What is inflation?

Inflation has been top of mind for many over the past few years. But how long will it persist? In June 2022, inflation in the United States jumped to 9.1 percent, reaching the highest level since February 1982. The inflation rate has since slowed in the United States , as well as in Europe , Japan , and the United Kingdom , particularly in the final months of 2023. But even though global inflation is higher than it was before the COVID-19 pandemic, when it hovered around 2 percent, it’s receding to historical levels . In fact, by late 2022, investors were predicting that long-term inflation would settle around a modest 2.5 percent. That’s a far cry from fears that long-term inflation would mimic trends of the 1970s and early 1980s—when inflation exceeded 10 percent.

Get to know and directly engage with senior McKinsey experts on inflation.

Ondrej Burkacky is a senior partner in McKinsey’s Munich office, Axel Karlsson is a senior partner in the Stockholm office, Fernando Perez is a senior partner in the Miami office, Emily Reasor is a senior partner in the Denver office, and Daniel Swan is a senior partner in the Stamford, Connecticut, office.

Inflation refers to a broad rise in the prices of goods and services across the economy over time, eroding purchasing power for both consumers and businesses. Economic theory and practice, observed for many years and across many countries, shows that long-lasting periods of inflation are caused in large part by what’s known as an easy monetary policy . In other words, when a country’s central bank sets the interest rate too low or increases money growth too rapidly, inflation goes up. As a result, your dollar (or whatever currency you use) will not go as far today as it did yesterday. For example: in 1970, the average cup of coffee in the United States cost 25 cents; by 2019, it had climbed to $1.59. So for $5, you would have been able to buy about three cups of coffee in 2019, versus 20 cups in 1970. That’s inflation, and it isn’t limited to price spikes for any single item or service; it refers to increases in prices across a sector, such as retail or automotive—and, ultimately, a country’s economy.

How does inflation affect your daily life? You’ve probably seen high rates of inflation reflected in your bills—from groceries to utilities to even higher mortgage payments. Executives and corporate leaders have had to reckon with the effects of inflation too, figuring out how to protect margins while paying more for raw materials.

But inflation isn’t all bad. In a healthy economy, annual inflation is typically in the range of two percentage points, which is what economists consider a sign of pricing stability. When inflation is in this range, it can have positive effects: it can stimulate spending and thus spur demand and productivity when the economy is slowing down and needs a boost. But when inflation begins to surpass wage growth, it can be a warning sign of a struggling economy.

Introducing McKinsey Explainers : Direct answers to complex questions

Inflation may be declining in many markets, but there’s still uncertainty ahead: without a significant surge in productivity, Western economies may be headed for a period of sustained inflation or major economic reset , as Japan has experienced in the first decades of the 21st century.

What does seem to be changing are leaders’ attitudes. According to the 2023 year-end McKinsey Global Survey on economic conditions , respondents reported less fear about inflation as a risk to global and domestic economic growth . But this sentiment varies significantly by region: European respondents were most concerned about the effects of inflation, whereas respondents in North America offered brighter views.

What causes inflation?

Monetary policy is a critical driver of inflation over the long term. The current high rate of inflation is a result of increased money supply , high raw materials costs , labor mismatches , and supply disruptions —exacerbated by geopolitical conflict .

In general, there are two primary types, or causes, of short-term inflation:

- Demand-pull inflation occurs when the demand for goods and services in the economy exceeds the economy’s ability to produce them. For example, when demand for new cars recovered more quickly than anticipated from its sharp dip at the beginning of the COVID-19 pandemic, an intervening shortage in the supply of semiconductors made it hard for the automotive industry to keep up with this renewed demand. The subsequent shortage of new vehicles resulted in a spike in prices for new and used cars.

- Cost-push inflation occurs when the rising price of input goods and services increases the price of final goods and services. For example, commodity prices spiked sharply during the pandemic as a result of radical shifts in demand, buying patterns, cost to serve, and perceived value across sectors and value chains. To offset inflation and minimize impact on financial performance, industrial companies were forced to increase prices for end consumers.

Learn more about McKinsey’s Growth, Marketing & Sales Practice.

What are some periods in history with high inflation?

Economists frequently compare the current inflationary period with the post–World War II era , when price controls, supply problems, and extraordinary demand in the United States fueled double-digit inflation gains—peaking at 20 percent in 1947—before subsiding at the end of the decade. Consumption patterns today have been similarly distorted, and supply chains have been disrupted by the pandemic.

The period from the mid-1960s through the early 1980s in the United States, sometimes called the “Great Inflation,” saw some of the country’s highest rates of inflation, with a peak of 14.8 percent in 1980. To combat this inflation, the Federal Reserve raised interest rates to nearly 20 percent. Some economists attribute this episode partially to monetary policy mistakes rather than to other causes, such as high oil prices. The Great Inflation signaled the need for public trust in the Federal Reserve’s ability to lessen inflationary pressures.

Inflation isn’t solely a modern-day phenomenon, of course. One very early example of inflation comes from Roman times, from around 200 to 300 CE. Roman leaders were struggling to fund an army big enough to deal with attackers from multiple fronts. To help, they watered down the silver in their coinage, causing the value of money to slowly fall—and inflation to pick up. This led merchants to raise their prices, causing widespread panic. In response, the emperor Diocletian issued what’s now known as the Edict on Maximum Prices, a series of price and wage controls designed to stop the rise of prices and wages (one helpful control was a maximum price for a male lion). But because the edict didn’t address the root cause of inflation—the impure silver coin—it didn’t fix the problem.

How is inflation measured?

Statistical agencies measure inflation first by determining the current value of a “basket” of various goods and services consumed by households, referred to as a price index. To calculate the rate of inflation over time, statisticians compare the value of the index over one period with that of another. Comparing one month with another gives a monthly rate of inflation, and comparing from year to year gives an annual rate of inflation.

In the United States, the Bureau of Labor Statistics publishes its Consumer Price Index (CPI), which measures the cost of items that urban consumers buy out of pocket. The CPI is broken down by region and is reported for the country as a whole. The Personal Consumption Expenditures (PCE) price index —published by the US Bureau of Economic Analysis—takes into account a broader range of consumer spending, including on healthcare. It is also weighted by data acquired through business surveys.

How does inflation affect consumers and companies differently?

Inflation affects consumers most directly, but businesses can also feel the impact:

- Consumers lose purchasing power when the prices of items they buy, such as food, utilities, and gasoline, increase. This can lead to household belt-tightening and growing pessimism about the economy .

- Companies lose purchasing power and risk seeing their margins decline , when prices increase for inputs used in production. These can include raw materials like coal and crude oil , intermediate products such as flour and steel, and finished machinery. In response, companies typically raise the prices of their products or services to offset inflation, meaning consumers absorb these price increases. The challenge for many companies is to strike the right balance between raising prices to cover input cost increases while simultaneously ensuring that they don’t raise prices so much that they suppress demand.

How can organizations respond to high inflation?

During periods of high inflation, companies typically pay more for materials , which decreases their margins. One way for companies to offset losses and maintain margins is by raising prices for consumers. However, if price increases are not executed thoughtfully, companies can damage customer relationships and depress sales —ultimately eroding the profits they were trying to protect.

When done successfully, recovering the cost of inflation for a given product can strengthen relationships and overall margins. There are five steps companies can take to ADAPT (adjust, develop, accelerate, plan, and track) to inflation:

- Adjust discounting and promotions and maximize nonprice levers. This can include lengthening production schedules or adding surcharges and delivery fees for rush or low-volume orders.

- Develop the art and science of price change. Instead of making across-the-board price changes, tailor pricing actions to account for inflation exposure, customer willingness to pay, and product attributes.

- Accelerate decision making tenfold. Establish an “inflation council” that includes dedicated cross-functional, inflation-focused decision makers who can act quickly and nimbly on customer feedback.

