehensive business plan:

- Use the Topics View to outline and organize different sections of your business plan, such as executive summary, market analysis, financial projections, and growth strategies

- The Status View will help you track the progress of each section, with statuses like Complete, In Progress, Needs Revision, and To Do

- Utilize the Timeline View to set deadlines and milestones for completing each section of your business plan

- The Business Plan View provides a holistic view of your entire plan, allowing you to easily navigate and review different sections

- Use the Getting Started Guide View to provide step-by-step instructions and guidance for completing your business plan

- Customize the Reference, Approved, and Section custom fields to add additional information and categorize different sections of your plan

- Update statuses and custom fields as you progress through each section to keep stakeholders informed of progress

- Monitor and analyze your business plan to ensure it effectively communicates your ideas and potential return on investment.

- Business Plan Template for Digital Marketers

- Business Plan Template for Dropshipping

- Business Plan Template for Qms

- Business Plan Template for Recreation Centers

- Business Plan Template for Beverage Distributors

Template details

Free forever with 100mb storage.

Free training & 24-hours support

Serious about security & privacy

Highest levels of uptime the last 12 months

- Product Roadmap

- Affiliate & Referrals

- On-Demand Demo

- Integrations

- Consultants

- Gantt Chart

- Native Time Tracking

- Automations

- Kanban Board

- vs Airtable

- vs Basecamp

- vs MS Project

- vs Smartsheet

- Software Team Hub

- PM Software Guide

Digital Methodology

Proven three-step approach to raising funds online.

Customer Reviews

1500+ nonprofits trust CauseVox. Read their reviews.

Expert Support

Main Street style helpful support from people that care.

We're unlike other fundraising software. Here's how it started.

Peer to Peer

Personal and team fundraising pages.

Event Ticketing

Sell free or paid tickets for in-person or virtual events.

Crowdfunding

Campaign pages for project fundraising.

Track donors and manage their giving history.

Forms and buttons for one-time and recurring giving.

Integrations

Connect CauseVox to other software.

Pledge Now, Pay Later

Take installment donations automatically.

Blog Articles

Latest fundraising tips and techniques.

Take a deep-dive into digital fundraising.

Guides & Templates

Free guides, how-to's, and templates.

Attend live or watch on-demand sessions with experts.

Case Studies

Read how other nonprofits are raising funds online.

Help Center

Support articles on how to use CauseVox.

Schedule Demo

Watch on-demand or book a live demo.

Find and post nonprofit jobs for free.

- Get Started

Why CauseVox?

Nonprofit fundraising plan: 13 must-do steps for success.

Education Writer

A nonprofit fundraising plan is a guiding document designed to help you raise the money you need to achieve your goals.

It breaks down your organization’s vision into actionable, highly-specific steps for success.

It doesn’t matter if you are running a multi-million dollar nonprofit organization or are a small start-up: the key to financial success is a well-thought-out fundraising plan. Don’t set yourself up for failure by just ‘winging’ the fundraising process.

Instead, get your team together (or go solo if it’s only you) and get to work on creating your nonprofit fundraising plan.

What Is A Nonprofit Fundraising Plan?

A nonprofit fundraising plan is a document that strategically organizes all of your fundraising activities over a certain period of time (usually one year). These strategic plans chart out campaign dates and strategies, donor-tracking and retention plans, special event details, and a targeted communication schedule.

In addition to being strategic, you want to make sure that your fundraising plan is flexible enough to accommodate changes as they arise. If your fundraising plan is rigid and formulaic, chances are, you’ll miss out on some great opportunities. The key is to have an adaptable fundraising strategy with set goals that will also allow you to respond to unexpected challenges. We know this all too well – after all, the pandemic certainly threw a wrench in even the best-laid plans.

Before we dive in on how to create your own nonprofit fundraising plan, I want to go over a couple of questions you might be asking.

What is Strategic Fundraising?

I mentioned strategic fundraising earlier but what is it exactly? Strategic fundraising refers to moving your organization’s mission forward by honing in on what you do best. It involves the buy-in of multiple stakeholders such as your staff and board members, and maps out a path forward as you raise funds.

A strategic fundraising plan is intended to keep you on track toward your fundraising goals by using your organization’s resources as effectively and efficiently as possible while keeping aligned with your overall mission and vision.

How Does a Nonprofit Fundraising Plan Differ From Other Fundraising Plans?

A nonprofit fundraising plan organizes your fundraising activities over the course of a year. You may have other fundraising plans that detail the fundraising campaigns and activities included within your overall plan.

Download a free fundraising plan template:

Why do you need a fundraising strategy.

First and foremost, fundraising plans get everyone – staff, volunteers, board members, and potential donors – focused and on-track to hitting your goals throughout the year. With a set plan in place, you can ensure that everyone is on the same page and won’t lose sight of priorities along the way. It should give your team a clear idea of what will be expected of them as well as the anticipated results.

These documents are also essential in shifting an entire organization’s attitude about fundraising. Let’s face it, fundraising is oftentimes reactionary. Problems such as an economic downturn or changes in federal funding can arise at any time.

A better way forward is to have fundraising goals, which then dictate your fundraising efforts and fundraising strategy.

A fundraising plan should provide a clear course of action from diversified funding streams, leaving everyone with a little less stress on their plate when problems do pop up.

It all boils down to the fact that when you are in the thick of an underperforming capital campaign, you are much more likely to come out on top if you have a plan in place to tackle the issues.

Are you ready to create a great fundraising plan? There’s no time like the present to get started. Follow these 13 must-do steps to ensure your fundraising plan is ready.

How To Write A Successful Fundraising Plan

1. reflect on your past finances.

Before you start putting together a fundraising plan for the upcoming year, it’s best to look at last year’s finances. At minimum, take a note of your total revenue and expenses. What’s going to carry over to this year? Which fundraising initiatives were successful? Which ones didn’t go as planned and either need more attention or should be scrapped altogether? Should more funds be allocated towards a certain initiative over another? Will new staff be brought on?

If you maintain a donor database or other CRM , you’ll be able to access this data quickly. If that data isn’t available or you are a start-up, look at your estimated budget or check out the stats of similar organizations.By reflecting on your past finances, you’ll be better equipped to create targeted fundraising goals going forward.

2. Define Your Vision

Any successful fundraising plan will have a vision. A vision statement acts as an anchor for your organization but outlines the direction going forward.

There’s only so many hours in a day, and only so many days in a year. Being able to articulate your organization’s vision allows you to strategically set priorities rather than attempting to tackle everything all at once. It lets your staff and your donors know the direction of where your organization is going and how you’re planning to get there. Keeping your vision statement top-of-mind as you’re creating your fundraising plan leaves little room to get sidetracked along the way.

