To read this content please select one of the options below:

Please note you do not have access to teaching notes, recent trends in agile new product development: a systematic review and agenda for future research.

Benchmarking: An International Journal

ISSN : 1463-5771

Article publication date: 8 September 2022

Issue publication date: 1 December 2023

The market's intense competition, the unpredictability of customer demands and technological advancements are compelling organizations to adopt new approaches, such as agile new product development (ANPD), which enables the introduction of new products to the market in a short span. The existing ANPD literature review articles are lacking in portraying recent developments, potential fields of adoption and the significance of ANPD in organizational development. The primary goal of this article is to investigate emerging aspects, current trends and conduct a meta-analysis using a systematic review of 177 ANPD articles published in peer-reviewed journals between 1998 and 2020.

Design/methodology/approach

The articles were categorized based on their year of publication, publishers, journals, authors, countries, universities, most cited articles, etc. The authors attempted to identify top journals, authors, most cited articles, enablers, barriers, performance metrics, etc. in the ANPD domain through the presented study.

The major themes of research articles, gaps and future trends are identified to assist academicians and ANPD practitioners. This study will benefit ANPD professionals by providing them with information on available literature and current ANPD trends.

Originality/value

Through meta-analysis, this study is one of the unique attempt to categorize ANPD articles to identify research gaps and highlight future research trends. A distinguishing feature of the presented study is the identification of active journals, publishers and authors, as well as enablers, barriers and performance metrics.

- Agile new product development

- New product development

- Systematic literature review

- Meta-analysis

- Categorised review

Palsodkar, M. , Yadav, G. and Nagare, M.R. (2023), "Recent trends in agile new product development: a systematic review and agenda for future research", Benchmarking: An International Journal , Vol. 30 No. 9, pp. 3194-3224. https://doi.org/10.1108/BIJ-05-2021-0247

Emerald Publishing Limited

Copyright © 2022, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

- Browse All Articles

- Newsletter Sign-Up

- 21 Apr 2023

- Research & Ideas

The $15 Billion Question: Have Loot Boxes Turned Video Gaming into Gambling?

Critics say loot boxes—major revenue streams for video game companies—entice young players to overspend. Can regulators protect consumers without dampening the thrill of the game? Research by Tomomichi Amano and colleague.

- 28 Mar 2023

The FDA’s Speedy Drug Approvals Are Safe: A Win-Win for Patients and Pharma Innovation

Expediting so-called breakthrough therapies has saved millions of dollars in research time without compromising drug safety or efficacy, says research by Ariel Stern, Amitabh Chandra, and colleagues. Could policymakers harness the approach to bring life-saving treatments to the market faster?

- 31 Jan 2023

- Cold Call Podcast

Addressing Racial Discrimination on Airbnb

For years, Airbnb gave hosts extensive discretion to accept or reject a guest after seeing little more than a name and a picture, believing that eliminating anonymity was the best way for the company to build trust. However, the apartment rental platform failed to track or account for the possibility that this could facilitate discrimination. After research published by Professor Michael Luca and others provided evidence that Black hosts received less in rent than hosts of other races and showed signs of discrimination against guests with African American sounding names, the company had to decide what to do. In the case, “Racial Discrimination on Airbnb,” Luca discusses his research and explores the implication for Airbnb and other platform companies. Should they change the design of the platform to reduce discrimination? And what’s the best way to measure the success of any changes?

- 12 Oct 2022

When Design Enables Discrimination: Learning from Anti-Asian Bias on Airbnb

Airbnb bookings dropped 12 percent more for hosts with Asian names than other hosts during the early months of the COVID-19 pandemic, says research by Michael Luca. Could better design deter bias, particularly during times of crisis?

- 05 May 2022

Why Companies Raise Their Prices: Because They Can

Markups on household items started climbing years before the COVID-19 pandemic. Companies have realized just how much consumers will pay for the brands they love, says research by Alexander MacKay. Closed for comment; 0 Comments.

- 19 Oct 2021

Should Global Beer Company Molson Coors Dive into the Cannabis Beverages Business?

In March 2019, Molson Coors CEO Mark Hunter considered a request to pull forward $65 million to build a facility in Canada to produce cannabis beverages. This request was not part of the original plan to test the waters with a few products in a small geography to see if there was a viable market opportunity, given that there was no legal market yet. It's this change in direction that gives Hunter pause. Should he approve the request, or push the team back to the original, more conservative plan? Senior Lecturer Derek van Bever and Steve Kaufman discuss balancing exploitation versus exploration inside this global brewing company in the case, "Beyond Beer: Brewing Innovation at Molson Coors." Open for comment; 0 Comments.

- 29 Sep 2021

For Entrepreneurs, Blown Deadlines Can Crush Big Ideas

After a successful launch, entrepreneurs struggle to anticipate the complexities of product upgrades, says research by Andy Wu and Aticus Peterson. They offer three tips to help startups avoid disastrous delays. Open for comment; 0 Comments.

- 02 Aug 2020

- What Do You Think?

Is the 'Experimentation Organization' Becoming the Competitive Gold Standard?

SUMMING UP: Digital experimentation is gaining momentum as an everyday habit in many organizations, especially those in high tech, say James Heskett's readers. Open for comment; 0 Comments.

- 28 Jul 2020

Racism and Digital Design: How Online Platforms Can Thwart Discrimination

Poor design decisions contribute to racial discrimination on many online platforms. Michael Luca and colleagues offer tips for reducing the risk, used by Airbnb and other companies. Open for comment; 0 Comments.

- 23 Mar 2020

- Working Paper Summaries

The Effects of Hierarchy on Learning and Performance in Business Experimentation

Do senior managers help or hurt business experiments? Analyzing a dataset of more than 6,300 experiments on the A/B/n testing platform Optimizely, this study suggests that involving senior executives in experimentation teams can have surprising consequences.

- 17 Feb 2020

- Sharpening Your Skills

How Entrepreneurs Can Find the Right Problem to Solve

Identifying a customer's pain points is the first step for entrepreneurs in developing a new product. Julia Austin offers tips for choosing the right "job to be done." Open for comment; 0 Comments.

- 16 Sep 2019

Crowdsourcing Is Helping Hollywood Reduce the Risk of Movie-Making

Hollywood insiders have created "The Black List," which helps surface good but often overlooked scripts. Does the wisdom of the crowd work at the box office? Research by Hong Luo. Open for comment; 0 Comments.

- 19 Dec 2018

Find and Replace: R&D Investment Following the Erosion of Existing Products

This study sheds light on how product outcomes shape the direction of innovation and markets for technology. In the drug development industry in particular, negative product shocks appear to spur investment changes both within the directly affected firm and in competing firms in the same R&D markets.

- 10 Dec 2018

Platform Competition: Betfair and the U.K. Market for Sports Betting

Since the early 2000s, online betting exchanges have had a new relationship with customers relative to traditional bookmakers, providing a platform to match individuals willing to lay and back the same outcome. This study shows how exchanges’ platform design choices have major implications for their likelihood of success.

- 06 Aug 2018

Supersmart Manufacturing Tools are Lowering Prices on TVs, Bulbs, and Solar Panels

Electronics manufacturers are finding it increasingly difficult to stay ahead of low-cost competitors, says Willy Shih. Open for comment; 0 Comments.

