HIGH SCHOOL

- ACT Tutoring

- SAT Tutoring

- PSAT Tutoring

- ASPIRE Tutoring

- SHSAT Tutoring

- STAAR Tutoring

GRADUATE SCHOOL

- MCAT Tutoring

- GRE Tutoring

- LSAT Tutoring

- GMAT Tutoring

- AIMS Tutoring

- HSPT Tutoring

- ISAT Tutoring

- SSAT Tutoring

Search 50+ Tests

Loading Page

math tutoring

- Elementary Math

- Pre-Calculus

- Trigonometry

science tutoring

Foreign languages.

- Mandarin Chinese

elementary tutoring

- Computer Science

Search 350+ Subjects

- Video Overview

- Tutor Selection Process

- Online Tutoring

- Mobile Tutoring

- Instant Tutoring

- How We Operate

- Our Guarantee

- Impact of Tutoring

- Reviews & Testimonials

- Media Coverage

- About Varsity Tutors

FREE CPA Financial Accounting and Reporting (FAR) Practice Tests

All cpa financial accounting and reporting (far) resources, free cpa financial accounting and reporting (far) practice tests, practice tests by concept, business combinations practice test, cost method practice test, equity method practice test, fair value method practice test, goodwill practice test, business combinations & investments practice test, consolidated financial statements practice test, derivatives, hedging, and foreign currency transactions practice test, compensation and accrued payroll practice test, accrued payroll expense practice test, retirement benefits practice test, stock compensation practice test, current assets practice test, bank reconciliations practice test, inventory costing methods practice test, prepaid expenses practice test, receivables practice test, current liabilities practice test, contingencies practice test, payables and accrued liabilities practice test, debt and equity financing practice test, bonds payable & long-term debt practice test, debt covenant obligations practice test, equity transactions practice test, expenses practice test, accounting for leases practice test, cost of goods sold practice test, income taxes practice test, financial reporting standards practice test, accounting changes & errors practice test, conceptual framework practice test, ifrs vs. gaap practice test, special purpose frameworks practice test, income statements & analysis practice test, calculate fluctuations & ratios practice test, income statement practice test, other comprehensive income practice test, non-income financial statements practice test, balance sheet practice test, statement of cash flows practice test, statement of retained earnings practice test, not for profit accounting practice test, nonreciprocal transfers practice test, statement of activities practice test, statement of financial position practice test, other long lived assets practice test, asset impairment practice test, intangible assets practice test, software, r&d costs practice test, property, plant and equipment practice test, asset retirement obligations practice test, capitalizing property, plant, and equipment practice test, depreciation and amortization practice test, revenue practice test, allowance method for doubtful accounts practice test, non-monetary exchanges practice test, revenue recognition practice test, state and local governments practice test, cafr (fund) accounting practice test, encumbrance accounting practice test, government-wide financial statements practice test, modified accrual basis of accounting practice test, practice quizzes, cpa financial accounting and reporting (far) problem set 31, cpa financial accounting and reporting (far) problem set 30, cpa financial accounting and reporting (far) problem set 29, cpa financial accounting and reporting (far) problem set 28, cpa financial accounting and reporting (far) problem set 27, cpa financial accounting and reporting (far) problem set 26, cpa financial accounting and reporting (far) problem set 25, cpa financial accounting and reporting (far) problem set 24, cpa financial accounting and reporting (far) problem set 23, cpa financial accounting and reporting (far) problem set 22, cpa financial accounting and reporting (far) problem set 21, cpa financial accounting and reporting (far) problem set 20, cpa financial accounting and reporting (far) problem set 19, cpa financial accounting and reporting (far) problem set 18, cpa financial accounting and reporting (far) problem set 17, cpa financial accounting and reporting (far) problem set 16, cpa financial accounting and reporting (far) problem set 15, cpa financial accounting and reporting (far) problem set 14, cpa financial accounting and reporting (far) problem set 13, cpa financial accounting and reporting (far) problem set 12, cpa financial accounting and reporting (far) problem set 11, cpa financial accounting and reporting (far) problem set 10, cpa financial accounting and reporting (far) problem set 9, cpa financial accounting and reporting (far) problem set 8, cpa financial accounting and reporting (far) problem set 7, cpa financial accounting and reporting (far) problem set 6, cpa financial accounting and reporting (far) problem set 5, cpa financial accounting and reporting (far) problem set 4, cpa financial accounting and reporting (far) problem set 3, cpa financial accounting and reporting (far) problem set 2.

The global body for professional accountants

- Search jobs

- Find an accountant

- Technical activities

- Help & support

Can't find your location/region listed? Please visit our global website instead

- Middle East

- Cayman Islands

- Trinidad & Tobago

- Virgin Islands (British)

- United Kingdom

- Czech Republic

- United Arab Emirates

- Saudi Arabia

- State of Palestine

- Syrian Arab Republic

- South Africa

- Africa (other)

- Hong Kong SAR of China

- New Zealand

- Our qualifications

- Getting started

- Your career

- Apply to become an ACCA student

- Why choose to study ACCA?

- ACCA accountancy qualifications

- Getting started with ACCA

- ACCA Learning

- Register your interest in ACCA

- Learn why you should hire ACCA members

- Why train your staff with ACCA?

- Recruit finance staff

- Train and develop finance talent

- Approved Employer programme

- Employer support

- Resources to help your organisation stay one step ahead

- Support for Approved Learning Partners

- Becoming an ACCA Approved Learning Partner

- Tutor support

- Computer-Based Exam (CBE) centres

- Content providers

- Registered Learning Partner

- Exemption accreditation

- University partnerships

- Find tuition

- Virtual classroom support for learning partners

- Find CPD resources

- Your membership

- Member networks

- AB magazine

- Sectors and industries

- Regulation and standards

- Advocacy and mentoring

- Council, elections and AGM

- Tuition and study options

- Study support resources

- Practical experience

- Our ethics modules

- Student Accountant

- Regulation and standards for students

- Your 2024 subscription

- Completing your EPSM

- Completing your PER

- Apply for membership

- Skills webinars

- Finding a great supervisor

- Choosing the right objectives for you

- Regularly recording your PER

- The next phase of your journey

- Your future once qualified

- Mentoring and networks

- Advance e-magazine

- Affiliate video support

- An introduction to professional insights

- Meet the team

- Global economics

- Professional accountants - the future

- Supporting the global profession

- Download the insights app

Can't find your location listed? Please visit our global website instead

- Audit and assurance case study questions

- Study resources

- Advanced Audit and Assurance (AAA)

- Technical articles and topic explainers

- Back to Advanced Audit and Assurance (AAA)

- How to approach Advanced Audit and Assurance

The first article in this series of two on Paper P7 case study questions discussed question style, what to look for in the requirements, how higher-level skills are tested, and the meaning of professional marks within a question requirement. This second article goes through part of a typical Section A case study question, applying the recommended approach described in the previous article. This approach comprises four stages.

Stage 1 – understanding the requirement

The first thing to do is to read and fully understand the question requirement. Here is the requirement we will be looking at in this article:

‘Prepare a report, to be used by a partner in your firm, in which you identify and evaluate the professional, ethical, and other issues raised in deciding whether to accept the appointment as provider of an assurance opinion as requested by Petsupply Co.’ (12 marks)

Note: this requirement includes two professional marks.

