Essays on Economics and Economists

R. H. Coase

231 pages | 5-1/4 x 8-1/2 | © 1994

Economics and Business: Economics--History

- Table of contents

- Author Events

- Related Titles

Table of Contents

Be the first to know.

Get the latest updates on new releases, special offers, and media highlights when you subscribe to our email lists!

Sign up here for updates about the Press

We will keep fighting for all libraries - stand with us!

Internet Archive Audio

- This Just In

- Grateful Dead

- Old Time Radio

- 78 RPMs and Cylinder Recordings

- Audio Books & Poetry

- Computers, Technology and Science

- Music, Arts & Culture

- News & Public Affairs

- Spirituality & Religion

- Radio News Archive

- Flickr Commons

- Occupy Wall Street Flickr

- NASA Images

- Solar System Collection

- Ames Research Center

- All Software

- Old School Emulation

- MS-DOS Games

- Historical Software

- Classic PC Games

- Software Library

- Kodi Archive and Support File

- Vintage Software

- CD-ROM Software

- CD-ROM Software Library

- Software Sites

- Tucows Software Library

- Shareware CD-ROMs

- Software Capsules Compilation

- CD-ROM Images

- ZX Spectrum

- DOOM Level CD

- Smithsonian Libraries

- FEDLINK (US)

- Lincoln Collection

- American Libraries

- Canadian Libraries

- Universal Library

- Project Gutenberg

- Children's Library

- Biodiversity Heritage Library

- Books by Language

- Additional Collections

- Prelinger Archives

- Democracy Now!

- Occupy Wall Street

- TV NSA Clip Library

- Animation & Cartoons

- Arts & Music

- Computers & Technology

- Cultural & Academic Films

- Ephemeral Films

- Sports Videos

- Videogame Videos

- Youth Media

Search the history of over 866 billion web pages on the Internet.

Mobile Apps

- Wayback Machine (iOS)

- Wayback Machine (Android)

Browser Extensions

Archive-it subscription.

- Explore the Collections

- Build Collections

Save Page Now

Capture a web page as it appears now for use as a trusted citation in the future.

Please enter a valid web address

- Donate Donate icon An illustration of a heart shape

Essays on economics and economists

Bookreader item preview, share or embed this item, flag this item for.

- Graphic Violence

- Explicit Sexual Content

- Hate Speech

- Misinformation/Disinformation

- Marketing/Phishing/Advertising

- Misleading/Inaccurate/Missing Metadata

Skew key stoning.

![[WorldCat (this item)] [WorldCat (this item)]](https://archive.org/images/worldcat-small.png)

plus-circle Add Review comment Reviews

4 Favorites

Better World Books

DOWNLOAD OPTIONS

No suitable files to display here.

IN COLLECTIONS

Uploaded by station12.cebu on April 3, 2019

SIMILAR ITEMS (based on metadata)

- Accessibility

Chicago Unbound

Home > Scholarship > Books

Essays on Economics and Economists

Ronald H. Coase Follow

Publication Date

University of Chicago Press

Link to University of Chicago’s Library Catalog

http://pi.lib.uchicago.edu/1001/cat/bib/1504228

Recommended Citation

Ronald H. Coase, Essays on Economics and Economists (University of Chicago Press, 1994).

Additional Information

Includes 15 previously published papers and an original preface

Full text not available in ChicagoUnbound.

Since September 20, 2013

Advanced Search

- Notify me via email or RSS

- Collections

- University of Chicago Law School

- D'Angelo Law Library

- Faculty Profiles

Privacy Copyright

Essays on Economics and Economists

Ronald h. coase.

231 pages, Paperback

First published May 2, 1994

About the author

Ratings & Reviews

What do you think? Rate this book Write a Review

Friends & Following

Community reviews.

Join the discussion

Can't find what you're looking for.

AVAILABLE FROM

About this book, table of contents.

One. The Institutional Structure of Production

Two. How Should Economists Choose?

Three. Economics and Contiguous Disciplines

Four. Economists and Public Policy

Five. The Market for Goods and the Market for Ideas

Six. The Wealth of Nations

Seven. Adam Smith's View of Man

Eight. Alfred Marshall's Mother and Father

Nine. Alfred Marshall's Family and Ancestry

Ten. The Appointment of Pigou as Marshall's Successor

Eleven. Marshall on Method

Twelve. Arnold Plant

Thirteen. Duncan Black

Fourteen. George J. Stigler

Fifteen. Economics at LSE in the 1930s: A Personal View

Uh-oh, it looks like your Internet Explorer is out of date. For a better shopping experience, please upgrade now.

Javascript is not enabled in your browser. Enabling JavaScript in your browser will allow you to experience all the features of our site. Learn how to enable JavaScript on your browser

Essays on Economics and Economists

Paperback (1)

- $30.00

- SHIP THIS ITEM Qualifies for Free Shipping Instant Purchase

Available within 2 business hours

- Want it Today? Check Store Availability

Related collections and offers

Product details, about the author, read an excerpt, table of contents.

Excerpted from Essays on Economics and Economists by R. H. Coase . Copyright © 1994 The University of Chicago. Excerpted by permission of The University of Chicago Press. All rights reserved. No part of this excerpt may be reproduced or reprinted without permission in writing from the publisher. Excerpts are provided by Dial-A-Book Inc. solely for the personal use of visitors to this web site.

Related Subjects

Customer reviews.