- Plan options beyond pricing to reduce costs. Use “value engineering” to reimagine a portfolio and provide cost-reducing alternatives to price increases.

- Track execution relentlessly. Create a central supporting team to address revenue leakage and to manage performance rigorously. Traditional performance metrics can be less reliable when inflation is high .

Beyond pricing, a variety of commercial and technical levers can help companies deal with price increases in an inflationary market , but other sectors may require a more tailored response to pricing.

Learn more about our Financial Services , Industrials & Electronics , Operations , Strategy & Corporate Finance , and Growth, Marketing & Sales Practices.

How can CEOs help protect their organizations against uncertainty during periods of high inflation?

In today’s uncertain environment, in which organizations have a much wider range of stakeholders, leaders must think about performance beyond short-term profitability. CEOs should lead with the complete business cycle and their complete slate of stakeholders in mind.

CEOs need an inflation management playbook , just as central bankers do. Here are some important areas to keep in mind while scripting it:

- Design. Leaders should motivate their organizations to raise the profile of design to a C-suite topic. Design choices for products and services are critical for responding to price volatility, scarcity of components, and higher production and servicing costs.

- Supply chain. The most difficult task for CEOs may be convincing investors to accept supply chain resiliency as the new table stakes. Given geopolitical and economic realities, supply chain resiliency has become a crucial goal for supply chain leaders, alongside cost optimization.

- Procurement. CEOs who empower their procurement organizations can raise the bar on value-creating contributions. Procurement leaders have told us time and again that the current market environment is the toughest they’ve experienced in decades. CEOs are beginning to recognize that purchasing leaders can be strategic partners by expanding their focus beyond cost cutting to value creation.

- Feedback. A CEO can take a lead role in playing back the feedback the organization is hearing. In today’s tight labor market, CEOs should guide their companies to take a new approach to talent, focusing on compensation, cultural factors, and psychological safety .

- Pricing. Forging new pricing relationships with customers will test CEOs in their role as the “ultimate integrator.” Repricing during inflationary times is typically unpleasant for companies and customers alike. With setting new prices, CEOs have the opportunity to forge deeper relationships with customers, by turning to promotions, personalization , and refreshed communications around value.

- Agility. CEOs can strive to achieve a focus based more on strategic action and less on firefighting. Managing the implications of inflation calls for a cross-functional, disciplined, and agile response.

A practical example: How is inflation affecting the US healthcare industry?

Consumer prices for healthcare have rarely risen faster than the rate of inflation—but that’s what’s happening today. The impact of inflation on the broader economy has caused healthcare costs to rise faster than the rate of inflation. Experts also expect continued labor shortages in healthcare—gaps of up to 450,000 registered nurses and 80,000 doctors —even as demand for services continues to rise. This drives up consumer prices and means that higher inflation could persist. McKinsey analysis as of 2022 predicted that the annual US health expenditure is likely to be $370 billion higher by 2027 because of inflation.

This climate of risk could spur healthcare leaders to address productivity, using tech levers to boost productivity while also reducing costs. In order to weather the storm, leaders will need to quickly set high aspirations, align their organizations around them, and execute with speed .

What is deflation?

If inflation is one extreme of the pricing spectrum, deflation is the other. Deflation occurs when the overall level of prices in an economy declines and the purchasing power of currency increases. It can be driven by growth in productivity and the abundance of goods and services, by a decrease in demand, or by a decline in the supply of money and credit.

Generally, moderate deflation positively affects consumers’ pocketbooks, as they can purchase more with less money. However, deflation can be a sign of a weakening economy, leading to recessions and depressions. While inflation reduces purchasing power, it also reduces the value of debt. During a period of deflation, on the other hand, debt becomes more expensive. And for consumers, investments such as stocks, corporate bonds, and real estate become riskier.

A recent period of deflation in the United States was the Great Recession, between 2007 and 2008. In December 2008, more than half of executives surveyed by McKinsey expected deflation in their countries, and 44 percent expected to decrease the size of their workforces.

When taken to their extremes, both inflation and deflation can have significant negative effects on consumers, businesses, and investors.

For more in-depth exploration of these topics, see McKinsey’s Operations Insights collection. Learn more about Operations consulting , and check out operations-related job opportunities if you’re interested in working at McKinsey.

Articles referenced:

- “ Investing in productivity growth ,” March 27, 2024, Jan Mischke , Chris Bradley , Marc Canal, Olivia White , Sven Smit , and Denitsa Georgieva

- “ Economic conditions outlook during turbulent times, December 2023 ,” December 20, 2023

- “ Forward Thinking on why we ignore inflation—from ancient times to the present—at our peril with Stephen King ,” November 1, 2023

- “ Procurement 2023: Ten CPO actions to defy the toughest challenges ,” March 6, 2023, Roman Belotserkovskiy , Carolina Mazuera, Marta Mussacaleca , Marc Sommerer, and Jan Vandaele

- “ Why you can’t tread water when inflation is persistently high ,” February 2, 2023, Marc Goedhart and Rosen Kotsev

- “ Markets versus textbooks: Calculating today’s cost of equity ,” January 24, 2023, Vartika Gupta, David Kohn, Tim Koller , and Werner Rehm

- “ Inflation-weary Americans are increasingly pessimistic about the economy ,” December 13, 2022, Gonzalo Charro, Andre Dua , Kweilin Ellingrud , Ryan Luby, and Sarah Pemberton

- “ Inflation fighter and value creator: Procurement’s best-kept secret ,” October 31, 2022, Roman Belotserkovskiy , Ezra Greenberg , Daphne Luchtenberg, and Marta Mussacaleca

- “ Prime Numbers: Rethink performance metrics when inflation is high ,” October 28, 2022, Vartika Gupta, David Kohn, Tim Koller , and Werner Rehm

- “ The gathering storm: The threat to employee healthcare benefits ,” October 20, 2022, Aditya Gupta , Akshay Kapur , Monisha Machado-Pereira , and Shubham Singhal

- “ Utility procurement: Ready to meet new market challenges ,” October 7, 2022, Roman Belotserkovskiy , Abhay Prasanna, and Anton Stetsenko

- “ The gathering storm: The transformative impact of inflation on the healthcare sector ,” September 19, 2022, Addie Fleron, Aneesh Krishna , and Shubham Singhal

- “ Pricing during inflation: Active management can preserve sustainable value ,” August 19, 2022, Niels Adler and Nicolas Magnette

- “ Navigating inflation: A new playbook for CEOs ,” April 14, 2022, Asutosh Padhi , Sven Smit , Ezra Greenberg , and Roman Belotserkovskiy

- “ How business operations can respond to price increases: A CEO guide ,” March 11, 2022, Andreas Behrendt , Axel Karlsson , Tarek Kasah, and Daniel Swan

- “ Five ways to ADAPT pricing to inflation ,” February 25, 2022, Alex Abdelnour , Eric Bykowsky, Jesse Nading, Emily Reasor , and Ankit Sood

- “ How COVID-19 is reshaping supply chains ,” November 23, 2021, Knut Alicke , Ed Barriball , and Vera Trautwein

- “ Navigating the labor mismatch in US logistics and supply chains ,” December 10, 2021, Dilip Bhattacharjee , Felipe Bustamante, Andrew Curley, and Fernando Perez

- “ Coping with the auto-semiconductor shortage: Strategies for success ,” May 27, 2021, Ondrej Burkacky , Stephanie Lingemann, and Klaus Pototzky

This article was updated in April 2024; it was originally published in August 2022.

Want to know more about inflation?

Related articles.

What is supply chain?

How business operations can respond to price increases: A CEO guide

Five ways to ADAPT pricing to inflation

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

What Causes Inflation?

- Walter Frick

Why your money is worth less than it used to be.

What causes inflation? There is no one answer, but like so much of macroeconomics it comes down to a mix of output, money, and expectations. Supply shocks can lower an economy’s potential output, driving up prices. An increase in the money supply can stoke demand, driving up prices. And the expectation of inflation can become a self-fulfilling cycle as workers and companies demand higher wages and set higher prices.

Since the financial crisis of 2008 and the Great Recession, investors and executives have grown accustomed to a world of low interest rates and low inflation. No longer. In 2021, inflation began rising sharply in many parts of the world, and in 2022 the U.S. saw its worst inflation in decades.

- Walter Frick is a contributing editor at Harvard Business Review , where he was formerly a senior editor and deputy editor of HBR.org. He is the founder of Nonrival , a newsletter where readers make crowdsourced predictions about economics and business. He has been an executive editor at Quartz as well as a Knight Visiting Fellow at Harvard’s Nieman Foundation for Journalism and an Assembly Fellow at Harvard’s Berkman Klein Center for Internet & Society. He has also written for The Atlantic , MIT Technology Review , The Boston Globe , and the BBC, among other publications.

Partner Center

Essay on Rising Prices

Students are often asked to write an essay on Rising Prices in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Rising Prices

The phenomenon of rising prices.

Rising prices are a global issue affecting everyone. It refers to the increase in the cost of goods and services over time.

Causes of Rising Prices

Key causes include inflation, demand-supply imbalance, and increased production costs.

Effects of Rising Prices

Rising prices can decrease the purchasing power of money, making life difficult for people, especially those with fixed incomes.

Controlling Rising Prices

Government policies, like controlling inflation and balancing demand-supply, can help manage rising prices.

250 Words Essay on Rising Prices

Introduction.

The phenomenon of rising prices is a universal issue, influencing economies globally. This economic situation, also known as inflation, is a double-edged sword, with both negative and positive implications.

The Causes of Rising Prices

The primary causes of rising prices are supply and demand, cost of production, and government policy. When demand exceeds supply, prices rise. Similarly, an increase in production costs leads to a rise in the price of goods. Government policies, such as taxation or interest rates, can also influence prices.

Effects on the Economy

Inflation can stimulate economic growth by encouraging spending and investment due to the anticipation of higher future prices. However, uncontrolled inflation can lead to economic instability. It erodes the purchasing power of money, creating a burden for consumers, especially those with fixed incomes.

Managing Rising Prices

Effective management of rising prices is crucial. Central banks often use monetary policy tools, like adjusting interest rates, to maintain price stability. Governments can also implement fiscal policies, such as taxation and government spending, to control inflation.

While rising prices are an integral part of economic growth, they must be carefully managed to prevent detrimental effects on the economy. Understanding the causes and effects of inflation is essential for devising effective strategies to maintain economic stability.

500 Words Essay on Rising Prices

In the contemporary economic landscape, one of the most pressing issues is the incessant rise in prices. This phenomenon, often referred to as inflation, is a complex interplay of various factors, including market dynamics, government policies, and global economic conditions.

Driving Forces Behind Rising Prices

At the heart of rising prices is the economic principle of supply and demand. When demand for goods and services exceeds supply, prices tend to rise. This can be due to factors such as increased consumer spending, economic growth, or supply chain disruptions. Additionally, production costs – including wages, raw materials, and energy – also significantly contribute to price levels. When these costs increase, businesses often pass them onto consumers in the form of higher prices.

The Role of Monetary Policy

Monetary policy plays a crucial role in managing inflation. Central banks, such as the Federal Reserve in the United States, use tools like interest rates to control the money supply. When the economy is overheating, central banks might raise interest rates to reduce borrowing and spending, thereby curbing inflation. Conversely, during economic downturns, they may lower rates to stimulate spending and prevent deflation.

Global Economic Conditions and Rising Prices

In an increasingly interconnected world, global economic conditions significantly impact local price levels. For instance, if a major oil-producing country faces a crisis, oil prices globally can skyrocket. Similarly, global economic crises or pandemics can disrupt supply chains, leading to scarcity of goods and subsequent price hikes.

The Impact of Rising Prices

Rising prices have a profound impact on society. While moderate inflation is a sign of a healthy economy, high inflation erodes purchasing power, making it harder for people, especially those on fixed incomes, to afford goods and services. It can also create economic uncertainty, leading to reduced investment and slower economic growth.

However, rising prices aren’t necessarily negative. They can incentivize producers to increase supply, driving economic growth. Moreover, moderate inflation can help reduce the real burden of debt, as the value of money decreases over time.

Conclusion: Navigating the Challenge of Rising Prices

Addressing the issue of rising prices requires a delicate balance. Policymakers must carefully manage the money supply, while also promoting economic growth and stability. They must also consider the global economic landscape and how it influences local price levels.

While rising prices pose challenges, they are also an integral part of our economic system. Understanding the factors driving price increases and their implications can help us navigate these challenges and make informed decisions, both as individuals and as a society.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Rain Water Harvesting

- Essay on Rain

- Essay on Rabindranath Tagore

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Facing down a surprising U.S. inflation surge

Kennedy School experts in public finance and economic policy weigh in on the causes and responses to the highest American consumer price jump in three decades.

Inflation in the United States has jumped to the highest level in 30 years, reaching 6.2% in October as measured by the Consumer Price Index. The COVID-19 pandemic has fueled consumer demand for goods and services at a time when supply lines are constrained and many industries have been affected by staff shortages. The inflation surge has generated intense political debate on the causes and the appropriate response.

We asked several economists and public finance experts at Harvard Kennedy School—all of whom have held senior federal government economics roles—to offer brief perspectives on how they view the underlying issues and the key policy choices facing the Biden administration and Congress.

- Linda Bilmes - Inflation's impact at the state and local level

- Karen Dynan - Weighing the uncertainties

- Jeffrey Frankel - Inflation Do's and Don'ts

- Jason Furman - Supply and demand challenges

- Lawrence H. Summers - Biden team needs to signal its concern about inflation

Inflation risks also lie ahead for state and local governments

On the revenue side, income and sales tax receipts will largely keep pace with inflation, so moderate inflation is unlikely to have a major impact. However, if inflation leads to sharply higher interest rates that lead to a stock market sell-off, then states that are highly dependent on capital gains taxes (such as California and New Jersey) may suffer. Another area of vulnerability could be property taxes, especially states where increases in assessed values or in property taxes are capped, as with California’s Prop. 13. These prevent rising house prices feeding through into state revenues, and are also the major revenue source for local governments.

On the expense side, the biggest risk is rising wages, which consume the largest share of state budgets. We could see public sector unions pushing for a return of “CPI-plus” language in new labor agreements. This would automatically bake in the cost of higher inflation to local expenditures. In addition, high inflation could significantly weaken state pension plans, many of which assume that future wage increases will be only 2%. Most of the current generation of local pension managers have little experience with inflation. They need to begin adjusting their portfolios now to prevent erosion of their asset bases.

Linda Bilmes is the Daniel Patrick Moynihan Lecturer in Public Policy and previously served as Assistant Secretary of Commerce.

What's certain is just how many uncertainties lie ahead

What is not clear is how quickly these issues will resolve. The size and persistence of demand/supply imbalances has repeatedly surprised us, in part because virus caseloads have stayed unexpectedly high. We have only a limited understanding of why so many would-be workers are staying out of the labor force, making it hard to predict how many will return and how quickly. We are not sure how much inflation expectations have risen (a critical determinant of whether higher inflation sticks) because of measurement difficulties.

This uncertainty makes it difficult for monetary policymakers to know when they need to begin raising rates to avoid letting inflation stay at undesirably high levels. Given that they may need to revise their views quickly based on incoming data, it is especially important that they communicate the high degree of uncertainty. Surprising financial markets with an abrupt unexpected change in policy could lead to a rapid decline in asset prices that causes a significant setback in the economic recovery.

Karen Dynan is a professor of the practice of economics and former chief economist of the U.S. Treasury.

Some inflation-fighting do's and don'ts

Let’s start with two don'ts.

- Don’t do what Federal Reserve Chair Arthur Burns and President Richard Nixon did in 1971, in order to help the president’s reelection: They responded to moderate 5% to 6 % inflation with a combination of rapid monetary stimulus and doomed wage-price controls. The lid was blown off the boiling pot a few years later; the inflation rate jumped above 12%.

- Don’t do what Donald Trump did on April 2, 2020 , to help out American oil producers: He persuaded Saudi Arabia that OPEC must cut oil output and raise prices.

- Continue to fight in the Senate for a fully funded social spending bill (“Build Back Better”).

- Let imports into the country more easily. They are a safety valve for an overheated economy. Trump put up a lot of import tariffs , which raise prices to consumers—sometimes directly, as with washing machines, and sometimes indirectly, as with steel and aluminum, which are important inputs into autos and countless other goods. With or without foreign reciprocation, U.S. trade liberalization could bring prices down quickly in many supply-constrained sectors.

- Similarly, facilitating orderly immigration would help alleviate the shortage of workers that employers in some sectors are experiencing.

- Further vaccination would increase the supply of labor, through several possible channels. One channel would be to keep children in school, allowing more parents to go back to work. Another channel is to alleviate worker’s fears of infection in the workplace.

Jeffrey Frankel is the James W. Harpel Professor of Capital Formation and Growth and was a member of the Council of Economic Advisors from 1983-1984 and 1996-1999.

Supply and demand—and the Federal Reserve’s key role

Economists like to explain everything with demand and supply, and the concepts work well here. Demand is likely to remain high, fueled by households with healthy balance sheets, continued fiscal support, and very low interest rates. No one knows how long it will take supply to recover, or even whether it will fully recover, but it could be at least a year. The combination of strong demand and weak supply will likely keep inflation uncomfortably high.

President Biden can do a little about inflation by helping with port capacity and other supply-chain measures. Even better would be dropping President Trump’s tariffs on China. But these steps would only be small. The main agency charged with controlling inflation is the Federal Reserve. They are right to continue to be focused on the millions of people without jobs but should recalibrate towards incorporating more concern for inflation into their policy stance, including setting a default of more rate increases in 2022, something it can call off if inflation and/or employment is well below what we are currently expecting.

Jason Furman is the Aetna Professor of the Practice of Economic Policy and previously was chair of the Council of Economic Advisors under President Obama.

Biden team needs to signal its determination to address inflation

Simultaneously, the Administration should signal that a concern about inflation will inform its policies generally. Measures already taken to reduce port bottlenecks may have limited effect but are a clear positive step. Buying inexpensively should take priority over buying American. Tariff reduction is the most important supply-side policy the administration could undertake to combat inflation. Raising fossil fuel supplies, such as the recent deployment of the Strategic Petroleum Reserve, is crucial. And financial regulators need to step up and be attentive to the pockets of speculative excess that are increasingly evident in financial markets.

Excessive inflation and a sense that it was not being controlled helped elect Richard Nixon and Ronald Reagan, and risks bringing Donald Trump back to power. While an overheating economy is a relatively good problem to have compared to a pandemic or a financial crisis, it will metastasize and threaten prosperity and public trust unless clearly acknowledged and addressed.

Lawrence H. Summers is Charles W. Eliot University Professor , Weil Director of the Mossavar-Rahmani Center for Business and Government, and president emeritus of Harvard University. His government positions included Secretary of the Treasury in the Clinton Administration and Director of the National Economic Council under President Obama. Portions of this essay were excerpted from a Washington Post column .

Banner image by AP Photo/Noah Berger; inline image by Xinhua via Getty Images; faculty portraits by Martha Stewart

More from HKS

Helping homeowners during the covid-19 pandemic: lessons from the great recession, democratizing the federal regulatory process: a blueprint to strengthen equity, dignity, and civic engagement through executive branch action, economic inequality and insecurity: policies for an inclusive economy.

Get smart & reliable public policy insights right in your inbox.

- Facebook social media link

- Twitter social media link

- YouTube social media link

- LinkedIn social media link

Mobile Menu Overlay

The causes of and responses to today’s inflation.

December 6, 2022

By Joseph E. Stiglitz, Ira Regmi

- Share this page on Facebook

- Share this page on Twitter

- Share this page via Email Mail Icon Rectangle in the shape of an envelope

The evidence is overwhelming: were there no supply problems, aggregate demand would not be excessive. The inflation we’ve experienced is best understood as resulting from industry-specific problems that many Organisation for Economic Co-operation and Development (OECD) countries are facing. A strong labor market is part of the solution, not the problem.

Over the last couple years, the world has experienced the highest levels of inflation in more than four decades. There are multiple sources of economic disruption that have likely contributed to this inflation, most notably pandemic shutdowns and reopenings and Russia’s invasion of Ukraine. The inflation, in turn, has sparked a debate about its causes, with some claiming it is demand-induced, largely the result of high spending in response to the pandemic. Others focus on pandemic-induced supply shortages and demand shifts, possibly exacerbated by market power and market manipulation. While there may be elements of all of these, the policy response needs to address the dominant cause. If it’s a result of excessive aggregate demand , then monetary policy—reducing aggregate demand through monetary tightening—is appropriate. If it’s largely supply-driven, a more tailored response is required, including fiscal policy that alleviates the supply constraints.

Our analysis concludes that today’s inflation is largely driven by supply shocks and sectoral demand shifts, not by excess aggregate demand.

Monetary policy, then, is too blunt an instrument because it will greatly reduce inflation only at the cost of unnecessarily high unemployment, with severe adverse distributive consequences. This paper presents a variety of fiscal and other policy measures that hold out the prospect of having a more significant effect on inflation. In particular, these measures would reduce inflation’s impact on the most vulnerable and provide long-term benefits to the economy without the likely high costs of excessively rapid and large increases in interest rates.

We look at both the aggregate and sectoral-level data, and show, notably, that real personal consumption has largely been below trend, particularly in the periods when inflation heated up, and total real aggregate demand has been consistently below trend, which reinforces the conclusion that the “problem” arises from the supply side.

As seen in the Figure above, real personal consumption has largely been below trend, particularly in the periods when inflation heated up. In addition, with three fiscal quarters of anemic growth, from the fourth quarter of 2021 to the second quarter of 2022, it is hard to see how excess demand by itself could be at the root of the problem.

Is today’s inflation the result of excessive aggregate demand, or is it the result of overlapping sectoral supply side shifts and shocks? We just released a new paper by @JosephEStiglitz and @Regmi_Ira making a wide-ranging case for the latter. 🧵(1/8) https://t.co/TTVBUoOXwo — Roosevelt Institute (@rooseveltinst) December 6, 2022

With three fiscal quarters of anemic growth, from the fourth quarter of 2021 to the second quarter of 2022, it is hard to see how excess demand by itself could be at the root of the problem. Moreover, inflation in the United States is no worse than in other countries even as Americans saw a more robust recovery, largely because we had more fiscal support. A sectoral breakdown of inflation, as well as a closer look at the patterns in the timing of inflation, further support the conclusion that excessive spending during the pandemic is not the principal cause of today’s inflation.

Breaking down inflation by sector reveals that it is tied to the obvious shocks and supply chain interruptions the economy has experienced, from high food and energy prices to the shortage of microchips for automobiles.

We also explain how the large pandemic-induced shifts in demand, such as those associated with housing, have contributed to today’s inflation.

Another important factor is the increase in market concentration, which has generated greater market power; the current circumstances have provided a prime opportunity for a greater exercise of that market power.

A Wage-Price Spiral?

The paper also addresses the concern that inflation will seep through the economy, regardless of its original source, as a wage-price spiral is set in motion. We conclude that with nominal wages already tempered, this does not seem likely. Moreover, declining real wages are typically not a sign of a tight labor market. Weak unions, globalization, and changes in the structure of the economy provide part of the explanation for why wage-price dynamics today may be markedly different from 50 years ago.

Conventional economics worries that inflationary expectations might perpetuate inflation; but so far, inflationary expectations appear mild, perhaps because many market participants agree with our analysis that the underlying sources of today’s inflation are supply side interruptions, less temporary than people had hoped for at the onset of the inflation, but temporary nonetheless. Recent data are consistent with this perspective: While inflation does vary considerably month to month, it is heartening that it has slowed over the last four months to 2.8 percent (BLS CPI; authors’ calculations)—a slowing consistent with the supply side interpretation, but inconsistent with the standard macroeconomic demand-side analysis. (Because there was higher month-over-month inflation at the end of 2021 and the beginning of 2022, the year-over-year rate remains high at 7.7 percent.) The New York Federal Reserve’s “Underlying Inflation Gauge” peaked in July 2022 at 4.9 percent, and by October 2022 was at 4.2 percent.

The Right Policy Response

This analysis provides a different perspective from conventional economics on the appropriate policy responses to current inflation. Conventional wisdom, partly based on a wealth of experience in which demand shocks have given rise to inflation, holds that interest rates should be increased when there is inflation, whatever the cause . Interest rates worldwide have been abnormally low, partly because of the excessive reliance on monetary policy in response to the 2008 financial crisis. But the cost of capital should not be zero (or worse, negative).

Restoring interest rates to more normal levels has distinct advantages. Going beyond that—raising them too far and too quickly—is problematic, especially given the buildup of debt in the era of near-zero interest rates.

Most importantly, such increases in interest rates will not substantially lower inflation unless they induce a major contraction in the economy, which is a cure worse than the disease. An economic downturn like that is likely to have long-lasting adverse effects, and the most marginalized in society will bear the brunt. Volatile energy and food prices are largely internationally driven and not under the control of the Federal Reserve. The recent aggressive hikes have not remedied these price increases and are unlikely to do so in the future. Inflation induced by these price fluctuations may come down (as it has recently in some months in the United States), but not because of Fed action. To the contrary, the paper explains several reasons why large and rapid increases in interest rates, beyond normalizing them, may be counterproductive. For instance, they could impede investments that might alleviate some of the supply shortages.

By contrast, well-designed fiscal and other policies can help to ameliorate the supply shortages, tame inflation, and protect the vulnerable, providing long-term benefits even if it should turn out that inflationary pressures are transient.

Key Takeaways

Today’s inflation comes mostly from sectoral supply side disruptions, largely the result of the COVID-19 pandemic and its consequent disturbances to supply chains; and disruptions to energy and food markets originating from Russia’s invasion of Ukraine. Demand patterns too have undergone significant changes, again largely induced by the pandemic. In some sectors, these effects have been amplified as a result of the exercise of market power. But today’s inflation, for the most part, is not the result of significant excesses of aggregate demand such as might have arisen from excessive US pandemic spending.

While we welcome the return of interest rates to more normal levels, which reduces a number of distortions associated with persistent, abnormally low interest rates, increasing interest rates too far and too quickly risks a painful slowdown to the economy with minimal benefits to inflation short of a significant downturn. This would have particular adverse distributional consequences, especially for marginalized groups in the country.

There are fiscal and other measures that can and should be taken to alleviate particular sectoral inflationary pressures, and that are likely to be more effective than broad-based interest rate increases.

Recent data shows significant moderation of inflationary pressures, with nominal wage increases in particular being only a little over pre-pandemic levels. This, together with other indicators such as tempered inflationary expectations, goes a long way in alleviating worries about an incipient wage-price spiral.

Explore more of our work on inflation

Inflation in 2023: causes, progress, and solutions.

March 9, 2023

By Mike Konczal

A New Framework for Targeting Inflation: Aiming for a Range of 2 to 3.5 Percent

November 17, 2022

By Justin Bloesch

Why Market Power Matters for Inflation

September 22, 2022

As Inflation Slows, Don’t Credit the Fed

February 17, 2023

By Ira Regmi

How Not to Fight Inflation

January 30, 2023

By Joseph Stiglitz

Is it Time for the Fed to Pause

The Roosevelt Institute hosted a webinar to discuss this report, The Causes of and Responses to Today’s Inflation, by Joseph Stiglitz and Ira Regmi, who find that today’s inflation is largely driven by supply shocks and sectoral demand shifts.

Tags: Democratic Governance , Monetary Policy

Joseph Stiglitz

As chief economist and senior fellow at the Roosevelt Institute, Joseph Stiglitz focuses on income distribution, risk, corporate governance, public policy, macroeconomics, and globalization.

Ira Regmi is the program manager for the Macroeconomic Analysis program at Roosevelt where they support the team’s work on fiscal and monetary policy, unemployment, and growth to ensure an economy that works for all.

Inflation: Types, Causes and Effects (With Diagram)

Inflation and unemployment are the two most talked-about words in the contemporary society.

These two are the big problems that plague all the economies.

Almost everyone is sure that he knows what inflation exactly is, but it remains a source of great deal of confusion because it is difficult to define it unambiguously.

1. Meaning of Inflation:

Inflation is often defined in terms of its supposed causes. Inflation exists when money supply exceeds available goods and services. Or inflation is attributed to budget deficit financing. A deficit budget may be financed by the additional money creation. But the situation of monetary expansion or budget deficit may not cause price level to rise. Hence the difficulty of defining ‘inflation’.

ADVERTISEMENTS:

Inflation may be defined as ‘a sustained upward trend in the general level of prices’ and not the price of only one or two goods. G. Ackley defined inflation as ‘a persistent and appreciable rise in the general level or average of prices’. In other words, inflation is a state of rising prices, but not high prices.

It is not high prices but rising price level that constitute inflation. It constitutes, thus, an overall increase in price level. It can, thus, be viewed as the devaluing of the worth of money. In other words, inflation reduces the purchasing power of money. A unit of money now buys less. Inflation can also be seen as a recurring phenomenon.

While measuring inflation, we take into account a large number of goods and services used by the people of a country and then calculate average increase in the prices of those goods and services over a period of time. A small rise in prices or a sudden rise in prices is not inflation since they may reflect the short term workings of the market.

It is to be pointed out here that inflation is a state of disequilibrium when there occurs a sustained rise in price level. It is inflation if the prices of most goods go up. Such rate of increases in prices may be both slow and rapid. However, it is difficult to detect whether there is an upward trend in prices and whether this trend is sustained. That is why inflation is difficult to define in an unambiguous sense.

Let’s measure inflation rate. Suppose, in December 2007, the consumer price index was 193.6 and, in December 2008, it was 223.8. Thus, the inflation rate during the last one year was

223.8- 193.6/ 193.6 x 100 = 15.6

As inflation is a state of rising prices, deflation may be defined as a state of falling prices but not fall in prices. Deflation is, thus, the opposite of inflation, i.e., a rise in the value of money or purchasing power of money. Disinflation is a slowing down of the rate of inflation.

2. Types of Inflation:

As the nature of inflation is not uniform in an economy for all the time, it is wise to distinguish between different types of inflation. Such analysis is useful to study the distributional and other effects of inflation as well as to recommend anti-inflationary policies. Inflation may be caused by a variety of factors. Its intensity or pace may be different at different times. It may also be classified in accordance with the reactions of the government toward inflation.

Thus, one may observe different types of inflation in the contemporary society:

A. On the Basis of Causes:

(i) Currency inflation:

This type of inflation is caused by the printing of currency notes.

(ii) Credit inflation:

Being profit-making institutions, commercial banks sanction more loans and advances to the public than what the economy needs. Such credit expansion leads to a rise in price level.

(iii) Deficit-induced inflation:

The budget of the government reflects a deficit when expenditure exceeds revenue. To meet this gap, the government may ask the central bank to print additional money. Since pumping of additional money is required to meet the budget deficit, any price rise may the be called the deficit-induced inflation.

(iv) Demand-pull inflation:

An increase in aggregate demand over the available output leads to a rise in the price level. Such inflation is called demand-pull inflation (henceforth DPI). But why does aggregate demand rise? Classical economists attribute this rise in aggregate demand to money supply. If the supply of money in an economy exceeds the available goods and services, DPI appears. It has been described by Coulborn as a situation of “too much money chasing too few goods.”

Keynesians hold a different argument. They argue that there can be an autonomous increase in aggregate demand or spending, such as a rise in consumption demand or investment or government spending or a tax cut or a net increase in exports (i.e., C + I + G + X – M) with no increase in money supply. This would prompt upward adjustment in price. Thus, DPI is caused by monetary factors (classical adjustment) and non-monetary factors (Keynesian argument).

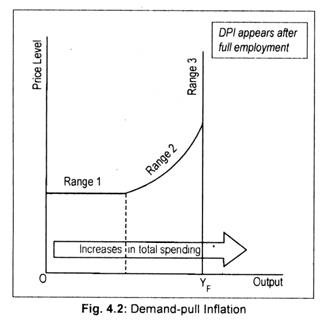

DPI can be explained in terms of Fig. 4.2, where we measure output on the horizontal axis and price level on the vertical axis. In Range 1, total spending is too short of full employment output, Y F . There is little or no rise in the price level. As demand now rises, output will rise. The economy enters Range 2, where output approaches towards full employment situation. Note that in this region price level begins to rise. Ultimately, the economy reaches full employment situation, i.e., Range 3, where output does not rise but price level is pulled upward. This is demand-pull inflation. The essence of this type of inflation is that “too much spending chasing too few goods.”

(v) Cost-push inflation:

Inflation in an economy may arise from the overall increase in the cost of production. This type of inflation is known as cost-push inflation (henceforth CPI). Cost of production may rise due to an increase in the prices of raw materials, wages, etc. Often trade unions are blamed for wage rise since wage rate is not completely market-determinded. Higher wage means high cost of production. Prices of commodities are thereby increased.

A wage-price spiral comes into operation. But, at the same time, firms are to be blamed also for the price rise since they simply raise prices to expand their profit margins. Thus, we have two important variants of CPI wage-push inflation and profit-push inflation.

Anyway, CPI stems from the leftward shift of the aggregate supply curve:

B. On the Basis of Speed or Intensity:

(i) Creeping or Mild Inflation:

If the speed of upward thrust in prices is slow but small then we have creeping inflation. What speed of annual price rise is a creeping one has not been stated by the economists. To some, a creeping or mild inflation is one when annual price rise varies between 2 p.c. and 3 p.c. If a rate of price rise is kept at this level, it is considered to be helpful for economic development. Others argue that if annual price rise goes slightly beyond 3 p.c. mark, still then it is considered to be of no danger.

(ii) Walking Inflation:

If the rate of annual price increase lies between 3 p.c. and 4 p.c., then we have a situation of walking inflation. When mild inflation is allowed to fan out, walking inflation appears. These two types of inflation may be described as ‘moderate inflation’.

Often, one-digit inflation rate is called ‘moderate inflation’ which is not only predictable, but also keep people’s faith on the monetary system of the country. Peoples’ confidence get lost once moderately maintained rate of inflation goes out of control and the economy is then caught with the galloping inflation.

(iii) Galloping and Hyperinflation:

Walking inflation may be converted into running inflation. Running inflation is dangerous. If it is not controlled, it may ultimately be converted to galloping or hyperinflation. It is an extreme form of inflation when an economy gets shattered.”Inflation in the double or triple digit range of 20, 100 or 200 p.c. a year is labelled “galloping inflation”.

(iv) Government’s Reaction to Inflation:

Inflationary situation may be open or suppressed. Because of anti-inflationary policies pursued by the government, inflation may not be an embarrassing one. For instance, increase in income leads to an increase in consumption spending which pulls the price level up.

If the consumption spending is countered by the government via price control and rationing device, the inflationary situation may be called a suppressed one. Once the government curbs are lifted, the suppressed inflation becomes open inflation. Open inflation may then result in hyperinflation.

3. Causes of Inflation:

Inflation is mainly caused by excess demand/ or decline in aggregate supply or output. Former leads to a rightward shift of the aggregate demand curve while the latter causes aggregate supply curve to shift leftward. Former is called demand-pull inflation (DPI), and the latter is called cost-push inflation (CPI). Before describing the factors, that lead to a rise in aggregate demand and a decline in aggregate supply, we like to explain “demand-pull” and “cost-push” theories of inflation.

(i) Demand-Pull Inflation Theory:

There are two theoretical approaches to the DPI—one is classical and other is the Keynesian.

According to classical economists or monetarists, inflation is caused by an increase in money supply which leads to a rightward shift in negative sloping aggregate demand curve. Given a situation of full employment, classicists maintained that a change in money supply brings about an equiproportionate change in price level.

That is why monetarists argue that inflation is always and everywhere a monetary phenomenon. Keynesians do not find any link between money supply and price level causing an upward shift in aggregate demand.

According to Keynesians, aggregate demand may rise due to a rise in consumer demand or investment demand or government expenditure or net exports or the combination of these four components of aggreate demand. Given full employment, such increase in aggregate demand leads to an upward pressure in prices. Such a situation is called DPI. This can be explained graphically.

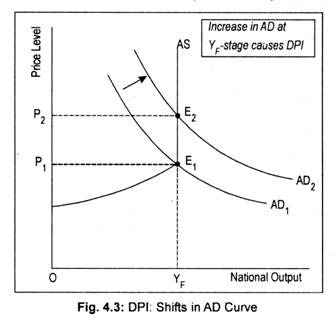

Just like the price of a commodity, the level of prices is determined by the interaction of aggregate demand and aggregate supply. In Fig. 4.3, aggregate demand curve is negative sloping while aggregate supply curve before the full employment stage is positive sloping and becomes vertical after the full employment stage is reached. AD 1 is the initial aggregate demand curve that intersects the aggregate supply curve AS at point E 1 .

The price level, thus, determined is OP 1 . As aggregate demand curve shifts to AD 2 , price level rises to OP 2 . Thus, an increase in aggregate demand at the full employment stage leads to an increase in price level only, rather than the level of output. However, how much price level will rise following an increase in aggregate demand depends on the slope of the AS curve.

(ii) Causes of Demand-Pull Inflation:

DPI originates in the monetary sector. Monetarists’ argument that “only money matters” is based on the assumption that at or near full employment excessive money supply will increase aggregate demand and will, thus, cause inflation.

An increase in nominal money supply shifts aggregate demand curve rightward. This enables people to hold excess cash balances. Spending of excess cash balances by them causes price level to rise. Price level will continue to rise until aggregate demand equals aggregate supply.

Keynesians argue that inflation originates in the non-monetary sector or the real sector. Aggregate demand may rise if there is an increase in consumption expenditure following a tax cut. There may be an autonomous increase in business investment or government expenditure. Government expenditure is inflationary if the needed money is procured by the government by printing additional money.

In brief, increase in aggregate demand i.e., increase in (C + I + G + X – M) causes price level to rise. However, aggregate demand may rise following an increase in money supply generated by the printing of additional money (classical argument) which drives prices upward. Thus, money plays a vital role. That is why Milton Friedman argues that inflation is always and everywhere a monetary phenomenon.

