Vol. 1 No. 2 (2019): Ethiopian Journal of Business Management and Economics/EJBME/

SEVERITY OF THE FACTORS IMBEDING THE SUSTAINABILITY OF MFIs IN ETHIOPIA

The effect of logistics management practice on organizational competitiveness: a case study of dashen brewery share company gondar, ethiopia, women in the informal business sectors: the role of street vending business for women’s livelihoods on azezo sub city, gondar, ethiopia, review of ethiopia’s growth and transformation plan (2010/11-2014/15) development theories origin and its strength and limitations: volume i, make a submission, information.

- For Readers

- For Authors

- For Librarians

Ethiopian Journal of Business Management and Economics@2020

Ethiopian Journal of Business and Economics (The) Journal / Ethiopian Journal of Business and Economics (The) / About the Journal (function() { function async_load(){ var s = document.createElement('script'); s.type = 'text/javascript'; s.async = true; var theUrl = 'https://www.journalquality.info/journalquality/ratings/2406-www-ajol-info-ejbe'; s.src = theUrl + ( theUrl.indexOf("?") >= 0 ? "&" : "?") + 'ref=' + encodeURIComponent(window.location.href); var embedder = document.getElementById('jpps-embedder-ajol-ejbe'); embedder.parentNode.insertBefore(s, embedder); } if (window.attachEvent) window.attachEvent('onload', async_load); else window.addEventListener('load', async_load, false); })();

The Ethiopian Journal of Business and Economics (EJBE) is a biannual peer-reviewed publication of the College of Business and Economics, Addis Ababa University. It seeks to encourage thinking among academics, practitioners and policy makers in the fields of Accounting and Finance, Economics, Business Management, and Public Administration and Development Management. Equally important, its main mission is to stimulate research-based and inter- and multi-disciplinary debate on the issues involving the four fields particularly as these pertain to the Ethiopian setting and development challenges. EJBE publishes research reports, book reviews, and Master’s thesis and PhD dissertation (abridged versions or chapters). Academic articles and other publishable works from related disciplines are also welcome. EJBE is an authoritative and refereed journal.

This journal content is now open access and licensed under Creative Commons Attribution-NonCommercial-NoDerivs CC BY-NC-ND.

Current Issue: Vol. 13 No. 2 (2023): The Ethiopian Journal of Business and Economics

Published: 2024-01-12

Firm-Level Determinants of Capital Structure Decisions of Construction Companies in Ethiopia

Women’s empowerment in decision making and its determinants on contraceptives in ethiopia: insights from edhs, logistics and customs digital transformation: digital maturity model as a comprehensive assessment framework, economic and social costs of 2019-2020 violent political unrest in ethiopia, the mediating role of the capital growth of wood-based micro and small enterprises on livelihoods in north western amhara, ethiopia.

AJOL is a Non Profit Organisation that cannot function without donations. AJOL and the millions of African and international researchers who rely on our free services are deeply grateful for your contribution. AJOL is annually audited and was also independently assessed in 2019 by E&Y.

Your donation is guaranteed to directly contribute to Africans sharing their research output with a global readership.

- For annual AJOL Supporter contributions, please view our Supporters page.

Journal Identifiers

A Systems View Across Time and Space

- Open access

- Published: 22 November 2022

Determinants of the sustainability and growth of micro and small enterprises (MSEs) in Ethiopia: literature review

- Beza Muche Teka ORCID: orcid.org/0000-0002-5486-2250 1

Journal of Innovation and Entrepreneurship volume 11 , Article number: 58 ( 2022 ) Cite this article

9401 Accesses

5 Citations

Metrics details

The role of micro and small enterprises (MSEs) has been recognized in Ethiopia at the strategic and policy levels. They are considered as a way to create jobs, alleviate poverty, ensure food security, and promote private sector development. Despite several government programs and support schemes aimed at empowering MSEs to be more competitive and sustainable, they continue to fail at alarming rates. Previous studies revealed that the failure rate of MSEs in developing countries like Ethiopia is higher than in developed countries due to a variety of internal and external factors. Thus, the objective of this study was to identify the major factors that commonly affect the sustainability and growth of MSEs in Ethiopia through systematic literature review. In order to achieve the objective of the study; published previous research works (journal articles) in the manufacturing and service sector from 2006 to 2021 were used. The findings from different empirical studies revealed that financial factors, marketing factors, political-legal variables, lack of adequate infrastructure, technological factors and manager or owner personal characteristics are the major factors that commonly determine the sustainability and growth of MSEs in Ethiopia. Finally, the study suggested that government, non-governmental organizations (NGOs), and financial institutions should give great attention towards the sustainability and growth of MSEs in Ethiopia.

Introduction

The contribution of Micro and Small enterprises (MSEs) to employment, growth, and sustainable development is now widely acknowledged throughout the world. Micro and small enterprises (MSEs) are described as the natural home of entrepreneurship. Most large enterprises in Ethiopia and throughout the world began as MSEs and grew to maturity over time as capital and business management experience accumulated (EEA, 2015 ; Ethiopia’s MSED Policy & Strategy, 2016 ). MSEs are considered critical to society's overall development. They are at the heart of economic and social empowerment for citizens, as governments cannot simply generate jobs for everyone. MSEs are one of the ideal locations for young people to be entrepreneurial, develop new technology, and develop substitute products to replace imported goods (Gebremariam, 2017 ). The importance of micro and small enterprises (MSEs) in a country's long-term growth has drawn the attention of numerous countries throughout the world. They promote economic development by reducing poverty, creating job opportunities, increasing self-sufficiency, increasing industrial production and exports, and making a major contribution to GDP growth (Baleseng, 2015 ; Rahel, 2018 ). MSEs have become key urban economic activities in most industrialized countries, notably in terms of creating urban jobs. MSEs and the informal sector are the primary income-generating activities in developing nations in general and in Ethiopia in particular, and so they contribute significantly to local economic development and are used as a basic means of survival (Gebre-egiziabher and Demeke 2004 as cited in Rahel, 2018 ). One of the primary drivers of economic growth and employment creation is the MSE sector. This is especially true in several low-income African nations, where MSEs and the informal sector account for over 90% of enterprises, generate over 50% of GDP, and employ over 63 percent of the population (Ahmed, 2012 as cited in Rahel, 2018 ). Micro and Small and enterprises are the economic activities that separate the developed and developing worlds (El-Khasawneh, 2012 as cited in Baleseng, 2015 ). Many academics recognize the importance of micro and small companies in economic development (Baleseng, 2015 ; EEA, 2015 ; Ethiopia's MSED Strategy, 2011 ; Ethiopia’s MSED Policy & Strategy, 2016 ; Rahel, 2018 ).

Due to differences in economic development across the world, the definition given to Micro and Small Enterprises is not similar. To define MSEs', different countries utilize different criteria such as the number of employees, yearly turnover, total assets, and startup capital. A micro enterprise in Ethiopia's industrial sector (manufacturing, building, and mining) is defined as a business that employs up to five people, including the owner, and/or has total assets of less than Birr 100,000. Similarly, a micro enterprise in the service sector (retail, transportation, hotel, tourism, ICT, and maintenance) is one that employs up to five people, including the owner, and has total assets of less than Birr 50,000. In the industrial sector, a small business is defined as one that employs 6 to 30 people and/or has a paid-up capital or total assets of less than Birr 1.5 million. According to Ethiopia's MSED Strategy ( 2011 ), a small service sector business has between 6 and 30 employees and/or total assets or paid-up capital of Birr 500,000.

Similarly, there is no single universally accepted definition for sustainability. MSEs sustainability is defined in a variety of ways by different scholars. For example, Hubbard ( 2009 ) defines a sustainable business as one that serves the demands of its stakeholders without jeopardizing its ability to supply those needs in the future. A sustainable firm, according to Savitz and Weber ( 2006 ), is one that generates profit for its shareholders while also safeguarding the environment and enhancing the lives of those with whom it interacts. As a result, sustainability stresses combining stakeholders' needs and profitability with environmental protection. Enterprises' sustainability can be interpreted in a variety of ways, with the potential to bring value to the environment, communities, customers, and the bottom line for businesses of all sizes. In Ethiopia, and in this study, sustainability is defined as an enterprise's ability to continue operating in a given business climate, as described by proclamation No. 686/2010 (Amare, 2020 ).

