Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Marketing report of Nestle 2014

Comparasion Cerelac Products between India and United Kingdom

Related Papers

manali tendolkar

ABOUT ADVERTU=ISING

IICSE University

Kitcha Ing-udomnoogoon

This thesis was conducted during the author's first year of a three-year PhD program at the IICSE University, USA. The thesis had its focus on exploring impacting factors and behaviors of product brand recommenders in relation to customer loyalty, which is an unexplored field of research in Thailand. Most research studies in Thailand focus on brand loyalty of end-customers, none has explored loyalty behaviors of product brand recommenders or product brand endorsers. Product brand recommenders/endorsers are those who recommend or endorse specific product brand(s) to potential end users and/or customers. Product brand recommenders might or might not be direct product brand users by nature. Quantitative research methods were mainly used in this dissertation research. A case study of customer loyalty behaviors of infant formula brand recommenders was explored in detail. Primary survey pen-and-paper based questionnaire and the interviews were the major information sources of the empirical data for the research, complemented with secondary data sources where relevant. The theoretical framework aims to find knowledge for compiling the main elements of customer loyalty behaviors of product brand recommenders in this thesis. The results of the thesis were customer loyalty model developed for brand recommenders of any product.

Xuzhen Yuan

Arsen Duplančić

Veritas: Jurnal Teologi dan Pelayanan

Margareth Jonathan

Ideally, a pastor’s child is a role model for religious life. However, a pastor’s child has some religious problems rooted in parental influence. This research aimed to determine whether each parenting style correla¬ted with the religiosity of a pastor’s child. This research hypothesizes that there was a significant correlation between the perceptions of authoritarian parenting, authoritative parenting, permissive parenting, and uninvolved parenting with the religiosity of adolescent pastors’ children. The sampling technique used was purposive sampling. As many as 172 Indonesian pastors’ children aged 13 to 17 years old participated in this study. The measuring instrument used were the Parenting Style measure and the Centrality of Religiosity (CRS). The research method is quantitative correlational research. The research results indicate no correlation between each type of parenting style and religiosity. As much as 76.7% of the pastors’ children were at the religious level, followe...

Jurnal Pengurusan

Chandrakantan Subramaniam

D. Alexis Hart

Indonesian Journal of Business and Entrepreneurship

Syafiq Mahmadah Hanafi

Global Biogeochemical Cycles

Ian R . Hall

Lecture Notes in Computer Science

john dilley

RELATED PAPERS

NAMMCO Scientific Publications

Sandie Wilson

Universitas Islam Negeri Sumatera Utara Medan

Tessa Simahate

哪里购买temple学位证书 天普大学毕业证学位证书留信人才入库

Faslnāmah-i Pizhūhish/Nāmah-i Iqtisādī

Hamid Amadeh

Evaluation of the Effect of Consciousness Energy Healing Treatment on Physicochemical and Thermal Properties of Flutamide

Dahryn Trivedi , Mahendra Kumar Trivedi , Alice Branton

Emrullah Türk

Nicoli Nattrass

Journal of Molecular Structure

Pál Miklós Sohár

Journal of Friction and Wear

Vladimir Kukareko

Dr. Shakira Huma

Molecular Ecology

Alan Hildrew

PLOS Pathogens

Thanh Hiệp Phạm

Jewish Questions and Irish Questions

Heather Miller Rubens

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Consumer Goods & FMCG ›

Food & Nutrition

Nestlé - statistics & facts

The business of the number one, moving ahead with a tainted reputation, staying in the lead, key insights.

Detailed statistics

Nestlé's net profit worldwide 2005-2023

Total workforce of the Nestlé Group worldwide 2008-2023

Global sales of the Nestlé Group 2005-2023

Editor’s Picks Current statistics on this topic

Food & Beverage

Nestlé's leading markets worldwide 2023, based on sales

Nestlé Group's sales distribution worldwide 2023, by region

Nestlé Group marketing spend 2015-2022

Further recommended statistics

- Basic Statistic Biggest companies in the world by market value 2023

- Premium Statistic Brand value of the leading FMCG brands worldwide 2023

- Premium Statistic Global net sales of the leading 50 FMCG companies 2023

- Premium Statistic Leading North American food and beverage processors 2022/2023

- Premium Statistic Global confectionery market: leading companies 2023, based on net sales

Biggest companies in the world by market value 2023

The 100 largest companies in the world by market capitalization in 2023 (in billion U.S. dollars)

Brand value of the leading FMCG brands worldwide 2023

Brand value of the leading FMCG brands worldwide in 2023 (in million U.S. dollars)

Global net sales of the leading 50 FMCG companies 2023

Leading 50 FMCG companies worldwide in 2023, based on net sales (in billion U.S. dollars)

Leading North American food and beverage processors 2022/2023

Leading food and beverage companies in North America in 2022/2023, based on sales (in million U.S. dollars)

Global confectionery market: leading companies 2023, based on net sales

Net sales of the leading confectionery companies worldwide in 2023 (in billion U.S. dollars)

- Premium Statistic Global sales of the Nestlé Group 2005-2023

- Premium Statistic Nestlé's net profit worldwide 2005-2023

- Premium Statistic Nestlé's leading markets worldwide 2023, based on sales

- Basic Statistic Nestlé Group's sales distribution worldwide 2023, by region

- Premium Statistic E-commerce sales as a share of Nestlé's group sales worldwide 2012-2023

- Premium Statistic EBIT of the Nestlé Group worldwide 2008-2023

- Basic Statistic Total workforce of the Nestlé Group worldwide 2008-2023

- Premium Statistic Nestlé Group marketing spend 2015-2022

Nestlé Group's sales worldwide from 2005 to 2023 (in billion CHF)

Nestlé's net profit worldwide 2005-2023

Net profit of the Nestlé Group worldwide from 2005 to 2023 (in million CHF)

Nestlé's leading markets worldwide 2023, based on sales

Leading markets of Nestlé worldwide in 2023, based on sales (in billion CHF)*

Nestlé Group's sales distribution worldwide 2023, by region

Global sales share of the Nestlé Group in 2023, by region

E-commerce sales as a share of Nestlé's group sales worldwide 2012-2023

Nestlé's e-commerce sales as a share of group sales worldwide in 2012 to 2023

EBIT of the Nestlé Group worldwide 2008-2023

EBIT of the Nestlé Group worldwide from 2008 to 2023 (in million CHF)

Total number of Nestlé employees worldwide from 2008 to 2023 (in 1,000s)

Nestlé Group's marketing and administration expenses worldwide from 2015 to 2022 (in billion CHF)

Product segments

- Premium Statistic Global sales of Nestlé 2023, by product category

- Premium Statistic Nestlé's organic growth worldwide in 2023, by product category

- Basic Statistic Sales of Nestlé's confectionery sector worldwide 2010-2023, by segment

- Premium Statistic Leading LRB companies in the U.S. 2022, based on volume share

- Premium Statistic Key brands' market share of bottled still water in the U.S. 2023

- Premium Statistic Key brands' market share of bottled sparkling water in the U.S. 2023

Global sales of Nestlé 2023, by product category

Nestlé Group's sales worldwide in 2023, by product category (in million CHF)

Nestlé's organic growth worldwide in 2023, by product category

Nestlé's organic sales growth worldwide in 2023, by product category

Sales of Nestlé's confectionery sector worldwide 2010-2023, by segment

Sales of Nestlé's confectionery sector worldwide from 2010 to 2023, by segment (in million CHF)

Leading LRB companies in the U.S. 2022, based on volume share

Leading liquid refreshment beverage (LRB) companies in the United States in 2022, based on volume share

Key brands' market share of bottled still water in the U.S. 2023

Market share of the leading bottled still water brands in the United States in 2023, based on sales

Key brands' market share of bottled sparkling water in the U.S. 2023

Market share of the leading seltzer, bottled sparkling/mineral water brands in the United States in 2023, based on sales

Regional operations

- Premium Statistic Sales of Nestlé in Zone North America (NA) from 2021-2023, by product categories

- Premium Statistic Nestlé's sales share in Zone North America (NA) from 2021-2023, by product categories

- Premium Statistic Sales of Nestlé in Zone Latin America (LATAM) from 2021-2023, by product categories

- Premium Statistic Nestlé's sales share in Zone Latin America from 2021-2023, by product categories

- Premium Statistic Sales of Nestlé in Zone EUR 2021 to 2023, by product categories

