Ola vs Uber Complete case study, comparison and Business Model

- Post author: Tanya Mishra

- Post published: April 29, 2023

- Post category: Uncategorized

- Post comments: 0 Comments

The rise of ride-hailing/ taxi services has entirely transformed the transportation industry. Booking a ride on your smartphone and having it come pick you up from your doorstep is a common occurrence these days. The convenience of ride-hailing services has led to a meteoric rise in their usage, especially in crowded urban regions. Statista projects that the worldwide ride-hailing market is likely to expand by US$ 126.5 billion by 2025.

While their services are comparable, there are significant distinctions between the two firms that set them apart. This blog will compare and contrast Ola and Uber, looking at their respective business plans, marketing approaches, and brand identities in great detail. We’ll also look at other essential criterias, such as market share, revenue, and growth rate, to determine which firm is more successful in India.

Ola vs Uber Comparision

When it comes to comparing Ola vs Uber, there are numerous aspects to contemplate, including service excellence, pricing, security, and accessibility. Let’s take a meticulous glance at the Uber and Ola case study with these distinctive factors.

Market Share and User Base:

In terms of market share, Ola has a significant lead over Uber in India. According to a report , Ola had a 59% market share in India’s ride-hailing market in 2022, while Uber had a 41% market share. However, both companies have faced stiff competition from other ride-hailing services such as Rapido and Meru Cabs.

As of the current year 2022, Ola has amassed a whopping 100+ million registered users in India, whereas Uber boasts approximately 93+ million users. Nevertheless, it’s noteworthy to mention that the count of monthly active users for both corporations is considerably lesser.

Ola and Uber Marketing Strategy Case Study:

Both Uber and Ola in India have extensively invested in advertising and branding to establish themselves as the preeminent ride-hailing service. Ola has been widely recognized for its assertive marketing initiatives, encompassing TV commercials, billboards, and social media promotions. On the flip side, Uber has concentrated further on crafting a polished and refined brand persona. Uber has recently launched a plethora of innovative brand campaigns in India, such as “Uber Zindagi” and “Khudki Gaadi”, to entice a larger customer base.

Business Model:

Both Ola Auto vs Uber Auto have analogous business models, which entail linking commuters with chauffeurs through a mobile application. Nevertheless, there are certain disparities in their methodology. Ola boasts of a multifaceted business model, encompassing many services such as Ola Auto and Ola Bike. Ola additionally provides a plethora of payment alternatives, encompassing cash, debit cards, credit cards, and mobile wallets. Conversely, Uber concentrates on automobile journeys and has freshly introduced amenities like Uber Auto and Uber Moto in certain urban areas.

One of the paramount aspects that patrons contemplate when selecting a transportation service is the cost. Uber and Ola in India provide competitive rates and have introduced numerous exclusive promotions to entice additional patrons. Nevertheless, when it comes to overall cost-effectiveness, Ola is reputed to be marginally more economical than Uber. Additionally, Ola presents a plethora of alternatives for ride-sharing, which can substantially diminish the expenses of commuting.

Security is a significant apprehension for both Ola and Uber patrons. Both corporations have implemented a plethora of safety measures, including cutting-edge GPS tracking, in-app emergency buttons, and rigorous driver verification protocols. Ola has recently introduced a novel feature named “Guardian” that enables patrons to share their ride particulars with their emergency associates. Similarly, Uber has recently launched a novel feature dubbed “Ride Pass” that enables patrons to share their ride details with reliable acquaintances instantaneously.

Customer Support:

Regarding customer assistance, both Ola Cab vs Uber India possesses specialized customer support squads that are accessible round the clock to handle customer inquiries and grievances. Nevertheless, Ola is reputed to provide exceptional customer assistance compared to Uber. Ola business boasts a committed customer assistance squad that can be contacted through various channels like phone, email, and social media platforms. On the contrary, Uber’s exceptional customer assistance squad can solely be accessed via the in-app assistance hub or electronic mail.

Brand Image: Ola and Uber branding case study

In terms of brand perception, both Ola Cab vs Uber India enjoys robust brand recognition in India. Nevertheless, Ola is commonly regarded as a quintessentially Indian brand, whereas Uber is often viewed as a globally recognized brand. This is primarily attributable to the fact that Ola has been functioning in India for a more extended period and has a more indigenous approach to its amenities. On the contrary, Uber has been renowned for its exceedingly comprehensive perspective and has triumphantly broadened its amenities to numerous nations across the globe.

Service Quality:

Both Ola and Uber provide comparable services, such as ride-sharing, car rentals, and bike-sharing. Nevertheless, the caliber of assistance may fluctuate contingent on aspects like the chauffeur’s proficiency, the state of the automobile, and the accessibility of conveniences like Wi-Fi and mobile chargers.

Ola and Uber utilize dynamic pricing, which implies that tariffs may fluctuate based on factors such as demand, traffic, and the hour of the day. Nevertheless, Ola is reputed for providing comparatively economical fares than Uber in several cities, thereby assisting the enterprise in acquiring a greater market share in India.market share in India.

Performance – Ola vs Uber

In terms of efficiency, both Uber Cabs vs Ola Cabs have achieved remarkable success in their markets. Ola enjoys a substantial market share in India, whereas Uber reigns supreme in the US and numerous other nations. As per a recent study, Uber amassed over 1 billion global downloads in 2022, whereas Ola garnered more than 550 million+ million downloads. Furthermore, Ola exhibited a superior expansion rate in comparison to Uber, with a year-on-year surge of 42% as opposed to Uber’s 21%.

Business Model Analysis – Ola vs Uber case study

Ola’s distinctive business strategy revolves around providing cost-effective rides to its clients. The corporation has accomplished this by utilizing agile pricing and offering motivation to drivers. Ola business model has additionally broadened its offerings to encompass various transportation alternatives like Ola Auto, Ola Bike, and Ola Rentals, accommodating diverse client requirements. Ola has recently launched Ola Share, an innovative carpooling service that enables passengers to share their rides with fellow commuters heading in the same direction. This service has garnered immense popularity in numerous cities.

On the contrary, Uber business model is also concentrated on providing cost-effective rides to patrons. The corporation has accomplished this feat by implementing surge pricing during high-demand periods and offering diverse incentives to drivers. Uber has additionally broadened its range of services to incorporate UberGo, UberX, UberPOOL, and UberBLACK, accommodating various customer requirements. Uber has recently launched UberEATS, an innovative food delivery platform that brings delicious meals from nearby eateries straight to hungry customers.

Both corporations function on a comparable model, where they receive a percentage of the fare paid by the passenger as their remuneration. Nevertheless, there are some notable disparities in their methodology towards their drivers. Ola has an exceedingly driver-friendly policy, providing them with numerous incentives and benefits, such as comprehensive health insurance and substantial financial assistance. Uber, conversely, has faced censure for its handling of drivers, who are deemed as autonomous contractors and not staff members.

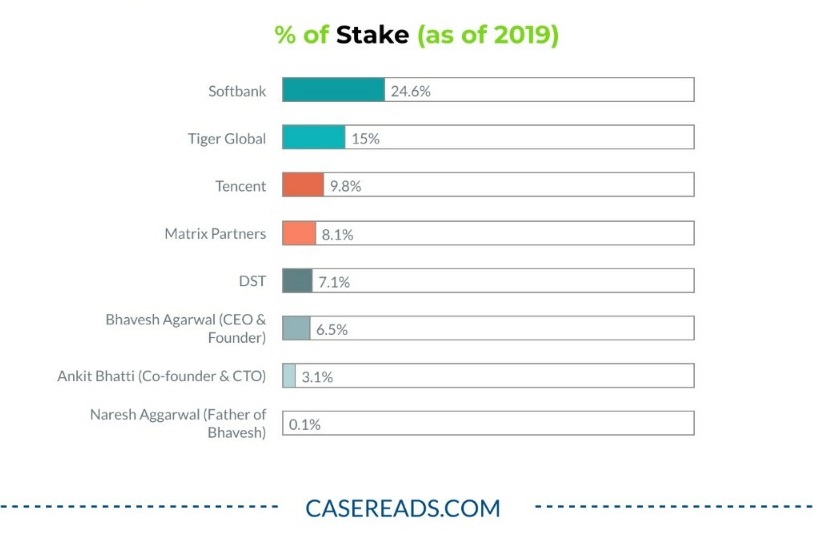

Regarding financing, both Ola and Uber have obtained significant investments from diverse investors. Uber has received financing from SoftBank, Toyota, and the Public Investment Fund of Saudi Arabia, while Ola has just garnered funds from SoftBank, Tencent, and Sequoia Capital, among other important investors.

