- SEBI IPO Status

- Live Subscription

- Allotment Status

- Shareholder Quota

- Market Holidays

Top 10 Most Expensive Stocks In India 2024

Updater Services: A Unique Model Combining Facility Management and Business Support…

Best IPO Stocks That Doubled Investors’ Money

Best Option Trading Strategies For Beginners

NSCCL- 7 Most Important Points about NSE Clearing

- Mainboard IPOs in 2024

- Mainboard IPOs in 2023

- Mainboard IPOs in 2022

- Mainboard IPOs in 2021

- Mainboard IPOs in 2020

- Mainboard IPOs in 2019

- Mainboard IPOs in 2018

- Mainboard IPOs in 2017

- Mainboard IPOs in 2016

- SME IPOs in 2024

- SME IPOs in 2023

- SME IPOs in 2022

- SME IPOs in 2021

- SME IPOs in 2020

- SME IPOs in 2019

- SME IPOs in 2018

- SME IPOs in 2017

- About IPO Central

- Authors’ Corner

- Advertise with IPO Central

Magenta Lifecare IPO GMP, Review, Price, Allotment

Sattrix Information IPO GMP, Review, Price, Allotment

Kronox Lab IPO GMP, Price, Date, Allotment

Associated Coaters IPO GMP, Review, Price, Allotment

TBI Corn IPO GMP, Review, Price, Allotment

Kronox Lab Sciences IPO: 10 Key Points Investors Should Know

Upcoming IPOs in June 2024 – Seven Mainboard Offers Expected

Awfis Space Solutions IPO: 10 Key Points Investors Should Know

Awfis Space IPO GMP, Price, Date, Allotment

Aimtron Electronics IPO GMP, Review, Price, Allotment

10.50% IIFL Samasta Finance NCD June 2024

Go Digit IPO: 10 Points Investors Should Know

Indegene IPO: 10 Points Investors Should Know

JNK India IPO Ratings: Here is Why Analysts Are Positive Ratings

Cheviot Buyback Record Date 2024, Price, Entitlement Ratio

eClerx Services Buyback Record Date 2024, Price, Entitlement Ratio

Bajaj Consumer Buyback Record Date 2024, Price, Entitlement Ratio

Ajanta Pharma Buyback Record Date 2024, Price, Entitlement Ratio

Sharda Motor Buyback Record Date 2024, Price, Entitlement Ratio

Oravel Stays Unlisted Share Price

Philips India Unlisted Share Price

Cochin International Airport Unlisted Share Price

Swiggy IPO: Valuation Markup But Shares Continue at Discount in Pre-IPO…

Bira 91 Unlisted Share Price

Upstox Vs Groww: Stock Broker Comparison

Top Bootstrapped Companies in India

- Advisory Review

Research and Ranking Review: Charges, Services, Trial, Complaints

Last updated on December 27, 2023

Established in the year 2016, Research & Ranking is a SEBI registered equity advisory which aims to aid equity investors in wealth building through long-term investing. The firm offers a robust technology-enabled platform backed by detailed research that helps in wealth creation by generating personalized portfolios as per investors financial goals. We dived into the firm’s service offerings and here is Research and Ranking Review.

Research & Ranking is a part of Equentis Group, established in the year 2009. Over the years, the advisory built a team of professionals across Mumbai, Thane, Delhi and Bengaluru, while the company’s registered office is based in Mumbai.

Over the next 2-3 years, Research & Ranking plans to get listed as well as go overseas and serve international investors by mirroring their technology-based investment advisory model’s success in developed markets including the UK, the USA and Middle-east.

Research and Ranking (Equentis Wealth Advisory Services Private Limited) Details

Research and ranking review: services.

Research and Ranking services primarily focus on long-term investing and has built its investment schemes accordingly.

5 in 5 Wealth Creation Strategy: It is designed to help investors to invest in a personalized and competently diversified portfolio of 20-25 stocks with the potential to generate 4-5 times returns in 5-6 years.

MisPriced Opportunities (MPO): This service helps investors to profit from market fluctuations by investing in stocks trading below their underlying value, thereby having the potential to generate 25-50% returns in 6-12 months.

Research & Ranking service named Dhanwaan and EWA Exclusive are their two premium offering for HNI and Ultra-HNI clients who wish to create massive wealth by investing in high growth businesses with the potential to grow at a rapid rate with India’s growth trajectory, thus compounding investor wealth at a CAGR rate of 25-35%.

Dhanwaan – A Premium Non-Discretionary Portfolio Management Service: Invest in a highly personalized and concentrated portfolio of 20-25 stocks with the strong past track record of 4-5 times returns in 5-6 years.

Informed InvestoRR: It helps investors to by giving regular relevant information which thus impact your investment as an investor. Research and Ranking is collecting all the quality information on stocks and market and is providing it on a single platform.

Research and Ranking Charges

Research and Ranking charges for its services on yearly basis, with the plans for one and five years and the paying cycle being in every 6 months. Please note that GST charges of 18% are imposed separately in addition to the prices shown below:

As seen above, Research and Rankings charges goes from moderate to high. Customers can choose subscription plans according to their needs and service required, as the plans seem to cater to small as well as large & HNI investors.

Read also: Upcoming IPOs in 2024

Research and Ranking Complaints and Customer Service

Research and Ranking reviews have been quite positive according to their customers for the services they got, and its registered complaints on the site portal has been also very low. Most of the business websites have rated it with good ratings with moderate customer complaints. Research and Ranking customer service seem to be quite nice according to its long-term users.

Research and Ranking Review: Pros and Cons

- Good customer service

- Variety of services

- Long-term investments only

- No free trial

Explore more advisory reviews

Disclaimer – The objective behind Research and Ranking review is to offer an unbiased view of the company’s service offerings and cost of subscription services. This review of Research and Ranking service offerings is only for information purpose and is not a recommendation for investors

RELATED ARTICLES MORE FROM AUTHOR

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advertise with Us

- Terms of Use

- Privacy Policy

Subscribe Now! Get features like

- Latest News

- Entertainment

- Real Estate

- Exit Poll 2024 Live

- AP Exit Poll 2024 Live

- UP Exit Poll 2024 Result Live

- India vs Bangladesh Live Score

- Odisha Exit Poll 2024 Live

- Bangladesh vs India

- Election 2024 Result

- My First Vote

- Lok Sabha Election 2024 Live

- T20 World Cup 2024

- World Cup Schedule 2024

- World Cup Most Wickets

- World Cup Most Runs

- The Interview

- World Cup Points Table

- Web Stories

- Virat Kohli

- Mumbai News

- Bengaluru News

- Daily Digest

- Election Schedule 2024

Research & Ranking’s unique strategy creates phenomenal wealth for investors

Creating wealth from the stock market is both a science and an art which requires detailed research and a little patience..

With whopping 480% Gains in 6 Years, India’s leading equity advisory Research & Ranking has proved this right and helped over 15000 investors and 1500 lifetime investors fulfil their financial goals effortlessly. The advisory strongly believes in educating and empowering investors, and their registered users include over 3,50,000 investors who are only growing by the day.

Research & Ranking's main product offering, the 5 in 5 Wealth Creation Strategy is designed to help investors to invest in a personalized and adequately diversified portfolio of 20-25 stocks with the potential to generate 4-5 times returns in 5-6 years. The company's second offering, known as the Mispriced Opportunities strategy helps investors to encash on the market fluctuations by investing in stocks trading below their intrinsic value, thereby having the potential to generate 25-50% returns in 6-12 months.

Research & Ranking also offers two premium advisory services named Dhanwaan and EWA Exclusive for HNI and Ultra-HNI clients which aims to create massive wealth by investing in high growth businesses with the potential to grow at a rapid rate with India's growth trajectory, thus compounding investor wealth at a CAGR rate of 25-35%.

With a dedicated team of over 200 professionals across Mumbai, Thane, Delhi and Bengaluru, Research & Ranking considers customer satisfaction one of its top priorities. Having achieved many milestones in a short span of few years, Research & Ranking has set its sight on new achievements for 2021. This includes becoming a True Fintech company which delivers best returns to their customers.

In line with their firm belief that ‘Knowledge is the key to success in investing' the team at Research & Ranking plans to launch an Ed-Tech platform soon to facilitate easy and quick learning for investors.

In the current calendar year, the company is also planning to launch a new product offering named Multiplierr.

“Our revolutionary new product offering is targeted at those investors who wish to invest a small amount in the stock market. We’re excited about this upcoming product launch as it is designed keeping in mind the limitations of a retail investor. At the same time, this new product demonstrates how real wealth can be made through smart investing. We are sure that this strategic decision will pave the way towards enhancing our reach towards investors across the country,” stated Research & Ranking’s Founder-Director, Manish Goel.

