- Portal Login

OPEN ACCOUNT

- Start Application

- Finish an Application

- What You Need

- A Guide to Chosing the Right Account

FOR INDIVIDUALS

- Individual, Joint or IRA

- Non-Professional Advisors

FOR INSTITUTIONS

- Institutions Home

- Registered Investment Advisors

- Proprietary Trading Groups

- Hedge Funds

- Introducing Brokers

- Family Offices

- Compliance Officers

- Small Businesses

- Employee Plan Administrator SIMPLE IRA

- Full-Service Administrator Insurance Providers

- Money Managers

- Fund Administrators

- Hedge Fund Allocators

- Commissions

- Margin Rates

- Interest Rates

- Short Sale Cost

- Research and News

- Market Data

- Stock Yield Enhancement

- Products and Exchange Search

- Order Types

- Securities Financing

- Features in Focus

- Probability Lab

- Global Outsourced Trading Desk

- Sustainable Investing

- IBKR GlobalAnalyst

- PortfolioAnalyst

- Bonds Marketplace

- Mutual Funds Marketplace

- No Transaction Fee ETFs

- Investors' Marketplace

- Short Securities Availability

- Cash Management

- Third Party Integration

- Interactive Advisors

- IBKR Campus

- Traders' Academy

- Traders' Insight

- IBKR Podcasts

- IBKR Quant Blog

- Student Trading Lab

- Traders' Glossary

- Traders' Calendar

- Strength and Security

- Information and History

- News at IBKR

- Press and Media

- Investor Relations

- Sustainability

- Regulatory Reports

- Refer a Friend

- Affiliate Programs

- Fund Your Account

- For Individuals

- For Institutions

- Institutional Sales Contacts

- Browse Our FAQs

- Tax Information

Commissions Options

COMMISSIONS

Minimize Your Costs to Maximize Your Returns*. Low commissions with no added spreads, ticket charges, platform fees, or account minimums.

United States

Third party fees - ibkr pro, exchange fees, regulatory fees.

Options Regulatory Fee (ORF): USD 0.02685 /contract 3,4

Transaction Fees

SEC Transaction Fee: USD 0.0000278 * Value of Aggregate Sales 5

FINRA Trading Activity Fee: USD 0.00279 * Quantity Sold

OCC Clearing Fees

Trades of 1-2750 contracts: USD 0.02 /contract

Trades > 2750 contracts: USD 55.00 /trade

Third Party Fees - IBKR Lite

United states - examples, tiered examples:.

Contract Volume ≤ 10,000 per month:

1 Contract @ USD 2 Premium = USD 1.00 2 Contract @ USD 5 Premium = USD 1.30 3 Contract @ USD 0.075 Premium = USD 1.50 5 Contract @ USD 0.03 Premium = USD 1.25

Contract Volume 10,001 - 50,000 per month:

1 Contract @ USD 2 Premium = USD 1.00 2 Contract @ USD 5 Premium = USD 1.00 3 Contract @ USD 0.075 Premium = USD 1.50 5 Contract @ USD 0.03 Premium = USD 1.25

Contract Volume 50,001 - 100,000 per month:

1 Contract @ USD 2 Premium = USD 1.00 2 Contract @ USD 5 Premium = USD 1.00 5 Contract @ USD 2 Premium = USD 1.25

Contract Volume ≥ 100,001 per month:

1 Contract @ USD 2 Premium = USD 1.00 5 Contract @ USD 5 Premium = USD 1.00 7 Contract @ USD 2 Premium = USD 1.05

NANOS Options on Cboe

Mexico - Example

Fixed examples:.

1 AMXL Contract = MXN 25 1 NAFTRAC Contract = MXN 20 1 QQQQ Contract = MXN 30

- Volumes on both US and Canadian markets contribute to sliding scale.

- IBKR Lite accounts are charged a fixed rate commission on the first 1,000 U.S. option contracts traded per month. For U.S. options volume in excess of 1,000 contract per month, IBKR will apply the IBKR Pro U.S. options tiered commission model.

- The Options Regulatory Fee ("ORF") is charged by the following exchanges: AMEX, BATS, BOX, CBOE, CBOE2, EDGX, EMERALD, ISE, GEMINI, MERCURY, MIAX, MEMX, NOM, NASDAQBX, PSE, PHLX.

- Fee applies to executions which clear in the "Customer" account with OCC. This will generally include Public Customer and Professional Customer transactions.

- Transaction fees are only charged for sell orders.

- Direct routed orders are charged USD 1.00/contract on all option premiums

- Third party clearing, regulatory, and transaction fees are charged on NANOS options on Cboe

- IBKR's Tiered (i.e., commission plus external venue fees/rebates) commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. Costs passed on to clients in IBKR’s Tiered commission schedule may be greater than the costs paid by IBKR to the relevant exchange, regulator, clearinghouse or third party. For example, IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. In certain circumstances, IBKR may receive discounts with respect to third party fees, including exchange and/or clearing fees, that may not pass-through to clients.

- Commissions apply to all order types.

- Commissions are not charged for US exercise and assignment.

- Commissions are not charged for US cabinet buy-to-close trades. This is applicable only when the option minimum tick is > $0.01. Complex orders are excluded.

- IBKR considers exchange fees and/or rebates in determining where to route an order. Under certain circumstances, IBKR may route a marketable order to an exchange that is not currently posting the national best bid or offer (NBBO) but which may be willing to "step up" and execute the order at the NBBO, in order to avoid or reduce the exchange fee for executing the order. If this routing method is used, the client generally will pay a lower execution fee than client would have otherwise paid. In those cases where IBKR routes to an exchange that is not currently posting the NBBO in order to reduce or avoid exchange fees, IBKR will guarantee the client a fill at the NBBO at the time that IBKR routed the order.

- Volume breaks are applied based on monthly cumulative trade volume summed across all options contracts at the time of the trade. Contract volumes for advisor, separate trading limit, and broker accounts are summed across all accounts for the purpose of determining volume breaks. These fees are applied on a marginal basis for a given calendar month. If for example, you execute 12,000 US contracts in a month, your execution costs would be: 10,000 contracts at USD 0.65 2,000 contracts at USD 0.50

- Modified orders will be treated as the cancellation and replacement of an existing order with a new order. On certain exchanges, this may have the effect of subjecting modified orders to commission minimums as if they were new orders. For example, if an order for 200 contracts is submitted and 100 contracts execute, then you modify the order and another 100 contracts execute, a commission minimum would be applied to both 100 contract orders.

- Order minimums will be applied to the individual legs of a COMBO order.

- Non-Trading Permit Holders, non-broker/dealer and professional customers may be eligible for the CBOE Frequent Trader program. Under the program, rebates may be provided on certain CBOE proprietary products. Clients must contact the exchange directly regarding the application and approval process. Once enrolled, clients should notify IBKR by email at [email protected] to ensure their orders are routed with the proper FTID designation. Once enrolled, rebates will be provided directly from the CBOE

- IBKR may change these rates at any time in its sole discretion. Commission rates may also vary by program or arrangement. Restrictions apply. The published rates are for direct clients of IBKR. Clients introduced through another broker or managed by an advisor may pay additional commissions set by their introducing broker or advisor. Clients should contact their introducing broker or advisor about the rates that will apply to their account.

* Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.

- Quarterly Earnings

- Monthly Metrics

- Annual Report & Proxy

- Presentations & Events

- Press Releases

- SEC Filings

- Founder's Letter

- Corporate Governance

- Executive Profiles

- Sustainability Report

- Transfer Agent

- Contact IBKR Investor Relations

Commissions Options

COMMISSIONS

Minimize Your Costs to Maximize Your Returns*. Low commissions with no added spreads, ticket charges, platform fees, or account minimums.

United States

Third party fees, exchange fees, regulatory fees.

Options Regulatory Fee (ORF): USD 0.02685 /contract 2,3

Transaction Fees

SEC Transaction Fee: USD 0.0000278 * Value of Aggregate Sales 4

FINRA Trading Activity Fee: USD 0.00279 * Quantity Sold

OCC Clearing Fees

Trades of 1-2750 contracts: USD 0.02 /contract

Trades > 2750 contracts: USD 55.00 /trade

United States - Examples

Tiered examples:.

