Get expert advice delivered straight to your inbox.

Impulse Buying: Why We Do It and How to Stop

13 Min Read | Oct 13, 2023

Let’s be honest here: Impulse buying is kind of fun—at least in the moment. You walk into Target for diapers, and before you know it . . . boom. Your cart is full of Chip and Joanna’s amazing throw pillows.

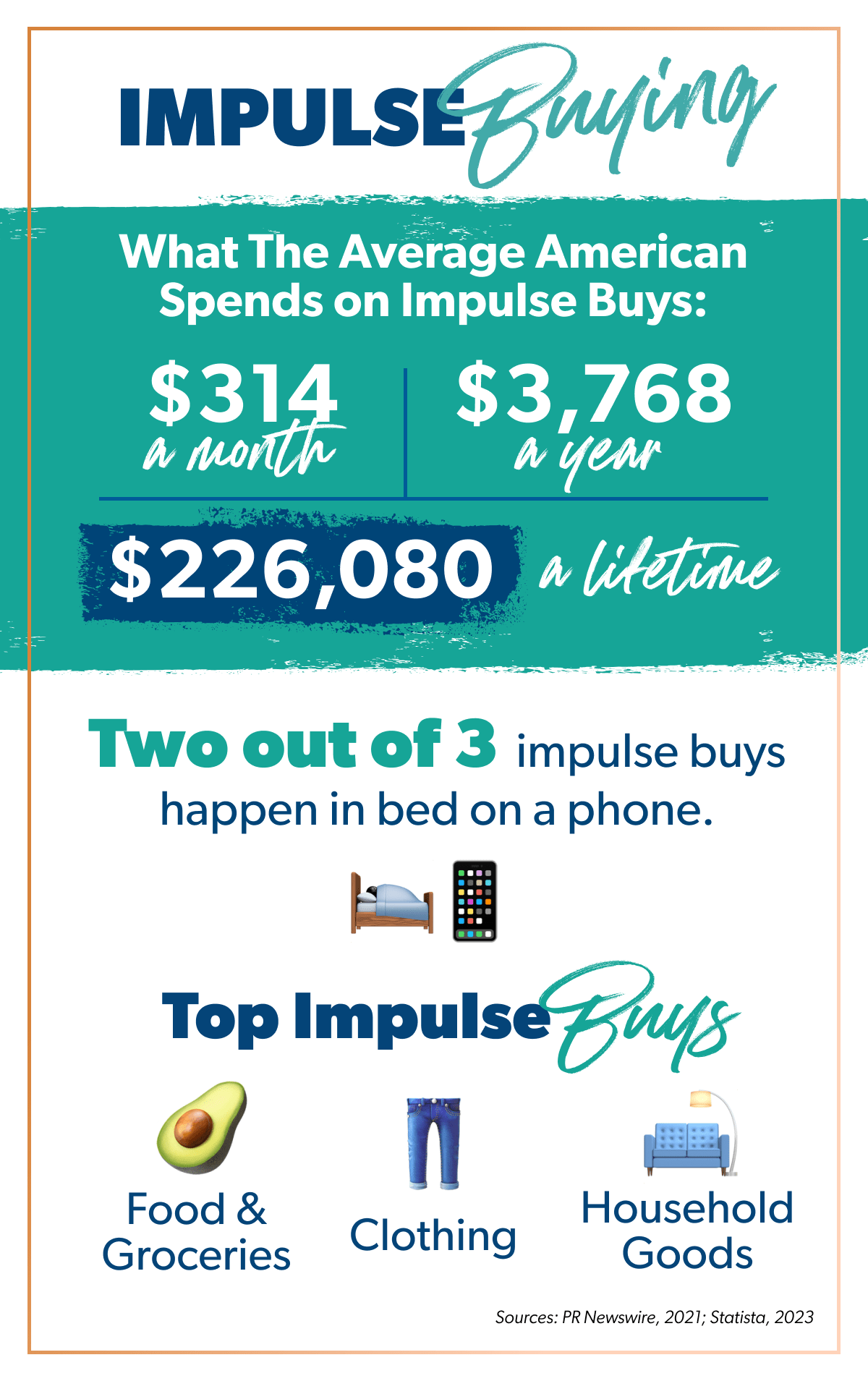

This is actually really normal. Americans impulsively spend an average of $314 every month. 1 That adds up to an extra $3,768 spent every year and about $226,080 in a lifetime! Ouch!

I couldn’t help myself. I had to plug those numbers into our retirement calculator . And listen—if you invested that $314 every month for 10 years at an 11% average annual rate of return, you’d have over $68,000! Nothing like the magic of compound growth to put things into perspective.

What Is an Impulse Buy?

An impulse buy is any purchase you make when you weren’t planning to. If it’s not planned for in your budget ahead of time, it’s an impulse buy.

It can be as small as grabbing a candy bar in the checkout line (that wasn’t on your grocery list) or as big as walking into a car dealership “just to browse” and driving off in a brand-new SUV.

Examples of impulse buying:

- Candy, gum and energy drinks in the checkout line

- Clothing and shoes

- Video games

- Candles (Bath & Body Works is basically an entire store of impulse buys, am I right?)

- Home improvement purchases

- Toys (to keep the kids under control at the store)

- Extra cleaning supplies (just in case)

- Cars (yes, even cars!)

- “Treat yourself” buys

- Coffee and takeout

Almost all of us have fallen for the temporary excitement of impulse buying. In fact, a recent survey shows average impulse spending is up nearly 72% since 2020! 2 And our own State of Personal Finance study reveals 45% of Americans say they struggle to avoid impulse buys.

Now, for any men reading this, I can see you nodding along, thinking, My wife does this all the time! But hold your horses. The top impulse purchases are clothing, household goods, and food and groceries. 3 The last I checked, men buy those items too.

Why Do We Keep Impulse Buying?

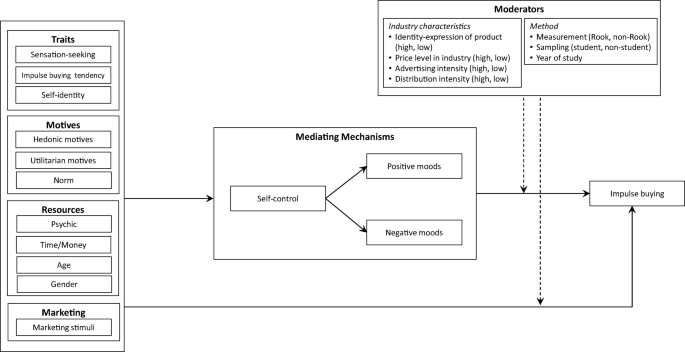

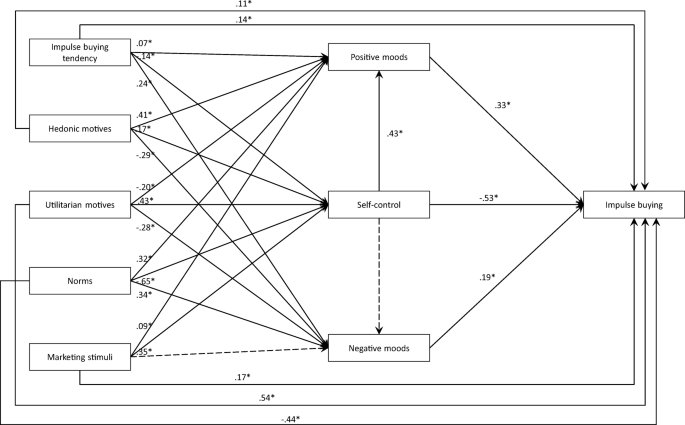

Do you ever wonder how impulse buying gets you? There are four main reasons I see for why people impulse buy. They are:

- Our emotions

- Our past experiences

- A good deal

- The pure love of shopping

We impulse buy because of emotions.

Emotions play a huge part in what we buy. Our personal finances are just that— personal . So it makes sense that when something’s going on with us personally, it shows up in our money habits too.

When you’re having a rough day, does a little retail therapy sound like the cure? Maybe it’s nothing extreme. Maybe it’s just grabbing a new baseball cap or a new pair of earrings. You tell yourself it’s not a big deal—you just want to get something nice to make yourself feel better.

Making decisions based on pure emotion is a surefire way to let impulse buying take control. And sneaky marketers know this. They’ll play on your emotions with their ads, hoping it’ll hit a nerve that causes you to buy.