Q1. Ola vs Uber which is cheap?

Typically, Ola is marginally more economical than Uber in India, particularly for communal journeys and brief distances.

Q2. Ola vs Uber which is better?

Each Ola and Uber possess their unique strengths and weaknesses, and the ultimate decision relies on personal preferences and priorities.

Q3. How exactly does Uber contend with Ola in the Indian market?

Uber fiercely competes with Ola in India by offering competitive pricing, exciting promotions, and expanding its reach to new cities and services.

Q4. How does the fare comparison differ between Ola and Uber?

The tariffs for Ola and Uber differ based on variables such as distance, time of day, and demand.

Q5. What is the distinctive business strategy of Ola vs Uber?

Ola and Uber generate substantial revenue by taking a nominal commission on each ride and have remarkably expanded into new services like scrumptious food delivery and rental services.

Final Words

In conclusion, both Ola and Uber have remarkably transformed India’s ride-hailing sector and have revolutionized how individuals travel in metropolitan regions. Although both corporations possess their advantages and drawbacks, they have successfully acquired a substantial portion of the market by introducing inventive solutions and maintaining competitive pricing.

In the end, the decision between Ola and Uber boils down to individual inclination and specific necessities such as cost, accessibility, and client assistance. Therefore, it is crucial to meticulously contemplate all these aspects before selecting a ride-hailing platform in India.

You Might Also Like

What is Liquid Mutual Funds? Best Liquid Mutual Funds in India

Scope Of Investing In AI-Focused Companies. Top 5 AI company stocks in India

Difference Between NSE and BSE – How to Choose an Exchange for Your Trades

Leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Looking to try stock market fantasy game?

Play on StockPe now to win big rewards with secured withdrawals.

Uber vs. Ola: How fight for Indian taxi market ended up in court

- Medium Text

Editing by Paritosh Bansal and Alex Richardson

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Sustainability Chevron

Australia backs long-term gas drilling despite 2050 climate goals

Australia's Labor government on Thursday laid out a strategy to boost natural gas development even as it remains committed to net zero carbon emissions by 2050, highlighting demand from key Asian trade partners.

Ola Case Study – The Success Story Of Ola!

Supti Nandi

Updated on: August 17, 2023

What’s the first thing that comes to your mind after hearing the term “Ola”? Online cab booking! Isn’t it? Have you ever wondered how Ola became synonymous with online booked cabs? Due to its successful operations and services. Well, that’s true. But apart from that numerous other factors have also played crucial roles to make the cab-booking start-up successful. So, in this write-up, we will shed light on Ola Case Study and will decode the success story of Ola.

Stay tuned!

Ola: A Brief Overview

Ola, originally known as Ola Cabs, is a successful Indian ride-hailing company that has revolutionized the cab booking industry. The success story of Ola is a result of the visionary thinking and perseverance of its co-founder, Bhavish Aggarwal.

The name “Ola” was derived from the Spanish word “Hola” meaning “Hello” or greetings. Before diving deeper, let’s have a brief overview of the company-

History of Ola

The birth story of Ola begins with the difficulty faced by Bhavish Aggarwal (Founder). How? When he was unable to find a reliable cab.

Ola was established on December 3rd, 2010, to address the pain points faced by commuters in India. Bhavish Aggarwal, while he was traveling from Bangalore to Bandipur, faced difficulties in finding a reliable cab.

You too, might have faced this sort of difficulty a decade back! Didn’t you? So, what did you do at that time? Contacting a local taxi aggregator with fluctuating prices was the only solution. This problem sparked the idea of creating a platform that would connect passengers with cab drivers efficiently and conveniently. The affordable and standard price of cab bookings was the cherry on top.

What problem did Ola solve? The cab booking problem!

From its humble beginnings, Ola quickly gained traction and became one of the fastest-growing startups in India. It surpassed its global rivals like Uber and Meru Cabs. Thus, it became India’s leading ride-hailing platform.

Ola’s Journey

The successful journey of Ola has been marked by rapid growth, strategic partnerships, and innovations. It introduced features like Ola Money, a digital payment solution, and Ola Share, a carpooling service aimed at reducing traffic congestion and promoting eco-friendly transportation options.

In addition to ride-hailing, Ola ventured into other segments like food delivery (Ola Foods) and electric vehicle infrastructure (Ola Electric). Ola Electric gained attention for its plans to build a network of electric vehicle charging stations and develop electric two-wheelers.

Ola’s success can be attributed to various factors such as its user-friendly app, wide availability of cabs, competitive pricing, and focus on customer satisfaction. We will dig deeper into these factors in the next section.

Key Factors that attributed to Ola’s success

This is the most important part of the Ola case study. The success story of Ola can be attributed to the following key factors-

(A) Innovative Business Model

Ola introduced an innovative business model by offering a convenient and affordable alternative to traditional taxi services. It is based on the concept of the “ sharing economy .” It connects passengers needing rides with drivers who use their vehicles.

Some of the highlighting features of the Ola Business Model are-

(A.1) Asset Utilization

Ola optimizes the use of existing resources (drivers’ cars). How? By providing a platform for drivers to offer rides when they have available time, increasing the utilization of their vehicles.

(A.2) Flexible Income

Drivers have the flexibility to work when they want, allowing them to earn income on their terms. This can be particularly appealing to those seeking part-time or flexible employment.

(A.3) Convenience

Passengers can request rides using the Ola app, which provides real-time tracking, cashless payments, and a seamless booking process.

(A.4) Dynamic Pricing

Ola employs a dynamic pricing model (surge pricing) during peak demand times. This feature incentivizes more drivers to come online, ensuring passengers can find rides even during busy periods.

(A.5) Inclusive Model

Ola has expanded beyond urban areas, providing transportation services to underserved and remote regions. Thereby, it enhanced mobility and connectivity.

(A.6) Data Utilization

Ola collects data on travel patterns, demand, and user preferences. This feature enables them to optimize their services, improve efficiency, and offer tailored promotions.

Thus, Ola’s innovative business model leverages technology, data, and a decentralized workforce to transform the transportation industry. It aims to provide affordable and convenient ridesharing services to a wide range of customers.

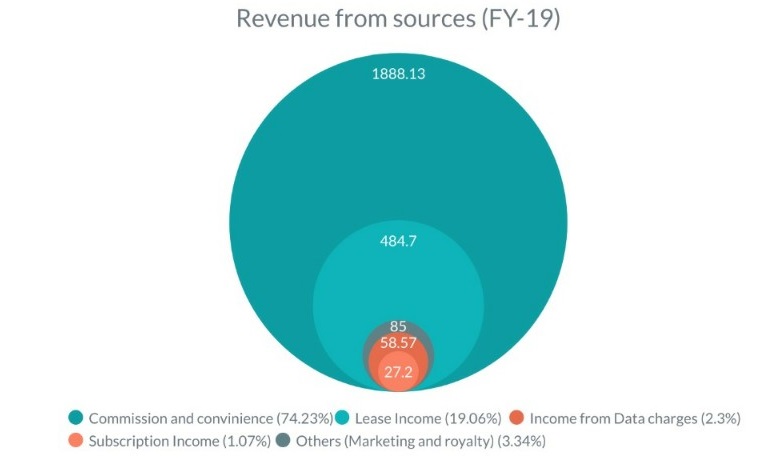

(B) Diverse Revenue Sources: How Does Ola Make Money?

In fiscal year 2022, Ola earned revenue worth Rs.1,970 crore ($250 million). That’s quite impressive. Isn’t it? This fact boils down to one question. How does Ola make money? Ola generates revenue primarily through the following sources-

(B.1) Ride-Hailing Services

As you know, Ola’s core business involves ride-hailing services to customers. The company earns money by charging passengers for the rides they take. The fare charged is usually based on factors such as distance traveled, time taken, and other applicable fees.

(B.2) Commissions from Drivers

Ola takes a percentage of the fare as a commission from its drivers, who operate as independent contractors. This commission varies by region and service type.

