10 Top Product Research Tools (2024)

If you sell physical goods to consumers, access to a good product research tool can be invaluable.

From developing a business idea to delivering the products your most loyal customers want, the right product research software will help you with things like:

- Monitoring product trends

- Identifying hot products for sale right now

- Conducting a competitor analysis

- Researching keywords related to top products

- Developing new product ideas

In this guide, we’re exploring 10 of the best product research tools on the market today for Shopify stores, retail merchants, Amazon sellers, dropshipping entrepreneurs, and everyone in between.

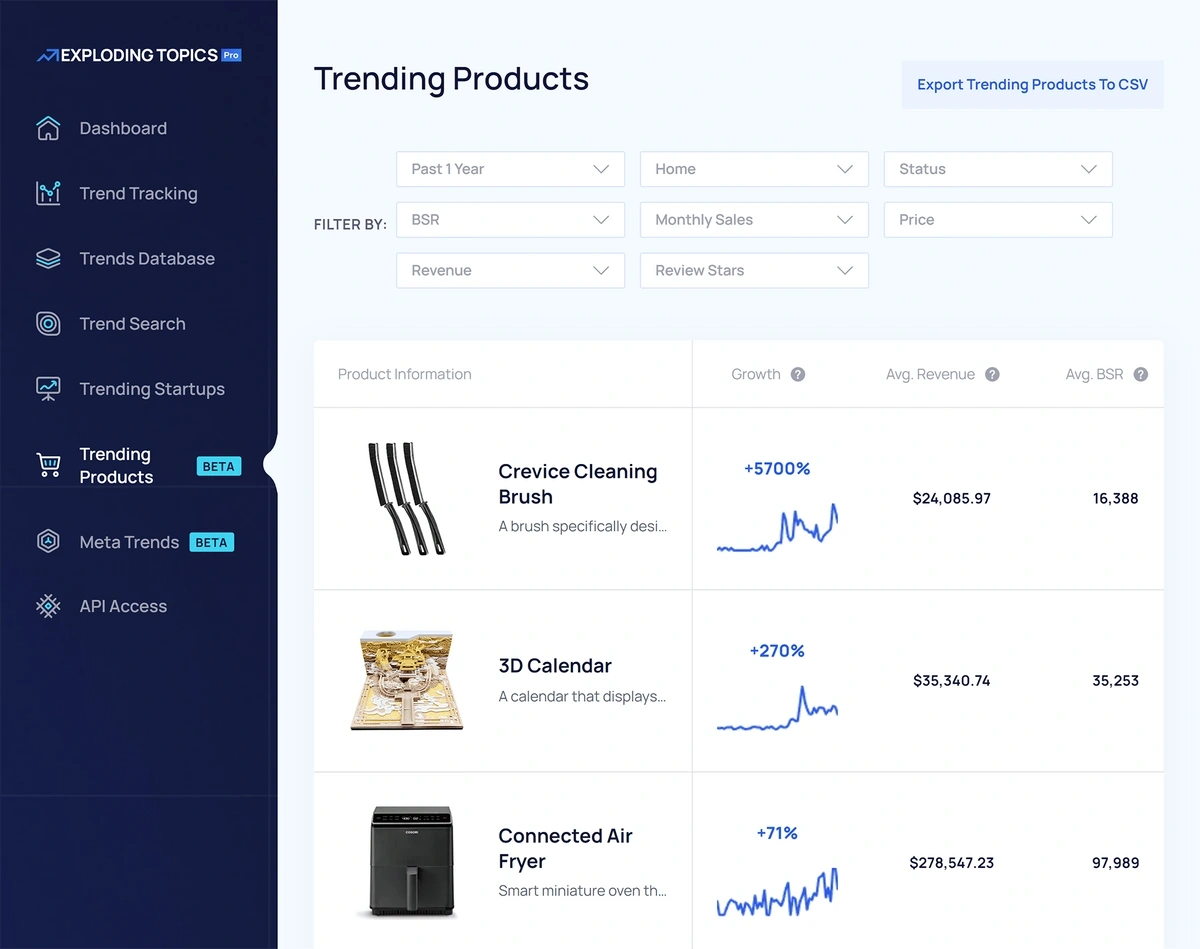

1. Exploding Topics

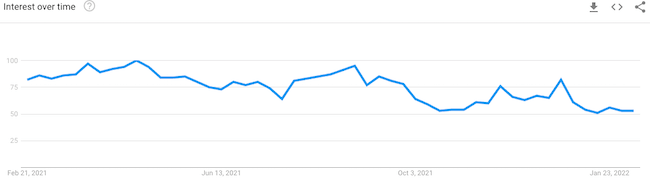

Exploding Topics is a trend-spotting tool that provides valuable insights about the products people are interested in right now.

We use artificial intelligence (AI) to scan the Internet and see what products, trends, and companies people are talking about. We look at blogs, news sites, social media platforms, and more, so you get a complete picture of people’s interest.

From there, our team of (human) data analysts evaluate the data and identifies the top trends online. These results go into our large trend database, where you can:

- See which topics are currently exploding in interest online

- Get information about which products are increasing in popularity

- Discover details about how top products are selling

- Learn what reviews these top products are getting

You can then use this information to do things like:

- Build profitable DTC sites

- Develop new products in line with consumer interest

- Outpace your competitors by offering trending products for sale before anyone else

Here’s an example: we identified “mushroom coffee” as a trending product category in October 2019.

While there was interest in the product at that time, organic search interest in this product really took off in early 2023.

Exploding Topics users already had mushroom coffee on their radar for almost 3 years. If this product was one that aligned with their business, they were well poised to take advantage of the explosion in interest.

You can begin using Exploding Topics to find trending products for free. If you’d really like to stay ahead of new product trends, though, an Exploding Topics Pro membership can give you that additional competitive edge. Our pro users get:

- Access to the entire trends database

- The ability to conduct trend database searches by keyword

- Every trend report we publish

- Instant trend alerts

- Enhanced details about trending products’ performance

You can give Exploding Topics Pro a try right now with our two-week trial for $1. After that, Pro plans are as low as $39 per month (billed annually).

2. Dropship Spy

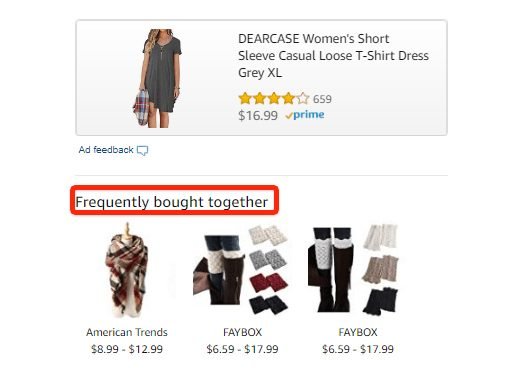

Dropship Spy is a product research tool for e-commerce businesses that use drop shipping services to sell goods.

The tool works for Amazon and Shopify sellers and can help you connect with dropshipping suppliers on Aliexpress and other sites.

When using Dropship Spy for product research, each item you view includes details on:

- Best-selling products across a variety of social media platforms

- Aliexpress sales volume

- Amazon product ranking stats and keywords

- Historical sales metrics

- Instagram influencers who promote similar products

- The services offered by each influencer, and at what rates

Dropship Spy is a comprehensive solution for dropship businesses, as you can also get access to:

- Pricing and profit calculators

- CSV files of existing product reviews

- Product videos

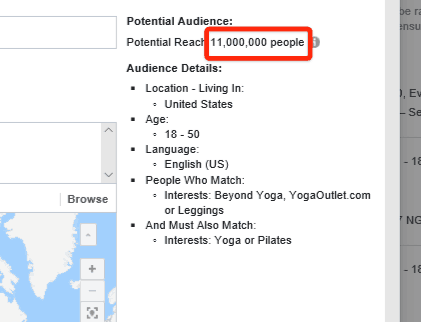

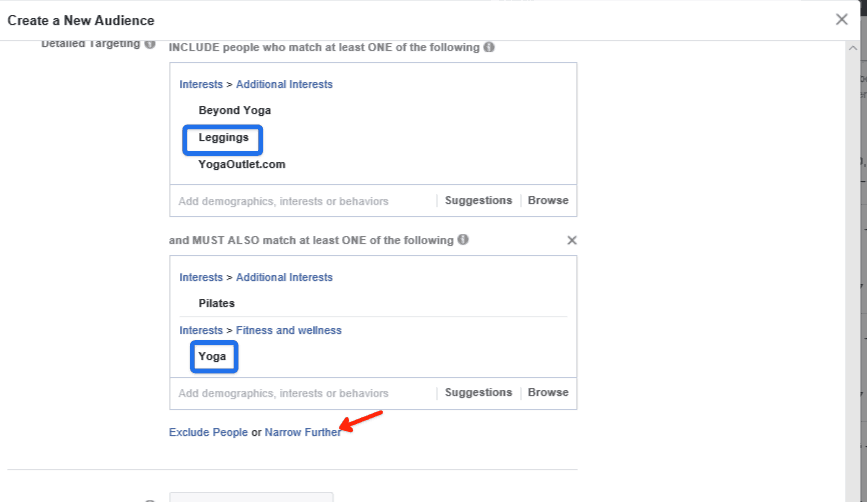

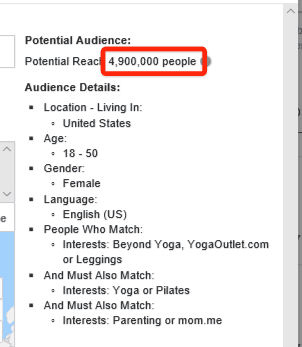

- Facebook ad audience segments

- Pre-written social media ad copy

If you’re trying to make your e-commerce business as hands-off as possible, then Dropship Spy’s data and library of resources could be a suitable solution.

However, because it’s only focused on products for dropshipping stores, this won’t be the best solution for anyone who plans to make, source, stock, and ship products themselves.

Access to Dropship Spy costs $39 per month, or $119 for an entire year.

3. Helium10

Helium10 is a product research platform that offers paid and free tools for businesses using Walmart or Fulfillment By Amazon (also known as Amazon FBA).

With a Helium10 account, you can:

- Use a Chrome extension to pull up details on Amazon and Walmart product listings

- Generate sales estimates for products that interest you

- Find the highest performing keywords for each product

- Identify trending products at Amazon and Walmart

The platform also offers additional insights to help you optimize existing product listings. If you’re committed to selling through Amazon and Walmart’s marketplaces, then this could be a good tool to have on hand.

With Helium10’s free plan, you can get access to the Chrome extension, keyword tool, trending products database, and PPC audit along with a few other resources.

However, this free access comes with limits. To use more of Helium10’s features, you’ll need to opt for a paid plan that starts at $39 per month (or $29 per month when billed annually).

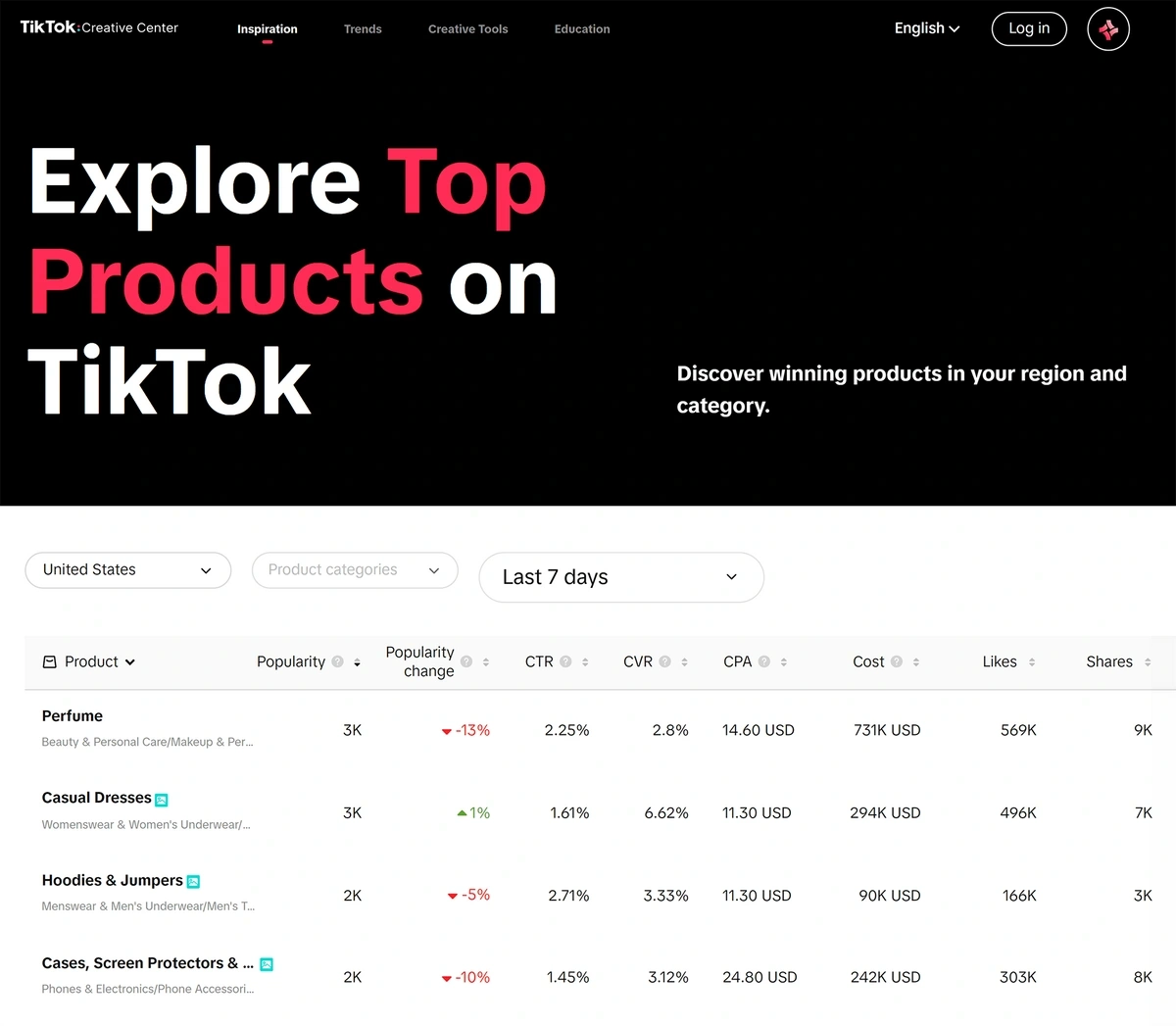

4. TikTok Creative Center

The TikTok Creative Center has a top products list that’s free to use—you don’t even need a TikTok account to browse the data.

The Creative Center can give you insights on:

- Best sellers by region, organized by popularity

- Changes in popularity over a time period

- The standard click through rate on TikTok ads for a popular product

- The typical amount of money spent by advertisers to achieve one sale

- The total amount of money spent on ad campaigns for a popular product

- Related product categories for each popular item

While much of this data is only directly usable if you’re going to run product ads on TikTok, the ability to search top products by region can be useful for product marketers on any e-commerce platform.

There are over 800 million people using TikTok, so it’s often a useful source for understanding what people are interested in.

You’ll just need to remember that this data is specific to TikTok users , who are typically under 40 years old—and many of them under 20. If that’s your target demographic, then it might be worth looking at the Creative Center data.

If not, or if you want a more holistic picture of what all internet users are interested in, you’ll want to pick a more comprehensive trend spotting website .

5. Thieve.co

Thieve is another dropshipping product research tool and a potential alternative to Dropship Spy.

There are four primary ways that you can use Thieve to identify products:

- Browse lists of popular products by category, such as electronics and homeware.

- Swipe through popular products from all categories to generate a list of products that interest you.

- Read about trending product niches, such as “Zoom Flex,” which refers to looking good on video calls.

- Upload an image you find online and locate potential product manufacturers and sources.

Once you’ve identified products you like, you can use Thieve’s other key features to:

- Find Aliexpress suppliers making profitable products

- See how much it costs to source particular products

- Generate product page descriptions

- Find product images

- Remove product logos and split grouped images into individual files

Thieve only works with Aliexpress products, so if you prefer to source goods elsewhere, you won’t get much value out of Thieve.