- 21 Feb 2018

When a Competitor Abandons the Market, Should You Advance or Retreat?

Companies pay close attention when a competitor drops out of the market, according to new research by Joshua Lev Krieger. Too often, though, they come to the wrong conclusion. Open for comment; 0 Comments.

- 20 Dec 2017

- Lessons from the Classroom

How to Design a Better Customer Experience

With the help of LEGO bricks, Stefan Thomke helps business executives discover how design principles can serve as building blocks to create a great customer experience. Open for comment; 0 Comments.

- 06 Dec 2017

Trials and Terminations: Learning from Competitors' R&D Failures

When companies terminate R&D projects, it has ripple effects on the project selection decisions of rival firms and the broader competitive environment. Examining firm responses to others’ failures, this paper introduces a new model of R&D investment decisions, and empirically investigates when knowledge generated by rivals directly enters specific project investment decisions.

- 29 Mar 2017

The Story of Why Humans Are So Careless With Their Phones

Consumers act more recklessly with the products they own when better versions become available, according to research by Silvia Bellezza, Joshua M. Ackerman and Francesca Gino. This comic by Josh Neufeld explains. Open for comment; 0 Comments.

- 20 Jul 2016

Airplane Design Brings Out the Class Warfare in Us All

Air rage is often blamed on overcrowded flights and postage stamp-size seats, but researchers Michael Norton and Katherine A. DeCelles find another culprit: resentment toward passengers in first class. Open for comment; 0 Comments.

Integrations

What's new?

Prototype Testing

Live Website Testing

Feedback Surveys

Interview Studies

Card Sorting

Tree Testing

In-Product Prompts

Participant Management

Automated Reports

Templates Gallery

Choose from our library of pre-built mazes to copy, customize, and share with your own users

Browse all templates

Financial Services

Tech & Software

Product Designers

Product Managers

User Researchers

By use case

Concept & Idea Validation

Wireframe & Usability Test

Content & Copy Testing

Feedback & Satisfaction

Content Hub

Educational resources for product, research and design teams

Explore all resources

Question Bank

Research Maturity Model

Guides & Reports

Help Center

Future of User Research Report

The Optimal Path Podcast

Maze Guides | Resources Hub

Product Research: The Building Blocks of a User-Centered Solution

0% complete

Product research is a foundational step in building user-centric products. It allows you to understand customer needs, preferences, and market trends, informing the development of successful solutions to user problems. Read on for the ultimate guide to product research, including methods, processes, and best practices—plus our favorite tips from the industry’s leading experts.

Product research 101: Definition, methods, and best practices

You may only build new products once, but you iterate on them continuously. The ongoing evolution of a product’s user experience (UX), informed by user insights, is pivotal to staying ahead of competitors and giving your users exactly what they need. In chapter one of this guide, we’ll explore what product research is, give an overview of key methods (and when to use them), plus best practices to follow.

What is product research?

Product research is any research you conduct to better inform your product and understand your user and market. Unlike user research , product research goes beyond evaluating the user experience and includes market analysis, pricing, feature prioritization, and assessing business viability.

Product research is a broader term than UX research—you can conduct research on the user, the interaction, the market, or your business strategy.

Matthieu Dixte , Product Researcher at Maze

It helps you understand the world you are bringing your product into, and what your users expect to do with a product like yours—so you can use their insights to influence development and design decisions.

Product research can be conducted in multiple ways, such as talking directly to users in focus groups or user interviews , or through product experimentation, usability tests and competitive analysis.

Other research terms you might come across

Ultimately, all research falls under the 'product research' banner if it influences the final product. For some product teams, ‘user research’ and ‘product research’ may be interchangeable. But there are some subtle differences between various research terms that it can be helpful to know. Here are the distinctions between key terms you might hear, explained by Maze's Product Researcher, Matthieu Dixte:

- Market research: Discover who is leading the market, who your direct and indirect competitors are, and what similar products are available to your users at what price

- User research: Understand the user, including their needs, pain points, likes and dislikes, and characteristics—both as a consumer and user of your product

- User experience (UX) research : Learn how your user perceives and interacts with your product—where they click, which paths they follow, and where they search for information on-page

- Product discovery : Uncover what your users’ needs and problems are, validate ideas for potential solutions before development, and apply user insights to your product strategy

- Continuous product discovery : Adapt the mindset of an ever-evolving product and user; conduct research continuously throughout the product lifecycle and ensure all decisions are informed by user insights

For example, let’s say you’re thinking of developing and launching a note-taking app for teenagers. You’d need to conduct market research to see if there are any similar products in high demand to gauge if your tool is something customers want. In parallel, you should run user research to discover who your user persona would be and what their pain points are.

You also have to do product discovery to identify the best way to build and design your potential product to make it appealing for teens. And, if you want to know how your users will feel about your product compared to other options, you need product research .

Lastly, run UX research tests on your mobile and web app to gather feedback, and improve the experience. You should continue to talk with users regularly after launch by adopting a continuous product discovery mindset (and ensure you’re always updating and offering the right product).

Talk to more users without needing to grow your product team

Recruit and test users from Maze’s high-quality panel to get more eyes on your product, without increasing payroll.

Why is product research important?

Are we making the right assumptions? Is this product what users really need? Can they use it effectively?

Research answers all those questions. But product research goes a step further by placing those answers in the context of your niche and the market. It empowers your team—not only to create unbiased, user-centric products—but also to create best-selling products that are based on a robust business strategy and deep understanding of the market.

Product research will also help you:

Head in the right direction

Conducting types of product research like competitive analysis gives you inside information on what your users value in a similar product—and what they’re missing. It ensures you’re heading in the right direction by only working on aspects of your product you know will succeed. This helps you speed time-to-market, reduce the cost of fixing future mistakes, and achieve higher goals.

Product research allows you to “define the total addressable market and north star metric, based on the customer segments that found your idea and product valuable. We would fail at achieving product-market fit without doing customer research,” explains Prerna Kaul , Product Lead for Alexa AI at Amazon.

Make the right decisions at the right time

User data can inform your decisions and help you prioritize them according to the goals of the business. “Make choices regarding the evolution of your product and find the right balance between what you want to deliver to improve the user experience, and the benefits it’ll bring to your company,” advises Matthieu. Without product research, you’re building products in the dark with no idea whether your target audience will like or buy them—which could mean wasted resources and sinking revenue.

Get stakeholder buy-in

You’ve probably found yourself explaining multiple times to stakeholders why you need to prioritize one feature over another. Conducting product research enables you to “clearly articulate the customer value proposition to leadership, tech, and science counterparts,” says Prerna. Having quantitative and qualitative user insights provides reassurance to stakeholders and speeds up sign-off—while ensuring the wider organization is aligned on your product ideas.

In short, product research provides you evidence you need to start evangelizing research among your organization, and get the whole team on board.

Understand the position your users hold in the market

User research is about getting to know your target audience and building ideal customer profiles, but product research is about discovering where your potential customers are located in the market and which trending products to take note of. If your audience is already using a similar product, this means finding out: Which one? Why? Are they willing to switch to a different product? What would it take for you to get them to switch?

“Analyzing the market lets you determine which areas could be ripe for disruption or creation. By analyzing existing products and doing conceptual thinking you can build a picture of how you can get your product to gain traction in the market and offer something new, nuanced, or better than the current options,” says Nick Simpson , Head of UX at Airteam.