(B.3) Surge Pricing

This is a very interesting source of revenue. How? You may ask. Due to its fluctuation! Isn’t Ola famous for its standardized pricing? Yes, it is true. But the pricing changes as per the traffic on the road! During peak demand periods or high-traffic situations, Ola may implement surge pricing. This feature temporarily increases the fare to incentivize more drivers to be available. This allows Ola to generate higher revenue during times of increased demand.

(B.4) Subscription Plans

Ola offers subscription plans that allow users to pay a fixed fee upfront for a certain number of rides or a specific period. These plans provide a sense of convenience and predictability for frequent riders.

(B.5) Food Delivery (Ola Foods)

As you have read above, Ola introduced a food delivery segment too! Through Ola Foods, it earns revenue by charging restaurants a commission on orders placed through its platform. Thus, it competes with major food delivery platforms like Zomato and Swiggy . Although Ola has stopped and re-launched Ola Foods multiple times. But as of now, it operates through cloud kitchens .

(B.6) Ola Money

Ola has a digital wallet called “Ola Money.” Users can add funds to their Ola Money wallet. You can use it to pay for rides, food orders, and other services within the Ola ecosystem. Ola earns money through transaction fees and by investing the funds in the wallet.

(B.7) Advertisements and Partnerships

Ola collaborates with brands for promotional campaigns or advertisements within their vehicles or app. Such partnerships provide an additional stream of revenue.

Thus, these revenue streams collectively contribute to Ola’s overall financial performance and growth.

C) Market Disruption

Do you know what is the most impressive part of the Ola case study? Its market disruption strategy! Ola disrupted the traditional taxi industry in India through its innovative business model. By leveraging technology and a user-friendly app, Ola transformed the way people access and use transportation services. It offered a convenient and cashless booking process, real-time tracking, and dynamic pricing, which were absent in traditional taxis.

(C.1) Part-time drivers

Ola’s model empowered a large number of individual vehicle owners to become part-time drivers, significantly increasing the supply of available rides. This led to reduced waiting times and increased accessibility for passengers, challenging the monopoly-like hold traditional taxis had on the market.

(C.2) Cost-Effective Model

Additionally, Ola introduced cost-effective carpooling options, promoting resource optimization and reducing congestion. Ola case study is incomplete without its cost-effective model. We have explained it in the previous sections in detail. The dynamic pricing mechanism during peak hours ensured that even during high-demand periods, users could find rides, thus addressing a common pain point with traditional taxis.

(C.3) Sharing Economy

By embracing the sharing economy, Ola not only provided affordable transportation alternatives but also created flexible income opportunities for drivers. The traditional taxi industry is often burdened by regulatory complexities and inconsistent service. It struggled to keep up with Ola’s tech-driven convenience and efficiency. You can say that Ola disrupted the traditional taxi landscape in India by introducing an innovative, technology-driven platform. It offered convenience, efficiency, affordability, and income opportunities. Thus, it led to a paradigm shift in how people perceive and use transportation services.

(D) Strategic Expansion

It is a crucial part of Ola case study. Ola strategically expanded by diversifying its services beyond ride-sharing services. It introduced several subsidiaries and services-

Some other services of Ola are-

- Ola Fleet : It involves the leasing of taxis to partnered drivers

- Ola Foods : Do you know, Ola acquired the Indian subsidiary of Foodpanda in 2017? With this, Ola entered into the food delivery segment. Thus, it competed with Z omato & Swiggy .

- Ola Financial Services : In 2015, Ola launched mobile payments and wallet services in the Ola app. It was called OlaMoney. It offered lucrative financial services like buy now pay later, insurance, vehicle loans, and credit cards.

- Ola Electric : Ola Electric Mobility is an Indian electric two-wheeler manufacturer, based in Bengaluru. It was established in 2017 as a wholly-owned subsidiary of ANI Technologies, the parent entity of Ola Cabs.

- Ola Ambulance: Ola has been providing Ola Emergency medical care services in several cities throughout India since Covid-19. It enables citizens to access essential medical care without any delay. (However, there are no latest updates on Ola Emergency Services. In case we find any authentic and latest reports, we will update you soon!)

(E) Global Expansion

Ola ventured into international markets too! Yes, it established its presence in-

- United Kingdom

- New Zealand

These expansions aimed to increase market share, and revenue streams, and create an ecosystem of interconnected services. By adapting to evolving consumer needs and exploring new territories. Ola aims to secure a competitive edge in the global transportation and mobility industry. Thus, Ola case study emphasizes on the significance of global expansion.

(F) Sustainable Practices

Ola Cabs incorporates sustainable practices by introducing electric vehicles (EVs) into its fleet. This initiative aims to reduce carbon emissions and promote clean transportation. They implement ride-sharing to optimize vehicle usage, reducing traffic congestion and pollution. Ola also focuses on driver-partner welfare, offering benefits and training programs. Sustainable practices are the important part of Ola case study.

The Ola “ Mission Electric ” initiative aims to pledge to reject petrol vehicles and opt for e-vehicles. It committed to introducing electric vehicles and reducing global emissions and fossil fuel dependency. It wants to make India, the epic center of electrification.

The company invests in charging infrastructure and collaborates with governments for EV adoption. These practices contribute to a greener environment, lower carbon footprint, and a more sustainable urban transportation ecosystem.

(G) Customer Centric Approach

Ola’s customer-centric approach prioritizes delivering a seamless and personalized experience to users. They focus on understanding customer needs, enhancing service quality, and promoting convenience. Ola’s app interface, real-time tracking, diverse ride options, and responsive customer support exemplify their commitment to user satisfaction. Regular feedback integration and loyalty rewards reinforce this approach, ensuring Ola continually evolves to meet and exceed customer expectations, fostering lasting relationships and loyalty.

In the Ola case study, its success story is characterized by its innovative approach to transportation, strategic expansion, and continuous efforts to improve customer satisfaction. Thus, it became a prominent player in the ride-hailing industry.

How Ola is different from its contemporary cab services?

Ola differentiates itself from other cab services through its innovative pay-per-performance model for drivers and its commission-based earning structure for every taxi booking. This unique approach allows Ola to attract drivers and incentivize them to provide excellent service to customers.

Also, it differentiates itself from its contemporary cab services through its innovative features. Such as an extensive range of ride options, a user-friendly app interface, etc.

Unlike its competitors, Ola offers various vehicle choices, including economy, premium, and shared rides, catering to diverse customer preferences. The app’s intuitive design simplifies booking, real-time tracking, and cashless payments. Ola’s focus on localized features, such as language preferences and in-app entertainment, sets it apart. Additionally, Ola’s commitment to sustainability, electric vehicle integration, and driver welfare showcases its forward-thinking approach. These elements collectively distinguish Ola case study as a holistic and customer-centric ride-hailing platform.

Market Share of Ola

In terms of market share, Ola has been a dominant player in the Indian online taxi services market. In FY 2022, Ola’s market share accounted for approximately 59%. Back in FY 2019, Ola accounted for approximately 72.44% of the total revenue generated by the online taxi services market in India. However, it’s important to note that market dynamics can change over time. As of September 2019, Ola and Uber had market shares of 35% and 45% respectively. But now their market share is 50% and 41% respectively. This indicates a competitive landscape with fluctuating shares.

Note : We have written a detailed comparison on the topic “ Ola vs Uber: Which one is doing better business in India? ” You can look into it for more information.

Why was Ola banned?

On March 2023, the Delhi Government banned online taxi services including that of Ola, Uber, and Rapido bikes. Reason? The government banned Ola citing violations of the Motor Vehicles Act, of 1988. It made aggregators liable for a fine worth Rs.1 lakh.

As per the amendments made in the Motor Vehicles Act in 2019, the aggregators weren’t permitted to operate without a valid license. The government didn’t want the aggregators to compromise the safety of customers. That’s why only those with invalid licenses were banned.

Challenges Faced by Ola

Apart from the ban described above, Ola faced numerous challenges that also impacted its operations. Some of the major challenges were-

1. Regulatory Hurdles

Ola has often encountered regulatory challenges in various regions due to the disruption it brought to the traditional taxi industry. Local governments and taxi unions have raised concerns about Ola’s business model, safety standards, and the classification of drivers as independent contractors.

2. Competition and Market Saturation

Ola has faced intense competition from other ride-hailing platforms, especially Uber. The struggle for market dominance led to price wars and aggressive discounts, impacting Ola’s profitability and brand image. As the market became saturated, customer acquisition became more challenging.

