Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

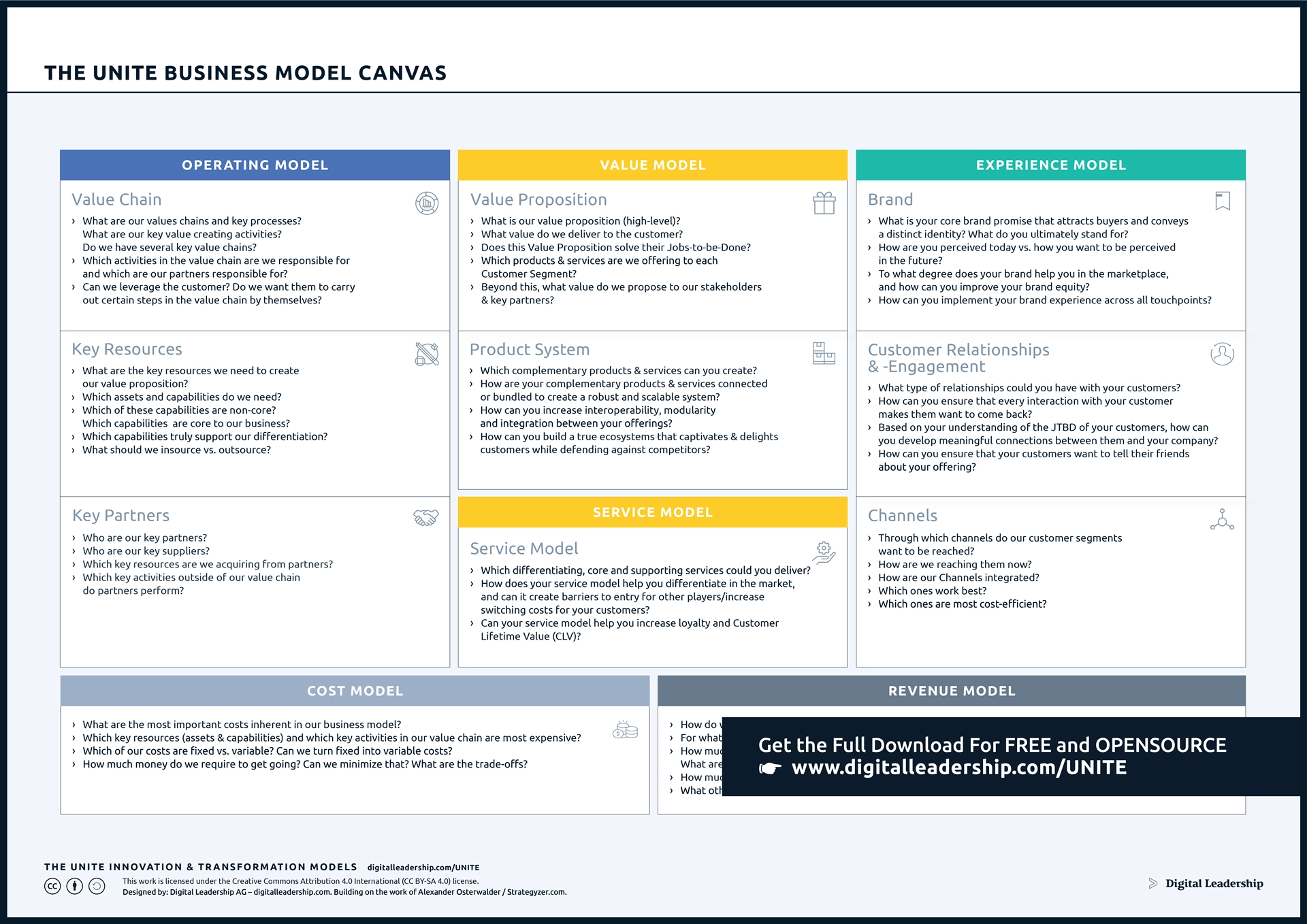

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

What is a Business Plan? Definition, Tips, and Templates

Published: June 07, 2023

In an era where more than 20% of small enterprises fail in their first year, having a clear, defined, and well-thought-out business plan is a crucial first step for setting up a business for long-term success.

Business plans are a required tool for all entrepreneurs, business owners, business acquirers, and even business school students. But … what exactly is a business plan?

In this post, we'll explain what a business plan is, the reasons why you'd need one, identify different types of business plans, and what you should include in yours.

What is a business plan?

A business plan is a documented strategy for a business that highlights its goals and its plans for achieving them. It outlines a company's go-to-market plan, financial projections, market research, business purpose, and mission statement. Key staff who are responsible for achieving the goals may also be included in the business plan along with a timeline.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

What is a business plan used for?

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Working on your business plan? Try using our Business Plan Template . Pre-filled with the sections a great business plan needs, the template will give aspiring entrepreneurs a feel for what a business plan is, what should be in it, and how it can be used to establish and grow a business from the ground up.

Purposes of a Business Plan

Chances are, someone drafting a business plan will be doing so for one or more of the following reasons:

1. Securing financing from investors.

Since its contents revolve around how businesses succeed, break even, and turn a profit, a business plan is used as a tool for sourcing capital. This document is an entrepreneur's way of showing potential investors or lenders how their capital will be put to work and how it will help the business thrive.

All banks, investors, and venture capital firms will want to see a business plan before handing over their money, and investors typically expect a 10% ROI or more from the capital they invest in a business.

Therefore, these investors need to know if — and when — they'll be making their money back (and then some). Additionally, they'll want to read about the process and strategy for how the business will reach those financial goals, which is where the context provided by sales, marketing, and operations plans come into play.

2. Documenting a company's strategy and goals.

A business plan should leave no stone unturned.

Business plans can span dozens or even hundreds of pages, affording their drafters the opportunity to explain what a business' goals are and how the business will achieve them.

