17 Stock Market Worksheets PDFs (Plus Stock Market Lessons)

By: Author Amanda L. Grossman

Posted on Last updated: January 9, 2024

Use these 17 stock market worksheet PDFs (and stock market lesson PDFs) to engage your students, kids, and teens.

Teaching students about investing, and looking for some killer stock market worksheet PDFs (that also happen to be free)?

I’ve got you covered.

You don’t have to be a stock market wizard to teach your students, thanks to some great stock market lesson pdfs, lesson plans, and worksheets.

Psst: one of the best ways to teach students about investing and the stock market is to actually have them play it. But don’t worry – they needn’t lose any money. Here are 6 free stock market game for students , and 9 investing board games for kids .

Stock Market Worksheet PDFs

Teaching kids about stocks and how to invest is such a worthy cause – it’s one of the best ways to ensure they’ll have a solid financial future.

I can clearly remember learning (or, at least trying to learn) how to read stock tables in my seminar class back in middle school. We each chose a stock, and then read the stock tables on it from week-to-week over a series of a few months.

At first, reading a stock table is like trying to read hieroglyphics at a museum – it just isn’t intuitive.

But then as we worked through it together, it became less intimidating. Do the same with your own students! They’ll thank you when they’re older.

And you don’t have to do it alone (especially if you’re not confident with investing, yourself).

Whether you’re looking for worksheets to follow specific stocks on the stock market, or company valuation worksheets, or price to earning ratio worksheets – you’ll find them below.

1. One-Page Stock-Monitoring Worksheet

Suggested Age: 4-8 grade

Sometimes, simple is best, right?

Here’s a one-page stock purchase worksheet you can download for free (after you sign up for a free Teachers Pay Teachers account).

It’s a way for your students to choose a stock to buy with $XXX amount of cash, and then to monitor that stock over several weeks.

Other one-page stock market worksheets include:

- Stock Market Research : Suggested Age Range: 7-12 grade

- Stock Market Tracker : Suggested Age Range: 7-12 grade

To go along with this, you’ll likely want to give your students a worksheet on how to read a stock table. I’ve got that coming up, next!

2. Playing an Investment Game

Suggested Age Range: 9-12 grade

The Consumer Financial Protection Bureau came up with this new stock market worksheet where kids work through why they think a company's stocks rose or fell.

This is great, critical thinking they can definitely use when they invest in real life!

Psst: want your child to start buying real stocks? Here are 7 stock apps for kids . And here's a Global Stock Pitch Competition .

3. Stocks, Stocks, Stocks

Suggested Age Range: Not given.

What I love about this teacher guide + accompanying student worksheets is they teach everyone how to read stock market tables.

Because let’s be honest – those can look so intimidating!

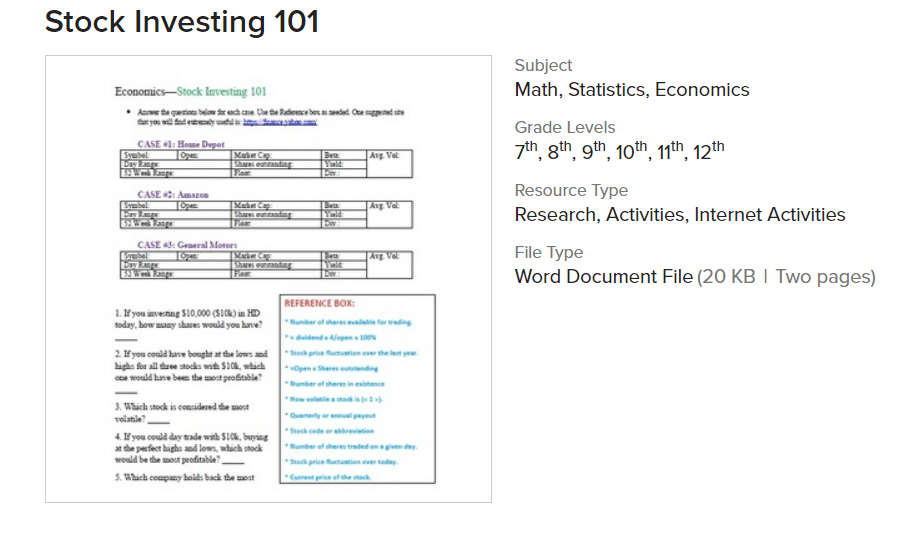

4. Stock Investing 101 Worksheet

Suggested Age Range: 7-12 grade

This is a free Microsoft Word document that walks your students through three familiar companies on the stock market: Amazon, Home Depot, and General Motors.

They’re asked to fill in a bunch of info for each one, then more thinking-questions like which stock is the most volatile, and which stock is the most profitable.

5. Stock Market Definitions and Terms

Looking for NYSE terms + an answer key? Great!

This stock market vocabulary worksheet is very simple and straightforward, and will help you to reinforce a lesson on understanding how to maneuver the stock exchange (links to the worksheets are all the way at the bottom).

Psst: don’t forget to download the answer key – that has all the definitions on it.

6. Price to Earnings Ratio Worksheet

A great lesson to teach your students is how to value a stock. You can do this by helping them to figure out the price to earnings using this worksheet.

7. Buy, Sell or Hold?: An Overview of Investing

Practical Money Skills offers both a teacher’s guide and student worksheets talking about what the stock market is, plus has them work through the price to earnings ratio for real-life stocks. This is Lesson #21, FYI.

8. What’s Up with the Stock Market?

BizKids has a great video plus accompanying stock market worksheet pdfs that teach your child to think about investment strategies. Students will also learn how to read a stock ticker.

9. Dividend-Paying Stocks

Suggested Age Range: Teens

Here’s a great, free teaching guide + worksheets on dividend-paying stocks.

Psst: you'll want to check out these fun compound interest activities for kids , too.

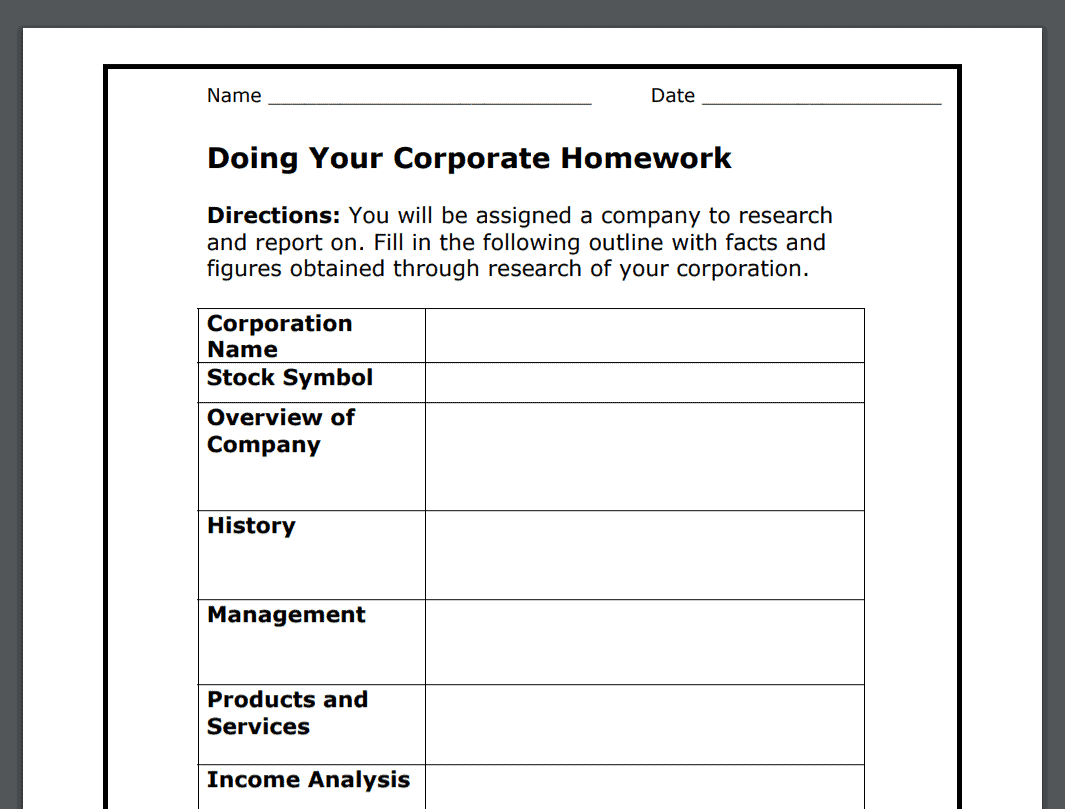

10. Doing Your Corporate Homework

Suggested Age Range: not given.

Either assign a corporation to each student, or let them choose one. Then, have them do research on the company by using this worksheet.

Afterwards, ask them if they should buy that company’s stock or no.

11. Are Stocks a Risky Long-Term Investment?

Suggested Age Range: 7-12 grades

Your students will analyze stock markets returns from 1871 to 2014, and then answer questions to determine whether or not it’s a good idea to invest in stocks over the long term.

Psst: you’ll want to check out my article on 7 best investment books for kids and teens .

Stock Market Lessons PDFs

Looking for more than just a one-page stock market worksheet?

I’ve got exciting stock market lesson PDFs, PowerPoint presentations, and anything else you need to teach your students all about the stock market.