We impulse buy because of our past.

If impulse buying and overspending are problems for you, it could be that you were never taught how to handle money well.

Thinking about how money was handled in the household you grew up in will help you understand the foundation for your beliefs about money—aka your money mindset . If you’re married, this can also help you get to the root of money arguments you and your spouse may have. Their experience was probably totally different than yours, which means you guys are coming at this from two different perspectives.

Start budgeting with EveryDollar today!

If you want to do some more digging on how your past affects your spending today, check out my newest book, Know Yourself, Know Your Money .

We impulse buy when we believe it’s a deal.

I totally get this one because I love a good sale. I mean, who wants to pay full price? Or worse . . . for shipping and handling? Thank you, Amazon Prime, for making anything other than free two-day shipping feel like a crime.

But, you guys, this is a total marketing tactic. According to a survey, 64% of shoppers impulse buy because of a sale. 4 When you think you’re getting a deal or “free shipping,” you’re way more likely to pull the trigger on the purchase—and that’s exactly what the marketers want you to do. I’m sorry, but it’s the truth. I’d bet Jeff Bezos’ fortune on it.

We impulse buy because we enjoy shopping.

Shopping really does make you feel better in the moment. When we shop, the body releases dopamine—that’s right, the brain’s happiness drug.

This love of shopping, in and of itself, isn’t a bad thing. What’s dangerous is when all that impulse buying adds up and your love of shopping turns into a shopping addiction . Your body starts relying on that dopamine hit, so you continue to feed it with more and more spending. But the point here is that it’s easy to like shopping on impulse—science says so.

How to Stop Impulse Buying

Okay, so how the heck do you keep impulse buying at bay? This is where I really want to help you, so get comfortable. Whether you’re on Baby Step 1 or Baby Step 7 , I’ve come up with 14 tips to help you dodge the temptation to overspend.

1. Make a budget and stick to it.

First things first: You need a budget. If you don’t already have one, then stop right now and get started with our free budgeting app, EveryDollar .

And the kicker is, you have to actually stick to it ! A budget isn’t a magic wand that will suddenly make all of your money behave. It’s on you to tell your money where to go each month and then follow through with that plan. If it’s not already budgeted for, don’t spend the money. Yep, it’s as simple and as hard as that. You can do this!

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple . (Yes, please.)

2. Give yourself permission to spend.

Yep, I just told you to stick to your budget—and you always should. But it’s also important to throw a little fun money in there too! Give yourself (and your spouse, if you’re married) a line item in the budget with your name on it for your fun spending.

Depending on your situation, this might be $10 a month or $100 a month. Just make sure the amount is reasonable and affordable for your budget .

The next time you’re walking through the mall and something catches your eye, you just have to check your fun money fund. Now you can shop guilt-free! You’ve already budgeted a small portion of spending money for it, so that reward or treat isn’t an impulse buy anymore.

3. Wait a day (or longer!) before you make a purchase.

Listen: Two-thirds of impulse shopping happens in our beds on our smartphones. 5 It’s so easy to see something we want and click, click, click it into a purchase.

One way to help here is to give yourself a day or so to calm down when an impulse buy gets you jazzed. Once you have a cool head and a fresh perspective, ask yourself if you’ll actually use this thing and if you can pay cash for it now. That’s a no-nonsense way to look at the purchase and save yourself from tons of financial stress in the future.

And watch out for deals that are only good for 24 hours. Don’t let a countdown rush you into buying anything! Remember the offer, save some money, and be ready for it next time if you can’t afford it right now. Because a sale will come back around. Trust me.

4. Shop with a plan in mind.

Figuring out what items you want to buy and how much you’ll spend before you ever start shopping is one of my favorite ways to overcome impulse buying. With a plan in place, you’ll be less likely to give in to overspending. Your shopping list can range from grocery items to the Christmas gifts you plan to purchase for your extended family—just know what it is you want to buy before you go.

P.S. The best way to curb those grocery and takeout impulse buys is with a meal plan—and I’ve got a free meal planning and grocery guide that can save you from stress and overspending!

5. Beware of joining too many email lists.

Has anyone else’s inbox been absolutely flooded with sales lately? I mean, I’ve been doing great sticking to my budget , with everything planned and accounted for. But then, I check my inbox and find 15 different emails announcing one deal after another!

Now, I wasn’t even thinking about shopping—but then these marketers catch my attention, and I just have to see what’s on sale, right? Guys, we all could use a little “unsubscribe” in our lives.

6. Don’t shop when you’re emotional.

We just talked about this, but it’s worth mentioning again—don’t let your emotions control your spending habits! You might have a great day and make an impulse buy in the thrill of the moment. Or maybe you’re having a bad day, and you tell yourself you deserve something nice or that this item will make you feel better.

We’ve all been there before. It can happen pretty easily. So how can you fix it? Whether you’re celebrating or trying to cheer yourself up, don’t buy anything when your emotions are riding a roller coaster.

7. Bring someone with you when you shop.

Accountability goes a long way here. Do you have a sibling or friend who’s willing to get in your face and tell you not to buy something? Bring them on your shopping trip. Tell them what you plan to buy, and ask them to talk some sense into you if you start straying from the strategy.

8. Take only the amount of cash you’ll need.

Figure out how much money you need for the items you want to buy, and only take that amount in cash . You could even go a step further and leave your debit card at home so you don’t tempt yourself to buy more with plastic (even the debit card kind).

If you stick to your shopping plan and don’t bring any extra money along on the trip, you can’t make an impulse buy. It’s pretty much impossible. Now that’s the power of cash !

9. Stop the comparisons.

This is a game changer when it comes to impulse buying. If you always compare what you have (or don’t have) to others, you’ll never be satisfied. When we start comparing ourselves to other people , we’re playing a game we’ll never win.

Instead of looking at what someone else has and thinking, Oh, I need that too , take a step back and look at your life. Learn to be grateful for what you do have. If you change your perspective, you’ll find you already have a lot to be grateful for.

10. Get off social media.

It’s true—if you’re having trouble with comparisons, social media isn’t going to make it any better. If you know you have trouble being content when you scroll past everyone’s highlight reel, then remove the source of the problem. I’m not saying you have to kick social media to the curb forever, but try deleting Instagram and Facebook for a week (or more) and see if you notice a difference.

Even if you don’t find yourself falling into that comparison trap, the reality is that social media is one big billboard for impulse buying. Everywhere you scroll, someone is trying to get you to spend your money. But if you’re not on the app, you won’t see all the businesses with flashy sales and new products for you to spend your hard-earned dollars on.

11. Do a no-spend challenge.

Desperate times call for desperate measures, and sometimes a no-spend challenge is just what the doctor ordered. If you haven’t heard of this before, it’s pretty much just like it sounds—you don’t spend any money (on nonessential items).

You still pay for things like your rent or mortgage, regular bills, utilities, groceries, etc. But you don’t spend money on things like restaurants, the hair salon, new shoes or a new kitchen accessory. Basically, don’t even set foot in a store unless it’s to buy groceries (that are on your list!).

12. Forget your card number.

Okay, I admit it. I’ve memorized my debit card number. Real shocking for a spender, I know. I’ve done so much online shopping with this debit card that I actually have the number memorized.

If this is you, this seems perfectly efficient and you get me. If this sounds crazy to you, the rest of us are a little jealous that impulse buying is that much harder for you to do online. But does your card number autofill from your phone or web browser? Is your PayPal just one click away when you check out? If the answer is yes, you might want to consider erasing those numbers from your digital memory.

13. Ditch the credit card(s).

If you put those impulse buys on a credit card—and don’t pay off the balance—you end up paying even more than the average $314 a month I mentioned earlier. Why? Because you’ll have that average credit card interest rate too. Yup, you’ll have to pay 20.68% more on those things you didn’t plan to buy or probably even need. 6

You guys, don’t let the temptation for rewards lure you in to using credit cards (that includes store cards too). They make it way too easy to turn today’s purchase into tomorrow’s problem—because you don’t see the cash leave your wallet or your checking account balance go down. It’s too simple when you don’t technically have to pay for it then and there, which is exactly how credit cards work.

Ditch the credit cards and the impulse buys.