Having read the requirement, break it down. You are asked to do two things:

- identify, ie state from the information provided

- evaluate, ie discuss from a critical point of view.

The requirement asks you to consider ‘professional, ethical, and other issues’. This could cover a wide range of considerations, such as:

- ethics: independence, competence, conflicts of interest, confidentiality, assessing integrity

- professional issues: the risk profile of the work requested, the fee – and whether it is sufficient to compensate for high risk, availability of staff, managing client expectations, logistical matters such as timing, legal and regulatory matters – such as money laundering, and (in some cases) obtaining professional clearance

- other issues: whether the work ‘fits’ with the commercial strategy of the audit firm, the potential knock-on effect of taking on the work – such as the impact on other clients, or on other work performed for this client.

You are asked to produce a report, so remember that the professional marks available will be awarded for using the correct format, the use of professional business language, and for presenting your comments as a logical flow culminating in a conclusion.

From reading the requirement, you know that the question scenario will be based on a potential assurance assignment and will be broadly based around acceptance issues.

Stage 2 – reading the scenario

When reading through the detail of the scenario, you should now be alert to information relevant to this requirement. Highlight important points that you think are relevant to the scenario and remember to focus on issues that could affect your acceptance of a potential assurance assignment.

Now read the following extract from the scenario and highlight the salient points – remember to look out for any factors relevant to the ethical, professional, and other issues described above.

Extract: You are a senior manager in Dyke & Co, a small firm of Chartered Certified Accountants, which specialises in providing audits and financial statement reviews for small to medium-sized companies. You are responsible for evaluating potential assurance engagements, and for producing a brief report on each prospective piece of work to be used by the partners in your firm when deciding whether to accept or decline the engagement. Dyke & Co is keen to expand the assurance services offered, as a replacement for revenue lost from the many small‑company clients choosing not to have a statutory audit in recent years. It is currently May 2007.

Petsupply Co has been an audit client of Dyke & Co for the past three years. The company owns and operates a chain of retail outlets selling pet supplies. The finance director of Petsupply Co recently communicated with your firm to enquire about the provision of an assurance report on data provided in the Environmental Report published on the company’s website. The following is an extract from the e-mail sent to your firm from the finance director of Petsupply Co:

‘At the last board meeting, my fellow directors discussed the content of the Environmental Report. They are keen to ensure that the data contained in the report is credible, and they have asked whether your firm would be willing to provide some kind of opinion verifying the disclosures made. Petsupply Co is strongly committed to disclosing environmental data, and information gathered from our website indicates that our customers are very interested in environmental matters. It is therefore important to us that Petsupply Co reports positive information which should help to retain existing customers, and to attract new customers. I am keen to hear your views on this matter at your earliest convenience. We would like verification of the data as soon as possible.’

You have looked at Petsupply Co’s Environmental Report on the company website, and found a great deal of numerical data provided, some of which is shown below in Table 1.

Table 1: Petsupply Co's environmental report – numerical data

Stage 3 – take time to think about the requirement and the scenario.

As discussed in the previous article, you must take time and not rush to answer. When evaluating this particular scenario try to think widely about the information provided. Your answer should cover a broad range of issues rather than concentrating on one or two. Your comments must be tailored to the scenario. It is pointless, for example, to write about a general acceptance issue which is not specifically related to Petsupply Co.

It is important to appreciate that few marks will be available for stating the issue. The higher-level skill marks in this question will be awarded for a discussion of why the issue is relevant to the decision about whether or not to provide the assurance service to Petsupply Co. The requirement is to evaluate the scenario and therefore it is crucial to demonstrate an appreciation that there may be two conflicting sides to the discussion.

Table 2 shows an example of a thought process which identifies the issues and explains why each issue is relevant to the requirement; the issues are shown in the order in which they appear in the question.

Table 2: Example of a thought process which identifies issues and shows relevance to the requirement

Table 2 is not an answer, it is a thought process. This is what you should be thinking about after reading through the scenario. The previous article stressed the importance of thinking through the scenario. It may help to jot these ideas down in an answer plan before making a start on your written answer, as this will help you to prioritise the points and give the report a logical flow.

Stage 4 – writing the report

The requirement states that two professional marks are available. As discussed in the previous article, these marks are not for the technical content of the answer, but for the way the relevant points are communicated. The report will be evaluated on the following:

- Use of a report format – a brief introduction, clear separate sections each discussing a different point, and a final conclusion.

- Style of writing – the report is addressed to the partner and so language should be appropriate. You do not need to explain things that would be obvious to a partner, and you must be tactful.

- Clarity of explanation – make sure that each point is explained simply and precisely, and avoid ambiguity.

- Evaluation skills – demonstrate that each point may have a positive and a negative side.

Remember, when answering any question requirement it is quality not quantity that counts. You should make each point succinctly and remain focused on the specific requirement. Questions can be time pressured, but it is important to remember that you should be able to read the requirement, think about it, and write an answer in the time available. This means that there is only a limited amount of time available for actually writing the answer, so keep it short and to the point. Irrelevant waffle earns no marks and will detract from the professional skills evaluation. What follows is an outline report format for this requirement:

Introduction

- Report is internal, addressed to a partner, covering proposed assurance service for existing audit client

Section 1 – ethical matters

- Provision of non-audit service

- Impact on total fee from client

- Competence to perform work – specialised engagement

Section 2 – risk-related matters

- High inherent risk – figures prone to manipulation

- Data highly subjective

- Need to rely on systems put in place by client

Section 3 – commercial matters

- Fee will have to be high enough to compensate for high risk

- Fee may need to compensate for specialists if used

- Strategic fit – assignment in line with commercial goals of Dyke & Co

- Build up experience in non-audit service

- Ascertain whether assignment will be recurring

Section 4 – other matters

- Managing client expectation regarding type of opinion sought

- Managing client expectation regarding timeframe

- Summary of key issues and decision on acceptance

Note: not all of the above points are necessary to secure a pass mark; the marking scheme is also flexible enough to cater for comments that may not appear in the ‘model answer’.

This article shows how to approach one requirement from a typical Section A question in Paper P7. It is important to practise technique by attempting as many questions as possible, starting with the Pilot Paper for Paper P7.

Written by a member of the Paper P7 examining team

Related Links

- Student Accountant hub page

Advertisement

- ACCA Careers

- ACCA Career Navigator

- ACCA Learning Community

Useful links

- Make a payment

- ACCA-X online courses

- ACCA Rulebook

- Work for us

Most popular

- Professional insights

- ACCA Qualification

- Member events and CPD

- Supporting Ukraine

- Past exam papers

Connect with us

Planned system updates.

- Accessibility

- Legal policies

- Data protection & cookies

- Advertising

Course Resources

Case studies.

A set of in-class activities is available for some of the modules in this course, to support face-to-face and hybrid classes. These are not already built into the assignment tool of your learning management system (Canvas, Blackboard, etc.), but they can be downloaded for use or previewed, below:

- Module 2: Case Study: Revenue Recognition and Materiality

- Module 4: Case Study: Googling Google

- Module 5: Case Study: The Great Texas Fruitcake Caper

- Module 6: Case Study: Mark to Market

- Module 8: Case Study: Crazy Eddie Antar

- Module 13: Case Study: Facebook

- Case Studies. Provided by : Lumen Learning. License : CC BY: Attribution

FAR CPA Exam Questions

All CPA Exam Questions | AUD Questions | BEC Questions | FAR Questions | REG Questions

Are you ready to pass the FAR CPA Exam ? Find out by testing yourself with free CPA Exam questions from Wiley CPA . This download includes actual, AICPA-released CPA Exam questions, as well as sample questions written by our team of experts. It also includes detailed answer explanations to help you understand your areas of weakness. These CPA Exam practice questions mimic the actual CPA Exam Sections and feature the latest topics you’ll see on exam day.