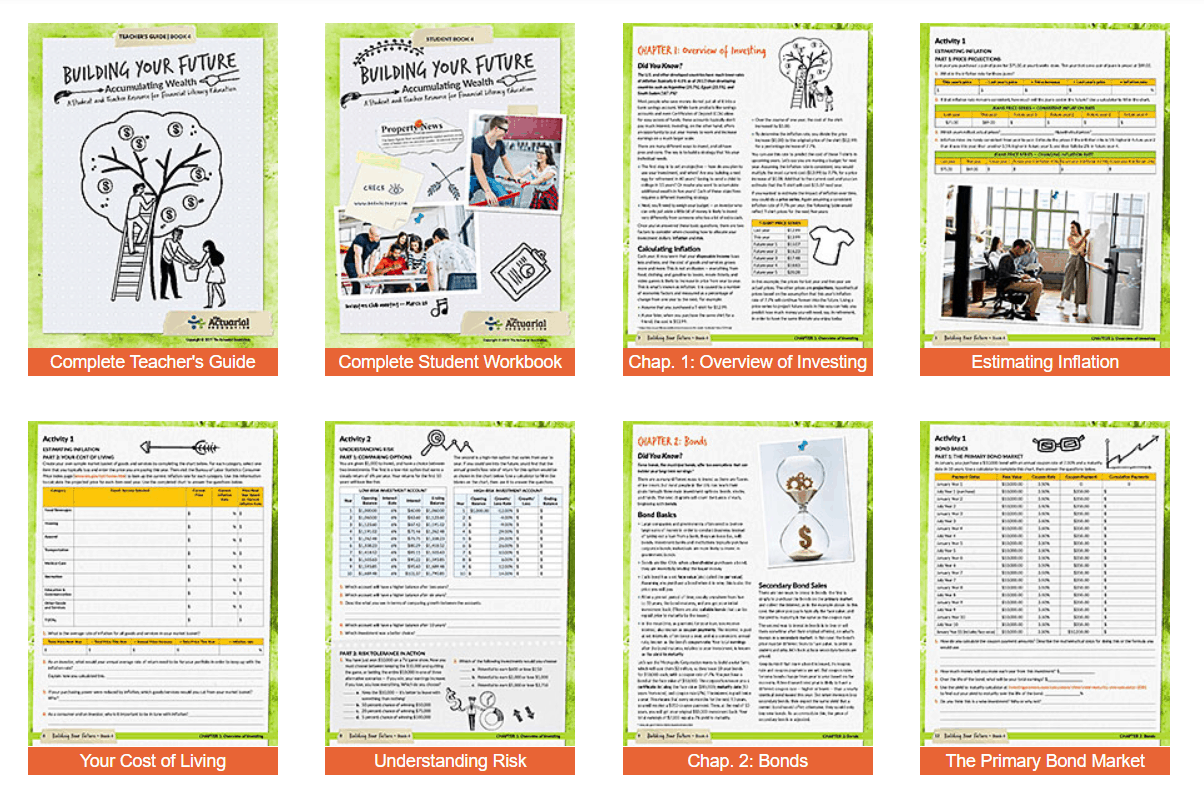

12. Building Your Future: Accumulating Wealth

Suggested Age Range: High school

Are you ready for a really comprehensive set of stock market worksheets and lessons for students?

This is it!

You’ll definitely want to download and read the 22-page Teacher’s Guide that goes along with it.

Investing subjects covered (with 39 pages of stock market worksheets) include:

- Overview of investing

- Asset allocation

- Evaluating stocks

- Building a bond portfolio

- Mutual funds

13. EconEdLink’s Buy and Hold: A Stock Market Simulation

Suggested Age: 9-12 grades

Sign up for a free account with EconEdLink, and get access to this great lesson on the stock market.

You and your students will go through a brief simulation on an IPO (Initial Public Offering).

You’ll get access to:

- PowerPoint presentation (with Notes section talking points for teachers)

- Printable Stock, Bonds, and Money cards

- Stock market quiz worksheet + answer key

- Guiding questions

You can use these tools to teach your students things like why diversifying when purchasing stocks is a good idea, and why corporations sell stocks.

14. EconEdLink’s Where Did all the Money Go?

Suggested Age Range: 9-12 grades

I like how this lesson on the Great Depression gives students clues and has them solve the mystery of what caused the Great Depression.

Great lesson on how interdependent everything is – including the stock market, jobs, banks, farmers, etc.

15. Teaching Financial Crisis

Looking to tie in your stock market teaching with actual history about financial crisis (where the stock market has played a major role)?

Personally, I think it’s great to teach kids that recessions and bear stock markets are a natural occurrence, and that they have always bounced back.

This resource has 8 lesson plans to teach financial crisis, specifically by comparing the financial crisis of 1907 to the financial crisis of 2007.

FYI: The worksheets are more like PDFs for kids to reach, but they’re still very informational.

16. Money Working for You Stock Market Lesson Plan

Register with High School Financial Planning, and check out Module 4 on investing, which is an entire lesson plan around investing.

You’ll get the following, all free:

- Instructor lesson packs

- Student lesson packs

- Lesson slide decks

There you have it – some awesome, and free stock market worksheet PDFs for students (both kids and teens) that will help them understand the stock market. Much better than I did at their age, anyway!

- Latest Posts

Amanda L. Grossman

Latest posts by amanda l. grossman ( see all ).

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023

Stash Learn

Menu Toggle

Back to Stash

Home / Investing / 72 Stock Market Terms Every Beginner Trader Should Know

Dec 8, 2023

72 Stock Market Terms Every Beginner Trader Should Know

New to investing? Dive into this breakdown of stock market terms every beginner should know.

Learning to navigate the stock market as a new investor can be intimidating, but getting familiar with basic stock market terms can get you up and running sooner than you’d think.

Understanding stock market fundamentals is key to making smart investing decisions, keeping a pulse on the market, and eventually taking on more complex trading strategies. Use the terms below to get a jump start on learning basic stock market vocabulary and create a strong foundation for your long-term wealth goals . In this article, we’ll cover:

- Asset allocation

- Asset classes

- Averaging down

- Bear market

- Bid-ask spread

- Blue-chip stocks

- Bull market

- Capitalization

- Capital gains

- Common stock

- Current ratio

- Day trading

- Debt-to-equity ratio

- Diversification

- Dividend yield

- Dollar-cost averaging

- Dow Jones Industrial Average (DJIA )

- Earnings per share (EPS)

- Economic bubble

- Equal weight rating

- Equity income

- Exchange-traded funds (ETFs)

- Expense ratio

- Going short

- Growth and income funds

- Growth stocks

- Head and shoulders pattern

- Index funds

- Initial public offering (IPO)

- Limit order

- Liquidity

- Market index

- Market volatility

- Moving average

- Mutual funds

- Non-fungible token (NFT)

- Order imbalance

- Outstanding shares

- Preferred stock

- Price quote

- Profit margin

- Risk tolerance

- Stock market holidays

- Stock option

- Stock portfolio

- Stock split

- Time horizon

- Value stocks

- Volume-weighted average price (VWAP)

- 52-week range

What is the stock market?

The stock market is a collection of markets where people buy and sell shares of publicly traded companies. When someone invests in a stock, their investment is represented by a share, or partial ownership, of that company.

The stock market operates by potential buyers naming the highest price they’ll pay for an asset (the “bid”) and potential sellers naming the lowest price they’re willing to sell for (the “ask”). Trades are typically executed by stockbrokers on behalf of individual investors.

72 stock market terms for new investors

The stock market terms below are a great starting point if you’re new to trading stocks. Study these terms to familiarize yourself with common stock lingo that any new investor should understand.

1. Arbitrage

Arbitrage refers to purchasing an asset from one market and selling it to another market where the selling price is higher than what you paid for it, resulting in profit.

An ask is the selling price that a trader offers for their shares.

3. Asset Allocation

Asset allocation is an investment strategy that aims to balance risk and reward by dividing a certain percentage of investments—like stocks, bonds, real estate, cash, etc.—across different assets in an investment portfolio.

4. Asset Classes

Asset classes are categories of assets, such as stocks, bonds, real estate, or cash.

5. Averaging Down

Averaging down is an investing strategy that involves buying additional shares of an asset or stock after its price has fallen, resulting in a lower average purchase price.

6. Bear Market

A bear market is a market condition in which prices are expected to fall. Typically, this entails major indexes or stocks decreasing by 20% or more compared to previous highs.

Beta is the measure of an asset’s risk in relation to the market. A stock with a beta of 1.5 means that the stock typically moves 50% more than the market in the same direction. Generally, a higher beta indicates a riskier investment—if the market rises 10%, the stock will rise by 15%, but if the market falls by 10%, the stock will fall by 15%.

The price a trader is willing to pay for shares of a stock or other asset.

9. Bid-Ask Spread

Bid-ask spread is the difference between what buyers are willing to pay and the price sellers are asking for a stock.

10. Blockchain

A blockchain is a record-keeping database in which transactions made in Bitcoin or other cryptocurrencies are recorded across multiple computers and distributed across the entire network of those computers.

11. Blue-Chip Stocks

Blue-chip stocks are common stocks of well-known companies known for their quality and history of growth.

A bond is a type of security loaned by an investor to a borrower like a company or government used to fund its operations.

13. Bull Market

A bull market is a market condition in which prices are expected to rise.

14. Buyback

A buyback is when a company repurchases outstanding shares to reduce the number of shares on the market and return profits to their investors, resulting in an increased value of the remaining shares.

15. Capitalization

Also known as market cap , capitalization is the total market value of all a company’s outstanding shares. It’s calculated by multiplying the total number of shares by the current share price.

16. Capital Gains

Capital gains refers to the profit earned after selling an asset or investment for a higher price than you paid for it.

17. Common Stock

This is one of the most basic stock market terms to know. Common stock is a type of security that represents ownership in a company. Holders of common stock are able to vote on matters like corporate policies and elect directors within that company.

18. Current Ratio

The current ratio is a measure of a company’s ability to pay short-term debt. It’s determined by dividing current assets by current liabilities.

19. Day Trading

Day trading is the practice of buying and selling shares of stock within a single day.

20. Debt-to-Equity Ratio

Debt-to-equity ratio represents a function of a company’s debt relative to its equity, or the value of its assets minus its liabilities. The ratio is found by dividing total liabilities by total shareholder equity.

21. Diversification

Diversification is an investment strategy that divides investment funds across a variety of assets in order to minimize overall risk.

22. Dividend

“ Dividend ” is one of the most basic terms for the stock market. It’s simply a portion of a company’s earnings paid out to its shareholders.

23. Dividend Yield

A dividend yield is a dividend expressed as a percentage of its stock price .

24. Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy in which you invest a fixed amount on a regular basis regardless of the price of the asset.

25. Dow Jones Industrial Average (DJIA)

Also known as Dow 30, the Dow Jones Industrial Average is a stock market index consisting of the 30 most-traded blue-chip stocks on the New York Stock Exchange. It’s used to measure the performance of shares among the largest U.S. companies and gauge the overall direction of stock prices.

26. Earnings per Share (EPS)

Earnings per share is a company’s profit divided by its number of outstanding shares, and is used to measure corporate profitability.

27. Economic Bubble

An economic bubble is a situation where asset prices surge to significantly higher levels than the fundamental value of that asset.

28. Equal Weight Rating

An equal weight rating is a measure used by equity analysts to signify how well a stock is performing relative to other stocks. An equal weight rating suggests that a stock will perform similarly with the average of all the stocks being used for comparison.

29. Equity Income

Equity income is used to describe any income received from stock dividends.