3. Consider New Trends for Your Fundraising Plan

Through the pandemic, nonprofits have demonstrated their resiliency by rolling with the punches and reimagining the way they market their fundraising. It’s no surprise that how we market and fundraise is constantly changing, especially with new technology.

Keeping up to date with emerging fundraising trends can help you market and engage more effectively and efficiently. Here are a few new marketing trends worth considering when putting together your fundraising plan:

Influencer Marketing

Does the adage “people donate to people who they trust” sound familiar? That’s because it’s so true! With 49% of consumers depending on influencer recommendations , influencers are here to stay.

Teaming up with a celebrity or a public figure to amplify your reach isn’t a new concept but social media has created all sorts of opportunities for specific niches of influencer marketing. These days, influencers can be any popular figure or subject matter expert with a significant online following. They can be local celebrities, board members, or politicians eager to advocate for your cause. There’s also varying levels of influencers but they generally fall into one of two buckets:

- Macro influencers – larger reach (100K+ following)

- Micro influencers – smaller reach (10K-100K following)

There’s benefits of leveraging both but it certainly depends on your budget. Macro influencers obviously have a wider reach which is helpful for growing brand awareness. On the other hand, micro influencers may have fewer followers compared to their macro counterparts but they tend to have higher engagement due to being closer with their audience.

If you’re in the beginning stages of influencer marketing, know that it’ll take time, effort, and research. However, when you find the right person to endorse your cause, they’re enhancing your credibility by putting you front and center of an audience that already trusts them too.

Video Marketing

In today’s digital world, nonprofits and charities should consider investing in video and visual storytelling as a key fundraising tool.

Over the past decade video marketing has only grown in popularity. With more and more smartphone users, people are spending an average of 19 hours a week watching videos online. When it comes to fundraising, 80% of the highest-grossing campaigns on CauseVox have used video as part of their campaign. In fact, 57% of people who watch nonprofit videos go on to make a donation .

Without a doubt, an impactful nonprofit video is one of the most effective tools in your belt for rallying support. I’m referring to those videos that showcase the remarkable journey from trial to triumph of an individual or group.

The best thing about video marketing is that it doesn’t have to be a full-scale production especially if you have limited marketing dollars. These days, shooting high-quality videos doesn’t have to cost an arm and leg. Short-form videos on TikTok and Instagram Reels are extremely popular ways to connect with your audience. All you need is a smartphone and good lighting to get started!

SEO… you’ve likely heard this acronym tossed around but what is it exactly?

Search Engine Optimization, or SEO, is another way to target your audience and expand your reach organically. How search engines work can seem like a mystery but SEO can help demystify it a bit. In short, search engines use algorithms that crawl, index, and rank websites. When a user enters a search query, a search engine will return content that best matches the query.

Effective SEO means optimizing your website to show up at the top of search engine result pages (SERPs) when users enter keywords and phrases relevant to your mission. The higher you rank, the more often you show up – which means that users will be more likely to see and click on your link. Ultimately, the goal of SEO is to increase website traffic and subsequently bring in and convert donors .

If you haven’t made SEO a central part of your fundraising strategy yet, you should. This means making sure that you have relevant keywords that represent your brand, creating high-quality content, and mobile-optimizing your website. I can talk about SEO all day and it certainly deserves a dedicated article (or class) of its own. Luckily, there’s a webinar you can check out that breaks down how to build a sustainable SEO strategy.

Although it can take up to six months to see improvements in your search engine ranking, the long-term ROI proves that it’s an effective marketing and fundraising tactic.

4. Set Your Fundraising Plan Goals

Your fundraising goals should be based on what funds you need to keep the organization operating.

Your goals are also the catalyst and “North Star” for all your fundraising activities.

It is best to start with what your costs were during the last three fiscal years. If that data isn’t available or you are a start-up, look to your estimated budget or check out the stats of similar organizations.

Jot down the precise amount you need for the upcoming year. Then, build on this goal. Do you see growth in your organization’s future? If so, increase your year-to-year goals based on your anticipated growth.

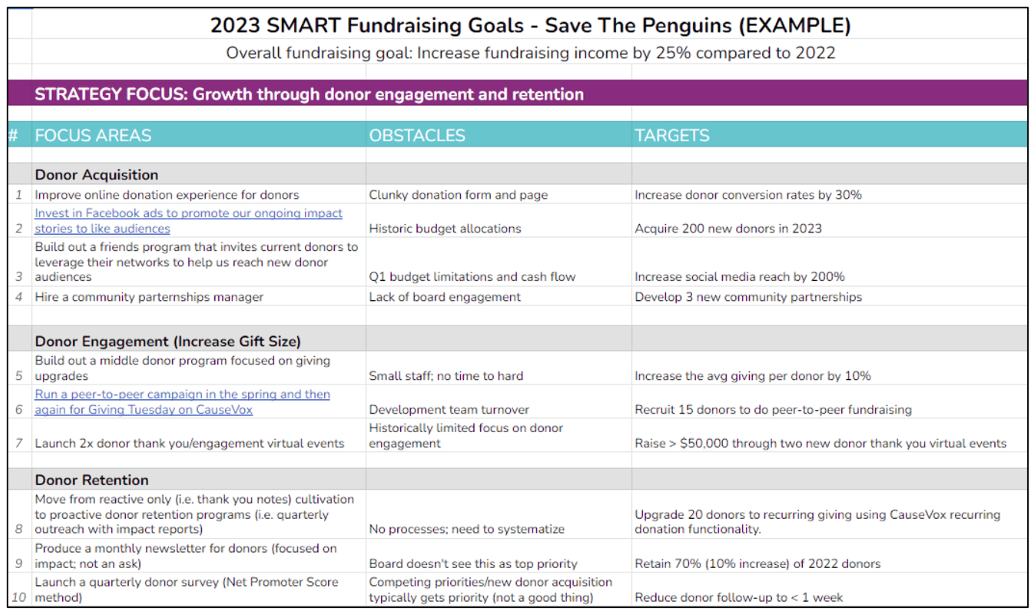

You’ll notice that the fundraising goal worksheet example above follows the SMART framework: Specific, Measurable, Achievable, Relevant, and Time-Bound. Here’s how to get SMART when charting out your goals:

- Specific: What will the goal accomplish? How will it be accomplished?

- Measurable: How will you measure success? How will you know when you’ve accomplished your goal?

- Achievable: Is it realistic and possible? Have others done it before?

- Relevant: Is the goal relevant to the problem you’re trying to address?

- Time Bound: When do you expect to complete this goal?

5. Align With Your Mission

You’ve got the right team in place and a basic idea of the goals you need to meet. Now it is time to make sure these goals align with your nonprofit’s fundraising objectives.