Essays on Economics and Economists

About this ebook, about the author, rate this ebook, reading information, more by r. h. coase.

Similar ebooks

- Even more »

Account Options

- Try the new Google Books

- Advanced Book Search

Get this book in print

- Buy From Transaction Publishers

- Barnes&Noble.com

- Books-A-Million

- All sellers »

Selected pages

Other editions - View all

Common terms and phrases, popular passages, references to this book, bibliographic information.

Economic history

Economics 101

Why introductory economics courses continued to teach zombie ideas from before economics became an empirical discipline

Walter Frick

The environment

We need to find a way for human societies to prosper while the planet heals. So far we can’t even think clearly about it

Ville Lähde

Credit card nation

Americans have always borrowed, but how exactly did their lives become so entangled with the power of plastic cards?

Sean H Vanatta

Who bears the risk?

Under the guise of empowerment and freedom, politicians and business are offloading lifethreatening risk to individuals

Suzanne Schneider

Does capitalism make ‘non-playable characters’ of us all? An uncanny exploration

The cruelty of crypto

Selling itself as the new American dream, crypto exposes the vulnerable to fraud and scams, and loads risk onto the poor

Rachel O’Dwyer

Going cashless

It’s not in the interests of the ordinary person but it’s not a conspiracy either. A cashless society is a system run amok

Brett Scott

Finance as alchemy

Finance fraud is not a deviation from an essentially rational system but a window onto the reality-distortion of markets

Aris Komporozos-Athanasiou

Whether above a pub or in a castle, our childhood homes leave an indelible mark

The empty basket

Economics is the language of power and affects us all. What can we do to improve its impoverished menu of ideas?

Ha-Joon Chang

Demography and migration

How the world’s harshest lockdown hit India’s millions of migrant workers

Anthropology

Keeping the score

The gifts we exchange are both generous and yet fraught with social rules and obligations. Marcel Mauss explained why

Gili Kliger

Living out of a truck, Maikhuu finds promise and peril on Mongolia’s ‘coal highway’

We all play by economic rules set by men. What could a feminist economics look like?

Is paying with hand-drawn banknotes artistry or forgery? The knotty case of J S G Boggs

Beyond Eurocentrism

If you really want decolonisation, go beyond cultural criticism to the deep structural insights of economist Samir Amin

Ingrid Harvold Kvangraven

A softer economics

Financial markets are entangled and uncertain. When will economists let go of physics envy to embrace the quantum revolution?

David Orrell

The worldly turn

After generations of ‘blackboard economics’, Berkeley and MIT are leading a return to economics that studies the real world

‘My people!’ A Trinidadian’s love letter to his island, just before its 1962 independence

The biggest picture

No wonder we cannot agree on how globalisation works and whether it’s a good thing. All the stories we have are flawed

Anthea Roberts & Nicholas Lamp

Animals and humans

Familiarity breeds roach-respect, and even love, for a group of Florida insect farmers

Thinkers and theories

Bigger isn’t better – the renegade ‘Buddhist economics’ of E F Schumacher

Stock-picking for humanity

Everyone on the planet has a stake in making investment more ethical. What’s new is that they have the power to do so too

Ellen Quigley

Future of technology

Tech companies shroud their algorithms in secrecy. It’s time to pry open the black box

.chakra .wef-1t4fkg7{margin-top:16px;margin-bottom:16px;line-height:normal;color:#ffffff;display:block;background:#000000;margin:0px;font-size:2.5rem;padding-left:16px;padding-right:16px;padding-bottom:12px;border-radius:0.25rem;border-top-left-radius:0;border-bottom-left-radius:0;-webkit-box-decoration-break:clone;-webkit-box-decoration-break:clone;box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-1t4fkg7{display:inline;}}@media screen and (min-width:56.5rem){.chakra .wef-1t4fkg7{font-size:4rem;}} 'Cautious optimism': Here's what chief economists think about the state of the global economy

Domestic politics has also emerged as a risk for the global economy. Image: Unsplash/Pedro Lastra

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Aengus Collins

Kateryna karunska.

- The near-term outlook for the global economy is looking brighter, according to the latest Chief Economists Outlook .

- Yet the report found that uncertainty and volatility remain, with domestic and international politics continuing to be a factor.

- Almost seven in 10 expect global growth to return to 4% in the next five years.

Despite geopolitical tensions and lingering economic headwinds, the outlook for the global economy is improving.

The May 2024 Chief Economists Outlook from the World Economic Forum found that just 17% of economists surveyed expect conditions to worsen this year, a significant improvement compared to the 56% recorded in January.

"Uncertainty persists, but signs of brightening are reflected in the latest survey," the report notes. "The developing economic mood is one of cautious optimism."

The Chief Economists Outlook , published three times a year, surveys leading chief economists from across industries and international organizations. The latest edition explores key trends in the global economy, including the latest outlook for growth and inflation, the implications of recent geopolitical and domestic political developments and prospects of reviving medium-term growth.

"Many of the global developments that have been highlighted as sources of heightened volatility and complexity in this and recent editions of the Chief Economists Outlook – including geopolitical rifts and technological transformation – have profound and far-reaching implications for the future pace and trajectory of the global economy," the report states.

Sources of volatility

While some of the sharpest near-term risks to the global economy may have eased, uncertainty remains high, and the chief economists highlighted a number of potentially disruptive factors.

Nearly all respondents (97%) expect international geopolitics to cause global economic volatility throughout 2024, up from 90% in September 2023.

