- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Trainee Accountant Cover Letter Example

Writing a cover letter as a trainee accountant can be an exciting yet challenging task. From crafting an engaging introduction, to highlighting your most relevant qualifications and experiences, it’s important to make sure your cover letter is well-written and stands out from the competition. This guide provides key tips and an example of a trainee accountant cover letter, to help you create the perfect cover letter that will get you noticed.

If you didn’t find what you were looking for, be sure to check out our complete library of cover letter examples .

Start building your dream career today!

Create your professional cover letter in just 5 minutes with our easy-to-use cover letter builder!

Trainee Accountant Cover Letter Sample

Dear [Hiring Manager],

I am writing to apply for the position of Trainee Accountant at [Company Name]. I am a highly organized and detail- oriented individual with a passion for numbers and working with data.

I recently graduated from [University Name] with a Bachelor’s Degree in Accounting and have acquired a professional accounting designation. I have had two internships and a part- time job in an accounting department which have provided me with experience preparing financial statements, auditing, and analyzing financial data. I am also proficient in using popular accounting software such as Sage and QuickBooks.

I believe I have the necessary skills and experience to make a positive contribution to [Company Name]. My ability to process large amounts of data quickly and accurately will be an asset to the team. I am also confident that my strong problem- solving skills and natural aptitude for organization will help me succeed in this role.

I am a motivated and hardworking individual who will go above and beyond for every task I am given. I have a strong sense of teamwork and collaboration, which I believe will be beneficial in this role. I am excited to learn more about the position and believe I could be a great asset to your company.

I am confident that my qualifications and experience make me an excellent candidate for this position. I have enclosed my resume and I look forward to speaking with you soon.

Sincerely, [Your Name]

Create My Cover Letter

Build a profession cover letter in just minutes for free.

Looking to improve your resume? Our resume examples with writing guide and tips offers extensive assistance.

What should a Trainee Accountant cover letter include?

A cover letter is an important component of any job application; it introduces the applicant to the potential employer and provides a brief summary of their qualifications for the role. As a Trainee Accountant, your cover letter should include the following key points:

- An introduction that explains why you are the ideal candidate for the position and why you are interested in the Trainee Accountant role.

- A summary of your relevant qualifications and experience, such as accounting qualifications and any professional internships or certifications.

- A discussion of key skills that you possess which are applicable to the Trainee Accountant role, such as advanced knowledge of accounting software, excellent problem- solving skills, and the ability to effectively communicate with clients and colleagues.

- A brief explanation of your career goals and how they align with the position.

- A closing statement that expresses your enthusiasm for the position and reiterates your interest in the Trainee Accountant role.

By including a carefully crafted cover letter with your job application, you can demonstrate to potential employers that you are the right candidate for the Trainee Accountant role.

Trainee Accountant Cover Letter Writing Tips

Writing a successful cover letter for a trainee accountant position should include a few key elements and strategies. Here are some tips to help you get started:

- Research the company and role you are applying for. This will allow you to tailor the content of your cover letter to the specific job you are applying for.

- Write a concise and professional opening statement that briefly explains why you are a good fit for the position.

- Highlight your accounting skills, experience and qualifications. Be sure to mention any relevant coursework, experience or certifications you have obtained.

- Explain why you are passionate about becoming a trainee accountant and how you can bring value to the company.

- Provide clear examples of any related experience you have, such as working as an intern or volunteer.

- Include any extra- curricular activities that demonstrate your commitment to the profession.

- Conclude your cover letter by expressing your enthusiasm for the role and reiterating your interest in the position.

- Be sure to proofread and edit your cover letter before sending it out. This will help ensure that it is free of errors and mistakes.

Common mistakes to avoid when writing Trainee Accountant Cover letter

Writing a cover letter for a trainee accountant position is a challenge. You want to make sure you stand out from the competition and make a strong impression on the hiring manager. However, making mistakes in your cover letter can cost you the job. Here are some common mistakes to avoid when writing your trainee accountant cover letter:

- Not Customizing Your Cover Letter: Your cover letter should be customized for each position. You should include specific details that demonstrate your knowledge and interest in the company. Taking the time to customize your cover letter will show the hiring manager that you are serious about the position and willing to go the extra mile.

- Not Highlighting Your Relevant Qualifications: You should use your cover letter to highlight your qualifications that make you a strong candidate for the trainee accountant position. Make sure to include your education, professional experience, and any other relevant skills and qualifications that would make you stand out from other applicants.

- Not Proofreading Your Cover Letter: Before submitting your cover letter, make sure to proofread it for any errors. Typos, grammar mistakes, and incorrect punctuation will make a poor impression on the hiring manager and can cost you the job. Make sure to triple check your cover letter before submitting it.

- Not Providing Specific Examples: Instead of making general statements about your skills, provide specific examples to demonstrate how you have used your skills in the past. This will help the hiring manager visualize what you could bring to the role.

- Not Following the Instructions: Make sure to read the job description carefully and follow all instructions. If the instructions ask you to submit your cover letter in a specific format, make sure to do so. Not following instructions can be an easy way to end up in the “no” pile.

By avoiding these common mistakes, you can ensure that your cover letter for a trainee accountant position stands out from the competition and makes

Key takeaways

Writing an impressive Trainee Accountant cover letter can increase your chances of getting a job. A good cover letter should be tailored to the job you’re applying for and highlight the experiences, qualifications and skills that make you the best candidate for the role. Here are the key takeaways for writing an impressive Trainee Accountant cover letter:

- Research: Research the company you’re applying for and the role to make sure you’re a good fit. This will help you tailor your cover letter and make sure it’s relevant and compelling.

- Show passion: Demonstrate your enthusiasm for the role and the company, and show that you’re passionate about the job and what you can bring to the company.

- Highlight key skills: Showcase the skills and qualifications you have that make you the best candidate for the job.

- Demonstrate experience: Showcase your experience and emphasize the qualities you have that make you the right person for the role.

- Keep it concise: Your cover letter should be concise and to the point. Keep it to one page and don’t repeat information that’s in your resume.

- Proofread: Always proofread your cover letter to make sure there are no spelling or grammar errors.

By following these key takeaways for writing an impressive Trainee Accountant cover letter, you’ll be able to make a great first impression and increase your chances of getting the job. Good luck!

Frequently Asked Questions

1. how do i write a cover letter for an trainee accountant job with no experience.

Writing a cover letter for an Trainee Accountant job when you have no experience can be a challenge. However, it is possible to make a great impression on potential employers by highlighting your enthusiasm for the role and explaining why you feel you would be a great fit even without experience. Begin your cover letter by introducing yourself and expressing your interest in the Trainee Accountant role. Explain that even though you do not have any experience, you are eager to learn and will work hard to achieve success. Provide examples of related skills that you possess, such as an aptitude for numbers or a strong attention to detail. Finish your cover letter by reiterating your enthusiasm for the role and indicating that you would be a great fit.

2. How do I write a cover letter for an Trainee Accountant job experience?

When writing a cover letter for an Trainee Accountant job with experience, it is important to focus on the specific qualifications that make you a great candidate for the role. Begin your letter by introducing yourself and expressing your interest in the Trainee Accountant job. Then, provide a brief summary of your relevant experience that is applicable to the job. Showcase the skills you’ve acquired in previous roles that would be beneficial for the position. Demonstrate your mastery of accounting concepts and your commitment to accuracy and efficiency. Finish your cover letter by reiterating your enthusiasm and offering to provide additional information if needed.

3. How can I highlight my accomplishments in Trainee Accountant cover letter?

One of the best ways to highlight your accomplishments in a Trainee Accountant cover letter is to provide clear examples of your work. Share any successes that you have had in previous roles, such as a high rate of accuracy in your financial reports or successful project completion. You can also mention any awards or recognition that you have received for your work. Additionally, include any relevant technical skills you have acquired in the field, such as knowledge of financial software or software to manage data. Finally, it’s important to emphasize how your qualifications make you a great fit for the position and how you can use your skills to contribute to the organization’s success.