30. Exchange

An exchange, or stock exchange, is a marketplace where investors and traders buy and sell stocks. You’ve probably heard of the most well-known exchanges in the U.S.: the New York Stock Exchange (NYSE) and Nasdaq.

31. Exchange-Traded Funds (ETFs)

Commonly known as ETFs , exchange-traded funds are a collection of stocks or bonds combined in a single fund that can be purchased and traded on major stock exchanges. Similar to mutual funds, they’re a pooled investment fund, meaning a “pool” of money is aggregated from multiple investors.

32. Expense Ratio

An expense ratio measures the cost of owning a mutual fund, including expenses like the management of the fund, overhead fees, and any other costs associated with running the fund. It’s essentially an administrative fee paid to the company in return for owning the fund. The ratio is measured as a percentage of your total investment—for example, if you invest $10,000 in a fund with an expense ratio of .20%, you’ll pay $20 on top of your investment.

33. Futures

A future is a contract that requires a buyer to purchase a specific asset, and the seller to sell that asset at a certain future date at an agreed-upon price. Futures are a way for investors to hedge current investments—a risk management strategy intended to offset potential losses in other investments.

34. Going Long

Going long refers to the act of buying stock shares with the expectation that the asset’s price will rise, resulting in a profit.

35. Going Short

Going short —the opposite of going long—refers to the act of selling stock shares with the expectation that the asset’s price will fall. When an investor goes short on an asset, they borrow that asset, sell it, and hopefully purchase it later at a lower price if the price does decline, resulting in profit.

36. Growth and Income Funds

This is a type of mutual fund or ETF that has both a history of capital gains (growth) and income generated from dividends (income). Growth and income funds have a two-sided strategy of both long-term growth and short-term income.

37. Growth Stocks

A growth stock is a common stock of a company whose revenues are expected to grow at a significantly higher rate than what’s average for that industry.

38. Head and Shoulders Pattern

The head and shoulders pattern refers to a specific chart formation seen on a technical analysis chart. It appears when a stock price reaches three peaks: when the price peaks then declines; rises above that peak and declines again; and rises a third time (but not as high as the second peak) and then declines again. The second peak represents the formation’s “head,” and the first and third peaks represent the “shoulders.” It’s generally considered to be an indicator of an impending bear market.

39. Index Funds

Index funds are investment funds that follow the performance of a specific benchmark or stock market index, like the S&P 500. When you invest in an index fund , your money is used to invest in every company in that index. This results in a more diverse portfolio than if you were hand-selecting individual stocks, for example.

40. Inflation

Inflation is the rate of increase in prices for goods and services in the economy.

41. Initial Public Offering (IPO)

An IPO refers to a previously private company that becomes public by selling stock

shares on the stock market.

42. Limit Order

A limit order is an order to buy or sell a stock at or below a specific price. Limit orders give traders control over how much they pay.

43. Liquidity

Liquidity measures how quickly and easily a stock can be bought or sold without impacting its price. Cash, for example, is the most liquid asset—no exchange is necessary to gain value from it, and it’s already in its most liquid form. On the other hand, a car is less liquid—regardless of its value, you might have to wait to sell it at its best price.

Sometimes referred to as “buying on margin,” margin is when investors borrow money from a broker to purchase a stock, similar to a loan.

45. Market Index

A market index tracks the performance of a certain collection of stocks, often grouped to represent a certain industry. They’re a tool for investors to gauge the health of the stock market by comparing current and past stock prices.

46. Market Volatility

Market volatility is a measure of how much and how often the value of the stock market fluctuates.

47. Moving Average

A moving average is the average price of stocks or other assets over a specific period of time. Generally used in technical analysis charts, it’s calculated by averaging data from the previous time periods to help investors identify the current direction of price trends.

48. Mutual Funds

Mutual funds are pools of investments from shareholders used to “mutually” buy securities like stocks, bonds, and other assets.

Nasdaq, or National Association of Securities Dealers Automated Quotations, is an electronic exchange where investors can buy and sell stocks through an automated network of computers. It’s the second-largest stock exchange in the world, following the NYSE.

More broadly, Nasdaq can also refer to the Nasdaq Composite Index, a stock market index of over 3,300 companies listed on the Nasdaq exchange. In this context, it can be thought of similarly to other indexes like the DJIA or the S&P 500.

50. Non-Fungible Token (NFT)

A non-fungible token, more commonly known as an NFT, is a blockchain-based financial security. Each NFT represents a unique digital asset. “Non-fungible” indicates that it can’t be replicated or replaced with something else.

51. Order Imbalance

An order imbalance occurs when orders of one type of stock aren’t offset by opposite orders, resulting in an excess of orders for that specific stock and sometimes volatile price changes.

52. OTC Stocks

OTC stocks , or over-the-counter stocks, are securities that are traded on a broker-dealer network instead of on a major U.S. stock exchange. They’re often used by smaller companies who don’t meet the requirements to be listed on a formal stock exchange.

53. Outstanding Shares

Outstanding shares refers to the total number of a company’s shares that have been issued to shareholders, including restricted shares.

54. P/E Ratio

Used to value a company, the P/E ratio , or price-earnings ratio, is the ratio of a company’s share price to the company’s earnings per share.

55. Preferred Stock

Preferred stock is a type of stock that combines characteristics of both common stock and bonds. Owners of preferred stock receive different rights than common stockholders , like receiving dividends before common stockholders, but they generally don’t come with corporate voting rights like common stocks do.

56. Price Quote

A price quote is the price of a stock or other security as quoted on an exchange. Price quotes usually come with important supplemental information to help traders make more informed investment decisions.

57. Profit Margin

Profit margins are used to gauge the profitability of a company. It’s expressed as a percentage and is calculated by dividing the company’s net profit (total revenue minus total expenses) by total revenue.

58. Recession

A recession is defined as a period of decline in economic performance throughout the economy, generally lasting for at least several months.

59. Risk Tolerance

Risk tolerance is a measure of the level of risk you’re willing to accept on your investments. Someone with a lower risk tolerance typically sees lower returns on their investments in exchange for lower overall risk in periods of market decline.

60. Roth IRA

A Roth IRA is an individual retirement account that allows you to contribute after-tax dollars, allowing your earnings to grow and be withdrawn tax-free.

The stock market includes shares from thousands of different companies, which are broken into 11 different sectors . A sector is a group of companies with similar business products, services, or characteristics.

Shares are units of ownership in part of a company’s total stock .

63. Stock Market Holidays

While this isn’t necessarily a term or definition, it’s important to know what days you can and can’t buy or sell on the U.S. stock exchange. The U.S. stock market observes 10 holidays a year, closing on those days. In 2023, the observed holidays are New Years Day, Martin Luther King Jr. Day, President’s Day, Good Friday, Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Thanksgiving, and Christmas.

64. Stock Option

A stock option is a contract that gives an investor the right to purchase or sell a specific number of stock shares at a predetermined price within a specified time period.

65. Stock Portfolio

A stock portfolio is an individual’s collection of investments, including stocks, bonds, mutual funds, and other financial assets. While a portfolio refers to all of your investments, they might not be contained in one single account.

66. Stock Split

A stock split occurs when a corporation increases the number of its outstanding shares by distributing more shares to current stockholders. By splitting existing shares into multiple new shares, the stock becomes more affordable.

67. Time Horizon

Time horizon refers to the period of time an investor expects to hold an investment, which will vary based on personal investment goals and strategies. For example, investing in a retirement account like a 401(k) has a longer time horizon, since the funds won’t be withdrawn until you reach retirement age. Generally speaking, longer time horizons correlate to more risk potential in a portfolio, and shorter time horizons correlate to a more conservative (less risky) portfolio.

68. Value Stocks

Value stocks are shares of companies selling at bargain prices that investors expect to rise because the company’s financial fundamentals suggest the shares are actually worth more than the current value.

Volume is a measure of how much a certain stock or other investment has been traded over a certain period of time. Volume is a critical component of strategically analyzing stock market trends, and is often used to determine market strength.

70. Volume-Weighted Average Price (VWAP)

Volume-weighted average price (VWAP) is a measure of the average trading price of a stock or other asset, adjusted for volume. It’s calculated by dividing the total dollar value of trading in that asset by the volume of trades.

Yield refers to the income earned on an investment over a set period of time, expressed as a percentage of your original investment.

72. 52-week Range

The 52-week range is a technical indicator that measures the lowest and highest price of a stock traded during a 52-week period. Traders use this measure to analyze current stock prices and predict its future movements.

Learning to navigate the stock market and stock trade terms for the first time might feel daunting, but consider this your official first step on the path to developing your investing muscles. When you come across a term you’re unfamiliar with in your own research, refer back to this post until you’ve mastered them. You’ll find that learning these stock terms for beginners is more doable than you think.

The more time you invest in learning stock market terms and fundamentals, the more confident you’ll become as an investor. And if you’re looking for a little more support, consider turning to a platform like Stash . We make it easy to invest what you can afford on a set schedule, all the while providing unlimited financial education and personalized advice based on your risk level—so you can start building long-term wealth , even if you’ve never invested before.

Investing made easy.

Start today with any dollar amount.

FAQs About Stock Market Terms

Have more questions about stock market terms? We have answers.

Why Should You Know Stock Market Terms?

Establishing a working knowledge of stock market terms forms the foundation for the rest of your investment journey. It’s the gateway to crafting a strategic market approach, understanding different trading strategies, and making sense of market fluctuations that will inform your future trading decisions.

How Do You Buy Stocks?

Before investing a dollar, get clear on your investment goals—this informs everything from your investment timeline to the specific investments you’ll choose. From there, the process of buying your first shares of stock is surprisingly easy:

- Open a brokerage account

- Research what stocks you want to buy

- Determine how much you can afford to invest

- Purchase your first share

- Maximize returns with a buy and hold strategy

What Are the Most Used Stock Market Terms?

The most used stock market terms include bear market, bull market, dividend, ask, bid, and blue-chip stocks.

All episodes are available now. You can listen to Teach Me How to Money right here on our site, and via the podcast apps below.

Related Articles

Stocks That Pay Dividends: A Guide to Investing in Dividend Stocks

How To Find Undervalued Stocks: An 8-Step Guide

What Is Passive Investing?

How To Read a Stock Chart: A Beginner’s Guide + Stock Chart Glossary

What Are the Different Types of Investments?

How To Diversify Investments: A Beginner’s Guide for 2024

Invest in yourself.