Global economy nears soft landing, says IMF

2024 is a record year for elections. Here’s what you need to know

Geopolitical rivalries are costly for global businesses. Here’s why – and what's at stake

Domestic politics has also emerged as a risk for the global economy. More than eight in 10 respondents (83%) said domestic politics will be a source of volatility in 2024 – a year when more than half the world's population is set to go to the polls.

Chief economists were more sanguine about the immediate impacts of advanced technologies such as artificial intelligence (AI). In fact, most chief economists (69%) disagree that AI will be a source of volatility in 2024.

Regional dynamics are mixed

The outlook for economic growth varies significantly by region, according to the chief economists.

There has been a notable uptick in optimism on the economic prospects of the United States. Nearly all the chief economists surveyed (97%) now expect moderate or stronger growth in the American economy in 2024, up from 59% in January.

Chief economists foresee consistently buoyant activity in the economies of Asia.

Asia remains a source of optimism, too. All of the respondents expect at least moderate growth in South Asia and East Asia and the Pacific this year. In South Asia, in particular, growth prospects have improved significantly, with 70% expecting strong or very strong growth in the region this year, up from 52% in January.

The expectations for China are somewhat more muted, as weak consumption data and ongoing property market woes dampen the near-term outlook. About three-quarters of chief economists foresee moderate growth in China this year and only 4% predict strong growth in 2024.

The outlook is considerably more pessimistic for Europe, with almost seven in 10 expecting weak growth in 2024 and none of the respondents predicting strong or very strong growth.

For the rest of the world, the majority of chief economists expect moderate growth, with a slight improvement in expectations since January.

Inflation expectations vary across regions too, but the extent of this variation has begun to diminish, and the latest results reveal convergence towards a moderate outlook for inflation.

expect moderate inflation in the US

Expect moderate inflation in europe.

In the US, around two-thirds of chief economists expect moderate inflation to persist this year. The outlook is generally unchanged in Europe, where 57% of respondents expect moderate inflation and a quarter expect low inflation.

China remains an outlier in terms of the presence of deflationary risks. More than eight in 10 chief economists expect low or very low inflation this year, with the share of those predicting very low inflation almost doubling since January. Elsewhere, expectations of low inflation have also strengthened in East Asia and the Pacific (43%) and in Central Asia (32%), up by more than 10 percentage points since January.

Challenges for businesses and policymakers

The current global economic landscape makes for a tough decision-making environment for businesses and policymakers, according to the chief economists. Almost eight in ten expect heightened complexity to be a growing challenge for public and private sector leaders throughout 2024.

An even higher share of respondents said the same about tensions between politics and economics (86%), as increasing polarization and volatility in domestic politics become more prominent with the wave of elections this year.

Looking at the factors expected to drive corporate decision making this year, both economic and political factors feature prominently, as the graphic above illustrates. Notably, almost twice as many chief economists said companies’ growth targets will drive decision-making as those that think the same about companies’ environmental and social targets.

The longer-term view

Encouragingly, the chief economists’ relative optimism about the outlook for economic growth stretches beyond the short term. At a time when many medium-term forecasts have been slashed—the International Monetary Fund (IMF) forecast of global growth of 3.1% five years from now is at its lowest in decades—the chief economists see the possibility of a sustained rebound in growth.

Responding to the growing challenges facing the world requires more than a simple increase in the rate of growth.

Almost seven in ten said they expect global growth to return to 4% within the next five years, and four in ten expect that within the next three years. That would mark a welcome improvement in the global economy, although it is worth noting that a minority of respondents (23%) do not share this optimism and said that they do not expect the global economy to return to 4% growth over any timeframe.

Looking at the potential drivers of growth over the next five years, the chief economists are unambiguous in expecting technological transformation, AI, and the green and energy transition to play a positive role, particularly in high-income economies. By contrast, there is a strong consensus that geopolitics, domestic politics, debt levels, climate change and social polarization are set to dampen growth in both high- and low-income economies.

Looking at what policy-makers can do to boost growth in the next five years, chief economists highlighted innovation, infrastructure development, education and skills development, and monetary policy as the most effective policy levers regardless of countries’ income levels. Policy action in a number of other areas – including institutions, social services and access to finance – are expected to be more beneficial for low-income than high-income economies. There is a notable lack of consensus among the chief economists on the likely growth impact of environmental and industrial policies.

The societal implications of many of these policy areas extends well beyond growth, to cover distinct goals and values related to issues such as sustainability and inequality. With this in mind, the latest Chief Economists Outlook concludes by noting that economic policy increasingly needs to "focus on the character or composition of economic activity" around the world.

"Responding to the growing challenges facing the world requires more than a simple increase in the rate of growth," the report states.

Navigating the future of growth: a new tool for a new era

Global trade growth could more than double in 2024. Here’s why

We need to kickstart growth – but this time, it must work for all

Related topics:

- Share full article

Advertisement

Supported by

Paul Krugman

Should Biden Downplay His Own Success?

By Paul Krugman

Opinion Columnist

The performance of America’s economy over the past two years has been remarkable, especially given the dire predictions of many observers. Remember the economists who forecast a recession in 2023? Remember all those warnings that getting inflation down would require years of high unemployment?

Instead, our economic growth has been the envy of other wealthy nations . Stocks are way up since President Biden took office. Inflation has declined sharply and unemployment is still below 4 percent. The latest numbers seem to support the view that the apparent acceleration of prices earlier this year was a statistical blip, and that disinflation is still on track.