- Premium Statistic Nestlé's sales share in Zone EUR 2021-2023, by product categories

- Premium Statistic Sales of Nestlé in AOA 2021-2023, by product categories

- Premium Statistic Nestlé's sales distribution share in AOA 2021-2023 by product categories

- Premium Statistic Sales of Nestlé Greater China (GC) 2023, by product categories

- Premium Statistic Nestlé's sales share Greater China 2023, by product category

Sales of Nestlé in Zone North America (NA) from 2021-2023, by product categories

Sales of Nestlé in Zone North America (NA) from 2021 to 2023, by product categories (in million CHF)

Nestlé's sales share in Zone North America (NA) from 2021-2023, by product categories

Sales distribution share of Nestlé in Zone North America (NA) from 2021 to 2023, by product categories

Sales of Nestlé in Zone Latin America (LATAM) from 2021-2023, by product categories

Sales of Nestlé in Zone Latin America (LATAM) from 2021 to 2023, by product categories (in million CHF)

Nestlé's sales share in Zone Latin America from 2021-2023, by product categories

Sales distribution share of Nestlé in Zone Latin America (LATAM) from 2021 to 2023, by product categories

Sales of Nestlé in Zone EUR 2021 to 2023, by product categories

Sales of Nestlé in Zone EUR from 2021 to 2023, by product categories (in million CHF)

Nestlé's sales share in Zone EUR 2021-2023, by product categories

Sales distribution share of Nestlé in Zone EUR from 2021 to 2023, by product categories

Sales of Nestlé in AOA 2021-2023, by product categories

Sales of Nestlé in Asia, Oceania, and Africa (AOA) from 2021 to 2023, by product categories (in million CHF)*

Nestlé's sales distribution share in AOA 2021-2023 by product categories

Sales distribution share of Nestlé in Asia, Oceania, and Africa (AOA) from 2021 to 2023, by product categories*

Sales of Nestlé Greater China (GC) 2023, by product categories

Sales of Nestlé in Greater China (GC) in 2023, by product categories (in million Swiss francs)

Nestlé's sales share Greater China 2023, by product category

Sales distribution of Nestlé in Greater China in 2023, by product category

Sustainability and social responsibility

- Premium Statistic Nestlé's global GHG emissions 2021-2023, by scope

- Premium Statistic Breakdown of Nestlé's emissions by supply chain link in 2023

- Premium Statistic Use of renewable electricity at manufacturing sites of Nestlé 2021-2023

- Premium Statistic Share of Nestlé management positions held by women 2021-2023

- Premium Statistic Share of cocoa sourced through the Nestlé Cocoa Plan 2021-2023

Nestlé's global GHG emissions 2021-2023, by scope

Direct and indirect greenhouse gas emissions of Nestlé worldwide from 2021 to 2023 (in million metric tons of carbon dioxide equivalent)

Breakdown of Nestlé's emissions by supply chain link in 2023

Use of renewable electricity at manufacturing sites of Nestlé 2021-2023

Use of renewable electricity at manufacturing sites of Nestlé from 2021 to 2023

Share of Nestlé management positions held by women 2021-2023

Share of Nestlé management positions held by women from 2021 to 2023

Share of cocoa sourced through the Nestlé Cocoa Plan 2021-2023

Share of cocoa used by Nestlé that was sourced through the Nestlé Cocoa Plan from 2021 to 2023

Competitors

- Basic Statistic Net sales of General Mills worldwide 2014-2023

- Premium Statistic Global net sales of the Hershey Company 2006-2023

- Premium Statistic Kellanova Company's net sales worldwide 2004-2023

- Premium Statistic Mondelez International's net revenue worldwide 2011-2023

- Premium Statistic PepsiCo's net revenue worldwide 2007-2023

- Basic Statistic Unilever: revenue worldwide 2007-2023

Net sales of General Mills worldwide 2014-2023

Net sales of General Mills worldwide from 2014 to 2023 (in million U.S. dollars)*

Global net sales of the Hershey Company 2006-2023

Net sales of the Hershey Company worldwide from 2006 to 2023 (in billion U.S. dollars)

Kellanova Company's net sales worldwide 2004-2023

Net sales of the Kellanova worldwide from 2004 to 2023 (in million U.S. dollars)

Mondelez International's net revenue worldwide 2011-2023

Net revenue of Mondelez International worldwide from 2011 to 2023 (in million U.S. dollars)

PepsiCo's net revenue worldwide 2007-2023

PepsiCo's net revenue worldwide from 2007 to 2023 (in billion U.S. dollars)

Unilever: revenue worldwide 2007-2023

Revenue of Unilever Group worldwide from 2007 to 2023 (in million euros)

Further reports

Get the best reports to understand your industry.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

The Brand Hopper

All Brand Stories At One Place

Nestle: A Look at the Marketing Strategies and Global Presence

Nestle: A Look at the Marketing Strategies and Global Presence 15 min read

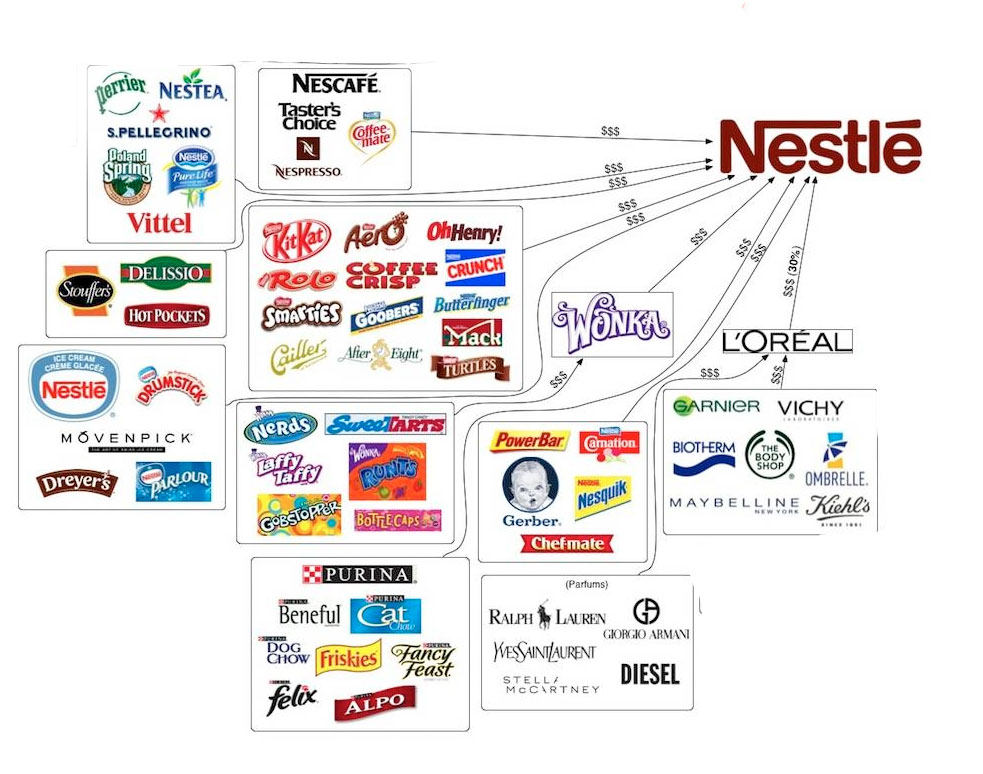

Nestlé is a Swiss multinational food and drink processing conglomerate corporation headquartered in Vevey, Vaud, Switzerland . It is the largest food company in the world, measured by revenue and other metrics. Nestlé has over 2000 brands ranging from global icons to local favorites, and it is present in 191 countries around the world.

Nestlé was founded in 1866 by Henri Nestlé , a Swiss chemist and pharmacist. Nestlé’s first product was a baby food called Farine Lactée Henri Nestlé, which was designed to help infants who were unable to breastfeed. The company quickly grew and expanded its product line, and by the early 20th century, Nestlé was one of the largest food companies in the world.

Nestlé continued to grow and expand throughout the 20th century. The company acquired a number of other food and drink companies, and it also expanded into new markets. In the 1980s, Nestlé began to focus on developing healthier and more nutritious products. The company also began to invest in sustainable agriculture and water management practices.