To show potential investors that they've addressed every question and thought through every possible scenario, entrepreneurs should thoroughly explain their marketing, sales, and operations strategies — from acquiring a physical location for the business to explaining a tactical approach for marketing penetration.

These explanations should ultimately lead to a business' break-even point supported by a sales forecast and financial projections, with the business plan writer being able to speak to the why behind anything outlined in the plan.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

You're all set!

Click this link to access this resource at any time.

Free Business Plan [Template]

Fill out the form to access your free business plan., 3. legitimizing a business idea..

Everyone's got a great idea for a company — until they put pen to paper and realize that it's not exactly feasible.

A business plan is an aspiring entrepreneur's way to prove that a business idea is actually worth pursuing.

As entrepreneurs document their go-to-market process, capital needs, and expected return on investment, entrepreneurs likely come across a few hiccups that will make them second guess their strategies and metrics — and that's exactly what the business plan is for.

It ensures an entrepreneur's ducks are in a row before bringing their business idea to the world and reassures the readers that whoever wrote the plan is serious about the idea, having put hours into thinking of the business idea, fleshing out growth tactics, and calculating financial projections.

4. Getting an A in your business class.

Speaking from personal experience, there's a chance you're here to get business plan ideas for your Business 101 class project.

If that's the case, might we suggest checking out this post on How to Write a Business Plan — providing a section-by-section guide on creating your plan?

What does a business plan need to include?

- Business Plan Subtitle

- Executive Summary

- Company Description

- The Business Opportunity

- Competitive Analysis

- Target Market

- Marketing Plan

- Financial Summary

- Funding Requirements

1. Business Plan Subtitle

Every great business plan starts with a captivating title and subtitle. You’ll want to make it clear that the document is, in fact, a business plan, but the subtitle can help tell the story of your business in just a short sentence.

2. Executive Summary

Although this is the last part of the business plan that you’ll write, it’s the first section (and maybe the only section) that stakeholders will read. The executive summary of a business plan sets the stage for the rest of the document. It includes your company’s mission or vision statement, value proposition, and long-term goals.

3. Company Description

This brief part of your business plan will detail your business name, years in operation, key offerings, and positioning statement. You might even add core values or a short history of the company. The company description’s role in a business plan is to introduce your business to the reader in a compelling and concise way.

4. The Business Opportunity

The business opportunity should convince investors that your organization meets the needs of the market in a way that no other company can. This section explains the specific problem your business solves within the marketplace and how it solves them. It will include your value proposition as well as some high-level information about your target market.

5. Competitive Analysis

Just about every industry has more than one player in the market. Even if your business owns the majority of the market share in your industry or your business concept is the first of its kind, you still have competition. In the competitive analysis section, you’ll take an objective look at the industry landscape to determine where your business fits. A SWOT analysis is an organized way to format this section.

6. Target Market

Who are the core customers of your business and why? The target market portion of your business plan outlines this in detail. The target market should explain the demographics, psychographics, behavioristics, and geographics of the ideal customer.

7. Marketing Plan

Marketing is expansive, and it’ll be tempting to cover every type of marketing possible, but a brief overview of how you’ll market your unique value proposition to your target audience, followed by a tactical plan will suffice.

Think broadly and narrow down from there: Will you focus on a slow-and-steady play where you make an upfront investment in organic customer acquisition? Or will you generate lots of quick customers using a pay-to-play advertising strategy? This kind of information should guide the marketing plan section of your business plan.

8. Financial Summary

Money doesn’t grow on trees and even the most digital, sustainable businesses have expenses. Outlining a financial summary of where your business is currently and where you’d like it to be in the future will substantiate this section. Consider including any monetary information that will give potential investors a glimpse into the financial health of your business. Assets, liabilities, expenses, debt, investments, revenue, and more are all useful adds here.

So, you’ve outlined some great goals, the business opportunity is valid, and the industry is ready for what you have to offer. Who’s responsible for turning all this high-level talk into results? The "team" section of your business plan answers that question by providing an overview of the roles responsible for each goal. Don’t worry if you don’t have every team member on board yet, knowing what roles to hire for is helpful as you seek funding from investors.

10. Funding Requirements

Remember that one of the goals of a business plan is to secure funding from investors, so you’ll need to include funding requirements you’d like them to fulfill. The amount your business needs, for what reasons, and for how long will meet the requirement for this section.

Types of Business Plans

- Startup Business Plan

- Feasibility Business Plan

- Internal Business Plan

- Strategic Business Plan

- Business Acquisition Plan

- Business Repositioning Plan

- Expansion or Growth Business Plan

There’s no one size fits all business plan as there are several types of businesses in the market today. From startups with just one founder to historic household names that need to stay competitive, every type of business needs a business plan that’s tailored to its needs. Below are a few of the most common types of business plans.

For even more examples, check out these sample business plans to help you write your own .

1. Startup Business Plan

As one of the most common types of business plans, a startup business plan is for new business ideas. This plan lays the foundation for the eventual success of a business.

The biggest challenge with the startup business plan is that it’s written completely from scratch. Startup business plans often reference existing industry data. They also explain unique business strategies and go-to-market plans.

Because startup business plans expand on an original idea, the contents will vary by the top priority goals.

For example, say a startup is looking for funding. If capital is a priority, this business plan might focus more on financial projections than marketing or company culture.

2. Feasibility Business Plan

This type of business plan focuses on a single essential aspect of the business — the product or service. It may be part of a startup business plan or a standalone plan for an existing organization. This comprehensive plan may include:

- A detailed product description

- Market analysis

- Technology needs

- Production needs

- Financial sources

- Production operations

According to CBInsights research, 35% of startups fail because of a lack of market need. Another 10% fail because of mistimed products.

Some businesses will complete a feasibility study to explore ideas and narrow product plans to the best choice. They conduct these studies before completing the feasibility business plan. Then the feasibility plan centers on that one product or service.

3. Internal Business Plan

Internal business plans help leaders communicate company goals, strategy, and performance. This helps the business align and work toward objectives more effectively.