The Financial Accounting & Reporting (FAR) section of the CPA Exam is mainly focused on financial accounting and reporting of for-profit entities. Expect a few questions over accounting for not-for-profit entities and governmental entities. Its five testlets are broken into two with 33 MCQs apiece (66 total) and three with a total of 8 TBSs. In general, 50% of your score comes from MCQs and 50% from TBSs.

Here’s a sneak peak of what you’ll get from your free download of CPA Questions:

The following information pertains to Jet Corp. outstanding stock for Year 1:

What are the number of shares Jet should use to calculate Year 1 earnings per share?

B is Correct

The effect of the stock split is applied retroactively to all changes in the number of shares of common stock outstanding before the split.

The weighted average shares outstanding for this firm for Year 1 is: 45,000 = [20,000(2) + 10,000(1/2)]. The split affects only the shares issued before date of the split. The July 1 issuance is weighted only by 1/2 a year because the shares were outstanding only 1/2 a year. EPS is computed only on common stock outstanding. The preferred shares have no effect on the computation.

Nala Inc. reported deferred tax assets and deferred tax liabilities at the end of 20X4 and at the end of 20X5.

According to FASB 109, for the year ended 20X5, Nala should report deferred income tax expense or benefit equal to the

A is Correct

Total income tax expense is the sum of the current and deferred portions.

The current portion is the income tax liability for the year.

The deferred portion is the net sum of the changes in the deferred tax accounts.

Consider the tax-accrual entry for a year, assuming no estimated tax payments have been made:

The $2 deferred tax expense equals the increase in the deferred tax liability of $5, less the increase in the deferred tax asset of $3.

Which one of the following would constitute a highly inflationary economy when determining the functional currency of a foreign entity?

C is Correct

For determining a functional currency, a highly inflationary (hyperinflationary) economy is one that has experienced a cumulative inflation of 100% or more over the past 3 years. Inflation of 35% per year over the past three years is a cumulative 105% and constitutes a highly inflationary economy.

The General Fund pays an invoice for telecommunications that includes charges owed by the Water Utility Enterprise Fund. The Enterprise Fund subsequently remits its share of the telecommunications charges to the General Fund. The General Fund records the amount received from the Enterprise Fund as:

D is Correct

Interfund Reimbursements are Nonreciprocal Transactions in which a government determines that an expenditure or expense was initially recorded in one fund and should be accounted for and reported as an expenditure or expense in another fund. In this example, the General Fund paid and recorded as an expenditure all of an invoice that included a portion that pertained to another fund. The reimbursement from the Enterprise Fund should be recorded as a decrease in expenditures in the General Fund, to offset that portion previously recognized as an expenditure in the General Fund that was attributable to the Enterprise Fund. The Enterprise Fund should record an increase in expense at the time the reimbursement is made.

For access to more sample CPA questions with detailed explanations sign up for a free trial of the Wiley CPA Review Course.

We use cookies to learn how you use our website and to ensure that you have the best possible experience. By continuing to use our website, you are accepting the use of cookies. Learn More

myCBSEguide

- Accountancy

- Class 11 Accountancy Case...

Class 11 Accountancy Case Studies Questions

Table of Contents

myCBSEguide App

Download the app to get CBSE Sample Papers 2023-24, NCERT Solutions (Revised), Most Important Questions, Previous Year Question Bank, Mock Tests, and Detailed Notes.

CBSE introduced case-based questions in class 11 accountancy question papers last year to enhance and develop analytical and reasoning skills among students. Class 11 Accountancy Case Studies Questions are given in CBSE model question papers too. Last year sample case-based questions were released by the CBSE and immediately an air of confusion was created among all. This concept was uncharted territory for both students and teachers.

A hypothetical text was provided on the basis of which the student was required to solve the given case-based question asked by CBSE in the accountancy class 11 exam. Initially, the case-based questions appeared to be tedious for both the students and the teachers as they were unprepared to deal with the new pattern of questions but now a lot more clarity is there that has made the question paper quite student-friendly.

Case Study Questions in class 11 (Accountancy)

Case-based questions in Accountancy are considered to be quite challenging by the class 11 students. The questions need to be well prepared and adequately practiced before attempting the class 11 accountancy exam. The accountancy class 11 syllabus is a well-integrated program that facilitates the students to comprehend and learn the basic accounting theories/principles. The subject is the base of major accounting fundamentals that are studied in depth at an advanced level in class 12. For students appearing for grade 11 exams from the Commerce stream, Accountancy is a prime subject. Accountancy is considered to be the most difficult of all other core subjects in the class 11 commerce stream.

The subject is consuming and the case studies are termed to be troublesome for they do require conceptual clarity. To ace this CBSE exam, students need to put in the extra effort. Among all the core subjects of the Commerce stream i.e accountancy, economics and business studies, it’s accountancy that renders a tough time for the students because of its complex theories and principles. It is an arduous task to score well in the 11-grade accountancy examination without adequate practice and knowledge. Many students who opt for the commerce stream after their 10-grade exams target chartered accountancy as a career option, so the subject is of paramount importance for them.

Accountancy syllabus of class 11 CBSE

The entire Accountancy course is divided into 2 parts:

- Part A, Financial Accounting _ I

- Part B, Financial Accounting _ II

Most of the case study questions are centered around the exercises of NCERT textbooks. It is recommended to read the textbooks religiously. There are 2 prescribed textbooks for class 11 Accountancy that have been published by NCERT. But Accountancy has an extensive curriculum and students need to go through other reference books too. Adhering only to NCERT textbooks will not be adequate to achieve proficiency in this subject.

CBSE Class – 11

Accountancy (Code No. 055) Syllabus

Case Study Passage (Accountancy class 11)

In these questions, the students would go through a paragraph with a hypothetical situation, based on which critical reasoning type questions will have to be answered by them. It is important for the students to inspect the passage carefully before trying to attempt the questions. In the coming examination cycle (2022-23), case-based questions will carry a weightage of around 15 to 20%. These questions can be centered on any chapter from the NCERT textbook for accountancy, class 11. Students need to brace well for the case-based questions prior to appearing for their accountancy examination as these questions require a thorough understanding of the key concepts in their syllabus. CBSE aims to increase the weightage of such questions in the years to come.

Kind of case-based Questions in Accountancy

Accountancy is a subject that deals with trade and commerce. The subject records allocate and outline the transactions of a business. The subject is for sure demanding thus requiring a greater effort from the students in order to strive for a perfect score. It is believed to be demanding but at the same time, it is scoring.

The case-based questions asked in the CBSE accountancy question paper for class 11 are of two types:

- Objective- Such questions are asked in the MCQ format

- Subjective- The questions would be answered briefly only but these questions are the ones that would require detailed analysis and application of some fundamental accountancy theories.