Today, Nestlé is a leading provider of food and drink products around the world. The company’s products are sold in over 190 countries , and Nestlé employs over 339,000 people . Nestlé is committed to providing its customers with high-quality, nutritious products that are affordable and accessible. The company is also committed to sustainable business practices that protect the environment and promote social responsibility.

Here are some of Nestlé’s most popular brands:

- San Pellegrino

- Häagen-Dazs

- Lean Cuisine

Nestlé is a global leader in the food and drink industry. The company is committed to providing its customers with high-quality, nutritious products that are affordable and accessible. Nestlé is also committed to sustainable business practices that protect the environment and promote social responsibility.

Table of Contents

History of Nestle – Making of a food giant

The story of Nestle begins in Switzerland in the mid-19th century. In 1866, Henri Nestle , a pharmacist, developed a nutritious and easy-to-digest infant food known as Farine Lactée . The product was a lifesaver for mothers who were unable to breastfeed their infants and quickly gained popularity throughout Europe.

Nestle’s infant food was so successful that in 1874, he formed a company with a group of investors to expand production and distribution. The new company, known as Société Farine Lactée Henri Nestlé , was headquartered in Vevey, Switzerland, and began exporting its products to other parts of Europe, as well as to the United States and Asia.

In the years that followed, Nestle continued to innovate and expand its product offerings. In 1905, the company launched Nescafe, an instant coffee that quickly became a global sensation. Over the next few decades, Nestle expanded into new product categories, including chocolate, dairy products, and pet food, and established a presence in markets around the world.

During World War II, Nestle faced significant challenges as the global conflict disrupted supply chains and created food shortages. Nevertheless, the company persevered and continued to innovate, launching new products such as Nesquik, a chocolate powder for making milkshakes, in 1948.

In the post-war years, Nestle continued to expand its global presence through a series of acquisitions and partnerships. In 1974, the company merged with the Swiss-based food company, Alimentana, to become Nestle Alimentana SA . The merger brought together two of Switzerland’s largest food companies and helped to solidify Nestle’s position as a global leader in the food and beverage industry.

Today, Nestle is one of the largest and most recognizable consumer goods companies in the world, with a presence in nearly every country on the planet. Despite its size and scale, the company remains committed to the principles of quality, sustainability, and social responsibility that have guided its success for over 150 years.

Brand Portfolio of Nestle – something for everyone

Nestle is a global food and beverage company with over 2,000 brands in its portfolio. Here are some of the most well-known brands:

- Nescafé: Nescafé is the world’s largest coffee brand, with over 200 different varieties of coffee sold in over 180 countries. Nescafé was created in 1938 by Nestlé in Switzerland. The name is a portmanteau of the words “Nestlé” and “café”. Nescafé is available in a variety of forms, including instant coffee, ground coffee, and coffee pods.

- Nespresso: Nespresso is a premium coffee brand that sells single-serve coffee capsules. Nespresso was created in 1986 by Nestlé in Switzerland. The name is a combination of the words “espresso” and “capsule”. Nespresso coffee capsules are made from high-quality coffee beans and are compatible with Nespresso coffee machines.

- Maggi: Maggi is a global brand of seasonings, soups, and noodles. Maggi was created in 1872 by Julius Maggi in Switzerland. The name is derived from the German word “Mager”, which means “lean”. Maggi products are sold in over 100 countries and are known for their high quality and affordable prices.

- Kit Kat: Kit Kat is a popular chocolate bar that is sold in over 100 countries. Kit Kat was created in 1935 by Rowntree’s of York, England. The name is a combination of the words “Kit” and “Kat”, which were the names of two popular cats in the United Kingdom at the time. Kit Kat bars are made with milk chocolate and wafers and are available in a variety of flavors, including original, dark chocolate, and mint.

- Nesquick: Nesquick is a chocolate powder that is used to make milk shakes and other drinks. Nesquick was created in 1948 by Nestlé in Switzerland. The name is a combination of the words “Nestlé” and “quick”, as Nesquick is a quick and easy way to make a delicious chocolate drink. Nesquick is available in a variety of flavors, including original, strawberry, and chocolate hazelnut.

- Gerber: Gerber is a brand of baby food that is sold in over 80 countries. Gerber was created in 1928 by Daniel Gerber in Fremont, Michigan, United States. The name is derived from the name of Daniel Gerber’s wife, Dorothy Gerber. Gerber baby food is known for its high quality and nutritious ingredients.

- Purina: Purina is a brand of pet food that is sold in over 50 countries. Purina was created in 1902 by William H. Danforth in St. Louis, Missouri, United States. The name is derived from the Latin word “purus”, which means “pure”. Purina pet food is known for its high quality and nutritious ingredients.

- San Pellegrino: San Pellegrino is a brand of sparkling water that is sold in over 150 countries. San Pellegrino was created in 1899 in San Pellegrino Terme, Italy. The name is derived from the name of the town where it is produced. San Pellegrino sparkling water is known for its high quality and refreshing taste.

- Häagen-Dazs: Häagen-Dazs is a brand of ice cream that is sold in over 50 countries. Häagen-Dazs was created in 1961 in New York City, United States. The name is a made-up name that is intended to sound Scandinavian. Häagen-Dazs ice cream is known for its high quality and rich flavor.

- DiGiorno: DiGiorno is a brand of frozen pizza that is sold in over 30 countries. DiGiorno was created in 1995 by Nestlé in the United States. The name is a combination of the words “Dig” and “Giorno”, which means “day” in Italian. DiGiorno frozen pizza is known for its high quality and authentic taste.

- Lean Cuisine: Lean Cuisine is a brand of frozen meals that is sold in over 20 countries. Lean Cuisine was created in 1981 by Stouffer’s in the United States. The name is a combination of the words “lean” and “cuisine”. Lean Cuisine frozen meals are known for their low calorie and fat content and their convenient packaging.

These are just a few of Nestlé’s many brands. The company has a wide range of products that are sold in over 190 countries. Nestlé is committed to providing its customers with high-quality, nutritious products that are affordable and accessible. The company is also committed to sustainable business practices that protect the environment and promote social responsibility.

Strategy of Nestle in different markets around the world

Nestle is a global food and beverage company that operates in over 190 countries around the world. Its presence in each market varies depending on factors such as consumer preferences, cultural norms, and regulatory environments . However, Nestle’s strategy in each market is to adapt to local tastes and customs, while also leveraging its global scale and resources.

One way that Nestle adapts to local markets is by developing products that are tailored to local tastes and preferences. For example, in India, Nestle offers a range of products that cater to local culinary traditions, such as Maggi noodles that are flavored with spices and herbs popular in Indian cuisine. Similarly, in China, Nestle offers a range of products that incorporate traditional Chinese ingredients and flavors, such as congee and tea-flavored milk drinks .

Nestle also adapts to local markets by developing marketing campaigns that resonate with local consumers. For example, in Brazil, Nestle has a longstanding partnership with the country’s national soccer team, and has sponsored a number of initiatives aimed at promoting healthy lifestyles among Brazilian children. In Japan, Nestle has launched a number of marketing campaigns that appeal to the country’s obsession with cute and whimsical characters, such as its “KitKat Chocolatory” stores that offer limited edition flavors and packaging .

In addition to adapting its products and marketing to local markets, Nestle also works closely with local suppliers and distributors to ensure that its products are available and affordable in each market. This includes partnering with local farmers to source raw materials, as well as investing in local manufacturing and distribution infrastructure.

However, Nestle’s efforts to adapt to local markets have not always been successful. In some cases, the company has faced backlash from consumers and regulators who feel that its products are not in line with local tastes and customs. For example, in India, Nestle faced a major controversy in 2015 when its popular Maggi noodles were found to contain excess levels of lead and MSG, leading to a nationwide ban on the product. The incident highlighted the challenges of adapting to local markets while also maintaining quality and safety standards.

Despite these challenges, Nestle’s global presence and commitment to adapting to local markets have enabled it to maintain a leading position in the global food and beverage industry. By leveraging its scale and resources, while also working closely with local partners, Nestle is well-positioned to continue growing and innovating in markets around the world.

Financial Growth of Nestle

A brief overview of Nestlé’s financial growth over the years:

Revenue: Nestlé’s revenue has grown steadily over the years, from CHF 59.2 billion in 2010 to CHF 92.4 billion in 2022 .

Profit: Nestlé’s profit has also grown steadily over the years, from CHF 9.4 billion in 2010 to CHF 15.4 billion in 2022.