In addition to this, be sure to check out our cover letter templates , cover letter formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

Let us help you build your Cover Letter!

Make your cover letter more organized and attractive with our Cover Letter Builder

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Trainee Accountant Cover Letter Example

Boost your chances of getting hired & learn to perfect your next cover letter with this expertly drafted Trainee Accountant cover letter example. Download this cover letter example for free or revise it in our proven and tested cover letter maker.

Related resume guides and samples

How to write an appealing accountant resume

How to build the perfect auditor resume

How to build a great bookkeeper resume

Ultimate tips for the perfect finance analyst resume

Five great tips for your insurance agent resume

How to write an appealing investment advisor resume?

Create the perfect resume for a role in tax services

Trainee Accountant Cover Letter Example (Full Text Version)

Karina traczyk.

Dear Hiring Managers,

I am writing to express my interest in the Trainee Accountant position at Zarmey Consulting, Inc. in Melbourne, Australia. With a strong background in financial services and extensive field knowledge, I believe I am well-suited for this role.

During my tenure at Cobham Consulting, Ltd., I provided support to Senior Accountants through various tasks such as audit assignments, financial statement preparation, and record maintenance. I also actively participated in team meetings, calculated tax liabilities, and executed financial transactions.

My experience has honed my critical thinking, problem-solving, attention to detail, and analytical skills, all of which are essential for this position. With a degree in Accounting & Finance from Monash University and certification as a Financial Accountant, I am proficient in using important software programs like FreshBooks, Wave, Sage 50cloud, Xero, and Zoho Books.

I am eager to contribute my skills and knowledge to a dynamic company like yours that values growth and flexibility. Thank you for considering my application.

Sincerely, Karina Traczyk

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Humanities Student Auditor Student Internship Personal Assistant Professions And Applied Sciences Student Formal Sciences Student Facilities Manager Administration Bookkeeper Accountant Tax Services University Student

Related social sciences student resume samples

Related administrative cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

Discover the latest MyICAEW app for ACA students and members, available to download now. Find out more

- Benefits of membership

Gain access to world-leading information resources, guidance and local networks.

- Visit Benefits of membership

Becoming a member

98% of the best global brands rely on ICAEW Chartered Accountants.

- Visit Becoming a member

- Pay fees and subscriptions

Your membership subscription enables ICAEW to provide support to members.

Fees and subscriptions

Member rewards.

Take advantage of the range of value added or discounted member benefits.

- Member rewards – More from your membership

- Technical and ethics support

- Support throughout your career

Information and resources for every stage of your career.

Member Insights Survey

Let us know about the issues affecting you, your business and your clients.

- Complete the survey

From software start-ups to high-flying airlines and high street banks, 98% of the best global brands rely on ICAEW Chartered Accountants. A career as an ICAEW Chartered Accountant means the opportunity to work in any organisation, in any sector, whatever your ambitions.

Everything you need to know about ICAEW annual membership fees, community and faculty subscriptions, eligibility for reduced rates and details of how you can pay.

Membership administration

Welcome to the ICAEW members area: your portal to members'-only content, offers, discounts, regulations and membership information.

- Continuing Professional Development (CPD)

Continuing Professional Development (CPD) is an integral part of being a successful ICAEW Chartered Accountant.

The ICAEW Chartered Accountant qualification, the ACA, is one of the most advanced learning and professional development programmes available. It is valued around the world in business, practice and the public sector.

ACA for employers

Train the next generation of chartered accountants in your business or organisation. Discover how your organisation can attract, train and retain the best accountancy talent, how to become authorised to offer ACA training and the support and guidance on offer if you are already providing training.

Digital learning materials via BibliU

All ACA, ICAEW CFAB and Level 4 apprenticeship learning materials are now digital only. Read our guide on how to access your learning materials on the ICAEW Bookshelf using the BibliU app or through your browser.

- Find out more

Take a look at ICAEW training films

Focusing on professional scepticism, ethics and everyday business challenges, our training films are used by firms and companies around the world to support their in-house training and business development teams.

Attract and retain the next generation of accounting and finance professionals with our world-leading accountancy qualifications. Become authorised to offer ACA training and help your business stay ahead.

CPD guidance and help

Continuing Professional Development (CPD) is an integral part of being a successful ICAEW Chartered Accountant. Find support on ICAEW's CPD requirements and access resources to help your professional development.

ICAEW flagship events

ICAEW boasts an extensive portfolio of industry-leading conferences. These flagship events offer the opportunity to hear from and interact with all the key players in the industry. Find out what's coming up.

Leadership Development Programmes

ICAEW Academy’s in-depth leadership development programmes take a holistic approach to combine insightful mentoring or coaching, to exclusive events, peer learning groups and workshops. Catering for those significant transitions in your career, these leadership development programmes are instrumental to achieving your ambitions or fulfilling your succession planning goals.

Specialist Finance Qualifications & Programmes

Whatever future path you choose, ICAEW will support the development and acceleration of your career at each stage to enhance your career.

Why a career in chartered accountancy?

If you think chartered accountants spend their lives confined to their desks, then think again. They are sitting on the boards of multinational companies, testifying in court and advising governments, as well as supporting charities and businesses from every industry all over the world.

- Why chartered accountancy?

Search for qualified ACA jobs

Matching highly skilled ICAEW members with attractive organisations seeking talented accountancy and finance professionals.

Volunteering roles

Helping skilled and in-demand chartered accountants give back and strengthen not-for-profit sector with currently over 2,300 organisations posting a variety of volunteering roles with ICAEW.

- Search for volunteer roles

- Get ahead by volunteering

Advertise with ICAEW

From as little as £495, access to a pool of highly qualified and ambitious ACA qualified members with searchable CVs.

Early careers and training

Start your ACA training with ICAEW. Find out why a career in chartered accountancy could be for you and how to become a chartered accountant.

Qualified ACA careers

Find Accountancy and Finance Jobs

Voluntary roles

Find Voluntary roles

While you pursue the most interesting and rewarding opportunities at every stage of your career, we’re here to offer you support whatever stage you are or wherever you are in the world and in whichever sector you have chosen to work.

ACA students

"how to guides" for aca students.

- ACA student guide

- How to book an exam

- How to apply for credit for prior learning (CPL)

Exam resources

Here are some resources you will find useful while you study for the ACA qualification.

- Certificate Level

- Professional Level

- Advanced Level

Digital learning materials

All ACA learning materials are now digital only. Read our guide on how to access your learning materials on the ICAEW Bookshelf via the BibliU app, or through your browser.

- Read the guide

My online training file

Once you are registered as an ACA student, you'll be able to access your training file to log your progress throughout ACA training.

- Access your training file

- Student Insights

Fresh insights, innovative ideas and an inside look at the lives and careers of our ICAEW students and members.

- Read the latest articles

System status checks

Getting started.

Welcome to ICAEW! We have pulled together a selection of resources to help you get started with your ACA training, including our popular 'How To' series, which offers step-by-step guidance on everything from registering as an ACA student and applying for CPL, to using your online training file.

Credit for prior learning (CPL)

Credit for prior learning or CPL is our term for exemptions. High quality learning and assessment in other relevant qualifications is appropriately recognised by the award of CPL.

Apply for exams

What you need to know in order to apply for the ACA exams.

The ACA qualification has 15 modules over three levels. They are designed to complement the practical experience you will be gaining in the workplace. They will also enable you to gain in-depth knowledge across a broad range of topics in accountancy, finance and business. Here are some useful resources while you study.

