- Privacy Policy

Home » Survey Research – Types, Methods, Examples

Survey Research – Types, Methods, Examples

Table of Contents

Survey Research

Definition:

Survey Research is a quantitative research method that involves collecting standardized data from a sample of individuals or groups through the use of structured questionnaires or interviews. The data collected is then analyzed statistically to identify patterns and relationships between variables, and to draw conclusions about the population being studied.

Survey research can be used to answer a variety of questions, including:

- What are people’s opinions about a certain topic?

- What are people’s experiences with a certain product or service?

- What are people’s beliefs about a certain issue?

Survey Research Methods

Survey Research Methods are as follows:

- Telephone surveys: A survey research method where questions are administered to respondents over the phone, often used in market research or political polling.

- Face-to-face surveys: A survey research method where questions are administered to respondents in person, often used in social or health research.

- Mail surveys: A survey research method where questionnaires are sent to respondents through mail, often used in customer satisfaction or opinion surveys.

- Online surveys: A survey research method where questions are administered to respondents through online platforms, often used in market research or customer feedback.

- Email surveys: A survey research method where questionnaires are sent to respondents through email, often used in customer satisfaction or opinion surveys.

- Mixed-mode surveys: A survey research method that combines two or more survey modes, often used to increase response rates or reach diverse populations.

- Computer-assisted surveys: A survey research method that uses computer technology to administer or collect survey data, often used in large-scale surveys or data collection.

- Interactive voice response surveys: A survey research method where respondents answer questions through a touch-tone telephone system, often used in automated customer satisfaction or opinion surveys.

- Mobile surveys: A survey research method where questions are administered to respondents through mobile devices, often used in market research or customer feedback.

- Group-administered surveys: A survey research method where questions are administered to a group of respondents simultaneously, often used in education or training evaluation.

- Web-intercept surveys: A survey research method where questions are administered to website visitors, often used in website or user experience research.

- In-app surveys: A survey research method where questions are administered to users of a mobile application, often used in mobile app or user experience research.

- Social media surveys: A survey research method where questions are administered to respondents through social media platforms, often used in social media or brand awareness research.

- SMS surveys: A survey research method where questions are administered to respondents through text messaging, often used in customer feedback or opinion surveys.

- IVR surveys: A survey research method where questions are administered to respondents through an interactive voice response system, often used in automated customer feedback or opinion surveys.

- Mixed-method surveys: A survey research method that combines both qualitative and quantitative data collection methods, often used in exploratory or mixed-method research.

- Drop-off surveys: A survey research method where respondents are provided with a survey questionnaire and asked to return it at a later time or through a designated drop-off location.

- Intercept surveys: A survey research method where respondents are approached in public places and asked to participate in a survey, often used in market research or customer feedback.

- Hybrid surveys: A survey research method that combines two or more survey modes, data sources, or research methods, often used in complex or multi-dimensional research questions.

Types of Survey Research

There are several types of survey research that can be used to collect data from a sample of individuals or groups. following are Types of Survey Research:

- Cross-sectional survey: A type of survey research that gathers data from a sample of individuals at a specific point in time, providing a snapshot of the population being studied.

- Longitudinal survey: A type of survey research that gathers data from the same sample of individuals over an extended period of time, allowing researchers to track changes or trends in the population being studied.

- Panel survey: A type of longitudinal survey research that tracks the same sample of individuals over time, typically collecting data at multiple points in time.

- Epidemiological survey: A type of survey research that studies the distribution and determinants of health and disease in a population, often used to identify risk factors and inform public health interventions.

- Observational survey: A type of survey research that collects data through direct observation of individuals or groups, often used in behavioral or social research.

- Correlational survey: A type of survey research that measures the degree of association or relationship between two or more variables, often used to identify patterns or trends in data.

- Experimental survey: A type of survey research that involves manipulating one or more variables to observe the effect on an outcome, often used to test causal hypotheses.

- Descriptive survey: A type of survey research that describes the characteristics or attributes of a population or phenomenon, often used in exploratory research or to summarize existing data.

- Diagnostic survey: A type of survey research that assesses the current state or condition of an individual or system, often used in health or organizational research.

- Explanatory survey: A type of survey research that seeks to explain or understand the causes or mechanisms behind a phenomenon, often used in social or psychological research.

- Process evaluation survey: A type of survey research that measures the implementation and outcomes of a program or intervention, often used in program evaluation or quality improvement.

- Impact evaluation survey: A type of survey research that assesses the effectiveness or impact of a program or intervention, often used to inform policy or decision-making.

- Customer satisfaction survey: A type of survey research that measures the satisfaction or dissatisfaction of customers with a product, service, or experience, often used in marketing or customer service research.

- Market research survey: A type of survey research that collects data on consumer preferences, behaviors, or attitudes, often used in market research or product development.

- Public opinion survey: A type of survey research that measures the attitudes, beliefs, or opinions of a population on a specific issue or topic, often used in political or social research.

- Behavioral survey: A type of survey research that measures actual behavior or actions of individuals, often used in health or social research.

- Attitude survey: A type of survey research that measures the attitudes, beliefs, or opinions of individuals, often used in social or psychological research.

- Opinion poll: A type of survey research that measures the opinions or preferences of a population on a specific issue or topic, often used in political or media research.

- Ad hoc survey: A type of survey research that is conducted for a specific purpose or research question, often used in exploratory research or to answer a specific research question.

Types Based on Methodology

Based on Methodology Survey are divided into two Types:

Quantitative Survey Research

Qualitative survey research.

Quantitative survey research is a method of collecting numerical data from a sample of participants through the use of standardized surveys or questionnaires. The purpose of quantitative survey research is to gather empirical evidence that can be analyzed statistically to draw conclusions about a particular population or phenomenon.

In quantitative survey research, the questions are structured and pre-determined, often utilizing closed-ended questions, where participants are given a limited set of response options to choose from. This approach allows for efficient data collection and analysis, as well as the ability to generalize the findings to a larger population.

Quantitative survey research is often used in market research, social sciences, public health, and other fields where numerical data is needed to make informed decisions and recommendations.

Qualitative survey research is a method of collecting non-numerical data from a sample of participants through the use of open-ended questions or semi-structured interviews. The purpose of qualitative survey research is to gain a deeper understanding of the experiences, perceptions, and attitudes of participants towards a particular phenomenon or topic.

In qualitative survey research, the questions are open-ended, allowing participants to share their thoughts and experiences in their own words. This approach allows for a rich and nuanced understanding of the topic being studied, and can provide insights that are difficult to capture through quantitative methods alone.

Qualitative survey research is often used in social sciences, education, psychology, and other fields where a deeper understanding of human experiences and perceptions is needed to inform policy, practice, or theory.

Data Analysis Methods

There are several Survey Research Data Analysis Methods that researchers may use, including:

- Descriptive statistics: This method is used to summarize and describe the basic features of the survey data, such as the mean, median, mode, and standard deviation. These statistics can help researchers understand the distribution of responses and identify any trends or patterns.