MSEs are considered the best mechanisms for capital accumulation and economic empowerment in Ethiopia because they play an important role in creating employment opportunities, particularly for urban youth and women. They also serve as an engine to transform economies from agricultural to industrial (Gebremariam, 2017 ). Ethiopia's industrial development policy prioritizes the development of micro and small businesses. MSEs are the primary engines of employment creation in urban areas, and job creation is at the heart of the country's development strategy. The importance of MSEs as job creators is pushed not only in low-income nations like Ethiopia, but also in high-income countries like the United States. As a result, because MSEs play such an important role in job creation, one of Ethiopia's top development priorities is to stimulate and strengthen MSE development (Ethiopia’s MSED Policy & Strategy, 2016 ).

Most governments have seen an increase in awareness and acknowledgment of the role played by Micro and Small Enterprises (MSEs) and their contribution to the economy as a result of the current highly competitive environment (Hlatshwako, 2012 ), which is not unique to Ethiopia. The relevance of the micro and small enterprise sector in Ethiopia, especially for low-income, poor, and female populations, can be shown in their substantial presence, percentage of employment, and minimal capital requirements. Governments and other development partners are interested in micro and small firms for these reasons alone. MSEs are considered as a burgeoning private sector in many developing nations, particularly countries in transition, such as Ethiopia, where they create the foundation for private-sector-led growth (Ethiopia’s MSED Policy & Strategy, 2016 ).

These roles of MSEs have been recognized in Ethiopia at the strategic and policy levels. They are considered as a way to create jobs, alleviate poverty, ensure food security, and promote private sector development (Gebrehiwot and Wolday, 2006 ). Ethiopia is one of the countries working to meet the Sustainable Development Goals (SDGs). Policy and strategy for the growth of micro and small enterprises can make a significant contribution to achieving sustainable development goals. The Sustainable Development Goals, as well as the national and ministerial Growth and Transformation Plans (GTP) II documents, pay significant attention to the issue of job creation and employment, and it is closely linked to the Micro and Small Enterprise Development Policy and Strategy (Ethiopia’s MSED Policy & Strategy, 2016 ). Various development plans in Ethiopia have emphasized broad-based growth and transformation through the promotion of MSEs', but both the degree of unemployment and the quality of jobs remain a worry. As a result, one of the main problems facing Ethiopia's government is to increase employment opportunities to alleviate widespread poverty and establish an internationally competitive industrial system. Thus, increasing employment opportunities to alleviate the widespread poverty and create an internationally competitive industrial structure are among the policy challenges the Ethiopian government is currently confronting (Meressa, 2020 ). Therefore, in order to make the MSEs sector the engine of economic growth and reduce the problem of unemployment, it is important to understand factors influencing the sustainability and growth of MSEs in the context of Ethiopia. Thus, the objective of this study is to identify the major factors that commonly affect the sustainability and growth of MSEs in Ethiopia through systematic literature review.

Methodology

To identify the factors that affect the sustainability and growth of MSEs in Ethiopia, several studies were conducted in the past and majority of the studies found contradictory results. Hence, the focus of the current study is to identify the major and common factors that influence the sustainability and growth of MSEs in Ethiopia through systematic literature review. Only past similar empirical studies in Ethiopia related to the sustainability and growth of MSEs in the manufacturing and service sector were considered. The period of the study includes research outputs published by international journals, covering from 2006 to 2021. Finally, the findings from different empirical studies were summarized and compared and then conclusions were drawn about the most important factors that commonly influence the sustainability and growth of micro and small enterprises in Ethiopia.

Theories related to the sustainable growth of SMEs (theories of change)

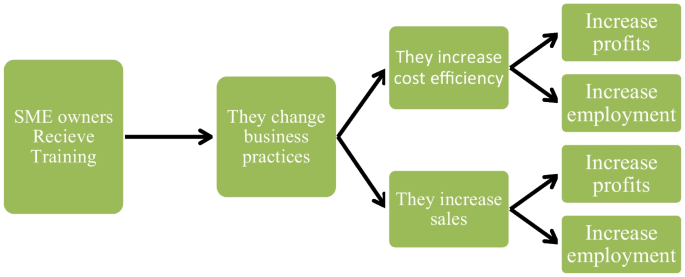

If–then business management theory of change.

Business management skills are a primary driver of productivity. Lack of managerial skills and capability among SME employees and leadership is a substantial limitation to company growth and the ability of SMEs to resist economic shocks (Addis, 2019 ; Alene, 2020 ; Bruhn et al., 2013 ; Iddrisu et al., 2012 ). As a result, one frequent belief among development practitioners is that increasing the capacity of SME owners and employees will improve the performance and growth of their businesses if they learn new skills, resulting in increased labor demand, additional sales revenue, and job creation (Gebremariam, 2017 ; USAID, 2019 ; Worku, 2009 ) (Fig. 1 ).

Access to finance theory of change

One of the most critical impediments to SME sustainability and growth is a lack of investment funding, and access to credit is a key driver of business success (Loening, et al. 2010 ). Credit makes it possible for businesses to invest in productive assets that will boost productivity, increase production, and hire additional personnel as production inputs (Ibid). Several studies have looked into the impact of access to financing interventions on the growth of small businesses (Kassa, 2021 ; Meressa, 2020 ). According to the findings, some of these measures, such as better credit information and collateral law change, can help firms perform better in areas like sales and employment (Cook & Olafsen, 2016 ; USAID, 2019 ) (Fig. 2 ).

Access to credit information theory of change

According to the evidence, information asymmetries impede SMEs' access to funding, while credit information can assist SMEs’ in becoming more financially integrated (Cook & Olafsen, 2016 ; Global Financial Development Report, 2014 ; MSED Strategy, 2011 ; Kassa, 2021 ; USAID, 2019 ; William, 2017 ). Any information that helps a lender determine if a company is creditworthy is considered such information, and it is typically used to calculate credit scores that predict repayment based on borrower characteristics (Global Financial Development Report, 2014 ) (Fig. 3 ).

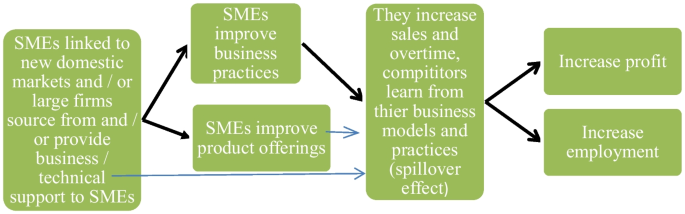

Market access theory of change

SMEs may be able to scale up through expanding into new markets. However, breaking into these areas can be difficult. SMEs struggle to access information about market opportunities, and potential clients do not know how to easily find SMEs’ that can meet their needs. Moreover, many market opportunities are out of reach for SMEs’, due to legal and financial constraints, along with high quality standards (Innovations for Poverty Action, 2017 ). Both the SME and the large purchasing firm gain from a market linkages approach (helping the creation of long-term commercial partnerships between SME suppliers and larger buyer enterprises). Through this approach, SMEs’ can achieve a stable market for their products and services. Market linkages initiatives have been shown to improve SME sales and employment, as well as have a favorable impact on SME sustainability (Arráiz et al., 2013 ; USAID, 2019 ). Businesses with greater ties to a range of organizations grow more quickly than their competitors (Meressa, 2020 ) (Fig. 4 ).

Literature review

Micro and Small Enterprises (MSEs) are considered as an important contributor to economic growth and employment creation in Ethiopia (Ethiopia’s MSED Policy & Strategy, 2016 ; Negash and Sileshi, 2019 ). However; despite several government programs and support schemes aimed at empowering MSEs to be more competitive and sustainable, they continue to fail at alarming rates (Baleseng, 2015 ; Rahel, 2018 ). Micro and small enterprises fail at a high rate across the world. MSE entrepreneurs encounter numerous challenges that hinder their long-term viability and growth. While many MSEs start-ups survive in Ethiopia, many others fail after a few years, leaving only a small fraction to expand into medium and large businesses (Amare, 2020 ; Cherkos et al., 2018 ; Ethiopia’s MSED Policy & Strategy, 2016 ). Previous studies revealed that the failure rate of MSEs in developing countries like Ethiopia is higher than in developed countries due to a variety of internal and external variables (Arinaitwe, 2002 as cited in Rahel, 2018 ). These factors have an impact on the MSEs day-to-day operations as well as its long-term performance and survival. The incidence of termination of small and medium-sized enterprises in Ethiopia is relatively common. For example; of the 650 enterprises considered in one Zone (administrative province), 330 (50.8%) were found to be censored (sustained enterprise) and the remaining 320 (49.2%) were found to be terminated or failed enterprises (Amare, 2020 ). Similarly a study conducted by Cherkos et al. ( 2018 ) also prove that because of poor working premises, lack of access to finance, infrastructure problem and lack of entrepreneurship competency, there was 50% drop—out rate in MSEs in Amhra Region, Ethiopia. This situation creates pressure on the country's economy by producing jobless citizens which is contrary to Ethiopian government micro and small enterprise development policy and strategy (Ethiopia’s MSED Policy & Strategy, 2016 ) focused on the issue of job creation and employment through MSEs'. Therefore, the current study is intended to identify the major factors that commonly affect the growth and sustainability of MSEs' in Ethiopia through systematic literature review.

Conceptual framework of the study

From the above related theories and empirical literature reviews, the following conceptual framework is developed for the current study. The variables included in the conceptual framework are classified as internal and external factors. Accordingly; financial factors, marketing factors, infrastructural factors, political-legal factors and technological factors are grouped under external factors whereas managers/owners personal characteristics is an internal factor (Fig. 5 ).

Determinants of the sustainability and growth of MSEs: empirical evidence in Ethiopia

- Financial factors

Lack of access to finance, poor book keeping and accounting system, shortage of adequate initial investment, shortage of working capital, poor repayment culture and their inappropriate use of credit are the major financial factors that determine the sustainability and growth of MSEs in Ethiopia (Addis, 2019 ; Alene, 2020 ; Amare, 2020 ; Batisa, 2019 ; Ethiopia’s MSED Policy & Strategy, 2016 ; Fikadu, 2015 ; Gebremariam, 2017 ; Gemechu & Teklemariam, 2016 ; Gebrehiwot & Wolday, 2006 ; Hagos et al., 2014 ; Kass, 2021 ; Meressa's, 2020 ; MSED Strategy, 2011 ; Rahel, 2018 ; Solomon, et al., 2016 ; Samuel, 2019 ; Vedanthadesikan & Malarvizhi, 2018 ). Because small businesses are "too big" for microfinance organizations but "too tiny" for banks in terms of loan size, access to credit appears to be a major binding limitation for their expansion. This reflects the "missing middle financial intermediaries" that support small businesses. Small businesses face a greater difficulty in obtaining finance than micro businesses, which typically have access to microfinance institutions (MFIs’) because their lending needs are within the capacity of MFIs’. Due to the burdensome bureaucracy and high collateral requirements, a huge percentage of micro and small businesses have not applied for a loan or credit from formal financial institutions. Lack of collateral is one of the main challenge preventing growth oriented MSEs from achieving their rapid growth potential and becoming competitive in the market. Most enterprises are unable to obtain finance at the right time and of the required amount. Lack of continuity and absence of financial services that meet the specific nature of a particular business complicate the problem (MSED Strategy, 2011 ; Tarfasa et al., 2016 ). Lack of access to medium or long-term loans is a key stumbling block for businesses looking to grow their operations. The reasons for this are well known, particularly the fact that MSEs pose a high risk to lenders because many of them lack adequate assets and are undercapitalized. Furthermore, banks find it difficult to analyze the creditworthiness of potential MSE borrowers due to weak accounting records and a lack of other financial data. Furthermore, due to the relatively high cost of processing small loans, banks are often hesitant to lend to MSEs'. Commercial banks and formal money lending organizations are hesitant to lend money to MSEs or request strict requirements such as collateral security due to management inefficiency, poor repayment culture, inappropriate use of credit, lack of experience in using credit to improve competitiveness, and lack of precise information needed to assess the risk of providing money to MSEs. As a result, most MSEs prefer to use personal savings and contributions from relatives as a main source of credit (MSED Strategy, 2011 ; Kassa, 2021 ; William, 2017 ) which is consistent with the country’s Micro and Small Enterprise Development Policy & Strategy (Ethiopia’s MSED Policy & Strategy, 2016 ).

Enterprises having access to finance expand faster than those with limited credit, despite the fact that the majority of businesses encounter numerous problems in obtaining debt financing from formal institutions (Kassa, 2021 ; Meressa, 2020 ). This corresponds to the access to finance theory of change (USAID, 2019). For example, according to a study conducted by Kassa using binary logistics regression, MSEs can be improved by 13.475 times when the owners obtain credit from financial institutions, it implying that without financial resources, the success and growth of the enterprises will not be achieved easily by the business owners. On the other hand, financial and resource management inefficient MSEs were 5.49 times more likely to fail than their competitors (Worku, 2009 ). All these imply that more access to finance contributes to the growth of MSEs (Kanbiro and Bekele, 2020 ).

Evidently, with regard to the impact of initial investment, Meressa ( 2020 ) on his empirical study indicates that businesses that started with at a higher beginning investment expand quicker than those that started with a lower first investment or in other words it implies that enterprises which started their business operation with higher initial investment grow faster than their counterparts and they have better sustainability experience (Ethiopia’s MSED Policy & Strategy, 2016 ; Kassa, 2021 ).

- Marketing factors

Inadequacy of market, difficulty of searching new market, lack of demand forecasting, poor customer handling system, lack of available market information, lack of promotion, lack of connection with successful and other businesses or market linkage, and lack of adaptability are the major marketing factors that determine the sustainability of MSEs in Ethiopia. Empirical results indicated a positive relationship between MSEs growth and market access (Addis, 2019 ; Batisa, 2019 ; Amare, 2020 ; Ethiopia’s MSED Policy & Strategy, 2016 ; Gebremariam, 2017 ; Gemechu & Teklemariam, 2016 ; Gebrehiwot and Wolday, 2006 ; Hagos et al., 2014 ; Kassa, 2021 ; MSED Strategy, 2011 ; Rahel, 2018 ; Solomon, et al. 2016 ; Samuel, 2019 ; Tadesse, 2020 ; Vedanthadesikan & Malarvizhi, 2018 ). For example, the odds ratio result of a study conducted by Negash and Sileshi ( 2019 ) indicates that the growth of MSEs which have access to market is 29.19 times greater than those which have not good marketing access. When it comes to market linkage, businesses that have a stronger connection to a variety of organizations expand faster than their competitors; which is in line with the market access theory of change (Meressa, 2020 ; USAID, 2019 ). Meressa also demonstrated that businesses with more connections to diverse organizations through trade shows and bazaars grow quicker than their competitors. In general; MSEs which had access to market linkage registered higher growth rate than those which had no access to market linkage (Alemayehu and Gecho, 2016 ). Limited market linkage, on the other hand, makes MSEs', particularly small businesses, not benefited from technology transfers, marketing their products and other useful business relationships (Tarfasa et al., 2016 ). As a result, they are becoming despondent to continue their business (Feyisa and Tamene, 2019 ).

Political-legal factors

Political-legal variables such as lack of government support, tax and lack of accessible information on government regulations are the major political and legal factors that determine the sustainability and growth of MSEs in Ethiopia (Addis, 2019 ; Amare, 2020 ; Batisa, 2019 ; Gemechu & Teklemariam, 2016 ; Hagos et al., 2014 ; Rahel, 2018 ; Vedanthadesikan & Malarvizhi, 2018 ; Vedanthadesikan & Malarvizhi, 2018 ; WilliIam, 2017 ). The suitability and sufficiency of the work premise provided by the government threaten to utilize the potential of MSEs. Furthermore, a lack of an enabling business task environment from the support institution has an impact on MSEs long-term viability and growth. Although the Ethiopian government has attempted to liberalize and improve the policy, regulatory, and institutional support environment for MSEs', resulting in increased investment and competition as well as improvements in licensing procedures, Gebrehiwot and Wolday ( 2006 ) found that there is still divergence between stated policies and directives. Lack of adequate business support services and unfair tax request by the revenue office continue to be major roadblocks to MSEs sustainability and growth. However; collaboration with business support institutions and other organizations can serve to acquire the expertise and services that currently are lacking in the industry (Wodajo, et al. 2020 ). Furthermore, weak business environment, and policy and regulatory barriers are among the common challenges’ MSEs are facing in Ethiopia (Solomon, et al., 2016 ).

- Infrastructure factors

Lack of infrastructure such as electricity, lack of access to land or work place/shade and inappropriate business location are the main challenges that affect the sustainability and growth of MSEs in Ethiopia. The empirical findings of most previous studies revealed that access to infrastructure is a crucial determinant in MSEs success, since those with sufficient infrastructure expand quicker than those that do not (Addis, 2019 ; Amare, 2020 ; Batisa, 2019 ; EEA, 2015 ; Gemechu & Teklemariam, 2016 ; Gebremariam, 2017 ; WilliIam, 2017 ; Samuel, 2019 ; Vedanthadesikan & Malarvizhi, 2018 ). Enterprises that own adequate land as a working premise have a better chance of making a profit and grow faster than their competitors (Alene, 2020 ; Meressa, 2020 ). MSEs that were operating at own working premise grow faster than those that operates at rented and at family working premise. Furthermore, due to the relatively high rent cost that hinder their expansion and diversification, MSEs operating in rented working premises had a lower growth rate than MSEs operating in their family working premises (Abay et al., 2014 ; Kanbiro & Bekele, 2020 ). MSEs having better access to adequate infrastructure expand quicker than their competitors. As a result, access to infrastructure (such as access to working premises, proximity to raw materials and having enabling working environments) has a positive and considerable impact on MSE sustainability and growth in Ethiopia (EEA, 2015 ; Hagos et al., 2014 ). On the other side, poor business environment and lack of adequate infrastructure (like frequent power outages, and a scarcity of water) have significant negative impact on MSEs sustainability and growth (Alemayehu and Gecho, 2016 ; Tarfasa et al., 2016 ). For example; Cherkos et al. ( 2018 ) on their empirical study indicated that due to daily power interruption, 25% of MSEs work time is lost. Cherkos et al. also shows that even though working areas are built, around 65% of the MSEs did not start work due to lack of infrastructure or facilities in the sheds. Similarly, inadequacy of working premises is a major challenge; most of the MSEs are working at a very small room which is completely unsuitable for production and service delivery (Feyisa & Tamene, 2019 ). Business location has also significant impact on the growth of MSEs. Micro and Small scale enterprises located in urban areas or near to different infrastructures grow faster than enterprises located in rural areas or far from different services and infrastructures (Addis, 2019 ; Meressa, 2020 ; Samuel, 2019 ).

- Manager or owner personal characteristics

Owners/managers' age, education level, lack of prior experience in accounting and business management, family size, MSE's age, lack of business knowledge, lack of strongly held confidence and underdeveloped entrepreneurial mindsets/entrepreneurship competency among the operators of MSEs, lack of good communication skill and a lack of technical and managerial experience/skill gap all influenced the sustainability and growth of MSEs in Ethiopia (Alene, 2020 ; EEA, 2015 ; Ethiopia’s MSED Policy & Strategy, 2016 ; Hagos et al., 2014 ; Kanbiro & Bekele, 2020 ; Kassa, 2021 ; MSED Strategy, 2011 ). MSE growth is adversely correlated with the owner's age and family size. This suggests that the younger owner with a smaller family grows faster than the older owner with a larger family. This result assured that the youngest owners’ enterprises were more successful than the other group (Kassa, 2021 ). The owner/manager’s education and prior experience has also a good and considerable impact on MSE growth. This demonstrates that MSEs owned/operated by people with a greater degree of education and prior experience expand quicker than their counterparts or in other words it implies that firms owned and managed by entrepreneurs with a higher formal education do better financially than their peers (Alene, 2020 ). For example; the odds ratio result of an empirical study conducted by Alemayehu and Gecho ( 2016 ) indicated that the probability of MSEs growth for MSEs which had owners with education level 12 completed and above is 11.7 times higher than those MSEs with education level under 12 grade. In general, firms with more experienced, educated and trained entrepreneurs grow more rapidly than those with entrepreneurs possessing smaller stocks of human capital (Wodajo, et al., 2020 ).

Most of the enterprise operators did not have prior experience in basic accounting and business management and thus they are not able to effectively manage their businesses. This invariably resulted in large scale start up failures and loss of hope, even desperation, on the part of the operators (Ethiopia’s MSED Policy & Strategy, 2016 ; MSED Strategy, 2011 ). Most importantly, human capital development is critical for company employees, since it has been established that companies with a higher proportion of trained and skilled production workers expand at a statistically significant faster rate than companies with a lower proportion of trained workers (Tarfasa et al., 2016 ) which is consistent with the business and technical training theory of change (USAID, 2019 ). In Ethiopia, managerial efficiency and entrepreneurship skill are the most important variables in ensuring the long-term survival of micro and small businesses (Gebremariam, 2017 ; Worku, 2009 ). Having a high degree of managerial abilities and entrepreneurship competency improves the long-term survival and profitability of micro and small enterprises. For example; the binary logistics regression odds ratio result by Negash and Sileshi ( 2019 ) related to entrepreneurship competency explains that the probability of growing for those MSEs having entrepreneurship competency is 60.79 times higher than those MSEs that have no entrepreneurship competency. Previous entrepreneurial experience and training have significant positive effect on enterprises performance. This implies that as an individual firm's experience grows, so does the firm's profitability and growth (Alene, 2020 ). On the other hand; lack of access to training has negative contribution towards the growth of MSE (Kanbiro & Bekele, 2020 ).

In terms of the effect of gender on the growth of micro and small businesses, Tefera et al. (2013) found that there is a considerable gender difference in the growth of MSEs, with male-owned businesses increasing faster than female-owned businesses because of the fact that woman has dual responsibility. On the contrary, empirical study conducted by Merssa ( 2020 ) revealed insignificant effect of gender on growth of micro and small enterprises. Similarly, Negash and Sileshi on their study also identified that owner/manager characteristics such as gender and age have no significance influence on the growth of MSEs.

With regard to training, entrepreneurs who receive business training to build the required skills and information needed to improve business performance perform better in their businesses. Similarly, MSEs with access to business information expand quicker than their rivals because having adequate business information can improve and strengthen customer interactions, boost firm image, promote market connectivity, and enable them to compete with other businesses (Addis, 2019 ; Batisa, 2019 ; USAID, 2019 ).

Furthermore, job-related factors such as a lack of harmonious relationships among employees/teamwork, lack of determination, lack of initiative to assess one's strength, and lack of tolerance to work hard or motivation are the primary internal variables that affect MSEs sustainability and growth in Ethiopia (Ethiopia’s MSED Policy & Strategy, 2016 ; Rahel, 2018 ). Motivation of owner is found significant for MSEs growth. Due to lack of interest to join MSEs; owners who join MSEs at last when they unable to get any alternative are not ready to perform their activity by their own interest; as a result they become unsuccessful. On the other hand MSE owners who joined MSEs by their own choice regardless of other alternatives perform well. This implies that growth rate for MSEs with owners who joined by choice is higher than those joined because of lack of alternative (Alemayehu & Gecho, 2016 ).

Technological factors

The widespread use of outdated technology and working techniques is the other major challenge to MSEs competitiveness. Among the primary technical related variables that have a significant impact on MSEs sustainability and growth are lack of open mindedness and preparedness for continual improvement, as well as a lack of readiness to adapt new technology and working techniques (Ethiopia’s MSED Policy & Strategy, 2016 ). To overcome technological, operational, and market competitiveness difficulties, MSEs must first commit for change and continual improvement (Addis, 2019 ; Batisa, 2019 ; Ethiopia’s MSED Policy & Strategy, 2016 ; MSED Strategy, 2011 ; Samuel, 2019 ; ).

Other factors

In addition to the above major factors, lack of knowledge of the potential of MSEs (the attitude that considers engagement in MSEs a sign of poverty and backwardness and then discounts their potential economic role), preference for paid employment and dependency are also among the challenges that negatively influence the sustainability and growth of micro and small Enterprises in Ethiopia (Ethiopia’s MSED Policy & Strategy, 2016 ). Further, innovation and imitation have also significant positive effect on growth of MSEs and it is suggested that the owner-managers of small enterprises can achieve higher growth through following different form of innovations and imitations such as product, process, work practice, marketing and supply relations. This can be realized by enhancing human capital through training and experience (Wodajo, et al., 2020 ).

Conclusion and recommendation

Micro and Small enterprises are the backbones of a country's long-term economic growth. It can be utilized as an explicit approach for promoting faster and more inclusive economic growth. Various development plans in Ethiopia have emphasized broad-based growth and transformation through the promotion of MSEs (Ethiopia’s MSED Policy & Strategy, 2016 ). However, despite a lot of effort that has been made by the government to improve the sustainability and growth of micro and small enterprises, they are confronted with several factors. Some enterprises fail to sustain, some others remain for a long period without transforming, and most are producing similar and non-standard products (Cherkos et al., 2018 ).

This study will be utilized as input for policymakers and development agencies to aid the country's economic progress by identifying the major factors that commonly influence MSEs sustainability and growth. It will also be employed as a source of information for comparable future studies. Both internal and external factors that determine the sustainability and growth of MSEs in Ethiopia are identified through systematic empirical literature review.

Accordingly, financial factors (such as lack of access to finance, poor bookkeeping and accounting system, shortage of adequate initial investment, shortage of working capital, poor repayment culture, their inappropriate use of credit, lack of experience in using credit to improve competitiveness and lack of precise information needed to assess the risk of providing money to MSEs), marketing factors (such as poor customer handling system, lack of available market information, lack of promotion, lack of connection with successful and other businesses or market linkage, and lack of adaptability), political-legal variables (such as lack of government support, unfair tax request by the revenue office, policy and regulatory barriers, lack of adequate business support service, and lack of accessible information on government regulations), lack of adequate infrastructure (such as electricity, poor business environment, scarcity of water, proximity to raw materials, work place/shade and inappropriate business location), manager or owner personal characteristics (such as owners/managers' age, education level, poor experience in accounting and business management, lack of entrepreneurship competency, lack of business knowledge, lack of strongly held confidence and underdeveloped entrepreneurial mindsets among the operators of MSEs', lack of technical and managerial experience/skill gap, lack of harmonious relationships among employees/teamwork, a lack of determination, a lack of initiative to assess one's strength, and a lack of tolerance to work hard), and technological factors such as use of outdated technology and little or no readiness among MSEs in adapting new technology are identified as the major factors that commonly determine the sustainability and growth of MSEs in Ethiopia.

Therefore; to reduce the negative effect of lack of access to finance on MSEs sustainability and growth, the study recommends that banks and other credit giving financial institutions should come up with creative policies that make it easy for the MSEs to access financing. Microfinance institutions, as the primary source of credit for micro and small enterprises, must develop distinct loan portfolios or financial products for businesses at various stages of development, as well as establish monitoring and follow-up systems to assess the appropriate and result-oriented use of loans and then to improve their creditworthiness. The provision of post-loan support to MSEs should be the focus area of MFIs and government leaders at all levels. Another way to address the lack of financial resources for MSEs in countries where banks demand high collateral security is to build on and strengthen the self-help efforts of MSE operators and their families; savings education should be incorporated into the curriculum and implemented as one of the main functions of schools and TVETs’. A certain amount of savings shall be considered as a precondition when young graduates intend to start their businesses and borrow from financial institutions and also appropriate awareness creation mechanisms for promoting savings shall be developed through MFIs. In addition, the government should think towards the establishment of especial financial institution like venture capital firms to finance and mentor entrepreneurs who have good business idea but have no initial capital.

Market-based skills training, technological support, and market linkages should be established, as well as support aimed at improving their marketing capacities. Training programs shall be planned and delivered based on training needs assessments and shall be provided to help businesses improve their business and managerial skills. To help MSEs become more productive and develop faster, research-based technology and standardization support shall be provided by higher education institutions.

Some Micro and Small Enterprises have limited availability of some kind of resources while they may have excess in other kind of resources. The development and maintenances of organizational networks pave the ways to sharing resources and information among network members (Wodajo, et al., 2020 ).

For other factors, it is suggested that the government and other stakeholders (such as NGOs and financial institutions) should improve their provision of basic business information and financial management skills, as this will allow MSEs to make more informed investment decisions and improve their entrepreneurial skills.

The study also suggested that even if both internal and external factors have impact on sustainability and growth of micro and small enterprises, MSEs are recommended to focus and strive on solving the internal factors by themselves rather than waiting third party solutions for external factors because solving internal factors need less effort and can easily promote the overall performance of enterprises (Cherkos et al., 2018 ).

Finally, though most of the past studies findings with regard to the determinants of the sustainability and growth of MSEs are consistent with those factors identified by the Micro and Small Enterprise Development Policy & Strategy document of Ethiopia (Ethiopia’s MSED Policy & Strategy, 2016 ), the problems are not still addressed, so the researcher recommended that the old and outdated Micro and Small Enterprise Development Policy & Strategy of the country should be revised taking in to account the current dynamic business environment.

Limitation of the study and future research directions

The conclusion of the current study is simply based on summary of the results of similar previous research works which didn’t indicate the statistical effect of the identified factors on the sustainability and growth of MSEs in Ethiopia. Therefore, future researchers’ can conduct similar research through Meta-Analysis by incorporating the statistical significance effect of different factors.

Source: Adopted from USAID ( 2019 )

If-then business and thecnical training theory of change.

If–then access to credit theory of change.

If–then access to credit information theory of change.

If–then market linkage theory of change.

Source: Own development (2022)

Conceptual framework.

Availability of data and materials

The datasets used/literatures/during the current study will be available from the author on reasonable request.

Abbreviations

Micro and small enterprises

Small and medium enterprises

Non-Governmental Organizations

Gross domestic product

Micro and small enterprises development

Information communication technology

Federal Democratic Republic of Ethiopia

Growth and transformation plan

Microfinance institutions

Ethiopia Economic Association

Technical and vocational education trainings

Abay, H. H., Tessema, F. G., & Gebreegziabher, A. H. (2014). External factors affecting the growth of micro and small enterprises (MSEs) in Ethiopia: a case study in Shire Indasselassie Town, Tigray. European Journal of Business and Management., 6 (34), 134–146.

Google Scholar

Addis, A. T. (2019). Factors affecting the performance of micro and small enterprises in Wolita Sodo Town. International Journal of Research in Business Studies and Management, 6 (12), 18–26.

Alemayehu, D., & Gecho, Y. (2016). Determinants of micro and small enterprises growth: The case of Durame Town, Kembata Tembaro Zone, Southern Nations and Nationalities and Peoples Region, Ethiopia, 2016. International Journal of Business and Economics Research, 5 (5), 161–175.

Article Google Scholar

Alene, E. T. (2020). Determinants that influence the performance of women entrepreneurs in micro and small enterprises in Ethiopia. Journal of Innovation and Entrepreneurship, 9 (1), 1–20. https://doi.org/10.1186/s13731-020-00132-6

Amare, W. A. (2020). Challenges that hinder the sustainability of small and medium scale enterprises in East Gojjam Zone, Northern Ethiopia challenges that hinder the sustainability of small and medium scale enterprises. International Journal of Development Research, 10 (7), 37926–37934. https://doi.org/10.37118/ijdr.19201.07.2020

Arráiz, I., Henríquez, F., & Stucchiet, R. (2013). Supplier development programs & firm performance: Evidence from Chile”. Small Business Economics, 41 (1), 277–293.

Baleseng, M.C. (2015). Factors affecting the sustainability of SME in the manufacturing sector of Gaborone, Botswana. Mini-dissertation submitted in partial fulfillment of the requirements for the degree of masters of business administration in the faculty of commerce and administration at the Mafikeng campus of the north-west university.

Batisa, S. (2019). Determinants of youth based micro and small enterprises growth in Dawro Zone A Case of Mareka Wereda. International Journal of Research in Business Studies and Management, 6 (12), 27–37.

Bruhn, M., Karlan, D., & Schoar, A. (2013). The impact of consulting services on small and medium enterprises. World Bank Policy Research Working Paper 6508. Washington, DC: World Bank.

Cherkos, T., et al. (2018). Examining significant factors in micro and small enterprises performance: case study in Amhara region, Ethiopia. Journal of Industrial Engineering International, 14 , 227–239.

Cook, P., & Olafsen, E. (2016). Growth entrepreneurship in developing countries: a preliminary literature review . World Bank.

Ethiopian Economic Association (EEA, 2015). Small and Micro Enterprises (SMEs) Development in Ethiopia: Policies, Performances, Constraints and Prospects. EEA Research Brief.

Ethiopia’s MSED Strategy. (2011). Government of the Federal Democratic Republic of Ethiopia, Micro and Small Enterprise Development Strategy, provision framework and methods of Implementation.

Ethiopia’s MSED Policy and Strategy. (2016). Federal Democratic Republic of Ethiopia (FDRE), Ministry of urban development and housing: Micro and Small Enterprise Development Policy & Strategy.

Feyisa, B. D., & Tamene, K. A. (2019). The roles of micro and small enterprises in empowering women: the case of Jimma Town, Ethiopia. International Journal of Multicultural and Multi-Religious Understanding, 6 , 139–151.

Fikadu, G. F. (2015). Determinants of micro and small enterprises growth in Ethiopia: the case of Nekemte Town of Oromia Region, Ethiopia. European Journal of Business and Management, 7 (13), 2015.

Gebrehiwot, A. & Wolday, A. (2006). Micro and Small Enterprises (MSE) Development in Ethiopia: Strategy, Regulatory Changes and Remaining Constraints. https://doi.org/10.22004/ag.econ.249856 .

Gebremariam, F. M. (2017). Factors affecting the growth of women-operated micro and small enterprises (MSEs) in Ethiopia. Üniversitepark Bülten, 6 (1), 56–66. https://doi.org/10.22521/unibulletin.2017.61.5

Gemechu, A., & Teklemariam, F. (2016). Determinants of Micro and Small Enterprises Performance in South West Ethiopia: The Case of Manufacturing Enterprises in Bench Maji, Sheka, and Kefa Zones. Global Journal of Management and Business Research: Administration and Management., 16 (10), 29–37.

Global Financial Development Report (2014). Financial Inclusion.” https://doi.org/10.1596/978-0-8213-9985-9 . Washington, DC: World Bank .

Hagos, H., Gebremichael, A., & Getie, A. (2014). Determinants of micro and small enterprises growth in rural area: Evidence from Feresmay Town. Journal of Economics and Sustainable Development, 5 (19), 68–79.

Hlatshwako, P.L. (2012).Challenges facing small and medium enterprises in Manzini, Swaziland. Master of Business Administration, University of Kwazulu Natal, South Africa. http://hdl.handle.net/10413/10804

Hubbard, G. (2009). Measuring organizational performance: Beyond the triple bottom line. Business Strategy and the Environment, 18 (1), 177–191.

Iddrisu, A., et al. (2012). How can micro and small enterprises in Sub-Saharan Africa become more productive? The impacts of experimental basic managerial training. World Development, 40 (3), 458–468.

Innovations for Poverty Action (2017). Small and Medium Enterprise Program, Five Years in Review: 2011–2016.

Kanbiro, O., & Bekele, Y. (2020). Determinants of women business growth: Evidence from micro and small scale enterprises in Hawassa City Administration, Sidama Regional State, Ethiopia. American Journal of Theoretical and Applied Business., 6 (4), 79–90. https://doi.org/10.11648/j.ajtab.20200604.15

Kassa, E. T. (2021). Socioeconomic determinants of micro and small enterprise growth in North Wollo and Waghimira Zone selected towns. Journal of Innovation and Entrepreneurship, 10 , 28. https://doi.org/10.1186/s13731-021-00165-5

Loening, J., Rijkers, B., & Soderbom, M. (2010). A rural-urban comparison of manufacturing enterprise performance in Ethiopia. World Development, 38 (9), 1278–1296.

Meressa, H. A. (2020). Growth of micro and small scale enterprises and its driving factors: empirical evidence from entrepreneurs in emerging region of Ethiopia. Journal of Innovation and Entrepreneurship, 9 (1), 1–22. https://doi.org/10.1186/s13731-020-00121-9

Negash, G., & Sileshi, T. (2019). Determinants of micro and small enterprises growth in selected towns of West Shoa Zone, Oromia Regional State, Ethiopia. International Journal of Small and Medium Enterprises, 2 (2), 20–32.

Proclamation no. 686/2010 commercial registration and business licensing proclamation.

Rahel, F. (2018). Factors affecting sustainability of small and medium-scale enterprises: the case of Addis Ababa, Ethiopia. A Thesis Submitted to the Department of Management in Partial Fulfillment of the Requirement for Masters of Business Administration. htttps://localhost:80/xmlui/handle/123456789/12565.

Samuel, B. (2019). Determinants of youth based micro and small enterprises growth in Dawro Zone A Case of Mareka Wereda. International Journal of Research in Business Studies and Management, 6 (12), 27–37.

Savitz, A. W., & Weber, K. (2006). How today’s best-run companies are achieving economic, social, and environment success-and how you can too, turkey . McGraw-Hill Book Company Limited.

Solomon T., Tadele, F., Shiferaw, K., & Daniel, B. (2016). Determinants of growth of micro and small enterprises (MSEs): Empirical evidence from Ethiopia. Swiss program for research on global issues for development, R4D Working Paper 2016/3.

Tadesse, M. C. (2020). Factor afecting the growth and continuity of micro and small enterprise in Robe Town. European Journal of Business and Management, 12 (16), 21–31.

Tarfasa, S., Ferede, T., Kebede, S., & Behailu, D. (2016). Determinants of growth of micro and small enterprises (MSEs): Empirical evidence from Ethiopia. World Trade Institute , 1–29.

United States Agency for International Development (USAID, 2019). Theories of change: High-growth small and medium enterprise development.

Vedanthadesikan, G., & Malarvizhi, V. A. (2018). Sustainability of a micro enterprise—a case study. IOSR Journal of Humanities and Social Science (IOSR-JHSS), 23 (8), 55–60.

William, E. (2017). Business constraints affecting the small and micro enterprises in Tanzania: A case of Bahi district in Dodoma region. A dissertation submitted in partial fulfillment of the requirements for the Master of Science in finance of the St. John’s University of Tanzania.

Wodajo, A. D., Mekonen, E. K., & Abera, S. F. (2020). Growth Determinants of Micro and Small Enterprises in Ethiopia: Evidence from Selected Woredas of Gurage Zone. Open Journal of Business and Management, 8 , 1339–1360. https://doi.org/10.4236/ojbm.2020.83086

Worku, Z. (2009). Efficiency in management as a determinant of long-term survival in micro, small and medium enterprises in Ethiopia. Problems and Perspectives in Management, 7 (3), 76–84.

Download references

Acknowledgements

Not applicable.

This research is done by the researcher himself and no funding opportunity from any source.

Author information

Authors and affiliations.

Department of Accounting and Finance, College of Business and Economics, Debre Markos University, Debre Markos, Ethiopia

Beza Muche Teka

You can also search for this author in PubMed Google Scholar

Contributions

Not applicable since the investigator (Dr. Beza Muche) is sole author. The author read and approved the final manuscript.

Authors information

This review manuscript is done by Dr. Beza Muche Teka. Dr. Beza Muche has seven publications in different reputable international journals.

Corresponding author

Correspondence to Beza Muche Teka .

Ethics declarations

Competing interests.

The author declare that no anyone who have competing interests in this manuscript.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Teka, B.M. Determinants of the sustainability and growth of micro and small enterprises (MSEs) in Ethiopia: literature review. J Innov Entrep 11 , 58 (2022). https://doi.org/10.1186/s13731-022-00261-0

Download citation

Received : 29 October 2021

Accepted : 16 November 2022

Published : 22 November 2022

DOI : https://doi.org/10.1186/s13731-022-00261-0

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Sustainability and growth

- political-legal variables

Leadership in Ethiopia

- First Online: 05 November 2016

Cite this chapter

- Abeba Beyene Mengistu 6 &

- Terri R. Lituchy 7

Part of the book series: Palgrave Studies in African Leadership ((PSAL))

1005 Accesses

1 Citations

The objective of this chapter is to provide vital and well-researched information on indigenous and modern leadership practices and investment opportunities in Ethiopia. Secondary data was obtained from research articles, books, newspapers, and the Internet. Semi-structured interviews were conducted with two foreign and two local leaders. Findings indicate the existence of well-established and currently exercised indigenous and modern leadership practices in the country. Ethiopians were basically described as a very hospitable and respectful people having high self-respect and self-pride. Both secondary and primary data analysis confirm the suitability of the country for investments because of the prevailing huge investment opportunity, political stability, peace and self-security, sufficiently knowledgeable and experienced human resources, and the friendly nature of the Ethiopian people.

A powerful friend becomes a powerful enemy. (Ethiopian Proverb)

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Addis Ababa Chamber of Commerce and Sectoral Associations (AACCSA). (2013). Overall background. Retrieved from http://tradedirectory.addischamber.com/countryprofile.php

Adeyemi, T. O., & Adu, E. T. (2013). Head teachers’ leadership styles’ and teachers job satisfaction in primary schools in Ekiti State, Nigeria. International Journal of Academic Research in Economics and Management Studies, 2 (2), 69–79.

Google Scholar

AFP. (2015, July 24). Barak Obama leaves US for trip to Kenya, Ethiopia. The East African . Retrieved from http://www.theeastafrican.co.ke/news/Obama-leaves-US-Africa-trip-Kenya-Ethiopia--/-/2558/2805576/-/n7f9vhz/-/index.html

Alemnew, Z. (2012, August 19). Interview: Zumara Nuru, the founder of Awara Amba Community. Horn Affairs English. Retrieved from http://hornaffairs.com/en/2014/08/19/zumra-nuru-awra-amba-community/

Alemu, L. Akalu. (2012). A study of socio-cultural identity and adjustment of Ethiopian immigrants in Atlanta (Masters Thesis). Clark Atlanta University, Atlanta.

Alemu, A., Belay, E., Padmaja, K., & Gessesse, T. (2013). Socio-cultural sustainability of the Awra Amba community, and its implications for intervention. International Journal of Innovative Research and Development, 2 (10), 117–120.

Assefa, H., Bienen, D., & Ciuriak, D. (2013). Ethiopia’s investment prospects: A sectoral overview. African Review of Economics and Finance, 4 (2), 203–246.

Atlaw, D., Teklemariam, D., & Dong-Geun, H. (2014). Determinants of foreign direct investment: Reflections from Ethiopia. Social and Basic Sciences Research Review, 2 (2), 85–95.

Baker, C., & Campbell, B. (2013, November). Context matters: An Ethiopian case study. Adapting leadership development methods to serve different cultures. Center for Creative Leadership . Retrieved from http://insights.ccl.org/wp-content/uploads/2015/04/ContextMatters.pdf

Billene. (2014). Ethiopia’s first female deputy prime minister . African Feminism . Retrieved from http://africanfeminism.com/2014/04/11/ethiopias-first-female-deputy-pm/

Birhanu, F. M. (2014). Country report: Ethiopia—Green growth, investment, environment and sustainable development in Ethiopia. IUCNAEL Journal . Retrieved from www.iucnael.org/en/documents/1155-ethiopia/file

Bongela, M. (2012, June 27). Warm-hearted hospitality sets Ethiopia apart. Mail & Guardian . Retrieved from http://mg.co.za/article/2012-05-18-warm-hearted-hospitality-sets-ethiopia-apart

CSA. (2015). Central statistics agency of Ethiopia. Retrieved from http://www.csa.gov.et

Deloitte. (2014). Ethiopia, a growth miracle. Ethiopian Investment Commission . Retrieved from http://www2.deloitte.com/za/en/pages/strategy/articles/ethiopia-growth-miracle.html

Duressa, Z., & Asfaw, M. (2014). Transformational leadership and its applications in the public service organizations of Ethiopia. International Affairs and Global Strategy, 23 , 10–29.

Duressa, Z., & Debela, T. (2014). Leadership effectiveness in public service organizations of Ethiopia: Perceptions of leaders in public service organizations. Journal of Law, Policy and Globalization, 26 , 115–129.

Ekor, M., Adeniyi, O., & Saka, J. (2015). Ethiopia and the BRICS: An assessment of trade and investment flows. Economy , 2(1), 1–9. Retrieved from http://www.asianonlinejournals.com/index.php/Economy/article/view/254/pdf_13

Ethiopian Investment Commission. (2015). Strategic sectors. Retrieved from http://www.investethiopia.gov.et/investment-opportunities/strategic-sectors/ .

Fernandes, C., & Awamleh, R. (2004). The impact of transformational and transactional leadership styles on employee’s satisfaction and performance: An empirical test in a multicultural environment. International Business and Economics Research Journal, 3 (8), 65–76.

Firsing, S. (2015, July 17). Obama’s visit to strengthen America’s ties in East Africa. The Conversation . Retrieved from http://theconversation.com/obamas-visit-to-strengthen-americas-ties-in-east-africa-41740

Gebre-Medhin, S. (2015, March 4). Ethiopia: Ethiopian Herald interview with Prof Ephraim Issac. The Ethiopian Herald . Retrieved from http://nazret.com/blog/index.php/2015/03/04/ethiopia-ethiopian-herald-interview-with

Halpern, O. (2007, August 21). In Ethiopia, one man’s model for a just society. The Christian Science Monitor . Retrieved from http://www.csmonitor.com/2007/0821/p01s02-woaf.html

Hanges, P. J., Dorfaman, P. W., Shteynbrg, G., & Bates, A. L. (2006). Culture and leadership: A connectionist information processing model. Advances in Global Leadership, 4 , 7–37.

Article Google Scholar

Hofstede, G. (2001). Culture’s consequences: Comparing values, behaviors, institutions and organizations across nations (2nd ed.). Beverly Hills, CA: Sage.

Hora, E. A. (2014). Factors that affect women participation in leadership and decision making positions. Asian Journal of Humanity, Art and Literature, 1 (2), 98–118.

India Today. (2013). Narendra Modi when six-year-old sold tea at Vadnagar station, says a new book. Retrieved from http://indiatoday.intoday.in/story/narendra-modi-sold-tea-at-vadnagar-station-says-new-book/1/286117.html

Karbo, T. (2013). Religion and social cohesion in Ethiopia. International Journal of Peace and Development Studies, 4 (3), 43–52.

Kotter, J. P., & Schlesinger, L. A. (1992). Choosing strategies for change. In J. J. Gabarro (Ed.), Managing people and organizations (pp. 395–409). Boston: Harvard Business School Publication.

Kuhnert, K. W., & Lewis, P. (1987). Transactional and transformational leadership: A constructive/developmental analysis. Academy of Management Review, 12 (4), 648–657.

Lunenburg, F. C. (2011). Leadership versus management: A key distinction—At least in theory. International Journal of Management, Business and Administration, 14 (1), 1–4.

Machumu, H. J., & Kaitila, M. M. (2014). Influence of leadership styles on teachers’ job satisfaction: A case of selected primary schools in Songea and Morogoro Districts, Tanzania. International Journal of Educational Administration and Policy Studies, 6 (4), 53–61.

Ministry for Foreign Affairs of Finland. (2014). Country strategy for development cooperation with Ethiopia: 2014–2017. Retrieved from http://formin.finland.fi/public/download.aspx?ID=137909&GUID=%7BA1BB9117-A768-42B0-A5E5-0D179FFE68BD%7D

Nigussie, N., & Demissie, A. (2013). Relationship between leadership styles of nurse managers and nurses’ job satisfaction in Jimma University Specialized Hospital. Ethiopian Journal of Health Science, 23 (1), 49–58.

Northouse, P. G. (2010). Leadership: Theory and practice (5th ed.). Thousand Oaks, CA: Sage.

Okock, O., & Asfaw, M. (2014). Assessment of gender equality in Ethiopia: The position of Ethiopian women’s political representation from the world, Sub-Saharan Africa, and Eastern Africa Ethiopian Civil Service University. Journal of Law, Policy and Globalization, 28 , 102–124.

Okorojo, L. I., Anyanwu, O. J., & Ukpere, W. I. (2014). Impact of leadership styles on teaching and learning process in Imo State. Mediterranean Journal of Social Sciences, 5 (4), 180–193.

Omar, W. A., & Hussin, F. (2013). Transformational leadership style and job satisfaction relationship: A study of structural equation modeling (SEM). International Journal of Academic Research in Business and Social Sciences, 3 (2), 346–365.

Roul, S. K. (2012). Practice and Problems of Principals’ Leadership Style and Teachers’ Job Performance in Secondary Schools of Ethiopia. e-Reflection. An International Multidisciplinary Peer Reviewed E Journal.1 (4), Pages, 227–243.

Sadeghi, A., & Pihie, A. (2013). The role of transformational leadership style in enhancing lecturers’ job satisfaction. International Journal of Business and Social Science, 4 (8), 264–271.

Shibru, B., & Darshan, G. M. (2011). Transformational leadership and its relationship with subordinate satisfaction with the leader (The Case of Leather Industry in Ethiopia). Interdisciplinary Journal of Contemporary Research in Business, 3 (5), 686–697.

Stogdill, R. M. (1974). Handbook of leadership . New York: Free Press.

Tadesse, D. (2013, November 16). The rule of law in the indigenous traditional Gada system. AllAfrica. Retrieved from http://allafrica.com/stories/201311260190.html

Tsegay, T. S. (2012). Some Ethiopian women leaders’ perceptions about their leadership. Advancing Women in Leadership, 33 , 75–86.

Wahab, J. A., Fuad, C. F., Ismail, H., & Majid, S. (2014). Headmasters’ transformational leadership and their relationship with teachers’ job satisfaction and teachers’ commitments. International Education Studies, 7 (13), 40–48.

Waters-Bayer, A. (2003). Daldal: Dams to trap silt and water, on Irob innovation in northern Ethiopia. United Nations Educational Scientific and Cultural Organization . Retrieved from http:// www.unesco.org/most/bpik9-2.htm

Yahaya, N., Mohammad, A., Talib, M., Ismail, J., Shariff, Z., Yahaya, A., et al. (2011). Relationship between leadership personality types and source of power and leadership styles among managers. African Journal of Business Management, 5 (22), 9635–9648.

Zewdu, B. (2002). Systems of local governance among the Gurage: The Yajoka Qicha and the Gordana Sera in Ethiopia. In B. Zewdu & S. Pausewang (Eds.), The challenge of democracy from below (pp. 17–28). Stockholm: ElandersGotab.

Download references

Author information

Authors and affiliations.

Addis Ababa University, Addis Ababa, Ethiopia

Abeba Beyene Mengistu

CETYS Universidad, Mexicali, Baja California, Mexico

Terri R. Lituchy

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Abeba Beyene Mengistu .

Copyright information

© 2017 The Author(s)

About this chapter

Mengistu, A.B., Lituchy, T.R. (2017). Leadership in Ethiopia. In: LEAD: Leadership Effectiveness in Africa and the African Diaspora. Palgrave Studies in African Leadership. Palgrave Macmillan, New York. https://doi.org/10.1057/978-1-137-59121-0_12

Download citation

DOI : https://doi.org/10.1057/978-1-137-59121-0_12

Published : 05 November 2016

Publisher Name : Palgrave Macmillan, New York

Print ISBN : 978-1-137-59119-7

Online ISBN : 978-1-137-59121-0

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

ADDIS ABABA UNIVERSITY SCHOOL OF COMMERCE PROJECT MANAGEMENT Practices of Project Manager Selection in Ethio Telecom

Related Papers

Nur Hanim Abd Ghani

11th International Conference on Management of Technology and Information System

Cíntia Araújo, Ph.D

Information technology (IT) project success is a research topic that has received attention of academics and practitioners, at least, in the lasted two decades (Atkinson, 1999; Delone & Mclean, 2002). Organizations have been making increasing investments on IT to improve productivity and quality of processes (Assis, 2011). Despite all research and investments on IT, the rate of failures on this kind of projects is high (The Standish Group, 2013). Two research questions drive this paper: (1) Do project manager competencies influence team commitment to the IT project success? (2) How can the project team’s commitment affect the success (or failure) of an IT project? In order to answer these questions, we did twelve in-depth interviews with IT project managers of different companies. The main findings show that IT professionals believe that soft skills are indeed more important to guarantee project success than technical skills. The research indicated that project managers who developed soft skills can coordinate their teams better and build commitment within team members.

Hassan H Bodicha

Problem background: The problem of this research paper is centered on project risk management process and its relation to the success of construction projects. Organizations, project managers and all other stakeholders have been complaining of myriads of challenges on how to identify critical factors that can lead to project success. This issue has made these scholars and practitioners to concern themselves with the issue of project success and try to establish some other appropriate factors that measure project success from early as 1960s.These scholars have identified different critical success factors of construction project but how it is impacted on by risk management process is a research gap that this study will try to fill. Purpose: The purpose of this research paper is to establish the effect of project risk management process on the success of construction project. Methodology: The study empirically review literatures on the theoretical framework of project risk management process and its relation to project success in construction industry Conclusions: The study found out that risk factors have significant impact on the success of constructions project success regardless of the type or complexity of the project. This means that the traditional success factors of cost, scope, time and quality are universally inherent in all construction projects and should always be considered as a base for all other forms of critical success factors however this is not a guarantee of project success since the main weakness of project success is not from the traditional success factors but rather the society that is pressurizing project managers to succeed in all tasks. Therefore, critical success factors are necessities aimed at supporting projects managers in tracking various risk factors associated with projects and make an informed decision. Recommendations: Therefore, project managers need to develop a more appropriate critical success factor identification technique in order to avoid the problem of over planning or under planning at the start of the project. When the construction project is being planned, an appropriate measuring tool for critical success factor analysis may need to be identified and defined; this is a gap that needs further research. Also, the literature review on was limited to construction projects only and it is not exhaustive thus confirmation of this work may be done in other sectors. Keywords: Project, risk, risk factors, risk management, project management, project success, success criteria and critical success factors.

IBIMA Business Review Journal

Bogdan Lent

Roberto Sbragia

Project managers can play a key role in implementing organizational strategy by using entrepreneurial approaches when responding to new needs and opportunities. Nevertheless, the operational responsibilities of a project manager – planning and control – are in stark contrast to the characteristics of an entrepreneur. In light of these contradictory viewpoints, it is important to assess whether managers showing entrepreneurial characteristics are associated with more successful projects. A field survey was conducted, involving 164 project managers most of whom were male and had graduate-level education and broad practical business experience. Non-parametric statistics was used and showed that enterprising tendency on the part of project managers is correlated with more successful projects, and creativity, in particular, was one of the most relevant variables.

San Gajadhar

Journal of Project, Program & Portfolio Management

Rosária F S M Russo

The study sought to identify and assess the quality of project management practices as well as the critical success factors for projects in Ghana. The study adopted an exploratory approach and utilized a survey method to collect data on project management practices of Ghanaian organizations. Purposive sampling was used in selecting the sample which comprised 200 managers from different economic sectors. Results from the study indicated that the critical factors that contribute to the success of a project include top management support, effective communication, clarity of project purpose and goals, and stakeholder involvement. Documentation and dissemination of critical success factors and best practices in project management will improve the quality of project management in Ghana. The absence of a structured system of documentation of project management practices among Ghanaian project managers has resulted in a dearth of empirical data. The inability of the researchers to sample organisations across Ghana is considered as one of the study's limitations, an example of a geographical constraint. This research focused on the key factors and best practices that lead to the success of projects in Ghana.

OJSSR 2013, 1(9):238-249

Han Ping Fung

The purpose of this mixed methods sequential explanatory study was to evaluate what are the team outcome factor(s) that can contribute to project performance in Malaysia by surveying 52 project managers. Later, the study continued by following up with six selected participants to investigate those positive results in more detail via an online interview. In the first phase, only one team outcome factor i.e. team satisfaction was tested significantly influencing project performance. In the second phase, multiple case studies were conducted to investigate how and why team satisfaction influences project performance whereby four major themes emerged from the “how” question and one major theme emerged from the “why” question. The findings of both phases were discussed. Limitations and future recommendation were also provided.

RELATED PAPERS

Jesus Aramayo

Ricardo Pinto

Mairead Hogan , Orla McHugh

Procedia Technology

Caroline Dominguez

International Journal of Applied Systemic Studies

David Gallegos

PAK Publishing Group

KANDHA VADIVU

rohman rohman

German Giraldo

German E. Giraldo

Zamri Napiah

Mohammad Ichsan

Loay Alnaji

mbaforum.ir

arash shahin

khairul anwar

eprints.utm.my

Muzani Mustapa

T.R. Gopalakrishnan Nair

2011 Malaysian Conference in Software Engineering

T.R.Gopalakrishnan Nair

GODFRED KOI-AKROFI

Lukáš Vartiak

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

We use cookies that are necessary to make our site work as well as analytics cookie and third-party cookies to monitor our traffic and to personalise content and ads.