- Exam results

You will receive your results for all Certificate Level exams, the day after you take the exam and usually five weeks after a Professional and Advanced Level exam session has taken place. Access your latest and archived exam results here.

Training agreement

Putting your theory work into practice is essential to complete your ACA training.

Student support and benefits

We are here to support you throughout your ACA journey. We have a range of resources and services on offer for you to unwrap, from exam resources, to student events and discount cards. Make sure you take advantage of the wealth of exclusive benefits available to you, all year round.

- Applying for membership

The ACA will open doors to limitless opportunities in all areas of accountancy, business and finance anywhere in the world. ICAEW Chartered Accountants work at the highest levels as finance directors, CEOs and partners of some of the world’s largest organisations.

ACA training FAQs

Do you have a question about the ACA training? Then look no further. Here, you can find answers to frequently asked questions relating to the ACA qualification and training. Find out more about each of the integrated components of the ACA, as well as more information on the syllabus, your training agreement, ICAEW’s rules and regulations and much more.

- Anti-money laundering

Guidance and resources to help members comply with their legal and professional responsibilities around AML.

Technical releases

ICAEW Technical Releases are a source of good practice guidance on technical and practice issues relevant to ICAEW Chartered Accountants and other finance professionals.

- ICAEW Technical Releases

- Thought leadership

ICAEW's Thought Leadership reports provide clarity and insight on the current and future challenges to the accountancy profession. Our charitable trusts also provide funding for academic research into accountancy.

- Academic research funding

Technical Advisory Services helpsheets

Practical, technical and ethical guidance highlighting the most important issues for members, whether in practice or in business.

- ICAEW Technical Advisory Services helpsheets

Bloomsbury – free for eligible firms

In partnership with Bloomsbury Professional, ICAEW have provided eligible firms with free access to Bloomsbury’s comprehensive online library of around 80 titles from leading tax and accounting subject matter experts.

- Bloomsbury Accounting and Tax Service

Country resources

Our resources by country provide access to intelligence on over 170 countries and territories including economic forecasts, guides to doing business and information on the tax climate in each jurisdiction.

Industries and sectors

Thought leadership, technical resources and professional guidance to support the professional development of members working in specific industries and sectors.

Audit and Assurance

The audit, assurance and internal audit area has information and guidance on technical and practical matters in relation to these three areas of practice. There are links to events, publications, technical help and audit representations.

The most up-to-date thought leadership, insights, technical resources and professional guidance to support ICAEW members working in and with industry with their professional development.

- Corporate Finance

Companies, advisers and investors making decisions about creating, developing and acquiring businesses – and the wide range of advisory careers that require this specialist professional expertise.

- Corporate governance

Corporate governance is the system by which companies are directed and controlled. Find out more about corporate governance principles, codes and reports, Board subcommittees, roles and responsibilities and shareholder relations. Corporate governance involves balancing the interests of a company’s many stakeholders, such as shareholders, employees, management, customers, suppliers, financiers and the community. Getting governance right is essential to build public trust in companies.

Corporate reporting

View a range of practical resources on UK GAAP, IFRS, UK regulation for company accounts and non-financial reporting. Plus find out more about the ICAEW Corporate Reporting Faculty.

Expert analysis on the latest national and international economic issues and trends, and interviews with prominent voices across the finance industry, alongside data on the state of the economy.

- Financial Services

View articles and resources on the financial services sector.

- Practice resources

For ICAEW's members in practice, this area brings together the most up-to-date thought leadership, technical resources and professional guidance to help you in your professional life.

Public Sector

Many ICAEW members work in or with the public sector to deliver public priorities and strong public finances. ICAEW acts in the public interest to support strong financial leadership and better financial management across the public sector – featuring transparency, accountability, governance and ethics – to ensure that public money is spent wisely and that public finances are sustainable.

Sustainability and climate change

Sustainability describes a world that does not live by eating into its capital, whether natural, economic or social. Members in practice, in business and private individuals all have a role to play if sustainability goals are to be met. The work being undertaken by ICAEW in this area is to change behaviour to drive sustainable outcomes.

The Tax area has information and guidance on technical and practical tax matters. There are links to events, the latest tax news and the Tax Faculty’s publications, including helpsheets, webinars and Tax representations.

Keep up-to-date with tech issues and developments, including artificial intelligence (AI), blockchain, big data, and cyber security.

Trust & Ethics

Guidance and resources on key issues, including economic crime, business law, better regulation and ethics. Read through ICAEW’s Code of Ethics and supporting information.

Communities

ICAEW Communities

Information, guidance and networking opportunities on industry sectors, professional specialisms and at various stages throughout your career. Free for ICAEW members and students.

- Discover a new community

ICAEW Faculties

The accountancy profession is facing change and uncertainty. The ICAEW Faculties can help by providing you with timely and relevant support.

- Choose to join any of the faculties

UK groups and societies

We have teams on the ground in: East of England, the Midlands, London and South East, Northern, South West, Yorkshire and Humberside, Wales and Scotland.

- Access your UK region

- Worldwide support and services

Support and services we offer our members in Africa, America, Canada, the Caribbean, Europe, Greater China, the Middle East, Oceania and South East Asia.

- Discover our services

ICAEW Faculties are 'centres of technical excellence', strongly committed to enhancing your professional development and helping you to meet your CPD requirements every year. They offer exclusive content, events and webinars, customised for your sector - which you should be able to easily record, when the time comes for the completion of your CPD declaration. Our offering isn't exclusive to Institute members. As a faculty member, the same resources are available to you to ensure you stay ahead of the competition.

Communities by industry / sector

Communities by life stage and workplace, communities by professional specialism, local groups and societies.

We aim to support you wherever in the world you work. Our regional offices and network of volunteers run events and provide access to local accounting updates in major finance centres around the globe.

- Ukraine crisis: central resource hub

Learn about the actions that ICAEW members are taking to ensure that their clients comply with sanctions imposed by different countries and jurisdictions, and read about the support available from ICAEW.

Insights pulls together the best opinion, analysis, interviews, videos and podcasts on the key issues affecting accountancy and business.

- See the latest insights

- Making COP count

This series looks at the role the accountancy profession can play in addressing the climate crisis and building a sustainable economy.

- Read more on COP28

Professional development and skills

With new requirements on ICAEW members for continuing professional development, we bring together resources to support you through the changes and look at the skills accountants need for the future.

- Visit the hub

When Chartered Accountants Save The World

Find out how chartered accountants are helping to tackle some of the most urgent social challenges within the UN Sustainable Development Goals, and explore how the profession could do even more.

- Read our major series

Insights specials

A listing of one-off Insights specials that focus on a particular subject, interviewing the key people, identifying developing trends and examining the underlying issues.

Top podcasts

Insights by topic.

ICAEW Regulation

- Regulatory News

View the latest regulatory updates and guidance and subscribe to our monthly newsletter, Regulatory & Conduct News.

- Regulatory Consultations

Strengthening trust in the profession

Our role as a world-leading improvement regulator is to strengthen trust and protect the public. We do this by enabling, evaluating and enforcing the highest standards in the profession.

Regulatory applications

Find out how you can become authorised by ICAEW as a regulated firm.

ICAEW codes and regulations

Professional conduct and complaints, statutory regulated services overseen by icaew, regulations for icaew practice members and firms, additional guidance and support, popular search results.

- Training File

- Practice Exam Software

- Ethics Cpd Course

- Routes to the ACA

- ACA students membership application

- Join as a member of another body

- How much are membership fees?

- How to pay your fees

- Receipts and invoices

- What if my circumstances have changed?

- Difficulties in making changes to your membership

- Faculty and community subscription fees

- Updating your details

- Complete annual return

- Promoting myself as an ICAEW member

- Verification of ICAEW membership

- Become a life member

- Become a fellow

- Request a new certificate

- Report the death of a member

- Membership regulations

- New members

- Career progression

- Career Breakers

- Volunteering at schools and universities

- ICAEW Member App

- Working internationally

- Self employment

- Support Members Scheme

- CPD is changing

- CPD learning resources

- Your guide to CPD

- Online CPD record

- How to become a chartered accountant

- Register as a student

- Train as a member of another body

- More about the ACA and chartered accountancy

- How ACA training works

- Become a training employer

- Access the training file

- Why choose the ACA

- Training routes

- Employer support hub

- Get in touch

- Apprenticeships with ICAEW

- A-Z of CPD courses by topic

- ICAEW Business and Finance Professional (BFP)

- ICAEW Annual Conference 2024

- Audit & Assurance Conference 2024

- Restructuring & Insolvency Conference

- Virtual CPD Conference

- Virtual Healthcare Conference 2024

- All our flagship events

- Financial Talent Executive Network (F-TEN®)

- Developing Leadership in Practice (DLiP™)

- Network of Finance Leaders (NFL)

- Women in Leadership (WiL)

- Mentoring and coaching

- Partners in Learning

- Board Director's Programme e-learning

- Corporate Finance Qualification

- Diploma in Charity Accounting

- ICAEW Certificate in Insolvency

- ICAEW Data Analytics Certificate

- Financial Modeling Institute’s Advanced Financial Modeler Accreditation

- ICAEW Sustainability Certificate for Finance Professionals

- ICAEW Finance in a Digital World Programme

- All specialist qualifications

- Team training

- Start your training

- Improve your employability

- Search employers

- Find a role

- Role alerts

- Organisations

- Practice support – 11 ways ICAEW and CABA can help you

- News and advice

- ICAEW Volunteering Hub

- Support in becoming a chartered accountant

- Vacancies at ICAEW

- ICAEW boards and committees

- Exam system status

- ICAEW systems: status update

- Changes to our qualifications

- How-to guides for ACA students

- Apply for credits - Academic qualification

- Apply for credits - Professional qualification

- Credit for prior learning (CPL)/exemptions FAQs

- Applications for Professional and Advanced Level exams

- Applications for Certificate Level exams

- Tuition providers

- Latest exam results

- Archived exam results

- Getting your results

- Marks feedback service

- Exam admin check

- Training agreement: overview

- Professional development

- Ethics and professional scepticism

- Practical work experience

- Access your online training file

- How training works in your country

- Student rewards

- TOTUM PRO Card

- Student events and volunteering

- Xero cloud accounting certifications

- Student support

- Join a community

- Wellbeing support from caba

- Student mentoring programme

- Student conduct and behaviour

- Code of ethics

- Fit and proper

- Level 4 Accounting Technician Apprenticeship

- Level 7 Accountancy Professional Apprenticeship

- AAT-ACA Fast Track FAQs

- ACA rules and regulations FAQs

- ACA syllabus FAQs

- ACA training agreement FAQs

- Audit experience and the Audit Qualification FAQs

- Independent student FAQs

- Practical work experience FAQs

- Professional development FAQs

- Six-monthly reviews FAQs

- Ethics and professional scepticism FAQs

- Greater China

- Latin America

- Middle East

- North America

- Australasia

- Russia and Eurasia

- South East Asia

- Charity Community

- Construction & Real Estate

- Energy & Natural Resources Community

- Farming & Rural Business Community

- Forensic & Expert Witness

- Global Trade Community

- Healthcare Community

- Internal Audit Community

- Manufacturing Community

- Media & Leisure

- Portfolio Careers Community

- Small and Micro Business Community

- Small Practitioners Community

- Travel, Tourism & Hospitality Community

- Valuation Community

- Audit and corporate governance reform

- Audit & Assurance Faculty

- Professional judgement

- Regulation and working in audit

- Internal audit resource centre

- ICAEW acting on audit quality

- Everything business

- Latest Business news from Insights

- Strategy, risk and innovation

- Business performance management

- Financial management

- Finance transformation

- Economy and business environment

- Leadership, personal development and HR

- Webinars and publications

- Business restructuring

- The Business Finance Guide

- Capital markets and investment

- Corporate finance careers

- Corporate Finance Faculty

- Debt advisory and growth finance

- Mergers and acquisitions

- Private equity

- Start-ups, scale-ups and venture capital

- Transaction services

- Board committees and board effectiveness

- Corporate governance codes and reports

- Corporate Governance Community

- Principles of corporate governance

- Roles, duties and responsibilities of Board members

- Stewardship and stakeholder relations

- Corporate Governance thought leadership

- Corporate reporting resources

- Small and micro entity reporting

- UK Regulation for Company Accounts

- Non-financial reporting

- Improving Corporate Reporting

- Economy home

- ICAEW Business Confidence Monitor

- ICAEW Manifesto 2024

- Energy crisis

- Levelling up: rebalancing the UK’s economy

- Resilience and Renewal: Building an economy fit for the future

- Social mobility and inclusion

- Autumn Statement 2023

- Investment management

- Inspiring confidence

- Setting up in practice

- Running your practice

- Supporting your clients

- Practice technology

- TAS helpsheets

- Support for business advisers

- Join ICAEW BAS

- Public Sector hub

- Public Sector Audit and Assurance

- Public Sector Finances

- Public Sector Financial Management

- Public Sector Financial Reporting

- Public Sector Learning & Development

- Public Sector Community

- Latest public sector articles from Insights

- Climate hub

- Sustainable Development Goals

- Accountability

- Modern slavery

- Resources collection

- Sustainability Committee

- Sustainability & Climate Change community

- Sustainability and climate change home

- Tax Faculty

- Budgets and legislation

- Business tax

- Devolved taxes

- Employment taxes

- International taxes

- Making Tax Digital

- Personal tax

- Property tax

- Stamp duty land tax

- Tax administration

- Tax compliance and investigation

- UK tax rates, allowances and reliefs

- Artificial intelligence

- Blockchain and cryptoassets

- Cyber security

- Data Analytics Community

- Digital skills

- Excel community

- Finance in a Digital World

- IT management

- Technology and the profession

- Trust & Ethics home

- Better regulation

- Business Law

- UK company law

- Data protection and privacy

- Economic crime

- Help with ethical problems

- ICAEW Code of Ethics

- ICAEW Trust and Ethics team.....

- Solicitors Community

- Forensic & Expert Witness Community

- Latest articles on business law, trust and ethics

- Audit and Assurance Faculty

- Corporate Reporting Faculty

- Financial Services Faculty

- Academia & Education Community

- Construction & Real Estate Community

- Entertainment, Sport & Media Community

- Retail Community

- Career Breakers Community

- Black Members Community

- Diversity & Inclusion Community

- Women in Finance Community

- Personal Financial Planning Community

- Restructuring & Insolvency Community

- Sustainability and Climate Change Community

- London and East

- South Wales

- Yorkshire and Humberside

- European public policy activities

- ICAEW Middle East

- Latest news

- The World’s Fastest Accountant

- Access to finance special

- Attractiveness of the profession

- Audit and Fraud

- Audit and technology

- Adopting non-financial reporting standards

- Cost of doing business

- Mental health and wellbeing

- Pensions and Personal Finance

- More specials ...

- The economics of biodiversity

- How chartered accountants can help to safeguard trust in society

- Video: The financial controller who stole £20,000 from her company

- It’s time for chartered accountants to save the world

- Video: The CFO who tried to trick the market

- Video: Could invoice fraud affect your business?

- Company size thresholds and CGT on residences

- Lessons in leadership from ICAEW's CEO

- So you want to be a leader?

- A busy new tax year, plus progress on the Economic Crime Act

- Does Britain have a farming problem?

- Budget 2024: does it change anything?

- Will accountants save the world? With ICAEW CEO Michael Izza

- Crunch time: VAT (or not) on poppadoms

- Where next for audit and governance reform?

- A taxing year ahead?

- What can we expect from 2024?

- More podcasts...

- Top charts of the week

- EU and international trade

- CEO and President's insights

- Diversity and Inclusion

- Sponsored content

- Insights index

- Charter and Bye-laws

- Archive of complaints, disciplinary and fitness processes, statutory regulations and ICAEW regulations

- Qualifications regulations

- Training and education regulations

- How to make a complaint

- Guidance on your duty to report misconduct

- Public hearings

- What to do if you receive a complaint against you

- Anti-money laundering supervision

- Working in the regulated area of audit

- Local public audit in England

- Probate services

- Designated Professional Body (Investment Business) licence

- Consumer credit

- Quality Assurance monitoring: view from the firms

- The ICAEW Practice Assurance scheme

- Licensed Practice scheme

- Professional Indemnity Insurance (PII)

- Clients' Money Regulations

- Taxation (PCRT) Regulations

- ICAEW training films

- Helpsheets and guidance by topic

- ICAEW's regulatory expertise and history

- Job-essential skills

- Job hunting

- CVs and job applications

- Writing your covering letter

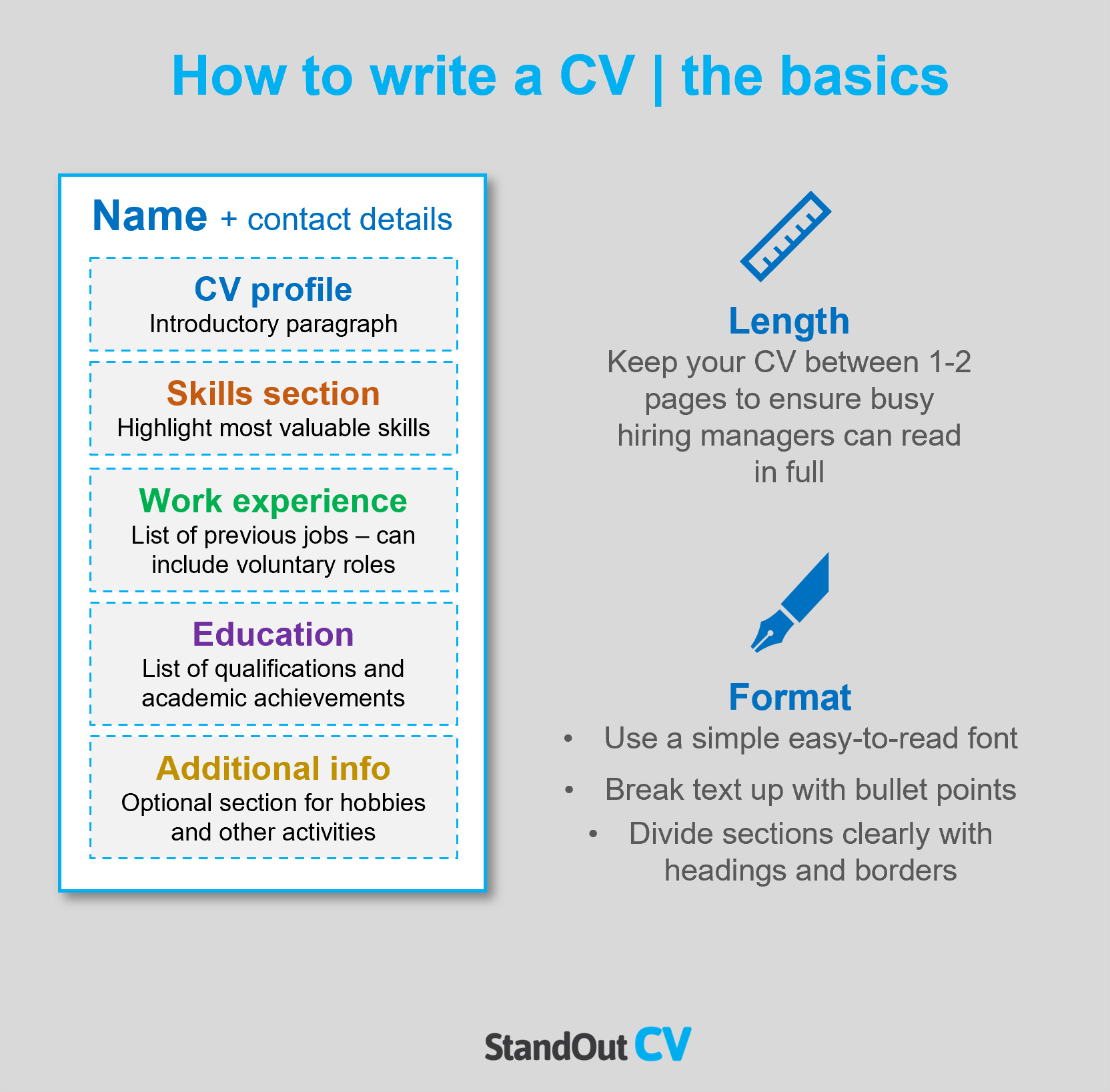

What makes a great CV

Update History

Why is a covering letter important?

How to write a good covering letter.

- What about a cover letter for a job that's not advertised?

Points to remember

Covering letters - top 10 crimes.

A cover letter should be brief, well written and highlight the main points why you are a good candidate – your key strengths, job-relevant skills, experience and knowledge.

A covering letter should summarise what’s in your CV and provide specific examples to support your ability to do the job. It should not introduce anything new that’s not in your CV. It is a good idea to think about what competencies the role is asking for in candidates and to make sure the covering letter (and your CV) highlights your capabilities in these areas.

Make sure you tailor your covering letter according to each job application rather than have a ‘one-size fits all’ letter. Many candidates do not spend enough time on their covering letter, so having a personalised, well-written covering letter will help you stand out from the crowd.

Including a covering letter with your CV can boost your chances of getting a reply.

The way you write about yourself, the layout of your letter as well as your grammar and attention to detail forms part of the impression a recruiter gains from your application. In fact, some recruiters can place more emphasis on your cover letter than your CV. This is because the way you write a covering letter can help tell an employer if you are articulate and have a good command of the English language or whether you demonstrate logical thinking or are organised with a good eye for detail. These are all very valuable qualities that most employers would want to see in any good quality candidate. So it is vital that you take care to produce a good covering letter to go along with your good CV.