- Inferential statistics: This method is used to make inferences about the larger population based on the data collected in the survey. Common inferential statistical methods include hypothesis testing, regression analysis, and correlation analysis.

- Factor analysis: This method is used to identify underlying factors or dimensions in the survey data. This can help researchers simplify the data and identify patterns and relationships that may not be immediately apparent.

- Cluster analysis: This method is used to group similar respondents together based on their survey responses. This can help researchers identify subgroups within the larger population and understand how different groups may differ in their attitudes, behaviors, or preferences.

- Structural equation modeling: This method is used to test complex relationships between variables in the survey data. It can help researchers understand how different variables may be related to one another and how they may influence one another.

- Content analysis: This method is used to analyze open-ended responses in the survey data. Researchers may use software to identify themes or categories in the responses, or they may manually review and code the responses.

- Text mining: This method is used to analyze text-based survey data, such as responses to open-ended questions. Researchers may use software to identify patterns and themes in the text, or they may manually review and code the text.

Applications of Survey Research

Here are some common applications of survey research:

- Market Research: Companies use survey research to gather insights about customer needs, preferences, and behavior. These insights are used to create marketing strategies and develop new products.

- Public Opinion Research: Governments and political parties use survey research to understand public opinion on various issues. This information is used to develop policies and make decisions.

- Social Research: Survey research is used in social research to study social trends, attitudes, and behavior. Researchers use survey data to explore topics such as education, health, and social inequality.

- Academic Research: Survey research is used in academic research to study various phenomena. Researchers use survey data to test theories, explore relationships between variables, and draw conclusions.

- Customer Satisfaction Research: Companies use survey research to gather information about customer satisfaction with their products and services. This information is used to improve customer experience and retention.

- Employee Surveys: Employers use survey research to gather feedback from employees about their job satisfaction, working conditions, and organizational culture. This information is used to improve employee retention and productivity.

- Health Research: Survey research is used in health research to study topics such as disease prevalence, health behaviors, and healthcare access. Researchers use survey data to develop interventions and improve healthcare outcomes.

Examples of Survey Research

Here are some real-time examples of survey research:

- COVID-19 Pandemic Surveys: Since the outbreak of the COVID-19 pandemic, surveys have been conducted to gather information about public attitudes, behaviors, and perceptions related to the pandemic. Governments and healthcare organizations have used this data to develop public health strategies and messaging.

- Political Polls During Elections: During election seasons, surveys are used to measure public opinion on political candidates, policies, and issues in real-time. This information is used by political parties to develop campaign strategies and make decisions.

- Customer Feedback Surveys: Companies often use real-time customer feedback surveys to gather insights about customer experience and satisfaction. This information is used to improve products and services quickly.

- Event Surveys: Organizers of events such as conferences and trade shows often use surveys to gather feedback from attendees in real-time. This information can be used to improve future events and make adjustments during the current event.

- Website and App Surveys: Website and app owners use surveys to gather real-time feedback from users about the functionality, user experience, and overall satisfaction with their platforms. This feedback can be used to improve the user experience and retain customers.

- Employee Pulse Surveys: Employers use real-time pulse surveys to gather feedback from employees about their work experience and overall job satisfaction. This feedback is used to make changes in real-time to improve employee retention and productivity.

Survey Sample

Purpose of survey research.

The purpose of survey research is to gather data and insights from a representative sample of individuals. Survey research allows researchers to collect data quickly and efficiently from a large number of people, making it a valuable tool for understanding attitudes, behaviors, and preferences.

Here are some common purposes of survey research:

- Descriptive Research: Survey research is often used to describe characteristics of a population or a phenomenon. For example, a survey could be used to describe the characteristics of a particular demographic group, such as age, gender, or income.

- Exploratory Research: Survey research can be used to explore new topics or areas of research. Exploratory surveys are often used to generate hypotheses or identify potential relationships between variables.

- Explanatory Research: Survey research can be used to explain relationships between variables. For example, a survey could be used to determine whether there is a relationship between educational attainment and income.

- Evaluation Research: Survey research can be used to evaluate the effectiveness of a program or intervention. For example, a survey could be used to evaluate the impact of a health education program on behavior change.

- Monitoring Research: Survey research can be used to monitor trends or changes over time. For example, a survey could be used to monitor changes in attitudes towards climate change or political candidates over time.

When to use Survey Research

there are certain circumstances where survey research is particularly appropriate. Here are some situations where survey research may be useful:

- When the research question involves attitudes, beliefs, or opinions: Survey research is particularly useful for understanding attitudes, beliefs, and opinions on a particular topic. For example, a survey could be used to understand public opinion on a political issue.

- When the research question involves behaviors or experiences: Survey research can also be useful for understanding behaviors and experiences. For example, a survey could be used to understand the prevalence of a particular health behavior.

- When a large sample size is needed: Survey research allows researchers to collect data from a large number of people quickly and efficiently. This makes it a useful method when a large sample size is needed to ensure statistical validity.

- When the research question is time-sensitive: Survey research can be conducted quickly, which makes it a useful method when the research question is time-sensitive. For example, a survey could be used to understand public opinion on a breaking news story.

- When the research question involves a geographically dispersed population: Survey research can be conducted online, which makes it a useful method when the population of interest is geographically dispersed.

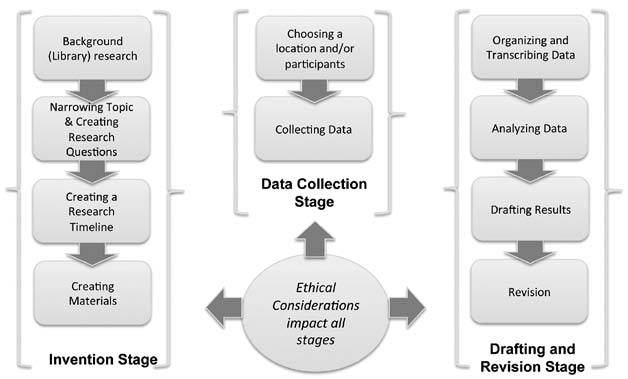

How to Conduct Survey Research

Conducting survey research involves several steps that need to be carefully planned and executed. Here is a general overview of the process:

- Define the research question: The first step in conducting survey research is to clearly define the research question. The research question should be specific, measurable, and relevant to the population of interest.

- Develop a survey instrument : The next step is to develop a survey instrument. This can be done using various methods, such as online survey tools or paper surveys. The survey instrument should be designed to elicit the information needed to answer the research question, and should be pre-tested with a small sample of individuals.

- Select a sample : The sample is the group of individuals who will be invited to participate in the survey. The sample should be representative of the population of interest, and the size of the sample should be sufficient to ensure statistical validity.

- Administer the survey: The survey can be administered in various ways, such as online, by mail, or in person. The method of administration should be chosen based on the population of interest and the research question.

- Analyze the data: Once the survey data is collected, it needs to be analyzed. This involves summarizing the data using statistical methods, such as frequency distributions or regression analysis.