Earnings per share: Nestlé’s earnings per share have also grown steadily over the years, from CHF 2.00 in 2010 to CHF 3.00 in 2022.

Dividends: Nestlé has paid a dividend every year since 1875. The dividend has grown steadily over the years, from CHF 0.10 per share in 2010 to CHF 0.25 per share in 2022.

Nestlé’s financial growth is due to a number of factors, including:

A strong global brand: Nestlé is one of the most recognized brands in the world. This gives the company a significant advantage in the global marketplace.

A diversified product portfolio: Nestlé has a wide range of products, which helps to insulate the company from economic downturns in any particular market.

A strong focus on innovation: Nestlé is constantly investing in new products and technologies, which helps to keep the company ahead of the competition.

A commitment to sustainability: Nestlé is committed to sustainable business practices, which helps to reduce the company’s environmental impact and improve its long-term profitability.

Nestlé is a well-managed company with a strong track record of financial growth. The company is well-positioned to continue to grow in the years to come.

Marketing Strategies of Nestle

Nestle is one of the world’s largest food and beverage companies and has a range of marketing strategies to promote its many brands and products. Here are some of the key marketing strategies that Nestle employs:

Branding : Nestle’s marketing strategy relies heavily on the strength of its brands. Many of Nestle’s products are household names, such as Nescafe, KitKat, and Gerber, and the company invests heavily in brand recognition through advertising campaigns, sponsorships, and product placements.

Social media : Nestle uses social media platforms to engage with consumers and promote its products. The company has a presence on platforms such as Facebook, Twitter, and Instagram, where it shares product updates, promotions, and other content. Nestle also uses social media to gather feedback from customers and respond to customer inquiries and complaints.

Influencer marketing : Nestle also employs influencer marketing to reach new audiences and promote its products. The company partners with influencers in different markets to create content that showcases its products and engages with consumers.

Digital marketing : Nestle uses a range of digital marketing strategies, including search engine optimization (SEO), pay-per-click (PPC) advertising, and email marketing, to reach consumers online. The company also uses data analytics to track consumer behavior and tailor its marketing efforts to specific audiences.

Experiential marketing : Nestle also employs experiential marketing to create memorable experiences for consumers. This includes events such as pop-up stores, tasting events, and interactive displays that allow consumers to try Nestle’s products and learn more about the company.

Sponsorships : Nestle also sponsors a range of events and organizations, such as sports teams and music festivals, to increase brand awareness and promote its products. For example, Nestle has a longstanding partnership with the International Olympic Committee and is a major sponsor of the Olympic Games.

Health and wellness : Nestle also emphasizes health and wellness in its marketing strategy, particularly in markets where consumers are increasingly concerned about the nutritional value of the foods they consume. The company promotes its products as healthy and nutritious, and invests in research and development to create new products that meet consumer demand for healthier options.

Overall, Nestle’s marketing strategy is focused on building brand awareness, engaging with consumers through social media and influencer marketing, and creating memorable experiences that promote its products. The company also adapts its marketing strategy to local markets, tailoring its approach to specific cultural and regulatory environments.

Social Media Strategy of Nestle

Nestlé uses social media to connect with consumers, build relationships, and drive sales. The company has a presence on a variety of social media platforms, including Facebook, Twitter, Instagram, and YouTube.

Nestlé’s social media strategy is focused on the following key areas:

Content creation: Nestlé creates high-quality content that is relevant to its target audience. The company’s content is informative, engaging, and visually appealing.

Engagement: Nestlé encourages engagement with its social media followers. The company responds to comments and questions, and it runs contests and promotions.

Listening: Nestlé listens to what its social media followers are saying. The company uses this feedback to improve its products and services.

Measurement: Nestlé measures the results of its social media campaigns. The company tracks website traffic, social media engagement, and sales.

Nestlé’s social media strategy is successful because it is focused on creating high-quality content, engaging with followers, and listening to feedback. The company’s social media campaigns have helped it to connect with consumers, build relationships, and drive sales.

Here are some specific examples of how Nestlé uses social media:

- Nestlé uses Facebook to share recipes, tips, and information about its products. The company also runs contests and promotions on Facebook.

- Nestlé uses Twitter to share news and updates about the company. The company also responds to customer questions and comments on Twitter.

- Nestlé uses Instagram to share photos and videos of its products. The company also runs contests and promotions on Instagram.

- Nestlé uses YouTube to share videos about its products and company. The company also runs contests and promotions on YouTube.

Nestlé’s social media strategy is a key part of the company’s overall marketing strategy. The company uses social media to connect with consumers, build relationships, and drive sales.

Also Read: Exploring the Brand Architecture of HUL

Controversies around Nestle

Nestle, being a global food and beverage company, has faced several controversies over the years. Here are some of the most notable controversies around Nestle:

Infant formula : In the 1970s, Nestle faced criticism over its promotion of infant formula in developing countries. The company was accused of encouraging mothers to use formula instead of breastfeeding, which led to health problems and even death for some infants. Nestle faced a boycott and protests, and eventually changed its marketing practices.

Child labor : Nestle has faced allegations of using child labor in its supply chain. In 2015, the company admitted to finding instances of child labor in its cocoa supply chain in Ivory Coast, and pledged to take steps to eliminate the practice.

Environmental impact : Nestle has also faced criticism over its impact on the environment. In 2018, the company was named one of the top plastic polluters in the world, with its products accounting for a significant amount of plastic waste in the oceans. Nestle has pledged to increase its use of recycled plastic and reduce its plastic packaging.

Water rights : Nestle has also been criticized for its water extraction practices. The company has faced protests and legal challenges in several countries over its use of groundwater for bottled water production. Critics argue that Nestle is depleting local water resources and undermining access to water for local communities.

Palm oil sourcing : Nestle has faced criticism over its sourcing of palm oil, which is associated with deforestation and habitat destruction. The company has pledged to eliminate deforestation from its supply chain and source sustainable palm oil.

Health claims : Nestle has faced criticism over health claims made for some of its products. For example, in 2019, the company was sued over its use of the term “no added sugars” on its Milo chocolate drink in Australia. The lawsuit alleged that the product contained added sugars and was therefore misleading to consumers.

Overall, Nestle has faced criticism over a range of issues, including its marketing practices, supply chain management, environmental impact, and health claims. The company has taken steps to address some of these issues, but continues to face scrutiny from critics and activists.

To read more content like this, subscribe to our newsletter

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Related Posts

A Deep Dive into Marketing Strategies of Deutsche Telekom

A Deep Dive into the Marketing Strategies of Nextera Energy

Marketing Strategies and Marketing Mix of Elevance Health

Terms and Conditions

Mortality from Nestlé’s Marketing of Infant Formula in Low and Middle-Income Countries

Infant formula use has been implicated in tens of millions of infant deaths in low and middle-income countries over the past several decades, but causal evidence of its link with mortality remains elusive. We combine birth record data from over 2.6 million infants across 38 countries in the Demographic and Health Surveys (DHS) with reconstructed historical data from annual investor reports on the timing of Nestlé entrance into infant formula country markets. Consistent with the hypothesis that formula mixed with unclean water could act as a disease vector, we find that infant mortality increased in households with unclean water sources by 19.4 per thousand births following Nestlé market entrance, but had no effect among other households. This rate is equivalent to a 27% increase in mortality in the population using unclean water and amounts to about 212,000 excess deaths per year at the peak of the Nestlé controversy in 1981.

We thank Claire Boone, Ingvild Madsen-Lampe and Carol Spector for outstanding research assistance, and Jere Behrman, Melissa Binder, Kitt Carpenter, Janet Currie, Andrew Dustan, Gregory Heath, Russell Mask, Ted Miguel, Nigel Rollins, Kira Villa, and Tom Vogl as well as seminar participants at UC Berkeley, UC Davis, Princeton, Vanderbilt, Notre Dame, Covenant College, University of New Mexico, University of Minnesota, Montana State University, and the 2017 International Economic Association Meetings in Mexico City. The authors have no financial or material interests in the results in this paper. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.