How To Prepare For Case-based Questions in Accountancy Grade 11

Students need to prepare well for the case-based questions before appearing for their class 11 Accountancy exams. Here are some tips which will help the student to solve the case-based questions at ease:

- Go through the provided text carefully

- Analyze the situation provided as part of the question asked

- Focus on following correct formats in your responses, accountancy is one subject where apart from the concepts students need to be careful about the formats.

- Brush up well on the theory portion of accountancy, this is the key to scoring a perfect score.

- Practice rigorously

- Provide to-the-point responses

Students need to solidify their concepts in order to ace the accountancy class 11 exam. Case studies can be easily solved if your key fundamentals are crystal clear. These simple points if kept in mind will definitely help the students to fetch good marks in case study questions in class 11 Accountancy .

Case study question examples in accountancy

Here are some given case study questions for CBSE class 11 Accountancy. If you wish to get more case study questions and other study material, download the myCBSEguide app now. You can also access it through our student dashboard.

Accountancy Case Study 1

Read the hypothetical text given and answer the following questions:

Sachin and Dravid are partners in firm sharing profits and losses in the ratio of 3:2. Their balance sheet is given below:

Balance Sheet as on 31.03.2017

On 01.04.2017, they admit Ashwin as a new partner into partnership on the following terms a) He brings in 40,000 as capital and 18,000 towards goodwill for 1/4th share in future profits b) Depreciate furniture by 10% and buildings are revalued at 45,000

- c) PDD is increased to 3,500

- d) Prepaid insurance * 2,000.

Prepare: i) Revaluation Account

. ii) Partners’ Capital Accounts

iii) New Balance

Accountancy Case Study 2

Ram and Shyam are two friends who both have just attended their first class of accountancy. The friends were intrigued by the different branches of accounting and their widespread application. Ram personally liked the branch of accounting in which fund flow statement and budgetary control is used and that branch helps in planning and controlling of operations. As the concept of accounting was further explored, they began discussing the different users of accounting. Ram said that he finds it interesting that even the employees demand information relating to business. Shyam said he finds more interesting the fact that even competitors want information on the relative strengths and weaknesses of the enterprise and for making comparisons, Shyam further said that even accounting helps owners to compare one year’s costs, expenses, and sales with those of other years. However, they were quite shocked by the fact that the management-worker relations were not taken into consideration in the accounting. Meanwhile, Ram and Shyam had an argument at the end of the discussion. Ram was saying that accounting is an art whereas Shyam was saying that accounting is a science. Their teacher came in and said something to them which made them stop the argument.

Q1. What might their teacher have said to solve their argument?

- Ram, please understand, Shetty is correct in this situation

(b) Shyam, please understand, Ram is correct In this situation.

(c) Both are correct

(d) None is correct

Q2. Shyam talked about which type of users of accounting?

(a) Internal users

(b) External users

(c) Both (a) and (b)

(d) None of these.

Q3. Which limitation of accounting is being talked about by them?

(a) Influenced by personal judgment

(b) Omission of qualitative information.

(c) Incomplete information

(d) Based on historical costs

Q4. Which advantage of accounting is being talked about by Shyam in the last part of the first para?

(a) Provides information regarding profit and loss

(b) Provides completes and systematic record

(c) Enables comparative study

(d) Evidence in legal matters

Q5. Which branch of accounting is liked by Ram?

(a) Financial accounting

(b) Cost accounting

(c) Management accounting

(d) Tax accounting

Accountancy Case Study 3

Read the following case study and answer questions

Sam and Jay started with Cash 10,000 and Machinery 1,00,000. They decided to set up a production line for PPE kits for. the protection from Covid 19 virus. As their demand rose, they decided to buy one more piece of machinery. For the same, they took bank overdraft and purchased the machinery. The quality of the company’s product was extremely high and therefore, it could develop a reputation for itself in the market and business was flourishing. After 1.5 years, their old machinery turned obsolete so they decided to sell the same. They sold it and got some cash proceeds. To further increase the brand presence among the concerned stakeholders, they decided to run advertisements from the cash proceeds of machinery sold. As more and more customers demanded their product, they decided to launch a discount for bulk purchases. The discount was not to be recorded in the books of accounts. This campaign was successful and they earned a lot of profits from the same.

Q1. Which type of discount is being discussed in the last part of the passage?

(a) Trade discount

(b) Cash discount

(d) Can’t be determine

Q2. Which asset is discussed in the line, “The quality of the company’s product was very high and therefore, it could develop a reputation for itself in the market and business was flourishing”?

(a) Tangible

(b) Intangible

(c) Current.

(d) Both (a) and (c)

Q3. Which type of liability is discussed in the passage?

(a) Non-current

(b) Current

(d) Can’t be determined

Q4. What was the capital initially invested?

(b) 1,00,000

(c) 1,10,000

Q5. The passage involves capital receipts (apart from initial capital invested).

Advantages of case study questions in Accountancy

The entire class 11 Accountancy syllabus is divided into 2 textbooks that are prescribed by NCERT. The examiner can ask case study questions from any chapter or concept. Students are expected to prepare themselves thoroughly. They ought to practice class 11 Accountancy case-based questions from the various options available to them, so as to ace the subject.

- Uplift the analytical skills of students

- Provide a well-rounded understanding of the concepts

- Enhance intellectual capabilities in students

- Help students to retain knowledge in their long-term memory

- The questions would help to discard the concept of rote learning

- Case studies encourage practical learning.

“Procrastination is the thief of time”

Test Generator

Create question paper PDF and online tests with your own name & logo in minutes.

Question Bank, Mock Tests, Exam Papers, NCERT Solutions, Sample Papers, Notes

Related Posts

- Competency Based Learning in CBSE Schools

- Class 11 Physical Education Case Study Questions

- Class 11 Sociology Case Study Questions

- Class 12 Applied Mathematics Case Study Questions

- Class 11 Applied Mathematics Case Study Questions

- Class 11 Mathematics Case Study Questions

- Class 11 Biology Case Study Questions

- Class 12 Physical Education Case Study Questions

Leave a Comment

Save my name, email, and website in this browser for the next time I comment.

- Skip to primary navigation

- Skip to main content

Free ACCA & CIMA online courses from OpenTuition

Free Notes, Lectures, Tests and Forums for ACCA and CIMA exams

20% off ACCA & CIMA Books

OpenTuition recommends the new interactive BPP books for June 2024 exams, Get your discount code >>

ACCA Past Papers – ACCA Past Exams – Questions and Answers

Links to all acca past papers, fundamentals.

(ACCA does not publish past AB, MA and FA exams – to practice you need to buy Revision Kit for these exams)

AB Accountant in Business Specimen Exam Paper

See also AB Revision Mock exam

MA Management Accounting Specimen Exam Paper

See also MA Mock exam

FA Financial Accounting Specimen Exam Paper

See also FA Mock exam

LW Specimen Exam Paper (ENG & GLO)

Questions: Corporate and Business Law-LW(ENG) – LW(ENG) Answers

Questions: Corporate and Business Law-LW(GLO) – LW(GLO) Answers

Paper LW Past Exams ENG (Q&A) | Paper LW Past Exams GLO (Q&A)

See also: ACCA LW Mock Exam (ENG) | ACCA LW Mock Exam (GLO)

Pm specimen exam | pm past exams, see also pm cbe mock exam | pm revision kit live, tx specimen exam | tx past exam papers, (these exams are out of date, you need to get updated revision kit), fr specimen exam | fr past exam papers, see also fr objective test exam (section a) | fr revision kit live, aa specimen exam | aa past exam papers, see also: aa mock exam | aa practice questions | aa revision kit live, fm specimen exam | fm past exam papers, see also fm practice test (section a) | fm revision kit live, professional level, sbr corporate reporting.