- Draw conclusions: The final step is to draw conclusions based on the data analysis. This involves interpreting the results and answering the research question.

Advantages of Survey Research

There are several advantages to using survey research, including:

- Efficient data collection: Survey research allows researchers to collect data quickly and efficiently from a large number of people. This makes it a useful method for gathering information on a wide range of topics.

- Standardized data collection: Surveys are typically standardized, which means that all participants receive the same questions in the same order. This ensures that the data collected is consistent and reliable.

- Cost-effective: Surveys can be conducted online, by mail, or in person, which makes them a cost-effective method of data collection.

- Anonymity: Participants can remain anonymous when responding to a survey. This can encourage participants to be more honest and open in their responses.

- Easy comparison: Surveys allow for easy comparison of data between different groups or over time. This makes it possible to identify trends and patterns in the data.

- Versatility: Surveys can be used to collect data on a wide range of topics, including attitudes, beliefs, behaviors, and preferences.

Limitations of Survey Research

Here are some of the main limitations of survey research:

- Limited depth: Surveys are typically designed to collect quantitative data, which means that they do not provide much depth or detail about people’s experiences or opinions. This can limit the insights that can be gained from the data.

- Potential for bias: Surveys can be affected by various biases, including selection bias, response bias, and social desirability bias. These biases can distort the results and make them less accurate.

- L imited validity: Surveys are only as valid as the questions they ask. If the questions are poorly designed or ambiguous, the results may not accurately reflect the respondents’ attitudes or behaviors.

- Limited generalizability : Survey results are only generalizable to the population from which the sample was drawn. If the sample is not representative of the population, the results may not be generalizable to the larger population.

- Limited ability to capture context: Surveys typically do not capture the context in which attitudes or behaviors occur. This can make it difficult to understand the reasons behind the responses.

- Limited ability to capture complex phenomena: Surveys are not well-suited to capture complex phenomena, such as emotions or the dynamics of interpersonal relationships.

Following is an example of a Survey Sample:

Welcome to our Survey Research Page! We value your opinions and appreciate your participation in this survey. Please answer the questions below as honestly and thoroughly as possible.

1. What is your age?

- A) Under 18

- G) 65 or older

2. What is your highest level of education completed?

- A) Less than high school

- B) High school or equivalent

- C) Some college or technical school

- D) Bachelor’s degree

- E) Graduate or professional degree

3. What is your current employment status?

- A) Employed full-time

- B) Employed part-time

- C) Self-employed

- D) Unemployed

4. How often do you use the internet per day?

- A) Less than 1 hour

- B) 1-3 hours

- C) 3-5 hours

- D) 5-7 hours

- E) More than 7 hours

5. How often do you engage in social media per day?

6. Have you ever participated in a survey research study before?

7. If you have participated in a survey research study before, how was your experience?

- A) Excellent

- E) Very poor

8. What are some of the topics that you would be interested in participating in a survey research study about?

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

9. How often would you be willing to participate in survey research studies?

- A) Once a week

- B) Once a month

- C) Once every 6 months

- D) Once a year

10. Any additional comments or suggestions?

Thank you for taking the time to complete this survey. Your feedback is important to us and will help us improve our survey research efforts.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Questionnaire – Definition, Types, and Examples

Case Study – Methods, Examples and Guide

Observational Research – Methods and Guide

Quantitative Research – Methods, Types and...

Qualitative Research Methods

Explanatory Research – Types, Methods, Guide

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Survey Research: Definition, Examples and Methods

Survey Research is a quantitative research method used for collecting data from a set of respondents. It has been perhaps one of the most used methodologies in the industry for several years due to the multiple benefits and advantages that it has when collecting and analyzing data.

LEARN ABOUT: Behavioral Research

In this article, you will learn everything about survey research, such as types, methods, and examples.

Survey Research Definition

Survey Research is defined as the process of conducting research using surveys that researchers send to survey respondents. The data collected from surveys is then statistically analyzed to draw meaningful research conclusions. In the 21st century, every organization’s eager to understand what their customers think about their products or services and make better business decisions. Researchers can conduct research in multiple ways, but surveys are proven to be one of the most effective and trustworthy research methods. An online survey is a method for extracting information about a significant business matter from an individual or a group of individuals. It consists of structured survey questions that motivate the participants to respond. Creditable survey research can give these businesses access to a vast information bank. Organizations in media, other companies, and even governments rely on survey research to obtain accurate data.

The traditional definition of survey research is a quantitative method for collecting information from a pool of respondents by asking multiple survey questions. This research type includes the recruitment of individuals collection, and analysis of data. It’s useful for researchers who aim to communicate new features or trends to their respondents.

LEARN ABOUT: Level of Analysis Generally, it’s the primary step towards obtaining quick information about mainstream topics and conducting more rigorous and detailed quantitative research methods like surveys/polls or qualitative research methods like focus groups/on-call interviews can follow. There are many situations where researchers can conduct research using a blend of both qualitative and quantitative strategies.

LEARN ABOUT: Survey Sampling

Survey Research Methods

Survey research methods can be derived based on two critical factors: Survey research tool and time involved in conducting research. There are three main survey research methods, divided based on the medium of conducting survey research:

- Online/ Email: Online survey research is one of the most popular survey research methods today. The survey cost involved in online survey research is extremely minimal, and the responses gathered are highly accurate.

- Phone: Survey research conducted over the telephone ( CATI survey ) can be useful in collecting data from a more extensive section of the target population. There are chances that the money invested in phone surveys will be higher than other mediums, and the time required will be higher.

- Face-to-face: Researchers conduct face-to-face in-depth interviews in situations where there is a complicated problem to solve. The response rate for this method is the highest, but it can be costly.

Further, based on the time taken, survey research can be classified into two methods:

- Longitudinal survey research: Longitudinal survey research involves conducting survey research over a continuum of time and spread across years and decades. The data collected using this survey research method from one time period to another is qualitative or quantitative. Respondent behavior, preferences, and attitudes are continuously observed over time to analyze reasons for a change in behavior or preferences. For example, suppose a researcher intends to learn about the eating habits of teenagers. In that case, he/she will follow a sample of teenagers over a considerable period to ensure that the collected information is reliable. Often, cross-sectional survey research follows a longitudinal study .

- Cross-sectional survey research: Researchers conduct a cross-sectional survey to collect insights from a target audience at a particular time interval. This survey research method is implemented in various sectors such as retail, education, healthcare, SME businesses, etc. Cross-sectional studies can either be descriptive or analytical. It is quick and helps researchers collect information in a brief period. Researchers rely on the cross-sectional survey research method in situations where descriptive analysis of a subject is required.

Survey research also is bifurcated according to the sampling methods used to form samples for research: Probability and Non-probability sampling. Every individual in a population should be considered equally to be a part of the survey research sample. Probability sampling is a sampling method in which the researcher chooses the elements based on probability theory. The are various probability research methods, such as simple random sampling , systematic sampling, cluster sampling, stratified random sampling, etc. Non-probability sampling is a sampling method where the researcher uses his/her knowledge and experience to form samples.

LEARN ABOUT: Survey Sample Sizes

The various non-probability sampling techniques are :

- Convenience sampling

- Snowball sampling

- Consecutive sampling

- Judgemental sampling

- Quota sampling

Process of implementing survey research methods:

- Decide survey questions: Brainstorm and put together valid survey questions that are grammatically and logically appropriate. Understanding the objective and expected outcomes of the survey helps a lot. There are many surveys where details of responses are not as important as gaining insights about what customers prefer from the provided options. In such situations, a researcher can include multiple-choice questions or closed-ended questions . Whereas, if researchers need to obtain details about specific issues, they can consist of open-ended questions in the questionnaire. Ideally, the surveys should include a smart balance of open-ended and closed-ended questions. Use survey questions like Likert Scale , Semantic Scale, Net Promoter Score question, etc., to avoid fence-sitting.

LEARN ABOUT: System Usability Scale

- Finalize a target audience: Send out relevant surveys as per the target audience and filter out irrelevant questions as per the requirement. The survey research will be instrumental in case the target population decides on a sample. This way, results can be according to the desired market and be generalized to the entire population.

LEARN ABOUT: Testimonial Questions

- Send out surveys via decided mediums: Distribute the surveys to the target audience and patiently wait for the feedback and comments- this is the most crucial step of the survey research. The survey needs to be scheduled, keeping in mind the nature of the target audience and its regions. Surveys can be conducted via email, embedded in a website, shared via social media, etc., to gain maximum responses.

- Analyze survey results: Analyze the feedback in real-time and identify patterns in the responses which might lead to a much-needed breakthrough for your organization. GAP, TURF Analysis , Conjoint analysis, Cross tabulation, and many such survey feedback analysis methods can be used to spot and shed light on respondent behavior. Researchers can use the results to implement corrective measures to improve customer/employee satisfaction.

Reasons to conduct survey research

The most crucial and integral reason for conducting market research using surveys is that you can collect answers regarding specific, essential questions. You can ask these questions in multiple survey formats as per the target audience and the intent of the survey. Before designing a study, every organization must figure out the objective of carrying this out so that the study can be structured, planned, and executed to perfection.

LEARN ABOUT: Research Process Steps

Questions that need to be on your mind while designing a survey are:

- What is the primary aim of conducting the survey?

- How do you plan to utilize the collected survey data?

- What type of decisions do you plan to take based on the points mentioned above?

There are three critical reasons why an organization must conduct survey research.

- Understand respondent behavior to get solutions to your queries: If you’ve carefully curated a survey, the respondents will provide insights about what they like about your organization as well as suggestions for improvement. To motivate them to respond, you must be very vocal about how secure their responses will be and how you will utilize the answers. This will push them to be 100% honest about their feedback, opinions, and comments. Online surveys or mobile surveys have proved their privacy, and due to this, more and more respondents feel free to put forth their feedback through these mediums.

- Present a medium for discussion: A survey can be the perfect platform for respondents to provide criticism or applause for an organization. Important topics like product quality or quality of customer service etc., can be put on the table for discussion. A way you can do it is by including open-ended questions where the respondents can write their thoughts. This will make it easy for you to correlate your survey to what you intend to do with your product or service.

- Strategy for never-ending improvements: An organization can establish the target audience’s attributes from the pilot phase of survey research . Researchers can use the criticism and feedback received from this survey to improve the product/services. Once the company successfully makes the improvements, it can send out another survey to measure the change in feedback keeping the pilot phase the benchmark. By doing this activity, the organization can track what was effectively improved and what still needs improvement.

Survey Research Scales

There are four main scales for the measurement of variables:

- Nominal Scale: A nominal scale associates numbers with variables for mere naming or labeling, and the numbers usually have no other relevance. It is the most basic of the four levels of measurement.

- Ordinal Scale: The ordinal scale has an innate order within the variables along with labels. It establishes the rank between the variables of a scale but not the difference value between the variables.

- Interval Scale: The interval scale is a step ahead in comparison to the other two scales. Along with establishing a rank and name of variables, the scale also makes known the difference between the two variables. The only drawback is that there is no fixed start point of the scale, i.e., the actual zero value is absent.

- Ratio Scale: The ratio scale is the most advanced measurement scale, which has variables that are labeled in order and have a calculated difference between variables. In addition to what interval scale orders, this scale has a fixed starting point, i.e., the actual zero value is present.

Benefits of survey research

In case survey research is used for all the right purposes and is implemented properly, marketers can benefit by gaining useful, trustworthy data that they can use to better the ROI of the organization.

Other benefits of survey research are:

- Minimum investment: Mobile surveys and online surveys have minimal finance invested per respondent. Even with the gifts and other incentives provided to the people who participate in the study, online surveys are extremely economical compared to paper-based surveys.

- Versatile sources for response collection: You can conduct surveys via various mediums like online and mobile surveys. You can further classify them into qualitative mediums like focus groups , and interviews and quantitative mediums like customer-centric surveys. Due to the offline survey response collection option, researchers can conduct surveys in remote areas with limited internet connectivity. This can make data collection and analysis more convenient and extensive.

- Reliable for respondents: Surveys are extremely secure as the respondent details and responses are kept safeguarded. This anonymity makes respondents answer the survey questions candidly and with absolute honesty. An organization seeking to receive explicit responses for its survey research must mention that it will be confidential.

Survey research design

Researchers implement a survey research design in cases where there is a limited cost involved and there is a need to access details easily. This method is often used by small and large organizations to understand and analyze new trends, market demands, and opinions. Collecting information through tactfully designed survey research can be much more effective and productive than a casually conducted survey.

There are five stages of survey research design:

- Decide an aim of the research: There can be multiple reasons for a researcher to conduct a survey, but they need to decide a purpose for the research. This is the primary stage of survey research as it can mold the entire path of a survey, impacting its results.

- Filter the sample from target population: Who to target? is an essential question that a researcher should answer and keep in mind while conducting research. The precision of the results is driven by who the members of a sample are and how useful their opinions are. The quality of respondents in a sample is essential for the results received for research and not the quantity. If a researcher seeks to understand whether a product feature will work well with their target market, he/she can conduct survey research with a group of market experts for that product or technology.

- Zero-in on a survey method: Many qualitative and quantitative research methods can be discussed and decided. Focus groups, online interviews, surveys, polls, questionnaires, etc. can be carried out with a pre-decided sample of individuals.

- Design the questionnaire: What will the content of the survey be? A researcher is required to answer this question to be able to design it effectively. What will the content of the cover letter be? Or what are the survey questions of this questionnaire? Understand the target market thoroughly to create a questionnaire that targets a sample to gain insights about a survey research topic.

- Send out surveys and analyze results: Once the researcher decides on which questions to include in a study, they can send it across to the selected sample . Answers obtained from this survey can be analyzed to make product-related or marketing-related decisions.