There are other reasons that may push aggregate demand and, hence, price level upwards. For instance, growth of population stimulates aggregate demand. Higher export earnings increase the purchasing power of the exporting countries. Additional purchasing power means additional aggregate demand. Purchasing power and, hence, aggregate demand may also go up if government repays public debt.

Again, there is a tendency on the part of the holders of black money to spend more on conspicuous consumption goods. Such tendency fuels inflationary fire. Thus, DPI is caused by a variety of factors.

(iii) Cost-Push Inflation Theory:

In addition to aggregate demand, aggregate supply also generates inflationary process. As inflation is caused by a leftward shift of the aggregate supply, we call it CPI. CPI is usually associated with non-monetary factors. CPI arises due to the increase in cost of production. Cost of production may rise due to a rise in cost of raw materials or increase in wages.

However, wage increase may lead to an increase in productivity of workers. If this happens, then the AS curve will shift to the right- ward not leftward—direction. We assume here that productivity does not change in spite of an increase in wages.

Such increases in costs are passed on to consumers by firms by raising the prices of the products. Rising wages lead to rising costs. Rising costs lead to rising prices. And, rising prices again prompt trade unions to demand higher wages. Thus, an inflationary wage-price spiral starts. This causes aggregate supply curve to shift leftward.

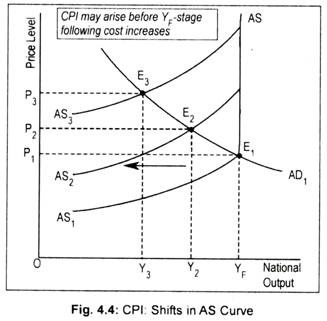

This can be demonstrated graphically where AS 1 is the initial aggregate supply curve. Below the full employment stage this AS curve is positive sloping and at full employment stage it becomes perfectly inelastic.

Intersection point (E 1 ) of AD 1 and AS 1 curves determine the price level (OP 1 ). Now there is a leftward shift of aggregate supply curve to AS 2 . With no change in aggregate demand, this causes price level to rise to OP 2 and output to fall to OY 2 . With the reduction in output, employment in the economy declines or unemployment rises. Further shift in AS curve to AS 3 results in a higher price level (OP 3 ) and a lower volume of aggregate output (OY 3 ). Thus, CPI may arise even below the full employment (Y F ) stage.

(iv) Causes of Cost-Push Inflation:

It is the cost factors that pull the prices upward. One of the important causes of price rise is the rise in price of raw materials. For instance, by an administrative order the government may hike the price of petrol or diesel or freight rate. Firms buy these inputs now at a higher price. This leads to an upward pressure on cost of production.

Not only this, CPI is often imported from outside the economy. Increase in the price of petrol by OPEC compels the government to increase the price of petrol and diesel. These two important raw materials are needed by every sector, especially the transport sector. As a result, transport costs go up resulting in higher general price level.

Again, CPI may be induced by wage-push inflation or profit-push inflation. Trade unions demand higher money wages as a compensation against inflationary price rise. If increase in money wages exceed labour productivity, aggregate supply will shift upward and leftward. Firms often exercise power by pushing prices up independently of consumer demand to expand their profit margins.

Fiscal policy changes, such as increase in tax rates also leads to an upward pressure in cost of production. For instance, an overall increase in excise tax of mass consumption goods is definitely inflationary. That is why government is then accused of causing inflation.

Finally, production setbacks may result in decreases in output. Natural disaster, gradual exhaustion of natural resources, work stoppages, electric power cuts, etc., may cause aggregate output to decline. In the midst of this output reduction, artificial scarcity of any goods created by traders and hoarders just simply ignite the situation.

Inefficiency, corruption, mismanagement of the economy may also be the other reasons. Thus, inflation is caused by the interplay of various factors. A particular factor cannot be held responsible for any inflationary price rise.

4. Effects of Inflation:

People’s desires are inconsistent. When they act as buyers they want prices of goods and services to remain stable but as sellers they expect the prices of goods and services should go up. Such a happy outcome may arise for some individuals; “but, when this happens, others will be getting the worst of both worlds.”

When price level goes up, there is both a gainer and a loser. To evaluate the consequence of inflation, one must identify the nature of inflation which may be anticipated and unanticipated. If inflation is anticipated, people can adjust with the new situation and costs of inflation to the society will be smaller.

In reality, people cannot predict accurately future events or people often make mistakes in predicting the course of inflation. In other words, inflation may be unanticipated when people fail to adjust completely. This creates various problems.

One can study the effects of unanticipated inflation under two broad headings:

(a) Effect on distribution of income and wealth; and

(b) Effect on economic growth.

(a) Effects of Inflation on Distribution of Income and Wealth:

During inflation, usually people experience rise in incomes. But some people gain during inflation at the expense of others. Some individuals gain because their money incomes rise more rapidly than the prices and some lose because prices rise more rapidly than their incomes during inflation. Thus, it redistributes income and wealth.

Though no conclusive evidence can be cited, it can be asserted that following categories of people are affected by inflation differently:

(i) Creditors and debtors:

Borrowers gain and lenders lose during inflation because debts are fixed in rupee terms. When debts are repaid their real value declines by the price level increase and, hence, creditors lose. An individual may be interested in buying a house by taking loan of Rs. 7 lakh from an institution for 7 years.

The borrower now welcomes inflation since he will have to pay less in real terms than when it was borrowed. Lender, in the process, loses since the rate of interest payable remains unaltered as per agreement. Because of inflation, the borrower is given ‘dear’ rupees, but pays back ‘cheap’ rupees. However, if in an inflation-ridden economy creditors chronically loose, it is wise not to advance loans or to shut down business.

Never does it happen. Rather, the loan-giving institution makes adequate safeguard against the erosion of real value. Above all, banks do not pay any interest on current account but charges interest on loans.

(ii) Bond and debenture-holders:

In an economy, there are some people who live on interest income—they suffer most. Bondholders earn fixed interest income: These people suffer a reduction in real income when prices rise. In other words, the value of one’s savings decline if the interest rate falls short of inflation rate. Similarly, beneficiaries from life insurance programmes are also hit badly by inflation since real value of savings deteriorate.

(iii) Investors:

People who put their money in shares during inflation are expected to gain since the possibility of earning of business profit brightens. Higher profit induces owners of firm to distribute profit among investors or shareholders.

(iv) Salaried people and wage-earners:

Anyone earning a fixed income is damaged by inflation. Sometimes, unionised worker succeeds in raising wage rates of white-collar workers as a compensation against price rise. But wage rate changes with a long time lag. In other words, wage rate increases always lag behind price increases. Naturally, inflation results in a reduction in real purchasing power of fixed income-earners.

On the other hand, people earning flexible incomes may gain during inflation. The nominal incomes of such people outstrip the general price rise. As a result, real incomes of this income group increase.

(v) Profit-earners, speculators and black marketers:

It is argued that profit-earners gain from inflation. Profit tends to rise during inflation. Seeing inflation, businessmen raise the prices of their products. This results in a bigger profit. Profit margin, however, may not be high when the rate of inflation climbs to a high level.

However, speculators dealing in business in essential commodities usually stand to gain by inflation. Black marketers are also benefited by inflation.

Thus, there occurs a redistribution of income and wealth. It is said that rich becomes richer and poor becomes poorer during inflation. However, no such hard and fast generalisation can be made. It is clear that someone wins and someone loses during inflation.

These effects of inflation may persist if inflation is unanticipated. However, the redistributive burdens of inflation on income and wealth are most likely to be minimal if inflation is anticipated by the people. With anticipated inflation, people can build up their strategies to cope with inflation.

If the annual rate of inflation in an economy is anticipated correctly people will try to protect them against losses resulting from inflation. Workers will demand 10 p.c. wage increase if inflation is expected to rise by 10 p.c.