SBR International variant questions | SBR UK variant questions

SBR UK Specimen Exam

SBL Specimen exam | SBL Past exam papers

See also SBL revision lectures solving past ACCA questions ]

AFM Specimen Exam | AFM past exam papers

See also afm revision lectires based on past questions, apm specimen exam | apm past exam papers.

[See also APM revision lectures based on ACCA questions]

ATX Advanced Taxation

(These exams are out of date, you need to get updated Revision kit)

AAA Past exam papers: International variant | UK variant

Free acca lectures | free acca notes | acca exams dates.

How to pass exams | The Most Common Mistakes in the Exam Hall

Reader Interactions

August 19, 2021 at 6:57 am

Hello, where can I find past exam papers for Fundamental papers F1 to F4 for ACCA course ? Thank you.

Leave a Reply Cancel reply

You must be logged in to post a comment.

Financial Accounting Notes | PDF, Syllabus | MBA 2021

- Post last modified: 9 July 2021

- Reading time: 22 mins read

- Post category: MBA Study Material

Download Financial Accounting Notes PDF 2021 for MBA. We provide complete MBA financial accounting notes. MBA financial accounting study material includes financial accounting notes , f inancial accounting book , courses, case study, MCQ, syllabus, question paper, questions and answers and available in financial accounting pdf notes form.

Financial Accounting subject is included in B.COM and BBA, so students can able to download financial accounting MBA 1st year and financial accounting for MBA.

Table of Content

- 1 MBA Financial Accounting Syllabus

- 2 Financial Accounting Notes PDF

- 3.1 What is Financial Accounting?

- 4 Financial Accounting Question Paper

- 5 MBA Financial Accounting Question Paper PDF

- 6 Financial Accounting Books

- 7 Go On, Share & Help your Friend

Financial Accounting Notes can be downloaded in financial accounting pdf from the below article.

MBA Financial Accounting Syllabus

A detailed Financial Accounting Syllabus as prescribed by various Universities and colleges in India are as under. You can download the syllabus in financial accounting pdf form.

Book-Keeping and Accounting – Financial Accounting – Concepts and Conventions – Double Entry System – Preparation of Journal, Ledger and Trial Balance – Preparation of Final Accounts –Trading, Profit and Loss Account and Balance Sheet With Adjustment Entries, Simple Problems Only – Capital and Revenue Expenditure and Receipts.

Depreciation – Causes – Methods of Calculating Depreciation – Straight Line Method, Diminishing Balance Method, and Annuity Method – Ratio Analysis – Uses and Limitations – Classification of Ratios – Liquidity, Profitability, Financial and Turnover Ratios – Simple Problems Only.

Funds Flow Analysis – Funds From Operation, Sources, and Uses of Funds, Preparation of Schedule of Changes In Working Capital and Funds Flow Statements – Uses And Limitations – Cash Flow Analysis – Cash From Operation – Preparation of Cash Flow Statement – Uses and Limitations – Distinction Between Funds Flow and Cash Flow – Only Simple Problems

Marginal Costing – Marginal Cost and Marginal Costing – Importance – Break-Even Analysis – Cost Volume Profit Relationship – Application of Marginal Costing Techniques, Fixing Selling Price, Make or Buy, Accepting a Foreign Order, Deciding Sales Mix.

Cost Accounting – Elements of Cost – Types of Costs – Preparation of Cost Sheet – Standard Costing – Variance Analysis – Material Variances – Labour Variances – Simple Problems Related to Material And Labour Variances Only.

Financial Accounting Notes PDF

Financial accounting notes, what is financial accounting.

Financial Accounting Definition : Financial accounting is the process of preparing financial statements that companies’ use to show their financial performance and position to people outside the company, including investors, creditors, suppliers, and customers.

Financial Accounting Question Paper

Some of the Financial Accounting questions and answers are mentioned below with financial accounting question paper pdf

- How many types of business transactions are there in accounting?

- Explain real and nominal accounts with examples.

- Which accounting platforms have you worked on? Which one do you prefer the most?

- What is double-entry bookkeeping? What are the rules associated with it?

- What is working capital?

- How do you maintain accounting accuracy?

- What is TDS? Where do you show TDS on a balance sheet?

- What is the difference between ‘accounts payable (AP)’ and ‘accounts receivable (AR)’?

- What is the difference between a trial balance and a balance sheet?

- Is it possible for a company to show positive cash flows and still be in grave trouble?

- What are the common errors in accounting?

- What is the difference between inactive and dormant accounts?

- Why do you think Accounting Standards are mandatory?

- What are some of the ways to estimate bad debts?

- What is a deferred tax asset and how is the value created?

- What is the equation for Acid-Test Ratio in accounting?

MBA Financial Accounting Question Paper PDF

Some of the financial accounting question paper pdf are mentioned below:

- “Insurance is a process in which uncertainties are made certain.” Discuss the statement and explain the importance of insurance.

- Define insurance and describe its main characteristics.

- Describe the various kinds of insurance.

- “A contract of insurance is a contract of utmost good faith.” Discuss.

- Define insurable interest. Discuss the importance of this principle.

- Define a bank. Explain the origin and growth of banking in the modern sense.

- Why is an institution called a bank? What are the different types of bank?

- Explain the functions which a modern bank perform.

- Define risk. Discuss the various types of risk.

- In assessing the credit risk, what factors should be kept in mind? Discuss.

- What do you mean by risk management? Explain the different aspects of financial risk management.

Financial Accounting Books

Below is the list of financial accounting book as recommended by the top university in India.

- Lal, Jawahar and Seema Srivastava, Financial Accounting, Himalaya Publishing House.

- Monga, J.R., Financial Accounting: Concepts and Applications, Mayoor Paper Backs, New Delhi.

- Shukla, M.C., T.S. Grewal and S.C.Gupta. Advanced Accounts. Vol.-I. S. Chand & Co., New Delhi.

- S. N. Maheshwari, Financial Accounting, Vikas Publication, New Delhi.

- T.S, Grewal, Introduction to Accounting, S. Chand and Co., New Delhi

- P.C. Tulsian, Financial Accounting, Tata McGraw Hill, New Delhi.

- Bhushan Kumar Goyal and HN Tiwari, Financial Accounting, Vikas Publishing House, New Delhi.

MBA Study Material – Download ✅ [2020] PDF

Download MBA Study Material ✅ PDF, Book, Syllabus [2020]( Download MBA Study Material )

BBA & BCOM Study Material – Download ✅ [2020] PDF

Download BBA – BCOM Study Material ✅ PDF, Book, Syllabus [2020]( Download BBA & BCOM Study Material )

Managerial Economics Notes Download ✅ [2020] PDF

Managerial Economics Notes | PDF, Books, Paper, Syllabus | MBA 2020 ( Download Managerial Economics Notes )

Cost Accounting Notes ✅ [2020] PDF

Cost Accounting Notes | PDF, Syllabus, Book | BBA, BCOM 2020 ( Download Cost Accounting Notes )

Strategic Management Notes Download ✅ [2020] PDF

Strategic Management Notes | PDF, Books, Paper, Syllabus | MBA 2020 ( Download Strategic Management Notes )

Business Law Notes Download ✅ [2020] PDF

Business Law Notes | PDF, Books, Syllabus | MBA, BBA, B COM 2020 ( Download Business Law Notes )

Organisational Behaviour Notes Download ✅ [2020] PDF

Organisational Behaviour Notes PDF | MBA, BBA, BCOM 2020 ( Download Organisational Behaviour Notes )

Production and Operations Management Notes Download ✅ [2020] PDF

Production and Operations Management Notes PDF | MBA 2020 ( Download Production and Operations Management Notes)

Total Quality Management Notes Download ✅ [2020] PDF

Total Quality Management PDF | Notes, Paper | MBA 2020 ( Download Total Quality Management PDF )

Brand Management Notes Download ✅ [2020] PDF

Brand Management Notes PDF | MBA 2020 ( Download Brand Management Notes )

International Marketing Notes Download ✅ [2020] PDF

International Marketing Notes PDF | Syllabus, Book MBA 2020 ( Download International Marketing Notes )

Management Information System Notes ✅ [2020] PDF

Management Information System Notes PDF | MBA 2020 ( Download Management Information System Notes )

Training and Development in HRM Notes ✅ [2020] PDF

Training and Development in HRM Notes PDF | MBA 2020 ( Download Training and Development in HRM Notes )

Sales Management Notes Download ✅ [2020] PDF

Sales Management Notes | PDF, Book, Syllabus, Paper | MBA 2020 ( Download Sales Management Notes )

Organisational Development and Change Notes ✅ [2020] PDF

Organisational Development and Change Notes PDF | MBA 2020 ( Download Organisational Development and Change Notes )

Human Resource Management Notes ✅ [2020] PDF

Human Resource Management Notes | HRM PDF | MBA [2020]( Download Human Resource Management Notes )

Financial Accounting Notes ✅ [2020] PDF

Financial Accounting Notes PDF for MBA 2020 | Download ( Download Financial Accounting Notes )

Business Economics Notes ✅ [2020] PDF

Business Economics Notes | PDF, Paper, Books, Syllabus, | BBA, BCOM 2020 ( Download Business Economics Notes )

Financial Accounting PDF Notes, Syllabus, Books BBA, BCOM 2020 ( Download Financial Accounting PDF Notes )

Management Science Notes ✅ [2020] PDF

Management Science Notes | PDF, Syllabus, Book | MBA 2020 ( Download Management Science Notes )

Marketing Management Notes ✅ [2020] PDF

Marketing Management Notes | PDF, Book, Syllabus | MBA [2020]( Download Marketing Management Notes )

Principles of Management Notes ✅ PDF

Principles of Management PDF | Notes, Books, Syllabus | BBA, B COM 2020 ( Download Principles of Management PDF )

Operation Research Notes ✅ PDF

Operation Research Notes | PDF, Books, Syllabus | MBA, BBA, B COM 2020 ( Download Operation Research Notes )

In the above article, a student can download Financial AccountingNotes PDF 2020 for MBA. Financial accounting study material includes financial accounting notes , financial accounting books , financial accounting syllabus , financial accounting question paper , financial accounting questions and answers , financial accounting courses in financial accounting pdf form.

Go On, Share & Help your Friend

Did we miss something? or You want something More? Come on! Tell us what you think about our post on Financial Accounting Notes , Book, Syllabus PDF | BBA, BCOM 2021 in the comments section and Share this post with your friends.

You Might Also Like

How to download notes on geektonight.

Production and Operations Management Notes PDF MBA 2024

Management theory and organisational behaviour notes, pdf | mba (2024), security analysis and portfolio management pdf, notes | mba (2024), information technology for business notes, pdf i mba 2024, consumer behaviour notes, pdf i mba 2024, business research methods notes, pdf i mba 2024, corporate taxation notes, pdf, notes, syllabus, paper | mba (2024).

![financial accounting case study questions and answers Read more about the article Marketing Management Notes | PDF, Syllabus | MBA [2021]](https://www.geektonight.com/wp-content/uploads/2020/03/Marketing-Management-Notes-300x150.jpg)

Marketing Management Notes | PDF, Syllabus | MBA [2021]

Business Communication PDF Notes (2024) | MBA, BBA, BCOM

Management Science Notes | PDF, Syllabus, Book | MBA 2021

Strategic Management Notes | PDF, Syllabus | MBA 2024

Leave a reply cancel reply.

You must be logged in to post a comment.

World's Best Online Courses at One Place

We’ve spent the time in finding, so you can spend your time in learning

Digital Marketing

Personal growth.

Development

- Members' Portal

- Professional Portal

USEFUL LINKS

- ATSWA Exam Results

- Centres for Professional Examinations

- Professional Examination Credit System

- Professional Student Payments

- Professional Exam Timetables

- Financial Status

- Application for Induction

- Profile Update

- Examination Status

- Professional Exam Dockets

- Professional Exam Results

- Professional Registration Number

- ATSWA Student Payments

- ATSWA Exam Timetables

- ATSWA Financial Status

- ATSWA Registration Number

- ATSWA Exam Dockets

- Professional

- Recognised Tuition Centres

- ICAN Accredited Tertiary Institutions

- MCATI Institutions as at March 2022

- Overview and Insight into the New Professional Exam Syllabus

- ATSWA Study Text

- Professional Study Text

- Scholarship Scheme

- Issuance of Transcript/Verification of Results

- Application Form for Grant

- Application Form for Loan

- Frequently Asked Questions

- Advanced Audit and Assurance

- Audit and Assurance

- Business Management and Finance

- Business Law

- Corporate Reporting

- Corporate Strategic Management and Ethics

- Financial Accounting

- Management Information

- Performance Management

- Financial Reporting

- Public Sector Accounting and Finance

- Examination Information Guide SFM

- Examination Information Guide Taxation

- Professional Level Advanced Taxation

- Public Sector Accounting and Finance (SET 1)

- Public Sector Accounting and Finance (SET 2)

- Taxation (SKILLS LEVEL)

- Advanced Taxation Pilot Questions

- Advanced Taxation Pilot Solutions

- Advance Taxation Pilot Questions 1 6

- Solution to Pilot Questions Advance Taxation

- Taxation Pilot Question

- Taxation Pilot Question 2

- Taxation Solution

- Taxation Suggested Solutions

- Business Law Pilot Questions

- Business Law Pilot 2nd Answer

- Business Law Pilot Answer

- PSAF-2019 Pilot Questions Set 2

- PSAF 2019 Pilot Solution Set 2

- Set 1 2019 Pilot Questions PSAF

- Set 1 2019 Pilot Solution PSAF

- Professional Level Examination - November 2022 Case Study PRE-SEEN

- Professional Level Examination - March - JULY 2020 Case Study PRE-SEEN

- Audit and Assurance (Questions)

- Audit and Assurance (Answers)

- Financial reporting (Questions)

- Financial reporting (Answers)

- Business, Management and Finance (Questions)

- Business, Management and Finance (Answers)

- Financial accounting (Questions)

- Financial accounting (Answers)

- Management Information (Questions)

- Management Information (Answers)

- Corporate Strategic Management and Ethics (Questions)

- Corporate Strategic Management and Ethics (Answers)

- Performance Management (Questions)

- Performance Management (Answers)

- Corporate reporting (Questions)

- Corporate reporting (Answers)

- Advanced Audit and Assurance (Questions)

- Advanced Audit and Assurance (Answers)

- Strategic financial management (Questions)

- Strategic financial management (Answers)

- Management Team

- Vision and Mission

- Technical Helpdesk

- Past Presidents

- ICAN Gallery

- ICAN Affiliates & Websites

- ICAN Students' Journal

- Read & Subscribe to ICAN E-Newsletters

- The Nigerian Accountant

- ICAN Technical Bulletin

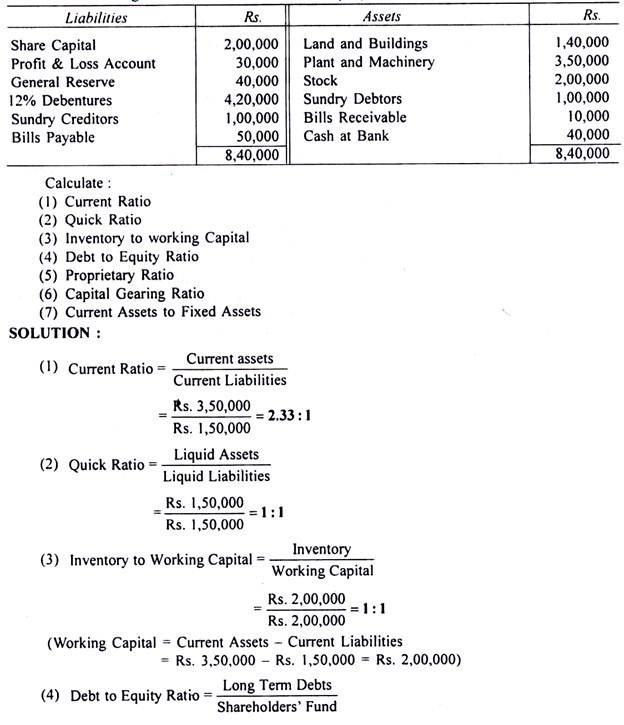

Ratio Analysis: Problems and Solutions | Accounting

Here is a compilation of top thirteen accounting problems on ratio analysis with its relevant solutions.

The following is the Balance Sheet of a company as on 31st March:

Exams Past Questions and Suggested Solutions

- BUSINESS & CORPORATE LAW (PAPER 1.3)

- BUSINESS MANAGEMENT & INFORMATION SYSTEMS (PAPER 1.2)

- FINANCIAL ACCOUNTING (PAPER 1.1)

- INTRODUCTION TO MANAGEMENT ACCOUNTING (PAPER 1.4)

- AUDIT & ASSURANCE (PAPER 2.3)

- PRINCIPLES OF TAXATION (PAPER 2.6)

- FINANCIAL MANAGEMENT (PAPER 2.4)

- FINANCIAL REPORTING (PAPER 2.1)

- MANAGEMENT ACCOUNTING (PAPER 2.2)

- PUBLIC SECTOR ACCOUNTING & FINANCE (PAPER 2.5)

- ADVANCED AUDIT & ASSURANCE (PAPER 3.2)

- STRATEGIC CASE STUDY (PAPER 3.4)

- CORPORATE REPORTING (PAPER 3.1)

- ADVANCED TAXATION PAPER (PAPER 3.3)

NOTE TO READERS

The proposed answers are thorough approaches to the questions and are based on the entire range of marks available. They are not responses that candidates may reasonably expect to submit within the time constraints. The offered solutions should not be viewed as the only viable option.

Any offered solution’s analysis, assumptions, conclusions, and suggestions may represent only one of many alternative ways. Furthermore, the offered solutions’ organization, language, and structure do not reflect the only appropriate style.

Click here to download

Click to download, atswa past questions & solutions (march 2022), atswa past questions & solutions (september 2021), atswa past questions & solutions (march 2021).

- QUANTITATIVE TOOLS IN BUSINESS (PAPER 1.4)

- CORPORATE STRATEGY, ETHICS & GOVERNANCE (PAPER 2.6)

- ADVANCED FINANCIAL MANAGEMENT (PAPER 3.3)

- TAXATION & FISCAL POLICY (PAPER 3.4)

Part One (1)

Part two (2), part three (3), part four (4).

- International

- Schools directory

- Resources Jobs Schools directory News Search

LIBF UNIT 2 JUNE 2024 CASE STUDY 1 QUIZ - 'Ben and Lucy' | FINANCIAL STUDIES CeFS U2 CS1 70x Q&A

Subject: Business and finance

Age range: 16+

Resource type: Assessment and revision

Last updated

16 May 2024

- Share through email

- Share through twitter

- Share through linkedin

- Share through facebook

- Share through pinterest

LIBF Certificate in Financial Studies Unit 2 (FCML) June 2024 Part B Exam - 70x ‘Ben and Lucy’ Case Study Questions

70x questions (with answers provided) to support students to become familiar and/or test their understanding of the ‘Ben and Lucy’ case study (CeFS Unit 2 June 2024 Exam).

The questions can be used flexibly either within class or given to students to complete as an independent learning/homework activity. By getting students to complete these 70x questions you can be sure that they have read and understood the case study.

As part of the purchase you will be provided with:

- PowerPoint that goes through all questions then goes through all questions and answers

- Word document that contains a list of all the questions

- Word document that contains a list of all the questions and answers

- Revision videos for each topic within Unit 2 (YouTube)

PowerPoint and Word documents do not include any names or school logos so can be used straight away without any further work on your part - A READY-TO-USE RESOURCE!!!

LIBF Certificate in Financial Studies

Unit 2 - Financial Capability for the Medium and Long Term (FCML)

Also available for June 2024 examinations:

U2 CS1 QUIZ - ‘Ben and Lucy’ https://www.tes.com/teaching-resource/resource-13040198

U2 CS1 ANNOTATED CASE STUDY - ‘Ben and Lucy’ https://www.tes.com/teaching-resource/resource-13040217

U2 CS2 QUIZ - ‘Alex’s New Car (PCP)’ https://www.tes.com/teaching-resource/resource-13040969

U2 CS2 ANNOTATED CASE STUDY - ‘Alex’s New Car (PCP)’ https://www.tes.com/teaching-resource/resource-13040245

U4 CS1 QUIZ - ‘Frank and Nina’ https://www.tes.com/teaching-resource/resource-13040204

U4 CS1 ANNOTATED CASE STUDY - ‘Frank and Nina’ https://www.tes.com/teaching-resource/resource-13040232

Tes paid licence How can I reuse this?

Your rating is required to reflect your happiness.

It's good to leave some feedback.

Something went wrong, please try again later.

This resource hasn't been reviewed yet

To ensure quality for our reviews, only customers who have purchased this resource can review it

Report this resource to let us know if it violates our terms and conditions. Our customer service team will review your report and will be in touch.

Not quite what you were looking for? Search by keyword to find the right resource:

IMAGES

VIDEO

COMMENTS

This thesis is compiled of twelve case studies, each on a unique accounting concept. Each case study was analyzed in a group of two to four students, and each student completed a write-up answering the case questions and examining the proper accounting treatment for each issue in the case. Case topics included financial statement

The first of our financial statements examples is the cash flow statement. The cash flow statement shows the changes in a company's cash position during a fiscal period. The cash flow statement uses the net income figure from the income statement and adjusts it for non-cash expenses. This is done to find the change in cash from the beginning ...