Besides the typical elements in a startup business plan, an internal business plan may also include:

- Department-specific budgets

- Target demographic analysis

- Market size and share of voice analysis

- Action plans

- Sustainability plans

Most external-facing business plans focus on raising capital and support for a business. But an internal business plan helps keep the business mission consistent in the face of change.

4. Strategic Business Plan

Strategic business plans focus on long-term objectives for your business. They usually cover the first three to five years of operations. This is different from the typical startup business plan which focuses on the first one to three years. The audience for this plan is also primarily internal stakeholders.

These types of business plans may include:

- Relevant data and analysis

- Assessments of company resources

- Vision and mission statements

It's important to remember that, while many businesses create a strategic plan before launching, some business owners just jump in. So, this business plan can add value by outlining how your business plans to reach specific goals. This type of planning can also help a business anticipate future challenges.

5. Business Acquisition Plan

Investors use business plans to acquire existing businesses, too — not just new businesses.

A business acquisition plan may include costs, schedules, or management requirements. This data will come from an acquisition strategy.

A business plan for an existing company will explain:

- How an acquisition will change its operating model

- What will stay the same under new ownership

- Why things will change or stay the same

- Acquisition planning documentation

- Timelines for acquisition

Additionally, the business plan should speak to the current state of the business and why it's up for sale.

For example, if someone is purchasing a failing business, the business plan should explain why the business is being purchased. It should also include:

- What the new owner will do to turn the business around

- Historic business metrics

- Sales projections after the acquisition

- Justification for those projections

6. Business Repositioning Plan

.webp?width=650&height=450&name=businessplan_6%20(1).webp)

When a business wants to avoid acquisition, reposition its brand, or try something new, CEOs or owners will develop a business repositioning plan.

This plan will:

- Acknowledge the current state of the company.

- State a vision for the future of the company.

- Explain why the business needs to reposition itself.

- Outline a process for how the company will adjust.

Companies planning for a business reposition often do so — proactively or retroactively — due to a shift in market trends and customer needs.

For example, shoe brand AllBirds plans to refocus its brand on core customers and shift its go-to-market strategy. These decisions are a reaction to lackluster sales following product changes and other missteps.

7. Expansion or Growth Business Plan

When your business is ready to expand, a growth business plan creates a useful structure for reaching specific targets.

For example, a successful business expanding into another location can use a growth business plan. This is because it may also mean the business needs to focus on a new target market or generate more capital.

This type of plan usually covers the next year or two of growth. It often references current sales, revenue, and successes. It may also include:

- SWOT analysis

- Growth opportunity studies

- Financial goals and plans

- Marketing plans

- Capability planning

These types of business plans will vary by business, but they can help businesses quickly rally around new priorities to drive growth.

Getting Started With Your Business Plan

At the end of the day, a business plan is simply an explanation of a business idea and why it will be successful. The more detail and thought you put into it, the more successful your plan — and the business it outlines — will be.

When writing your business plan, you’ll benefit from extensive research, feedback from your team or board of directors, and a solid template to organize your thoughts. If you need one of these, download HubSpot's Free Business Plan Template below to get started.

Editor's note: This post was originally published in August 2020 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

![group business plan definition How to Write a Powerful Executive Summary [+4 Top Examples]](https://blog.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write a Powerful Executive Summary [+4 Top Examples]

19 Best Sample Business Plans & Examples to Help You Write Your Own

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2023

![group business plan definition 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![group business plan definition The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Business Plan Development

Masterplans experts will help you create business plans for investor funding, bank/SBA lending and strategic direction

Investor Materials

A professionally designed pitch deck, lean plan, and cash burn overview will assist you in securing Pre-Seed and Seed Round funding

Immigration Business Plans

A USCIS-compliant business plan serves as the foundation for your E-2, L-1A, EB-5 or E-2 visa application

Customized consulting tailored to your startup's unique challenges and goals

Our team-based approach supports your project with personal communication and technical expertise.

Pricing that is competitive and scalable for early-stage business services regardless of industry or stage.

Client testimonials from just a few of the 18,000+ entrepreneurs we've worked with over the last 20 years

Free tools, research, and templates to help with business plans & pitch decks

What Is A Business Plan (& Do I Really Need One?)

The term "business plan" is a familiar one, often bandied about in entrepreneurial circles. Yet, despite its ubiquity, it's remarkable how much mystery and confusion can surround this essential business tool.

What exactly is a business plan? What purpose does it serve? How is it structured? This article aims to lift the veil, demystifying the business plan and revealing its multifaceted nature.

Business Plan Definition

A business plan is a document that describes a company's objectives and its marketing, financial, and operational strategies for achieving them. It's more than a mere document; it's a structured communication tool designed to articulate the vision of the business, allowing stakeholders to easily find the information they seek.

The business plan is a tangible reflection of the strategic planning that has gone into the business's future. While the plan is a static document, the planning is a dynamic process, capturing the strategic thinking and decision-making that shape the business's direction.

Purposes of a Business Plan

1. attracting funding opportunities.

A well-crafted business plan illustrates the company's potential for growth and profitability. It outlines the company's vision, mission, and strategies, providing a clear roadmap for success. A potential investor, whether venture capitalists or angel investors, can see how capital will be utilized, fostering trust and confidence in the business venture. A bank or financial institution can assess your company's ability to meet debt service obligations and compliance with strict financial accounting to meet underwriting requirements.

2. Aligning Organizational Objectives

A business plan acts as a unifying document that aligns the team with the company's goals and strategies. It ensures that everyone is on the same page, working towards common objectives. This alignment fosters collaboration and efficiency, driving the business towards its targets.

3. Validating the Business Concept

Before launching, a business plan helps in validating the feasibility of the business idea. It's a rigorous process that tests the concept against real-world scenarios, ensuring that the idea is not only innovative but also practical and sustainable. This validation builds credibility and prepares the business for the challenges ahead. For an existing business, a business plan can help address a possible merger and acquisition (M&A), rolling out a new business product or location, or expanding the target market.