3. Driver Partner Relations

Maintaining a healthy relationship with its driver-partners has been a challenge for Ola. Concerns over fare cuts, incentive changes, and working conditions have led to protests and strikes by drivers, affecting the company’s operations and reputation.

4. Economic and Financial Factors

Economic downturns and fluctuations can impact consumer spending habits, affecting Ola’s ride demand and revenue. Maintaining profitability and financial stability in such conditions is a continual challenge.

Future Plans of Ola

In terms of expansion, Ola has plans to extend its services to 500 towns, bringing shared mobility to 500 million people. They have begun aggressive expansion overseas too! Additionally, Ola is venturing into new avenues of transportation. By the end of 2023, they are set to launch a motorbike. This plan is followed by the introduction of a battery-powered car in 2024. These upcoming vehicles will further expand Ola’s presence in the mobility sector.

Overall, Ola Cabs is dedicated to embracing electric mobility and expanding its services to reach millions of people across different towns. Through their “ Mission Electric ” initiative, they aim to contribute to a sustainable and eco-friendly future. Also, providing convenient transportation options to its customers is one of its essential features.

Startups are one of the key players in the nation’s development. Not only it boosts innovation but also provides employment and services. However, as per the statistics, startups have extremely high mortality rates. Reason? Lack of strategic planning, humongous losses, expenditures, etc. Fortunately, some startups have turned the tables in India with their successful operations. And Ola is one of them!

Ola case study is a popular success story in the Indian startup ecosystem. It exemplifies the power of innovation, entrepreneurship, and understanding the needs of the market. By leveraging technology, Ola created a platform that transformed the way people commute in India, providing convenience and reliability.

Overall, Ola’s success can be attributed to its commitment to providing a seamless and efficient cab booking experience to its users. It became a kingpin of online cab booking services. All thanks to its constant efforts to adapt to changing market dynamics.

Related Posts:

Really impressive and informative thanks supti ….😊😊🤗❣️

It was a knowledge gainer and well research drafted. I am eager to know how Ola initially persuaded Taxi drivers to operate on their App Whether it was D2C or by digital marketing.

Contact Info: Axponent Media Pvt Ltd, 706-707 , 7th Floor Tower A , Iris Tech Park, Sector 48, Sohna Road, Gurugram, India, Pin - 122018

© The Business Rule 2024

Contextual Inquiry Related to Cab Booking: Using Uber and Ola Cabs in India

- First Online: 01 June 2021

Cite this chapter

- Akash Rode 5 &

- Ganesh Bhutkar 5

496 Accesses

Ola Cabs and Uber are leading Cab Booking Apps in India that offer services like cab booking, ridesharing, and food delivery. To cater to the increasing demand from customers and to expand their horizons, these tech giants are involved in constant competition with each other to gain new users and retain existing ones. This research paper is a result of an extensive study of the notion of cab booking in India. The objective is to understand the nature and the perception of Indian users who avail these cab services via mobile apps, especially users of Uber and Ola Cabs. In doing so, the motive is to empathize with Indian cab users, both drivers and travelers, by understanding their problems and frustrations. This is achieved by using the ethnographic approach of Contextual Inquiry and work models are developed based on the insights found therein.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Drife, Taxis in India – The History, Geography and Economics of it. Medium, @Drife Official, May 6, 2019

Google Scholar

Taxi, Wikipedia, https://simple.wikipedia.org/wiki/Taxi , Accessed on Jan 07, 2020

Sachitanand, R. The challenges before cab aggregators in India. The Economic Times, Industry, Transportation, Shipping, October 28, 2018

Utkarsh. The Evolution of the Indian Taxi Market - Comparing the Biggies. Inc42, Features, Datalabs, 25 Nov, 2015

Demographics of India. Wikipedia, https://en.wikipedia.org/wiki/Demographics_of_India . Accessed on Jan 12, 2020

Uber. Wikipedia, https://en.wikipedia.org/wiki/Uber . Accessed on 04 Jan 2020

Helling, B. Uber cars: Your guide to the various types of Uber cars. Ridester, Brett Helling, May 20, 2020

What do different types of Uber cars mean. Quora, Uber, August 22, 2018

IndSA, Comms. Uber Launches Uber Boat in Mumbai. Uber Newsroom, India, January 30, 2019

Arun. Know 20 different types of travelers you can come across. Treebo, Blog, Travel Hacks, February 20, 2018

Reddy, R. Uber and Ola are still not safe for women. Livewire, Personal category, June 27, 2019

Sharma, I. Panic buttons won’t fix Ola and Uber’s sexual-assault problem. Quartz India, Double-edged Sword, June 8, 2018

N. Borkar, Competitive analysis of the Indian food delivery industry – Zomato, Swiggy, UberEats and food panda. Medium, @Nikhil Borkar, October 19 (2018)

S. Bansal, Ola Drops Food Panda Delivery, Lays off Several Employees (Livemint, Companies, Startups, April 2020)

R. Rajesh, S. Chincholkar, A study on consumer perception of Ola and Uber Taxi services. Indian J Comp Sci 3 (2018)

Khade, A., Patil, V.: A Study of customer satisfaction level of Ola and Uber paid taxi services with special reference to Pune city. Int J Manag Technol Eng, 8, VIII, 1596–1603. (2018)

S. Yamuna, R. Vijayalakshmi, K. Jeeva, D. Boopathi, R. Kumar, A progressive study on users perception and satisfaction towards online cab service with reference to Coimbatore. Int J Res Appl Sci Eng Technol 7, IV , 156–157 (2019)

R. Shukla, A. Chandra, H. Jain, OLA VS UBER: The battle of dominance. IOSR J Bus Manag 1, XI , 73–78 (2017)

N. Khatoon, N. Kumar, P. Singh, S. Kumari, S. Lakhimsetti, The Platform Economy: A Case Study on Ola and Uber from the Drivers’ Partners Perspective (Tata Institute of Social Sciences, 2019)

G. Manjunath, Brand awareness and customers satisfaction towards OLA cabs in Bengaluru North and South region. RJSSM 5 (2015)

D. Uthira, A diagnostic study of cab aggregation industry using Serviqual gap model. Int J Market Technol 8 (6), 59–84 (2018)

Y. Cui, Q. He, A. Khani, Travel behavior classification: An approach with social network and deep learning. Transportation Research Record: J Transport Res Board 2672 (47), 68–80 (2018)

Article Google Scholar

G. Ayyappan, A. Kumaravel, A novel classification approach of travel review dataset based on health. Int J Comp Sci Eng 11 (6), 30–33 (2019)

Joseph, S, Chen., Yu-Chih, Huang., Jen-Son, Cheng.: Vacation lifestyle and travel behaviors, J. Travel Tour. Mark., 26, 494–506. (2009)

J. Golob, F. Golob, Classification of approaches to travel-behavior analysis. TRB Special Rep 201 , 83–107 (2015)

MATH Google Scholar

P. Kale, G. Bhutkar, V. Pawar, N. Jathar, Contextual design of intelligent food carrier in refrigerator: An Indian perspective, in Human Work Interaction Design. Work Analysis and Interaction Design Methods for Pervasive and Smart Workplaces , Advances in Information and Communication Technology, 468, ed. by J. Abdelnour Nocera, B. Barricelli, A. Lopes, P. Campos, T. Clemmensen, (Springer, Cham, 2015)

V. Shinde, G. Bhutkar, V. Pawar, Overview of Garbage Monitoring System, Humanizing Work and Environment, 2017 (AMU, India, 2017)

Uber Eats. Wikipedia,. https://en.wikipedia.org/wiki/Uber_Eats , Accessed on 14 Jan 2020

Pal, B. Among these 8 categories, what type of traveler are you?. Travind, Blog, Types Of Travelers, December 30, 2017

King, S. What kind of traveler are you?. Conde Nast traveller, blog, Steve King

N. Wani, G. Bhutkar, S. Ekal, Conducting contextual inquiry of twitter for work engagement: An Indian perspective. Int J Comp Appl 168 (9), 975–8887 (2017)

U. Pandya, R. Rungta, G. Iyer, Impact of use of mobile apps of Ola cabs and taxi for sure on yellow and black cabs. Pac Bus Rev Int 9 (9), 91–105 (2017)

Bhattacharya, A. Ola Vs Uber the latest score in the great Indian taxi app game. Quartz India, Be Fast or Be Last, February 12, (2019)

Bellis, M. Hailing: History of the taxi. Thoughtco, Humanities, History & Culture, February 5, 2020