A Handbook of Case Studies in Finance 5. research development projects are worth the funding of cash through the firm's capitalization structure (debt, equity or retained earnings). It is the process of allocating resources for major capital, investment or expenditures. Capital Market Instruments.

Our completely free CPA Financial Accounting and Reporting (FAR) practice tests are the perfect way to brush up your skills. Take one of our many CPA Financial Accounting and Reporting (FAR) practice tests for a run-through of commonly asked questions. You will receive incredibly detailed scoring results at the end of your CPA Financial ...

How to approach Advanced Audit and Assurance. The first article in this series of two on Paper P7 case study questions discussed question style, what to look for in the requirements, how higher-level skills are tested, and the meaning of professional marks within a question requirement. This second article goes through part of a typical Section ...

These are not already built into the assignment tool of your learning management system (Canvas, Blackboard, etc.), but they can be downloaded for use or previewed, below: Module 2: Case Study: Revenue Recognition and Materiality. Module 4: Case Study: Googling Google. Module 5: Case Study: The Great Texas Fruitcake Caper. Module 6: Case Study ...

Accounting questions and answers. TASK DETAILS: Text: Financial Accounting CASE STUDY Topic: Conceptual Framework and Financial Statements Learning Objectives: SLO2: Prepare the basic financial statements such as the balance sheet, income statement and the cash flows. DECISION CASE STUDY ANALYZING A COMPANY AS AN INVESTMENT A year out of ...

Financial Accounting and Reporting STUDY GUIDE. ii Eighth edition 2018 First edition 2010 ... Revision questions 397 Answers to revision questions 423 Before you begin questions: Answers and commentary 437 ... Case study A practical example or illustration, usually involving a real world scenario. ...

Accounting questions and answers. ACCT2005 - Financial Accounting 2 SP2 2020 Case Study for Annual Report Assignment The following details are taken from the accounting records of the company as at 30 June 2020: Debit Credit $ $ Revenues 91,796,420 Sales returns 16,780 Extraordinary Loss/es 1,820,000 Cost of sales 10,794,530.

The Financial Accounting & Reporting (FAR) section of the CPA Exam is mainly focused on financial accounting and reporting of for-profit entities. Expect a few questions over accounting for not-for-profit entities and governmental entities. Its five testlets are broken into two with 33 MCQs apiece (66 total) and three with a total of 8 TBSs.

At Quizlet, we're giving you the tools you need to take on any subject without having to carry around solutions manuals or printing out PDFs! Now, with expert-verified solutions from Financial Accounting 16th Edition, you'll learn how to solve your toughest homework problems. Our resource for Financial Accounting includes answers to chapter ...

Find step-by-step solutions and answers to Financial Accounting - 9781260786521, as well as thousands of textbooks so you can move forward with confidence. ... Self-Study Questions. Page 147: Self-Study Questions. Page 148: Self-Study Questions. Page 148: Review Questions. Page 149: Review Questions. Page 150: Brief Exercises. Page 150: Review ...

Part B, Financial Accounting _ II; Most of the case study questions are centered around the exercises of NCERT textbooks. It is recommended to read the textbooks religiously. There are 2 prescribed textbooks for class 11 Accountancy that have been published by NCERT. ... Read the following case study and answer questions. Sam and Jay started ...

The two fundamental qualities that make accounting information useful for decision making are A) comparability and timeliness. B) materiality and neutrality. C) relevance and faithful representatio... The pervasive criterion by which accounting information can be judged is that of A) decision usefulness.

Chapter 9. Accounting policies, changes in accounting estimate and errors (IAS 8) Chapter 10. Inventory (IAS 2) Chapter 10. Agriculture (IAS 41) Chapter 11. Financial instruments (IFRS 9) Chapter 12. Leases (IFRS 16) Chapter 13. Provisions, contingent assets and liabilities (IAS 37) Chapter 14. Events after the reporting date (IAS 10) Chapter 15.

ACCA Past Papers - ACCA Past Exams - Questions and Answers, Download PDF documents, ACCA Articles and Tests, ACCA Exam tips, Essential Guide articles. ... Answers: Financial Accounting (FA) (Extra MTQs) FA (Extra MTQs) Answers: See also FA Mock exam . LW Specimen Exam Paper (ENG & GLO)

Accounting questions and answers; ACC 120 - Principles of Financial Accounting Case #3 - Version B Directions Prepare financial statements for the year ended as of December 31, 20xx. You are only responsible for preparing the Income Statement, Statement of Retained Earnings and a Classified Balance Sheet Complete Case #3 in this Excel workbook ...

Download Financial Accounting Notes PDF 2021 for MBA. We provide complete MBA financial accounting notes. MBA financial accounting study material includes financial accounting notes, f inancial accounting book, courses, case study, MCQ, syllabus, question paper, questions and answers and available in financial accounting pdf notes form.

ATSWA Study Text. Professional Study Text. Scholarship Scheme. Transcripts. Issuance of Transcript/Verification of Results. Tuition House Support Fund. Application Form for Grant. Application Form for Loan. Frequently Asked Questions.

Here is a compilation of top thirteen accounting problems on ratio analysis with its relevant solutions. Problem 1: The following is the Balance Sheet of a company as on 31st March: Problem 2: From the following particulars found in the Trading, Profit and Loss Account of A Company Ltd., work out the operation ratio of the business concern: Problem 3: The following is the summarised Profit and ...

ADVANCED AUDIT & ASSURANCE (PAPER 3.2) STRATEGIC CASE STUDY (PAPER 3.4) CORPORATE REPORTING (PAPER 3.1) ADVANCED TAXATION PAPER (PAPER 3.3) NOTE TO READERS. The proposed answers are thorough approaches to the questions and are based on the entire range of marks available. They are not responses that candidates may reasonably expect to submit ...

The total assessable income is $25,800 per year, calculated by adding $800, $3,000, $7,000, and $15,000. Threshold for Income Test: The minimum annual income required for couples to get a full pension is $85,100. For each dollar over this limit, the pension decreases by $0.50.

Get Textbook Solutions and 24/7 study help for. Financial Accounting. Step-by-step solutions to problems over 34,000 ISBNs Find textbook solutions.

The expense account is now accurately stated by increasing it by $1,000. These entries ensure the financial statements of ABC Electronics Inc. reflect accurate and up-to-date financial information, adhering to the accrual basis of accounting

Study with Quizlet and memorize flashcards containing terms like Four Key Elements of Bookkeeping Ethics, What is DEALER, What's is the accounting Equation? and more. ... Financial Accounting. 162 terms. awesomekelvin580. Preview. WGU C213 Accounting for Decision Makers PVAC. Teacher 58 terms. session01. Preview. NMLS SAFE Test. Teacher 98 ...

I need to answer the following questions for the case study (uMUNCH food-delivery app fesibility analysis) To find the case study, you can write in the website of couse hero this subject ( F19 ACCT 7004 otten umunch.pdf ) Questions Q1: Analyse the data provided in the Harvard Case study and try to assess the risk of the new business by calculating the margin of safety and return on investment.

70x questions (with answers provided) to support students to become familiar and/or test their understanding of the 'Ben and Lucy' case study (CeFS Unit 2 June 2024 Exam). The questions can be used flexibly either within class or given to students to complete as an independent learning/homework activity.