14. Keep your goals in mind.

Here’s a real shocker: Giving in to an impulse buy won’t help you achieve your financial goals —whether that’s getting out of debt , paying off your mortgage, or investing for your future. Buying on impulse and overspending will eat up any extra money you were saving to put toward those awesome goals. So don’t shoot yourself in the foot here. Help yourself out by remembering the important goals you’re working toward!

Control Starts With Clarity

Spending money can be super fun, especially if you’re a spender, like me. But that excitement never lasts. If you want to learn more about your spending tendencies and take control of your money for good, I want you to do two things today.

First, get on that budget! Remember, EveryDollar is free , and it’s how you’ll stop wondering where your money went—and start telling it where to go.

Second, check out my newest book, Know Yourself, Know Your Money . You’ll see the way your past and personality affect how you handle your money—and learn how to start moving forward with your finances.

Listen, I want you to get the clarity you need to get unstuck with your finances. And you can! Take these two steps, and start being intentional—not impulsive—with your money.

Did you find this article helpful? Share it!

About the author

Rachel Cruze

Rachel Cruze is a #1 New York Times bestselling author, financial expert, host of The Rachel Cruze Show, and co-host of Smart Money Happy Hour. Rachel writes and speaks on personal finance, budgeting, investing and money trends. As a co-host of The Ramsey Show, America’s second-largest talk radio show, Rachel reaches millions of weekly listeners with her personal finance advice. She’s appeared on Good Morning America and Fox News and been featured in TIME, REAL SIMPLE and Women’s Health, among others. Through her shows, books, syndicated columns and speaking events, Rachel shares fun, practical ways to take control of your money and create a life you love. Learn More.

How to Stop Spending Money

Has the constant cycle of overspending led you to wonder how to stop spending money? You’re not the only one. Spending money doesn’t have to lead to debt and make you feel stuck with your finances. Here’s how:

How to Change Your Money Mindset

What beliefs, attitude and mindset do you have around money? What you believe will directly affect the way you handle money.

How to Avoid Impulse Buying

By Isabella Simonetti Jan. 12, 2023

- Share full article

Buyer’s remorse is real . But there are ways to avoid overspending on things you just don’t need. I asked Justin Pritchard, the owner of Approach Financial Planning, a retirement planning firm in Montrose, Colo., for advice.

Here’s what he told me →

Make automatic deposits into different savings accounts. Pritchard called this the “pay yourself first strategy.” These deposits leave you with less available cash in your checking account that you might be tempted to spend.

Write a Post-it note to stick on your credit card that lists your spending priorities. The note might say “pause” or “slow down.” This reminder allows you to rethink how you’re spending your money and redirect your spending toward your goals.

Delete your credit card information from your Amazon account. This will add a barrier before you check out — you’ll be required to enter your credit card information manually, forcing you to pause and think about the purchases more carefully.

Use a list when you go shopping , both in person and online. This can help you be thoughtful about your purchases and not buy items that fall outside of your main spending priorities.

Get more advice on managing your money .

A Guide to Making Better Financial Moves

Making sense of your finances can be complicated. the tips below can help..

Inheriting money after the death of a loved one while also grieving can be an emotional minefield, particularly for younger adults. Experts share ways to handle it wisely .

Either by choice or because they are priced out of the market, many people plan to never stop renting. Building wealth without home equity requires a different mind-set.

You may feel richer as you pay your mortgage down and home values go up. As a result, some homeowners end up with a lot of home equity but low retirement savings. Here’s the problem with that situation.

Can your investment portfolio reflect your values? If you want it to, it is becoming easier with each passing year .

The way advisers handle your retirement money is about to change: More investment professionals will be required to act in their customers’ best interest when providing advice about their retirement money.

The I.R.S. estimates that 940,000 people who didn’t file their tax returns in 2020 are due back money. The deadline for filing to get it is May 17.

Advertisement

- Credit Cards

- All Credit Cards

- Find the Credit Card for You

- Best Credit Cards

- Best Rewards Credit Cards

- Best Travel Credit Cards

- Best 0% APR Credit Cards

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Credit Card Sign-Up Bonuses

- Best Credit Cards to Build Credit

- Best Credit Cards for Online Shopping

- Find the Best Personal Loan for You

- Best Personal Loans

- Best Debt Consolidation Loans

- Best Loans to Refinance Credit Card Debt

- Best Loans with Fast Funding

- Best Small Personal Loans

- Best Large Personal Loans

- Best Personal Loans to Apply Online

- Best Student Loan Refinance

- Best Car Loans

- All Banking

- Find the Savings Account for You

- Best High Yield Savings Accounts

- Best Big Bank Savings Accounts

- Best Big Bank Checking Accounts

- Best No Fee Checking Accounts

- No Overdraft Fee Checking Accounts

- Best Checking Account Bonuses

- Best Money Market Accounts

- Best Credit Unions

- All Mortgages

- Best Mortgages

- Best Mortgages for Small Down Payment

- Best Mortgages for No Down Payment

- Best Mortgages for Average Credit Score

- Best Mortgages No Origination Fee

- Adjustable Rate Mortgages

- Affording a Mortgage

- All Insurance

- Best Life Insurance

- Best Life Insurance for Seniors

- Best Homeowners Insurance

- Best Renters Insurance

- Best Car Insurance

- Best Pet Insurance

- Best Boat Insurance

- Best Motorcycle Insurance

- Best Travel Insurance

- Event Ticket Insurance

- Small Business

- All Small Business

- Best Small Business Savings Accounts

- Best Small Business Checking Accounts

- Best Credit Cards for Small Business

- Best Small Business Loans

- Best Tax Software for Small Business

- Personal Finance

- All Personal Finance

- Best Budgeting Apps

- Best Expense Tracker Apps

- Best Money Transfer Apps

- Best Resale Apps and Sites

- Buy Now Pay Later (BNPL) Apps

- Best Debt Relief

- Credit Monitoring

- All Credit Monitoring

- Best Credit Monitoring Services

- Best Identity Theft Protection

- How to Boost Your Credit Score

- Best Credit Repair Companies

- Filing For Free

- Best Tax Software

- Best Tax Software for Small Businesses

- Tax Refunds

- Tax Brackets

- Taxes By State

- Tax Payment Plans

- Help for Low Credit Scores

- All Help for Low Credit Scores

- Best Credit Cards for Bad Credit

- Best Personal Loans for Bad Credit

- Best Debt Consolidation Loans for Bad Credit

- Personal Loans if You Don't Have Credit

- Best Credit Cards for Building Credit

- Personal Loans for 580 Credit Score Lower

- Personal Loans for 670 Credit Score or Lower

- Best Mortgages for Bad Credit

- Best Hardship Loans

- All Investing

- Best IRA Accounts

- Best Roth IRA Accounts

- Best Investing Apps

- Best Free Stock Trading Platforms

- Best Robo-Advisors

- Index Funds

- Mutual Funds

- Home & Kitchen

- Gift Guides

- Deals & Sales

- Sign up for the CNBC Select Newsletter

- Subscribe to CNBC PRO

- Privacy Policy

- Your Privacy Choices

- Terms Of Service

- CNBC Sitemap

Follow Select

Our top picks of timely offers from our partners

Impulse purchases are costing consumers almost $2,000 a year — here's how to cut back

Cnbc select helps you understand what impulse buying is and how you can cut back to save money..

If you've ever waited in line to check out at a supermarket or convenience store and felt the urge to buy a candy bar or pack of gum, you are not alone — they are there for that exact reason. An impulse purchase is made in the spur of the moment without any forethought or planning. While it's often associated with smaller purchases like snacks, impulse buying can also be seen in big-ticket items like a last-minute getaway or a car you simply intended to test drive.

A 2023 survey conducted by OnePoll found that impulse buys have declined 48% compared to the previous year, with 72% of people surveyed citing inflation as a factor. Nevertheless, over one-third of people still say that the majority of their shopping is impulse purchases.

CNBC Select dives into why people are drawn to these last-minute purchases and how a better understanding of impulse purchases can help you save your money.

What we'll cover

What is an impulse purchase, the four types of impulse purchases, why do people impulse buy, how to stop impulsive buying, bottom line.

An impulse purchase is defined as an unplanned and spontaneous decision to buy something. This sounds pretty straightforward, but there are some nuances. There are many different reasons that someone could suddenly decide to purchase something, such as their emotional state, effective advertising tactics, cultural factors, wanting the feeling of instant gratification and others on top of that.