Survey examples: 10 tips to design the perfect research survey

Picking the right survey design can be the key to gaining the information you need to make crucial decisions for all your research. It is essential to choose the right topic, choose the right question types, and pick a corresponding design. If this is your first time creating a survey, it can seem like an intimidating task. But with QuestionPro, each step of the process is made simple and easy.

Below are 10 Tips To Design The Perfect Research Survey:

- Set your SMART goals: Before conducting any market research or creating a particular plan, set your SMART Goals . What is that you want to achieve with the survey? How will you measure it promptly, and what are the results you are expecting?

- Choose the right questions: Designing a survey can be a tricky task. Asking the right questions may help you get the answers you are looking for and ease the task of analyzing. So, always choose those specific questions – relevant to your research.

- Begin your survey with a generalized question: Preferably, start your survey with a general question to understand whether the respondent uses the product or not. That also provides an excellent base and intro for your survey.

- Enhance your survey: Choose the best, most relevant, 15-20 questions. Frame each question as a different question type based on the kind of answer you would like to gather from each. Create a survey using different types of questions such as multiple-choice, rating scale, open-ended, etc. Look at more survey examples and four measurement scales every researcher should remember.

- Prepare yes/no questions: You may also want to use yes/no questions to separate people or branch them into groups of those who “have purchased” and those who “have not yet purchased” your products or services. Once you separate them, you can ask them different questions.

- Test all electronic devices: It becomes effortless to distribute your surveys if respondents can answer them on different electronic devices like mobiles, tablets, etc. Once you have created your survey, it’s time to TEST. You can also make any corrections if needed at this stage.

- Distribute your survey: Once your survey is ready, it is time to share and distribute it to the right audience. You can share handouts and share them via email, social media, and other industry-related offline/online communities.

- Collect and analyze responses: After distributing your survey, it is time to gather all responses. Make sure you store your results in a particular document or an Excel sheet with all the necessary categories mentioned so that you don’t lose your data. Remember, this is the most crucial stage. Segregate your responses based on demographics, psychographics, and behavior. This is because, as a researcher, you must know where your responses are coming from. It will help you to analyze, predict decisions, and help write the summary report.

- Prepare your summary report: Now is the time to share your analysis. At this stage, you should mention all the responses gathered from a survey in a fixed format. Also, the reader/customer must get clarity about your goal, which you were trying to gain from the study. Questions such as – whether the product or service has been used/preferred or not. Do respondents prefer some other product to another? Any recommendations?

Having a tool that helps you carry out all the necessary steps to carry out this type of study is a vital part of any project. At QuestionPro, we have helped more than 10,000 clients around the world to carry out data collection in a simple and effective way, in addition to offering a wide range of solutions to take advantage of this data in the best possible way.

From dashboards, advanced analysis tools, automation, and dedicated functions, in QuestionPro, you will find everything you need to execute your research projects effectively. Uncover insights that matter the most!

MORE LIKE THIS

Top 20 Employee Engagement Software Solutions

May 3, 2024

15 Best Customer Experience Software of 2024

May 2, 2024

Journey Orchestration Platforms: Top 11 Platforms in 2024

Top 12 Employee Pulse Survey Tools Unlocking Insights in 2024

May 1, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

9 Survey research

Survey research is a research method involving the use of standardised questionnaires or interviews to collect data about people and their preferences, thoughts, and behaviours in a systematic manner. Although census surveys were conducted as early as Ancient Egypt, survey as a formal research method was pioneered in the 1930–40s by sociologist Paul Lazarsfeld to examine the effects of the radio on political opinion formation of the United States. This method has since become a very popular method for quantitative research in the social sciences.

The survey method can be used for descriptive, exploratory, or explanatory research. This method is best suited for studies that have individual people as the unit of analysis. Although other units of analysis, such as groups, organisations or dyads—pairs of organisations, such as buyers and sellers—are also studied using surveys, such studies often use a specific person from each unit as a ‘key informant’ or a ‘proxy’ for that unit. Consequently, such surveys may be subject to respondent bias if the chosen informant does not have adequate knowledge or has a biased opinion about the phenomenon of interest. For instance, Chief Executive Officers may not adequately know employees’ perceptions or teamwork in their own companies, and may therefore be the wrong informant for studies of team dynamics or employee self-esteem.

Survey research has several inherent strengths compared to other research methods. First, surveys are an excellent vehicle for measuring a wide variety of unobservable data, such as people’s preferences (e.g., political orientation), traits (e.g., self-esteem), attitudes (e.g., toward immigrants), beliefs (e.g., about a new law), behaviours (e.g., smoking or drinking habits), or factual information (e.g., income). Second, survey research is also ideally suited for remotely collecting data about a population that is too large to observe directly. A large area—such as an entire country—can be covered by postal, email, or telephone surveys using meticulous sampling to ensure that the population is adequately represented in a small sample. Third, due to their unobtrusive nature and the ability to respond at one’s convenience, questionnaire surveys are preferred by some respondents. Fourth, interviews may be the only way of reaching certain population groups such as the homeless or illegal immigrants for which there is no sampling frame available. Fifth, large sample surveys may allow detection of small effects even while analysing multiple variables, and depending on the survey design, may also allow comparative analysis of population subgroups (i.e., within-group and between-group analysis). Sixth, survey research is more economical in terms of researcher time, effort and cost than other methods such as experimental research and case research. At the same time, survey research also has some unique disadvantages. It is subject to a large number of biases such as non-response bias, sampling bias, social desirability bias, and recall bias, as discussed at the end of this chapter.

Depending on how the data is collected, survey research can be divided into two broad categories: questionnaire surveys (which may be postal, group-administered, or online surveys), and interview surveys (which may be personal, telephone, or focus group interviews). Questionnaires are instruments that are completed in writing by respondents, while interviews are completed by the interviewer based on verbal responses provided by respondents. As discussed below, each type has its own strengths and weaknesses in terms of their costs, coverage of the target population, and researcher’s flexibility in asking questions.

Questionnaire surveys

Invented by Sir Francis Galton, a questionnaire is a research instrument consisting of a set of questions (items) intended to capture responses from respondents in a standardised manner. Questions may be unstructured or structured. Unstructured questions ask respondents to provide a response in their own words, while structured questions ask respondents to select an answer from a given set of choices. Subjects’ responses to individual questions (items) on a structured questionnaire may be aggregated into a composite scale or index for statistical analysis. Questions should be designed in such a way that respondents are able to read, understand, and respond to them in a meaningful way, and hence the survey method may not be appropriate or practical for certain demographic groups such as children or the illiterate.

Most questionnaire surveys tend to be self-administered postal surveys , where the same questionnaire is posted to a large number of people, and willing respondents can complete the survey at their convenience and return it in prepaid envelopes. Postal surveys are advantageous in that they are unobtrusive and inexpensive to administer, since bulk postage is cheap in most countries. However, response rates from postal surveys tend to be quite low since most people ignore survey requests. There may also be long delays (several months) in respondents’ completing and returning the survey, or they may even simply lose it. Hence, the researcher must continuously monitor responses as they are being returned, track and send non-respondents repeated reminders (two or three reminders at intervals of one to one and a half months is ideal). Questionnaire surveys are also not well-suited for issues that require clarification on the part of the respondent or those that require detailed written responses. Longitudinal designs can be used to survey the same set of respondents at different times, but response rates tend to fall precipitously from one survey to the next.

A second type of survey is a group-administered questionnaire . A sample of respondents is brought together at a common place and time, and each respondent is asked to complete the survey questionnaire while in that room. Respondents enter their responses independently without interacting with one another. This format is convenient for the researcher, and a high response rate is assured. If respondents do not understand any specific question, they can ask for clarification. In many organisations, it is relatively easy to assemble a group of employees in a conference room or lunch room, especially if the survey is approved by corporate executives.

A more recent type of questionnaire survey is an online or web survey. These surveys are administered over the Internet using interactive forms. Respondents may receive an email request for participation in the survey with a link to a website where the survey may be completed. Alternatively, the survey may be embedded into an email, and can be completed and returned via email. These surveys are very inexpensive to administer, results are instantly recorded in an online database, and the survey can be easily modified if needed. However, if the survey website is not password-protected or designed to prevent multiple submissions, the responses can be easily compromised. Furthermore, sampling bias may be a significant issue since the survey cannot reach people who do not have computer or Internet access, such as many of the poor, senior, and minority groups, and the respondent sample is skewed toward a younger demographic who are online much of the time and have the time and ability to complete such surveys. Computing the response rate may be problematic if the survey link is posted on LISTSERVs or bulletin boards instead of being emailed directly to targeted respondents. For these reasons, many researchers prefer dual-media surveys (e.g., postal survey and online survey), allowing respondents to select their preferred method of response.

Constructing a survey questionnaire is an art. Numerous decisions must be made about the content of questions, their wording, format, and sequencing, all of which can have important consequences for the survey responses.

Response formats. Survey questions may be structured or unstructured. Responses to structured questions are captured using one of the following response formats:

Dichotomous response , where respondents are asked to select one of two possible choices, such as true/false, yes/no, or agree/disagree. An example of such a question is: Do you think that the death penalty is justified under some circumstances? (circle one): yes / no.

Nominal response , where respondents are presented with more than two unordered options, such as: What is your industry of employment?: manufacturing / consumer services / retail / education / healthcare / tourism and hospitality / other.

Ordinal response , where respondents have more than two ordered options, such as: What is your highest level of education?: high school / bachelor’s degree / postgraduate degree.

Interval-level response , where respondents are presented with a 5-point or 7-point Likert scale, semantic differential scale, or Guttman scale. Each of these scale types were discussed in a previous chapter.

Continuous response , where respondents enter a continuous (ratio-scaled) value with a meaningful zero point, such as their age or tenure in a firm. These responses generally tend to be of the fill-in-the blanks type.

Question content and wording. Responses obtained in survey research are very sensitive to the types of questions asked. Poorly framed or ambiguous questions will likely result in meaningless responses with very little value. Dillman (1978) [1] recommends several rules for creating good survey questions. Every single question in a survey should be carefully scrutinised for the following issues:

Is the question clear and understandable ?: Survey questions should be stated in very simple language, preferably in active voice, and without complicated words or jargon that may not be understood by a typical respondent. All questions in the questionnaire should be worded in a similar manner to make it easy for respondents to read and understand them. The only exception is if your survey is targeted at a specialised group of respondents, such as doctors, lawyers and researchers, who use such jargon in their everyday environment. Is the question worded in a negative manner ?: Negatively worded questions such as ‘Should your local government not raise taxes?’ tend to confuse many respondents and lead to inaccurate responses. Double-negatives should be avoided when designing survey questions.

Is the question ambiguous ?: Survey questions should not use words or expressions that may be interpreted differently by different respondents (e.g., words like ‘any’ or ‘just’). For instance, if you ask a respondent, ‘What is your annual income?’, it is unclear whether you are referring to salary/wages, or also dividend, rental, and other income, whether you are referring to personal income, family income (including spouse’s wages), or personal and business income. Different interpretation by different respondents will lead to incomparable responses that cannot be interpreted correctly.

Does the question have biased or value-laden words ?: Bias refers to any property of a question that encourages subjects to answer in a certain way. Kenneth Rasinky (1989) [2] examined several studies on people’s attitude toward government spending, and observed that respondents tend to indicate stronger support for ‘assistance to the poor’ and less for ‘welfare’, even though both terms had the same meaning. In this study, more support was also observed for ‘halting rising crime rate’ and less for ‘law enforcement’, more for ‘solving problems of big cities’ and less for ‘assistance to big cities’, and more for ‘dealing with drug addiction’ and less for ‘drug rehabilitation’. A biased language or tone tends to skew observed responses. It is often difficult to anticipate in advance the biasing wording, but to the greatest extent possible, survey questions should be carefully scrutinised to avoid biased language.

Is the question double-barrelled ?: Double-barrelled questions are those that can have multiple answers. For example, ‘Are you satisfied with the hardware and software provided for your work?’. In this example, how should a respondent answer if they are satisfied with the hardware, but not with the software, or vice versa? It is always advisable to separate double-barrelled questions into separate questions: ‘Are you satisfied with the hardware provided for your work?’, and ’Are you satisfied with the software provided for your work?’. Another example: ‘Does your family favour public television?’. Some people may favour public TV for themselves, but favour certain cable TV programs such as Sesame Street for their children.

Is the question too general ?: Sometimes, questions that are too general may not accurately convey respondents’ perceptions. If you asked someone how they liked a certain book and provided a response scale ranging from ‘not at all’ to ‘extremely well’, if that person selected ‘extremely well’, what do they mean? Instead, ask more specific behavioural questions, such as, ‘Will you recommend this book to others, or do you plan to read other books by the same author?’. Likewise, instead of asking, ‘How big is your firm?’ (which may be interpreted differently by respondents), ask, ‘How many people work for your firm?’, and/or ‘What is the annual revenue of your firm?’, which are both measures of firm size.

Is the question too detailed ?: Avoid unnecessarily detailed questions that serve no specific research purpose. For instance, do you need the age of each child in a household, or is just the number of children in the household acceptable? However, if unsure, it is better to err on the side of details than generality.

Is the question presumptuous ?: If you ask, ‘What do you see as the benefits of a tax cut?’, you are presuming that the respondent sees the tax cut as beneficial. Many people may not view tax cuts as being beneficial, because tax cuts generally lead to lesser funding for public schools, larger class sizes, and fewer public services such as police, ambulance, and fire services. Avoid questions with built-in presumptions.

Is the question imaginary ?: A popular question in many television game shows is, ‘If you win a million dollars on this show, how will you spend it?’. Most respondents have never been faced with such an amount of money before and have never thought about it—they may not even know that after taxes, they will get only about $640,000 or so in the United States, and in many cases, that amount is spread over a 20-year period—and so their answers tend to be quite random, such as take a tour around the world, buy a restaurant or bar, spend on education, save for retirement, help parents or children, or have a lavish wedding. Imaginary questions have imaginary answers, which cannot be used for making scientific inferences.

Do respondents have the information needed to correctly answer the question ?: Oftentimes, we assume that subjects have the necessary information to answer a question, when in reality, they do not. Even if a response is obtained, these responses tend to be inaccurate given the subjects’ lack of knowledge about the question being asked. For instance, we should not ask the CEO of a company about day-to-day operational details that they may not be aware of, or ask teachers about how much their students are learning, or ask high-schoolers, ‘Do you think the US Government acted appropriately in the Bay of Pigs crisis?’.

Question sequencing. In general, questions should flow logically from one to the next. To achieve the best response rates, questions should flow from the least sensitive to the most sensitive, from the factual and behavioural to the attitudinal, and from the more general to the more specific. Some general rules for question sequencing:

Start with easy non-threatening questions that can be easily recalled. Good options are demographics (age, gender, education level) for individual-level surveys and firmographics (employee count, annual revenues, industry) for firm-level surveys.

Never start with an open ended question.

If following a historical sequence of events, follow a chronological order from earliest to latest.

Ask about one topic at a time. When switching topics, use a transition, such as, ‘The next section examines your opinions about…’

Use filter or contingency questions as needed, such as, ‘If you answered “yes” to question 5, please proceed to Section 2. If you answered “no” go to Section 3′.

Other golden rules . Do unto your respondents what you would have them do unto you. Be attentive and appreciative of respondents’ time, attention, trust, and confidentiality of personal information. Always practice the following strategies for all survey research:

People’s time is valuable. Be respectful of their time. Keep your survey as short as possible and limit it to what is absolutely necessary. Respondents do not like spending more than 10-15 minutes on any survey, no matter how important it is. Longer surveys tend to dramatically lower response rates.

Always assure respondents about the confidentiality of their responses, and how you will use their data (e.g., for academic research) and how the results will be reported (usually, in the aggregate).

For organisational surveys, assure respondents that you will send them a copy of the final results, and make sure that you follow up with your promise.

Thank your respondents for their participation in your study.

Finally, always pretest your questionnaire, at least using a convenience sample, before administering it to respondents in a field setting. Such pretesting may uncover ambiguity, lack of clarity, or biases in question wording, which should be eliminated before administering to the intended sample.

Interview survey

Interviews are a more personalised data collection method than questionnaires, and are conducted by trained interviewers using the same research protocol as questionnaire surveys (i.e., a standardised set of questions). However, unlike a questionnaire, the interview script may contain special instructions for the interviewer that are not seen by respondents, and may include space for the interviewer to record personal observations and comments. In addition, unlike postal surveys, the interviewer has the opportunity to clarify any issues raised by the respondent or ask probing or follow-up questions. However, interviews are time-consuming and resource-intensive. Interviewers need special interviewing skills as they are considered to be part of the measurement instrument, and must proactively strive not to artificially bias the observed responses.

The most typical form of interview is a personal or face-to-face interview , where the interviewer works directly with the respondent to ask questions and record their responses. Personal interviews may be conducted at the respondent’s home or office location. This approach may even be favoured by some respondents, while others may feel uncomfortable allowing a stranger into their homes. However, skilled interviewers can persuade respondents to co-operate, dramatically improving response rates.

A variation of the personal interview is a group interview, also called a focus group . In this technique, a small group of respondents (usually 6–10 respondents) are interviewed together in a common location. The interviewer is essentially a facilitator whose job is to lead the discussion, and ensure that every person has an opportunity to respond. Focus groups allow deeper examination of complex issues than other forms of survey research, because when people hear others talk, it often triggers responses or ideas that they did not think about before. However, focus group discussion may be dominated by a dominant personality, and some individuals may be reluctant to voice their opinions in front of their peers or superiors, especially while dealing with a sensitive issue such as employee underperformance or office politics. Because of their small sample size, focus groups are usually used for exploratory research rather than descriptive or explanatory research.

A third type of interview survey is a telephone interview . In this technique, interviewers contact potential respondents over the phone, typically based on a random selection of people from a telephone directory, to ask a standard set of survey questions. A more recent and technologically advanced approach is computer-assisted telephone interviewing (CATI). This is increasing being used by academic, government, and commercial survey researchers. Here the interviewer is a telephone operator who is guided through the interview process by a computer program displaying instructions and questions to be asked. The system also selects respondents randomly using a random digit dialling technique, and records responses using voice capture technology. Once respondents are on the phone, higher response rates can be obtained. This technique is not ideal for rural areas where telephone density is low, and also cannot be used for communicating non-audio information such as graphics or product demonstrations.

Role of interviewer. The interviewer has a complex and multi-faceted role in the interview process, which includes the following tasks:

Prepare for the interview: Since the interviewer is in the forefront of the data collection effort, the quality of data collected depends heavily on how well the interviewer is trained to do the job. The interviewer must be trained in the interview process and the survey method, and also be familiar with the purpose of the study, how responses will be stored and used, and sources of interviewer bias. They should also rehearse and time the interview prior to the formal study.

Locate and enlist the co-operation of respondents: Particularly in personal, in-home surveys, the interviewer must locate specific addresses, and work around respondents’ schedules at sometimes undesirable times such as during weekends. They should also be like a salesperson, selling the idea of participating in the study.

Motivate respondents: Respondents often feed off the motivation of the interviewer. If the interviewer is disinterested or inattentive, respondents will not be motivated to provide useful or informative responses either. The interviewer must demonstrate enthusiasm about the study, communicate the importance of the research to respondents, and be attentive to respondents’ needs throughout the interview.

Clarify any confusion or concerns: Interviewers must be able to think on their feet and address unanticipated concerns or objections raised by respondents to the respondents’ satisfaction. Additionally, they should ask probing questions as necessary even if such questions are not in the script.

Observe quality of response: The interviewer is in the best position to judge the quality of information collected, and may supplement responses obtained using personal observations of gestures or body language as appropriate.

Conducting the interview. Before the interview, the interviewer should prepare a kit to carry to the interview session, consisting of a cover letter from the principal investigator or sponsor, adequate copies of the survey instrument, photo identification, and a telephone number for respondents to call to verify the interviewer’s authenticity. The interviewer should also try to call respondents ahead of time to set up an appointment if possible. To start the interview, they should speak in an imperative and confident tone, such as, ‘I’d like to take a few minutes of your time to interview you for a very important study’, instead of, ‘May I come in to do an interview?’. They should introduce themself, present personal credentials, explain the purpose of the study in one to two sentences, and assure respondents that their participation is voluntary, and their comments are confidential, all in less than a minute. No big words or jargon should be used, and no details should be provided unless specifically requested. If the interviewer wishes to record the interview, they should ask for respondents’ explicit permission before doing so. Even if the interview is recorded, the interviewer must take notes on key issues, probes, or verbatim phrases

During the interview, the interviewer should follow the questionnaire script and ask questions exactly as written, and not change the words to make the question sound friendlier. They should also not change the order of questions or skip any question that may have been answered earlier. Any issues with the questions should be discussed during rehearsal prior to the actual interview sessions. The interviewer should not finish the respondent’s sentences. If the respondent gives a brief cursory answer, the interviewer should probe the respondent to elicit a more thoughtful, thorough response. Some useful probing techniques are:

The silent probe: Just pausing and waiting without going into the next question may suggest to respondents that the interviewer is waiting for more detailed response.

Overt encouragement: An occasional ‘uh-huh’ or ‘okay’ may encourage the respondent to go into greater details. However, the interviewer must not express approval or disapproval of what the respondent says.

Ask for elaboration: Such as, ‘Can you elaborate on that?’ or ‘A minute ago, you were talking about an experience you had in high school. Can you tell me more about that?’.

Reflection: The interviewer can try the psychotherapist’s trick of repeating what the respondent said. For instance, ‘What I’m hearing is that you found that experience very traumatic’ and then pause and wait for the respondent to elaborate.

After the interview is completed, the interviewer should thank respondents for their time, tell them when to expect the results, and not leave hastily. Immediately after leaving, they should write down any notes or key observations that may help interpret the respondent’s comments better.

Biases in survey research

Despite all of its strengths and advantages, survey research is often tainted with systematic biases that may invalidate some of the inferences derived from such surveys. Five such biases are the non-response bias, sampling bias, social desirability bias, recall bias, and common method bias.

Non-response bias. Survey research is generally notorious for its low response rates. A response rate of 15-20 per cent is typical in a postal survey, even after two or three reminders. If the majority of the targeted respondents fail to respond to a survey, this may indicate a systematic reason for the low response rate, which may in turn raise questions about the validity of the study’s results. For instance, dissatisfied customers tend to be more vocal about their experience than satisfied customers, and are therefore more likely to respond to questionnaire surveys or interview requests than satisfied customers. Hence, any respondent sample is likely to have a higher proportion of dissatisfied customers than the underlying population from which it is drawn. In this instance, not only will the results lack generalisability, but the observed outcomes may also be an artefact of the biased sample. Several strategies may be employed to improve response rates:

Advance notification: Sending a short letter to the targeted respondents soliciting their participation in an upcoming survey can prepare them in advance and improve their propensity to respond. The letter should state the purpose and importance of the study, mode of data collection (e.g., via a phone call, a survey form in the mail, etc.), and appreciation for their co-operation. A variation of this technique may be to ask the respondent to return a prepaid postcard indicating whether or not they are willing to participate in the study.

Relevance of content: People are more likely to respond to surveys examining issues of relevance or importance to them.

Respondent-friendly questionnaire: Shorter survey questionnaires tend to elicit higher response rates than longer questionnaires. Furthermore, questions that are clear, non-offensive, and easy to respond tend to attract higher response rates.

Endorsement: For organisational surveys, it helps to gain endorsement from a senior executive attesting to the importance of the study to the organisation. Such endorsement can be in the form of a cover letter or a letter of introduction, which can improve the researcher’s credibility in the eyes of the respondents.

Follow-up requests: Multiple follow-up requests may coax some non-respondents to respond, even if their responses are late.

Interviewer training: Response rates for interviews can be improved with skilled interviewers trained in how to request interviews, use computerised dialling techniques to identify potential respondents, and schedule call-backs for respondents who could not be reached.

Incentives : Incentives in the form of cash or gift cards, giveaways such as pens or stress balls, entry into a lottery, draw or contest, discount coupons, promise of contribution to charity, and so forth may increase response rates.

Non-monetary incentives: Businesses, in particular, are more prone to respond to non-monetary incentives than financial incentives. An example of such a non-monetary incentive is a benchmarking report comparing the business’s individual response against the aggregate of all responses to a survey.

Confidentiality and privacy: Finally, assurances that respondents’ private data or responses will not fall into the hands of any third party may help improve response rates

Sampling bias. Telephone surveys conducted by calling a random sample of publicly available telephone numbers will systematically exclude people with unlisted telephone numbers, mobile phone numbers, and people who are unable to answer the phone when the survey is being conducted—for instance, if they are at work—and will include a disproportionate number of respondents who have landline telephone services with listed phone numbers and people who are home during the day, such as the unemployed, the disabled, and the elderly. Likewise, online surveys tend to include a disproportionate number of students and younger people who are constantly on the Internet, and systematically exclude people with limited or no access to computers or the Internet, such as the poor and the elderly. Similarly, questionnaire surveys tend to exclude children and the illiterate, who are unable to read, understand, or meaningfully respond to the questionnaire. A different kind of sampling bias relates to sampling the wrong population, such as asking teachers (or parents) about their students’ (or children’s) academic learning, or asking CEOs about operational details in their company. Such biases make the respondent sample unrepresentative of the intended population and hurt generalisability claims about inferences drawn from the biased sample.

Social desirability bias . Many respondents tend to avoid negative opinions or embarrassing comments about themselves, their employers, family, or friends. With negative questions such as, ‘Do you think that your project team is dysfunctional?’, ‘Is there a lot of office politics in your workplace?’, ‘Or have you ever illegally downloaded music files from the Internet?’, the researcher may not get truthful responses. This tendency among respondents to ‘spin the truth’ in order to portray themselves in a socially desirable manner is called the ‘social desirability bias’, which hurts the validity of responses obtained from survey research. There is practically no way of overcoming the social desirability bias in a questionnaire survey, but in an interview setting, an astute interviewer may be able to spot inconsistent answers and ask probing questions or use personal observations to supplement respondents’ comments.

Recall bias. Responses to survey questions often depend on subjects’ motivation, memory, and ability to respond. Particularly when dealing with events that happened in the distant past, respondents may not adequately remember their own motivations or behaviours, or perhaps their memory of such events may have evolved with time and no longer be retrievable. For instance, if a respondent is asked to describe his/her utilisation of computer technology one year ago, or even memorable childhood events like birthdays, their response may not be accurate due to difficulties with recall. One possible way of overcoming the recall bias is by anchoring the respondent’s memory in specific events as they happened, rather than asking them to recall their perceptions and motivations from memory.

Common method bias. Common method bias refers to the amount of spurious covariance shared between independent and dependent variables that are measured at the same point in time, such as in a cross-sectional survey, using the same instrument, such as a questionnaire. In such cases, the phenomenon under investigation may not be adequately separated from measurement artefacts. Standard statistical tests are available to test for common method bias, such as Harmon’s single-factor test (Podsakoff, MacKenzie, Lee & Podsakoff, 2003), [3] Lindell and Whitney’s (2001) [4] market variable technique, and so forth. This bias can potentially be avoided if the independent and dependent variables are measured at different points in time using a longitudinal survey design, or if these variables are measured using different methods, such as computerised recording of dependent variable versus questionnaire-based self-rating of independent variables.

- Dillman, D. (1978). Mail and telephone surveys: The total design method . New York: Wiley. ↵

- Rasikski, K. (1989). The effect of question wording on public support for government spending. Public Opinion Quarterly , 53(3), 388–394. ↵