Contract Volume ≤ 10,000 per month:

1 Contract @ USD 2 Premium = USD 1.00 2 Contract @ USD 5 Premium = USD 1.30 3 Contract @ USD 0.075 Premium = USD 1.50 5 Contract @ USD 0.03 Premium = USD 1.25

Contract Volume 10,001 - 50,000 per month:

1 Contract @ USD 2 Premium = USD 1.00 2 Contract @ USD 5 Premium = USD 1.00 3 Contract @ USD 0.075 Premium = USD 1.50 5 Contract @ USD 0.03 Premium = USD 1.25

Contract Volume 50,001 - 100,000 per month:

1 Contract @ USD 2 Premium = USD 1.00 2 Contract @ USD 5 Premium = USD 1.00 5 Contract @ USD 2 Premium = USD 1.25

Contract Volume ≥ 100,001 per month:

1 Contract @ USD 2 Premium = USD 1.00 5 Contract @ USD 5 Premium = USD 1.00 7 Contract @ USD 2 Premium = USD 1.05

NANOS Options on Cboe

Mexico - Example

Fixed examples:.

1 AMXL Contract = MXN 25 1 NAFTRAC Contract = MXN 20 1 QQQQ Contract = MXN 30

- Volumes on both US and Canadian markets contribute to sliding scale.

- The Options Regulatory Fee ("ORF") is charged by the following exchanges: AMEX, BATS, BOX, CBOE, CBOE2, EDGX, EMERALD, ISE, GEMINI, MERCURY, MIAX, MEMX, NOM, NASDAQBX, PSE, PHLX.

- Fee applies to executions which clear in the "Customer" account with OCC. This will generally include Public Customer and Professional Customer transactions.

- Transaction fees are only charged for sell orders.

- Direct routed orders are charged USD 1.00/contract on all option premiums

- Third party clearing, regulatory, and transaction fees are charged on NANOS options on Cboe

- IBKR's Tiered (i.e., commission plus external venue fees/rebates) commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. Costs passed on to clients in IBKR’s Tiered commission schedule may be greater than the costs paid by IBKR to the relevant exchange, regulator, clearinghouse or third party. For example, IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. In certain circumstances, IBKR may receive discounts with respect to third party fees, including exchange and/or clearing fees, that may not pass-through to clients.

- Commissions apply to all order types.

- Commissions are not charged for US exercise and assignment.

- Commissions are not charged for US cabinet buy-to-close trades. This is applicable only when the option minimum tick is > $0.01. Complex orders are excluded.

- IBKR considers exchange fees and/or rebates in determining where to route an order. Under certain circumstances, IBKR may route a marketable order to an exchange that is not currently posting the national best bid or offer (NBBO) but which may be willing to "step up" and execute the order at the NBBO, in order to avoid or reduce the exchange fee for executing the order. If this routing method is used, the client generally will pay a lower execution fee than client would have otherwise paid. In those cases where IBKR routes to an exchange that is not currently posting the NBBO in order to reduce or avoid exchange fees, IBKR will guarantee the client a fill at the NBBO at the time that IBKR routed the order.

- Volume breaks are applied based on monthly cumulative trade volume summed across all options contracts at the time of the trade. Contract volumes for advisor, separate trading limit, and broker accounts are summed across all accounts for the purpose of determining volume breaks. These fees are applied on a marginal basis for a given calendar month. If for example, you execute 12,000 US contracts in a month, your execution costs would be: 10,000 contracts at USD 0.65 2,000 contracts at USD 0.50

- Modified orders will be treated as the cancellation and replacement of an existing order with a new order. On certain exchanges, this may have the effect of subjecting modified orders to commission minimums as if they were new orders. For example, if an order for 200 contracts is submitted and 100 contracts execute, then you modify the order and another 100 contracts execute, a commission minimum would be applied to both 100 contract orders.

- Order minimums will be applied to the individual legs of a COMBO order.

- Non-Trading Permit Holders, non-broker/dealer and professional customers may be eligible for the CBOE Frequent Trader program. Under the program, rebates may be provided on certain CBOE proprietary products. Clients must contact the exchange directly regarding the application and approval process. Once enrolled, clients should notify IBKR by email at [email protected] to ensure their orders are routed with the proper FTID designation. Once enrolled, rebates will be provided directly from the CBOE

- IBKR may change these rates at any time in its sole discretion. Commission rates may also vary by program or arrangement. Restrictions apply. The published rates are for direct clients of IBKR. Clients introduced through another broker or managed by an advisor may pay additional commissions set by their introducing broker or advisor. Clients should contact their introducing broker or advisor about the rates that will apply to their account.

* Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.

- Best Stock Brokers Best Stock Trading Apps Best Stock Trading Platforms for Beginners Best Paper Trading Platforms Best Day Trading Platforms

- Best Futures Trading Platforms Best Options Trading Platforms Best Penny Stock Brokers Best International Brokers All Guides arrow_right_alt

- Robinhood vs Webull Charles Schwab vs E*TRADE Fidelity vs Robinhood TradeStation vs Interactive Brokers

- E*TRADE vs Interactive Brokers Charles Schwab vs Fidelity Merrill Edge vs Fidelity Compare Brokers arrow_right_alt

- done About Us done How We Test done Why Trust Us done Our Policy on AI done Media

- done 2024 Annual Awards done Historical Rankings done How We Make Money done Meet the Team

Interactive Brokers Review

Written by Sam Levine, CFA, CMT Edited by Carolyn Kimball Fact-checked by Steven Hatzakis Reviewed by Blain Reinkensmeyer

Interactive Brokers has global reach, professional-caliber tools, investment options for any objective or market, and, to top it off, is often the least expensive in many of the categories we analyze. Now it’s focused on becoming more accessible to individual investors.

- Minimum Deposit: $0.00

- Stock Trades: $0.00

- Options (Per Contract): $0.65

Pros & Cons

thumb_up_off_alt Pros

- An astounding array of highly customizable tools, investment choices, and research.

- The ability to trade in foreign markets and hold multiple currencies.

- Convenient mobile apps and a very good web portal for individual investors.

thumb_down_off_alt Cons

- Conservative in granting trading permissions.

- Occasionally inconvenient for plain-vanilla investing.

- If you’re looking for a friendly companion for your investing journey, either adopt a kitten or choose another broker.

Overall summary

feed Recent news

January 2024: Crypto ETFs. Interactive Brokers now allows trading of spot bitcoin ETFs in brokerage accounts.

Investment options

Interactive Brokers provides the most diverse offering in the industry and leads by a wide margin in multiple areas, including international trading. Globally, customers in over 200 countries can trade in more than 150 markets.

I ran into two frustrations with IBKR. One probably won’t affect many retail customers, and the other will affect virtually everyone. The first is its somewhat restrictive trading permissions. If you want to trade options or leveraged trading products (such as SQQQ), be aware that IBKR has unusually high standards for granting permission to trade them.

If you’re just sticking to stocks and ETFs, you’ll likely run into another small annoyance: the need to specify a trading instrument after entering a ticker symbol. For example, entering “NVDA” into the search bar yielded around two dozen ways to take a position on the company. Happily, the common stock was the first choice, but it’s something that doesn’t happen as often at domestic-only brokers. I’d appreciate an account setting that defaults searches to certain markets.

Cryptocurrency: Interactive Brokers added cryptocurrency trading to its offerings in 2021. Traders can trade bitcoin, ethereum, litecoin, and bitcoin cash through their integrated account. And, whoa man, is crypto trading cheap: Commissions are 0.12% to 0.18%, with a minimum of $1.75 per order and a maximum of 1% of trade value.

Forex: Do you want to lock in a high exchange rate before traveling overseas or diversify away from a gyrating U.S. dollar? No problem. It’s easy and inexpensive to exchange currencies at IBKR, a feature you won’t find at many other brokers. (If you’re interested in trading forex , see the IBKR review on our sister site, ForexBrokers.com.)

Other: Interactive Brokers lets U.S. investors trade spot gold in amounts as small as one ounce. There are also Micro and Small futures contracts, opening access to the futures markets to a broader audience. Small Exchange futures are only $0.08 per contract.

account_balance One of the best for high net worth

We analyzed online brokers' offerings for clients with over $1 million of liquid, investable assets. See our guide to the Best Brokerage Firms for High Net Worth Individuals .