By using this website you agree to our Terms of Use and Privacy Policy . To begin investing on Stash, you must be approved from an account verification perspective and open a brokerage account.

Welcome to Stash101, our free financial education platform. Stash101 is not an investment adviser and is distinct from Stash RIA. Nothing here is considered investment advice.

Stock Market

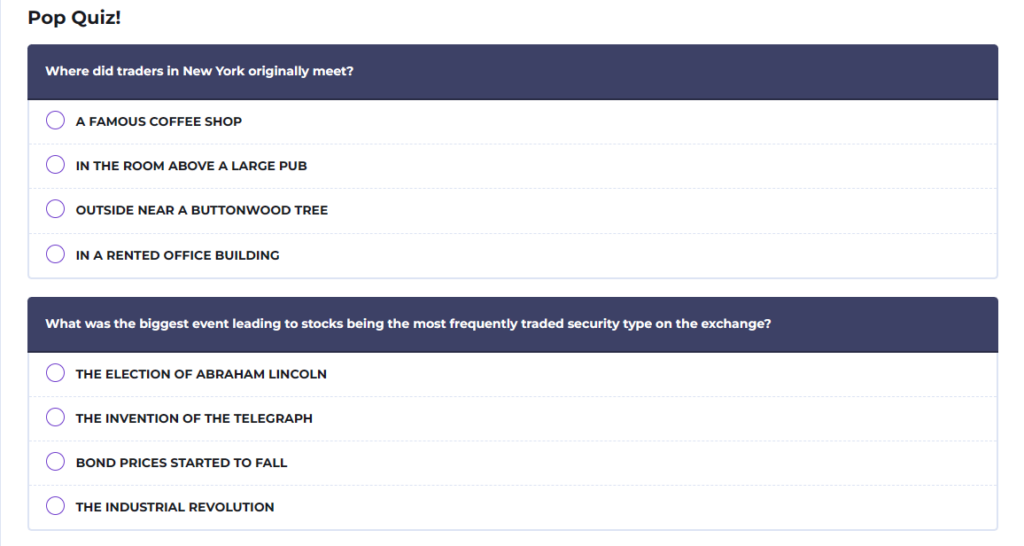

Stock Market teaches students all about the stock exchange, the bull and bear markets, and what shares are. Students will discover how the stock market started in May of 1792. They will learn about the Buttonwood Agreement and about commissions. The Buttonwood Agreement led to what is now called the New York Stock Exchange (NYSE).

By the end of this lesson, students will be able to identify and define many of the terms associated with stocks. They will a basic understanding of how the market works and how to make money with investing. There are several suggestions in the “Options for Lesson” section that may aid in your instruction. For instance, you may invite a stock broker to speak with the class and provide additional information.

Description

Additional information, what our stock market lesson plan includes.

Lesson Objectives and Overview: Stock Market is a great lesson for 5th and 6th grade students. Your students will learn all about the stock exchange and related terms. They have likely heard of the stock market, but they may not fully understand it. Students will learn about buying, investing, selling, and trading. And they will even have the chance to simulate the stock exchange and purchase and trade stock.

Classroom Procedure

Every lesson plan provides you with a classroom procedure page that outlines a step-by-step guide to follow. You do not have to follow the guide exactly. The guide helps you organize the lesson and details when to hand out worksheets. It also lists information in the yellow box that you might find useful. You will find the lesson objectives, state standards, and number of class sessions the lesson should take to complete in this area. In addition, it describes the supplies you will need as well as what and how you need to prepare beforehand.

Options for Lesson

You can check out the “Options for Lesson” section of the classroom procedure page for additional suggestions for ideas and activities to incorporate into the lesson. Students may work alone or in groups for the activity. You could also increase or decrease the length of time for the activity. Have students create an imaginary company and give other students a set amount of money to invest in the imaginary companies. Then discuss how students decided on the investments. Invite a stock broker or another financial expert to speak with the class about the stock market, investing, etc. Assign each student a company of which they can research the stock value from the company’s founding up to the present day.

Teacher Notes

The teacher notes page provides an extra paragraph of information to help guide the lesson and remind you what to focus on. While students may have heard about the stock market, they may not really understand what it involves. This lesson is meant to provide a foundational understanding. You might also benefit from teaching this lesson in conjunction with others about money or the economy. The blank lines on this page are available for you to write out thoughts and ideas you have as you prepare the lesson.

STOCK MARKET LESSON PLAN CONTENT PAGES

Introduction to the stock market.

The Stock Market lesson plan contains four pages of content. The word stock simply refers to the supply of a product or maybe a service. And the market is usually a public place where people can buy, sell, or trade those products or services. However, in a financial market, the stock refers to the supply of money that a company has raised. The money comes from people who gave the company money in the hopes that the company will make a profit. In return, the people who gave the money will earn more money.

Stock market , then, is the business of buying and selling stock. It is not a place like a grocery store or a food market. Wall Street is the name of a street in New York City’s financial district, and sometimes we say “Wall Street” to refer to the United States stock market. The financial district is the place where many people (or computers) buy and sell stock for themselves and other people.

The first stock market began on May 17, 1792, when 24 stockbrokers (people who buy and sell stock) and merchants signed the Buttonwood Agreement. This agreement had two provisions. First, the brokers were only to deal with each when buying or selling stock. And second, commissions (the money brokers made on each sale) were to be 0.25%. The agreement was signed underneath a buttonwood tree.

Later, the agreement led to the formation of the New York Stock and Exchange Board. This is now the New York Stock Exchange (NYSE), which is a company on Wall Street. It is also the world’s largest stock exchange. It provides a means for buyers and sellers to trade shares of stock in companies registered for public trading. There are other stock exchanges throughout the world as well, such as the London Stock Exchange (LSE) and another American exchange called the NASDAQ (National Association of Securities Dealers Automated Quotations) Stock Market.

Using the stock exchanges brokers, people and businesses can invest their money in public companies throughout the world. The public companies often want to grow their business, build more factories, or develop new products. So they turn to the selling of stocks to raise money for the company.

How Stocks Work

The next page outlines how the stock market functions. A company could borrow money from a bank to grow their business, but they would have to pay the money back to the bank. However, instead of borrowing money, a company can issue stock and raise money without going into debt. The people who buy the stock give money to the company to help the business grow.

In some way, you can think of it as opening a lemonade stand. After you open, you realize you don’t have enough money for all the supplies. You ask your parents for some money to help pay for lemons, cups, signage and other supplies. They give you the money, and you start selling. Once you begin making a profit, you pay them back and give them some of your profits. However, if you lose money, your parents will lose their money too. It is a risk they took to help you build your lemonade business.

Only business corporations can issue stock. A business owned by one person (sole-proprietorship) or a few people (partnership) cannot. A corporation has a special legal status and does not depend on the people who run it. And it has legal rights and responsibilities to the people who buy the company’s stock.

Shareholders and Stockholders

People who buy stock in a company own part of the company. Each part they own is called a share. For example, let’s go back to the lemonade stand. If you sold 100 shares of stock in your company at $1.00 per share, a person who purchased one share would own 1% of the company. A person who had 25 shares would own 25% of the company. The people who own the stock are called stockholders or shareholders.

The shareholders usually have voting rights in a company too. They could vote in people for the board of directors, for instance. The board will run the company and make major decisions for the company’s success. Stockholders usually have one vote for each share of stock they own. That means that the more stock a person owns, the greater influence they may have on the company. Quarterly or yearly reports are also sent to stockholders to inform them how the company is doing.

Every stockholder wants the company to grow and earn a profit. If the company earns money, the stockholders share the profits after the expenses are paid. Usually, when people invest money in companies by purchasing stock, they will earn more than they would if they left the money in the bank or made other investments.

For example, if the lemonade stand made a profit of $100, the people who purchased shares of the stock would double their money and earn a 100% profit. Banks and other investments usually yield much less. Of course, not all stocks earn such a high rate of return. But over time, investing in and buying shares of stock in a company usually leads to a greater profit.

On the other hand, if a company does poorly, goes out of business, and loses money, a stockholder can lose the money they invested in the company. The prices of stock for a company, though, will usually rise and fall over time. For example, a share of stock in a company today might cost $23, but tomorrow it could be worth $25 and the next day drop to $22. The rise and fall of stock prices drive people to “play” the stock market for a living.

Playing the Stock Market

There are people who play the stock market by buying and selling stock at the right time to earn money. For example, if the price of a stock goes down, a broker may purchase the stock at the lower price. They hold it for a while until the value of the stock rises or goes up and then sell it. If they can do this, they earn a profit simply by buying and selling stock at the right time.

For example, your lemonade stand stock may be worth $1 a share in the beginning but go up to $1.25 per share. The people who originally invested can now sell their shares for 25 cents profit per share to someone who is willing to buy the stock. The value of the stock could go down, however, and shareholders could lose money.

Students will learn that stock prices fluctuate daily and weekly. People will often hold onto a stock for a much longer period of time. The price of the share will change often, but over a long period of time, the value of stocks often rises. In summary, if a company does well, the value of shares rises. If a company struggles, the value of shares will go down.

Investors and brokers are often the people who follow the stock market very closely and invest another person’s or company’s money. They follow the overall rise and fall of the stock market and watch closely for companies that may increase in value and those that may decrease in value. At the end of each day, the market determines the overall value of stock shares that companies, brokers, and investors bought or sold, or traded. The stock market value is then reported as going “up” or “down.”

There are stock markets throughout the world, and investors will carefully watch what happens to the value of stocks in other countries too. Sometimes this helps them make choices as to whether they should buy or sell shares of stock throughout the day.

Bears and Bulls

There are two groups of investors—bears and bulls. A bear is an investor who believes the stock market will go down and will be cautious when buying stock. A bull is an investor who believes the stock market will go up and put more money into buying shares of stock. Investors can also be bearish or bullish about a single kind of stock. The term bear market describes a time when stock prices are falling. Naturally, then, a bull market is a period of rising stock prices. Bear markets are usually bad; bull markets are good.

Without stocks (the shares of value in a company), many businesses would not have the money to grow and develop their products or services. The idea of a stock market has been around for a long time. In fact, people purchased stocks to finance the Pilgrim’s voyage to America. They hoped the travelers would find something valuable in the New World, ensuring the investors made a profit.

For example, imagine that friends you know want to search for gold reportedly buried in the side of a mountain. Your friends might need money to purchase equipment and tools. You give them the money hoping the gold will be found. If it is, they have agreed to give you a certain percentage of the profit.