Bust out that organizational mission statement. This statement should answer these questions:

- Why is your organization in operation?

- What types of change are you making in the world?

Base your fundraising plan on how these dollars are helping put your mission into action.

You aren’t just raising money. You are raising money to make a difference. So, dissect your mission statement and goals and align the two. Explain, in detail, how much money you need to accomplish everything in your mission.

6. Detail Your Methods

After you’ve aligned your goals and mission, it is time to describe exactly how you will be raising those funds. You want your fundraising plan to be so detailed that even those outside of the organization will be able to understand it!

List the types of fundraising techniques you will be using. Include strategies such as:

- Crowdfunding campaigns

- Face-to-face asks

- Phone calls

- Mail campaigns

- Email marketing campaigns

- Fundraising Events

- Thank-a-thon

- Grants and matching gifts

- Corporate giving and partnership development

- Recurring donation campaigns

- Month-long focus on endowments and planned giving

- Capital campaigns

(Be sure to also check out our comprehensive list of fundraising ideas for more inspiration.)

Then, list the steps you need to take before and after each of the above activities. You may need to train volunteers, get your materials ready, or talk to someone about setting up the campaign website. Take some time to really dive deep into each of your fundraising strategies.

Also, be sure to think of both short-term and long-term activities. What can you focus on now and what fundraising tactic can you expand if your organization needs additional funding?

7. Look at the Big Picture

Does your organization have a strategic plan? If so, you’ll want to make sure that your fundraising plan aligns with it. Creating 1-year, 3-year, and 5-year plans is a best practice in the nonprofit world, and you can do this with your fundraising plan as well.

Your 1-year fundraising plan should be very specific. Detail every fundraising activity you will engage in over the course of the year.

Your 3 and 5-year plans can be much broader. Highlight key activities for each month, as well as your ultimate goals. If you see your organization growing and needing additional resources in 5 years, then outline a basic schedule that includes the steps you need to take in order to meet this demand.

Also, be sure you’re tracking every cent of fundraising revenue from previous years, as this will help you create data-backed fundraising goals for the future.

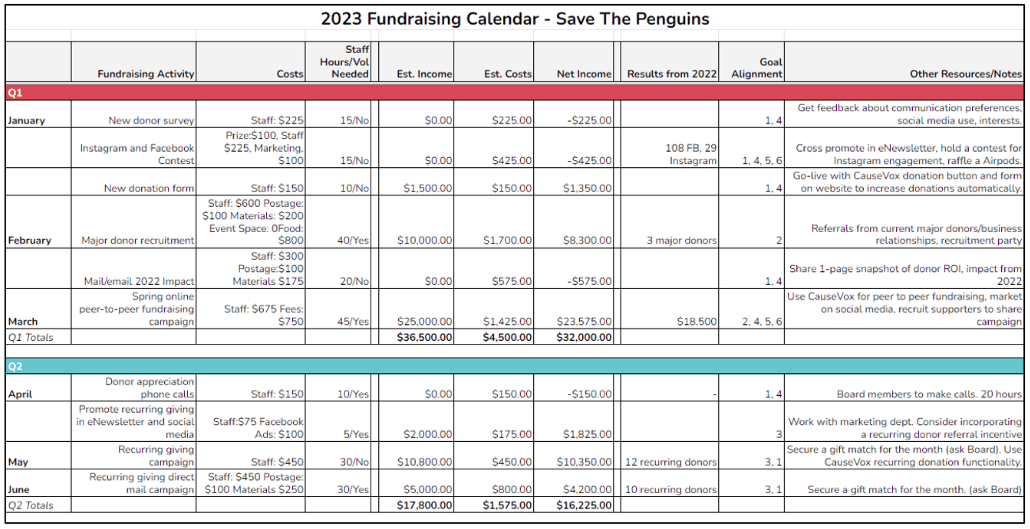

8. Bust Out Your Fundraising Plan Calendar

You’ve written down all of your fundraising plan information in a document. Your team has come to an agreement on appropriate financial goals, aligned those with your mission, described your fundraising techniques in detail, and then put this information into 1, 3, and 5-year plans.

Now, it’s time to get out your calendar which will supplement your total fundraising plan. Your fundraising calendar will help you to stay on task throughout the year. Let’s say you are nearing the busiest time of the year for fundraising—the holidays.

Your calendar should detail all the steps you need to take before the “busy season” starts such as establishing your goal, website preparations, and volunteer training.

Mark down your hard deadlines, action deadlines, communication schedule, and your donor retention strategy schedule. Viewing these dates as inflexible will keep you on task, even if you have to make adjustments here and there.

Keep your fundraising calendar on hand at every development meeting. This is a great tool to keep your schedule and goals top of mind. Need to keep track of important dates that may be related to your cause? Check out NonProfit Tech for Good’s sample cause awareness day calendar .

Take a look at our article on creating a fundraising calendar for additional information on creating a stellar fundraising calendar. You’ll find a template and worksheet you can use to build your own calendar.

Your final fundraising plan is likely to change as your organization grows, and that is okay! It isn’t meant to be a static document.

You should never ‘fly by the seat of your pants’ in fundraising. You are setting yourself up for failure if you go this route. Taking the time to develop a thorough fundraising plan will pay off in dividends and help you and your fundraising team stay on-task for years to come.

9. Assemble the Troops

When it comes to planning, you definitely need all hands on deck, so figure out who needs to be involved in the process. After all, your development team may be in charge of fundraising, but it takes the entire organization to produce consistent results.

So, let’s get the right people sitting around the table. First, make sure that your board of directors is involved. Their input and support are necessary for this document to “go live.”

Small organizations may only have one or two employees, and it is, therefore, best to have your board there to advise you and get involved helping to create the plan.

Larger organizations that have many departments should focus on creating this plan with top-down support. Therefore, it is best to include the leadership team, the development department, and those working with communications and marketing.

If you are at a loss as to where to start, talk with a professional nonprofit consultant. They can get you started or even guide you through the process if you require extra help.

10. Determine & Delegate Activities

At this stage, it might seem like there’s so much to do and only so much time to do it in. Once you’ve got your team assembled, create a timeline to determine who’s doing what and when. Your timeline will be a roadmap for all your fundraising efforts and can include things like when to launch a campaign or when to schedule out social media posts.

Make sure to review your timeline with your team to ensure that everyone’s on the same page and that it’s realistic. Chances are, your team members are saddled with other responsibilities so by divvying up activities, you can ensure that you’re not overwhelming them if they already have a heavy workload.

Consider using a project management software to help with this process.

