To read this content please select one of the options below:

Please note you do not have access to teaching notes, digital taxation, artificial intelligence and tax administration 3.0: improving tax compliance behavior – a systematic literature review using textometry (2016–2023).

Accounting Research Journal

ISSN : 1030-9616

Article publication date: 12 March 2024

Issue publication date: 1 May 2024

This paper aims to analyze the impact of tax digitalization, focusing on artificial intelligence (AI), machine learning and blockchain technologies, on enhancing tax compliance behavior in various contexts. It seeks to understand how these emerging digital tools influence taxpayer behaviors and compliance levels and to assess their effectiveness in reducing tax evasion and avoidance practices.

Design/methodology/approach

Using a systematic review technique with the Preferred Reporting Items for Systematic Reviews and Meta-Analyses method, this study evaluates 62 papers collected from the Scopus database. The papers were analyzed through textometry of titles, abstracts and keywords to identify prevailing trends and insights.

The review reveals that digitalization, particularly through AI and blockchain, significantly enhances tax compliance and operational efficiency. However, challenges persist, especially in emerging economies, regarding the adoption and integration of these technologies in tax systems. The findings indicate a global trend toward digital Tax Administration 3.0, emphasizing the importance of regulatory frameworks, capacity building and simplification for small and medium enterprises (SMEs).

Practical implications

The findings provide guidance for policymakers and tax administrations, underscoring the necessity of strategic planning, regulatory backing and global cooperation to effectively use digital technologies in tax compliance. Emphasizing the need for tailored support for SMEs, the study also calls for expanded research in less represented areas and specific sectors, such as SMEs and developing economies, to deepen global insights into digital tax compliance.

Originality/value

This study has attempted to fill the gap in the literature on the comprehensive impact of fiscal digitalization, particularly AI-based, on tax compliance across different global contexts, adding to the discourse on digital taxation.

- Digital taxation

- Tax Administration 3.0

- Artificial intelligence

- Tax compliance

- Tax revenues

- Systematic review

Belahouaoui, R. and Attak, E.H. (2024), "Digital taxation, artificial intelligence and Tax Administration 3.0: improving tax compliance behavior – a systematic literature review using textometry (2016–2023)", Accounting Research Journal , Vol. 37 No. 2, pp. 172-191. https://doi.org/10.1108/ARJ-12-2023-0372

Emerald Publishing Limited

Copyright © 2024, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

- Browse All Articles

- Newsletter Sign-Up

- 15 Dec 2020

- Working Paper Summaries

Designing, Not Checking, for Policy Robustness: An Example with Optimal Taxation

The approach used by most economists to check academic research results is flawed for policymaking and evaluation. The authors propose an alternative method for designing economic policy analyses that might be applied to a wide range of economic policies.

- 31 Aug 2020

- Research & Ideas

State and Local Governments Peer Into the Pandemic Abyss

State and local governments that rely heavily on sales tax revenue face an increasing financial burden absent federal aid, says Daniel Green. Open for comment; 0 Comments.

- 12 May 2020

Elusive Safety: The New Geography of Capital Flows and Risk

Examining motives and incentives behind the growing international flows of US-denominated securities, this study finds that dollar-denominated capital flows are increasingly intermediated by tax haven financial centers and nonbank financial institutions.

- 01 Apr 2019

- What Do You Think?

Does Our Bias Against Federal Deficits Need Rethinking?

SUMMING UP. Readers lined up to comment on James Heskett's question on whether federal deficit spending as supported by Modern Monetary Theory is good or evil. Open for comment; 0 Comments.

- 20 Mar 2019

In the Shadows? Informal Enterprise in Non-Democracies

With the informal economy representing a third of the GDP in an average Middle East and North African country, why do chronically indebted regimes tolerate such a large and untaxed shadow economy? Among this study’s findings, higher rates of public sector employment correlate with greater permissibility of firm informality.

- 30 Jan 2019

Understanding Different Approaches to Benefit-Based Taxation

Benefit-based taxation—where taxes align with benefits from state activities—enjoys popular support and an illustrious history, but scholars are confused over how it should work, and confusion breeds neglect. To clear up this confusion and demonstrate its appeal, we provide novel graphical explanations of the main approaches to it and show its general applicability.

- 02 Jul 2018

Corporate Tax Cuts Don't Increase Middle Class Incomes

New research by Ethan Rouen and colleagues suggests that corporate tax cuts contribute to income inequality. Open for comment; 0 Comments.

- 13 May 2018

Corporate Tax Cuts Increase Income Inequality

This paper examines corporate tax reform by estimating the causal effect of state corporate tax cuts on top income inequality. Results suggest that, while corporate tax cuts increase investment, the gains from this investment are concentrated on top earners, who may also exploit additional strategies to increase the share of total income that accrues to the top 1 percent.

- 08 Feb 2018

What’s Missing From the Debate About Trump’s Tax Plan

At the end of the day, tax policy is more about values than dollars. And it's still not too late to have a real discussion over the Trump tax plan, says Matthew Weinzierl. Open for comment; 0 Comments.

- 24 Oct 2017

Tax Reform is on the Front Burner Again. Here’s Why You Should Care

As debate begins around the Republican tax reform proposal, Mihir Desai and Matt Weinzierl discuss the first significant tax legislation in 30 years. Open for comment; 0 Comments.

- 08 Aug 2017

The Role of Taxes in the Disconnect Between Corporate Performance and Economic Growth

This paper offers evidence of potential issues with the current United States system of taxation on foreign corporate profits. A reduction in the US tax rate and the move to a territorial tax system from a worldwide system could better align economic growth with growth in corporate profits by encouraging firms to invest domestically and repatriate foreign earnings.

- 07 Nov 2016

Corporate Tax Strategies Mirror Personal Returns of Top Execs

Top executives who are inclined to reduce personal taxes might also benefit shareholders in their companies, concludes research by Gerardo Pérez Cavazos and Andreya M. Silva. Open for comment; 0 Comments.

- 18 Apr 2016

Popular Acceptance of Morally Arbitrary Luck and Widespread Support for Classical Benefit-Based Taxation

This paper presents survey evidence that the normative views of most Americans appear to include ambivalence toward the egalitarianism that has been so influential in contemporary political philosophy and implicitly adopted by modern optimal tax theory. Insofar as this finding is valid, optimal tax theorists ought to consider capturing this ambivalence in their work, as well.

- 20 Nov 2015

Impact Evaluation Methods in Public Economics: A Brief Introduction to Randomized Evaluations and Comparison with Other Methods

Dina Pomeranz examines the use by public agencies of rigorous impact evaluations to test the effectiveness of citizen efforts.

- 07 May 2014

How Should Wealth Be Redistributed?

SUMMING UP James Heskett's readers weigh in on Thomas Piketty and how wealth disparity is burdening society. Closed for comment; 0 Comments.

- 08 Sep 2009

The Height Tax, and Other New Ways to Think about Taxation

The notion of levying higher taxes on tall people—an idea offered largely tongue in cheek—presents an ideal way to highlight the shortcomings of current tax policy and how to make it better. Harvard Business School professor Matthew C. Weinzierl looks at modern trends in taxation. Key concepts include: Studies show that each inch of height is associated with about a 2 percent higher wage among white males in the United States. If we as a society are uncomfortable taxing height, maybe we should reconsider our comfort level for taxing ability (as currently happens with the progressive income tax). For Weinzierl, the key to explaining the apparent disconnect between theory and intuition starts with the particular goal for tax policy assumed in the standard framework. That goal is to minimize the total sacrifice borne by those who pay taxes. Behind the scenes, important trends are evolving in tax policy. Value-added taxes, for example, are generally seen as efficient by tax economists, but such taxes can bear heavily on the poor if not balanced with other changes to the system. Closed for comment; 0 Comments.

- 02 Mar 2007

What Is the Government’s Role in US Health Care?

Healthcare will grab ever more headlines in the U.S. in the coming months, says Jim Heskett. Any service that is on track to consume 40 percent of the gross national product of the world's largest economy by the year 2050 will be hard to ignore. But are we addressing healthcare cost issues with the creativity they deserve? What do you think? Closed for comment; 0 Comments.

- University home

- For business

- Alumni and supporters

- Our departments

- Visiting us

Tax Administration Research Centre (TARC)

Tarc | tax administration research centre.

Watch the recording of our 24th May workshop 'Household Responses to Direct Stimulus Payments and Other Shocks'

View the recording and presentations

Find out what's happening at TARC in our Winter 2022 newsletter

RCEA Conference on Recent Developments in Economics, Econometrics and Finance - session recordings now available

View the conference presentations and papers

JOTA Special Issue on Taxation of Cryptoassets - Call for Papers

TARC's mission is to deliver outstanding interdisciplinary research in tax administration and policy that addresses the major challenges and strategic priorities confronting policymakers and tax authorities today.

We conduct high quality research with a view to strengthening the theoretical and empirical understanding of the delivery and design of effective tax policies and operations. Our Research uses multiple methodologies, and the research team includes economists, accountants, experimentalists, lawyers, political scientists and psychologists.

- Research at TARC

- TARC Publications

- The Journal of Tax Administration

- IMF/TARC Conference

- Annual Conference

- Masterclasses, Mini-Workshops and Seminars

Optimal Tax Administration

This paper sets out a framework for analyzing optimal interventions by a tax administration, one that parallels and can be closely integrated with established frameworks for thinking about optimal tax policy. At its heart is a summary measure of the impact of administrative interventions—the “enforcement elasticity of tax revenue”—that is a sufficient statistic for the behavioral response to such interventions, much as the elasticity of taxable income serves as a sufficient statistic for the response to tax rates. Amongst the applications are characterizations of the optimal balance between policy and administrative measures, and of the optimal compliance gap.

We thank Anne Brockmeyer, John Creedy, Vitor Gaspar, Norman Gemmell, Christian Gillitzer, Shafik Hebous, Christos Kotsogiannis, Alan Plumley and Mick Thackray for many helpful comments and suggestions, and Will Boning for excellent research assistance. Views and opinions are ours alone, and should not be attributed to the management or Executive Board of the International Monetary Fund, nor to the National Bureau of Economic Research.

MARC RIS BibTeΧ

Download Citation Data

Published Versions

Michael Keen & Joel Slemrod, 2017. " Optimal Tax Administration, " IMF Working Papers, vol 17(8).

More from NBER

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

A Systems View Across Time and Space

- Open access

- Published: 16 February 2021

Factors influencing taxpayers to engage in tax evasion: evidence from Woldia City administration micro, small, and large enterprise taxpayers

- Erstu Tarko Kassa ORCID: orcid.org/0000-0002-8199-4910 1

Journal of Innovation and Entrepreneurship volume 10 , Article number: 8 ( 2021 ) Cite this article

72k Accesses

15 Citations

6 Altmetric

Metrics details

The main purpose of this paper is to investigate factors that influence taxpayers to engage in tax evasion. The researcher used descriptive and explanatory research design and followed a quantitative research approach. To undertake this study, primary and secondary data has been utilized. From the target population of 4979, by using a stratified and simple random sampling technique, 370 respondents were selected. To verify the data quality, the exploratory factor analysis (EFA) was conducted for each variable measurements. After factor analysis has been done, the data were analyzed by using Pearson correlation and multiple regression analysis. The finding of the study revealed that the relationship between the study independent variables with the dependent variable was positive and statistically significant. The regression analysis also indicates that tax fairness, tax knowledge, and moral obligation significantly influence taxpayers to engage in tax evasion, and the remaining moral obligation and subjective norms were not statistically significant to influence taxpayers to engage in tax evasion.

Introduction

In developed and developing countries, business owners, government workers, service providers, and other organizations are forced by the government to pay a tax for a long period in human being history, and no one can escape from the tax of the country. To support this, there is an interesting statement mentioned by Benjamin Franklin “nothing is certain except death and taxes”. This statement confirmed that every citizen should be subjected to the law of tax, and they are obliged to pay the tax from their income. To build large dams, to construct transportation infrastructures, and to provide quality social services for the community, collecting a tax from citizens plays a significant role for the governments (Saxunova and Szarkova, 2018 ).

Tax is the benchmark and turning point of the country’s overall development and changing the livelihoods and enhancing per capital income of the individuals. The gross domestic product of the developed countries and average revenue ratio were 35% in the year 2005, whereas in developing countries the share was 15% and in third world countries also not more than 12% (Mughal, 2012 ).

In the developing world, countries have no system to collect a sufficient amount of tax from their taxpayers. The expected amount of revenue cannot be enhanced due to different reasons. Among the reasons tax operation of the system may not be smooth, tax evasion and lack of awareness creation for the taxpayers are common in the developing world, and citizens are not committed to paying the expected amount of tax for their countries (Fagbemi et al., 2010 ). In today’s world, this remains very much the same as persons now pay taxes to their governments. As the world has evolved, tax compliance has taken a back seat with tax avoidance and tax evasion being at the forefront of the taxpayer’s main objective. Tax avoidance is the use of legal means to reduce one’s tax liability while tax evasion is the use of illegal means to reduce that tax liability (Alleyne & Harris, 2017 ). Tax evasion is a danger to the community; the countries and international organizations have been making an effort to fight undesirable phenomena related to taxation, the tax evasion, or tax fraud (Saxunova and Szarkova, 2018 ).

Tax evasion may brings a devastating loss for the country's GDP at the micro level, and it became a debatable and a special concern for tax collector authorities (Aumeerun et al., 2016 ). The participants in tax evasion activity critized by different individuals and groups by considering the loss that brings to the country economy (Alleyne & Harris, 2017 ).

According to Dalu et al., ( 2012 ) state that in the Zimbabwe tax system there are identical devils tax evasion and tax avoidance that create a problem for the government to collect a tax from taxpayers. Like Zimbabwe, many nations have faced challenges to cover the annual budget and to construct different infrastructures due to the budget deficit created by tax evasion (Alleyne & Harris, 2017 ; Turner, 2010 ).

Scholars especially economists agreed that tax evasion may be considered a technical problem that exists in the tax collection system, whereas psychologists believed that tax evasion is a social problem for the countries (Terzić, 2017 ).

Tax evasion practices are more worsen in developing countries than when we compare against the developed countries. Tax evasion is like a pandemic for the countries because they are unable to control it. Therefore, governments were negatively affected by tax evasion to improve the life standard of its citizens and to allocate a budget for public expenditure, and it became a disease for the country’s economy and estimated to cost 20% of income tax revenue (Ameyaw et al., 2015 ; degl’Innocenti & Rablen, 2019 ; Palil et al., 2016 ).

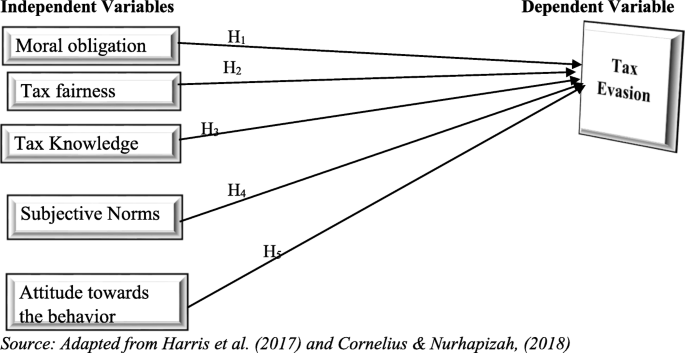

Several factors may lead taxpayers to engage in tax evasion. Among the factors, tax knowledge, tax morale, tax system, tax fairness, compliance cost, attitudes toward the behavior, subjective norms, perceived behavioral control, and moral obligation are major factors (Alleyne & Harris, 2017 ; Rantelangi & Majid, 2018 ). Other factors have also a significant effect on taxpayers to engage in tax evasion practice such as capital intensity, leverage, fiscal loss, compensation, profitability, contextual tax awareness, interest rate, inflation, average tax rate, gender, and ethical tax awareness on tax evasion (Annan et al., 2014 ; AlAdham et al., 2016 ; Putra et al., 2018 ).

According to Woldia City Administration Revenue Office annual report ( 2019/2020 ) from July 1, 2019, to June 30, 2020, 232,757,512 birr was planned to be collected from taxpayers; however, the office was able to collect only 198,537,785.25 birr; however, the remaining 34,219,726.75 birr have not been collected by the office from the taxpayers. The reason behind this was there might be some factors that lead to taxpayers not to pay the annual tax from their annual income. Based on the review of the previous studies and by diagnosing the tax collection system in the city administration, the researcher identified the gaps. The first gap that motivated the researcher to undertake this study is that the prior studies did not address the factors that influence the tax collection system of Ethiopia, specifically, there is no research result that was able to show which factors influence taxpayers to engage in tax evasion in the Woldia city administration. The other gap is the previous study focused on the demographic, economic, social, and other factors. However, this study mainly focused on the behavioral and other factors that lead taxpayers to engage in tax evasion.

To indicate the benefit of this study, the study specifies on which critical factors the authority will focus on to enhance annual revenue and to aware tax payers of the devastating impact of tax evasion. Moreover, the paper may bring new insights on tax evasion influential non-economic factors that the researchers may give more emphasis on the upcoming researches. This paper will also contribute innovative ways to know the reasons why tax payers engage in tax evasion and inform the authority at which factors they will struggle to reduce their influence and to enhance revenue. The study can be an evidence that the tax authority should launch innovative techniques to control tax evasion practices. Moreover, applying fair tax system in the collectors’ side, the enterprises become innovative and will expand their business.

To sum up, in this study, the researcher examined which factor (tax knowledge, tax fairness, subjective norms, moral obligation, and attitude towards the behavior) influences taxpayers to engage in tax evasion activities. Based on the above discussion, the objective of the study is to examine factors that influence taxpayers to engage in tax evasion in Woldia city administration.

Literature review

Tax and tax evasion.

Tax is charged by the government to the business, governmental organization, and individual without any return forwarded from the authority. Tax can be categorized as direct tax which is collected from the profit of the companies and the incomes of individuals, and the other category of tax is an indirect tax collected from consumers’ payment (James and Nobes, 1999 ).

Tax evasion is a word explaining individuals, groups, and companies rejecting the expected amount of payment for the authority. It is a criminal offense on the view of law (Nangih & Dick, 2018 ). The overall procedure of tax collection faced different challenges especially tax evasion the most important one. Tax evasion is done intentionally by taxpayers by avoiding and hiding different documents that become evidence for the tax collection authorities. It is simply an illegal act to pay the true amount of the tax (Aumeerun et al., 2016 ; Storm, 2013 ). Tax evasion is a crime that is able to distort the overall economic, political, and social system of the country. The economic aspect of tax evasion affects fair distribution of wealth for the citizens. The social aspect also creates different social groups motivated by tax evasion discouraged by these individuals due to unfair competition (AlAdham et al., 2016 ). Tax evasion is a mal-activity that reduces the amount of tax paid by the payers. Perhaps the taxpayers who engaged in evasion activity may be supported by the legislative of the country (Kim, 2008 ; Putra et al., 2018 ; Allingham & Sandmo, 1972 ). According to Al Baaj et al. ( 2018 ) argument, there are two types of tax evasions. The first one is the legal evasion or tax avoidance which is supported by the legislation of the countries and the right is given for the taxpayer, but it is not constitutional (Gallemore & Labro, 2015 ; Zucman, 2014 ).

Theoretical reviews on factors affecting tax evasion

The illegal activity done by taxpayers has many determinants that lead them to engage in tax evasion. Among the factors that trigger taxpayers who participate in this activity are the economic factors. Under the economic factors, business sanctions, business stagnation, and the amount of tax burden are considered as influential factors. On the other hand, legal factors, social factors, demographic factors, mental factors, and moral factors are the most important factors (Saxunova and Szarkova, 2018 ). Many factors determine the taxpayers’ interest to engage in tax evasion. Among the factors, the following are considered under this review.

The factors that able to influence taxpayers to engage in tax evasion are moral obligation . It is a principle and a duty of taxpayers by paying a reasonable amount of tax for the tax authorities without the enforcement of others. It is an intrinsic motivation of payers paying the tax (Sadjiarto et al., 2020 ). When taxpayers have low tax morals, they will become negligent to pay their allotted tax, and they will engage in tax evasion (Alm & Torgler, 2006 ; Frey & Oberholzer-Gee, 1997 ; Torgler et al., 2008 ). According to Feld and Frey ( 2007 ), when tax officials are responsible and provide respect in their duties toward taxpayers, tax morale or the honesty of taxpayers will increase. Tax morals may be affected by a demographic and another factor like income level, marital status, and religion (Rantelangi & Majid, 2018 ). It is the determinant behavior of tax payers whether they participate or not. Tax morals can affect positively taxpayers to engage in tax evasion (Nangih & Dick, 2018 ; Terzić, 2017 ). It is known that taxes levied by the concerned authority are ethical. As cited by Ozili ( 2020 ), McGee ( 2006 ) argues that there are three basic views on the ethics and moral of tax evasion. The first view is tax evasion is unethical and should not be practice by any payer, the second argument deals that the state is illegal and has no moral authority to take anything from anyone, and the last argument is tax evasion can be ethical under some conditions and unethical under other situations; therefore, the decision to evade tax is an ethical dilemma which considers several factors (Robert, 2012 ). Therefore, the discussion leads to the following hypothesis:

H 1 . Moral obligation has a negative influence on taxpayers to engage in tax evasion.

The other factor that influences taxpayers to engage in tax evasion is tax fairness . Tax fairness is a non-economic factor that determines the tax collection of the country (Alkhatib et al., 2019 ). It is known that the tax collection procedures, principles, and implementation must be fair. Unethical behavior may happen due to the unfairness of the tax collection process. The fairness of tax may influence payers positively to pay the tax. When the tax rate is not reasonable and fair, the payers will regret to engage in the tax evasion practices and they will inform authorities their annual income without denying the exact amount. Considering the ability of paying or acceptable tax rates helps to maintain the fairness of the taxation system (Rantelangi & Majid, 2018 ). The governments choose to levy in what amounts and on whom will pay a high tax rate (Thu, 2017 ). The tax rate is a factor that induces taxpayers to pay less amount from their income. The rate of tax should be fair and reasonable for the payers (Ozili, 2020 ). As cited by Gandhi et al. ( 1995 ) the Allingham and Sandmo’s model, Allingham and Sandmo ( 1972 ) shows that the tax rate on payment can be positive, zero, or negative, which implies that an increase in the tax rate may cause the tax payment to increase, remain the same, or decrease. The theoretical literature could not evidence the claim that an increase in the tax rate will lead to an increase in tax evasion (Gandhi et al., 1995 ). The fairness of tax is controversial and argumentative because there may not happen a similar amount of tax for all payers (Abera, 2019 ). Thus, based on this ground the study hypothesis would be:

H 2 . Tax fairness has a positive influence on taxpayers to engage in tax evasion.

Tax knowledge is vital for taxpayers to know the cause and effect brought to them to engage in tax evasion. If tax payers are well informed about tax evasion, their participation in tax evasion would be infrequent; the reverse is true for a taxpayer who is not well informed. Tax-related information should give more emphasis to enhance the knowledge of taxpayers and experts of the authority (Poudel, 2017 ). Tax knowledge is a means to enhance the revenue of the country from the side of tax payers (Sadjiarto et al., 2020 ). If the authorities cascade different training for taxpayers about tax evasion and other tax-related issues, taxpayers become reluctant to engage in tax evasion (Rantelangi & Majid, 2018 ). Tax knowledge is a determinant factor for the taxpayer to engage and retain from the tax evasion activities (Abera, 2019 ). When taxpayers are undertaking their routine tasks without tax knowledge, they may involve in certain risks that expose them to engage in tax evasion (Thu, 2017 ). Thus, the discussion leads to the following hypothesis:

H 3 . Tax knowledge has a negative influence on taxpayers engaged in tax evasion.

The stakeholders, government experts, families, individuals, groups, and peers influence taxpayers whether they engaged in tax evasion or not (Alleyne & Harris, 2017 ). As cited by Alkhatib et al. ( 2019 ), the influence of peer groups on tax taxpayers is high, thus affecting the taxpayers’ preferences, personal values, and behaviors to engage in tax evasion (Puspitasari & Meiranto, 2014 ). The stakeholders around the taxpayers might be motivators to push taxpayers in the criminal act of tax evasion. This act called subjective norms meant that the payers are influenced by peers and other stakeholders. When the tax payer is reluctant to pay a tax for the authority, his/her friends are more likely to hide tax. As cited by Abera ( 2019 ), there is a strong relationship between social norms and subjective norms with tax evasion and affects the small business taxpayers (Nabaweesi, 2009 ). The above discussion can support the following hypothesis of the study:

H 4 . Subjective norms have a positive influence on taxpayers to engage in tax evasion.

The other factor that influences taxpayers to engage in tax evasion is an attitude towards the behavior of taxpayers. Attitude is a means of evaluating the activities whether they are positive or negative of any object. Many studies have been done by different scholars by defining and identifying the relationship between the attitudes of taxpayers with tax evasion (Alleyne & Harris, 2017 ). If the attitude of taxpayers towards taxation is negative, they will be reluctant to pay their obligation to the authority; the reverse is true when taxpayers have positive attitudes towards taxation (Abera, 2019 ). Based on the above discussion, the hypothesis of the study would be as follows:

H 5 . Tax payers’ attitude towards the behavior has a positive influence on taxpayers to engage in tax evasion.

Conceptual framework of the study

The researcher identified the variables and presented the relationship between independent and dependent variables as follows (Fig. 1 ):

Conceptual framework of the study. Adapted from Alleyne and Harris ( 2017 ) and Rantelangi and Majid ( 2018 )

Materials and methods

The researcher applied descriptive and explanatory research design to carry out this study. The explanatory research design enables the researcher to show the cause and effect relationship between independent and dependent variables, and the descriptive research also helps to describe the event as it is. The quantitative approach has been followed by the researcher to analyze and interpret the numerical data collected from the respondents. The researcher used primary and secondary data. The primary data was collected from the respondents by using questionnaires, and the secondary data was also collected from the reports, websites, and other sources.

The target population of the study was 4979 taxpayers (micro, small, and large enterprises). From the total taxpayers, 377 are categorized under level “A,” 207 are under level “B,” and the remaining 4395 taxpayers are categorized under level “C”. From the target population by using a stratified sampling technique, the respondents have been selected. The target population has been divided by the level of taxpayers; after dividing the population by level, the researcher applied a simple random sampling technique to select respondents. To identify the target participants or sample size in this study, the researcher used Yamane’s ( 1967 ) formula. Hence, the formula is described as follows:

where N = target population, n = sample size, e = error term

Based on the sample size, the respondents have participated proportionally as follows from each level. The total population was divided by strata based on the level categorized by the authorities. By using a simple random sampling technique, 28 respondents were from level “A,” 15 respondents from level “B,” and 327 respondents from level “C” have participated.

Regarding data collection instruments , the data was collected by self-administered standardized questionnaires. The variable of the study a moral obligation was measured by 4 items; after conducting factor analysis, the fourth variable or questionnaire has been removed and after that correlation and regression analysis has been done for 3 items; the value of Cronbach’s alpha was .711; the other factor attitude towards the behavior was measured by 4 items with a value of .804 Cronbach’s alpha; the third variable subjective norms was also measured by 4 items; the value of Cronbach’s Alpha was .887, and tax evasion was measured by 5 items; the Cronbach’s alpha value was .868. For the above-listed variables, the questionnaires were adapted from Alleyne and Harris ( 2017 ), and the remaining variable tax fairness was measured by 7 items, the Cronbach’s alpha value was .905, the items were adapted from Benk et al. ( 2012 ), and the last variable tax knowledge was measured by 5 items. However, after conducting factor analysis, the fifth item has been removed due to low value of the variable. After the removal of the fifth item, the Cronbach’s alpha value for the remaining items was .800, the items were adapted from Poudel ( 2017 ). For all variables, the researcher has used a five-point Likert scale from strongly agree to strongly disagree.

To analyze the collected data, the researcher used descriptive statistics analysis, factor analysis, correlation analysis, and multiple regression analysis to know the result of variables by using SPSS Version 22. Moreover, the model of the study is described as follows:

where Y = tax evasion, X 1 = moral obligation, X 2 = tax fairness, X 3 = tax knowledge, X 4 = subjective norms, and X 5 = attitude towards the behavior, β = beta coefficient, B 0 = constant, e = other factors not included in the study (0.05 random error).

Results and discussion

Level of respondents.

As indicated in Table 1 from the total respondents, 88.4% are categorized under level “C,” 4.1% are leveled under “B,” and the remaining 7.6% of respondents have been categorized under level “A”.

Factor analysis of the study variables

To undertake exploratory factor analysis, the data should fulfill the following assumptions. The first assumption is the variables should be ratio, interval, and ordinal; the second one is within the variables there should be linear associations; the third assumption is a simple size should range from 100 to 500; and the last assumption is the data without outliers. Thus, this study data have been checked by the researcher whether the data meets the assumption or not. After checking the assumptions, factor analysis was conducted as follows.

KMO and Bartlett’s test

Conducting KMO and Bartlett’s test is a precondition to conduct the factor analysis of the study measuring variables. KMO measures the adequacy of the sample of the study. In the result reported in Table 2 , the value was 0.883 and enough for the factor analysis. Related with Bartlett test as shown in Table 2 , the value is 5727.623 ( p < 0.001), which reveals the adequacy of data using factor analysis.

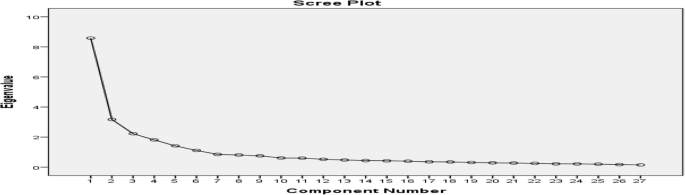

As shown in Table 3 , factors were extracted from study data; there was a linear relationship between variables. From the table, we can understand that 6 variables have more than one eigenvalue. The first factor scored the value 31.782 of the variance, the second value is 11.739 of the variance, the third factor scored 8.246 of the variance, the fourth factor accounts for 6.725 of the variance, the fifth factor also accounts for 5.233, and the last factor scored 4.123 of the variance. All six factors were explained cumulatively by 67.85% of the variance.

As shown in the Fig. 2 , the scree plot starts to turn down slowly at the low eigenvalue which is less than 1. The six factors eigenvalue is greater than one.

Scree plot. Source: own survey (2020)

The pattern matrix is shown in Table 4 which is able to show the loading of each variable and the relationship of variables in the study. The highest value among the factors measured the variable considerably. The cutoff point of loading was set at .35 and above. Based on the loading cutoff point except two factors, all are significant and analyzed under this study. From the six variables (five independent and one dependent) incorporated under this study, the identified factors show that how significantly enough to measure the situation. These factors have scored greater than 1 eigenvalue and able to explain 67.85% of the variance. In general, the detail variables and their factor are described as follows:

The first component tax fairness has 7 factors; the eigenvalue is 8.58 and able to explain 31.78 of the total variance. In this component, the highest contributed factor was item TF3 (weight = .925), TF5 (weight = .865), TF1 (weight = .859), TF2 (weight = .778), TF4 (.668), TF6 (weight = .614), and TF7 (weight = .568). The second component was tax evasion and has 5 items; the eigenvalue is 3.17 and explaining 11.73 of the variance. The factor weight of the items, TE4 (factor weight = .860), TE5 (factor weight = .810), TE3 (factor weight = .730), TE2 (factor weight = .650), and the last one is TE1 (factor weight = .606). The third component was subjective norms; it has 4 factors the weight of each factor described as follows. The first item SNS1 weight = .898, SNS2 factor weight = .887, SNS4 factor weight = .846, and SNS3 factor weight = .820. Moreover, the eigenvalue of this component is 2.226 and explained 8.246 of the variance of the study. The fourth component is an attitude towards the behavior. This variable has four factors that have 1.816 eigenvalue and explained 6.725 of the total variance. Among the items, ATB2 factor weight = .863, ATB1 factor weight = .792, ATB3 factor weight = .791 and the last factor is ATB4 factor weight = .500. The fifth component of the study is tax knowledge; at the very beginning of this variable, the researcher adapted five items. However, one item (TK5) was not significant and removed from this analysis. In this component, the highest value was scored by TK3 (factor weight = .866), the second highest TK2 (factor weight = .801), the third highest factor weight (weight = .700), and the last factor is TK4 (weight = .690). The eigenvalue of this component was 1.413 and explained 5.233% of the variance. The last component is a moral obligation; like tax knowledge, the researcher adapted for this variable 4 items, though, one item (MO4) was not significant and removed from the items list. The eigenvalue of this component was 1.113 and explained 4.123 of the variance. From the items, MO1 scored the highest factor weight of .891, the second highest weight in this component was MO3 with a factor weight of .854, and the third highest factor weight was scored by MO3 with a value of .508.

Association analysis of the study variables

To analyze the correlation between variables as shown in the Table 5 , the relation between subjective norms with taxpayers engaged in tax evasion is r = 0.240 ( p < 0.05); this indicates that there is a statistically significant relationship between the two variables. The relationship between ATB with TE, MO with TE, TK with TE, and TF with TE, the Pearson correlation result is r = 0.318 ( p < 0.05), r = 0.371 ( p < 0.05), .446, and r = 0.691 ( p < 0.05) respectively and statistically significant. It implies that the independent variables have a positive relationship with the dependent variable of the study with a statistically significant level of p < 0.05 and n = 370.

Effect analysis of the study variables

As shown in Table 6 , the study independent variables (SNS, ATB, MO, TK, and TF) explained the study dependent variable (TE) by 54.9%. This result indicates that there are other variables that explain the dependent variable by 45.1% which has not been investigated under this study.

Hypothesis test

The proposed hypothesis of the study has been tested based on the coefficient of regression and the “ p ” value of the study variables. The detail result is described as follows:

As shown in Table 7 , moral obligation influences positively the taxpayers to engage in tax evasion activities with a beta value of .177 and p < .05. This result entails that the taxpayers are influenced by other stakeholders to engage in tax evasion, and they have low moral value to pay the tax levied by the government. This result is supported by the finding of Alleyne and Harris ( 2017 ), Rantelangi and Majid ( 2018 ), and Sadjiarto et al. ( 2020 ). Thus, the hypothesis related to this variable has been rejected because moral obligation influences positively taxpayers to engage in tax evasion.

H 2 . Tax fairness has a positive influence on taxpayers to engage in tax evasion

To minimize the participation of taxpayers engaged in tax evasion, tax fairness plays a significant role. The regression result indicates in Table 7 that tax fairness positively influences the taxpayers to engage in tax evasion. This result is similar to the finding of Majid et al., ( 2017 ) and contradicts with the finding of Rantelangi and Majid ( 2018 ) and Alkhatib et al. ( 2019 ). Accordingly, the proposed hypothesis has been accepted because the beta value is .563 and the p value is less than .05.

H 3 . Tax knowledge has a negative influence on taxpayers to engage in tax evasion

Table 7 shows that tax knowledge influences the taxpayers positively to engaged in tax evasion. The beta value is .183 and the value is p = 0.00. It is known that when the taxpayers were not well informed about the importance of tax for the country development and the devastating issues of tax evasion, they will be forced to engage in tax evasion. This finding contradicts the finding of Rantelangi and Majid ( 2018 ) and is supported by the finding of AlAdham et al. ( 2016 ). To conclude, the proposed hypothesis rejected because tax knowledge positively influenced the taxpayers to engage in tax evasion.

H 4 . Subjective norms have a positive influence on taxpayers engaged in tax evasion

Table 7 indicates that subjective norms have not been significantly influenced positively by the taxpayers engaged in tax evasion, which means taxpayers were not influenced by others to participate in tax evasion activities. This result is consistent with the finding of Alleyne and Harris ( 2017 ). Thus, the proposed hypothesis is rejected because the variable of subjective norms was not statistically significant with a p value of .099.

H 5 . Tax payers’ attitude towards the behavior has a positive influence on taxpayers to engage in tax evasion

As indicated in Table 7 , attitudes toward the behavior were not significantly influencing the taxpayers to participate in tax evasion with the p value of .985. However, according to the study conducted by Alleyne and Harris ( 2017 ), attitude toward the behavior significantly predicts the intentions of taxpayers to engage in tax evasion. This finding contradicts with this study result. To conclude, the proposed hypothesis has been rejected because the variable is not statistically significantly influencing the taxpayers to engage in tax evasion activities.

According to Table 7 through the examination of coefficients, moral obligation had a positive effect on tax evasion having a coefficient of .197. This means that a 1% change in moral obligation keeping the other things remain constant can result to motivate taxpayers to engage in tax evasion by 19.7% in the same direction. This finding is similar to the result of Alleyne and Harris ( 2017 ), Nangih and Dick ( 2018 ), Rantelangi and Majid ( 2018 ), and Sadjiarto et al. ( 2020 ). Tax knowledge had a positive effect on tax evasion having a coefficient of .174. This indicates that a 1% change in tax knowledge keeping the other things constant can result in a change in taxpayers to engage in tax evasion by 17.4% in the same direction. This finding contradicts the finding of Rantelangi and Majid ( 2018 ) and is similar to the finding of AlAdham et al. ( 2016 ) and Thu ( 2017 ). Tax fairness also had a positive effect on tax evasion having a coefficient of .468. This implies that a 1% change in tax fairness keeping the other things remain constant can result in a change in taxpayers engage in tax evasion by .468% in the same direction. This result is similar to the finding of Majid et al. ( 2017 ) and contradicts the finding of Alkhatib et al. ( 2019 ) and Rantelangi and Majid ( 2018 ). Thus, the final model of the study would be:

Tax evasion = .623 + .197MO + .174TK + .468TF

To generalize, the standardized beta coefficient indicates that tax fairness highly affects taxpayers to engage in tax evasion by 56.3%, tax knowledge affects secondly taxpayers to engage in tax evasion by 18.3%, and moral obligation affects taxpayers to engage in tax evasion by 17.7%. The remaining variables subjective norms and attitude towards the behavior were not statistically significant.

Conclusion and recommendations

Every citizen of the country was subjected to pay the tax of the country levied by the authority that administered the revenue. However, the taxpayer may be reluctant to pay a tax based on their revenue. There are push factors that instigate payers to engage in tax evasion. Sometimes the payers may be convinced themselves that being engaged in tax evasion is ethical, others may consider it unethical. They may argue “I Do Not Receive Benefits, Therefore I Do Not Have to Pay” (Robert, 2012 ). This study tried to examine the factors that influence taxpayers to engage in tax evasion by identifying five factors namely moral obligation , tax fairness , tax knowledge , subjective norms , and taxpayers’ attitude towards the behavior . The study findings based on the result analysis described as follows.

The correlation analysis of the study shows that there was a positive and statistically significant relationship between independent variables with the dependent variable (tax evasion). The regression result, on the other hand, revealed that tax knowledge affects taxpayers to participate in tax evasion activities with a statistically significant level. This finding can be evidence that the knowledge of the taxpayers regarding the importance of tax is limited. Because according to the regression result, they engaged in the tax evasion activities in the study area. The other factor that affects taxpayers to engage in tax evasion is tax fairness. The regression result of tax fairness supported that taxpayers have been affected by the fairness of the tax system in the study area to participate in tax evasion. The finding confirms that the tax charged by the government is not fair for payers. Thus, we can conclude that due to the absence of tax fairness taxpayers are engaged in tax evasion in the city administration. The other variable moral obligation regression result confirms that moral obligation affects positively taxpayers to engage in tax evasion. This is signal that taxpayers did not know the moral value of retaining from tax evasion that is why the moral obligation results in positive and statistical significance. Generally, tax fairness highly affects taxpayers to evade taxes, tax knowledge affects secondly, and moral obligation affected tax payers thirdly to evade tax in the city administration.

Based on the findings, the following recommendations have been forwarded by the researcher. The first one is creating a fair tax payment system, or charging fair tax for the payers helps to reduce the participation of payers in tax evasion. The second recommendation is cascading different training related to tax will help taxpayers to pay a tax based on their annual income. The last recommendation is related to tax moral or moral obligation. The moral is an abounding rule for human beings to know the right and wrong activities. The authority is better to strive to recognize the payers about the moral obligations of the payers and better to inform to the payers to think about the shattering effect of tax evasion for the country development and city as well.

Further future lines of research will attempt to:

Investigate the employees’ side of tax authority and the perception of the community towards tax evasion.

Explore other influencing factors that affect tax payers to engage in tax evasion which are not incorporated under this study.

Conducting a comparative study on one city, region, and country with others.

Suggestion for future study

This study addresses only one city administration in Amhara region; other researchers are better to undertake the study on one more cities.

Availability of data and materials

All data are included in the manuscript and available on hand too.

Abbreviations

Attitude towards the behavior

- Moral obligation

Micro and small enterprises

Subjective norms

- Tax evasion

- Tax fairness

- Tax knowledge

Abera, A. A. (2019). Factors affecting presumptive tax collection in Ethiopia: Evidence from category “C” taxpayers in Bahir Dar City. Journal of Tax Administration , 5 (2), 74–96.

Google Scholar

Al Baaj, Q. M. A., Al Marshedi, A. A. S., & Al-Laban, D. A. A. (2018). The impact of electronic taxation on reducing tax evasion methods of Iraqi companies listed in the Iraqi stock exchange. Academy of Accounting and Financial Studies Journal , 22 (4) Retrieved from: www.abacademies.org/articles/ .

AlAdham, M. A. A., Abukhadijeh, M. A., & Qasem, M. F. (2016). Tax evasion and tax awareness evidence from Jordan. International Business Research , 9 (12) https://doi.org/10.5539/ibr.v9n12p65 .

Alkhatib, A. A., Abdul-Jabbar, H., Abuamria, F., & Rahhal, A. (2019). The effects of social influence factors on income tax evasion among the Palestinian SMEs. International Journal of Advanced Science and Technology , 28 (17), 690–700.

Alleyne, P., & Harris, T. (2017). Antecedents of taxpayers’ intentions to engage in tax evasion: Evidence from Barbados. Journal of Financial Reporting and Accounting (Emerald Publishing Limited) , 15 (1), 2–21 https://doi.org/10.1108/JFRA-12-2015-0107 .

Article Google Scholar

Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: a theoretical analysis. Journal of Public Economics , 1 (3-4), 323–338.

Alm, J., & Torgler, B. (2006). Culture differences and tax morale in the United States and in Europe. Journal of Economic Psychology , 27 (2), 224–246.

Ameyaw, B., Addai, B., Ashalley, E., & Quaye, I. (2015). The effects of personal income tax evasion on socio-economic development in Ghana: A case study of the informal sector. British Journal of Economics, Management & Trade (Sciencedomain international) , 10 (4), 1–14 https://doi.org/10.9734/BJEMT/2015/19267 .

Annan, B., Bekoe, W., & Nketiah-Amponsah, E. (2014). Determinants of Tax Evasion in Ghana: 1970-2010. International Journal of Economic Sciences and Applied Research , 6 ( 3 ), 97 – 121 .

Aumeerun, B., Jugurnath, & Soondrum, H. (2016). Tax evasion: Empirical evidence from sub-Saharan Africa. Journal of Accounting and Taxation (Academic Journals) , 8 (7), 70–80 https://doi.org/10.5897/JAT2016.022 .

Benk, S., Budak, T., & Cakmak, A. F. (2012). Tax professionals’ perceptions of tax fairness: Survey evidence in Turkey. International Journal of Business and Social Science , 3 (2) Centre for Promoting Ideas, USA.

Dalu, T., Maposa, V. G., Pabwaungana, S., & Dalu, T. (2012). The impact of tax evasion and avoidance on the economy: a case of Harare, Zimbabwe. African Journal Economic and Sustainable Development , 1 (3), 284–296.

degl’Innocenti, D. G., & Rablen, M. D. (2019). Tax evasion on a social network. Journal of Economic Behavior and Organization (Elsevier B.V) , 79–91 https://doi.org/10.1016/j.jebo.2019.11.001 .

Fagbemi, T. O., Uadiale, O. M., & Noah, A. O. (2010). The ethics of tax evasion: Perceptual evidence from Nigeria. European Journal of Social Sciences , 17 ( 3 ).

Feld, L. P., & Frey, B. S. (2007). Tax Compliance as the Result of a Psychological Tax Contract: The Role of Incentives and Responsive Regulation. Law & Policy , 29 (1), 102–120.

Frey, B. S., & Oberholzer-Gee, F. (1997). The Cost of Price Incentives: An Empirical Analysis of Motivation Crowding- Out. The American Economic Review , 87 (4), 746–755.

Gallemore, J., & Labro, E. (2015). The importance of the internal information environment for tax avoidance. Journal of Accounting and Economics , 60 (1), 149–167.

Gandhi, V. P., Edrill, L. P., Mackenzie, G. A., Manas-Anton, L. A., Modi, J. R., Richupan, S., … Shome, P. (1995). Supply-side tax policy: Its relevance to developing countries . International Monteray Fund.

James, S. R., & Nobes, C. (1999). The Economics of Taxation: Principles, Policy, and Practice , (vol. 7). Financal Times Management.

Kim, S. (2008). Does political intention affect tax evasion? Journal of Policy Modeling , 30 (3), 401–415.

Majid, N., Rantelangi, C., & Iskandar (2017). Tax evasion: Is it ethical or unethical? (based on Samarinda taxpayers’ perception). In Mulawarman international conference on economics and business (MICEB 2017) , (pp. 13–18). Atlantis Press http://creativecommons.org/licenses/by-nc/4.0/ .

McGee, R. W. (2006). Three views on the ethics of tax evasion. Journal of Business Ethics , 67 (1), 15–35.

Mughal, M. M. (2012). Reasons of Tax Avoidance and Tax Evasion: Reflections from Pakistan. Journal of Economics and Behavioral Studies , 4 (4), 217–222.

Nabaweesi, J. (2009). Social norms and tax compliance among small business enterprises in Uganda (Master’s thesis) . Retrieved from http://makir.mak.ac.ug/handle/10570/2525

Nangih, E., & Dick, N. (2018). An empirical review of the determinants of tax evasion in Nigeria: Emphasis on the informal sector operators in Port Harcourt Metropolis. Journal of Accounting and Financial Management , 4 (3) http://www.iiardpub.org/ .

Ozili, P. K. (2020). Tax evasion and financial instability. Journal of Financial Crime. Emerald Publishing Limited , 27 (2), 531–539 https://doi.org/10.1108/JFC-04-2019-0051 .

Palil, M. R., Malek, M. M., & Jaguli, A. R. (2016). Issues, challenges and problems with tax evasion: The institutional factors approach. Gadjah Mada International Journal of Busines , 18 (2), 187–206.

Poudel, R. L. (2017). Tax knowledge among university teachers in Pokhara. The Journal of Nepalese Bussiness Studies , 10 ( 1 ).

Puspitasari, E., & Meiranto, W. (2014). Motivational postures in tax compliance decisions: An experimental studies. International Journal of Business, Economics and Law , 5 (1), 100–110.

Putra, P. D., Syah, D. H., & Sriwedari, T. (2018). Tax avoidance: Evidence of as a proof of agency theory and tax planning. International Journal of Research and Review , 5 (9), 2454–2223.

Rantelangi, C., & Majid, N. (2018). Factors that influence the taxpayers’ perception on the tax evasion. In Advances in economics, business and management research (AEBMR) , (p. 35). Atlantis Press.

Robert, W. M. G. (2012). The ethics of tax evasion; perspectives in theory and practice . North Miami: Springer Science+Business Media https://doi.org/10.1007/978-1-4614-1287-8 .

Sadjiarto, A., Susanto, A. N., Yuniar, E., & Hartanto, M. G. (2020). Factors affecting perception of tax evasion among Chindos. In Advances in economics, business and management research:23rd Asian Forum of Business Education(AFBE 2019),144 , (pp. 487–493). Atlantis Press SARL.

Saxunova, D., & Szarkova, R. (2018). Global Efforts of Tax Authorities and Tax Evasion Challenge. Journal of Eastern Europe Research in Business and Economics , 2018 , 1–14.

Storm, A. (2013). Establishing The Link Between Money Laundering And Tax Evasion. International Business & Economics Research Journal (IBER) , 12 (11), 1437.

Terzić, S. (2017). Model for determining subjective and objective factors of tax evasion. Notitia - Journal for Economic, Business and Social Issues, Notitia Ltd. , 1 (3), 49–62.

Thu, H. N. (2017). Determinants to tax evasion behavior in Vietnam. Journal of Management and Sustainability Canadian Center of Science and Education. https://doi.org/10.5539/jms.v7n4p123 .

Torgler, B., Demir, I. C., Macintyre, A., & Schaffner, M. (2008). Causes and Consequences of Tax Morale: An Empirical Investigation. Economic Analysis and Policy , 38 (2), 313–339.

Turner, Sean C. (2010). Essays on Crime and Tax Evasion . Dissertation, Georgia State University, 2010. https://scholarworks.gsu.edu/econ_diss/64

Woldia City Administration Revenue Office (2019/2020). 2012E.C annual report. Woldia .

Yamane, T. (1967). Statistics: An Introductory Analysis , (2nd ed., ). New York: Harper and Row.

Zucman, G. (2014). Taxing accross borders: Tracking personal wealth and corporate profits. The Journal of Economic Perspectives , 28 (4), 121–148.

Download references

Acknowledgements

I am grateful to all anonymous reviewers, my respondents, and Woldia City administration revenue office experts sharing the required information.

The author has not received a fund from any organization.

Author information

Authors and affiliations.

Woldia University, Woldia, Ethiopia

Erstu Tarko Kassa

You can also search for this author in PubMed Google Scholar

Contributions

The research was done independently. I have carried out the whole work of the study. The author read and approved the final manuscript.

Corresponding author

Correspondence to Erstu Tarko Kassa .

Ethics declarations

Competing interests.

The author declares that there are no competing interest.

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Kassa, E.T. Factors influencing taxpayers to engage in tax evasion: evidence from Woldia City administration micro, small, and large enterprise taxpayers. J Innov Entrep 10 , 8 (2021). https://doi.org/10.1186/s13731-020-00142-4

Download citation

Received : 01 October 2020

Accepted : 09 December 2020

Published : 16 February 2021

DOI : https://doi.org/10.1186/s13731-020-00142-4

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

An official website of the United States Government

- Kreyòl ayisyen

- Search Toggle search Search Include Historical Content - Any - No Include Historical Content - Any - No Search

- Menu Toggle menu

- INFORMATION FOR…

- Individuals

- Business & Self Employed

- Charities and Nonprofits

- International Taxpayers

- Federal State and Local Governments

- Indian Tribal Governments

- Tax Exempt Bonds

- FILING FOR INDIVIDUALS

- How to File

- When to File

- Where to File

- Update Your Information

- Get Your Tax Record

- Apply for an Employer ID Number (EIN)

- Check Your Amended Return Status

- Get an Identity Protection PIN (IP PIN)

- File Your Taxes for Free

- Bank Account (Direct Pay)

- Payment Plan (Installment Agreement)

- Electronic Federal Tax Payment System (EFTPS)

- Your Online Account

- Tax Withholding Estimator

- Estimated Taxes

- Where's My Refund

- What to Expect

- Direct Deposit

- Reduced Refunds

- Amend Return

Credits & Deductions

- INFORMATION FOR...

- Businesses & Self-Employed

- Earned Income Credit (EITC)

- Child Tax Credit

- Clean Energy and Vehicle Credits

- Standard Deduction

- Retirement Plans

Forms & Instructions

- POPULAR FORMS & INSTRUCTIONS

- Form 1040 Instructions

- Form 4506-T

- POPULAR FOR TAX PROS

- Form 1040-X

- Circular 230

13th Annual IRS-TPC Joint Research Conference on Tax Administration

More in our agency.

- IRS Organization

- A Closer Look

- Financial and Budget Reports

- Statistics of Income Bulletins

- Projections Publications

- Corporation Complete Reports

- Corporation Source Books

- Corporation Income Tax Returns Line Item Estimates

- Partnership Returns Line Item Estimates

- Individual Complete Reports

- Individual Income Tax Returns Line Item Estimates

- Compendium of Studies of Tax-Exempt Organizations

- Program Documentation Data Items by Forms and Schedules

- IRS Research Conference and Bulletins

- Statistics of Income Publications Archive

- Historical Data Tables

- Statistics of Income Working Papers

- Upcoming Data Releases

- Individual Tax Statistics

- Business Tax Statistics

- Charitable and Exempt Organizations Statistics

- Estate, Gift and Trust Statistics

- IRS Data Book

- IRS Operations and Budget

- Taxpayer Research and IRS Data

- About Statistics of Income (SOI)

- Do Business with the IRS

- Criminal Investigation

- Whistleblower Office

- Freedom of Information Act

- Privacy Policy

- Civil Rights

- Vulnerability Disclosure Policy

Thursday, June 22, 2023, 8:35 a.m. – 4:45 p.m.

Brookings Institution 1775 Massachusetts Ave, NW Washington, DC, 20036

The Internal Revenue Service and the Urban-Brookings Tax Policy Center co-sponsored their 13th annual tax administration research conference this year. It was held on June 22, 2023, at the Brookings Institution in Washington, DC. For more information about IRS research conferences, including previous conference programs and papers, see IRS Research Conference for links to previous conferences.

13th Annual IRS-TPC Joint Research Conference on Tax Administration Presentations PDF

8:35 a.m. – 8:45 a.m. – Opening

Wendy Edelberg* (Director of the Hamilton Project, Brookings Institution)

Eric Toder* (Institute Fellow, Urban-Brookings Tax Policy Center)

Barry Johnson* (Deputy Chief Data and Analytics Officer, Research, Applied Analytics and Statistics (IRS))

8:45 a.m. – 10:40 a.m. – Session 1: Service is Our Surname

Moderator: Deena Ackerman* (U.S. Department of The Treasury)

Jan Millard* (IRS, RAAS); Sarah Smolenski, Jonah Flateman, Jamil Mirabito, Omar Faruqi, Lauren Szczerbinski, Michael Stavrianos (ASR Analytics)

Howard Rasey* , Shannon Murphy, Frank Greco, Javier Framinan (IRS, W&I); Angela Colona, Javier Alvarez (IRS, Taxpayer Experience Office)

Elaine Maag, Nikhita Airi* , Lillian Hunter (Urban-Brookings Tax Policy Center)

Thomas Hertz* (IRS, RAAS)

Discussants:

- Janet Holtzblatt* (Urban-Brookings Tax Policy Center)

- Emily Y. Lin* (U.S. Department of the Treasury)

10:40 a.m. - 10:55 a.m. – Break

11:55 a.m. - 12:25 p.m. – session 2: estimating audit aftershocks.

Moderator: John Guyton* (IRS, RAAS)

Allan Partington* , Murat Besnek (Australian Taxation Office)

- The Long-Term Impact of Audits on Nonfiling Taxpayers India Lindsay* , Jess Grana (MITRE); Alan Plumley (IRS, RAAS)

Alan Plumley* , Daniel Rodriguez (IRS, RAAS); Jess Grana, Alexander McGlothlin (MITRE)

Discussant:

William Boning* (U.S. Department of the Treasury)

12:25 p.m. – 1:25 p.m. – Keynote Speaker/Lunch

Catherine Rampell* (Washington Post)

1:25 p.m. – 2:55 p.m. – Session 3: Understanding Contemporary Taxpayers

Moderator: Russell James* (IRS, RAAS)

Emily Y. Lin* , Navodhya Samarakoon (U.S. Department of the Treasury)

Andrea Lopez-Luzuriaga (Universidad del Rosario); Carlos Scartascini* (Inter-American Development Bank)

Jeffrey L. Hoopes (University of North Carolina at Chapel Hill); Tyler S. Menzer* , Jaron H. Wilde (University of Iowa)

Discussant:

Yan Sun* (IRS, RAAS)

2:55 p.m. - 3:10 p.m. – Break

3:10 p.m. - 4:40 p.m. – Session 4: Hidden Assets, Hidden Networks

Moderator: Robert McClelland* (Urban-Brookings Tax Policy Center)

Tomas Wind* , David Bratt, Alissa Graff, Anne Herlache (IRS, RAAS)

Chris Hess, Joshua King* , Ashley Nowicki, Andrew Soto, Getaneh Yismaw, Ririko Horvath (IRS, RAAS); Brandon Gleason (IRS, Criminal Investigation); Jacob Brooks, Daniel Hales, Michael Stavrianos, Will Sundstrom (ASR Analytics)

Niels Johannesen (University of Copenhagen); Daniel Reck* (University of Maryland); Max Risch (Carnegie Mellon University); Joel Slemrod (University of Michigan); John Guyton, Patrick Langetieg (IRS, RAAS)

Discussant:

Paul Organ* (U.S. Department of the Treasury)

4:40 p.m. - 4:45 p.m. – Wrap-up

Barry Johnson* (Deputy Chief Data and Analytics Officer, Research, Applied Analytics, and Statistics (IRS))

* Bolded names indicate presenters.

For more information about IRS research conferences, including previous conference programs and papers:

- IRS Research Conference

- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

50+ Focused Taxation Research Topics For Your Dissertation

Published by Ellie Cross at December 29th, 2022 , Revised On May 2, 2024

A thorough understanding of taxation involves drawing from multiple sources to understand its goals, strategies, techniques, standards, applications, and many types. Tax dissertations require extensive research across a variety of areas and sources to reach a conclusive result. It is important to understand and present tax dissertation themes well since they deal with technical matters.

Choosing the right topic in the area of taxation can assist students in understanding how much insight and knowledge they can contribute and the tools they will need to authenticate their study.

If you are not sure what to write about, here are a few top taxation dissertation topics to inspire you .

The Most Pertinent Taxation Topics & Ideas

- The effects of tax evasion and avoidance on and the supporting data

- How does budgeting affect the management of tertiary institutions?

- How does intellectual capital affect the development and growth of huge companies, using Microsoft and Apple as examples?

- The importance and function of audit committees in South Africa and China: similarities and disparities

- How taxation can aid in closing the fiscal gap in the UK economy’s budget

- A UK study comparing modern taxation and the zakat system

- Is it appropriate to hold the UK government accountable for subpar services even after paying taxes?

- Taxation’s effects on both large and small businesses

- The impact of foreign currencies on the nation’s economy and labour market and their detrimental effects on the country’s tax burden

- A paper explaining the importance of accounting in the tax department

- To contribute to the crucial growth of the nation, do a thorough study on enhancing tax benefits among American residents

- A thorough comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- According to the most recent academic study on tax law, what essential improvements are needed to implement tax laws in the UK?

- A thorough investigation of Australian tax department employees’ active role in assisting residents of all Commonwealth states to pay their taxes on time.

- Why establishing a taxation system is essential for a country’s growth

- What is the tax system’s greatest benefit to the poor?

- Is it legitimate to lower the income tax so that more people begin paying it?

- What is the most significant investment made using tax revenue by the government?

- Is it feasible for the government to create diverse social welfare policies without having the people pay the appropriate taxes?

- How tax avoidance by people leads to an imbalance in the government budget

- What should deter people from trying to avoid paying taxes on time?

- Workers of the tax department’s role in facilitating tax evasion through corruption

- Investigate the changes that should be made to the current taxation system. A case study based on the most recent UK tax studies

- Examine the variables that affect the amount of income tax UK people are required to pay

- An analysis of the effects of intellectual capital on the expansion and development of large businesses and multinationals. An Apple case study

- A comparison of the administration and policy of taxes in industrialised and emerging economies

- A detailed examination of the background and purposes of international tax treaties. How successful were they?

- An examination of the effects of taxation on small and medium-sized enterprises compared to giant corporations

- An examination of the effects of tax avoidance and evasion. An analysis of the worldwide Panama crisis and how tax fraud was carried out through offshore firms

- A critical analysis of how the administration of higher institutions is impacted by small business budgeting

- Recognising the importance of foreign currency in a nation’s economy. How can foreign exchange and remittances help a nation’s finances?

- An exploration of the best ways tax professionals may persuade customers to pay their taxes on time

- An investigation of the potential impact of tax and accounting education on the achievement of the nation’s leaders

- How the state might expand its revenue base by focusing on new taxing areas. Gaining knowledge of the digital content creation and freelance industries

- An evaluation of the negative impacts of income tax reduction. Will it prompt more people to begin paying taxes?

- A critical examination of the state’s use of tax revenue for human rights spending. A UK case study

- A review of the impact of income tax on new and small enterprises. Weighing the benefits and drawbacks

- A comprehensive study of managing costs so that money may flow into the national budget without interruption. A study of Norway as an example

- An overview of how effective taxes may contribute to a nation’s development of a welfare state. A study of Denmark as an example

- What are the existing problems that prevent the government systems from using the tax money they receive effectively and completely?

- What are people’s opinions of those who frequently avoid paying taxes?

- Explain the part tax officials play in facilitating tax fraud by accepting small bribes

- How do taxes finance the growth and financial assistance of the underprivileged in the UK?

- Is it appropriate to criticise the government for not providing adequate services when people and businesses fail to pay their taxes?

- A comprehensive comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- A critical evaluation of the regulatory organisations was conducted to determine the tax percentage on different income groups in the UK.

- An investigation into tax evasion: How do wealthy, influential people influence the entire system?

- To contribute to the crucial growth of the nation, conduct a thorough investigation of enhancing tax benefits among British nationals.

- An assessment of the available research on the most effective ways to manage and maintain an uninterrupted flow of funds for a better economy.

- The effect and limitations of bilateral and multilateral tax treaties in addressing double taxation and preventing tax evasion.

- Assess solutions: OECD/G20 Base Erosion and Profit Shifting (BEPS) project and explore the implications for multinational corporations.

- The Impact of Tax cuts in Obtaining Social, monetary, and Aesthetic Ends That Benefit the Community.

- Exploring the Effect of Section 1031 of the Tax Code During Transactions on Investors and Business People.

- Investigating the role of environmental taxes and incentives in addressing global environmental challenges.

- Evaluating the impact of increased transparency on multinational enterprises and global efforts to combat tax evasion and illicit financial flows.

- Exploring the health and financial effects of a proposed policy to increase the excise tax on cigarettes.

Hire an Expert Writer

Orders completed by our expert writers are

- Formally drafted in an academic style

- Free Amendments and 100% Plagiarism Free – or your money back!

- 100% Confidential and Timely Delivery!

- Free anti-plagiarism report

- Appreciated by thousands of clients. Check client reviews

We hope that you will be able to write a first-class dissertation or thesis on one of the issues identified above at your own pace and submit a solid draft. If you wish to use any of the above taxation dissertation topics directly, you may do so. Many people, however, prefer tailor-made topics that meet their specific needs. If you need help with topics or a taxation dissertation, you can also use our dissertation writing services . Place your order now !

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find taxation dissertation topics.

To find taxation dissertation topics:

- Study recent tax reforms.

- Analyse cross-border tax issues.

- Explore digital taxation challenges.

- Investigate tax evasion or avoidance.

- Examine environmental tax policies.

- Select a topic aligned with law, economics, or business interests.

You May Also Like

Business psychology improves job satisfaction and motivates employees to perform better. In simple terms, it is the study of how people and groups interact to maximize their productivity.

Nurses provide daily clinical care based on evidence-based practice. They improve patient health outcomes by using evidence-based practice nursing. Take a look at why you should consider a career as an EBP nurse to contribute to the healthcare industry.

Feminist dissertation topics focus on the people who believe that women should have equal chances and rights as men. Feminism is a historical, social, and political movement founded by women to achieve gender equality and remove injustice.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

China and Tax Administration Revelations: book review by Mick Moore

Published on 24 May 2024

Professorial Fellow

I have come to expect that good research into how China’s government organisations actually function is likely to tell us that:

Compared to the rest of the world, many things are organised differently in China.

Chinese arrangements often work quite well, such that the non-Chinese world could usefully examine them – not so much for direct lessons as for the stimulus that comes from seeing differently.

But the official Chinese narratives tend to conceal the ways in which these organisations work, and obscure the reasons for their effectiveness.

We can rarely learn much from China by listening to the official line. Good research, well communicated, is key.

Wei Cui’s book The Administrative Foundations of the Chinese Fiscal State (Cambridge University Press, 2022) meets those expectations – brilliantly.

Thank you, Martin Hearson , for drawing my attention to it!

Wei Cui’s book combines extensive empirical research and intellectual breadth

How can any individual have both the opportunity and licence to do extensive empirical research on Chinese tax data and policy and the intellectual breadth to frame the conclusions in terms of grand contrasts between China and ‘the West’ (especially the US), and, to some extent, ‘developing countries’?

Following education at Harvard, Tufts, Yale and New York University, Wei Cui first practiced law in New York and then moved to Beijing for seven years. There he taught and practiced law and advised Chinese government organisations on tax. He now teaches at the University of British Columbia . He thus has extensive experience of two very different tax systems. While in China, he seems to have eagerly exploited whatever research opportunities came his way.