Over the next 2-3 years, Research & Ranking intends get listed as well as go global and cater to international investors by replicating their technology-based investment advisory model's success in developed markets including the USA, UK and the Middle-east.

Established in the year 2016, Research & Ranking is a SEBI registered equity advisory which aims to help equity investors create wealth through long-term investing. The advisory offers a robust technology-enabled platform backed by detailed research that guides investors in their wealth creation journey by creating personalized portfolios as per their financial goals.

Research & Ranking is a part of Equentis Group, incorporated in the year 2009 and offers complete support to investors in their journey of wealth creation right from onboarding.

To learn more about the different types of wealth creation strategies offered by Research & Ranking, visit www.researchandranking.com.

Disclaimer: This content is distributed by Digpu News Network. No HT journalist is involved in creation of this content.

Join Hindustan Times

Create free account and unlock exciting features like.

- Terms of use

- Privacy policy

- Weather Today

- HT Newsletters

- Subscription

- Print Ad Rates

- Code of Ethics

- West Bengal Exit Poll 2024 Live

- Maharashtra Exit Poll 2024 Live

- Bihar Exit Poll 2024 Live

- Delhi Exit Poll 2024 Live

- Karnataka Exit Poll 2024 Live

- Live Cricket Score

- India Squad

- T20 World Cup Schedule

- Cricket Teams

- Cricket Players

- ICC Rankings

- Cricket Schedule

- Points Table

- T20 World Cup Australia Squad

- Pakistan Squad

- T20 World Cup England Squad

- India T20 World Cup Squad Live

- T20 World Cup Most Wickets

- T20 World Cup New Zealand Squad

- Other Cities

- Income Tax Calculator

- Budget 2024

- Petrol Prices

- Diesel Prices

- Silver Rate

- Relationships

- Art and Culture

- Taylor Swift: A Primer

- Telugu Cinema

- Tamil Cinema

- Board Exams

- Exam Results

- Competitive Exams

- BBA Colleges

- Engineering Colleges

- Medical Colleges

- BCA Colleges

- Medical Exams

- Engineering Exams

- Horoscope 2024

- Festive Calendar 2024

- Compatibility Calculator

- The Economist Articles

- Lok Sabha States

- Lok Sabha Parties

- Lok Sabha Candidates

- Explainer Video

- On The Record

- Vikram Chandra Daily Wrap

- EPL 2023-24

- ISL 2023-24

- Asian Games 2023

- Public Health

- Economic Policy

- International Affairs

- Climate Change

- Gender Equality

- future tech

- Daily Sudoku

- Daily Crossword

- Daily Word Jumble

- HT Friday Finance

- Explore Hindustan Times

- Privacy Policy

- Terms of Use

- Subscription - Terms of Use

- Tata Steel share price

- 167.15 1.80%

- ICICI Bank share price

- 1,119.65 0.43%

- ITC share price

- 426.15 0.50%

- NTPC share price

- 358.90 -0.31%

- HDFC Bank share price

- 1,530.85 1.07%

Research & Ranking's Model Portfolio clocks 79% gains

The portfolio stands among the top five multicap pms performers basis one year returns for the period ending september 2021..

Mumbai, November 29, 2021: Research and Ranking announced the portfolio clocking 79% gains in the one year ending 30th September 2021. This milestone is a major achievement for Equentis Wealth Advisory on its mission to make wealth through long-term investment. The returns not only beat the Nifty returns of 57% hands down but also stood amongst the top five multi-cap PMS in the country.

“Our performance is a result of focus on outperforming sectors such as consumer discretionary, building materials, and chemicals amongst others," says Jaspreet Singh Arora, Chief Investment Officer, at Research & Ranking. With a 60-40 mix between Large Cap and Mid/Small cap and beta of less than 1, the concentrated 20 stock portfolio has been designed to withstand volatility, provide moderate risk, and high reward for our retail and HNI investors.

The outperformance v/s Nifty and superior standing amongst the best multi-cap PMS in the country continues quarter after quarter. "Research & Ranking continues to improve its services and also add more offerings to diversify and expand the business and offer enhanced solutions to investors across the country," said Manish Goel, Founder-Director at Research & Ranking.

This news comes in the wake of the recent initiatives of the company. The company launched Informed InvestoRR, a product that will help investors discern facts and data from the noise around. To learn more about Informed InvestoRR, click here.

Most portfolio management services focus on ‘Wealth Management, while Research & Ranking focuses solely on long-term wealth creation. What makes Research & Ranking’s approach novel is the company’s philosophy of building a fortune through deploying patient long-term capital on predominantly high-growth stocks. The team at Research & Ranking strongly believes creating wealth overnight is not possible. So, they undertake thorough due diligence to create a mini-universe of attractive opportunities followed by the creation of a personalized portfolio tailored to the customer’s risk appetite and financial goals.

Stock markets are complex, where wealth creation from equity is not easy. However, with some patience, disciplined investing, and detailed research, anybody can create wealth. While persistence and restraint are traits investors must develop themselves, investors can have an edge if they avail the services of financial advisory services like Research & Ranking.

About Research & Ranking

Research & Ranking is a leading technology-enabled equity advisory service in India. With a team strength of 200+ professionals spread across Mumbai, Thane, Noida, Bangalore, and Chennai in India, Research & Ranking focuses on making stock market investing hassle-free, rewarding, and easy process for investors pan-India. Since its inception in 2014, Research & Ranking has helped over 23000 investors to fulfill their financial goals.

Disclaimer: This content is distributed by Digpu News Network. No HT journalist is involved in the creation of this content.

Milestone Alert! Livemint tops charts as the fastest growing news website in the world 🌏 Click here to know more.

You are on Mint! India's #1 news destination (Source: Press Gazette). To learn more about our business coverage and market insights Click Here!

Wait for it…

Log in to our website to save your bookmarks. It'll just take a moment.

You are just one step away from creating your watchlist!

Oops! Looks like you have exceeded the limit to bookmark the image. Remove some to bookmark this image.

Your session has expired, please login again.

Congratulations!

You are now subscribed to our newsletters. In case you can’t find any email from our side, please check the spam folder.

Subscribe to continue

This is a subscriber only feature Subscribe Now to get daily updates on WhatsApp

Open Demat Account and Get Best Offers

Start Investing in Stocks, Mutual Funds, IPOs, and more

- Please enter valid name

- Please enter valid mobile number

- Please enter valid email

- Select Location

I'm interested in opening a Trading and Demat Account and am comfortable with the online account opening process. I'm open to receiving promotional messages through various channels, including calls, emails & SMS.

The team will get in touch with you shortly

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

Our award-winning investment research can help you make informed investment decisions.

- In-depth investment research from third-party providers and Schwab experts

- Specialized tools, support, and solutions for investors

Access stock market research with timely, fact-based insights from Schwab and leading independent providers.

Indices - View the latest movements of the most popular domestic and international indices, or dive in for a closer look.

Sectors & industries - See how sectors are trending at a glance with heat maps based on your chosen time frame.

Breaking news - See the latest headlines to help you stay on top of the markets.

Schwab insights and commentary - Receive timely market and economic analysis from our specialists so you can make more informed investing decisions. View our latest market insights .

Market reports - Get a balanced perspective with premium, independent research from third-party firms, including Morningstar ® and Argus. See a sample report .

Find and analyze possible opportunities with investment research tools that help you filter out the noise.

These convenient features can help you quickly find potential trade opportunities.

Schwab Stock List™

These lists offer a convenient way to find top-ranked companies based on factors like Analyst Ratings, Price Performance, and more.

Select Lists

ETFs and mutual funds on our Select Lists have been screened to provide a basic standard of liquidity, viability, and structural stability to help you make more informed investing decisions.

Use pre-defined screens or customize your own to find trade candidates that fit your criteria.

Once you have a trade idea in mind, these easy-to-use and customizable tools can help you conduct detailed analysis on a wide range of data and information.

Analyze price movement, volume, and more with interactive price charts and an array of overlaid indicators and comparisons.

Access the latest pricing information, historical performance data, and other critical financial metrics of any potential trade or investment, such as dividends, expected earnings, and more.

Access data-driven resources and support to help inform your decisions.