11. Perform a SWOT Analysis

As an additional level of assessment and to make sure nothing is slipping between the cracks, you may want to perform a SWOT analysis . When done correctly, a SWOT analysis can be an extremely powerful fundraising tool.

But what exactly is a SWOT analysis and why should you use it?

SWOT stands for Strengths, Weaknesses, Opportunities, and Threats. A SWOT analysis is a strategic planning and evaluation tool that can provide direction by assessing your organization’s internal (strengths and weaknesses) and external factors (opportunities and threats). Below is a SWOT analysis template with sample questions in each domain:

A SWOT analysis takes a critical look at your operations, giving you a clearer idea of the overall health of your organization, how you’re doing compared to similar organizations, and areas where you can improve.

12. Segment and Strategize For Different Donor Types

When it comes to fundraising, personalization is key. You wouldn’t talk to a ten year old the same you would communicate to a thirty-year old. It’s the same concept with your donor base.

You donors aren’t a monolith so skip the generic communications and instead, segment and tailor your messaging for different donor types. One of the most common ways you’ll see a nonprofit segment donors is by gift amount. You could have a segment for small-dollar donors, mid-level donors, and major donors. Of course, it’s up to you to choose what the cutoff amount for each category is.

Major Donors

The definition of a major donor will vary from organization to organization. For some, the criteria for a major donor could be anyone who gives $10K or more, while others may view anything above $1K as a substantial gift. Regardless of how you define who a major donor is, as a fundraising professional, you already know that they’re important, especially since 88% of all nonprofit funds come from just 12% of donors .

Mid-Level Donors

Similar to major donors, the amount threshold will vary based on your average gift size and donor base. Mid-level gifts can range anywhere from a few hundred dollars to a few thousand dollars.

Small-Dollar Donors

Small-dollar donors are just as important as mid-level or major donors. These are individuals providing $5, $25, or even $75 to your organization each year. Even if it may seem like a nominal amount, it’s still important to steward them well .

Once you’re done segmenting, make sure the messaging to your donor is appropriate for the amount they’ve given. If the most a donor has donated to your organization was $25, asking them for $1,000 doesn’t make a lot of sense and would likely turn them off.

In a similar vein, small-dollar and mid-level donors have the best potential to be monthly recurring donors which can provide more value over a lifetime compared to a one-time donor who may donate a higher amount. Sometimes, breaking down a large amount into smaller chunks over time is more digestible and an easier ask for your donor.

For instance, Anne is a $25 donor but she donates to your cause every month. That’s $300 every year. Ben on the other hand is a $500 donor but he only gives once. Over the course of 3 years, Anne will have given $900 compared to Ben’s one-time gift of $500. While you still value and appreciate Ben’s gift, based on this, it’s worthwhile for you to focus on communicating recurring giving programs to your small-dollar and mid-level donor groups.

To maximize gift size while fully automating donation payments, CauseVox’s pledge donation option allows donors to make a donation pledge now and pay in designated installments.

Other Ways to Segment

While segmenting by gift amount is popular and common, it’s not always the most personal approach. How much someone gives only tells you their giving capacity but it doesn’t provide much more information otherwise. You’re not going to know how often they give on average (propensity), why they gravitated to your cause, and what they care about (affinity).

If you don’t want to segment by gift amount, you can always consider segmenting donors based on their level of involvement, their interests, or even by geography. For example, a volunteer will interact differently with your organization compared to someone who’s receiving services. Alternatively, you wouldn’t want to send the same messaging to a lapsed donor and to someone who engages with your organization regularly.

When you’re attuned to the specificities of a donor (i.e. their interest and intent), you can make their donor journey way more meaningful. The possibilities are endless, so go wild!

13. Keep Everything Organized With the Right Software

The last step in your fundraising plan is to figure out how to keep everything organized.

Are you cobbling together disparate donor information across multiple spreadsheets? Are you struggling to find the most recent version of a spreadsheet? Do you have spreadsheet fatigue? If the answer is a resounding ‘yes’, you’re not alone. It honestly sounds like a nightmare.

Fortunately, there’s a better way. Whether you’re using Google Sheets or Excel, it is not remotely close to being a replacement for a dedicated donor database. When it comes to keeping everything organized, it’s time to ditch the spreadsheets and switch to a customer relationship management (CRM) software. CRMs are designed to help you track donor information, provide insights, and give you more control of your fundraising efforts. Of course, choosing the right software can make or break your fundraising plan.

Let’s face it, there’s no shortage of fundraising software out there. If you’re trying to narrow down your options, here’s why you should choose CauseVox. Our fundraising platform is designed increase giving and reduce back-office tasks with features such as:

- Smart donation forms,

- Automated receipts,

- Donation tracking and insights,

- Built-in CRM to track and build donor relationships,

- Event ticketing,

- Customizable peer-to-peer and crowdfunding campaigns,

- And expert support delivered by real people

We’ve helped thousands of nonprofits simplify their fundraising and reach their goals. You’ve put in the blood, sweat, and tears all year. Let us help you make your job a little easier, all starting at an unbeatable cost of $0 .

Download a comprehensive fundraising plan template:

Get started on causevox.

Book a demo to learn how CauseVox can help you maximize your digital fundraising in 2023 and beyond!

This post was updated in December 2023 for freshness, accuracy, and comprehensiveness.

Ultimate Guide To Peer-to-Peer Fundraising

Customer Story: Spur Local Raises Over $1M With Their Give Local Campaign

Fundraising Strategies for Nonprofits: Craft the Best Approach for Your Organization

Create a Killer Fundraising Plan - Best Practices, Strategies, & Downloadable Template

Product Update: CauseVox Automated Matching

Maximize giving day success with peer-to-peer fundraising, choose another topic to explore:, fundraising, peer-to-peer, social media, simplify and grow your fundraising.

It honestly felt like using CauseVox expanded our team by another member.

Kelly McLaughlin

Director of Donor Engagement at CCAN

Here's what we found for you:

Nothing on that. However, here are a few recommended searches others have found helpful:

Share via: Ever wished your donations could go even further? Enter automated matching—an indispensable tool that transforms the way your organization secures support for its cause. Research from the CauseVox […]

Share via: Chances are, you know what Giving Tuesday is by now. However, it’s important to recognize that Giving Tuesday is just one of many giving days your organization can […]

Share via: Here at CauseVox, we love a good success story. And we couldn’t think of a better organization to highlight than Spur Local. Spur Local blew it out of […]

Product Overview

- Donor Database Use a CRM built for nonprofits.

- Marketing & Engagement Reach out and grow your donor network.

- Online Giving Enable donors to give from anywhere.

- Reporting & Analytics Easily generate accurate reports.

- Volunteer Management Volunteer experiences that inspire.

