Please upgrade your browser

E*TRADE uses features that may not be supported by your current browser and might not work as intended. For the best user experience, please use an updated browser .

Understanding assignment risk in Level 3 and 4 options strategies

E*TRADE from Morgan Stanley

With all options strategies that contain a short option position, an investor or trader needs to keep in mind the consequences of having that option assigned , either at expiration or early (i.e., prior to expiration). Remember that, in principle, with American-style options a short position can be assigned to you at any time. On this page, we’ll run through the results and possible responses for various scenarios where a trader may be left with a short position following an assignment.

Before we look at specifics, here’s an important note about risk related to out-of-the-money options: Normally, you would not receive an assignment on an option that expires out of the money. However, even if a short position appears to be out of the money, it might still be assigned to you if the stock were to move against you just prior to expiration or in extended aftermarket or weekend trading hours. The only way to eliminate this risk is to buy-to-close the short option.

- Short (naked) calls

Credit call spreads

Credit put spreads, debit call spreads, debit put spreads.

- When all legs are in-the-money or all are out-of-the-money at expiration

Another important note : In any case where you close out an options position, the standard contract fee (commission) will be charged unless the trade qualifies for the E*TRADE Dime Buyback Program . There is no contract fee or commission when an option is assigned to you.

Short (naked) call

If you experience an early assignment.

An early assignment is most likely to happen if the call option is deep in the money and the stock’s ex-dividend date is close to the option expiration date.

If your account does not hold the shares needed to cover the obligation, an early assignment would create a short stock position in your account. This may incur borrowing fees and make you responsible for any dividend payments.

Also note that if you hold a short call on a stock that has a dividend payment coming in the near future, you may be responsible for paying the dividend even if you close the position before it expires.

An early assignment generally happens when the put option is deep in the money and the underlying stock does not have an ex-dividend date between the current time and the expiration of the option.

Short call + long call

(The same principles apply to both two-leg and four-leg strategies)

This would leave your account short the shares you’ve been assigned, but the risk of the position would not change . The long call still functions to cover the short share position. Typically, you would buy shares to cover the short and simultaneously sell the long leg of the spread.

Pay attention to short in-the-money call legs on the day prior to the stock’s ex-dividend date, because an assignment that evening would put you in a short stock position where you are responsible for paying the dividend. If there’s a risk of early assignment, consider closing the spread.

Short put + long put

Early assignment would leave your account long the shares you’ve been assigned. If your account does not have enough buying power to purchase the shares when they are assigned, this may create a Fed call in your account.

However, the long put still functions to cover the position because it gives you the right to sell shares at the long put strike price. Typically, you would sell the shares in the market and close out the long put simultaneously.

Here's a call example

- Let’s say that you’re short a 100 call and long a 110 call on XYZ stock; both legs are in-the-money.

- You receive an assignment notification on your short 100 call, meaning you sell 100 shares of XYZ stock at 100. Now, you have $10,000 in short stock proceeds, your account is short 100 shares of stock, and you still hold the long 110 call.

- Exercise your long 110 call, which would cover the short stock position in your account.

- Or, buy 100 shares of XYZ stock (to cover your short stock position) and sell to close the long 110 call.

Here's a put example:

- Let’s say that you’re short a 105 put and long a 95 put on XYZ stock; the short leg is in-the-money.

- You receive an assignment notification on your short 105 put, meaning you buy 100 shares of XYZ stock at 105. Now, your account has been debited $10,500 for the stock purchase, you hold 100 shares of stock, and you still hold the long 95 put.

- The debit in your account may be subject to margin charges or even a Fed call, but your risk profile has not changed.

- You can sell to close 100 shares of stock and sell to close the long 95 put.

Long call + short call

Debit spreads have the same early assignment risk as credit spreads only if the short leg is in-the-money.

An early assignment would leave your account short the shares you’ve been assigned, but the risk of the position would not change . The long call still functions to cover the short share position. Typically, you would buy shares to cover the short share position and simultaneously sell the remaining long leg of the spread.

Long put + short put

An early assignment would leave your account long the shares you’ve been assigned. If your account does not have enough buying power to purchase the shares when they are assigned, this may create a Fed call in your account.

All spreads that have a short leg

(when all legs are in-the-money or all are out-of-the-money)

Pay attention to short in-the-money call legs on the day prior to the stock’s ex-dividend date because an assignment that evening would put you in a short stock position where you are responsible for paying the dividend. If there’s a risk of early assignment, consider closing the spread.

However, the long put still functions to cover the long stock position because it gives you the right to sell shares at the long put strike price. Typically, you would sell the shares in the market and close out the long put simultaneously.

What to read next...

How to buy call options, how to buy put options, potentially protect a stock position against a market drop, looking to expand your financial knowledge.

Great, you have saved this article to you My Learn Profile page.

Clicking a link will open a new window.

4 things you may not know about 529 plans

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Thanks for you sent email.

How dividends can increase options assignment risk

Most experienced investors are familiar with the adage that "if an investment opportunity sound too good to be true, it probably is." While this sentiment may often be associated with overly optimistic assumptions, it also applies to investors who sell options contracts without first considering the ex-dividend date for a stock or ETF.

How dividends work

A quick review of how dividends work: A dividend represents a payment of a company's revenues to shareholders, most often in the form of cash. Cash dividends are paid out on a per-share basis. For example, if you own 100 shares of a stock that pays a $0.50 quarterly dividend, you will receive $50.

Not all companies pay dividends, but if you're investing in options contracts for companies that do pay them, you need to keep several important dates in mind:

- Declaration date: Date on which a company announces the per-share amount of its next dividend.

- Record date: The cut-off date established by the company to determine which shareholders of its stock are eligible to receive a distribution. This is usually, but not always, 1 day after the ex-dividend date.

- Ex-Dividend date: Date on which a stock's price adjusts downward to reflect its next dividend payment. For example, if a stock pays a $0.50 dividend, the stock price will drop by a half point prior to trading on the ex-dividend date. If you buy a stock on or after the ex-dividend date, you are not entitled to the next dividend.

- Dividend (payment) date: Date shareholders receive cash in their account from a dividend.

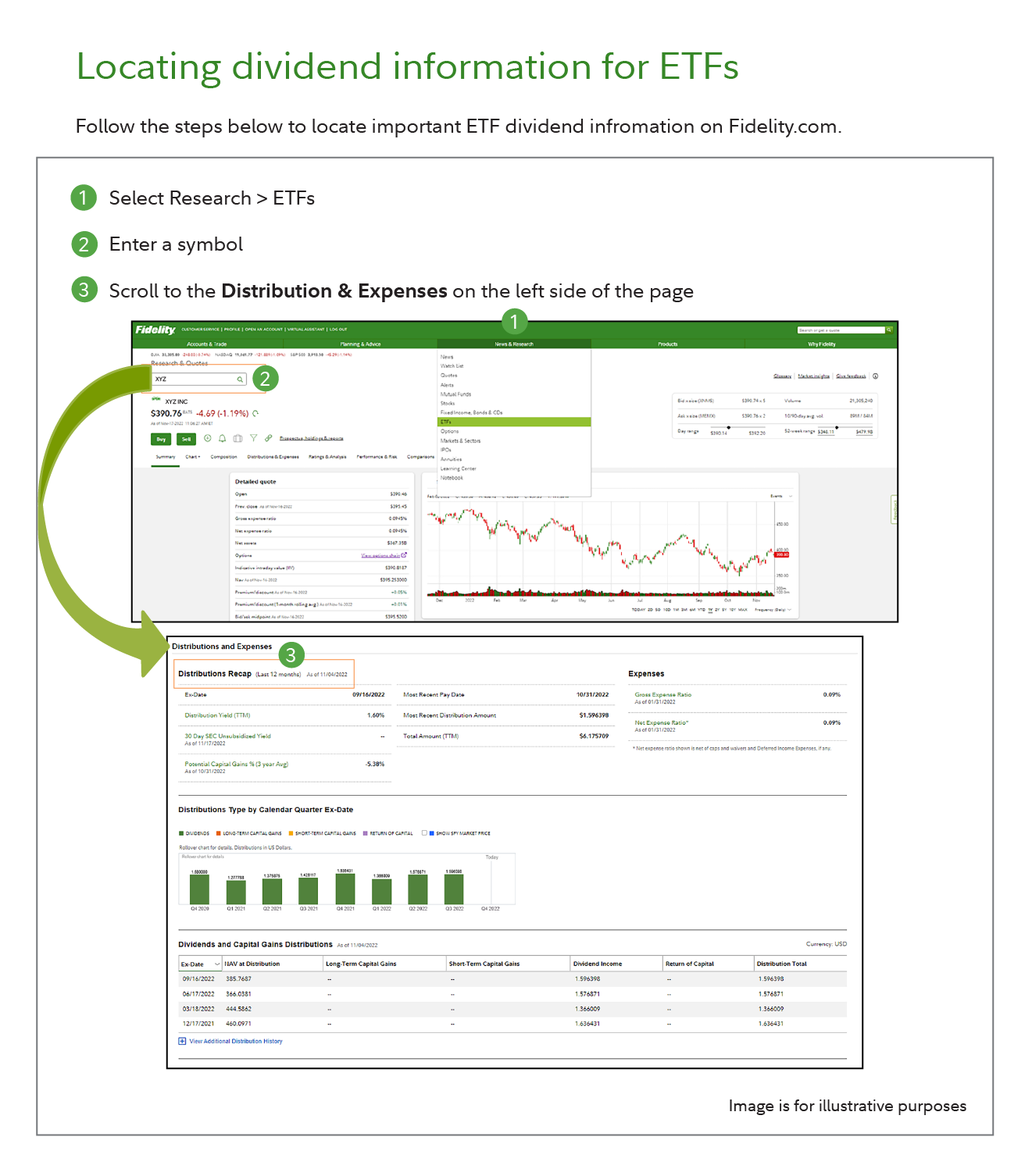

See Locating dividend information for stocks for additional details.

Dividends offer an effective way to earn income from your equity investments. However, call option holders are not entitled to regular quarterly dividends, regardless of when they purchase their options. And, unlike stock or ETF prices, options contract prices are not adjusted downward on ex-dividend dates.

This can cause a problem for anyone who has sold an options contract without first considering the impact of dividends. Why? Because the risk of being assigned on an option contract is higher when the underlying security of an in-the-money option starts trading ex-dividend. To understand the risks and how dividends impact options contracts, let's explore some potential scenarios.

Avoiding or managing early assignment on covered calls

As noted above, the ex-dividend date is particularly important to anyone who writes a covered or uncovered call option. If a covered call option you have sold is in the money and the dividend exceeds the remaining time value of the option, there is a good chance an owner of those calls will exercise his options early.

If you are assigned, you must deliver your shares of the underlying security, as well as the dividend income, to the owner of the call. Let's examine a hypothetical example to illustrate how this works.

- Bob owns 500 shares of ABC stock, which pays a quarterly $0.50 dividend.

- The stock is trading around $25 a share on August 1 when Bob decides to sell 5 October 30 calls.

- By early October, ABC stock has risen to $31 and, as a result, Bob's covered calls are in the money by $1. The calls will expire in 10 days and tomorrow the stock will start trading ex-dividend.

- Because the remaining time value of the call option is less than the value of the dividends, the call owner will likely exercise his options on the day before the ex-dividend date.

See Locating option values in Active Trader Pro ® .

If Bob does not take any action to close his covered call position, there is a good chance he will be assigned on the ex-dividend date. This means he will no longer own 500 shares of the stock and he will not receive the dividend income.

To avoid this scenario, Bob has a couple of choices:

- He could buy back the calls he sold to retain the stock and the dividend. However, he would have to do this prior to the ex-dividend date. If he waits until the ex-dividend date or later, he will not be entitled to the dividend income. Keep in mind that it's possible to get assigned prior to the day before the ex-dividend date, so this strategy is not foolproof.

- The other option is to close out his short position and write a new covered call with a later expiration date or a higher strike price. This strategy is known as "rolling" your options contract forward.

Sign up for Fidelity Viewpoints weekly email for our latest insights.

Avoiding or managing early assignment on calls not covered by shares

Now let's consider what could happen if Bob had sold uncovered calls on ABC stock:

- As in the example above, ABC stock pays a quarterly $0.50 dividend and is trading around $25 a share

- Bob has a negative view on the stock and decides to sell 5 uncovered October 30 calls

- By early October, ABC stock has risen to $31 and, as a result, his uncovered calls are in the money by $1

To make matters worse, Bob learns that tomorrow the stock will start trading ex-dividend. Because the remaining time value of the options is less than the value of the dividends, owners of these calls will likely exercise their options 1 day prior to the ex-dividend date.

To limit his exposure, Bob has several choices. He can buy back his uncovered calls at a loss, buy the stock to capture the dividend, or sit tight and hope to not be assigned. If his calls are assigned, however, he will have to pay the $250 in dividend income, in addition to covering the cost of delivering 500 shares of ABC stock. If Bob had initiated an option spread (buying and selling an equal number of options of the same class on the same underlying security but with different strike prices or expiration dates), he could also consider exercising his long option position to capture the dividend.

Other considerations and risks

If you are implementing a spread strategy that includes long contracts and short contracts, you need to remain particularly vigilant in regard to assignment risk. If both contracts are in the money and you are assigned on the short contracts, you will not be notified until the following business day. While you can exercise your long position on the ex-dividend date to eliminate the short stock position that was created, you will still owe the dividend because you were short the stock prior to the ex-dividend date.

Ways to avoid the risk of early assignment

If you are selling options (covered or uncovered), there is always the risk of being assigned if your trade moves against you. This risk is higher if the underlying security involved pays a dividend. However, there are ways to reduce the likelihood of being assigned early. These include:

- Do your homework: Know if the stock or ETF pays a dividend and when it will start trading ex-dividend

- Avoid selling options on dividend-paying stocks or ETFs when your trade includes ex-dividend

- Invest in European-style options: American-style options can be assigned at any time before the option expires, European-style options can only be exercised at expiration

See Locating dividend information for ETFs for details.

If you are a Fidelity customer and you have questions about your exposure to assignment risk, you can always contact a Fidelity representative for help.

Research options

Get new options ideas and up-to-the-minute data on options.

More to explore

Options strategy guide, 5 steps to develop an options trading plan, subscribe to fidelity viewpoints ®, looking for more ideas and insights, thanks for subscribing.

- Tell us the topics you want to learn more about

- View content you've saved for later

- Subscribe to our newsletters

We're on our way, but not quite there yet

Oh, hello again, thanks for subscribing to looking for more ideas and insights you might like these too:, looking for more ideas and insights you might like these too:, fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. done add subscriptions no, thanks. analyzing stock fundamentals investing for beginners finding stock and sector ideas advanced trading strategies trading options stocks using technical analysis a covered call writer forgoes participation in any increase in the stock price above the call exercise price, and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. there are additional costs associated with option strategies that call for multiple purchases and sales of options, such as spreads, straddles, and collars, as compared with a single option trade. options trading entails significant risk and is not appropriate for all investors. certain complex options strategies carry additional risk. before trading options, please read characteristics and risks of standardized options . supporting documentation for any claims, if applicable, will be furnished upon request. 772967.5.0 mutual funds etfs fixed income bonds cds options active trader pro investor centers stocks online trading annuities life insurance & long term care small business retirement plans 529 plans iras retirement products retirement planning charitable giving fidsafe , (opens in a new window) finra's brokercheck , (opens in a new window) health savings account stay connected.

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

Assignment Of Rights Agreement

Jump to section, what is an assignment of rights agreement.

An assignment of rights agreement is a written document in which one party, the assignor, assigns to another party all or part of their rights under an existing contract. The most common example of this would be when someone wants to sell their shares of stock in a company.

When you buy shares from someone else (the seller), they agree to transfer them over and give up any control they had on that share. This way, another party can take ownership without going through the trouble of trying to buy the whole company themselves.

Common Sections in Assignment Of Rights Agreements

Below is a list of common sections included in Assignment Of Rights Agreements. These sections are linked to the below sample agreement for you to explore.

Assignment Of Rights Agreement Sample

Reference : Security Exchange Commission - Edgar Database, EX-99.(H)(7) 5 dex99h7.htm FORM OF ASSIGNMENT AGREEMENT , Viewed December 20, 2021, View Source on SEC .

Who Helps With Assignment Of Rights Agreements?

Lawyers with backgrounds working on assignment of rights agreements work with clients to help. Do you need help with an assignment of rights agreement?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignment of rights agreements. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Assignment Of Rights Agreement Lawyers

A corporate and commercial attorney with experience in transactional legal services including corporate and finance transactions, mergers and acquisitions, real estate, commercial contracts, bankruptcy, restructuring, international business transactions and general counsel services. Additional background skills and experience include investment banking, financial analysis, and commercial litigation. Sectors covered include technology, media, franchises, and business services providers, from start-ups to medium and large enterprises.

Daliah Saper operates a cutting-edge internet and social media law practice that regularly leads local and national media outlets to solicit her commentary on emerging internet law issues involving cyberbullying, sexting, catfishing, revenge porn, anonymous online defamation, domain name and user-name squatting, privacy, and the latest business decisions made by social media platforms such as Facebook, Twitter and YouTube. As a litigator Daliah represents companies bringing or defending business and intellectual property disputes. (She has argued cases in a number of jurisdictions including taking a case all the way to the Illinois Supreme Court.) As a transactional lawyer she helps clients choose the right business entity, drafts contracts and licensing agreements, advises on sweepstakes and contest rules, and ensures website terms of use and privacy policies are compliant, and provides comprehensive trademark and copyright counseling. Since founding Saper Law Offices in 2005, Daliah has been named a 40 Under 40 by Law Bulletin Publishing Co., a top Media & Advertising attorney by Super Lawyers Magazine 14 years in a row, and has been repeatedly recognized as a leading media and entertainment lawyer by Chambers and Partners. For the past eleven years, she also has taught entertainment and social media law at Loyola University Chicago School of Law.

Alen Aydinian is a seasoned real estate attorney with a wealth of experience in handling transactional matters, real estate transactions, and lease agreements. As a licensed real estate broker, Alen Aydinian brings a unique perspective to the table, allowing clients to benefit from both legal expertise and practical industry knowledge. He is a trusted advisor in the realm of real estate transactions and lease agreements. Whether representing buyers, sellers, landlords, or tenants, Alen Aydinian is committed to providing strategic counsel and dedicated advocacy every step of the way. Clients rely on him for sound legal guidance, proactive problem-solving, and unwavering support throughout the transaction process.

The Law Office of George K. Fuiaxis, from the very beginning in 2002, has built a reputation with its clients as an unmatched, diligent, hands on law practice that is always on duty to find the best course of action for its clients. With a supreme pledge of exceptional service to its clients in the areas of Real Estate (Commercial & Residential), Loan Modifications, Intellectual Property, Corporate Law & Business Transactions, Wills, Trusts & Estates, the Law Office of George K. Fuiaxis creates solutions for the many faceted problems faced by its clients. The office represents several various clients, including well known lending institutions, foreign and domestic corporations, sellers and buyers of residential and commercial real estate, residential and commercial landlords and tenants, well known restaurant and business owners, automobile dealerships, airline companies, well known fashion, sports and entertainment industry individuals and corporations, information technology (IT) startups and well known IT companies.

I'm a business law generalist with over 24 years of experience, including as in-house General Counsel, as outside counsel through my own firm and as an attorney in an Am Law 100 law firm. My employers and clients uniformly appreciate my ability to (i) negotiate and close transactions quickly and effectively, and (ii) to make the complex simple. Among other things, I can efficiently assist you on entity formation, governance, and structure; HR issues; mergers and acquisitions; and the negotiation and drafting of all types of commercial contracts. I'm the proud recipient of multiple Martindale-Hubbell Client Distinction Awards given only to the top 5% of attorneys for quality of service.

Strategic thinking business minded Outside General Counsel here to help you with your company. I have been able to help guide business owners from startup through series A, B, & C funding and ultimately IPO's. Regardless of your plans I am here to help you succeed as you grow your business.

Mr. Mehdipour attended the University of California San Diego where he received his degree in political science. After graduating from UCSD, Mr. Mehdipour attended Southwestern University School of Law where he received his JD. Upon passing the bar, Mr. Mehdipour gained invaluable experience both in a law firm and business setting. Mr. Mehdipour uses his prior business and legal experiences to negotiate the most advantageous results for his clients.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Business lawyers by top cities

- Austin Business Lawyers

- Boston Business Lawyers

- Chicago Business Lawyers

- Dallas Business Lawyers

- Denver Business Lawyers

- Houston Business Lawyers

- Los Angeles Business Lawyers

- New York Business Lawyers

- Phoenix Business Lawyers

- San Diego Business Lawyers

- Tampa Business Lawyers

Assignment Of Rights Agreement lawyers by city

- Austin Assignment Of Rights Agreement Lawyers

- Boston Assignment Of Rights Agreement Lawyers

- Chicago Assignment Of Rights Agreement Lawyers

- Dallas Assignment Of Rights Agreement Lawyers

- Denver Assignment Of Rights Agreement Lawyers

- Houston Assignment Of Rights Agreement Lawyers

- Los Angeles Assignment Of Rights Agreement Lawyers

- New York Assignment Of Rights Agreement Lawyers

- Phoenix Assignment Of Rights Agreement Lawyers

- San Diego Assignment Of Rights Agreement Lawyers

- Tampa Assignment Of Rights Agreement Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- More from M-W

- To save this word, you'll need to log in. Log In

Definition of assignment

task , duty , job , chore , stint , assignment mean a piece of work to be done.

task implies work imposed by a person in authority or an employer or by circumstance.

duty implies an obligation to perform or responsibility for performance.

job applies to a piece of work voluntarily performed; it may sometimes suggest difficulty or importance.

chore implies a minor routine activity necessary for maintaining a household or farm.

stint implies a carefully allotted or measured quantity of assigned work or service.

assignment implies a definite limited task assigned by one in authority.

Examples of assignment in a Sentence

These examples are programmatically compiled from various online sources to illustrate current usage of the word 'assignment.' Any opinions expressed in the examples do not represent those of Merriam-Webster or its editors. Send us feedback about these examples.

Word History

see assign entry 1

14th century, in the meaning defined at sense 1

Phrases Containing assignment

- self - assignment

Dictionary Entries Near assignment

Cite this entry.

“Assignment.” Merriam-Webster.com Dictionary , Merriam-Webster, https://www.merriam-webster.com/dictionary/assignment. Accessed 17 May. 2024.

Legal Definition

Legal definition of assignment, more from merriam-webster on assignment.

Nglish: Translation of assignment for Spanish Speakers

Britannica English: Translation of assignment for Arabic Speakers

Subscribe to America's largest dictionary and get thousands more definitions and advanced search—ad free!

Can you solve 4 words at once?

Word of the day.

See Definitions and Examples »

Get Word of the Day daily email!

Popular in Grammar & Usage

More commonly misspelled words, your vs. you're: how to use them correctly, every letter is silent, sometimes: a-z list of examples, more commonly mispronounced words, how to use em dashes (—), en dashes (–) , and hyphens (-), popular in wordplay, the words of the week - may 17, birds say the darndest things, a great big list of bread words, 10 scrabble words without any vowels, 12 more bird names that sound like insults (and sometimes are), games & quizzes.

Understanding Share Transfer or Transfer of Shares

This article will help you understand all about share transfer and the procedure for the transfer of shares in a company.

With the economy changing, the ways of investing money have also changed. It was not long ago when we had many companies that were owned by just a single individual. Today, many companies are owned by a pool of individuals .

This article will help you understand all about share transfer and the procedure for the transfer of shares in a company .

Transfer of Shares

When a company is formed, the shares are allotted . After some time, shareholders will want to sell a part or all of their shares to someone else; this is called the transfer of shares in the company . But what exactly goes into this process?

What is transfer of shares?

There would be times where you would want to change the share structure of your company . This can be done by changing the existing proportion of shares between shareholders or adding a new shareholder. So, the transfer of shares in the company is the process of transferring existing shares from one person to another , either by selling or by gifting them.

When a person purchases or receives a company’s stock , they get a certificate that shares the details of the ownership of the shares, known as the stock certificate . So, when this person decides to transfer the shares to someone else, they would have to perform a transfer using a share transfer form.

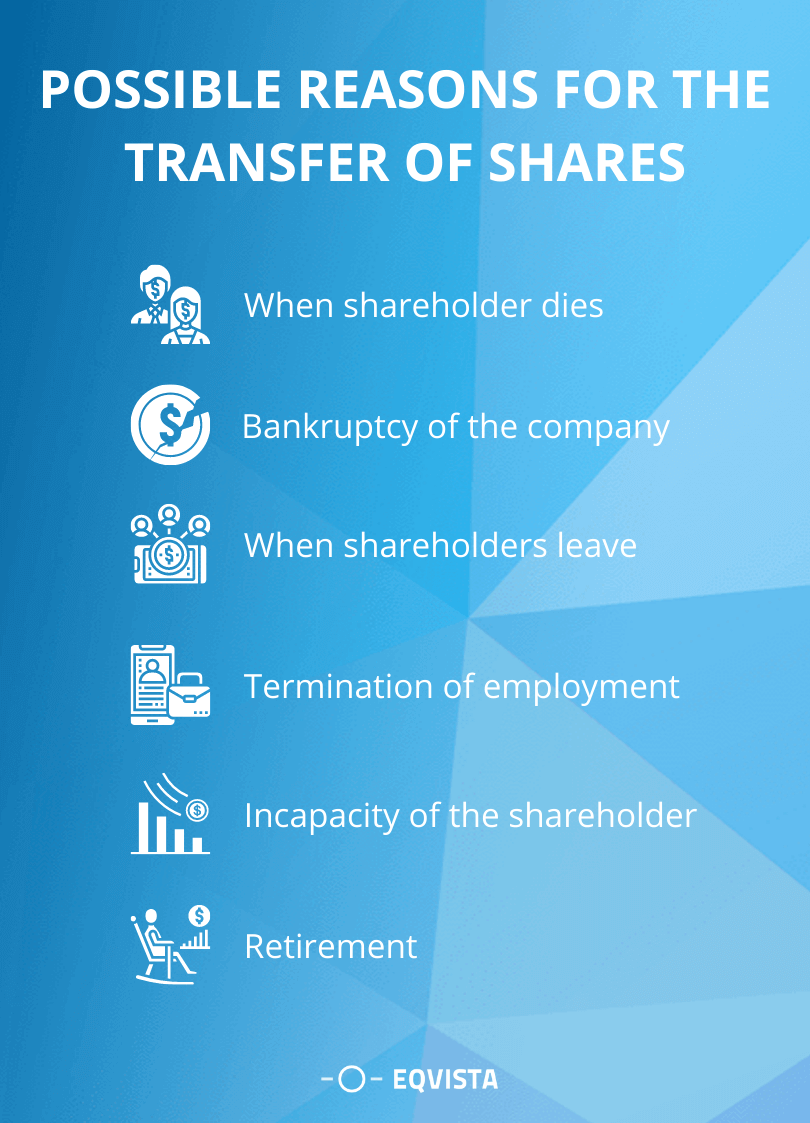

Possible reasons for the transfer of shares

A share transfer takes place under many different conditions. For instance, when a shareholder leaves the company , they would have to transfer the shares to another shareholder. The same happens when a shareholder dies or retires . With this, it is important to know the process of the transfer.

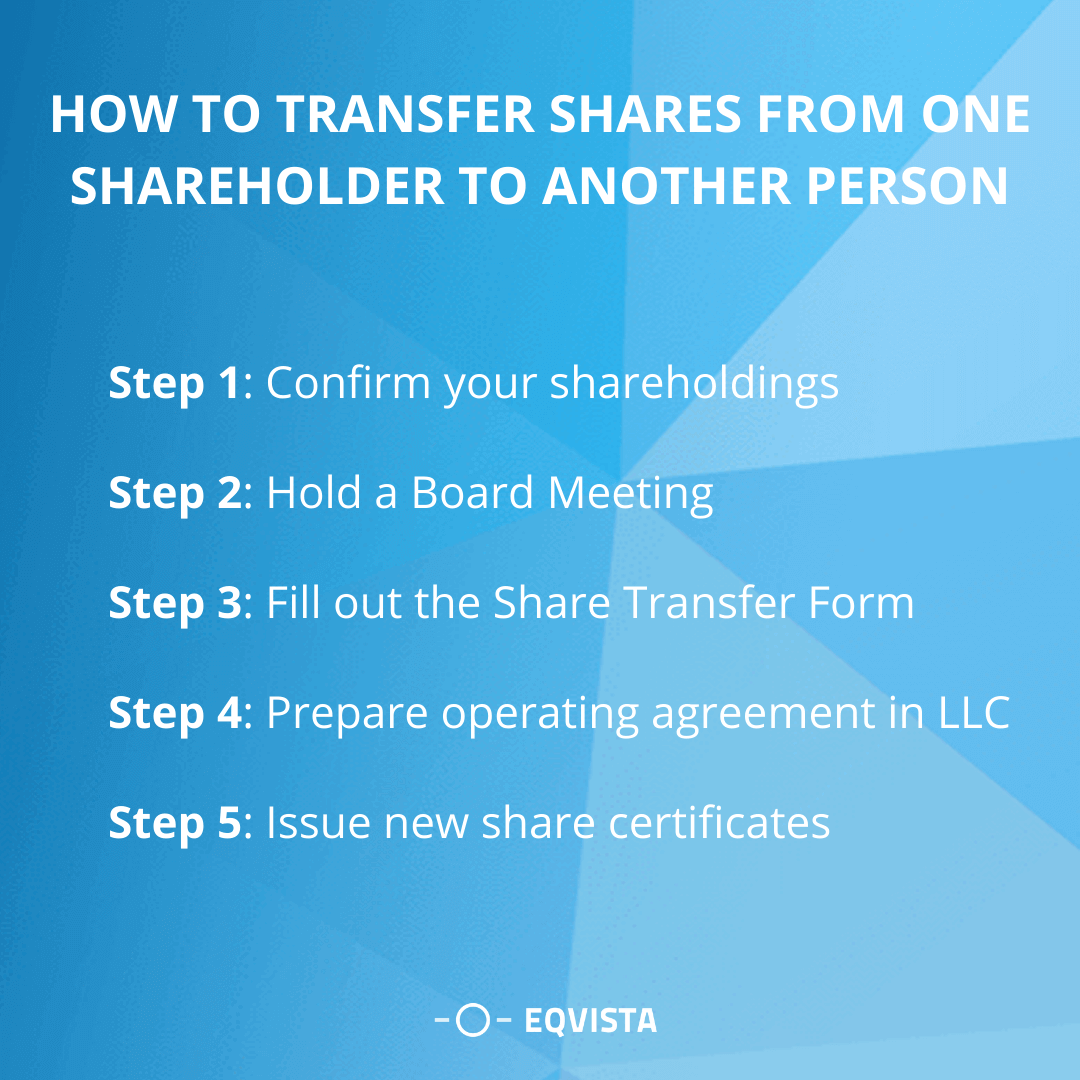

Here’s a short summary of the procedure for transfer of shares:

- Step 1 : Confirm your shareholdings: You need to confirm the number of shares you have, including the number of shares you want to give away and the number you want to keep.

- Step 2 : Hold a Board Meeting: As per the board agreement, the share transfer has to be approved by the board before it can be done. So, hold a board meeting and get the action approved.

- Step 3 : Fill the Share Transfer Form: It is the J30 form , a standard document used to transfer existing shares from one person to another. This form would hold the details of the seller or gifter of the shares, the receiver, number of shares, type of shares, and consideration paid. The shareholder selling the shares would then have to sign and date the form. If the shares are being transferred by the company and not an individual shareholder, then the director of the company would have to sign it.

- Step 4 : Issue new share certificates: With the confirmed share structure in place, the company’s next step is to issue new share certificates detailing the shareholdings. These will also render any previous share certificates as effectively canceled.

Share Transfer Form

The share transfer form , which is also known as a share transfer instrument , is a standard document that is needed for the transfer of shares in a company. This document is used when a shareholder or the company wants to sell or gift their company shares to another person or company.

The document is simple, where it outlines the particulars of the party selling the shares, the particulars of the person receiving it, the number of shares to be transferred, the company whose shares are transferred, the cost of each share, etc. As per the law, a private company cannot directly transfer shares to a person, but an existing shareholder can do so . When the form is filled, the transferor and the transferee will sign the document .

With this, the company can then affix its common seal on the document . Or, in place of this, either two directors, or one director and one secretary would need to sign on the document. If either party is an organization, then the authorized representative of the organization needs to sign the form. This will act as the seal for the transaction and is an integral part of confirming the transfer of shares in the company . Once this has been done, the document is kept in the company’s records.

How To Transfer Shares From One Shareholder to Another Person?

The transfer of shares in the company seems to be the same for all companies, but we know that there are different types of business entities, and each has its own kind of structures and processes. Keeping this in mind, we have shared the process of the transfer of shares for each main kind of company:

#1 Transfer of shares in a Corporation

The shares in a corporation are freely transferable . Nonetheless, the Articles of Incorporation, the agreement between the shareholder, or the bylaws might place some reasonable restrictions on the transfer of shares. For being about to transfer shares, the shareholder would require the board members’ approval and the approval of all the other shareholders in the company . Once this is done, the share transfer form is filled in, and the new share certificate is issued accordingly to the person getting the shares.

When the corporation sells its shares, the corporation would have to pay tax on the income and gain at the corporate level . And there is no preferential tax rate for capital gains recognized by a corporation. The money obtained from the sale of the shares is taxed as a dividend. And if it is sold as a plan of liquidation, it is taxed as a capital gain .

However, if an individual shareholder is selling the shares , they would have to pay tax on the capital gains at the preferential individual tax rate.

#2 Transfer of shares in S corporation

S corporations are corporations for all non-tax purposes. And that is why the steps needed for the transfer of shares are normally the same as those in the C corporation . Once the company or the individual shareholder decides to transfer the shares, they would need The Board’s approval, and then they need to fill the share transfer form. With this, the new share certificate is issued, and the shares are transferred. Ensure that all these transactions are noted in the company’s records and the cap table .

Since S corporations are pass-through entities , the tax implications are different from a C corp. When the shares in a company are sold, the S corporation would have to pay tax on the capital gains at the corporate level . This is then passed out to the shareholders. And if the shareholders are individuals, the amount is then taxed at the preferential capital gains tax rate. Shareholders get a step-up in tax basis in their shares as a result of corporate gain recognition.

#3 Transfer of shares in LLC

An LLC is governed by an Operating Agreement created when it is formed. This agreement provides the details on how the transfer of shares would be done in the company. If you are a shareholder in the LLC, you would have signed the operating agreement as well. And even though the operating agreement should have the rules that define the transfer of shares in the company, the LLC can also have a buy-sell agreement for it separately. It would share details taking into consideration every situation possible that can lead to the transfer of shares.

With this said, the transfer of shares in an LLC is not so different from that of a corporation. The only difference is that the transfer is governed by the rules in the operating agreement or by a buy-sell agreement . Once the board has approved the share transfer, and the conditions as per the agreement are met, the share transfer form must be filled and signed. As soon as it is signed, the shares are handed to the transferee, and the stock certificate is issued . With this, the company also needs to record the transaction in the company’s records and the cap table.

Taxation for Transfer of Shares

Selling stocks can have consequences on your tax bill. If your stock transaction resulted in you making a profit , you would owe the government capital gains tax . And if your transactions had a capital loss, you can use the loss to reduce your income for the year. You also get the option to carry the loss to the next year so that you can offset any capital gain that you make.

Let us understand what capital gains are a bit more before we can talk about the taxation of the transfer of shares.

What is a capital gain?

Capital gain is the difference in the amount you paid for the shares from the amount you sold the shares . In fact, capital gains aren’t just used for stocks, but it is for any asset you sell and get paid more than you paid for it.

There are two kinds of capital gains, namely, short-term and long-term capital gains. Short-term capital gains are when you own the stock or asset for less than a year before selling it off. In this case, you are taxed at the same rate as your income. This means that the short-term gain tax rate is equal to the income tax rate for your bracket.

If you own the stock for more than a year , it is considered a long-term capital gain . In this case, you are taxed at a much lower rate than your income tax. As a matter of fact, in 2020, single taxpayers get to pay:

- 0% on long-term capital gains if their taxable income is below $40,000 ,

- 15% – if their income is between $40,000 and $441,450 , and

- 20% – if their income is more than $441,450 .

Take the help of your accountant or lawyer to know more about your tax bracket.

Now, the tax you pay also depends on what you are doing with the shares . There are two situations, both have been explained below in detail:

#1 Selling Shares

In general, the capital gains tax will have to be paid for when you sell or give for free an asset, such as shares . The tax applied to it would depend on your income and the total capital gains you made from the shares in that year.

#2 Transfer as Gift

There are situations where a shareholder wishes to give their own shares as a gift to someone else. And the good news here is that there is no capital gains tax on the shares that are offered as gifts to your spouse or civil partner . But there is a general rule that when an individual gifts a chargeable asset like a company’s shares, it is considered disposal. This gives rise to a chargeable gain in the same way just it happens during the transfer of shares in exchange for money.

Nonetheless, when you gift shares, the shares’ market value at the time of disposal is taken into account for the capital gains tax and inheritance tax purposes. The logic behind this is that the tax is imposed on the increase in the value of the shares during the time the person owned them , that is if the value of the shares has increased from the time they acquired them to the time they gave them away for free.

Imagine you get 5,000 shares at $0.10 per share . It is evident that the value of the shares would increase as the company grows. Let us say that the market value of the shares is now $2 per share . So, if you want to give away the complete 5,000 shares for free, they would be liable for capital gains tax. This would be calculated on the difference between the current market value of the shares ($2 * 5,000 = $10,000) and the acquisition value of the shares ($0.10 * 5,000 = $500) . This means that the remaining amount of $9,500 would be subject to tax .

Transfer Shares on Eqvista

With all the above explained and now that you have understood everything, it is essential to record every transaction you make. Recording it means documenting the transaction in your cap table. And Eqvista is an advanced cap table software to help you record and manage all your equity transactions .

Before you begin, you will need to make sure that you have an account on Eqvista and have created your company account .

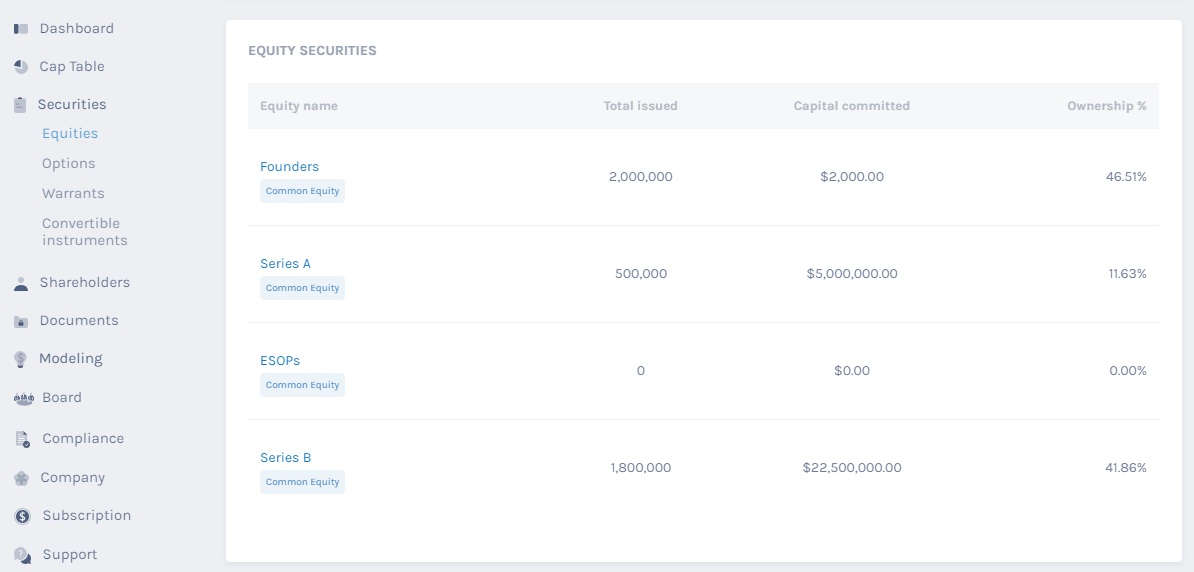

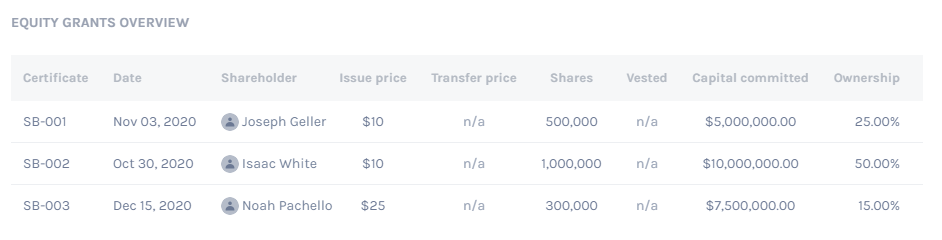

Step 1: Log into your account , select your company profile and from the dashboard, click on “Equities” under the “Securities” tab.

Here, click on the equity class from where the share transfer is about to take place. In this case, we select the option “Series B” .

Step 2: Once you do this, you will reach the next page, as below:

From here, select the certificate number of the shareholder whose shares are being transferred. In this case, we selected the option “SB-002” .

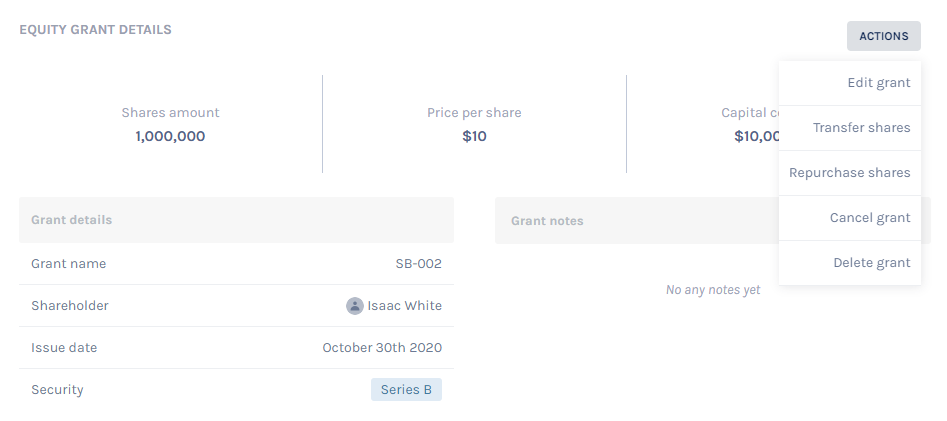

Step 3: This will take you to the page where you can see the details of this transaction. Next click on “Action” and then on “Transfer shares” .

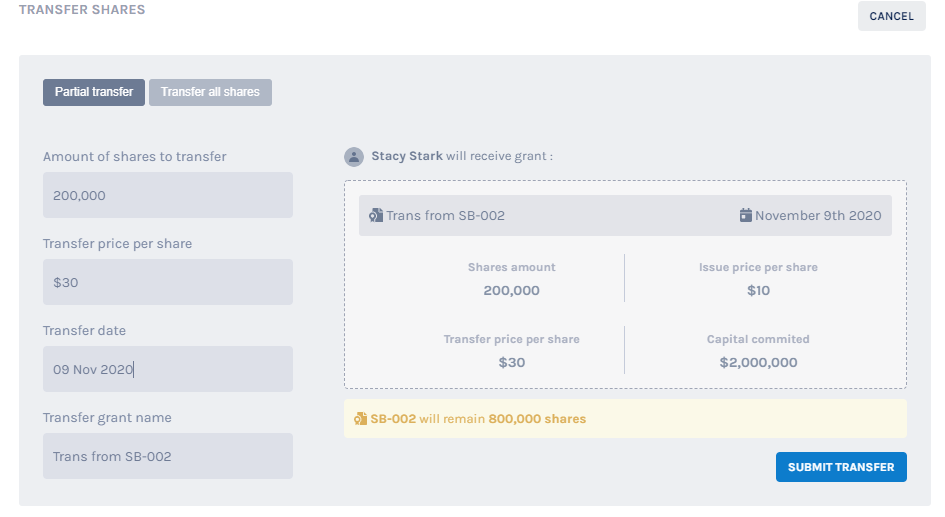

There are two kinds of transfers that you can make. One is the partial transfer and one is the transfer of all shares . Here we chose partial transfer, and type in the transferee’s name.

Step 4: You will reach the next step where you need to add the number of shares that you want to transfer. Since it is a partial transfer, and the shareholder who is making the transfer has about 1,000,000 shares, we choose to make a transfer of 200,000 shares here.

You will also have to add the price of the share at the time of the transfer . In this case we add in the share price of $30, and press on Submit .

With this, the transaction would be complete, and you will be redirected to the page of the transferor shareholder .

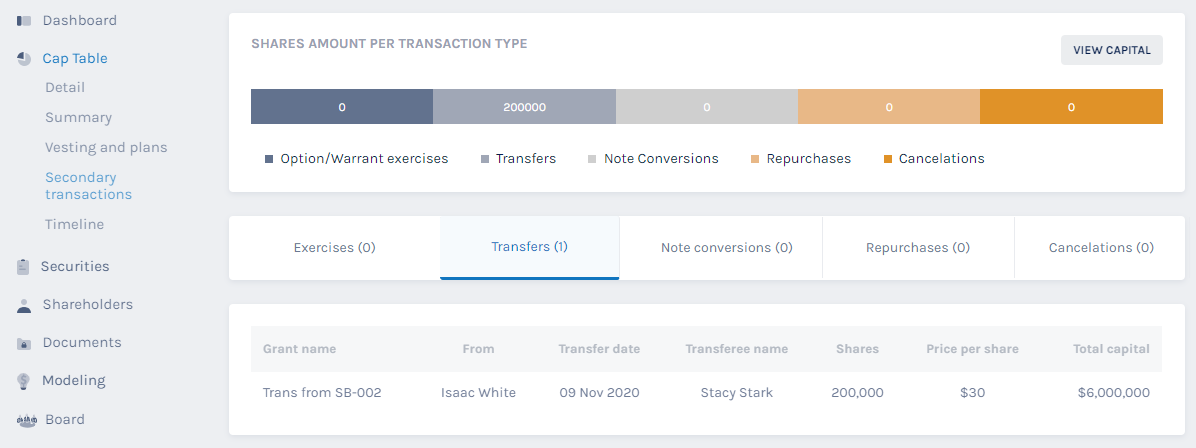

Step 5: To see the transfer and its effect on the secondary transactions of your cap table, you need to click on “Cap table” from the left side menu and then on “Secondary transactions” . This will take you to the following page.

Here, click on the “Transfers” tab to see the transfer transaction as shown below.

And just like this, you can easily make the transfer of shares in the company through Eqvista . To know more about the Eqvista app and how to use it, check out our knowledge center or contact us today!

More about Transfer of Shares

Interested in issuing & managing shares.

If you want to start issuing and managing shares, Try out our Eqvista App , it is free and all online!

Rajah Lehal

Authorizing vs. allocating vs. issuing shares in your company, october 17, 2017.

Company owners or investors, when drafting or digging through the details of the ownership of company shares, will come across the concept of authorized shares, issued shares and sometimes allocated (and unissued) shares. I have written this article to clear up any confusion on these three (3) states.

The Concept of Authorized Shares

When registering a new business, the articles of incorporation in some jurisdictions will require that the registrant file the number of shares that can be issued. It is very common to authorize an unlimited number of shares in any given share classes:

The authorized capital of the corporation consists of an unlimited number of:

- (a) Class A Common Voting Shares (the “Class A Common Voting Shares”);

- (b) Class B Non-Voting Shares (the “Class B Non-Voting Shares” and collectively with Class A Common Voting Shares, are the “Share Classes”)

By doing so the corporation can issue shares as many times as it wishes without amending the articles of incorporation.

Authorizing a LIMITED Number of Issuable Shares

A careful investor will sometimes require that a limit is placed upon the issuance of new shares in any and all share classes. Such a restriction ensures that the number of shares available for issue are a matter of public record, and therefore any changes to the number of shares available for issue would require a formal amendment of the articles.

The Concept of Allocated but Unissued Shares

To provide investors and/or co-founders comfort as to the balance of share ownership, the equity of a corporation may be split in some way in advance, with shares allocated but not issued. The issue of the shares might accompany a scheduled “buy-in”, or option conversion.

In the intermediate period, the company can still track the number of shares allocated to each shareholder, and also possibly to “treasury” - i.e. available for issuance to investors and/or to other employees. Pre-calculating the division of shares, and tracking the allocations in the company’s share register (whether or not such allocated shares are issued), will provide comfort to the shareholders or soon-to-be-shareholders on their proportionate ownership.

The Concept of Issued Shares

Issued shares are the easiest to explain, these are the shares of the company that have been transferred into the hands of one or more specific shareholders, and to which certain voting or dividend rights (among others) will attach.

Share Capitalization Table

A share capitalization table helps to illustrate these various “states of being” of a specific type of share.

- Limiting the number of authorized shares is a tactic that a careful investor might use to prevent an unauthorized share issue

- A share capitalization table will help to provide each business owner with comfort as to such owner’s pro rata share holding

- It’s important to be aware of your share ownership versus all other owners (on a fully diluted basis)

For more information, check out these blog posts :

- Breaking Down Share Issuance Step by Step

- What to Consider When Selecting the Corporation’s Share Attributes

Committed to offering clients expert, personalised legal advice

Assignment of shares in case of a limited company: required documents

In case of limited liability companies, shareholders may assign their shares. This assignment procedure may be performed by a Romanian lawyer .

A consequence of such a share assignment is that the assignor – the person assigning his shares, leaves the company and therefore loses his capacity of shareholder, while the assignee – the person who receives the shares – continues the activity of the company by acquiring the capacity of shareholder.

The share assignment procedure must be carried out at the Trade Registry. Lawyers appointed in this regard shall submit on behalf of the limited liability company (Ltd) all required documents.

Assigning shares is a procedure that may require two steps (if shares are assigned to persons outside the Ltd) or one single step (if shares are assigned to one or more of the Ltd’s existing shareholders). Shares may be assigned to individuals or companies (Romanian or foreign).

Two-step assignment of shares

Documents that need to be prepared as a first step:

- request for the assignment of shares;

- Decision of the General Assembly of Shareholders or, as the case may be, Decision of the sole shareholder (the assignment of shares must be expressly stipulated and all necessary information regarding the assignment);

- Assignment Agreement between the assignor and the assignee;

It is possible to be represented by a Romanian lawyer based on a special power of attorney.

Documents that need to be prepared during the second phase of the procedure:

- Registration request;

- Proof that the Decision of the General Assembly of Shareholders or the Decision of the sole shareholder was published in the Official Gazette;

- Decision of the General Assembly of Shareholders or, as the case may be, the Decision of the sole shareholder, which must include information about the assignment of shares;

- Copies of the individuals’ Identity Cards and, as the case may be, of the incorporation certificates in the case of companies, of those who shall acquire the capacity of shareholder;

- Statement given by the shareholder – company – that it complies with all required conditions for acting in the capacity of shareholder;

- Incorporation certificate, original or a copy bearing an Apostil, from the Trade Registry where the foreign company is registered, certifying its existence;

- Restated Articles of Incorporation – original copy.

Publisher: Budusan si Asociatii

Corporate legal services

Personal legal services, member directory, knowledge hub, legal information.

We use cookies to gather certain statistics and detect bots. These statistics will not be used for advertising purposes or similar by our organisation, they are only used to count page views using Google Analytics.

Understanding an assignment and assumption agreement

Need to assign your rights and duties under a contract? Learn more about the basics of an assignment and assumption agreement.

Get your assignment of agreement

by Belle Wong, J.D.

Belle Wong, is a freelance writer specializing in small business, personal finance, banking, and tech/SAAS. She ...

Read more...

Updated on: November 24, 2023 · 3 min read

The assignment and assumption agreement

The basics of assignment and assumption, filling in the assignment and assumption agreement.

While every business should try its best to meet its contractual obligations, changes in circumstance can happen that could necessitate transferring your rights and duties under a contract to another party who would be better able to meet those obligations.

If you find yourself in such a situation, and your contract provides for the possibility of assignment, an assignment and assumption agreement can be a good option for preserving your relationship with the party you initially contracted with, while at the same time enabling you to pass on your contractual rights and duties to a third party.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting the assignment is known as the assignee.

In order for an assignment and assumption agreement to be valid, the following criteria need to be met:

- The initial contract must provide for the possibility of assignment by one of the initial contracting parties.

- The assignor must agree to assign their rights and duties under the contract to the assignee.

- The assignee must agree to accept, or "assume," those contractual rights and duties.

- The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.

A standard assignment and assumption contract is often a good starting point if you need to enter into an assignment and assumption agreement. However, for more complex situations, such as an assignment and amendment agreement in which several of the initial contract terms will be modified, or where only some, but not all, rights and duties will be assigned, it's a good idea to retain the services of an attorney who can help you draft an agreement that will meet all your needs.

When you're ready to enter into an assignment and assumption agreement, it's a good idea to have a firm grasp of the basics of assignment:

- First, carefully read and understand the assignment and assumption provision in the initial contract. Contracts vary widely in their language on this topic, and each contract will have specific criteria that must be met in order for a valid assignment of rights to take place.

- All parties to the agreement should carefully review the document to make sure they each know what they're agreeing to, and to help ensure that all important terms and conditions have been addressed in the agreement.

- Until the agreement is signed by all the parties involved, the assignor will still be obligated for all responsibilities stated in the initial contract. If you are the assignor, you need to ensure that you continue with business as usual until the assignment and assumption agreement has been properly executed.

Unless you're dealing with a complex assignment situation, working with a template often is a good way to begin drafting an assignment and assumption agreement that will meet your needs. Generally speaking, your agreement should include the following information:

- Identification of the existing agreement, including details such as the date it was signed and the parties involved, and the parties' rights to assign under this initial agreement

- The effective date of the assignment and assumption agreement

- Identification of the party making the assignment (the assignor), and a statement of their desire to assign their rights under the initial contract

- Identification of the third party accepting the assignment (the assignee), and a statement of their acceptance of the assignment

- Identification of the other initial party to the contract, and a statement of their consent to the assignment and assumption agreement

- A section stating that the initial contract is continued; meaning, that, other than the change to the parties involved, all terms and conditions in the original contract stay the same

In addition to these sections that are specific to an assignment and assumption agreement, your contract should also include standard contract language, such as clauses about indemnification, future amendments, and governing law.

Sometimes circumstances change, and as a business owner you may find yourself needing to assign your rights and duties under a contract to another party. A properly drafted assignment and assumption agreement can help you make the transfer smoothly while, at the same time, preserving the cordiality of your initial business relationship under the original contract.

You may also like

What does 'inc.' mean in a company name?

'Inc.' in a company name means the business is incorporated, but what does that entail, exactly? Here's everything you need to know about incorporating your business.

October 9, 2023 · 10min read

How to write a will: A comprehensive guide to will writing

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

May 17, 2024 · 11min read

How to Start an LLC in 7 Easy Steps (2024 Guide)

2024 is one of the best years ever to start an LLC, and you can create yours in only a few steps.

May 16, 2024 · 22min read

- Search Search Please fill out this field.

- Trading Skills

- Trading Basic Education

Disposition: Definition, How It Works in Investing, and Example

James Chen, CMT is an expert trader, investment adviser, and global market strategist.

:max_bytes(150000):strip_icc():format(webp)/photo__james_chen-5bfc26144cedfd0026c00af8.jpeg)

What Is a Disposition?

A disposition is the act of selling or otherwise "disposing" of an asset or security . The most common form of a disposition would be selling a stock investment on the open market, such as a stock exchange.

Other types of dispositions include donations to charities or trusts, the sale of real estate, either land or a building, or any other financial asset. Still, other forms of dispositions involve transfers and assignments . The bottom line is that the investor has given up possession of an asset.

Key Takeaways

- A disposition refers generally to the selling securities or assets on the open market.

- Dispositions can also take the form of transfers or donations to charities, endowments, or trusts.

- For business dispositions, the SEC requires certain reporting to be completed depending on the nature of the disposition.

- Dispositions that are donations, assignments, or transfers, can often be used to take advantage of beneficial tax treatment.

Understanding a Disposition

A "disposition of shares" is perhaps the most commonly used phrase regarding a disposition. Let’s say an investor has been a long-time shareholder of a particular company, but lately, the company may not be doing so well.

If they decide to exit the investment, it would amount to a disposition of that investment—a disposition of shares. Most likely, they would sell their shares through a broker on a stock exchange . Ultimately, they have decided to get rid of, or dispose of, that investment.

If the sale results in any sort of capital gain , then the investor will have to pay capital gains tax on the profits of the sale if they meet the requirements set by the Internal Revenue Service (IRS).

Other types of dispositions include transfers and assignments, where someone legally assigns or transfers particular assets to their family, a charity, or another type of organization. Mostly this is done for tax and accounting purposes, where the transfer or assignment relieves the disposer of tax or other liabilities.

For example, if an investor purchased stock for $5,000 and the investment grew to $15,000, the investor can avoid the capital gains tax on their profit by donating it to a charity. The investor is then able to include the entire $15,000 as a tax deduction .

Business Disposition

Businesses also dispose of assets, and very often, of entire business segments or units. This is commonly known as divestiture and can be done through a spinoff , split-up , or split-off .

The Securities and Exchange Commission (SEC) has very specific guidelines on how these dispositions must be reported and handled. If the disposition is not reported in the financial statements of a company, then pro forma financial statements are required if the disposition meets the requirements of a significance test.

"Significance" is determined by either an income test or an investment test. An investment test measures the investment value in the unit being disposed of compared to total assets. If the amount is more than 10% as of the most recent fiscal year-end, then it is considered significant.

The income test measures if the "equity in the income from continuing operations before taxes, extraordinary items, and cumulative effects of changes in accounting principles" is 10% or more of such income of the most recent fiscal year-end. In certain situations, the threshold level can be increased to 20%.

The Disposition Effect

Behavioral economics also has something to say about one's propensity to sell a winning vs. losing position based on the concept of loss aversion . The "disposition effect" is a term that describes investor behavior in which they have a tendency to sell winning investments too early before realizing all potential gains while holding on to losing investments for longer than they should, hoping that the investments will turn around and generate a profit.

This effect was first introduced by Hersh Shefrin and Meir Statman in 1985 in their paper, "The Disposition to Sell Winners Too Early and Ride Losers Too Long: Theory and Evidence." Studies show that investors should do the exact opposite of what the disposition effect states they tend to do.

The National Law Review. " SEC Amends Financial Statement Requirements for Business Acquisitions and Dispositions " Accessed Nov. 3, 2020.

:max_bytes(150000):strip_icc():format(webp)/business_building_153697270-5bfc2b9846e0fb0083c07d69.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Key Differences

Know the Differences & Comparisons

Difference Between Transfer and Transmission of Shares

Transfer of shares requires and instrument of transfer, whereas no such instrument is required in the transmission of shares. To further understand, the difference between transfer and transmission of shares, you need to have a glance at the article excerpt, provided below.

Content: Transfer of Shares Vs Transmission of Shares

Comparison chart, definition of transfer of shares.

Transfer of shares refers to the intentional transfer of title (rights as well as duties) to shares by one person to another. There are two parties to transfer of shares, i.e. transferor and transferee.

The shares of the public company are freely transferable unless there is an express restriction provided in the articles of association. However, the company can refuse the transfer of shares, if it has a valid reason for the same. In the case of a private company, there is a restriction on the transfer of shares subject to certain exceptions.

Definition of Transmission of Shares

There are some cases when the transfer of shares occurs due to the operation of law, i.e. when the registered shareholder is no more, or when he is insolvent or lunatic. Transmission of shares also occurs when the shares are held by a company, and it is wound up.

The shares are transferred to the legal representative of the deceased and the official assignee of the insolvent. The transmission is recorded by the company when the transferee gives the proof of entitlement of shares.

Key Differences Between Transfer and Transmission of Shares

The significant differences between transfer and transmission of shares are provided below:

- When the shares are transferred by one party to another party, voluntarily, it is known as transfer of shares. When the transfer of shares happens due to the operation of law, it is referred to as transmission of shares.

- Transfer of shares is done intentionally whereas death, bankruptcy and lunacy are the reasons for transmission of shares.

- The transfer of shares is initiated by the parties to transfer, i.e. transferor and transferee. Unlike transmission of shares which is initiated by the legal representative of the concerned member.

- Transferee pays an adequate consideration to the transferor for the transfer of shares. In the case of transmission of shares, no consideration shall be paid.

- Execution of valid transfer deed is necessary when there is the transfer of shares, but not in the transmission of shares.

- When the transfer is completed, the liability of the transferor is over. On the other hand, the original liability of shares exists.

- Stamp duty is payable on the market value of shares in case of transfer while in the transmission of shares no stamp duty is to be paid.

By and larger, transfer of shares is the normal course of transferring property, while the transmission of shares takes place only on demise or insolvency of the shareholder. Moreover, Transfer of shares is very common, but the transmission of shares takes place only on the happening of the certain event.

You Might Also Like:

Charles Sarkodie says

December 3, 2018 at 3:13 pm

Read the above with much interest and my question is with regard to the transmission of shares — when a company is dissolved can the shares be transmitted upon the death of a deceased shareholder ?

Amiruddin Khan says

October 5, 2019 at 3:31 am

Ofcourse it is also mentioned incase of insolvency the transmission of the share takes place by the legl heir

Jeewan Mittal says

September 28, 2020 at 5:29 pm

In full partition of HUF shareholding of huf is awarded to co-parceners, You need to pay stamp duty or not ?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

What is a stock split?

- Understanding stock splits

Why do companies split stock?

- How a stock split affects you

- Stock Split FAQs

What Is a Stock Split?

Paid non-client promotion: Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate investing products to write unbiased product reviews.

- A stock split is when a company decides to increase the number of shares by dividing its existing shares into additional shares.

- Stock splits don't provide any economic value to the company. They just reduce the stock's price, making it more affordable.

- Stock splits are often good signs for shareholders, attracting new investors and eventually leading to a share-price rise.

As an investor, the idea of "splitting" anything is probably not at the top of your list.

But when it comes to stocks, your portfolio may benefit from a split.

A stock split occurs when a company makes its shares more affordable by dividing its existing shares into a larger number of less expensive ones.

In a stock split, the company's overall value stays the same. A split may reduce the price per share, but it doesn't affect the company's market capitalization. There are simply more shares to go around.

If you're already a shareholder in a company when it declares a stock split, not much changes. Nevertheless, it's important to grasp how stock splits work, especially for understanding how the market may react post-split.

Understanding stock splits

Dividing the pie into more slices .

Publicly traded companies have a set amount of outstanding shares available in the market.

A stock split is exactly what it sounds like: It's an action by a company's board of directors to increase the number of available shares of stock by "splitting" existing shares.

A stock can be split in as many ways as a company chooses, supplemented with ratios such as "2-for-1," "3-for-1," all the way up to "100-for-1." All this tells you is how much one share is now worth. For instance, in a 2-for-1 split, every single share held by an investor now becomes two. When this happens, the number of shares the investor has will literally double.

When companies opt for a stock split, they increase the overall number of outstanding shares and lower the value of each individual share. But that doesn't mean the overall valuation of the company changes. Nor does the overall dollar amount of the investor's stake.

Example: A 2-for-1 split

To provide an example, let's say Apple ( AAPL ) decides to do a 2-for-1 stock split. For simplicity's sake, assume you own one share of Apple's stock.

With its 2-to-1 split, Apple grants you one additional share, so you now have a total of two. But each share is then valued at half of the original. The two shares have the same monetary value as the one share pre-split.

For existing shareholders, the result is the same — the total value of their shares remains consistent. There are just more pieces of the pie.

For new investors, an announcement of a stock split can signal a time to buy , since a lower price per share means buying at lower prices. Overall, stock splits often signal to the market that the share price is increasing and the company is optimistic it will continue to do so in the future.

There are many reasons why a company may consider a stock split. Since stock splits don't add market value , much of it comes down to making the stock more attainable to everyday investors, and how this impacts behavior by influencing the psychology of investors.

Here are the main reasons why a company may split a stock:

Increased affordability

The main purpose of a stock split is to reduce the price of an expensive stock — especially when compared with price levels of peers in the industry — making it accessible to more investors. If a stock costs less, it might be easier for an investor to incorporate it into their portfolio, especially if the shares were rather expensive before a share split.

Some companies have held sizable stock splits. Amazon, for example, announced that its common shares would undergo a 20-for-1 stock split in 2022, which took place in June. Following this event, every investor had 19 additional shares for every unit of common stock they had before this event.

Interestingly enough, there are some famous stock splits which have been even larger. For example, Warren Buffett's Berkshire Hathaway split its shares 50-for-1 back in 2010. More recently, Chipotle announced in March 2024 that it would go forward with a 50-for-1 stock split.

Boosting liquidity (ease of trading)

Because a stock split increases the number of shares in circulation, it can result in greater liquidity , which makes it easier for the stock to be traded. By reducing share prices, companies can attract a wider range of investors, therefore boosting trading volume.

Such an increase in liquidity benefits investors as it makes buying and selling stocks at fair prices much simpler. Trades can also be executed much faster.

Bullish results

When a stock splits, the company creating this split is often perceived to be a successful one. The fact that the share price is so high that it must split its stock indicates to investors that the company has been performing well, and its shares must be a good investment.

A stock split also often increases the share price after its initial reduction. As the reduced price makes a stock cheaper, more investors are able to purchase it, driving up the demand and, therefore, the price.

How a stock split affects you

There are several ways that a stock split can impact you as an individual shareholder.

More shares, lower price

For starters, a share split results in a greater number of shares outstanding that simply have a proportionately lower price. This development can prove bullish, as reducing the price of a share may influence investors by making them think it is a better deal and motivating them to purchase it. This, in turn, can increase the value of the shares over the long run.

Another way a share split can impact you as an investor is by making individual common shares more affordable. Following one of these events, you may be able to purchase shares of a stock that were previously unaffordable because their price was too high.

This might make it easier for you to construct your ideal portfolio. For example, let's say that a share of a company you want to purchase is trading for $2,500. If it undergoes a 20-for-1 split, and its price goes down to $125, that might make it far more accessible, getting you closer to your intended allocation.

One more way that splitting shares in this manner can impact you as an individual is by providing a signal to the broader markets that a company opting to split its shares is succeeding and will continue to do well going forward. Such an event can prove positive for a company's image, generating favorable visibility and therefore drawing investors to the organization.

This could in turn fuel greater demand for the company's shares, causing their value to rise and increasing the value of your portfolio.

Your total investment value remains the same

A stock split, in and of itself, will not change the monetary value of your stake in a company. This is important to keep in mind, as an investor may respond to such a split by thinking that their investment in a particular business is greater than it was before.

A stock split is a way for a company to increase the number of shares outstanding without issuing new shares, an event that would dilute the value of existing shares.

Stock Split FAQs

Stock splits will not make you rich directly, but they can increase demand for shares, causing them to rise in value over the long-term.

Stock splits are frequently interpreted as being a positive sign, but it is important to research the underlying cause of any such split.

You should not buy shares of a company based solely on a decision to split the organization's stock. Instead, you should evaluate the company's fundamentals and future growth prospects, in addition to evaluating how the shares would fit in with your investment strategy.

The dividends paid by shares adjust proportionately following a stock split. In other words, you should receive the same amount of dividends after the split as you did before it.

Yes, shares of any company can undergo a split, as long as the company's board of directors approves such a move.

- Main content

Transfer Forward Brenen Lorient Signs With UNT

5/15/2024 3:12:00 PM | Men's Basketball

At Justice Alito’s House, a ‘Stop the Steal’ Symbol on Display

An upside-down flag, adopted by Trump supporters contesting the Biden victory, flew over the justice’s front lawn as the Supreme Court was considering an election case.

A photo obtained by The Times shows an inverted flag at the Alito residence on Jan. 17, 2021, three days before the Biden inauguration. Credit...

Supported by

- Share full article

By Jodi Kantor

Jodi Kantor, who has been reporting on the Supreme Court, including the behind-the-scenes story of how the justices overturned the right to abortion, welcomes tips at nytimes.com/tips .

- May 16, 2024

After the 2020 presidential election, as some Trump supporters falsely claimed that President Biden had stolen the office, many of them displayed a startling symbol outside their homes, on their cars and in online posts: an upside-down American flag.

One of the homes flying an inverted flag during that time was the residence of Supreme Court Justice Samuel A. Alito Jr., in Alexandria, Va., according to photographs and interviews with neighbors.

The upside-down flag was aloft on Jan. 17, 2021, the images showed. President Donald J. Trump’s supporters, including some brandishing the same symbol, had rioted at the Capitol a little over a week before. Mr. Biden’s inauguration was three days away. Alarmed neighbors snapped photographs, some of which were recently obtained by The New York Times. Word of the flag filtered back to the court, people who worked there said in interviews.

While the flag was up, the court was still contending with whether to hear a 2020 election case, with Justice Alito on the losing end of that decision. In coming weeks, the justices will rule on two climactic cases involving the storming of the Capitol on Jan. 6, including whether Mr. Trump has immunity for his actions. Their decisions will shape how accountable he can be held for trying to overturn the last presidential election and his chances for re-election in the upcoming one.

“I had no involvement whatsoever in the flying of the flag,” Justice Alito said in an emailed statement to The Times. “It was briefly placed by Mrs. Alito in response to a neighbor’s use of objectionable and personally insulting language on yard signs.”

Judicial experts said in interviews that the flag was a clear violation of ethics rules, which seek to avoid even the appearance of bias, and could sow doubt about Justice Alito’s impartiality in cases related to the election and the Capitol riot.

The mere impression of political opinion can be a problem, the ethics experts said. “It might be his spouse or someone else living in his home, but he shouldn’t have it in his yard as his message to the world,” said Amanda Frost, a law professor at the University of Virginia.

This is “the equivalent of putting a ‘Stop the Steal’ sign in your yard, which is a problem if you’re deciding election-related cases,” she said.

Interviews show that the justice’s wife, Martha-Ann Alito, had been in a dispute with another family on the block over an anti-Trump sign on their lawn, but given the timing and the starkness of the symbol, neighbors interpreted the inverted flag as a political statement by the couple.

The longstanding ethics code for the lower courts, as well as the recent one adopted by the Supreme Court, stresses the need for judges to remain independent and avoid political statements or opinions on matters that could come before them.

“You always want to be proactive about the appearance of impartiality,” Jeremy Fogel, a former federal judge and the director of the Berkeley Judicial Institute, said in an interview. “The best practice would be to make sure that nothing like that is in front of your house.”

The court has also repeatedly warned its own employees against public displays of partisan views, according to guidelines circulated to the staff and reviewed by The Times. Displaying signs or bumper stickers is not permitted, according to the court’s internal rule book and a 2022 memo reiterating the ban on political activity.

Asked if these rules also apply to justices, the court declined to respond.

The exact duration that the flag flew outside the Alito residence is unclear. In an email from Jan. 18, 2021, reviewed by The Times, a neighbor wrote to a relative that the flag had been upside down for several days at that point.

In recent years, the quiet sanctuary of his street, with residents who are Republicans and Democrats, has tensed with conflict, neighbors said. Around the 2020 election , a family on the block displayed an anti-Trump sign with an expletive. It apparently offended Mrs. Alito and led to an escalating clash between her and the family, according to interviews.