Challenge your assumptions and anticipate problems

When Prerna worked at Walmart Labs, her team introduced a feature for users to scan products in the Scan and Go app. “We initially believed that all of our inventory was available in a common database and accessible through the app. However, during research and user testing, we identified that some rare products were not in the online database,” she explains.

This caused test users to drop off the app, so her team had to take a step back and prioritize fixing inventory issues before launching the product. Without conducting product research, you can be left guessing at the cause of user problems, or wondering why they prefer a particular product. Research offers your team a chance to challenge what you think you know, and pre-empt what you don’t.

Product tip 💡

You can use Maze to conduct multiple tests on your product through development, such as Five-Second Tests or Content and Copy Testing , or get insights on your live product through Live Website Testing .

Product research methods

There are many different product research and UX research methods , all of which offer different kinds of data and insight, depending on your objectives. If you’re looking to conduct product research to better understand your users, market, or competitors, here are eight product research methods you should consider to help you build winning products.

1. Customer interviews

Interviews can take place at any take of the product development process and consist of direct conversations with current or potential customers. You may choose to conduct interviews with a market panel during concept testing and idea screening to validate your ideas, or you may want to speak to current users after the product goes live to gather post-launch feedback. Interviews are a varied and flexible product research method.

During customer interviews, you should ask open and unbiased research questions to gather insights about customer needs, preferences, and experiences regarding their pain points, your product, and competitors.

2. Voice of customer (VoC) analysis

Gauge what current and potential customers are saying about your products or competitor products online. You can do this using VoC tools , by reviewing what people post on social media, looking at Google Trends, or reading reviews on websites like G2.

You should conduct customer voice analysis continuously throughout the lifecycle as it can help you gain a competitive advantage. “Review what’s publicly published, check feature requests, and ask sales, customer success, or support teams for feedback coming from the user,” adds Matthieu.

For example, if a competitor gets acquired by a bigger firm and users start to complain about them removing a feature, you can use the opportunity to develop a similar functionality or improve the one you have. You can also make it more visible on-page and get the sales and marketing teams to use the information to advertise your product.

3. Diary studies

Diary studies involve users self-reporting behaviors, habits, and experiences over a period of time. This is often used during the discovery phase with a competitor product, or later down the line with a prototype. By observing how users feel prior to, during, and after using your (or a competitor) product—and their experience throughout—you can gather valuable, in-the-moment insights within a real life context.

You can conduct diary studies on paper, video, or online on a mobile app or a dedicated platform.

Data from diary research can turn into new product ideas, new features, or inform your current project. For instance, if you have a social media scheduling tool and you identify that users open a time zone calculator when they’re scheduling posts, you instantly have a new feature idea, to add a widget with different time zones.

Learn more about the types of diary study and how to conduct diary research here.

4. Competitive analysis

Analyze competitors' products and strategies to identify what works for them and identify any gaps in the market. The idea behind competitive product analysis is to explore your competitor’s products in-depth, sign up for an account, use them for a while, and take notes of top features, UX, and price points. You can run competitive analysis during the discovery, concept validation , or prototyping stages with direct and indirect competitors, or aspirational businesses.

Matthieu Dixte, Product Researcher at Maze, notes the value of competitive analysis is in understanding your users perspective: “We conduct a lot of competitive analysis at Maze because it's really important for us to understand if the market is mature regarding a particular topic—and to identify the current ground covered. This helps us understand the pros and cons our customers perceive when they choose between our product or another tool.”

Surveys can be a great way to get feedback or gather user sentiment relating to existing products or future concepts. You can also use them to dig deeper into the data gathered during other tests, and understand user issues and preferences in context.

For example, if you ran an A/B test and discovered that certain copy was causing potential users to churn, you could follow-up with a survey with targeted questions around their demographics, preferences, and personal views. This would help add qualitative insights to your quantitative data, and help understand what your users are looking for from your product.

Remember, you can create surveys at any stage of the product development to collect data from users in small or large volumes. You can use different types of surveys and survey principles to validate or debunk hypotheses, prioritize features, and identify your target market. For example, you could ask questions about your product, competitors, and prices or even your customer’s preferences and market trends.

Surveys can have a high drop-out rate, harming the validity of your data. Check out our survey design guide to discover the industry’s top secrets to an engaging survey which keeps users hooked.

6. Usability testing

Since conducting product research is also about understanding how well your customers navigate through your product and if they find it usable, you can run usability or prototype tests . Usability testing evaluates the usability of your product by asking test participants to complete tasks on your tool and seeing how they interact with it.

While typically conducted as a pre-launch check, usability testing is now widely understood as a building block of continuous research. Conducting regular usability tests is crucial to staying familiar with users, taking the pulse of your product, and ensuring every new product decision is informed with real data.

Conduct usability tests on a product research tool like Maze and record your participant’s audio, video, and screen with Clips . This offers you a mix of quantitative and qualitative data to learn why participants take certain actions to complete test tasks.

7. Fake door testing

The fake door testing method, also called the ‘painted door method’, is a way to validate whether your customers would be interested in a particular feature. “It works by faking a feature that is not actually available and implementing a tracker to know how many people click on it,” explains Matthieu.

When people click on the feature, they see a message explaining it’s not available at the moment. If the click-rate is high, you can assume there’s interest in the feature and conduct further research to identify how to design and develop it.

While it’s a quick way to gauge interest, fake door testing runs the risk of frustrating users, so if you’re using this method on a live product, you should be cautious and set a short testing period to avoid creating false expectations in your users.

8. Focus groups

Focus groups are when you gather a group of users to try your product and discuss their thoughts on the design, UX, usability, or price. You’ll offer them prompts or ask a series of user research questions to spark conversation, then observe and take notes.

This can be an expensive or admin-heavy method, as you need to rent a space, find participants who are willing to attend, and compensate them for their time. However, you can also conduct focus groups remotely through video conferencing tools. These groups are a good way of generating new product ideas or gaining deep insight in a short space of time, as you can hear directly from your users and adjust your questioning to follow up on important topics or opinions which participants mention.

When to perform product research

Source: 2023 Continuous Product Discovery Report

According to our 2023 Continuous Product Discovery Report , most teams conduct research at problem discovery (59%) and problem validation (57%), with only 36% researching post-launch.

The consensus is that product teams don’t think that’s enough—78% think they could research more often: which means there’s a big opportunity for you to implement regular research at all stages of the product research process .

Here’s when to conduct research on your product:

- At problem discovery stage to outline a hypothesis based on user insights

- During problem validation to prove your hypothesis

- During solution generation and concept development to see if you’re moving in the right direction

- As you’re screening different ideas for prioritization to identify the ones your users value most

- At solution definition and once you have your initial design to test early wireframes

- After developing a prototype to see assess usability and direction

- During validation and testing to review changes made to previous prototypes

- After development, and post-launch to get feedback and plan your future steps

- Before launching a new feature or doing product optimization to gauge users’ perceptions

Best practices for effective product research

If you only have time to consider one best practice for product research, we’ll keep it short. Just start.

Any research is better than none, and there’s a wealth of knowledge out there waiting to be discovered. If you don’t use it, your competitors will.

Now, here are six other best practices to help you improve your results and get the best insights possible:

1. Conduct research continuously

Your product is never done, at least not while the market, your customers, and technology are evolving. So, for your users to keep choosing you, you need to grow with them, adapt to trends, and keep iterating on your product. The right way to make product iterations is by conducting continuous product research, having frequent communication with your users, and actively listening to the market.

Did you know that user-centric organizations achieve 2.3x better business outcomes? 📊

By putting customers' needs front and center, research-mature organizations are driving better customer satisfaction (1.9x), customer retention (2.4), and increased revenue (4.2x). Learn more in our Research Maturity Report .

2. Focus on the business problem when presenting to stakeholders

It’s easy to get so involved in the product that you forget to mention how it helps the business when presenting research findings. To get stakeholders on board and to build great products that are profitable, always keep the business needs in mind. There’s no product without business success, so always align with your stakeholders and bring it back to team KPIs and business metrics. To convey your story, it’s a good rule of thumb to start each cross-team meeting by presenting the business problem, then sharing how adding a certain feature decision will help you solve it, before getting into the data that backs this up.

3. Embrace your curiosity

One of the biggest mistakes you can make in product research is letting cognitive biases take over the process. Work in teams and ask questions out of curiosity—consider research a way to disprove your hypothesis or challenge your assumptions, rather than a way to prove them right. As Prerna Kaul, Product Lead for Alexa AI at Amazon explains, you often gain more insight from an answer you don’t want to hear. “A huge trust-buster is when researchers sell an idea to customers and reinforce their pre-existing beliefs.” Doing so makes the user tell you what you want to hear but not what you need to know. It’s better to know that you have the wrong assumptions early on and build products that solve the right problem.

It’s non-negotiable to ensure that you are solving the right problem for the customer. Your solution is a painkiller, not a vitamin.

Prerna Kaul , Product Lead for Alexa AI at Amazon

4. Focus on the end goal rather than specific features

When you work closely with a product you’re passionate about, it’s only natural to think of all the possibilities, and minute details and features of the product. However, it’s crucial to understand that, while you might be the one making the internal decisions, the user will have the final call. Getting hung up on specific features will get you frustrated if users disagree, or lead you to make biased choices. To overcome this, you can write a research statement explaining the big problem you’re trying to achieve with the product. Come back to this before and after each decision, to keep your choices grounded in what’s best for the user.

“We always ask: Are we solving the right problem by creating this product? Is it going to have a measurable benefit to people?” says Nick Simpson, Head of UX at Airteam. “Then, we try to answer those questions through research methods to determine whether this investment will be worth it, to both business and users.” By thinking of the overall end goal at all stages, you get to build profitable products and features that really respond to that intention.

5. Take notes of everything

This one might go without saying, but it’s crucial to keep track of everything. Not just to inform future research and remind yourself where decisions came from, but to democratize research and bring the entire organization into your research process .

Set up a centralized research repository that anyone can access, and share it with your wider organization. Within the product team, keep a record of all user insights, even if they sound impossible to achieve at first. “These ‘futuristic’ thoughts or ideas are the ones that can either inform future iterations of the product or that you can creatively turn into something more feasible to design and build,” explains Nick. Keeping an organized information bank enables everyone on the team to get to know the user, the market, and why you’ve made certain decisions in the past.

6. Combine user feedback with data

While your users should be at the center of your business, don’t rely solely on their comments without checking other data. In reality, not everything people say is exactly what they do . Research participants can be influenced by any number of factors, mostly unconscious, so it’s important to use qualitative and quantitative data to reinforce each other.

For example, the users you interviewed might tell you they love a certain feature, but when you contrast those comments with heatmap data and time on page, you see that only a small percentage of your customers actually use it. Consider what research can be conducted to ascertain why this is, how you can improve those metrics, or whether it’s more helpful to refocus efforts on a different feature with a higher profit margin.

Keep learning about product research

In this chapter, we’ve covered a lot about product research:

- What product research is (and what it’s not)

- How researching your product is beneficial to your business

- The different methods you can use to conduct product research

- When to conduct product research

- Best practices for your research

Now, it’s time to kickstart your product research process in the next chapter. We’ll also talk about how to conduct product experiments and competitive analysis, so stay tuned.

Product research process

Top Marketing Research Articles Related to Product Development Research

Learn all about new product development research. Quirks.com is the largest source of marketing research information.

Search Results

More Filters

Loading filters...

Article Product development: Leveraging qualitative research to meet customer expectations Kimberly Pate | May 14, 2024

Sponsored Video quantilope and Melitta Group Virtual Session: Fab-brew-lous Collaboration: Product Innovations from the Melitta Group Julian Hellgoth, Ann-Katrin Nentwig | May 1, 2024

Article How to conduct an effective concept test: The process, methods and benefits Josh White | April 3, 2024

Article In Case You Missed It...March/April 2024 Quirk's Staff | March 1, 2024

Article Discovering the real story: How virtual IHUTs offer deeper insights Krystal Rudyk | February 7, 2024

Article UX ResearchOps: Five ways to boost research efforts Paul Hagen | February 6, 2024

Article User experience research: The top trends and best practices Alida Staff | January 19, 2024

Article In Case You Missed It...January/February 2024 Quirk's Staff | January 1, 2024

Article Product discovery: What it is and best practices UserTesting Staff | January 16, 2024

Article How to conduct a win-loss analysis Nick Kane | December 22, 2023

Article Before You Go: 10 minutes with Marat Fleytlikh, Kraft Heinz Emily C. Koenig | November 1, 2023

Article Wilton Brands strategy for great insights and analytics teamwork Maddie Swenson | October 30, 2023

Article Usage and attitude studies: What are they and how to conduct them Chloe Cook | August 14, 2023

Article Bringing Spruce Cowffee to market Elliot Savitzky, Hannah Robbins | July 1, 2023

Sponsored Article 21 Top Taste Test/Sensory Research Companies Quirk's Staff | July 1, 2023

Learn / Guides / Product research basics

Back to guides

A step-by-step guide to the product research process

A strong product research process ensures product teams maximize resources, meet key business goals, and make confident decisions that will deliver successful products and features to create customer delight.

But, how do you conduct effective product research?

Just as there’s no single way to develop a product, no single research process fits all product teams. But there are key steps that will help you balance business goals and user needs for actionable product research .

This article takes you through the factors you should consider to tailor product research to your desired outcomes and provides a step-by-by-step guide to doing research right.

Use Hotjar to streamline your product research process

Hotjar offers product teams a rich stream of quantitative and qualitative data that keeps you connected to user needs at every stage of research.

What to consider before starting product research

Before jumping into the research process , product managers prepare their team. Take time to consider the why and determine how you can design the process to meet your unique product requirements.

Reflect on:

Why you’re doing the research

Get connected with the deep purpose of your research: what you need to understand to create a profitable and effective product .

Determine specific outcomes of the research process.

During the early product discovery stages, generating new product ideas for innovation and getting to know your users better will serve as a solid foundation throughout the research process. At later stages, look for concrete feedback on a new product, or possible upgrades and feature updates for an existing product. The why behind the research should guide your process.

Categorizing your users

Determining customer needs and segmenting users are crucial steps that impact the success of any product research strategy.

You might use a random sample of potential or existing customers; or segment users according to region, industry, or other criteria to spot patterns across different demographics.