- Bloomerang Payments Process payments seamlessly.

- Mobile App Get things done while on the go.

- Data Management Gather and update donor insights.

- Integrations

- Professional Services & Support

- API Documentation

Learn & Connect

- Articles Read the latest from our community of fundraising professionals.

- Guides & Templates Download free guides and templates.

- Webinars & Events Watch informational webinars and attend industry events.

- DEI Resources Get DEI resources from respected and experienced leaders.

- Ask An Expert Real fundraising questions, answered.

- Bloomerang Academy Learn from our team of fundraising and technology experts.

- Consultant Directory

- Comms Audit Tool

- Donor Retention Calculator

- Compare Bloomerang

- Volunteer Management

The Essential Guide to Writing a Fundraising Plan

- Fundraising

- Strategy/Planning

Easily Manage Your Donor & Fundraising Needs in Bloomerang!

Nonprofits with written fundraising plans consistently outperform organizations without them. However, many nonprofits lack these important guiding strategies . One study found that 37% of organizations with budgets under $1 million and 22% of organizations with budgets over $1 million don’t have a fundraising plan in place .

A fundraising plan defines clear goals, keeps your team on track, provides accountability, and ultimately helps you raise more for your cause. But where should you start when writing your plan?

In this quick guide, we’ll explain the crucial steps your team needs to take to build your fundraising plan.

6 steps to creating a fundraising plan

While every fundraising plan looks a bit different, they all involve the same planning steps and core components.

1. Assess past performance.

The first step in making a fundraising plan isn’t thinking about the future — it’s taking stock of your past. Establishing a baseline rooted in past successes and failures allows you to set measurable, realistic goals.

Look back at your previous fundraising initiatives and outreach campaigns to assess your strengths, challenges, and opportunities. Ask yourself these questions:

- Which fundraising sources offer the best return on investment?

- How well are we engaging with our donors?

- What were our donor retention and new donor acquisition rates?

- How many of our fundraising initiatives reached their goals?

- Who are our most loyal donors ? What do we want to learn from them, and how will we ask?

Answer these questions and review the data from past campaigns to understand where your organization currently stands and how you can build on past performance.

2. Define goals.

Writing down your goals encourages you to clarify objectives and identify the tasks and timeline needed to complete them. The best goals are SMART goals: specific, measurable, attainable, relevant, and time-bound.

Here are a few examples of SMART goals you might set for your organization:

- We will plan and launch a monthly giving program by September 1. We will engage at least 100 donors in the program.

- We will recruit two volunteers to join the board development committee. We will train them and have them in place by April 15.

- We will grow our donor base by 10% by June using direct mail appeals , social media posts, and our giving day campaign.

- We will improve overall donor retention by 5% (to 50% overall) by creating and implementing a donor-centered stewardship plan . This plan will include at least seven meaningful, personal thank you touches in a six-month period.

Define your goals by looking at your past performance and your nonprofit’s future growth plans. What can you reasonably achieve with the tools and capacity you currently have?

3. Update your case for support.

Your nonprofit’s case for support is the reason you give donors for why they should contribute to your cause. When building a fundraising plan, it helps to have a solid case for support you can rely on to craft your fundraising and marketing initiatives.

When you can organize your messaging around a guiding idea or theme, you’ll have an easier time communicating to donors about why they should support you and what their support will accomplish.

Refresh your organization’s case for support by:

- Conducting audience research. Has your organization’s audience evolved or grown recently? Conduct audience research to assess the demographics, interests, and motivations of your supporter base. This helps you ensure you’re creating a case for support that appeals to your unique audience.

- Incorporating storytelling. Centralizing your messaging around a single person or story helps you build empathy among your audience members. Use storytelling techniques , such as introducing the main character, the issue your organization is trying to address, and your proposed solution.

- Connecting donations to impact. Donors want to know that their contributions will actually make a difference. Make sure your message includes specific descriptions of how you’ll use donations. For instance, you might explain that a $100 gift can purchase supplies for 10 shelter dogs, or a monthly $20 donation helps keep your children’s after-school program running.

Once you’ve revamped your case for support, you can incorporate it into your email, social media, and direct mail campaigns, as well as your in-person donor meetings.

4. Identify fundraising methods.

What are the actual fundraising initiatives, campaigns, or events you’re going to launch in order to reach your defined goals? For example, you might decide to plan:

- Peer-to-peer fundraising campaigns

- An auction/gala

- A social media challenge

- A fundraising 5K/Fun Run

- A direct mail campaign

- An email campaign

- A giving day/Giving Tuesday challenge

Choose your fundraising initiatives based on events and campaigns you’ve had the greatest success with in the past as well as what you think supporters will be most interested in moving forward. For instance, you might have held most of your fundraising events in person in the past, but recently discovered that supporters are interested in attending virtual or hybrid events . You can incorporate these event types more moving forward to appeal to supporters’ current preferences.

5. Prepare your marketing channels.

A strong fundraising plan also needs to include the marketing channels you’ll use to get the word out about your fundraising initiatives. These marketing channels might include:

- Social media

- Direct mail

- Your website

- Local news/radio

Review your donor profiles and marketing engagement analytics to determine your target audience’s preferred communication platforms. Then, focus your efforts on those channels to connect with the right people. This allows you to keep your focus on marketing channels that will deliver a higher return on investment (ROI) for your campaign.

6. Determine and assign responsibilities.

The next step in crafting your fundraising plan is assigning responsibilities to your staff, board members, and other volunteers and adding them to a calendar.

Your fundraising plan should clearly define:

- Each overall goal (fundraising amount to hit, donors to connect with, etc.)

- The individual, team, or department in charge of working toward that goal

- The associated fundraising initiatives you will launch to help reach that goal

- Benchmarks to hit along the way

- The events you will host to support that goal

With a clear plan, you ensure all team members are on the same page and aligned on your priorities. However, that doesn’t mean your plan has to be set in stone. Unexpected circumstances and challenges frequently arise throughout the course of carrying out any strategy, along with new opportunities you might not have thought of. Keep your plan flexible and adjust it as needed to account for these obstacles and opportunities.

Keep in mind that to carry out your fundraising plan effectively and efficiently, you’ll require the support of dedicated fundraising tools . This includes platforms like your:

- Nonprofit CRM to store and manage donor information, identify your most and least engaged donors, and pull fundraising reports

- Email marketing software to help create campaigns and analyze email engagement metrics

- Social media scheduling tools to help you develop an active social media presence

- Event planning software to plan and manage your fundraising events and volunteer staff

- Matching gift database tool to follow up with match-eligible donors and encourage them to submit matching gifts through their employers

If you’re lacking any of these solutions and looking to expand your technology stack, be sure to choose solutions that integrate with your existing software. This allows for streamlined data migrations and keeps all of your fundraising activities under one roof. Then, if you want to pull names from your donor database to create an event guest list, or create an email campaign to connect with match-eligible donors, you can easily do so.

