Kazakhstan Economy

Key economic indicators, economic snapshot, our forecasts, kazakhstan's economy in numbers:.

Nominal GDP of USD 225 billion in 2022.

GDP per capita of USD 11,373 compared to the global average of USD 10,589.

Average real GDP growth of 3.2% over the last decade.

Economic structure:

International trade:, economic growth:, fiscal policy:, unemployment:, monetary policy:, exchange rate:.

47 indicators covered including both annual and quarterly frequencies.

Consensus Forecasts based on a panel of 24 expert analysts.

Kazakhstan Economic Data

Free sample report.

Interested in Kazakhstan economic reports, analysis and data? FocusEconomics provides data, forecasts and analysis for hundreds of countries and commodities. Request your free sample report now.

- Utility Menu

Kazakhstan Strategy and Policy

Kazakhstan's macro challenges ahead: a summary of the views.

Kazakhstan has achieved many of its goals by transforming itself into a market economy, unleashing the productive capacity of its citizens and creating the conditions for the country to benefit from international trade and investment. In addition, it has discovered large quantities of oil reserves that will allow it to sustain a tripling of oil production in the next two decades. The international experience suggests that oil wealth is notoriously difficult to manage. Several elements come in to complicate matters:

- Over-heating

- Dutch disease

- Rent-seeking

- Resource curse

The Government of Kazakhstan has stated that one of its priorities is the diversification of its economy. This represents a major challenge in light of the dynamics that oil wealth tends to create. An economic policy that is able to achieve diversification will have to use many of its limited degrees of freedom to achieve it. Hence, all policy instruments should be used.

This report is a collection of policy memos that deal with the choices the government faces going forward in the broad area of macroeconomic policies, including fiscal policy and institutions, monetary and exchange rate arrangements and policies, financial policies, industrial policy, trade policy and broad issues in institutional development.

Ensuring a Competitive and Stable Real Exchange Rate: A Macroeconomic Policy Strategy

Oil exporting countries tend to have strong and volatile real exchange rates that conspire against their ability to diversify the economy. Real exchange rate appreciation and its associated Dutch Disease have received ample attention. Less well known is the fact that a recurring feature of oil exporting economies has been a real exchange rate cycle associated with the ups and downs of oil revenues. The central bank and the government can fight what they deem to be unwarranted real appreciation through an arsenal of potential tools that include fiscal contraction, unsterilized intervention, reserve requirements, capital adequacy requirements, requirements on foreign borrowing and the regulation of pension funds.

On the Tenge: Monetary and Exchange Rate Policy

This memo discusses the determinants of the real exchange rate and discusses alternative options for the choice of monetary regime, such as floating exchange rates, fixed exchange rates, and various alternative nominal anchors for monetary policy (including the currently popular regime of inflation targeting). Two polar cases are rejected, as likely to turn out to be too constraining for Kazakhstan while a newly proposed regime, called Peg the Export Price (PEP) would accomplish the desired shifts in the terms of trade automatically. The goal would be to achieve the benefits of a nominal anchor, and yet remain robust with respect to changes in the terms of trade that an uncertain future could bring.

Monetary and Exchange Rate Policy: An Alternative View

Exchange rate and monetary policies in a country like Kazakhstan can be guided by many objectives, but there ought to be four priority goals: to provide a nominal anchor for the economy; to insulate the economy as far as possible against foreign nominal shocks, such as inflation in trading partners' economies or sharp movements in the nominal exchange rates of economies with which Kazakhstan is closely associated; to insulate the economy as far as possible against foreign real exchange rate shocks; and to allow the relative price non-tradables to rise as the role of oil in Kazakhstan's economy grows and the economy's purchasing power rises. The previous discussion suggests that a fixed exchange rate (even if the peg is to a basket) and a purely floating exchange rate (with no concern whatsoever for the course of the real exchange rate) are probably inappropriate policies for Kazakhstan. The objectives outlined above could in principle be achieved by one of the two regimes: A crawling exchange rate with wide bands around it or an inflation target married to a managed float. This memo explores these policy options.

Notes on an Industrial Strategy for Kazakhstan: The Growth Challenge

Developing countries confront two sorts of growth challenges. The first revolves around the problem of igniting growth. Luckily, this is not Kazakhstan's problem. The economy is growing rapidly and there is a foreign investment boom driven by oil discoveries. The second kind of growth challenge is that of sustaining growth. Comparative experience suggests that sustaining growth is usually harder than igniting it. Kazakhstan must meet this challenge if the country is to converge to the living standards that prevail in the advanced economies. The institutional transformations can be summarized under two headings: (i) institutions that provide resilience to shocks; and (ii) institutions that maintain productive dynamism.

Financial Sector Reform in Kazakhstan

Both in its scope and its achievements, the process of financial sector reform in Kazakhstan over the past few years has been remarkable. A decade of ambitious measures including banking consolidation, the provision of deposit insurance, the establishment of an independent regulator, and pension reform have led to a sharp rise in financial intermediation and a high degree of confidence in the banking system. These accomplishments have fetched rich dividends for the economy. However, recent developments also reveal that further and deeper reforms are required to consolidate and sustain the rapidly expanding financial sector as it seeks to support and facilitate an even larger and more diversified economy. This note examines a selected set of issues within the financial sector of Kazakhstan that might require reform, and makes related recommendations. The main issues that will be addressed in this note are as follows:

- Deposit insurance and the credit boom

- Foreign currency borrowings and reserve requirements

- Pension fund investment options

Kazakhstan Trade Policy

This memorandum deals with three related issues. The importance of integrating trade policies into Kazakhstan's overall economic strategy; the opportunities created by Kazakhstan's entry into the WTO; and Kazakhstan's regional trading arrangements.

Kazakhstan: Institutions

There is a long list of “Institutions” that common sense suggests would help a country grow. However, beyond the obvious (and some exceptions noted below), there is no evidence suggesting that some institutions are better than others. Though, the importance of institutions is a key lesson emerging from the analysis of market reforms in Latin America and Post Soviet economies there is little agreement amongst economists as to which institutions are deemed to be most relevant. Unfortunately, people at the World Bank, Davos, and others have to talk about institutions. This creates the false impression that there is some magic solution out there that countries should adopt. The evidence in favor of decentralization or raising wages to deter corruption – two institutional reforms that Kazakhstan is considering – is not great. In this spirit, Kazakhstan faces a challenging agenda for institutional reform. We must tackle the problem of institutional reform at two distinct conceptual levels: we can think of concrete rules and legislation that contain the workings of the economy - call this, institutions type 1 – or at a more general level, we can think of the belief systems that citizens have as containing the institutions and the market interactions – call this institutions type 2. This memo explores these two institutional types in more depth.

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( A locked padlock ) or https:// means you’ve safely connected to the .gov website. Share sensitive information only on official, secure websites.

