- Search Search Please fill out this field.

Why Is Investing Important?

Investing is not just beneficial, it is necessary for retirement

:max_bytes(150000):strip_icc():format(webp)/image0-MichaelBoyle-30f78c37d3174fe298f9407f0b5413e2.jpeg)

What Is Investing?

Why should you invest, how much money should you invest, how to start investing, frequently asked questions (faqs).

mapodile / Getty Images

Not everyone saves for retirement, and even those who do may not be putting away nearly enough to last through the retirement years. A 2020 Federal Reserve study showed that about 25% of non-retirees were not saving for retirement. However, everyone needs to invest to create wealth, beat inflation, and save for retirement and other financial goals.

Investing does not need to involve saving large sums of money. Due to compound interest, you can earn money on your initial amount invested plus all the accumulated interest from previous periods. While everyone should be investing, each person has a different investment strategy that fits their personal and financial goals.

Learn what investing is, how much money you should invest, different investment strategies, and where to begin when investing.

Key Takeaways

- You do not need a lot of money to begin investing. Even small amounts of your money can earn money faster due to the power of compounding.

- Investing can help to create wealth, meet financial goals, beat inflation, and save for retirement.

- One investment strategy does not fit everyone. Your investment choices will differ from those of your friends and family.

- Your investment strategy depends on your financial situation, how much risk you are willing to take, how long you hope to invest, and other factors.

Investing is the act of purchasing assets or goods with a goal of generating income and appreciation. Investments, which are assets or goods purchased, are used to create future wealth. Often, these goods are in the form of stocks or bonds, but can also involve real estate or alternative assets such as cryptocurrency or gold.

Investing your money is important for a few reasons. You want to create wealth to help during times of need, job loss, or for future goals. You also want to take advantage of compounding while taking into consideration inflation, so your money is not worth less over time. In addition, if you plan on stopping work at some point and retiring, investing is important to help you achieve those goals.

Let’s examine a few of the reasons why investing is so important.

Wealth Creation

Wealth could mean different things to different people. It could mean a certain amount of money in your bank account, or it could be defined as certain financial goals you set for yourself. Either way, investing can help you get there.

If your aim is paying off debt, sending your child to college, buying a home, starting a business, or saving for retirement, investing can help you reach those goals faster than money accumulating in your bank account. By investing, you can build wealth, which is the increase in value of all of your assets.

Wealth creation is not just a goal that may help you through your lifetime. You can leave behind a financial legacy by building generational wealth through investing. Generational wealth can not only provide strong financial footing for your children, but may be a step toward bridging the wealth gap faced by many communities.

Compounding

With investing, you can take advantage of compound interest . Compound interest is the interest you earn on your invested money plus the money earned in each prior period. It is sometimes called “interest on interest.” Compound interest allows you to grow your wealth quickly. For example, if you invested $50 a month for 15 years, your total contribution over that period would be $9,000. Assuming a 10% rate of return, that $9,000 would grow to over $19,000 in that period thanks to compound interest.

You can visualize different scenarios of how your money would grow by using a compound interest calculator .

To Beat Inflation

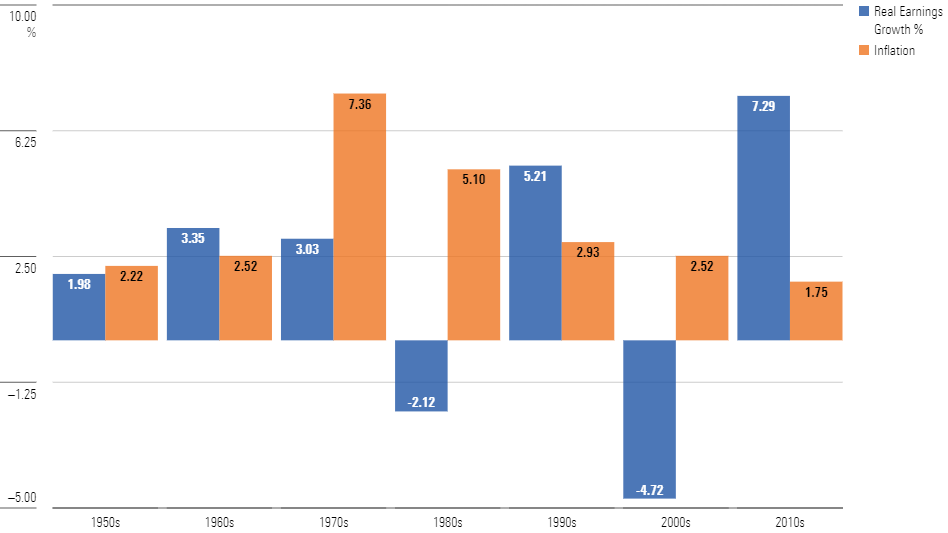

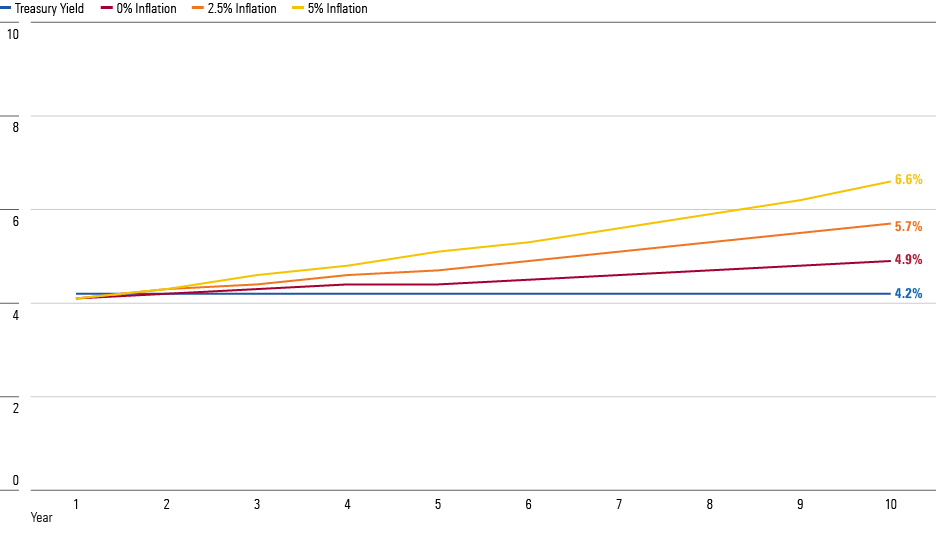

Inflation refers to the overall increase in price level of products over time. If prices are rising over time, this means your money buys less today than it did yesterday. If there is inflation over a period of 30 or 40 years, your money will be worth considerably less while the cost of living has grown. One way to beat inflation is to invest your money. If your money earns more than the inflation rate, this means your money is worth more tomorrow than it is today.

If you plan on stopping work and retiring, you need to have a large amount of money saved to live off of when you no longer work. Investing can help bridge the gap between what you save and what you need to live off of for 20 or 30 years.

To start investing for retirement, you can start working backward from a number you set for yourself for retirement savings. That number can be determined by thinking about how soon you want to retire, and what kind of lifestyle and expenses you think you will have in retirement. You then can come up with an investing strategy for retirement aligning your current financial situation with your retirement goals.

While you can invest for short-term goals such as buying a home, most people invest to fund their retirement. In the U.S., people typically choose to retire around 65 years old if they are financially able to. This means that for the reminder of their lifetime, they will need to rely on their investments to fund their lifestyle. There are still expenses that need to be paid in retirement, such as utilities, housing, food, and any travel.

To figure out how much you should invest now to fund retirement or other goals, financial experts suggest a few different methods.

These rules or formulas may not work for everyone. Consider your financial situation before deciding how much and how to invest your money.

Save 20% of Your Paycheck

Some experts suggest saving 20% of your paycheck . That means you can live off 80% of your income for all of your housing, needs, and wants. This method is used by many for the simplicity in setting aside a portion of their money each paycheck. In most cases, you can automate 20% of your paycheck to go directly into an investment account each month, which makes this method one of the most favorable methods to use. However, that may not be possible for everyone.