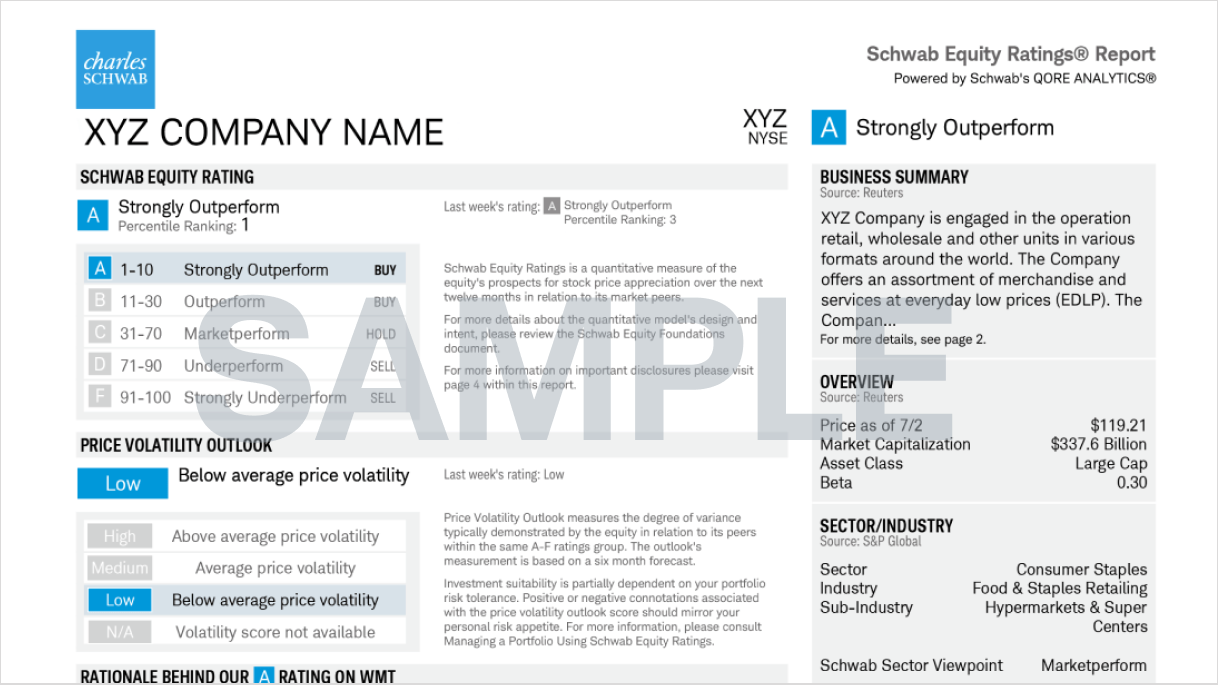

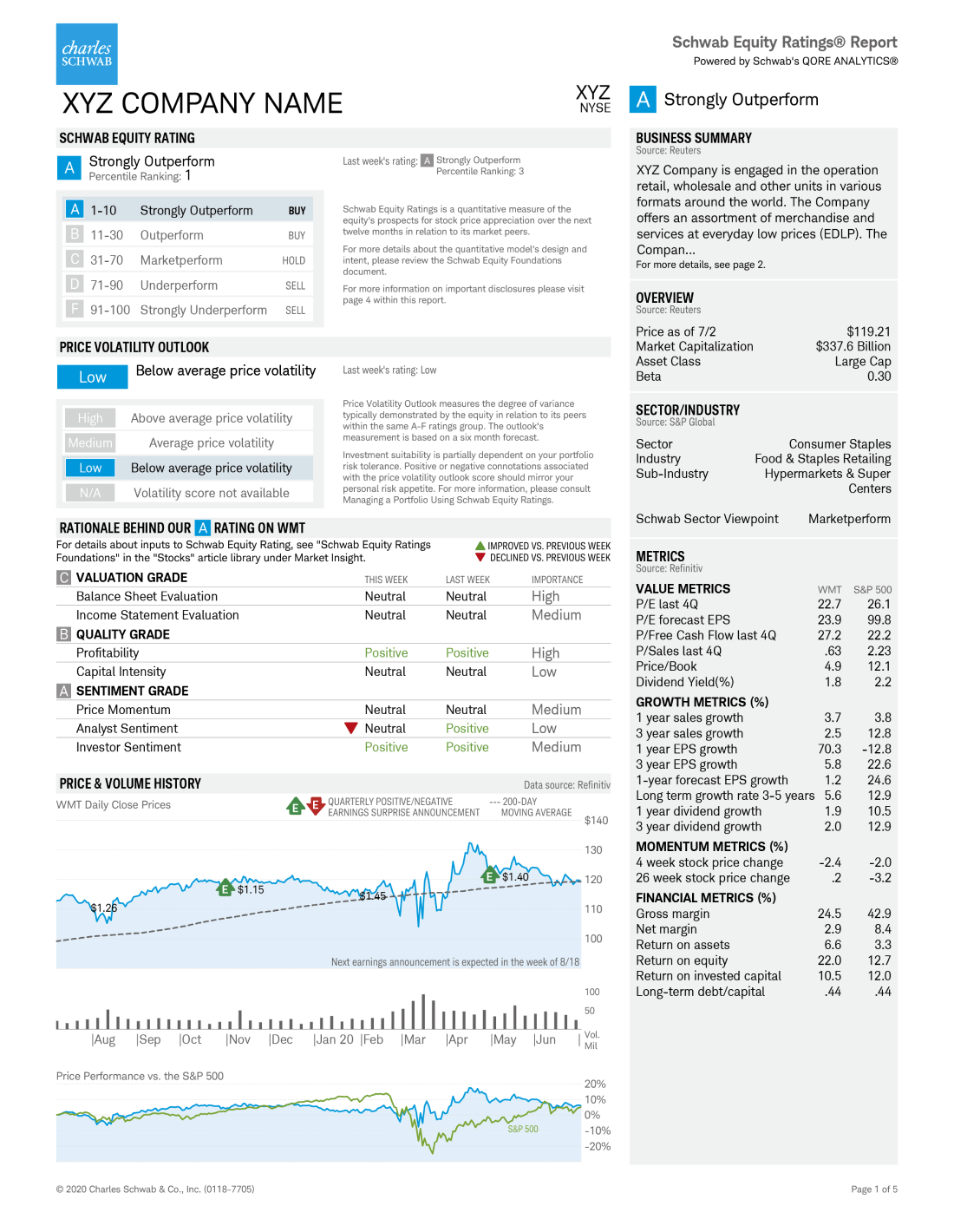

Schwab Equity Ratings®

Schwab assigns an A–F grade to approximately 3,000 U.S.-traded stocks to provide you with a quick assessment of our 12-month outlook.

Live, personalized support

Talk one-on-one with experienced trading specialists who share your passion for trading.

Continue your trading and investing journey.

Preview our research tools, learn about trading stocks, explore our investment products, have more questions we're here to help., morningstar.

Welcome to Equentis Research and Ranking.

We make equity investments easy for you

Sign in to Your Customized Portfolio

Not an existing subscriber? Start Now!

OTP Verification

Did’t get OTP ? Resend OTP

Login with your Password

Login with Password

Forgot Password?

Login with OTP

Forgot Your Password

Back to login

Having trouble verifying your email id? Support

SEBI Registered Investment Adviser Details: Registered name: Equentis Wealth Advisory Services Private Limited , Type of registration: Non-Individual , Registration No.: INA000003874. , Validity: Dec 08, 2015 – Perpetual

Copyright © 2023 Equentis Wealth Advisory Services Pvt. Ltd. All Rights Reserved.

Account Blocked

Your account has been blocked due to excess invalid attempts. You have entered wrong password more than 4 times.

For further assistance please contact [email protected]

An OTP Is Sent to Your Registered Email Address. .

An OTP Is Sent to Your Registered Mobile Number & Email Address. -->

Reset Your Password

Your password must.

Be at least 8 characters Include an Uppercase letter Include a number or a special character Not start or end with a space

Confirm Password

Your password must be the same as the new password.

MouthShut.com Would Like to Send You Push Notifications. Notification may includes alerts, activities & updates.

Concern / Feedback Form

Secure your account

Please enter your valid contact number to receive OTP.

Just one step away to protect your account with 2FA.

Add extra security with 2 Factor Authentication

Protect your account by adding an extra layer of security.

OTP Verification

Your 2FA is Activated

Home > Ecommerce and Online Business > Business and Finance Websites > Research And Ranking

Research And Ranking

MouthShut Score

Service & Support:

Information Depth:

Time to load:

User friendly:

Upload your product photo

Contact Number

The ingenuineness of this review appears doubtful. Justify your opinion.

I feel this review is:

- Write Review

- Specifications

- Question & Answer

Research And Ranking Reviews

You will get Standard Market known calls . Exit calls are good. But many times stocks further went up after my exit .

They are good at what they do . But if you are small investor( below 40 lakhs) it will not work out for you as 35-40% of your real returns you would have paid as thier fees.

They are not gods to foresee future so dont expect that, Some stocks were exited at loss some with decent returns.

I decided not to continue as my post tax I was better off investing in an Index Fund.