If you use Aliexpress, though, you can start browsing a limited number of products on Thieve for free. To use every feature, you’ll need a paid plan.

Thieve doesn’t make its pricing public, but they offer a two week free trial to test the service and get pricing information.

6. JungleScout

JungleScout is another Amazon market research and product analysis tool for FBA sellers.

When using JungleScout, you can:

- Look at product sales and performance

- Forecast how many products you may sell

- View Amazon product reviews

- Conduct Amazon product keyword research

- Track seasonal shifts in purchasing habits

- Verify which manufacturers your competitors use

Like Helium10, JungleScout offers a Chrome extension to help you quickly access product data while browsing Amazon.

Once you’ve found trending products to sell on Amazon , you can continue to use JungleScout to help you request customer reviews, track sales data, optimize listings, and run promotions.

JungleScout plans start at $49 per month, or $29 per month when billed annually, and include a seven-day free trial.

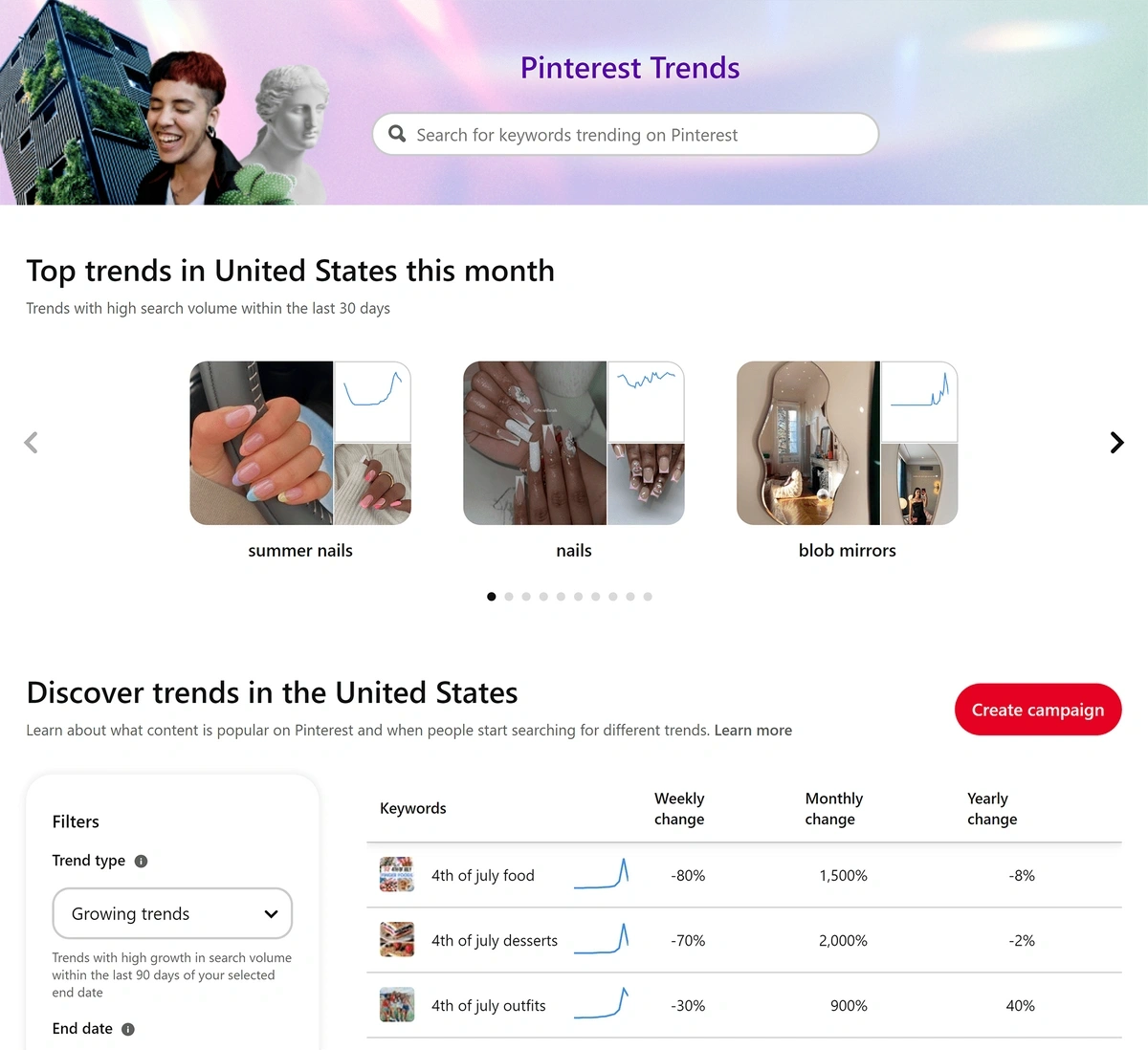

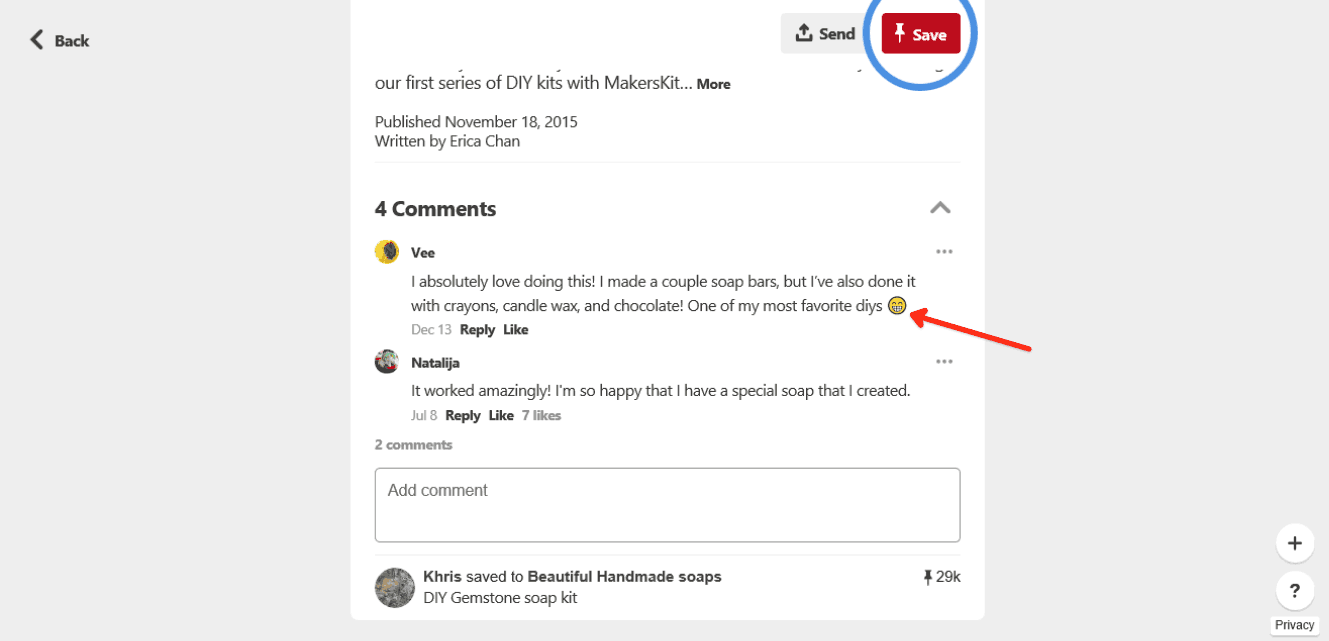

7. Pinterest Trends

Pinterest Trends is like the TikTok Creative Center in that it lets you see which products and niches are popular among users in your region.

You can use Pinterest Trends to research:

- Current products of interest

- Products of interest by season

- Products related to specific consumer interests or keywords

- Product interest by user age and other demographics

- The weekly, monthly, and yearly change in product interest

Clicking on any trend or product gives you an in-depth look at:

- How interest fluctuates over time

- Related trends and products

- Demographic details about the users interested in this item

- Related Pins

Because many people use Pinterest to save links from all over the web, you can use the Pinterest trends feature to get an idea of what might be popular on various e-commerce and dropship platforms.

There’s no charge to use Pinterest Trends, so you can use it by itself or as a supplement to any of the other tools on this list.

Algopix is a product research tool for Walmart, Amazon, and eBay sellers.

If you're interested in selling through more than one marketplace, then Algopix is a nice choice for building out your inventory and planning product prices.

When using Algopix, you can see a variety of product metrics including:

- The best-selling products in any category

- Who the highest-profile sellers are in a given channel

- Changes in prices, including promotions

- Sales rates by location

Algopix can also help you find products that are similar to one you're researching. If you have a product description, you can put it into Algopix and get a list of potential matches.

You'll need to subscribe to the platform for $35 per month or $336 per year in order to use every feature across all marketplace channels.

If you only sell through Amazon, you can use Algopix for free. Simply connect your seller account to conduct up to five category and 20 product searches every day.

9. eBay Terapeak

Terapeak is a database of insights about eBay sales.

You can actually access Terapeak information directly through your eBay seller account, and see information like:

- Product and category performance

- Current popular products

- Products attracting buyer interest

- Average sales prices

- Typical item condition

- Average shipping costs

- Popularity of free shipping

- Unsold inventory levels

- Most popular listing formats

Terapeak will also show you historic sales trends, so you can begin to make predictions about how your sales may fluctuate based on time of year or other factors.

All of this information is available for free to eBay sellers with a Basic Store or higher tier subscription. These plans start at $21.95 per month when billed annually.

10. Seller Assistant App

Seller Assistant App is another product insights tool for Amazon sellers.

Unlike some other Amazon tools that focus on dropshipping, Seller Assistant App can help you figure out how much you'll make by reselling products that you locate through discount stores, bin stores, liquidation sales, and more.

By entering a product into the Seller Assistant App, you can see information like:

- Average sale prices over one, three, and six-month periods

- Fees and expenses incurred by selling this product on Amazon

- Whether or not anyone has made an intellectual property claim on products of this type

- Your potential profit margin

- Best seller rank over one, three, and six-month periods

- Total product stock currently for sale on Amazon

- Other variations of the product currently for sale on Amazon

You'll even be able to see how much the product is selling for on other websites including Amazon, The Home Depot, Target, and eBay.

The Seller Assistant App costs $15.99 per month, or $149 per year, to use. You'll be able to look up 3,500 products every month—and higher plan tiers are available if you find yourself exceeding this limit.

Many product research tools are platform-specific—if you know you sell on eBay, for instance, you'll likely want to give Algopix or Terapeak a try first. And if you’re a dropshipper, you’ll want to take a closer look at Dropship Spy or Thieve.

But it's worthwhile to have a broader product research tool in your arsenal as well. Services like Exploding Topics and Pinterest Trends can help you understand what's popular across the internet at large—and plan for the next big e-commerce trend.

Want to learn more about how these tools can help your online store grow? Check out our comprehensive guide to finding trending products and discover everything you need for successful e-commerce sales.

Find Thousands of Trending Topics With Our Platform

Learn / Guides / Product research basics

Back to guides

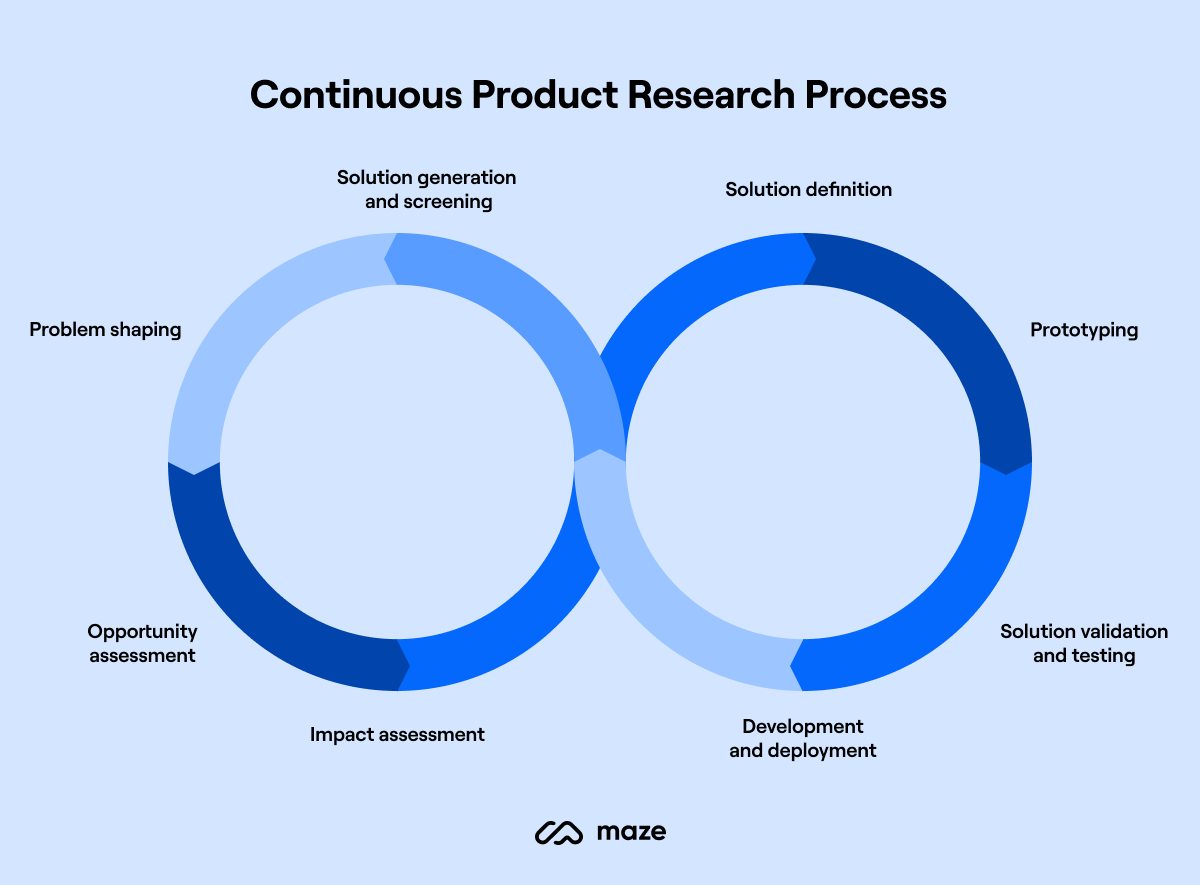

A step-by-step guide to the product research process

A strong product research process ensures product teams maximize resources, meet key business goals, and make confident decisions that will deliver successful products and features to create customer delight.

But, how do you conduct effective product research?

Just as there’s no single way to develop a product, no single research process fits all product teams. But there are key steps that will help you balance business goals and user needs for actionable product research .

This article takes you through the factors you should consider to tailor product research to your desired outcomes and provides a step-by-by-step guide to doing research right.

Use Hotjar to streamline your product research process

Hotjar offers product teams a rich stream of quantitative and qualitative data that keeps you connected to user needs at every stage of research.

What to consider before starting product research

Before jumping into the research process , product managers prepare their team. Take time to consider the why and determine how you can design the process to meet your unique product requirements.

Reflect on:

Why you’re doing the research

Get connected with the deep purpose of your research: what you need to understand to create a profitable and effective product .

Determine specific outcomes of the research process.

During the early product discovery stages, generating new product ideas for innovation and getting to know your users better will serve as a solid foundation throughout the research process. At later stages, look for concrete feedback on a new product, or possible upgrades and feature updates for an existing product. The why behind the research should guide your process.