The 4% Rule

Another rule of thumb that many financial experts use is the 4% rule. It suggests that by withdrawing 4% of your retirement funds each year, you will have enough money to live off of, while still generating enough returns to maintain its current value even after adjusting for inflation. For example, if you have $1.25 million in retirement savings, in accordance with the 4% rule, you could withdraw $50,000 in the first year. The next year, you should be able to withdraw another 4% of the remaining balance, and the cycle should continue for each year you live in retirement.

This rule is useful because if you can estimate your annual expenses in retirement, you can work backward from this amount, and determine how much money you need to save each month during the time you have left until retirement.

One Investment Strategy Does Not Fit All

Your investment strategy is personal and should depend on your goals and risk tolerance. You may have a few short-term goals, such as purchasing a car or home, and also some longer-term goals, such as saving for retirement. Understanding your personal risk tolerance is important because different people are willing to stomach large swings in the value of their investments, while others get very nervous if an investment falls in value.

Often, investments recover in the long run. The S&P 500, which is one of the major stock indexes people track, has given an annualized 12% return over the last 10 years as of March 2022.

If you are uncomfortable with risk, this will shape your investment strategy toward more diversified or even short-term assets. Longer-term investments could be riskier in some assets because there is more uncertainty over a longer time horizon; however, for some assets, a longer investment period may help average out periods of outsized short-term gains or losses.

With investing, there is a risk-reward trade-off, which means when an asset has more risk, it tends to pay a bigger reward.

Figuring out your personal investing strategy may take some time, and most investors adapt their strategies because their life circumstances are different and may change over time. For example, people who are younger tend to be riskier in their investments, whereas older adults tend to be less risky since they have fewer working years to recoup any investment losses.

Bridging the Wealth Gap

Investing can also help people and communities who often find the deck stacked against them due to the wealth gap when it comes to financial opportunities.

Women, for example, typically would need to invest more and for a longer period of time to meet retirement goals, because they are often paid lower than their male counterparts for the same job, and because the average worldwide lifespan of a woman is seven years longer. Even though research suggests that women are better investors than men, they tend to be more conservative in their investments, so taking a more proactive and aggressive strategy could benefit women.

Individuals within Black or Hispanic communities are known to have less resources and wealth, which is exacerbated by the worsening of the racial wealth gap . According to the 2019 Survey of Consumer Finances, Black households had 7.8 times less median household wealth, and Hispanic households had 5.2 times less median household wealth than White households. Investing may be a small step toward helping to narrow down this wealth gap.

You don’t need thousands of dollars to begin investing. You can set aside a little money each month to begin your investing journey. Let’s think about a simple example in which you set aside $100 each month from the age of 25 to 65. If you just put this money into your checking account, you would end up with $48,000 in 40 years ($100 x 12 months x 40 years = $48,000). However, if you invest the money and earn a 10% annual interest rate, compounded annually, your $48,000 will grow to more than $530,000. Your money makes money over time.

You can begin investing by talking to your employer to see if they have a retirement account such as a 401(k) or 403(b). You can contribute a portion of your paycheck each pay period toward your retirement account and begin selecting investments that are offered to you. If you are not offered a retirement account at your employer, you can also invest in an individual retirement account (IRA) .

You can open one at a brokerage firm or an online brokerage firm such as TDAmeritrade, Wealthfront, or Charles Schwab. At a brokerage firm, you can also open a private investment account to begin investing. These types of accounts do not have penalties if you pull out your money before you hit a certain age, like a retirement account does, but they also do not have some of the tax benefits that come with a retirement account.

Why is diversification important in investing?

Diversification allows you to spread your money across many investments, which minimizes risk. If one company or asset class does not perform well, diversification will ensure you do not lose all of your money, because you have multiple investments.

Why is investing important at a young age?

Investing early allows you to take advantage of compound interest. Investing at an earlier age also allows you to begin creating wealth sooner. If you wait to begin investing, you may need to put away a lot more of your paycheck to meet your personal and financial goals.

Why is ESG investing important?

ESG investing is also commonly called “socially responsible investing” or “impact investing.” ESG investing is important because matching your investment choices with your personal feelings and goals allows your money to work toward companies you feel are important for society.

Board of Governors of the Federal Reserve System. “ Report on the Economic Well-Being of U.S. Households in 2019, Featuring Supplemental Data From April 2020 .”

S&P Dow Jones Indices. “ S&P 500 .”

PRB. “ Around the Globe, Women Outlive Men .”

Mercer. " Inside Employees Minds Women & Wealth .”

Fidelity. " Who's the Better Investor: Men or Women? "

Federal Reserve. “ Changes in U.S. Family Finances From 2016 to 2019: Evidence From the Survey of Consumer Finances ,” Page 11.

Home — Essay Samples — Economics — Stock Market — The Significance of the Stock Market: History, Function, and Future

The Significance of The Stock Market: History, Function, and Future

- Categories: Stock Market

About this sample

Words: 749 |

Published: Jan 30, 2024

Words: 749 | Pages: 2 | 4 min read

Table of contents

History of the stock market, structure and function of the stock market, factors affecting the stock market, benefits and risks of investing in the stock market, strategies for successful stock market investing, the stock market and the economy, challenges and future of the stock market.

- Bodie, Z., Kane, A., & Marcus, A. (2014). Investments . McGraw Hill Education.

- Graham, B., & Dodd, D. (2010). Security Analysis: The Classic 1934 Edition . McGraw-Hill Professional.

- Malkiel, B. G. (2015). A random walk down Wall Street: The time-tested strategy for successful investing . WW Norton & Company.

- Shiller, R. J. (2017). Irrational Exuberance . Princeton University Press.

- Investopedia. (2021). The Stock Market: A Beginner's Guide . Retrieved from https://www.investopedia.com/articles/basics/06/savinginvesting.asp

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Dr. Karlyna PhD

Verified writer

- Expert in: Economics

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

5 pages / 2597 words

2 pages / 1025 words

2 pages / 1099 words

2 pages / 1045 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Stock Market

About ASICASIC (Australian Securities and Speculations Commission) is Australia's corporate, markets and money related administrations supplier. They give help to Australia's monetary notoriety and development by confirming that [...]

A recent line of research found that trust plays an important role in financial decision-making. A great deal of confidence that the financial sector is fair is required for Investing in the stock market and financial products [...]

“Supply and demand” are two of the most well-known words in the subject of economics. Simply put, “supply” is the amount of something that is available, or can be made available, to consumers. “Demand” is how much consumers want [...]

Terrorism financing refers to activities that provides financing or financial support to individual terrorists or terrorist groups. A government that maintains a list of terrorist organizations normally will also pass laws to [...]

This paper analyzes the compliance of distributed, autonomous block chain management systems (BMS) like Bitcoin with the requirements of Islamic Banking and Finance. The following analysis shows that a BMS can conform with the [...]

The burgeoning economic growth that corporate India witnessed since the 1990s brought to the forefront the need for Indian companies to adopt corporate governance practices and standards, which are consistent with [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Stock Market and Small Investors Expository Essay

Introduction, factors that determine the quality of stock, disadvantages faced by small investors when investing in the stock market, advantages enjoyed by small investors when investing in the stock market.

The stock market is one in which shares are traded. This trading may either be through exchanges or sometimes it might be carried out through over-the-counter markets. The stock market is also referred to as the equity market and it serves as one of the most important areas of a country’s economy (Bogle, 2010). A stock market offers an opportunity to companies to gain more investors while being able to access more capital.

The stock market can either be primary or secondary. In a primary market, there is issuance of shares whereas subsequent trading of shares takes place in the secondary market (North & Caes, 2011).

The stock market offers excellent investment opportunities where the money invested earns a good return either in form of capital appreciation or regular income from dividends. Stocks are preferably purchased for investment purposes when their prices are low so that they produce relatively high profits through dividends.