Yet there’s still a lingering conventional wisdom that says Biden shouldn’t trumpet his economic record. The Washington Post’s editorial board just wrote that “Telling Americans the economy is good won’t work.” The Financial Times’s editorial board wrote that “The president’s state of the nation address in March was littered with superlatives about the economy” but that his messaging “risks negating the experience of voters on the ground” — basically saying that Biden shouldn’t talk about his economic achievements, even implying that he should try to relate to voters by acknowledging that the economic picture out there is bad, which it isn’t.

Now, I am neither a political strategist nor a political historian, but I think I know enough to say that a 21st-century replay of Jimmy Carter’s infamous so-called malaise speech would be a bad move.

That said, telling voters to buck up and realize how good they have it would also be a bad move. But has anyone in the Biden administration said anything like that? It would be pretty obtuse if they had. But I’m not aware of any examples. As far as I can tell, administration officials, including Biden himself, talk about low unemployment, falling inflation and rising real wages — and do so very carefully, studiously avoiding the bombast and excessive boasting so common in the previous administration. But even mentioning good economic news is supposedly an affront to everyday Americans because it amounts to denying their lived experience.

Which brings me to a point I’ve been pounding on for a while that bears repeating: There’s overwhelming evidence that most Americans’ negative views about the economy don’t reflect their lived experience.

Here’s a relatively new example: fast food. Recently, the online lending marketplace LendingTree released the results of a survey in which nearly 80 percent of Americans said that inflation has turned fast food into a luxury they’re forced to consume less often. And indeed, fast food prices have gone up quite a bit in recent years.

But they haven’t surged to the extent that legend has it. Those headlines you see that say McDonald’s prices have doubled? They’re usually referring to prices from a decade ago , and are wrong even so.

A few days after that survey was released, management at McDonald’s issued an open letter responding to hyperbolic claims about the chain’s prices. Since 2019 (the last full year before the economic shocks of the Covid-19 pandemic), McDonald’s reports, the price of a Big Mac hasn’t doubled; it’s up 21 percent. That’s still substantial, but it’s less than the rise in the median worker’s earnings over the same period of time.

And it’s worth looking at what people are actually doing. Spending at restaurants was up 7 percent from March 2023 to March 2024; some of this was inflation, but not all of it , so Americans seem to be buying quite a lot of a luxury good they say they can’t afford.

To be clear, nobody is suggesting that Biden administration officials should tell Americans to sit down, eat their Happy Meals and stop complaining. And from my own conversations I can tell you that these officials are well aware that they have limited ability to change a negative economic narrative that has become widely entrenched, even if it’s inaccurate. But demands that Biden stay quiet about good economic news — particularly when there’s a lot of good economic news to talk about — seem to be saying that he should in effect validate misinformation. Why would anyone consider this a good idea?

Well, here’s my take: As I said, I’m no political consultant, but people telling Biden to downplay the fact that his big spending has worked out well for the economy are to some degree revealing their own ideological biases rather than giving solid political advice.

The situation today is not unlike what we saw in the early 2010s, when policy pivoted far too soon from fighting unemployment to obsessing about deficits , making it harder to make the case that sometimes government activism really does work. In the same way that the Great Recession became fodder for deficit hawks, for a little while, the inflation surge in 2021 and 2022 became glory days for the inflation hawks.

But it turned out that they were wrong: The almost painless disinflation of 2023 largely vindicated Biden economists, who argued early on that post-Covid inflation wasn’t the second coming of the 1970s, that it most resembled inflation after World War II — a transitory burst that ended as supply chains normalized. The “transitory” part ended up taking a bit longer than expected, but they were basically right.

So how should Biden and his people talk about the economy now? I’d suggest that they simply tell the truth as they see it. Which, as far as I can tell, is what they’ve been doing all along.

The Times is committed to publishing a diversity of letters to the editor. We’d like to hear what you think about this or any of our articles. Here are some tips . And here’s our email: [email protected] .

Follow the New York Times Opinion section on Facebook , Instagram , TikTok , WhatsApp , X and Threads .

Paul Krugman has been an Opinion columnist since 2000 and is also a distinguished professor at the City University of New York Graduate Center. He won the 2008 Nobel Memorial Prize in Economic Sciences for his work on international trade and economic geography. @ PaulKrugman

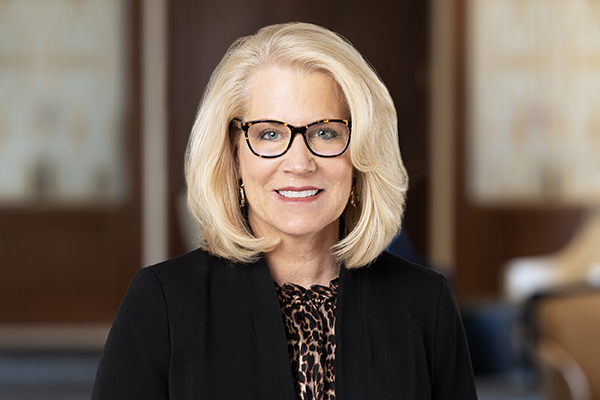

First Vice President, COO and Fed System Treasury Director Kathy O’Neill to Retire

Kathy O’Neill

ST. LOUIS — The Federal Reserve Bank of St. Louis today announced First Vice President, Chief Operating Officer and Federal Reserve System Treasury Director Kathy O’Neill intends to retire effective Aug. 15, 2024. O’Neill’s retirement comes after a 36-year career of dedicated public service to the Bank, the Federal Reserve’s Eighth District and the Federal Reserve System.

“Kathy’s commitment to the St. Louis Fed and the Federal Reserve System has been remarkable,” St. Louis Fed President Alberto Musalem said. “Over her career, she provided strong leadership during significant change in the banking system, the payments industry and the Fed System. She also helped steer the Bank through executive leadership changes and the pandemic. As a highly collaborative colleague, she has been instrumental in the overall performance and culture of the Bank, and in strengthening the fiscal agency relationship between the Fed System and the U.S. Treasury.”

Musalem added, “Kathy has always focused on talent development and diversity, equity and inclusion, helping to mentor and advance the careers of many in the Bank and System. I am also grateful for her distinguished service as interim president of the Bank and for the support she has given to me so far. I am looking forward to continuing to work closely with her during the next several months.”

A search committee comprising President Musalem and St. Louis Fed Class B and Class C directors (those not affiliated with a financial institution) will conduct a selection process to replace O’Neill, subject to approval by the Board of Governors of the Federal Reserve System.

O’Neill has served as first vice president, COO and Treasury director since Jan. 1, 2021, and has responsibility for the St. Louis Fed’s day-to-day operations throughout the entire Eighth District. She chairs the Bank’s Management Committee and leads the Fed System’s overall fiscal agency relationship with the U.S. Treasury.

O’Neill assumed the duties of interim Bank president following the retirement of James Bullard in July 2023 until Musalem’s appointment in April 2024. She participated in six meetings of the Federal Open Market Committee (FOMC) during that time.

“Working at the St. Louis Fed has truly been an honor and a privilege. I am proud of what we do to foster an economy that works for all,” O’Neill said. “I am grateful to have had the opportunity to partner with many dedicated, diverse and distinguished individuals over the course of my career, and I hope to leave behind a legacy of excellence, empowerment, integrity and inclusion throughout the organization.”

A native of Chicago and a graduate of the University of Illinois, O’Neill joined the Federal Reserve Bank of Chicago in February 1988 as a product manager in the Financial Services department. She moved to the St. Louis Fed in August 1989 to take a similar product management role. During her Fed career, she has held a variety of positions of increasing responsibility in the Operations, Public Affairs, Financial Services and Business Development functions. She also performed numerous leadership roles in the Fed System during her tenure. In February 2001, she joined the newly established Treasury Relations and Support Office (TRSO) as vice president and helped establish and enhance the Fed System’s fiscal agency support functions for the U.S. Treasury. She was promoted to senior vice president in charge of the TRSO and Treasury Operations functions in 2009. She has worked closely with Fed System and Treasury leaders to guide this national fiscal agency support function for the last 23 years.

O’Neill is also a graduate of the Kellogg School of Business’ Executive Leadership Program at Northwestern University and serves on the Board of Trustees for Webster University and the Chair’s Council of Greater St. Louis, Inc.

Contact Laura Girresch

Office: (314) 444-6166

Cell: (314) 348-3639

- Data library

2024 Housing Market Forecast and Predictions: Housing Affordability Finally Begins to Turnaround

As we look ahead to 2024 , we see a mix of continuity and change in both the housing market and economy. Against a backdrop of modest economic growth, slightly higher unemployment, and easing inflation longer term interest rates including mortgage rates begin a slow retreat. The shift from climbing to falling mortgage rates improves housing affordability, but saps some of the urgency home shoppers had previously sensed. Less frenzied housing demand and plenty of rental home options keep home sales relatively stable at low levels in 2024, helping home prices to adjust slightly lower even as the number of for-sale homes continues to dwindle.

Realtor.com ® 2024 Forecast for Key Housing Indicators

Home Prices Dip, Improving Affordability

Home prices grew at a double-digit annual clip for the better part of two years spanning the second half of 2020 through 2022, a notable burst following a growing streak that spanned back to 2012. As mortgage rates climbed, home price growth flatlined, actually declining on an annual basis in early 2023 before an early-year dip in mortgage rates spurred enough buyer demand to reignite competition for still-limited inventory. Home prices began to climb again, and while they did not reach a new monthly peak, on average for the year we expect that the 2023 median home price will slightly exceed the 2022 annual median.

Nevertheless, even during the brief period when prices eased, using a mortgage to buy a home remained expensive. Since May 2022, purchasing the typical for-sale home listing at the prevailing rate for a 30-year fixed-rate mortgage with a 20% down payment meant forking over a quarter or more of the typical household paycheck. In fact, in October 2023, it required 39% of the typical household income and this share is expected to average 36.7% for the full calendar year in 2023. This figure has typically ranged around 21%, so it is well above historical average. We expect that the return to pricing in line with financing costs will begin in 2024, and home prices, mortgage rates, and income growth will each contribute to the improvement. Home prices are expected to ease slightly, dropping less than 2% for the year on average. Combined with lower mortgage rates and income growth this will improve the home purchase mortgage payment share relative to median income to an average 34.9% in 2024, with the share slipping under 30% by the end of the year.

Home Sales Barely Budge Above 2023’s Likely Record Low

After soaring during the pandemic, existing home sales were weighed down in the latter half of 2022 as mortgage rates took off, climbing from just over 3% at the start of the year to a peak of more than 7% in the fourth quarter. The reprieve in mortgage rates in early 2023, when they dipped to around 6%, brought some life to home sales, but the renewed climb of mortgage rates has again exerted significant pressure on home sales that is exacerbated by the fact that a greater than usual number of households bought homes over the past few years, and despite stories of pandemic purchase regret , for the most part, these homeowners continue to be happy in their homes.