Similarly, a percentage of inflation premium will be demanded by creditors from debtors. Business firms will also fix prices of their products in accordance with the anticipated price rise. Now if the entire society “learn to live with inflation”, the redistributive effect of inflation will be minimal.

However, it is difficult to anticipate properly every episode of inflation. Further, even if it is anticipated it cannot be perfect. In addition, adjustment with the new expected inflationary conditions may not be possible for all categories of people. Thus, adverse redistributive effects are likely to occur.

Finally, anticipated inflation may also be costly to the society. If people’s expectation regarding future price rise become stronger they will hold less liquid money. Mere holding of cash balances during inflation is unwise since its real value declines. That is why people use their money balances in buying real estate, gold, jewellery, etc. Such investment is referred to as unproductive investment. Thus, during inflation of anticipated variety, there occurs a diversion of resources from priority to non-priority or unproductive sectors.

(b) Effect on Production and Economic Growth:

Inflation may or may not result in higher output. Below the full employment stage, inflation has a favourable effect on production. In general, profit is a rising function of the price level. An inflationary situation gives an incentive to businessmen to raise prices of their products so as to earn higher volume of profit. Rising price and rising profit encourage firms to make larger investments.

As a result, the multiplier effect of investment will come into operation resulting in a higher national output. However, such a favourable effect of inflation will be temporary if wages and production costs rise very rapidly.

Further, inflationary situation may be associated with the fall in output, particularly if inflation is of the cost-push variety. Thus, there is no strict relationship between prices and output. An increase in aggregate demand will increase both prices and output, but a supply shock will raise prices and lower output.

Inflation may also lower down further production levels. It is commonly assumed that if inflationary tendencies nurtured by experienced inflation persist in future, people will now save less and consume more. Rising saving propensities will result in lower further outputs.

One may also argue that inflation creates an air of uncertainty in the minds of business community, particularly when the rate of inflation fluctuates. In the midst of rising inflationary trend, firms cannot accurately estimate their costs and revenues. That is, in a situation of unanticipated inflation, a great deal of risk element exists.

It is because of uncertainty of expected inflation, investors become reluctant to invest in their business and to make long-term commitments. Under the circumstance, business firms may be deterred in investing. This will adversely affect the growth performance of the economy.

However, slight dose of inflation is necessary for economic growth. Mild inflation has an encouraging effect on national output. But it is difficult to make the price rise of a creeping variety. High rate of inflation acts as a disincentive to long run economic growth. The way the hyperinflation affects economic growth is summed up here. We know that hyper-inflation discourages savings.

A fall in savings means a lower rate of capital formation. A low rate of capital formation hinders economic growth. Further, during excessive price rise, there occurs an increase in unproductive investment in real estate, gold, jewellery, etc. Above all, speculative businesses flourish during inflation resulting in artificial scarcities and, hence, further rise in prices.

Again, following hyperinflation, export earnings decline resulting in a wide imbalances in the balance of payment account. Often galloping inflation results in a ‘flight’ of capital to foreign countries since people lose confidence and faith over the monetary arrangements of the country, thereby resulting in a scarcity of resources. Finally, real value of tax revenue also declines under the impact of hyperinflation. Government then experiences a shortfall in investible resources.

Thus economists and policymakers are unanimous regarding the dangers of high price rise. But the consequence of hyperinflation are disastrous. In the past, some of the world economies (e.g., Germany after the First World War (1914-1918), Latin American countries in the 1980s) had been greatly ravaged by hyperinflation.

The German inflation of 1920s was also catastrophic:

During 1922, the German price level went up 5,470 per cent. In 1923, the situation worsened; the German price level rose 1,300,000,000 (1.3 billion) times. By October of 1923, the postage in the lightest letter sent from Germany to the United States was 200,000 marks. Butter cost 1.5 million marks per pound, meat 2 million marks, a loaf of bread 200,000 marks, and an egg 60,000 marks! Prices increased so rapidly that waiters changed the prices on the menu several times during the course of a lunch!! Sometimes, customers had to pay the double price listed on the menu when they observed it first!!! A photograph of the period shows a German housewife starting the fire in her kitchen stove with paper money and children playing with bundles of paper money tied together into building blocks!

Currently (September 2008), Indian economy experienced an inflation rate of almost 13 p.c.—an unprecedented one over the last 16 or 17 years. However, an all-time record in price rise in India was struck in 1974-75 when it rose more than 25 p.c. Anyway, people are ultimately harassed by the high dose of inflation. That is why, it is said that ‘inflation is our public enemy number one.’ Rising inflation rate is a sign of failure on the part of the government.

Related Articles:

- Demand Pull Inflation and Cost Push Inflation | Money

- Essay on the Causes of Inflation (473 Words)

- Cost-Push Inflation and Demand-Pull or Mixed Inflation

- Difference between Open Inflation and Suppressed Inflation

Essay on Inflation

Inflation is a term that resonates through the corridors of our daily lives, affecting decisions made by individuals, businesses, and governments alike. It refers to the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Central banks attempt to limit inflation, and avoid deflation, to keep the economy running smoothly. This essay delves into the causes of inflation, its various effects on the economy and individuals, and the strategies employed to manage it, aiming to provide a comprehensive understanding suitable for a student participating in an essay writing competition.

The Causes of Inflation

Inflation is primarily caused by two factors: demand-pull and cost-push inflation. Demand-pull inflation occurs when demand for goods and services exceeds supply, causing prices to rise. This can happen due to increased consumer spending, government expenditure, or investment. Cost-push inflation, on the other hand, happens when the cost of production increases, leading producers to raise prices to maintain their profit margins. This increase in production costs can be due to rising wages, increased taxes, or higher prices for raw materials.

- Demand-pull inflation occurs when the overall demand for goods and services in an economy exceeds its supply. This excess demand leads to rising prices as businesses raise prices to capitalize on increased consumer demand.

- Factors contributing to demand-pull inflation include robust consumer spending, increased government spending, low-interest rates, and high levels of investment.

- Cost-push inflation is driven by rising production costs, which are then passed on to consumers in the form of higher prices. These rising costs can result from various factors, such as increased wages, higher energy prices, or supply chain disruptions.

- For example, if oil prices spike, it can lead to increased transportation costs, which may cause businesses to raise prices on their products.

- Built-in inflation, also known as the wage-price spiral, occurs when workers demand higher wages to keep up with rising prices. When businesses pay higher wages, they often pass those costs on to consumers, causing prices to rise further. This cycle can continue, perpetuating inflation.

- Expectations of future inflation can also contribute to built-in inflation, as people adjust their behavior and spending patterns in anticipation of rising prices.

- The policies of central banks, such as the Federal Reserve in the United States, can influence inflation. When central banks implement loose monetary policies, such as low-interest rates and quantitative easing, it can increase the money supply and potentially lead to demand-pull inflation.

- Central banks can also use tight monetary policies, such as raising interest rates, to combat inflation and reduce spending.

- Government fiscal policies, including changes in taxation and government spending, can affect inflation. An increase in government spending without corresponding revenue sources can stimulate demand and contribute to inflation.

- Tax cuts can also increase disposable income, leading to higher consumer spending and potential demand-pull inflation.

- Exchange rate fluctuations can impact inflation by influencing the prices of imported goods. A depreciating domestic currency can make imports more expensive, contributing to cost-push inflation.

- Conversely, a strengthening currency can lower import prices and help reduce inflation.

- Unforeseen events, such as natural disasters, geopolitical tensions, or disruptions in the supply chain, can cause sudden supply shortages or surpluses. These shocks can result in sharp price movements and contribute to inflation.

- For instance, a severe drought can reduce agricultural output, leading to higher food prices.

- Global economic conditions and trends, such as changes in international commodity prices or global economic growth, can influence inflation in individual countries.

- Economic policies in major trading partners can also have spill-over effects on domestic inflation.

The Effects of Inflation