Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

More Americans are joining the ‘cashless’ economy

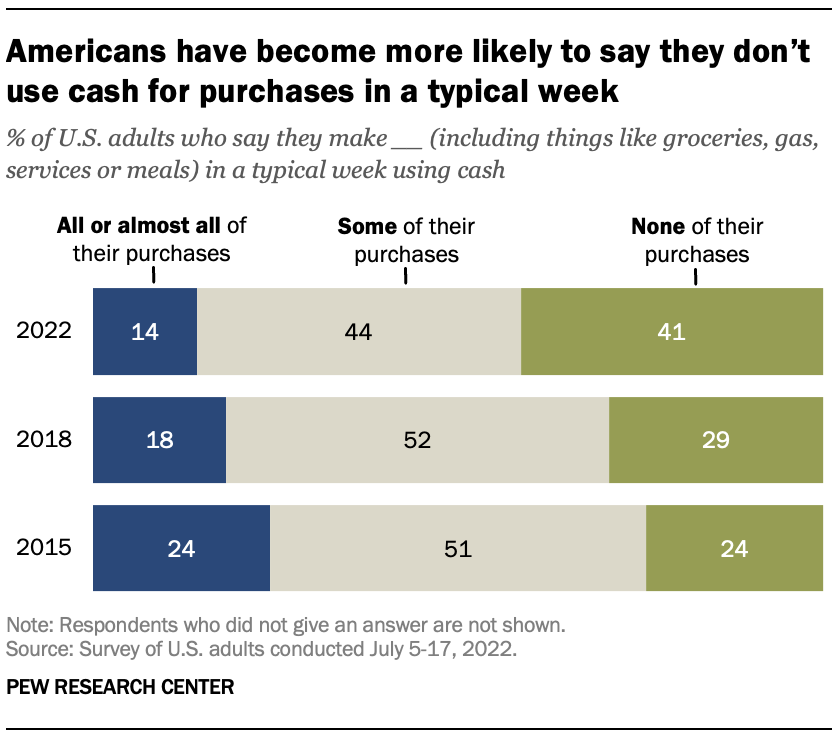

In less than a decade, the share of Americans who go “cashless” in a typical week has increased by double digits. Today, roughly four-in-ten Americans (41%) say none of their purchases in a typical week are paid for using cash, up from 29% in 2018 and 24% in 2015, according to a new Pew Research Center survey.

Conversely, the portion of Americans who say that all or almost all of their purchases are paid for using cash in a typical week has steadily decreased, from 24% in 2015 to 18% in 2018 to 14% today. Still, roughly six-in-ten Americans (59%) say that in a typical week, at least some of their purchases are paid for using cash.

Pew Research Center conducted this study to better understand Americans’ use of cash for everyday purchases and how this practice has changed over time. For the new material in this analysis, the Center surveyed 6,034 U.S. adults from July 5-17, 2022. This included 4,996 respondents from the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. It also included an oversample of 1,038 respondents from Ipsos’ KnowledgePanel. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology .

Here are the questions, responses and methodology used for this analysis.