This is consistent with what visitors to Realtor.com report when asked why they are not planning to sell their homes. The number one reason homeowners aren’t trying to sell is that they just don’t need to; concern about losing an existing low-rate mortgage is the top financial concern cited. Our current projection is for 2023 home sales to tally just over 4 million, a dip of 19% over the 2022 5 million total.

With many of the same forces at play heading into 2024, the housing chill will continue, with sales expected to remain essentially unchanged at just over 4 million. Although mortgage rates are expected to ease throughout the course of the year, the continuation of high costs will mean that existing homeowners will have a very high threshold for deciding to move, with many likely choosing to stay in place. Moves of necessity–for job changes, family situation changes, and downsizing to a more affordable market–are likely to drive home sales in 2024.

Shoppers Find Even Fewer Existing Homes For Sale

Even before the pandemic, housing inventory was on a long, slow downward trajectory. Insufficient building meant that the supply of houses did not keep up with household formation and left little slack in the housing market. Both homeowner and rental vacancy remain below historic averages . In contrast with the existing home market, which remains sluggish, builders have been catching up, with construction remaining near pre-pandemic highs for single-family and hitting record levels for multi-family .

Despite this, the lack of excess capacity in housing has been painfully obvious in the for-sale home market. The number of existing homes on the market has dwindled. With home sales activity to continue at a relatively low pace, the number of unsold homes on the market is also expected to remain low. Although mortgage rates are expected to begin to ease, they are expected to exceed 6.5% for the calendar year. This means that the lock-in effect, in which the gap between market mortgage rates and the mortgage rates existing homeowners enjoy on their outstanding mortgage, will remain a factor. Roughly two-thirds of outstanding mortgages have a rate under 4% and more than 90% have a rate less than 6%.

Rental Supply Outpaces Demand to Drive Mild Further Decline in Rents

After almost a full year of double-digit rent growth between mid-2021 and mid-2022, the rental market has finally cooled down, as evidenced by the year-over-year decline that started in May 2023 . In 2024, we expect the rental market will closely resemble the dynamics witnessed in 2023, as the tug of war between supply and demand results in a mild annual decline of -0.2% in the median asking rent.

New multi-family supply will continue to be a key element shaping the 2024 rental market. In the third quarter of 2023, the annual pace of newly completed multi-family homes stood at 385,000 units. Although absorption rates remained elevated in the second quarter, especially at lower price points, the rental vacancy rate ticked up to 6.6% in the third quarter. This uptick in rental vacancy suggests the recent supply has outpaced demand, but context is important. After recent gains, the rental vacancy rate is on par with its level right before the onset of the pandemic in early 2020, still below its 7.2% average from the 2013 to 2019 period. Looking ahead, the strong construction pipeline– which hit a record high for units under construction this summer –is expected to continue fueling rental supply growth in 2024 pushing rental vacancy back toward its long-run average.

While the surge in new multi-family supply gives renters options, the sheer number of renters will minimize the potential price impact. The median asking rent in 2024 is expected to drop only slightly below its 2023 level. Renting is expected to continue to be a more budget friendly option than buying in the vast majority of markets, even though home prices and mortgage rates are both expected to dip, helping pull the purchase market down slightly from record unaffordability.

Young adult renters who lack the benefit of historically high home equity to tap into for a home purchase will continue to find the housing market challenging. Specifically, as many Millennials age past first-time home buying age and more Gen Z approach these years, the current housing landscape is likely to keep these households in the rental market for a longer period as they work to save up more money for the growing down payment needed to buy a first home. This trend is expected to sustain robust demand for rental properties. Consequently, we anticipate that rental markets favored by young adults , a list which includes a mix of affordable areas and tech-heavy job markets in the South, Midwest, and West, will be rental markets to watch in 2024.

Key Wildcards:

- Wildcard 1: Mortgage Rates With both mortgage rates and home prices expected to turn the corner in 2024, record high unaffordability will become a thing of the past, though as noted above, the return to normal won’t be accomplished within the year. This prediction hinges on the expectation that inflation will continue to subside, enabling the recent declines in longer-term interest rates to continue. If inflation were to instead see a surprise resurgence, this aspect of the forecast would change, and home sales could slip lower instead of steadying.

- Wildcard 2: Geopolitics In our forecast for 2023 , we cited the risk of geopolitical instability on trade and energy costs as something to watch. In addition to Russia’s ongoing war in Ukraine, instability in the Middle East has not only had a catastrophic human toll, both conflicts have the potential to impact the economic outlook in ways that cannot be fully anticipated.

- Wildcard 3: Domestic Politics: 2024 Elections In 2020, amid the upheaval of pandemic-era adaptations, many Americans were on the move. We noted that Realtor.com traffic patterns indicated that home shoppers in very traditionally ‘blue’ or Democratic areas were tending to look for homes in markets where voters have more typically voted ‘red’ or Republican. While consumers also reported preferring to live in locations where their political views align with the majority , few actually reported wanting to move for this reason alone.

Housing Perspectives:

What will the market be like for homebuyers, especially first-time homebuyers.

First-time homebuyers will continue to face a challenging housing market in 2024, but there are some green shoots. The record-high share of income required to purchase the median priced home is expected to begin to decline as mortgage rates ease, home prices soften, and incomes grow. In 2023 we expect that for the year as a whole, the monthly cost of financing the typical for-sale home will average more than $2,240, a nearly 20% increase over the mortgage payment in 2022, and roughly double the typical payment for buyers in 2020. This amounted to a whopping nearly 37% of the typical household income. In 2024 as modest price declines take hold and mortgage rates dip, the typical purchase cost is expected to slip just under $2,200 which would amount to nearly 35% of income. While far higher than historically average, this is a significant first step in a buyer-friendly direction.

How can homebuyers prepare?

Homebuyers can prepare for this year’s housing market by getting financially ready. Buyers can use a home affordability calculator , like this one at Realtor.com to translate their income and savings into a home price range. And shoppers can pressure test the results by using a mortgage calculator to consider different down payment, price, and loan scenarios to see how their monthly costs would be impacted. Working with a lender can help potential buyers explore different loan products such as FHA or VA loans that may offer lower mortgage interest rates or more flexible credit criteria.

Although prices are anticipated to fall in 2024, housing costs remain high, and a down payment can be a big obstacle for buyers. Recent research shows that the typical down payment on a home reached a record high of $30,000 . To make it easier to cobble together a down payment, shoppers can access information about down payment assistance options at Realtor.com/fairhousing and in the monthly payment section of home listing pages. Furthermore, home shoppers can explore loan products geared toward helping families access homeownership by enabling down payments as low as 3.5% in the case of FHA loans and 0% in the case of VA loans .

What will the market be like for home sellers?

Home sellers are likely to face more competition from builders than from other sellers in 2024. Because builders are continuing to maintain supply and increasingly adapting to market conditions, they are increasingly focused on lower-priced homes and willing to make price adjustments when needed. As a result, potential sellers will want to consider the landscape for new construction housing in their markets and any implications for pricing and marketing before listing their home for sale.

What will the market be like for renters?

In 2024, renting is expected to continue to be a more cost-effective option than buying in the short term even though we anticipate the advantage for renting to diminish as home prices and mortgage rates decline.

However, for those considering the pursuit of long-term equity through homeownership, it’s essential to not only stay alert about market trends but also to carefully consider the intended duration of residence in their next home. When home prices rise rapidly, like they did during the pandemic, the higher cost of purchasing a home may break even with the cost of renting in as little as 3 years. Generally, it takes longer to reach the breakeven point, typically within a 5 to 7-year timeframe. Importantly, when home prices are falling and rents are also declining, as is expected to be the case in 2024, it can take longer to recoup some of the higher costs of buying a home. Individuals using Realtor.com’s Rent vs. Buy Calculator can thoroughly evaluate the costs and benefits associated with renting versus buying over time and how many years current market trends suggest it will take before buying is the better financial decision. This comprehensive tool can provide insights tailored to a household’s specific rent versus buying decision and empowers consumers to consider not only the optimal choice for the current month but also how the trade-offs evolve over several years.

Local Market Predictions:

All real estate is local and while the national trends are instructive, what matters most is what’s expected in your local market.

Sign up for updates

Join our mailing list to receive the latest data and research.

IMAGES

VIDEO

COMMENTS

1: The Institutional Structure of Production. 2: How Should Economists Choose? 3: Economics and Contiguous Disciplines. 4: Economists and Public Policy. 5: The Market for Goods and the Market for Ideas. 6: The Wealth of Nations. 7: Adam Smith's View of Man. 8: Alfred Marshall's Mother and Father. 9: Alfred Marshall's Family and Ancestry.

In fifteen essays, Coase evaluates the contributions of a number of outstanding figures, including Adam Smith, Alfred Marshall, Arnold Plant, Duncan Black, and George Stigler, as well as economists at the London School of Economics in the 1930s. Ronald H. Coase was awarded the Nobel Prize in Economic Science in 1991.

Essays on economics and economists by Coase, R. H. (Ronald Henry) Publication date 1995 Topics Marshall, Alfred, 1842-1924, Economic policy, Economics -- History, Economics, Economists -- Biography Publisher Chicago : University of Chicago Press Collection printdisabled; trent_university; internetarchivebooks Contributor

Ronald Coase, apart from his economic genius, is an excellent writer. In this series of essays Coase traverses a wide range of topics in the discipline from what part economists should play in public policy to who Alfred Marshall's Uncle was. As the title of the book suggests, the first seven essays deal with economics, and Coase's views on it.

Books. Essays on Economics and Economists. R. H. Coase. University of Chicago Press, Nov 16, 2012 - Business & Economics - 232 pages. Reflections on two centuries of economic history from a Nobel Prize winner in the field: "An accessible collection by a renowned economist."—Library Journal How do economists decide what questions to ...

Ronald H. Coase, Essays on Economics and Economists (University of Chicago Press, 1994). Additional Information. Includes 15 previously published papers and an original preface. Full text not available in ChicagoUnbound. DOWNLOADS. Since September 20, 2013. COinS . Enter search terms:

Understanding the way economists see the world is a necessary step on the way to good economics writing. Chapter 1 describes the keys you need to succeed as a writer of economics and offers an overview of the writing process from beginning to end. Chapter 2 describes the basic methods economists use to analyze data and communicate their ideas.