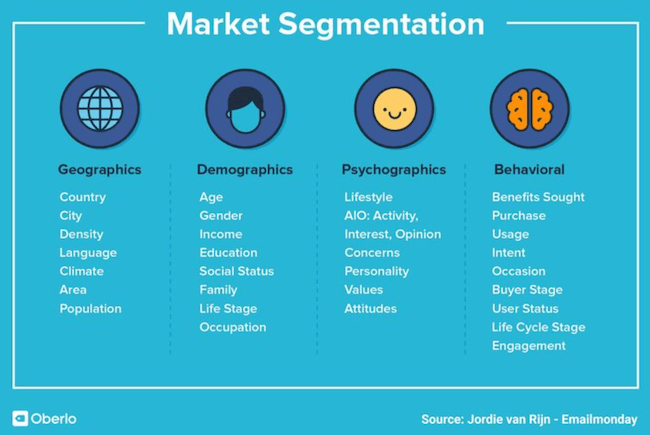

Categorizing your users

Determining customer needs and segmenting users are crucial steps that impact the success of any product research strategy.

You might use a random sample of potential or existing customers; or segment users according to region, industry, or other criteria to spot patterns across different demographics.

Trial users can give immediate product feedback, which is usually incredibly easy to implement (a new theme, for example) or incredibly difficult, like an entirely new functionality or platform for your product. Your long-time users can give nuanced feedback, but they overlook what doesn't work due to their expertise.

Finding that middle ground of users who like what you offer but aren't stuck to your brand is essential. These users appreciate being treated like their insights matter most—because they do.

Finding impartial user insights can be tricky since many tools track users who’ve been paid or incentivized to click through to your website or product. Product experience insights software like Hotjar can help by providing organic, unbiased user data that gives you a clear picture of your customer experience (CX) .

Pro tip: Hotjar Highlights lets you sort and curate user insights and attributes, and share them with your product team. You can also watch Session Recordings of users from specific countries or industries—or filter recordings to see only satisfied or dissatisfied user experiences, which can provide valuable information on what’s working (and what’s not).

A Hotjar Session Recording

Your core business goals

The best product research processes overlap with the overall organizational vision, so update your research goals in line with company goals to ensure alignment.

Designing your research process with cross-functional collaboration in mind is a great way to eliminate any communication issues, ensure all departments collect data that tests product profitability, business goals, and user satisfaction.

Your team’s methodology

Different product methodologies emphasize different aspects of product research throughout its lifecycle, so it’s important to consider techniques that will fit your team’s working stages.

Teams who use waterfall methodologies usually rely on bursts of intense research before development and again during pre-launch. They also make a clear distinction between the product’s research and development phases.

Teams who use agile, lean, or DevOps methods usually integrate research with the broader product development process, engaging in continuous discovery methods.

Whatever your methodology, infuse research into every stage of the product lifecycle to achieve business goals like increased revenue, acquisitions, and user adoption.

Choosing which research tools to use

When you’re deciding how to do product research, you’ll need to consider your budget and company size to pick out your tool stack.

Manual research techniques like user interviews can be time-consuming and cost-intensive, but useful to forge a personal connection with users and ask improvised questions based on their responses.

Automated research tools (like Hotjar 👋) increase speed, efficiency, and cost-effectiveness, and reduce human error. They allow you to reach a larger target audience and ensure you’re getting clean, unbiased product feedback —in person, users are more likely to feel pressure to compliment your product or underplay their concerns, but with tools like Hotjar, you’ll get genuine, in-the-moment feedback from users as they engage with your product.

Which team members will contribute

Involve different team members at each stage of the product workflow. For example, when you’re validating product ideas, you may want to include marketing and technical departments; and when you’re testing product usability , you may want to rely on the expertise of your engineers.

It’s also important to consider what research other departments have done before launching your own process, so you don’t waste resources duplicating generic market research.

8 steps for amazing product research

Amazing product research is all about doing smart research to unearth effective insights without getting lost in an information overload that derails your product workflow .

Follow these eight steps to guide your product research strategies to achieve valuable, actionable product insights that will inform your product’s entire lifecycle, from ideation to execution.

1. Define your research goals

First, set your high-level goals, which should test business objectives as well as customer-centric product discovery. These are often drawn directly from the product vision and strategy.

Then, create attainable, specific goals or questions for your team to focus on during each stage of their research. This might include:

Conducting market research for the product’s adoption before its launch

Identifying areas where key features can be improved after the product launch

Evaluating the product’s performance throughout the product lifecycle

2. Understand your users

User needs are at the center of effective product research processes.

Engage in user discovery—identify and understand your customer—as early as possible , even before you have definite product or feature ideas. Open-ended user research is a key source of product inspiration and innovation, and an essential step in determining product-market fit .

Then, when you have product proposals, prototypes, or a minimum viable product ( MVP) , you can start seeking more specific feedback.

User research is all about interacting with your current or potential users and learning what they want and need . Developing a user-centric culture of ongoing research will help you gauge the market demand, position your product against the competition, and generate customer delight .

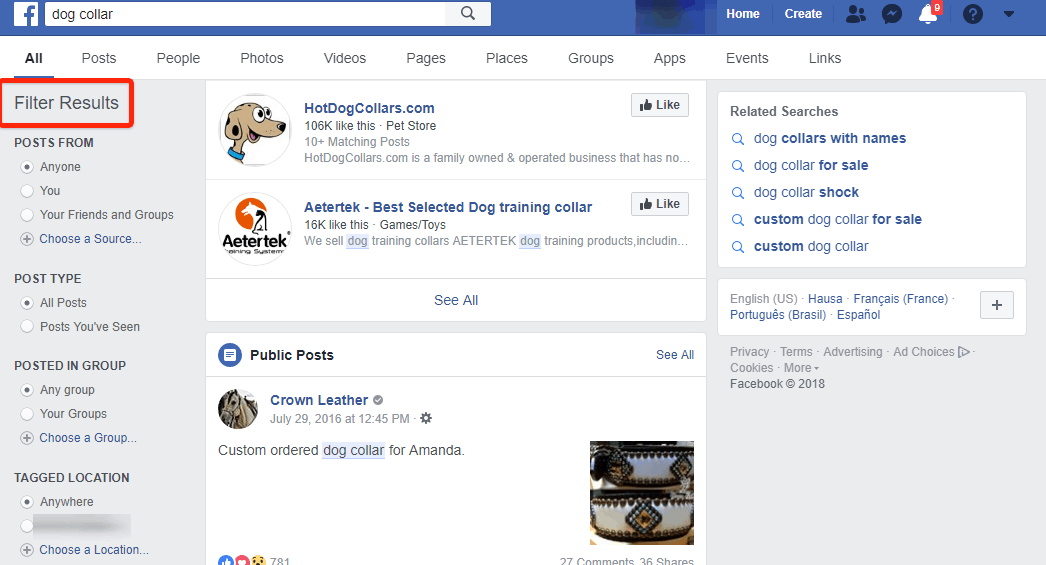

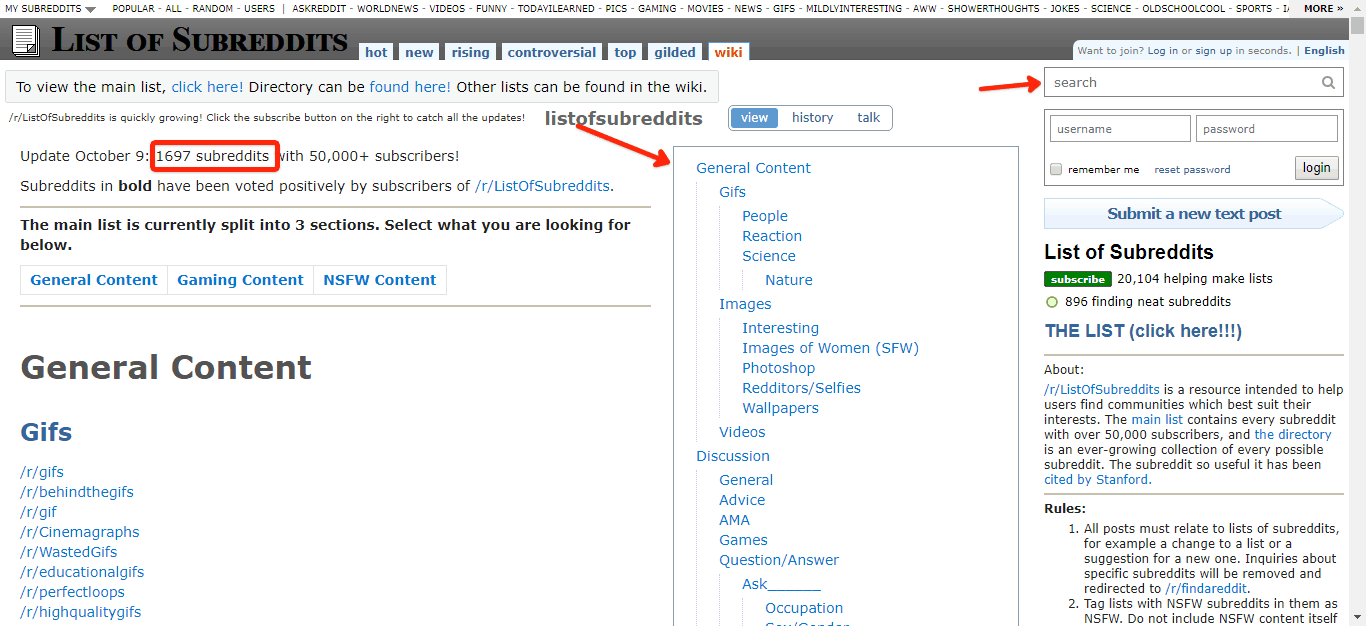

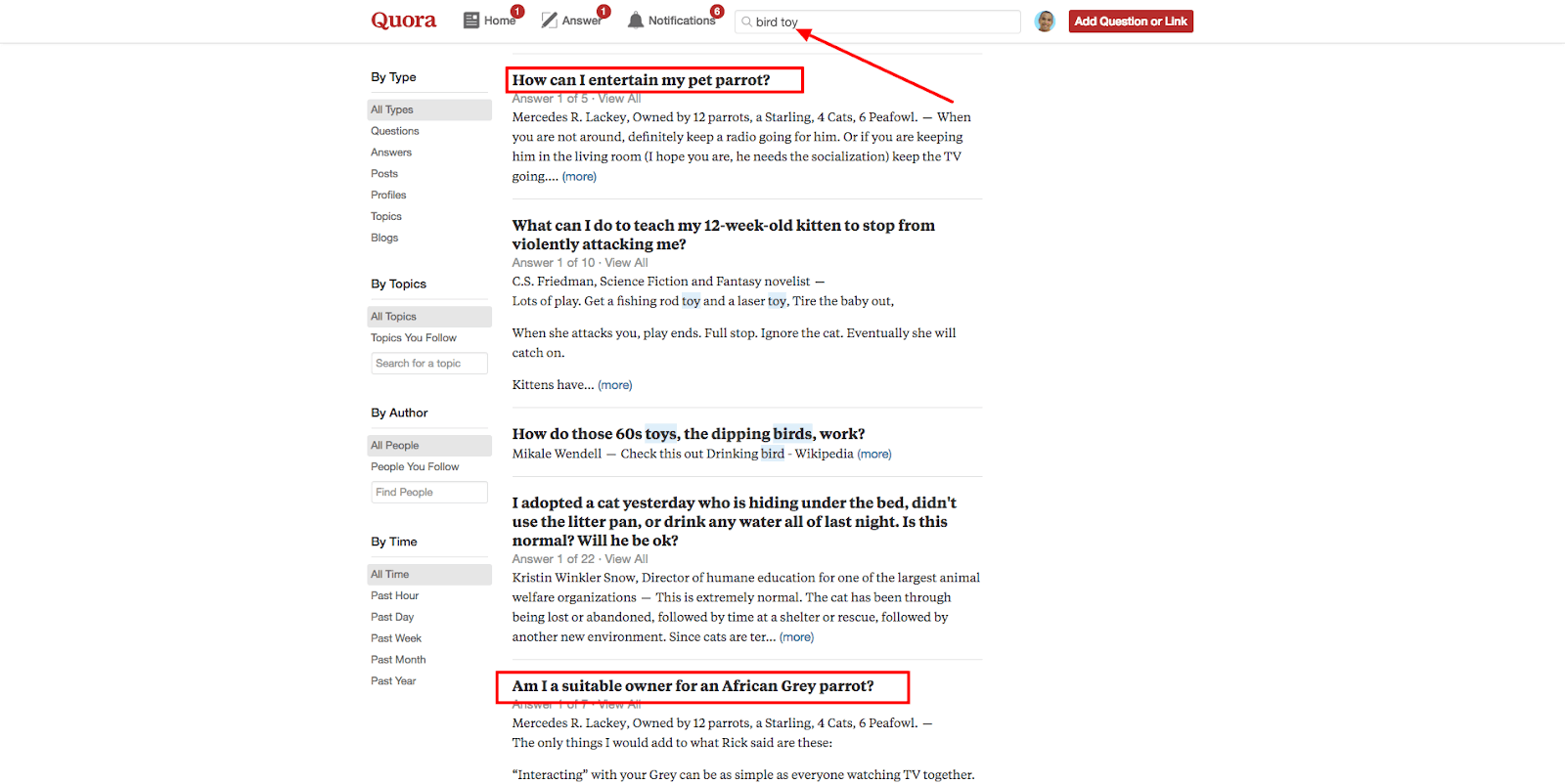

To create a user-centric research culture, conduct user interviews and create user personas. You can also connect more passively with your user demographic by looking at forums, Facebook groups, or sites like Reddit that are used by your customer niche.

The more organic the research process, the better. It’s ideal to catch users in situations where they answer by instinct instead of having carefully crafted answers. It's what they say instinctively that leads to better product solutions.

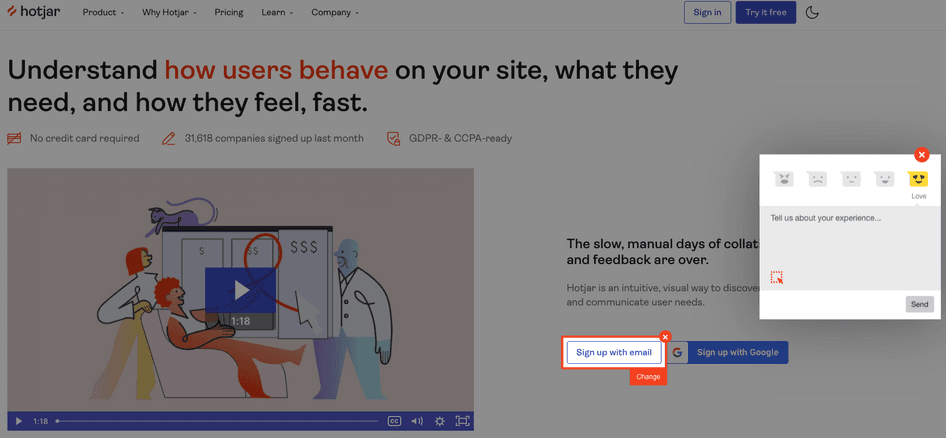

Pro tip: use Feedback widgets to gather user feedback in a non-invasive way.

Hotjar’s Feedback widgets are integrated into the product interface , so users can give quick feedback and then carry on with their tasks. This means you can survey your users and gain valuable insights by learning what they’re thinking and feeling as they interact with the product.

A Hotjar feedback widget

3. Do market research for your product

Run thorough competitive and comparative analyses to test the business potential of your product against other solutions on the market , and engage in opportunity mapping to get stakeholder buy-in.

You can also use historical market data and trade reports to predict potential profitability and run keyword research to understand users and what potential customers are searching for to generate product ideas.

Once you’ve validated whether there’s a viable market for your product and determined how saturated that target market is, focus on your product’s unique selling points.

Pro tip: even if you already have a product established in a specific market, make sure to assess the market periodically. Markets and competitors change, and making assumptions because of your initial research processes can be a costly mistake. Work with your marketing team here to validate your ideas and avoid guesswork.

Evaluate your product regularly against the industry by creating a value curve. The value curve plots the product offerings currently available in the market on one axis, and the factors the industry is competing on and investing in heavily on the other. This can help you spot market opportunities, ensure product relevance, and get ideas for features you could add to increase user demand and open up new user bases.

Check out how Gavin increased conversions for his lead generation agency by 42% with Hotjar.