Commissions and fees

Interactive Brokers, our No. 1 pick for free stock trading , offers two pricing plans: IBKR Pro (meant for professionals) and IBKR Lite (for casual investors).

IBKR Lite: With IBKR Lite, there are no market data fees and all U.S. stock and ETF trades are $0. Options trades are $0.65 per contract. The only caveat to IBKR Lite is slightly lower-quality order executions due to payment for order flow (PFOF). Like most other $0 commission brokers, under IBKR Lite, Interactive Brokers makes money from PFOF. Though we’re no fans of PFOF at StockBrokers.com, it only affects executions by a few pennies per $1,000 traded. Retail investors shouldn’t let it be a dealbreaker.

IBKR Pro stock trades: The tiered pricing plan starts at $.0035 per share ($0.35 minimum), unless you’re trading 300,000 or more shares monthly, which can drive it down to as low as $.0005. There’s also a fixed Pro plan that isn’t volume-dependent. Institutions will pay this for being able to route orders to dark pools in hopes of getting better executions on their gazillion share positions, something those of us trading 50 shares of Amazon or Apple shouldn’t worry about.

IBKR Pro options trades: On U.S. exchanges using Interactive Brokers SMART routing, commissions per options contract are tiered. Any premium greater than $0.10 equals $0.65 per contract with a $1 minimum and no maximum. For premiums between $0.05 and $0.10, the rate is $0.50 per contract. Finally, for premiums less than $0.05, the rate is $0.25 per contract.

IBKR Pro other benefits: Interactive Brokers does not accept payment for order flow in IBKR Pro, a key element in providing quality order execution.

Mutual funds: Interactive Brokers offers over 48,000 mutual funds globally, with over 11,000 in the U.S. Of the U.S. mutual funds, over 4,000 are ticket charge-free; otherwise, the standard fee is the lesser of 1.5% of the trade value or $14.95, which is still a good price compared to most other brokers.

Penny stocks: IBKR Pro is not a good choice for trading penny stocks, as you’ll pay a per-share commission.

Mobile trading apps

Given the flagship IBKR Mobile, Impact, and GlobalTrader apps, there’s something for everyone, unless you’re looking for a lighthearted approach or personal finance coaching. IBKR won’t hound you to quit your daily Starbucks and save $5 a day. It seeks to be a technology and price leader rather than becoming the next e-Suze Orman or e-Jean Chatzky.

There are three mobile apps available to retail investors. The two novice-focused apps, Impact and GlobalTrader, cater to different interests while sharing many elements. Clients can use any or all three apps.

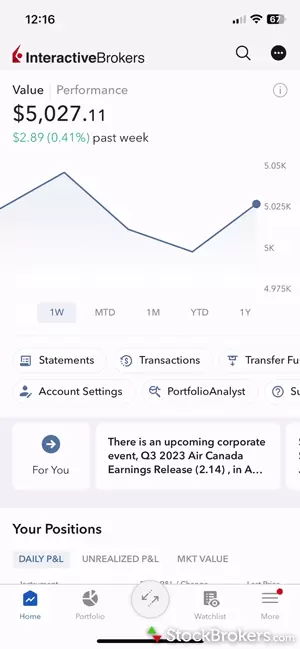

IBKR Mobile: The IBKR Mobile app is the most feature-laden of IBKR’s mobile app suite. From lightning-quick streaming data to full-featured order entry and portfolio management, IBKR Mobile includes almost everything experienced investors and professionals require to trade on the go, and it’s not too heavy a lift for individual investors, either.

GlobalTrader: Beginners and foreign stock aficionados will enjoy using GlobalTrader, which allows fractional stock trades, options trading and convenient access to foreign shares. Everything is clearly laid out and easy to operate. I’d rank GlobalTrader above many apps from beginner-focused brokers.

Impact: The Impact app, which focuses on ESG (environmental, social and governance) investing, prompts you to choose values that are important to you, such as clean water or opposition to animal testing. From there, you can identify companies that support those values and even “swap” positions in your portfolio with a single trade. Your Impact dashboard will display an A-F grade for your portfolio based on the values chosen.

Charting: Charting on IBKR Mobile is robust. There’s a revamped charting package that’s a notable improvement over an already very good one. There are over 90 optional indicators, 80 drawing tools, and easy customizations. One nitpick: I wasn’t able to find stock and/or index comparisons. Customizations are saved to the cloud, so chart markups can appear on any platform.

Tap for a demo of IBKR's mobile app.

IBKR mobile apps gallery

currency_pound Investing in the U.K.

Interactive Brokers also made our top picks for trading apps in the United Kingdom, along with four other strong contenders. Read more on our sister site, UK.StockBrokers.com .

Other trading platforms and tools

Interactive Brokers’ flagship platform, the desktop-based Trader Workstation (TWS), supports trading almost everything under the sun. While TWS is not designed for new investors, it easily ranks among the best trading platforms in the industry, even if it does come across as being a bit long in the tooth. Luckily IBKR seems to be addressing that with a new desktop app.

IBKR Desktop: A recent addition to IBKR’s stable of platforms is the downloadable Desktop. Though it’s clearly under development (I tested version 0.04) and very skinny in features, it’s a big leap forward in design compared to Trader Workstation. I’m eagerly awaiting a fully built-out version. For now, it’s more of a feature to watch than a platform for daily use.

TWS trading tools: Tools designed for seasoned traders abound within TWS: algo trading, an Options Strategy Lab, Volatility Lab, Risk Navigator, Market Scanner, and Strategy Builder, to name a few. Watch lists can include anything from equities to individual options contracts, futures, forex, warrants – you name it. Hundreds of data points are available for column customization.

IBot: IBot, also available in IBKR Mobile, uses a foundation of artificial intelligence to quickly service customer requests via chat (or voice in the iPhone app). Portfolio information, orders, quotes, and more are all supported. Think, "What's the last price of GOOG?" or, "Chart AAPL vs. MSFT" or, "Buy 100 shares of META."

Client Portal: This platform for less-experienced traders is offered through Interactive Brokers’ website and includes all the core features necessary to trade and manage a portfolio. Portal, like IBKR Mobile, is feature-rich without trying to pack as much data as possible onto the screen, striking a good balance between utility and ease of use.

Client Portal and Trader Workstation (TWS) gallery

For casual investors, sticking to Fundamentals Explorer within Client Portal is, hands down, the way to go for doing research. Trader Workstation is a better fit for seasoned traders and professionals.

Fundamentals Explorer: Built to help everyday investors perform traditional fundamental research on stocks, ETFs, and mutual funds, the Fundamentals Explorer page uses charts and graphs to visualize data. For example, the Social Sentiment analysis tab uses a slew of X (formerly Twitter) data to plot sentiment over time on a chart, which helps visualize social activity around a stock. There are also automated technical opinions from Trading Central.

Stock research: TWS research highlights include numerous screeners, extensive back-testing functionality, and portfolio analysis tools, which are all excellent. For traders looking to conduct specific research, Interactive Brokers offers third-party provider feeds a la carte. Any provider package purchased integrates straight into TWS.

However, performing even basic research on stocks, ETFs, and mutual funds on TWS is nothing like the traditional full-service brokerage experience one might find at Charles Schwab or Fidelity . It’ll take a while to learn how to navigate TWS to find the information you want and assemble a layout that works for you. Expect some frustration.

The web-based Client Portal, in contrast, is far easier to use and, while not quite as intuitive as the offerings of leaders in this arena, is a much lighter lift than TWS, and goes far deeper than many other firms’ web offerings.

ESG research: Interactive Brokers includes a variety of environmental, social and governance ratings and research across its platforms, including the abovementioned Impact tool, which lets you score your portfolio stock holdings for ESG-specific metrics.

PortfolioAnalyst: One of my favorite functions on a Bloomberg terminal was its portfolio performance reporting. I could see how my portfolio stacked up against a benchmark and what was driving the differences: The function told me whether my under/outperformance was due to stock picking, sector allocations, or market timing. Unfortunately, a Bloomberg terminal costs well over $24K a year. So you can imagine how happy I am to find that IBKR offers the same thing for free. PortfolioAnalyst provides traders with hedge fund-level reporting on their portfolio's performance and makeup. Interactive Brokers also offers a free version for non-clients where you can link all your accounts and run reports. It's a compelling tool for traders with assets spread across several brokers.

Interactive Brokers offers numerous options to learn about trading and investing under the Education tab on the home page. Check out IBKR Campus and the Trader's Academy if you're getting started. There is a wide variety of well-organized written material, video content, and even some quizzes with progress tracking. Unlike some brokers that want to come across as cute and cuddly (not that there’s nothing wrong with that), IBKR’s educational material takes a professional tone. Its content will inform, not entertain. That’s fine by me.

Banking services

While Interactive Brokers does not provide traditional banking services, it does offer its version of a cash management account with a debit card, bill pay, and the ability to earn interest on uninvested cash. Bill payments and ATM withdrawals are $0.50.

Your account must be denominated in a base currency that has a positive interest rate to earn interest. There are also minimum tier cutoff levels, wherein you earn a yield only on cash that exceeds those levels, which vary per currency.

Customer service

To score Customer Service, StockBrokers.com partners with customer experience research firm Confero to conduct phone tests from locations throughout the United States. For this year's testing, 135 customer service tests were conducted over six weeks, with wait times logged for each call.

Customer service representatives were asked for assistance or details for prospective customers in several areas of broker services, including account opening, trading tools, apps, rollovers, active trading, and more. Here are the results for Interactive Brokers.

- Average Connection Time: 1-2 minutex

- Average Net Promoter Score: 4.2 / 10

- Average Professionalism Score: 3.7 / 10

- Overall Score: 7.7 / 10

- Ranking: 12th of 13 brokers

Final thoughts

With industry-leading commission rates for professional traders, more than 100 optional order types (and that’s not counting third-party offerings), trading in over 150 markets, and platforms suitable for beginners or professionals, Interactive Brokers is an excellent choice for sophisticated investors and the professionals who serve them. I also like IBKR for beginner investors looking for fractional shares, paper trading, easy mobile apps and trustworthy educational content, but some other brokers do offer a friendlier novice experience.

Here are our three top takeaways for Interactive Brokers for 2024.

- Interactive Brokers is best known for offering traders access to global markets. Additionally, professionals can take advantage of industry-leading commissions, including the lowest margin rates across all balance tiers.

- Interactive Brokers is an excellent choice for day trading , mobile trading , options trading , futures trading , and professional trading.

- IBKR is also a great choice for beginners, but a bit more, well, pizzazz would go a long way.

- Best Futures Trading Platforms of June 2024

- Best Brokers for Penny Stock Trading of June 2024

- Best Day Trading Platforms of June 2024

- Best Stock Trading Apps of 2024

- Best Stock Brokers for June 2024

- Best Stock Trading Platforms for Beginners of June 2024

- Best Options Trading Platforms & Brokers

- Best Paper Trading Platforms of June 2024

More Guides

Popular stock broker reviews, is my money safe with interactive brokers.

Interactive Brokers is well-capitalized and is licensed and regulated in nearly a dozen major jurisdictions, making it a safe broker to hold your money. Interactive Brokers is a publicly traded company (NASDAQ: IBKR) with a market capitalization of over $34 billion as of October 2023.

Money held in an investment account with Interactive Brokers in the U.S. is protected by SIPC insurance, which covers up to $500,000 in securities and up to $250,000 in cash. If you hold more than $250,000 in cash, Interactive Brokers offers a Insured Bank Deposit Sweep Program, which provides up to $2.5 million in FDIC insurance in addition to the SIPC insurance. There’s additional account coverage through Lloyd’s of London. This coverage, of course, doesn’t extend to investment losses.

The degree of security may depend on the specific country you are located in and the related regulatory requirements that Interactive Brokers follows in countries where it holds client funds, such as the U.S., U.K., Canada, Australia, Singapore, India and Japan.

Is Interactive Brokers FDIC insured?

Interactive Brokers does not carry FDIC insurance, because it is not a bank. Instead, IBKR is a member of the Securities Investor Protection Corporation, which insures clients against losses due to broker insolvency, and IBKR carries additional protection through Lloyd’s of London. It can, however, sweep cash balances into FDIC-insured banks.

Is Interactive Brokers good for beginners?

IBKR has many beginner-friendly features, such as fractional shares, paper trading, and simplified mobile apps. The broker’s investor education covers a broad range of topics and lets you test your newly acquired knowledge through quizzes. Other brokers might come across as friendlier, but IBKR delivers on substance.

Is there a disadvantage to using Interactive Brokers?

Interactive Brokers is one of our top-rated brokerage firms due to its comprehensive tools, great choice of platforms, and very attractive pricing. It also has excellent educational content and continues to be an industry innovator. That said, some investors might prefer a simpler experience over the global capabilities and impersonal presentation of IBKR.

Why is Interactive Brokers so cheap?

Interactive Brokers is cheap because it leverages technology efficiently and competes as a low-cost provider. According to CSI Markets, Interactive Brokers’ revenue per employee was recently over $3.8 million, which compares favorably to competitor Charles Schwab’s figure of $621,826.

Does IBKR have fees?

IBKR Lite is the zero-commission tier for retail brokers at Interactive Brokers. There’s also a pro version that charges commissions. Like all brokers, IBKR has incidental charges. One of the most unusual is a fee of $1 or more per withdrawal, if you exceed one withdrawal per calendar month.

Are Interactive Brokers’ fees high?

IBKR competes aggressively on price and is often among the lowest-cost brokers in several areas, especially in margin rates and cryptocurrency trading.

Does Interactive Brokers trade crypto?

Does Interactive Brokers trade crypto? Yes, Interactive Brokers customers can trade bitcoin, bitcoin cash, ethereum, and litecoin.

What is the difference between IBKR Pro and Lite?

Interactive Brokers’ Lite tier is intended for individual investors and provides commission-free stock and ETF trades in exchange for IBKR receiving payment for order flow. IBKR Pro is for larger trades and higher volume traders and also charges lower margin rates. Most individuals will likely be better off choosing IBKR Lite, but it’s easy to switch between them as your needs evolve.

About Interactive Brokers

Headquartered in Greenwich, Connecticut, Interactive Brokers (NASDAQ: IBKR) was founded in 1978 by Thomas Peterffy, who is respected as "an early innovator in computer-assisted trading." Interactive Brokers is most widely recognized for its extensive international reach. The firm places almost 2 million trades per day and services over 1.5 million client accounts with over $296 billion in customer equity.

Interactive Brokers 2024 Results

For the StockBrokers.com 2024 Annual Awards , announced on Jan. 23, 2024, all U.S. equity brokers we reviewed were assessed on over 200 different variables across eight areas: Commissions & Fees, Investment Options, Platforms & Tools, Research, Mobile Trading , Education, Ease of Use, and Overall.

StockBrokers.com also presented “Best in Class” awards to brokers for additional categories Beginners , Options Trading , Futures Trading , Day Trading , IRA Accounts , Investor Community, Penny Stock Trading , Bank Brokerage , High Net Worth Investors , and Customer Service. A “Best in Class” designation means finishing in the top five brokers for that category.

For more information, see how we test .

Category awards

Industry awards, compare interactive brokers competitors.

Select one or more of these brokers to compare against Interactive Brokers.

StockBrokers.com Review Methodology

Our mission at StockBrokers.com is simple: provide thorough and unbiased reviews of online brokers, based on an extraordinary level of hands-on testing and data collection. Our ratings and awards are based on this data and our in-house experts’ deep authority in the field; brokers cannot pay for preferential treatment. Here’s more about trustworthiness at StockBrokers.com.

Our research team conducts thorough testing on a wide range of features, products, services, and tools for U.S. investors, collecting and validating thousands of data points in the process; this makes StockBrokers.com home to the largest independent database on the web covering the online broker industry. We test all available trading platforms for each broker and evaluate them based on a host of data-driven variables. All research, writing and data collection at StockBrokers.com is done by humans, for humans. Read our generative AI policy here .

As part of our process, all brokers had the annual opportunity to provide updates and key milestones and complete an in-depth data profile, which we hand-checked for accuracy. Brokers also were offered the opportunity to provide executive time for an annual update meeting.

Our rigorous data validation process yields an error rate of less than .001% each year, providing site visitors quality data they can trust. Learn more about how we test .

Interactive Brokers fees and features data

The data collection efforts at StockBrokers.com are unmatched in the industry. The following tables show a deeper dive into the offerings available at this broker. You can also compare its offerings side-by-side with those of other brokers using our Comparison Tool .

In addition to meticulous annual data collection by our in-house analyst, every broker that participates in our review is afforded the opportunity to complete an in-depth data profile. We then audit each data point to ensure its accuracy.

Trading fees

Account fees, margin rates, order types, stock trading apps, stock app features, stock app charting, trading platforms overview, trading platform stock chart features, day trading features, investment research overview, stock research features, etf research features, mutual fund research features, options trading overview, banking features, customer service options.

Interactive Brokers' Wikipedia

Was this page helpful? Yes or No

Compare Interactive Brokers

See how Interactive Brokers stacks up against other brokers.

About the Editorial Team

Sam Levine has over 30 years of experience in the investing field as a portfolio manager, financial consultant, investment strategist and writer. He also taught investing as an adjunct professor of finance at Wayne State University. Sam holds the Chartered Financial Analyst and the Chartered Market Technician designations and is pursuing a master's in personal financial planning at the College for Financial Planning. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets.

Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers.com Annual Review. Carolyn has more than 20 years of writing and editing experience at major media outlets including NerdWallet, the Los Angeles Times and the San Jose Mercury News. She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex (some might say befuddling) topics to help consumers make informed decisions about their money.

Steven Hatzakis is the Global Director of Research for ForexBrokers.com. Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative.

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets.

- Portal Login

OPEN ACCOUNT

- Start Application

- Finish an Application

- What You Need

- A Guide to Chosing the Right Account

FOR INDIVIDUALS

- Individual, Joint or IRA

- Family Advisors

FOR INSTITUTIONS

- Institutions Home

- Registered Investment Advisors

- Proprietary Trading Groups

- Hedge Funds

- Introducing Brokers

- Family Offices

- Compliance Officers

- Small Businesses

- Money Managers

- Fund Administrators

Commissions

- Margin Rates

- Interest Rates

- Short Sale Cost

- Research and News

- Market Data

- Stock Yield Enhancement Program

- Products and Exchange Search

- Order Types

- Securities Financing

- Features in Focus

- Probability Lab

- Sustainable Investing

- RSP and TFSA Information

- IBKR GlobalAnalyst

- PortfolioAnalyst

- Bonds Marketplace

- No Transaction Fee ETFs

- Investors' Marketplace

- Short Securities Availability

- Cash Management

- Third Party Integration

- IBKR Campus

- Traders' Academy

- Traders' Insight

- IBKR Podcasts

- IBKR Quant Blog

- Student Trading Lab

- Traders' Glossary

- Traders' Calendar

- Strength and Security

- Information and History

- News at IBKR

- Press and Media

- Investor Relations

- Sustainability

- Regulatory Reports

- Refer a Friend

- Affiliate Programs

- Fund Your Account

- For Individuals

- For Institutions

- Institutional Sales Contacts

- Browse Our FAQs

- Tax Information

COMMISSIONS

Minimize Your Costs to Maximize Your Returns 1

Low commissions on products across 150 global markets No added spreads, ticket charges, platform fees, or account minimums.

Commissions below are for U.S. markets. Click each product for full global commissions.

Stocks/etfs.

USD 0.0005 to 0.0035 per share

USD 0 on No Transaction Fee ETFs

USD 0.005 per share

USD 0.15 to 0.65 per contract

USD 0.65 per contract

USD 0.25 to 0.85 per contract

USD 0.85 per contract

Fixed: US-Future and Future Options

Spot Currencies

0.08 to 0.20 basis points × Trade Value per order

Tight spreads as narrow as 1/10 PIP

10 basis points × Face Value per order

View commission details for more information on transaction fees, minimums and maximums.

Disclosures

- Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.

- 1 basis point=0.0001.

- IBKR may change these rates at any time in its sole discretion. Commission rates may also vary by program or arrangement. Restrictions apply. The published rates are for direct clients of IBKR. Clients introduced through another broker or managed by an advisor may pay additional commissions set by their introducing broker or advisor. Clients should contact their introducing broker or advisor about the rates that will apply to their account.

Interactive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and Member - Canadian Investor Protection Fund . Know Your Advisor: View the CIRO AdvisorReport. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide investment advice or recommendations regarding the purchase or sale of any securities or derivatives. Our registered office is located at 1800 McGill College Avenue, Suite 2106, Montreal, Quebec, H3A 3J6, Canada.

Know Your Advisor: View the CIRO AdvisorReport

Commissions

- Stocks, ETFs and Warrants

- Futures and FOPs

- Spot Currencies

- Fixed Income

- Mutual Funds

- Exchange Incentive Program

North America

Asia-pacific.

Our transparent Tiered pricing for options in US markets includes our low broker commission, which decreases depending on volume, plus exchange and regulatory fees. 1

United States - Smart Routed 2 : Tiered Commissions

United states - nanos options on cboe, united states - direct routed, united states - exchange fees, united states - regulatory fees, united states - transaction fees, united states - occ clearing fees, canada: tiered commissions.

- IBKR's Tiered commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. Costs passed on to clients in IBKR’s Tiered commission schedule may be greater than the costs paid by IBKR to the relevant exchange, regulator, clearinghouse or third party. For example, IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients.

- Access to IB SmartRouting for US Listed Securities is generally available only to IBKR Pro accounts.

- Volumes on both US and Canadian markets contribute to sliding scale.

- The Options Regulatory Fee ("ORF") is charged by the following exchanges: AMEX, BATS, BOX, CBOE, CBOE2, EDGX, EMERALD, ISE, GEMINI, MERCURY, MIAX, NOM, NASDAQBX, PSE, PHLX.

- Fee applies to executions which clear in the "Customer" account with OCC. This will generally include Public Customer and Professional Customer transactions.

- Transaction fees are only charged for sell orders.

- Commissions apply to all order types.

- Commissions are not charged for US exercise and assignment.

- Commissions are not charged for US cabinet buy-to-close trades. This is applicable only when the option minimum tick is > $0.01. Complex orders are excluded.

- IBKR considers exchange fees and/or rebates in determining where to route an order. Under certain circumstances, IBKR may route a marketable order to an exchange that is not currently posting the national best bid or offer (NBBO) but which may be willing to "step up" and execute the order at the NBBO, in order to avoid or reduce the exchange fee for executing the order. If this routing method is used, the client generally will pay a lower execution fee than client would have otherwise paid. In those cases where IBKR routes to an exchange that is not currently posting the NBBO in order to reduce or avoid exchange fees, IBKR will guarantee the client a fill at the NBBO at the time that IBKR routed the order.

- Volume breaks are applied based on monthly cumulative trade volume summed across all options contracts at the time of the trade. Contract volumes for advisor, separate trading limit, and broker accounts are summed across all accounts for the purpose of determining volume breaks. These fees are applied on a marginal basis for a given calendar month. If for example, you execute 12,000 US contracts in a month, your execution costs would be: 10,000 contracts at USD 0.65 2,000 contracts at USD 0.50

- Modified orders will be treated as the cancellation and replacement of an existing order with a new order. On certain exchanges, this may have the effect of subjecting modified orders to commission minimums as if they were new orders. For example, if an order for 200 contracts is submitted and 100 contracts execute, then you modify the order and another 100 contracts execute, a commission minimum would be applied to both 100 contract orders.

- Order minimums will be applied to the individual legs of a COMBO order.

Our transparent Tiered pricing for options includes our low broker commissions, plus exchange, and clearing fees. VAT, also referred to as consumption tax , goods and services tax , where applicable, will be separately applied for eligible services. 1,2

European and Asian Index Options are considered part of the Futures pricing scheme. Volumes are combined with the Futures and FOP trading volume for the tier break consideration. They will not be combined with the monthly volume of stock options when determining commissions. Clients wishing to receive the Tier commissions for European and Asian Index Options must select tiered pricing for Futures & FOPs through Client Portal.

European Stock Options – Single Tier

European stock options – volume incentive tiers 4, 5, european index options 4, exchange and regulatory fees.

- Stamp duty on option exercise (UK=0.5%) is directly passed through to the customer.

- Exchange fees for Swedish options are not used to determine the minimum per order. Exchange fees are passed through in addition to the stated IBKR commissions.

- Note, index options traded under the tiered pricing structure are combined with futures and option on futures trading for volume tiers. They will not be included with the monthly volume of stock options when determining commissions.

- EUR 1.00 per Order

- GBP 1.00 per Order

- CHF 1.35 per Order

- For the purpose of determining the monthly volume tier, each mini stock option contract traded on Euronext Paris will count as 1/10 of the volume of one standard size stock option contract.

- Commissions are charged for exercise and assignment.

- Cost-Plus Tiered pricing available for index options with the exception of index options in Sweden. See futures commissions for more information.

- Modified orders will be treated as the cancellation and replacement of an existing order with a new order. On certain exchanges, this may have the effect of subjecting modified orders to commission minimums as if they were new orders. For example, if an order for 200 contracts is submitted and 100 contracts execute, then you modify the order and another 100 contracts execute, a commission minimum would be applied to both 100 contract orders. Orders that persist overnight will be considered a new order for the purposes of determining order minimums.

- Volume breaks are applied based on monthly cumulative trade volume summed across all options contracts at the time of the trade. Contract volumes for advisor, separate trading limit, and broker accounts are summed across all accounts for the purpose of determining volume breaks. These fees are applied on a marginal basis for a given calendar month. If for example, you execute 12,000 European stock options contracts in a month, your execution costs would be: 8,000 contracts at EUR 1.00 4,000 contracts at EUR 0.70

Our transparent Tiered pricing for options in non-US markets includes our low broker commission, which decreases depending on volume, plus exchange, regulatory and overnight position fees. 1

Australian Index Options – Volume Incentive Tiers 2,3

Tiered plans charge our low broker commissions, decrease based on volume, plus exchange, regulatory, and clearing fees, plus VAT where applicable. In cases where an exchange provides a rebate, we pass some or all of the savings directly back to you. 1

- The cost for exercise/assignments of ASX options will be 0.275 per contract for stock options and 0.75 per contract for index options.

- Index Option volume will be combined with the Future and FOP trading volume for the tier break consideration.

- All exchange and regulatory fees included except for Hong Kong stock options.

- Commissions are not charged for exercise and assignment, except in Australia.

- Tiered pricing available for index options. See futures commissions for more information.

- European and Asian Index Options are available for Cost-Plus Tiered pricing.

Options - Tiered Pricing Structure

- Portal Login

OPEN ACCOUNT

- Start Application

- Finish an Application

- What You Need

- A Guide to Chosing the Right Account

FOR INDIVIDUALS

- Individual, Joint or IRA

- Family Advisors

FOR INSTITUTIONS

- Institutions Home

- Registered Investment Advisors

- Proprietary Trading Groups

- Hedge Funds

- Introducing Brokers

- Family Offices

- Compliance Officers

- Small Businesses

- Money Managers

- Fund Administrators

Commissions

- Margin Rates

- Interest Rates

- Short Sale Cost

- Research and News

- Market Data

- Stock Yield Enhancement Program

- Products and Exchange Search

- Order Types

- Securities Financing

- Features in Focus

- Probability Lab

- Sustainable Investing

- RSP and TFSA Information

- IBKR GlobalAnalyst

- PortfolioAnalyst

- Bonds Marketplace

- No Transaction Fee ETFs

- Investors' Marketplace

- Short Securities Availability

- Cash Management

- Third Party Integration

- IBKR Campus

- Traders' Academy

- Traders' Insight

- IBKR Podcasts

- IBKR Quant Blog

- Student Trading Lab

- Short Videos

- Traders' Glossary

- Traders' Calendar

- Strength and Security

- Information and History

- News at IBKR

- Press and Media

- Investor Relations

- Sustainability

- Regulatory Reports

- Refer a Friend

- Fund Your Account

- For Individuals

- For Institutions

- Institutional Sales Contacts

- Browse Our FAQs

- Tax Information

Commissions Options

Minimize Your Costs to Maximize Your Returns*. Low commissions with no added spreads, ticket charges, platform fees, or account minimums.

North America Europe Asia-Pacific

United States

Third party fees, exchange fees, regulatory fees.

Options Regulatory Fee (ORF): USD 0.01925 /contract 2,3

Transaction Fees

SEC Transaction Fee: USD 0.000008 * Value of Aggregate Sales 4

FINRA Trading Activity Fee: USD 0.00244 * Quantity Sold

OCC Clearing Fees

Trades of 1-2750 contracts: USD 0.02 /contract

Trades > 2750 contracts: USD 55.00 /trade

United States - Examples

Tiered examples:.

Contract Volume ≤ 10,000 per month:

1 Contract @ USD 2 Premium = USD 1.00 2 Contract @ USD 5 Premium = USD 1.30 3 Contract @ USD 0.075 Premium = USD 1.50 5 Contract @ USD 0.03 Premium = USD 1.25

Contract Volume 10,001 - 50,000 per month:

1 Contract @ USD 2 Premium = USD 1.00 2 Contract @ USD 5 Premium = USD 1.00 3 Contract @ USD 0.075 Premium = USD 1.50 5 Contract @ USD 0.03 Premium = USD 1.25

Contract Volume 50,001 - 100,000 per month:

1 Contract @ USD 2 Premium = USD 1.00 2 Contract @ USD 5 Premium = USD 1.00 5 Contract @ USD 2 Premium = USD 1.25

Contract Volume ≥ 100,001 per month:

1 Contract @ USD 2 Premium = USD 1.00 5 Contract @ USD 5 Premium = USD 1.00 7 Contract @ USD 2 Premium = USD 1.05

NANOS Options on Cboe

Mexico - Example

Fixed examples:.

1 AMXL Contract = MXN 25 1 NAFTRAC Contract = MXN 20 1 QQQQ Contract = MXN 30

- Volumes on both US and Canadian markets contribute to sliding scale.

- The Options Regulatory Fee ("ORF") is charged by the following exchanges: AMEX, BATS, BOX, CBOE, CBOE2, EDGX, EMERALD, ISE, GEMINI, MERCURY, MIAX, MEMX, NOM, NASDAQBX, PSE, PHLX.

- Fee applies to executions which clear in the "Customer" account with OCC. This will generally include Public Customer and Professional Customer transactions.

- Transaction fees are only charged for sell orders.

- Direct routed orders are charged USD 1.00/contract on all option premiums

- Third party clearing, regulatory, and transaction fees are charged on NANOS options on Cboe

- IBKR's Tiered (i.e., commission plus external venue fees/rebates) commission models are not intended to be a direct pass-through of exchange and third-party fees and rebates. Costs passed on to clients in IBKR’s Tiered commission schedule may be greater than the costs paid by IBKR to the relevant exchange, regulator, clearinghouse or third party. For example, IBKR may receive volume discounts that are not passed on to clients. Likewise, rebates passed on to clients by IBKR may be less than the rebates IBKR receives from the relevant market. For example, IBKR may receive enhanced rebate payments for exceeding volume thresholds on particular markets, but typically will not pass these enhancements directly to clients. In certain circumstances, IBKR may receive discounts with respect to third party fees, including exchange and/or clearing fees, that may not pass-through to clients.

- Commissions apply to all order types.

- Commissions are not charged for US exercise and assignment.

- Commissions are not charged for US cabinet buy-to-close trades. This is applicable only when the option minimum tick is > $0.01. Complex orders are excluded.

- IBKR considers exchange fees and/or rebates in determining where to route an order. Under certain circumstances, IBKR may route a marketable order to an exchange that is not currently posting the national best bid or offer (NBBO) but which may be willing to "step up" and execute the order at the NBBO, in order to avoid or reduce the exchange fee for executing the order. If this routing method is used, the client generally will pay a lower execution fee than client would have otherwise paid. In those cases where IBKR routes to an exchange that is not currently posting the NBBO in order to reduce or avoid exchange fees, IBKR will guarantee the client a fill at the NBBO at the time that IBKR routed the order.

- Volume breaks are applied based on monthly cumulative trade volume summed across all options contracts at the time of the trade. Contract volumes for advisor, separate trading limit, and broker accounts are summed across all accounts for the purpose of determining volume breaks. These fees are applied on a marginal basis for a given calendar month. If for example, you execute 12,000 US contracts in a month, your execution costs would be: 10,000 contracts at USD 0.65 2,000 contracts at USD 0.50

- Modified orders will be treated as the cancellation and replacement of an existing order with a new order. On certain exchanges, this may have the effect of subjecting modified orders to commission minimums as if they were new orders. For example, if an order for 200 contracts is submitted and 100 contracts execute, then you modify the order and another 100 contracts execute, a commission minimum would be applied to both 100 contract orders.

- Order minimums will be applied to the individual legs of a COMBO order.

- Non-Trading Permit Holders, non-broker/dealer and professional customers may be eligible for the CBOE Frequent Trader program. Under the program, rebates may be provided on certain CBOE proprietary products. Clients must contact the exchange directly regarding the application and approval process. Once enrolled, clients should notify IBKR by email at [email protected] to ensure their orders are routed with the proper FTID designation. Once enrolled, rebates will be provided directly from the CBOE

* Lower investment costs will increase your overall return on investment, but lower costs do not guarantee that your investment will be profitable.

Interactive Brokers Canada Inc. is a member of the Canadian Investment Regulatory Organization (CIRO) and Member - Canadian Investor Protection Fund . Know Your Advisor: View the IIROC AdvisorReport. Trading of securities and derivatives may involve a high degree of risk and investors should be prepared for the risk of losing their entire investment and losing further amounts. Using borrowed money to finance the purchase of securities involves greater risk than using cash resources only. If you borrow money to purchase securities, your responsibility to repay the loan and pay interest as required by its terms remains the same even if the value of the securities purchased declines. Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide investment advice or recommendations regarding the purchase or sale of any securities or derivatives. Our registered office is located at 1800 McGill College Avenue, Suite 2106, Montreal, Quebec, H3A 3J6, Canada.

Know Your Advisor: View the IIROC AdvisorReport

URL: www.interactivebrokers.ca/en/index.html?f=

If you are an institution, click below to learn more about our offerings for RIAs, Hedge Funds, Compliance Officers and more.

EDGX Options Fees

- Rebates are in parentheses.

- Stock legs on EDGX buy writes charged USD 0.001/share.

- Rates are applicable for executions on the Exchange's complex order.

Introduction to Webull

How webull works.

- Pros and Cons

- Trustworthiness

- Webull vs. Other Online Brokerages

- Why You Should Trust Us

Webull Review 2024: Is It the Right Broker for You?

Paid non-client promotion: Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate investing products to write unbiased product reviews.

Webull is a mobile-first discount brokerage with a minimalist design for straightforward, convenient investing. Its user-friendly interfaces make investing accessible for beginners, with commission-free stock and options trades. Although its educational resources are limited, Webull is a community-driven platform encouraging investors to connect and share insights.

Webull is offering a 3.50% IRA match on all new contributions and transfers (ends June 30, 2024)

$0 ($2,000 for margin accounts)

0% (0.2% for robo-advisor)

Earn a 3.50% IRA match on all new contributions and transfers (ends June 30, 2024)

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. No minimum deposit

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Commission-free trading on US-listed stocks, ETFs, and options

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Cash and margin accounts available

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Webull Smart Advisor

- con icon Two crossed lines that form an 'X'. No joint brokerage accounts or education savings accounts

- con icon Two crossed lines that form an 'X'. No mutual funds

- con icon Two crossed lines that form an 'X'. Limited educational resources and retirement planning tools

Webull is best for beginners and intermediate investors in search of commission-free investments, expert market data, extended hours trading, and robo-advice. The app could also be a good fit for futures and options traders looking for an easy-to-navigate platform.

- App store rating: 4.7 iOS/4.4 Android

- Consider it if: You're after something that's free to use (for most people) and friendly to active traders

Webull is an easy-to-navigate trading platform offering a thriving online community and an extensive selection of advanced trading tools. It caters to beginners and casual investors who can appreciate easy access to real-time market data, intuitive research tools, paper trading, and much more.

You can diversify your portfolio by investing in a wide range of investable securities, such as stocks, ETFs, futures , fractional shares, over-the-counter (OTC) trades, and index options. Uninvested cash can earn 5.00% APY if you enroll in Webull's free Cash Management Program.

Webull's portfolio management tools and educational resources are limited compared to some of the best online brokerages . The platform also doesn't offer mutual funds. Webull cryptocurrency trading is no longer available.

Webull is generally best for beginners and intermediate investors who value community and the convenience of mobile trading.

Here's how to use Webull's trading platform to fund your nest egg, trade on margin, or invest in fractional shares.

Webull: Overall Rating

You can open an individual Webull brokerage account with a $0 minimum balance through the platform's desktop, mobile app, or web-based platform called WebTrade. Margin accounts require at least $2,000 in equity to open.

All users can access commission-free trades, enhanced pattern recognition tools, community features, technical analysis, paper trading, and extended trading hours. Available investable securities include stocks, ETFs, options, futures, fractional shares, and index options. Only stocks, ETFs, and options have no commission fees.

Webull also offers recurring investment strategies for stocks and ETFs to help investors reach their long-term goals. This feature can help manage portfolio risk and ensure steady growth over time.

Webull Smart Advisor

Smart Advisor is Webull's new intuitive robo-advisor that diversifies your asset allocation and offers hands-off portfolio monitoring and personalized risk distribution. A team of 130 financial experts uses quantitative analysis and insight to manage automated portfolios.

For a minimum of $100, Webull will build you a custom portfolio primarily of ETFs based on the results of your risk assessment. You can only retake the risk assessment twice every three months.

Retirement Accounts

Webull supports traditional IRAs , Roth IRAs, and rollover IRAs. You can set up an individual retirement account and contribute with pre-tax or post-tax contributions. In addition, you can roll over your employer-sponsored retirement plan if you choose.

You can grow your nest egg by investing in commission-free stocks, ETFs, and options. Like other Webull brokerage accounts, IRAs can be monitored and managed on the mobile app. Also, IRAs are now eligible for automated portfolio building and management through Webull's Smart Advisor.

Webull offers a limited-time 3.5% IRA match for all new contributions and transfers (ends June 30, 2024).

Webull Fees

Webull is a low-cost online brokerage offering commission-free trades and minimal fees.

Most Webull brokerage accounts have no minimum balance requirement and no annual fees. However, a Smart Advisor account requires a $100 minimum and charges a 0.2% annual advisory fee after your six-month free trial period ends.

Although there are no minimum balance requirements or commissions on US-listed stocks, ETFs, or options, some of Webull's regulatory agencies and clearing firms still apply small fees on each trade. A $0.55 per contact fee may be applied to certain options trades.

Fractional share investing starts at $5.

Pros and Cons of Webull

Webull trustworthiness.

Webull Financial LLC has received an F rating from the Better Business Bureau . The BBB uses a grade range of A+ to F when rating companies, so this is the lowest score a company can receive. The BBB also says on its website that its ratings don't guarantee whether a company will be reliable or perform well.

According to its website, the BBB has given Webull an F for multiple reasons, including government actions against the brokerage and Webull's failure to respond to customer complaints.

In March 2023, FINRA fined Webull $3 million, accusing the company of not conducting due diligence when approving users for options trading, having an ineffective customer communication system, and neglecting to report certain complaints to FINRA.

Webull vs. Other Online Brokerages

Webull vs. interactive brokers.

Webull and Interactive Brokers are comprehensive, low-cost trading platforms offering commission-free investments like stocks and ETFs. However, they differ regarding investment options, fees, and features.

Interactive Brokers is the overall stronger investment app , offering more unique wealth-building products and services like a Bonds Marketplace, automated themed portfolios, multi-custody solution through its PortfolioAnalyst tool, and access to shortable stocks and bonds. Sophisticated investors and those looking to trade commodities are better off with IBKR.

Webull is a better choice for options traders since it offers commission-free trades, and only certain contracts charge a $0.55 fee. Beginners and casual investors looking for straightforward mobile trading and community features may also prefer Webull.

Interactive Brokers review

Webull vs. Robinhood

Webull and Robinhood Investing are good choices for beginner active traders in search of low-cost brokerage products and simple user interfaces. But Robinhood is a better choice for IRA investors since it offers a 1% match on investor contributions in its recently launched traditional and Roth IRAs.

Robinhood is the better option for investing in cryptocurrencies as Webull no longer offers crypto trading. Robinhood also offers a beta NFT platform and a web3 wallet.

Webull is better for passive investors looking to invest through a robo-advisor since Robinhood only offers active investing strategies. Webull is the better platform to open an IRA since it currently offers a limited-time 3.5% IRA match for all new contributions and transfers (ends June 30, 2024). Robinhood also offers an IRA match bonus, but you'll have to pay for Robinhood Gold to receive its highest rate (3%).

Robinhood review

Webull FAQs

Webull is a mobile-focused online brokerage offering self-directed and automated trading accounts for individuals and retirement-focused investors. The minimalist platform simplifies trading for beginners while also offering a decent selection of commission-free stocks, ETFs, and options. Additional features include paper trading, margin trading, fractional shares, and futures.

Webull is an easy-to-navigate platform suitable for beginner investors interested in active and passive investing strategies. The discount brokerage offers commission-free stocks, ETFs, and options. Its educational resources are lacking compared to other online brokerages for beginners, but its community features may make up for that by allowing users to discuss trading techniques and insights.

Webull is a safe online trading platform regulated by the SEC and FINRA. It's equipped with two-factor authentication and provides up to $500,000 in SIPC insurance.

A self-directed brokerage account with Webull doesn't require a minimum deposit. Webull's robo-advisor, Smart Advisor, requires a $100 minimum deposit to open an account.

Webull offers fractional shares of stocks and ETFs for as little as $5, so investors can more easily invest in a wider range of companies. Fractional share investing is a cost-effective way to diversify your portfolio and mitigate risk.

Why You Should Trust Us: How We Reviewed Webull

Webull was reviewed using Business Insider's rating methodology for investing platforms . It examines asset availability, access, ethics, fees, and overall customer experience. Platforms are given a rating from 0 to 5.

Online brokerages offer multiple assets, trading tools, and other educational resources. Some platforms are better for more advanced or active investors, while others may be better for beginners and passive investors. Webull was evaluated with a focus on how it performs in each category.

- Main content

IMAGES

VIDEO

COMMENTS

IBKR Lite accounts are charged a fixed rate commission on the first 1,000 U.S. option contracts traded per month. For U.S. options volume in excess of 1,000 contract per month, IBKR will apply the IBKR Pro U.S. options tiered commission model. The Options Regulatory Fee ("ORF") is charged by the following exchanges: AMEX, BATS, BOX, CBOE, CBOE2 ...

The Options Regulatory Fee ("ORF") is charged by the following exchanges: AMEX, BATS, BOX, CBOE, CBOE2, EDGX, EMERALD, ISE, GEMINI, MERCURY, MIAX, MEMX, NOM, NASDAQBX, PSE, PHLX. Fee applies to executions which clear in the "Customer" account with OCC. This will generally include Public Customer and Professional Customer transactions.

Interactive Brokers Australia Pty. Ltd. ABN 98 166 929 568 is licensed and regulated by the Australian Securities and Investments Commission (AFSL: 453554) and is a participant of ASX, ASX 24 and Cboe Australia. Registered Office: Level 40, Grosvenor Place, 225 George Street, Sydney 2000, New South Wales, Australia. Website: www.interactivebrokers.com.au

Options / North America. Your total US options commissions include IB fees, that are tiered based on volume, plus exchange fees. ... Commissions are not charged for US exercise and assignment. ... separate trading limit, and broker accounts are summed across all accounts for the purpose of determining volume breaks. These fees are applied on a ...

Use the TWS Option Exercise window to either: (i) exercise an option prior to expiration, or (ii) deliver "contrary intentions" to the clearinghouse for the options held; e.g., The Options Clearing Corporation ("OCC") for options traded on U.S. options exchanges. You must also use the TWS Option Exercise window to instruct the clearinghouse ...

Multi-leg options and exercise and assignment fees. ... Minimum deposit requirements for options trading. Interactive Brokers currently requires a $10,000 minimum deposit for most investors ...

Interactive Brokers 2024 Results. For the StockBrokers.com 2024 Annual Awards, announced on Jan. 23, 2024, all U.S. equity brokers we reviewed were assessed on over 200 different variables across eight areas: Commissions & Fees, Investment Options, Platforms & Tools, Research, Mobile Trading, Education, Ease of Use, and Overall.

Interactive Brokers Australia Pty. Ltd. ABN 98 166 929 568 is licensed and regulated by the Australian Securities and Investments Commission (AFSL: 453554) and is a participant of ASX, ASX 24 and Cboe Australia. Registered Office: Level 40, Grosvenor Place, 225 George Street, Sydney 2000, New South Wales, Australia. Website: www.interactivebrokers.com.au

The broker does not support option exercises, assignments, deliveries or other effects of settlement that the broker determines may result in undue risk or operational risks/concerns. ... than 0.01 in the money will be automatically exercised by CNET without the need for any explicit instructions from the broker or its customers. Index options ...

Interactive Brokers Canada Inc. is an order execution-only dealer and does not provide investment advice or recommendations regarding the purchase or sale of any securities or derivatives. Our registered office is located at 1800 McGill College Avenue, Suite 2106, Montreal, Quebec, H3A 3J6, Canada. Know Your Advisor: View the CIRO AdvisorReport.

Interactive Brokers' commission schedules for stocks, options, futures, futures options, SSFs, EFPs, spot currencies, fixed income and Mutual Funds, as well as Trade Desk fees. ... 1 CAC40 Index Option = IBKR Execution Fee EUR 0.90 + Exchange Fee EUR 0.20 + Clearing Fee EUR 0.13 + Regulatory Fee EUR 0.00 = EUR 1.23 ... The cost for exercise ...

Psingh2021. IBKR option assignment fee? I got charged $40. Fees, commisions & market data. Needed help from the IBKR gang! I got charged approx. $40 when my 8.5 CLOV put got assigned.

It looks like there is a fee of 0.000119 * quantity of stock sold for getting assigned. So one contract would be 0.000119 * 100. Writing the ITM put option with less then 7 DTE will be a much higher probability of getting exercised. A lot can happen to a stock especially in this environment. 2.

Interactive Brokers' commission schedules for stocks, options, futures, futures options, SSFs, spot currencies, metals, fixed income and Mutual Funds, as well as Trade Desk fees.

Commissions are not charged for US exercise and assignment. Commissions are not charged for US cabinet buy-to-close trades. This is applicable only when the option minimum tick is > $0.01. Complex orders are excluded. IBKR considers exchange fees and/or rebates in determining where to route an order. Under certain circumstances, IBKR may route ...

While there's no assignment or exercise fee, Webull, like all brokerages, does charge per-contract regulatory fees of a few cents on all options trades. It also levies a $0.55 per contract fee ...

Discover the best online brokerage account in 2024. Compare fees, investment options, services, and features to find the top brokerage account.

The following represents fees charged by IBKR for the processing of Corporate Actions affecting securities in your portfolio. Universal. Type. Fees. Requests to exercise Dissenter or Appraisal Rights. USD 500 + external costs. Hong Kong Stock Tenders for Cash. 0.1% Stamp Duty.

Interactive Brokers Australia Pty. Ltd. ABN 98 166 929 568 is licensed and regulated by the Australian Securities and Investments Commission (AFSL: 453554) and is a participant of ASX, ASX 24 and Cboe Australia. Registered Office: Level 40, Grosvenor Place, 225 George Street, Sydney 2000, New South Wales, Australia. Website: www.interactivebrokers.com.au

Compare different state-run 529 programs to access diverse investment options, low fees, and tax advantages. ... Interactive Brokers. Interactive Brokers is a great choice for expert traders ...