Looking for more information about creating and carrying out an effective fundraising plan? Review Bloomerang’s additional resources on the topic:

- Fundraising Apps: 25+ Tools To Help Your Org Raise More . Interested in learning more about the best fundraising software tools available for nonprofits? This roundup reviews the most effective solutions and what they specialize in.

- Major Gifts: The Ultimate Guide to Kickstart Your Program . Acquiring major gifts requires a specialized, tailored fundraising strategy aimed at developing relationships with high-value donors. Use this guide to build your major gift fundraising program.

- The Ultimate Donor Engagement Guide + Top Strategies . Your fundraising plan must include a dedicated strategy for engaging with donors and developing stronger bonds. This guide provides top strategies for better donor engagement.

Bloomerang’s fundraising solutions help nonprofits build and launch effective fundraising plans.

Our tools help you raise more and create lasting change.

Exclusive Resources

Related Articles

Jane Baxter Lynn

Fundraising plan template: Your step-by-step guide

With our fundraising plan template, we’ll walk you through everything you need to know about drafting your own campaign fundraising plan.

What does every nonprofit and charity have in common? They all need a fundraising plan for each campaign!

A fundraising plan template will help you organise and maximise your campaign’s success. It doesn’t matter what your organisation does, or who or what you’re raising money for. Without a strategic plan, you’ll be leaving money on the table.

Luckily, whether you’re planning a peer fundraising campaign or an active fundraising event like a 5k race, most fundraising plans follow a similar formula:

- Determine your desired outcome

- Set fundraising goals and benchmarks

- Define a budget

- Decide on a fundraising tactic

- Create a timeline

- Give your campaign a test run

- Market your event or campaign

- Launch your campaign

- Send out “thank yous” and analyse your results

Let’s explore each of the steps in a typical fundraising plan template, using a peer-to-peer campaign as an example. Keep in mind, this is for a single campaign, not your organisation’s overall fundraising strategy.

1. Determine Your Desired Outcome

Your fundraising campaign’s goals are really the heart of what your efforts are all about. In fact, you should consider them the foundation of your entire plan, from conception to completion .

Before you define your budget, audience, or fundraising goal, you should think about what you want to get out of your fundraising campaign. What are you hoping to do and achieve with the funds you raise? Are you looking to increase awareness and the engagement of your supporters? Who will benefit from your campaign? Which fundraisers and donors will you target as your intended audience?

Your desired outcome will serve as your campaign’s North Star, and will help you determine the rest of your decisions.

2. Set Fundraising Goals and Benchmarks

Let’s assume you’ve decided on a peer-to-peer campaign. If you do a specific annual fundraising campaign, you can look to your previous year’s metrics to get an idea of what your goals should be. If this is your first peer-to-peer campaign, no worries! As long as your goals are clearly defined, your chances of hosting a successful fundraising campaign will go way up.

We recommend setting SMART goals. This means they’re:

✅ Specific : Your goal should be precise ✅ Measurable : Your goal needs to be quantifiable ✅ Achievable : Your goal is realistic and you have the necessary resources ✅ Relevant : Your goal aligns with your overall efforts ✅ Time-Bound : Your goal has a set deadline

Let’s say your nonprofit is a breast cancer foundation. You formed it after surviving breast cancer, and every year host a walk-a-thon to raise money for cancer research. Last year, your nonprofit raised $22,000 and acquired 50 new donors.

Here are some examples of SMART goals:

Goal 1: Raise $25,000 for breast cancer research by hosting your annual walk-a-thon on Sept 7.

🎯 Specific : You want to raise $25,000 for breast cancer research during your annual walk-a-thon. 📈 Measurable : Your goal is measurable in dollars. 🏆 Achievable : Your nonprofit raised $22,000 last year. Increasing your fundraising revenue to $25,000 this year seems achievable. 🙌 Relevant : You’ve hosted walk-a-thons before to great success. 🗓 Time-Bound : You have until the end of Sept. 7 to achieve your goal.

Goal 2: Increase your number of new donors to 60 by the end of the walk-a-thon.

🎯 Specific : You want 60 new donors to give during your annual walk-a-thon. 📈 Measurable : Your goal is measurable in your number of new donors. 🏆 Achievable : You acquired 50 new donors last year. Acquiring 60 this year seems reasonable. 🙌 Relevant : You’ve hosted walk-a-thons before to great success. 🗓 Time-Bound : You have until the end of Sept. 7 to achieve your goal.

3. Define a Fundraising Budget

It’s time to crunch the numbers . As we just mentioned, it’ll come in handy to first review your budget and expenses from last year.

Create a spreadsheet that lists the items and costs of everything you need to budget for. Here are a few line items to consider:

- Fundraising platform costs (unless the platform is free )

- Personnel and administrative expenses

- Credit card processing fees

- Marketing costs (direct and indirect)

- Social media advertising

- Fundraising consultant fees

If this is your first campaign of this nature, do your research to estimate roughly how much each of these items may cost. Luckily with a peer-to-peer fundraising campaign, you might find that a small budget can go a long way

4. Decide on a Fundraising Tactic

Here are a few questions you should ask yourself, your staff, and maybe even your active board members:

❓ What is your fundraising campaign’s message? It should be tangible, clear, concise, and emblematic of your organisation’s work.

❓ What type of fundraising campaign do you want to do? Are you planning a Facebook birthday fundraiser , social media challenge, grassroots community effort , etc.?

❓ Are you going to focus solely on individual donors or teams? Corporate sponsorships? Public figures or influencers? Some combination of the three?

❓ How will you encourage major donors to give more? Are you going to gamify your fundraiser by encouraging team members to compete against one another

to rank on a leaderboard? Will you entice them with major gifts for each donation level?

❓ What fundraising software will you use to track and quantify the success of your campaign?

The questions might feel endless at first, but they’re key to settling on a fundraising idea and getting the planning process started. Ultimately, you’ll be glad you spent the time preparing up front.

You may find yourself revisiting and updating your basic plan as you go, and that’s okay! Your answers to these questions are meant to give you direction — they’re not etched in stone … yet.

If you feel like you need a little help, we have multiple free campaign templates for you to use.

5. Create a Timeline

Now that you’ve identified your goals, budget estimates, and approach, it’s time to put everything together. Create a fundraising campaign timeline , and fill it out thoroughly with each step of the process to launch your campaign — remember, details matter!