4. Get to know industry trends

Next, combine your understanding of your users and market with research on technology trends that may affect user expectations of your product or its long-term viability.

Stay on top of trends by regularly engaging with tech cultures —read trade magazines and news sites, listen to tech news podcasts, and follow key trendspotters on social media and specialist forums. You can also use tools like Google Trends , Trend Hunter , and PSFK .

Another key source of tech trend information is your engineering team . Chances are, you have plenty of techies on your team who are up to speed on different aspects of technology and what’s forecasted to change.

Pro tip: rigorously analyze trends and put them into context to understand what has staying power, as you avoid jumping on every passing fad. Create a learning culture that embraces experimentation and gives team members the opportunity to share their knowledge.

Analyze the latest trending topics and projects in mainstream open-source communities across the Internet such as GitHub. These communities are an incredible resource for identifying tech trends that are sustainable, disruptive, and have immense staying power.

It's also important to subscribe to prominent tech publications and leading technology platforms such as Azure and AWS to get the latest tech news and new feature announcements delivered directly to your inbox. This way, your product team is always in the know about the most important tech trends that are shaping product development and product markets.

5. Validate ideas with current or potential users

Once you’ve developed a strong sense of your users, market, and technology, it’s time to start testing concrete ideas and solutions.

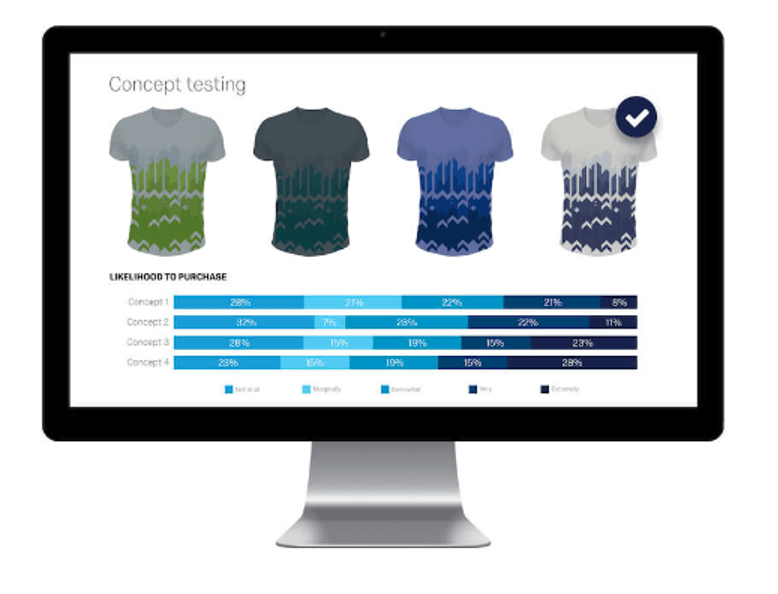

Based on your early research, identify possible products, features, or upgrades that could meet user needs as well as business goals. Then, run concept testing to evaluate the user experience.

First, identify key users or user types to test. Recruit participants for customer interviews or focus groups, or deploy Hotjar Surveys , Incoming Feedback tools, and Session Recordings to test ideas with existing users.

Then, ask questions or set tasks and observe user responses. You may just want to explain concepts to users at this stage—or you can use wireframes or mockups; or, at later stages, prototypes or MVPs.

Make sure you account for confirmation bias and false-positive responses from users when designing the validation process. Include open- and closed-ended questions and use measures like purchase intent to determine customer adoption.

Pro tip: use fake door testing to gauge interest in new features across your existing user base.

In fake door tests, you show users a call-to-action for a product action that doesn’t exist yet. Once they click to perform the action, they’ll be taken to a page that explains this feature isn’t available yet—you may also choose to include a short survey on this page to learn more about their interest. By reviewing answers to survey questions and the click-through rate , product teams can quickly validate ideas for new features or improvements with users.

6. Test your MVP

The next step in your product research process is to develop a Minimum Viable Product based on validated ideas and run tests to improve subsequent iterations.

This is a critical stage in product research that you shouldn’t skip. Waiting for the fully developed product before running tests makes it harder to fix software and prioritize bug issues, causing major delays.

Quality assurance (QA) testing, regression testing, and performance testing check the MVP’s functionality and show developers where they need to make product changes .

User tests are also key at this stage. Different types of product testing , like tree testing and card sorting, can confirm whether users can easily navigate your product to find the functionality they need.

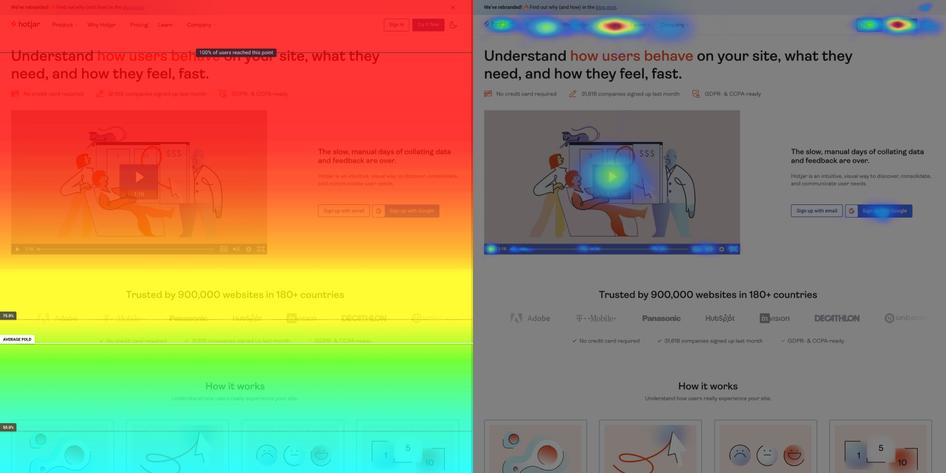

A/B tests and multivariate tests , where you split your user base into groups and give them different versions of a product or feature, can help you decide which iteration to run with. Hotjar Heatmaps allow you to easily compare where users click and scroll on different versions of the product.

7. Continue research after the product launch

Consider doing a soft launch—or even canary deployment—where you release new products or features to a small group of users

Gather data to weed out bugs

Finally, adapt the product based on user responses

Then you can roll it out to all users.

But even once you’ve launched the final product, your research isn’t over. The best product teams stay connected with their users and regularly analyze market trends and tech changes.

After the product is released, either through a soft launch or a regular launch, implementing a data-driven approach to the go-to-market strategy is crucial in parsing consumer reports and validating trends and customer opinions.

Continuous research ensures that your product stays relevant and successfully meets customer needs, which will boost user metrics and business metrics alike.

So how can you continue your research throughout the product lifecycle?

Watch session recordings to spot blockers and bugs where users are rage clicking or dropping off the product journey

Use heatmaps to understand which product elements are most popular—and unpopular—with users

Measure product analytics like click-through rate (CTR) and product conversion rate

Stay up to date on industry and market trends

Incorporate regular opportunities for cross-team discussions to get different research perspectives

Schedule regular user and customer interviews

Use product experience insights tools like Hotjar to give you a steady stream of user feedback through Surveys and Feedback widgets

8. Turn research into action

The final step in any product research process is to organize your research and turn insights into action.

Curate your research into specific, actionable themes to cut through the noise and gather valuable, user-centric insights.

Then, use your research to establish a strong product strategy and roadmap to guide your product development process. Make sure you compare the strategy and roadmap with new research at regular intervals and update where needed, though it’s important to strike a balance: these documents should be dynamic but relatively stable touchpoints.

Your product research should also drive your day-to-day decisions and product backlog management , and form the basis of your product storytelling to help get stakeholder buy-in.

Why creating a user-centric research culture is essential

Remember: at heart, all product research is user research.

Product teams who are endlessly curious about their users—who they are, what they need, how they experience your product—can better meet the demands of an ever-evolving market, inspire customer loyalty, and increase their Net Promoter Score (NPS) . With a learning mindset and a commitment to customer-centric product discovery, you can transform research into innovation and sustainable business growth .

FAQs on the product research process

What is product research.

Product research is the process of gathering data about your product’s purpose, intended users, and market to meet user needs and achieve business goals.

What are the steps in the product research process?

The 8 steps in an effective product research process are:

1) Define your research goals

2) Understand your users

3) Do market research for your product

4) Get to know industry trends

5) Validate ideas with current or potential users

6) Test your MVP

7) Continue research after the product launch

8) Turn research into action

Why is product research important?

Strong product research is critical to product management because:

It ensures the product will meet customer needs and hit business targets

It helps product managers (PMs) develop a data-informed product vision, strategy, and roadmap

It helps PMs make confident decisions on the product backlog and day-to-day tasks

It keeps the product team motivated and connected with the purpose of their work

It helps the product team communicate product value to stakeholders to get buy-in and secure resources

Prioritize product features

Previous chapter

Guide index

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

- Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

Product Experience

Product Research

What is product research?

Why is product research important, how to conduct product research.

- Using quantitative and qualitative product research

Areas of product research

- Top product research tips

- Qualtrics’ product research tools

See how ProductXM works

26 min read Don’t skimp on your product research. The insights you gather and act upon can mean the difference between selling products that are a roaring success or an abject failure.

You’re in the process of developing a new product idea with a view to launch it on the market . Or maybe you’re reviewing and updating an existing product that’s already on the market in the hope of making it better.

It’s a risk – get it wrong and you could make an expensive mistake; get it right and you could have a successful, profitable product, service or experience delivering amazing returns on your investment. So how can you make sure you end up in the second category?

This is where product research comes in. It helps you:

- Evaluate and prioritize your ideas

- Test and validate concepts

- Assess names and packaging designs

- Check out the competition

- Set the right selling price

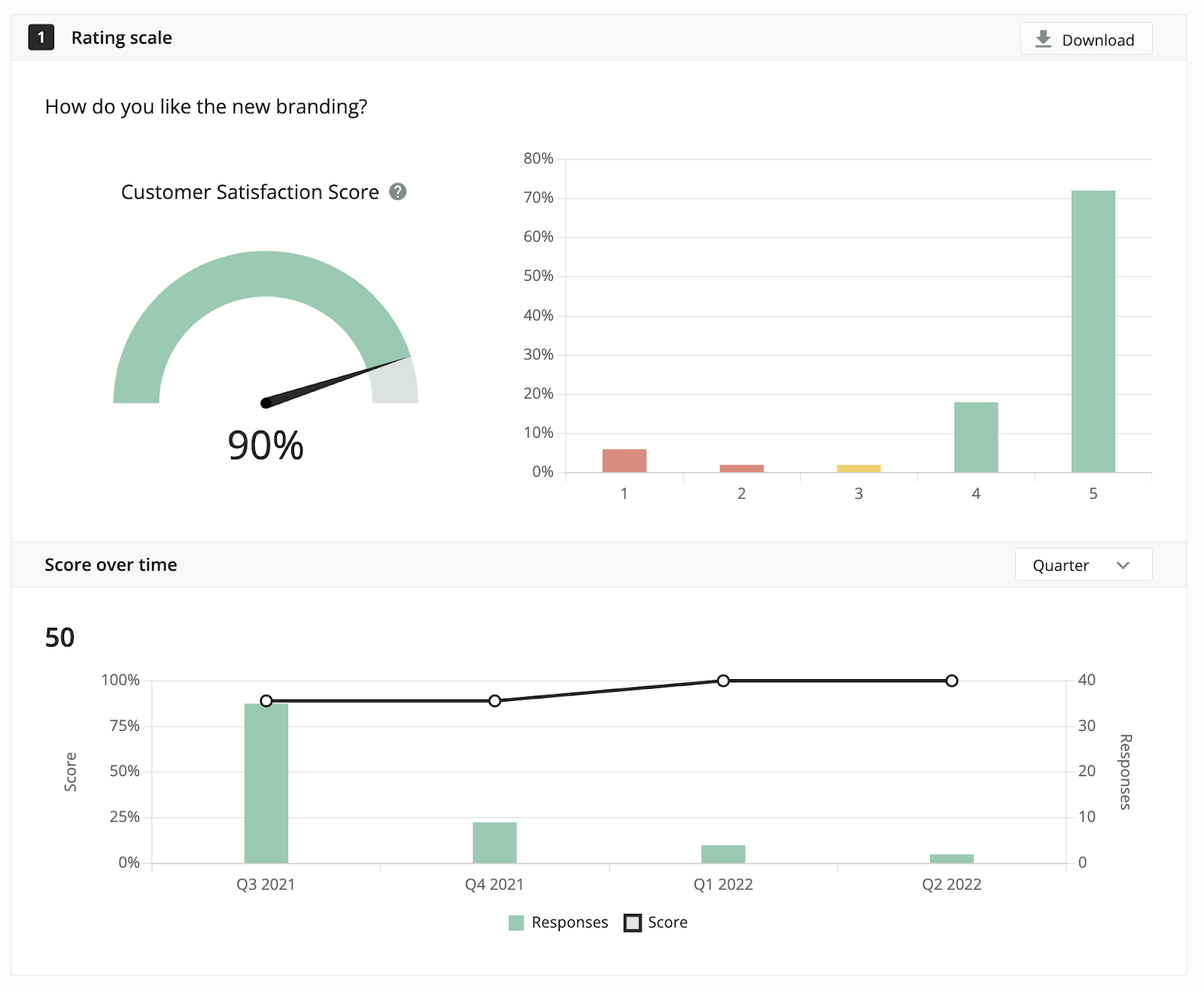

- Gauge customer satisfaction and monitor product-market fit post-launch

- Continually improve the product

Product research is the term most often used to describe this process, but it’s not just about physical products. The research process we’re describing here could apply equally to a physical product such as a smartphone, a service like cloud storage, or an experience like a tour or hotel stay.

Product research goes hand-in-hand with market research, which identifies a target customer, develops typical buyer personas, and analyses purchasing behavior. Together, the two help you make informed decisions about how to find the right fit between what people need or want, and what you can offer them.

Get started with our free product research survey template

A product, service or experience idea can be brilliant and original, but if nobody wants to buy it, there’s no way it can be successful. At best, it will be an impressive oddity, and at worst, a total waste of time. Likewise, if you’re proposing changes to an existing product or service but they’re not the ones your customers value, you could end up doing more harm than good.

Product research will tell you whether your idea resonates with potential customers. Because a product is only worth what people are willing to pay for it, you’ll also be able to extend your research process to set a product price accordingly.

And if your competitors are doing better than you, you need to find out why, identify any gaps that they’ve missed and uncover emerging trends so you can get ahead.

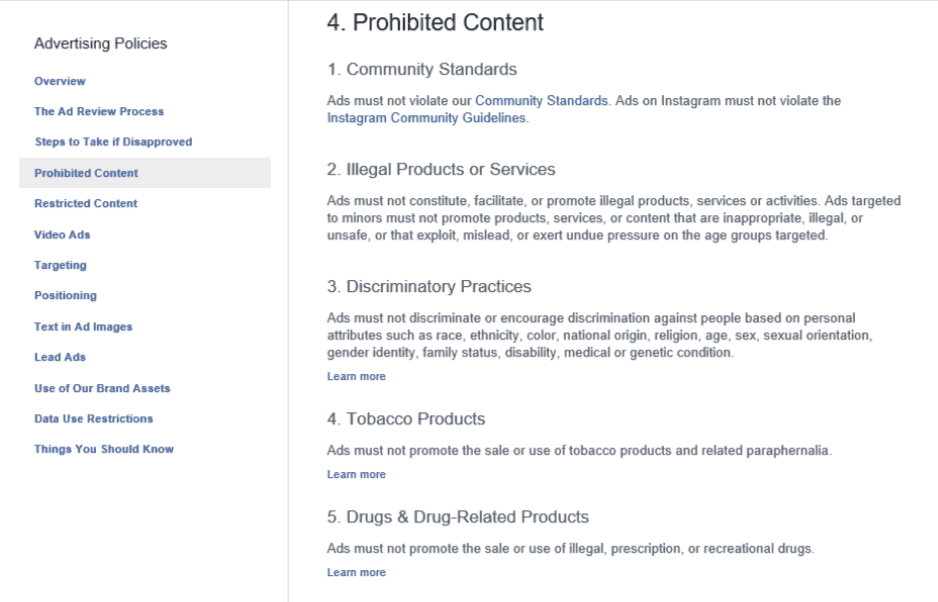

Sure, you can start your research online. Amazon, review sites, and social media will give you an idea of what’s out there and how buyers react to products, but if you want to dig deeper and own your niche, you need to invest in user experience (UX) research .