There are four defined types of impulse purchases. These four categories also help better understand the process that happens before the act of purchasing.

- Pure impulse buying: This is the easiest kind of impulse buying to recognize and is the base level in which someone makes an impulse decision based on a certain emotion. An example would be buying a candy bar at the checkout aisle of a store because you suddenly crave something sweet after seeing it.

- Reminder impulse buying: You see an item or remember a certain thing that reminds you that you need a separate item. For example, you go to the grocery store to buy some bread, but when you walk past the toothbrushes, you remember that you're out of toothpaste so you buy some.

- Suggestion impulse buying: This one stems from a more rational place where our mind creates the need for an item. This is usually when you're convinced to buy something due to a marketing message. For instance, you're out to lunch and instead of ordering your regular soda, you decide to try sparkling water because you heard it has fewer calories.

- Planned impulse buying: Planned impulse buying sounds like an oxymoron, but it heavily revolves around discounts, promotions and items you had already thought about purchasing. For example, you are walking through your local electronics store and see a DVD you had thought about buying a few weeks ago, see that it's now 50% off and purchase it.

Now with these all in mind, they are still called impulse purchases for a reason, and even with them laid out and defined it can still be difficult to fully comprehend your behavior in the moment.

There are a few main reasons that people tend to give in to their impulse buying habits, the first one being their emotions. Retail therapy is very real, and people will often make purchases to make themselves feel good. Similar to doing many things that make people happy, shopping can release dopamine so there's an actual chemical reason that people love shopping just as they would a rollercoaster.

Another significant reason people impulse buy is thanks to deals and sales. People love to get a good deal, so when they see something is 50% off, considering if they actually need it gets pushed a little further into the background. It's another reason many sites offer free shipping on orders over a certain amount, people love to feel like they're getting the best deal they can.

External pressure can also greatly affect impulse purchasing habits . This can be something as small as your child pleading with you for his favorite breakfast cereal, or something larger like societal pressure or aiming to boost your social status through purchasing a fancy car or a new suit.

Regardless of the specific reason that each individual is affected by, the more you are aware of your own spending habits and can start taking steps towards combatting any potentially problematic impulse buying trends.

Create a budget

Creating a budget is a great first step toward helping you control your impulse purchases. There are a number of budgeting and expense tracker apps available that can help you better manage your money, or stay on track.

While this might sound counterintuitive, you may be able to combat impulse shopping by giving yourself permission to spend, within reason. Trying to cut it out entirely is not only sometimes not feasible, but doesn't allow you any wiggle room for some fun.

While they still might be impulse buys, planning ahead and creating an overall strategy can help you keep your spending in check and hold yourself accountable for your purchasing habits. You can add impulse purchases into your budget, but make it a reasonable amount. On average, people spend $151 a month on impulse purchases , so consider starting this section of your budget at $50 or $75.

In addition, if you're using a rewards credit card like the Citi Double Cash® Card , you can get 2% back on all your purchases (1% cash back when you buy, plus an additional 1% as you pay for those purchases) which can help relieve some of the guilt while saving money. The card also has no annual fee and new cardmembers can get a 0% intro APR for the first 18 months on balance transfers (after that it's a variable 19.24% - 29.24%).

Citi Double Cash® Card

Earn 2% on every purchase with unlimited 1% cash back when you buy, plus an additional 1% as you pay for those purchases. To earn cash back, pay at least the minimum due on time. Plus, for a limited time, earn 5% total cash back on hotel, car rentals and attractions booked on the Citi Travel℠ portal through 12/31/24

Welcome bonus

Earn $200 cash back after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

0% for the first 18 months on balance transfers; N/A for purchases

Regular APR

19.24% - 29.24% variable

Balance transfer fee

For balance transfers completed within 4 months of account opening, an intro balance transfer fee of 3% of each transfer ($5 minimum) applies; after that, a balance transfer fee of 5% of each transfer ($5 minimum) applies

Foreign transaction fee

Credit needed.

Fair/Good/Excellent

See rates and fees . Terms apply.

Read our Citi Double Cash® Card review.

Have a savings plan

It's also important to have a savings plan with both short-term and long-term goals . Separate your savings from your day-to-day spending money so you aren't tempted or capable of using it for unintended purchases. Consider opening a high-yield savings account like UFB Secure Savings so you can earn interest on the money you save.

UFB Secure Savings

Annual percentage yield (apy).

Up to 5.25% APY on any savings balance; add a UFB Freedom Checking and meet checking account qualifications to get an additional up to 0.20% APY on savings

Minimum balance

$0, no minimum deposit or balance needed for savings

No monthly maintenance or service fees

Overdraft fee

Overdraft fees may be charged, according to the terms ; overdraft protection available

Free ATM card with unlimited withdrawals

Maximum transactions

6 per month; terms apply

Terms apply.

Read our UFB Secure Savings review .

Stick to shopping lists

Another way to try and keep yourself focused when shopping is to go in with a plan and list. Know what your goals are before you even enter the store, and by having a list you can have a visual and tactile reminder of the specific items you are to purchase.

It can be easy to walk into the grocery store on an empty stomach and get carried away, but by preparing yourself beforehand and checking things off your list, you have a better chance of staying on target.

Compare offers to find the best savings account

Trying to understand why you impulse buy might be able to help you cut down on some of your bad financial habits . You can take the necessary steps towards limiting your impulse purchases ahead of time before you step into the store.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every article is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of financial products . While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date.

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here .

- Best business credit card sign-up bonuses — get over $1,000 in value Jason Stauffer

- Americor review — what you need to know Jasmin Suknanan

- Here are the 9 best antivirus software Ryley Amond

How To Stop Impulse Buying: Tips And Tricks

Hanna kielar.

5 - Minute Read

PUBLISHED: Mar 22, 2023

Have you ever made a spontaneous or emotional purchase with little to no consideration? Standing in the checkout line and tacking on a pack of gum, putting a pair of jeans in the cart when all you came for was to exchange a shirt, or getting some retail therapy after a long day would all qualify as impulse buying – and making a habit of this behavior can put a serious strain on your finances.

If you’re guilty of routine impulse spending, you’re not alone and you’ve come to the right place. Let’s take a closer look at what impulse buying is, discuss why it’s a problem and tips to help you break the habit.

What Is Impulse Buying?

Impulse buying is the act of spending money on anything without careful thought and consideration. When you buy impulsively, you make a purchase that prioritizes your satisfaction in the moment without evaluating the consequences of the purchase later down the road.

This type of spending is often emotionally driven and gives consumers a temporary sense of gratification. Impulse spending might be motivated by a lack of self-control, a sale or promotion, or even the brand of the product. Sometimes, those promotional emails or a bad day at work get the best of us.

Why Should You Stop Impulse Buying?

While you may feel entitled to frequently treat yourself with your hard-earned money, impulse shopping can eat a big chunk of your finances. In fact, 73% of shoppers in a 2022 study said the majority of their purchases were impulse buys. According to the same survey, the average person spent $314 on impulse purchases each month in 2022. And, the frequency of impulse purchases is increasing as well – not just the amount of money spent.

It may come as no surprise that the money going toward impulse purchases is money that could go toward paying down debt or building your emergency fund . Especially if you’re using credit cards, racking up bills from impulse buying can dig you into a deep financial hole that’s difficult to come out of. Fortunately, you can break this bad habit in several ways – which we’ll consider next.

Stay on top of your spending

9 tips on how to stop impulse spending.

Ready to stop impulse buying? Here are some practical tips and tricks to get started.

1. Create A Budget

Without a budget, it’s easy to spend irresponsibly or tack on unplanned purchases. Laying out a budget gives you a framework to keep your spending in line. While many personal budget templates are available, it’s important to personalize your budget to suit your financial situation and work for your goals. Different types of budgets are available to get you started, including the 50/30/20 rule and the 80/20 rule.

Dedicating portions of your budget to specific spending areas and debts can help you avoid tacking on unplanned items. This is where the Rocket Money SM app can especially come in handy. It allows you to create your budget and track your progress so you have a better chance of sticking to your plan.

2. Use Cash

The cash-only budget, otherwise known as the budget envelope method, is another strategy for reducing impulse buying. Some consumers who limit their spending to the cash they have on hand find that they spend a lot less than when they use debit and credit cards . That’s because you’re actually watching the amount of cash you have dwindle, and it makes you think twice about whether you really need to part with it.

But as with any budgeting method, there are both pros and cons of the budget envelope system . While some people find it easier to save money and have better visibility into how much they spend, others might find it harder to keep track of their spending with cash. Some folks are also uncomfortable carrying cash around and find that many places don’t accept cash at all, which can make this method challenging.

3. Stop And Think

As simple as it sounds, you might avoid impulse buying by simply taking a moment to really consider the pros and cons of your purchase. After all, impulse buying stems from a failure to think the purchase through, so why not stop yourself before you get to the checkout line and determine whether each item in your cart is a necessity?

Ask yourself: “Do I really need this? Is it worth it? Is there something else I should spend this money on or save for?” Pondering these questions will help you reconsider a purchase and possibly put it back on the shelf.

4. Shop In The Right State Of Mind

Because impulse buying is usually an emotional or rash decision, it’s important to be in the right state of mind when shopping. If you’re stressed or sad, you might try to make up for it with shiny new gifts. If you’re tired, you might be less inclined to spend time considering your purchases. If you’re hungry, you might add on more snacks and new foods.

Try to be clear-headed when you make a purchase of any kind. Perhaps that means shopping in the morning before work so you’re not tired or on edge. Or maybe you find it’s best to shop after a workout when you’ve released some stress.

5. Avoid Temptation

Another way to eliminate bad spending habits is to avoid the temptation to spend frivolously. Whether your go-to outlet is online shopping or your favorite local clothing store, try restraining yourself from heading to the store or visiting the website where you’ll be tempted to make an impulse purchase.

Instead of driving over to your local clothing store when you’re bored, take a walk or check out a store with items you’re not tempted to buy.

6. Postpone Your Purchase

If you’re not sure whether a purchase is an impulse buy, hold off. Put it back on the shelf or store it in your “save for later” folder. If you’re still thinking about it in a few days, maybe then go back and get it. After a few days pass, you might find that you don’t have the same urge to spend or you’re in a better state of mind.

Give yourself a waiting period for any unplanned purchase. Whether it’s 1 day or a week, delaying your purchase can end up saving you a lot of money.

7. Try A No-Spend Challenge

A no-spend challenge is when you designate a certain time period where you only spend on your living expenses . During this challenge, you don’t spend anything on nonessentials. In other words, you’ll pay to cover your rent or mortgage, utilities, phone bill and any other necessities, but you’ll skip take-out orders, going to the movies or splurging on a new pair of shoes.

This challenge allows you to prioritize responsible spending and save money on purchases you don’t need to make. Any money you don’t spend can go toward other goals, like paying off your student loans or building up your savings account.

8. Remove Your Saved Card Info

Many of us know how easy it is to order online with just a click of a button – your card information is saved and ready to go. To make it a bit more difficult, remove your card information from anywhere it’s saved. That way, when you want to order an item, you’ll have to reenter all your card information.

This gives you a moment to consider whether this purchase is really worth the money and the time spent reentering your information. When the process is no longer effortless, you might second guess an impulse purchase.

9. Unsubscribe From Your Favorite Retailers

Sometimes you have no intention of spending money, but an email pops up showing you a promotion on one of your go-to buys. You might as well stock up, right? Retailers are only getting smarter – and they document your purchases and send hard-to-ignore promotions for your favorite products.

This is why it’s crucial to unsubscribe from text alerts and newsletters from your favorite stores. If you aren’t aware of a sale, you won’t fear missing out on it.

More Simple Tricks To Stop Impulse Spending

Below are some other simple ways to stop impulse spending. You can try these when the methods above don’t cut it:

- Bring a shopping partner. If you’re going to a store where you notoriously overspend, bring along someone who’s a good influence. Encourage your shopping partner to hold you accountable for making responsible purchases.

- Shop with a list. Before you go shopping, make a list of the items you need. Push yourself to stick to these items to prevent any unplanned purchases and rule out the potential of overspending .

- Set clear financial goals. To stop impulse shopping, you need to have something to work toward. Whether your hope is to pay off credit card bills or save for a down payment on a house , set clear financial goals to stay motivated.

- Allow yourself some discretionary spending. Remember, you’re allowed to treat yourself every now and then. When you create your budget, set aside some money for occasional non-essentials that both bring you joy and fit within the monthly budget.

The Bottom Line

While you’re entitled to reward yourself with your hard-earned money from time to time, it’s important to be able to identify impulse buying and put a quick stop to it. When impulse shopping begins impeding your ability to achieve financial goals, use the budgeting tips and tricks we’ve reviewed here to spend responsibly. When you’re ready to create a personal budget, sign up with Rocket Money to efficiently manage your finances.

Create a budget that works for you

Rocket Money makes it easy to budget using custom spending categories to reach your goals.

Related Resources

How Much Of Your Paycheck Should You Save?

Personal Finance - 6-Minute Read

Hanna Kielar - Oct 31, 2023

52-Week Money Challenge: What It Is And How To Get Started

Personal Finance - 5-Minute Read

Sarah Li Cain - Jan 7, 2023

How 7 Rocket Money Team Members Use Rocket Money

Personal Finance - 8-Minute Read

Kimberly Hamilton - Oct 4, 2022

How To Stop Impulse Buying: 50 Tips To Take Control

Did you know the average U.S. consumer spends $5,400 every year on impulse purchases?

This is close to the average credit card balance of an American adult, according to CreditCards.com .

Which means, if we could all have a little more self-control, we would be out of debt a heckuva lot sooner!

But, if you’re like me, it’s one of the main reasons you have so much debt.

My impulse buying has been a *huge* contributor to living beyond my means and racking up credit card debt. From $5 Starbucks frappuccinos to a last-minute summer vacation splurge, I’ve allowed my emotions to overrule common sense too many times.

In addition to adding to my financial mess, my impulse buying has caused feelings of regret, guilt, disappointment, discouragement, and defeat. These are *not* helpful when trying to reach your goals!

Spending money impulsively can bust your budget, but it can also keep you from developing smart money habits in the long run. Ultimately, if you don’t learn how to stop impulse buying, you’ll never reach financial freedom.

Overcoming the habit of impulse buying and the consequences it creates takes time, self-awareness, and a little bit of helpful knowledge. The key is being intentional about identifying your motivation for spending.

All of us have given in to the temptation of an impulse purchase – even the most disciplined budgeters. But the more you can control your spending, the less harm this bad habit will cause to your finances.

Anyone can learn how to stop impulse buying and be more intentional with their money. The first step is knowing how to identify this damaging habit.

Would you rather print out this list of 50 tips to stop impulse buying? Download it for FREE!

Table of Contents

What is (and isn’t) impulse buying?

Although the term indicates buying something on impulse, it goes farther than just an unplanned purchase. An impulse buy typically has 3 characteristics:

- It wasn’t planned.

- There’s an exposure to a stimulus.

- The decision is made spontaneously.

Impulse buying is actually a well-researched behavior that helps marketers understand their customers better and how they respond to various stimuli. After all, once they figure out the “switch” from casual shopper to committed buyer, they’ve hit a marketing gold mine!

An impulse purchase can range from a pack of gum to a new car, but it’s typically dependent on the stimuli a consumer is exposed to, and it’s always unplanned. Emotions play a large part in impulsive buying, and that’s why marketers carefully consider product wrapping, store placement, and display presentation to trigger feelings that lead to a purchase.

Of course, not every unplanned purchase is an impulse buy.

If you plan to go shopping for new work clothes but you’re not sure what you’ll buy, that’s not impulse buying as long as you stay within the budget you’ve already set. Even though you didn’t *plan* to buy a specific skirt and shoes, you still bought with intention of purpose and set aside enough money to purchase them. That is *not* buying on impulse.

However … if you happened to see a sweet deal on a new toaster so you swiftly added it to your cart … that would be an impulse buy.

Knowing the difference and choosing to shop intentionally will help you control your spending and reach your financial goals faster.

Types of impulse buying

There are several reasons your feelings can trick you into buying something impulsively. Some may even convince you that you’re not buying impulsively and your purchase is actually a necessary one.

Of course, we’re all familiar with the product displays at the cash register . Items like gum and candy, batteries, chapstick, and magazines are placed here strategically because marketers know you will buy them on a whim. This is a true impulse buy.

But then you might see some gift cards and think I need to get my boss a gift anyway so I’ll just grab me one of these gift cards. So even though you may feel like the purchase was initiated by a need, it is still unplanned, unnecessary, and based on your emotions.