One more thing. On website and app they say their customer Ghansham bought TCS in 2004 . DONT FALL FOR IT!. They were not even born then. The company was formed in 11 August 2016. Later renamed to Equentis in 2024. May be That Gansham didn't take advice so his portfolio is held for 18 years. otherwise there might be an exit call by them.

- Flag This Review

- Thank You! We appreciate your effort.

View more comments

I have taken premium membership of research and ranking and they told me lot of promissary thing about company unlisted share. you will huge benefit by investing in unlisted companies. on their advice I invest rs 2593350/ for eight companies and I deposit money in their account and they send me DEAL CONFIRMATION LETTER on 13/02/2024. They transfer 7 stocks in my DP Account and one stock CARRIER AIRCONDITIONING AND REFRIGERATION LTD which they quoted me 800 shares @ 424/ total 339200/ but still they not transfer besides many reminder. company is fully en efficent in their service. I told them to go legally against them but their response is very bad. I request investor to think twice before using their services.

its easy to pay money to them but difficult to take back. I am having more money to invest but due to their negligence behaviour I stop investing with them and planning to go legally against them. to refund my money or transfer of shares after 3 month.

you can imagine how best is their service.

God give them intelligence. This is not buisness ethics whic they are doing with their customers.

I am member from 2022 Jan they offer three type of service like mpo 5 in 5 all services are good but in 5in5 services they offers not good and they promise 4to5 times it's not work they even not able to cover 12% yoy profil.

I have upload ss file to go through what they recommend and what price current going on.

I hope it will improve there service as they charges for there services it's not fare.

YOUR RATING ON

Once you purchase their plan, that's it!

There will be no connection between you and them. They will be least bothered to pick up the call even if you contact them via phone and email.

They will suggest from price range(say 100-150) but say if the stock goes to 70 or less than that, there will be no communication whether to hold it or sell it. This is very crucial from the customer's point of view.

They are only bothered to get there money, once you make the payment then no one from there company has even courtesy to check on there customers. To get there fee they can call 20 times a day or even at 11 in the night. After the payment we have to keep calling them again and again. This is not some fake review, I'm there Client and I have taken there so called premium service and I have made the payment on jan7th 2024 and its been 22 days I have not received single call . Infact i am trying to call them but no one answer . In this R&R wants to go public. First take care of your existing clients.

Guys first of all the staff which they hired are not nism certified...I am shocked thats why I suggest you take your time do analysis take YouTube help and invest your hard earn money in good money there are many companies among 4500 stock which still have potential and within 5years they will give you atleast 300 to 400 percent return

So better then churning your money behind this broking firm invest properly .few are the tips always buy the stock in dip and sell it on peak remember where there is good news spread its actually bad news and when there is bad news it's time to invest check periodically chart history of stock where it's taking support .always keep atleast 10 to 12 stock to manage your portfolio I am bloody sure that our of 12 stock within 5 years of long term investment easily you can earn atleast 300 to 400 percent and in some stock more than that also and last not to waist your money by taking subscription packages nobody take cares of your money better than you only the thing is that you need to understand market sentiment and behaviour

They only follow up during subscription and after that no one follows up you. So far I got 3 recommendations and out of them only one was under 400 which performing very bad since 2 months. Rest 2 stocks are very high price and they are already running at High ever. I would suggest not waste your money to subscribe this service. Believe me you will get better tips by watching other share market channel or YouTube ??.

I appreciate your recommendations. I am fully satisfied your research team till now. I hope more better efforts will be continued in future. All your team members are very sincere & cooperative. I heartly thanks to all & good wishes.

After my association with Research and Ranking I have started understanding the market in greater detail and make good profits on a regular basis. Not only is the success rate on your calls very good, you are also approachable and helpful regarding any doubts about the market.

Research and Ranking has added value in terms of exposing me to new opportunities available in the market.Brought to notice many new companies to me. In one of the stocks recommended by Research and Ranking, I made 3 times money till date. It was a very good find. Research and Ranking service is a great way of exploring new companies and understanding them.Many small cap shares were not even known to me earlier. However, after going through the Research and Ranking I find I have missed lot of opportunities in my earlier years. I am now 65 years old and I have been in the market for the last 30 to 35 years!Now I am confident that more opportunities exist in small caps and midcaps rather than large caps.I am still holding many shares recommended by Research and Ranking.

I had never invested in stocks.I subscribed to Research and Ranking to explore high untapped potential in small cap stocks.I invested same amount of money in all Research and Ranking recommendations. In some stocks, I got early profits.I learned disciplined approach in investing from Research and Ranking.

Research and Ranking is a trusted service. My life has changed far better since subscribing to Research and Ranking. I’ve made reasonable gains on many stocks recommended.

They have spoiled my portfolio. Don't waste your hard earned money.

Very good unbiased recommendations. All the report's recommendation are in-depth and very good overall when one see the site one can easily understand the fundamentals of investing. very useful. The main thing is Research and Ranking can be trusted. Overall my experience has been very good

Don't trust them, they have dedicated sales division to call people and lured them from their fake data's and achievements.

First they provide you small amount subscription then after 3-4 months again call you to provide full fledged subscription for 25 years and demand for lot of money for investment in different portfolios.

Overall you are feeling stressed and under financial crunches because of their regular demands.

When it comes to refund of subscription amount then nobody pay any attention to your query, by giving unsatisfactory excuses they digest your amount completely.

In such scenario I lost around 55k.

Rest is your personal call.

Their service is premium and useless. Dont fall into the trap based on the reviews of this company. They are the paid ones. I took the service for 6 months. Within 10 days I realized their service is not worthful. Their refund policy is horrible. When I opted for the refund within the 10 days they told will give the remaining money with 60% deduction.

I am a genuine victim.

Research and Ranking have added value in terms of exposing me to new opportunities available in the market. Brought to notice many new companies to me. In one of the stocks recommended by Research and Ranking, I made 3 times the money to date. It was a very good find. Research and Ranking service is a great way to explore and understand new companies. Many small-cap shares were not even known to me earlier. However, after going through the Research and Ranking I find I have missed a lot of opportunities in my earlier years. I am now 46 years old and I have been in the market for the last 10 to 55 years! Now I am confident that more opportunities exist in small caps and midcaps rather than large caps. I am still holding many shares recommended by Research and Ranking.

Though I am in the markets for the last many years as an investor and no doubt money can easily be made during good times, I realize the importance of a good partner during bad times, such as the current phase. I fully trust Research and Ranking Wealth Alliance's impartial & conservative views during all phases/cycles of the market and they can be fully relied on for a fruitful handholding not only during the current bad phase but throughout. I respect them for their impartial and unbiased views.

Before subscribing to Research and Ranking, my investments were based on business magazines and channels. But I wanted to get actual facts and figures before making investments. Research and Ranking have been good decision-making tools for investments based on long-term trends instead of market favorites. Most of the companies that I have invested in, have given me good returns if I hold them for at least 2 years despite the current market dynamics.

Worthless.They Don’t give proper followup. Customer Support service zero. Before subscribing they call you all time day night. Once subscribed they don’t even pick your call. Really disappointed from research and ranking team.

Thank you for sharing the requirements with us. We'll contact you shortly.

We will get back to you shortly.

Set Email Alert

Alert on more product reviews

Capitalmarket

Equitymaster

Indiainfoline

Walletwatch

Recent Reviews on Ecommerce and Online Business

"Read before going to bed"

By: VikasAzanchee

"This broker"

By: Rupal_Barad

"Briefly about my plans"

On: Ultimatetraders

By: Karim_Sandal

Tips on Ecommerce and Online Business

Writing Reviews on MouthShut

Online Shopping Experience

General Thoughts About MouthShut

General Tips on Mystery Shopping

Photo Uploaded successfully.

Upload Photos

Upload photo files with .jpg, .png and .gif extensions. Image size per photo cannot exceed 10 MB

Upload Menus

Upload menu files with .jpg, .png and .gif extensions. Image size per photo cannot exceed 10 MB

Recommended Top Articles

Research and ranking photos.

See all Photos

Research And Ranking Location

Recent Questions and Answers on Research And Ranking

May i know the charges related details

Oct 04, 2022

By: icicishoaib97

Select a product from search suggestions

Free MouthShut app saves money.

An OTP has been sent to your email and mobile number. Please enter OTP to verify the account.

Didn't receive? Resend OTP

An OTP has been sent to your email address. Please Enter OTP to verify your email address

Regional Research Institute of Unani Medicine 2024-25: Admission, Course, Fees, Cutoff etc.

The Regional Research Institute of Unani Medicine College Srinagar has been part of the Central Council for Research in Unani Medicine, Ministry of AYUSH, Govt. of India, since 1985. It is a leading Unani medical research institute in Jammu and Kashmir. The campus includes a Clinical Department (with OPD, IPD, laboratories, and pharmacy), a Survey of Medicinal Plant Unit, a Drug Standardization Research Unit, an administrative block, a PG department, a canteen, an herbal garden, and an animal house. The institute is affiliated with the University of Kashmir.

This article will provide detailed information about the Regional Research Institute of Unani Medicine , covering the fee structure, courses offered, admission procedures, cutoffs, facilities, and an overall college review.

College Overview

Before we complete the college review, let us look at the essential details of the Regional Research Institute of Unani Medicine .

Course Offered

Here, you can find information about the courses offered by the Regional Research Institute of Unani Medicine, Let’s take a look.

BUMS Admission 2024-25

If you want admission to the Regional Research Institute of Unani Medicine, you must follow the college admission procedure; here in this Section, we provide detailed information about the Regional Research Institute of Unani Medicine UG/ PG Admission Process.

Fee Structure

The fee structure of the Regional Research Institute of Unani Medicine for various Ayurvedic courses is mentioned below.

Note: The Fees will be Updated Soon.

BUMS Cutoff 2023

The College Cut-off is the minimum mark you need to get admitted. A list of top scores is made based on these cutoff marks. To join this Institute, you must pass the Cutoff for your chosen course. Here’s the Regional Research Institute of Unani Medicine cutoff:

Note : Cutoff will be updated soon.

Documents Required

Candidates who will be allotted a seat in this college will be asked to report with the following documents to complete the formalities.

For UG Candidates

- Scorecard or Rank Letter

- Class 10 certificate and mark sheet (for date of birth)

- Class 12 certificate and mark sheet

- ID proof (Aadhar/PAN Card/Driving License/Passport)

- Eight passport-size photographs

- Provisional Allotment Letter

- Caste Certificate (if applicable)

- PwD Certificate (if applicable)

- Passport Size Photograph

- Fee Receipt

For PG Candidates

- The admit card for AIAPGET 2024

- AIAPGET 2024 scorecard

- Copy of the AIAPGET 2024 application form

- Class Xth certificate and mark sheet

- Class XIIth certificate and mark sheet

- Graduation mark sheet

- Certificate of Completion of Internship

- Recent passport-sized photographs

Facilities Available

Regional Research Institute of Unani Medicine offers its students a magnificent and comprehensive range of facilities on campus.

Contact Details

Regional Research Institute of Unani Medicine College Address : Nasim Bagh, Srinagar, 190006 Official website : https://rrium.uok.edu.in

Related Posts

- Shree Janata Homoeopathic Medical College Akola 2024-25: Admission, Fees, Course, Cutoff, Intake etc.

- List of BAMS College in Kerala 2024-25: Govt & Private Seats, Fees, Establishment etc.

- Institute of Asian Medical Sciences Srinagar 2024-25: Admission, Course, Fees, Cutoff etc.

- SN Ayurveda College Karimpinpuzha Puthur 2024-25: Admission, Courses, Fees, Cutoff etc.

About C.T Sai Prasad

Hi, I'm C.T. Sai Prasad with a year of expertise in MBBS and Ayush courses. I have detailed knowledge of various colleges' fee structures, cutoffs, and intake procedures. If you're looking for insights or assistance in pursuing MBBS or BAMS courses, feel free to comment below—I'm here to help!

Leave a Comment Cancel reply

Notify me via e-mail if anyone answers my comment.

- About the Hub

- Announcements

- Faculty Experts Guide

- Subscribe to the newsletter

Explore by Topic

- Arts+Culture

- Politics+Society

- Science+Technology

- Student Life

- University News

- Voices+Opinion

- About Hub at Work

- Gazette Archive

- Benefits+Perks

- Health+Well-Being

- Current Issue

- About the Magazine

- Past Issues

- Support Johns Hopkins Magazine

- Subscribe to the Magazine

You are using an outdated browser. Please upgrade your browser to improve your experience.

New IRB fee schedule

By Hub staff report

Effective July 1, 2024, there will be a new IRB fee schedule for research studies subject to either standard or sIRB billing. The threshold for standard billing for studies with commercial funding has been increased from >$10,000 to >$15,000 to assist study teams with small commercial funding support. The new fee schedule will apply to new applications submitted on or after July 1, 2024.

For more information and to see the new fee schedule, click here .

News Network

- Johns Hopkins Magazine

- Get Email Updates

- Submit an Announcement

- Submit an Event

- Privacy Statement

- Accessibility

Discover JHU

- About the University

- Schools & Divisions

- Academic Programs

- Plan a Visit

- my.JohnsHopkins.edu

- © 2024 Johns Hopkins University . All rights reserved.

- University Communications

- 3910 Keswick Rd., Suite N2600, Baltimore, MD

- X Facebook LinkedIn YouTube Instagram

Fidelity Won't Levy Proposed Fees on Purchases From Boutique ETF Firms, Sources Say

Fidelity Won't Levy Proposed Fees on Purchases From Boutique ETF Firms, Sources Say

A sign marks a Fidelity Investments office in Boston, Massachusetts, U.S., April 28, 2022. REUTERS/Brian Snyder

By Suzanne McGee

(Reuters) - Fidelity Investments will not impose new fees on investors buying exchange-traded funds (ETFs) issued by a group of smaller asset management firms, having made progress on a revenue-sharing agreement with issuers, sources familiar with the matter told Reuters.

Agreements with the issuers to cover some of the costs associated with trading on its platform would be a win for Fidelity, which initially faced resistance from the ETF community to the idea of the revenue-sharing agreement.

Fidelity warned a group of nine issuers in April that if those firms didn't negotiate or agree on a deal, their investors would have to pay up to $100 per ETF purchase on the Fidelity platform. Those fees would have been effective on June 3.

Smaller asset managers within the rapidly growing but highly competitive ETF industry worry about the impact of handing over as much as 15% of their revenue earned from sales on Fidelity's platform to the firm.

"The decision to harmonize some of our fee policies comes as our level of support and service for ETFs across the industry is growing rapidly," said a Fidelity spokesperson. The firm's aim is to ensure "a more consistent approach" to sharing the costs of maintaining a trading platform for ETFs and other assets.

Fidelity, which has allowed investors to trade ETFs without fees since 2019, last year asked the group of nine smaller issuers, including Simplify Asset Management, Rayliant Global Advisors and AXS Investments, to help shoulder operating costs.

It was unclear which of the nine firms have signed new revenue-sharing agreements with Fidelity and how many are still negotiating.

At least one of the investment boutiques, however, said Fidelity had left them between a rock and a hard place.

"One path - refusing to pay them and allowing our investors to be hit with this fee - is death," said Jason Hsu, founder and chairman of Rayliant Global Advisors, adding that investors would simply turn to other ETFs.

The alternative "is to hand over a very large slice of the profit margins" on the firm's ETFs, he said, just days before beginning negotiations with the brokerage.

Rayliant has four ETF products, none of which have more than $100 million in assets.

The spat between Fidelity and the ETF issuers has given investors a glimpse into the economics of those trading platforms and their role in the growing ETF market. Over the last decade, both issuers and platforms have slashed fees to attract new investors.

"The shift by Fidelity and Schwab to offering their investors free trading in ETFs beginning in 2019 changed the landscape," said Dave Nadig, an independent ETF analyst.

Fidelity's attempt to extract fees from issuers "is completely unsurprising, since Fidelity can argue that it offers value, but for many of these issuers, paying 10% to 15% of their revenue would wipe out their margins."

ETF industry members worry that paying access fees will eventually make it tougher for them to launch new products, compete with industry giants and keep ETF fees low.

Taylor Krystkowiak, vice president and investment strategist at Themes ETFs, said the move “raises costs for us and potentially for investors, raises the bar for success and survival for new issuers, and empowers the big incumbent firms" like BlackRock Inc. and Fidelity itself to reinforce their market share. His firm was not one of the nine named by Fidelity as potentially subject to a surcharge.

"This is a giant step backwards," he said.

(Reporting by Suzanne McGee; Editing by Ira Iosebashvili and Sonali Paul)

Copyright 2024 Thomson Reuters .

Join the Conversation

Tags: funds , United States

America 2024

Health News Bulletin

Stay informed on the latest news on health and COVID-19 from the editors at U.S. News & World Report.

Sign in to manage your newsletters »

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

You May Also Like

The 10 worst presidents.

U.S. News Staff Feb. 23, 2024

Cartoons on President Donald Trump

Feb. 1, 2017, at 1:24 p.m.

Photos: Obama Behind the Scenes

April 8, 2022

Photos: Who Supports Joe Biden?

March 11, 2020

NYC’s Verdict on Trump: Not One of Us

Lincoln Mitchell June 1, 2024

Will Trump’s Guilty Verdict Help Biden?

Susan Milligan May 31, 2024

Texas Court Punts Abortion Ban Challenge

Aneeta Mathur-Ashton May 31, 2024

Key Reactions to Trump’s Guilty Verdict

Lauren Camera and Laura Mannweiler May 31, 2024

5 Key Questions About Trump Verdict

Cecelia Smith-Schoenwalder May 31, 2024

His Own Worst Enemy?

Lauren Camera May 31, 2024

Bank of America CEO Expects 10% to 15% Jump in Investment Banking Fees in Q2

FILE PHOTO: Bank of America Chairman and CEO Brian Thomas Moynihan speaks during the U.S. Senate Banking, Housing and Urban Affairs Committee oversight hearing on Wall Street firms, on Capitol Hill in Washington, U.S., December 6, 2023. REUTERS/Evelyn Hockstein/File Photo

NEW YORK (Reuters) - Bank of America's investment banking fees are expected to rise 10% to 15% in the second quarter from a year earlier, CEO Brian Moynihan said on Thursday, after an almost two-year industry slump due to market volatility, rising interest rates and geopolitical turmoil.

Trading revenue is also expected to grow at a low single-digit percentage in the current quarter, with equities' strong performance partially offset by broadly flat revenue in fixed income, he told investors at a conference.

Goldman Sachs President John Waldron also said on Thursday that equity capital markets are recovering, but at a slower clip than debt markets.

Wall Street bosses have said they are finally seeing signs of a broader pickup in investment banking as equities trade near record highs, while corporate clients adjust to high interest rates for a longer period.

Consumer spending is still growing but at a slower rate, while U.S. loan demand remains solid but is not robust due to higher borrowing costs, Moynihan said.

BofA, the second largest U.S. lender, expects net interest income, or the difference between what a lender earns on loans and pays out on deposits, to come in at 1% below its forecast of $14 billion in the second quarter.

At its first-quarter earnings call in April, BofA Chief Financial Officer Alastair Borthwick said NII would likely hit a low point in the second quarter before growing again in the second half of the year.

Shares of BofA fell 2% in afternoon trading.

(Reporting by Saeed Azhar and Manya Saini; Editing by Richard Chang)

Copyright 2024 Thomson Reuters .

Tags: United States

The Best Financial Tools for You

Credit Cards

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

See a newsletter example .

You May Also Like

Fidelity vs. charles schwab.

Marc Guberti May 31, 2024

7 Best Oil and Gas Stocks to Buy in 2024

Matt Whittaker May 31, 2024

Testing Dave Ramsey's Investing Advice

Wayne Duggan May 31, 2024

7 of the Best Ways to Invest $5,000

Tony Dong May 31, 2024

9 Best Growth Stocks to Buy for 2024

Wayne Duggan May 30, 2024

5 of the Best Stocks to Buy Now

Ian Bezek May 30, 2024

Recovering From a Stock Market Loss

Tony Dong May 30, 2024

How to Invest in India's Stock Market

Jeff Reeves May 30, 2024

7 Best High-Dividend ETFs for Income

Glenn Fydenkevez May 29, 2024

7 Top Women Investors

Coryanne Hicks May 29, 2024

7 Best Mid Cap Stocks to Buy Now

Jeff Reeves May 29, 2024

Best Vanguard Funds for Beginners

Tony Dong May 28, 2024

10 of the Best Stocks to Buy for 2024

John Divine May 28, 2024

9 Best Cheap Stocks to Buy Under $10

Wayne Duggan May 28, 2024

8 Stocks Warren Buffett Bought & Sold

Jeff Reeves May 28, 2024

Top-Rated ETFs to Buy Now

Marc Guberti May 28, 2024

7 Best Long-Term Stocks to Buy

Glenn Fydenkevez May 24, 2024

What Is Par Value for Stocks and Bonds?

Coryanne Hicks May 24, 2024

11 Top Sector ETFs to Buy

Jeff Reeves May 24, 2024

Stock Market Holidays in 2024

Daniel J. Lee May 24, 2024

Long Term Investment

“wealth Creation” Research Reports

Get wealth advisory now, get a preview of our research expertise with long term investment recommendations reports.

In-depth research is our greatest strength. You can get a glimpse of the detailed research that we conduct before recommending any investment idea, through these wealth creation research reports. It is safe to assume that these companies could be a part of one of the personalized portfolios that we design for our investors. Our research Team have handpicked the recommended stocks to multiply your wealth over the long run. Hence, we strongly advise you not to judge these companies based on the daily volatility of the stock prices of these companies.

5 in 5 Wealth Creation Strategy

Union Bank of India

View Research Reports

Polycab India Ltd

Radico Khaitan Ltd.

The Phoenix Mills Limited

Mispriced Opportunities

CreditAccess Grameen Limited

Build your Potential High Growth Portfolio!

Fill the Form to Speak to Our Team

Want Investment Advice? Register Now

expand_more contact_support Want Investment Advice? Register Now

Money blog: Why are concert tickets so expensive? Here's who is really responsible

Ticket prices for some concerts have reached astronomical levels in recent years - we've looked at why and who is profiting. Read this and the rest of our Weekend Money content below and join us for live updates again from Monday.

Saturday 1 June 2024 21:08, UK

- Taylor Swift

Weekend Money

- Where is all the money going? Here's who is really responsible for concert tickets going crazy

- Strikes, new bank notes, cat fines and airport disruption: Main June money dates for your calendar

- Your comments: Man Utd WFH crackdown, Sterling's uni pledge, pebble fines and standing charges

Best of the week

- 'A truck unloaded a £600 car that her son bought on eBay thinking it was a toy' - the schoolgate stories that led to GoHenry

- Think twice before buying your holiday clothes from Zara

- Savings account that could bag you a free £8,500 in five years

- The popular sweets that are the 'least bad' for you

- Best pub chef in UK shares amazing cheap pasta recipe

- 'My mortgage lender is ending my two-year fix and I haven't been in the house for two years - can they do this?'

- Best of the Money blog - an archive

Ask a question or make a comment

By Katie Williams , Money team

Spending a fair chunk on going to see your favourite big artist is not new - but it certainly feels like concert prices have entered a new stratosphere.

Fans of Bruce Springsteen have paid upwards of £120 for "rear pitch" standing tickets for his May 2024 tour, while some expressed disappointment recently over the £145 price tag of standing tickets for Billie Eilish's 2025 UK leg.

And while you could have nabbed Beyonce or Taylor Swift tickets in the UK for £50 (before fees) if you took a "nosebleed" seat, these had limited availability and quickly sold out. General admission standing tickets for Swift's Eras tour - which comes to the UK next week - started at £110.40 and those at the front had to shell out £172.25. It didn't stop there - by the time many fans got to the front of the online ticket queue, the only tickets left cost upwards of £300.

So what's behind rising ticket costs? These are some of the reasons...

Fans willing to pay for big spectacles

Simply put, ticket prices would come down if people voted with their feet.

Matt Hanner, booking agent and operations director at Runway, said prices at the top level had "risen considerably" - but the increase was partly being driven by demand.

"We're seeing a lot more stadium shows, greenfield, outdoor festival-type shows which are now a staple of towns around the country," he said.

"There's a growing number of people that are happy to spend a large chunk of their disposable income on going to a major music event."

Jon Collins, chief executive of LIVE, the trade body representing the UK's live music industry, had a similar view.

He said there were more large-scale shows and tours now than ever, and there was "massive appetite" among music lovers for "bigger spectacles".

Fancy shows mean higher costs - with staffing, the price of the venue, transport, artists' needs, insurance and loads more to factor in.

Of course, all these things are affected by inflation. Collins said ticket prices also factored in the rising costs that had hit every venue from the grassroots scene to major arenas.

"You've got a couple of different factors - you've got the spectacle of the show and the production cost and everything that goes into the ticket price. But then you've also got the fundamentals," he said.

The cost of venue hire has increased "significantly" in the past couple of years due to electricity and gas price rises, he added.

"You've got the increase in the cost of people… very justifiable costs like increases in minimum wage and living wage. At every stage of the process we've got these cost increases that will all push through the pressure on the ticket price."

Are artists being greedy?

How much money artists really earn off live touring is of interest to many - but the music industry is generally reluctant to release details.

The people we spoke to suggested it was not as simple as artist greed because, as we mentioned earlier, there's a lot to pay for before anything reaches their bank accounts.

The Guardian spoke to anonymous insiders about this topic in 2017. Its report suggested that between 50-70% of gross earnings were left for promoters and artists. The piece also cited a commonly quoted figure that the promoter takes 15% of what is left and the act will get 85%.

It all depends on the calibre of the artist and how much work the promoter has had to put in - they could end up with a bigger share if it was a hard push to get the show sold.

The people we spoke to said music acts and their teams would discuss the ticket price, and the bigger the act, the more sway they have - but it's ultimately set by the promoter.

Taylor Swift - arguably the biggest popstar on the planet right now - is personally earning between $10m and $13m (£8m - £10.5m) on every stop of her Eras Tour, according to Forbes. She is reported to take home a whopping 85% of all revenue from the tour.

But it's worth pointing out, too, that she's been known to be generous with her cash, having given $100,000 bonuses to the dozens of lorry drivers working on the tour.

What have other artists said?

Some artists have been critical of the high ticket prices being demanded by others.

Tom Grennan told ITV two years ago that he had seen "loads of artists putting tickets out that are way too expensive for the times that we are in", adding that he wanted people to enjoy shows without worrying if they could pay their bills.

Singer-songwriter Paul Heaton was also praised for capping ticket prices for his tour with Jacqui Heaton at £30 in a bid to tackle music industry "greed" and help people during the cost of living.

British star Yungblud recently announced his own music festival, Bludfest - saying the industry was too expensive and needed to be "shaken up".

"I believe that gigs are too expensive, festivals are too expensive, and I just wanted to work to create something that has been completely done by me," he told Sky News.

Meanwhile, frequent Swift collaborator Jack Antonoff has said "dynamic pricing" by ticket sale sites such as Ticketmaster was also an issue when it came to cost.

He told Stereogum that he wanted artists to be able to opt out of the system - which basically means ticket prices increase when a show is in demand - and be able to sell them at the price they choose.

On its website, Ticketmaster describes its "Platinum" tickets as those that have their price adjusted according to supply and demand.

It says the goal of the dynamic pricing system is to "give fans fair and safe access to the tickets, while enabling artists and other people involved in staging live events to price tickets closer to their true market value".

The company claims it is artists, their teams and promoters who set pricing and choose whether dynamic pricing is used for their shows.

Ticketing website fees

As well as dynamic pricing, "sneaky" fees by online ticket sites are also causing issues for live music lovers, according to the consumer champion Which?.

A report from the group last month said an array of fees that isn't seen until checkout can add around 20% to the cost of concert and festival tickets.

Which? has urged a crackdown on the "bewildering" extra charges, which include booking, "delivery" and "transaction" fees, venue charges and sometimes charges for e-tickets.

The Cure lead singer Robert Smith tweeted that he was "sickened" after fans complained last year about processing fees on Ticketmaster that wound up costing more than the ticket itself in some cases.

Responding to the Which? findings, Ticketmaster (which was far from the only company named) said: "Fees are typically set by and shared with our clients… who all invest their skill, resource and capital into getting an event off the ground. Ticketmaster supports legislation that requires all-in pricing across the industry."

Live Nation and Ticketmaster sued over 'dominance'

The US government is suing Ticketmaster owner Live Nation over allegations the company is "monopolising" the live events industry.

Justice department officials said it was unfair for the firm to control around 70% of primary ticketing for concerts in America.

Live Nation has been accused of using lengthy contracts to prevent venues from choosing rival ticket companies, blocking venues from using multiple ticket sellers and threatening venues that they could lose money and support if Ticketmaster wasn't the chosen seller.

Live Nation said the lawsuit reflected a White House that had turned over competition enforcement "to a populist urge that simply rejects how antitrust law works".

"Some call this 'anti-monopoly', but in reality it is just anti-business," it said.

And it said its share of the market had been shrinking and its profit margin of 1.4% was the "opposite of monopoly power".

The lawsuit "won't solve the issues fans care about relating to ticket prices, service fees and access to in-demand shows", the company said.

"We will defend against these baseless allegations, use this opportunity to shed light on the industry and continue to push for reforms that truly protect consumers and artists."

As well as reportedly controlling most of the ticketing market, Live Nation also owns and represents some acts and venues.

Canadian artist Dan Mangan told Moneywise this was enabling the company to take "more and more of the pie".

He said when venue rent, equipment and other costs were taken into account, lesser known artists could take as little as 20% of ticket sales.

Another major cost on tickets in the UK is VAT (value added tax).

At 20%, it's pretty hefty. It was brought down to 5% and then 12.5% as the live music industry was hampered by COVID, but returned to the pre-pandemic level in April 2022.

The charge puts the UK "out of step" with other countries, Collins said.

"In competitive major markets like France, it's 5%. Germany it's 7%, Italy it's 10%. Sales tax in the US is typically 6% or 7%. So we are significantly out of step with other markets when it comes to how much VAT we charge on tickets," he said.

Touring now bigger source of income for major stars

With the decline of physical products and the rise of subscription listening, artists are earning less from making music - and income from live shows has become more important for the biggest stars.

Writer and broadcaster Paul Stokes said major stars who would have toured infrequently in the past were now willing to put on more shows as it becomes increasingly profitable.

Some artists will even pencil in multiple nights at huge venues like Wembley Arena, he said - something that wouldn't have been considered two decades ago.

"When Wembley was built and they said 'we'll be doing regular shows' you'd think 'are there acts big enough to fill this massive stadium?'

"It's become absolutely part of the live calendar that artists will come and play not just one night at Wembley, but two or three every every summer."

Stokes said this demand has also prompted the scale of shows that we've become used to seeing, featuring expensive production and pyrotechnics.

Not being felt evenly

While a night out seeing a platinum-selling artist is likely to be an expensive affair, industry figures are also keen to point out that the escalation in ticket prices isn't necessarily happening at a lower level.

Collins said that while major stars were putting on arena shows, there would be plenty of other live music taking place at the same time, "from the free pub gig to the £10 ticket at the grassroots venue, to the £30 mid-cap".

"There's an absolute range of opportunities for people to experience live music, from free through to experiencing the biggest stars on the planet," he said.

But concertgoers choosing to save their cash for artists they're more familiar with may have led to a "suppression" of prices for lesser-known acts, Hanner noted.

"Everyone's short of disposable income because there's a cost of living crisis. [Artists' and promoters'] core costs are going up as well, so it's more expensive for everyone. That fear of pricing people out is just being compounded," he said.

"I think [that] has definitely led to prices being suppressed [at the lower level], when really they should have been going up."

With May in the rearview mirror, here are the key money dates for your calendar in June.

1 June onwards - benefit changes

While benefits rose 6.7% from 8 April for many claimants, those who had their last assessment period before then will have had to wait until June to receive the new, higher rate.

The exact date in June when that payment is made will depend on when you were assessed.

Also from 1 June, all people claiming Housing Benefit alone will be asked to claim Universal Credit instead within three months of receiving the letter.

Failure to do so could result in you losing your entitlement.

1-2 June - Heathrow disruption

Hundreds of border force officers at Heathrow Airport are striking until Sunday in a dispute over rosters.

More than 500 of its members working on passport control at terminals 2, 3, 4 and 5 are taking action.

Disruption is expected over the weekend as families return to the UK at the end of the half-term holiday.

5 June - new banknotes

Banknotes featuring the face of the King will enter circulation across the UK.

Notes that feature the portrait of the late Queen will remain legal tender and will co-circulate.

The new banknotes will only be printed to replace those that are worn and to meet any overall increase in demand.

10 June - £500 cat fines

All cats over 20 weeks old in England must be microchipped by 10 June.

You could face a £500 if you miss the deadline and don't get your cat microchipped in the following 21 days.

The law does not apply to the rest of the UK.

16 June - Father's Day

As the day dedicated to dads and father figures approaches, it may be worth remembering to put some cash aside to treat them in mid-June.

19 June - inflation data released

We'll get May's inflation data in the monthly drop from the Office for National Statistics.

This will give us the clearest indication of whether the Bank of England will lower interest rates.

Remember, the Bank's target is 2% (April's headline rate was 2.3%), so the closer we get to that number the better.

20 June - interest rate decision

Another Monetary Policy Committee meeting at the Bank of England will determine whether we finally get a drop in interest rates.

Many economists predict a cut from 5.25% will happen in August, but June isn't ruled out.

27 June - doctors' strike

Junior doctors in England will begin a five-day strike at 7am over pay.

The last strike by junior doctors led to 91,048 appointments, operations and procedures being postponed.

30 June - meter readings

Not a fixed date - more of a reminder.

From 1 July, the energy price cap will fall by £122 per year.

Your provider will do most of the work, but you can help keep your bill accurate by submitting meter readings (unless you have a smart meter) ahead of this date.

The big topics covered in the Money blog this week that got you commenting were...

- Manchester United giving staff who don't want to come into the office a week to resign

- Raheem Sterling offering to pay for 14 people to go to university

- Fines for pebble-taking tourists on beaches

- The standing charge rising despite the energy price cap being cut

Let's start with the two football-related stories.

Sir Jim Ratcliffe, new part-owner of Manchester United, sent an email round on Tuesday offering all non-playing staff the chance to resign (with their annual bonus paid early) within the week if they do not like his plan to stop working from home ...

Some praised his decision...

Well done Sir Jim Ratcliffe. Finally, somebody who has the guts to stand up and end this 'working from home' nonsense! edwinbasnett

Sir Jim has got it right, decisions are decisive and provide clear expectations and an option to get out. WFH doesn't work at the levels seen following COVID, I'm sure it does for some but many take advantage and it's far more difficult to manage. Tel

Others not so much...

Thankfully there's not quite so stark an ultimatum from my employer, but I am planning to leave soon. It's a nonsense commuting to an office where I then engage with other colleagues over Teams/Zoom. Jim

Who wants to work for a **** like that anyway with that attitude? No filter

Earlier in the week, we learnt Raheem Sterling will financially support 14 students through university.

Applications for the Raheem Sterling Foundation Scholarship Programme - which closed on Thursday - were open to students of black, African and Caribbean heritage from socio-economically under-represented backgrounds to help bridge the equality gap.

This will be the second year the Chelsea forward will assist successful applicants at King's College London and the University of Manchester.

Readers said...

Sterling is a credit to sport, football and his heritage. I hope more footballers will join him and his endeavours. Judy

This is brilliant - I have never understood why professionals in many fields do not give more back to their communities. Just a visit to their old primary school could turn a bright light on for so many kids. Why don't many more do it? Old white woman

Well done Raheem Sterling for financially supporting 14 students who would like to attend university. Sometimes professional football players get a negative press but this is amazing, well done. Anthony G

Away from football and to Cumbria - where beach-goers have been warned they could face a fine of up to £1,000 if they remove pebbles or shells across the area.

You said...

Why aren't the same rules applied to stop Southern Water dumping all their s*** into our seas. They take millions of pounds from normal people who trust them to process it correctly. Anti s outhern water

So that means the thrill of going to the beach and collecting a few shells is stopped. What about the scallop shells used in restaurants and supermarkets? What about the sacks of shells sold at garden centres? What about the tonnes of sand used every day etc etc? JR

Has the world gone mad? £1,000 fine for taking pebbles home from a beach? I think most children take a few pebbles home with them. Bob

Many of you responded to last Friday's announcement that while the energy price cap would fall in July, standing charges - the set amount you pay for gas and electric each day regardless of use - would be going up.

Martin Lewis's explanation of it can be read here...

Here's what you said...

Are there any regulations for energy supplies regarding the standing charge? Every time the unit price drops my supplier raises the standing charge. SianW

Our energy bills have dropped, now the heating is off. However, the high daily standing charge means my bills are off the starting blocks even before the switches are flicked. Come the winter the price cap will rise again - not unlike profiteering in wartime. Porthy

My standing charges are almost three times what they used to be. I've cut back on my usage to the point I pay more a month in standing charges than I do usage so having the unit price drop makes little impact. P hunt

The energy companies have ripped us off for the last two years. The daily standing charge has to go. The shareholders have had real good dividends over the past few years, and therefore must pay for the people that can't pay their bills, because of the bonuses they have received. michael rogers

The Money blog is your place for consumer news, economic analysis and everything you need to know about the cost of living - bookmark news.sky.com/money.

It runs with live updates every weekday - while on Saturdays we scale back and offer you a selection of weekend reads.

Check them out this morning and we'll be back on Monday with rolling news and features.

The Money team is Emily Mee, Bhvishya Patel, Jess Sharp, Katie Williams, Brad Young and Ollie Cooper, with sub-editing by Isobel Souster. The blog is edited by Jimmy Rice.

An investigation has been launched into whether the biggest banking merger since the financial crisis could harm competition.

The Competition and Markets Authority announced the inquiry into Nationwide's £2.9bn takeover of rival Virgin Money this morning.

The move would bring together the fifth and sixth largest retail lenders, creating a combined group with around 24.5 million customers and nearly 700 branches.

It would spell the end of the Virgin Money brand, with Nationwide planning to rebrand the business within six years.

The CMA has invited interested parties to give their views on the deal, as it considers whether it could "result in a substantial lessening of competition" in the market.

Nationwide struck the takeover agreement in March, and last week a clear majority of 89% of Virgin Money shareholders voted in favour, helping to clear the path to complete.

The government has sold £1.24bn of its shares in NatWest, accelerating the process of private ownership.

The Treasury's shareholding in the high street bank has fallen by approximately 3.5 percentage points to 22.5%.

NatWest, formerly Royal Bank of Scotland, received multibillion-pound bailouts during the 2008 financial crisis, leaving the government with an 84% stake.

The government has been selling down its stake in the lender, with Chancellor Jeremy Hunt planning to sell all of its interest in the bank by 2025 or 2026 should the Conservatives be re-elected.

There was supposed to be a public share sale this summer, allowing individuals, not just institutional investors, to purchase stock, but the plans have been shelved due to the election.

In recent years, the sell-off has become more rapid. In 2018, the government owned 62% of the group, but by December of last year that was down to just under 38%.

In March, that fell below 30%, meaning the government was no longer classed as a controlling shareholder in the lender.

Earlier this year, NatWest wrote to shareholders asking them to support an increase in the amount of stock the bank could buy back from the government in a year, from just under 5% to 15%.

The establishment of Great British Energy is among the last remnants of the "green prosperity plan" devised and championed by Ed Miliband, the shadow secretary of state for energy security and net zero, three years ago.

The former Labour leader's vision was to spend £28bn per year in the first five years of an incoming Labour government on decarbonising the UK economy.

However, as the current leader Sir Keir Starmer recognised, the issue was swiftly weaponised by the Conservatives because all the money - as Mr Miliband himself had made clear - would have been borrowed.

More importantly, the plan did not survive contact with Rachel Reeves, the shadow chancellor, who has made fiscal responsibility her priority.

The £28bn-a-year spending pledge was watered down in February this year to one of £23.7bn over the life of the next parliament.

A sizeable chunk of that will be on Great British Energy, described by Mr Miliband as "a new publicly owned clean power company", which Labour has said will be initially capitalised at £8.3bn.

And, instead of the money being borrowed, Labour is now saying "it will be funded by asking the big oil and gas companies to pay their fair share through a proper windfall tax".

Read on here...

Edinburgh, Aberdeen and Dundee are joining Glasgow as cities with Low Emission Zones where motorists could face fines up to £480 if they don't comply.

The zones were introduced two years ago, but drivers were given a grace period before charges began.

In Dundee, the grace period ended today - in Edinburgh and Aberdeen it's tomorrow.

A non-compliant vehicle entering the zone can be charged £60, which doubles with each subsequent breach up to a maximum of £480.

If paid within 14 days, the initial fine will be halved to £30.

Despite the warning, only 55% of drivers in Scotland are confident they know where the zones are in operation, according to online marketplace Carwow.

Some 30% of Scottish motorists are not sure if they understand the rules and 24% are not sure if their vehicle is compliant.

"We therefore need to tackle the lack of understanding among motorists about Low Emission Zones in Scotland – where they are and which cars are compliant - because, without better knowledge, millions of drivers are at risk of being fined," said Sally Foote, chief commercial officer at Carwow.

The Low Emission Zones aim to discourage high-polluting vehicles from entering certain areas, just like those in English cities like Sheffield and Bristol.

Unlike English Clean Air Zones, Scottish LEZs apply to all types of vehicles except motorbikes and mopeds.

Non-compliant vehicles are not allowed into those zones whatsoever, unlike English LEZs, which apply a daily charge.

Ultra-low emission vehicles are automatically compliant, but others must conform to certain Euro emission ratings, which can be found in your V5C logbook - or you can check online.

Cars, vans, minibuses, taxis and private hire vehicles with a petrol engine must have at least a Euro 4 rating, while those with diesel engines should have a Euro 6.

Grants are available to people living within 20km of a LEZ who have no other choice but to sell or adapt their vehicles.

Hackers say they have stolen confidential information from all Santander staff and millions of customers, reports the BBC.

A gang going by the name of ShinyHunters posted an advert on a hacking forum claiming to be selling 30 million people's bank account details, six million account numbers and balances, 28 million credit card numbers and HR information for staff.

Earlier this month, the bank said data was accessed belonging to customers in Chile, Spain and Uruguay and all current Santander employees, but nothing that would allow transactions to take place.

As of March, Sandander as a whole employed more than 211,000 people and as of 30 June 2021, 20,900 employees worked for Santander UK.

Santander has declined to comment on the claims beyond a statement released on 14 May.

It read: "Certain information relating to customers of Santander Chile, Spain and Uruguay, as well as all current and some former Santander employees of the group had been accessed.