STOCK MARKET LESSON PLAN WORKSHEETS

The Stock Market lesson plan includes three worksheets: an activity worksheet, a practice worksheet, and a homework assignment. Each one will reinforce students’ comprehension of lesson material in different ways and help them demonstrate when they learned. Use the guidelines on the classroom procedure page to determine when to distribute each worksheet to the class.

PURCHASE SHARES ACTIVITY WORKSHEET

After dividing into pairs, students will purchase shares of five different stocks. They will have an imaginary $5000 to allocate among the stocks. They will track the rising and falling prices of the stocks over a period of time. The lesson states two weeks. However, you could provide real companies for the students to monitor and adjust the amount of time they will track the prices.

At the beginning of the activity, students will answer a set of questions. After the two weeks pass, they will answer another set of questions based on their experience.

DEFINITION MATCH PRACTICE WORKSHEET

The practice worksheet lists 15 statements. Students will match the definition to the correct term. Afterward, they will answer five other questions, most of which are based on the lesson material.

STOCK MARKET HOMEWORK ASSIGNMENT

For the homework assignment, students must first fill in the blanks to 10 questions using the words in the word bank. Afterward, there is another set of statements. Students will determine whether the statement is true or false and mark it appropriately.

Worksheet Answer Keys

There are answer keys for both the practice and homework worksheets at the end of the lesson plan document. Correct answers are in red to make it easy for you to compare them to students’ work. If you choose to administer the lesson pages to your students via PDF, you will need to save a new file that omits these pages. Otherwise, you can simply print out the applicable pages and keep these as reference for yourself when grading assignments.

Related products

Careers: Web Developer

Careers: Astronomer

Careers: Robotics Engineer

Make your life easier with our lesson plans, stay up-to-date with new lessons.

- Lesson Plans

- For Teachers

© 2024 Learn Bright. All rights reserved. Terms and Conditions. Privacy Policy.

- Sign Up for Free

- Contests With Prizes

- Mutual Funds

- Making Your First Investments

- Beginner Charts and Analysis

- Technical Analysis

- Advanced Trading Strategies

- Charts and Patterns

- Broker Center

- Investing Course

- Personal Finance Calculators

- Newsletters

- The 10 Terms You Need To Know

- A – G

- H – M

- N – T

- U – Z and #

- Teacher’s Guide

- Lesson Plans

- HowTheMarketWorks In The Classroom

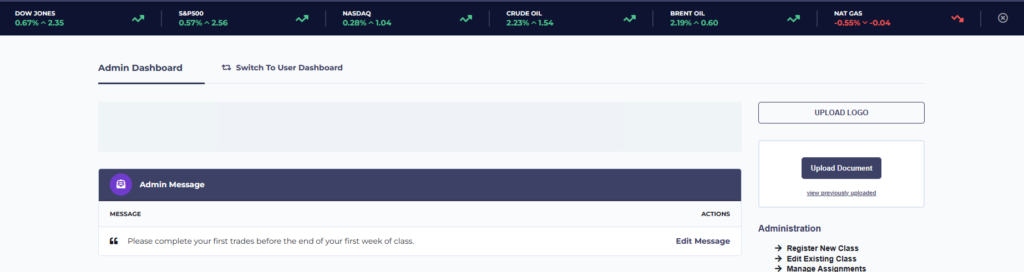

Core Stock Market Project

This project is the “Core”, which most teachers use as the basis for their HTMW class stock game. The other recommendations in this library usually follow this format (with some variation). This makes it very flexible to work with your classes.

This project usually runs between 4 and 16 weeks. Longer contests tend to work better. This is because students are exposed to more “market news” for a longer time, and is a better introduction to “real” investing outside of the classroom.

Project Overview

The goal of this project is to introduce students to basic investing concepts, and get exposure to the real-world financial markets. Each student will build their own portfolio of stocks and mutual funds, with a set of initial investing goals, and regular investing journal entries. At the end of the session, students will create and present a 5-10 minute presentation to the class. The presentation should discuss the goals they set, and how they worked with the changing markets over the course of the contest. Students will also need to submit a report detailing their trading activities.

Project Set-Up

Contest rules.

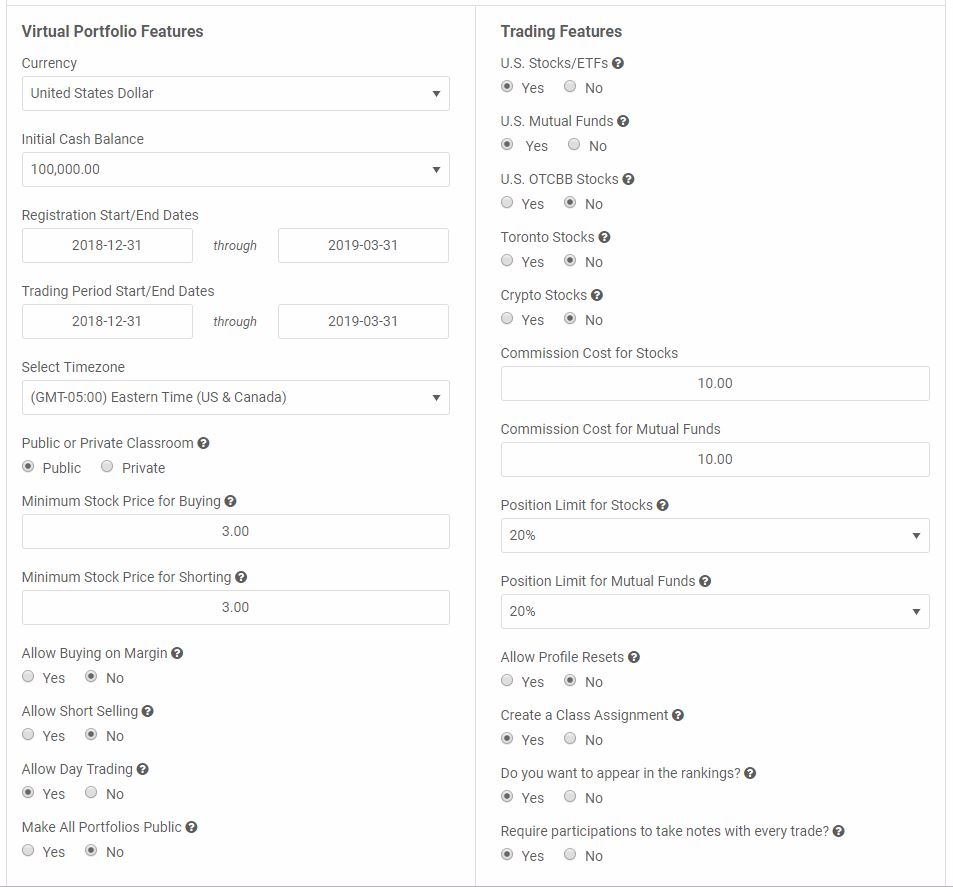

Use these settings to set up your class contest:

- Initial Cash: $100,000

- Registration/Trading Dates: as long as your class allows (we recommend starting this project early – likely before your discuss investing in detail in the class itself)

- Minimum Prices: $3

- Short Selling: OFF

- Day Trading: ON

- Margin Trading: OFF

- Public Portfolios: OFF

- Allow US Stocks and Mutual Funds

- Commission: $10/trade

- Position Limits: 20% (students can’t invest more than 20% of their portfolio in any single stock)