UX research focuses solely on the user of a particular product, looking at how human beings interact with products and services and learning from their experiences.

UX research typically covers the following areas:

Target demographic

Demographic targeting or segmentation helps you understand who your particular product or service is targeting. Demographic information includes everything from gender and age to education and income.

Uncovering a need is one of the main drivers for creating a winning product. For example, if you’re selling into a particular market, your UX research can help you identify flaws in particular products or services and what your potential customers might want from something new. Likewise, researching customer needs helps you to identify what you shouldn’t focus on.

When you research products and UX, you should also examine what your target market wants out of the product or service. Want differs from need as a product need is a requirement, whereas a want could specify certain features of capabilities. They can also differ in priority based on each customer.

For example, this could be improving how your product or service works, or the UX outcomes — e.g. does the product make their job easier or give them more time to focus on other activities?

This should all form part of your UX research and can give you a huge advantage if you get it right.

What do your customers think about you or your product? What do they think about your competitors , and how do you compare to those competitors in their eyes?

What do your customers think about the problem they have? Or how can they solve it? Do you think about their problem the same way they do?

You need to understand how your customers think and what they think if you’re going to convince them to buy your product.

Understanding your customers’ behavior should form a big part of your product research process. Not just in terms of how they go about their lives or work — which can help you understand how your products fit in — but also how they do their product research when looking for a solution. Do they base their purchase decisions on word-of-mouth? Do they typically buy online, or are they more likely to want to visit a retailer to see, hear and touch their potential purchase?

Think about the use case for your product or service. If it’s a gadget, will they use it in the home or out and about? This consideration might inform whether you build in a battery power feature or rely on a wall socket. If it’s a shoe-shine service, would they prefer to be able to walk in off the street or is an appointment system more appealing?

Understanding their behavior can help with your product development to meet a need, and also with your marketing strategy and sales messaging.

Motivations

What drives your customers to find and buy products or services? This is something you need in your product research so you can create solutions that further their success.

Customer motivations are either conscious or subconscious, e.g. they’re aware of a problem and need a solution, or driven by changes or demand in the market (for example, a government requirement to implement certain technologies for business operations).

Product research can help you to understand these motivators, subsequently enabling you to tailor your market messaging and create amazing products.

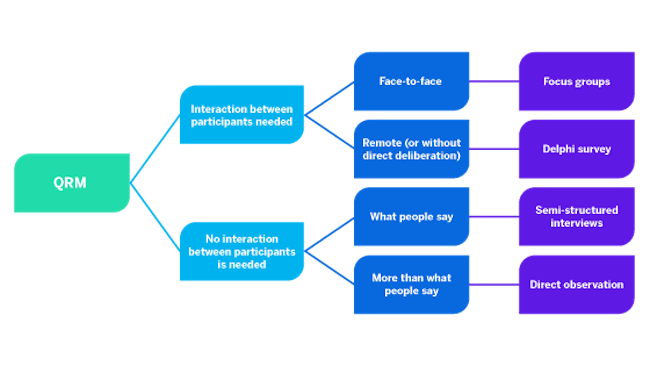

Using quantitative and qualitative methods for product research

Product research relies heavily upon qualitative and quantitative research methods — this includes capturing feedback , observing how people use products, and analyzing existing data (or new data) to uncover trends or opportunities.

Combining both qualitative and quantitative research methods will help you to identify the most pivotal market trends, as well as understand the specific thoughts and beliefs of customers. Here’s a quick breakdown of how each product research method works:

Quantitative UX research

Quantitative research is a starting point. It’s all about crunching the numbers that translate into informative statistics. Surveys and polls (online, mobile, paper, telephone) are the most commonly used methods, although you can add data from analytics platforms to the mix.

Qualitative UX research

Qualitative research joins the dots of the quantitative data by revealing what people think, believe, and feel about a product. Rather than ticking boxes, people say or write what they think either in open text boxes on surveys, or during interviews and focus groups. Qualitative UX research provides context, painting a picture using the data.

Breaking product research down into manageable stages will increase its effectiveness. These stages are:

Market research

Understanding the current marketplace can help you not only identify any trends in particular buying habits or fads that are attracting short-term attention. It can also help you identify areas of opportunity that you could exploit.

Market research helps with pricing decisions based on whether your market is stable or growing. From the research, you’ll uncover market size and competition, as well as answers to the following questions:

- What are the best-selling products already in your market and where do you fit in compared to them?

- Is there low competition in your market, or is it saturated?

- Are you selling a product that’s got high demand? And how long does that high demand last?

- Is your product something that can be sold year-round? Or is your product seasonal?

Customer research

We’ve already touched on this, but your product research should include your customers.

For example, research demographics to understand who they are, use psychographic information to understand their wants and needs, and leverage specific customer segmentation to ensure you’re targeting the right section of the market with your product or services. All of this will help you to build a better picture of your audience.

Your customer research should also include where you plan to sell your products based on your customers’ preferences. Will you need to sell online? Or is your product something your customers will want to see in person first?

If you plan to sell online, you’ll need to factor in other elements of your selling and marketing strategy. This will be everything from keyword research for marketing and understanding the search volume for your products, to shipping costs if you’re going to sell nationally, or internationally.

New product development

Finally, you should examine your specific product idea. This includes whether there’s a demand for it, what the pricing landscape is like and where you should position yourself, minute product details like the size and weight, or whether you’re selling perishable goods or consumables.

Furthermore, if you’re selling the same product as the competition, how are you planning to compete? Are you going to compete on price and if so, what will your selling price need to be to gain an advantage while generating a profit margin?

Segmentation Research

Segmentation is the strategic lens through which you view your market landscape. It’s used to identify who to target so that you can develop, maintain, or adjust branding and marketing tactics and identify product optimization and innovation opportunities. The most profitable products are those that are targeted at specific segments of a market and tackle a particular need or problem.

Ask yourself the following:

- How large is that segment?

- Are your customers early adopters or more traditional? Are they open to new ways to do things or will they need to be convinced?

How people perceive your brand speaks volumes about what they are prepared to buy from you. Just as you wouldn’t buy a computer from a supermarket, you wouldn’t buy your groceries from a technology store (more importantly, it’s highly likely that neither would sell either of those products).

Concept testing

Concept testing should be conducted in an agile environment.

Begin early in the process with an MVP to test on existing and potential customers. A series of small studies done throughout the product innovation cycle will ensure that your new product is refined by customer input.

It is always more cost-effective to refine a new offering as it is being developed than to have to drop or make significant changes to a product that has already consumed a great deal of investment.

This continues as you roll out your new product. You must stay in touch with your target audience as they use the product, and take on board comments and suggestions for improvement. There are many benefits to concept testing:

- It’s cost-effective and flexible: You can send out simple, quick surveys if you want high-level rapid feedback, or longer ones if you want to dig deeper into the detail

- You’ll be able to optimize your product: You’ll gather useful information on things like branding, pricing, and market status that will make a real impact on your development decisions

- Continuous quality assurance: You can use the same audience to give feedback on your improvements, or survey a new audience to get fresh insights on your product development.

- Great brand loyalty: You’ll build up good customer relationships and increase your brand equity by including potential customers in your product’s design and development.

Improve your concept testing with our Introduction to Concept testing eBook

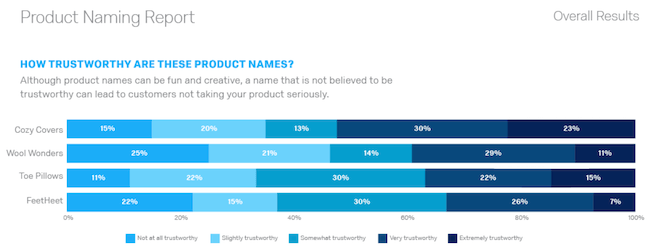

Naming research

What’s in a name? A best selling product, we hope.

Product naming is the process of coming up with compelling, unique names for your new products.

We would always recommend using qualitative research, with its emphasis on verbal expression, to test product names with your prospective customers, and using a text analytics tool to categorize text responses by both topic and sentiment automatically.

When deciding on product names (we recommend between 3 and 15 options) to run past your respondents, remember these six golden rules:

- It should be easy to remember: consumers must be able to recall the name easily

- It should be memorable: There’s a lot of product ‘noise’, and your name needs to be heard above it

- It must be easy to pronounce: Word of mouth is important, and if your customers can’t say it, they won’t mention it to others

- It must be easily understood: It helps if the name hints at what the product does unless you have a colossal marketing budget to explain a more leftfield name

- It must translate well with international audiences: We’ve all heard the apocryphal story that Coca Cola originally transliterated as ‘bite the wax tadpole’ in Chinese. Whatever the truth, make sure audiences around the world can pronounce your product name and it doesn’t mean anything problematic.

- It has to be a name you can own. No one wants to discover after a comprehensive research program that the name everyone loves is not available for use.

Provide your respondents with a product description, and ideally images of the product. Break your testing between:

- Overall name questions: How does each name compare with the others? Rank the names in order of preference, or against criteria such as trustworthiness, appeal or creativity. Do respondents have any names of their own? The results of this testing will give you the top names overall and in every category.

- Individual name questions: Would respondents buy this product with this specific name? How does this name make them feel? Individual name analysis should reveal name sentiment, as well as data about a consumer’s likelihood to purchase or consider your product.

Feature research

You use this to identify which product features your customer’s value so that you can add or improve them.

But you always need to keep in the back of your mind that a product is more than just the sum of its features – it’s how they work together to give a seamless experience that’s important. Research will help you do that.

There are three areas of feature research that you’ll need to undertake:

- Identifying customers’ wants and needs : Customer needs analysis will give you insights into personal values, purchasing decisions, and pricing tolerance . Conjoint analysis, with its multiple product attribute comparison/trade-off scenarios, will inform which features customers consider most valuable.

- Internal development : Once you’ve analyzed what customers want, you need to bring your feature back in-house and seek the expert opinion of your product managers, business analysts, marketers, designers, engineers, and customer experience teams.

- Test with customers : You’ve created a feature that customers want, and your in-house teams have approved them. Now you can use product feature prioritization to understand the features your customers’ value (and don’t). Survey: usage (where and how the customer uses the feature); ‘top of mind’ negative and positive associations with the feature; product categorization (comparing with the competition to see which features make a product more or less ‘swappable’).

Pricing research

A product is only worth what people are prepared to pay for it. You need to ensure that its price is low enough for people to feel they’ve got good value, and you also make sufficient profit, but not so cheap that its quality is questioned.

You also need to consider how many units you’ll need to sell based on your product prices to have a good profit margin.

When you conduct pricing research , you’ll discover:

- How willing the market is to buy your product

- The highest return on your development investment

- How to maintain your brand’s value

- When and how to alter your pricing effectively

- The costs involved in producing your product

Pricing research is done through a combination of market research, competitor research , market analysis, and testing in the marketplace.

Use product pricing research tools. These use one or more of the following methodologies to ask survey respondents:

- Van Westendorp price sensitivity meter is a type of direct pricing research that asks survey respondents four simple questions to gauge whether your product is too expensive or a bargain

- Gabor-Granger pricing methodology uses predefined price points to determine the highest price a respondent would pay for your product

- Conjoint analysis gives respondents a choice between product packages and then asks them to choose one of the feature/price configurations to create the ideal option. Each option comes with trade-offs and the best time for use

Free eBook: 16 Research Methods to Maximize Product Success

Top new product development tips

You could come up with an amazing product or service, but without product research, you’ll never know if there’s a market for it. Furthermore, you might price it wrong and/or target the wrong customers, severely limiting (or preventing entirely) your sales.

The good news is that there are a lot of product research tips and product research tools we can share with you:

Research existing products on the market

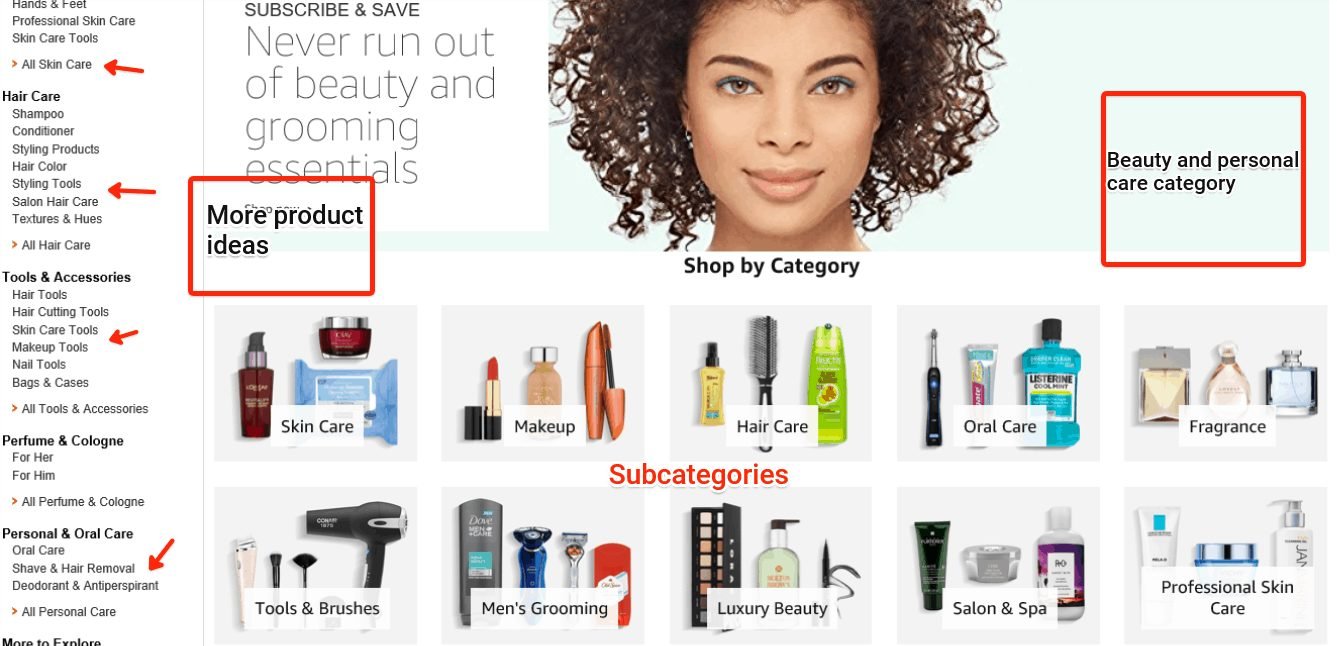

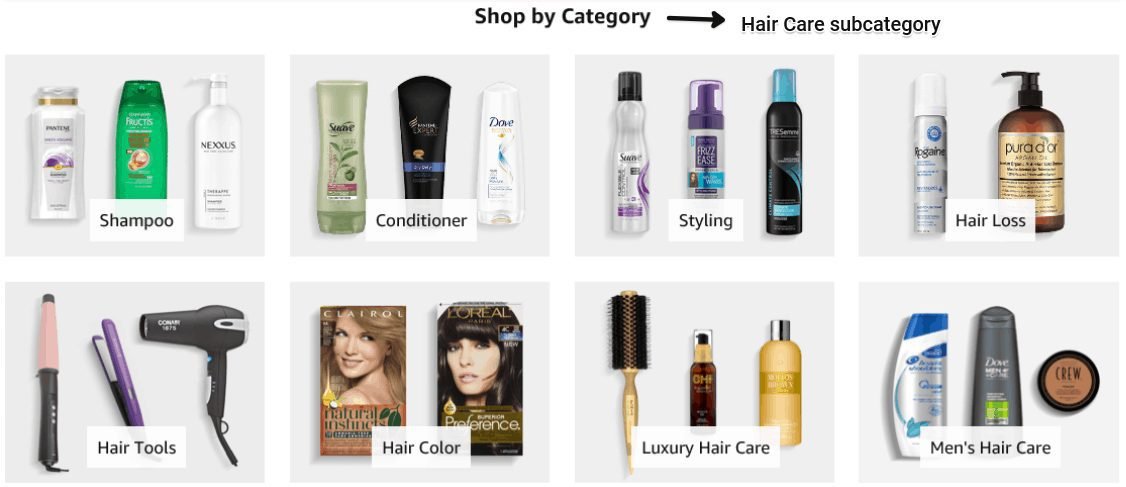

The easiest way to do product research is to examine what products are already available in your marketplace and identify the top-selling products on the market that you’re competing with.