Another type of impulse buy occurs when you see a pleasing display in the store , and you’re reminded that you should probably stock up on this item because you’re going to run out eventually anyway, right?

And then finally there’s that irresistible offer that you would be dumb to refuse , so better get it now! It might not be on sale tomorrow, so you’re saving money by buying today!

All of these scenarios were initiated by some type of stimuli (usually a pleasing visual display) that triggered a feeling and ultimately an unplanned purchase.

Learning how to stop impulse buying requires an awareness of the underlying emotions involved. If you can identify when your feelings are trying to control the situation, you can make better decisions.

What do feelings have to do with it?

You can’t control what you’ll see in the store, but you *can* learn to be aware of how you’re feeling before you go in. When you can identify what you’re feeling, and how your feelings influence your spending habits, you’re halfway to winning the battle against impulsive buying.

As humans, we tend to give our emotions a little too much say in the decisions we make. And when it comes to spending money, marketers know that buying stuff feels good.

Not only that – buying something *spontaneously* actually releases the chemical dopamine in our brains, which gives us a natural high.

That’s why stores are very strategic about product placement, lighting, music, color, and sometimes even smell. All of these factors subconsciously affect how we feel, and can have a huge influence on whether or not we’re going to buy more than we planned.

Pretty tricksy, eh?

And feeling *happy* isn’t the only emotional motivator to spend more. Feeling stress and anxiety can also drive you to buy on impulse.

When we feel tense, worried, or overwhelmed, our bodies have a built-in alarm that goes off in the brain. This alarm is called the amygdala, and its purpose is to keep you safe and alert. It also drives you to seek protection or comfort. When the amygdala is sounding its alarm, we can feel compelled to seek relief in the easiest, quickest way possible.

Unfortunately, the amygdala doesn’t know the difference between a life-threatening situation and an argument with your spouse.

So, if you need a break from your partner after a spat, you might just head to Target for a little therapy. Shopping therapy, that is.

That’s your amygdala trying to find you some relief. It’s just doing its job. A little dopamine released in the brain can do wonders for your mood.

But you can also be draining your wallet if you habitually buy something just to feel better.

There’s nothing wrong with you if you want to find relief from stress. It’s *how* you get relief that can be a problem.

When our emotions are running high, we tend to make decisions based on how we feel and we often don’t think about the consequences of our actions. This causes us to neglect considering how an unplanned purchase will affect our financial future.

The goods news is you have a choice. You don’t have to be controlled by your amygdala. You can step back, get perspective, and make a choice that aligns with what you truly value.

But first, it’s important to be aware of underlying motivators that can cause you to buy something impulsively. This way, as you learn how to stop impulse buying, you can make better decisions despite what you’re feeling in the moment.

What leads to impulse buying?

So far I’ve mentioned how emotions and external stimuli can lead to impulse buying. Another factor that influences spontaneous spending requires even greater heightened awareness: your unconscious mind.

Science has shown that 95% of our behaviors are driven by the unconscious mind, and that includes our purchasing decisions .

So, what does this mean for the average consumer?

Basically, when you fail to tap into those unconscious thoughts that drive your impulsive buying decisions, you’re at the mercy of shrewd marketers who know how to convince you to spend money – even when you don’t really have it to spend.

If you’re committed to learning how to stop impulse buying, then it’s critical you know what deep-seated thoughts are driving your actions.

Here are 8 beliefs and behaviors that often operate below the surface of our conscious thinking and lead to an impulsive purchase:

- You’ll save money. When you see a killer deal on something you might need in the future, you feel irresponsible for not taking it. This is when you convince yourself that spending the money will save you money.

- You identify with the brand. When you have a positive emotion tied to a certain brand or product, the more likely you’ll be willing to spend money on it – planned or unplanned.

- Vicarious ownership. Although it can be fun to hear your friend’s experience with the latest household gadget, you’d probably rather experience it firsthand. This builds an emotional connection to the product and leads to an increased chance of impulsively buying it the next time you see it in the store.

- FOMO. The Fear of Missing Out can take a few different forms. A popular product that is often sold out, a positive experience your friend had, or a search for that *perfect* item are all variations of FOMO that can motivate you to buy something you otherwise wouldn’t have.

- You’re a hunter and gatherer. It’s human nature to collect stuff and stock up on resources for fear of running out. This behavior used to serve us well thousands of years ago, but today it usually stems from a scarcity mentality .

- You avoid your feelings. As mentioned earlier, part of your amygdala’s job is to seek relief in times of danger or distress. This is very helpful when you’re in a burning building, but not so much if you’re just stressed out because of your job. The better choice is to deal with your stress in a healthy way instead of trying to cover it up with a spending spree.

- You want to keep up with the Joneses. When neighbor Sue buys a brand new Lexus, there’s a level of comparison and competitiveness that can rear its ugly head. If you don’t tame the beast , you might end up with a car payment you can’t really afford.

- You have an addiction. Most people that have an addiction are the last to know about it. If you seriously struggle with overspending and impulse buying, consider the possibility that your “innocent” habit is really a full-blown addiction that you need to get help for.

Why is impulse buying a problem?

Even if you’ve read this far, you still might think that a little impulse buying here and there isn’t a big deal. Which, can be true. Or not.

If you are currently experiencing any of the financial problems listed here, you can confidently consider that impulse buying might be a factor:

It busts your budget

Okay, so this one’s pretty obvious. If you’re following a spending plan, you should know how much of your money is going where so you don’t run out.

When you’re in the middle of the month and you don’t have enough money left to put gas in your car, it’s possible you’re making too many unplanned purchases.

It prevents you from reaching your savings goals

A part of your budget should be a savings fund. If your savings account has barely budged an inch (or worse – has gotten smaller), you might want to track your spending to see if you’re wasting savings on impulse purchases.

It creates more debt

Debt is often a series of small, insignificant, unplanned purchases that pile up over time. If you looked at your credit card balances today, I bet you wouldn’t remember how it got that high.

It’s easy to buy impulsively when it doesn’t immediately cost anything. If your debt keeps creeping higher, review past statements and add up how much of it was unplanned spending.

It perpetuates a paycheck to paycheck cycle

When you spend money impulsively, you are not in control of your finances. This can result in bad purchasing habits that damage your financial future. If you never learn how to stop impulse buying, it will be difficult to escape the paycheck to paycheck cycle.

It contributes to a scarcity mindset

If you struggle to make ends meet because your impulse purchases are draining your income, you can start seeing your job as a means to an end instead of a fulfilling part of your life. This can lead to feelings of hopelessness and apathy.

When you believe you’ll never get out of debt or be better with money, you’ll likely continue to spend money on things you don’t need as a way to escape reality.

It causes buyer’s remorse

Who wants to feel guilt, regret, and shame? These feelings feed into limiting beliefs that keep you from ultimately achieving your financial goals. You can avoid buyer’s remorse by being intentional with your finances and spending money on things you truly value.

It creates relationship problems

When opposites attract, money can be a point of conflict. Typically one of you is trying to save and the other just wants to spend. This can cause arguments and tension in the relationship.

For the spender, this is a formula for impulse buying – which perpetuates the cycle.

It’s okay to set aside part of your budget as “fun money”. But if you make unplanned financial decisions that hinder the goals you’ve both set, then impulse buying is creating a problem.

It prevents the development of healthy money habits

If you ever want to achieve financial freedom, you’ll need to learn some healthy money habits. Budgeting, saving, investing, and delaying gratification are all excellent examples – but they require intention, discipline and planning.

Impulse buying will keep you from developing these habits, and ultimately prevent you from reaching your financial goals.

It hinders your financial success

Who doesn’t want to be financially independent? Everyone wants to be rich, but few are willing to make the sacrifices to get there.

If you cannot control your spending habits, they will control your financial future.

How do I know *I* have a problem?

If you want to learn how to stop impulse buying, you must first admit there’s a problem. This can be the first step toward positive change.

So how do you know if your impulse buying is just an occasional indulgence or an unhealthy dependency that can derail your financial future?

Besides the negative consequences I’ve already mentioned, here are three key warning signs that impulse buying might be a serious issue in your life:

- You typically fail to consider why you are spending money and what you’re spending it on.

- You get a “shopper’s high” from buying new things and often experience excitement when making unplanned purchases.

- You frequently make spending decisions spontaneously, especially when you are feeling heightened emotions.

