Market Research for Launching New Products: A Step-by-Step Guide

- Posted on March 6, 2024

- | Modified on March 13, 2024

- | Starting Your Business

- March 6, 2024

Key Points:

- Understand FMCG vs CPG Differences

- Methods: Primary, Secondary Research

- Critical Steps in the Pre-launch Process

- Cost-Conscious Market Research Methods

Key Steps After Gathering Market Insights

Article summary.

- Business owners must know the difference between FMCG and CPG.

- Doing thorough research is vital for a successful product launch.

- Research helps owners understand what customers need and who they’re up against.

- Use both primary and secondary methods to research well.

- Key steps: know the market, target customers, create a unique product, plan marketing, test, launch, and track.

- Use surveys, social media, and interviews for affordable research.

- After research, work with a CPG branding agency for clear strategies.

Market Research Can Make or Break Your Business

If you’re launching a new food , beauty, or supplement product, making your product stand out amidst intense competition is likely top of mind. Going up against industry giants and established FMCG (fast-moving consumer goods) and CPG (consumer packaged goods) brands can seem daunting. To effectively launch a FMCG or CPG brand and compete against established products, new brands must undergo methodical branding and packaging development and conduct thorough market research to define their niche and find opportunities. Our step-by-step guide on market research for launching new products will help you get started on the right path to a profitable business.

Before we explore the specific steps for market research tailored to new product businesses, let’s first define what is CPG vs FMCG.

What is CPG vs FMCG?

What is CPG?

CPG is a broader category that includes FMCG but also includes other consumer products for personal or household use beyond just consumables. In addition to foods and beverages, CPG spans apparel, cosmetics, cleaning products, pet supplies, and consumer electronics – essentially any product designed for frequent replenishment or personal consumption from traditional retail channels.

What are the 5 main categories of CPGs?

- Food and beverages: This includes items like bread, juice , soups , cookies , and sauces .

- Household products: This includes items like laundry detergent, paper towels, trash bags, and cleaning supplies.

- Personal care products: This includes items like shampoo, soap, toothpaste, and deodorant.

- Beauty products: This includes items like makeup , skincare products , and hair care products .

- Over-the-counter drugs: This includes items like pain relievers, allergy medication, and cold medicine.

Examples of well-known CPG companies

- Food and beverages: Nestle, Unilever, PepsiCo, Coca-Cola, Kraft Heinz

- Household products: Procter & Gamble, Clorox, Kimberly-Clark, SC Johnson & Son

- Personal care products: L’Oreal, Johnson & Johnson, Colgate-Palmolive, Unilever

- Beauty products: Estee Lauder, L’Oreal, Avon , Shiseido

What is FMCG?

FMCG refers to affordable consumer products that are purchased frequently and consumed rapidly. These fast-moving goods include food items, beverages, toiletries, over-the-counter medicines, and other consumables found in grocery, convenience, and drugstore settings. Key attributes of FMCG products are their low cost, high volume, and short shelf life.

FMCG Key Market Segments:

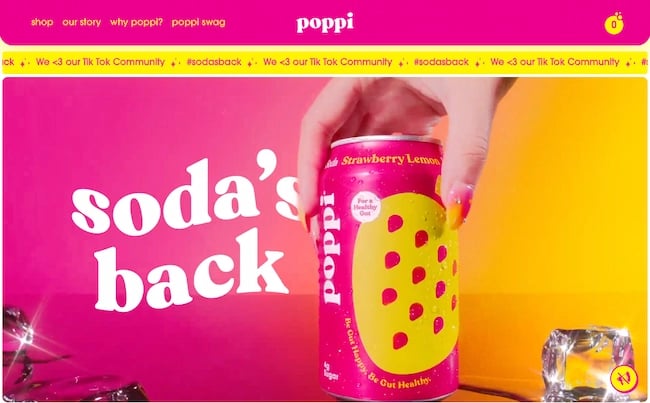

- Food and Beverages : Juice, Soda, Snacks, Tea, Coffee , Chocolate .

- Personal care products: Skincare, Cosmetics, Hair care

- Health care products: Over-the-counter Drugs, Vitamins & Dietary Supplements , Oral Care, Feminine Care

Examples of top FMCG companies

- Procter & Gamble (P&G): Including Pampers, Tide, Gillette, and Crest.

- Nestlé: Popular brands under Nestlé’s umbrella include KitKat, Nescafé, Maggi, and Purina.

- Unilever: Some of its famous brands are Dove, Knorr, Lipton, and Axe.

- The Coca-Cola Company: Including Coca-Cola, Sprite, Fanta, and Minute Maid.

- PepsiCo: Including soft drinks (Pepsi, Mountain Dew), snacks (Lays, Doritos), and beverages (Gatorade, Tropicana).

Here are the key differences:

Cpg – consumer packaged goods.

- A broader category that includes FMCG as well as other consumer products

- Encompasses both durable and non-durable goods used for personal/household purposes

- Examples: food, beverages, cosmetics, cleaning products, apparel, electronics

- Sold through various channels – retail, wholesale, online etc.

FMCG – Fast Moving Consumer Goods

- Refers to low-cost, non-durable products that are frequently purchased and rapidly consumed

- Examples: food, beverages, toiletries, over-the-counter drugs

- High volume and high turnover products

- Typically sold at retail stores, supermarkets, convenience stores

So in essence:

- CPG is the overall umbrella term for most consumer products packaged for purchase

- FMCG is a sub-category focused on faster turnover consumer items

Some other key differences:

- FMCGs generally have lower price points than other CPGs

- FMCG marketing emphasizes volume, impulse purchases, constant promotions

- CPG marketing varies based on product category and purchase cycles

While there is overlap, FMCG goods are consumed rapidly and purchased frequently, while the CPG category also includes more durable, higher-priced goods meant for longer-term consumption.

While FMCG places more emphasis on value pricing and rapid turnover, CPG products can span a wider range in terms of price point, purchase cycles, and shopping experiences. However, both categories are consumer-driven and highly competitive when it comes to earning enduring brand loyalty and market share.

Understanding where your new product offering fits within the CPG or FMCG landscape is critical before undertaking market research.

What is market research and why is it done?

Market research is about figuring out if new opportunities are worth pursuing by looking at how much they can grow, who else is competing, and if customers are interested.

The primary purpose of market research is to tackle complex issues related to new product development, technology innovation, market exploration, strategic planning, and competitive analysis . Market research provides a crucial customer-centric foundation for businesses by deeply understanding their target audience .

Why do you do market research before starting a business?

Conducting market research before launching a product business is crucial for laying a strong brand foundation . It provides essential insights and foresight necessary for estimating, refining, and precisely planning various aspects of the business.

Two main benefits are:

Maintaining a customer-centric approach.

- Market research reveals customer needs, desires, pain points

- This allows companies to truly prioritize the customer experience

- Customer-centric businesses are 60% more profitable

- The STP (segmentation-targeting-positioning) process enables laser-focused customer-centricity

Making More Effective Connections with the Audience

- Research identifies the right marketing channels for reaching the target market

- It prevents wasting resources on ill-fitted platforms

- Content and messaging can be tailored to “speak the language” of the audience

- This resonates better and drives higher engagement

Investing in market research upfront highlights specific characteristics and preferences of the intended customer base. This insight allows businesses to align their entire product, positioning, and promotion strategy around those customers which leads to a more profitable business.

Types of Market Research:

Market research typically involves two main types: primary and secondary. Each serves distinct purposes and offers unique advantages.

What is Primary Market Research?

Primary market research for a new product involves conducting a specialized study by yourself to uncover the wants and needs of individuals who match the profile of your target market, typically by directly engaging with them and asking them questions about your product. You can achieve this using various interviewing techniques: face-to-face, phone calls, focus groups, and online surveys and competitor visits, to gather information directly from customers or potential customers.This method aims to delve into individual preferences, behaviors, and experiences.

What is Secondary Market Research?

Secondary research involves accessing pre-existing data, reports, and studies compiled by others, such as government agencies, trade associations, or industry publications, which can be obtained faster and more affordably, primarily through online sources, articles, reference libraries, or industry associations. Yet it also comes with constraints. The information gathered from a different audience may not align with your target audience, leading to biased data. Simply put, if you didn’t gather the data firsthand, it’s secondhand information that may not be as trustworthy as primary research data. It provides insights into market size, trends, competitors, and industry dynamics.

Differences between primary and secondary research:

Primary research offers firsthand product insights into individual consumer behavior, while secondary research provides a broader understanding of market dynamics and trends. Both types of research play crucial roles in informing strategic business decisions for new product businesses.

Primary research typically requires more time as it involves conducting surveys, interviews, or focus groups. Secondary research, on the other hand, is quicker as it relies on existing data sources.

Data Collection Methods

Primary research utilizes techniques like surveys and focus group discussions, while secondary research relies on online sources and published materials.

Presentation of Insights

Primary research often presents findings through charts, tables, and participant quotes. Secondary research uses decision-making models such as Porters 5 Forces , SWOT analysis , and value proposition canvases to organize and present information effectively.

Why do CPG & FMCG Companies use Market Research?

Companies use market research for several key reasons:

Understanding customer needs.

Market research for new and existing products help companies grasp what their customers want, their preferences, and behaviors. This knowledge is vital for tailoring products and services to meet customer demands effectively.

Gaining competitive insight

Market research offers valuable information about competitors, their strengths, weaknesses, and strategies. This allows companies to identify opportunities, stay ahead of rivals, and make strategic decisions.

Developing new products

Market research enables companies to test new product ideas and gather feedback from potential customers before launching. This minimizes the risk of product failure and ensures that products align with customer needs.

Analyzing markets

Product market research helps companies determine the size of their target market and segment it into different customer groups with distinct needs and behaviors. This segmentation aids in targeting and positioning new products effectively.

Setting prices

Product market research assists companies in determining optimal product pricing strategies by considering factors like customer willingness to pay, market conditions, and competition.

Overall, market research equips companies with crucial insights to make informed decisions, spot new product opportunities, and enhance their operations.

How is consumer research conducted in FMCG & CPG companies?

Major FMCG and CPG companies conduct a variety of market research methods and techniques to gain insights into consumer behavior, preferences, and trends.

Here are some common ways CPG & FMCG companies conduct market research:

Consumer surveys and polls.

Companies use online surveys, phone interviews, focus groups, and in-person polls to gather data directly from consumers about their purchasing habits, brand perceptions, product usage, and feedback.

Retail Data Analysis

CPG and FMCG companies closely analyze point-of-sale (POS) data from retailers to track sales volumes, market shares, pricing dynamics, and distribution metrics across product categories and geographic regions.

Ethnographic Research

Companies send researchers to observe consumers in their natural environments (homes, workplaces, etc.) to understand how existing products are used, shopped for, and consumed in real life.

Online Behavior Tracking

With consumer permissions, companies can track online activity like website visits, social media engagement, search queries, and ecommerce purchases to map the digital consumer journey.

Product Testing and Sampling

New products, packaging , and marketing campaigns are tested amongst consumer panels to measure product appeal, buying intent, and feedback before launching.

Ad Tracking and Testing

Advertising concepts, campaigns and media placements are continuously tested and optimized based on ongoing measurement of their impact on consumer perception and behavior.

Leading Indicator Monitoring

Economic and demographic data as well as cultural/lifestyle trend reports are analyzed to forecast emerging consumer needs and sentiments.