To determine the quality of various stocks, an investor should consider a number of factors. These factors include management of the company, the products offered by the company, the competitive position of the market, the asset base, the company’s liquidity, the volatility of the stock, and the strength of the company’s corporate governance (North & Caes, 2011).

Depending on the number of shares held by different investors, the issue of ‘big’ investors and ‘small’ investors come up. As the words suggest, ‘big’ investors are those who hold more shares while ‘small’ investors refer to those holding a lesser number of shares. The question that arises is, who between the ‘big’ or ‘small’ investors enjoy the most benefits or endure the most disadvantages?

Small investors are faced with the difficulty of building a diversified portfolio. Whereas big investors may have enough money to purchase as many stocks as they want, small investors lack these funds and they are only able to purchase a few stocks.

This becomes very risky since they concentrate all their money in that investment (Fisher, 2012). In addition, the administrative costs that are charged on these few stocks may at times be too high for the small investors to afford their upkeep.

Some firms may also set a very high minimum opening requirement as the deposit. This makes it very difficult for small investors to navigate their way in the stock markets. Small investors are also faced with the problem of high fees which are charged as a percentage of their total investment (Lensink, Bo, & Sterken, 2001). This in turn reduces the dividends they receive at the end of a financial period.

Ironically, small investors derive their benefits from their portfolios size. As earlier discussed, small investors are just that, small. In fact, they are advised to remain just as small as they are. Unlike the ‘big’ investor, ‘small’ investors can just purchase the top picks when they are on offer in the sector (DePorre, 2007).

This is mainly because the purchases of the small investor do not largely affect the prices of the shares in the market since they only deal with a few stocks unlike the big investors who would influence the share prices in the market.

In addition, the small investors are able to act with greater speed to every available opportunity in the sector than the big investors since they manage their own undertakings (Cohen, 2012). Furthermore, the risk endured by small investors is very minimal since only a few stocks are involved unlike the big investors who deal in massive stocks.

In conclusion, the misconception that small investors do not stand a chance against the big investors in the stock market should be cleared. On one hand, there are advantages to them remaining just small while on the other hand, there may be some advantages that tag along these small investors.

Bogle, J. C. (2010). The Little Book of Common Sense Investing: The Only Way to Guarantee Your Fair Share of Stock Market Returns. New Jersey: John Wiley & Sons.

Cohen, G. (2012, August 12). How Small Investors Gain Such a Big Advantage Over Wall Street . Web.

DePorre, J. R. (2007). Invest Like a Shark: How a Deaf Guy with No Job and Limited Capital Made a Fortune Investing in the Stock Market. New Jersey: FT Press.

Fisher, P. A. (2012). Common Stocks and Uncommon Profits, Paths to Wealth through Common Stocks, Conservative Investors Sleep Well, and Developing an Investment Philosophy. New Jersey: John Wiley & Sons, 2012.

Lensink, R., Bo, H., & Sterken, E. (2001). nvestment, Capital Market Imperfections, and Uncertainty: Theory and Empirical Results. Massachusetts: Edward Elgar Publishing.

North, C., & Caes, C. J. (2011). The Stock Market. New York: The Rosen Publishing Group.

- Dividend Policy of Large Publicly-Traded Company

- Emirati Investor's Portfolio Management

- The Personal Stock Investing

- Hellenic Community Trust: Investment

- Benefits and Pitfalls of Investing in a Unique Supplier of Vendor-Managed Inventory

- Overall Attractiveness of China as Potential Markets and Investment Sites

- Investment Appraising Methods

- Problems of Insider Trading

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2019, July 5). Stock Market and Small Investors. https://ivypanda.com/essays/stock-market-investments/

"Stock Market and Small Investors." IvyPanda , 5 July 2019, ivypanda.com/essays/stock-market-investments/.

IvyPanda . (2019) 'Stock Market and Small Investors'. 5 July.

IvyPanda . 2019. "Stock Market and Small Investors." July 5, 2019. https://ivypanda.com/essays/stock-market-investments/.

1. IvyPanda . "Stock Market and Small Investors." July 5, 2019. https://ivypanda.com/essays/stock-market-investments/.

Bibliography

IvyPanda . "Stock Market and Small Investors." July 5, 2019. https://ivypanda.com/essays/stock-market-investments/.

- Call 1-800-769-2560

- Now & Noteworthy

- Ideas & Motivation

- Tech & Culture

- Investing Academy

- Investing Truths

- Question of the Week

- Investing Guides

Key Benefits of Investing In Stocks

Stocks can be a valuable part of your investment portfolio. Owning stocks in different companies can help you build your savings, protect your money from inflation and taxes, and maximize income from your investments. It's important to know that there are risks when investing in the stock market. Like any investment, it helps to understand the risk/return relationship and your own tolerance for risk.

Let's look at three benefits of investing in stocks.

Build. Historically, long-term equity returns have been better than returns from cash or fixed-income investments such as bonds. However, stock prices tend to rise and fall over time. Investors may want to consider a long-term perspective for their equity portfolio because these stock-market fluctuations do tend to smooth out over longer periods of time.

Protect. Taxes and inflation can impact your wealth. Equity investments can give investors better tax treatment over the long term, which can help slow or prevent the negative effects of both taxes and inflation.

Maximize. Some companies pay shareholders dividends 1 or special distributions. These payments can provide you with regular investment income and enhance your return, while the favourable tax treatment for Canadian equities can leave more money in your pocket. (Note that dividend payments from companies outside of Canada are taxed differently.)