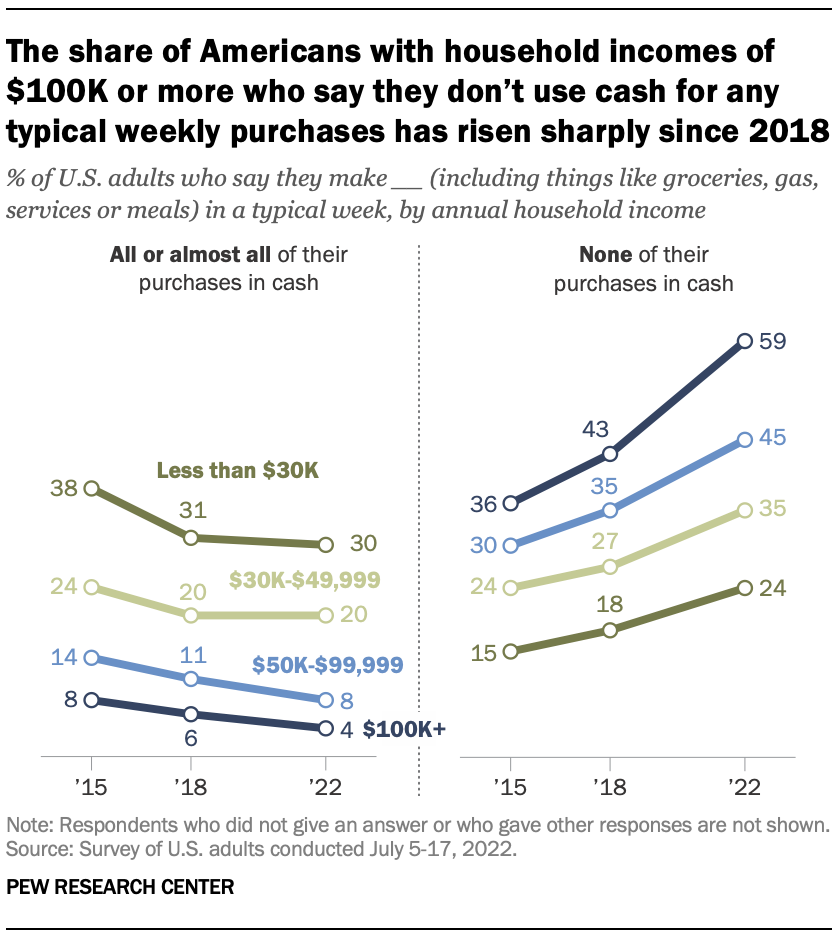

Americans with lower incomes continue to be more reliant on cash than those who are more affluent. Three-in-ten Americans whose household income falls below $30,000 a year say they use cash for all or almost all of their purchases in a typical week. That share drops to 20% among those in households earning $30,000 to $49,999 and 6% among those living in households earning $50,000 or more a year.

Even so, growing shares of Americans across income groups are relying less on cash than in previous years. This is especially the case among the highest earners: Roughly six-in-ten adults whose annual household income is $100,000 or more (59%) say they make none of their typical weekly purchases using cash, up from 43% in 2018 and 36% in 2015.

There are also differences by race and ethnicity in cash usage. Roughly a quarter of Black adults (26%) and 21% of Hispanic adults say that all or almost all of their purchases in a typical week are paid for using cash, compared with 12% of White adults who say the same.

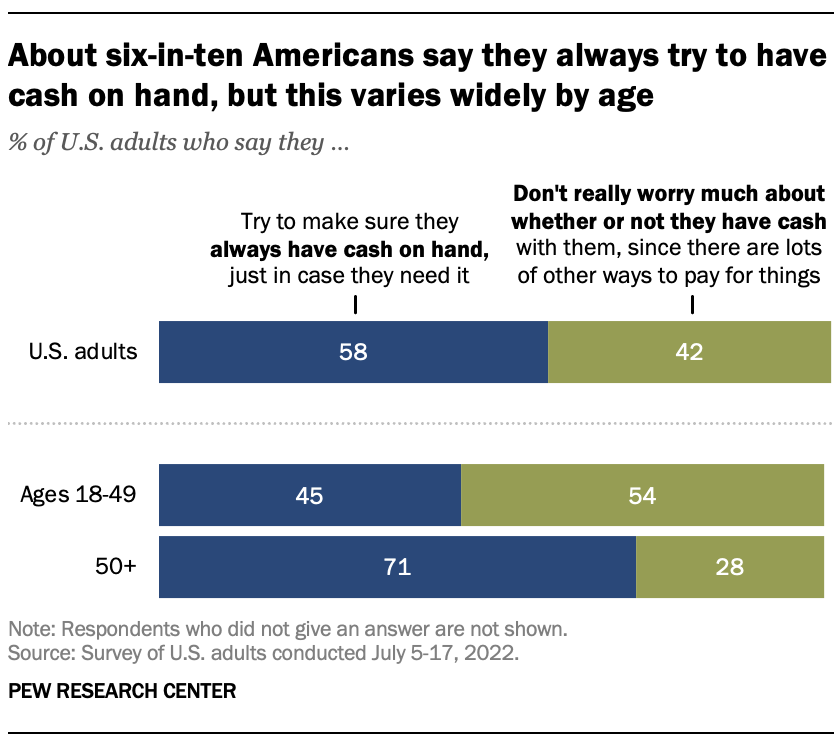

Even though cash is playing less of role in people’s weekly purchases, the survey also finds that a majority of Americans do try to have cash on hand. About six-in-ten adults (58%) say they try to make sure they always have cash on hand, while 42% say they do not really worry much about whether they have cash with them since there are other ways to pay for things. These shares have shifted slightly through the years .

As was true in previous surveys , Americans’ habits related to carrying cash vary by age. Adults under 50 are less likely than those ages 50 and older to say they try to always have cash on hand (45% vs. 71%). And just over half of adults younger than 50 (54%) say they don’t worry much about whether or not they have cash on them, compared with 28% of those 50 and older.

Note: Here are the questions, responses and methodology used for this analysis.

Read more from our series examining Americans’ experiences with money, investing and spending in the digital age:

- For shopping, phones are common and influencers have become a factor – especially for young adults

- Payment apps like Venmo and Cash App bring convenience – and security concerns – to some users

- 46% of Americans who have invested in cryptocurrency say it’s done worse than expected

- Economy & Work

- Emerging Technology

- Personal Finances

- Technology Adoption

Michelle Faverio is a research analyst focusing on internet and technology research at Pew Research Center .

Asian Americans, Charitable Giving and Remittances

A look at small businesses in the u.s., 7 facts about americans and taxes, key facts about asian americans living in poverty, methodology: 2023 focus groups of asian americans, most popular.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Age & Generations

- Coronavirus (COVID-19)

- Family & Relationships

- Gender & LGBTQ

- Immigration & Migration

- International Affairs

- Internet & Technology

- Methodological Research

- News Habits & Media

- Non-U.S. Governments

- Other Topics

- Politics & Policy

- Race & Ethnicity

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

Terms & Conditions

Privacy Policy

Cookie Settings

Reprints, Permissions & Use Policy

Digitalization and the Transition to a Cashless Economy

- First Online: 03 December 2021

Cite this chapter

- Paweł Marszałek ORCID: orcid.org/0000-0002-7935-6178 3 &

- Katarzyna Szarzec ORCID: orcid.org/0000-0002-7675-2239 3

1102 Accesses

3 Citations

The aim of the chapter is to identify the main determinants of the cashless economy, to characterize its impact on the behaviour of economic agents, and to discuss its potential advantages and disadvantages for various agents. The cashless economy is discussed both from the perspective of economic theory and the perspective of the functioning of monetary and financial systems. The most important determinants of the transition to the cashless economy are discussed: digitalization and new technologies; changes in the activities of commercial banks, which are creators of cashless money and quasi-money instruments; changes in customers’ demand for cash; and macroeconomic factors. The cashless economy seems to offer the largest benefits for banks, central banks and big tech companies. They have used new technologies more intensely and have worked on designing their own digital currencies. However, from the point of view of a household, the cashless economy could deepen financial exclusion.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

The relations between different functions of money and possibility of their separation are discussed e.g. by McCallum (2003).

Access to Cash Review: Final Report. (2019). Retrieved from: https://www.accesstocash.org.uk/media/1087/final-report-final-web.pdf

Achor, P. N., & Robert, A. (2012). Shifting policy paradigm from cash-based economy to cashless economy: the Nigeria experience. Afro Asian Journal of Social Sciences, 4, 1–16. Retrieved from: http://www.onlineresearchjournals.com/aajoss/art/124.pdf

Alonso, J., Ganga, H., Belio, J. L., Martín, Á., Mirón, P., Plata, C. T., Rubio, A., Santos, A., & Burke, J. V. (2018, June). The use of cash and its determinants . BBVA Research, Madrid. Retrieved from: https://www.bbvaresearch.com/wp-content/uploads/2018/06/2018-06-The-use-of-cash-and-its-determinants_EDI-vf.pdf

Altavilla, C., Burlon, L., Giannetti, M., & Holton, S. (2019). Is there a zero lower bound? The effects of negative policy rates on banks and firms (Working Paper Series 2289). European Central Bank.

Google Scholar

Angelakis, E., Azhar, E. I., Bibi, F., Yasir, M., Al-Ghamdi, A. K., Ashshi, A. M., Elshemi, A. G., & Raoult, D. (2014). Paper money and coins as potential vectors of transmissible disease. Future Microbiology, 9 (2), 249–261. https://doi.org/10.2217/fmb.13.161

Article Google Scholar

Auer, R., Cornelli, G., & Frost, J. (2020). Covid-19, cash, and the future of payments. BIS Bulletin No 3. https://EconPapers.repec.org/RePEc:bis:bisblt:3 .

Bech, M., & Garratt, R. (2017, September). Central bank cryptocurrencies. BIS Quarterly Review , 55–70. https://EconPapers.repec.org/RePEc:bis:bisqtr:1709f .

Bernholz, P. (2003). Monetary regimes and inflation. History, economic and political relationship. Edward Elgar.

Bindseil, U. (2019). Central bank digital currency: Financial system implications and control. International Journal of Political Economy, 48 (4), 303–335. https://doi.org/10.1080/08911916.2019.1693160

Black, F. (1970). Banking and interest rates in a world without money: The effects of uncontrolled banking. Journal of Bank Research, 1 , 9–20.

Bofinger, P. (2018). Digitalisation of money and the future of monetary policy . VoxEU. Retrieved from https://voxeu.org/article/digitalisation-money-and-future-monetary-policy

Chen, H., Engert, W., Huynh, K., Nicholls, G. & Zhu, J. (2021). Cash and COVID-19: The effects of lifting containment measures on cash demand and use (Discussion Papers 2021-3). Bank of Canada. Retrieved from: https://www.bankofcanada.ca/wp-content/uploads/2021/03/sdp2021-3.pdf

Cochrane, J. H. (1998). “A frictionless view of U.S. inflation,” NBER chapters, In NBER macroeconomics annual, 13 , 323–421, National Bureau of Economic Research, Inc.

Cochrane, J. H. (2005). Money as stock. Journal of Monetary Economics, 52 (3), 501–528. https://doi.org/10.1016/j.jmoneco.2004.07.004

Costa Storti, C., & De Grauwe, P. (2001). Monetary policy in a cashless society (CEPR Discussion paper no. 2696). Brussels. Retrieved from https://ssrn.com/abstract=261872

Cowen, T., & Kroszner, R. (1987). The development of the new monetary economics. Journal of Political Economy, 95 (5), 567–590.

Cronin, D. (2012). New monetary economics revisted. Cato Journal, 32 (3), 581–594.

De Meijer, C. (2010). SEPA for cash. The single European cash area: Towards a more efficient European cash society. EPC Newsletter , 146.

Deloitte. (2020). Global payments remade by COVID-19. Scenarios for resilient leader . Retrieved from: https://www2.deloitte.com/content/dam/Deloitte/global/Documents/Financial-Services/gx-fsi-global-payments-remade-by-covid-19.pdf

Demirgüç-Kunt, A., Klapper, L., Singer, D., Ansar, S., & Hess, J. (2018). Global Findex Database 2017: Measuring Financial Inclusion and the Fintech Revolution . World Bank Group.

EBC. (2000, November). Issues arising from the emergence of electronic money. Monthly Bulletin .

Ejiofor, V. E., & Rasaki, J. O. (2012). Realising the benefits and challenges of cashless economy in Nigeria: Its perspective. International Journal of Advances in Computer Science and Technology, 1 , 7–13.

Engert, W., & Fung, B. S. (2017). Central bank digital currencies: motivations and implications (Staff Discussion Paper 2017-16). Bank of Canada. Retrieved from: https://www.bankofcanada.ca/2017/11/staff-discussion-paper-2017-16/

Fabris, N. (2019). Cashless society—The future of money or a Utopia? Journal of Central Banking Theory and Practice, 8 (1), 53–66. https://doi.org/10.2478/jcbtp-2019-0003

Fama, E. (1980). Banking in the theory of finance. Journal of Monetary Economics, 6 (1), 39–57.

Federal Deposit Insurance Corporation (FDIC). (2020) How America Banks: Household Use of Banking and Financial Services, 2019 FDIC Survey (October 2020) . Retrieved from: https://www.fdic.gov/analysis/household-survey/2019report.pdf

Friedman, B. M. (1999). The future of monetary policy: The central bank as an army with only a signal corps ? International Finance, 2 (3), 321–338. https://doi.org/10.1111/1468-2362.00032

Friedman, B. M. (2000). Decoupling at the margin: The threat to monetary policy from the electronic revolution in banking. International Finance, 3 (2), 261–272.

Gimpel, H., Rau, D., & Roeglinger, M. (2018). Understanding FinTech start-ups—A taxonomy of consumer-oriented service offerings. Electronic Markets, 28 (4), 245–264. https://doi.org/10.1007/s12525-017-0275-0

Gobble, M. A. M. (2018). Digitalization, digitization, and innovation. Research-Technology Management, 61 (4), 56–59. https://doi.org/10.1080/08956308.2018.1471280

Goczek, Ł., & Witkowski, B. (2015). Determinants of non-cash payment (NBP Working Paper No. 196). Retrieved from: https://www.nbp.pl/publikacje/materialy_i_studia/196_en.pdf

Golosova, J., & Romanovs, A. (2018). The advantages and disadvantages of the blockchain technology conference. In 2018 IEEE 6th Workshop on Advances in Information, Electronic and Electrical Engineering (AIEEE) Deutsche Bank Research, Frankfurt, 2016 November .

Gordon, R. J. (2000). Does the „new economy” measure up to the great inventions of the past? The Journal of Economic Perspectives, 14 (4), 49–74. https://doi.org/10.1257/jep.14.4.49

Greenfield, R. L., & Yeager, L. B. (1983). A Laissez-Faire approach to monetary stability. Journal of Money, Credit and Banking, 15 (3), 302–315.

Gupta, V. (2017, February). A brief history of blockchain. Harvard Business Review [online]. Retrieved from: https://hbr.org/2017/02/a-brief-history-of-blockchain

Hakkarainen, P. (2021, February 3). Digitalisation disrupts traditional banking? Speech by Member of the Supervisory Board of the ECB, at the 5th Afore Conference, Frankfurt am Main. Retrieved from: https://www.bankingsupervision.europa.eu/press/speeches/date/2021/html/ssm.sp210203~17a2ae3848.en.html

Hall, R. E. (1982). Monetary trends in the United States and the United Kingdom: A review from the perspective of new developments in monetary economics. Journal of Economic Literature, 20 , 1552–1556.

Handa, J. (2000). Monetary economics . Routledge.

Immordino, G., & Russo F. F. (2016, June). Cashless payments and tax evasion (Center for Studies in Economic and Finance Working paper, 445). https://doi.org/10.12775/CJFA.2017.021

Ingham, G. (2004). Nature of money . Polity.

Ingham, G. (2020). Money . Cambridge: Polity.

Iwańczuk-Kaliska, A. (2017). Challenges for central banks in a changing payments landscape. Financial Internet Quarterly, 13 (2), 75–86.

Jakubowska, M. (2017). The role of cashless Transactions in the process of limiting the scale of the shadow economy. Copernican Journal of Finance & Accounting, 6 (4), 23–37.

Jobs, T. A., & Lin, H. H. (2016). Negative interest rate policy (NIRP): Implications for monetary transmission and bank profitability in the Euro area (IMF Working Papers). Issue 172. https://doi.org/10.5089/9781475524475.001

Jurek, M., & Marszałek, P. (2015). Policy alternatives for the relationship between ECB monetary and financial policies and new member states (FESSUD Working Papers, 112).

King, B. (2018). Bank 4.0: Banking everywhere, never at bank . Marshall Cavendish Business.

King, R., & Shen, A. (2020, March 20). Will cash survive Covid-19? Central Banking . Retrieved from: https://www.centralbanking.com/central-banks/currency/7509046/will-cash-survive-covid-19

Lavoie, M. (2016). Understanding the global financial crisis: Contributions of post-Keynesian economics. Studies in Political Economy, 97 (1), 58–75. https://doi.org/10.1080/07078552.2016.1174463

Leyshon, A., & Thrift, N. (1995). Geographies of financial exclusion: Financial abandonment in Britain and the United States. Transactions of the Institute of British Geographers, New Series, 20 (3), 312–341.

Lietaer, B., & Belgin, S. (2012). New money for a new world . Quiterra Press.

Mai, H. (2016). Cash, freedom and crime: Use and impact of cash in a world going digital (EU Monitor Global financial markets, 23). Deutsche Bank Research. Retrieved from: https://www.dbresearch.com/PROD/RPS_EN-PROD/Cash%2C_freedom_and_crime%3A_Use_and_impact_of_cash_in/RPS_EN_DOC_VIEW.calias?rwnode=PROD0000000000435631&ProdCollection=PROD0000000000441785

Marszałek, P. (2016). Local money systems and their features (FESSUD Working Papers Series, no. 188). Retrieved from: https://www.researchgate.net/publication/318284721_Working_Paper_Series_No_188_Local_money_systems_and_their_features_Local_money_systems_and_their_features

Maurya, P. (2019). Cashless economy and digitalization. In Proceedings of 10th International Conference on Digital Strategies for Organizational Success . Retrieved from: https://ssrn.com/abstract=3309307 or http://dx.doi.org/10.2139/ssrn.3309307

McCallum, B. T. (2004). Monetary policy in economies with little or no money. Pacific Economic Review, 9 , 81–92. https://doi.org/10.1111/j.1468-0106.2004.00213.x

Nakamura, L. (2000). Economics and the new economy: the invisible hand meets creative destruction. The Business Review , 15–30.

Ozili, P.K. (2020). Financial inclusion and Fintech during COVID-19 crisis: Policy solution. The Company Lawyer Journal, 8 . https://doi.org/10.2139/ssrn.3585662

Paneta, F. (2020). From the payments revolution to the reinvention of money, Speech at the Deutsche Bundesbank conference on the “Future of Payments in Europe” . Retrieved from: https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp201127~a781c4e0fc.en.html

Pickhardt, M., & Prinz, A. (Eds.). (2012). Tax evasion and the shadow economy . Edward Elgar Publishing Company.

Reis, J., Amorim, M., Melao, N., & Matos, P. (2018). Digital transformation: A literature review and guidelines for future research. In Á. Rocha, H. Adeli, L. P. Reis, & S. Costanzo (Eds.), Trends and advances in information systems and technologies . WorldCIST'18 2018. Advances in Intelligent Systems and Computing (Vol. 745). Springer. https://doi.org/10.1007/978-3-319-77703-0_41

Reistad, D. (1967). The coming cashless society. Business Horizons, 10 (3), 23–32. https://doi.org/10.1016/0007-6813(67)90080-8

Rifkin, J. (2011). The third industrial revolution: How lateral power is transforming energy, the economy, and the world . Palgrave Macmillan.

Rogoff, K. (2016). The curse of cash . Princeton University Press.

Book Google Scholar

Rogoff, K. (2017). Dealing with monetary paralysis at the zero bound. Journal of Economic Perspectives, 31 (3), 47–66. https://doi.org/10.1257/jep.31.3.47

Rogoff, K. S. (2014). Costs and benefits to phasing out paper currency (NBER Working Paper No. 20126, NBER Macroeconomics Annual Conference, 29). https://doi.org/10.1086/680657

Sahay, R., Eriksson von Allmen, U., Lahreche, A., Khera, P., Ogawa, S., Bazarbash, M., & Beaton, K. (2020). The promise of Fintech: Financial inclusion in the post Covid-19 era (IMF Departmental Paper, No. 20/09). Retrieved from: https://www.imf.org/en/Publications/Departmental-Papers-Policy-Papers/Issues/2020/06/29/The-Promise-of-Fintech-Financial-Inclusion-in-the-Post-COVID-19-Era-48623

Sajter, D. (2013). Privacy, identity, and the perils of the cashless society, conference: Culture, identity, society—European realities, Osijek, Croatia, 20–21.03.2013 . Retrieved from: https://www.researchgate.net/publication/326060290_Privacy_Identity_and_the_Perils_of_the_Cashless_Society

Schneider, F. (2013). The shadow economy in Europe . A.T. Kearney.

Schneider, F. (2019). Restricting or abolishing cash: An effective instrument for eliminating the shadow economy, corruption and terrorism? Some remarks. SUERF Conference Proceedings, Vienna.

Schwab, K. (2016). The fourth industrial revolution . Penguin.

Sennett, R. (2006). The culture of the new capitalism . Yale University Press.

Serhan, C. (2020). Dirty money: Does the risk of infectious disease lower demand for cash? (IMF Working Papers). https://doi.org/10.5089/9781513560892.001

Stiroh, K. (1999). Is there a new economy? Challenge, 42 (4), 82–101.

Strebko, J., & Romanovs, A. (2018). The advantages and disadvantages of the blockchain technology. In 2018 IEEE 6th workshop on advances in information, electronic and electrical engineering (AIEEE) (pp. 1–6). https://doi.org/10.1109/AIEEE.2018.859225

Warchlewska, A. (2020). Will the development of cashless payment technologies increase the financial exclusion of senior citizens? Acta Scientiarum Polonorum – Oeconomia, 19 (2). https://doi.org/10.22630/ASPE.2020.19.2.21

White, L. H. (1987). Accounting for non-interest-bearing currency: A critique of the legal restrictions theory of money. Journal of Money, Credit and Banking, 19 (4), 448–456.

Wisniewski, T. P., Polasik, M., Kotkowski, R., & Moro, A. (2021, February 28). Switching from cash to cashless payments during the COVID-19 pandemic and beyond . https://doi.org/10.2139/ssrn.3794790

Wolman, D. (2012). The end of money. Counterfeiters, preachers, techies, dreamers—And the coming cashless society . Da Capo Press.

Woodford, M. (1998). Doing without money: Controlling inflation in a post-monetary world. Review of Economic Dynamics, 1 (1), 173–219. https://doi.org/10.1006/redy.1997.0006

Woodford, M. (2003). Interest and prices . Princeton University Press.

Worthington, S. (2000). Changes in payments markets, past, present and future: A comparison between Australia and the UK. International Journal of Bank Marketing, 18 (5), 212–221. https://doi.org/10.1108/02652320010356771

Yaqub, J. O., Bell, H. T., Adenuga, I. A., & Ogundeji, M. O. (2013). The cashless policy in Nigeria: Prospects and challenges. International Journal of Humanities and Social Science, 3 (3), 200–212.

Yeager, L. B. (1983). Stable money and free market currencies. Cato Journal, 3 (1), 305–333.

Yeager, L. B. (1985). Deregulation and monetary reform. American Economic Review, 75 (2), 103–107.

Zelizer, V. (1989). The social meaning of money: “Special monies.” American Journal of Sociology, 95 (2), 342–377.

Download references

Acknowledgements

The project is financed within the Regional Excellence Initiative programme of the Minister of Science and Higher Education of Poland, years 2019–2022, grant no. 004/RID/2018/19, financing 3,000,000 PLN.

Author information

Authors and affiliations.

Poznań University of Economics and Business, Poznań, Poland

Paweł Marszałek & Katarzyna Szarzec

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Paweł Marszałek .

Editor information

Editors and affiliations.

Department of International Marketing, Poznań University of Economics and Business, Poznań, Poland

Milena Ratajczak-Mrozek

Department of Money and Banking, Poznań University of Economics and Business, Poznań, Poland

Paweł Marszałek

Rights and permissions

Reprints and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Marszałek, P., Szarzec, K. (2022). Digitalization and the Transition to a Cashless Economy. In: Ratajczak-Mrozek, M., Marszałek, P. (eds) Digitalization and Firm Performance. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-83360-2_10

Download citation

DOI : https://doi.org/10.1007/978-3-030-83360-2_10

Published : 03 December 2021

Publisher Name : Palgrave Macmillan, Cham

Print ISBN : 978-3-030-83359-6

Online ISBN : 978-3-030-83360-2

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

- Login To RMS System

- About JETIR URP

- About All Approval and Licence

- Conference/Special Issue Proposal

- Book and Dissertation/Thesis Publication

- How start New Journal & Software

- Best Papers Award

- Mission and Vision

- Reviewer Board

- Join JETIR URP

- Call For Paper

- Research Areas

- Publication Guidelines

- Sample Paper Format

- Submit Paper Online

- Processing Charges

- Hard Copy and DOI Charges

- Check Your Paper Status

- Current Issue

- Past Issues

- Special Issues

- Conference Proposal

- Recent Conference

- Published Thesis

Contact Us Click Here

Whatsapp contact click here, published in:.

Volume 6 Issue 1 January-2019 eISSN: 2349-5162

UGC and ISSN approved 7.95 impact factor UGC Approved Journal no 63975

Unique identifier.

Published Paper ID: JETIRT006018

Registration ID: 191701

Page Number

Post-publication.

- Downlaod eCertificate, Confirmation Letter

- editor board member

- JETIR front page

- Journal Back Page

- UGC Approval 14 June W.e.f of CARE List UGC Approved Journal no 63975

Share This Article

Important links:.

- Call for Paper

- Submit Manuscript online

- Dr.V.Chandrakala

Cite This Article

2349-5162 | Impact Factor 7.95 Calculate by Google Scholar An International Scholarly Open Access Journal, Peer-Reviewed, Refereed Journal Impact Factor 7.95 Calculate by Google Scholar and Semantic Scholar | AI-Powered Research Tool, Multidisciplinary, Monthly, Multilanguage Journal Indexing in All Major Database & Metadata, Citation Generator

Publication Details

Download paper / preview article.

Download Paper

Preview this article, download pdf, print this page.

Impact Factor:

Impact factor calculation click here current call for paper, call for paper cilck here for more info important links:.

- Follow Us on

- Developed by JETIR

IMAGES

VIDEO

COMMENTS

The cashless society is a collective vision of global citizens to create a f aster, more flexible, automated payment system. This study aims to formulate. findings on publications from 2012-2022 ...

The idea of a cashless economy appeared long before the feasibility of cashless instruments (Bátiz-Lazo, Haigh and Stearns, 2016). ... the main aim of this paper is to provide additional evidence for which factors are determinants of a cashless economy. This research aims to understand which factors among socioeconomic variables (including ...

In less than a decade, the share of Americans who go "cashless" in a typical week has increased by double digits. Today, roughly four-in-ten Americans (41%) say none of their purchases in a typical week are paid for using cash, up from 29% in 2018 and 24% in 2015, according to a new Pew Research Center survey.. Conversely, the portion of Americans who say that all or almost all of their ...

Considering the variety of legal, economic, social and technological concerns involved, this special issue adopts 2 complementary foci to study cashlessness in India: technological visions and the systems undergirding it, and practices of end users. The special issue includes four papers. The first paper argues that the Digital India programme ...

The aim of the chapter is to identify the main determinants of the cashless economy, to characterize its impact on the behaviour of economic agents, and to discuss its potential advantages and disadvantages for various agents. ... As was argued in pre-COVID research, a virus could live on paper money and coins (Angelakis et al., 2014), thus ...