- Search ITA Search

- Market Overview

- Market Challenges

- Market Opportunities

- Market Entry Strategy

- Agricultural Sector

- Education Services and Technologies

- Environmental Technologies

- Franchising

- Information and Communication Technologies

- Infrastructure

- Mining Equipment and Services

- Oil & Gas Equipment and Services

- Power Generation

- Transport and Logistics

- Trade Barriers

- Import Tariffs

- Import Requirements and Documentation

- Labeling/Marking Requirements

- U.S. Export Controls

- Temporary Entry

- Prohibited and Restricted Imports

- Customs Regulations

- Standards for Trade

- Trade Agreements

- Licensing Requirements

- Distribution and Sales Channels

- Selling Factors and Techniques

- Trade Financing

- Protecting Intellectual Property

- Selling to the Public Sector

- Business Travel

- Investment Climate Statement

Kazakhstan is the second-largest republic of the former Soviet Union, after Russia, and the ninth-largest country in the world in the territory. The country has an abundance of natural resources - including oil, gas, coal, uranium, and other mineral deposits - and has exploited these resources to build Central Asia’s leading economy. Kazakhstan is also emerging as a major transport and logistics hub in the region, linking the large and fast-growing markets of China and South Asia to those of Russia and Western Europe by road, rail and ports on the Caspian Sea. Kazakhstan presents a trade gateway to a market of about 100 million consumers in Caspian Sea countries, 76 million in Central Asia and 350 million in Western China. In addition, Kazakhstan boasts significant agricultural potential for grain and livestock production and U.S. companies are well positioned to help Kazakhstan diversify across this segment of the economy. With a growing middle class, Kazakhstan provides trade and investment prospects for U.S. firms seeking new opportunities in this growing, emerging market.

Since gaining independence in 1991, Kazakhstan has steadily worked to improve its business and investment climate. The Government of Kazakhstan realizes the need to implement transformative economic reforms to boost productivity and growth. Implementation of reforms has been uneven, however, and challenges remain in addressing problems related to the country’s competitiveness and economic diversification, its over-reliance on the extractive sector, corruption, inefficient bureaucracy, criminal liability for unintended tax infractions, and arbitrary law enforcement, especially at the regional and municipal levels.

2022 Kazakhstan Unrest and Reforms

In early January 2022, Kazakhstan was engulfed in mass protests that started over fuel price increases and escalated into violent protests across the country, especially in Almaty. Subsequent dismissals and arrests of top government officials close to the family of former president Nursultan Nazarbayev were signs of a significant shift of power within the political elite from Nazarbayev to current president Kassym-Zhomart Tokayev. Rather than slowing down the momentum for reforms, the January events have in fact achieved the opposite, with President Tokayev proposing a Reform Agenda of robust economic, political, and social reforms.

Following the unrest, President Tokayev promised a new democratic order, organizing the first referendum in 27 years, to approve constitutional changes aimed at limiting presidential powers in favor of the parliament and implementing significant decentralization. Another important development was Tokayev’s push for the repatriation of offshore illegally acquired assets and redemption of about $473 million back into the country.

The next phase of reforms will have to confront some of Kazakhstan’s systemic and structural economic challenges to achieve currency stability, manage inflation, reduce income inequality and state’s involvement in the economy along with greater diversification, privatization, digital and green transitions.

Civil society is watching closely the issue of whether the rhetoric will continue to live up to reality as President Tokayev proceeds to convey his preoccupation with improving the living standards, eliminating income gaps, and creating jobs and decent labor conditions.

War in Ukraine

Kazakhstan is striving to extricate itself from the shadow of Russia’s war on Ukraine and ensure financial and economic stability. The reinvasion of Ukraine by Russia, and subsequent Western sanctions levied against Russia and Belarus, are having significant repercussions in Kazakhstan, a member of the Eurasian Economic Union (EAEU) with a long border and extensive trade and economic relations with Russia.

At the time of this writing. the Kazakhstani currency (tenge) has lost value due to the volatility of the Russian ruble. Kazakhstan has also been burdened by the measures taken to comply with Western sanctions on Russia. The bulk of Kazakhstani energy is exported to and through Russia: with about 80 percent of all oil produced in Kazakhstan’s western oilfields being exported through southern Russia via the Caspian Pipeline Consortium (CPC). The majority of imports and exports traditionally have been transported through Russia and/or Belarus, with major supply chain disruptions due to Western sanctions and Russian/Belarusian responses. The situation between Russia and Ukraine also affects the country’s investment attractiveness.

Nevertheless, Kazakhstan, a state historically under Russian influence, now pursues a complex balancing multi-vector foreign policy to diversify its economic corridors. This involves seeking support from the U.S. and the EU to contribute to strengthening Kazakhstan’s economic position and national independence in a region stuck between a revanchist Russia and an assertive China.

Kazakhstan’s president Kassym-Jomart Tokayev told Russian President Vladimir Putin during a public panel at the St. Petersburg International Economic Forum that his country would not recognize the “quasi-states” of the Donetsk and Luhansk “peoples’ republics” in eastern Ukraine. Kazakhstan will not help Russia evade sanctions, emphasizing its obligation to the international community.

Besides strong political commitment to building a solid reputation as the strongest, most stable and reform-oriented economy in Central Eurasia, Kazakhstan still faces slow productivity growth, wealth inequality, rising living costs, limited job opportunities, and weak institutions. There is still a need to take a stronger stand against corruption, improve the rule of law, and increase competition and private sector growth.

Key Statistics and Economic Indicators

Kazakhstan has an export-oriented economy that is highly dependent on shipments of oil and related products (58 percent of total exports). In addition to oil, its main export commodities include natural gas, ferrous metals, copper, aluminum, zinc and uranium. It counts China, Italy, Russia, the Netherlands, Uzbekistan, India, Turkey, and France as its main export destinations. Others include Switzerland, Greece, Spain, Romania, and South Korea. The United States accounts for 1.1 % of Kazakhstani exports.

Kazakhstan’s imports from the United States totaled $1.12 billion in 2020, according to the United Nations COMTRADE database on international trade as of July 2022. The main imports from the U.S. in 2020 were machinery, nuclear reactors and boilers (25 percent), electrical and electronic equipment (8.8 percent), vehicles (6.1 percent), articles of iron and steel (6 percent), pharmaceuticals (4.1percent), mineral fuels and oil (3.5 percent), plastics (3.3 percent), aircraft parts (1.9 percent) and other.

A sharp increase in global oil prices substantially improved Kazakhstan’s trade balance and reduced the current account deficit to 3 percent of GDP in 2021 (from 3.8 percent in 2020). FDI inflows and higher foreign borrowing by state enterprises financed this deficit.

Spillovers from Russia’s economic collapse will disrupt Kazakhstan’s supply chains, weaken trade flows and dent its growth prospects, according to the World Bank. Real GDP growth is expected to be 3.5-4.0 percent in 2023. Trade disruptions, lower business confidence, and increased currency volatility will also lower growth, as will March storm damage at the Russian Black Sea terminal of Kazakhstan’s main oil pipeline, the CPC, , through which about 80 percent of Kazakhstan’s oil is exported.

Despite the ongoing global challenges, Kazakhstan’s economy grew by 4.6 percent between January and May this year, and remains the largest economy in Central Asia and a country with much unfulfilled potential.

The country remains the world’s largest producer of uranium and possesses enormous deposits of a wide range of metals, including gold, iron, chrome, copper, zinc, vanadium and rare earths. Kazakhstan also has the second–largest oil reserves and the second–largest oil production after Russia among the former Soviet republics. The United States is among the largest foreign investors in Kazakhstan, with the bulk of investment directed in the oil & gas industry.

Launched in 2018, the Astana International Financing Center (AIFC) offers special tax, visa, and employment regimes for companies looking to invest in this middle-income market. The AIFC Court and International Arbitration Center (separate and independent from the Republic of Kazakhstan judicial system) provide a common law court system for the resolution of commercial disputes. AIFC is also actively involved in developing green finance and a green bonds market in the country, as well as other sustainable development programs.

A growing middle class and a rise in real incomes have increased demand for quality products and brand names. Inexpensive Russian and Chinese goods flow across Kazakhstan’s borders, but Western goods and expertise are also in demand. In some cases, consumers are willing to pay more for imported goods and services that offer higher quality and innovation. Customer service in Kazakhstan is sometimes lacking; providing customers with after-sales service could give businesses an edge in the market.

The country has much to build on: experienced leaders interested in taking Kazakhstan to the next level; an economy with unfulfilled potential that continues to deliver sustained growth, despite its failings; a developing civil society eager to assist in the reform process; large land area with potential for development of agriculture and renewable energy; a geographical position that places it in the crossroads of regional transportation, and a young, dynamic, and educated work force.

New Opportunities Revealed by the COVID-19 Pandemic

While upending the economy in 2020, the COVID-19 crisis has also revealed opportunities in Kazakhstan. In particular, the crisis has placed a renewed focus on logistics, digital technologies, and the financial sector. According to KPMG’s report on the Impact of COVID-19 on Key Economic Sectors in Kazakhstan, among the most pressing needs are: use of e-platforms to deliver key public services (including remote education to rural areas); online trade solutions; cargo transportation; development of digital products in the financial sector; IT solutions to track productivity of remote work; modernization of telecommunications networks due to high workload; financing and investments in airports and capital-intensive projects in mining and agriculture among others.

Overseas Security Advisory Council (OSAC)

The Overseas Security Advisory Council’s mission is to promote security cooperation between American business and private sector interests worldwide, and the U.S. Department of State. OSAC, which falls under the Bureau of Diplomatic Security, is an active partner of American businesses and universities, helping them to remain competitive and secure in a global environment through the dissemination of vital security-related information. The Council, established in 1985 under Secretary of State George Shultz, is made up of 34 private sector and four public sector member organizations that represent specific industries or agencies that operate abroad. The more than 4,600 U.S. companies and organizations affiliated with OSAC receive the tools needed to cope with security-related issues abroad. The Mission Kazakhstan OSAC Country Committee is an overseas extension of OSAC and provides a forum for effective communication between U.S. Embassy Nur-Sultan/U.S. Consulate General Almaty and the U.S. private sector in Kazakhstan. The Mission Kazakhstan OSAC committee is one of over 150 OSAC Country Committees operating globally.

Objectives:

- Establish continuing liaison and provide for operational security cooperation between State Department security functions and the private sector

- Provide for regular and timely interchange of information between the private sector and the State Department concerning developments in the overseas security environment

- Recommend methods and provide material for coordinating security planning and implementation of security programs

- Recommend methods to protect the competitiveness of American businesses operating worldwide.

OSAC created Sector Committees to provide U.S. private sector organizations a networking platform for discussing security issues and challenges unique to their industry or community:

- Media & Entertainment

- Faith Based

- International Development/NGOs

- Hotel and lodging

For more information about OSAC please visit www.OSAC.gov. For U.S. companies with a presence in Kazakhstan interested in joining the U.S. Mission Kazakhstan OSAC Country Committees in Atyrau, Almaty or Nur-Sultan, please contact [email protected] .

Special American Business Internship Training Program (SABIT)

A global technical assistance program housed in the U.S. Department of Commerce, SABIT promotes free, fair, and reciprocal economic relationships between the United States and Kazakhstan. The program builds partnerships and provides opportunities for mid- to senior-level business leaders from transitioning countries to see, first-hand, U.S. business practices. The program’s worldwide alumni network of almost 7,000 leaders from the business, community, and scientific organizations all over the world use their SABIT training to create better business climates for trade and investment and are predisposed to work with American companies. More than 470 of these leaders are from Kazakhstan.

The SABIT training is industry-specific and is developed closely with the U.S. private sector, facilitating high-level meetings with U.S. companies, industry associations, educational institutions, et al. These meetings provide a forum where U.S. organizations share innovative leadership ideas with the delegates and showcase their technologies, equipment, and services. The program links American companies with foreign partners and aids both in the development of new relationships and strengthening of existing ties. Programs focus mainly on the private sector, but government officials often participate as well, allowing U.S. companies important access to decision-makers in complex markets.

The U.S.-based training programs generate significant diplomatic and commercial results by assisting American organizations in creating new relationships and strengthen existing ties with foreign partners and customers. The linkages formed through SABIT also serve as a basis for new business development and lead to tangible results. For example, the program has generated more than USD1 billion in U.S. exports to Eurasia alone since its inception in 1990. This represents a return on investment of 14-to-1.

Starting in 2021, the SABIT program in Central Asia focuses solely on promoting the development of Renewable Energy sources in the region. Due to the pandemic, SABIT holds online webinars for local companies and government representatives on Wind and Solar Power generation, Energy Market Design and other topics partnering with American associations and the private sector. For more information on the SABIT Program, please visit: https://www.trade.gov/sabit .

Political & Economic Environment: State Department’s website for background on the country’s political environment

Official website of the

President of the Republic of Kazakhstan

- State of the nation address

Strategies and programs

The Strategy for development

“Kazakhstan-2050” Strategy”

In December 2012, in his State of the Nation Address, the Head of State presented the Development Strategy of the Republic of Kazakhstan until 2050. The Strategy’s main goal is to create a welfare society based on a strong state, a developed economy with universal labor opportunities, as well as to enter the club of top 30 most developed countries of the world.

To achieve this goal, the “Kazakhstan-2050 “Strategy” provides implementation of seven long-term priorities:

1. Economic policy of the new course – all around economic pragmatism based on the principles of profitability, return on investment and competitiveness.

2. Comprehensive support of entrepreneurship – leading force in the national economy.

3. New principles of social policy – social guarantees and personal responsibility.

4. Knowledge and professional skills are key landmarks of the modern education, training and retraining system.

5. Further strengthening of the statehood and development of the Kazakhstan democracy.

6. Consistent and predictable foreign policy is promotion of national interests and strengthening of regional and global security.

7. New Kazakhstan patriotism is basis for success of our multiethnical and multi-confessional society. Read the full text of the Strategy here:

The Strategy for development of the Republic of Kazakhstan until the year 2030

In October 1997 the President of the Republic of Kazakhstan in his Address to the people of the country «Prosperity, security and ever growing welfare of all the Kazakhstanis» presented the Strategy for development of the Republic of Kazakhstan until the year 2030. The "Kazakhstan-2030" Strategy outlined a long-term way of development of the sovereign republic, directed at transforming the country into one of the safest, most stable, ecologically sustained states of the world with a dynamically developing economy.

The "Kazakhstan-2030" Strategy for development provides implementation of seven long-term priorities :

- National security.

- Domestic political stability and consolidation of the society.

- Economic growth based on an open market economy with high level of foreign investments and internal savings.

- Health, education and well-being of kazakhstani citizens.

- Power resources.

- Infrastructure, more particularly transport and communication.

- Professional state.

These priorities served as a basis for building country’s development plans for medium-term and long-term periods. The Strategic plan for development of the Republic of Kazakhstan until the year 2010, approved by the Decree of the President of the Republic of Kazakhstan in December, 2001 became the first long-term stage of implementation of the "Kazakhstan-2030" Strategy. The next stage of implementation of the "Kazakhstan-2030" Strategy is the Strategic plan for development of the Republic of Kazakhstan until the year 2020.

Download program’s full description

National projects of the Republic of Kazakhstan:

1. The pilot national project "Comfortable School";

2. The pilot national project "Modernization of Rural Health":

3. The pilot national project “Accessible Internet”.

February 9, 2015

President Nursultan Nazarbayev signed the Law of the Republic of Kazakhstan “On introducing amendments and additions to the Labour Code of the Republic of Kazakhstan” aimed at providing employment guarantees and social support of youth.

Head of State addressed the Kazakhstan-Singapore Business Forum

May 23, 2024

June 9, 2021

On further measures of the Republic of Kazakhstan in the field of human rights

Kazakhstan’s Economy

Oct 01, 2014

560 likes | 2.44k Views

CONFIDENTIAL. Kazakhstan’s Economy. By H.E. Yerlan Abildayev Ambassador Embassy of Kazakhstan in Canada 2011. OVERVIEW OF KAZAKHSTAN. Political status: Republic Area of land : 2.7 million sq.km Capital city : Astana Population : 16.3 million (2009)

Share Presentation

- development

- fdi inflows

- 5 bln tenge

- oil gas sector modernization

Presentation Transcript

CONFIDENTIAL Kazakhstan’s Economy By H.E. Yerlan Abildayev Ambassador Embassy of Kazakhstan in Canada 2011

OVERVIEW OF KAZAKHSTAN • Political status: Republic • Area of land: 2.7 million sq.km • Capital city: Astana • Population: 16.3 million (2009) • GDP/GDP per capita: USD 146 bln/USD 8,9 (2010) • GDP growth: 9.0% p.a. (2003-09) • Main religions: Islam, Russian Orthodox • Main languages • Kazakh (state language): 64% • Russian (official/business language): 95% • Key ethnic groups • Kazakh: 67.0% • Russian: 26.8% • Ukrainian: 3.7% • Uzbek: 2.5% • Currency: Tenge (KZT; USD 1 = ~ KZT 146) Source: EIU country profile

Astana City

Palace of Peace and Reconciliation ("The Pyramid of Peace”)

Almaty City at Zailiyski Alatau Mountain foothill

Executive Summary After a decade of exceptionally strong economic growth and development, Kazakhstan’s ability to withstand shocks hasbeen tested since the onset of the global liquidity crisis in 2007. Against expectations by many, appropriate policyresponses and strong financial ratios have enabled Kazakhstan, which was identified as being among the worst affected,to avoid a severe banking crisis with a run on deposits, a currency crisis and depletion of FX reserves and a recession. The government’s key priorities for the next two years include the stabilisation of the financial sector, supporting the small and medium sized enterprise (SME) sector, develop the agro-industrial sector and the real estate market, advancing the diversification of the economy, boosting employment and supporting socially vulnerable groups of the population. • External liquidity position strengthened in the beginning of 2010 as a result of improved balance of payments dynamics. Due to comfortable export prices and continuous FDI inflows in 2010, the current account of balance of payments is positive. • Long-term prospects remain good given Kazakhstan’s vast endowment of natural resources and the government policies to support the economy’s diversification through infrastructure development and improvements to the business environment.

Resilient fundamentals supported by a strong sovereignbalance sheet… Key macroeconomic indicators 2003 2004 2005 2006 2007 2008 2009 2010 GDP growth rate (% change oya) 9.3 9.6 9.7 10.7 8.9 3.3 1.2 7.0 Per capita GDP (US$) 2,070 2,870 3,770 5,290 6,772 8,514 6,496 8,978 Current account (% GDP) (0.9) 0.8 (1.8) (2.4) (7.8) 5.2 6.3 2.95 Trade balance (% GDP) 11.9 15.7 18.1 18.1 14.4 25.1 13.8 19.7 Exports of goods (US$ bln) 42.9 47.7 49.5 47.9 46.1 54.4 43.1 60.0 International reserves (US$ bln) 5 9.3 7.1 19.1 17.6 19.4 18.6 28.0

…and a government’s broad ranging Anti-Crisis Plan tolimit the extent of the economic slowdown • Total anti-crisis funds allocated amount 3029bln tenge (20.2bln. USD), including: • Anti-crisis measures on 5 directions – 1 691bln tenge (11.3bln USD) • Reduction of minimal reserve requirements – 490bln tenge (3.3 bln. USD) • Reduction of tax pressure -500bln tenge (3.3 bln. USD) • Implementation of new plan of further modernization of economy and realization of employment strategy (Road Map) - 348bln tenge (2.3 bln. USD)

Outstanding and diverse natural resource wealth supports long-term growth prospects • The country holds about 3.2% of the world’s total proven oil reserves. Overall prospective resources are estimated at between two and three times the size of proven reserves - Over the next decade, Kazakhstan is expected to double oil production on the back of higher production at the Tengiz field and launch of the Kashagan field, which is the fifth largest in the world by reserves • The republic holds 1.4% and 3.4% of the total world reserves of natural gas and coal, respectively. • Kazakhstan possesses all known useful minerals including major deposits of ferrous and non-ferrous metals, uranium and gold • Kazakhstan is also a significant exporter of grain, ranking among the world’s leading ten exporting countries

New measures of the Government for the industry development The Program of forced industrial-innovative development of Kazakhstan for 2010-2014 (PFIID) • Main goal of PFIID – maintenance of diversification and competitive recovery of Kazakhstan • economy for a long period • PFIID Objectives: • - consolidation of business and government effort and concentration of state resources on • development of priority sectors of economy; • forming of favorable macroeconomic and investment climate and forming of efficient institutions andmechanisms of government and business interaction • Within the framework of PFIID the Industrialization Map is being implemented • In present the preliminary portfolio of 115 investment projects with amount of 11,26 trln. tenge hasbeen selected. • Expected results: • sustained pace of economic development with the annual EVA growth approx. to 50% • - competitive recovery of economy and structural shifts in economy and industry in benefit to • productions with high-technological products and high added value • - improvement of growth rates of working efficiency and shifts in the structure of GDP with increase ofshare of manufacture up to 14,5% 13

Largest projects of Industrialization Map Agriculture: Construction of grain elevator complex in Mangystau oblast, 7bln. tenge 1 Construction industry and production of construction materials: Construction ofcement plant in EKO, 19.5 blntenge 2 Oil processing, infrastructure of oil & gas sector: Modernization and reconstruction ofAtyrau Oil processing plant, 395 bln. tenge 3 Metallurgy and production of finished metal products: Reconstruction of Tarazmetallurgy plant, 12 bln. tenge 4 Chemical and pharmaceutical industry: Construction of Gas-Chemical complex inAtyrau oblast, 945 bln. tenge 5 Energy: ConstructionofBalkhash thermal power-station, 375 bln. tenge 6 Transport and telecommunication infrastructure: Reconstruction of “Astana- Schuchinsk” automobile road, 114 bln. tenge 7 Others: Locomtive-assembly plantiin Asana, 21 bln. tenge In purpose of realization of industrial, innovative, infrastructure projects it is projected to attract creditlines of “Eximbank” of China and China Development Bank in amount of $ 13 bln. and “Vnesheconombank” of Russia in amount of $3 bln. 14

Multi- annual foreign investment projects ensures sustainability of FDI inflows despite the global crisis • Kazakhstan has become a regional leader in attracting FDI, with the EU and the US amongst the largest investors in the country. Overall FDI in January – September 2010 - 13 bln USD • FDI inflows have become increasingly diversified, flowing into various non-oil sectors of economy such as metallurgy manufacture and financial sector. • Despite the crisis FDI inflows will continue to come into projects of oil & gas sector development.

Creation of a Customs Union Perspectives of Customs Union (CU) in framework of EurAzEC • Increase of trade turnover between countries (Belarus, Kazakhstan and Russia). For local enterprises the market will expand to around 170 mln people. • 2. As a result of unification of customs tariffs on goods from third countries, the weighted average tariff almost doubled. This will promote the decrease of reliance on imports. • This will give the chance to Kazakh goods to penetrate the markets which were firmly occupied by goods from third countries (particularly, from China) due to the difficulty of price competition. • 3. Improving the investment and business climate in Kazakhstan (lower VAT, employment taxes) should help to secure foreign inflows to non-oil sectors aimed at common market. • 4. The customs union will be a stimulus for cooperation of complementary enterprises and creation of vertically-integrated corporations in Russia, Belarus and Kazakhstan. • 5. Unification of tax tariffs will lead to its growth for Kazakhstan, and with additional investment attracted would lead to increase state budget revenues

Kazakhstan’s Top 10 Trade Partners in 2010 • Countries Export (mln USD) Import (mln USD) • Russia 4820,4 11006,2 • China 10122,1 3964,5 • Italy 9576,8 1580,6 • France 4433,1 501,3 • Netherlands 4161,0 301,8 • Germany 1749,7 1828,2 • Austria 2528,7 222,2 • Canada 2439,1 217,2 • USA 868,1 1313,1 • Britain 1379,5 724,7 • Turkey 1234,8 616,3

THANK YOU… 18

- More by User

Kazakhstan D rylands Management Project’s Objectives

Kazakhstan D rylands Management Project’s Objectives. Project Background. Kazakhstan inherited one of the greatest agricultural challenges of the post Soviet republics: dry lands, around 180 mln hectares, previously being used as pastures and rangelands, are degrading. . Project Background.

280 views • 21 slides

DOING BUSINESS IN KAZAKHSTAN

DOING BUSINESS IN KAZAKHSTAN. MARCH 2014, DUBAI. GDP Growth Comparison . Sector Contribution to GDP. Oil & Gas. Proven oil reserves ( bln bbl). Kazakhstan oil production ( mln tons). 38.9. Oil & Gas. Largest contributor to the GDP 25%. 54% of FDIs.

834 views • 13 slides

Kazakhstan : NEW OPPORTUNITIES FOR INVESTMENTS

Kazakhstan : NEW OPPORTUNITIES FOR INVESTMENTS. April 14, 2011 Zurich, Swiss Confederation. Agenda. Why Kazakhstan is attractive for investors? II. Investing in K azakhstan Contact details. Why Kazakhstan is attractive for investors. 1. Natural Resources

465 views • 27 slides

KAZAKHSTAN OIL & GAS SECTOR

KAZAKHSTAN OIL & GAS SECTOR. Introduction to the above. Introduction. Kazakhstan has made significant economic progress in the relatively short time since independence from the Soviet Union.

427 views • 7 slides

Lecture 1 Introduction in the history of Kazakhstan Kovtun O.A-senior teacher

KARAGANDA STATE MEDICAL UNIVERSITY Department: History of Kazakhstan and social-political disciplines. Lecture 1 Introduction in the history of Kazakhstan Kovtun O.A-senior teacher of department’s History of Kazakhstan and SPD . “Golden man”-is symbol of Independent Kazakhstan.

743 views • 20 slides

Korea-Kazakhstan Industry & Tech Cooperation

Korea-Kazakhstan Industry & Tech Cooperation . Two. Map. CONTENTS . o Introduction o Trade Landscape o Investment Landscape o Industrial & Tech Tie-Ups by Sector o Conclusion. Introduction. Introduction . □. •. □. Kazakhstan.. . Korea .. . 3 . Introduction. □. Kazakhstan.. .

345 views • 18 slides

Concept Transition of the Republic of Kazakhstan to Green Economy

Concept Transition of the Republic of Kazakhstan to Green Economy. Ministry of Environment and Water Resources of the Republic of Kazakhstan April 10-12 , 2014. Existing key sectors of economy targets extended with transition to the Green Economy. Additional targets. Sector.

367 views • 8 slides

Republic of Kazakhstan

Republic of Kazakhstan. President of the Republic of Kazakhstan N ursultan Nazarbaev

468 views • 24 slides

Role of University Rankings in Kazakhstan

Role of University Rankings in Kazakhstan. Prof . Sholpan Kalanova. BRATISLAVA 2011. Kazakhstan’s Higher Education System. Source : Agency of Statistics of the Republic of Kazakhstan. 2010 – Joining the Bologna Process. Kazakhstan’s Higher Education System.

403 views • 17 slides

Independent Kazakhstan: way forward

Independent Kazakhstan: way forward. Kazakhstan entered to the third millennium with a population of 14.8 million people. It’s territory spreads

609 views • 14 slides

13 th Kazakhstan International Exhibition - TOURISM & TRAVEL

13 th Kazakhstan International Exhibition - TOURISM & TRAVEL. POST SHOW REPORT. 24 – 26 April 2013 Almaty , Kazakhstan , IEC « Atakent » Pavilions 10 & 11. Official Opening Ceremony took place at 11.00 at the central entrance of Pavilion 10 on the 24 th of April.

293 views • 8 slides

KAZAKHSTAN STOCK EXCHANGE INC.

KAZAKHSTAN STOCK EXCHANGE INC. Tallinn 2007, May 13–14. YOUNG AND SINGLE. KASE was established at November 17, 1993 under the name of Kazakh Interbank Currency Exchange, two days after the launching of tenge – new legal tender of Kazakhstan.

570 views • 28 slides

The Role of Italy in the Development of Kazakhstan-EU Energy Relations

The Role of Italy in the Development of Kazakhstan-EU Energy Relations. EUCE Conference at UVic - July 16-18 Presenter: Lyailya Nurgaliyeva PhD candidate Kyushu University. Contents. Purpose of the research Impact of Kazakhstan into European energy security

234 views • 10 slides

H.E. Mr. Akylbek Kamaldinov Ambassador of the Republic of Kazakhstan in Japan

H.E. Mr. Akylbek Kamaldinov Ambassador of the Republic of Kazakhstan in Japan. Factors of attractiveness of the investment climate in Kazakhstan. “NATIONAL EXPORT AND INVESTMENT AGENCY “KAZNEX INVEST” JSC Ministry of Industry and New Technologies of the Republic of Kazakhstan. KAZAKHSTAN.

393 views • 15 slides

Istanbul Forum Country Exercise: Kazakhstan

Istanbul Forum Country Exercise: Kazakhstan. Key issues. From natural resources (oil & gas) to knowledge R&D basis declining Weak links between publicly funded R&D and local industry. How does Kazakhstan compare to other countries with respect to these issues?.

268 views • 10 slides

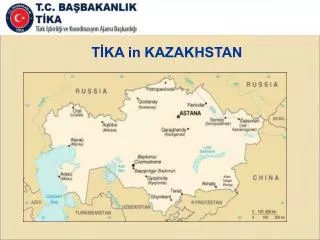

TİKA in KAZAKHSTAN

TİKA in KAZAKHSTAN. GENERAL OVERVIEW. TIKA focuses on capacity building projects in Kazakhstan, through bilateral and regional training programmes for experts and bureaucrats. More than 1.000 Kazakh experts were trained in Turkey in the last 10 years.

344 views • 13 slides

Agency on statistics of the Republic of Kazakhstan

Agency on statistics of the Republic of Kazakhstan. National MDG progress report in Kazakhstan. BRIEFLY ABOUT KAZAKHSTAN. Kazakhstan is located on a joint of two continents : Europe and Asia . The territory i s 2,7 mln . km 2 . By territorial size Kazakhstan ranks 9th in the world.

527 views • 19 slides

Kazakhstan Investment Conference San Diego, California 9 September 2005

Kazakhstan Investment Conference San Diego, California 9 September 2005. Investing for Kazakhstan’s Future Power Needs: The AES Corporation Experience 1996 - 2005. Dale W. Perry Vice President, AES Corporation Regional Director Kazakhstan, Russia and Central Asia. Growth Prospects.

318 views • 19 slides

Energy sector of Kazakhstan Zhakupova M.S.

Energy sector of Kazakhstan Zhakupova M.S. Energy sector of Kazakhstan. United Energy System (UES) of Kazakhstan represents a part of the utited power grid the former USSR; UES of Kazakhstan consist of three zones: - Northern, Southern and Western;

638 views • 31 slides

Challenges and Changes: Kazakhstan Through Eyes of World Bank

David Knight

This interview was originally published by Astana Times on March 14, 2024.

Thirty-two years ago, Kazakhstan began an unprecedented journey. As the country embraced independence from the USSR, its economic system, like those of other former Soviet republics, began to experience radical change. Fast forward to today and Kazakhstan is a world player in the oil trade, a growing force in the trade of rare earth minerals and a burgeoning source of fintech.

The road that Kazakhstan traveled to reach the success of 2024, however, was far from easy. It required strategic thinking, calculated risks and sometimes painful changes. The World Bank played a crucial supportive role as the country sought to create an independent free market economy. The organization continues today to be a strategic partner for Kazakhstan. We spoke with David Knight, the lead country economist of the World Bank for Central Asia. Knight, with contributions from his colleagues Natasha Sharma, Azamat Agaidarov and Henry Aviomoh, was kind enough to provide a detailed analysis of Kazakhstan’s current challenges and future opportunities in an in-depth interview.

The World Bank’s projects in Kazakhstan

In reflecting on significant projects that the World Bank has undertaken in Kazakhstan in recent years, Knight noted that the bank’s partnership in Kazakhstan spans more than 30 years and is guided by the Kazakhstan Country Partnership Framework (CPF) 2020-2025.

“The WBG includes the International Bank for Reconstruction and Development (IBRD), the International Finance Corporation (IFC) and the Multilateral Investments Guarantee Agency (MIGA). Our support and interventions are informed by the government’s priorities and our analytical work, including through our Joint Economic Research Program (JERP), which informs the government’s economic and social development reform agenda, and has been in place for over 20 years. Since engaging in Kazakhstan, IBRD has supported 50 projects with over $8 billion,” he said.

Today, the bank has six active projects focused on areas such as connectivity, water systems, innovation and technology, landscape management and restoration, and education modernization.

“These projects are already showing tangible results,” Knight added.

Some highlights include the 1,600 kilometers of road constructed along an International Transit Corridor from Western Europe to Western China to facilitate trade and logistics, which has also strengthened local connectivity. Agricultural investments have resulted in 76,000 hectares of irrigation and drainage services being improved and the development of 700 kilometers of lined canals. IBRD and the IFC have supported around 250,000 small and medium enterprises to deploy innovative technology.

Other projects included institutional support to tax administration and the justice sector. IFC’s focus on private sector solutions to address development challenges has seen a portfolio of over $257 million. Examples of partnerships include helping the government to structure a public-private partnership to develop the Almaty Ring Road (BAKAD) and the construction of a new terminal at Almaty Airport.

Meanwhile MIGA’s focus on providing guarantees has been instrumental in facilitating private investment into rail. In 2023, MIGA issued a guarantee of more than $500 million to the National Railway Company Kazakhstan Temir Zholy (KTZ) to help access long-term international commercial financing at favorable terms, which is expected to increase the reliability of railway services and track network and improve safety.

Knight emphasized that the World Bank plays a role beyond economic support.

“But the Bank’s contributions are not just about financing, and we are importantly a ‘knowledge bank.’ We have, and will continue to, leverage our deep global experience and long presence in Kazakhstan to provide policy-relevant analysis and ideas and engage in dialogue to support a successful and ambitious reform agenda in Kazakhstan. For example, last year, our Country Climate and Development Report supported the government’s preparation of the Low Emissions Development Strategy in Kazakhstan while our Country Economic Memorandum, Dependence | Distance | Dispersion, mapped out a chart for feasible economic development. JERP analysis has supported the drafting of a new Investment Policy Concept, the Concept of Local Self Governance, a new Law on the Development of Agglomerations, and a new methodology for setting the minimum wage to name just a few,” he said.

Priorities for private sector-led growth and societal development

When asked about the priorities that need to be addressed by the new government and how Kazakhstan can handle internal challenges, Knight said the priorities for growth differ from country to country, depending on the specific context and comparative advantages.

“For Kazakhstan, the focus should be on unleashing the dynamic and innovative forces of the private sector to lead the way, with the public sector taking a back seat by facilitating this growth, rather than directing it,” Knight explained. “In practice this means reducing the state’s footprint in competitive, economic sectors and upgrading the regulatory framework for state-owned enterprises to ensure a level playing field and encourage the private sector to thrive, which in turn can create new sources of jobs. Business support policies, and industrial policy more generally, can and should play a role in Kazakhstan’s development trajectory but it must play second fiddle to the private sector and be carefully designed to reinforce economically viable activity and not to provide ‘life support’ for dead-end sectors of the economy. This applies especially to the financial sector, where prevalent government subsidies currently distort the market and undermine the powerful role it can play in growth. Upgrading and liberalizing international trade in goods, services, and in digital spaces will be critical for identifying new growth and export opportunities in Kazakhstan.”

Knight not only commented on economic factors but also considered societal issues. Literacy rates are needed to operate successfully in a modern world economy.

“This is a critical area to address because a highly skilled workforce increasingly becomes the most important asset of a country as it strives to reach high-income status,” he said.

Between 2012 and 2022 Kazakhstan made progress in strengthening various aspects of governance, including control of corruption and government effectiveness.

Knight noted that while Kazakhstan has made progress in strengthening its social protection system, there are further steps that can be taken.

“For example, as the government moves to phase out fossil fuel subsidies, the financial capacity of the housing utilities program, a local government social protection program, could be strengthened. Greater means-testing and climate vulnerability mapping can help to improve the targeting and coverage of social protection programs for the poorest and most vulnerable. Partnership with the WBG can help in all these areas through access to our global knowledge and expertise, policy reform, and new investments. Furthermore, complementary support from the IFC and MIGA in facilitating high-value private sector investments in priority areas can have a big impact too,” he said.

Diversification of economy

Kazakhstan’s efforts to diversify its economy have some challenges. Over the last two decades, the composition of exports has continued to be dominated by petroleum exports, and services trade as a share of GDP declined over this period.

“We advise that, rather to focus on specific sectors, to seek to diversify the country’s assets, as set out in the report, Diversified Development, to sustainably shift the country’s capabilities beyond a narrow focus on natural resources. The decarbonization agenda can also support economic diversification. A commendable Low Emissions Development Strategy is in place which now requires action to ensure implementation. Taking tangible steps towards carbon pricing, making the emissions trading system functional, investing in renewable energy, and deploying new technologies could have substantial payoffs for the country. In this sense, decarbonization can be seen as a new driver for economic growth to support new technologies and innovation, which will require the state to play an enabling role,” he said.

Knight shared his opinion on the goal, set by the government of Kazakhstan, of doubling the country’s GDP in the upcoming five years.

He noted, “The government target towards doubling the GDP will entail growing at 6 percent, in real terms, every year for five years. This is a very ambitious goal, which few countries have achieved. But even if Kazakhstan does not reach this goal, it is a laudable ambition and can be a call to action to make the radical and brave reforms necessary to raise growth and sustain this improved performance. We have already highlighted the three areas where Kazakhstan needs to make progress – enterprise and dynamism with the state facilitating greater innovation and research, human capital and social mobility, and the decarbonization agenda which can support new markets and diversification. With commitment and concerted action, a lot can be achieved in five years to move Kazakhstan back onto the trajectory to high-income status,” he said.

According to the expert, what is most important, and can be done quickly, is to develop and implement a new generation of structural reforms that tackle the biggest constraints to growth.

“Moving towards decarbonization requires a new mindset and for industrial players to refocus their efforts on clean and greener technologies. Developing human capital is a longer-term endeavor but is one that is important to focus on, nevertheless. Re-engineering the role of the state, from SOEs and direct intervention to oversight and incentives, is critical to unleash the private sector and create jobs. Many of these reforms will be tough and encounter opposition by some groups. But evidence suggests that this is what is needed for the betterment of the country, and ultimately, in the interests of all,” he said.

Cooperation with the Kazakh government

Knight noted that The World Bank works closely with the authorities to identify and support transformational projects in the joint priority areas. The program in Kazakhstan builds inclusive growth and the transformation of Kazakhstan into a modern society with a more effective system of public administration and a knowledge-based, diversified, and private-sector driven sustainable economy.

“Working with the government, we have developed a pipeline of new projects that support reaching high-income status with decarbonization and broad-based benefits for the population. The WBG works on the principle of the ‘cascade,’ which means that our support should leverage far greater amounts of financing from the private sector in priority areas. The types of investments that Kazakhstan needs requires more than the government and international financial institutions can provide,” he added.

However, facilitating private financing requires having an enabling environment for the private sector, where distortions are removed and a level playing field is in place.

“We currently have two new projects that are in the final stages of preparation. The Kazakhstan Digital Acceleration for an Inclusive Economy Project (DARE) will support equitable access to high-quality, affordable broadband infrastructure in remote areas and help to accelerate economic diversification and improved access to services. The Inclusive and Sustainable Economic Growth Development Policy Operation supports reforms in the economy to achieve tangible results, against which we provide direct financing to the government budget. Key areas of reform are related to the green energy transition, developing more competitive markets, and promoting inclusion. Looking ahead, we are committed to working in partnership with the government to develop new projects which can bring innovative and global best practice solutions,” he said.

Vision for future

Finally, when asked about vision for the future of Kazakhstan for the next five years, Knight stated that their vision for Kazakhstan is one in which people are increasingly empowered – to take risks, start businesses, invest in high potential enterprises, and to seek and gain opportunities to improve their skills and find jobs.

“This increasingly dynamic churn will spur innovation and productivity in new sectors of the economy. With new innovative firms entering the market, other firms may fail – this is healthy creative destruction that will propel the economy forward. The state should engage in an open and consultative way with a broad section of the public and the business community, and carefully form policy. Policies shouldn’t be rushed as time is needed to prepare but by the same token, time shouldn’t be wasted. A climate that fosters ownership and performance, rather than compliance in the public sector should be created. Public servants should be enabled to use their discretion, take risks, and not be suffocated by bureaucracy, while keeping robust, risk-based checks and balances in place,” he said.

Investments should be focused on Kazakh people and their movements empowered within the country.

“We would like to see Kazakhstan becoming a regional and global leader by forging new and multilateral economic linkages as it seeks to diversify and grow. Kazakhstan can be a leading part of a new, cooperative Central Asia that together will be on the map for major investors to establish dynamic economies of scale and value chains. This means working cooperatively to improve connectivity and reduce regulatory misalignments. And finally, Kazakhstan has the opportunity, as the largest economy in Central Asia, to be at the forefront of decarbonization initiatives which can spur economic diversification and new markets while contributing to global public goods,” he said.

From the author

The World Bank has a rich history, a compelling present relationship and an important future role to play in Kazakhstan. There is much to be learned from this institution’s analysis and advice when it comes to Kazakhstan’s best path to sustainable growth and development.

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

IMAGES

VIDEO

COMMENTS

Kazakhstan's economy grew by 5.1% in 2023, driven by exports and fiscal stimulus. The 2024 economic forecast anticipates a growth slowdown to 3.4%, with a rebound to 4.7% in 2025 due to increased oil production. Kazakhstan Overview Overview Context Strategy Economy Country Context

The economy of Kazakhstan is the largest in Central Asia in both absolute and per capita terms. In 2021, Kazakhstan attracted more than US$370 billion of foreign investments since becoming an independent republic after the collapse of the former Soviet Union. [18] It possesses oil reserves as well as minerals and metals.

An overview of the World Bank's work in Kazakhstan Kazakhstan 2021 Population, million 19 GDP, current US$ billion 202.9 GDP per capita, current US$ 10,693.5 ... Spillovers from Russia's economic collapse will disrupt Kazakhstan's supply chains and dent its growth prospects. Real GDP growth is expected to slow to 1.5-2.0 percent in

Overview 8 2. Growth and Inflation: moderate growth sustained by domestic demand and pickup in inflation 10 3. Balance of Payment and Exchange Rate: widened current account deficit and modest real exchange rate depreciation 12 4. Monetary Policy and the Financial Sector: inflation is under control, but credit

Kazakhstan's economy started to recover in the second half of 2020, although real GDP is still lower than pre-COVID-19. After suffering the worst contraction in the past two decades, Kazakhstan's real GDP rebounded in the third quarter of 2020, and growth has extended to the first quarter of 2021. Real GDP in Q1 2021 grew moderately at 1.9 ...

Kazakhstan In brief Policy will remain centred on the president, Kassym-Jomart Tokayev. Risks to political stability are elevated as strikes in the oil sector in Western Kazakhstan continue, which, given the right trigger, have the potential to snowball into widespread unrest.

National Bank of Kazakhstan (NBK)'s target of 5 percent. Risks to the outlook are tilted to the downside. The state's footprint in the economy remains large and structural reform implementation has been slow in recent years. Despite strong buffers , the economy needs to be better prepared for future shocks in both the short term (e.g.,

Overview Key Economic Indicators Economic Snapshot Our Forecasts Kazakhstan's economy in numbers: Nominal GDP of USD 225 billion in 2022. GDP per capita of USD 11,373 compared to the global average of USD 10,589. Average real GDP growth of 3.2% over the last decade. Share of the region's population Share of the region's GDP Economic structure:

The Government of Kazakhstan has stated that one of its priorities is the diversification of its economy. This represents a major challenge in light of the dynamics that oil wealth tends to create. An economic policy that is able to achieve diversification will have to use many of its limited degrees of freedom to achieve it.

The Kazakhstan Economic Update is a semi-annual report that analyzes recent economic developments, prospects, and policy issues in Kazakhstan. Download the full report — Kazakhstan Economic Update - Shaping Tomorrow: Reforms for Lasting Prosperity | Russian version Kazakhstan's economic forecast for the next two years is steady growth.

Market Overview. Last published date: 2022-09-01. Kazakhstan is the second-largest republic of the former Soviet Union, after Russia, and the ninth-largest country in the world in the territory. The country has an abundance of natural resources - including oil, gas, coal, uranium, and other mineral deposits - and has exploited these resources ...

Learn about the economic outlook, challenges, and opportunities of Kazakhstan, a key partner of the Asian Development Bank since 1994.

Kazakhstan's economy to expand by 5.5 per cent in 2025 despite a temporary slowdown in 2024 Uzbekistan's GDP to expand by 6.5 per cent in 2024 and 6.0 per cent in 2025 According to the latest Regional Economic Prospects (REP) report published by the European Bank for Reconstruction and Development (EBRD), Central Asian economies in 2024 are ...

To achieve this goal, the "Kazakhstan-2050 "Strategy" provides implementation of seven long-term priorities: 1. Economic policy of the new course - all around economic pragmatism based on the principles of profitability, return on investment and competitiveness. 2. Comprehensive support of entrepreneurship - leading force in the ...

economic Middle of Eurasia Landlocked Population (2015): 17,6 million • GDP (2015): USD 190 billion GDP per capita (2015): USD 10,830 Industry share in GDP: Around 36% (2014) GDP growth 1.2% (projected for 2015) Kazakhstan is a major producer and net exporter of energy

New economic policy. | PPT Economy of Kazakhstan: Myths and reality. New economic policy. May 18, 2016 • 2 likes • 1,214 views A Aidarkhan Kussainov Presentation of the book of Aidarkhan Kussainov "Economy of Kazakhstan^ Myths and Reality. New economic policy, Information space and National Idea". KIMEP, Almaty, May 2016 Read more

Kazakhstan's Economy. By H.E. Yerlan Abildayev Ambassador Embassy of Kazakhstan in Canada 2011. OVERVIEW OF KAZAKHSTAN. Political status: Republic Area of land : 2.7 million sq.km Capital city : Astana Population : 16.3 million (2009) Download Presentation development 3 bln fdi inflows 2 bln 5 bln tenge oil gas sector modernization jean + Follow

Kazakhstan Presentation. May 5, 2010 • Download as PPT, PDF •. 16 likes • 22,105 views. D. daryabelkina. 1 of 18. Download now. Kazakhstan Presentation - Download as a PDF or view online for free.

This is a list of regions of Kazakhstan by nominal GDP, in Kazakhstani tenge and US dollars. Regions of Kazakhstan by GDP per capita. Map key: > US$40,000 > US$10,000 > US$5,000 > US$3,000 List. Statistics shown are for 2022 levels, according to Kazakhstan's Bureau of National Statistics.

Fast forward to today and Kazakhstan is a world player in the oil trade, a growing force in the trade of rare earth minerals and a burgeoning source of fintech. The road that Kazakhstan traveled to reach the success of 2024, however, was far from easy. It required strategic thinking, calculated risks and sometimes painful changes.