4. Facilitating Legal and Regulatory Compliance

Whether it's securing a visa for international operations or meeting other regulatory requirements, a business plan can be an essential tool. It provides the necessary information in a structured format, demonstrating compliance with legal and regulatory standards. This can streamline processes and prevent potential legal hurdles.

5. Articulating and Formalizing the Business Vision

The business plan is more than a set of numbers and projections; it's the embodiment of the business vision. It communicates the essence of the business to stakeholders, turning abstract ideas into a concrete operational plan. It's a vital tool for leadership to articulate and formalize the vision, setting the stage for strategic execution.

Identifying the Right Type of Business Plan

Once you understand who your business plan is for and what specific needs it must address, you can identify the type of plan that best suits your situation. Business plans can be categorized into two main types: traditional and lean, each serveing its own unique purpose.

Traditional Business Plan

The Traditional Business Plan is a detailed and comprehensive document, often used by a new business, especially those seeking significant funding. It provides a complete picture of the company's vision, strategies, and operations. A traditional business plan leaves no stone unturned, offering a robust tool that communicates the business's entire vision and plan to stakeholders.

Lean Business Plan

In contrast, the Lean Business Plan is an abbreviated structure that still emphasizes the key elements of a Traditional Business Plan, but in less detail. It's suitable for early-stage startups, small businesses, or situations where agility and speed are essential. The Lean Business Plan focuses on the essentials, providing a quick overview without overwhelming details. It's a flexible and adaptable tool that can evolve with the business. One of the primary distinctions between it and a Traditional Business Plan is that a Lean Business Plan does not typically include financial planning, or if it does, it's a simple financial forecast or cash burn.

Components of a Business Plan

There are many places online where you can buy a business plan template. Often, those documents are just an outline of the sections of the business plan and what is included in each. If that's what you're looking for, here's a good business plan outline:

Executive Summary

The Executive Summary is the first section read but often the last written, as it encapsulates the entire plan. If the company has a mission statement, it's typically included here. When used for funding, it includes the ask or uses of funds, and for investment, it may contain an investor proposition. It's a concise overview that sets the tone, summarizing each section that follows.

Company Overview

The Company Overview is the foundation of the business, articulating how it operates, generates revenue, and delivers unique value to its customers. This section defines products and/or service the business sells, as well as the company’s business model and unique value proposition. It covers key partners, pricing strategy, revenue model, and other essential business activities.

Market Analysis Summary

The Market Analysis is the business intelligence portion of the plan. It comprises an industry analysis, market segments, target customers, competitive analysis, competitive advantage. This section provides insights into the market landscape, identifying opportunities, challenges, and how the business positions itself uniquely within the industry.

Strategy & Implementation Summary

Here, the business plan should outline the short-term and long-term objectives, marketing strategy and sales approach. It's a roadmap that details how the business will achieve its goals, including tactical steps, timelines, and resources. In a business plan for investors, the inclusion of an exit strategy can provide a vision for the future, considering various potential outcomes.

Management Summary

The Management Summary offers profiles of key personnel, their qualifications, roles, and plans to fill talent gaps. It's a snapshot of the leadership team, providing assurance that the right people are in place to execute the business plan successfully.

Financial Projections

This section includes standard financial statements like the profit & loss statement (P&L), the balance sheet, and the cash flow statement. It offers a detailed financial blueprint, illustrating the company’s revenue drivers and unit assumptions, income statement, a break-even analysis, and a sensitivity analysis to examine how changes in variables affect outcomes. For businesses with complex structures, framing the revenue in terms of market share can offer additional insight into the viability and feasibility of the financial projections.

The Appendices often include year 1 and year 2 monthly financial statements, intellectual property like patents and trademarks, construction blueprints, and other essential documentation. It's a repository for supporting information that adds depth and context to the main sections of the plan.

Do I Need a Business Plan?

The question "Do I need a business plan?" is one that many entrepreneurs and business leaders grapple with. The answer, however, is not as straightforward as it might seem. While not every business requires a traditional business plan, the strategic planning process is essential for all.

In some cases, a traditional business plan is required. Applying for a Small Business Administration (SBA) loan , obtaining a entrepreneurship visa , or meeting specific investor requirements may mandate a comprehensive business plan.

However a traditional business plan isn’t always necessary. For example, in early-stage investor funding, particularly in industries like SaaS, a lean business plan accompanied by a pitch deck presentation will often suffice. The focus here is on agility and essential information rather than exhaustive detail.

Every Business Needs Business Planning

Unlike the traditional business plan, which may or may not be required depending on the situation, business planning as a process is indispensable for every business, regardless of size or stage.

Business planning is a dynamic, continuous process. It's not confined to a single document but evolves with the business, adapting to changes, challenges, and opportunities. Effective strategic planning ensures internal alignment with both long-term vision and short-term objectives. It's a holistic approach that guides business goal-setting decision-making, resource allocation, and strategic direction. It often serves as the basis for a fully developed marketing plan.

Every business, from a small startup to a large corporation, benefits from strategic planning. It's a practice that fosters growth, innovation, and resilience, providing a roadmap for success.

Not every business needs a traditional business plan as a document, but all businesses need to engage in business planning as a process. While the traditional business plan serves specific purposes and audiences, business planning is a universal practice that guides and grows the business.

Entrepreneurs and business leaders must assess their specific needs, recognizing that the traditional business plan is just one tool among many. The true value of the business plan lies in continuous planning, adapting, and aligning with the unique vision and goals of the business.

How to Write a Management Summary for Your Business Plan

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

Understanding Venture Debt vs Venture Capital

Despite growth in sectors like artificial intelligence, venture capital funding has seen better days. After peaking at $347.5 billion in 2021, there...

Going Beyond Writing: The Multifaceted Role of Business Plan Consultants

Most people think of a professional business plan company primarily as a "business plan writer." However, here at Masterplans, we choose to approach...

- Search Search Please fill out this field.

- Building Your Business

What Is a Business Plan?

Business Plan Explained in Less Than 5 Minutes

:max_bytes(150000):strip_icc():format(webp)/KhadijaKhartit-4f144e2b63ee4dd4af60ac8a02233c50.jpg)

Definition and Examples of a Business Plan

How a business plan works, types of business plans, business plan vs. business model.

Geber86 / Getty Images

A business plan is a detailed written document that describes your business’s activities, goals, and strategy. A strong plan outlines everything from the products a company sells to the executive summary to the overall management. In essence, a business plan should guide a founder’s actions through each stage of growth

Think of your business plan as a road map. It documents the various stages of starting and running your business, including business activities and objectives. Business plans create the structure you need to make decisions by outlining the financial and operational goals you’re striving toward.

One of the most common reasons for crafting a business plan is to attract investors—and, in return, receive funding. As an early stage company, for example, you may leverage your business plan to convince investors or banks that your entity is credible and worthy of funding. The business plan should prove that their money will be returned .

A business plan can also be useful for when a well-developed company goes through a merger or acquisition . As outlined by the U.S. Small Business Administration (SBA), a merger creates a new entity via the combination of two businesses. An acquisition, on the other hand, is when a company is purchased and absorbed into an existing business. In either case, a business plan helps establish relationships between business entities, making a merger or acquisition more likely.

- Alternate name : Strategic plan

A business plan is a formalized outline of the business operations, finances, and goals you aim to achieve to be a successful company. When designing a business plan, companies have leeway for how long, short, or detailed it can be. So long as it outlines the foundational aspects of the business, in most cases, it will be effective.

The most common type of business plan is a traditional business plan. This style tends to have the following common elements, generally in this order.

- Executive summary : Tells your reader why your company will be successful. Includes the company’s mission statement , product information, and basics regarding the business structure.

- Company description : Where you brag about your entity’s strengths. Answer the question, what problem is your team solving?

- Market analysis : A deep dive into your industry and the competition. Consider why competitors are successful. How can your offering do it better? If applicable, how can you enhance the experience for the consumer?

- Management plan : Outlines leadership structure of the company and may be best detailed as a chart. This way, readers can see exactly who is planning to run the company and how they will impact growth.

- Marketing and sales plan : Details how you’ll attract consumers with your product or service, and how you will retain those customers. All strategies outlined in this section, such as the use of digital marketing , will be referenced in your financial plan.

- Funding request : For those companies asking for funding, this is where you’ll detail the amount of funding you’ll need to achieve your goals. Clearly explain how much you need and what it will be used for.

- Financial plan : Convinces the reader that your company is financially stable and can turn a profit . You will need to include a balance sheet , an income statement, and the cash flow statement (or cash flow projection, in the case of a new venture).

- Appendix : Where any supporting documents, such as legal documents, licenses of employees, and pictures of the product will be included.

Your company’s business plan should fit your needs, which will often depend on what stage of growth you are in. If you are considering starting a new venture, for example, writing a detailed business plan can help prove if your concept is viable or not.

If your business is seeking financial capital, though, you will want your business plan to be investor-ready. This will require you to have a funding request section, which would be placed right above your financial plan.

You should avoid using lofty terms or technical jargon that those outside your team won’t understand. A business plan is meant to be shared with those inside and outside your organization. Simple and effective language is best.

Your business’s stage impacts the length and detail of a business plan. As discussed, a traditional plan follows a detailed structure, from the executive summary to the appendix. It is a lengthier document, often amounting to dozens of pages, and is often used when seeking funding to prove business viability. In most cases, crafting a traditional plan will take lots of due diligence work.

The other main type of business plan is a lean startup plan. A lean startup plan is much more high-level and shorter than the traditional version. Companies just starting development will often create a lean startup plan to help them navigate where they should start. These can be as short as one or two pages.

A lean plan will include the following elements.

- Key partnerships : Notes other services or businesses you will work with, such as manufacturers and suppliers.

- Key activities and resources : Outlines how your company will gain a competitive advantage and create value for your consumers. Resources you may leverage include capital, staff, or intellectual property.

- Value proposition : Clearly defines the unique value your company offers.

- Customer relationships : Details the customer experience from start to finish.

- Channels : How will you stay connected with your customers? Detail those methods here.

- Cost structure and revenue streams : Details the most significant costs you will face as well as how your business will actually make money.

Remember that business plans are meant to change as your company grows or pivots. You should actively review and edit your business plan to keep it up to date with business activities. For example, you may start with a lean plan and move to a traditional plan when you hit the fundraising stage.

A business plan may often be confused with a business model, and it is easy to understand why. Simply put, a business plan is the holistic overview of the business, while a business model is a skeleton for how money will be made.

Key Takeaways

- A business plan is a comprehensive document that outlines a business’s operations, finances, and goals. It guides the business’s day-to-day decisions.

- A business plan is necessary for your company’s success, as it creates a path to scalability.

- There are two main types of business plans: a traditional business plan and a lean startup plan.

- A traditional business plan will be essential when you begin to seek debt or equity capital for your company.

U.S. Small Business Administration. “ Merge and Acquire Businesses .” Accessed June 8, 2021.

U.S. Small Business Administration. " Write Your Business Plan ." Accessed June 8, 2021.

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Business Plan

By Entrepreneur Staff

Business Plan Definition:

A written document describing the nature of the business, the sales and marketing strategy, and the financial background, and containing a projected profit and loss statement

A business plan is also a road map that provides directions so a business can plan its future and helps it avoid bumps in the road. The time you spend making your business plan thorough and accurate, and keeping it up-to-date, is an investment that pays big dividends in the long term.

Your business plan should conform to generally accepted guidelines regarding form and content. Each section should include specific elements and address relevant questions that the people who read your plan will most likely ask. Generally, a business plan has the following components:

Title Page and Contents A business plan should be presented in a binder with a cover listing the name of the business, the name(s) of the principal(s), address, phone number, e-mail and website addresses, and the date. You don't have to spend a lot of money on a fancy binder or cover. Your readers want a plan that looks professional, is easy to read and is well-put-together.

Include the same information on the title page. If you have a logo, you can use it, too. A table of contents follows the executive summary or statement of purpose, so that readers can quickly find the information or financial data they need.

Executive Summary The executive summary, or statement of purpose, succinctly encapsulates your reason for writing the business plan. It tells the reader what you want and why, right up front. Are you looking for a $10,000 loan to remodel and refurbish your factory? A loan of $25,000 to expand your product line or buy new equipment? How will you repay your loan, and over what term? Would you like to find a partner to whom you'd sell 25 percent of the business? What's in it for him or her? The questions that pertain to your situation should be addressed here clearly and succinctly.

The summary or statement should be no more than half a page in length and should touch on the following key elements:

- Business concept describes the business, its product, the market it serves and the business' competitive advantage.

- Financial features include financial highlights, such as sales and profits.

- Financial requirements state how much capital is needed for startup or expansion, how it will be used and what collateral is available.

- Current business position furnishes relevant information about the company, its legal form of operation, when it was founded, the principal owners and key personnel.

- Major achievements points out anything noteworthy, such as patents, prototypes, important contracts regarding product development, or results from test marketing that have been conducted.

Description of the Business The business description usually begins with a short explanation of the industry. When describing the industry, discuss what's going on now as well as the outlook for the future. Do the necessary research so you can provide information on all the various markets within the industry, including references to new products or developments that could benefit or hinder your business. Base your observations on reliable data and be sure to footnote and cite your sources of information when necessary. Remember that bankers and investors want to know hard facts--they won't risk money on assumptions or conjecture.

When describing your business, say which sector it falls into (wholesale, retail, food service, manufacturing, hospitality and so on), and whether the business is new or established. Then say whether the business is a sole proprietorship, partnership, C or Sub chapter S corporation. Next, list the business' principals and state what they bring to the business. Continue with information on who the business' customers are, how big the market is, and how the product or service is distributed and marketed.

Description of the Product or Service The business description can be a few paragraphs to a few pages in length, depending on the complexity of your plan. If your plan isn't too complicated, keep your business description short, describing the industry in one paragraph, the product in another, and the business and its success factors in two or three more paragraphs.

When you describe your product or service, make sure your reader has a clear idea of what you're talking about. Explain how people use your product or service and talk about what makes your product or service different from others available in the market. Be specific about what sets your business apart from those of your competitors.

Then explain how your business will gain a competitive edge and why your business will be profitable. Describe the factors you think will make it successful. If your business plan will be used as a financing proposal, explain why the additional equity or debt will make your business more profitable. Give hard facts, such as "new equipment will create an income stream of $10,000 per year" and briefly describe how.

Other information to address here is a description of the experience of the other key people in the business. Whoever reads your business plan will want to know what suppliers or experts you've spoken to about your business and their response to your idea. They may even ask you to clarify your choice of location or reasons for selling this particular product.

Market Analysis A thorough market analysis will help you define your prospects as well as help you establish pricing, distribution, and promotional strategies that will allow your company to be successful vis-à-vis your competition, both in the short and long term.

Begin your market analysis by defining the market in terms of size, demographics, structure, growth prospects, trends, and sales potential. Next, determine how often your product or service will be purchased by your target market. Then figure out the potential annual purchase. Then figure out what percentage of this annual sum you either have or can attain. Keep in mind that no one gets 100 percent market share, and that a something as small as 25 percent is considered a dominant share. Your market share will be a benchmark that tells you how well you're doing in light of your market-planning projections.

You'll also have to describe your positioning strategy. How you differentiate your product or service from that of your competitors and then determine which market niche to fill is called "positioning." Positioning helps establish your product or service's identity within the eyes of the purchaser. A positioning statement for a business plan doesn't have to be long or elaborate, but it does need to point out who your target market is, how you'll reach them, what they're really buying from you, who your competitors are, and what your USP (unique selling proposition) is.

How you price your product or service is perhaps your most important marketing decision. It's also one of the most difficult to make for most small business owners, because there are no instant formulas. Many methods of establishing prices are available to you, but these are among the most common.

- Cost-plus pricing is used mainly by manufacturers to assure that all costs, both fixed and variable, are covered and the desired profit percentage is attained.

- Demand pricing is used by companies that sell their products through a variety of sources at differing prices based on demand.

- Competitive pricing is used by companies that are entering a market where there's already an established price and it's difficult to differentiate one product from another.

- Markup pricing is used mainly by retailers and is calculated by adding your desired profit to the cost of the product.

You'll also have to determine distribution, which includes the entire process of moving the product from the factory to the end user. Make sure to analyze your competitors' distribution channels before deciding whether to use the same type of channel or an alternative that may provide you with a strategic advantage.

Finally, your promotion strategy should include all the ways you communicate with your markets to make them aware of your products or services. To be successful, your promotion strategy should address advertising, packaging, public relations, sales promotions and personal sales.

Competitive Analysis The purpose of the competitive analysis is to determine:

- the strengths and weaknesses of the competitors within your market.

- strategies that will provide you with a distinct advantage.

- barriers that can be developed to prevent competition from entering your market.

- any weaknesses that can be exploited in the product development cycle.

The first step in a competitor analysis is to identify both direct and indirect competition for your business, both now and in the future. Once you've grouped your competitors, start analyzing their marketing strategies and identifying their vulnerable areas by examining their strengths and weaknesses. This will help you determine your distinct competitive advantage.

Whoever reads your business plan should be very clear on who your target market is, what your market niche is, exactly how you'll stand apart from your competitors, and why you'll be successful doing so.

Operations and Management The operations and management component of your plan is designed to describe how the business functions on a continuing basis. The operations plan highlights the logistics of the organization, such as the responsibilities of the management team, the tasks assigned to each division within the company, and capital and expense requirements related to the operations of the business.

Financial Components of Your Business Plan After defining the product, market and operations, the next area to turn your attention to are the three financial statements that form the backbone of your business plan: the income statement, cash flow statement, and balance sheet.

The income statement is a simple and straightforward report on the business' cash-generating ability. It is a scorecard on the financial performance of your business that reflects when sales are made and when expenses are incurred. It draws information from the various financial models developed earlier such as revenue, expenses, capital (in the form of depreciation), and cost of goods. By combining these elements, the income statement illustrates just how much your company makes or loses during the year by subtracting cost of goods and expenses from revenue to arrive at a net result, which is either a profit or loss. In addition to the income statements, include a note analyzing the results. The analysis should be very short, emphasizing the key points of the income statement. Your CPA can help you craft this.

The cash flow statement is one of the most critical information tools for your business, since it shows how much cash you'll need to meet obligations, when you'll require it and where it will come from. The result is the profit or loss at the end of each month and year. The cash flow statement carries both profits and losses over to the next month to also show the cumulative amount. Running a loss on your cash flow statement is a major red flag that indicates not having enough cash to meet expenses-something that demands immediate attention and action.

The cash flow statement should be prepared on a monthly basis during the first year, on a quarterly basis for the second year, and annually for the third year. The following 17 items are listed in the order they need to appear on your cash flow statement. As with the income statement, you'll need to analyze the cash flow statement in a short summary in the business plan. Once again, the analysis doesn't have to be long and should cover highlights only. Ask your CPA for help.

The last financial statement you'll need is a balance sheet. Unlike the previous financial statements, the balance sheet is generated annually for the business plan and is, more or less, a summary of all the preceding financial information broken down into three areas: assets, liabilities and equity.

Balance sheets are used to calculate the net worth of a business or individual by measuring assets against liabilities. If your business plan is for an existing business, the balance sheet from your last reporting period should be included. If the business plan is for a new business, try to project what your assets and liabilities will be over the course of the business plan to determine what equity you may accumulate in the business. To obtain financing for a new business, you'll need to include a personal financial statement or balance sheet.

In the business plan, you'll need to create an analysis for the balance sheet just as you need to do for the income and cash flow statements. The analysis of the balance sheet should be kept short and cover key points.

Supporting Documents In this section, include any other documents that are of interest to your reader, such as your resume; contracts with suppliers, customers, or clients, letters of reference, letters of intent, copy of your lease and any other legal documents, tax returns for the previous three years, and anything else relevant to your business plan.

Some people think you don't need a business plan unless you're trying to borrow money. Of course, it's true that you do need a good plan if you intend to approach a lender--whether a banker, a venture capitalist or any number of other sources--for startup capital. But a business plan is more than a pitch for financing; it's a guide to help you define and meet your business goals.

Just as you wouldn't start off on a cross-country drive without a road map, you should not embark on your new business without a business plan to guide you. A business plan won't automatically make you a success, but it will help you avoid some common causes of business failure, such as under-capitalization or lack of an adequate market.

As you research and prepare your business plan, you'll find weak spots in your business idea that you'll be able to repair. You'll also discover areas with potential you may not have thought about before--and ways to profit from them. Only by putting together a business plan can you decide whether your great idea is really worth your time and investment.

More from Business Plans

Financial projections.

Estimates of the future financial performance of a business

Financial Statement

A written report of the financial condition of a firm. Financial statements include the balance sheet, income statement, statement of changes in net worth and statement of cash flow.

Executive Summary

A nontechnical summary statement at the beginning of a business plan that's designed to encapsulate your reason for writing the plan

Latest Articles

Dollar tree is raising its price cap to $7: 'the macro environment has gotten in our way'.

The discount chain's cap was most recently raised to $5 last June.

Walgreens Boots Alliance Gets Bill for $2.7 Billion From the IRS After Tax Audit

'Tis the (tax) season.

These Are the Five Attributes of Highly Successful and Happy People

If you'd like to be happier or more successful this year, then ask yourself if you're truly exuding these five attributes. The happiest and most successful people I know execute on these game-changers exceptionally well.

What is a Business Plan? Definition and Resources

9 min. read

Updated April 10, 2024

If you’ve ever jotted down a business idea on a napkin with a few tasks you need to accomplish, you’ve written a business plan — or at least the very basic components of one.

The origin of formal business plans is murky. But they certainly go back centuries. And when you consider that 20% of new businesses fail in year 1 , and half fail within 5 years, the importance of thorough planning and research should be clear.

But just what is a business plan? And what’s required to move from a series of ideas to a formal plan? Here we’ll answer that question and explain why you need one to be a successful business owner.

- What is a business plan?

A business plan lays out a strategic roadmap for any new or growing business.

Any entrepreneur with a great idea for a business needs to conduct market research , analyze their competitors , validate their idea by talking to potential customers, and define their unique value proposition .

The business plan captures that opportunity you see for your company: it describes your product or service and business model , and the target market you’ll serve.

It also includes details on how you’ll execute your plan: how you’ll price and market your solution and your financial projections .

Reasons for writing a business plan

If you’re asking yourself, ‘Do I really need to write a business plan?’ consider this fact:

Companies that commit to planning grow 30% faster than those that don’t.

Creating a business plan is crucial for businesses of any size or stage.

If you plan to raise funds for your business through a traditional bank loan or SBA loan , none of them will want to move forward without seeing your business plan. Venture capital firms may or may not ask for one, but you’ll still need to do thorough planning to create a pitch that makes them want to invest.

But it’s more than just a means of getting your business funded . The plan is also your roadmap to identify and address potential risks.

It’s not a one-time document. Your business plan is a living guide to ensure your business stays on course.

Related: 14 of the top reasons why you need a business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

What research shows about business plans

Numerous studies have established that planning improves business performance:

- 71% of fast-growing companies have business plans that include budgets, sales goals, and marketing and sales strategies.

- Companies that clearly define their value proposition are more successful than those that can’t.

- Companies or startups with a business plan are more likely to get funding than those without one.

- Starting the business planning process before investing in marketing reduces the likelihood of business failure.

The planning process significantly impacts business growth for existing companies and startups alike.

Read More: Research-backed reasons why writing a business plan matters

When should you write a business plan?

No two business plans are alike.

Yet there are similar questions for anyone considering writing a plan to answer. One basic but important question is when to start writing it.

A Harvard Business Review study found that the ideal time to write a business plan is between 6 and 12 months after deciding to start a business.

But the reality can be more nuanced – it depends on the stage a business is in, or the type of business plan being written.

Ideal times to write a business plan include:

- When you have an idea for a business

- When you’re starting a business

- When you’re preparing to buy (or sell)

- When you’re trying to get funding

- When business conditions change

- When you’re growing or scaling your business

Read More: The best times to write or update your business plan

How often should you update your business plan?

As is often the case, how often a business plan should be updated depends on your circumstances.

A business plan isn’t a homework assignment to complete and forget about. At the same time, no one wants to get so bogged down in the details that they lose sight of day-to-day goals.

But it should cover new opportunities and threats that a business owner surfaces, and incorporate feedback they get from customers. So it can’t be a static document.

For an entrepreneur at the ideation stage, writing and checking back on their business plan will help them determine if they can turn that idea into a profitable business .

And for owners of up-and-running businesses, updating the plan (or rewriting it) will help them respond to market shifts they wouldn’t be prepared for otherwise.

It also lets them compare their forecasts and budgets to actual financial results. This invaluable process surfaces where a business might be out-performing expectations and where weak performance may require a prompt strategy change.

The planning process is what uncovers those insights.

Related Reading: 10 prompts to help you write a business plan with AI

- How long should your business plan be?

Thinking about a business plan strictly in terms of page length can risk overlooking more important factors, like the level of detail or clarity in the plan.

Not all of the plan consists of writing – there are also financial tables, graphs, and product illustrations to include.

But there are a few general rules to consider about a plan’s length:

- Your business plan shouldn’t take more than 15 minutes to skim.

- Business plans for internal use (not for a bank loan or outside investment) can be as short as 5 to 10 pages.

A good practice is to write your business plan to match the expectations of your audience.

If you’re walking into a bank looking for a loan, your plan should match the formal, professional style that a loan officer would expect . But if you’re writing it for stakeholders on your own team—shorter and less formal (even just a few pages) could be the better way to go.

The length of your plan may also depend on the stage your business is in.

For instance, a startup plan won’t have nearly as much financial information to include as a plan written for an established company will.

Read More: How long should your business plan be?

What information is included in a business plan?

The contents of a plan business plan will vary depending on the industry the business is in.

After all, someone opening a new restaurant will have different customers, inventory needs, and marketing tactics to consider than someone bringing a new medical device to the market.

But there are some common elements that most business plans include:

- Executive summary: An overview of the business operation, strategy, and goals. The executive summary should be written last, despite being the first thing anyone will read.

- Products and services: A description of the solution that a business is bringing to the market, emphasizing how it solves the problem customers are facing.

- Market analysis: An examination of the demographic and psychographic attributes of likely customers, resulting in the profile of an ideal customer for the business.

- Competitive analysis: Documenting the competitors a business will face in the market, and their strengths and weaknesses relative to those competitors.

- Marketing and sales plan: Summarizing a business’s tactics to position their product or service favorably in the market, attract customers, and generate revenue.

- Operational plan: Detailing the requirements to run the business day-to-day, including staffing, equipment, inventory, and facility needs.

- Organization and management structure: A listing of the departments and position breakdown of the business, as well as descriptions of the backgrounds and qualifications of the leadership team.

- Key milestones: Laying out the key dates that a business is projected to reach certain milestones , such as revenue, break-even, or customer acquisition goals.

- Financial plan: Balance sheets, cash flow forecast , and sales and expense forecasts with forward-looking financial projections, listing assumptions and potential risks that could affect the accuracy of the plan.

- Appendix: All of the supporting information that doesn’t fit into specific sections of the business plan, such as data and charts.

Read More: Use this business plan outline to organize your plan

- Different types of business plans

A business plan isn’t a one-size-fits-all document. There are numerous ways to create an effective business plan that fits entrepreneurs’ or established business owners’ needs.

Here are a few of the most common types of business plans for small businesses:

- One-page plan : Outlining all of the most important information about a business into an adaptable one-page plan.

- Growth plan : An ongoing business management plan that ensures business tactics and strategies are aligned as a business scales up.

- Internal plan : A shorter version of a full business plan to be shared with internal stakeholders – ideal for established companies considering strategic shifts.

Business plan vs. operational plan vs. strategic plan

- What questions are you trying to answer?

- Are you trying to lay out a plan for the actual running of your business?

- Is your focus on how you will meet short or long-term goals?

Since your objective will ultimately inform your plan, you need to know what you’re trying to accomplish before you start writing.

While a business plan provides the foundation for a business, other types of plans support this guiding document.

An operational plan sets short-term goals for the business by laying out where it plans to focus energy and investments and when it plans to hit key milestones.

Then there is the strategic plan , which examines longer-range opportunities for the business, and how to meet those larger goals over time.

Read More: How to use a business plan for strategic development and operations

- Business plan vs. business model

If a business plan describes the tactics an entrepreneur will use to succeed in the market, then the business model represents how they will make money.

The difference may seem subtle, but it’s important.

Think of a business plan as the roadmap for how to exploit market opportunities and reach a state of sustainable growth. By contrast, the business model lays out how a business will operate and what it will look like once it has reached that growth phase.

Learn More: The differences between a business model and business plan

- Moving from idea to business plan

Now that you understand what a business plan is, the next step is to start writing your business plan .