Taxicab, Wikipedia, https://en.wikipedia.org/wiki/Taxicab , Accessed on 07 Jan 2020

Bharadwaj, S. Taxi industry in India: A story of bootleggers and Baptists. Swarajya Magazine, Politics, November 20, 2016

Lobo, J. In the age of Uber and Ola, Mumbai’s iconic taxis are becoming works of art. Quartz India, The One And Only, April 20, 2018

Deo, V. Everything you wanted to know about the big 5 cab services in India. Techstory, Business, May 5, 2015

Uber Driver & Grandmother By Urooj Ashfaq. YouTube, https://youtu.be/EzJhTb564iA . Accessed on Jan 12, 2020

Uber Pool & Wagon R Standup Comedy by Ashutosh Gupta. YouTube, https://youtu.be/omy0JIUNuAw . Accessed on 12 Jan 2020

It’s My Birthday Standup Comedy by Sumit Anand. YouTube, https://youtu.be/6CdhE3hh2CQ , accessed on 12 Jan 2020

Five Star Rating Vinay Sharma Standup Comedy. YouTube, https://youtu.be/TxmGrsT0v3c , accessed on Jan 12, 2020

Ola Share ka Suffer Standup Comedy by Rajat Chauhan. YouTube, https://youtu.be/bj-uhD9jjWg , accessed on Jan 12, 2020

Ola Cabs. Wikipedia, https://en.wikipedia.org/wiki/Ola_Cabs . Accessed on 04 Jan 2020

Download references

Author information

Authors and affiliations.

Centre of Excellence in Human-Computer Interaction, Vishwakarma Institute of Technology (VIT), Pune, India

Akash Rode & Ganesh Bhutkar

You can also search for this author in PubMed Google Scholar

Editor information

Editors and affiliations.

Uganda Christian University, Mbale University College, Mukono, Uganda

Emmanuel Eilu

School of Computing & Information Technology, Makerere University, Kampala, Uganda

Rehema Baguma

Karlstad University, Karlstad, Sweden

John Soren Pettersson

Vishwakarma Institute of Technology, Pune, Maharashtra, India

Ganesh D. Bhutkar

Rights and permissions

Reprints and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this chapter

Rode, A., Bhutkar, G. (2021). Contextual Inquiry Related to Cab Booking: Using Uber and Ola Cabs in India. In: Eilu, E., Baguma, R., Pettersson, J.S., Bhutkar, G.D. (eds) Digital Literacy and Socio-Cultural Acceptance of ICT in Developing Countries. Springer, Cham. https://doi.org/10.1007/978-3-030-61089-0_3

Download citation

DOI : https://doi.org/10.1007/978-3-030-61089-0_3

Published : 01 June 2021

Publisher Name : Springer, Cham

Print ISBN : 978-3-030-61088-3

Online ISBN : 978-3-030-61089-0

eBook Packages : Computer Science Computer Science (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Taxi Drivers and Taxidars: A Case Study of Uber and Ola in Delhi

2018, Journal of Developing Societies

This article examines the role of the sharing economy in India’s development through the examples of aggregated taxis such as Uber and Ola in Delhi. 1 Based on a general survey of Uber and Ola drivers and users in Delhi, we argue that Uber and Ola do not measure up to their expected potential in the development of India’s economy on the parameters of ecological sustainability, employment through renting out assets and reduction in the need to own assets. Yet, Uber and Ola are notable for the creation of viable employment opportunities for drivers, and their many benefits for urban middle class users. Unique to the Uber and Ola phenomenon in India is the interception of driver opportunities by taxidars (taxi-owners). This tweaked Uber model for the Indian market allows the middle class individual—the police official, bureaucrat, property dealer, transporter or a professional—an entry into the aggregated taxi market.

Related Papers

Urban Platforms and the Future City: Transformations in Infrastructure, Governance, Knowledge and Everyday Life

Anurag Mazumdar

Examining the practices, strategies and policies of those involved in ride-hailing platforms as imagined affordances reveal how India’s platform urbanism is co-constituted. The negotiations of ride-hailing drivers with multiple techno-social actors and arrangements are engendered by both enabling and disabling neoliberalism. This chapter explores the contestations and affordances of the ride-hailing economy, the practices and discourses of performing “community” and the governance of and by platforms. It presents original discourse and textual analysis of journalistic accounts of Uber and Ola drivers’ narratives, advertisements, YouTube videos and corporate blogs published between 2013 and 2019. The micro-politics, contestations and dissonances of ride-hailing taxi platforms in India reveal how motoring structures and infrastructures are organised as well as how practices and discourses illuminate their operation. One important conclusion is that the strategies and practices to enable and disable “sharing” do not map onto individual actors, leaving the “sharing” ethic as fundamentally contingent and messy.

Aktuelle Forschungsbeiträge zu Südasien

Tobias Kuttler

Digital mobility platforms such as “Uber” are forms of passenger transportation that have become integral parts of the mobility landscape of cities. The policy response to these services has varied across the world, from complete abolition to integration into local transportation laws. The global business model of Uber has been met with fierce resistance by local taxi service providers and resulted in open conflicts in cities such as Barcelona, Berlin, Paris and even stirred violence e.g. in Johannesburg. In all these cities, taxi operators feared and experienced a substantial loss of patronage. Due to the legal challenges and increased competition in almost every part of the world, the consequences have been widely reported and discussed in the media. However, the dynamics of the changing mobility landscapes in cities have been poorly understood so far, partially because they have been observed without taking into account global as well as specific local processes of urban change. Although being a universal business model making use of similar sets of digital tools, I point towards the fact that the actual operation of these services is embedded in the local social, political and economic fabric. While being a “disruptive” business model, I argue that these services are also part of a wider process of urban change. At the same time, the operation of such services builds on pre-existing social inequalities, socio-spatial fragmentation and exploitation that are defining characteristics of the capitalistic city in both the global North and South. This PhD project aims at better understanding the nature of the apparent conflict between the “new” and “old” forms of mobility. I chose Mumbai, with its iconic black-and-yellow taxi, as a case study.

AoIR Selected Papers of Internet Research

Anushree Gupta

Working in the digital platform economies has typically been characterised by a corporatised and media fuelled narrative of independence—as a route to financial independence, freedom to determine work schedules, and the positioning of workers as ‘independent contractors’. This terminology suggests a sense of novelty in the nature of jobs and the upending of hierarchies by technological processes. This panel aims at excavating the pre-existing power dynamics between customers, workers and intermediaries. Taxi driving, delivering food and providing domestic care services have long been informal forms of work segregated along lines of caste, religion, class and gender in urban India. What has the platformisation of this work meant for workers, their experiences of work and the opening up of this work? Has the involvement of technological intermediaries led to an opening up and the opening up of this work outside of its parochial considerations of class, caste, gender, religion? The pan...

suresh kumar subudhi

The Boston Consulting Group (BCG) is a global management consulting firm and the world's leading advisor on business strategy. We partner with clients from the private, public, and not-for-profit sectors in all regions to identify their highest-value opportunities, address their most critical challenges, and transform their enterprises. Our customized approach combines deep insight into the dynamics of companies and markets with close collaboration at all levels of the client organization. This ensures that our clients achieve sustainable competitive advantage, build more capable organizations, and secure lasting results. Founded in 1963, BCG is a private company with more than 90 offices in 50 countries. For more information, please visit bcg.com.

Work Organisation, Labour & Globalisation

Padmini Sharma

The development of platform capitalism is restructuring social relations across the globe by altering traditional hierarchical structures, internal labour relations and their micro-political interactions. Digitally mediated platforms appear to be changing relational dynamics, contributing to a growth in individualisation among the workers. The platform economy, in general, and ride-hailing services, in particular, represent an emerging capitalistic regime that is breeding a working class with often contradictory class locations and class positions. Because the class dimension in the existing literature concerning platform workers in India has been less critically approached, this research intends to use class-based theorisation to analyse capital–labour relations in the ride-hailing service, with the aim of reflecting on the linkages between class location, class consciousness and class practices among the workers. This article highlights how the internal contradictions, combined wi...