He has taught regulated industries and economic analysis and public policy. Mr. Coase was the editor of the Journal of Law and Economics from 1964 to 1982. Among his many publications are The Firm, the Market and the Law (1988) and Essays on Economics and Economists (1994).

In fifteen essays, Coase evaluates the contributions of a number of outstanding figures, including Adam Smith, Alfred Marshall, Arnold Plant, Duncan Black, and George Stigler, as well as economists at the London School of Economics in the 1930s. Ronald H. Coase was awarded the Nobel Prize in Economic Science in 1991.

In fifteen essays, Coase evaluates the contributions of a number of outstanding figures, including Adam Smith, Alfred Marshall, Arnold Plant, Duncan Black, and George Stigler, as well as economists at the London School of Economics in the 1930s. Ronald H. Coase was awarded the Nobel Prize in Economic Science in 1991.

In this series of essays Coase traverses a wide range of topics in the discipline from what part economists should play in public policy to who Alfred Marshall's Uncle was. As the title of the book suggests, the first seven essays deal with economics, and Coase's views on it. The essays are short, witty (some of them) and never dull.

II, "Researching Economic Topics," tries to explain the scholarly and analytical approach behind economics papers. The third part, "Genres of Economics Writing," briefly surveys some of the kinds of papers and essays economists write. It is in the fourth part, "Writing Economics," that the manual homes in on discipline-specific writing.

In fifteen essays, Coase evaluates the contributions of a number of outstanding figures, including Adam Smith, Alfred Marshall, Arnold Plant, Duncan Black, and George Stigler, as well as economists at the London School of Economics in the 1930s. Ronald H. Coase was awarded the Nobel Prize in Economic Science in 1991. Product Details.

Essays on economics and economists. By RONALD H. COASE. Chicago and London: University of Chicago Press, 1994. Pp. viii, 222. $11.95, paper. ISBN -226-11102-4, cloth; -226-11103-2, pbk. JEL 96-0003 ... examine some general questions concerning how economists go about their business: how they tackle the problems of the economic system, choose ...

Essays on Economics and Economists - Ebook written by R. H. Coase. Read this book using Google Play Books app on your PC, android, iOS devices. Download for offline reading, highlight, bookmark or take notes while you read Essays on Economics and Economists.

Essays in Economics. : This work comprises the major papers of this extraordinary Nobel Laureate in economics. The common concern of the papers included in this volume is economic theory, its structure, uses, and abuses. As the late Harry G. Johnson said: "No one reading this volume can fail to be struck by the depth of scholarship Professor ...

This essay reviews Dani Rodrik's superb book Economics Rules and argues that it can serve as an ideal platform for discussing what economists can and should accomplish. The essay comments on some of the major issues in contemporary economics exam-ined in the book: whether economics is a science, the meaning of economic models, the nature of ...

ABSTRACT. This work comprises the major papers of this extraordinary Nobel Laureate in economics. The common concern of the papers included in this volume is economic theory, its structure, uses, and abuses. As the late Harry G. Johnson said: "No one reading this volume can fail to be struck by the depth of scholarship Professor Leontief is ...

Economic Thought - Essays on Economics and Economists. By R. H. Coase. Chicago: University of Chicago Press, 1994, Pp. viii, 222. $11.95. - Volume 56 Issue 4

Political Economy or Economics is a study of mankind in the ordinary business of life; it examines that part of individual and social action which is most closely connected with the attainment and with the use of the material requisites of wellbeing. Thus it is on the one side a study of wealth; and on the other, and more important side, a part ...

The abuses of Popper. A powerful cadre of scientists and economists sold Karl Popper's 'falsification' idea to the world. They have much to answer for. Charlotte Sleigh. Society Essays from Aeon. World-leading thinkers explore big ideas from history, politics, economics, sociology, philosophy, archaeology and anthropology, and more.

Planting lots of trees failed. What was required was a mix of grasses and shrubs that could enrich the soil and co-exist with trees. By a similar logic, local governments need to nurture diverse ...

Monthly consumer-spending growth fell from 0.7% in March to just 0.2% in April. Overall spending shrank in real terms. Retail sales have weakened, with brands from McDonald's, a burger purveyor ...

Encouragingly, the chief economists' relative optimism about the outlook for economic growth stretches beyond the short term. At a time when many medium-term forecasts have been slashed—the International Monetary Fund (IMF) forecast of global growth of 3.1% five years from now is at its lowest in decades—the chief economists see the ...

Yet there's still a lingering conventional wisdom that says Biden shouldn't trumpet his economic record. The Washington Post's editorial board just wrote that "Telling Americans the ...

Essay; Schools brief; Business & economics. ... A protégée of one of Russia's most influential liberal economists, she has spent most of her 11 years in the job trying to foster an open ...

Essays by economic education specialists. Timely Topics Podcast. Conversations with experts on their research and topics in the news. ... Musalem is an economist and executive with public and private sector experience in economic policy, finance and markets. Staff Contacts;

my experience, economists often have mixed feelings towards criticism of their profession. In particular, I recall angry looks from some senior theorists after lectures I gave about the dilemmas facing an economic theorist (Rubinstein (2006b)), which included some skeptical comments on the way that Economic Theory is perceived by many economists.

In 2024 as modest price declines take hold and mortgage rates dip, the typical purchase cost is expected to slip just under $2,200 which would amount to nearly 35% of income. While far higher than ...

Most attempts to enact change, they say, get tangled in red tape. Yet the European Parliament has gradually become more powerful since its inception as a directly elected chamber in 1979. The ...