The marketplace for case solutions.

Emirates Airline: Connecting the Unconnected – Case Solution

The case study describes the story of Emirates Airline, which was founded in 1985 and belonged among the three largest commercial airlines by 2013. The case details the business strategy, how Emirates' chooses new routes, technology, and equipment and manages its human resources, marketing and branding, and government relationships, which form an internally consistent strategy, which capitalizes on opportunities across geographic markets. However, will Emirates' strategy be sustainable facing increasing technical and political challenges to expand and new competition from the Middle East?

Juan Alcacer, John Clayton Harvard Business School ( 714432-PDF-ENG ) Jan 29, 2014

Case questions answered:

Case study questions answered in the first solution:

- In an industry where profitable firms are scarce, Emirates Airline has delivered solid growth and solid financial performance for years. Why? What is behind the Emirates’ success? (Think in terms of their resources/capabilities as well as their strategic decisions.)

- Who should Emirates be afraid of the most in terms of competitors? Why?

- Is Emirates’ strategy sustainable? Why? Imagine that you were the replacement for Tim Clark. What would you change?

Case study questions answered in the second solution:

- In an industry where profitable companies are scarce, Emirates Airlines has provided solid growth and profitability for years. Why? What is behind their success? Describe their global strategy.

- What is the role of Dubai in Emirates’ success?

- Is Emirates’ strategy sustainable?

- Make recommendations for future growth, including any control or implementation considerations.

Not the questions you were looking for? Submit your own questions & get answers .

Emirates Airline: Connecting the Unconnected Case Answers

You will receive access to two case study solutions! The second is not yet visible in the preview.

Question 1: In an industry where profitable firms are scarce, Emirates Airline has delivered solid growth and solid financial performance for years. Why? What is behind the Emirates’ success? (Think in terms of their resources/capabilities as well as their strategic decisions.)

Emirates Airline, one of the fastest-growing airlines globally, has delivered solid growth and financial performance for years. This solid growth roots in resilient business and leadership strategies.

First of all, Emirates focused on its customer service. By differentiating itself from all the major competitors in this industry, Emirates was able to build value for its brand, retain its customers, and build on its customers’ loyalty.

What helped Emirates Airline realize at a very early stage its location as a strategic advantage? Dubai’s location offered Emirates an economic advantage. Moreover, Dubai’s low operational costs have helped Emirates manage its business model well, given the low wages of workers.

Secondly, Emirates has leveraged its brand value through an advertisement campaign focused on attracting one of the biggest football teams, Real Madrid. By targeting Real Madrid fans as a customer segment, Emirates enhanced its customer base and built on its customer loyalty.

Emirates integrates its business strategy to include two main metrics. First, the business model and how to become more profitable, and second, its operational effectiveness.

First, the Emirate’s business model focused on the major metrics that generate profits. Emirates is viewed as a global airline and the carrier choice in the Middle East region and even beyond. Emirates also focused on promoting Dubai as a technological hub, well-advanced and safe.

Also, Emirates focused on building a reputation around its brand globally by mainly focusing on maintaining high safety standards, integral in this aviation industry and service levels.

Second, the operational integration strategy of Emirates Airline focused on targeting global-level activities that would positively impact Emirates’ overall business strategy. For example, Emirates, in this category, focused on building sales channels globally, building a global marketing program that targets certain customer segments, and managing its crew by hiring a high-skilled crew to overcome language and cultural barriers.

Third, Emirates invested in its technology to enhance its global presence. Emirates invested in its website to offer its content in 13 different languages. This helped Emirates reach out to its customers on a global scale.

Emirates also realized the potential benefit of investing in Boeing and Airbus airplane models. Although the initial investment was high, Emirates could gain a competitive advantage from this investment and is remarkably known as the first Airline to have Boeing and Airbus-connected flights to South Asia.

Internal Factors that aided in the success and sustainability of Fly Emirates:

Geographic location:

The MENA region is generally unstable in recent years, but the UAE is unique. Emirates succeeded in distinguishing itself as a strong independent country, politically and economically. Passengers are willing to travel to certain geographic locations, and they feel safe flying Emirates Airline. Dubai has significantly increased the number of passengers by covering the entire region, and they motivated them by eliminating visa requirements for many countries and making it easier for others.

Far from the rain, snow, or storms, Dubai has relatively good weather. Hence, there are fewer factors that cause delays, like European and American airspaces.

Human resources:

Emirates employs more than 60,000 workers. It developed effective training procedures for new employees and ensured that the old and new employees adhered to the company rules, ethics, and policies. Emirates implied the Corporate and Social Responsibility program to maintain a competitive edge in the global market. As a result, every member is valued in the company as an important asset and rewarded them with excellent benefits and a generous salary.

Emirates Airline provides attractive annual leave, education allowance, accident insurance, medical provisions, and other benefits where the employee feels both comfortable and safe.

Moreover, Emirates is committed to equal employment opportunities regardless of race, ancestry, color, religion, national origin, sex, sexual orientation, age, marital status, or citizenship. Consequently, the employees will contribute to making the company reach its annual goal of profit.

Entertainment system:

Emirates was the first airline in the world to implement the…

Unlock Case Solution Now!

Get instant access to this case solution with a simple, one-time payment ($24.90).

After purchase:

- You'll be redirected to the full case solution.

- You will receive an access link to the solution via email.

Best decision to get my homework done faster! Michael MBA student, Boston

How do I get access?

Upon purchase, you are forwarded to the full solution and also receive access via email.

Is it safe to pay?

Yes! We use Paypal and Stripe as our secure payment providers of choice.

What is Casehero?

We are the marketplace for case solutions - created by students, for students.

Provide details on what you need help with along with a budget and time limit. Questions are posted anonymously and can be made 100% private.

Studypool matches you to the best tutor to help you with your question. Our tutors are highly qualified and vetted.

Your matched tutor provides personalized help according to your question details. Payment is made only after you have completed your 1-on-1 session and are satisfied with your session.

- Homework Q&A

- Become a Tutor

All Subjects

Mathematics

Programming

Health & Medical

Engineering

Computer Science

Foreign Languages

Access over 20 million homework & study documents

Case study: the emirates group, 2014..

Sign up to view the full document!

24/7 Homework Help

Stuck on a homework question? Our verified tutors can answer all questions, from basic math to advanced rocket science !

Similar Documents

working on a homework question?

Studypool is powered by Microtutoring TM

Copyright © 2024. Studypool Inc.

Studypool is not sponsored or endorsed by any college or university.

Ongoing Conversations

Access over 20 million homework documents through the notebank

Get on-demand Q&A homework help from verified tutors

Read 1000s of rich book guides covering popular titles

Sign up with Google

Sign up with Facebook

Already have an account? Login

Login with Google

Login with Facebook

Don't have an account? Sign Up

Emirates Case Study: Strategy, External Environment, and Competitive Forces

Added on 2023-01-23

About this Document

End of preview

Want to access all the pages? Upload your documents or become a member.

Emirates Airline: A Case Study on External and Internal Factors lg ...

Nintendo case study: strategy, value chain, and competitive advantage lg ....

Emirates Internal and External Environment Report (Assessment)

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

SWOT analysis

Emirates Airline Company (mostly referred just as Emirates), is a Dubai-based company in the aviation industry. The company is performing relatively well despite its short existence.

The company recorded its first freight on October 25, 1985. In the first quarter of 2010, despite effects of 2008 Global financial crisis, the company’s profits increased four folds to reach a record USD 925 million (Emirates Airline Company Corporate Website, 2010). This paper evaluates internal and external environments of the company (SWOT and Porters five forces respectively).

SWOT analysis is an evaluation of strengths, weaknesses, opportunities and threats that a company has.

The company has strong brand name and boosts as the national carrier of Dubai. It has over 100 destinations; it has an experienced crew team who have a remarkable customer service. According to March 2010 letter to shareholders, the company had 36,652 employees of different nationalities.

The company has embarked on having modern technology and equipments. The management of the company led by Sheikh Ahmed Al Maktoum, the Chief Executive Officer, is well experienced and makes strategic and timely decisions to remain competitive. The company have innovated in-flight entertainment and communication systems, which has made it a pacesetter in the industry (Emirates Airline Company Corporate Website, 2010).

A company always have some internal weaknesses that limit its level of growth. In most cases, it is something that can be dealt with if internal processes are effectively looked into. Recently, the company was gotten off-guard by the new development of low cost planes. This proves a deficit in its research and development team; it has not been very robust.

Another weakness that can be seen in the company is its human resources retention policy; there is a high staff turnover to the disadvantage of the company.

Opportunity

One opportunity that the company is having is globalisation; the world is becoming a global village. For this, transport and communication networks are having an increased demand. The company being a player in the industry is likely to enjoy high demand of its services so, when strategic decisions and alliances are made, then the company can tap in the market effectively. Another opportunity that faces the company is an increase in international trade. Demand for cargo and passenger transport is on the rise.

The company is facing an increasing competition from other players in the Gulf region such as Abu Dhabi-based Etihad and Doha-based Qatar Airways. There has also been an influx of low cost planes, which have affected the prices in the company; they include Air Arabia and Fly-Dubai. Other than competition, the company is facing unfair business operation with the recent move being a move by Canadian government and two UAE airlines to deny the company landing rights to Canadian three major cities; Toronto, Vancouver and Calgary.

Some European countries like Germany have been concerned about the company’s pricing, routes and landing rights. The world security situation poses a danger to the airline industry; more people are shying off from using planes, as they are not aware of the security threats that await them.

Cases of air rage are on the rise making people to fear using air transport for short distances. For example, September 9 th terrorists attack in the United States, SARS epidemic in Asia, and the spread of H1N1 flu virus in 2009. The world financial crisis has affected trade in the world and Emirates is not spared either (Hitt, Hoskisson & Ireland, 2003).

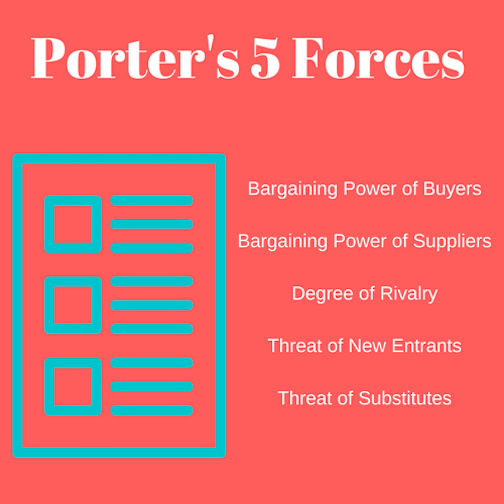

Porter’s five forces

In 1985, Porter came up with five forces that affect a business. The forces can be used to gauge a company’s competitiveness and its market position. Emirates has been a leader in airline industry, it the national carrier of Dubai, its fives forces are:

Supplier’s power

Emirates depend on different suppliers for various goods and services. Some of these services may be licences and permits offered by different countries allowing the company to land on its airports. The world has embarked on “open air” policy were access to different destination has been facilitated by the use of designated routes.

For the supply of normal operational materials like fuel, uniforms and outsourced services, the company has maintained good relations with its suppliers. It has an integrated supply chain management, which ensures there are commodities when needed.

The main problem that the company is having is entry in some “green” destinations and some European countries. For instance, it has been denied access for political and ideological reasons. One such place is in London Heathrow and Paris Charles de Galle airports, where the company was given second-class degree airports. This limits the company’s growth and operations.

Barrier to entry

Every industry has some barriers to entry that affect a new company negatively. It may be trade secrets, operational costs involved or economies of scale. Emirates has been denied access to some destinations, like in Germany and some countries like Canada has limited the destinations it can land.

This affects the company’s operations negatively. The emergence of low cost planes has created a barrier to entry of domestic market in some countries like the United States of America. This has reduced the competitiveness of the company in such areas.

Threats of substitutes

The aviation industry has high competition and customers have a variety of choices to choose. There are prestigious planes companies that the company has to compete with; the model of the Emirates planes allow for first class, business class and economy on the same plane. However, there are companies offering these classes in individual planes. This gives them a better choice. The industry is facing intensive competition from the entry of low cost planes; they have affected domestic transport more than international transport.

Buyers’ power

Customers are the backbone of a company; the airline industry customers are rational thus they choose a carrier that suits them. This has created some price wars among airline companies a move that have led to reduced business at Emirates.

The airline industry is highly competitive and a small deficiency in a company can led to the company’s failure. Some factors are beyond the control of a company but they affect it negatively. Such factors include world economic performance and technological developments (Hitt, Hoskisson & Ireland, 2003).

Emirate Airline Company is the national carrier of Dubai; it has more than 100 destinations. The success of the company is vested in its experienced management and employees, who make timely strategic decisions. However, the company global growth is affected by world’s economic and political situations and developments in the airline industry. To remain competitive, the company has rolled out a 5-10 operational growth addressing issues that have limited its operations.

Emirates Airline Company Corporate Website. (2010). Emirates. Retrieved from https://www.emirates.com/english/ .

Hitt, M., Hoskisson, R., & Ireland, K.(2003). Strategic Management: Competitiveness and Globalization . South Western: Thomson Learning.

- Operations Management Practices of Emirates Airline

- The Perception of an Airport and Airport Experience

- Emirates Airlines

- Case Analysis for Land’s End

- Integrated Marketing Communication (IMC) and Customer Satisfaction Strategy

- LECO Company Strategic Vision

- KPN and NTT DoCoMo: Business Modeling

- Customer Value: e-Bay

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2018, July 23). Emirates Internal and External Environment. https://ivypanda.com/essays/emirates-case-study/

"Emirates Internal and External Environment." IvyPanda , 23 July 2018, ivypanda.com/essays/emirates-case-study/.

IvyPanda . (2018) 'Emirates Internal and External Environment'. 23 July.

IvyPanda . 2018. "Emirates Internal and External Environment." July 23, 2018. https://ivypanda.com/essays/emirates-case-study/.

1. IvyPanda . "Emirates Internal and External Environment." July 23, 2018. https://ivypanda.com/essays/emirates-case-study/.

Bibliography

IvyPanda . "Emirates Internal and External Environment." July 23, 2018. https://ivypanda.com/essays/emirates-case-study/.

Emirates Airlines

- Harvard Case Studies

Harvard Business Case Studies Solutions – Assignment Help

In most courses studied at Harvard Business schools, students are provided with a case study. Major HBR cases concerns on a whole industry, a whole organization or some part of organization; profitable or non-profitable organizations. Student’s role is to analyze the case and diagnose the situation, identify the problem and then give appropriate recommendations and steps to be taken.

To make a detailed case analysis, student should follow these steps:

STEP 1: Reading Up Harvard Case Study Method Guide:

Case study method guide is provided to students which determine the aspects of problem needed to be considered while analyzing a case study. It is very important to have a thorough reading and understanding of guidelines provided. However, poor guide reading will lead to misunderstanding of case and failure of analyses. It is recommended to read guidelines before and after reading the case to understand what is asked and how the questions are to be answered. Therefore, in-depth understanding f case guidelines is very important.