Journal of Management and Science

Rushina Singhi

Urban commuters are faced with diverse problems ranging from traffic jams, parking congestions, ownership responsibilities of vehicles etc. Urban mobility is in need of means that address the contemporary problems of the commuters and provide ubiquitous accessibility. This is the reason behind the success of car aggregators in urban regions of India. Car-sharing is an alternative to personal vehicle ownership. Car-sharing refers to accessing a car for money typically with the help of an online application. Car sharing provides an experience of enjoying all the benefits of a car without ownership responsibilities. Although there are many car-sharing providers around the world but remarkably car manufacturing companies like BMW, Ford, GM and others have also launched car sharing programs. This study is restricted to the car sharing programs launched by car manufacturing companies. Though such car sharing facilities by car manufacturing companies are not yet available in India yet this...

Volvo Research and Education Foundation

Subhasish Borah

The transport sector in India currently faces the epochal challenge of mitigating the high demand impacts while adapting to the low-carbon future. With this study VREF and the authors aim to provide a holistic understanding of the various informal and shared mobility modes and services in India with a primary objective of facilitating more efficient, evidence-based policy-making processes. The study is concerned with shared mobility as a new mobility service emerging in addition to traditional services, drawing on Internet technologies to meet the demand with high efficiency: rideshare taxis, public bike sharing, bike renting, carpooling, car renting, and ride-hailing services (including minibuses) emerging in various Indian cities. The study views conventional informal mobility and the new shared mobility services as one sector contributing to paratransit services for a large population in Indian cities. India’s informal and shared mobility sector is closely linked with informal livelihood, crucial for many households moving out of poverty. However, severe customer competition leads to road safety challenges, a lack of traffic discipline, and operational inefficiency. The vehicles often need to be better maintained, and the selective crackdown by the authorities coupled with a lack of efficient regulatory mechanisms add to the ‘informality’ of these services. With the emerging shared mobility market, there is an opportunity to organize this sector with better legislative and regulatory support. This study aims to provide the most recent overview of this sector to understand and appreciate the issues while building a case for better policy and regulatory support. The present study aims to address these issues by posing the following research questions: What is the status of informal and shared mobility services in Indian cities regarding the level of service, regulatory frameworks, and emerging socio-economic trends? What are the gaps in the existing research, and how can they be addressed in the future research agenda for ISM services in India? The study aims to provide state-of-the-art knowledge of informal and shared mobility in India, drawing on a review of academic and gray literature, dialogues with stakeholders, and data collection with quantitative and qualitative analysis.

Valahian Journal of Economic Studies

Leena A Kaushal

The ongoing debates and discussions about sharing economy revolve round its definition, regulations and impact on economy, business and consumers. The paper attempts to develop a theoretical framework that define the sharing economy and analyse the possible association between the sharing economy and sustainability. The paper also assesses the need for an institutional and regulatory framework to strengthen sharing economy as an economic driver, potentially contributing to the more sustainable growth of the world economy.

Revista de Gestão

Roberto patrus

Purpose The purpose of this paper is to analyze why people have become suppliers in the sharing economy (SE) as Uber drivers in a developing country. Design/methodology/approach From a background on SE, car sharing and gig economy, the authors carried out a qualitative research. The analysis was based on 20 semi-structured interviews conducted with Uber drivers, and on the authors’ participant observation as Uber drivers and passengers in the third largest Brazilian city, Belo Horizonte. Findings Empirical evidence shows that becoming an Uber driver is more a matter of solving unemployment on a more permanent way rather than a search for a temporary and flexible work to supplement income. Although there are benefits related to flexibility, income and social interactions, negative externalities identified herein lead to the conclusion that the overall work relations and conditions are negative. Originality/value Much in the literature of the SE is focused on understanding consumer be...

Ishita Trivedi

This paper tries to demystify the political economy that motivates commuters in Delhi to perceive auto rickshaw fares as ‘high, and unfair’ and auto drivers as inherently ‘greedy and nonchalant’ people. I argue that the perception about this sector is simplistic and fuelled by the middle class’ need to shoot the messenger- or, the most visible part of that process- i.e. the auto-rickshaw driver. My argument is presented in five sections- a brief introduction of the auto financier’s mafia-like credit systems, and monopoly of permits that allows total control over the operation of three-wheelers on-road; underlining the post-colonial roots of Delhi’s Global City aspirations and how that translates in a regulatory system that is discriminatory to drivers; how the drivers, as a collective, participate in the democratic politics of the city, and relate to the state; the ubiquity of the auto-rickshaw on Delhi roads, and the consequent ramifications of being politically visible; finally, I turn the spotlight on the middle-class milieu, their activism, and the bourgeoisie environmentalism of the Indian Supreme Court.

RELATED PAPERS

… Plains Research: A …

Gloria Gonzalez-Kruger

Eduardo Moussalle Grissolia

Carlos Augusto Martinez Mamian

Estenio Ericson Botelho De Aze

Qualitative Inquiry

Rosemary Reilly

Turkish Journal of Botany

C.CEM ERGÜL

East African Journal of Forestry and Agroforestry

Goodluck Massawe

Krisztián Józsa

Vision Research

JOSE ROGELIO DOMINGUEZ RAMIREZ

Bulletin of the American Astronomical Society

Gianluca Massei

Stephanie Preising

Indonesian Journal of Electrical Engineering and Computer Science

Maham Kamil

Journal of Alloys and Compounds

Bioresource Technology

Mª Carmen Lobo Bedmar

RANSFORD OPOKU DARKO

Tayo Akinyosoye

Journal of Learning Disabilities

Lisa Weyandt

Journal of the Taiwan Institute of Chemical Engineers

Hossein Eshghi

Revista Médica Electrónica

Yasmin Rodriguez Acosta

Proceedings of the National Academy of Sciences

John Coffin

Dzieje Najnowsze : [kwartalnik poświęcony historii XX wieku]

Bohdan Halczak

Journal of Mammalogy

Hailey Boone

Materials Research

Rafael Rodriguez-Clemente

Transactions of the Indian Institute of Metals

Chitnarong Sirisathitkul

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Revolutionizing Digital Communication: The Power of Olly and AI

- AI-Powered Video Editing with Snapy.ai: The Future of Content Creation is Here

- Dawn of AI-Powered Video Editing: Transform Your Videos with Silence Remover Online

- The Dawn of Generative AI: Why and How to Adopt it for your Business

- Harnessing the Power of Generative AI for Business Innovation: An Exclusive Consultancy Approach

Original content with a single minded focus on value addition.

Ola case study: The story of a Millionaire without a car

With this piece, we take a look at the Ola case study. Essentially discovering how Ola came into being, understanding their business model and finally what’s next for them. Let’s jump right in the story.

The Ola case study: The story of Ola

The year is 2010. Bhavish calls a taxi service portal to rent a taxi. He has to travel to Bandipur from Bangalore. He’s already in a rush and the driver is still not here. Helpless, he sits there waiting for his taxi to pick him up.

The driver comes and Bhavish boarded the car. He thought there’s no point of questioning the driver why he is late. He already knows the driver’s answer. Quietly, he is waiting for his destination to arrive soon.

The jungle arrives. To Bhavish surprise, the driver stopped the car in the middle of the jungle.

Bhavish: “Why have you stopped the car?”.

Driver: I won’t go further.

Bhavish: But why?

Driver: Road is dangerous ahead. I’ll charge extra for it.

Bhavish: It makes no sense. We have already fixed the price. You should have charged considering all the factors.

Driver: No, I won’t go until you pay me more.

Bhavish thought if he’ll deny payment to the driver, he won’t resist and will continue at the fixed price. But the driver leaves him in the middle of the jungle and returns back to Bangalore. It left Bhavish infuriated.

While walking back, Bhavish realises he has to do something about this issue. He is seeing an opportunity that will turn the life of millions. And this is how OLA cabs came to existence !

Business model: How does OLA Work?

Most people think Ola is a taxi service business. If you’re one of them, then you are slightly wrong.

Ola is a taxi aggregator business. They act as an intermediary between taxi drivers and customers. The company partners with private taxi owners, provide them process and technical equipment for booking through the Ola app.

They follow the ‘Asset Light Model’ where a business owns few capital assets in comparison to the value of its operations. Ola has given full autonomy to drivers by making them entrepreneurs. This way Ola doesn’t have to worry about car’s EMI cost, petrol cost, maintenance cost, driver’s salary, etc. Ola has become highly profitable because they only have to invest in technological advancement. It’s a win-win for both Ola and the drivers.

Revenue model: How does OLA earn money?

Ola charges a 15% commission on every ride . For example, if a ride costs Rs.200 to the customer, Ola will claim Rs.30 and the remaining amount will go in the pockets of the driver.

Ola has been doing 1.5 million rides approximately on a daily basis which means they are at least earning half a million daily.

Ola has introduced a ‘Minimum Business Guarantee’ model which ensures every driver earns Rs.1300 daily. If unable to do so, Ola adds money to the driver’s account linked to Ola after deducting it’s 15% commission.

Other revenue streams of Ola

- Ola Money: Joined the league of Paytm, PhonePe, AmazonPay, etc. through which customers can make payments to various vendors as well as for their ride.

- Ola Prime Play: Providing a comfortable and more personalized experience to customers at the nominal fee.

- In-cab advertisements: Use of promotional tools like brochures, leaflets, etc. to promote different brands who are ready to pay.

- Cab leasing: The company purchases the car and then lease it out to the drivers. It helps in building asset value as well as bring revenue in the form of the fee charged from drivers.

- Corporate tie-ups: Creating customized packages for the corporates and their employees at a subsidized rate.

OLA VS UBER:

One cannot talk about OLA, without mentioning Uber. Uber came in India after 3 years of Ola and according to Bhavish, he had never heard of Uber before. There is a continuous fight between both the companies for the largest market share. Currently, Uber operates in 58 cities while Ola in 250 cities. While Uber has said in its recent report that It has more than 50% of market share in India but no evidence was presented.

Being the leader in the market is significant for both players. While India is the home market for Ola and it is holding that spot of the largest market share, managing its profitability is crucial as it plans for a public market listing in 2021. For Uber, India continues to be an important market for the company to drive growth in terms of the number of rides.

A big advantage of Uber is the number of drivers downloading its app. On this parameter, Uber has left Ola far behind. In the coming future when the only factor will be availability, the company with a larger number of drivers will succeed, and right now Uber seems to win that battle.

What’s Next?

Ola electric mobility : Ola’s mission was to put 1 million electric vehicles on Indian roads by 2021. It even got a thumbs up from Softbank who invested $250 million in Ola’s mission.

Then the pandemic happened!

Like many of its brethren, Ola is conserving cash. They have cut down 1400 jobs, about a 1/3rd of its Indian workforce. The pandemic has forced travel and transportation space to halt their expansion plans. Even Uber has furloughed 6700 employees globally. In response to the fear of the hailing cab now, Ola is planning to install shields between drivers and passengers. Sanitizing cabs, providing sanitizers and masks to drivers, etc. to convince the customer that riding with Ola is safe.

Global domination: Since 2018, Ola has expanded its operations in Australia, UK, and New Zealand. And as the pandemic situation has been brought under control in Australia and New Zealand, companies see a huge opportunity.

The single market that Ola is betting on is London. As Ola estimated, it is as big as all of India. On the other hand, uber’s license was revoked due to continuous compromise made with the security of its riders. Ola has already signed up tens of thousands of drivers before the pandemic. Now, as the situation improves and the economy is slowly opening, people are getting back to normal life.

Again, Bhavish sees a business opportunity in the current distress which is may yield him a huge profit in the coming time.

This interesting piece was penned by Rishita Bansal . She is a brand planner & storyteller. If you liked the piece, share it with your best friend on WhatsApp or LinkedIn .

If you are a business student, you must absolutely follow us here .

ola case study, ola case study, ola case study, ola case study, ola case study, ola case study, ola case study, ola case study, ola case study, Story of ola, Story of ola, Story of ola, Story of ola, Story of ola, ola case study

- 7Ps of Marketing Mix: Explained well with examples

- [Part 2] “Design thinking, the need of the hour”: The Placement Season of 2020

You May Also Like

101 of Consumer Insights for Brand Managers

What is KVIC? – An epitome of ‘Aatmanirbhar Bharat’

Idea Cellular case study: From Idea to Vi

5 thoughts on “ ola case study: the story of a millionaire without a car ”.

Ola is not taking 15 % commission

They are take More than 25 % from the Driver

Pingback: Trends in startup Space - Evolving Startup Business models

Yes ola is taking almost 30% including taxes customer service charge everything and they are giving only 10 rupees for an kilometre this 10 rupees is not only for kilometre waiting time traveling time including in this 10 rupees only for one kilometer and for 200 rp they are charging 60 rupees and for driver 140 only if I traveled for 14 kilometre 15% are all fake news

Pingback: The 101 Of How Product Innovation Works?

Great blog post! I really enjoyed reading your insights on this topic. Your writing is clear, concise, and informative. I appreciate the effort you put into researching and presenting your ideas in an engaging way. The examples you provided were very helpful in illustrating your points and making the content relatable. Thank you for sharing your knowledge and expertise on this subject. I look forward to reading more of your work in the future!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Login To RMS System

- About JETIR URP

- About All Approval and Licence

- Conference/Special Issue Proposal

- Book and Dissertation/Thesis Publication

- How start New Journal & Software

- Best Papers Award

- Mission and Vision

- Reviewer Board

- Join JETIR URP

- Call For Paper

- Research Areas

- Publication Guidelines

- Sample Paper Format

- Submit Paper Online

- Processing Charges

- Hard Copy and DOI Charges

- Check Your Paper Status

- Current Issue

- Past Issues

- Special Issues

- Conference Proposal

- Recent Conference

- Published Thesis

Contact Us Click Here

Whatsapp contact click here, published in:.

Volume 6 Issue 2 February-2019 eISSN: 2349-5162

UGC and ISSN approved 7.95 impact factor UGC Approved Journal no 63975

Unique identifier.

Published Paper ID: JETIRY006030

Registration ID: 196373

Page Number

Post-publication.

- Downlaod eCertificate, Confirmation Letter

- editor board member

- JETIR front page

- Journal Back Page

- UGC Approval 14 June W.e.f of CARE List UGC Approved Journal no 63975

Share This Article

Important links:.

- Call for Paper

- Submit Manuscript online

- Swaroop Tiwari

Cite This Article

2349-5162 | Impact Factor 7.95 Calculate by Google Scholar An International Scholarly Open Access Journal, Peer-Reviewed, Refereed Journal Impact Factor 7.95 Calculate by Google Scholar and Semantic Scholar | AI-Powered Research Tool, Multidisciplinary, Monthly, Multilanguage Journal Indexing in All Major Database & Metadata, Citation Generator

Publication Details

Download paper / preview article.

Download Paper

Preview this article, download pdf, print this page.

Impact Factor:

Impact factor calculation click here current call for paper, call for paper cilck here for more info important links:.

- Follow Us on

- Developed by JETIR

Browser not supported

This probably isn't the experience you were expecting. Internet Explorer isn't supported on Uber.com. Try switching to a different browser to view our site.

Redefining career growth: a tale of two sales leaders

Carissa Evans, Mid-Market Sales Manager and Robbie Keegan, Grocery and Retail Head of Sales, have had two different career paths at Uber Eats but have both been able to grow their careers as sales leaders by moving across different categories. Today they lead sales teams in two different lines of business. Carissa’s team supports our restaurant partners to achieve their business goals on our platform. Robbie and his team partner with brands outside of restaurants to help our customers get almost anything delivered with the convenience of Uber Eats. They both agree that the exposure and experience outside of the traditional sales role is what sets apart a career in sales at Uber.

Robbie says : “Uber’s different lines of business are at different stages of growth in each of our markets, which in turn means the opportunities for personal and professional growth are wide-ranging and readily available. Whether you’re seeking to deepen your expertise in a specific area or explore new horizons, there’s always a path forward.”

We sat down with Robbie and Carissa, both based in Sydney, to find out more about their career paths, the support they’ve had to grow at Uber and what advice they have for other sales professionals.

Tell us about yourself and your role.

Carissa: “I joined Uber Eats 2 years ago as a Partner Success Manager in our Enterprise Sales team and I’m now leading a team of 8 Account Managers on our Mid-Market Sales team. My role is to set the strategy and coach the team to better support our Restaurant Partners. Ultimately, we are responsible for helping the restaurants on our platform achieve their business goals with Uber, which means we get to solve an ever changing variety of problems.”

Robbie: “I joined Uber Eats 4 years ago as an Account Manager looking after small and medium sized businesses in New Zealand. I quickly transitioned to a new role focused on the highest potential mid-market brands which I managed for two quarters before joining the grocery and retail team, a newly established line of business for Uber at the time. Our mission is to help our customers get almost anything on the Uber Eats platform through partnerships outside of restaurants such as grocery, liquor, convenience, pharmacy and more. Initially I led account management for small-medium sized businesses and have since taken on mid-market and enterprise customers, now overseeing both account management and acquisition.”