Different Stocks, Different Benefits

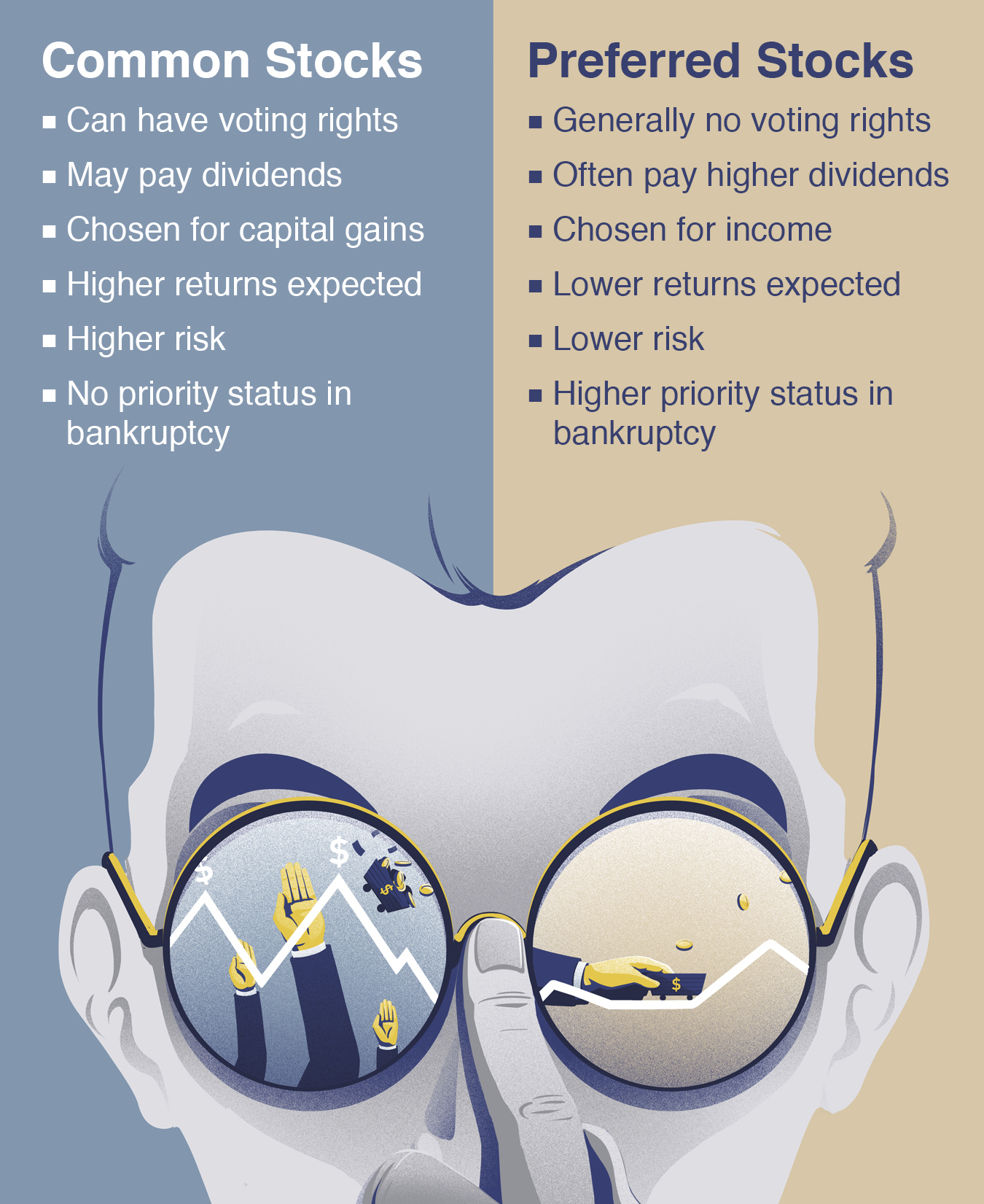

The two main types of equity investments below can each offer investors different benefits .

1. Common shares

Common shares are the most (you guessed it!) common type of equity investment for Canadian investors. They can offer:

Capital growth. The price of a stock will go up or down over time. When it goes up, shareholders can choose to sell their shares at a profit.

Dividend income. Many companies pay dividends to their shareholders, which can be a source of tax-efficient income for investors.

Voting privileges. The ability to vote means shareholders have some measure of control over who runs the company and how.

Liquidity. Typically, common shares can be bought and sold more quickly and easily than other investments, such as real estate, art or jewellery. This means investors can buy or sell their investment for cash with relative ease.

Advantageous tax treatment. Dividend income and capital gains are taxed at a lower rate than employment income and interest income from bonds or GICs.

2. Preferred shares

Preferred shares can offer investors the following benefits:

Reliable income stream. Generally, preferred shares come with a fixed dividend amount that must be paid before any dividends are paid to common shareholders.

Higher income. Compared to common shares, preferred shares tend to pay higher dividends. (Note: preferred-share dividends come with the same advantageous tax treatment as dividends on common shares.)

Variety. There are many types of preferred shares, each with different features. For example, some allow for unpaid dividends to accumulate, while others can be converted into common shares.

The Advantages of Dividends

Dividends are a way for companies to distribute a portion of their profits to shareholders. Typically, dividends are paid in cash on a quarterly basis, although not all companies pay dividends. For example, companies that are still growing might choose to reinvest their profits back into their business to help grow it.

For investors, dividends can offer advantages in areas such as:

Returns. Receiving dividend payments on your stock can increase the total return on your investment.

Volatility. Dividends can help lower volatility by helping support the stock price.

Income. Dividends can provide investors with investment income.

Stability. Companies that manage their cash flow effectively tend to maintain consistent or growing dividend payments. Business stability and earnings growth often leads to a higher share price over time.

Taxation. Canadian dividends are taxed at a lower rate than interest income from bonds or GICs.

Example: This table shows how the after-tax yield of a dividend is higher than the after-tax yield of interest from a fixed-income product because of tax credits. This example uses the highest marginal tax bracket for an Ontario resident in 2018.

Fast Fact: Did you know that you can automatically reinvest your dividends?

You can choose to have RBC Direct Investing automatically reinvest the cash dividends you earn on eligible securities into shares 2 of the same securites on your behalf. Read more about how a Dividend Reinvestment Plan (DRIP) works.

The information provided in this article is for general purposes only and does not constitute personal financial advice. Please consult with your own professional advisor to discuss your specific financial and tax needs.

Your Subscription Failed

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2022.

Any information, opinions or views provided in this document, including hyperlinks to the RBC Direct Investing Inc. website or the websites of its affiliates or third parties, are for your general information only, and are not intended to provide legal, investment, financial, accounting, tax or other professional advice. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Direct Investing Inc. or its affiliates. You should consult with your advisor before taking any action based upon the information contained in this document.

Furthermore, the products, services and securities referred to in this publication are only available in Canada and other jurisdictions where they may be legally offered for sale. If you are not currently a resident of Canada, you should not access the information available on the RBC Direct Investing Inc. website.

> Next: Stocks: Understanding the Risk-Return Relationship

Top 10 Traded Stocks and ETFs in April 2024

Here's what RBC Direct Investing clients traded and added to watchlists in April.

What Happens To Stock and Bond Prices When Rates Fall?

We look at how stocks and bonds may react to declining rates.

Here Are Your Company Balance Sheet Crib Notes

Understanding this statement is a must for investors interested in trading.

Inspired Investor

Inspired Investor brings you personal stories, timely information and expert insights to empower your investment decisions. Visit About Us to find out more.

- Legal Terms of Use

- Disclaimers

- Accessibility

This web site is operated by RBC Direct Investing Inc. © Royal Bank of Canada 2001- 2017

- > Financial Analytics

Top 10 Benefits of the Stock Market

- Utsav Mishra

- Jun 13, 2021

“The key to making money in stocks is not to get scared out of them.” ― Peter Lynch

The stock market refers to public markets for issuing, purchasing, and selling stocks that trade over-the-counter or on a stock exchange.

Stocks, sometimes known as equities, represent fractional ownership in a corporation, and the stock market is a marketplace for investors to buy and sell such investable assets.

A well-functioning stock market is crucial to economic development because it allows businesses to swiftly acquire funds from the general public.

In a word, stock exchanges provide a safe and regulated environment in which market participants can confidently trade shares and other qualified financial products with zero to low operational risk. The stock markets operate as primary and secondary markets, according to the guidelines set forth by the regulator.

Although most countries have one stock exchange, there can be more than one stock exchange in a country.

(Related blog: 10 Largest Stock Exchanges in the World )

In this blog, we are going to focus on the benefits of the stock market.

What are the Benefits of the Stock Market ?

The stock market provides the investor with several benefits and provides them with the easy handling of their money. These benefits include;

Gain received

The ability of the market to generate the kinds of gains it does is the most essential component of investing directly in markets.

Stock markets have always stood the test of time, rising in value over time, even though individual stock values fluctuate daily, according to historical data.

Investing in companies with a consistent growth pattern and increased earnings every quarter, or in industries that contribute to the country's economic growth, will result in you steadily developing your wealth and growing the value of your investment over time.

As this value grows, there is a gain of money and the investors receive all the benefits over the money they had invested. It is said that a long-term investment in certain stocks is a guarantee of gain in the stock market.

Safety against Inflation

The fundamental goal of investments is to guarantee our future, but we must keep track of inflation regularly.

The gains will be nil if inflation and the rate of return on investments are comparable. In an ideal world, the rate of return on investments would be higher than inflation.

Stock markets and benchmark indexes have consistently outperformed inflation.

(Must read: What is Inflation? Demand-pull and Cost-push )

If inflation is about 3-4 percent, for example, markets have seen annual returns of roughly ten percent.

Also, the benchmarks with their rise and fall have been the prime source of prediction of inflation. For example, if the market is constantly crashing then the news breaks out that inflation is near in the country.

Liquidity or Ease of Conversion

Stocks are considered liquid assets since they can be easily converted to cash and have a large number of purchasers at any given time.

The same cannot be said for all assets; some, such as real estate, are difficult to sell. It could take months to see a return on your home investment. It is, however, much simpler in the case of stocks.

If the average volume of transactions is high then we can say that there are multiple buyers and sellers for that specific stock.

This liquidity of a stock market is one of the key benefits for the investors as the process never stops.

Investors get the advantage of economy

The stock market is always a factor in a thriving economy, and it responds to all economic growth indices like gross domestic product (GDP), inflation, corporate profit, and so on.

Investors in the stock market can directly benefit from a thriving economy, and the value of their investments rises in lockstep with economic expansion.

When an economy is growing, corporate earnings rise, and as a result, the ordinary individual's income rises.

As a result, customer demand rises, increasing sales. As a result, the value of your investment in a specific company rises, i.e. the share price rises.

Transparency

The stock market in every country is regulated by a regulatory body, for example in India, the body is SEBI. the market functions by the guidelines of it and the bodies regulate stock exchange, transparency in the market, and protect the rights of investors.

This means that when an investor invests in the stock market, not only his money but also his rights are protected by these regulatory bodies. This saves them from any kind of fraudulent activity done by the company they have invested in.

This makes the investments even secure and gives the investors the confidence and trust of no mishappenings.

(Must read: What is fundamental analysis? )

Flexibility of investment

For a beginner in the stock market, the road isn’t easy and the risks need to be smaller.

For this, they need to invest in stocks that are not high priced. This is where the stock market helps the investor. It gives them the flexibility of smaller investments. These small investments can be done by buying small-cap and mid-cap stocks. Stocks do not require a large initial investment.

Another advantage of directly investing in stocks is that you can buy at your leisure; you are not obligated to invest a certain amount every month.

Benefits of Dividend

A dividend is an additional income for investors, which is paid annually by most companies.

Dividend payments arrive even if the stock has lost value and represent income on top of any profits that come from eventually selling the stock.

These dividend incomes too have a lot of benefits.

Fund a retirement

Pay for more investing

Help you grow your investment portfolio

Ownership stake in the brand

By investing in stocks of a certain company the investor buys an ownership stake in the company. It offers them a sense of belonging to the company you enjoy.

It implies that as a shareholder, they have a say in how a corporation makes choices and can vote on those decisions. Several times, shareholders have intervened to prevent management from making irrational actions that are harmful to their interests.

The annual report of any company is sent to its stockholders to let them know about the functioning.

A Hassle-Free Trading

Technology has helped almost all the existent sectors. The stock market isn’t untouched by it. Stocks can be bought and sold easily with the help of technology. Earlier when all the work was limited to pen and paper, this hassle-free trading wasn’t feasible for many.

Nowadays there are various mobile applications for this purpose. One can easily buy or sell their stocks in a certain company. Various platforms are there which tell the investors about the profit and loss of any specific stock so that they can easily know which stock to invest in.

(Also read: 10 Fundamentals of Technical Analysis )

Versatility of investment

Shares, bonds, mutual funds , and derivatives are among the financial products available in the stock market. This gives investors a wide range of things to choose from when it comes to investing their money.

This flexibility benefits investors by allowing them to diversify their investment portfolios, which helps to mitigate the risks associated with stock investing. As for explaining about risks, here are 4 types of financial risk in the banking industry.

Conclusion

These were the benefits of planned investment in the stock market. Although there is a bit of risk that we often hear from people around us, we don’t always look at the benefits of it.

(Recommended blog: Introduction to investment banking )

Proper research in the stock market is never harmful to investment, not just it reduces risk but also guarantees profit to you. And lastly, most importantly it protects your money.

Share Blog :

Be a part of our Instagram community

Trending blogs

5 Factors Influencing Consumer Behavior

Elasticity of Demand and its Types

What is PESTLE Analysis? Everything you need to know about it

An Overview of Descriptive Analysis

What is Managerial Economics? Definition, Types, Nature, Principles, and Scope

5 Factors Affecting the Price Elasticity of Demand (PED)

6 Major Branches of Artificial Intelligence (AI)

Scope of Managerial Economics

Dijkstra’s Algorithm: The Shortest Path Algorithm

Different Types of Research Methods

Latest Comments

Thanks for sharing this information, an Amazing writeup! If anyone wants to know more about Stock marketing facts can visit our website: https://www.moneymoksh.com/

When appropriately invested in the stock market, you can gain high profits. The article explains the top 10 benefits of the Indian stock market. You can also invest in Stock Market with Share India.

thanks for sharing best benfits of stock market .

The blog educates us regarding the advantages of investing in stock market. It also explains how to conveniently invest in stock market with Share India

Essay on Stock Market

Students are often asked to write an essay on Stock Market in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Stock Market

What is the stock market.

The stock market is a place where stocks are bought and sold. A stock is a share of ownership in a company. When you buy a stock, you are becoming a part-owner of that company.

How Does the Stock Market Work?

The stock market is a complex system, but the basic idea is that buyers and sellers come together to agree on a price for a stock. The price of a stock is determined by supply and demand. When there are more buyers than sellers, the price of the stock goes up. When there are more sellers than buyers, the price of the stock goes down.

Why Do People Invest in Stocks?

People invest in stocks for a variety of reasons. Some people invest to make money. They buy stocks that they believe will go up in value, and then they sell them for a profit. Other people invest to save for retirement. They buy stocks that they believe will provide them with a steady income in the future.

Risks of Investing in Stocks

Investing in stocks is not without risk. The value of stocks can go down as well as up. This means that you could lose money if you invest in stocks. However, over the long term, the stock market has historically provided a good return on investment.

250 Words Essay on Stock Market

What is a stock market.

A stock market is a place where people buy and sell shares of companies. When you buy a share of a company, you are essentially becoming a part-owner of that company. The value of your share will go up if the company does well, and it will go down if the company does poorly.

How Does a Stock Market Work?

Stock markets are typically regulated by government agencies. These agencies set rules and regulations to ensure that the markets are fair and orderly. When you buy or sell a share of stock, you do so through a stockbroker. Stockbrokers are licensed professionals who help investors buy and sell stocks.

Why Invest in the Stock Market?

There are many reasons why people invest in the stock market. Some people invest to make money, while others invest to save for retirement or to build wealth for their families. The stock market can be a volatile place, but over the long term, it has historically been a good investment.

Risks of Investing in the Stock Market

There are also risks associated with investing in the stock market. The value of your investments can go down as well as up, and you could lose money. It is important to understand the risks involved before you invest in the stock market.

The stock market can be a complex and confusing place, but it can also be a rewarding one. If you are considering investing in the stock market, it is important to do your research and understand the risks involved. You should also consider seeking the help of a financial advisor.

500 Words Essay on Stock Market

A stock market is a place where people can buy and sell stocks. Stocks are pieces of ownership in a company. When you buy a stock, you are essentially becoming a part-owner of that company. Companies issue stocks to raise money to grow their business.

The stock market is a regulated marketplace where buyers and sellers of stocks can come together to trade. The price of a stock is determined by supply and demand. When there are more people who want to buy a stock than there are people who want to sell it, the price goes up. When there are more people who want to sell a stock than there are people who want to buy it, the price goes down.

Types of Stock Markets

There are two main types of stock markets: primary and secondary. In a primary market, companies sell stocks to investors for the first time. In a secondary market, investors buy and sell stocks that have already been issued.

Benefits of Stock Market

The stock market can be a great way to grow your wealth over time. When companies do well, their stock prices go up, and you can sell your stocks for a profit. The stock market can also be a good way to save for retirement.

Risks of Stock Market

The stock market is not without its risks. Stock prices can go down as well as up, and you could lose money if you sell your stocks at a lower price than you paid for them. It is important to do your research before you invest in any stock.

How to Invest in Stock Market

If you are interested in investing in the stock market, there are a few things you need to do first. You need to open a brokerage account, which is an account that allows you to buy and sell stocks. You also need to learn about the different types of stocks and how to analyze them. Once you have done your research, you can start investing in stocks.

The stock market can be a great way to grow your wealth over time, but it is important to understand the risks involved before you invest. If you do your research and invest wisely, you can increase your chances of success.

That’s it! I hope the essay helped you.

If you’re looking for more, here are essays on other interesting topics:

- Essay on Stereotypes And Prejudice

- Essay on Stereotypes

- Essay on Statue Of Liberty

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

17 Key Advantages and Disadvantages of Common Stocks

Common stocks are securities that represent ownership in a specific corporation. When you hold them, then you can exercise control by electing a board of directors or voting on corporate policies.

Stockholders with common stock or at the bottom of the priority ladder for the ownership structure. If liquidation occurs, then common shareholders have rights to company assets after any bond obligations, preferred shareholders, and other creditors receive payment in full. That means this investment option is riskier than debt or a preferred share.

It also means that this investment resource usually outperforms bonds and preferred shares from a long-term perspective. Most companies will issue all three types of securities.

We have been looking at the advantages and disadvantages of common stocks since 1602 when the Dutch East India Company issued its first shares and began the Amsterdam Stock Exchange. These are the critical points you will want to review.

List of the Advantages of Common Stocks

1. You can invest in companies with limited liability. When you purchase common stock in a company, then your personal assets are not at risk if the organization gets into legal trouble. The extent of your liability is the amount that you put into the investment. That’s good news for you if the stock goes bad and the business ends up owing creditors a lot of money or faces a significant judgment. Although you will be out the money that you put into the organization, the loss could be something that helps you when you file your taxes for that year.

2. Common stocks offer a higher earning potential. Although investing in common stocks provides more risk than conservative options like a certificate of deposit or a money market account, the returns are typically better. Because your returns aren’t guaranteed as a shareholder, there is no limit to how much you can gain. If you don’t mind taking some of the guarantees away from the minimum and maximum amount that you can earn, then your wealth can start growing more over time with this option.

As with any investment, there is also an opportunity to lose everything when you purchase common stocks. That’s why a measure of caution is always a good idea when looking at this option.

3. You can easily purchase common stock on virtually any trading platform. If you don’t mind buying or selling common stock at market prices, then you have a highly liquid investment that you can convert into cash at almost any time. Virtually any trading platform will let you open an account to purchase this asset at any time. You can also work with a financial advisor to complete these transactions. Most of the industry has moved to a zero-fee approach for trades, so it doesn’t cost you anything to buy stock or sell it. The ease of this investment makes it a simple way to diversify your portfolio.

4. Common stocks can provide dividends. Some companies will pay dividends when you purchase common stock and hold it for a specific amount of time. These organizations will pay a particular amount based on the number of shares that you hold in the company. Some will pay monthly, others quarterly, and annual payments are also possible. If you invest in these dividend stocks, then you can help your wealth grow by creating a ladder of returns that you can use.

5. You can trade common stocks in a variety of ways. Online traders make it simple and inexpensive to trade common stocks from major exchanges around the world. You can work with brokers who allow margin trading and short selling for eligible listings. That means you can use borrowed funds to purchase stocks or sell borrowed securities in the expectation of buying them back at a lower price. Options on specific stocks to hedge against market volatility or guess on price movements.

6. You’ll get to take advantage of a growing economy. When the economy begins to grow, then so do corporate earnings. That’s because this outcome works to create employment opportunities, which then creates more income. As profits get higher, more sales occur, and that means higher levels of consumer demand that drive revenues into the black. If you can identify where a company stands in its business cycle, then your potential to grow wealth through investing in common stock is incredible. Just make sure that you hedge your bets by diversifying your portfolio instead of investing in only one stock.

7. It’s the best way to get ahead of inflation problems. The average rate of inflation in the United States hovers around 3%. Common stocks have averaged an annualized return of 10% historically. That means the value of your portfolio can grow at a net of 7% each year. If you were to put your money into a savings account or CD that provided a 2.2% return, then the actual value of your cash would go down for the year. Investing in common stocks is the best way to get ahead of inflation problems in most years, even if you see a loss happen here or there.

8. You can leverage the value of common stock as collateral. If you are in the market to purchase a big-ticket item, then the value of your common stock can be used as collateral for a loan or a line of credit. The liquidity of this financial asset is what makes this leverage possible. Lenders understand that they can use the stock as a way to pay off a future debt if you run into financial trouble. Because this lowers the overall risk of lending money to you, it may become possible to secure a lower interest rate when buying a new car or another significant item.

9. It is possible to buy and sell common stock around the world. Do you want to purchase common stock for your portfolio? Then you have access to a world of opportunities. Several markets in numerous countries are open for trading when you secure an online account with an appropriate level of access. That means your money can work for you around the clock if that’s what you feel your investments require. New York, London, Tokyo, Singapore, and more geographic locations provide ways to gain equity in companies so that you can work to beat the rate of inflation with your value growth each year.

List of the Disadvantages of Common Stocks

1. You are the last person to get paid during a company liquidation. If the organization goes into liquidation and you hold common stocks, then you are going to be the last person who gets paid. Most shareholders that use this investing option rarely see any of their money come back in that situation. If there is nothing left after every creditor, debt holder, and preferred stockholder get what is due to them, then you’re just out of luck. That’s why a diverse portfolio that works to manage your risk factors is the best way to resolve this disadvantage.

2. You don’t have much control over your investment. Although you may get awarded with voting rights when purchasing common stocks, it is often difficult or impossible to exercise any control over this investment. If you were to put that money into a company that you control, then your decisions on strategies and best practices can lead to a profitable experience. When you add common stock to your portfolio, then you are subjected to the will of every other stockholder.

The only way to invest in common stocks and avoid this disadvantage is to gain a majority share of a company with your investment. That’s an expensive proposition to consider for most corporations, so it is only available to those with the highest levels of wealth.

3. Your portfolio can lose substantial value in a single day. The stock markets around the world are highly volatile right now. Frequent price swings of several percentage points could happen in a single trading session. Not only is it possible for your portfolio to gain a substantial amount in a short period, but there is also the potential to lose everything in a single day. If you decide to trade on margin, that means a margin call and the forced liquidation of stocks could happen at a significant loss.

4. Companies are not required to pay dividends on common stocks. Although some organizations regularly pay dividends on common stocks and have done so for decades, there is no obligation for a company to take this action. Shareholders who use this investment vehicle are not obligated to receive a portion of the profits that a business earns. That means part of your risk factor in choosing this investment option is that you can lock in a loss for a thinly traded stock in fast-moving markets without realizing what you are doing. The downside risks are very high, which is my mutual funds are often a priority when investors first start to trade.

5. You might need to navigate several different common stock classes. Some organizations issue multiple classes of common stock. You might see Class A, Class B, or Class C shares – and so on. The advantage of this structure is that the owners gain access to capital markets while retaining control and warding off potentially hostile takeovers. The disadvantage goes to the investor who has lower voting rights, trading volume, and liquidity issues and some of the lowest share classes.

6. It can take time to generate significant gains. When Six Flags announced that its efforts in China weren’t going to be paying off as well as they hoped, the stock took an immediate nosedive of nearly $8 per share. That means over five years of gains were wiped out in just hours for some investors. If people purchased the stock in recent days, then they experienced a significant loss overnight.

If you decide to purchase stocks on your own, then you must research each company to determine its potential for profitability. It is up to you to learn how to read financial statements and understand the information provided in annual reports. You must also have time to monitor the stock market since even the best company’s prices will fall during market corrections, crashes, or bear environments.

7. Investing in common stock can be an emotional rollercoaster at times. The prices of common stock rise and fall all of the time. Trading that occurs around the world can impact the results of your equity value at any time of day. You must avoid the trap of buying high when the market seems strong and selling low because you’re afraid that you might lose everything. If you tend to worry about your finances, then the best thing to do is to avoid looking at the constant price fluctuations that occur. Just make sure that you check in regularly to verify that your portfolio’s performance is meeting your financial goals.

8. You will face high levels of professional competition when investing in common stocks. Professional traders and institutional investors have more time to monitor the stock market and research companies. That means their work has a competitive edge against your investing efforts if you don’t have the same amount of time available. These folks have access to sophisticated trading tools and financial models that reduce their risk factors when making and investing decision.

Unless there is a specific dividend stock or investing strategy to implement, beginners typically approach the stock market through guesswork. You have to compete with those professionals to earn a return. That isn’t always easy to do.

Common stocks are a suitable investment for most people. It’s a limited way to gain some market exposure for your savings that you can manage without taking a lot of risk. Although the potential for losing money is present, a savings account or certificate of deposit will also lose value if inflation rates are higher than the promised return given to you.

Even if you only have a few dollars to invest each month, working with fractional providers who can give you access to some of today’s top-performing shares can be a way to make your money start growing.

The advantages and disadvantages of common stock must be carefully considered, just as they are with any other investment. You have the potential to gain a lot of wealth from this activity, but there is always a risk of loss to manage. That’s why I diversified portfolio that includes these investments is a balanced way to provide for your future.

Essay on Stock Exchange: Top 8 Essays | Business Management

Here is a compilation of essays on ‘Stock Exchange’ for class 9, 10, 11 and 12. Find paragraphs, long and short essays on ‘Stock Exchange’ especially written for school and college students.

Essay on Stock Exchange

Essay Contents:

- Essay on the Drawbacks of Stock Exchange

Essay # 1. Meaning of Stock Exchange:

Stock exchange is an important constituent of capital market. It constitutes that part of the capital market which is concerned with the purchase and sale of the industrial, government and other securities. In simple words, a stock exchange is an open market place which entertains the purchase and sale of second-hand securities.

ADVERTISEMENTS:

It is a highly organised market for the purchase and sale of securities of public companies, government and semi-government bodies. In this manner, the stock exchange helps an investor to sell his holdings readily and conveniently. A stock exchange ultimately helps the inventor, the trader, the investor, the industrialist and the banker. In this context, it is described as the business of all businesses.

Essay # 2. Definition of Stock Exchange :

The stock exchange has been variously defined by different eminent authorities on the subject.

Some of the important definitions are as follows:

According to Pyle, “Security exchanges are market places where securities that have been listed thereon may be bought and sold for either investment or speculation.”

According to Garg, “A stock exchange is an association of persons engaged in the buying and selling of stocks, bonds and shares for the public on commission and are guided by certain rules and usages.”

According to Hastings, “Stock exchange or securities market comprises the places where buyers and sellers of stock and bonds or their representatives undertake transactions involving the sale of securities.”

According to Hartley Withers, “A stock exchange is something like a vast warehouse where securities are taken away from shelves and sold across the counters at a fixed price in a catalogue which is called the official list.”

The Securities Contracts (Regulation) Act, 1956. defines a stock exchange as, “an association, organisation or body of individuals, whether incorporated or not, established for the purpose of assisting, regulating and controlling business in buying, selling and dealing in securities.”

Essay # 3. Characteristics of Stock Exchange:

Following are the essential features of a stock exchange:

1. It is an organised capital market.

2. It is an association or body of individuals whether incorporated or not.

3. It is an open market for the purchase and sale of all kinds of securities, viz., shares of public companies, debentures or bonds of government and semi- government bodies.

4. It works under a code of set rules and regulations.

5. It helps the investor, the trader, the industrialist and the banker whether for investment or speculation purposes.

Essay # 4. Importance of Stock Exchange:

A stock exchange has been rightly described as the nerve centre of modern commercial world. Stock exchanges are, in fact, the theatres of business transactions and act as a gauge-glass of the politics and finances of a nation.

It has been rightly said that the modern capitalistic economy cannot exist in the absence of well organised stock exchanges. It is because stock exchanges facilitate the necessary mobilisation of capital required by companies in the business sector. They have been aptly described the, ‘shrines of values’, the ‘citadel of capital’ or ‘fortress of finance’.

In the modern times, a stock exchange has come to be recognised as the barometer of the economic progress of a nation. Bismark once advised a youngman of his country (Germany) who was going to England to study its economic progress in these words: “If you want to know how things in Britain are going on, do not study the House of Commons, but watch the London Stock Exchange.”

Prof. Marshall has rightly observed, “Stock exchanges are not merely chief theatres of business transactions, they are also barometers which indicate the general condition of the atmosphere of business.” In brief, the business of a stock exchange may be described as “the business of businesses.”

Someone has remarkably summed up its importance by describing it “as the market of the world, the nerve centre of politics and finance of a nation, the barometer of its prosperity and adversity.”

Essay # 5. Functions of a Stock Exchange:

The important functions of stock exchange are discussed below:

(i) Ready Market for Securities:

A stock exchange provides a ready market for the sale and purchase of existing securities. This facilitates the steady marketability of shares and debentures. It also provides price continuity to the investors regarding the securities they hold or intend to purchase.

It is the place where persons with cash can convert it into securities and those with securities can readily realise cash. The easy marketability of securities enhances their liquidity and, hence, increases the value of securities.

(ii) Mobilisation of Surplus Savings:

It is another important function of a stock exchange. It creates favourable climate suitable for investment of surplus funds into business sector. A stock exchange, thus, encourages savings and chanelises the funds towards industrial progress. In this manner, stock exchange mobilise savings and channelise the flow of capital into most profitable ventures.

(iii) Capital Formation:

Stock exchanges play an active role in the capital formation of a nation. Stock exchange fosters the habit of saving, investing and risk-taking among the members of general public. The funds so mobilised are directed towards business sector for meeting capital requirements. In this way, stock exchange helps in the process of capital formation.

(iv) Evaluation of Securities:

As per stock exchange rules, all transactions on the exchange are required to be “recorded and made public”. Accordingly, the prices paid and received become official quotations. This enables the holders of securities to know their actual worth at any time. Besides, the market quotation helps the lender on the security of shares to assess the value of the security.

(v) Safety of Funds:

Stock exchanges work under set rules and regulations. This ensures safety of investable funds. Thus the stock exchanges protect the interests of investors through the strict enforcement of rules and regulations. Efforts are made to check over trading, illegitimate speculation, manipulation, etc. In the absence of organised stock exchanges the innocent investors may easily be deceived at the hands of clever brokers dealing in securities.

(vi) Dependable Guide for the Investors:

Stock exchange serves as a dependable guide for the investors. Regular dealings in stock exchange sifts the profitable investment from the risky ones. With the slow magic of time, securities which offer or promise better return come in the limelight while those which have no encouraging future decline in market price. This becomes a dependable guide to the discerning investor.

(vii) Listing of Securities:

Listing of securities is a very important function of stock exchange. A stock exchange does not deal in the securities of all companies. Listing of securities here means the inclusion of securities in the official list of a stock exchange for the purpose of trading.

Listing is done only after a careful examination of the capital structure and the business prospects of the companies. Besides enhancing the prestige of the companies, it puts the investors in a better position to judge the propriety of different securities.

(viii) Supply of Useful Commercial Information:

A stock exchange provides full information regarding listed companies. Having listed the securities, a stock exchange serves as a gauge-glass of the economic health of the concerned companies. It collects necessary information regarding non-listed companies also. Such information is usually provided in their respective Annual Official Year Books. This helps the prospective investors to evaluate various investment ventures.

(ix) Facilities for Genuine Speculation:

Stock exchanges facilitate genuine speculation. The genuine traders speculate and secure sizeable gains through fluctuations in securities’ prices. In fact, speculation is an integral part of stock exchange functions. Genuine speculation tends to smoother out wide fluctuation besides bringing near-equality in demand and supply at different places.

(x) Regulation of Company Management:

The stock exchanges indirectly regulate the company management. This is achieved through listing of securities. A company has to fulfill certain conditions before official listing of its securities. Besides, the company has to maintain efficient conditions in its operations in order to prevent any decrease in market quotations of its securities. Thus, stock exchanges regulate the workings of the company management.

Essay # 6. Regulation of Stock Exchange:

The stock exchanges have to be regulated to ensure stability to protect investors from the activities of unscrupulous speculators and to maintain a healthy investment climate.

The main purposes of stock exchange regulation are:

1. To check unfair and undesirable practices detrimental to the interest of the investors.

2. To take remedial steps to minimise violent fluctuations in securities prices.

3. To provide regulatory machinery with a view to ensuring a wholesome investment climate, and

4. To limit business outside the exchange.

The stock exchanges in India were found to be suffering from administrative and operational weaknesses in the past. Instead of playing a constructive role to smooth out wide fluctuations, they became dens of gambling resulting into violent fluctuations in securities prices. Consequently, they became the instruments of vested interests highly detrimental to investors and the general public.

The need was, therefore, felt for some uniform governmental control to enforce certain set rules and to ensure security to investors. For quite a long time, there was no uniform legislation in India to regulate the workings of stock exchanges.

In 1945, Government of India appointed Dr. RJ. Thomas to enquire into the matter and to submit necessary recommendations for bringing about possible reforms. Dr. Thomas submitted his report in 21947. The government officials viewed the report and recommended a draft legislation.

In 1951, the Government of India constituted another committee under the chairmanship of Mr. A.D. Gorwala which submitted its report in the same year. The government after detailed examination of the report, presented Securities Contracts (Regulation) Bill in 1954 which was passed in 1956. The Securities Contract (Regulation) Act came into force with effect from 20th February, 1957.

Provisions of Securities Contracts (Regulation) Act :

The main provisions of the Act are listed below:

1. Recognition of Stock Exchanges:

The Act permits only the recognised stock exchanges to function. No trading is, therefore, permitted on unrecognised stock exchanges. The recognition is granted by Central Government on an application by the concerned stock exchange.

The recognition depends upon the following conditions:

(a) The rules and bye-laws of the applicant stock exchange ensure fair dealing to the investors and protect their interests;

(b) The stock exchange is willing to adhere to the conditions that may be imposed by the government from time to time; and

(c) It is the interest of the trade and the community at large to accord recognition to the exchange.

The Central Government reserves the right to refuse or withdraw recognition in the interest of the trade or the community at large after giving an opportunity to be heard.

2. Regulation through Bye-laws:

The exchange is permitted to function only according to the bye-laws approved by the government.

These may relate to:

(a) The regulation of the hours of trading at stock exchange;

(b) The maintenance and regulation of clearing house;

(c) The publication of the contracts settled or carried over by the clearing house;

(d) The determination and declaration of market rates;

(e) Regulation or prohibition of blank transfers, tatawani business and budlas.

(f) The regulations for the listing of securities on stock exchange;

(g) The fixation of scale of brokerage, fees, fines and other charges;

(h) The settlement of disputes and claims by arbitration and other means; and

(i) The fixation of business allowed to an individual member.

3. Central Government Control:

The Act empowers the Central Government to exercise an effective control over stock exchanges. The recognised stock exchanges are required to provide such information as the Central Government may demand.

The Central Government has following powers:

(a) It can call upon the exchanges to submit periodical returns relating to their affairs.

(b) The Central Government has a right to order an inquiry into the affairs of an exchange whenever it thinks necessary.

(c) It can direct a stock exchange to adopt or amend any rule relating to its constitution and organisation.

(d) It can suspend the business of a recognised stock exchange for a period of seven days or more in the interests of the trade and public.

(e) It can compel certain public companies to get their securities listed.

(f) It can prohibit dealing in any security.

4. Control on Speculation :

As stated earlier, the government can prohibit trading in any security to prevent unhealthy speculation. The Act applies to all dealings in securities except the ‘spot’ or ‘across the counter’ transactions.

The Act can, however, also regulate spot delivery contracts, if considered necessary in the interests of trade or public at large. The Act has declared kerb trading illegal. Kerb trading means the business transacted outside the stock exchange before or after its business hours.

5. Directorate of Stock Exchanges :

The government set up the Directorate of Stock Exchanges in 1959 to enforce compliance of the regulatory provisions of the Securities Contracts (Regulation) Act. The Directorate keeps a close watch on it and acts as a vital link between the government and the leading stock exchanges of the country. It has its head office in Bombay.

Essay # 7. Advantages of Stock Exchanges:

To facilitate understanding, we may divide the main advantages of stock exchanges into following three categories:

I. Advantages to Investors :

1. Safeguard of Investors’ Interest:

A stock exchange accords protection to the investors by enforcing strict rules and regulations. Thus the chances of overtrading, illegitimate speculation and manipulation get reduced.

2. Perpetual Market:

A stock exchange provides a continuous market where various types of securities are purchased and sold. Accordingly, it provides liquidity to the shareholdings. Persons with cash can convert it into securities and those with securities can get cash for them. This facilitates investment.

3. Greater Collateral Security:

The liquidity provided by stock exchanges to the securities increases, in turn, their value and enhances their use as a collateral security. The collateral value of listed securities is always higher than that of the non-listed securities.

4. Better Investment Opportunities:

The stock exchange encourages proper use of capital by providing better investment opportunities. This facilitates proper channelisation of capital or investible funds.

5. Publication of Quotations:

Stock exchanges provide full information regarding the value of securities by publishing daily quotations of listed securities. In this manner, they prove a boon to the investors.

6. Avoidance of Undue Fluctuations in Prices:

This is another important advantage of stock exchanges. The price movements are rendered smoother by the operations of speculators such as bulls and bears.

II. Advantages to Companies :

1. Better Response from Investors:

By getting its securities listed at stock exchanges, a company can command better and quicker response from the investors.

2. Higher Market Value:

Owing to greater and better facilities available at stock exchanges, the market value of the listed securities tends to be higher.

3. Widened Market:

Stock exchanges enlarge the market for trading in securities.

Through greater publicity, they provide a wider base to deal in securities of various kinds.

4. Stability in Prices:

The stock exchange also brings stability in the prices of securities by checking undue fluctuations in securities’ prices. This stability is brought about by balancing operations of speculators.

5. Increase in Goodwill:

Stock exchanges help in enhancing the goodwill of the companies whose securities are listed there. It is an established fact that a company with listed securities commands better reputation than the one whose securities are not listed.

III. Advantages to Community :

1. Mobilisation of Surplus Funds:

By attracting surplus savings, stock exchange helps in mobilising the idle funds into profitable channels. The idle savings, thus, get channelised into profitable ventures.

2. Accelerates Industrial Development:

Stock exchanges finance economic and industrial development by mobilising surplus funds. Thus, they accelerate the pace of industrial development through capital mobilisation.

3. Promotes Savings:

By providing better investment opportunities, stock exchange encourages the habit of savings among the people of general community. The inculcation of saving habits, in turn, facilitates the process of capital formation.

4. Barometer of Economic Conditions:

As stated earlier, stock exchange is referred to as the mart of the world, the nerve centre of politics and finances of a nation and the barometer of its economic prosperity or adversity.

Essay # 8. Drawbacks of Stock Exchanges:

The stock exchanges, like all other useful institutions, are not free from drawbacks. Many unscrupulous persons indulge in various malpractices to further their personal ends. They abuse the facilities afforded by these institutions.

Some people have invariably found it as a bottomless pit-worse even than all the hells. Consequently, a stock exchange is at limes condemned as a ‘den of gamblers’.

Very often, there is gambling under the garb of genuine speculation. According to S.R. Davar, “Speculation has repeatedly spread to a dangerous extent on these exchanges, bringing in its train inevitable ruin and hardship involving both the innocent and the guilty.”

Some unscrupulous traders misuse the facility of listing to manipulate the dividend policy. But, a careful study of these objections will reveal that these incidents are due more to the abuse of the facilities offered by these excellent institutions, than to the nature of the transactions they normally put through.

In conclusion it may be stated that it is not the institution of stock exchange which is to blame, but the mean and selfish elements which bring about disaster to the community at large. The qualities of self-restraint, the sporting spirit, and the mutual trust and confidence if all combined can go a long way to exercise an educative influence among stock exchange men.

Related Articles:

- Top 9 Functions of Stock Exchange

- Difference between Commodity Exchange and Stock Exchange

- Stock Exchange and Speculation | Forex Management