MARC RIS BibTeΧ

Download Citation Data

- March 30, 2018

Mentioned in the News

More from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

How Nestlé’s Nescafé is Smashing its Sustainability Targets

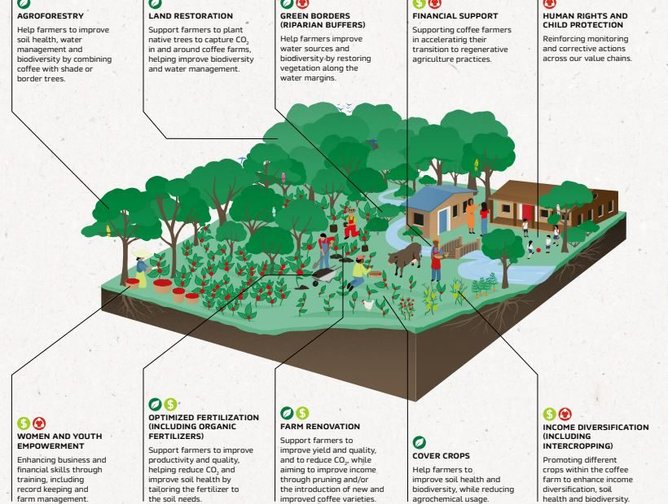

Nescafé, Nestlé's largest coffee brand, is sourcing over 20% of its coffee from farmers using regenerative agriculture practices two years ahead of target, according to its latest progress report.

The second Nescafé Plan 2030 Progress Report outlines how the move is contributing to improved farm yield and reduced greenhouse gas emissions.

Philipp Navratil, Head of Nestlé's Coffee Strategic Business Unit , said: "The Nescafé Plan embodies our unwavering commitment to help secure the future of coffee. This is at the heart of Nescafé.

“This second progress report is a testimony to the work we do every day on the ground with our partners, suppliers and farmers, in the regions from where we source our coffee, and it motivates us even more to continue our efforts."

The sustainability highlights

The report picks out a host of initiatives across the globe – and arrows in on their impact.

They include:

- 148,000 coffee farmers in 16 countries trained in regenerative agriculture in 2023

- More than 800 agronomists and specialist staff worked with coffee farmers in Nescafé Plan field programmes

- Distributed 21 million coffee plantlets to help farm renovation and rejuvenation for better yields (cumulative total above 290 million since 2010)

- Independent assessment of regenerative agriculture practice adoption on 37 farmer units across 11 origins in 2023

- The Nestlé Global Reforestation Programme planted more than three million trees in its coffee value chains to capture carbon and support biodiversity.

What is the Plan?

The Nescafé Plan 2030 ‘aims to issue a progress report every year to update on the brand's work in helping coffee farming communities transition to regenerative agriculture practices and, as a result, to help improve their livelihoods’.

The goals are:

- By 2025: 100% responsibly sourced coffee; source 20% of coffee through regenerative agriculture methods.

- By 2030: Source 50% of coffee through regenerative agriculture methods; 50% greenhouse gas emissions reduction.

Philipp said: “By the end of 2023, 92.5% of our global coffee supplies were responsibly sourced.

“In addition, coffee sourced from regenerative agriculture represented more than 20% of our total 2023 volumes.”

He added: “Our own actions were not the only factor at play in this transition toward regenerative agricultural practices. Many experts, both within our company and from partner organisations in the field, are playing critical roles in the Nescafé Plan.

“As farmers use techniques such as intercropping or soil analysis for the first time, technology and community groups are helping them to share their experiences and learn from others.”

More highlights

To illustrate the global reach of its business and the focus on transformation in all of the nations where it has a presence, Nescafé flagged up many other highlights from 2023:

- Started expanding conditional cash incentive schemes to accelerate farmer transition to regenerative agriculture for more than 3,000 farmers in Côte d'Ivoire, Indonesia and Mexico

- Supported a pilot deployment of weather insurance for more than 800 smallholder farmers in Indonesia

- Established Agrinest, a social media platform for farmer-to-farmer connections and agricultural learning. More than 1,600 farmers in Vietnam and 240 farmers in Indonesia are already using the platform

- In Honduras, during 2023 Nescafé trained 12,000 young people from coffee communities in entrepreneurship, coffee quality and regenerative agriculture.

Helping others to go by the book

Nestlé has also contributed to the Regenerative Agriculture for Low-Carbon and Resilient Coffee Farms - A Practical Guidebook.

Created in collaboration with the Alliance of Bioversity International and the International Center for Tropical Agriculture (CIAT), it provides field agronomists, trainers and professionals working with coffee farmers with a set of best practices that they can use and adapt to different farming contexts, helping farmers transition to regenerative agriculture.

The guidebook is publicly available to the coffee sector.

Make sure you check out the latest edition of Sustainability Magazine and also sign up to our global conference series - Sustainability LIVE 2024

Sustainability Magazine is a BizClik brand

- Why McKinsey Aims to be World’s Top Decarbonisation Catalyst ESG

- Is LEGO Group Right to Link Exec Bonuses to Sustainability? Sustainability

- How has Unilever Updated its Climate Transition Action Plan? Sustainability

- Microsoft’s New Strategy to Cut Soaring Scope 3 Emissions Sustainability

Featured Articles

Sustainability LIVE New York: Meet Our Speakers

Discover the lineup for Sustainability LIVE New York. Don’t miss out on your chance to attend the two-day virtual event on 3 and 4 June 2024 …

The Sustainability & ESG Awards Submissions – 1 Week to Go

Just one more week to go until submissions close for The Sustainability & ESG Awards launching at Sustainability LIVE London Global Summit …

American Express’s Madge Thomas joins Sustainability LIVE NY

Madge Thomas, President of the American Express Foundation and Head of Corporate Sustainability at American Express, to speak at Sustainability LIVE New …

PepsiCo CSO Jim Andrew joins Sustainability LIVE New York

Amy Brachio, EY Joins Sustainability LIVE New York

Sustainability LIVE Launches New Advertising Campaign

- We’re LIVE! Sustainability LIVE Dubai

- One Day to Go Until Sustainability LIVE Dubai 2024

- Sustainability LIVE New York – One Month to Go

- Sustainability LIVE Dubai – The Panels

- Sustainability LIVE Dubai: One Week to Go

Salesforce is closed for new business in your area.

McKinsey Global Private Markets Review 2024: Private markets in a slower era

At a glance, macroeconomic challenges continued.

McKinsey Global Private Markets Review 2024: Private markets: A slower era

If 2022 was a tale of two halves, with robust fundraising and deal activity in the first six months followed by a slowdown in the second half, then 2023 might be considered a tale of one whole. Macroeconomic headwinds persisted throughout the year, with rising financing costs, and an uncertain growth outlook taking a toll on private markets. Full-year fundraising continued to decline from 2021’s lofty peak, weighed down by the “denominator effect” that persisted in part due to a less active deal market. Managers largely held onto assets to avoid selling in a lower-multiple environment, fueling an activity-dampening cycle in which distribution-starved limited partners (LPs) reined in new commitments.

About the authors

This article is a summary of a larger report, available as a PDF, that is a collaborative effort by Fredrik Dahlqvist , Alastair Green , Paul Maia, Alexandra Nee , David Quigley , Aditya Sanghvi , Connor Mangan, John Spivey, Rahel Schneider, and Brian Vickery , representing views from McKinsey’s Private Equity & Principal Investors Practice.

Performance in most private asset classes remained below historical averages for a second consecutive year. Decade-long tailwinds from low and falling interest rates and consistently expanding multiples seem to be things of the past. As private market managers look to boost performance in this new era of investing, a deeper focus on revenue growth and margin expansion will be needed now more than ever.

Perspectives on a slower era in private markets

Global fundraising contracted.

Fundraising fell 22 percent across private market asset classes globally to just over $1 trillion, as of year-end reported data—the lowest total since 2017. Fundraising in North America, a rare bright spot in 2022, declined in line with global totals, while in Europe, fundraising proved most resilient, falling just 3 percent. In Asia, fundraising fell precipitously and now sits 72 percent below the region’s 2018 peak.

Despite difficult fundraising conditions, headwinds did not affect all strategies or managers equally. Private equity (PE) buyout strategies posted their best fundraising year ever, and larger managers and vehicles also fared well, continuing the prior year’s trend toward greater fundraising concentration.

The numerator effect persisted

Despite a marked recovery in the denominator—the 1,000 largest US retirement funds grew 7 percent in the year ending September 2023, after falling 14 percent the prior year, for example 1 “U.S. retirement plans recover half of 2022 losses amid no-show recession,” Pensions and Investments , February 12, 2024. —many LPs remain overexposed to private markets relative to their target allocations. LPs started 2023 overweight: according to analysis from CEM Benchmarking, average allocations across PE, infrastructure, and real estate were at or above target allocations as of the beginning of the year. And the numerator grew throughout the year, as a lack of exits and rebounding valuations drove net asset values (NAVs) higher. While not all LPs strictly follow asset allocation targets, our analysis in partnership with global private markets firm StepStone Group suggests that an overallocation of just one percentage point can reduce planned commitments by as much as 10 to 12 percent per year for five years or more.

Despite these headwinds, recent surveys indicate that LPs remain broadly committed to private markets. In fact, the majority plan to maintain or increase allocations over the medium to long term.

Investors fled to known names and larger funds

Fundraising concentration reached its highest level in over a decade, as investors continued to shift new commitments in favor of the largest fund managers. The 25 most successful fundraisers collected 41 percent of aggregate commitments to closed-end funds (with the top five managers accounting for nearly half that total). Closed-end fundraising totals may understate the extent of concentration in the industry overall, as the largest managers also tend to be more successful in raising non-institutional capital.

While the largest funds grew even larger—the largest vehicles on record were raised in buyout, real estate, infrastructure, and private debt in 2023—smaller and newer funds struggled. Fewer than 1,700 funds of less than $1 billion were closed during the year, half as many as closed in 2022 and the fewest of any year since 2012. New manager formation also fell to the lowest level since 2012, with just 651 new firms launched in 2023.

Whether recent fundraising concentration and a spate of M&A activity signals the beginning of oft-rumored consolidation in the private markets remains uncertain, as a similar pattern developed in each of the last two fundraising downturns before giving way to renewed entrepreneurialism among general partners (GPs) and commitment diversification among LPs. Compared with how things played out in the last two downturns, perhaps this movie really is different, or perhaps we’re watching a trilogy reusing a familiar plotline.

Dry powder inventory spiked (again)

Private markets assets under management totaled $13.1 trillion as of June 30, 2023, and have grown nearly 20 percent per annum since 2018. Dry powder reserves—the amount of capital committed but not yet deployed—increased to $3.7 trillion, marking the ninth consecutive year of growth. Dry powder inventory—the amount of capital available to GPs expressed as a multiple of annual deployment—increased for the second consecutive year in PE, as new commitments continued to outpace deal activity. Inventory sat at 1.6 years in 2023, up markedly from the 0.9 years recorded at the end of 2021 but still within the historical range. NAV grew as well, largely driven by the reluctance of managers to exit positions and crystallize returns in a depressed multiple environment.

Private equity strategies diverged

Buyout and venture capital, the two largest PE sub-asset classes, charted wildly different courses over the past 18 months. Buyout notched its highest fundraising year ever in 2023, and its performance improved, with funds posting a (still paltry) 5 percent net internal rate of return through September 30. And although buyout deal volumes declined by 19 percent, 2023 was still the third-most-active year on record. In contrast, venture capital (VC) fundraising declined by nearly 60 percent, equaling its lowest total since 2015, and deal volume fell by 36 percent to the lowest level since 2019. VC funds returned –3 percent through September, posting negative returns for seven consecutive quarters. VC was the fastest-growing—as well as the highest-performing—PE strategy by a significant margin from 2010 to 2022, but investors appear to be reevaluating their approach in the current environment.

Private equity entry multiples contracted

PE buyout entry multiples declined by roughly one turn from 11.9 to 11.0 times EBITDA, slightly outpacing the decline in public market multiples (down from 12.1 to 11.3 times EBITDA), through the first nine months of 2023. For nearly a decade leading up to 2022, managers consistently sold assets into a higher-multiple environment than that in which they had bought those assets, providing a substantial performance tailwind for the industry. Nowhere has this been truer than in technology. After experiencing more than eight turns of multiple expansion from 2009 to 2021 (the most of any sector), technology multiples have declined by nearly three turns in the past two years, 50 percent more than in any other sector. Overall, roughly two-thirds of the total return for buyout deals that were entered in 2010 or later and exited in 2021 or before can be attributed to market multiple expansion and leverage. Now, with falling multiples and higher financing costs, revenue growth and margin expansion are taking center stage for GPs.

Real estate receded

Demand uncertainty, slowing rent growth, and elevated financing costs drove cap rates higher and made price discovery challenging, all of which weighed on deal volume, fundraising, and investment performance. Global closed-end fundraising declined 34 percent year over year, and funds returned −4 percent in the first nine months of the year, losing money for the first time since the 2007–08 global financial crisis. Capital shifted away from core and core-plus strategies as investors sought liquidity via redemptions in open-end vehicles, from which net outflows reached their highest level in at least two decades. Opportunistic strategies benefited from this shift, with investors focusing on capital appreciation over income generation in a market where alternative sources of yield have grown more attractive. Rising interest rates widened bid–ask spreads and impaired deal volume across food groups, including in what were formerly hot sectors: multifamily and industrial.

Private debt pays dividends

Debt again proved to be the most resilient private asset class against a turbulent market backdrop. Fundraising declined just 13 percent, largely driven by lower commitments to direct lending strategies, for which a slower PE deal environment has made capital deployment challenging. The asset class also posted the highest returns among all private asset classes through September 30. Many private debt securities are tied to floating rates, which enhance returns in a rising-rate environment. Thus far, managers appear to have successfully navigated the rising incidence of default and distress exhibited across the broader leveraged-lending market. Although direct lending deal volume declined from 2022, private lenders financed an all-time high 59 percent of leveraged buyout transactions last year and are now expanding into additional strategies to drive the next era of growth.

Infrastructure took a detour

After several years of robust growth and strong performance, infrastructure and natural resources fundraising declined by 53 percent to the lowest total since 2013. Supply-side timing is partially to blame: five of the seven largest infrastructure managers closed a flagship vehicle in 2021 or 2022, and none of those five held a final close last year. As in real estate, investors shied away from core and core-plus investments in a higher-yield environment. Yet there are reasons to believe infrastructure’s growth will bounce back. Limited partners (LPs) surveyed by McKinsey remain bullish on their deployment to the asset class, and at least a dozen vehicles targeting more than $10 billion were actively fundraising as of the end of 2023. Multiple recent acquisitions of large infrastructure GPs by global multi-asset-class managers also indicate marketwide conviction in the asset class’s potential.

Private markets still have work to do on diversity

Private markets firms are slowly improving their representation of females (up two percentage points over the prior year) and ethnic and racial minorities (up one percentage point). On some diversity metrics, including entry-level representation of women, private markets now compare favorably with corporate America. Yet broad-based parity remains elusive and too slow in the making. Ethnic, racial, and gender imbalances are particularly stark across more influential investing roles and senior positions. In fact, McKinsey’s research reveals that at the current pace, it would take several decades for private markets firms to reach gender parity at senior levels. Increasing representation across all levels will require managers to take fresh approaches to hiring, retention, and promotion.

Artificial intelligence generating excitement

The transformative potential of generative AI was perhaps 2023’s hottest topic (beyond Taylor Swift). Private markets players are excited about the potential for the technology to optimize their approach to thesis generation, deal sourcing, investment due diligence, and portfolio performance, among other areas. While the technology is still nascent and few GPs can boast scaled implementations, pilot programs are already in flight across the industry, particularly within portfolio companies. Adoption seems nearly certain to accelerate throughout 2024.

Private markets in a slower era

If private markets investors entered 2023 hoping for a return to the heady days of 2021, they likely left the year disappointed. Many of the headwinds that emerged in the latter half of 2022 persisted throughout the year, pressuring fundraising, dealmaking, and performance. Inflation moderated somewhat over the course of the year but remained stubbornly elevated by recent historical standards. Interest rates started high and rose higher, increasing the cost of financing. A reinvigorated public equity market recovered most of 2022’s losses but did little to resolve the valuation uncertainty private market investors have faced for the past 18 months.

Within private markets, the denominator effect remained in play, despite the public market recovery, as the numerator continued to expand. An activity-dampening cycle emerged: higher cost of capital and lower multiples limited the ability or willingness of general partners (GPs) to exit positions; fewer exits, coupled with continuing capital calls, pushed LP allocations higher, thereby limiting their ability or willingness to make new commitments. These conditions weighed on managers’ ability to fundraise. Based on data reported as of year-end 2023, private markets fundraising fell 22 percent from the prior year to just over $1 trillion, the largest such drop since 2009 (Exhibit 1).

The impact of the fundraising environment was not felt equally among GPs. Continuing a trend that emerged in 2022, and consistent with prior downturns in fundraising, LPs favored larger vehicles and the scaled GPs that typically manage them. Smaller and newer managers struggled, and the number of sub–$1 billion vehicles and new firm launches each declined to its lowest level in more than a decade.

Despite the decline in fundraising, private markets assets under management (AUM) continued to grow, increasing 12 percent to $13.1 trillion as of June 30, 2023. 2023 fundraising was still the sixth-highest annual haul on record, pushing dry powder higher, while the slowdown in deal making limited distributions.

Investment performance across private market asset classes fell short of historical averages. Private equity (PE) got back in the black but generated the lowest annual performance in the past 15 years, excluding 2022. Closed-end real estate produced negative returns for the first time since 2009, as capitalization (cap) rates expanded across sectors and rent growth dissipated in formerly hot sectors, including multifamily and industrial. The performance of infrastructure funds was less than half of its long-term average and even further below the double-digit returns generated in 2021 and 2022. Private debt was the standout performer (if there was one), outperforming all other private asset classes and illustrating the asset class’s countercyclical appeal.

Private equity down but not out

Higher financing costs, lower multiples, and an uncertain macroeconomic environment created a challenging backdrop for private equity managers in 2023. Fundraising declined for the second year in a row, falling 15 percent to $649 billion, as LPs grappled with the denominator effect and a slowdown in distributions. Managers were on the fundraising trail longer to raise this capital: funds that closed in 2023 were open for a record-high average of 20.1 months, notably longer than 18.7 months in 2022 and 14.1 months in 2018. VC and growth equity strategies led the decline, dropping to their lowest level of cumulative capital raised since 2015. Fundraising in Asia fell for the fourth year of the last five, with the greatest decline in China.

Despite the difficult fundraising context, a subset of strategies and managers prevailed. Buyout managers collectively had their best fundraising year on record, raising more than $400 billion. Fundraising in Europe surged by more than 50 percent, resulting in the region’s biggest haul ever. The largest managers raised an outsized share of the total for a second consecutive year, making 2023 the most concentrated fundraising year of the last decade (Exhibit 2).

Despite the drop in aggregate fundraising, PE assets under management increased 8 percent to $8.2 trillion. Only a small part of this growth was performance driven: PE funds produced a net IRR of just 2.5 percent through September 30, 2023. Buyouts and growth equity generated positive returns, while VC lost money. PE performance, dating back to the beginning of 2022, remains negative, highlighting the difficulty of generating attractive investment returns in a higher interest rate and lower multiple environment. As PE managers devise value creation strategies to improve performance, their focus includes ensuring operating efficiency and profitability of their portfolio companies.

Deal activity volume and count fell sharply, by 21 percent and 24 percent, respectively, which continued the slower pace set in the second half of 2022. Sponsors largely opted to hold assets longer rather than lock in underwhelming returns. While higher financing costs and valuation mismatches weighed on overall deal activity, certain types of M&A gained share. Add-on deals, for example, accounted for a record 46 percent of total buyout deal volume last year.

Real estate recedes

For real estate, 2023 was a year of transition, characterized by a litany of new and familiar challenges. Pandemic-driven demand issues continued, while elevated financing costs, expanding cap rates, and valuation uncertainty weighed on commercial real estate deal volumes, fundraising, and investment performance.

Managers faced one of the toughest fundraising environments in many years. Global closed-end fundraising declined 34 percent to $125 billion. While fundraising challenges were widespread, they were not ubiquitous across strategies. Dollars continued to shift to large, multi-asset class platforms, with the top five managers accounting for 37 percent of aggregate closed-end real estate fundraising. In April, the largest real estate fund ever raised closed on a record $30 billion.

Capital shifted away from core and core-plus strategies as investors sought liquidity through redemptions in open-end vehicles and reduced gross contributions to the lowest level since 2009. Opportunistic strategies benefited from this shift, as investors turned their attention toward capital appreciation over income generation in a market where alternative sources of yield have grown more attractive.

In the United States, for instance, open-end funds, as represented by the National Council of Real Estate Investment Fiduciaries Fund Index—Open-End Equity (NFI-OE), recorded $13 billion in net outflows in 2023, reversing the trend of positive net inflows throughout the 2010s. The negative flows mainly reflected $9 billion in core outflows, with core-plus funds accounting for the remaining outflows, which reversed a 20-year run of net inflows.

As a result, the NAV in US open-end funds fell roughly 16 percent year over year. Meanwhile, global assets under management in closed-end funds reached a new peak of $1.7 trillion as of June 2023, growing 14 percent between June 2022 and June 2023.

Real estate underperformed historical averages in 2023, as previously high-performing multifamily and industrial sectors joined office in producing negative returns caused by slowing demand growth and cap rate expansion. Closed-end funds generated a pooled net IRR of −3.5 percent in the first nine months of 2023, losing money for the first time since the global financial crisis. The lone bright spot among major sectors was hospitality, which—thanks to a rush of postpandemic travel—returned 10.3 percent in 2023. 2 Based on NCREIFs NPI index. Hotels represent 1 percent of total properties in the index. As a whole, the average pooled lifetime net IRRs for closed-end real estate funds from 2011–20 vintages remained around historical levels (9.8 percent).

Global deal volume declined 47 percent in 2023 to reach a ten-year low of $650 billion, driven by widening bid–ask spreads amid valuation uncertainty and higher costs of financing (Exhibit 3). 3 CBRE, Real Capital Analytics Deal flow in the office sector remained depressed, partly as a result of continued uncertainty in the demand for space in a hybrid working world.

During a turbulent year for private markets, private debt was a relative bright spot, topping private markets asset classes in terms of fundraising growth, AUM growth, and performance.

Fundraising for private debt declined just 13 percent year over year, nearly ten percentage points less than the private markets overall. Despite the decline in fundraising, AUM surged 27 percent to $1.7 trillion. And private debt posted the highest investment returns of any private asset class through the first three quarters of 2023.

Private debt’s risk/return characteristics are well suited to the current environment. With interest rates at their highest in more than a decade, current yields in the asset class have grown more attractive on both an absolute and relative basis, particularly if higher rates sustain and put downward pressure on equity returns (Exhibit 4). The built-in security derived from debt’s privileged position in the capital structure, moreover, appeals to investors that are wary of market volatility and valuation uncertainty.

Direct lending continued to be the largest strategy in 2023, with fundraising for the mostly-senior-debt strategy accounting for almost half of the asset class’s total haul (despite declining from the previous year). Separately, mezzanine debt fundraising hit a new high, thanks to the closings of three of the largest funds ever raised in the strategy.

Over the longer term, growth in private debt has largely been driven by institutional investors rotating out of traditional fixed income in favor of private alternatives. Despite this growth in commitments, LPs remain underweight in this asset class relative to their targets. In fact, the allocation gap has only grown wider in recent years, a sharp contrast to other private asset classes, for which LPs’ current allocations exceed their targets on average. According to data from CEM Benchmarking, the private debt allocation gap now stands at 1.4 percent, which means that, in aggregate, investors must commit hundreds of billions in net new capital to the asset class just to reach current targets.

Private debt was not completely immune to the macroeconomic conditions last year, however. Fundraising declined for the second consecutive year and now sits 23 percent below 2021’s peak. Furthermore, though private lenders took share in 2023 from other capital sources, overall deal volumes also declined for the second year in a row. The drop was largely driven by a less active PE deal environment: private debt is predominantly used to finance PE-backed companies, though managers are increasingly diversifying their origination capabilities to include a broad new range of companies and asset types.

Infrastructure and natural resources take a detour

For infrastructure and natural resources fundraising, 2023 was an exceptionally challenging year. Aggregate capital raised declined 53 percent year over year to $82 billion, the lowest annual total since 2013. The size of the drop is particularly surprising in light of infrastructure’s recent momentum. The asset class had set fundraising records in four of the previous five years, and infrastructure is often considered an attractive investment in uncertain markets.

While there is little doubt that the broader fundraising headwinds discussed elsewhere in this report affected infrastructure and natural resources fundraising last year, dynamics specific to the asset class were at play as well. One issue was supply-side timing: nine of the ten largest infrastructure GPs did not close a flagship fund in 2023. Second was the migration of investor dollars away from core and core-plus investments, which have historically accounted for the bulk of infrastructure fundraising, in a higher rate environment.

The asset class had some notable bright spots last year. Fundraising for higher-returning opportunistic strategies more than doubled the prior year’s total (Exhibit 5). AUM grew 18 percent, reaching a new high of $1.5 trillion. Infrastructure funds returned a net IRR of 3.4 percent in 2023; this was below historical averages but still the second-best return among private asset classes. And as was the case in other asset classes, investors concentrated commitments in larger funds and managers in 2023, including in the largest infrastructure fund ever raised.

The outlook for the asset class, moreover, remains positive. Funds targeting a record amount of capital were in the market at year-end, providing a robust foundation for fundraising in 2024 and 2025. A recent spate of infrastructure GP acquisitions signal multi-asset managers’ long-term conviction in the asset class, despite short-term headwinds. Global megatrends like decarbonization and digitization, as well as revolutions in energy and mobility, have spurred new infrastructure investment opportunities around the world, particularly for value-oriented investors that are willing to take on more risk.

Private markets make measured progress in DEI

Diversity, equity, and inclusion (DEI) has become an important part of the fundraising, talent, and investing landscape for private market participants. Encouragingly, incremental progress has been made in recent years, including more diverse talent being brought to entry-level positions, investing roles, and investment committees. The scope of DEI metrics provided to institutional investors during fundraising has also increased in recent years: more than half of PE firms now provide data across investing teams, portfolio company boards, and portfolio company management (versus investment team data only). 4 “ The state of diversity in global private markets: 2023 ,” McKinsey, August 22, 2023.

In 2023, McKinsey surveyed 66 global private markets firms that collectively employ more than 60,000 people for the second annual State of diversity in global private markets report. 5 “ The state of diversity in global private markets: 2023 ,” McKinsey, August 22, 2023. The research offers insight into the representation of women and ethnic and racial minorities in private investing as of year-end 2022. In this chapter, we discuss where the numbers stand and how firms can bring a more diverse set of perspectives to the table.

The statistics indicate signs of modest advancement. Overall representation of women in private markets increased two percentage points to 35 percent, and ethnic and racial minorities increased one percentage point to 30 percent (Exhibit 6). Entry-level positions have nearly reached gender parity, with female representation at 48 percent. The share of women holding C-suite roles globally increased 3 percentage points, while the share of people from ethnic and racial minorities in investment committees increased 9 percentage points. There is growing evidence that external hiring is gradually helping close the diversity gap, especially at senior levels. For example, 33 percent of external hires at the managing director level were ethnic or racial minorities, higher than their existing representation level (19 percent).

Yet, the scope of the challenge remains substantial. Women and minorities continue to be underrepresented in senior positions and investing roles. They also experience uneven rates of progress due to lower promotion and higher attrition rates, particularly at smaller firms. Firms are also navigating an increasingly polarized workplace today, with additional scrutiny and a growing number of lawsuits against corporate diversity and inclusion programs, particularly in the US, which threatens to impact the industry’s pace of progress.

Fredrik Dahlqvist is a senior partner in McKinsey’s Stockholm office; Alastair Green is a senior partner in the Washington, DC, office, where Paul Maia and Alexandra Nee are partners; David Quigley is a senior partner in the New York office, where Connor Mangan is an associate partner and Aditya Sanghvi is a senior partner; Rahel Schneider is an associate partner in the Bay Area office; John Spivey is a partner in the Charlotte office; and Brian Vickery is a partner in the Boston office.

The authors wish to thank Jonathan Christy, Louis Dufau, Vaibhav Gujral, Graham Healy-Day, Laura Johnson, Ryan Luby, Tripp Norton, Alastair Rami, Henri Torbey, and Alex Wolkomir for their contributions

The authors would also like to thank CEM Benchmarking and the StepStone Group for their partnership in this year's report.

This article was edited by Arshiya Khullar, an editor in the Gurugram office.

Explore a career with us

Related articles.

CEO alpha: A new approach to generating private equity outperformance

Private equity turns to resiliency strategies for software investments

The state of diversity in global private markets: 2022

- Get 7 Days Free

Proxy Server Market Trends 2024: Proxyway's Annual Report is Now Available

Proxyway - a major researcher of proxies and web scraping infrastructure - has released a free report on the proxy server market. Proxy Market Research is the largest overview of this kind, and it has been presented annually since 2019. The report is based on technical benchmarks of the most known proxy service providers.

NEW YORK, NY / ACCESSWIRE / May 15, 2024 / Web scraping has been trending upwards, especially in the e-commerce industry. Statista reported that around 60% of surveyed businesses were driving innovation with data last year. Automated data gathering helps companies to gain competitive advantage over other businesses and drive profit growth.

However, web scraping is becoming more challenging every year. Targets like Amazon or eBay use various anti-bot measures to prevent automated data collection. The reasons vary - some websites want to prevent competitive intelligence, while others want to reduce server load or stop bad-bot traffic.

Automated data collection is almost impossible without proxies. A proxy server routes requests through itself and conceals the real user's IP address and location. In simple terms, proxies are different IP addresses assigned by a proxy service provider. A proxy is a tool that allows access to publicly available data without triggering website security measures like IP bans or request limiting.

When it comes to choosing the right proxy service, things get complicated. Many companies differ in user experience, price, and proxy quality. Without extensive testing of such products, it is easy to fall into a marketing trap. Some providers promise large proxy pools, while others - great performance.

Proxyway tests major proxy providers each year and compares them in the Proxy Market Research. The report looks into 13 proxy providers that take the lion's share of the market and includes an evaluation of their technical performance, proxy network size, features, user experience, IP quality, and price. The research is valuable for both enterprises and small businesses looking for proxy services based on real-life tests rather than marketing promises.

The Main Highlights of the Proxy Market Research 2024

The report looks into three types of proxies: residential, mobile, and rotating datacenter. It presents each product's performance data based on millions of connection requests. Proxyway also tested proxies with popular targets like Amazon, Google, and a social media network.

Annual testing also allows for the provision of historical performance data, which is included with each product. Additionally, Proxyway covers aspects like pricing, features, and user experience.

Finally, the report includes a section on market trends covering increasing competition, new market entrants, ongoing price wars, AI-related use cases, legal disputes related to social media, and other topics about the industry's current state.

Proxy Market Research 2024 is publicly available on Proxyway's website. To access it, visit: https://proxyway.com/research/proxy-market-research-2024

Contact Information

Adam Dubois Co-Founder [email protected]

SOURCE: Proxyway

View the original press release on newswire.com.

Market Updates

5 stocks to buy while they’re trading at big discounts, markets brief: tech stocks lead ahead of nvidia earnings, how anti-obesity drugs are innovating the healthcare market, what’s happening in the markets this week, why immigration has boosted job gains and the economy, what to invest in during high inflation, never mind market efficiency: are the markets sensible, starbucks stock could use a pick-me-up after big selloff; is it a buy, stock picks, should you buy and hold an artificial intelligence portfolio, 3 cheap and dependable dividend-growth stocks to buy, the best bank stocks to buy, after earnings, is roblox stock a buy, sell, or fairly valued, after earnings, is lyft stock a buy, a sell, or fairly valued, 8 stock picks in the apparel industry, baidu earnings: advertising weakness offset by continued growth in cloud business, going into earnings, is target stock a buy, a sell, or fairly valued, sponsor center.

- Data library

2024 Housing Market Forecast and Predictions: Housing Affordability Finally Begins to Turnaround

As we look ahead to 2024 , we see a mix of continuity and change in both the housing market and economy. Against a backdrop of modest economic growth, slightly higher unemployment, and easing inflation longer term interest rates including mortgage rates begin a slow retreat. The shift from climbing to falling mortgage rates improves housing affordability, but saps some of the urgency home shoppers had previously sensed. Less frenzied housing demand and plenty of rental home options keep home sales relatively stable at low levels in 2024, helping home prices to adjust slightly lower even as the number of for-sale homes continues to dwindle.

Realtor.com ® 2024 Forecast for Key Housing Indicators

Home Prices Dip, Improving Affordability

Home prices grew at a double-digit annual clip for the better part of two years spanning the second half of 2020 through 2022, a notable burst following a growing streak that spanned back to 2012. As mortgage rates climbed, home price growth flatlined, actually declining on an annual basis in early 2023 before an early-year dip in mortgage rates spurred enough buyer demand to reignite competition for still-limited inventory. Home prices began to climb again, and while they did not reach a new monthly peak, on average for the year we expect that the 2023 median home price will slightly exceed the 2022 annual median.