Trial users can give immediate product feedback, which is usually incredibly easy to implement (a new theme, for example) or incredibly difficult, like an entirely new functionality or platform for your product. Your long-time users can give nuanced feedback, but they overlook what doesn't work due to their expertise.

Finding that middle ground of users who like what you offer but aren't stuck to your brand is essential. These users appreciate being treated like their insights matter most—because they do.

Finding impartial user insights can be tricky since many tools track users who’ve been paid or incentivized to click through to your website or product. Product experience insights software like Hotjar can help by providing organic, unbiased user data that gives you a clear picture of your customer experience (CX) .

Pro tip: Hotjar Highlights lets you sort and curate user insights and attributes, and share them with your product team. You can also watch Session Recordings of users from specific countries or industries—or filter recordings to see only satisfied or dissatisfied user experiences, which can provide valuable information on what’s working (and what’s not).

A Hotjar Session Recording

Your core business goals

The best product research processes overlap with the overall organizational vision, so update your research goals in line with company goals to ensure alignment.

Designing your research process with cross-functional collaboration in mind is a great way to eliminate any communication issues, ensure all departments collect data that tests product profitability, business goals, and user satisfaction.

Your team’s methodology

Different product methodologies emphasize different aspects of product research throughout its lifecycle, so it’s important to consider techniques that will fit your team’s working stages.

Teams who use waterfall methodologies usually rely on bursts of intense research before development and again during pre-launch. They also make a clear distinction between the product’s research and development phases.

Teams who use agile, lean, or DevOps methods usually integrate research with the broader product development process, engaging in continuous discovery methods.

Whatever your methodology, infuse research into every stage of the product lifecycle to achieve business goals like increased revenue, acquisitions, and user adoption.

Choosing which research tools to use

When you’re deciding how to do product research, you’ll need to consider your budget and company size to pick out your tool stack.

Manual research techniques like user interviews can be time-consuming and cost-intensive, but useful to forge a personal connection with users and ask improvised questions based on their responses.

Automated research tools (like Hotjar 👋) increase speed, efficiency, and cost-effectiveness, and reduce human error. They allow you to reach a larger target audience and ensure you’re getting clean, unbiased product feedback —in person, users are more likely to feel pressure to compliment your product or underplay their concerns, but with tools like Hotjar, you’ll get genuine, in-the-moment feedback from users as they engage with your product.

Which team members will contribute

Involve different team members at each stage of the product workflow. For example, when you’re validating product ideas, you may want to include marketing and technical departments; and when you’re testing product usability , you may want to rely on the expertise of your engineers.

It’s also important to consider what research other departments have done before launching your own process, so you don’t waste resources duplicating generic market research.

8 steps for amazing product research

Amazing product research is all about doing smart research to unearth effective insights without getting lost in an information overload that derails your product workflow .

Follow these eight steps to guide your product research strategies to achieve valuable, actionable product insights that will inform your product’s entire lifecycle, from ideation to execution.

1. Define your research goals

First, set your high-level goals, which should test business objectives as well as customer-centric product discovery. These are often drawn directly from the product vision and strategy.

Then, create attainable, specific goals or questions for your team to focus on during each stage of their research. This might include:

Conducting market research for the product’s adoption before its launch

Identifying areas where key features can be improved after the product launch

Evaluating the product’s performance throughout the product lifecycle

2. Understand your users

User needs are at the center of effective product research processes.

Engage in user discovery—identify and understand your customer—as early as possible , even before you have definite product or feature ideas. Open-ended user research is a key source of product inspiration and innovation, and an essential step in determining product-market fit .

Then, when you have product proposals, prototypes, or a minimum viable product ( MVP) , you can start seeking more specific feedback.

User research is all about interacting with your current or potential users and learning what they want and need . Developing a user-centric culture of ongoing research will help you gauge the market demand, position your product against the competition, and generate customer delight .

To create a user-centric research culture, conduct user interviews and create user personas. You can also connect more passively with your user demographic by looking at forums, Facebook groups, or sites like Reddit that are used by your customer niche.

The more organic the research process, the better. It’s ideal to catch users in situations where they answer by instinct instead of having carefully crafted answers. It's what they say instinctively that leads to better product solutions.

Pro tip: use Feedback widgets to gather user feedback in a non-invasive way.

Hotjar’s Feedback widgets are integrated into the product interface , so users can give quick feedback and then carry on with their tasks. This means you can survey your users and gain valuable insights by learning what they’re thinking and feeling as they interact with the product.

A Hotjar feedback widget

3. Do market research for your product

Run thorough competitive and comparative analyses to test the business potential of your product against other solutions on the market , and engage in opportunity mapping to get stakeholder buy-in.

You can also use historical market data and trade reports to predict potential profitability and run keyword research to understand users and what potential customers are searching for to generate product ideas.

Once you’ve validated whether there’s a viable market for your product and determined how saturated that target market is, focus on your product’s unique selling points.

Pro tip: even if you already have a product established in a specific market, make sure to assess the market periodically. Markets and competitors change, and making assumptions because of your initial research processes can be a costly mistake. Work with your marketing team here to validate your ideas and avoid guesswork.

Evaluate your product regularly against the industry by creating a value curve. The value curve plots the product offerings currently available in the market on one axis, and the factors the industry is competing on and investing in heavily on the other. This can help you spot market opportunities, ensure product relevance, and get ideas for features you could add to increase user demand and open up new user bases.

Check out how Gavin increased conversions for his lead generation agency by 42% with Hotjar.

4. Get to know industry trends

Next, combine your understanding of your users and market with research on technology trends that may affect user expectations of your product or its long-term viability.

Stay on top of trends by regularly engaging with tech cultures —read trade magazines and news sites, listen to tech news podcasts, and follow key trendspotters on social media and specialist forums. You can also use tools like Google Trends , Trend Hunter , and PSFK .

Another key source of tech trend information is your engineering team . Chances are, you have plenty of techies on your team who are up to speed on different aspects of technology and what’s forecasted to change.

Pro tip: rigorously analyze trends and put them into context to understand what has staying power, as you avoid jumping on every passing fad. Create a learning culture that embraces experimentation and gives team members the opportunity to share their knowledge.

Analyze the latest trending topics and projects in mainstream open-source communities across the Internet such as GitHub. These communities are an incredible resource for identifying tech trends that are sustainable, disruptive, and have immense staying power.

It's also important to subscribe to prominent tech publications and leading technology platforms such as Azure and AWS to get the latest tech news and new feature announcements delivered directly to your inbox. This way, your product team is always in the know about the most important tech trends that are shaping product development and product markets.

5. Validate ideas with current or potential users

Once you’ve developed a strong sense of your users, market, and technology, it’s time to start testing concrete ideas and solutions.

Based on your early research, identify possible products, features, or upgrades that could meet user needs as well as business goals. Then, run concept testing to evaluate the user experience.

First, identify key users or user types to test. Recruit participants for customer interviews or focus groups, or deploy Hotjar Surveys , Incoming Feedback tools, and Session Recordings to test ideas with existing users.

Then, ask questions or set tasks and observe user responses. You may just want to explain concepts to users at this stage—or you can use wireframes or mockups; or, at later stages, prototypes or MVPs.

Make sure you account for confirmation bias and false-positive responses from users when designing the validation process. Include open- and closed-ended questions and use measures like purchase intent to determine customer adoption.

Pro tip: use fake door testing to gauge interest in new features across your existing user base.

In fake door tests, you show users a call-to-action for a product action that doesn’t exist yet. Once they click to perform the action, they’ll be taken to a page that explains this feature isn’t available yet—you may also choose to include a short survey on this page to learn more about their interest. By reviewing answers to survey questions and the click-through rate , product teams can quickly validate ideas for new features or improvements with users.

6. Test your MVP

The next step in your product research process is to develop a Minimum Viable Product based on validated ideas and run tests to improve subsequent iterations.

This is a critical stage in product research that you shouldn’t skip. Waiting for the fully developed product before running tests makes it harder to fix software and prioritize bug issues, causing major delays.

Quality assurance (QA) testing, regression testing, and performance testing check the MVP’s functionality and show developers where they need to make product changes .

User tests are also key at this stage. Different types of product testing , like tree testing and card sorting, can confirm whether users can easily navigate your product to find the functionality they need.

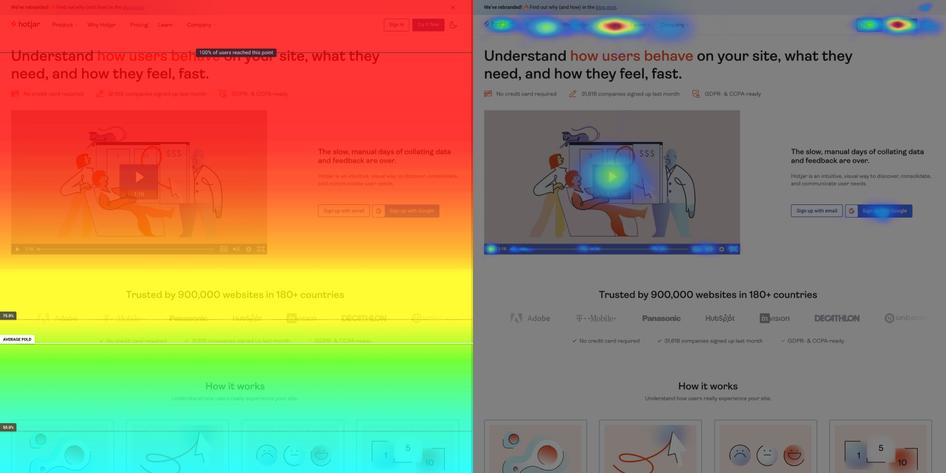

A/B tests and multivariate tests , where you split your user base into groups and give them different versions of a product or feature, can help you decide which iteration to run with. Hotjar Heatmaps allow you to easily compare where users click and scroll on different versions of the product.

7. Continue research after the product launch

Consider doing a soft launch—or even canary deployment—where you release new products or features to a small group of users

Gather data to weed out bugs

Finally, adapt the product based on user responses

Then you can roll it out to all users.

But even once you’ve launched the final product, your research isn’t over. The best product teams stay connected with their users and regularly analyze market trends and tech changes.

After the product is released, either through a soft launch or a regular launch, implementing a data-driven approach to the go-to-market strategy is crucial in parsing consumer reports and validating trends and customer opinions.

Continuous research ensures that your product stays relevant and successfully meets customer needs, which will boost user metrics and business metrics alike.

So how can you continue your research throughout the product lifecycle?

Watch session recordings to spot blockers and bugs where users are rage clicking or dropping off the product journey

Use heatmaps to understand which product elements are most popular—and unpopular—with users

Measure product analytics like click-through rate (CTR) and product conversion rate

Stay up to date on industry and market trends

Incorporate regular opportunities for cross-team discussions to get different research perspectives

Schedule regular user and customer interviews

Use product experience insights tools like Hotjar to give you a steady stream of user feedback through Surveys and Feedback widgets

8. Turn research into action

The final step in any product research process is to organize your research and turn insights into action.

Curate your research into specific, actionable themes to cut through the noise and gather valuable, user-centric insights.

Then, use your research to establish a strong product strategy and roadmap to guide your product development process. Make sure you compare the strategy and roadmap with new research at regular intervals and update where needed, though it’s important to strike a balance: these documents should be dynamic but relatively stable touchpoints.

Your product research should also drive your day-to-day decisions and product backlog management , and form the basis of your product storytelling to help get stakeholder buy-in.

Why creating a user-centric research culture is essential

Remember: at heart, all product research is user research.

Product teams who are endlessly curious about their users—who they are, what they need, how they experience your product—can better meet the demands of an ever-evolving market, inspire customer loyalty, and increase their Net Promoter Score (NPS) . With a learning mindset and a commitment to customer-centric product discovery, you can transform research into innovation and sustainable business growth .

FAQs on the product research process

What is product research.

Product research is the process of gathering data about your product’s purpose, intended users, and market to meet user needs and achieve business goals.

What are the steps in the product research process?

The 8 steps in an effective product research process are:

1) Define your research goals

2) Understand your users

3) Do market research for your product

4) Get to know industry trends

5) Validate ideas with current or potential users

6) Test your MVP

7) Continue research after the product launch

8) Turn research into action

Why is product research important?

Strong product research is critical to product management because:

It ensures the product will meet customer needs and hit business targets

It helps product managers (PMs) develop a data-informed product vision, strategy, and roadmap

It helps PMs make confident decisions on the product backlog and day-to-day tasks

It keeps the product team motivated and connected with the purpose of their work

It helps the product team communicate product value to stakeholders to get buy-in and secure resources

Prioritize product features

Previous chapter

Guide index

The state of AI in early 2024: Gen AI adoption spikes and starts to generate value

If 2023 was the year the world discovered generative AI (gen AI) , 2024 is the year organizations truly began using—and deriving business value from—this new technology. In the latest McKinsey Global Survey on AI, 65 percent of respondents report that their organizations are regularly using gen AI, nearly double the percentage from our previous survey just ten months ago. Respondents’ expectations for gen AI’s impact remain as high as they were last year , with three-quarters predicting that gen AI will lead to significant or disruptive change in their industries in the years ahead.

About the authors

This article is a collaborative effort by Alex Singla , Alexander Sukharevsky , Lareina Yee , and Michael Chui , with Bryce Hall , representing views from QuantumBlack, AI by McKinsey, and McKinsey Digital.

Organizations are already seeing material benefits from gen AI use, reporting both cost decreases and revenue jumps in the business units deploying the technology. The survey also provides insights into the kinds of risks presented by gen AI—most notably, inaccuracy—as well as the emerging practices of top performers to mitigate those challenges and capture value.

AI adoption surges

Interest in generative AI has also brightened the spotlight on a broader set of AI capabilities. For the past six years, AI adoption by respondents’ organizations has hovered at about 50 percent. This year, the survey finds that adoption has jumped to 72 percent (Exhibit 1). And the interest is truly global in scope. Our 2023 survey found that AI adoption did not reach 66 percent in any region; however, this year more than two-thirds of respondents in nearly every region say their organizations are using AI. 1 Organizations based in Central and South America are the exception, with 58 percent of respondents working for organizations based in Central and South America reporting AI adoption. Looking by industry, the biggest increase in adoption can be found in professional services. 2 Includes respondents working for organizations focused on human resources, legal services, management consulting, market research, R&D, tax preparation, and training.

Also, responses suggest that companies are now using AI in more parts of the business. Half of respondents say their organizations have adopted AI in two or more business functions, up from less than a third of respondents in 2023 (Exhibit 2).

Gen AI adoption is most common in the functions where it can create the most value

Most respondents now report that their organizations—and they as individuals—are using gen AI. Sixty-five percent of respondents say their organizations are regularly using gen AI in at least one business function, up from one-third last year. The average organization using gen AI is doing so in two functions, most often in marketing and sales and in product and service development—two functions in which previous research determined that gen AI adoption could generate the most value 3 “ The economic potential of generative AI: The next productivity frontier ,” McKinsey, June 14, 2023. —as well as in IT (Exhibit 3). The biggest increase from 2023 is found in marketing and sales, where reported adoption has more than doubled. Yet across functions, only two use cases, both within marketing and sales, are reported by 15 percent or more of respondents.

Gen AI also is weaving its way into respondents’ personal lives. Compared with 2023, respondents are much more likely to be using gen AI at work and even more likely to be using gen AI both at work and in their personal lives (Exhibit 4). The survey finds upticks in gen AI use across all regions, with the largest increases in Asia–Pacific and Greater China. Respondents at the highest seniority levels, meanwhile, show larger jumps in the use of gen Al tools for work and outside of work compared with their midlevel-management peers. Looking at specific industries, respondents working in energy and materials and in professional services report the largest increase in gen AI use.

Investments in gen AI and analytical AI are beginning to create value

The latest survey also shows how different industries are budgeting for gen AI. Responses suggest that, in many industries, organizations are about equally as likely to be investing more than 5 percent of their digital budgets in gen AI as they are in nongenerative, analytical-AI solutions (Exhibit 5). Yet in most industries, larger shares of respondents report that their organizations spend more than 20 percent on analytical AI than on gen AI. Looking ahead, most respondents—67 percent—expect their organizations to invest more in AI over the next three years.

Where are those investments paying off? For the first time, our latest survey explored the value created by gen AI use by business function. The function in which the largest share of respondents report seeing cost decreases is human resources. Respondents most commonly report meaningful revenue increases (of more than 5 percent) in supply chain and inventory management (Exhibit 6). For analytical AI, respondents most often report seeing cost benefits in service operations—in line with what we found last year —as well as meaningful revenue increases from AI use in marketing and sales.

Inaccuracy: The most recognized and experienced risk of gen AI use

As businesses begin to see the benefits of gen AI, they’re also recognizing the diverse risks associated with the technology. These can range from data management risks such as data privacy, bias, or intellectual property (IP) infringement to model management risks, which tend to focus on inaccurate output or lack of explainability. A third big risk category is security and incorrect use.

Respondents to the latest survey are more likely than they were last year to say their organizations consider inaccuracy and IP infringement to be relevant to their use of gen AI, and about half continue to view cybersecurity as a risk (Exhibit 7).

Conversely, respondents are less likely than they were last year to say their organizations consider workforce and labor displacement to be relevant risks and are not increasing efforts to mitigate them.

In fact, inaccuracy— which can affect use cases across the gen AI value chain , ranging from customer journeys and summarization to coding and creative content—is the only risk that respondents are significantly more likely than last year to say their organizations are actively working to mitigate.

Some organizations have already experienced negative consequences from the use of gen AI, with 44 percent of respondents saying their organizations have experienced at least one consequence (Exhibit 8). Respondents most often report inaccuracy as a risk that has affected their organizations, followed by cybersecurity and explainability.

Our previous research has found that there are several elements of governance that can help in scaling gen AI use responsibly, yet few respondents report having these risk-related practices in place. 4 “ Implementing generative AI with speed and safety ,” McKinsey Quarterly , March 13, 2024. For example, just 18 percent say their organizations have an enterprise-wide council or board with the authority to make decisions involving responsible AI governance, and only one-third say gen AI risk awareness and risk mitigation controls are required skill sets for technical talent.

Bringing gen AI capabilities to bear

The latest survey also sought to understand how, and how quickly, organizations are deploying these new gen AI tools. We have found three archetypes for implementing gen AI solutions : takers use off-the-shelf, publicly available solutions; shapers customize those tools with proprietary data and systems; and makers develop their own foundation models from scratch. 5 “ Technology’s generational moment with generative AI: A CIO and CTO guide ,” McKinsey, July 11, 2023. Across most industries, the survey results suggest that organizations are finding off-the-shelf offerings applicable to their business needs—though many are pursuing opportunities to customize models or even develop their own (Exhibit 9). About half of reported gen AI uses within respondents’ business functions are utilizing off-the-shelf, publicly available models or tools, with little or no customization. Respondents in energy and materials, technology, and media and telecommunications are more likely to report significant customization or tuning of publicly available models or developing their own proprietary models to address specific business needs.

Respondents most often report that their organizations required one to four months from the start of a project to put gen AI into production, though the time it takes varies by business function (Exhibit 10). It also depends upon the approach for acquiring those capabilities. Not surprisingly, reported uses of highly customized or proprietary models are 1.5 times more likely than off-the-shelf, publicly available models to take five months or more to implement.

Gen AI high performers are excelling despite facing challenges

Gen AI is a new technology, and organizations are still early in the journey of pursuing its opportunities and scaling it across functions. So it’s little surprise that only a small subset of respondents (46 out of 876) report that a meaningful share of their organizations’ EBIT can be attributed to their deployment of gen AI. Still, these gen AI leaders are worth examining closely. These, after all, are the early movers, who already attribute more than 10 percent of their organizations’ EBIT to their use of gen AI. Forty-two percent of these high performers say more than 20 percent of their EBIT is attributable to their use of nongenerative, analytical AI, and they span industries and regions—though most are at organizations with less than $1 billion in annual revenue. The AI-related practices at these organizations can offer guidance to those looking to create value from gen AI adoption at their own organizations.

To start, gen AI high performers are using gen AI in more business functions—an average of three functions, while others average two. They, like other organizations, are most likely to use gen AI in marketing and sales and product or service development, but they’re much more likely than others to use gen AI solutions in risk, legal, and compliance; in strategy and corporate finance; and in supply chain and inventory management. They’re more than three times as likely as others to be using gen AI in activities ranging from processing of accounting documents and risk assessment to R&D testing and pricing and promotions. While, overall, about half of reported gen AI applications within business functions are utilizing publicly available models or tools, gen AI high performers are less likely to use those off-the-shelf options than to either implement significantly customized versions of those tools or to develop their own proprietary foundation models.

What else are these high performers doing differently? For one thing, they are paying more attention to gen-AI-related risks. Perhaps because they are further along on their journeys, they are more likely than others to say their organizations have experienced every negative consequence from gen AI we asked about, from cybersecurity and personal privacy to explainability and IP infringement. Given that, they are more likely than others to report that their organizations consider those risks, as well as regulatory compliance, environmental impacts, and political stability, to be relevant to their gen AI use, and they say they take steps to mitigate more risks than others do.

Gen AI high performers are also much more likely to say their organizations follow a set of risk-related best practices (Exhibit 11). For example, they are nearly twice as likely as others to involve the legal function and embed risk reviews early on in the development of gen AI solutions—that is, to “ shift left .” They’re also much more likely than others to employ a wide range of other best practices, from strategy-related practices to those related to scaling.

In addition to experiencing the risks of gen AI adoption, high performers have encountered other challenges that can serve as warnings to others (Exhibit 12). Seventy percent say they have experienced difficulties with data, including defining processes for data governance, developing the ability to quickly integrate data into AI models, and an insufficient amount of training data, highlighting the essential role that data play in capturing value. High performers are also more likely than others to report experiencing challenges with their operating models, such as implementing agile ways of working and effective sprint performance management.

About the research

The online survey was in the field from February 22 to March 5, 2024, and garnered responses from 1,363 participants representing the full range of regions, industries, company sizes, functional specialties, and tenures. Of those respondents, 981 said their organizations had adopted AI in at least one business function, and 878 said their organizations were regularly using gen AI in at least one function. To adjust for differences in response rates, the data are weighted by the contribution of each respondent’s nation to global GDP.

Alex Singla and Alexander Sukharevsky are global coleaders of QuantumBlack, AI by McKinsey, and senior partners in McKinsey’s Chicago and London offices, respectively; Lareina Yee is a senior partner in the Bay Area office, where Michael Chui , a McKinsey Global Institute partner, is a partner; and Bryce Hall is an associate partner in the Washington, DC, office.

They wish to thank Kaitlin Noe, Larry Kanter, Mallika Jhamb, and Shinjini Srivastava for their contributions to this work.

This article was edited by Heather Hanselman, a senior editor in McKinsey’s Atlanta office.

Explore a career with us

Related articles.

Moving past gen AI’s honeymoon phase: Seven hard truths for CIOs to get from pilot to scale

A generative AI reset: Rewiring to turn potential into value in 2024

Implementing generative AI with speed and safety

Communication and Intelligent Systems

Proceedings of ICCIS 2023, Volume 3

- Conference proceedings

- © 2024

- Harish Sharma 0 ,

- Vivek Shrivastava 1 ,

- Ashish Kumar Tripathi 2 ,

- Lipo Wang ORCID: https://orcid.org/0000-0002-4257-7639 3

Department of Computer Science and Engineering, Rajasthan Technical University, Kota, India

You can also search for this editor in PubMed Google Scholar

Department of Electrical Engineering, National Institute of Technology Delhi, New Delhi, India

Department of computer science, malaviya national institute of technology, mnit campus, jaipur, india, school of electrical and electronic engineering, nanyang technological university, singapore, singapore.

- Presents research works in the field of communication and intelligent systems

- Includes original works presented at ICCIS 2023 held in Jaipur, India

- Provides state of the art to research scholars and postgraduates from various domains of engineering and related fields

Part of the book series: Lecture Notes in Networks and Systems (LNNS, volume 969)

Included in the following conference series:

- ICCIS: International Conference on Communication and Intelligent Systems

Conference proceedings info: ICCIS 2023.

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

Other volumes

- Intelligent Systems

- Communication and Control Systems

- Artificial Intelligence

- Machine Learning

- Pattern Recognition

- Image Processing

- ICCIS 2023 Proceedings

About this book

Editors and affiliations.

Harish Sharma

Vivek Shrivastava

Ashish Kumar Tripathi

About the editors

Bibliographic information.

Book Title : Communication and Intelligent Systems

Book Subtitle : Proceedings of ICCIS 2023, Volume 3

Editors : Harish Sharma, Vivek Shrivastava, Ashish Kumar Tripathi, Lipo Wang

Series Title : Lecture Notes in Networks and Systems

DOI : https://doi.org/10.1007/978-981-97-2082-8

Publisher : Springer Singapore

eBook Packages : Intelligent Technologies and Robotics , Intelligent Technologies and Robotics (R0)

Copyright Information : The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd. 2024

Softcover ISBN : 978-981-97-2081-1 Published: 04 June 2024

eBook ISBN : 978-981-97-2082-8 Published: 03 June 2024

Series ISSN : 2367-3370

Series E-ISSN : 2367-3389

Edition Number : 1

Number of Pages : XVIII, 482

Number of Illustrations : 39 b/w illustrations, 161 illustrations in colour

Topics : Computational Intelligence , Artificial Intelligence , Computer Imaging, Vision, Pattern Recognition and Graphics , Machine Learning

- Publish with us

Policies and ethics

- Find a journal

- Track your research

IMAGES

VIDEO

COMMENTS

This paper presents the results of the Product Development & Management Association (PDMA)'s 2021 Global Best Practices Research. This research surveyed NPD and innovation managers from 651 firms in 37 countries, expanding the global scope of the survey as compared with previous PDMA Best Practice studies.

Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, 69 (1): 151-176. Abstract. This review article deals with the current state of knowledge on the topic of launching new products ...

The repercussions of poor quality can outweigh the advantages of a new product launch, potentially inflicting devastating damage on the product's or company's brand [6, 7]. This paper is set out to identify and scrutinize the pivotal factors and challenges related to new product development. Consequently, the study poses two research questions, 1.

New product development (NPD) knowledge is linked to design or manufacturing processes ... This study aims to compile the best KM papers published between 2000 and 2022 and sort them by publication year, number of authors, number of references, page count, keyword density, field of study, and publisher to learn more about the parameters ...

New research on product development from Harvard Business School faculty on issues including what marketers can learn from consumers whose preferences lie outside of the mainstream, and how to best incorporate customer opinion when creating a new product. ... Examining firm responses to others' failures, this paper introduces a new model of R ...

When confronted with new product development (NPD), managers generally adopt quick fixes such as benchmarking with competing products and then attempting incremental changes over the competitors' product features. There are several approaches propounded in the past. Some focus on manufacturing, some on marketing and perception, and some on idea generation and stage-gating these concepts ...

New product development (NPD) is complex and is becoming more so. NPD leaders have always had to understand evolving customer needs, carefully exploit the benefits of emerging technologies, and work to align the many stakeholders required for new product success. But the pace of change is accelerating, and the tools that have served NPD well ...

Kavadias S, Ulrich KT (2020) Innovation and New Product Development: Reflections and Insights from the Research Published in the First 20 Years of Manufacturing & Service Operations Management. Manufacturing & Service Operations Management 22(1): 84-92.

The Handbook of Research on New Product Development (Golder and Mitra 2017) contains 19 chapters that provide depth on specific aspects of new product development and innovation. These chapters describe the frontiers of new products research as well as offer numerous insights for extending these frontiers of our knowledge base.

The Journal of Product Innovation Management (JPIM) is an interdisciplinary, international journal that seeks to advance our theoretical and managerial knowledge of innovation management and product development.The journal publishes original articles on organizations of all sizes (start-ups, small to medium sized enterprises, large corporations) and from the consumer, business-to-business, and ...

Recent trends in agile new product development: a systematic review and agenda for future research - Author: Manoj Palsodkar, Gunjan Yadav, Madhukar R. Nagare ... (ANPD), which enables the introduction of new products to the market in a short span. The existing ANPD literature review articles are lacking in portraying recent developments ...

This research proposes a new product development (NPD) framework for innovation-driven deep-tech research to commercialization and tested it with three case studies of different exploitation methods. The proposed framework, called Augmented Stage-Gate, integrates the next-generation Agile Stage-Gate development process with lean startup and design thinking approaches.

The literature on the front end in the New Product Development (NPD) literature is fragmented with respect to the identification and analysis of the factors that are critical to successful product development. The article has a two-fold purpose. First, it describes, analyses, and synthesizes those factors through a literature review of the research on the front end in NPD. Second, it ...