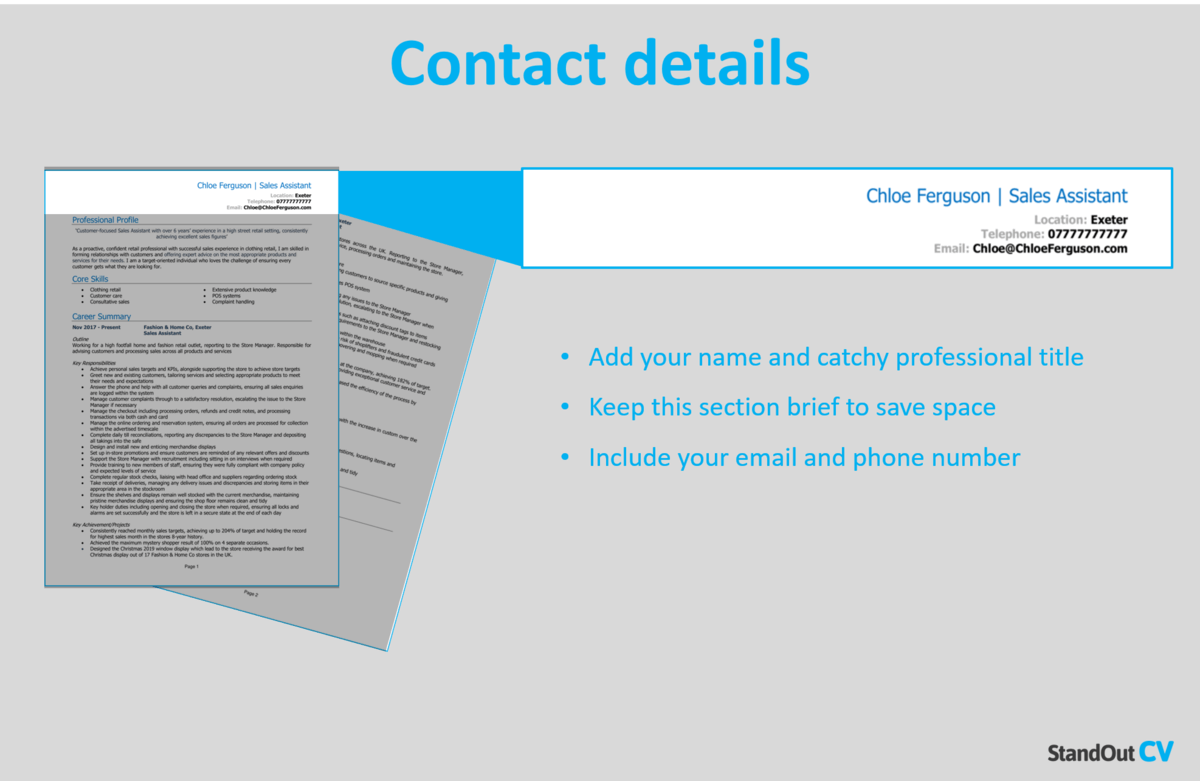

A covering letter should be concise, clear and easy to read. It should be no more than one side of A4 paper and should include:

- your name, full address and contact details to enable to recruiter to respond to you – hopefully inviting you for an interview.

- a heading and an opening line to make it clear which job you're applying for (eg, 'In response to your advertisement in XXX magazine of ZZZ date for the role of XYZ, I write to enclose my CV for your consideration'.

- an introductory paragraph about you / why you think you are right for the role that is being offered followed by bullet points or short statements relating to your skills, experience or capabilities for the role in question.

- a few specific examples.

- say when you are available to start (be as flexible as possible).

Please note that in some international locations, conventions regarding CV styles and covering letters are very different to the format we know in the UK. So if you are applying for a job outside the UK, please do your research regarding the accepted style and format of applications in the country you are applying to.

You can find a suggested covering letter structure at the end of this article.

How do I start and end a cover letter?

- If you know the name of the person you need to send your application to, then you should address the letter to that person and begin the letter (eg, ‘Dear Mr Edwards’ and end it with ‘Yours sincerely’, Helen Smith).

- If you don't know the name of the person, but have a job title, such as the HR Director, then you should address your covering letter to the HR Director and address them as ‘Dear Sir or Madam’. You should end this letter with ‘Yours faithfully’, Helen Smith.

- Make sure to include a final sentence that ends positively, politely and looks ahead to the next stage, for example, 'I would be happy to provide further information at interview' or 'I thank you in advance for your consideration and look forward to hearing from you'.

What about a cover letter for a job that's not advertised?

If you are planning to send a speculative application (ie, applying to a prospective employer without knowing if they are actually recruiting or not), simply follow the same rules as mentioned above: concise, no more than one side of A4 paper, enthusiastic in tone and highlight your strengths.

One key difference however, is that because you’re not applying for a specific job advert or known vacancy, you will need to do some research about the organisation, any of their previous job adverts, the values of the company or the competencies they ask for from applicants and then tailor your letter accordingly.

Try to find out the name of the correct person or their job title to send you application to. Otherwise, use your common sense. If you are applying for a finance-based role (as an example), it is probably going to be someone in the finance team that you could send your speculative application to.

Unless asked, you should avoid sending your speculative application to the Managing Director or Chief Executive. In most companies, they are unlikely to be the correct person to receive your unsolicited mail.

- A good covering letter is vital to support your CV.

- It is a summary of your capabilities, qualities and your suitability for that specific job.

- No more than one side of A4 paper – it is not an essay.

- Keep it concise. Avoid jargon and don’t use five words if two will do.

- Tailor your covering letter to each job application, rather than have a ‘one-size fits all’ approach.

- Use action verbs.

- It demonstrates your writing style (far better than your CV), so many employers will place just as much importance on your covering letter as what’s on your CV.

- Make your letter easy to read for an employer. Content, grammar, spelling and layout are all vital – double check everything you write as spell check won’t pick up ‘from’ instead of ‘form’. Take time and care with your letter.

- Relate your skills (eg, communicating, leadership, team working, problem-solving, resilience and self-motivation) to the job and the qualities or skills that the employer is looking for in candidates.

- If you are emailing your application (CV and covering letter), then paste the content of the covering letter into the email body and attach the CV. If you attach both and don’t write anything in the body of the email, then it may be misidentified as spam.

- If you are applying for a job in a country that requires a work permit or visa, you need to include whether you are eligible to work or whether you are looking for an employer to sponsor you.

- Too long One employer received a covering letter that was just as long as the CV. Needless to say, the application went straight into the bin. Remember to keep it concise.

- Too generic No attempt has been made to personalise the CV or covering letter. It is obvious to an employer when you have sent a standard letter rather than attempting to match your skills and strengths to those that the job or company is looking for. Remember to tailor your letter according to the skills and attributes that the employer is looking for.

- Poor spelling Incorrect spelling (eg, ‘there’ and ‘their’ or ‘to’ and ‘too’), poor grammar and use of jargon. Visit the BBC Skillswise website for grammar and spelling tips.

- Poorly formatted Inconsistent style or formatting (eg large bullet points in some places and smaller ones in other places or inconsistent use of full-stops, hyphens etc).

- Poorly researched Wrong spelling of company name or person you are writing to. Worse still is leaving the name of a company you have previously applied for in the letter.

- The show off Complicated, pretentious language and rambling structure.

- The shouter Unless asked to do so, don’t write in upper case – it’s like shouting at an employer!

- Not proof read Don’t just spell check your letter, make sure you carefully re-read and double check every word. Spell check won’t pick up the difference between ‘form’ and ‘from’ for example.

- Not being positive Negativity, lack of confidence in your approach or suggestion of neediness (eg, ‘I don’t have any relevant experience but I’m sure with lots of mentoring I would be OK.’)

- Remember where you're applying to For UK applications, don’t Americanise your letter. Many automatic spell check systems will change words to the American spelling (eg, ‘organize’ is American spelling vs ‘organise’ which is English spelling).

Read out this code to the operator.

Trainee Accountant Cover Letter

Martha Smith

123 Your Street

Your City, ST 12345

(123) 456-7890

4th September 2020

Becky Reader

CEO, Company Name

123 Address St

Anytown, ST 12345

Dear Ms. Reader,

With great willingness, I am applying for the position as trainee accountant which was advertised on your company’s website. I believe that my education and skills-set make me a suitable candidate for this vacancy.

I have a strong background in accountancy, from financial accounting to tax accounting and from management accounting to auditing and management control. I very much enjoy my courses in the area of management accounting. I am seriously considering taking my certification to be a CMA.

In addition to my personal qualities, I have a solid educational foundation and a passion for accounting. I am extremely enthusiastic in learning more about your open position and how I can meet the needs of your organization. I look forward to hearing from you and welcome an opportunity for a more in-depth discussion on how I might be of service to your company.

Please find my attached CV which shows my experiences in detail.

Thank you for taking the time to read my letter and I look forward to hearing from you.

© 2024. Jobcentre Near Me . All rights reserved. Privacy Policy / Terms and Conditions / Cookie Policy UK / Privacy Statement UK / Cookie Policy EU / Privacy Statement EU / Disclaimer

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- An introduction to professional insights

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- A winning covering letter

- Student e-magazine

- Professional skills

Your CV may be a masterpiece of self-promotion, but who is going to read it if your email or covering letter fails to impress? See what our experts have to say

For job-hunters, emails offer a number of advantages over the handwritten or typed letters that traditionally used to accompany CVs in the post. They are easier to compose, they generally require less formality in content and tone, and they are much more immediately accessible to the recipient. But simplicity, informality and speed can have drawbacks. Unless you observe some straightforward rules, the CV in which you have invested so much time and effort may never be opened.

Emails are typically read much faster than letters – but if the recipient’s inbox has piled up with applications, he or she might be more prone to making snap judgments, simply to expedite the initial screening process. A neatly-composed, correction-free handwritten letter will always stand out from those that have been dashed off in a hurry – but with email, there is a more level playing field, and it is what you say that will primarily dictate how the recipient responds.

Mind your language

‘It’s usually OK to be a little less formal in an email,’ says Charlie Carnall, a director at recruiter Hays Accountancy & Finance. ‘However, that’s not a green light to be over-familiar. If you’re in any doubt about whether your tone might strike the wrong note, it’s better to err on the side of caution.’ Remember that the purpose of your email (or covering letter) is to get your CV opened and read. But if technology gives you the ability to fire off your CV to scores of employers, the downside is that those employers will be on the receiving end of hundreds of applications. Many will therefore raise the bar considerably – and if they are looking for reasons to reject (which, in most cases, takes far less time than to accept), your email must be tailored accordingly. Make it personal. Address the recipient by name, saying why you are emailing them. If you have been asked to quote a reference number, do so. Don’t fall into the trap of assuming that the person you are emailing has only one function, which is to sift through applications for a single solitary job. ‘They may well use the same address as they do for their regular email, or for applications for other vacancies,’ says Gert Nzimiro, a director at Reed Accounting. ‘If the recipient has to work out for themselves why you have emailed them because you’ve not taken the time to explain yourself – when an explanatory email takes just minutes – it might indicate that you can’t follow simple instructions, or that you don’t regard your potential employer’s request as sufficiently important to comply.’ Nor will taking short cuts – by typing the reference number into the subject field and attaching your CV – pass muster with most recipients. ‘There needs to be a sense of a human being behind the email,’ says Carnall. ‘If you were posting a printout of your CV, you wouldn’t just scribble a reference number at the top of the front page; you’d write or type a letter. Yes, it’s easier for recipients to open emails, and then open attachments – but doesn’t mean you should leave it to them to find out why you’re emailing them.’

Why not me?

Your email may only be given a cursory glance – so get straight down to business. Referring back to the requirements that you know about (or those you safely assume would be needed), summarise why you think you would be right for the job. ‘Making a direct reference to what the employer’s looking for shows that you’re taking the application seriously – instead of just sending what is obviously a template email,’ says Tomas Bergl, manager at recruiters Robert Half in the Czech Republic. ‘If you’re applying via a recruitment consultant, tailoring the email demonstrates that you’re genuinely interested in the opportunity with their client. That may well keep you at the forefront of your consultant’s mind when new jobs arise, which can only be a good thing.’ If the job specifically requires someone who is part-qualified, make it clear that you are studying ACCA and state how far advanced you are in your studies. And if you have passed all your exams first time so far, say so. ‘If the company sponsors its trainees through exams for professional qualifications, they may look favourably on you as someone who’s unlikely to cost them a fortune in re-sits,’ says Carnall. ‘If you’ve managed to pass your exams while holding down a demanding job, that’s even better.’ In a job market that increasingly sees candidates who resign receiving counter‑offers from their present employer, recruiters and their clients appreciate evidence that you are committed to changing jobs, not window-shopping in order to force up your salary. By saying why the job for which you are applying appeals to you, you are saying 'I really do like the sound of this opportunity'. According to Nzimiro, that counts considerably to those who decide who gets called in for interviews. ‘Motivation is a key factor for employers,’ he says. ‘They want reassurance that candidates in whom they plan to invest time interviewing are worthwhile prospects.’

If the recipient is hovering on the cusp of inviting you in for interview but isn’t yet certain, how you conclude your email can make an impact on their decision – and on your prospects of being invited to make your case in person. ‘Leave them in no uncertainty; make it clear that you can do the job, you want the job and that you’d be happy to attend an interview,’ says Carnall. Take care not to be overly demanding when signing off. Politely asking for confirmation of receipt by reply might not seem like a big ask – but multiplied by 10, or by 50 (or even more), and it becomes untenable. Some candidates ask for confirmation as a misguided strategy to strike up a matey dialogue with the recipient, in the hope that they might then receive favourable attention. ‘Unless you have good reason to suspect that your email has gone astray – for instance, if you receive an undeliverable message from the employer’s server – it’s best to leave well alone and wait for a reply,’ says Bergl. ‘Many organisations will have automated reply systems in place. But even if they don’t, or if you don’t receive an immediate reply, it’s better to hold back. Careful screening of emailed applications takes a lot of time and manpower.’ Once you have sent off your email, don’t forget to save it. Email may facilitate job-hunting in volumes that wouldn’t be humanly possible with handwritten letters – but that makes good housekeeping essential. ‘It strikes completely the wrong note if a candidate doesn’t appear to remember the job for which he or she has applied,’ says Nzimiro. ‘That initial spark of interest at the employer’s end can easily be snuffed out.’ Similarly, make sure you know which version of your CV you sent. If you have modified it to highlight specific experience or competencies, but you don’t remember the modification, you risk looking as if you have falsified your application, even if that is absolutely not the case. And if that happens over the interview desk, your careful preparation may come undone…

Putting pen to paper...

Thousands of people still like to send a printed CV off to recruiters and employers by regular post. If that includes you, ensure your application makes a good impression as soon as it emerges from the envelope. An easy read : only send a handwritten letter if your writing is legible – ask an impartial friend for their honest opinion; if they cannot read it, then busy recruiters and HR professionals with pressing demands on their time won’t give it a second glance. Plain and simple : stick to plain white or cream paper, and use dark blue or black ink; deviating from convention might make your application stand out – but for all the wrong reasons. Proof read ruthlessly : before you write your ‘proper’ version, write out what you plan to say in draft form, and read it back to yourself, making any necessary tweaks to spelling, grammar or vocabulary as you go along. Only when you are happy should you put pen to paper. Sign your name : even if you are sending a typed covering letter (which is perfectly acceptable in this day and age), signing your name on the printout is a nice touch that personalises your application. But take care not to smudge – allow the ink to dry and fold your letter so that your signature isn’t affected by creases in the paper. Take a copy : emails and letters typed on a PC can easily be saved, to be retrieved at a later date. Try to keep photocopies of any handwritten letters you send – if that is not possible, at least keep a record of the companies to which you have written, including notes about how you might have adjusted your standard wording to fit a specific job or organisation.

"It’s usually OK to be a little less formal in an email. However, that’s not a green light to be over-familiar. If you’re in any doubt about whether your tone might strike the wrong note, it’s better to err on the side of caution." Charlie Carnall, Hays Accountancy & Finance

Related Links

- Read more articles from Student Accountant

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

- Continental Textiles

- David Luke and The Parently Group

- Interpart UK

- London Lash

- Audit & Accounts

- Corporate Finance

- Digital Transformation

- Employee Ownership Trusts

- Payroll (provided by advo)

- Tax Advisory

- Entrepreneurial & Family

- Internationally Mobile

- Lifestyle & Leisure

- Manufacturing & Engineering

- Technology, Media and Telecom (TMT)

- Working at HURST

- Current Opportunities

- Trainee opportunities

- Developing your career

- Speculative Applications

- Team Stories

Dates for the diary

- 'Owners share insights after selling their businesses

- 2023/24 – the 23-month tax year?

- 21st century Revenue – HMRC’s app and new texting service

- A budget for long term growth?

- Are you on top of Making Tax Digital’s latest developments?

- Are you ready for MTD?

- Associated company rules changing 1 April

- Autumn Statement 2022 - Sacrifice for stability?

- Basis period rules among tax changes coming up

- Better economic news creates room for headline tax reductions

- Bidding wars power up deals market

- Boost your business with the Help to Grow: Digital scheme

- Bounce Back Repayments Begin

- Budget 2021 & Spending Review – A New Age of Optimism?

- Budget R&D changes

- Budget Verdict: Some positives, but corporation tax hike will weaken UK's competitive edge, says Adrian Young

- Budget reflection: Stability in uncertain times

- Business Owners Urged to Accelerate Deal Plans

- Business leaders hope for a ‘no-surprises’ Budget

- Business rates loophole on second homes closing

- Business rates revaluation in 2023

- CGT reporting and payment deadline extended

- Can Truss now deliver on her tax promises?

- Can the child benefit charge be fixed?

- Capital gains targeted in Autumn Statement

- Capital gains tax receipts underline tempting target for Chancellor

- Cash basis reform: potential turnover threshold changes

- Chancellor Announces Significant Changes to R&D Tax Relief

- Changes coming to R&D claims

- ChatGPT: A big leap forward, but carries risks for business users

- Companies House reform brings tougher company checks

- Congratulations to Luke and Emily - two rising stars at HURST!

- Conservative tax hike passes Commons vote

- Dealmaker Max promoted to Associate Partner

- Debt-evading directors face new Insolvency Service powers

- Demise of paper tax returns

- Dissecting inflation: what a difference a year makes

- Don’t forget to include Covid-19 payments on self-assessment returns

- Due Diligence - preparing your business for transactions

- Duo gain promotion in Tax team

- Duo's arrival strengthens our tax team

- Dutch PrimeGlobal Partners, Visser and Visser, visit Manchester!

- Electric vehicles can boost income with salary sacrifice

- Ellie enjoys the trip of a lifetime in HURST's global exchange

- Finalising returns figures and filing early

- Financial forecasting a 'pivotal tool' to futureproof businesses

- First time buyers: time to act?

- Five gain promotion in our business services team

- Five principles of investing everyone should know

- Focus on tax year-end planning

- Freeport Tax Incentives

- Freeports up and running

- General election 2024

- Getting in touch: HMRC’s new email facility

- Government’s tax take on growth trajectory

- HICBC discovery assessments deemed invalid

- HMRC ramps up its checks

- HMRC sets its sights on hidden electronic sales

- HMRC withdraws P11D PDF alternative

- HMRC's April Interest Rate Cut

- HURST Away Day raises £4,000 for hospice

- HURST Corporate Finance advise EDM Group on its acquisition of RGF Support

- HURST Corporate Finance advises care home provider on latest deal to grow its portfolio

- HURST Launches Autumn Client Satisfaction Tracker

- HURST advises Active on its sale to tech company Babble

- HURST advises FMB on its sale to Finitor Wealth

- HURST advises PCS Asbestos Consultants on sale to AIM-listed Marlowe

- HURST advises as food group beefs up portfolio with Binghams acquisition

- HURST advises law firm's shareholders on sale to Express Solicitors

- HURST advises on employee ownership move for fast-growing Instinct Resourcing

- HURST advises on management buyout at Statiflo

- HURST advises on sale of HCD Economics to Prime Global

- HURST advises on the sale of Fortis Pharma Consulting

- HURST advising Thermatic on the takeover trail as it aims to double revenues to 50M

- HURST blazes a trail with leadership development programme

- HURST celebrates 40th anniversary

- HURST duo promoted to partner

- HURST expands into private client tax with partner appointment

- HURST helps Red Rose Packaging to wrap up sale to Logson Group

- HURST hosts PrimeGlobal's EMEA Business Leadership conference

- HURST joins UN Network to accelerate our ESG strategy

- HURST officially named one of the 2023 UK's Best Workplaces for Women™.

- HURST plays leading role as panicium acquires The Bury Black Pudding Company

- HURST scores with National Football Museum

- HURST sponsors Stockport Pride Festival

- HURST staff reach new heights for Willow Wood

- HURST tax duo advise TNEI on transition to employee ownership

- HURST team clean beach of 1,000 pieces of litter

- HURST team to the fore as Growth Company acquires Winning Moves

- HURST to help clients achieve net zero

- HURST ushers in new era with imaginative rebrand

- Help to Grow: Digital scheme expanded

- Higher rate taxpayers: no longer a select club

- Hot topics in data

- Hunger for acquisitions is on the rise

- IHT receipts reach £6 billion record

- Import VAT confusion continues

- Improving your financial health

- Increased income – the double-edged sword

- Inheritance tax receipts double in a decade

- Interest rates poised to rise amid inflation surge, investment expert says

- LABOUR ON COURSE FOR VICTORY BUT MAJORITY IS NOT GUARANTEED, SAYS LORD FINKELSTEIN

- LIFE AS A BUSINESS SERVICES ASSOCIATE

- Learning from old lessons - the importance of cash forecasting

- Leasehold shake-up on the horizon

- M & A trends-plan for success

- MTD income tax pilot

- Making Tax Digital delayed once more

- Making Tax Digital small business review

- Making Tax Digital update

- Making Tax Digital: avoiding VAT penalties

- Managing the end of furlough

- Maxing Tax Digital delayed until 2024

- Mental health and wellbeing charity for young people gets boost from HURST

- Milestone Year For HURST

- Mini Budget: The beginnings of a return to fiscal responsibility?

- Minimum wage to increase in 2022

- Mitigating rising corporation tax rates

- More disclosure on the cards for businesses

- More estates paying IHT

- NICs boost for the self-employed

- National insurance gap extension

- New Covid-19 business support package

- New VAT penalties regime on the horizon

- New energy bill support scheme for businesses

- New points-based penalties for late VAT returns

- North West a hotspot for overseas companies

- Our business services team continues to expand

- Over-65s set new employment record

- Pay attention to tax codes

- Pension top-ups for lower-paid employees

- Planes, trains and automobiles – managing employees’ transport challenges

- Planning to sell your company? How you can increase shareholder value

- Post Budget Review

- Probate fees reform, round three

- Qualtex Appoints HURST

- R&D tax relief reforms on the cards

- R&D: Reform on the cards

- Record number of trainees join our ranks

- Regional M&A market continues its strong run into 2023

- Renowned Political Commentator, Lord Daniel Finkelstein OBE, to share Expert Analysis on Anticipated Impact of General Election

- Retiring in 2021 or Beyond

- Savers could miss out on thousands of pounds in retirement

- Scammers step-up sophisticated frauds

- School leavers being welcomed onto our trainee accountant programme

- Second Tax Day brings change and consultation

- Sense & Stability – what business leaders are hoping to see in the Autumn Statement

- Setting new taxpayer records

- Sick pay rebate returns to help relieve pressure on businesses

- Six-fold increase on late payment interest rates

- Soaring inflation 'a worrying factor' for entrepreneurs

- Spring Statement - all you need to know

- Streetwize Accessories Motors to record revenues in milestone year

- THE BENEFITS OF GOING EMPLOYEE OWNED

- Tax gap at all-time low

- Tax taking centre stage in Tory leadership battle at ‘perilous’ time for UK businesses

- Taxpayer Protection Taskforce to tackle Covid-19 fraud

- Taxpayer victory leads to room hire VAT exemption

- The Budget surprise: changes to the pension tax rules

- The Chancellor’s May economy statement: all about energy

- The Importance of Protection in Financial Planning

- The Ofgem price cap returns