Your timeline will serve as your team’s roadmap throughout your campaign and keep everything on track. Think of it as a checklist that you’ll complete to execute your fundraising efforts. This could include creating a campaign website , scheduling social media posts, sending email blasts, and obtaining donor prizes.

Review it with your team to ensure you’ve covered all your bases and your timeline is realistic, then assign tasks accordingly.

Pro tip: Sometimes it’s easier to start at your campaign’s launch date, then work backwards.

6. Give Your Campaign a Test Run

Go over your campaign before launching it to identify any potential errors. If something isn’t working, it’s better to fix it before, rather than during.

Review your event’s timeline, determine when you’ll engage with your donors, and what you’ll say. Ask your team for feedback, and make corrections as you go.

You should also test your idea with your regular, long-term donors and supporters to get their feedback. For a peer-to-peer campaign, they could offer some insight, like what attracts their followers, or how to clarify your overall message.

The more prepared you are, the more successful your efforts are likely to be.

7. Market Your Campaign

With your nonprofit fundraising campaign in place, it’s time to start marketing ! There are literally hundreds of ways to market to your current donors. For example, if you’re running a peer-to-peer fundraising campaign, here are a few marketing tactics to consider:

📢 Create a landing page on your website highlighting your campaign, complete with an effective call to action and a user-friendly donation form .

📊 Create a wealth of organic content (copy, photos, videos, charts, graphs, etc.) to share on your website and social media.

📲 Post about your campaign on social media, and encourage your donor base to get their peers involved.

📝 Create an online petition, manifesto, or declaration to generate a list of potential donors prior to your campaign launch.

🧑🏽💻 Start an email marketing campaign. The average open rate for nonprofit emails is 25.17% , compared to the average open rate across a spectrum of industries, which is only 21.33%.

🗞 Contact media partners — like your local newspapers, radio, and other relevant sources — that may be inclined to boost your message.

8. Launch Your Campaign

You’re ready to launch! Congratulations! All your planning and hard work has led you to this point.

There are three key things you need to focus on at this point:

- Engage with your donors. This will help you leave a memorable impression and improve your donor retention rates.

- Have fun! If you’re enjoying yourself, your donors will, too — and in some cases, they’ll be inclined to donate more.

- Be flexible. Sometimes supporters will provide helpful feedback during your campaign, or you may need to make tweaks to adapt to changing circumstances. Also, it never hurts to have a back-up plan, just in case!

9. Send Out Thank-You Notes and Analyse Your Results

The final step to build into your fundraising plan is to thank donors. Thank your donors throughout the entire event, not just when they’re donating to your cause. After your fundraising event ends, thank them again for participating and share your campaign’s impact and success. Tell donors what you’ll be able to do with the funds raised, and stay upbeat, optimistic, and appreciative, even if you didn’t reach your goal (now you’ve got a goal for next year!).

In addition to thanking your donors, meet with your team and analyse the results of your fundraising efforts. Now that you have data, you can look back on every step of the campaign and determine what went well and what you can improve upon next time. The more you learn, the better chances you’ll have at running successful campaigns in the future.

A Fundraising Plan Template Can Organise Your Campaign

Not every campaign will emphasise each of the steps we’ve mentioned in this fundraising plan template, but it’s a general format that can help you map out your ideas. We know that planning a fundraising campaign can be a challenge. At Raisely, we’re simplifying the process with an all-in-one fundraising platform that provides plenty of tools to get a headstart on your next campaign, including easy website creation, a signature three-step donation form, and more.

Ready to create your next campaign?

Anthony Greer is a freelance content writer who crafts consistent, engaging, on-brand copy for nonprofits, real estate, and digital marketing agencies.

Giving Tuesday 2023 Guide: everything you need for a successful campaign

7 Key Elements of a Successful Regular Giving Program: A Comprehensive Guide for Charities & Nonprofits

Double your regular giving with Raisely’s new upsell feature

Boost your fundraising by up to 5% in 10 minutes: dollar handle order and default amounts

Stay in the loop..

Delivered to your inbox twice a month.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » strategy, how to write a nonprofit business plan.

A nonprofit business plan ensures your organization’s fundraising and activities align with your core mission.

Every nonprofit needs a mission statement that demonstrates how the organization will support a social cause and provide a public benefit. A nonprofit business plan fleshes out this mission statement in greater detail. These plans include many of the same elements as a for-profit business plan, with a focus on fundraising, creating a board of directors, raising awareness, and staying compliant with IRS regulations. A nonprofit business plan can be instrumental in getting your organization off the ground successfully.

Start with your mission statement

The mission statement is foundational for your nonprofit organization. The IRS will review your mission statement in determining whether to grant you tax-exempt status. This statement also helps you recruit volunteers and staff, fundraise, and plan activities for the year.

[Read more: Writing a Mission Statement: A Step-by-Step Guide ]

Therefore, you should start your business plan with a clear mission statement in the executive summary. The executive summary can also cover, at a high level, the goals, vision, and unique strengths of your nonprofit organization. Keep this section brief, since you will be going into greater detail in later sections.

Identify a board of directors

Many business plans include a section identifying the people behind the operation: your key leaders, volunteers, and full-time employees. For nonprofits, it’s also important to identify your board of directors. The board of directors is ultimately responsible for hiring and managing the CEO of your nonprofit.

“Board members are the fiduciaries who steer the organization towards a sustainable future by adopting sound, ethical, and legal governance and financial management policies, as well as by making sure the nonprofit has adequate resources to advance its mission,” wrote the Council of Nonprofits.

As such, identify members of your board in your business plan to give potential donors confidence in the management of your nonprofit.

Be as realistic as possible about the impact you can make with the funding you hope to gain.

Describe your organization’s activities

In this section, provide more information about what your nonprofit does on a day-to-day basis. What products, training, education, or other services do you provide? What does your organization do to benefit the constituents identified in your mission statement? Here’s an example from the American Red Cross, courtesy of DonorBox :

“The American Red Cross carries out their mission to prevent and relieve suffering with five key services: disaster relief, supporting America’s military families, lifesaving blood, health and safety services, and international service.”

This section should be detailed and get into the operational weeds of how your business delivers on its mission statement. Explain the strategies your team will take to service clients, including outreach and marketing, inventory and equipment needs, a hiring plan, and other key elements.

Write a fundraising plan

This part is the most important element of your business plan. In addition to providing required financial statements (e.g., the income statement, balance sheet, and cash flow statement), identify potential sources of funding for your nonprofit. These may include individual donors, corporate donors, grants, or in-kind support. If you are planning to host a fundraising event, put together a budget for that event and demonstrate the anticipated impact that event will have on your budget.