This research paper analyzes the trends and progress of digital payment for transactions in India and the developments to make India a cashless economy. It also examines whether a long-promised cashless society will become a reality, or will currency continue to play a critical role in everyday transactions, as it had for decades?

increase in prices, causing the economy toexperience inflation (Al-laham and Al-tarawneh 2009). There is no conclusive evidence on how the adoption of cashless payment might affect an economy. Cashless payment might have a positive impact on economic activ-ities (Hasan et al. 2012; Oyewole et al. 2013; Zandi et al. 2013) but it also provide

Lecturer, Department of Economics, Guru nanak girls P G College, Udaipur Email - [email protected]. Abstract: The shift towards a cashless economy, accelerated by advancements in digital payment technologies, has become a global phenomenon with far-reaching implications. This paper provides a thorough examination of.

The purpose of this paper is to stimulate research on DPS 2.0 concerning marketing's impact on the progress toward a cashless economy. Unlike the original DPS 1.0 system, DPS 2.0 enables cashless, virtual, automated, faster, flexible, and interoperable transactions aided by Web 2.0/Web 3.0, machine technology (e.g., POS, AI), mobile devices ...

In a cashless economy, all transactions take place online using . methods like debit/credit cards, Immediate Payment ... Quantitative Research Review, 2(2). Paper ID: SR23712131445 DOI: 10.21275/SR23712131445 1026 . Title: A Study of Cashless Transactions in Indian Economy: A Systematic Literature Review

The presented research paper analyses the progress made towards cashless economy in India during the years 2017-18 to 2021-22. For this, the data released by RBI in the Annual Progress Report 2020 and ... towards cashless economy is measured on the basis of percentage growth in paper based cashless payment and online payment modes and their ...

A cashless economy includes e-banking (mobile Banking/ Internet Banking), debit and credit cards, card swipe or point of sale(POS) machine and digital wallets where all types of transactions ... features difficulty in adopting a cashless economy in India. Pramana Research Journal Volume 9, Issue 3, 2019 ISSN NO: 2249-2976 29 https ...

paperless, cashless economy. The paper is aimed towards creating a sense of awareness about cashless economy, its benefits, challenges and the steps taken by government toward cashless economy. After the research conducted it was seen that cashless economy comes with various benefits but brings in a lot more challenges with it. Dr. Asha Sharma ...

Abstract : The purpose of this research is to investigate India's potential transition to a cashless economy, focusing on both the country's strengths and its limitations in this regard. The notion of a cashless economy is one of the most cutting-edge and in-demand ideas in the economics world today, and prominent economists are taking notice ...

The nature of cash indeed guarantees universal access to a basic means of payment for everyone. However, Rogof and Rogof (2017) states the risk of financial exclusion in a cashless economy, that is, the inability to access appro-priate financial services, of some groups. If cash disappears, financial exclusion might be.

This paper discusses the current scenario of Cashless India after demonization. It also strives to describe the focuses on the impact of devaluation on our economy, counterfeit currency, and challenges towards a cashless economy. 03. RESEARCH METHODOLOGY The prepared paper is a descriptive study of nature. The study has been carried out based ...

Introduction. Payment for daily consumption can be made by physical cash or cashless payment tools. Some frequently used cashless payment tools were credit transfer payments, cheques, direct debits (Tee and Ong 2016), credit cards (Shy 2020), charge cards and e-wallets (Teng and Khong 2021; Alam et al. 2021).Consumers used cashless payments due to their convenience (Jebarajakirthy and Shankar ...

Thus an attempt is made to study the cashless economy in India and to find out the benefits and challenges faced by people in India. OBJECTIVES OF THE PAPER 1. To study the concept of cashless economy. 2. To know the benefit and challenges of cashless economy. 3. To know the modes of cashless transactions. RESEARCH METHODOLOGY

This paper focus on concept of cashless economy, pros & cons and to know the modes of cashless transactions. The digital India is a leading programme of the government of India with a vision to convert India into a digitally authorized society and knowledge economy. "Faceless, Paperless, Cashless" is one of the declared rule of digital India.

RIYADH: Cashless payments in Saudi Arabia are expected to surge by 7.6 percent in 2024 to SR550 billion ($146.8 billion) as compared to SR511.5 billion the previous year, a report said. The report ...

The Indian economy is moving towards cashless economy after the demonetization of Indian currency notes on November 8, 2016 .The initial awe and confusion has given way to a whole lot of concerns ...