- You don’t consider your financial health when buying impulsively.

- You often buy something but never use it.

If you feel like your impulse buying is out of control, here are 50 practical tips to beat the temptation and be more intentional with your money.

How to stop impulse buying for good

Spending more than you have on things you don’t need is a recipe for financial disaster. Impulse buying can threaten financial stability, increase debt, and drain your savings account.

The key to beating the spending urge is self-awareness. Becoming mindful of your actions and the reason behind them is the first step toward being in control of your money.

There are several different ways you can start resisting negative spending habits. Learn how to stop impulse buying for good with this list of 50 strategies to choose from. Start with one you can commit to, then continue to add more to create your own personal plan to beat impulse buying.

#1 Make a budget you can stick to

If you’re not on a budget, now’s the time. A budget will help you stick to spending limits and save more money. The zero-sum budget is one method you could try.

#2 Always have a game plan

Never go shopping without a plan. Write a list of exactly what you need, including each item’s price if possible. Then stick to it!

#3 Hold yourself to a waiting rule

Set a rule that requires you to put some space and time between you and the item you’re tempted to buy impulsively. Any time you want to buy something you didn’t plan for, take anywhere from 24 hours to 30 days to decide if it’s a good decision. The less impact it has on your budget, the less time you need to decide.

#4 Pay with cash

Paying for purchases in cash is a totally different experience than paying with a card. When you have to actually physically part with your money (instead of just swiping a card), you’re less likely to go through with it.

#5 Freeze your credit card

If you just can’t trust yourself, take some drastic measures and freeze your cards. This will force you to spend in cash only, and you can always unfreeze them when your spending is under control.

#6 Include spontaneous spending in your budget

Splurging occasionally isn’t being irresponsible – as long as it’s already in your spending plan. Include a little fun money in your budget and give yourself permission to splurge every now and then. Learning how to stop impulse buying doesn’t mean you can never spend spontaneously. It just means you need to be strategic about it.

#7 Avoid tempting places

Do you *have* to go to Target for bread? If it’s too tempting to wander to the women’s clothing department, maybe go to a grocery store instead.

#8 Block online shopping opportunities

Shopping online is sooooo convenient. With just a few clicks it’s easy to spend more than you planned. Do yourself a favor and block the sites you shop at the most. At least until you get your impulsive spending habit under control.

#9 Drop the lists

Whenever I get asked for my email address I just say I don’t give it out. It’s too easy to spend money impulsively when I get an email from one of my favorite stores, tempting me with their latest sale!

#10 Choose free ways to celebrate

Keep a list of free or low-cost ways to celebrate a special achievement. Often it’s easy to convince ourselves that we “deserve” something extra because of our accomplishment. It’s okay to reward yourself, just be smart about it.

#11 Always do your research

Don’t let a killer deal on a big screen TV be the only reason you hand over your hard-earned money. Always do a little research first to make sure you’re getting all the features you really want. Then, go prepared with a list of questions to ask the salesperson. The more research you do, the more certain you’ll be that it’s a wise purchase.

#12 Know the return policy

The clearance section is one of my favorite places to browse, but sometimes that slashed price also comes with a no-return policy. Find out the store’s policy for clearance items before you check out. If you can’t return it, don’t buy it. If you do buy something impulsively because the price was too great to pass up, you always want the option to return it later if you choose.

#13 Define needs versus wants

Get real with yourself about the difference between wants and needs. You might feel like you “need” a new car because your current one is looking a little ragged, but the reality is that nobody *needs* a new vehicle.

Consider all of your options first (keeping the current car, buying a used car, taking public transportation) and then create a priority list of all the things you’d like to buy in the future. Choose the top 2 or 3 and set a goal date to purchase each one.

Having these things on your priority list is a good reminder that because they aren’t true needs, you have time to save up to pay cash instead of going into debt for them.

#14 Know what triggers you

If you’re serious about breaking your impulse buying habit, it’s important to know what your triggers are. When you’re aware of the circumstances that give you the urge to spend money, you can avoid them when necessary.

Maybe you’re tempted by TV commercials, Facebook ads, or the latest Target catalog. Or perhaps the urges are the strongest when you feel sad, bored, stressed, or angry. Once you identify what pushes you over the edge, seek out healthier alternatives.

#15 Don’t be swayed by sales

My husband has a difficult time resisting a good sale. And who can blame him? When you see a bargain on something you’re probably going to buy eventually anyway, you can get the feeling that you’re going to waste money later if you don’t spend it now.

This is a tricksy & false belief that can easily pull you into excessive debt and keep you from achieving your goals. Get in touch with what you truly value, and have a plan for buying those things that add that value to your life. Don’t be manipulated by a sale sign. Remember, you’re in control.

#16 Invite your frugal friend

Do you have a penny-pinching friend? Bring them with you when you need to go shopping for something. Ask them to hold you accountable to every penny you spend!

#17 And leave your shopping sisters behind

The flip side of #16 is avoiding shopping sprees with your friends. When your besties are spending money on whatever looks good, you’ll have a tough time beating the temptation to do the same.

#18 Stop keeping up with the Joneses

Be aware of the comparison trap. When you feel like you don’t measure up to neighbor Sue, it’s easy to think you need to buy things you don’t really need in order to keep up. I have two words for you: you don’t.

#19 Limit social media

You used to have to look out your window to feel a little jealousy over your neighbor’s new car. Now, you can go online and see the one your friend 6 states over just bought. There’s an easy fix for that: stay off social media . If you can’t give it up entirely, limit how much time you spend on it daily.

#20 Give yourself a challenge

Ever wonder how much you could actually save if you just stopped buying unnecessary stuff? Find out by going on a no-spend challenge! Try not buying anything you don’t absolutely need for 30 days, and see how much money you could be putting in your retirement fund instead.

#21 Know your why

Learning how to stop impulse buying means getting in touch with what you truly value. What are your financial goals? Do you want to get out of debt and save up for a comfortable retirement?

Write your goals down and carry them everywhere with you (on paper or in a phone app). When you feel tempted to spend impulsively, break out the list for some serious inspiration to walk away instead.

#22 Check your feelings at the door

Before you back out of that garage, have a mental check-in with yourself. If you’re feeling a heightened emotion (like stress, anxiety, frustration), then you might want to stay home until you know for sure your emotions aren’t controlling your decisions.

#23 Beware of boredom shopping

If you’re only at your favorite store because you’re bored, it’s time to figure out cheaper ways to be entertained. Finding a good book at the library or taking a hike at a local park are two free ways to spend your time without the temptation to spend money.

#24 Learn from others’ experiences

It’s easy to be convinced that a new kitchen gadget on Amazon would be the perfect tool to kick your cooking skills up a notch or two. That is, until you read the reviews that complain about the low quality or poor design. Learn from other people’s bad experiences and keep your money in your pocket.

#25 Hang on to every receipt

Even if you have a shopping fail and give in to spending more than you planned, there’s no reason you can’t back track and make a better choice. Always keep your receipts so you can return purchases you regret buying later. No harm done!

#26 Never shop on an empty stomach

For me, an impulse buy is often edible. And if I go to the grocery store on an empty stomach, I usually end up buying more than what’s on my list. Because of this, I make sure I eat something before going to a store full of food. It makes all the difference.

#27 Plan your meals

Another way to cut unnecessary spending when grocery shopping is to create a meal plan. Knowing what you’re going to eat and when, as well as what ingredients you need to buy, will do wonders for your food budget. You’ll also not be tempted to spontaneously go out to eat as often, which keeps even more money in your pocket.

#28 Take a deep breath

Impulse buying is typically done on an unconscious level. As you get better at realizing you have a choice not to spend, taking deep breaths can help create a diversion and help you be fully present in the moment. Deep breathing will also help you slow down and get your feelings in check before making a decision you’ll regret later.

#29 Track the temptations

Build awareness of your shopping habits by tracking how often you’re tempted to make an impulse buy. Keep a small calendar in your purse and make a note on every date you feel the urge to spend. This will help you become more conscious of what it feels like to be tempted and help you recognize the warning signs so you can make a better choice.

#30 Know what it’s truly costing you

Too often we ignore the true cost of an impulse buy. When you think of the money you’re spending in terms of an hourly wage, you might decide you don’t really want to buy something that will eat up 5 hours of your next paycheck.

Likewise, consider the opportunity cost of that unplanned purchase by reflecting on what you’ll need to give up in order to buy it. If you haven’t been able to save the money to go on that cruise you’ve been dreaming of, that’s a pretty high opportunity cost just to buy stuff you probably don’t need.

#31 Ask questions

Keep a list of “shopping” questions with you whenever you go shopping. Before you put that item in your cart, pull it out and answer each one. Some questions could be Does this purchase align with my values? Does this purchase fit into my financial goals? Is this purchase necessary? Will this purchase add true value to my life? A little reflection can be a very effective strategy to putting it back on the shelf.

#32 Reflect on your failures

Okay, so you spent money on something you didn’t plan for. Before you chalk it up to a bad day and moving on, take some time to reflect on how it made you feel. Did you experience a shopper’s high? Did it relieve stress at the time? How long did it last? Did you have buyer’s remorse? Did you feel like you failed? Take note of the emotional experience and let it help you decide if the money spent was really worth it.

#33 Dig a little deeper

Because impulse buying is often done at an unconscious level, it can require a heightened awareness to identify the true reason someone does it. Typically, it has little to do with physical needs and more about trying to fill an emotional one.

If you struggle with controlling your spending urges, challenge yourself to figure out why you are driven to spend impulsively. Once you’ve determined the real “why” behind your spending, look for healthier (and less expensive) ways to find fulfillment.

#34 Take an inventory

Check your cabinets and closets and know what you already have. There have been many times I bought something unplanned because I saw something on the shelf that I thought I needed more of. If I had just checked before spending, I would have known that I still had 2 tubes of toothpaste at the bottom of my vanity drawer.

#35 Make a compromise

Sometimes temptation is just too hard to resist. If you find yourself on the verge of committing to a cartful of stuff you didn’t plan on buying, take a few deep breaths as you do a quick mental calculation of how much it’s going to cost you.

Then, grab one small, inexpensive item from the cart and go straight to the register. In times when walking out without spending anything is too difficult, you can minimize the financial damage by making a compromise with yourself.

#36 Remember your last regret

Remembering those things you regret from your past can be a very effective way to make better choices in the future. When you’re on the fence about making an unplanned purchase, think about the last time you regretted an impulse buy. That may be all you need to put it back on the shelf.

#37 Consider layaway

When you’re really torn between making an impulse purchase and walking away, ask the store if they have a layaway plan. You’ll likely have to meet certain requirements (minimum down payment, cancellation fee), but it will give you the ability to take advantage of a good deal while also providing time and space to continue thinking about it.

#38 Chart your progress

Create a chart to track your financial goals, and place it somewhere you’ll see every day. Looking at your progress on a daily basis is one of the best ways to stay on track with your money and keep your spending aligned with what you truly value.

#39 Don’t drink and shop

Do I need to say more?

#40 Create a more meaningful option for your money

Take a quick review of your impulse buys over the past few months. Add up a rough estimate of the total cost, and compare that to a financial goal you’ve been wanting to reach.

Comparing the cost of your spontaneous shopping to a credit card balance you’ve meant to pay off can motivate you to curb your spending. Every time you’re tempted to make a spending decision on-the-spot, take note of the item’s price and put that amount toward your goal instead.

#41 Give to your favorite charities

One way to break the habit of spending on yourself is to give to your favorite charities instead. Find some organizations that line up with your values and start donating a percentage of your monthly budget.

Every time you want to carelessly drop a few bucks at Starbucks, think about how much more meaning that money could have if redirected to a favorite charity.

#42 Be more generous with loved ones

In addition to charities, consider increasing your generosity to families and friends. Think about how you can bless others with the income you’ve been blessed with. When we focus on others’ needs, it’s easier to deny ourselves the indulgence of impulse purchases.

#43 Choose meaningful memories over meaningless stuff

If you struggle with impulse buying, you likely have more stuff than you actually use. Refocus your priorities on building relationships through shared experiences, and create a savings account to fund them. Then, think about the memories you’ll make the next time you’re tempted to buy yet another pair of shoes.

#44 Develop a substitute habit

Once we engage in behavior unconsciously, it’s a habit. One of the best ways to break a bad habit is by replacing it with a good one.

Choose a substitute for impulse shopping that supports your financial goals, and start replacing your visits to the store with this other activity. After a few weeks of consistently making a different choice, your brain will find it easier to choose the new habit when you feel triggered.

#45 Put up some barriers

If you create inconvenient barriers to engaging in a habit, it’s easier to break.

For example, if you leave your credit cards at home, there’s a better chance you’ll pass by the sales rack because you don’t have a way to pay for it. Or if you unsubscribe from Amazon Prime, you might not want to pay shipping and wait an extra week to receive your purchase. Deleting any app that allows you to shop is also a way to create “friction” between you and an impulse buy.

#46 Write down what you’re spending

Another way to create awareness around your impulse buying habits is by keeping a spending journal. Much like a food journal, you would use it to log every transaction you make on discretionary purchases.

Although you would also track these expenses in a budget, the purpose of the spending journal is to become more conscious of how much and how often you spend more than you planned. You can also write down the circumstances surrounding each purchase and what you were thinking & feeling at the time.

#47 Choose your company wisely

Someone once said that we each are an average of the 5 people we hang out with the most. Do you want to be a saver and not a spender? Start hanging out with other savers. Not only will their good habits rub off on you, they’ll also be a great source of support, encouragement and sound advice.

#48 Go easy on yourself

A little guilt over an irresponsible purchase can influence you to make a better choice the next time you’re shopping. However, money shaming yourself for making a mistake isn’t helpful moving forward. Return the item if that’s a good option. Otherwise, recommit to your financial values and goals and try better next time.

#49 Develop an attitude of gratitude

Too often we forget how much we truly have to be grateful for. By keeping a gratitude journal, you can remind yourself of how much you’ve been blessed and create a genuine sense of contentment in your life. When we’re content with what we have, we don’t feel the need to fill our lives with stuff we don’t need.

#50 Reach out for support

Most people’s impulse buying habit is just that: a habit. One that’s hindering their financial goals and maybe creating unwanted debt, but a habit nonetheless.

For others, impulse buying has become compulsive and turned into an addiction. If you’re feeling hopeless and overwhelmed about your financial situation, I encourage you to get help. A licensed therapist or financial advisor can give you professional advice and direction that might be necessary in your situation.

Print out the full list of 50 tips to stop impulse buying here:

Money can’t buy joy

Different people have different motivations for buying impulsively.

For some, it’s FOMO – either with experiences friends are having or just finding the perfect item.

Then there’s the possibility of getting a killer deal – whether it’s needed or not.

For others, there could be a serious shopping addiction, and there is a constant chase for the next “high”.

For me, I would say the majority of my impulsive shopping came out of a YOLO mentality – You Only Live Once!

Regrettably, I’ve spent much of my life in debt because of bad financial decisions like impulse shopping.

And, not to say I don’t still occasionally fall into temptation, but I have gotten a lot better at resisting. Learning how to stop impulse buying in my own life has been a long and windy road. But, along the way, I’ve learned a few things that have made me wiser.

I’ve learned that a seemingly insignificant but stupid decision today can have consequences that last for years. I think about the consequences now, because I’ve lived them.

I’ve also learned that money can buy me happiness, but it can’t give me joy. Happiness has many degrees, is fleeting and unpredictable. But joy runs deep, through the soul, from heaven above.

Yes, I’ll feel happy when I buy that cute new purse, but then that happiness will dull over time as my new purse becomes my old one. Joy, on the other hand, is not dependent on material possessions and can’t be taken away by any earthly experience.

In other words, joy is priceless.

And then I’ve learned that gratefulness is the remedy . Having an attitude of gratitude can turn any fear of missing out into peaceful contentment.

Usually, when someone wants to indulge in some excessive spending, it’s motivated by an unfulfilled craving in life – a desire to be happier, or prettier, or smarter, or whatever.

But, if you take a moment to step back and remember how much you have to be truly grateful for, those desires give way to contentment.

Which is the last life lesson I’ll mention here. Learning to be content will cure your spending habit like nothing else.

When I am content with what I have, where I live, what I drive, what I wear, and everything else in my life – I am no longer driven by my desires to have more.

Instead, my heart is at peace, I can keep things in perspective, and I can make wiser decisions.

And these are things money can’t buy – impulsively or not.

Other posts you may enjoy: