- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

What is a business plan? Definition, Purpose, and Types

In the world of business, a well-thought-out plan is often the key to success. This plan, known as a business plan, is a comprehensive document that outlines a company’s goals, strategies , and financial projections. Whether you’re starting a new business or looking to expand an existing one, a business plan is an essential tool.

As a business plan writer and consultant , I’ve crafted over 15,000 plans for a diverse range of businesses. In this article, I’ll be sharing my wealth of experience about what a business plan is, its purpose, and the step-by-step process of creating one. By the end, you’ll have a thorough understanding of how to develop a robust business plan that can drive your business to success.

What is a business plan?

Purposes of a business plan, what are the essential components of a business plan, executive summary, business description or overview, product and price, competitive analysis, target market, marketing plan, financial plan, funding requirements, types of business plan, lean startup business plans, traditional business plans, how often should a business plan be reviewed and revised, what are the key elements of a lean startup business plan.

- What are some of the reasons why business plans don't succeed?

A business plan is a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. It’s a living document that you can update as your business grows and changes.

Looking for someone to write a business plan?

Find professional business plan writers for your business success.

These are the following purpose of business plan:

- Attract investors and lenders: If you’re seeking funding for your business , a business plan is a must-have. Investors and lenders want to see that you have a clear plan for how you’ll use their money to grow your business and generate revenue.

- Get organized and stay on track: Writing a business plan forces you to think through all aspects of your business, from your target market to your marketing strategy. This can help you identify any potential challenges and opportunities early on, so you can develop a plan to address them.

- Make better decisions: A business plan can help you make better decisions about your business by providing you with a framework to evaluate different options. For example, if you’re considering launching a new product, your business plan can help you assess the potential market demand, costs, and profitability.

The executive summary is the most important part of your business plan, even though it’s the last one you’ll write. It’s the first section that potential investors or lenders will read, and it may be the only one they read. The executive summary sets the stage for the rest of the document by introducing your company’s mission or vision statement, value proposition, and long-term goals.

The business description section of your business plan should introduce your business to the reader in a compelling and concise way. It should include your business name, years in operation, key offerings, positioning statement, and core values (if applicable). You may also want to include a short history of your company.

In this section, the company should describe its products or services , including pricing, product lifespan, and unique benefits to the consumer. Other relevant information could include production and manufacturing processes, patents, and proprietary technology.

Every industry has competitors, even if your business is the first of its kind or has the majority of the market share. In the competitive analysis section of your business plan, you’ll objectively assess the industry landscape to understand your business’s competitive position. A SWOT analysis is a structured way to organize this section.

Your target market section explains the core customers of your business and why they are your ideal customers. It should include demographic, psychographic, behavioral, and geographic information about your target market.

Marketing plan describes how the company will attract and retain customers, including any planned advertising and marketing campaigns . It also describes how the company will distribute its products or services to consumers.

After outlining your goals, validating your business opportunity, and assessing the industry landscape, the team section of your business plan identifies who will be responsible for achieving your goals. Even if you don’t have your full team in place yet, investors will be impressed by your clear understanding of the roles that need to be filled.

In the financial plan section,established businesses should provide financial statements , balance sheets , and other financial data. New businesses should provide financial targets and estimates for the first few years, and may also request funding.

Since one goal of a business plan is to secure funding from investors , you should include the amount of funding you need, why you need it, and how long you need it for.

- Tip: Use bullet points and numbered lists to make your plan easy to read and scannable.

Access specialized business plan writing service now!

Business plans can come in many different formats, but they are often divided into two main types: traditional and lean startup. The U.S. Small Business Administration (SBA) says that the traditional business plan is the more common of the two.

Lean startup business plans are short (as short as one page) and focus on the most important elements. They are easy to create, but companies may need to provide more information if requested by investors or lenders.

Traditional business plans are longer and more detailed than lean startup business plans, which makes them more time-consuming to create but more persuasive to potential investors. Lean startup business plans are shorter and less detailed, but companies should be prepared to provide more information if requested.

Need Guidance with Your Business Plan?

Access 14 free business plan samples!

A business plan should be reviewed and revised at least annually, or more often if the business is experiencing significant changes. This is because the business landscape is constantly changing, and your business plan needs to reflect those changes in order to remain relevant and effective.

Here are some specific situations in which you should review and revise your business plan:

- You have launched a new product or service line.

- You have entered a new market.

- You have experienced significant changes in your customer base or competitive landscape.

- You have made changes to your management team or organizational structure.

- You have raised new funding.

A lean startup business plan is a short and simple way for a company to explain its business, especially if it is new and does not have a lot of information yet. It can include sections on the company’s value proposition, major activities and advantages, resources, partnerships, customer segments, and revenue sources.

What are some of the reasons why business plans don't succeed?

- Unrealistic assumptions: Business plans are often based on assumptions about the market, the competition, and the company’s own capabilities. If these assumptions are unrealistic, the plan is doomed to fail.

- Lack of focus: A good business plan should be focused on a specific goal and how the company will achieve it. If the plan is too broad or tries to do too much, it is unlikely to be successful.

- Poor execution: Even the best business plan is useless if it is not executed properly. This means having the right team in place, the necessary resources, and the ability to adapt to changing circumstances.

- Unforeseen challenges: Every business faces challenges that could not be predicted or planned for. These challenges can be anything from a natural disaster to a new competitor to a change in government regulations.

What are the benefits of having a business plan?

- It helps you to clarify your business goals and strategies.

- It can help you to attract investors and lenders.

- It can serve as a roadmap for your business as it grows and changes.

- It can help you to make better business decisions.

How to write a business plan?

There are many different ways to write a business plan, but most follow the same basic structure. Here is a step-by-step guide:

- Executive summary.

- Company description.

- Management and organization description.

- Financial projections.

How to write a business plan step by step?

Start with an executive summary, then describe your business, analyze the market, outline your products or services, detail your marketing and sales strategies, introduce your team, and provide financial projections.

Why do I need a business plan for my startup?

A business plan helps define your startup’s direction, attract investors, secure funding, and make informed decisions crucial for success.

What are the key components of a business plan?

Key components include an executive summary, business description, market analysis, products or services, marketing and sales strategy, management and team, financial projections, and funding requirements.

Can a business plan help secure funding for my business?

Yes, a well-crafted business plan demonstrates your business’s viability, the use of investment, and potential returns, making it a valuable tool for attracting investors and lenders.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

ZenBusiness

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

What is a Business Plan? Definition and Resources

9 min. read

Updated May 10, 2024

If you’ve ever jotted down a business idea on a napkin with a few tasks you need to accomplish, you’ve written a business plan — or at least the very basic components of one.

The origin of formal business plans is murky. But they certainly go back centuries. And when you consider that 20% of new businesses fail in year 1 , and half fail within 5 years, the importance of thorough planning and research should be clear.

But just what is a business plan? And what’s required to move from a series of ideas to a formal plan? Here we’ll answer that question and explain why you need one to be a successful business owner.

- What is a business plan?

A business plan lays out a strategic roadmap for any new or growing business.

Any entrepreneur with a great idea for a business needs to conduct market research , analyze their competitors , validate their idea by talking to potential customers, and define their unique value proposition .

The business plan captures that opportunity you see for your company: it describes your product or service and business model , and the target market you’ll serve.

It also includes details on how you’ll execute your plan: how you’ll price and market your solution and your financial projections .

Reasons for writing a business plan

If you’re asking yourself, ‘Do I really need to write a business plan?’ consider this fact:

Companies that commit to planning grow 30% faster than those that don’t.

Creating a business plan is crucial for businesses of any size or stage. It helps you develop a working business and avoid consequences that could stop you before you ever start.

If you plan to raise funds for your business through a traditional bank loan or SBA loan , none of them will want to move forward without seeing your business plan. Venture capital firms may or may not ask for one, but you’ll still need to do thorough planning to create a pitch that makes them want to invest.

But it’s more than just a means of getting your business funded . The plan is also your roadmap to identify and address potential risks.

It’s not a one-time document. Your business plan is a living guide to ensure your business stays on course.

Related: 14 of the top reasons why you need a business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

What research shows about business plans

Numerous studies have established that planning improves business performance:

- 71% of fast-growing companies have business plans that include budgets, sales goals, and marketing and sales strategies.

- Companies that clearly define their value proposition are more successful than those that can’t.

- Companies or startups with a business plan are more likely to get funding than those without one.

- Starting the business planning process before investing in marketing reduces the likelihood of business failure.

The planning process significantly impacts business growth for existing companies and startups alike.

Read More: Research-backed reasons why writing a business plan matters

When should you write a business plan?

No two business plans are alike.

Yet there are similar questions for anyone considering writing a plan to answer. One basic but important question is when to start writing it.

A Harvard Business Review study found that the ideal time to write a business plan is between 6 and 12 months after deciding to start a business.

But the reality can be more nuanced – it depends on the stage a business is in, or the type of business plan being written.

Ideal times to write a business plan include:

- When you have an idea for a business

- When you’re starting a business

- When you’re preparing to buy (or sell)

- When you’re trying to get funding

- When business conditions change

- When you’re growing or scaling your business

Read More: The best times to write or update your business plan

How often should you update your business plan?

As is often the case, how often a business plan should be updated depends on your circumstances.

A business plan isn’t a homework assignment to complete and forget about. At the same time, no one wants to get so bogged down in the details that they lose sight of day-to-day goals.

But it should cover new opportunities and threats that a business owner surfaces, and incorporate feedback they get from customers. So it can’t be a static document.

Related Reading: 5 fundamental principles of business planning

For an entrepreneur at the ideation stage, writing and checking back on their business plan will help them determine if they can turn that idea into a profitable business .

And for owners of up-and-running businesses, updating the plan (or rewriting it) will help them respond to market shifts they wouldn’t be prepared for otherwise.

It also lets them compare their forecasts and budgets to actual financial results. This invaluable process surfaces where a business might be out-performing expectations and where weak performance may require a prompt strategy change.

The planning process is what uncovers those insights.

Related Reading: 10 prompts to help you write a business plan with AI

- How long should your business plan be?

Thinking about a business plan strictly in terms of page length can risk overlooking more important factors, like the level of detail or clarity in the plan.

Not all of the plan consists of writing – there are also financial tables, graphs, and product illustrations to include.

But there are a few general rules to consider about a plan’s length:

- Your business plan shouldn’t take more than 15 minutes to skim.

- Business plans for internal use (not for a bank loan or outside investment) can be as short as 5 to 10 pages.

A good practice is to write your business plan to match the expectations of your audience.

If you’re walking into a bank looking for a loan, your plan should match the formal, professional style that a loan officer would expect . But if you’re writing it for stakeholders on your own team—shorter and less formal (even just a few pages) could be the better way to go.

The length of your plan may also depend on the stage your business is in.

For instance, a startup plan won’t have nearly as much financial information to include as a plan written for an established company will.

Read More: How long should your business plan be?

What information is included in a business plan?

The contents of a plan business plan will vary depending on the industry the business is in.

After all, someone opening a new restaurant will have different customers, inventory needs, and marketing tactics to consider than someone bringing a new medical device to the market.

But there are some common elements that most business plans include:

- Executive summary: An overview of the business operation, strategy, and goals. The executive summary should be written last, despite being the first thing anyone will read.

- Products and services: A description of the solution that a business is bringing to the market, emphasizing how it solves the problem customers are facing.

- Market analysis: An examination of the demographic and psychographic attributes of likely customers, resulting in the profile of an ideal customer for the business.

- Competitive analysis: Documenting the competitors a business will face in the market, and their strengths and weaknesses relative to those competitors.

- Marketing and sales plan: Summarizing a business’s tactics to position their product or service favorably in the market, attract customers, and generate revenue.

- Operational plan: Detailing the requirements to run the business day-to-day, including staffing, equipment, inventory, and facility needs.

- Organization and management structure: A listing of the departments and position breakdown of the business, as well as descriptions of the backgrounds and qualifications of the leadership team.

- Key milestones: Laying out the key dates that a business is projected to reach certain milestones , such as revenue, break-even, or customer acquisition goals.

- Financial plan: Balance sheets, cash flow forecast , and sales and expense forecasts with forward-looking financial projections, listing assumptions and potential risks that could affect the accuracy of the plan.

- Appendix: All of the supporting information that doesn’t fit into specific sections of the business plan, such as data and charts.

Read More: Use this business plan outline to organize your plan

- Different types of business plans

A business plan isn’t a one-size-fits-all document. There are numerous ways to create an effective business plan that fits entrepreneurs’ or established business owners’ needs.

Here are a few of the most common types of business plans for small businesses:

- One-page plan : Outlining all of the most important information about a business into an adaptable one-page plan.

- Growth plan : An ongoing business management plan that ensures business tactics and strategies are aligned as a business scales up.

- Internal plan : A shorter version of a full business plan to be shared with internal stakeholders – ideal for established companies considering strategic shifts.

Business plan vs. operational plan vs. strategic plan

- What questions are you trying to answer?

- Are you trying to lay out a plan for the actual running of your business?

- Is your focus on how you will meet short or long-term goals?

Since your objective will ultimately inform your plan, you need to know what you’re trying to accomplish before you start writing.

While a business plan provides the foundation for a business, other types of plans support this guiding document.

An operational plan sets short-term goals for the business by laying out where it plans to focus energy and investments and when it plans to hit key milestones.

Then there is the strategic plan , which examines longer-range opportunities for the business, and how to meet those larger goals over time.

Read More: How to use a business plan for strategic development and operations

- Business plan vs. business model

If a business plan describes the tactics an entrepreneur will use to succeed in the market, then the business model represents how they will make money.

The difference may seem subtle, but it’s important.

Think of a business plan as the roadmap for how to exploit market opportunities and reach a state of sustainable growth. By contrast, the business model lays out how a business will operate and what it will look like once it has reached that growth phase.

Learn More: The differences between a business model and business plan

- Moving from idea to business plan

Now that you understand what a business plan is, the next step is to start writing your business plan .

The best way to start is by reviewing examples and downloading a business plan template. These resources will provide you with guidance and inspiration to help you write a plan.

We recommend starting with a simple one-page plan ; it streamlines the planning process and helps you organize your ideas. However, if one page doesn’t fit your needs, there are plenty of other great templates available that will put you well on your way to writing a useful business plan.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Reasons to write a business plan

- Business planning research

- When to write a business plan

- When to update a business plan

- Information to include

- Business vs. operational vs. strategic plans

Related Articles

6 Min. Read

How to Write an Ice Cream Shop Business Plan + Free Sample Plan PDF

10 Min. Read

14 Reasons Why You Need a Business Plan

11 Common Business Plan Mistakes You Should Avoid

8 Min. Read

How to Write an Auto Repair Shop Business Plan + Free PDF

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Strategic Account Planning: All You Need to Know

← Back to blog

What is Strategic Account Planning?

Strategic account planning is more than just a buzzword in the business world. It is a structured approach that allows companies to align their goals and objectives with the needs and expectations of their key accounts. By understanding and implementing strategic account planning, businesses can drive long-term success, foster strong customer relationships, and stay ahead of the competition.

At its core, strategic account planning involves a deep understanding of the customer’s business, industry, and challenges. It goes beyond transactional interactions and focuses on building strategic partnerships that are mutually beneficial for both parties involved. By investing time and effort into understanding the customer’s needs, businesses can develop tailored solutions, provide exceptional value, and become trusted advisors to their key accounts.

One of the key benefits of strategic account planning is the ability to retain and grow existing customer relationships. By understanding the customer’s unique challenges and objectives, businesses can proactively identify new opportunities for collaboration and growth. This not only helps in retaining the customer but also enables businesses to increase their share of wallet and drive revenue growth.

Benefits of Strategic Account Planning:

- Improved customer satisfaction and loyalty

- Increased revenue and profitability

- Enhanced cross-selling and upselling opportunities

- Stronger alignment of business goals and objectives

- Greater visibility into customer needs and expectations

However, it is important to note that strategic account planning is not a one-size-fits-all approach. Each customer and industry will have unique requirements and dynamics. Therefore, businesses must invest in the time and resources required to truly understand their key accounts and develop customized account plans.

Key Elements of Strategic Account Planning

By understanding strategic account planning and its implications, businesses can unlock the full potential of their key accounts and establish themselves as trusted partners in their industry.

Processes of Strategic Account Planning

Strategic account planning involves several key processes aimed at building value-driven relationships with key customers. Implementing these processes effectively can significantly contribute to long-term development and revenue maximization. Let’s delve into these essential processes:

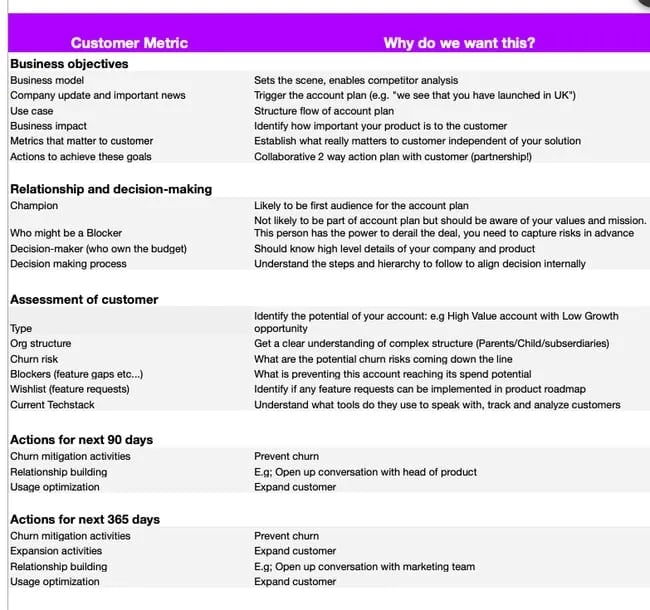

Current Position

Understanding the current position of the account is crucial. This includes analyzing account information such as revenue, profitability, product/service usage, geographic spread, and strategic initiatives. By leveraging publicly available data and asking relevant questions, such as the client’s future goals and potential obstacles, account managers can gain valuable insights into the client’s financial standing and organizational structure.

Voice of Customer (VOC)

Listening to the voice of the customer is paramount in strategic account planning. Engaging in meaningful discussions with clients helps uncover their challenges, concerns, and pain points. This insight is invaluable for tailoring products/services to meet client needs, driving customer loyalty, and increasing sales. Unlike publicly available data, VOC requires proactive communication and relationship-building efforts.

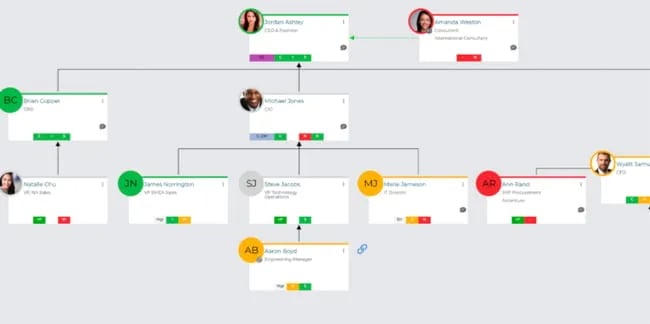

Relationship Management

Effective relationship management is essential for success in strategic account planning. This involves understanding the different types of relationships with clients and creating organization charts to identify key contacts, their roles, and their level of influence within the client organization. By mapping relationships and understanding the dynamics within the client’s organization, account managers can tailor their strategies and efforts accordingly.

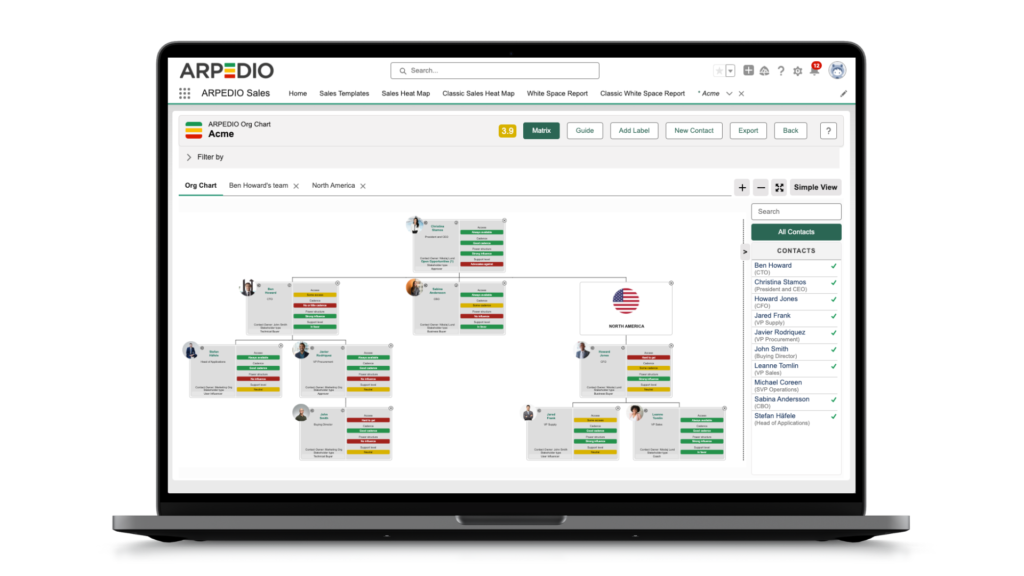

ARPEDIO’s Relationship Mapping & Org Chart Software, natively in Salesforce

Key Components of Strategic Account Planning

When it comes to strategic account planning, certain key components are crucial for achieving success. These components form the foundation of an effective account planning process. Let’s explore the essential elements that businesses should consider:

1. Understanding Customer Needs

One of the key components of strategic account planning is gaining a deep understanding of customer needs. By conducting thorough research and analysis , businesses can identify their customers’ pain points, challenges, and goals. This knowledge enables them to tailor their strategies and solutions to meet those specific needs.

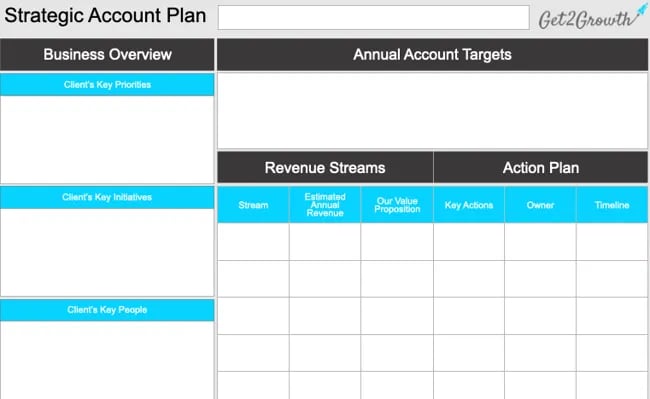

2. Setting Clear Objectives

To drive success in account planning , it’s important for businesses to set clear objectives. These objectives should be specific, measurable, achievable, relevant, and time-bound (SMART). By defining clear goals, businesses can align their efforts and track progress effectively.

3. Developing Effective Strategies

An effective account plan requires the development of well-thought-out strategies. These strategies should outline how businesses will address customer needs and achieve their objectives. It’s essential to consider factors such as value proposition, competitive advantage, and differentiation when developing these strategies.

Conducting Account Research and Analysis

In order to develop an effective strategic account plan, businesses need to conduct thorough account research and analysis. This crucial step provides valuable insights into the customers’ business environment, challenges, and goals, allowing businesses to tailor their strategies and offerings accordingly.

Account research involves gathering data and information about the customer’s industry, market trends, competition, and customer preferences. This can be done through market research reports, industry publications, customer interviews, and online surveys. By leveraging these sources, businesses can gain a comprehensive understanding of the customer’s unique needs and pain points.

Once the account research is complete, businesses can perform a detailed analysis of the gathered information. This analysis helps identify patterns, trends, and areas of opportunity that can shape the strategic account plan. It provides a solid foundation for making data-driven decisions and developing tailored strategies for customer engagement and growth.

Techniques and Tools for Account Research and Analysis

There are several techniques and tools available to aid businesses in conducting account research and analysis. These include:

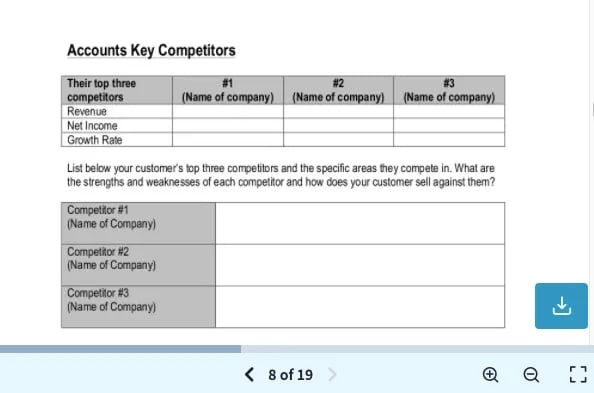

- SWOT analysis : A strategic tool that helps identify the strengths, weaknesses, opportunities, and threats associated with the customer’s business.

- Competitor analysis: Evaluating the customer’s direct and indirect competitors to understand their positioning, offerings, and market share.

- Customer segmentation: Dividing the customer base into distinct segments based on demographic, geographic, psychographic, or behavioral factors to better understand their unique needs.

- Financial analysis: Assessing the customer’s financial health, including revenue, profitability, and liquidity ratios, to gauge their stability and growth potential.

- Technology platforms: Utilizing customer relationship management (CRM) systems, data analytics tools, and social listening platforms to gather and analyze customer data effectively.

By employing these techniques and tools, businesses can uncover valuable insights and trends that drive informed decision-making and allow for the development of targeted strategies. With a well-rounded understanding of their customers and the market, businesses can position themselves as trusted advisors and add significant value to their strategic account relationships.

Developing a Strategic Account Plan

Developing a comprehensive strategic account plan is essential for businesses looking to drive long-term success and build strong customer relationships. In this section, we will guide you through the process of creating an effective account plan that aligns with your business objectives and meets the needs of your key stakeholders.

Identifying Key Stakeholders

One of the first steps in developing a strategic account plan is identifying the key stakeholders involved in the account. These stakeholders may include decision-makers, influencers, and end-users within the customer organization. By understanding their roles and responsibilities, you can tailor your account plan to address their specific needs and objectives.

Defining Value Propositions

To create a successful account plan, it’s crucial to define compelling value propositions that differentiate your offerings from competitors and address the unique challenges faced by the customer. By clearly articulating the value your products or services bring to the table, you can effectively communicate the benefits and outcomes that customers can expect.

Creating Actionable Goals and Initiatives

A strategic account plan should outline actionable goals and initiatives that align with both your business objectives and the customer’s goals. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). By breaking these goals down into initiatives, you can map out the steps required to achieve them and assign responsibilities to team members.

By following these steps and incorporating them into your strategic account plan, you can create a roadmap for success and establish a strong foundation for long-term growth. In the next section, we will explore strategies for effective communication and relationship building in strategic account planning.

Effective Communication and Relationship Building

Effective communication and relationship building are crucial components of successful strategic account planning. Building strong relationships with key accounts helps businesses establish trust, foster loyalty, and drive long-term growth. In this section, we will explore strategies for fostering strong relationships with key accounts and ensuring effective communication throughout the account planning process.

Fostering Strong Relationships

Building strong relationships with key accounts is about creating a connection based on trust, mutual understanding, and shared goals. Here are some strategies to foster strong relationships:

- Invest time in getting to know your key accounts. Listen actively to their needs, challenges, and objectives. This will help you tailor your approach and provide personalized solutions.

- Communicate regularly with your key accounts and be proactive in addressing their concerns. Show genuine interest in their success and offer support wherever needed.

- Deliver on your promises and exceed expectations. Consistently deliver value and demonstrate your commitment to the success of your key accounts.

- Collaborate with key accounts on joint initiatives and projects. This not only strengthens the relationship but also creates opportunities for mutual growth.

Ensuring Effective Communication

Effective communication is the foundation of successful account planning. It ensures that all stakeholders are aligned, goals are clear, and expectations are managed. Here are some strategies for effective communication:

- Establish clear channels of communication with your key accounts. Regularly check in, provide updates, and be responsive to any inquiries or requests.

- Listen actively to understand your key accounts’ needs and objectives fully. Ask relevant questions and seek clarification to ensure clear communication.

- Communicate strategically, tailoring your messages to resonate with each key account’s unique needs and preferences.

- Utilize a combination of communication methods, including face-to-face meetings, phone calls, emails, and video conferencing, to maintain a strong connection with your key accounts.

By prioritizing effective communication and relationship building, businesses can establish strong partnerships with key accounts, lay the foundation for long-term success, and unlock collaborative opportunities.

Aligning Sales and Marketing Efforts

Effective strategic account planning requires a seamless collaboration between the sales and marketing departments. Aligning sales and marketing efforts ensures a coordinated approach that maximizes customer relationships and drives business growth.

By integrating sales and marketing strategies, companies can create a unified front that delivers consistent messaging and a personalized customer experience. Sales teams can provide valuable insights to the marketing department, enabling them to develop targeted campaigns that resonate with key accounts. Likewise, marketing teams can equip sales teams with the necessary tools and resources to effectively communicate the value proposition to customers.

This alignment also helps to eliminate any disconnect between sales and marketing, fostering a stronger partnership and reducing internal conflicts. Sales and marketing teams are united in their shared goals and objectives, leading to improved communication, streamlined processes, and better overall outcomes.

Furthermore, aligning sales and marketing efforts allows businesses to leverage customer data and insights across both departments. This integrated approach enables a deeper understanding of customer needs, preferences, and behaviors, empowering sales and marketing teams to create more targeted and personalized strategies that drive results.

Ultimately, aligning sales and marketing efforts in strategic account planning enhances customer engagement, accelerates the sales cycle, and improves overall business performance.

Benefits of Aligning Sales and Marketing Efforts

The alignment of sales and marketing efforts offers numerous benefits for businesses:

- Improved lead generation: By working together, sales and marketing teams can generate high-quality leads through targeted campaigns and strategies.

- Enhanced customer experience: Consistent messaging and personalized interactions contribute to a positive customer experience, fostering loyalty and long-term relationships.

- Higher conversion rates: The synergy between sales and marketing ensures a smoother sales process, leading to higher conversion rates and increased revenue.

- Maximized ROI: Integrated sales and marketing efforts optimize resource allocation and minimize wasteful spending, resulting in a higher return on investment.

Proactive Account Management and Growth

Proactive account management is an integral part of achieving long-term success in business. By actively engaging with accounts and continuously delivering value, companies can foster strong relationships, drive customer satisfaction, and identify growth opportunities. In this section, we will explore key insights and strategies for effective account management and achieving sustainable growth.

Delivering Exceptional Customer Service

One of the foundations of proactive account management is delivering exceptional customer service. By going above and beyond to meet customer needs, companies can solidify their position as trusted partners. This involves:

- Anticipating customer needs: Understanding the unique requirements of each account and proactively identifying opportunities to provide value.

- Ensuring clear communication: Maintaining open lines of communication with accounts, actively listening to their feedback, and addressing any concerns in a timely manner.

- Providing personalized support: Tailoring solutions and support to meet the specific goals and challenges faced by each account.

Identifying Growth Opportunities

Proactive account management also involves identifying and capitalizing on growth opportunities. By analyzing account data and market trends, businesses can uncover potential areas for expansion. This includes:

- Understanding customer goals: Gaining a deep understanding of each account’s strategic objectives and aligning efforts to support their growth initiatives.

- Monitoring industry trends: Keeping a pulse on market developments, emerging technologies, and evolving customer needs to identify new opportunities for value creation.

- Collaborating with cross-functional teams: Engaging with sales, marketing, and product teams to leverage synergies and develop innovative solutions that drive customer satisfaction and business growth.

Utilizing Account Management Tools

Effective proactive account management often involves leveraging technology and tools to streamline processes and enhance productivity. By implementing the right account management software , businesses can:

- Track and manage account activities: Gain visibility into account interactions, progress, and potential risks, enabling better decision-making and proactive problem-solving.

- Automate tasks: Reduce manual administrative work, allowing account managers to focus on building relationships and delivering value.

- Generate actionable insights: Analyze data and generate reports to identify trends, measure account performance, and uncover opportunities for improvement.

To effectively implement proactive account management strategies, it’s crucial to leverage data-driven insights, nurture strong customer relationships, and continuously adapt and innovate. By prioritizing proactive account management and embracing a growth mindset, businesses can drive sustainable success for themselves and their valued customers.

Key Performance Metrics and Measurement

Measuring and tracking the success of strategic account planning is crucial. In order to evaluate the effectiveness of their account plans and make data-driven decisions, businesses need to monitor key performance metrics. These metrics provide valuable insights into the outcomes of their strategic initiatives and help identify areas for improvement.

Key Performance Metrics for Strategic Account Planning

When measuring the performance of strategic account plans, businesses should focus on several key metrics:

By regularly monitoring these performance metrics, businesses can assess the impact of their strategic account plans and make informed decisions to optimize their efforts. It is important to establish baseline measurements, set realistic targets, and consistently track progress to ensure continuous improvement and success.

With the right data and insights, businesses can identify areas for improvement, make informed adjustments to their strategies, and drive meaningful results through strategic account planning.

Overcoming Challenges in Strategic Account Planning

Strategic account planning is a crucial process for businesses to ensure long-term success and maintain strong customer relationships. However, it is not without its challenges. In this section, we will explore some common obstacles that businesses may encounter during strategic account planning and provide strategies and solutions for overcoming them.

Lack of Alignment and Communication

One of the key challenges in strategic account planning is the lack of alignment and communication between different departments within an organization. Sales, marketing, and customer service teams need to work cohesively to develop and execute account plans effectively. By fostering open lines of communication and implementing cross-functional collaboration, businesses can overcome this challenge and ensure everyone is working towards a common goal.

Changing Customer Needs

As customer preferences and requirements evolve, businesses must adapt their account plans to meet these changing needs. This can be a challenge, especially when organizations are not proactive in gathering customer feedback and monitoring market trends. By staying abreast of industry changes and regularly engaging with customers, businesses can stay ahead of the curve and continuously update their account plans to align with shifting customer needs.

In strategic account planning, identifying and building relationships with key stakeholders is crucial. However, it can be challenging to determine who the key decision-makers are within a customer organization. Conducting thorough research and leveraging existing relationships can help businesses overcome this hurdle and ensure they are engaging with the right individuals who have the authority to make purchasing decisions.

Managing Multiple Accounts

For businesses managing multiple key accounts, prioritization and resource allocation can become a challenge. It is essential to allocate resources effectively to ensure each account receives the necessary attention and support. By leveraging account management tools and establishing clear guidelines for prioritization, businesses can overcome this challenge and effectively manage multiple accounts.

Measuring Success

Measuring the success of strategic account planning can be difficult without defined metrics and performance indicators. Businesses need to establish clear goals and track relevant metrics to assess the effectiveness of their account plans. By leveraging data analytics and setting measurable objectives, businesses can overcome this challenge and make informed decisions to continuously improve their account planning process.

Overcoming challenges in strategic account planning is essential for businesses to achieve their goals and maintain successful customer relationships. By addressing the common obstacles discussed in this section and implementing the provided strategies, businesses can navigate the complexities of strategic account planning and drive long-term success.

In conclusion, this article has highlighted the essential elements and strategies required for successful strategic account planning. By adopting these practices and continuously refining the account plan, businesses can unlock their full potential, drive long-term success, and foster strong customer relationships.

Strategic account planning is a critical approach that enables businesses to understand and meet the unique needs of their most important customers. By taking the time to research and analyze each account, organizations can develop tailored strategies that address specific challenges and opportunities.

Furthermore, by focusing on effective communication and relationship building, businesses can strengthen collaborations with key accounts, enhance customer loyalty, and drive mutually beneficial growth. Regularly reviewing and evaluating key performance metrics can provide insights into the effectiveness of account plans and guide future decision-making.

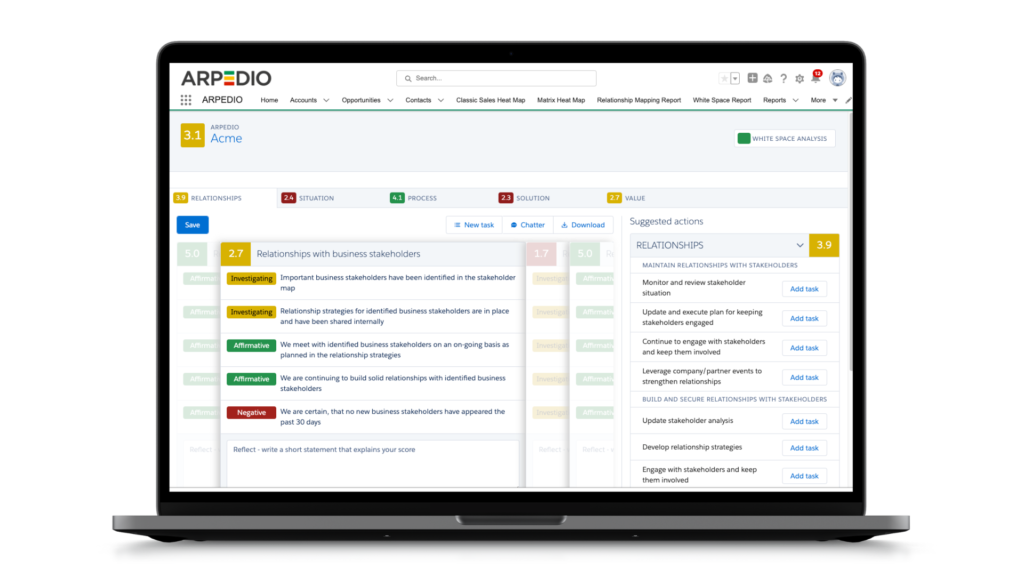

ARPEDIO Relationship Mapping & Org Chart Software

ARPEDIO Opportunity Management Software

Related posts

SAMA Annual Conference 2024 highlights

Unlimited Customization Possibilities with Our New Feature

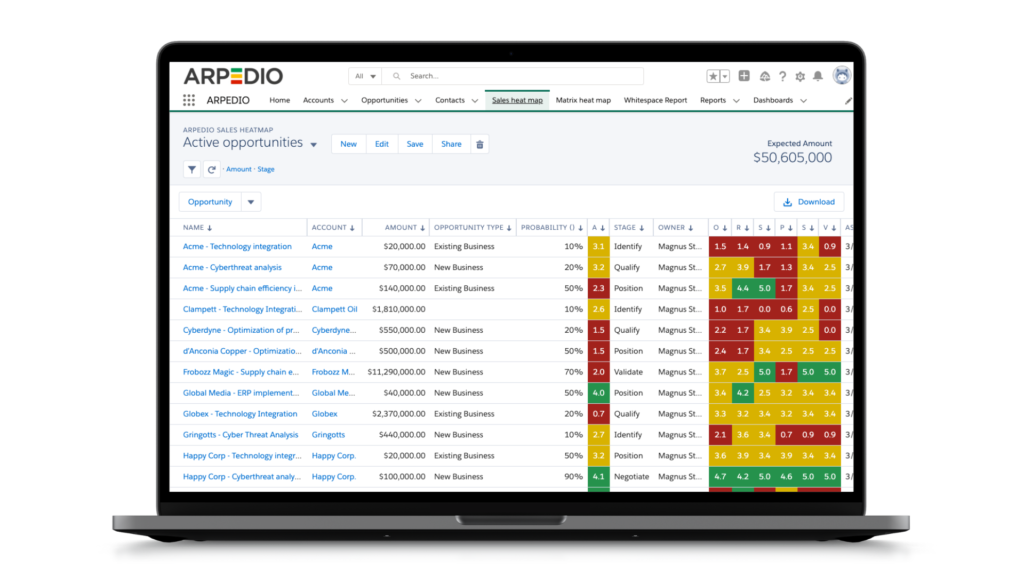

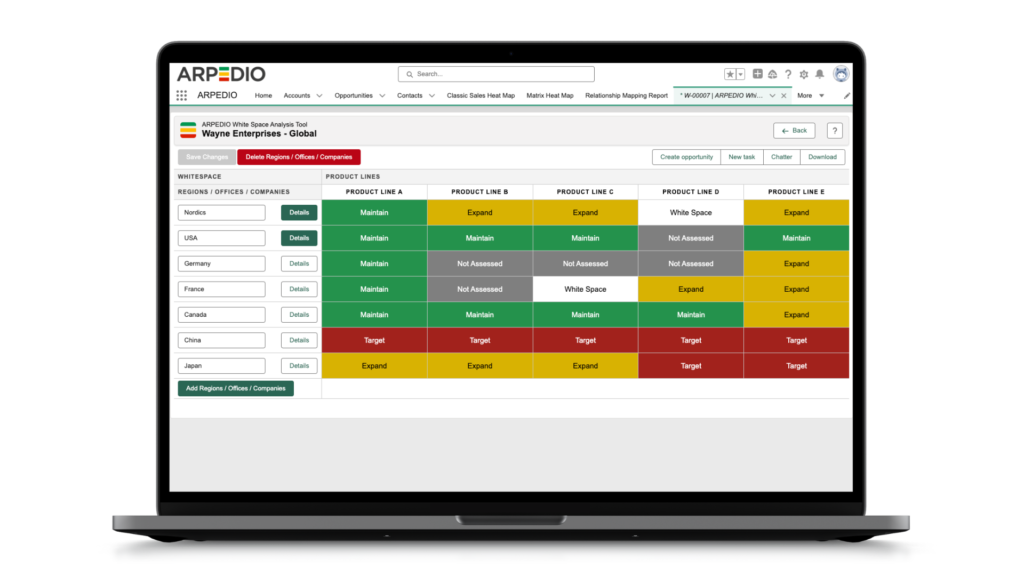

#1 account-based selling platform, powerful alone. superior together..

Relationship Mapping & Org Chart

Manage internal and external relationships with key stakeholders.

- Account Management

Build powerful account plans in Salesforce.

- Opportunity Management

Boost win rates, reduce sales cycles! Enhance forecast accuracy.

- White Space Analysis

Discover upsell and cross-sell opportunities in Salesforce.

Let's get started

- Platform Overview

- Relationship Mapping

- Salesforce Consulting

- B2B Sales Training

- Client Case Studies

- Privacy policy

- Change Cookie Consent

Good call – let's do some demo'ing!

Experience ARPEDIO in action: Access your free on-demand demo

Questions? Give us a shout!

Privacy settings

We collect and process your data on this site to better understand how it is used. We always ask you for consent to do that. You can change your privacy settings here.

Account Management: Build powerful account plans in Salesforce

Ready to experience powerful account planning in Salesforce?

30 minutes can change your business

What is a Business Plan?

Home › Business Management › What is a Business Plan?

Definition: A business plan is a detailed written steps and goals defined to guide a business’ course of action from its initial stages. A business plan provides a complete description and projection of the company as well as its core strategies and expected results.

- What Does Business Plan Mean?

The creation of a new organization or a new business requires coherent actions in order to achieve the desired outcomes. Following a business plan allows to link actions and resources to objectives and measurable goals. This plan can be used internally like a roadmap for the owner but also can be a requirement when looking for funding or partners.

A business plan is generally a precise, short document that commonly contains the following sections: executive summary, business description with its products or services, marketing plan, operational plan and financial plan with its forecasted financial statements for the first years of operation, often five to ten years. The initial business plan is later substituted by annual or bi-annual strategic plans.

Mark Tilson is a young professional that wants to start a new business. He has the idea of providing an innovative maintenance service to medium-size manufacturing companies but he needs funds to implement it. Mr. Tilson therefore decided to write a business plan to present the idea to some potential capital partners. He though that the ideas were already clear but soon realized that more analysis and pre-launching work was required.

How many employees the company will have? How the company will market its services? How much money the initial investment requires? How much profit the company is expected to generate at the end of the fifth year of operation? These and other questions must be answered and coherently written in the business plan. Finally, Mr. Tilson improved his ideas, presented the plan and found the required partner.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

Search 2,000+ accounting terms and topics.

- Basic Accounting Course

- Financial Accounting Basics

- Accounting Principles

- Accounting Cycle

- Financial Statements

- Financial Ratio

- Search Search Please fill out this field.

- Building Your Business

What Is a Business Plan?

Business Plan Explained in Less Than 5 Minutes

:max_bytes(150000):strip_icc():format(webp)/KhadijaKhartit-4f144e2b63ee4dd4af60ac8a02233c50.jpg)

Definition and Examples of a Business Plan

How a business plan works, types of business plans, business plan vs. business model.

Geber86 / Getty Images

A business plan is a detailed written document that describes your business’s activities, goals, and strategy. A strong plan outlines everything from the products a company sells to the executive summary to the overall management. In essence, a business plan should guide a founder’s actions through each stage of growth

Think of your business plan as a road map. It documents the various stages of starting and running your business, including business activities and objectives. Business plans create the structure you need to make decisions by outlining the financial and operational goals you’re striving toward.

One of the most common reasons for crafting a business plan is to attract investors—and, in return, receive funding. As an early stage company, for example, you may leverage your business plan to convince investors or banks that your entity is credible and worthy of funding. The business plan should prove that their money will be returned .

A business plan can also be useful for when a well-developed company goes through a merger or acquisition . As outlined by the U.S. Small Business Administration (SBA), a merger creates a new entity via the combination of two businesses. An acquisition, on the other hand, is when a company is purchased and absorbed into an existing business. In either case, a business plan helps establish relationships between business entities, making a merger or acquisition more likely.

- Alternate name : Strategic plan

A business plan is a formalized outline of the business operations, finances, and goals you aim to achieve to be a successful company. When designing a business plan, companies have leeway for how long, short, or detailed it can be. So long as it outlines the foundational aspects of the business, in most cases, it will be effective.

The most common type of business plan is a traditional business plan. This style tends to have the following common elements, generally in this order.

- Executive summary : Tells your reader why your company will be successful. Includes the company’s mission statement , product information, and basics regarding the business structure.

- Company description : Where you brag about your entity’s strengths. Answer the question, what problem is your team solving?

- Market analysis : A deep dive into your industry and the competition. Consider why competitors are successful. How can your offering do it better? If applicable, how can you enhance the experience for the consumer?

- Management plan : Outlines leadership structure of the company and may be best detailed as a chart. This way, readers can see exactly who is planning to run the company and how they will impact growth.

- Marketing and sales plan : Details how you’ll attract consumers with your product or service, and how you will retain those customers. All strategies outlined in this section, such as the use of digital marketing , will be referenced in your financial plan.

- Funding request : For those companies asking for funding, this is where you’ll detail the amount of funding you’ll need to achieve your goals. Clearly explain how much you need and what it will be used for.

- Financial plan : Convinces the reader that your company is financially stable and can turn a profit . You will need to include a balance sheet , an income statement, and the cash flow statement (or cash flow projection, in the case of a new venture).

- Appendix : Where any supporting documents, such as legal documents, licenses of employees, and pictures of the product will be included.

Your company’s business plan should fit your needs, which will often depend on what stage of growth you are in. If you are considering starting a new venture, for example, writing a detailed business plan can help prove if your concept is viable or not.

If your business is seeking financial capital, though, you will want your business plan to be investor-ready. This will require you to have a funding request section, which would be placed right above your financial plan.

You should avoid using lofty terms or technical jargon that those outside your team won’t understand. A business plan is meant to be shared with those inside and outside your organization. Simple and effective language is best.

Your business’s stage impacts the length and detail of a business plan. As discussed, a traditional plan follows a detailed structure, from the executive summary to the appendix. It is a lengthier document, often amounting to dozens of pages, and is often used when seeking funding to prove business viability. In most cases, crafting a traditional plan will take lots of due diligence work.

The other main type of business plan is a lean startup plan. A lean startup plan is much more high-level and shorter than the traditional version. Companies just starting development will often create a lean startup plan to help them navigate where they should start. These can be as short as one or two pages.

A lean plan will include the following elements.

- Key partnerships : Notes other services or businesses you will work with, such as manufacturers and suppliers.

- Key activities and resources : Outlines how your company will gain a competitive advantage and create value for your consumers. Resources you may leverage include capital, staff, or intellectual property.

- Value proposition : Clearly defines the unique value your company offers.

- Customer relationships : Details the customer experience from start to finish.

- Channels : How will you stay connected with your customers? Detail those methods here.

- Cost structure and revenue streams : Details the most significant costs you will face as well as how your business will actually make money.

Remember that business plans are meant to change as your company grows or pivots. You should actively review and edit your business plan to keep it up to date with business activities. For example, you may start with a lean plan and move to a traditional plan when you hit the fundraising stage.

A business plan may often be confused with a business model, and it is easy to understand why. Simply put, a business plan is the holistic overview of the business, while a business model is a skeleton for how money will be made.

Key Takeaways

- A business plan is a comprehensive document that outlines a business’s operations, finances, and goals. It guides the business’s day-to-day decisions.

- A business plan is necessary for your company’s success, as it creates a path to scalability.

- There are two main types of business plans: a traditional business plan and a lean startup plan.

- A traditional business plan will be essential when you begin to seek debt or equity capital for your company.

U.S. Small Business Administration. “ Merge and Acquire Businesses .” Accessed June 8, 2021.

U.S. Small Business Administration. " Write Your Business Plan ." Accessed June 8, 2021.

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers

Financial analysis is an essential part of your business plan. If you’re already in business that includes your profit and loss statement , cash flow statement and balance sheet .

These financial projections will give investors and lenders an understanding of the financial health of your business and the potential return on investment.

You may want to work with a financial professional to ensure your financial projections are realistic and accurate.

Step 7: Finalize your business plan

Once you’ve completed everything, it's time to finalize your business plan. This involves reviewing and editing your plan to ensure that it is clear, concise, and easy to understand.

You should also have someone else review your plan to get a fresh perspective and identify any areas that may need improvement. You could even work with a free SCORE mentor on your business plan or use a SCORE business plan template for more detailed guidance.

Compare the Top Small-Business Banks

Data effective 1/10/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The takeaway

Writing a business plan is an essential process for any forward-thinking entrepreneur or business owner. A business plan requires a lot of up-front research, planning, and attention to detail, but it’s worthwhile. Creating a comprehensive business plan can help you achieve your business goals and secure the funding you need.

Related content

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

- How to Get a Business License: What You Need to Know

- What Is a Cash Flow Statement?

Best Small Business Loans

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.