If you’re not already offering this product, you can create your own version, and with the right research, you can identify areas of improvement to differentiate your offering.

Look at product descriptions to see how existing products are being sold and use this to create products that fill a gap.

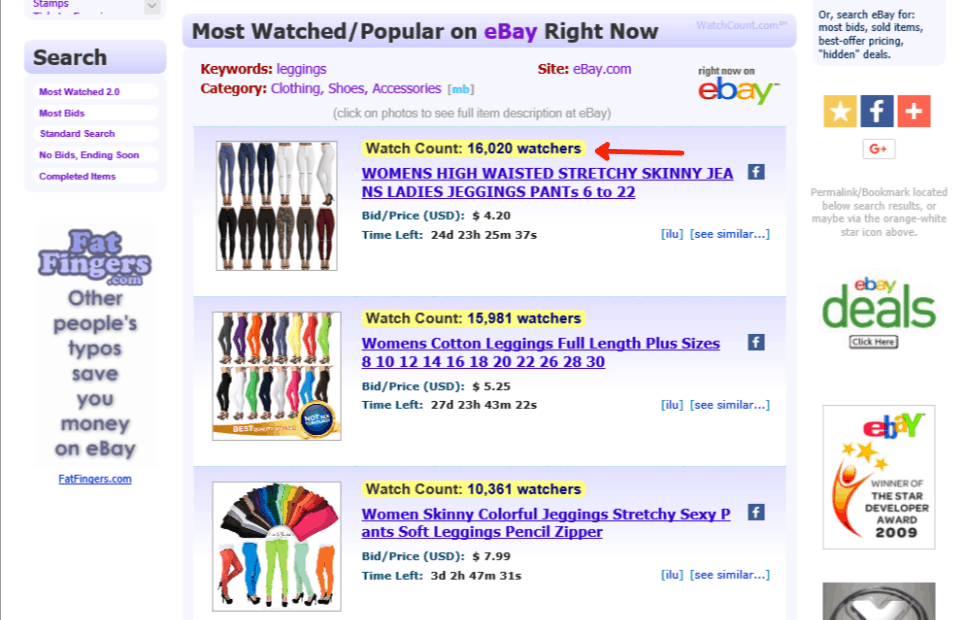

The easiest way to do product research is to get out and act as a customer. Go to popular online marketplaces like eBay and Amazon to see what people are looking at. Get out onto the high street and visit brick and mortar stores to see what product categories are already on the market.

All of the above will help you understand the current landscape and how you can fit in or disrupt it .

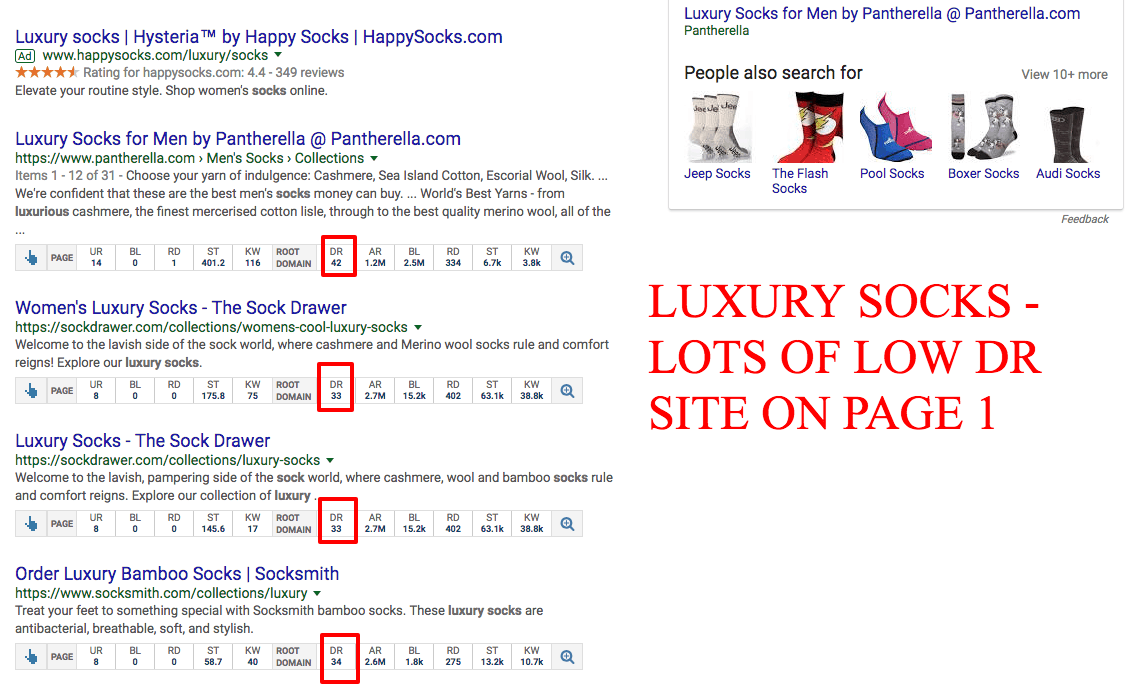

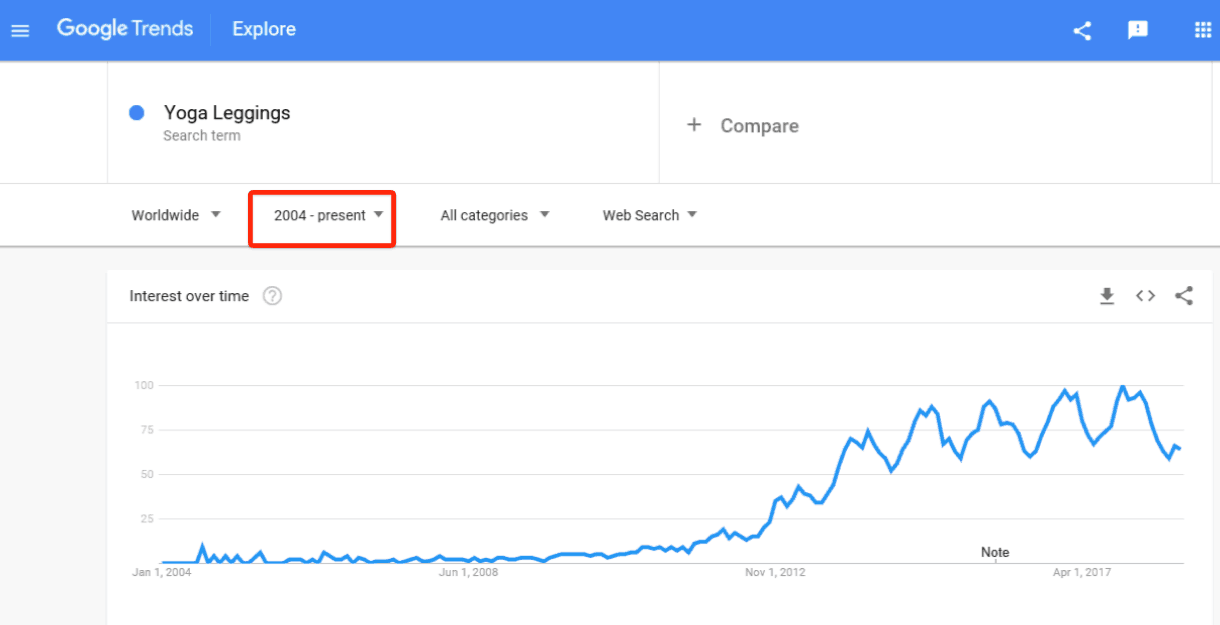

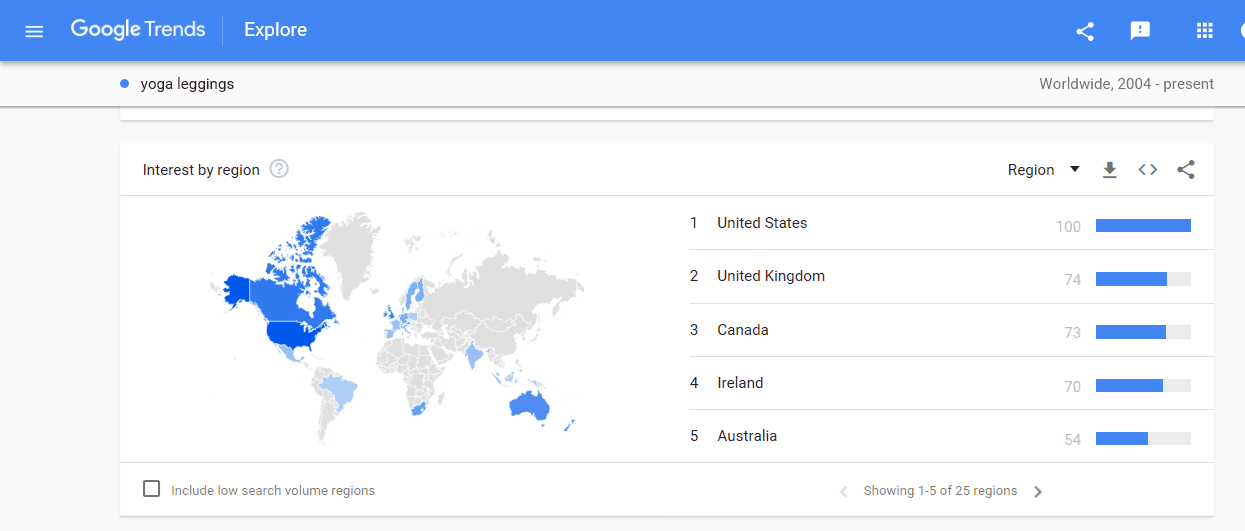

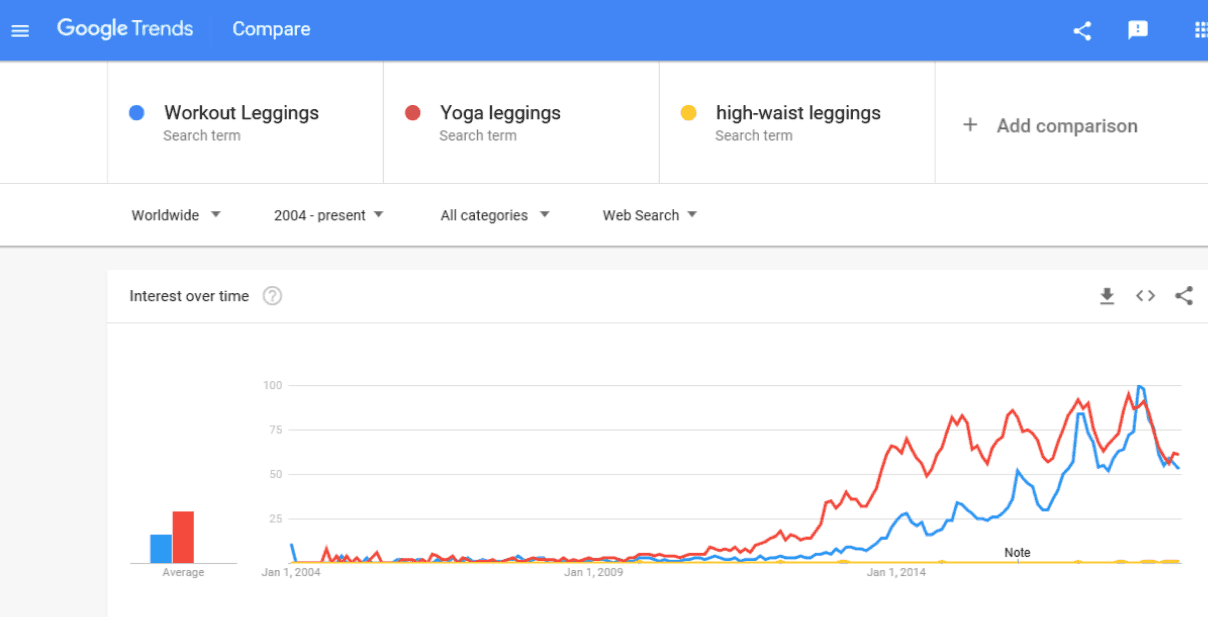

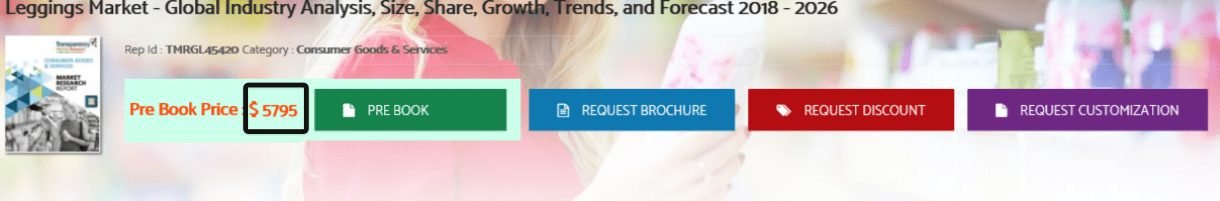

You can also look online at Google Trends and queries for particular products in your marketplace. Understanding these trends and the search volume for a particular keyword related to your products can help with your launch, as well as the optimization of product pages.

These trends can be particularly useful if you’re selling a seasonal product, as you can use real-time search data to see trending products, or changes to your market size when there might be more people looking for your product at certain times of the year.

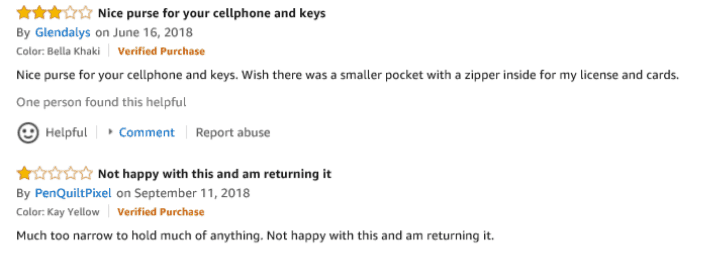

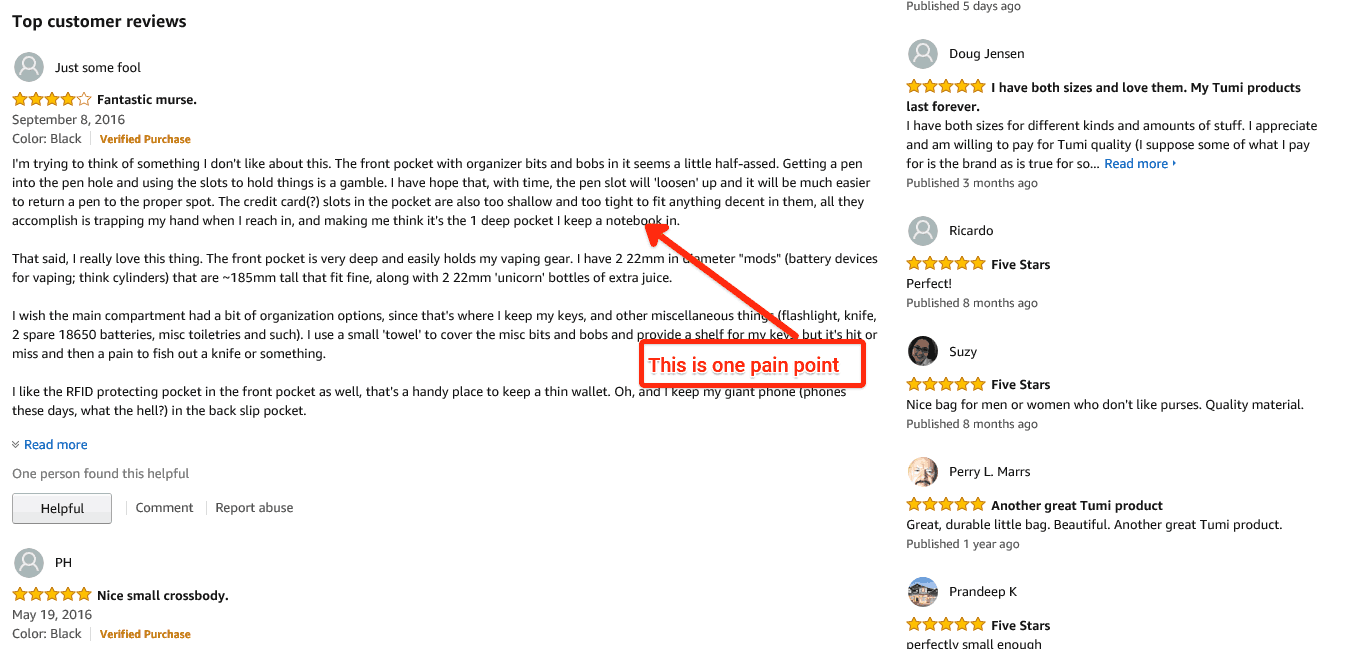

Look at online reviews

The best feedback on products will always come from customers. And the best place to find honest feedback is by looking at online reviews — whether they’re on Google or Amazon.

Especially if you’re an online business, these Amazon and online reviews are a trove of ideas that can help you with your product research.

For example, paying particular attention to poor reviews can help you identify gaps in a competitor’s offering that you can take advantage of.

Identify gaps in the market

You don’t have to reinvent the wheel with your product ideas, often you can simply take an existing product and improve on it.

Online reviews are incredibly useful for product research because customers will typically share their ideas for improvement as part of the submission.

Quantitative product research

Using quantitative research with online polls or product research tools can help you reach a large portion of your potential marketplace in a cost-effective way.

You can use this as a starting point to understand the market as a whole before drilling down into specifics.

Qualitative product research

As well as analyzing the wider market, you should get specific reviews and opinions of your products from customers using qualitative research .

Through focus groups or individual interviews, you can start to understand the sentiment towards your products and identify opportunities to capitalize on.

In the long run, this data can help you to develop new product ideas, especially if you uncover downsides or holes in your product development.

Ongoing product research

While research can help test and optimize your product idea before launch, it shouldn’t stop once the product is on the market.

You should continue to do your research as an ongoing project.

This will give you more information about how your product or service is perceived and can also help you identify ongoing room for improvement for your products to help you make more sales in the future.

Conducting thorough product research is key to more sales

Researching your products can make the difference between success and failure when it comes to launching winning products and having success in the long term.

It should produce a complete picture of your market, product, and customers and will produce the roadmap for your launch and ongoing sales .

Your research will help with everything from product development, to your marketing campaigns, to selling prices and ongoing development.

By doing in-depth research you’ll be able to make better, more informed decisions about your product ideas and help you create and sell more profitable products.

Find success with Qualtrics’ product research tools

By bringing customers into your product development process, you can identify and solve problems while uncovering new opportunities. Today’s digital tools make it easier than ever.

With the right research platform, you can accelerate your product development cycle using real insights from your customers and easily identify gaps in the market. This enables you to launch new, customer-oriented products, services, and solutions, or disrupt existing categories with offerings that have new or improved features.

You can also get instant access to feedback from multiple channels and data sources like Google Search and other search engines and social media sites.

Then, use smart analysis at every step of the product development lifecycle to launch products you know your customers will love. Concept testing enables you to validate every aspect of your offering, from features and branding to messaging and price, to set it up for success. You can also use conjoint analysis to find your customers’ ideal product configurations, e.g. packing, pricing, design and features.

Finally, close the product experience gap, instantly gather real-time feedback that you can use, and automate the process using automated actions.

Start your PX journey today with our free product research survey template

Related resources

Product feature research 10 min read, product analysis 13 min read.

Pricing Research

Product Price Optimization 12 min read

Product presentation 11 min read.

Buyer Personas

Customer Targeting 12 min read

Product Development

Product Development 11 min read

Product concept 12 min read, request demo.

Ready to learn more about Qualtrics?

Product Management

How to do Product Research [Step-by-Step Guide]

Associate Product Marketer at Zeda.io.

Mahima Arora

Created on:

May 15, 2024

Updated on:

14 mins read

![research ideas with product How to do Product Research [Step-by-Step Guide]](https://assets-global.website-files.com/62c41df069f3e62476a3ccbe/62d93a37cae828cd769d38c1_christina-wocintechchat-com-rg1y72eKw6o-unsplash.jpg)

Transform Insights into Impact

Build Products That Drive Revenue and Delight Customers!

An effective and robust product research process increases the chances of product success.

Seth W. Godin, an American author, once said – ‘Don’t find customers for your products, find products for your customers.’

The quote subtly hints at the necessity of product research. By performing product research beforehand, product managers can create the ideal product for customers.

Did you know that 90% of new product research focuses on ‘modifications’ and ‘additions’ rather than new concepts?

But even improving or adding new features to an existing product requires a proper product research process.

Product research enables managers to understand the current and future needs of the users. Thus, based on users’ pain points and what they are looking for, product managers can innovate products of a higher value.

Furthermore, organizations with a strong product research process understand the market better. They stay one step ahead of the competition and survive better in the long run.

Now that you know how important product research is, you must dive into how to do product research right away!

So, let’s begin!

10 Steps to Product Research

There’s no single product research process that fits all the product development teams. But there are certain key steps in the process that product managers must know about.

Here are the 10 essential steps to perform a successful product research process. Follow these steps to derive valuable product insights that will guide your product development decisions.

1. Define your research goals

Why are you performing the research?

Once product managers find an answer to the why, they can set the goals of the research.

Set the high-level goals first. You can set these goals considering the product strategy and vision, ensuring their alignment with business objectives.

Next, create SMART (Specific, Measurable, Attainable, Reliable, and Time-bound) goals for the product development team to focus on during each research stage. This may include;

- Performing market research for product adoption before its release

- Finding out the key areas or features of the product to be improved after the launch

- Assessing the product performance through the product’s lifecycle.

Setting clear, measurable, and time-bound goals for the product research process guides the product team’s actions. It helps them to understand what they need to do. Also, the goals help product managers to measure outcomes and make improvements where necessary.

2. Understand your customer's needs and pain points

An effective product research process is always customer-centric. So, start engaging in user discovery.

Understand user pain points. Start your user research even before planning the product features. Interact with your existing and potential users to identify their needs and wants.

Performing open-ended user research will help product managers to;

- Measure the market demand,

- Get inspiration for the new product

- Determine the product-market fit

- Product positioning against competitors, and

- Increase customer satisfaction.

Since user research is a vital part of the product research process, you can check out the best product discovery questions list .

After the user research, when product teams develop prototypes, they can start trials and ask for user feedback. Next, the insights from feedback can be used to improve the product.

3. Perform competitor and comparative analysis

The next step in the product research process is to know the competition.

- Start with competitive analysis . It involves reviewing the products that are directly similar to yours. For example, if a company sells smartphones, it is directly competing with other companies selling smartphones (like Samsung and Xiaomi).

- Next, perform a comparative analysis . It involves evaluating the alternative options for a product. For instance, an automobile manufacturer can compare the safety features of multiple car models to measure the sales of each and identify the features that require improvement.

Performing the analyses will provide insights that product teams can use to make the product better.

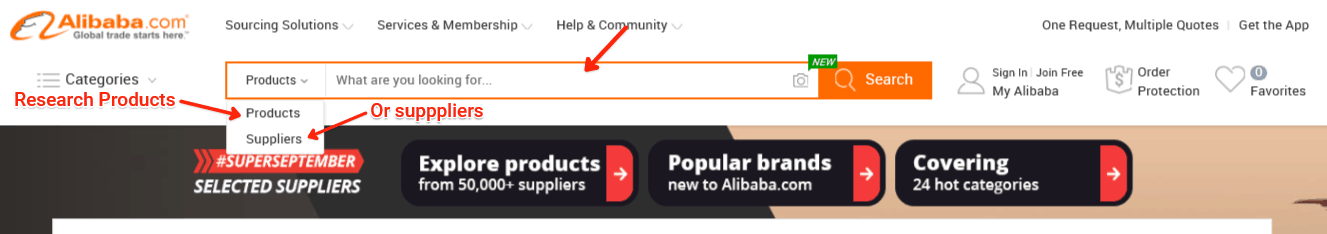

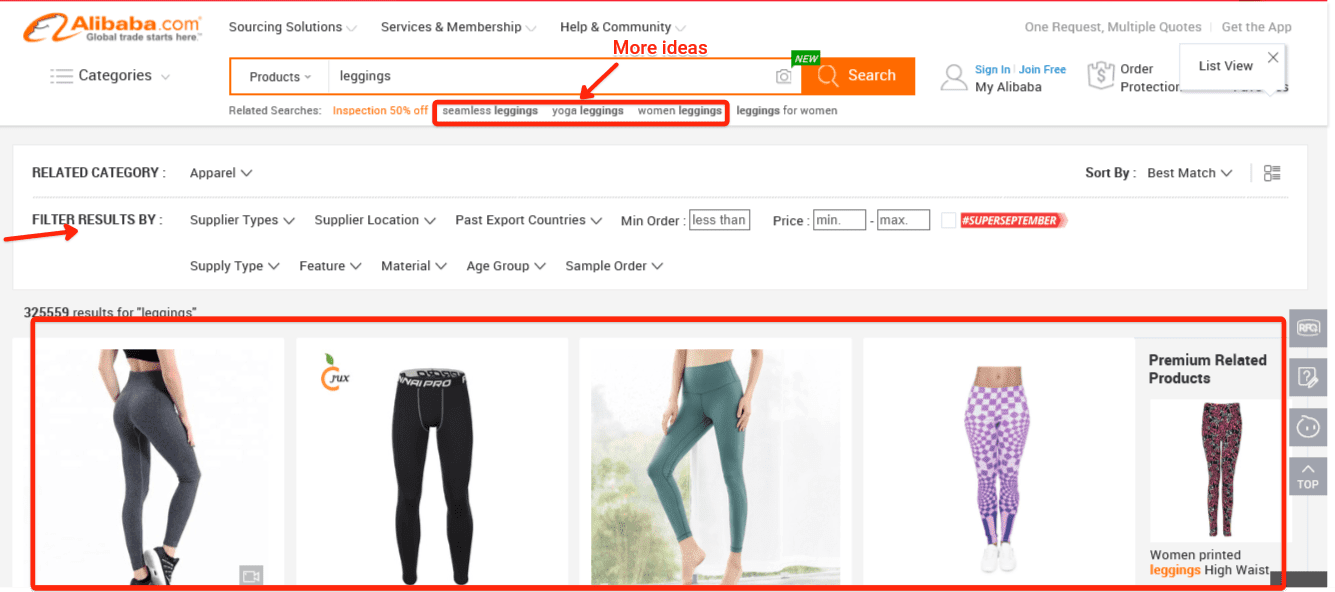

4. Study the market

Besides performing competitive and comparative analyses, product managers must run thorough market research to map the available opportunities.

Here are a few ways to study the market thoroughly;

- Use the historical market records, and research reports by academic institutions, government agencies, and trade associations.

- Observe and analyze the competitors’ strategies like advertising, pricing, and distribution of products.

- Read up on blogs, magazines, social media posts, and other specific content related to your space.

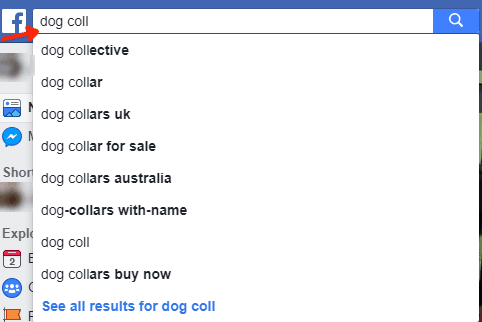

- Run keyword research to understand what your users are looking for. This can help you generate product ideas too.

Once product managers validate a viable market for the product and determine the market saturation, the development teams can focus on the product's USP (Unique Selling Points).

5. Conduct research using qualitative and quantitative methods

Further, product managers can use both qualitative and quantitative methods of market research.

Qualitative methods – The qualitative methods of market research aren’t statistically significant. These methods help product teams to understand the potential customers at a deeper level. Individual interviews, focus groups, observations or follow-me-homes, and interviews with professionals or field experts are a few qualitative methods you can utilize for market research.

Quantitative methods – Quantitative methods include conducting surveys, polls, or sending out questionnaires. Through quantitative methods, product managers study a large enough pool of respondents in their target market to have reasonable confidence in the collected data. For organizations with a limited budget, you can rely on the survey reports of other organizations in the relevant field.

6. Know the industry trends

Stay on top of the industry trends by updating your knowledge regularly. Observe the tech trends that may impact users’ expectations of your product or its viability in the long run.

Engage with the tech cultures – read blogs, news, and magazines, listen to tech podcasts, follow the latest tech updates on social media platforms, forums, etc. Product managers can also use tools like Google Trends, Trend Hunter, etc.

The IT teams in organizations also serve as a key source of tech information. Product managers can interact and take regular updates from them.

The industry trend updates can also help product managers to research future projections, disruptive technologies, and the chances of product category obsolescence. Thus, with these insights, the product teams can create products that are likely to be in demand in the future.

7. Validate product ideas

After thorough research, product teams can test ideas and solutions.

Based on the extensive research data, you can identify the possible products, their key features, or improvisations that can meet the user's needs. Further, you can perform concept testing to examine user experiences with concrete product ideas.

To start testing, identify the key users to test. Get participants for interviews, focus groups, or implement surveys, feedback tools, etc., to test the ideas with the existing users.

Product managers can also ask questions and assess user responses. Or, they may simply explain to the users the product concept using wireframes and mock-ups.

8. Build your product and test the MVP

A crucial step in the product research process and the most conclusive market research that product managers can perform to ensure product success. It is only after a lot of effort that product teams get to the point of testing MVP (Minimal Viable Product).

Testing MVP is all about creating the MVP and trying to sell the product or the product idea to the target audience. Several types of product testing, like card sorting, tree testing, etc., tell whether or not users can navigate your product easily, to find the different functionalities they are looking for.

Further, product managers can run a regression analysis, quality assurance, and performance testing to check the MVP functionalities. Running these tests helps the team to identify the areas where changes are needed.

Multivariate tests and A/B tests are helpful when the user base is split into different groups and each group has different products or product features. These tests help product managers to choose the perfect iteration.

9. Derive findings and insights from the market research data

The market research data is of no use unless you convert them into findings and insights.

Products managers and the product team must analyze the data to find out conclusive outcomes that can support their product decisions.

The team can then start building the final product or improvise the MVP based on the research insights.

10. Use the analysis to guide your product strategy

The final step in the product research process is to convert the research insights into action. Cut through the noise and gather valuable customer-centric insights .

Then, you can use the research to create a strong product roadmap and strategy to guide the entire product development process. When you perform new research, ensure to compare the strategy and roadmap to keep them updated.

Further, the research should also be used to make regular decisions, drive product backlog management , and create the basis for your product storytelling.

7 Tips to Conduct an Effective Product Research

A strategic approach to performing the product research process is essential. But alongside the planned strategy, product managers must consider a few tips or best practices to conduct the product research successfully.

1. Research highly-demanded products

At the initial stage, when you do not have a product concept, get inspired by the products high in demand.