Create an impact plan

An impact plan ties everything together. It demonstrates how your fundraising and day-to-day activities will further your mission. For potential donors, it can make a very convincing case for why they should invest in your nonprofit.

“This section turns your purpose and motivation into concrete accomplishments your nonprofit wants to make and sets specific goals and objectives,” wrote DonorBox . “These define the real bottom line of your nonprofit, so they’re the key to unlocking support. Funders want to know for whom, in what way, and exactly how you’ll measure your impact.”

Be as realistic as possible about the impact you can make with the funding you hope to gain. Revisit your business plan as your organization grows to make sure the goals you’ve set both align with your mission and continue to be within reach.

[Read more: 8 Signs It's Time to Update Your Business Plan ]

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Applications are open for the CO—100! Now is your chance to join an exclusive group of outstanding small businesses. Share your story with us — apply today.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

For more business strategies

How startups contribute to innovation in emerging industries, how entrepreneurs can find a business mentor, 5 business metrics you should analyze every year.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

6 Simple Fundraising Plan Tips [With Free Templates!]

Your nonprofit’s fundraising plan is the backbone of your success as an organization.

Without a solid fundraising plan in place, there would be nothing to guide your fundraising efforts and no way to tell if your nonprofit is on track to meet your goals.

Before implementing any change in fundraising strategy, you need to have an official fundraising plan in place. To get you started, here are 6 simple tips to consider:

- Gain fundraising plan input from key stakeholders.

- Develop goals (and challenges)!

- Set a fundraising plan timeline.

- Determine your fundraising methods.

- Build corporate partnerships into your fundraising plan.

- Tailor your case for support.

Bonus! Once your fundraising plan is in place, you should periodically assess your strategy. Check out Double the Donation’s ultimate fundraising strategy assessment to stay ahead of the curve!

Ready to get started on your fundraising plan? Let us break these tips down into a bit more detail.

1. Gain fundraising plan input from key stakeholders.

Stakeholders are an important part of your nonprofit’s team. Not only do they help fund your organization’s philanthropy, but they typically have final say over big-picture fundraising decisions.

Since a fundraising plan outlines a nonprofit’s key activities, it is important to get support from these board members and other key stakeholders.

There are a couple of ways you can gain input from your stakeholders:

- Experiential input. You can ask stakeholders directly about what fundraising strategies have worked well for your nonprofit in the past. Inquire about past fundraising activities, strengths and weaknesses. Take their feedback into consideration and be sure to demonstrate to them how you address their input.

- Consultant interviews. You might find it helpful to bring in a fundraising consultant . They can conduct stakeholder interviews to determine what is most important to your board and how to get everyone on the same page when designing your fundraising plan.

Remember: Your nonprofit’s board members are just as passionate about your organization’s mission as you are. Do not think of their approval as a bureaucratic hurdle to overcome, but rather an important step towards improving your fundraising plan.

2. Develop goals (and challenges)!

When designing your fundraising plan, your final product should reflect your nonprofit’s primary goals above all else.

It is easy to fall into the trap of vaguely fundraising without an endpoint in sight, but to stay on track your nonprofit needs to actively work toward a defined set of central goals.

Before designing your fundraising plan, your nonprofit needs to sit down and agree upon what goals to prioritize across all levels of your organization. Your goals should be:

- Specific, actionable, and measurable. Do not just decide to increase fundraising revenue, or plan to retain more donors. Set numeric benchmarks and timelines, and decide how you will tackle these goals.

- Evaluated against metrics. You cannot accurately assess your progress towards achieving a goal without having metrics in place to track your success. Diligently monitor consistent metrics so you can see how well you are improving and when you need to make changes to your fundraising plan.

( Bonus tip! Be sure to collect valuable data when carrying out your fundraising plan to help evaluate these metrics and shape your future fundraising plans. Check out Fundly’s guide to nonprofit CRMs for an idea of how your nonprofit can maximize the power of your donor database to improve your fundraising strategy.)

Additionally, one way to help your nonprofit stay on track is to identify upfront what potential challenges or obstacles you will face in the process of achieving your goals.

Some obstacles you might encounter could be:

- Seasonal fundraising dry spells

- Low donor retention

- Failure to obtain major gifts

- Poor fundraising event attendance

- Inadequate online engagement

For example, an animal shelter that wants to increase donor retention by X% over the summer months might identify the challenge of supporters being less engaged during this season since they may be traveling or caring for children on summer vacation. To reach their goal, they’ll need to recognize this challenge and develop strategies to overcome it.

Remember: Use your nonprofit’s history to guide you in identifying roadblocks and deciding on goals. Every nonprofit has its unique strengths and weaknesses and when designing a fundraising plan, it is important to know going in what is reasonable to expect from your organization.

3. Set a fundraising plan timeline.

Staying on top of your goals also means staying on top of your fundraising plan’s timeline.

Fundraising plans typically plot out a 3-5 year timeline for your nonprofit, with the first year being very detailed and the following years becoming less defined.

Your fundraising plan’s timeline should be developed into an annual fundraising calendar that details the year’s worth of activities for your organization.

When developing your timeline, keep a few things in mind:

- Milestones. Structure your timeline around a set of core milestones. These will both guide your progress and help you regularly assess your fundraising strategy.

- Accountability. Your timeline (and subsequently, your fundraising calendar) should clearly identify what departments are responsible for individual fundraising activities. This will help keep the different arms of your nonprofit on track and help your departments prioritize tasks throughout the year.

- Accessibility. Your timeline and calendar should be easily accessible to all members of your team, regardless of their department or role. Every team member should be aware of what other departments are up to; this way, they will have a better sense of the big picture of your organization and how your core fundraising goals are being achieved.

Not sure where to start when designing your fundraising plan timeline? Consider enlisting the help of a fundraising consulting firm. If you need a recommendation, DonorSearch has got you covered with their list of the top 11 fundraising consulting firms in the field!

Remember: During the design process, your fundraising timeline should be as specific as possible and you should hold yourself to the timeline as much as you can. However, if you find you are not progressing as quickly as you had planned, identify the roadblock and always give yourself room to edit the timeline if necessary.

4. Determine your fundraising methods.

A common thread among these tips has been specificity and when plotting out your fundraising plan, it is doubly important to specifically determine your fundraising methods.

It is not sufficient to simply say you will raise $XXX by such-and-such date. You need to plan out how you will raise that money and from whom you will solicit donations.

Fundraising is not a one size fits all process, and you should curate your fundraising methods with your prospects in mind. For example, consider these fundraising methods and how they serve prospects:

- Online donation pages. If your donors cannot all come to you, meet them where they are. Online donation is simply convenient; for nonprofits interested in prospects in varying geographical locations, utilizing optimized online donation tools is a must.