Market Intelligence

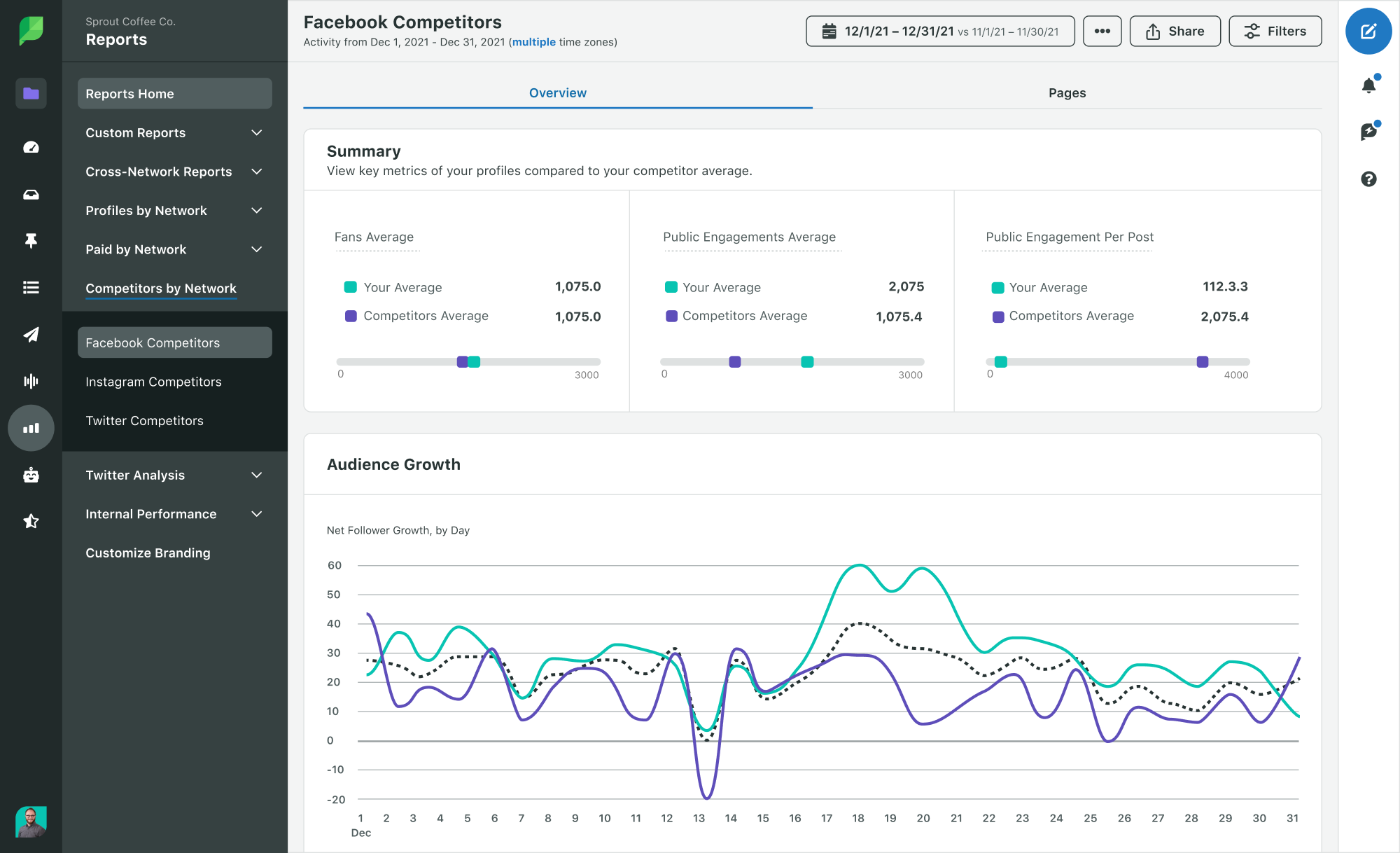

Companies subscribe to market research firms and industry reports to access detailed consumer insights, sales data, competitor analysis, and macro market trends. Market research firms help companies understand audience behavior across media platforms by providing valuable data and insights for informed decision-making.

FMCG & CPG giants are data-driven

Successful FMCG & CPG giants are heavily data-driven, constantly gathering intelligence from multiple sources to fine-tune products, promotions and positioning in an intensely competitive landscape.

For industry giants like Coca-Cola and Starbucks, product market research is an extremely detailed and multi-pronged exercise. Focus groups provide a broad understanding, complemented by surveys, questionnaires, social media monitoring and other techniques to uncover deeper consumer motivations, unmet needs, and emotional connections with products.

This comprehensive market analysis identifies potential threats and opportunities, tracks evolving tastes, informs improvements to existing products, and ultimately aims to boost sales by giving customers more of what they truly want.

While focus groups are powerful, companies leverage a diverse toolkit for research – from surveys to digital tracking to observational studies – to assemble a 360° view of the market landscape. Investing in rigorous, professional market research is critical for large enterprises to stay ahead of customer needs and make smart, data-backed decisions.

Major market research firms like Nielsen , Euromonitor , and Mintel are well-known for conducting syndicated research studies spanning consumer insights, product categories, geographies and more. Their off-the-shelf reports provide ready market intelligence.

What is syndicated market research?

The key difference between syndicated and custom market research is that custom studies are proprietary, conducted for and funded by a single client company. Syndicated research follows a standardized methodology with broader scope, with the findings packaged into reports sold across multiple clients in that industry.

Many companies utilize both syndicated and custom market research, because syndicated provides shared comprehensive market intelligence more economically, while custom offers narrow but personalized insights.

For new businesses in CPG and FMCG categories, syndicated research offers a cost-efficient way to gain comprehensive understanding of market dynamics, unmet consumer needs, white spaces and the competitive landscape. This can be invaluable for guiding product development and marketing strategies.

What is the first step in marketing research?

For new businesses launching products in the CPG space, the first step in marketing research is clearly identifying the specific consumer need or problem you are trying to solve.

- For a new food product line, your goal may be to understand what flavors or nutritional aspects consumers are lacking in current offerings.

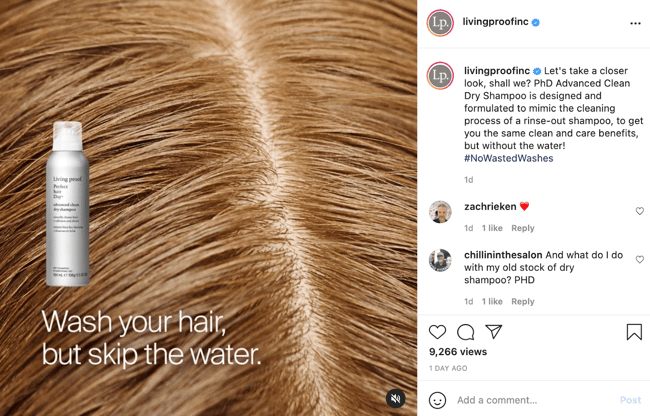

- For a beauty brand, you may want to research what skincare concerns are not being adequately addressed by existing products.

- For a supplement company, you need to identify gaps in the market for certain vitamin formulations or health focus areas.

In simple terms, this boils down to asking yourself – “What consumer pain point or desire is my new product fulfilling that competitors are not adequately serving?”

Conducting research at this initial stage aims to validate that you have pinpointed a genuine unmet consumer need before investing further into product development.

This step involves:

- Clearly defining the consumer segment/target audience you want to serve.

- Exploring their current frustrations, challenges or desires related to your product category through surveys, social listening, focus groups etc.

- Assessing how well existing CPG/FMCG brands are solving those consumer problems based on their product portfolios.

- Identifying the specific whitespace opportunity for your new product to fill that unmet need better than incumbents.

Without this crucial upfront validation, you risk developing a product that lacks a meaningful point of differentiation or consumer rationale for purchasing it over established brands.

Getting clarity on the core consumer insight problem you are solving lays the strategic foundation to then build out the rest of your marketing research, product development, branding and go-to-market planning. We will dive further into this topic in the next section.

How do you conduct market research for a new business?

When thinking about market research for launching new products, new CPG or FMCG businesses need to first start with researching their market and understanding what gaps are in the market and where their is a need for a new product. Most new businesses do their own market research for launching new products versus hiring expensive market research firms.

There are seven critical steps in the pre-launch market research process:

Understand the market and competition.

Uncover surprising insights about the market. For instance, successful snack products often incorporate food-like ingredients such as cereal, nuts, or fruit to appeal to customers.

Analyze competitors’ offerings and marketing materials to identify your product’s unique selling points and potential threats to success. You’ll want to make notes about their packaging, website and social media. How are they talking to their customers? Is there anything your competitors are doing well? That may be a niche for you to explore. Download the competitive analysis worksheet .

Analyze pricing to understand how to price your product. Use the product pricing sheet .

Target Your Customer

Focus on prospects most likely to purchase your product. Consider customers currently buying similar products and how your offering adds value to their experience. Create a buyer persona for your brand.

Define Your Unique Value Proposition

Determine what sets your product apart from competitors and why customers should choose it. Communicate your unique value proposition effectively to attract buyers.

Determine Your Marketing Strategy

Utilize market insights to craft an effective marketing plan. Consider various channels such as retailers, online platforms, and email marketing for high ROI .

Test the Product and Approach

Conduct thorough testing of the product and marketing approach before the launch. Gather feedback from potential customers to identify areas for improvement and ensure alignment with their needs and preferences. For example if you have a food product, test at your local farmers market to get feedback on your product.

Roll Out Your Campaign

Implement your marketing strategy across chosen channels, keeping consistency in messaging and branding . Monitor the performance closely and make adjustments as needed to optimize results.

Track the Overall Customer Lifecycle

Continuously monitor the product’s performance in the market and gather feedback from customers. Stay adaptable and be prepared to make changes to the product or marketing strategy to maintain competitiveness and meet evolving consumer demands.

How to do cost-effective market research for a new product?

If hiring a market research is not within your budget don’t worry. It is absolutely possible to conduct market research for launching new products on a budget.

Here are some cost-effective strategies:

Leverage online surveys.

- Use free survey tools like Google Forms, SurveyMonkey, Typeform

- Share surveys through your website, email lists, social media

- Offer incentives like discounts or giveaways to increase participation

- Keep surveys short and focused

Social Media Listening

- Monitor relevant hashtags, topics on Twitter, Instagram, Reddit etc.

- Join Facebook groups in your niche to understand pain points

- Analyze sentiment around your product category and competitors

Interview Your Current Customers

- Ask for feedback calls/emails with loyal customers

- Incentivize with samples/discounts for their time

- Discuss what they like, what’s missing and suggestions

Low-Cost Focus Groups

- Recruit friends, family or offer cash incentives

- Use free conference call/screen sharing tools

- Facilitate taste tests or product demonstrations

Observe Consumer Behavior

- Visit stores/locations where your target customers shop

- Watch how they evaluate and buy similar products

Free Market Reports

- Check resources like government databases, research journals

- Look for generalized industry reports even if not product-specific

Competitive Price and Product Analysis

- Examine competitors’ offerings, pricing, marketing messaging

- Identify potential gaps or areas to differentiate

Start Small and Economical

- Test concepts/prototypes in one area before scaling

- Validate interest and refine based on early feedback

Leverage Your Network

- Discuss with distributors, retailers, influencers in your space

- Get insider insights about market demands and white spaces

Get Creative with Your Market Research

The key is getting creative, taking advantage of free or low-cost tools, and directly engaging with your target audience as much as possible on a limited budget. Start lean but make research an ongoing priority.

Remember your brand is always evolving. As you learn more about your customers, you will continue to refine and tailor everything from your packaging design , to your messaging, to your social media marketing.

If you are just starting your brand you may be wondering how you do market research if you don’t have customers yet. Think about your family, friends, anyone who might be in your target market that will give you honest feedback. Think about who you know in your community, can you set up a table at your local gym to test out your new supplement brand , or maybe you know a the owner of the local spa and you can test your new skincare product there. If you have a food or beverage, a farmer’s market is a great way to test and gain market insights.

Steps to follow if you want to conduct market research:

- Develop a plan

- Understand the nature of the marketing problem

- Define the sampling method and sample size.

- Develop the survey tool and gather data.

- Analyze the findings and present them in a customer-centric manner.

- Extract the key insights from the data.

Segmentation, targeting, and positioning are pivotal in understanding the buyer’s journey and consumer behavior throughout this process. However, it’s important to note that market research cannot fully explain consumer behavior.

What is one of the significant challenges for marketing research?

One thing to keep in mind is what legendary ad man David Ogilvy said:

“The trouble with market research is that people do not think how they feel, don’t say what they think, and don’t do what they say.”

So before you base all your decisions on what people say you’ll want to consider observing their actions, analyzing their behavior, and validating their responses through various research methods.

Another challenge for marketing research is the lack of time and resources. Gathering relevant data without falling behind the competition can be a challenge as well as conducting comprehensive marketing research can be costly and time-consuming.

Market Research Questions for a New Product

Examples of Market Research Questions

- Demographic questions e.g. How old are you? Where do you live?

- How likely are you to recommend us to a friend?

- Did you consider any of our competitors? Who and why?

- What do you wish our product could do?

- How would you rate your most recent experience with us?

- How long have you been a customer?

- How much money do you usually spend on X products?

- What’s the maximum you’d pay for X?

What to Consider When Creating Market Research Questions

Consider the following as you create your questions. Be mindful not to create biased questions .

Set SMART Goals:

- Specific, Measurable, Attainable, Relevant, Timely.

- Keep focus on end goals throughout the process.

Understand Your Customer:

- Identify ideal customer personas.

- Address their struggles, desires, and preferences.

- Different perspectives from various departments enhance understanding.

Organize Questions into Topics:

- Prioritize essential information.

- Group questions by relevance and similarity.

Start Broad, Then Refine:

- Begin with general inquiries.

- Progress to more specific questions.

- Consider multiple surveys for detailed insights.

Use Conversational Language:

- Ensure questions are clear and unbiased.

- Read aloud for tone and clarity.

- Strive for a balance between engagement and neutrality.

Target Audience Selection:

- Focus on key stakeholders.

- Avoid surveying irrelevant or inactive customers.

- Consider diverse perspectives for comprehensive insights

Once you have gathered your market research for launching your new products or existing ones, what are your next steps?

Whether you are looking to rebrand with your new market insights or start a new brand (check out our food packaging design guide ), working with a CPG branding agency to identify actionable insights from your market research is worth the investment. They can help you take the information you gather and design products with your target audience in mind. They possess deep industry knowledge and expertise, ensuring that CPG packaging designs not only catch consumers’ attention but also effectively communicate brand identity and product benefits.

Market research for new product development in 6 steps

Market research for new product development will help you understand your users' needs, as well as potential risks and market opportunities.

What is market research in new product development?

Why do market research for new product development, the importance of market research in product development, choose the correct type of market research, how to conduct market research for a new product , examples of market research for new products, what product development idea have you been dallying off.

Picture this: you’ve got a great idea for a new product, or for improving your current product or service. At least, you think it’s great. When you explain it to others, they raise their eyebrows.

While you are incredibly enthusiastic about the product, they have critical questions about consumer trends , the market , and those latest developments in the world. Ouch.

‘My gut told me to go for’ won’t convince a lot of investors to invest in your idea. Plus, your designers, marketers and engineers will work in a much more confident way if they know that what they’re working on has a chance to succeed. The only way to give them that confidence, is through market research. And one of the most valuable types of research is that which you’ve carried out among your target consumers. This research provides you with proprietary data (also known as zero-party data ).

In this article, we’ll explore why consumer research is so important when you’re developing a new product or want to change something you’re currently already selling. We’ll take you through five crucial steps and give you some valuable tips along the way.

Market research for new product development can focus on different areas. You can research market viability, the demand for the product you have in mind, the features your target group is looking for, or the best way to position, price, communicate and market your product to your target audience. You take into account your competitors, market developments, and important trends. And whether you’re running market research for a startup or a massive brand, it’s an essential step to make sure your new products hit the mark. This can be a difficult task, leading many to consult US market research companies .

Market research for new product development is all about identifying opportunities and finding out if it’s worth bringing your product idea to life. And if so, how to do that in the best way.

It’s about more than what the competition is doing, and if your target audience would be willing to spend money on you. You can also dive into market trends to identify the best ways to market your product.

You can use market research to fine-tune your product development and the relevant aspects around it. Based on how your audience is developing, what price and type of message would grab their attention? What kind of marketing tactics are likely to work, and what channels dominate your market?

Consumer research is about understanding all the aspects of your market. You can approach it as a big puzzle, and once you have all the pieces in place, you can proudly present a solid plan or research to your investors and team, to help them understand why your product development idea is worth working on.

To get the best consumer insights, send a survey with our concept testing template . And for a sector-specific lowdown, find out all about the food product development process .

Market research for your new product development strategy helps you minimise risks and prepares you for a successful product launch. You get to know your market and audience in a way that helps you create not just the perfect product concept, but also the right messaging and marketing around it—something that will actually resonate with your audience.

Market research is used to base your decisions on facts, not just ideas and hunches – however good you might be at guessing games. Before spending time and money on a product idea, you get a good idea of how likely it is to be a success. This will also help you plan how much time and money you’ll actually need.

Investors and stakeholders will also want to see market research if you want to launch a new idea: they want some kind of security that the product will actually sell. Even though market research isn’t a crystal ball and doesn’t exactly predict the future, when it’s done right it can definitely give you a clear picture of how your product concept will be welcomed into the market.

Market research is not only important to verify if your completely new product idea is worth the work. You can also use it to optimise existing products, by keeping a close eye on how competitors are changing their products. You might even read online reviews on products similar to yours and see that customers are asking for specific features. This is also market research.

This also goes for adding new products to a line to supplement your current assortment, or if you want to start an entirely new adventure with your breakthrough product idea.

Market research for product development, whether new or existing, is all about listening to what is happening in the market. Step outside of your organisation and ask the people who pay for your products how you would make them even happier, or find out what trends you can jump onto now, so you can become a frontrunner in the future.

Product development shouldn’t just be done in-house, with your designers and developers closely looking at the product. It’s easy to get tunnel vision and build a product that’s more focused on what you can and want to deliver, and less on what the customer wants.

Market research done right forces you to step out of that bubble and not just look at how you can make the product shinier, faster and stronger, but how you can give it the right place in the market . Because product development is also developing a marketing and sales strategy . It’s having a customer journey and experience ready to put the product in and turn your customers into fans. All you need to do, is go talk to them!

Moreover, market research helps you determine what the marketing mix should look like, since developing a new product is never just about a product.

Turn customers into fans with market research tools

Compare the top market research tools of 2022, including details on their features and the best ways to use each tool.

Let’s get back to basics: what types of market research are there? We often lose ourselves in the wide variety of tools out there that give you data – but what kind of data is available, and how relevant is it to you?

It’s important to understand where data is coming from and how complete it is. How can you supplement it with additional research to get the full picture? Let’s look at the types of research you can – and should! – combine.

Quantitative market research

Don’t let the saying ‘quality over quantity’ fool you for this one—if you’re trying to make money, quantity certainly does matter. Quantitative research focuses on things you can measure .

How many people are interested in your type of product? What are they willing to spend, on average? Has that number been growing, been steady or are they willing to pay less and less? And if the latter is the case, is the group growing in size at least?

You can also gather information on how happy people are about a product or service. What’s lacking in this type of information is the motives behind it. For that, you need qualitative market research .

Qualitative market research

Qualitative research gives context to the numbers . Yes, people are increasingly interested in product X – but why is that? What were they looking at before, and what made them make the switch? Was it a change in price, a recommendation from a friend, something they saw in the news?

Now, it’s nearly impossible to gather qualitative data for all the quantitative data you measure. That’s why it’s incredibly important that you get that qualitative data from a hyper-relevant part of your target group. Don’t send out surveys to gather quantitative data from a specific part of your target group, and then ask another part to explain those numbers. That wouldn’t be helpful at all.

Qualitative data often comes from focus groups . You could find a focus group in the people that you survey, or by interviewing existing customers that fit the profile you’re studying. This will help you get a real-life picture of consumer needs and consumer problems. The best person to ask is the one you’re trying to fit into a buyer’s persona.

How is qualitative market research important for your product development process? It’ll help you understand the needs of your target market better. You conduct research that will steer your product idea generation in the right direction, gathered by real consumer insights and consumer feedback.

Of course, you can’t come to your market consumer in the initial stages of the process and ask them to design the product for you. You’ll gather the base information you have through quantitative methods and online new product development surveys , so you can ask focused concept testing questions to your focus group.

Primary market research

Primary market research is collecting raw data directly from your target customers or market by doing your own research. It simply means you only use data you yourself have collected, from things like surveys and focus groups – no trend reports from third parties.

This is important for product development research , because you can’t base your decisions and product development process on someone else’s findings for different product and target group entirely.

Anything you directly collect from your market, whether it’s through focus groups, surveys, interviews or product research is primary data.

Inform your product development with our JTBD template

Get up and running with your next product development project and learn what customers really need with our jobs-to-be-done (JTBD) template.

Secondary market research

Secondary research can be done using existing data . The fact that it’s not brand-new information, doesn’t mean that it doesn’t hold valuable insights. You just need to collect the right information and connect that to information that’s relevant for your case specifically.

Secondary research can be done to identify business risks, for instance by looking at market developments. Competitor research is also a valuable form of secondary research. Through competitor research you’ll get a real understanding of the other options your potential customers have – a good starting point for any new product development strategy.

What parts of market research can you not skip over when your goal is using it for product development research? We’ve divided it up into five bite-sized steps that will give you a solid framework to work within.

Step 1. Exploratory research

Basically, this is researching what you specifically want to research. It’s completely normal not to immediately know what your research goal is, or how you’ll get there. That’s where exploratory research comes in.

You start by gathering secondary data on all kinds of aspects. Find things that stand out, developments that you hadn’t thought about and things you want to know more about.

With that information, you can start defining what’s most relevant for you in this stage. Where are your knowledge gaps, and how do you make sure you get the relevant data to make wise business decisions?

This is not necessarily about gathering as much data as you can – you want to keep it manageable and relevant. Find out what questions you can’t answer straight away, and focus your exploratory research on that.

Step 3. Define research objectives

After your exploratory research, you can start pinpointing what you really need to know to move forward in your product development process.

Will you be focussing on customer needs, or how to get a competitive advantage? Will the market analysis focus on product demand and pricing, or is there still a lot of ground to cover in the physical product and usage habits?

It’s important to have a clear idea of what you’ll be researching. Ask yourself: what actionable insights do I need to win in this market segment? Make your objectives as concrete as you can, so your answers will be focused and you can confidently use them to base your next step on.

Step 4. Define the scope of the research

Of course, market research is a way to minimise risk. But there’s always a risk if you’re venturing out with a new product. You can never get a 100 percent guarantee of what will happen, until you launch your product.

That’s why it’s important to define a scope around your objectives. It can also help you to decide where you can use secondary data, and where you definitely need primary data.

Step 5. Decide on market research tools or partners

Are you going to focus on the product or business as usual while a research agency does the heavy lifting? Or do you want to keep everything in-house? In that case, you’re going to be in charge of deciding what market research tools you use. And the possibilities are nearly endless…

There’s a tool for every part of research, but it’s important that you use tools that are easy to work with, and collect all the data you want, so you don’t need to glue it all together from different tools. Especially if you’re going to talk directly to your consumers, you want to use a tool that’s as easy and pleasant to use for them as it is for you.

Of course, we have some suggestions. Check out our article on the 6 best—tried and tested—market research tools out there. And if you’re leaning towards agencies in the UK, here’s our rundown of the top market research agencies in London . And here are the top market research companies in the US .

Or, if you’d prefer to focus on sending out insightful customer insights surveys, see our list of the top 11 Qualtrics alternatives .

Step 6. Concept testing

As interesting as the market itself may be, this specific research is still about your product development idea. Is the idea you have in mind good enough to enter the market, or do you need input to fine-tune it?

That’s where concept testing comes in. With concept testing, you create an MVP that you can show to your focus groups. You find out what they think about it. What features do they miss and love? What would they pay for this? How easy is it to use?

But, like we said, you’re not just developing a product. You are also developing the marketing and communication around it, and that also needs to be tested thoroughly. That’s why you can also target your market research at your marketing for the new or improved product, by creating mock-ups and testing messaging with your focus group.

How are brands you love using Attest to do market research around product development? Let’s tale a look at US farming cooperative, Organic Valley . They save time and money by using quantitive analysis for new product development.

‘For a lot of our day-to-day work we had been using other tools that weren’t necessarily user-friendly, easy to use or intuitive. We were looking for a tool with a fairly rapid turnaround and I wanted my team to be able to use it themselves, I didn’t want to have to go out and hire somebody else,’ says Tripp Hughes, Organic Valley’s Senior Director of Consumer Strategy. He saw a need for a tool that his team could use, without having to go through excessive training.

After seeing Attest demoed at a conference, Hughes brought in some of his peers to take a look. They now use it for market analysis, concept ideation and testing, creative testing, and messaging testing.

Hughes estimates that being able to make quick initial learnings through Attest saves Organic Valley between 10 to 20 times what it would cost to make the discoveries later down the line.

‘The impact is coming in reduced time and improved next-round thinking that we’re taking into focus groups where we’ve got a high-cost factor. If we don’t go in with the right materials and the right framework, we’re wasting money. And so Attest has helped us do a lot of the front-end work that then we’re able to go and build on.’

Read more about how Organic Valley is developing awesome products with insights from Attest in this case study.

We get it – taking risks is scary. But developing new products is exciting, and could lift your business to the next level. And while doing product development research, you could find a lot more inspiration about other improvements you can make in your business.

If you’re looking for a tool that brings you closer to your target audience and helps you find hyper relevant results, try Attest.

Ask the right questions for NPD

Learn which product development survey questions you should ask to discover what customers value most, from pricing to features.

Customer Research Lead

Nick joined Attest in 2021, with more than 10 years' experience in market research and consumer insights on both agency and brand sides. As part of the Customer Research Team team, Nick takes a hands-on role supporting customers uncover insights and opportunities for growth.

Related articles

How to write concept testing survey questions that get real insights, new product development, evive nutrition brand manager amaël proulx on taking the states by storm, direct-to-consumer, 12 top storytelling marketing examples: how brands tell stories, subscribe to our newsletter.

Fill in your email and we’ll drop fresh insights and events info into your inbox each week.

* I agree to receive communications from Attest. Privacy Policy .

You're now subscribed to our mailing list to receive exciting news, reports, and other updates!

How To Do Market Research For New Product Development

Market research for new product development can be overwhelming.

It’s easy to get lost in a mountain of market reports with thousands of data points…. yet get no clear insights on which product is best for your brand.

Instead of aimlessly searching for new product ideas and sifting through endless market reports, this post will walk you through a simple step-by-step process that outlines:

- How to quickly find relevant new product ideas.

- Specific data and metrics you need to analyze each product opportunity (and how to find these metrics).

- How to use market research data to assess a product opportunity.

What Is Market Research For New Product Development?

Market research for new product development is the process of evaluating the demand, growth, and gaps in a market for a particular product (typically a physical product sold in a retail setting or direct to consumer).

These insights help you understand which products your target market wants, which ones are most profitable, and the key characteristics customers like and dislike about competitors' products.

With this data, you can more accurately predict which product will perform best for your business.

Types Of Market Research For New Product Development

There are four types of market research typically used for researching and developing products:

- Qualitative research

- Quantitative research

- Primary research

- Secondary research

Quantitative Research

Examples of quantitative data you might collect during the product market research process include:

- Market size and growth rates

- Pricing data

- Sales forecasts

- Website traffic data

- Market share of the top competitors

Quantitative data is helpful for benchmarking and is often the main type of research used to quickly gauge the potential of market opportunities.

Quantitative data can be fact-checked, but accuracy still varies depending on factors like sample size and data collection methods.

Qualitative Research

Qualitative research is data based on subjective opinions.

An example of qualitative data is customer feedback.

This data is helpful for product market research, as you can better understand customer pain points and what they like and dislike about what's already out there.

Some examples of qualitative research methods include:

- Interviews with potential customers

- Customer reviews

- Questionnaires and surveys

- Discussion analysis (monitoring conversations on social media, in forums, etc.)

- Feedback from focus groups

Primary Research

Primary research is data collected by you or your company.

Here are some examples of primary research:

- Results from a survey you conducted

- A report from sales data your team analyzed

- Customer interviews conducted by your team

The advantage of primary market research is that it's proprietary data your company owns. So your competitors won't have access to it. You can also tailor the data to answer your specific questions about the market.

The downside of primary research is that it’s expensive and time-consuming. You'll have to conduct the research, clean the data, and analyze it yourself.

You can hire a market research firm to help, but this will make it even more costly.

Secondary Research

Secondary research is data collected and published by other third-party sources, like an industry publication or government agency.

Here are some examples of secondary research:

- Free and paid market reports published by a source like Grand View Research or MarketResearch.com .

- Statistics published by a source like The U.S. Bureau of Labor Statistics or the U.S. Energy Information Administration .

- Data in the Census Business Builder .

Secondary research is usually cheaper than primary research, so it's great for the early stages of product market research when you're narrowing down your list of product ideas.

For example, if you're interested in the padel market, search "padel market forecast" to find free industry reports. You can look at statistics like compounding annual growth rate and market size to quickly gauge if the padel market is worth exploring in more detail.

The drawback of secondary research is that the data quality may vary as you can't control data quality.

So research how each provider collects and cleans the data they publish.

Step By Step Process To Conduct Market Research For Product Development

In this step-by-step market research process for new product development, you'll learn how to find, validate, and develop a great product.

Step 1: Research And Identify Trending Products

Many people browse social media and Amazon to find trending product ideas.

But emerging products, by definition, aren't easy to find.

You might spend hours browsing these platforms to find a few promising product ideas. And even the most diligent product researchers might still overlook the best emerging product ideas.

One solution to find great product ideas faster is to use a product research tool.

However, each tool contains different product ideas.

So the tool you choose significantly impacts the product ideas you find.

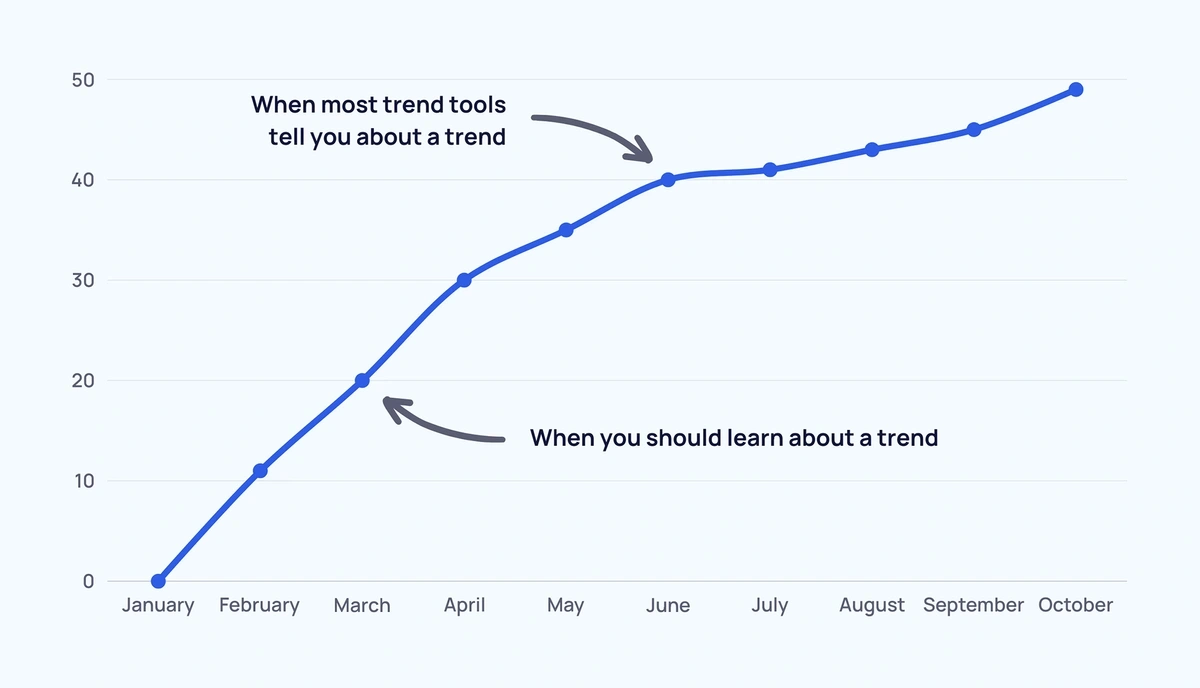

For example, many product research tools only show products that have grown significantly in the past few weeks. These are often fads, and demand may die out when you’re ready to launch your product.

Other product research tools show you products that are currently trending. Yet this isn't helpful if you want to launch a product before demand peaks.

Or, the product research tool might simply overlook the best product ideas. This is common with product research tools relying on human analysts to find product ideas, as even the best analysts may overlook a great product idea.

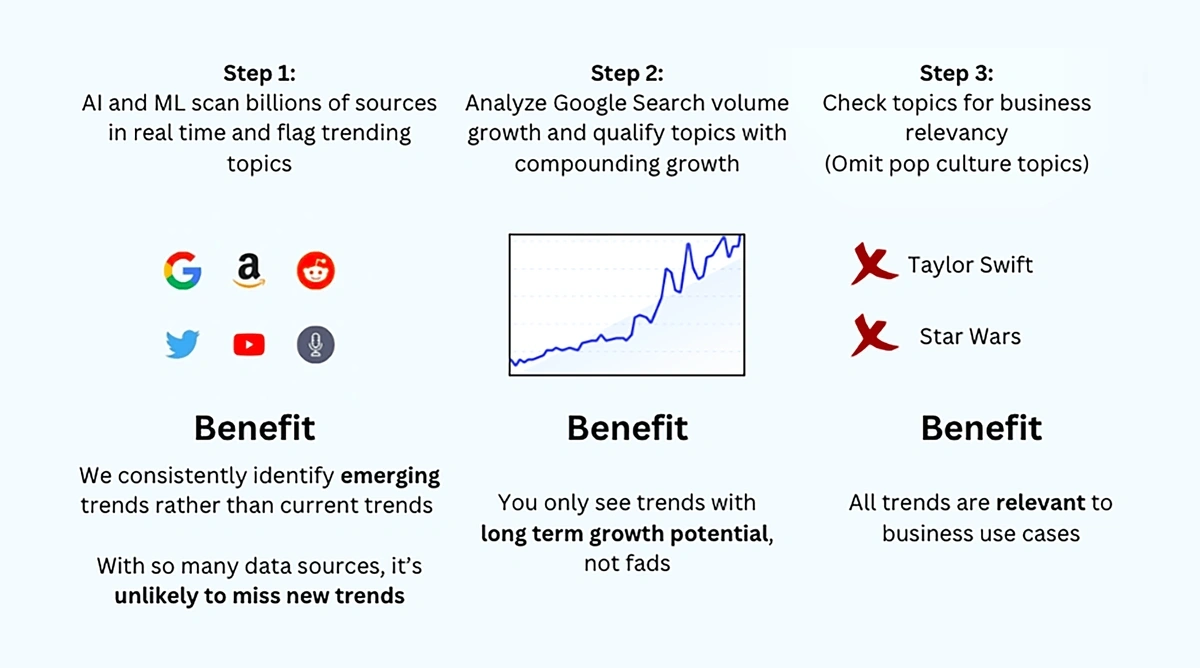

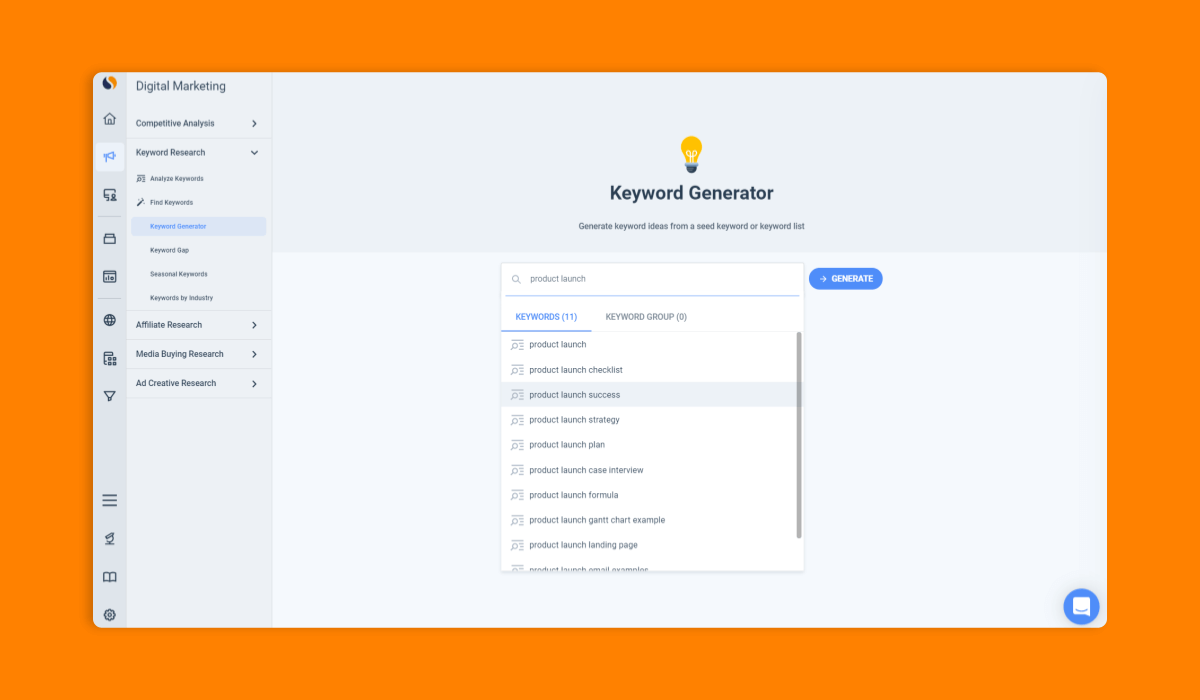

To solve these problems, we built our own product research tool, Exploding Topics.

It has a unique trend identification and qualification method that uses AI and ML to scan millions of data points across sources like YouTube, Amazon, Spotify, Google Search, and Reddit. This ensures it consistently spots emerging product ideas. Then, we use Google Search volume data to ensure the topic has a steady compounding growth trajectory.

This process allows Exploding Topics to consistently identify emerging products with long-term growth potential.

It's also easy to use.

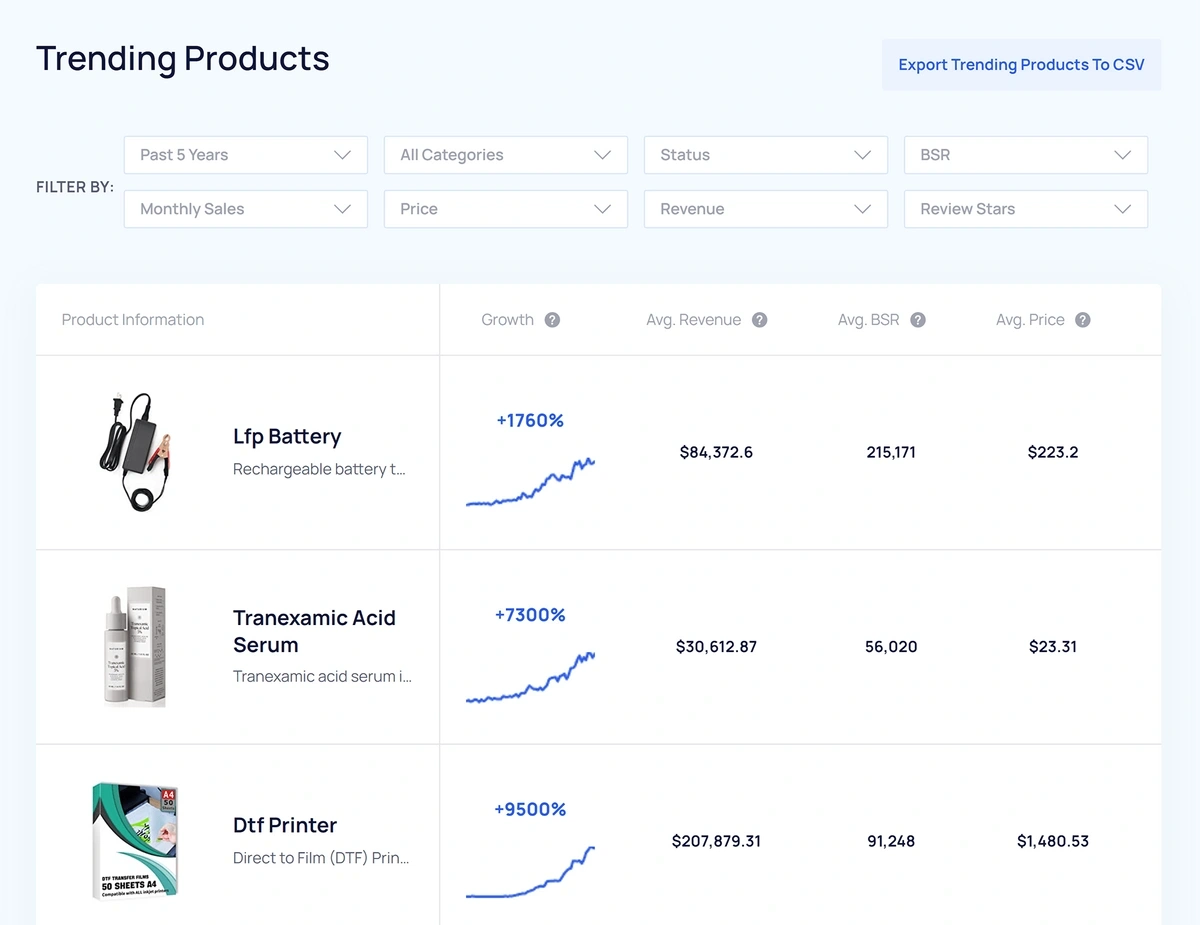

When you open the Trending Products dashboard, you'll see a list of trending products. You can filter the database by category (fitness, fashion, beauty, gaming, pets, etc.), BSR, monthly sales, price, revenue, and reviews.

The graph next to the product information also represents the keyword's Google Search volume trend so that you can gauge its growth trajectory:

When you see a product that interests you, click on it for more details, like a forecast of its growth trend for the coming year.

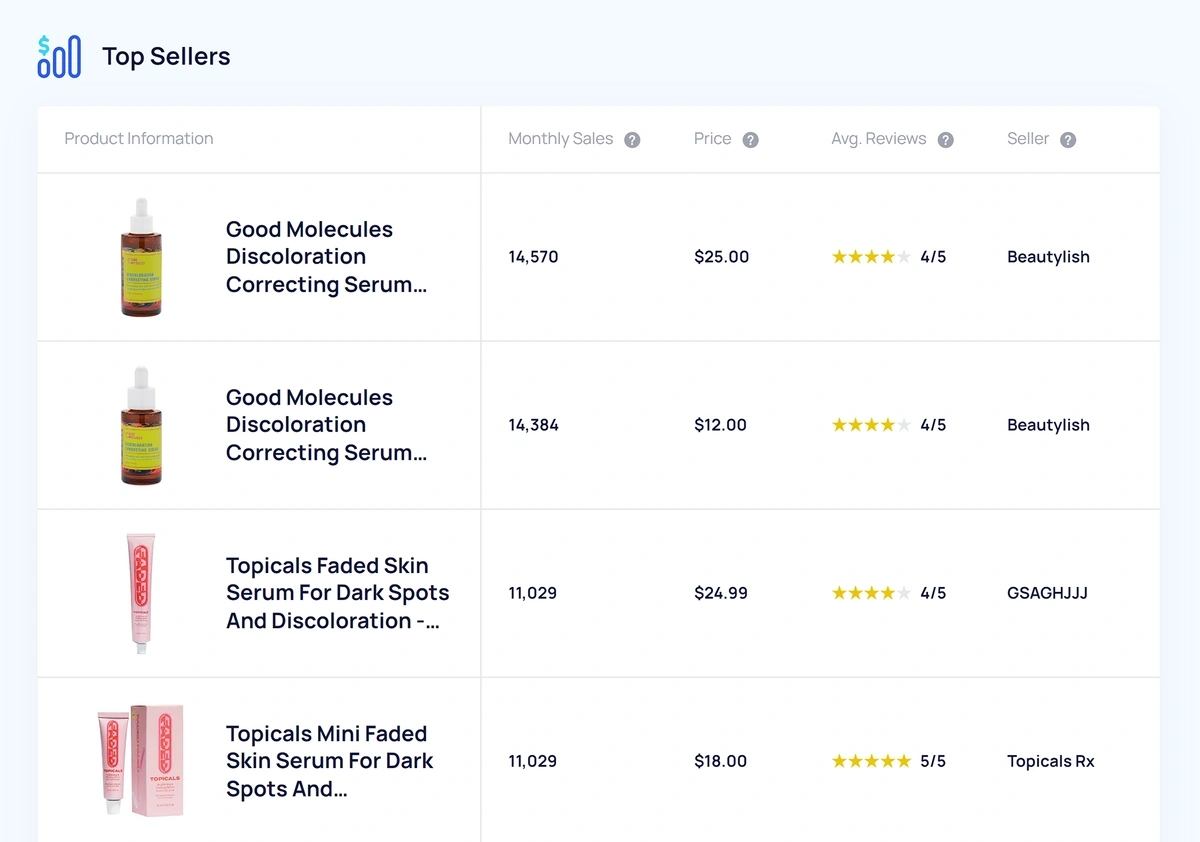

Further down the product page is a list of the Top Sellers for that product on Amazon.

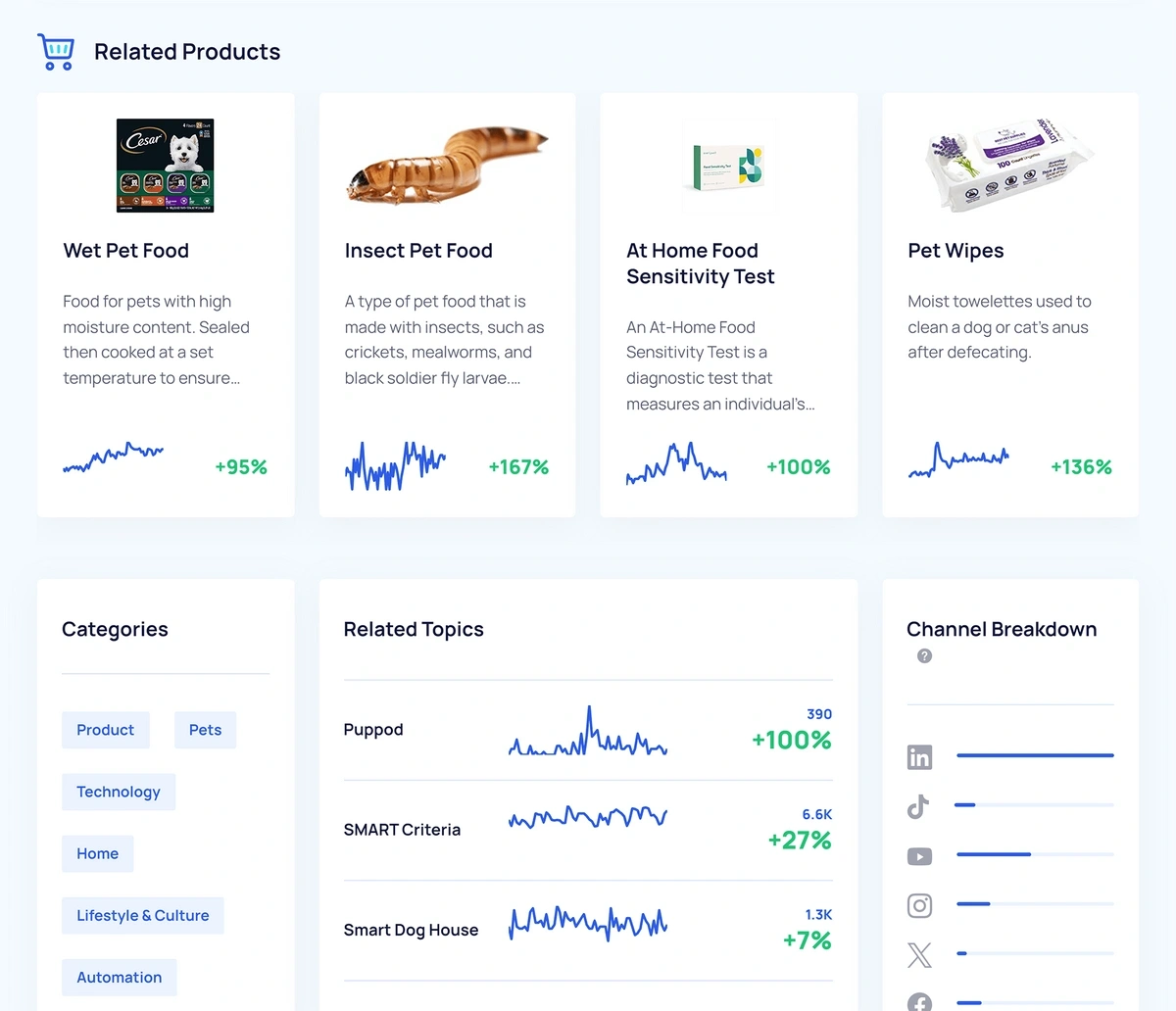

You’ll also see related trending products and topics. You can also click on any of those products for more detailed information.

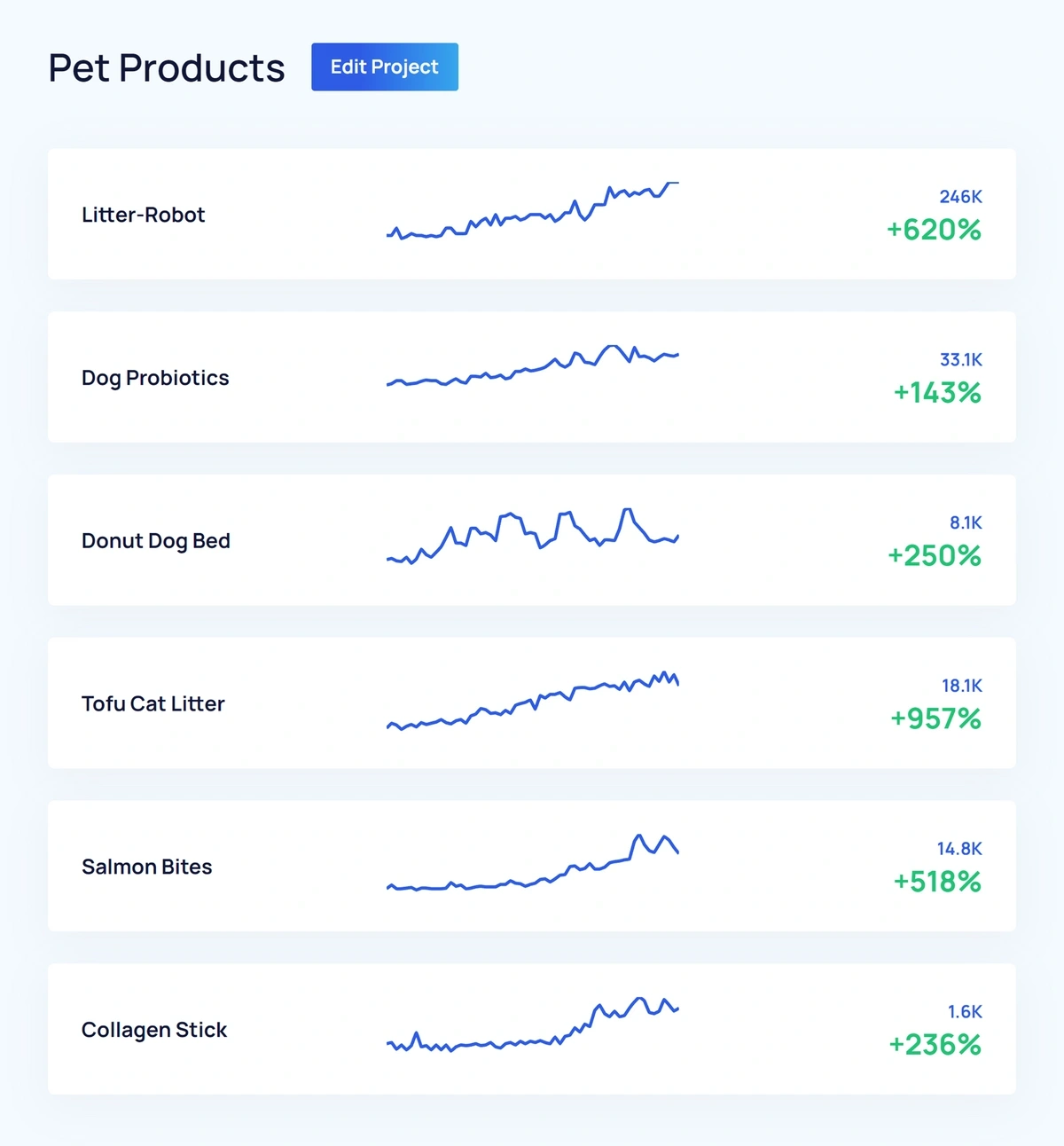

To track a product, click "Track Topic" and add it to a Project.

Projects are folders that live inside the Trend Tracking dashboard, and Exploding Topics updates each topic's growth trend in real time.

This makes it easy to gauge product growth at a glance so that you never have to worry about managing a product idea spreadsheet.

You can try Exploding Topics Pro for $1 to start researching product ideas.

Step 2: Analyze The Market For Each Product Idea

Your product is much more likely to succeed if it’s part of a growing market.

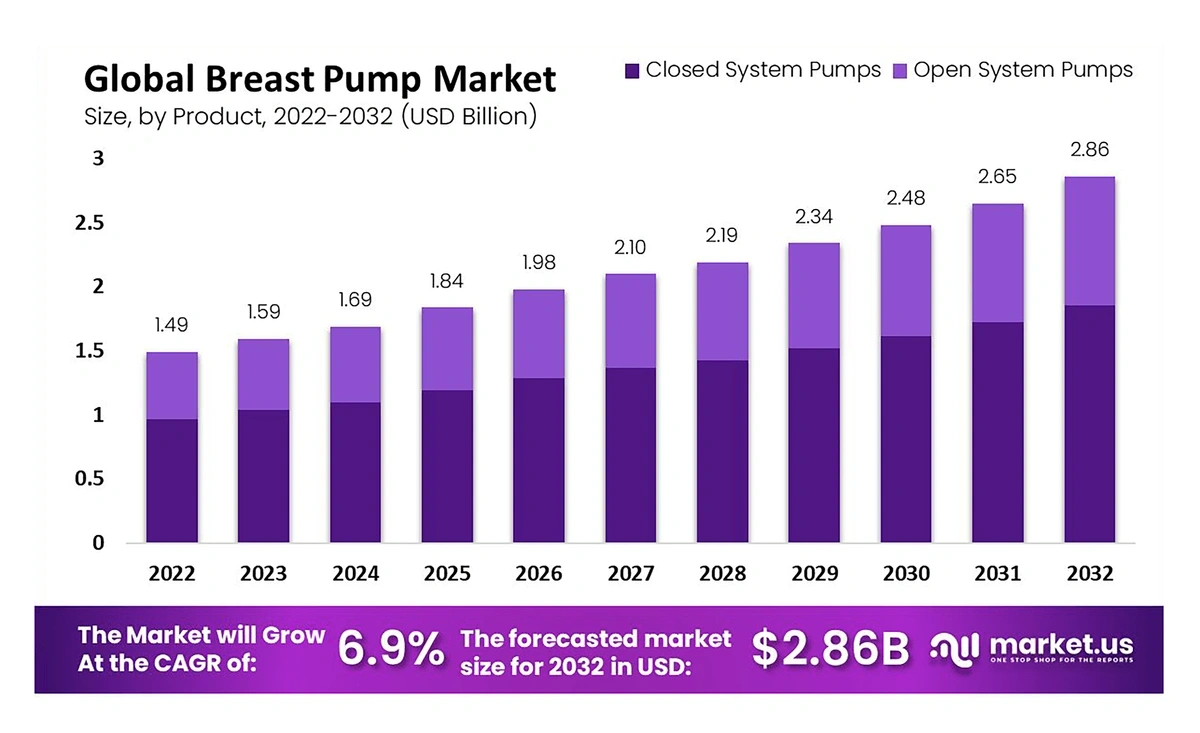

An easy way to quickly analyze a market’s general growth trajectory is to look at a market forecast.

Sources like Grand View Research , Globe Newswire , and Market.us usually offer free market reports with forecast data.

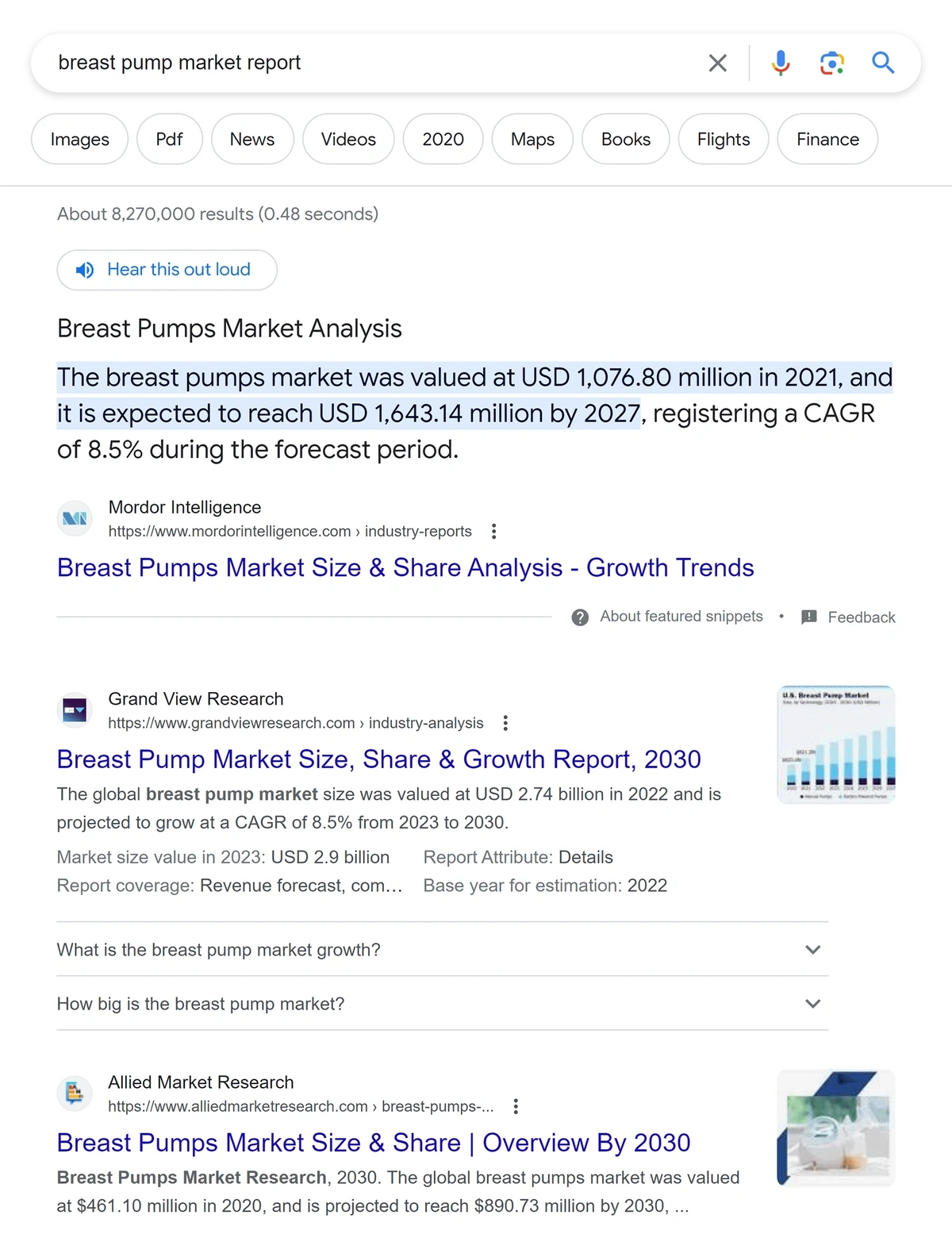

To find these reports, Google the product keyword and "market report:"

Next, identify the brands with the largest market share and analyze their growth trajectory.

If the market leaders are growing rapidly, the market is probably also expanding.

There are two ways to easily gauge a brand's growth.

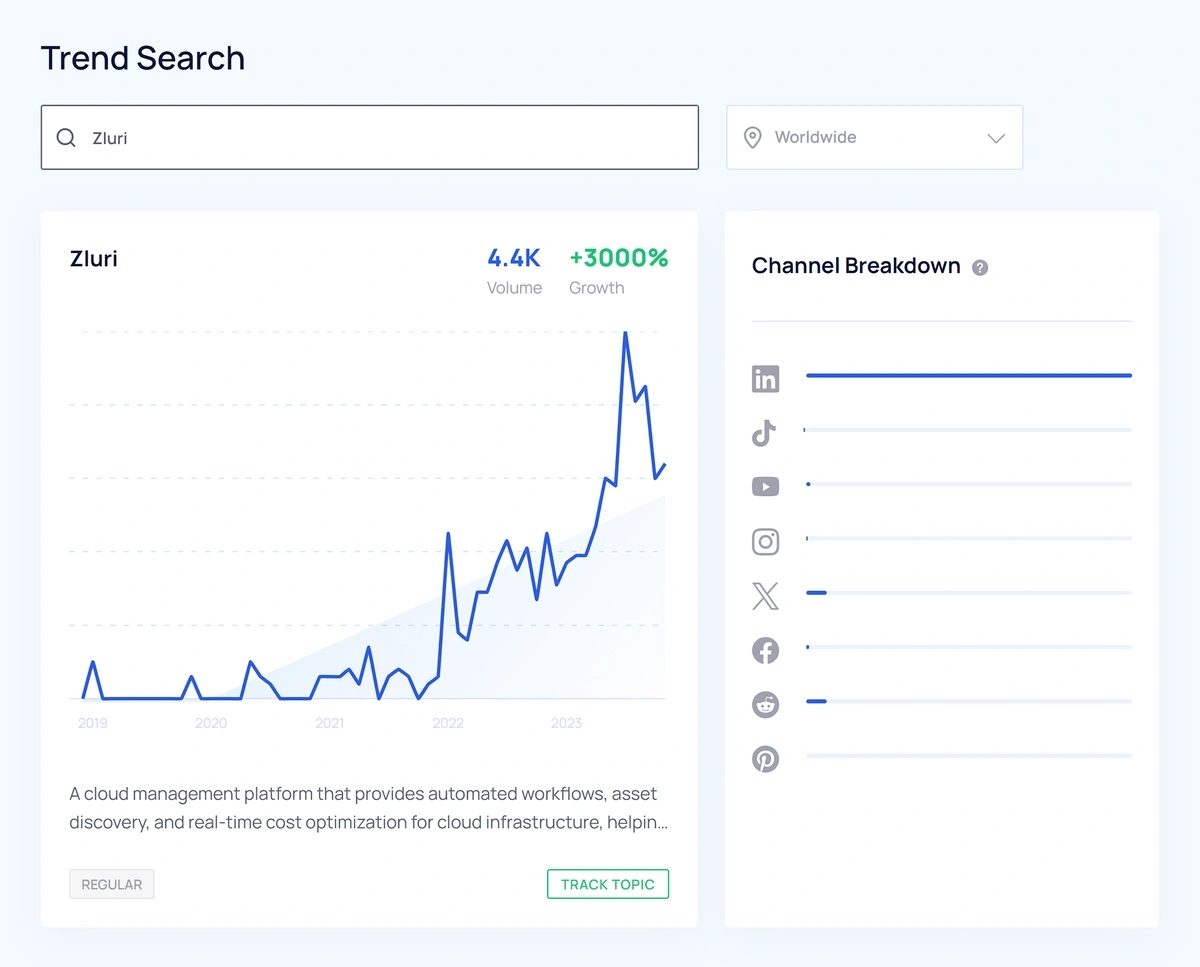

1. Check the brand’s Google Search volume trend .

You can find a brand's Google Search volume trend by typing the brand name into Google Trends or the Trends Search feature in Exploding Topics.

You can also click "Track Topic" and add it to a Project to monitor growth.

2. Employee headcount

A company is probably growing if it has steadily increased employee headcount over the past few years.

You can find employee headcount data by typing the brand name into LinkedIn and scrolling down to the bottom of the company page:

Funding data is also a great indicator of a market's growth trajectory.

Investors spend a lot of time and resources assessing market growth, so a lot of funding activity is a good sign the market is growing.

Paid tools like CB Insights and Pitchbook offer detailed funding data for most industries. You can also search "funding" and the industry name to find press releases, funding reports, and other relevant investment news.

Step 3: Conduct Customer Research

Once you find a trending product in a growing market, the next step is figuring out how to create the best product possible.

First, identify what customers like and dislike about existing products. Then, create a product that incorporates the elements customers like about existing products and solves the pain points they experience.

The easiest way to conduct customer research is to analyze customer reviews.

Amazon is the best resource to find verified reviews. As you're reading through the reviews, make notes on:

- Target Audience Demographics : Who is buying the product? (gender, age, location, etc.).

- Use Case : What problem did they purchase the product to solve?

- Praise : What do they like about the product?

- Pain Points : What do they like about the product?

For example, from the review below, you can tell that customers value soft material, accurate color descriptions, and expensive aesthetics. You can also see that customers want a more durable product.

Reading through reviews can help you better understand your target customers, but most people don't have time to read thousands of customer reviews.

So you can also copy and paste customer reviews into ChatGPT and ask it to extract insights on audience demographics, product use cases, likes, and dislikes.

Here's a prompt you can use to analyze the reviews. (In this screenshot, all of the reviews are pasted in quotes following the prompt):

Here’s a snippet of the response it generated:

You can also find Reddit or Facebook groups of your target audience.

For example, if you're considering selling infant vitamins, you could join these Facebook groups for moms:

After joining the group, you can ask members about the product you're researching. Here are some specific questions you can ask:

- Why did they purchase the product?

- How did they select the brand they purchased from?

- What do they like/dislike about the product?

You can also ask respondents if they would consider getting on a quick call. One-on-one interviews let you ask more follow-up questions to better understand the audience.

Talking to prospects is also a great way to build up some demand for your product and even recruit a group of beta testers.

If you already have an audience, ask them about your new product idea.

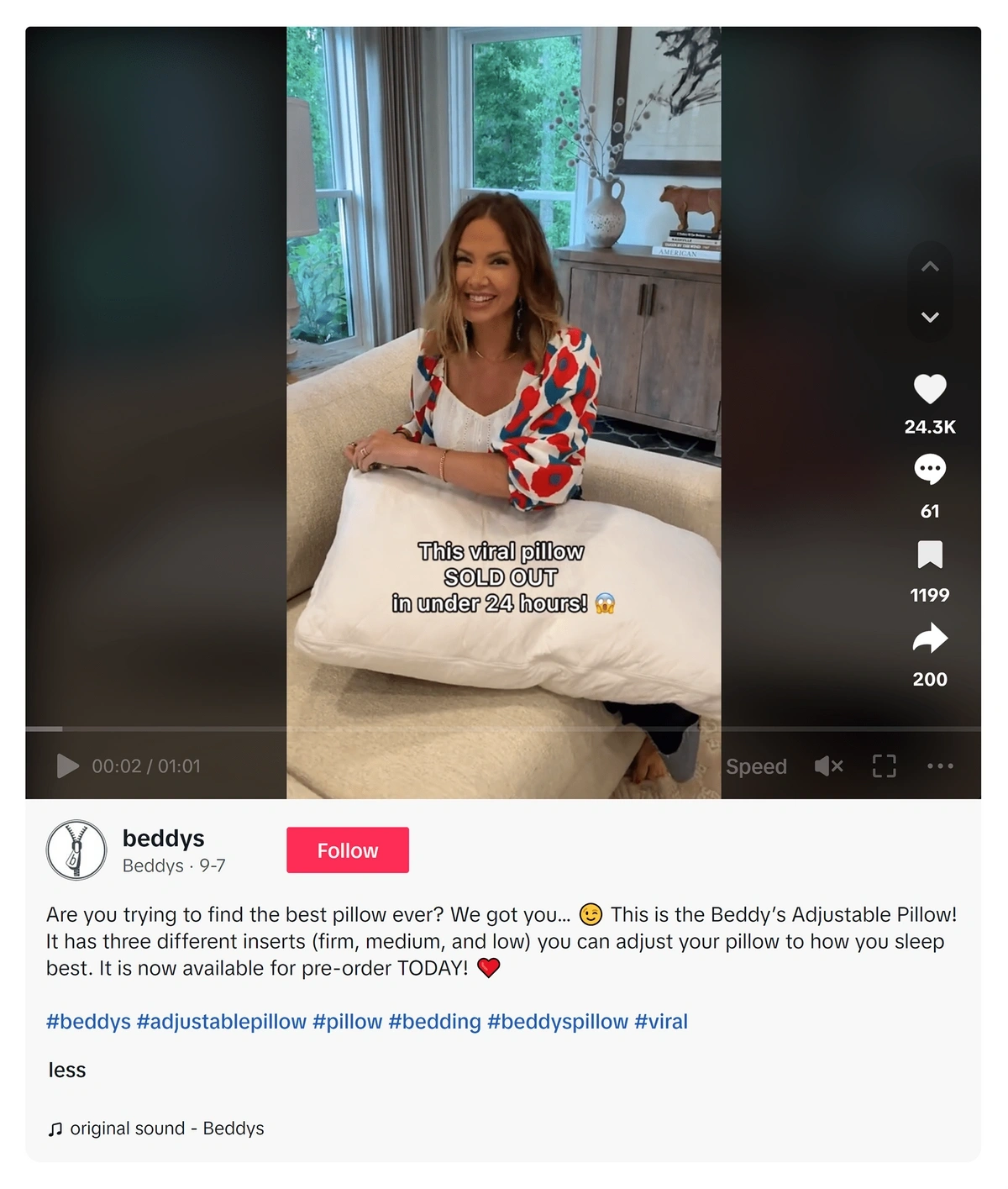

For example, this creator asked her TikTok followers what they thought of her sleepwear product idea.

Then, she documented the product development process and gathered feedback from her followers to craft a product they want.

For example, after designing a few concepts with the manufacturer, she created another video of the initial product designs and asked her audience for feedback.

Her product launch went on to be a major success and she sold out in a matter of hours.

Step 4: Pre-Sell Your Product And Gather Initial Feedback

The best way to validate market demand for your product concept is to see if people will buy it.

So design a few product samples and then run a pre-order sale.

If nobody buys the product, you'll avoid wasting thousands of dollars developing tens or hundreds of products that nobody wants.

And if your pre-order sale is successful, you can use that revenue to fund product development.

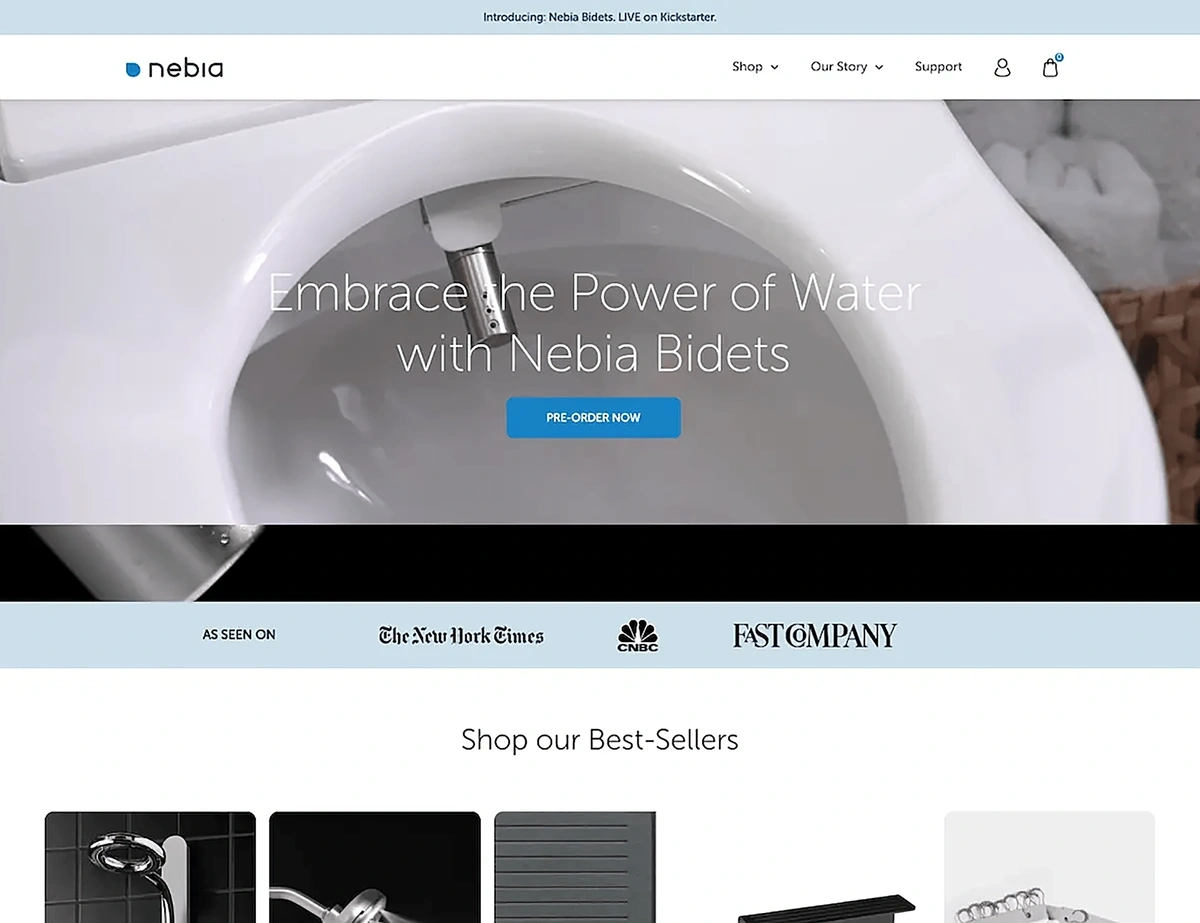

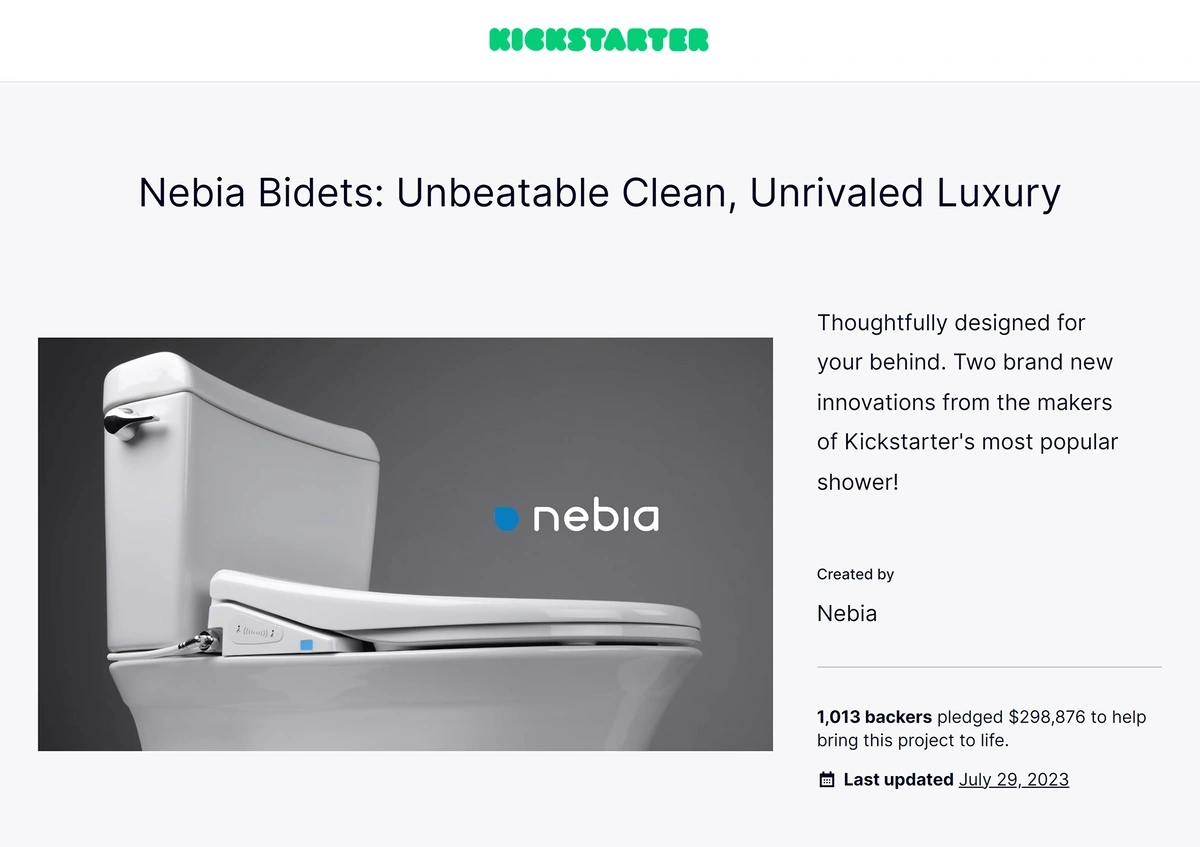

For example, Nebia ran a pre-order sale for its bidets to validate the product concept.

There are a few different ways you can generate pre-orders.

If you already have an audience, you can create a social media post or email your list and announce the pre-order sale.

This post is a great example of a pre-order sale video. The influencer explains how the product works, its benefits, and how it solves common pain points.

If you don't have an audience, you can work with an influencer to create a pre-order video for you.

You can also run Facebook or Instagram ads to a landing page to generate pre-orders. Facebook has a step-by-step guide explaining how to set up and run ads for pre-order sales.

Another option is to run a pre-order sale on Kickstarter.

Nebia is a great example of an ecommerce brand that validated its product idea on Kickstarter.

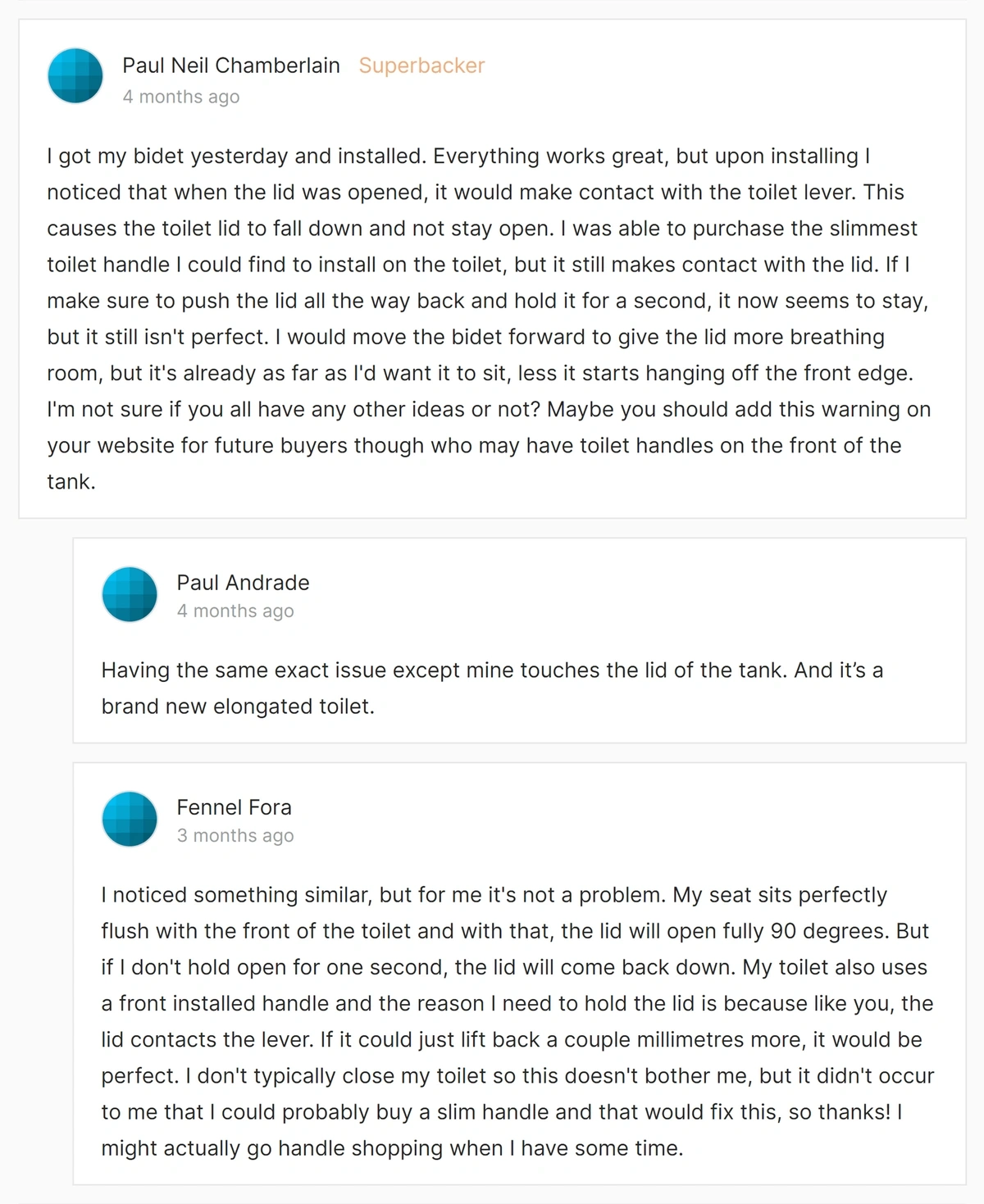

The Kickstarter community will also give you initial feedback on the product before you launch it to the public. Kickstarter users also know they're beta testers, so they tend to be more forgiving if the initial product concept isn't perfect.

You can also ask some Kickstarter buyers to record video reviews of the product for your public product launch.

Step 5: Launch Your New Product And Gather Feedback

After launching your product, gather feedback from your audience to continue iterating on the original product.

If you have a social media following, you can ask your audience what they like and dislike about the product.

You can also email your list offering a discount or coupon to complete a product survey.

Survey tools like Pollfish and SurveyMonkey make it easy to create and send a product survey.

In the survey, ask specific questions about the product. For example, if you’re selling athletic clothing, you could ask them to rate the product fit, material quality, durability, style, color, and other specific factors.

If you leave the questions too open ended, people will give you generic feedback that might not be very helpful for improving the product.

Start The New Product Market Research Process Today

A solid product market research process takes the guesswork out of product launches by giving you the data you need to identify and design the best product for your audience.

It will also give you more confidence on launch day, as you'll have solid evidence of strong demand for your product.

To get started with the first step of the product market research process, use Exploding Topics to browse thousands of emerging trending products today.

Find Thousands of Trending Topics With Our Platform

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

How to Conduct Market Research for a Startup

- 17 Mar 2022

With every innovative product idea comes the pressing question: “Will people want to buy it?”

As an entrepreneur with a big idea, what’s the best way to determine how potential customers will react to your product? Conducting market research can provide the data needed to decide whether your product fits your target market.

Before launching a new venture, you should understand market research. Here’s how to conduct market research for a startup and why it’s important.

Access your free e-book today.

What Is Market Research?

Market research is the process of gathering information about customers and the market as a whole to determine a product or service’s viability. Market research includes interviews, surveys, focus groups, and industry data analyses.

The goal of market research is to better understand potential customers, how well your product or service fits their needs, and how it compares to competitors’ offerings.

There are two types of research you can conduct: primary and secondary.

- Primary research requires collecting data to learn about your specific customers or target market segment. It’s useful for creating buyer personas, segmenting your market, and improving your product to cater to customers’ needs .

- Secondary research is conducted using data you didn’t collect yourself. Industry reports, public databases, and other companies’ proprietary data can be used to gain insights into your target market segment and industry.

Why Is Market Research Important for Entrepreneurs?

Before launching your venture, it’s wise to conduct market research to ensure your product or service will be well received. Feedback from people who fall into your target demographics can be invaluable as you iterate on and improve your product.

Performing market research can also help you determine a pricing strategy by gauging customers’ willingness to pay for your product. Additionally, it can improve the user experience by revealing what features matter most to potential customers.

When assessing which startups to fund, investors place heavy importance on thorough market research that indicates promising potential. Providing tangible proof that your product fulfills a market need and demonstrating you’ve taken the time to iterate on and improve it signal that your startup could be a worthwhile investment.

Related: How to Talk to Potential Investors: 5 Tips

How to Do Market Research for a Startup

1. form hypotheses.

What questions do you aim to answer through market research? Using those questions, you can make predictions called hypotheses . Defining your hypotheses upfront can help guide your approach to selecting subjects, researching questions, and testing designs.

An example question you may ask is: “How much are people in my target demographic willing to pay for the current version of my product?” Your hypothesis could be: “If my product contains all its current features, customers will be willing to pay $500 for it.”

Another example question you may ask is: “What’s the user’s biggest pain point, and is my product meeting their needs?” Your hypothesis could be: “I believe the user’s biggest pain point is needing an easy, unintimidating way to learn basic car maintenance, and I predict that my product meets that need.”

You can and should test multiple hypotheses, but try to select no more than a few per test, so the research stays focused.

Related: A Beginner’s Guide to Hypothesis Testing in Business

2. Select the Type of Research Needed to Test Hypotheses

Once you’ve formed your hypotheses, determine which type of research to conduct.

If your hypotheses focus on determining your startup’s place in the broader market, start with secondary research. This can include using existing data to determine market size, how much of that market your startup could reasonably own, who your biggest competitors are, and how your brand and product compare to theirs.

If your hypotheses require primary research, decide which data collection method best fits your needs. These can include one-on-one interviews, surveys, focus groups, and polls. Primary research allows you to gather insights into customer satisfaction and loyalty, brand awareness and perception, and real-time product usability.

3. Identify Target Demographics and Recruit Subjects

To gather meaningful insights, you need to understand your target demographic. Do you aim to cater to working parents, young athletes, or pet owners? Determine the type of person who can benefit from your product.

If you conduct primary research, you need to recruit subjects. This can be done in several ways, including:

- Word of mouth: The simplest but least reliable way to recruit participants is by word of mouth. Ask people you know to refer others to be research subjects, then screen them to confirm they fit your target demographic.

- Promoting the study on social media: Many social media platforms enable you to show an ad to people who fall into specific demographic categories or have certain interests. This allows you to get the word out to a large number of people who qualify.

- Hiring a third-party market research company: Some companies provide full market research services and recruit participants and conduct research on your behalf.

However you recruit subjects, ensure they take a screener survey beforehand, which allows you to determine whether they fit the specific demographic you want to study or have a trait that eliminates them from the research pool. It also provides demographic data—such as age and race—that enables you to select a diverse subset of your target demographic.

In addition, you can offer compensation to boost participation, such as money, meal vouchers, gift cards, or early access to your product. Make it clear that compensation is in appreciation for subjects’ time and honest feedback.

4. Conduct the Research

Once you’ve determined the type of research and target demographic necessary to test your hypotheses, conduct your research. To reduce bias, enlist someone unfamiliar with your hypotheses to perform interviews or lead focus groups.

Ask questions based on your audience and hypotheses. For instance, if you’re aiming to test existing customers’ purchase motivations, you may ask: “What challenge were you trying to solve when you first bought the product?”

If examining brand perception, your audience should consist of potential customers who don’t yet know your brand. Present them with a list of competitor logos—with yours in the mix—and ask them to rank the brands by perceived reliability.

While the questions you ask are vehicles to prove or disprove hypotheses, ensure they don’t lead subjects in one direction. To craft unbiased research questions , use neutral language and vary the order of options in multiple-choice questions. This can keep subjects from selecting the same option each time if they sense the third option is always mapped to a certain outcome. It also helps account for primacy bias (the tendency to select the first option in a list) and recency bias (the tendency to select the final option in a list).

Once you’ve collected data, ensure it’s organized efficiently and securely so you can protect subjects’ identities .

Related: 3 Examples of Bad Survey Questions and How to Fix Them

5. Gather Insights and Determine Action Items

After you’ve organized your data, analyze it to extract actionable insights. While some of the data will be qualitative rather than quantitative, you can detect patterns in responses to make it quantifiable. For instance, noting that 15 of 20 subjects mentioned feeling overwhelmed when attempting to assemble your product.

Once you’ve analyzed the data and communicated emerging trends using data visualizations , outline action items.

If the majority of users in your target demographic reported feeling overwhelmed while assembling your product, action items might include:

- Creating different versions of assembly instructions to test with other groups, varying diagrams and instructional language

- Researching instruction manual best practices

Each round of market research can offer more information about how your product is perceived and experienced by potential users.

Market Research as an Ongoing Endeavor

While it’s useful to conduct market research before launching your product, you should revisit your hypotheses and form new ones over the course of building your venture.

By conducting market research with each version of your product, you can gradually improve it and ensure it continues to fit target customers’ needs.

Are you interested in bolstering your entrepreneurship skills? Explore our four-week online course Entrepreneurship Essentials and our other entrepreneurship and innovation courses to learn to speak the language of the startup world.

About the Author

8 Tips to Optimize Your New Product Launch in a New Market

Are you running a startup or getting ready for a new product launch and feeling afraid to fail? You have good reason to be concerned. According to Harvard Business Review, 75% of product launches fail to entice consumers .

Visibility into potential profits and revenues and the ability to perform market research for your business plan with data analysis can be crucial for securing additional funding or scaling your business. To help, we’ve come up with eight tips for you to maximize your odds of successfully launching a new product in a new market. These same tips can be used when launching a new service or brand.

How to launch a new product in a new market

When you work to expand your market size, you should keep in mind that there are always risks involved, including the possibility of incurring heavy losses and even layoffs.

Data-driven decision-making is the number one way to avoid the pitfalls of launching in a new market and improving your brand’s online visibility.

1. Define your target market

Entering a new market requires creating a long-term strategy that clearly defines goals and outlines milestones for your new product launch. What are the main user demographics of your target market ? Are they mobile-first or social-savvy? When and where do they shop online? What is their age distribution?

Answering these questions about demographics and potential customers is a vital step in order for you to present your product in a way that makes sense to your target market whether it’s in your marketing plan or in your design.

Your starting point is to calculate your serviceable obtainable market (SOM) and, based on that, prepare a list of primary user personas. A user persona is a fictional character created to represent a customer type that might use a product or service based on their use case and how it can solve an existing problem. For more on how to create user personas, check out this blog post by Hotjar.

Target market example: Young adults aged 20- 30, who live in the United Kingdom and are potential students or new parents. They’re very keen on online shopping and, on average, spend 1,000 hours and 2,500 British pounds a year online.

Questions to ask about your target audience before your new product launch

Defining your market is one thing, getting the right people to act is another ball game. These questions will help you focus and refine your strategy.

- Which action do you want your target audience to take?

- Who are the people most likely to take the specific action and use your new product? (get specific about demographics: age, gender, location, device, etc.)

- What are their pain points that you can address with your product?

- What is the solution your product offers for these issues?

- Which comparable products does your target audience currently use?

- How much does it cost them to use the competitor’s product?

- Which communication channels do they use most frequently?

- How and when are they most likely to purchase your product (is it seasonal, time-sensitive, one-time, or recurring; will they purchase online or offline, cash or card, etc.)?

- Which communication channels would they prefer for feedback and support?

- What can you offer as an incentive? What would be most attractive for your target audience in relation to your product (a discount, demo, free trial)?

The next critical step is to figure out the best way to reach the specific audience you are targeting.

Ways to reach your audience

Answering the ten questions above puts you on the right track. You’ve assessed which channels your audience uses and how they prefer to communicate.

If you are already marketing to a similar audience, identify your most effective channels by analyzing your existing audience’s behavior . Check performance metrics, such as top referring domains, social media networks and affiliates, views and conversions, email open and click-through rates, and engagement metrics .

Next, you need to determine how to leverage what you know about your target audience’s behavior for your new product launch.

Imagine the purchasing funnel and how you will gently guide your potential customers through. You will need to prepare different content types for different funnel stages and distribute them on various channels.

Consider the funnel

Typically, your initial effort will focus on raising awareness for something new. You want to determine the best tactics that let you create a buzz. Social Media, blogs, native advertising , infographics, other visual content, and video clips are handy for the top of the funnel (TOFU). Large brands often start building up the anticipation level before the launch date.

In the middle of the funnel (MOFU), which is the consideration stage, you need to start engaging and presenting your product features more clearly. When people evaluate your product and consider a purchase, useful channels are podcasts, webinars, free guides, e-books, reports, and reviews. You can use PPC and display ads to promote some of your high-value content.

The final step towards deciding is usually the hardest for the prospect. At the bottom of the funnel (BOFU) you want to help them take the final step by finding ways to engage so you can address individual pain points. Use email marketing to distribute gated content that lets you collect leads. White Papers, comparisons, reports, and product presentations can provide the audience with the needed input.

Another approach could be to offer live events, workshops, and conferences, or you could do a raffle, a contest, or another challenge on social media. Get more ideas about how to get started with your content marketing and which content is best for each funnel stage.

2. Define your goals

Goal setting adds clarity and is an essential part of any successful product launch strategy. There are a number of goals that are commonly found in relation to launching in a new market:

Financial goals

If you want to set revenue goals, ask yourself: how many product units will I need to sell in order to cover my production and marketing costs? When do I expect to reach profitability? How much income can I generate in a month/quarter/year?

Financial goal examples: Add $1 million in incremental revenue over a year; increase profit margins by 10%; boost customer retention or renewals rates; increase profit margins by 10%.

Customer goals