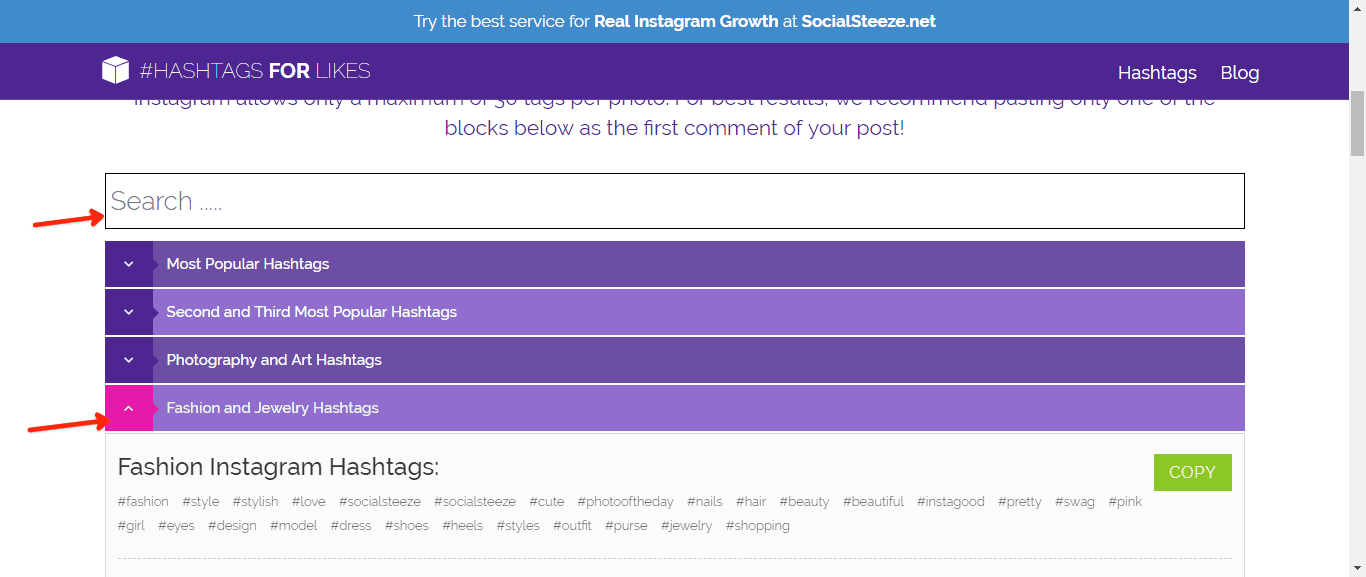

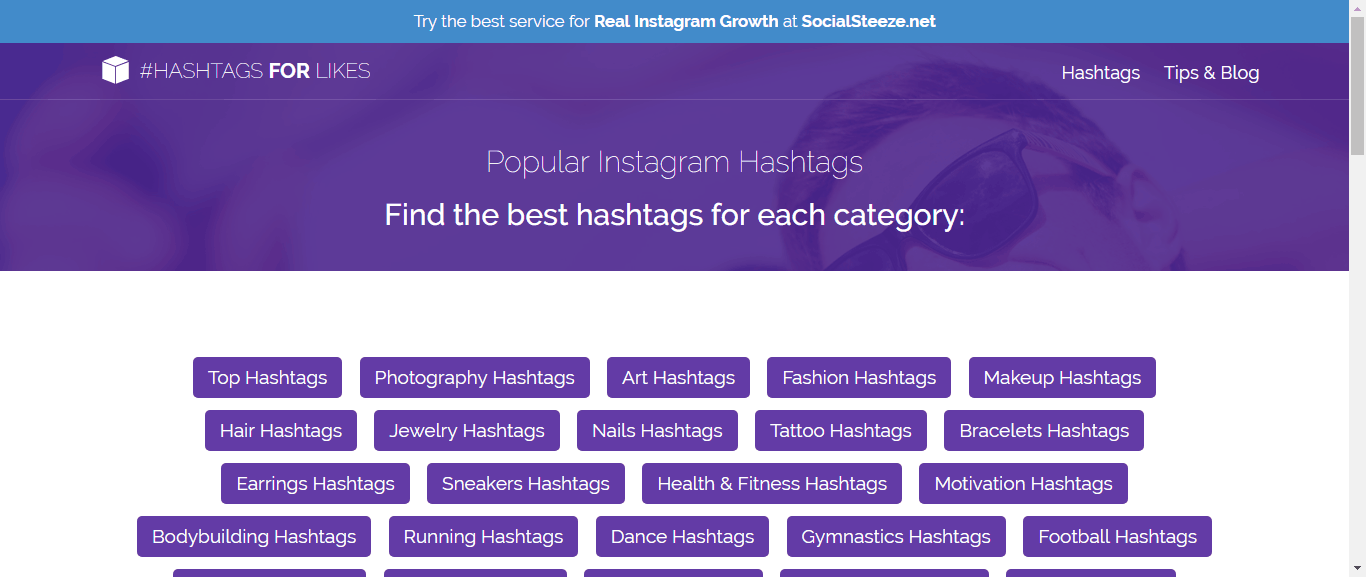

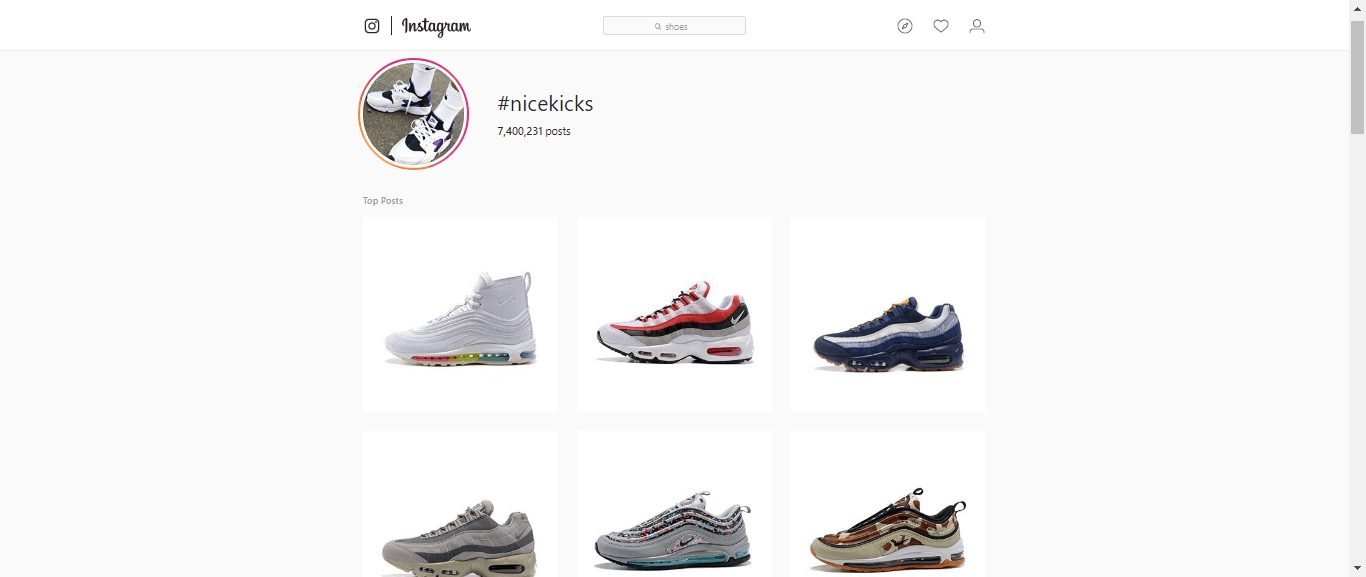

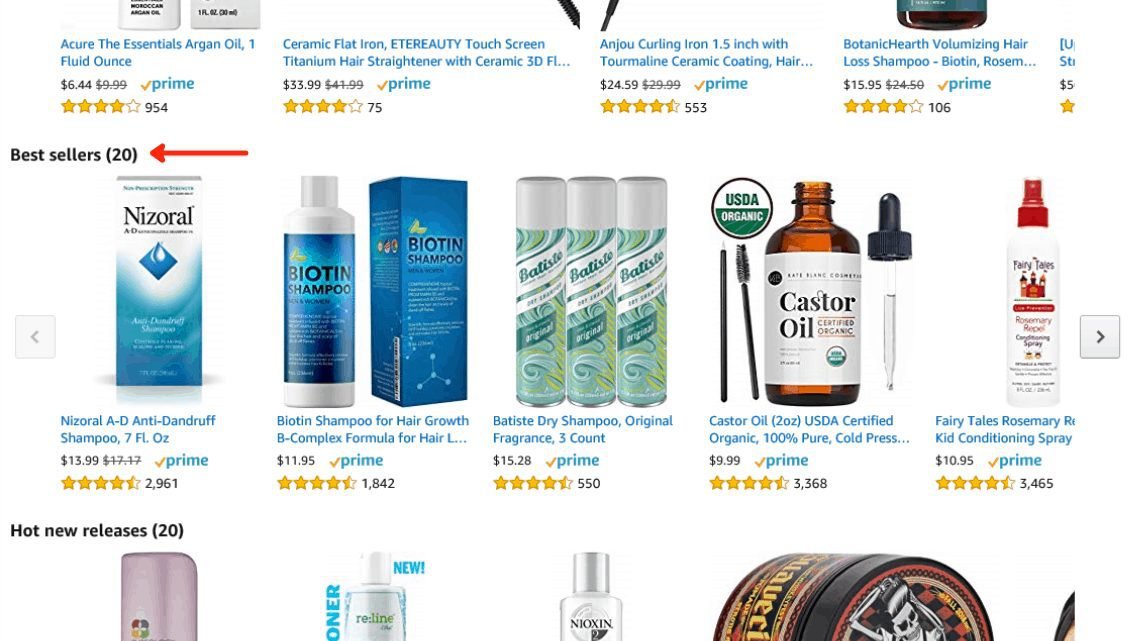

Check out trending hashtags, reviews, comments on review sites, and bestsellers list to find out the most popular products in your space.

Here, the goal is not to imitate the product in demand. It is to keep an open mind, ascertain the demand level, and evaluate if the product idea is awesome or not. The product manager’s goal is to perform an honest evaluation and get back to brainstorming with the collected inspirations.

2. Read about similar products

When performing a competitive analysis, read reviews and case studies on the products.

Product reviews are gold mines. You can find out what users like about the product and what they do not. Reading the reviews carefully can give you a list of the customer pain points.

Similarly, product managers must download or buy case studies from companies that sell similar products. The case studies generally include the product-related challenges and how the company solved them.

Evaluating reviews and case studies allows product managers to think through the potential issues and keep the solutions handy. Also, they can identify the product features that can be made better than that of the competitors.

3. Host a focus group

Evaluate your product by bringing in people who fit your target market. Give them a product profile – what the product will look like, its features, and benefits. Then, ask relevant questions concerning what they like and dislike about the product.

Though focus groups aren’t effective all the time, they can help product managers to get an idea of what people would say about the product.

Providing the focus group with an MVP or prototype works better. The feedback received is more valid and meaningful.

4. Get expert product engineers

Product managers can hire product engineers to get unbiased opinions on the product prototypes.

The experts work on a contractual basis. They evaluate the product design, and features, test prototypes, and ensure quality and usability.

If required, product engineers can also assess the market research, build design ideas, and supervise production.

5. Consider product marketing

Building the product is not the end of the product research process. Not overlooking product marketing is one of the best practices to follow.

Product managers must give equal importance to product positioning and marketing strategy. They can check out the competitors to understand;

- How they promote their products

- Whether or not their marketing strategy is successful

- How to make improvements in the strategy

Further, considering the target market is a must. Try answering questions like;

- Where do they mostly shop?

- What are their interests?

- What are the social media platforms and communication channels mostly used by the target market?

- Where do they discover the products from?

Considering these aspects, the marketing strategies, campaigns, and distribution channels must be planned.

6. Go for a soft launch

A trial or soft launch allows product managers to estimate sales. If the trial results aren’t satisfactory, they can modify the product before spending more on its marketing.

Soft launches need not be expensive. You can create a simple landing page for the product and then run a PPC or Pay per Click campaign to assess the demand.

You can also provide a form that interested users could fill up. Explain the product to those who inquire, maintain communication, and notify them when the product is available.

7. Continue product research

Continue your research even after the product launch . Ask for customer feedback, measure the outcomes of your marketing campaign, and track metrics like repeat purchases, new customers, etc.

Further, track competitors too. Observe their strategies and emerging trends. Also, test new strategies like referral programs or loyalty programs.

Product Research Tools

Building a user-centric product isn’t easy. Product managers must be equipped with the most effective tools. They must take every bit of help available to them.

A product research tool is something that can help the product teams a great deal. It helps in making product management a more organized and structured process. Further, using these tools, product managers can get data-backed user insights and accurate research findings.

Check out the best 5 product research tools you can invest in.

Zeda.io is one of the best product management tools that you must invest in. It is a platform where you can;

- Collect feedback, ideas, and feature requests from customers,

- Analyze the data from a single dashboard, convert them to actionable insights, identify trends

- Plan product roadmaps , create live roadmaps, and share them with teams and customers

- Prioritize product tasks with prioritization frameworks like RICE

- Execute the product development process in collaboration with teams

In a nutshell, Zeda.io is the all-in-one product management software that allows you to build a product seamlessly and in an organized way.

Also Read: Top AI Tools for Product Managers and Product Teams

Zendesk is a tool that helps you maintain interactions with your customers. It is a platform that allows collecting, understanding, and responding to user feedback .

Using Zendesk, product teams can listen to customer issues, develop a response plan, and deliver solutions to address their concerns.

Simply said, Zendesk ensures carrying out regular customer conversations as they are an integral part of the product research process. These customer conversations provide direct insights into customers' thoughts opinions, suggestions, and challenges.

Thus, you can learn from customer feedback and incorporate changes, and better features in the product to ensure an incredible user experience.

3. ProductPlan

In the product research process, the product research eventually converts to a product roadmap. It is the product roadmap that highlights the present and future priorities, workflows, product vision, and product progress.

Once you have come across the research stage, the focus is on building the product roadmap. ProductPlan is the platform you can use to build visual roadmaps. The tool helps in maintaining flexibility, team collaboration, and efficient addressing of issues.

Here’s why you should get ProductPlan in your product research tool stack.

- It is easy to use

- It allows customizing roadmaps with lists, layouts, and timelines

- The drag-and-drop interface helps in tailoring the roadmaps according to one’s needs

- You can collaborate with teams, tag the members, and also comment within the roadmap

Another must-have product management tool, Jira ensures a hassle-free product journey from prototyping to product launch.

Jira is a project management tool that primarily helps with;

- Organizing project tasks

- Managing scrum and agile teams

- Capturing and recording software bugs

With Jira, agile product teams can manage their workflow seamlessly. The tool offers 300+ integrations, is highly customizable, great for managing product issues, and overall effective product management.

5. Proto.io

After you have built a product, you cannot release it directly to the market. User feedback and validation are required. So, instead of building a full-fledged product, you create an MVP or prototype with the basic features for testing the waters first.

This is where Proto.io comes in. Proto.io is one of the leading prototyping tools that help you build a prototype quickly and easily.

- Proto.io has a great interactive drag-and-drop interface that lets you create the prototype to test each product feature or idea based on your research.

- It is user-friendly with integrated icons and easy image management

Thus, Proto.io increases your research efficiency. It helps you to offer customers an amazing product experience resulting in better customer satisfaction.

Also Read: Choosing the Best Product Discovery Tool: Top 5 Picks

Final Thoughts

How to do product research is a common but complex question. Not all organizations use the same way to perform product research. But the product research process does have a few key steps that are crucial for its success.

Throughout the process, just remember that product research is all about user research. The main goal is to understand the users, their needs, and their pain points.

Once product managers implement the user-centric approach, they can build better products – the products that would meet the ever-changing demands of the market. Further, it will increase customer satisfaction and inspire loyalty.

With platforms like Zeda.io , your product research process can get easier. You can seamlessly perform user research using Zeda.io ’s product features like the central dashboard, prioritization framework, building live product roadmap, easy tracking, sharing roadmaps with teams and customers, etc.

Suggested Read: The Product Management Process: 6 Essential Steps

Join Product Café Newsletter!

Sip on the freshest insights in Product Management, UX, and AI — straight to your inbox.