Harvard Case Study Solutions

STEP 2: Reading The Emirates Airlines Harvard Case Study:

To have a complete understanding of the case, one should focus on case reading. It is said that case should be read two times. Initially, fast reading without taking notes and underlines should be done. Initial reading is to get a rough idea of what information is provided for the analyses. Then, a very careful reading should be done at second time reading of the case. This time, highlighting the important point and mark the necessary information provided in the case. In addition, the quantitative data in case, and its relations with other quantitative or qualitative variables should be given more importance. Also, manipulating different data and combining with other information available will give a new insight. However, all of the information provided is not reliable and relevant.

When having a fast reading, following points should be noted:

- Nature of organization

- Nature if industry in which organization operates.

- External environment that is effecting organization

- Problems being faced by management

- Identification of communication strategies.

- Any relevant strategy that can be added.

- Control and out-of-control situations.

When reading the case for second time, following points should be considered:

- Decisions needed to be made and the responsible Person to make decision.

- Objectives of the organization and key players in this case.

- The compatibility of objectives. if not, their reconciliations and necessary redefinition.

- Sources and constraints of organization from meeting its objectives.

After reading the case and guidelines thoroughly, reader should go forward and start the analyses of the case.

STEP 3: Doing The Case Analysis Of Emirates Airlines:

To make an appropriate case analyses, firstly, reader should mark the important problems that are happening in the organization. There may be multiple problems that can be faced by any organization. Secondly, after identifying problems in the company, identify the most concerned and important problem that needed to be focused.

Firstly, the introduction is written. After having a clear idea of what is defined in the case, we deliver it to the reader. It is better to start the introduction from any historical or social context. The challenging diagnosis for Emirates Airlines and the management of information is needed to be provided. However, introduction should not be longer than 6-7 lines in a paragraph. As the most important objective is to convey the most important message for to the reader.

After introduction, problem statement is defined. In the problem statement, the company’s most important problem and constraints to solve these problems should be define clearly. However, the problem should be concisely define in no more than a paragraph. After defining the problems and constraints, analysis of the case study is begin.

STEP 4: SWOT Analysis of the Emirates Airlines HBR Case Solution:

SWOT analysis helps the business to identify its strengths and weaknesses, as well as understanding of opportunity that can be availed and the threat that the company is facing. SWOT for Emirates Airlines is a powerful tool of analysis as it provide a thought to uncover and exploit the opportunities that can be used to increase and enhance company’s operations. In addition, it also identifies the weaknesses of the organization that will help to be eliminated and manage the threats that would catch the attention of the management.

This strategy helps the company to make any strategy that would differentiate the company from competitors, so that the organization can compete successfully in the industry. The strengths and weaknesses are obtained from internal organization. Whereas, the opportunities and threats are generally related from external environment of organization. Moreover, it is also called Internal-External Analysis.

In the strengths, management should identify the following points exists in the organization:

- Advantages of the organization

- Activities of the company better than competitors.

- Unique resources and low cost resources company have.

- Activities and resources market sees as the company’s strength.

- Unique selling proposition of the company.

WEAKNESSES:

- Improvement that could be done.

- Activities that can be avoided for Emirates Airlines.

- Activities that can be determined as your weakness in the market.

- Factors that can reduce the sales.

- Competitor’s activities that can be seen as your weakness.

OPPORTUNITIES:

- Good opportunities that can be spotted.

- Interesting trends of industry.

- Change in technology and market strategies

- Government policy changes that is related to the company’s field

- Changes in social patterns and lifestyles.

- Local events.

Following points can be identified as a threat to company:

- Company’s facing obstacles.

- Activities of competitors.

- Product and services quality standards

- Threat from changing technologies

- Financial/cash flow problems

- Weakness that threaten the business.

Following points should be considered when applying SWOT to the analysis:

- Precise and verifiable phrases should be sued.

- Prioritize the points under each head, so that management can identify which step has to be taken first.

- Apply the analyses at proposed level. Clear yourself first that on what basis you have to apply SWOT matrix.

- Make sure that points identified should carry itself with strategy formulation process.

- Use particular terms (like USP, Core Competencies Analyses etc.) to get a comprehensive picture of analyses.

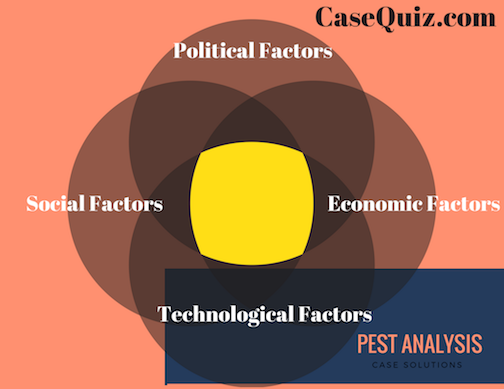

STEP 5: PESTEL/ PEST Analysis of Emirates Airlines Case Solution:

Pest analyses is a widely used tool to analyze the Political, Economic, Socio-cultural, Technological, Environmental and legal situations which can provide great and new opportunities to the company as well as these factors can also threat the company, to be dangerous in future.

Pest analysis is very important and informative. It is used for the purpose of identifying business opportunities and advance threat warning. Moreover, it also helps to the extent to which change is useful for the company and also guide the direction for the change. In addition, it also helps to avoid activities and actions that will be harmful for the company in future, including projects and strategies.

To analyze the business objective and its opportunities and threats, following steps should be followed:

- Brainstorm and assumption the changes that should be made to organization. Answer the necessary questions that are related to specific needs of organization

- Analyze the opportunities that would be happen due to the change.

- Analyze the threats and issues that would be caused due to change.

- Perform cost benefit analyses and take the appropriate action.

Pest analysis

PEST FACTORS:

- Next political elections and changes that will happen in the country due to these elections

- Strong and powerful political person, his point of view on business policies and their effect on the organization.

- Strength of property rights and law rules. And its ratio with corruption and organized crimes. Changes in these situation and its effects.

- Change in Legislation and taxation effects on the company

- Trend of regulations and deregulations. Effects of change in business regulations

- Timescale of legislative change.

- Other political factors likely to change for Emirates Airlines.

ECONOMICAL:

- Position and current economy trend i.e. growing, stagnant or declining.

- Exchange rates fluctuations and its relation with company.

- Change in Level of customer’s disposable income and its effect.

- Fluctuation in unemployment rate and its effect on hiring of skilled employees

- Access to credit and loans. And its effects on company

- Effect of globalization on economic environment

- Considerations on other economic factors

SOCIO-CULTURAL:

- Change in population growth rate and age factors, and its impacts on organization.

- Effect on organization due to Change in attitudes and generational shifts.

- Standards of health, education and social mobility levels. Its changes and effects on company.

- Employment patterns, job market trend and attitude towards work according to different age groups.

- Social attitudes and social trends, change in socio culture an dits effects.

- Religious believers and life styles and its effects on organization

- Other socio culture factors and its impacts.

TECHNOLOGICAL:

- Any new technology that company is using

- Any new technology in market that could affect the work, organization or industry

- Access of competitors to the new technologies and its impact on their product development/better services.

- Research areas of government and education institutes in which the company can make any efforts

- Changes in infra-structure and its effects on work flow

- Existing technology that can facilitate the company

- Other technological factors and their impacts on company and industry

These headings and analyses would help the company to consider these factors and make a “big picture” of company’s characteristics. This will help the manager to take the decision and drawing conclusion about the forces that would create a big impact on company and its resources.

STEP 6: Porter’s Five Forces/ Strategic Analysis Of The Emirates Airlines Case Study:

To analyze the structure of a company and its corporate strategy, Porter’s five forces model is used. In this model, five forces have been identified which play an important part in shaping the market and industry. These forces are used to measure competition intensity and profitability of an industry and market.

porter’s five forces model

These forces refers to micro environment and the company ability to serve its customers and make a profit. These five forces includes three forces from horizontal competition and two forces from vertical competition. The five forces are discussed below:

- THREAT OF NEW ENTRANTS:

- as the industry have high profits, many new entrants will try to enter into the market. However, the new entrants will eventually cause decrease in overall industry profits. Therefore, it is necessary to block the new entrants in the industry. following factors is describing the level of threat to new entrants:

- Barriers to entry that includes copy rights and patents.

- High capital requirement

- Government restricted policies

- Switching cost

- Access to suppliers and distributions

- Customer loyalty to established brands.

- THREAT OF SUBSTITUTES:

- this describes the threat to company. If the goods and services are not up to the standard, consumers can use substitutes and alternatives that do not need any extra effort and do not make a major difference. For example, using Aquafina in substitution of tap water, Pepsi in alternative of Coca Cola. The potential factors that made customer shift to substitutes are as follows:

- Price performance of substitute

- Switching costs of buyer

- Products substitute available in the market

- Reduction of quality

- Close substitution are available

- DEGREE OF INDUSTRY RIVALRY:

- the lesser money and resources are required to enter into any industry, the higher there will be new competitors and be an effective competitor. It will also weaken the company’s position. Following are the potential factors that will influence the company’s competition:

- Competitive advantage

- Continuous innovation

- Sustainable position in competitive advantage

- Level of advertising

- Competitive strategy

- BARGAINING POWER OF BUYERS:

- it deals with the ability of customers to take down the prices. It mainly consists the importance of a customer and the level of cost if a customer will switch from one product to another. The buyer power is high if there are too many alternatives available. And the buyer power is low if there are lesser options of alternatives and switching. Following factors will influence the buying power of customers:

- Bargaining leverage

- Switching cost of a buyer

- Buyer price sensitivity

- Competitive advantage of company’s product

- BARGAINING POWER OF SUPPLIERS:

- this refers to the supplier’s ability of increasing and decreasing prices. If there are few alternatives o supplier available, this will threat the company and it would have to purchase its raw material in supplier’s terms. However, if there are many suppliers alternative, suppliers have low bargaining power and company do not have to face high switching cost. The potential factors that effects bargaining power of suppliers are the following:

- Input differentiation

- Impact of cost on differentiation

- Strength of distribution centers

- Input substitute’s availability.

STEP 7: VRIO Analysis of Emirates Airlines:

Vrio analysis for Emirates Airlines case study identified the four main attributes which helps the organization to gain a competitive advantages. The author of this theory suggests that firm must be valuable, rare, imperfectly imitable and perfectly non sustainable. Therefore there must be some resources and capabilities in an organization that can facilitate the competitive advantage to company. The four components of VRIO analysis are described below: VALUABLE: the company must have some resources or strategies that can exploit opportunities and defend the company from major threats. If the company holds some value then answer is yes. Resources are also valuable if they provide customer satisfaction and increase customer value. This value may create by increasing differentiation in existing product or decrease its price. Is these conditions are not met, company may lead to competitive disadvantage. Therefore, it is necessary to continually review the Emirates Airlines company’s activities and resources values. RARE: the resources of the Emirates Airlines company that are not used by any other company are known as rare. Rare and valuable resources grant much competitive advantages to the firm. However, when more than one few companies uses the same resources and provide competitive parity are also known as rare resources. Even, the competitive parity is not desired position, but the company should not lose its valuable resources, even they are common. COSTLY TO IMITATE: the resources are costly to imitate, if other organizations cannot imitate it. However, imitation is done in two ways. One is duplicating that is direct imitation and the other one is substituting that is indirect imitation. Any firm who has valuable and rare resources, and these resources are costly to imitate, have achieved their competitive advantage. However, resources should also be perfectly non sustainable. The reasons that resource imitation is costly are historical conditions, casual ambiguity and social complexity. ORGANIZED TO CAPTURE VALUE: resources, itself, cannot provide advantages to organization until it is organized and exploit to do so. A firm (like Emirates Airlines) must organize its management systems, processes, policies and strategies to fully utilize the resource’s potential to be valuable, rare and costly to imitate.

STEP 8: Generating Alternatives For Emirates Airlines Case Solution:

After completing the analyses of the company, its opportunities and threats, it is important to generate a solution of the problem and the alternatives a company can apply in order to solve its problems. To generate the alternative of problem, following things must to be kept in mind:

- Realistic solution should be identified that can be operated in the company, with all its constraints and opportunities.

- as the problem and its solution cannot occur at the same time, it should be described as mutually exclusive

- it is not possible for a company to not to take any action, therefore, the alternative of doing nothing is not viable.

- Student should provide more than one decent solution. Providing two undesirable alternatives to make the other one attractive is not acceptable.

Once the alternatives have been generated, student should evaluate the options and select the appropriate and viable solution for the company.

STEP 9: Selection Of Alternatives For Emirates Airlines Case Solution:

It is very important to select the alternatives and then evaluate the best one as the company have limited choices and constraints. Therefore to select the best alternative, there are many factors that is needed to be kept in mind. The criteria’s on which business decisions are to be selected areas under:

- Improve profitability

- Increase sales, market shares, return on investments

- Customer satisfaction

- Brand image

- Corporate mission, vision and strategy

- Resources and capabilities

Alternatives should be measures that which alternative will perform better than other one and the valid reasons. In addition, alternatives should be related to the problem statements and issues described in the case study.

STEP 10: Evaluation Of Alternatives For Emirates Airlines Case Solution:

If the selected alternative is fulfilling the above criteria, the decision should be taken straightforwardly. Best alternative should be selected must be the best when evaluating it on the decision criteria. Another method used to evaluate the alternatives are the list of pros and cons of each alternative and one who has more pros than cons and can be workable under organizational constraints.

STEP 11: Recommendations For Emirates Airlines Case Study (Solution):

There should be only one recommendation to enhance the company’s operations and its growth or solving its problems. The decision that is being taken should be justified and viable for solving the problems.

- Order Status

- Testimonials

- What Makes Us Different

Emirates Airline Harvard Case Solution & Analysis

Home >> Economics Case Solutions >> Emirates Airline

Introduction

Emirates was established 25 years ago and grew to become the third largest global airline. In 1985, the Dubai government established the Airline with just two aircraft. Emirates is famous for its services globally. Emirates is famous for having employees from different nationalities and also excellent services from its staff. There were around 23 routes added in the year 2012 and 2013. The capacity growth was expected to grow by 18.4% in the year 2013. It was made possible by the deliveries of aircrafts which included the Airbus A380 flying to over 20 destinations. With the increasing demands of the aviation industries and the customers, Emirates cope with the challenges via its best fleet of the aircrafts. Recently Emirates integrated 41 A380s into its fleet, whereas, another 99 were scheduled to be included in the fleet of Emirates in the upcoming years.

In 1980’s the Middle East region was dominated by the Gulf Air. There was a regional carrier at that time which was being supported by different States like Bahrain, Oman, Qatar and the emirates of Abu Dhabi. The European carriers dominated the region whereas, the market was small and Gulf Air had a good market share in the Middle East. The leader of Dubai felt the need of new airline when Dubai faced allegations by Air Service in 1985. The experience of local airline was very minimal and they required sources for increasing the aid in services due to low experience.

Emirates Airlines is one of the fastest growing airlines and also considered to be the fifth most profitable airline in the world. It has been growing with a blinding pace and it grew by more than 20% since the last 17 years. The profit of Emirates was above $10 billion in the year 2013. If we look at the profits trend from 2010 to 2013, the profit in 2010 was very high and it was estimated to be around $19 billion, but in 2011 the profits seemed to decline and it was around $10 billion. Similarly, the same happened in 2012.

Case Analysis

Pest analysis of emirates airline.

PEST analysis is very important for identifying the macro-environmental factors and for improving the performance of the company.

The political factor is very important for any company and the performance of the company depends on the political factor. The political situation influences the aviation industry. Hence, the political factor is important and it should not be ignored. The airline industry is normally affected by the political situations such as wars and terrorism. The terrorist activities in the world normally causes the airline industry to set back and face many problems. The terrorism activities like USA (11 September), UK, Qatar, Syria and Lebanon made the regions unattractive for the tourists and travelers. Thus, this resulted in the reduction of the passenger traffic. Which is not good for the airline industries.

The instability in the political affects the airline business and hence the different unstable activities affected the business activities between airlines in the Middle East and the world and facing difficulty in joining the international joint ventures with the airlines such as American Airlines and others.

The economic factor is very important for success of any airline. For successful business in the airline industry the airline should be supported with the latest and modern airports. The airports which meet the customer’s requirements. For instance, UAE is taking initiatives for developing the airports in Abu Dhabi and Dubai. UAE invested around DH 71 billion in the extension and development of its airports over the coming 20 years.

The reason behind developing the airports is that the development enhances the economy, being independent on the oil revenues and switching more towards tourism. The UAE has recently developed itself for increasing the development in Dubai and Abu Dhabi. This is for the reason to increase the tourism in UAE and business ventures with international companies. Furthermore, the increase in tourism means an increase in passengers from the airlines.

The number of tourists, the world population and educated people are some of the major social factors. The population is increasing globally, the population of UAE is estimated to be 3,754,000 people in 2002 and it was increased to 4,320,000 in 2004........................

Emirates Airline Case Study Solution Commentary

This is a case study analysis on Emirates Airline and how it can benefit the UAE. This article will help you get an idea of what is involved with Dubai and other Dubai emirates. There are three different levels of analysis which need to be analyzed and understood; The Level of the Case Study, the Level of the Presenter and the Third Level of Analysis which is to understand the Mentality of the Case Study Analysis.

In the first level of analysis, there is The Case Study. The Case Study has a very definite nature and outcome, which can be dependent on the viewers thinking. The Results of this Case Study Analysis can also have a direct affect on the UAE leadership as it is a persuasive case study.

In the second level of analysis, there is the Level of the Presenter. At this level, the presenter, i.e. the Emirati citizens present at the conference, is the actual presenter. The content of the presentation can only be influenced by the audience opinion.

The third and final analysis is the Mentality of the Case Study. As we all know that this case study depends on the Mentality of the presenter. He can either push or pull the audience towards one of two options or they can actually support the presenter's claims in the case study.

Here are some of the insights from the Case Study Analysis of Emirates Airline. The results of the Case Study Analysis on Emirates Airline can be to some extent dependent on the general outlook of the audience. Emirates Airline has been involved in more than 1000 successful operations and it is also connected to a number of international airports.

The Case Study Analysis on Emirates Airline did a better job when the UAE Airline management were consulted for the case study. The CEO of Emirates Airline has a very good reputation and he is in a position to persuade the audience as well as present his claims. Emirates Airline is also connected to a number of international airports.

In the case study on Emirates Airline, the Case Study Analysis of PESTLE Analysis. This will benefit the future of the organization in a big way. This can also provide the audience with a stronger analytical capability that can help them to give a better insight in the data provided.

Another case study analysis on Emirates Airline on the Level of the Presenter. Again the presenter is the presenter and he can influence the audience directly. However, the Mentality of the case study will depend on the audience's opinion.

This analysis was done on the Level of the Case Study and here we can clearly understand that the Case Study provides an excellent opportunity for the audience to get a clear understanding of the approach. This case study also provides the audience with a strong analytical capability that will help them to give a better insight in the data provided. In this case study, the Mentality of the Case Study is to provide the audience with an analysis and understanding on both the front sides.

In conclusion, here are some of the insights from the Case Study Analysis of Emirates Airline. We can clearly understand that the Level of the Case Study is to provide an understanding of the approach that can give the audience with an analysis and understanding on both the front sides.

This analysis will also provide the audience with a clear understanding of the approach that can help them to give a better insight in the data provided. If the audience has a strong analytical capability and they are willing to make a difference by providing a better insight in the data provided, then they can also gain the benefits of the PESTLE Analysis.

Emirates Airline is a strategic partner of Airlines Alliance. It is the second largest airline in the world and it is a symbol of the rising power of the Emirates Airlines. This case study analysis is a valuable lesson in how to help the audience in making a difference.

Emirates Airline Case Analysis

As a passenger of Emirates Airline, you will want to understand all of the factors that affect your life. A good way to start is by reading the Emirates Airline Case Solution. This case study analyzes what causes issues and challenges for travelers traveling on Emirates Airline flights.

In this case study, you will learn the four key aspects of a PESTLE ANALYSIS. These include PESTLE POSITIONS, PESTLE POSING, PESTLE POSING TOGGLE, and PESTLE TOGGLE. You will also learn how to identify an Emirates Airline problem within each of these 4 areas.

An Emirates Airline pilot, Col. Wong has designed a special PESTLE Analysis. The four areas that are analyzed in this Pilot analysis include operational aspects. These include the management of passengers' tickets, operations at the boarding gate, the operation of passenger's transfers, and the training of pilots.

Another aspect that you will learn in the Emirates Airline Case Solution is PESTLE ASYMPSIA. This includes the need to document each task to be performed. You will also learn the role of PESTLE EVIDENCE in any Emirates Airline case.

The last aspect that you will learn in the Emirates Airline Case Solution is PESTLE LOGIC. This includes the role of PESTLE EVIDENCE in defining each line of action and the use of PESTLE LOGIC in the selection process. This will help you in identifying a problem , and determining how to resolve it.

Before you begin, you should be sure that you have read the Emirates Airline Case Solution thoroughly. If you have not read it before, read it now. It will help you when you are studying this case study.

In this case study, the first thing that you will learn is that Emirates Airline management is focusing on the service they provide their customers. You will learn that they have worked very hard to become a "first class airline". This is a goal that Emirates Airline is working to achieve.

When you have finished the Emirates Airline Case Solution, you will learn how to identify problems before they become a problem. This includes the use of PESTLE EVIDENCE, PESTLE POSITIONS, PESTLE POSING, and PESTLE TOGGLE. This is another goal that Emirates Airline is working towards.

After you have completed the Emirates Airline Case Solution, you will be able to identify the reason for the issues that have been faced by Emirates Airline customers. They will discuss how they handled those problems. You will also learn how the challenges were solved, and how the issues were addressed.

In the final section of the Emirates Airline Case Solution, you will learn the problem-solving method that Emirates Airline has used to solve their problems. You will learn how Emirates Airline used a PESTLE METHODOLOGY, a PESTLE ANALYSIS, and a PESTLE TASK FRAMEWORK. These three techniques are used in order to determine how the problems were handled.

When you have finished the Emirates Airline Case Solution, you will be able to review the whole process and determine the real results. You will also learn the causes for the problems and how Emirates Airline is working to overcome them. With this information, you will be able to identify the main problem areas that are causing problems for Emirates Airline passengers, and find ways to address them.

This case study is one of many that you can study to become an Emirates Airline consultant. This is a comprehensive guide to help you understand the basic concepts used in this case study.

Emirates Airline SWOT Analysis

The SWOT Analysis by a leading international aviation consultant and expert of aviation cases will create a unique and colorful background for your Emirates Airline Case Study. The SWOT analysis can be used to attract business on the Emirates airline, which in turn can help you gain a leading position in the world.

Another key strategy to consider in your Emirates Airline Case Study is the event that has triggered the increasing customer acceptance of Emirates. Emirates' long-standing relationship with Qatar Airlines will show up on your SWOT analysis. This might also mean that Emirates is facing a critical problem in the future and therefore needs to conduct research and find out more about the customer relations and customer sentiments towards Emirates airline.

Another avenue to consider in your Emirates Airline Case Study is the airline's ongoing maintenance activities. The reason why most airlines find it easier to improve their fleet maintenance and hire new personnel instead of improving the current level of service provided is that the airline has a substantial amount of customer satisfaction. Hence the airline has to continuously work towards increasing their level of customer satisfaction.

The third element that must be taken into consideration in your Emirates Airline Case Study is the airline's marketing strategy. It can be a bit hard to assess the success of Emirates marketing strategy because all that is done is to have the right messages that are relevant to the target market. Emirates marketing strategy is definitely not getting new customers in mind and instead just spreading the word about Emirates.

One of the best tools that you can use in your Emirates Airline Case Study is the use of an automated tool called SWOT Analysis. You can use this tool for looking at the risks and opportunities that are involved in your business model. It will then give you the exposure needed to make your business model successful.

Ifyou have found the risk level to be too high then this will be a good idea to remove the risk by conducting more tests on the product. If you can identify the risk and get rid of it then you will never be able to find a good customer. For this reason, you should always take the time to remove the risk that you see.

You can also conduct a SWOT Analysis to identify the risks associated with any new business opportunities or acquisitions by Emirates. This is also true if you are trying to change your approach by adding a new product or service.

In a proper Emirates Airline Case Study, a major feature that should be looked at is the customer satisfaction levels. A SWOT analysis will help you analyze the customer satisfaction that you should look at in your case study.

What are the customer satisfaction issues? Many people might look at customer satisfaction as a hidden risk and this risk is made up of three elements: the perception of customer dissatisfaction, the risk of customer dissatisfaction, and the business risk associated with the perceived dissatisfaction.

The first step in the prevention of customer satisfaction is by making sure that the perception of customer dissatisfaction is neutralized. To do this, you can assess your company to see what customers perceive to be their ideal travel experience. You will then be able to create a new product and style of service that will create a better customer experience.

There are many ways to increase customer satisfaction and you can hire new employees that are motivated to enhance customer satisfaction. All of this will be part of the customer satisfaction, but there is one element that is not talked about when determining a customer satisfaction rate and that is the business risk.

This is a business risk that is related to the airline's ability to make a profit and cover the risk that is involved in running a business. A SWOT analysis will make this risk simple to identify because it will show you the problem areas that are affecting your business. and it will highlight the things that you need to address to lower the business risk of running an airline business.

This is just a sample partial case solution. Please place the order on the website to order your own originally done case solution.

Related Case Solutions & Analyses:

Hire us for Originally Written Case Solution/ Analysis

Like us and get updates:.

Harvard Case Solutions

Search Case Solutions

- Accounting Case Solutions

- Auditing Case Studies

- Business Case Studies

- Economics Case Solutions

- Finance Case Studies Analysis

- Harvard Case Study Analysis Solutions

- Human Resource Cases

- Ivey Case Solutions

- Management Case Studies

- Marketing HBS Case Solutions

- Operations Management Case Studies

- Supply Chain Management Cases

- Taxation Case Studies

More From Economics Case Solutions

- Parmalat SpA: An Impressive Milking System

- William Levitt Levittown and the Creation of American Suburbia

- Random House: Shifting To E Books In A Globalized World

- Cebu Pacific Air (C)

- Global Software Industry in 2006

- International Rivers Network and the Bujagali Dam Project (A)

- Managing Supply-Demand Risk In Global Production: Creating Cost-Effective Flexible Networks

Contact us:

Check Order Status

How Does it Work?

Why TheCaseSolutions.com?

9th International Conference on Operations and Supply Chain Management, Vietnam, 2019

BUSINESS AND SUPPLY CHAIN STRATEGY OF FLYING ABOVE THE DESSERT: A CASE STUDY OF EMIRATES AIRLINES

Niyazudeen Kamarudeen University of Wollongong in Dubai , Knowledge Park, Dubai, UAE – 20183, Email: [email protected]

Balan Sundarakani University of Wollongong in Dubai, Knowledge Park, Dubai, UAE – 20183, Email: [email protected]

ABSTRACT: Emirates Airlines has been a dominant player in the Middle-East aviation industry earning enormous profits over a decade. However, the profit margin for the year 2017 has plunged lowest in the last 5 years of its service. This research investigates the rationale behind business and supply chain strategy of the organization by applying different tools during this challenging times and proposes recovery strategy from the recent financial scuffle. A case study methodology is adopted to investigate the Business and the Supply Chain Strategy of Emirates Airlines, with the research highlighting the Distinctive Capabilities of Emirates Airlines along with the Supply Chain Risks that prevails the organizations in the Aviation Industry. The findings of the research imparts the intelligence on the Business and Supply Chain Managers to optimize the internal resources & capabilities of the organization that can be imperative in creating distinctive competitive advantage and higher profit margins. Moreover, this research of investigating Emirates growth strategy internationally seems to bring value to other similar airline industry and will be of great value from managerial level to D-level executives for strategic planning process. The case study is limited to Emirates Airlines. However, the procurement risks associated with the purchase of Fuel in the aviation industry can be investigated further.

Keywords: Airlines Industry, Competitive Strategy, Business Strategy, Supply Chain Strategy

1.INTRODUCTION: Over the years, the introduction of Middle-Eastern carriers such as Emirates, Etihad and Qatar Airways has introduced major shift & modifications to the global air transport and major traffic routes. Among the major carriers of the middle-east countries, Emirates Airline stands out to be the most dominant in the region (O’Connell, 2011). Emirates Airline is a subsidiary of “ The Emirates Group ” that is owned by the Government of Dubai since its inception in 1985. From the beginning phase of its operation with two leased aircrafts, today the company has expanded gigantically into different sectors across 155 destinations in 83 countries around the globe with a total of 268 Aircrafts at an average age of just 68 months (Emirates, n.d.). Emirates airlines is one of the largest international airlines in the Middle East region and has been raked top among the airline companies in the world. Based in Dubai international airport and wholly owned by the

1 9th International Conference on Operations and Supply Chain Management, Vietnam, 2019 government of Dubai’s Investment Corporation, it operates over 3,600 flights per week from its Dubai hub. Emirates has been headquartered at a multi-million dollar facility situated in Dubai, which handles a strength of 105,000 employees at an increased rate of 11% from the previous year of its operation. Emirates Airlines is an integral part of “The Emirates Group”, which comprises more than 45 companies including Dnata , Fly Dubai, Emirates flight catering , Emirates sky cargo and Emirates Aviation University; making it one of the largest and diverse organization in the middle-east region. Apart from DNATA, Each of the other entities of Emirates Group has been given different management, strategy and goals. For example, Fly Dubai, one of the Budget Airline that is run by Emirates group has its management completely different & alienated from its primary Airline Company ‘Emirates Airline’. This strategy has assisted the group to allocate individual goals and responsibilities to each of its entities and evaluate the individual performance of the entity. Emirates Group has been one of the major contributor to the GDP of its home country, where 20% of the United Arab Emirates ’ GDP came from the Emirates Group (O’Connell, 2011). Such has been the importance of the company to both the Airline industry and the home country. In our study, we focus on the strategical operations of the Emirates Airlines in detail to develop a deeper understanding on the strategical functioning of heavily diversified companies.

1.1 Business Model

Customer Key partners: Key Activities: Customer Segments: Relationships: Boeing Airbus Aircraft maintenance Dubai International Airport First class , Business Baggage handling Ground Skywards Customer Fly Dubai, Quantas, class, Economy class , Handling Airport services Feedbacks Malaysian Airlines, Korean Individual Business Ticketing Airlines

Sales channels: Revenue Streams: Value Preposition: Cost Drivers:

Fuel Taxes Booking Apps Travel Branding Offers Staff/Labour Tickets Excess baggage Agents Airport Ticket Pricing Product Depreciation Aircraft Cargo Miscellaneous Online channels Development maintenance Airport service charges

Figure 1. Business Model of Emirates Airlines

1.2 Financial Performance: Despite political unrest in some regions and the visa restrictions from the U.S, Emirates has successfully managed to maintain profits for the record 29th year of operations. The addition of new destinations and the increased capacity of aircrafts & flight frequency has successfully contributed to the increase in number of passengers. However, in 2017, they faced decline in the profit due to increase in fuel cost, global financial crisis, slow growth of economic environment and terror threat in some regions (See figure 2). Despite the unfavorable economic factors and the deterioration of the U.A.E currency against the U.S, the company always maintained the operations to yield a

2 9th International Conference on Operations and Supply Chain Management, Vietnam, 2019 positive profit value by following a global competitive strategy of growth and constantly modernizing their fleet of aircrafts (Emirates Financial Commentary, 2017). The revenue of the company in 2017 was AED 83,739 Million, which is .3% higher than the previous year. Though the revenue due to passenger travel increased by 0.5% from the previous year, the 5% decrease in cargo revenue has significantly effected the overall revenue of the company (Emirates Annual Report, 2017).

OPERATING PROFIT OF EMIRATES AIRLINES IN AED BILLIONS

8.3 4.3 5.9 1.8 2.8 2.4

2011 - 201 2 2012 - 201 3 2013 - 201 4 2014 - 201 5 2015 - 201 6 2016 - 201 7

Figure 2. Operating Profit of Emirates Airlines

IATA has earlier forecasted that the profits of middle-east airlines in 2017 would significantly fall due to increased capacity of airlines and the limited demand growth (Cornwell, 2017). Similarly, Emirates has significantly lost 71% of the operating profit and 81% of the overall profit from 2016. In 2017, the operating profit of Emirates was AED 2.4 Billion, compared to AED 8.4 Billion in 2016. Cornwell (2017) stated that “Airlines in the Gulf benefited for years from high oil prices that spurred government spending and regional growth. But demand has softened and travel budgets have tightened after more than two years of depressed oil prices, exposure to weaker markets and currency fluctuations”.

2. THE CASE STUDY: 2.1 Emirates fleet :

Airbus A380 Boeing 777

Fleet 102 166 On order 76 173 Destinations 48 107 Cabin Crews More than 23000 More than 23500 Total passengers 99 million 226.5 million

Figure 3. Comparison of two major Aircraft models being used by Emirates Airline 3 9th International Conference on Operations and Supply Chain Management, Vietnam, 2019

At the end of 2016, Emirates has retired all their aircrafts apart from their Airbus A380 ’s and Boeing 777 from their active service including the Airbus A330 and A340. Currently they are the largest operator of both A380’s and 777’s, with several of them under order and are yet to be received. By keeping only two aircrafts in the active service fleet they are economizing their maintenance, training of crew and avoiding extra costs that comes with handling different ranges of aircrafts. The young fleet of Emirates which exhibits an average age of just 68 months are also yielding a higher fuel economy and reduced environmental pollution (Ramanujam, 2016).

2.2 Operational Strategy: Operational strategy involves incorporating set of activities that create value in the form of goods and service. Service quality and customer satisfaction is what the company focuses on. Strategic decision making in operations management of the system has helped the airline to have quicker and on-time orders (Mohamdi, 2015). The performance of the company can be easily monitored because of high effectiveness in production planning, inventory management and order fulfillment that enables the company to keep hold of operational uncertainty. They also focus on continuous innovation in their products, which have given them a competency among the competitors (Viola Wendel, 2015). Moreover, Emirates Airlines also encourages competition in terms of “Open Sky Strategy” to have a fair play between the competitors (Subosi, 2014). Some of the important operational strategies adopted by Emirates Airlines are: Scheduling long haul flights in order to reduce the cost associated with frequent landing Incorporation of wide body aircrafts in order to reduce the cost of seats per mile Maintaining a lower average age of aircraft which helps in reduced maintenance cost, increased fuel efficiency and customer attraction. The airlines operates wide-body Aircrafts to lower its seat per mile cost Long-Haul flights are mostly scheduled in order to reduce the costs associated with landing Installing latest technologies in the aircraft in terms of Entertainment, and I.T Technology development for booking, baggage and boarding Services. Some of the operational strategies mentioned above has transformed to be the core competency of the organization that has enabled to succeed in their service operations and make them stand out from the heavy competition around the world. The increase in revenue throughout the years until 2016 can be attributed to their core operational values that has been well received by the customers around the world.

2.3 Hub and Spoke Operation model The hub and spoke model is a mechanism that is used to connect different cities using a central hub for easier transit of passengers travelling to different parts of the world. In the case of Emirates Airlines, the hub of Emirates (Dubai) is located centrically between the European and Australasian countries. The location provides ample benefits to Emirates Airline such that out of 7 Billion people in the World, 3.5 Billion people reside within 8 Hour flight Journey from Dubai (Direction, 2012). In order to maximize this advantage, Emirates also provides long-haul to long- haul traffic flows between Asia, Australia and Europe.

4 9th International Conference on Operations and Supply Chain Management, Vietnam, 2019

Figure 4. Hub transportation topology

In order to evaluate the efficiency of the actual Hub performance, a comparison was performed by using Emirates and the two other leading Gulf carriers: Etihad Airways and Qatar Airways . They were compared with four International carriers: British Airways , Lufthansa , Air France and KLM which also operates in a Hub and spoke model. The study was carried out by O’Connell (2016) in his journal titled “A study into the hub performance Emirates, Etihad Airways and Qatar Airways and their competitive position against the major European hubbing airlines.”

Table 1. BenchMarking Hub Performance

WCR Airlines Main Hub Additional Hub Hub Model (O'Connell, 2016)

Etihad Airways Abu Dhabi - Single-Fortress Hub 2.31

Emirates Airlines Dubai - Single-Fortress Hub 1.47

Qatar Airways Doha - Single-Fortress Hub 2.17

KLM Airlines Amsterdam - Single-Fortress Hub 1.31

Lufthansa Airlines Frankfurt Munich Multiple-Reliever Hub 1.25

Air France Charles De Gaulle Paris Orly Multiple-Reliever Hub 1.44

British Airways London Heathrow Gatwick Multiple-Reliever Hub 1.13

For this study, the author employed Weighted Connectivity Ratio (WCR) and Average Routing factors (ARF) to compare the Hub performance of the Airlines. WCR states that if the ratio for connectivity is around 2, then the airline company is said to have a very good temporal connectivity and efficient Hub performance, which can be seen in the case of Etihad Airways (See table 1). However, for Gulf carriers in general, a good interconnectivity of operations was observed. If the WCR is close to 1, then connectivity to flights could be due to randomness rather than planned schedules. In the case of Emirates, it needs to be noted that with the highest number of long-haul flights than any other Gulf carrier, the company operates with the highest average sector length

5 9th International Conference on Operations and Supply Chain Management, Vietnam, 2019 which makes it difficult to organize connecting flights, hence leading to a lower value of WCR. However, the longer time in between connecting flights for Emirates actually translates to longer time spent by passengers in Dubai Duty-Free which is observed as a clever strategic tactic. Also, Emirates is observed to offer more flights than any of the competitors in some of the strategic locations (5 times a day to London and Paris, 4 times to Cape town, twice to Melbourne and once a day to Christchurch), which compensates for its lower Hub performance.

2.4 Competitive strategy The top companies around the world have been successful over a long period of time by possessing distinctive competitive advantages over their products and services. This strategy plays an important role in maintaining and developing regular & frequent customers for the products and service that the company markets. Emirates Airlines is a prime example which has portrayed the benefits of holding the service & product based competitive advantage that has enabled them to hold a considerable market share in the Airlines Market. One of the recent strategy that has enabled them to enhance the brand strength is the procurement of only Airbus and Boeing Aircrafts into the fleet. Since the company has been procuring new aircrafts for its fleet, the average age of the fleet has also been healthy which indicates better fuel efficiency and sustainability. Among some of the major Airlines leaders (With atleast 100 aircrafts), a comparison of the fleet size with the average fleet age in 2017 was studied and can been in table 2.

Table 2. Fleet Age Benchmarking of major global Airlines (Airlines with atleast 100 aircrafts)

Airlines Fleet Size Average Fleet Age (Years) Emirates Airlines 268 5.8 Etihad Airways 110 5.4 Qatar Airways 196 5 British Airways 293 10-14 Cathay Pacific Airways 194 10.6 Lufthansa Airlines 374 11.8 Singapore Airlines 113 7.8 Air France 344 12.6 KLM 201 10.9 The above list can be observed to be dominated by the Middle-East carriers. It can also be noted that the average fleet age of Emirates was 5.8 in 2017, which is only next to Qatar Airways with 5 and Etihad airways with 5.4. The lower age of the aircraft indicates the existence and inclusion of new aircrafts regularly into the fleet. Thus, it can be concluded that the differentiation strategy of the Emirates Airlines has proven to be supportive for establishing the quality of service and innovations exhibited by the organization

3. FINDINGS FROM THE CASE STUDY In order to investigate the strategic capabilities that provide the competitive advantage for Emirates Airlines which will enable them to overcome to recent financial scuffle, supply chain drivers and process map are explored, along with the evaluation of supply chain risks. The

6 9th International Conference on Operations and Supply Chain Management, Vietnam, 2019 findings obtained after applying different strategic and supply chain tools are analyzed and discussed in this section. supply chain drivers and strategy supply chain process map supply chain risk (strategic fit from EKFC) strategical backlogs

3.1 Supply chain drivers and strategy

Table 3. Supply Chain Strategy of Emirates Airlines

DRIVERS SC Strategy Justification Facility Responsive The centralized maintenance hangars and other facilities are located close to each other, adjacent to the Dubai airport.

Inventory Highly responsive Here inventory plays significant role as proper care and inspection is required along with wide variety of items. The logistical transportation in this section aims at the movement of materials through road and air Though the movement of items are generally within the airport and the Transportation Hybrid facilities that are located adjacent to each other, paving way for efficiency. When it comes to cargo services, focus tends more to factors like scale of economy which might be difficult to attain due to the uncertainty in demand. Though cost reduction is considered as a factor for labor intense works , quality has been the main concern for the company Sourcing Hybrid which overtakes the cost considerations in its service. For example, Emirates has its fleet of only Airbus & Boeing aircrafts, while the maintenance services are sourced in-house. Since Emirates have its name for luxurious travel, high pricing is justified by the services they are providing for first class and Pricing Hybrid business class . For the economy class, the price is somewhat comparable with that of the budget airlines. Emirates deploys Advanced I.T Systems for its functions such Information as inventory tracking, reservation systems etc. which links the Systems Efficient supply chain process together. This allows them to be Highly responsive and highly efficient at the same time with low investment, efficient reservation and inventory management.

From the day of its inauguration in October 25 1985, the supply chain structure of the Emirates Airlines has been emerging and expanding into one of the biggest operations in the airline industry. The Aircraft fleet of the Airline has been increasing gradually every year, which makes it difficult for the regional competitors to match with the current standards of the company. In the year 2011, a huge record was created in the history of aviation industry when Emirates ordered aircrafts

7 9th International Conference on Operations and Supply Chain Management, Vietnam, 2019 worth $15 Billion. In January 2018, Emirates has given an order of additional 36 A380 aircrafts worth $16 Billion. This gradual increase in the amount of flying machines induces pressure into the supply chain network of Emirates airlines. This is because the increasing number of aircrafts in the fleet requires incorporation of additional workshops, maintenance hangars and ramp spaces for the aircrafts with the average age of 68 months. Chopra and Meindl (2016) has inaugurated the idea of achieving strategic fit by grouping the supply chain drivers in terms of efficiency and responsiveness, which will aid in improving the overall performance of the supply chain network. Therefore, the table is constructed based on the supply chain strategy of individual functions. From the above Table 3, it can be justified that the overall supply chain drivers works towards hybrid between Efficient and Responsive but more inclined towards Responsiveness. Emirates Airlines, being a luxurious air service provider has strategically planned their drivers to be coordinated closely with each other to reduce the extra costs in the system, and thereby providing the service at a competitive rate compared to their competitors. In order to achieve higher performance in the supply chain cycle, it is important to focus on attaining ‘Strategic Fit’ by using the existing resources and capabilities to a great effect. Being the national carrier of Dubai, Emirates Airlines has grasped the opportunity of setting up the facilities contiguously, enabling them to save cost and time in the overall supply chain process The integration of the drivers can be seen in the supply chain process map in the next section (3.2)

3.2 Supply chain process map

Figure 5: Emirates Supply process map

The supply chain process of Emirates Airlines involves extensive collision of different suppliers including its own source for the enhancement of the supply chain surplus. The process flows through a sequence of operation initiated from the supplier process where the essential equipments and services which do not fall under the distinctive capability acquired by the

8 9th International Conference on Operations and Supply Chain Management, Vietnam, 2019 organization are procured from the external source. The activities under each department of the supply chain process is listed in the above figure 8. Throughout the process, the flow of information and fund takes place through each department. In order to increase the efficiency in the system, supply chain integration plays a major hold. Palma-Mendoza (2015) has stated that “At the core of gaining competitive advantage through Supply Chain Management (SCM) is Supply Chain Integration (SCI); when integration is achieved, the supply chain operates as a single entity driven directly by customer demand” (pp.620). In order to maximize the efficiency of the connectivity and reduce cost, the use of I.T Systems play a major role for this supply chain integration.

3.2.1 Supplier/Procurement: Emirates uses tendering process to select products and service that they like to purchase or outsource. As a result, the company have more than 500 suppliers supplying the different departments of the airlines (Basit, 2015). Apart from sourcing Aircraft and fuel as mentioned in section 4.4, the other materials sourced by Emirates Airlines are:

In flight Systems (Entertainment & Electronic Systems): Emirates was the first airline company to provide in-flight entertainment for all classes within their flights. Currently their in-flight service is called “ice” (Information, Communication , and Entertainment) which allows passengers to choose from 1200 channels including movies, sports and music, which is the combination of Panasonic Avionics Corporation’s 3000i systems, along with Rockwell Collins Airshow application and Inmarsat ’s internet facility.

Figure 6. In-flight entertainment system

In flight materials: Aircraft seats on all emirates flights are supplied by Texas based company Zodiac seats, this is accomplished in partnership with Panasonic Avionics to fit LCD screens and entertainment systems. First class seats on the A380 feature the zero-gravity seats by Mercedes-Benz. Emirates has also made a deal with Thales to equip future Boeing 777X aircrafts with Thales Avant entertainment systems (Figure 6). Food for Catering Services: Catering is provided by Emirates Catering Services which is located adjacent to the Dubai International Airport and Dubai Investment Park. Emirates flight catering facilities is one of the largest airline catering facility in the world managing roughly 200,000 meals daily on an average. This also includes Food Point situated in Dubai Investment Park (Sundarakani et al. 2018). Moreover, there is also the option for meals based

9 9th International Conference on Operations and Supply Chain Management, Vietnam, 2019