What’s it like working in sales at Uber Eats?

Carissa: “I get to work in an environment with intelligent, positive people who support career growth. There’s lots of opportunity to take on more work and develop professionally, so I’ve been able to continue to learn and challenge myself. The business makes sure you have an understanding of the role you play in the broader business strategy and then recognises performance and supports your growth. In summary, it’s a culture that promotes growth and supports your aspirations.” Robbie: “Uber’s work environment is synonymous with speed. It’s a place where the pace is fast, and collaboration between different teams, especially sales and operations, is not just encouraged but fundamental to success. The synergy between these elements creates an atmosphere where ideas flow freely, and everyone plays a vital part in Uber’s success.”

Tell us about the support you’ve received to grow your career.

Carissa : “I’ve been given all of the flexibility I’ve needed aligned to where I was at in my life and it hasn’t held me back from growing my career. I was promoted whilst I was on parental leave and was given the opportunity to come back part-time when I returned to work. The flexibility we have to work around personal commitments is amazing and I’ve always felt supported to put my health and family first.” Robbie: “ There has been a genuine investment in my professional growth. Our leaders have consistently shown a keen interest in guiding my career trajectory, fostering an atmosphere where open communication is not just welcome but encouraged. I’ve always felt empowered to express my thoughts honestly and knowing that my concerns are heard and valued.”

What’s different about working in sales at Uber?

Carissa: “ You get so much exposure outside of your role and gain such a breadth of experience at all levels of the organisation. Part of that means that you get to work with such a variety of people with different ideas and ways of thinking that really opens your mind and gets you exposure to such diversity of thought.”

Robbie: “Regardless of your role, you get a panoramic view of the operation. The visibility extends far beyond the boundaries of traditional sales roles and you get to work on such a range of different projects. One of the most rewarding aspects is witnessing the tangible impact of your work on the lives of those around you. Ideas come to life and you get to see the ripple effect reaching your friends and family in real life.”

Any advice for aspiring sales professionals?

Carissa: “Be proactive about your career growth by building your network and ensuring the right people are aware of your aspirations. Also, don’t be limited to the most obvious next career step and be open to what that next challenge is–experience from a lateral move can give you valuable experience in the long-term.”

Robbie: “Start by mastering your core role to become the go-to expert in your field. Once you’ve established a solid foundation, cultivate a mindset of openness to diverse opportunities. Actively seek chances to work beyond the confines of your role, as the experience gained in different areas is invaluable when transitioning into more senior positions.”

Grow your career. Explore open roles →

Posted by Uber

Come reimagine with us

Related articles.

Leading with a global perspective: Maisie Lam at Uber

6 May / Global

Sarita grew from Marketing Lead to General Manager of Uber Greece

2 May / Global

Kyrsten Jones on balancing leadership and motherhood at Uber

5 reasons to join Uber in Sales

Beyond disability: Jesse’s being the change he wants in the world

17 April / Global

Most popular

Migrating a Trillion Entries of Uber’s Ledger Data from DynamoDB to LedgerStore

Ensuring Precision and Integrity: A Deep Dive into Uber’s Accounting Data Testing Strategies

DragonCrawl: Generative AI for High-Quality Mobile Testing

From Predictive to Generative – How Michelangelo Accelerates Uber’s AI Journey

Resources for driving and delivering with Uber

Experiences and information for people on the move

Transforming the way companies move and feed their people

Expanding the reach of public transportation

Explore how Uber employees from around the globe are helping us drive the world forward at work and beyond

Engineering

The technology behind Uber Engineering

Uber news and updates in your country

Product, how-to, and policy content—and more

Sign up to drive

Sign up to ride.

International Journal of Research in Social Sciences Vol. 9 Issue 4, April 2019, ISSN: 2249-2496 Impact Factor: 7.081 Journal Homepage: http://www.ijmra.us, Email: [email protected] Double-Blind Peer Reviewed Refereed Open Access International Journal - Included in the International Serial Directories Indexed & Listed at: Ulrich's Periodicals Directory ©, U.S.A., Open J-Gage as well as in Cabell‟s Directories of Publishing Opportunities, U.S.A

Cab Aggregators in India : A Case Study of Ola and Uber

Vinod Kumar Bishnoi* Reetika Bhardwaj** Abstract Over the past few years, there has been an unprecedented growth in the Indian taxi industry. The demand for taxis in India is on the rise owing to the hassle free travelling experience offered to the passengers. Taxi is giving a stiff competition to both public transit and private car in the current times. India currently is witnessing a revolution in Indian taxi market. There is a downward trend in the usage of traditional taxis by the customers. With the growing smartphone penetration and active internet users, there is a surging demand for app based taxis. The objective of this paper is to gain insights about the present scenario of taxi industry in India and to compare desi and videsi taxi rivals i.e. ola and uber. The present study uses existing literature to explore the data extracted from databases of extensive repute such as Emerald, Science Direct and Taylor and Francis amongst others. Through the study, it is found that in India, as of now, ola is racing ahead of the global leader uber on different fronts.

Keywords: Cab aggregator, India‟s Taxi Market, OLA, UBER.

* Professor, Haryana School of Business ,Guru Jambheshwar University of Science & Technology ** Research Scholar, Haryana School of Business,Guru Jambheshwar University of Science & Technology

1029 International Journal of Research in Social Sciences http://www.ijmra.us, Email: [email protected]

ISSN: 2249-2496 Impact Factor: 7.081

1. INTRODUCTION A major chunk of the population these days prefer residing in the urban areas owing to the wide range of facilities available there i.e. good job prospects, better educational infrastructure or easy accessibility to everything. There is a continuous migration of the residents from rural to semi- urban and urban areas. According to United Nations Population Fund (UNFPA), world population living in urban areas would reach around 5 billion by 2030 and this urbanization would occur majorly in Asia and Africa. Day by day, the mobility requirements of the people are changing. There are numerous modes of transportation available that support the consumers‟ mobility such as trains, buses, metros in metropolitan areas. However, longer travel time taken and the non-flexibility of these modes have reduced the demand for the same among the people and the taxis offering the desired flexibility, comfort level and privacy are considered more convenient by the consumers (Salanovaet al., 2011). Taxi industry, by providing employment opportunities to a large number of people and by providing access to convenient transportation modes, aids in boosting the urban transportation systems, in economic and mobility terms respectively (Poóet al., 2018).

Dynamic lifestyle of the consumers coupled with the rising disposable income is mainly attributing to the growth of taxi services in India. Consumers are getting attracted towards the taxi market due to the hassle free experience provided during travelling as well as other offerings like various payment options, convenience in app based bookings, GPS enabled taxis, proficient drivers etc (Business Wire, 2017).

Taxi industry in India is worth approximately ₹ 48000 crores and is expected to grow expeditiously in future (Panigrahiet al., 2018). Within the taxi market segment, there is a burgeoning demand for the online cabs, especially in metropolitan areas and tier I cities which can be asserted from the very fact that monthly taxi rides surged by 30 percent in a year i.e. from 50 million in july, 2017 to 65 million in july, 2018(Redseer, 2018). In 2018, ridesharing from the app based sources and online modes resulted in revenue amounting to US$371mn (Statista, 2018). By FY 2020, the sale of taxis is expected to contribute around 15-17 percent of passenger vehicle volume in India (The Economic Times, 2017).

1030 International Journal of Research in Social Sciences http://www.ijmra.us, Email: [email protected]

2. OBJECTIVE The objective of this paper is to gain a better understanding about the current scenario of the taxi industry in India and to compare desi andvidesi taxi rivals i.e Ola and Uber.

3.METHODOLOGY The research and review paper have been obtained from databases of extensive repute such as Science Direct, Emerald and Taylor and Francis amongst others. Relevant research papers were extracted using keywords such as Cab aggregator, India‟s Taxi Market, Ola, Uber.

4.EVOLUTION OF THE TAXI INDUSTRY Indian taxi industry is fragmented and unorganized to a great extent. The taxi market in India is divided into two markets i.e. the unorganized market and the organized market. Individual car owner and agencies operating in a single or very few cities make up the unorganized sector. The organized sector, on the other hand, consists of the owners, affliators and aggregators (Redseer Consulting, 2014).