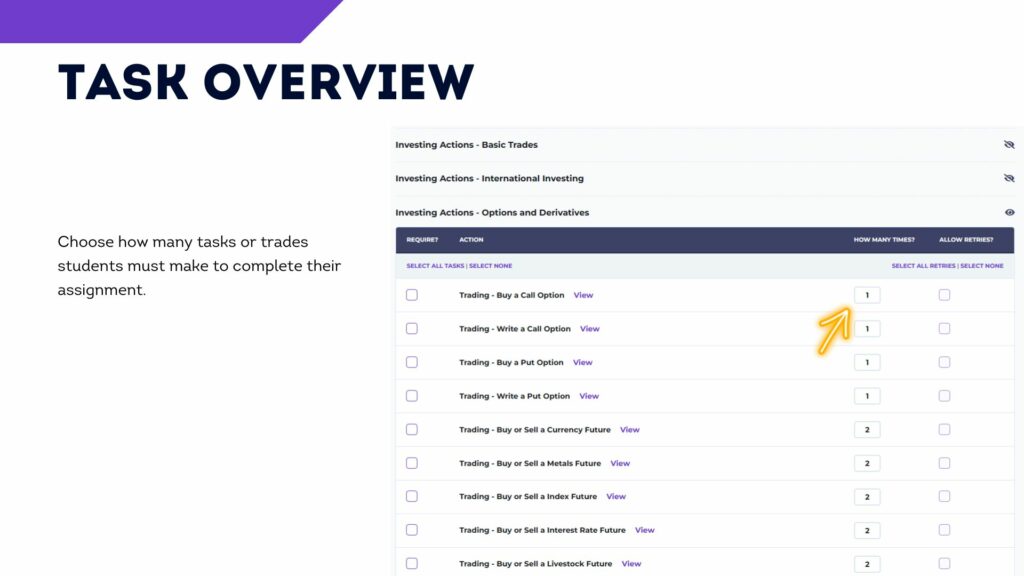

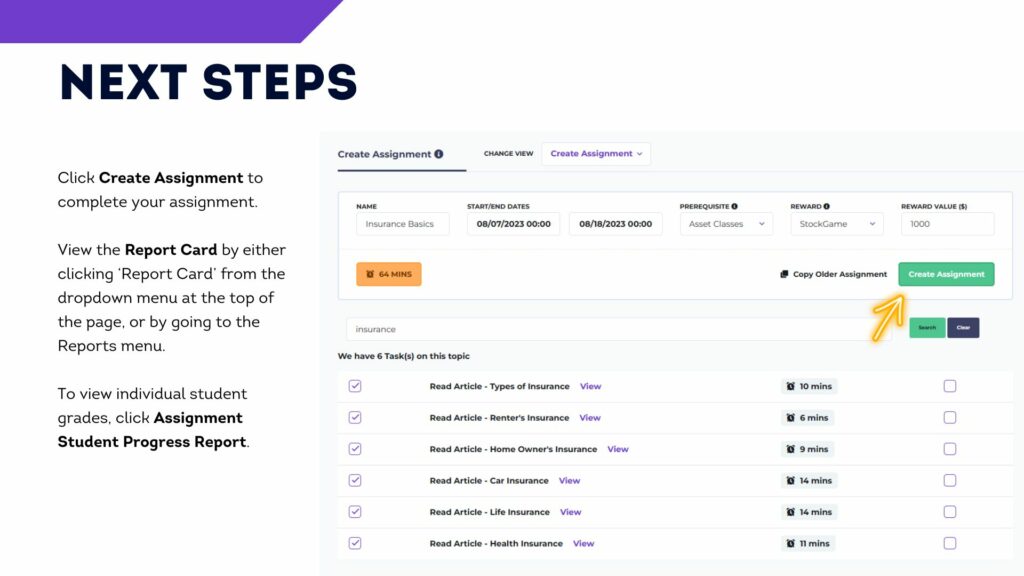

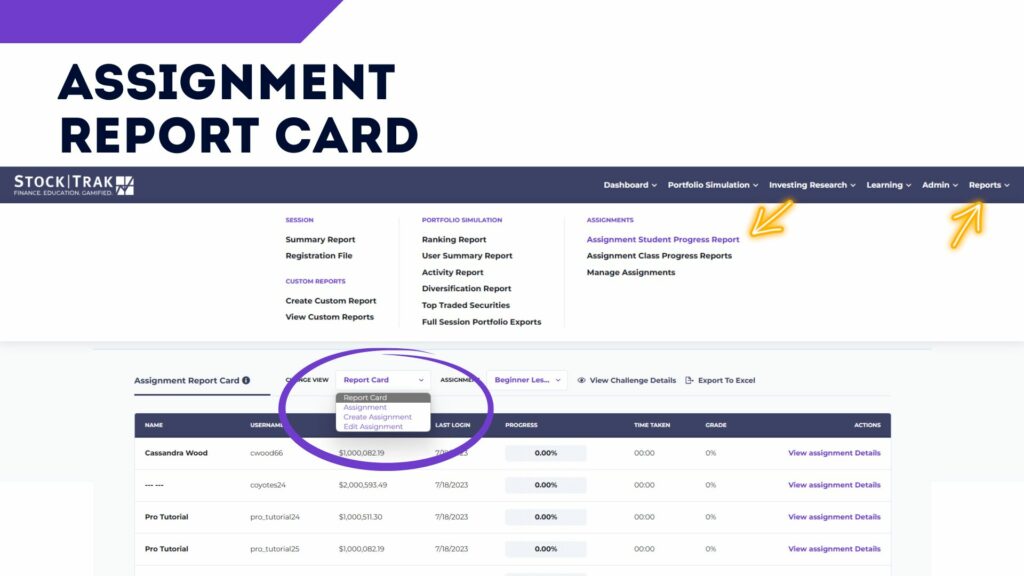

- Create an assignment

- Keep the teacher in the rankings

- Require Trading Notes

You will get a unique registration link to share with your students – this will let them create their login and join you into your class.

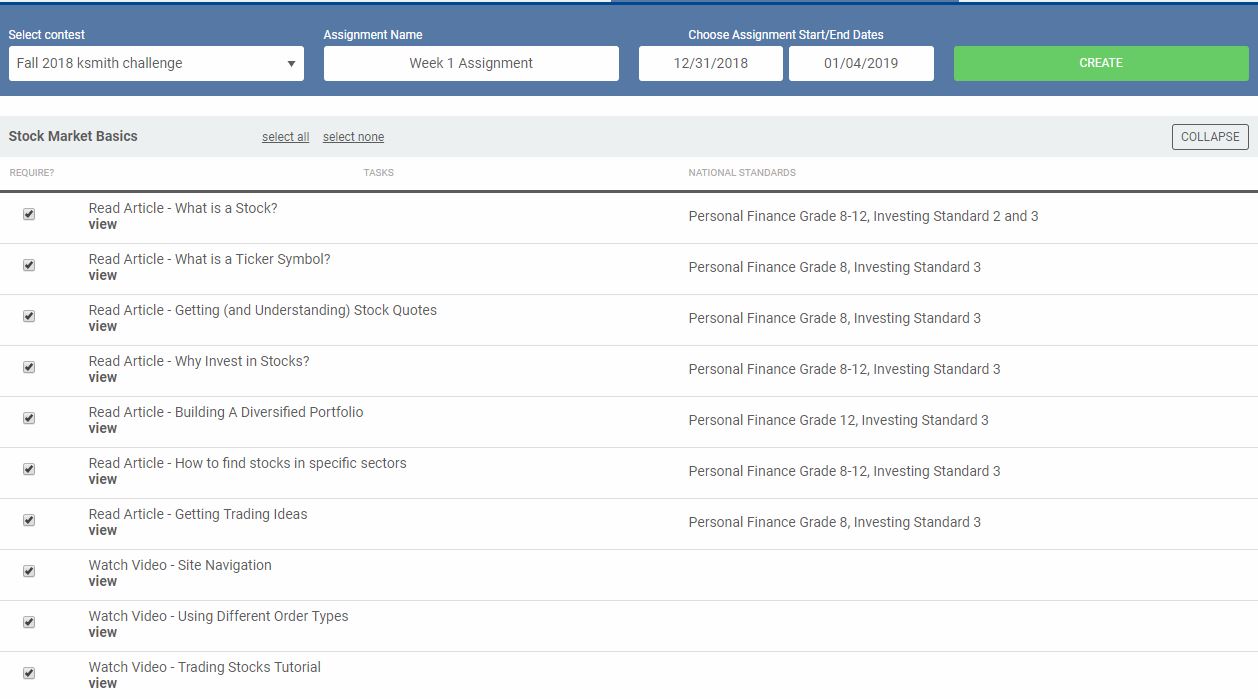

You should also add an “Assignment” to your class. Your first “Assignment” should last the first week of the trading period, and include the 10 items in the “Stock Market Basics” section. These are designed to provide students with a basic introduction to what a portfolio is and how to make trades, with short articles, videos, and tutorials.

Assignments keep the experience educational – it provides a clear structure for what your students are expected to learn, while introducing them to the game and how it works!

You can create more assignments for each week, including other tasks that align with what you are discussing in class. Most classes assign the next 10 items, under “Intermediate Investing Tips”, as the second week’s assignment.

Project Kick-Off

Kick off the project using our Cornerstone Lesson Plan – this is a short introduction to glossary terms and the concepts of stocks of investing. At the end of the lesson, have students create their logins for your HTMW class contest, and work through the first 10 “Stock Market Basics” lesson. This should usually take about 1 hour.

Next, introduce your students to a few “Scenarios”. These will determine the kinds of portfolios they will build. They can choose between:

- A retirement portfolio – the goal will be constant, slow growth, with an emphasis on avoiding losses (a portfolio for someone who wants to retire in 15 years)

- A growth portfolio – the goal will be high growth with some risk (a portfolio of someone in their 20’s or 30’s looking for high returns)

Now put students into groups of 3-5, based on which scenario they chose. Have each group prepare a list of 10 ticker symbols (ideally from at least 3 different sectors) of companies that they are familiar with, and that they think will perform well for their scenario. Students can find the ticker symbols, sectors, and performance charts for all US and Canadian stocks in the “Quotes” tool on HTMW. This should take between 30 and 45 minutes.

Then break up the groups, and have each student individually should pick 5 of these companies, and add them to their HTMW portfolio. Each student should also write a 1 page summary about why they chose the companies they did, and why they DIDN’T choose the other 5 companies the group identified (this can be homework). This ensures each student will have a unique portfolio, but based on some group thinking.

Weekly Check-In

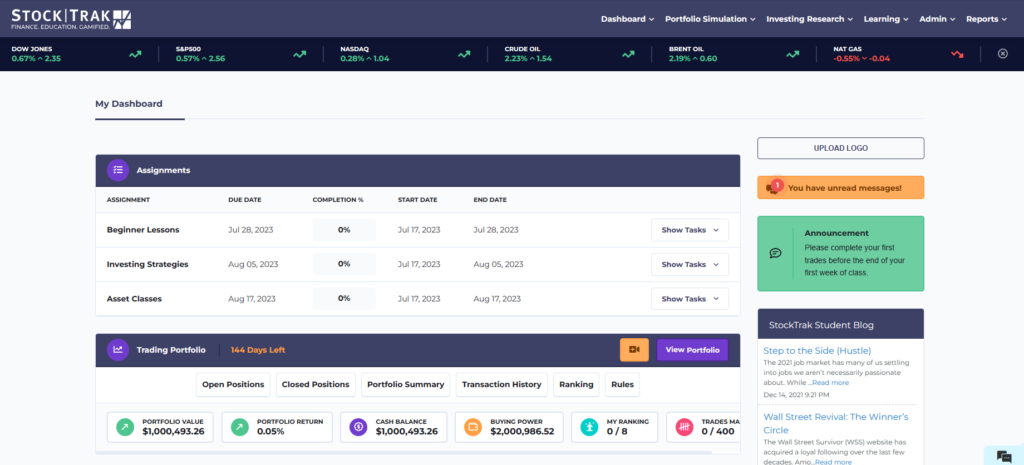

Ensure all students are checking their HTMW portfolio at least once a week (with the class rankings, most students will be checking a lot more often!). You can post the class rankings at the front of class to make sure students are staying engaged.

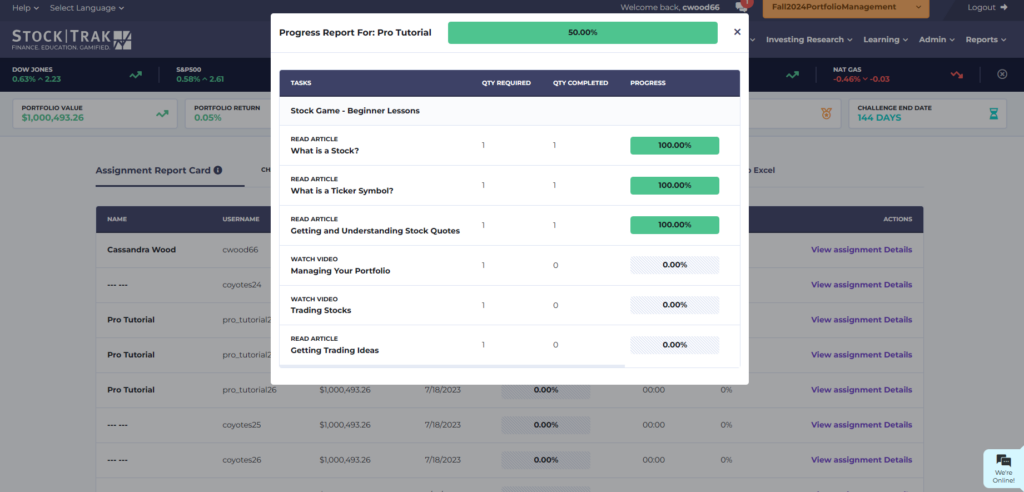

Keep using Assignments! You can easily track which students are participating, and remind students who start falling behind. Plus, the lessons are a great supplement to what you are already covering in class!

You will also want to encourage students to continue trading for the duration of the contest. Require students to make at least 3 trades in their portfolio each week (you can require this with an Assignment), and they should both be keeping Trade Notes with each trade, and a 1 paragraph Trade Summary that gives a short summary of what happened in their portfolio each week. This summary should include things like what stocks did well, which did poorly, how did market news impact their holdings, and how it relates back to other class topics under discussion.

Final Report

At the end of the trading period, student’s portfolios will automatically freeze, so they can continue to log in and see how they did at the end of the last day, but not place any new trades.

This gives the opportunity for students to prepare a final “Investment Report”. The Investment Report should be between 3-5 pages, divided into sections.

- A summary of their investing scenario, and how well they achieved their investing objectives

- A graph showing their portfolio performance for the duration of the contest

- A list of significant events during the contest that had a big impact on their portfolio (news reports impacting stock prices, ect)

- A pie chart showing their final holdings

- A profit/loss summary, showing where exactly they made and lost money

- An appendix with all of their weekly investing journals

Happy trading and let us know if you have any questions! If you have your own awesome class stock project that your students really loved, please share so other teachers can give it a try!

Read These Next

Comments are closed.

- Search Search

Browse More Articles

- Choosing Investments

- Beginner Strategies

- Beginner Charts

- Advanced Strategies

- Advanced Charts

- Motley Fool Stock Advisor Review

- Rule Breakers Review

- Best Investment Newsletters

- Best Stocks to Buy Now

- Top 10 Terms

- Teacher's Guide

- In The Classroom

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

Options Exercise, Assignment, and More: A Beginner's Guide

So your trading account has gotten options approval, and you recently made that first trade—say, a long call in XYZ with a strike price of $105. Then expiration day approaches and, at the time, XYZ is trading at $105.30.

Wait. The stock's above the strike. Is that in the money 1 (ITM) or out of the money 2 (OTM)? Do I need to do something? Do I have enough money in my account? Help!

Don't be that trader. The time to learn the mechanics of options expiration is before you make your first trade.

Here's a guide to help you navigate options exercise 3 and assignment 4 —along with a few other basics.

In the money or out of the money?

The buyer ("owner") of an option has the right, but not the obligation, to exercise the option on or before expiration. A call option 5 gives the owner the right to buy the underlying security; a put option 6 gives the owner the right to sell the underlying security.

Conversely, when you sell an option, you may be assigned—at any time regardless of the ITM amount—if the option owner chooses to exercise. The option seller has no control over assignment and no certainty as to when it could happen. Once the assignment notice is delivered, it's too late to close the position and the option seller must fulfill the terms of the options contract:

- A long call exercise results in buying the underlying stock at the strike price.

- A short call assignment results in selling the underlying stock at the strike price.

- A long put exercise results in selling the underlying stock at the strike price.

- A short put assignment results in buying the underlying stock at the strike price.

An option will likely be exercised if it's in the option owner's best interest to do so, meaning it's optimal to take or to close a position in the underlying security at the strike price rather than at the current market price. After the market close on expiration day, ITM options may be automatically exercised, whereas OTM options are not and typically expire worthless (often referred to as being "abandoned"). The table below spells it out.

- If the underlying stock price is...

- ...higher than the strike price

- ...lower than the strike price

- If the underlying stock price is... A long call is... -->

- ...higher than the strike price ...ITM and typically exercised -->

- ...lower than the strike price ...OTM and typically abandoned -->

- If the underlying stock price is... A short call is... -->

- ...higher than the strike price ...ITM and typically assigned -->

- If the underlying stock price is... A long put is... -->

- ...higher than the strike price ...OTM and typically abandoned -->

- ...lower than the strike price ...ITM and typically exercised -->

- If the underlying stock price is... A short put is... -->

- ...lower than the strike price ...ITM and typically assigned -->

The guidelines in the table assume a position is held all the way through expiration. Of course, you typically don't need to do that. And in many cases, the usual strategy is to close out a position ahead of the expiration date. We'll revisit the close-or-hold decision in the next section and look at ways to do that. But assuming you do carry the options position until the end, there are a few things you need to consider:

- Know your specs . Each standard equity options contract controls 100 shares of the underlying stock. That's pretty straightforward. Non-standard options may have different deliverables. Non-standard options can represent a different number of shares, shares of more than one company stock, or underlying shares and cash. Other products—such as index options or options on futures—have different contract specs.

- Stock and options positions will match and close . Suppose you're long 300 shares of XYZ and short one ITM call that's assigned. Because the call is deliverable into 100 shares, you'll be left with 200 shares of XYZ if the option is assigned, plus the cash from selling 100 shares at the strike price.

- It's automatic, for the most part . If an option is ITM by as little as $0.01 at expiration, it will automatically be exercised for the buyer and assigned to a seller. However, there's something called a do not exercise (DNE) request that a long option holder can submit if they want to abandon an option. In such a case, it's possible that a short ITM position might not be assigned. For more, see the note below on pin risk 7 ?

- You'd better have enough cash . If an option on XYZ is exercised or assigned and you are "uncovered" (you don't have an existing long or short position in the underlying security), a long or short position in the underlying stock will replace the options. A long call or short put will result in a long position in XYZ; a short call or long put will result in a short position in XYZ. For long stock positions, you need to have enough cash to cover the purchase or else you'll be issued a margin 8 call, which you must meet by adding funds to your account. But that timeline may be short, and the broker, at its discretion, has the right to liquidate positions in your account to meet a margin call 9 . If exercise or assignment involves taking a short stock position, you need a margin account and sufficient funds in the account to cover the margin requirement.

- Short equity positions are risky business . An uncovered short call or long put, if assigned or exercised, will result in a short stock position. If you're short a stock, you have potentially unlimited risk because there's theoretically no limit to the potential price increase of the underlying stock. There's also no guarantee the brokerage firm can continue to maintain that short position for an unlimited time period. So, if you're a newbie, it's generally inadvisable to carry an options position into expiration if there's a chance you might end up with a short stock position.

A note on pin risk : It's not common, but occasionally a stock settles right on a strike price at expiration. So, if you were short the 105-strike calls and XYZ settled at exactly $105, there would be no automatic assignment, but depending on the actions taken by the option holder, you may or may not be assigned—and you may not be able to trade out of any unwanted positions until the next business day.

But it goes beyond the exact price issue. What if an option is ITM as of the market close, but news comes out after the close (but before the exercise decision deadline) that sends the stock price up or down through the strike price? Remember: The owner of the option could submit a DNE request.

The uncertainty and potential exposure when a stock price and the strike price are the same at expiration is called pin risk. The best way to avoid it is to close the position before expiration.

The decision tree: How to approach expiration

As expiration approaches, you have three choices. Depending on the circumstances—and your objectives and risk tolerance—any of these might be the best decision for you.

1. Let the chips fall where they may. Some positions may not require as much maintenance. An options position that's deeply OTM will likely go away on its own, but occasionally an option that's been left for dead springs back to life. If it's a long option, the unexpected turn of events might feel like a windfall; if it's a short option that could've been closed out for a penny or two, you might be kicking yourself for not doing so.

Conversely, you might have a covered call (a short call against long stock), and the strike price was your exit target. For example, if you bought XYZ at $100 and sold the 110-strike call against it, and XYZ rallies to $113, you might be content selling the stock at the $110 strike price to monetize the $10 profit (plus the premium you took in when you sold the call but minus any transaction fees). In that case, you can let assignment happen. But remember, assignment is likely in this scenario, but it is not guaranteed.

2. Close it out . If you've met your objectives for a trade, then it might be time to close it out. Otherwise, you might be exposed to risks that aren't commensurate with any added return potential (like the short option that could've been closed out for next to nothing, then suddenly came back into play). Keep in mind, there is no guarantee that there will be an active market for an options contract, so it is possible to end up stuck and unable to close an options position.

The close-it-out category also includes ITM options that could result in an unwanted long or short stock position or the calling away of a stock you didn't want to part with. And remember to watch the dividend calendar. If you're short a call option near the ex-dividend date of a stock, the position might be a candidate for early exercise. If so, you may want to consider getting out of the option position well in advance—perhaps a week or more.

3. Roll it to something else . Rolling, which is essentially two trades executed as a spread, is the third choice. One leg closes out the existing option; the other leg initiates a new position. For example, suppose you're short a covered call on XYZ at the July 105 strike, the stock is at $103, and the call's about to expire. You could attempt to roll it to the August 105 strike. Or, if your strategy is to sell a call that's $5 OTM, you might roll to the August 108 call. Keep in mind that rolling strategies include multiple contract fees, which may impact any potential return.

The bottom line on options expiration

You don't enter an intersection and then check to see if it's clear. You don't jump out of an airplane and then test the rip cord. So do yourself a favor. Get comfortable with the mechanics of options expiration before making your first trade.

1 Describes an option with intrinsic value (not just time value). A call option is in the money (ITM) if the stock price is above the strike price. A put option is ITM if the stock price is below the strike price. For calls, it's any strike lower than the price of the underlying equity. For puts, it's any strike that's higher.

2 Describes an option with no intrinsic value. A call option is out of the money (OTM) if its strike price is above the price of the underlying stock. A put option is OTM if its strike price is below the price of the underlying stock.

3 An options contract gives the owner the right but not the obligation to buy (in the case of a call) or sell (in the case of a put) the underlying security at the strike price, on or before the option's expiration date. When the owner claims the right (i.e. takes a long or short position in the underlying security) that's known as exercising the option.

4 Assignment happens when someone who is short a call or put is forced to sell (in the case of the call) or buy (in the case of a put) the underlying stock. For every option trade there is a buyer and a seller; in other words, for anyone short an option, there is someone out there on the long side who could exercise.

5 A call option gives the owner the right, but not the obligation, to buy shares of stock or other underlying asset at the options contract's strike price within a specific time period. The seller of the call is obligated to deliver, or sell, the underlying stock at the strike price if the owner of the call exercises the option.

6 Gives the owner the right, but not the obligation, to sell shares of stock or other underlying assets at the options contract's strike price within a specific time period. The put seller is obligated to purchase the underlying security at the strike price if the owner of the put exercises the option.

7 When the stock settles right at the strike price at expiration.

8 Margin is borrowed money that's used to buy stocks or other securities. In margin trading, a brokerage firm lends an account owner a portion of the purchase price (typically 30% to 50% of the total price). The loan in the margin account is collateralized by the stock, and if the value of the stock drops below a certain level, the owner will be asked to deposit marginable securities and/or cash into the account or to sell/close out security positions in the account.

9 A margin call is issued when your account value drops below the maintenance requirements on a security or securities due to a drop in the market value of a security or when a customer exceeds their buying power. Margin calls may be met by depositing funds, selling stock, or depositing securities. Charles Schwab may forcibly liquidate all or part of your account without prior notice, regardless of your intent to satisfy a margin call, in the interests of both parties.

Just getting started with options?

More from charles schwab.

Today's Options Market Update

Weekly Trader's Outlook

Options Expiration: Definitions, a Checklist, & More

Related topics.

Options carry a high level of risk and are not suitable for all investors. Certain requirements must be met to trade options through Schwab. Please read the Options Disclosure Document titled " Characteristics and Risks of Standardized Options " before considering any options transaction. Supporting documentation for any claims or statistical information is available upon request.

With long options, investors may lose 100% of funds invested. Covered calls provide downside protection only to the extent of the premium received and limit upside potential to the strike price plus premium received.

Short options can be assigned at any time up to expiration regardless of the in-the-money amount.

Investing involves risks, including loss of principal. Hedging and protective strategies generally involve additional costs and do not assure a profit or guarantee against loss.

Commissions, taxes, and transaction costs are not included in this discussion but can affect final outcomes and should be considered. Please contact a tax advisor for the tax implications involved in these strategies.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

Short selling is an advanced trading strategy involving potentially unlimited risks and must be done in a margin account. Margin trading increases your level of market risk. For more information, please refer to your account agreement and the Margin Risk Disclosure Statement.

From Interactive Brokers

- More Campus

Finance Courses and Lessons

Featured Lessons

- TWS for Beginners

IBKR Desktop

Financial News and Market Commentary

Featured Articles

Whenever You Call Me, I’ll Be There: May 2, 2024

Stocks Cry Wolf Ahead of Powell: May. 1, 2024

Quantitative Code and News

Quant Articles

- Data Science

Insights on Backtesting

Data Science - Python Development - R Development

Quant Developer: Roadmap, Career, and Skills to Become a Quantitative Developer – Part II

Webinars from Financial Professionals

Webinar Topics

Latest Webinars

May / 08 / 2024 - 12:00 pm - EDT

What Investors Need to Know: Changing Demographics in Canada

May / 09 / 2024 - 6:00 pm - SGT

The 2024 Trader Playbook – The Big Themes for the Year

Financial Market Commentary Podcasts

Listen to IBKR Podcasts on

Featured Podcasts

- Cents of Security

Active vs Passive Investments

- IBKR Podcasts

The Dirt on Crop Progress: A Farmer’s Perspective

API Tools from Interactive Brokers

FIX Protocol

Third-Party Integrations

Featured API Articles

Python Development - REST Development

Handling Options Chains

- Python Development

Intro to the TWS API

Python Development - TWS Excel API

Connecting Python to Excel

Finance Training in the Classroom

Sample Curricula

The IBKR Advantage

Real-world experience for your classroom

IBKR Glossary of Financial Terms

Find by letter or search

Learn more about IBKR accounts

Low Commissions 1 , Global Access, Premiere Technology

Useful Tools and Information

Newsletter Signup

- All Finance Courses

- Beginner Courses

- Intermediate Courses

- Advanced Courses

- Other Trading Products

- IBKR Student Trading Lab

- Fundamentals

- Intro to IBKR Tools

- Advanced IBKR Tools

- Institutions

- Traders’ Insight Home

- IBKR Economic Landscape

- IBKR Commentary

- Fixed Income

- Commodities

- Securities Lending

- Technical Analysis

- IBKR Quant Home

- Quant Development

- Conferences

- C# Development

- C++ Development

- Java Development

- Julia Development

- R Development

- REST Development

- TWS Excel API

- Upcoming Webinars

- Webinars Aired

- Webinar Contributors

- AI & Machine Learning

- Alternative Investments

- Cryptocurrency

- Energy Sector

- Financial Spotlight

- International

- Women in Finance

- Podcasts Home

- Podcasts En Español

- Contributor Podcasts

- Leave a Review

- IBKR-API Home

- Documentation Changelog

- Getting Started

- Market Data Subscriptions

- Order Types

- Web API Documentation

- Web API Reference

- CPAPI v1.0 Documentation

- TWS API Documentation

- TWS API Reference

- Excel ActiveX

- Available/Existing Integrations

- Prospective Integrations

- For Teachers

- For Students

- Educator Trading Lab

- Simulated Competition

- Stock Trading Sample Assignments

- Option Trading Sample Assignments

- Futures Trading Sample Assignments

- Forex Trading Sample Assignments

- Computer Science Sample Assignments

- Economics Sample Assignments

- ESG Sample Assignment

- All Glossary Terms

- IBKR Quant Terms

More Campus Resources

- About The IBKR Campus

- IBKR Campus Contributors

- IBKR Guides

- IBKR Campus Newsletter

- Traders’ Insight Newsletter

- IBKR Webinars Newsletter

- IBKR Quant Newsletter

- IBKR API Newsletter

Stock Trading Sample Assignments and Resources

Ib trading platform basics.

Instruct your students to familiarize themselves with one or more of our three trading platforms – desktop, browser-based and mobile - using a variety of IB educational resources. Specific assignments can test your students' general knowledge of our trading platforms and can be organized based on the contents of QuickStart Guides, Users' Guides or Webinars.

Trader Workstation

Learn the basics of our market maker-designed TWS desktop trading platform.

Documentation

- TWS Users' Guide

Traders' Academy

Ibkr mobile.

Learn the basics of our mobile platform on a cell phone or tablet.

- IBKR Mobile for iOS for iPhone

- IBKR Mobile for iOS for iPad

- IBKR Mobile for Android for Phone

- IBKR Mobile for Android for Table

- IBKR Mobile - iPhone®

- IBKR Mobile - Android©

Stock Orders

Instruct your students to learn the basics of trading by placing basic and advanced orders.

Basic Orders

Place at least three different basic stock order types. For example, market, limit and stop orders.

Order Types page

- Order Types Sort by "stocks" to view all stock order types.

- Market Order

- Limit Order

- TWS Order Types

Reference Material

- IBKR Traders' Insight

Advanced Stock Orders

Instruct your students to place at least three different advanced stock order types. For example, All or None (AON), Bracket and Conditional orders.

- All or None Order

- Bracket Order

- Conditional Order

Short Selling

Instruct your students to place an order to sell short.

Market Data Fields

Add short selling market data fields to Classic TWS.

- Short Selling Market Data Fields

Additional Reference

- Traders' Academy - Securities Lending and Borrowing

- IBKR Traders' Insight - Securities Lending

Statements and Trade Confirmations

Instruct your students to check their daily activity statements and trade confirmation reports. Assignments can include running and analyzing a default statement; creating, running and analyzing a customized statement, and running and analyzing a trade confirmation report.

Statements and Trade Confirmation Reports are available from within Account Management.

Run default statements and create customized statements to view detailed information about the account activity, including positions, cash balances, transactions, and more.

Reporting Users' Guide

- Viewing Activity Statements

- Creating Customized Statements

- Sample Statements

- Trade Confirmation Reports

Run trade confirmation reports to view trade confirmations separately by asset class.

- Sample Trade Confirmation Reports

US Stock Commissions

Instruct your students to familiarize themselves with our commissions.

IB's Stock Commissions

Review IB's stock commissions and other pertinent pricing information.

- Commissions web page

IBKR Campus Newsletters

Get updates on podcasts, webinars, courses, and more from our IBKR pillars.

View the latest financial news articles from the top voices in the industry.

For those wanting to trade markets using computer-power by coders and developers.

Hear about the latest tools and techniques from our own IBKR API staff.

This website uses cookies to collect usage information in order to offer a better browsing experience. By browsing this site or by clicking on the "ACCEPT COOKIES" button you accept our Cookie Policy.

Traders' Insight RSS

To add ibkr traders’ insight to your rss feed, please paste the following link into your reader:, ibkr quant rss, to add ibkr quant to your rss feed, please paste the following link into your reader:, this page contains information regarding options trading.

To view this page, you must acknowledge that you have received the Characteristics & Risks of Standardized Options, also known as the options disclosure document (ODD). Options involve risk and are not suitable for all investors. For more information, click here to read the " Characteristics and Risks of Standardized Options " or visit: ibkr.com/occ

By acknowledging this disclosure you are also allowing this website to use "functional" cookies on your browser. To find out more about cookies, see our privacy settings.

Privacy Preference Center

Your privacy.

When you visit any website it may use cookies and web beacons to store or retrieve information on your browser. This information might be about you, your preferences or your device and is typically used to make the website work as expected. The information does not usually directly identify you, but can provide a personalized browsing experience. Because we respect your right to privacy, you can choose not to allow some types of cookies and web beacons. Please click on the different category headings to find out more and change our default settings. However, blocking some types of cookies may impact your experience on our website and limit the services we can offer.

Strictly Necessary Cookies

Strictly necessary cookies are necessary for the website to function and cannot be switched off in our systems. They are typically set in response to actions made by you which amount to a request for services, such as setting your privacy preferences, logging in or filling in forms. While you can set your browser to block or alert you about these cookies, some parts of the website will not work. These cookies do not store any personally identifiable information.

ALWAYS ACTIVE

Performance Cookies

Performance cookies and web beacons allow us to count visits and traffic sources so we can measure and improve website performance. They help us to know which pages are the most and least popular and see how visitors navigate around our website. All information these cookies and web beacons collect is aggregated and anonymous. If you do not allow these cookies and web beacons we will not know when you have visited our website and will not be able to monitor its performance.

Allow Performance Cookies:

Functional Cookies

Functional cookies enable our website to provide enhanced functionality and personalization. They may be set by us or by third party providers whose services we have added to our pages. If you do not allow these cookies then some or all of these services may not function properly.

Allow Functional Cookies: