مہنگائی پر ایک مضمون | Essay On Mehangai In Urdu

Back to: Urdu Essays List 2

آج کے زمانے میں کوئی نہیں جو بڑھتی ہوئی مہنگائی سے پریشان نہ ہو۔ ویسے تو مہنگائی ایک بین الاقوامی مسئلہ ہے۔ دنیا کے سبھی ملکوں میں ضروریات زندگی کی چیزوں کی قیمتوں میں روز بروز اضافہ ہو رہا ہے۔ بڑی حد تک یہ ایک فطری امر بھی ہے کیونکہ دنیا کی آبادی میں جس تیزی سے اضافہ ہوا ہے اس رفتار سے چیزوں کی پیداوار میں نہیں ہوا۔ اور یہ بھی بات ہم سب ہی جانتے ہیں کہ جب کسی چیز کے خواہشمند یا طلبگار زیادہ ہو جائیں تو اس کی قیمت بڑھنا شروع ہو جاتی ہے۔

دنیا میں لوہے، کوئلے اور پٹرول وغیرہ کے ذخیرے بڑھتی ہوئی صنعتی ترقی کے پیشِ نظر جس تیزی سے استعمال میں آ رہے ہیں اتنی تیزی سے نئے ذخیروں اور وسائل کی دریافت نہیں ہوسکتی۔ غرض یہ چند عام حقائق ہیں جو دنیا کی بڑھتی ہوئی مہنگائی کو سمجھنے میں ہمیں مدد دیتے ہیں۔ لیکن ہندوستان میں مہنگائی کا مسئلہ دنیا بھر کے سبھی ملکوں سے زیادہ شدید اور تشویشناک ہے۔

ہندوستان بنیادی طور پر غریب اور پسماندہ ملک ہے جو آزادی ملنے کے بعد سے ترقی کی جدوجہد میں مصروف ہے۔ لیکن ہماری ترقی کے تمام منصوبے ملک کی بڑھتی ہوئی آبادی کی ضروریات زندگی کی اشیاء کی کمی وغیرہ کی وجہ سے پوری طرح عمل میں نہیں آ پاتے۔ جس ملک کی بیشتر آبادی کو دو وقت پیٹ بھرنے کو اناج نہ مل سکے وہاں پر سماجی ترقی اور تہذیب و تمدن کی بہتری کی باتیں کرنا ایک کربناک مذاق ہی معلوم ہوتی ہیں۔

بہرحال ان مسائل کو دور کرنے کے لئے ملک کو بڑی بڑی قربانیاں دینی پڑیں اور جی توڑ کر کوشش کرنا پڑیں۔ اس سلسلے میں جو اقدامات اور کوششیں کی گئیں ان میں زرعی پیداوار، صنعتی ترقی اور بے روزگاری ختم کرنے کے منصوبے خاص اہمیت رکھتے ہیں۔ ابتداء میں ان منصوبوں کی ترقی کی رفتار دیکھ کر یہ امید پیدا ہوچلی تھی کہ جلد ہی ملک خودکفالتی کے راستے پر پوری طرح گامزن ہوجائے گا اور غریبی اور بدحالی کا خاتمہ ہوجائے گا۔ لیکن دوسری طرف ملک کی آبادی بھی غیر معمولی رفتار سے بڑھتی گئی اور ملک کی خوشحالی کے راستے میں ایک مہیب رکاوٹ بن کر سامنے آ کھڑی ہوئی۔ اور ستم بالائے ستم یہ کہ اسی دوران ملک کو کئی بدیشی طاقتوں سے جنگ کرنے پر مجبور ہونا پڑا۔

ظاہر ہے کہ ان حالات میں مہنگائی کا بڑھنا قدرتی تھا۔ لیکن موجودہ مہنگائی کی صورتحال کو منافع خوری بلیک مارکیٹ اور رشوت نے اس حد تک پہنچا دیا ہے کہ درمیانہ اور اوسط طبقے کے لوگ بھی پیٹ بھرنے اور تن ڈھانپنے کی ضرورتوں کو پورا نہیں کر سکتے۔ غریبی میں کمی کی بجائے بے پناہ اضافہ ہو گیا۔ آج ہندوستان میں بھوک، مفلسی اور بدحالی کا مسئلہ جتنا اہم ہوگیا ہے شاید پہلے کبھی نہیں تھا۔ ان حالات کے پیش نظر جمہوریت اور سوشلزم کے بلند بانگ دعوے اور ملکی رہنماؤں کے وعدے عوام کے لیے ایک سراب سے زیادہ حقیقت نہیں رکھتے۔

بڑھتی ہوئی مہنگائی اور اس کے نتیجے میں پیدا ہونے والی غریبی اور بدحالی کو روکنے کے لئے حکومت اور عوام دونوں کو جدوجہد اور عمل کرنے کی ضرورت ہے۔ حکومت کے دستور میں عوام سے اس بات کا وعدہ کیا گیا ہے کہ حکومت ان کی زندگی کی بنیادی ضرورتیں پوری کرنے کی ذمہ دار ہے۔ ویسے بھی عوامی حکومت یا جمہوریت اسی وقت اپنے نام کی اہل قرار دی جا سکتی ہے جب وہ اپنی عوام کو زندگی کی لازمی ضروریات کو پورا کرنے کا حق دے سکتے ہیں۔

مہنگائی روکنے کے لئے حکومت کو اپنے تمام وسائل اور قوت سے کام لینا چاہیے اور بلیک کرنے والوں، رشوت خوروں اور بے ایمانی کرنے والوں کو عبرت ناک سزائیں دینی چاہیے۔کیونکہ اگر جلد ہی موثر اقدامات نہیں کیے گئے تو یہ مسئلہ اتنا بڑھ جائے گا کہ اس پر قابو پانا ناممکن ہوجائے گا۔ مہنگائی کی وجہ سے ایک طرف تو حکومت کے بہت سے ترقیاتی منصوبے عمل میں نہیں آ پاتے اور دوسرے ملک میں بے اطمینانی اور جگہ جگہ حکومت کے خلاف جذبات پیدا ہوتے ہیں جو تخریبی کارروائیوں اور توڑ پھوڑ کی شکل میں ظاہر ہوتے ہیں اور ان تخریبی کارروائیوں سے ملک کے امن و اطمینان میں خلل پیدا ہوتا ہے اور ترقی کے منصوبے سست اور بے عمل ہو جاتے۔

اسی مسئلے کے نتیجے میں سرکاری ملازمین تنخواہوں میں اضافہ کی مانگ کرتے ہیں اور ہڑتال کرتے ہیں۔ ریلوے، ڈاک اور ایسے ہی اہم شعبوں کی ہڑتالوں سے ہر سال ملک کے کروڑوں روپے کا خسارہ ہوتا ہے اور تنخواہوں میں اضافہ کرنے سے ملکی بجٹ پر کافی بوجھ پڑ جاتا ہے اور مہنگائی بڑھتی رہتی ہے۔

حکومت ابھی تک موثر اقدامات کرنے سے قاصر رہی ہے۔ لیکن اس کی ایک بڑی وجہ یہ بھی ہے کہ عوام نے حکومت کو اس سلسلے میں مناسب تعاون نہیں دیا۔ ظاہر ہے کہ قانون اور حکومت ہی منافع خوروں کو سزا دے سکتی ہے لیکن کیا یہ عوام کا فرض نہیں کہ وہ ایسے لوگوں کو قانون کی نظر میں لائیں۔ پرامن طریقوں سے ذخیرہ اندوزوں وغیرہ کو بے نقاب کریں۔ اور ان کا سماجی بائیکاٹ کریں۔ اگر عوام اور حکومت دونوں اپنی ذمہ داریوں کو پوری طرح اور خلوص اور لگن سے انجام دینے کی کوشش کریں تو وہ دن دور نہیں جب ایک بار پھر ملک میں خوشحالی کا سورج چمکے گا۔

Essay on Inflation in Pakistan for Students

by Pakiology | Apr 21, 2024 | Essay | 0 comments

In this essay on inflation in Pakistan, we will look at the causes, effects, and solutions to this issue that has been affecting the country for decades. The term ‘inflation’ refers to a sustained rise in the prices of goods and services in an economy. In Pakistan, inflation has been a major concern since the late 1990s, with the Consumer Price Index (CPI) reaching a peak in 2023. We will explore the various factors that have contributed to inflation in Pakistan, its economic effects, and what can be done to address the issue.

Page Contents

Essay on Inflation Outlines

Causes of inflation in pakistan, effects of inflation, solution to control inflation.

- Introduction

Inflation in Pakistan is caused by several factors, which can be divided into two main categories: domestic and external. The main domestic causes of inflation are an increase in money supply, an increase in government spending, an increase in indirect taxes, and a decrease in economic growth.

The most significant contributor to inflation in Pakistan is an increase in the money supply. When there is too much money chasing after too few goods, prices rise, creating a situation known as demand-pull inflation. An increase in the money supply can be caused by the central bank printing more money or by the government borrowing more money from the public.

In addition, higher government spending can lead to inflation. This occurs when the government prints more money to finance its expenditure or borrows from the public and transfers the cost of this additional spending to businesses and consumers. This leads to higher prices for goods and services. Indirect taxes are another major factor that contributes to inflation in Pakistan. When indirect taxes are increased, prices of goods and services also increase, leading to an overall rise in prices.

Finally, low economic growth can also cause inflation in Pakistan. A weak economy reduces people’s purchasing power, forcing them to buy less, which reduces demand and leads to lower prices. However, when economic growth stalls, businesses are unable to sell their products at the same price as before, leading to a rise in prices.

Overall, inflation in Pakistan is caused by a combination of domestic and external factors. These include an increase in money supply, higher government spending, increases in indirect taxes, and a decrease in economic growth.

The effects of inflation on the economy can be both positive and negative. Inflation erodes the purchasing power of money, meaning that each unit of currency is worth less than it was before. This means that, as the cost of living increases, people can purchase fewer goods and services for the same amount of money. As a result, their standard of living decreases.

Inflation also reduces the real return on investments and savings, which can have a detrimental effect on economic growth. When inflation is high, people prefer to save their money rather than invest in a business or other activities. This reduces the availability of capital and results in slower economic growth.

In addition to decreasing standards of living, inflation can lead to unemployment if companies are not able to increase wages at the same rate as prices rise. This can lead to an increase in poverty, as people struggle to afford necessities. Furthermore, when prices rise faster than wages, it puts pressure on government budgets and can increase public debt.

Inflation can also cause the value of the local currency to depreciate against foreign currencies. This has a direct impact on the cost of imports and makes domestic goods less competitive in international markets. It can also have an indirect impact on exports, as it reduces the competitiveness of local producers in foreign markets.

Inflation is a serious issue in Pakistan, and it needs to be addressed to improve the country’s economic conditions. The following are some of the measures that can be taken to control inflation in Pakistan:

1. Fiscal policy: A strong fiscal policy is necessary for controlling inflation. The government should increase its revenue by implementing taxes on the wealthy and reducing public spending. This will help reduce budget deficits, which will result in lower inflation.

2. Monetary policy: The State Bank of Pakistan should adopt a tighter monetary policy to control inflation. It should raise interest rates so that investors have an incentive to save rather than spend, thus curbing demand-pull inflation.

3. Supply-side measures: There should be an increase in the production of essential commodities and products to meet the demand of consumers. This will help reduce prices and inflation in the long run.

4. Subsidies: The government should provide subsidies to those who are suffering due to the high prices of essential items. This will help them cope with the rising cost of living and ensure that they have access to essential goods and services.

5. Stabilizing exchange rate: A stable exchange rate between foreign currencies and the rupee is necessary for controlling inflation. The State Bank of Pakistan should strive to keep the rupee’s value stable by using currency swaps and other methods.

These measures can go a long way in controlling inflation in Pakistan. By taking these measures, the government can help improve the country’s economic condition and create an environment conducive to investment and growth.

What is inflation in simple words?

Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.

What are the 4 main causes of inflation?

The 4 main causes of inflation are: Demand-pull inflation: when there is an increase in demand for goods and services that outstrip the economy’s ability to produce them. Cost-push inflation: when the cost of production increases, causing companies to raise prices to maintain their profit margins. Built-in inflation: when businesses expect prices to rise and build that expectation into their prices, causing a self-fulfilling cycle of inflation. Imported inflation: when the cost of imported goods increases, leading to higher prices for consumers.

What are the 5 main causes of inflation?

The 4 main causes of inflation are: 1. Demand-pull inflation 2. Cost-push inflation 3. Built-in inflation 4. Imported inflation 5. Monetary inflation

What is inflation introduction?

Inflation is a phenomenon that has been observed throughout history. It refers to the sustained increase in the general price level of goods and services in an economy over a period of time.

Find more Essays on the following Topics

Ask Your Questions

You might like, democracy in pakistan essay with quotations.

Explore the evolution, challenges, and progress of democracy in Pakistan in this in-depth essay. Gain insights into...

Problems of Karachi Essay | 200 & 500 Words

Explore the multifaceted challenges faced by Karachi in this comprehensive essay. From overpopulation to traffic...

A True Muslim Essay With Quotations 2023

A true Muslim essay is about the qualities of a true Muslim and how they embody the teachings of Islam in their daily...

An Essay on My Mother: A Tribute to Mothers

Mothers are the backbone of a family and a crucial influence in the lives of their children. From an early age,...

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Submit Comment

- class-9-notes

- Friendship quotes

- Scholarships

- Science News

- Study Abroad

- Study in Australia

- SZABMU MDCAT

- UHS Past MCQs

- Universities

- Privacy Policy

Essay on inflation/Rising prices in Pakistan with quotations

Rising prices / inflation essay 300 - 400 words.

Inflation essay for 2nd year, class 12 PDF download

Inflation is taxation without legislation - Milton Friedman

Inflation is the crabgrass in your savings - Robert Orben

Inflation is the parent of unemployment and the unseen robber of those who have saved - Margret Thatcher

Production is the only answer to inflation - Anonymous

8 comments:

Just better butnit good

Nice Good effort

It's short a little bit but the content is good

Post a Comment

Trending Topics

Latest posts.

- 1st year Urdu past papers solved pdf download 2023

- 1st year guess paper 2024 Punjab Board pdf

- 1st year Urdu Guess Paper New 2024

- 1st year Islamiat complete Notes PDF Download

- 1st year all subjects notes for FBISE and Punjab Boards pdf

- 1st year chemistry guess paper 2024 pdf download

- 1st year economics guess paper 2024 pdf download

- 1st year Past papers solved and unsolved all Punjab Boards

- 1st year education guess paper 2024 pdf download

- 1st year Urdu Khulasa Nasar and Nazam pdf download

- 1st year English guess paper 2024 Punjab board

- 2nd year guess paper 2024 Punjab board

- 2nd year English guess paper 2024 for Punjab Boards

- 1st year English MCQs Objective Solved Notes

- 1st year English complete notes pdf download

- 2nd year all subjects notes PDF Download

- 2nd year tarjuma tul Quran book pdf download

- BISE Hyderabad

- BISE Lahore

- bise rawalpindi

- BISE Sargodha

- career-counseling

- how to pass

- Punjab Board

- Sindh-Board

- Solved mcqs

- Student-Guide

Hyper Inflation Explained, Definition, Causes, Effects, Solutions, Example (Urdu-English)

What is Hyperinflation? Reasons, Solution, Effects, Hyper Inflation in Pakistan (Essay in Urdu & English) Hyperinflation is a very rapid or out-of-control inflation. It occurs when there is a continuing increase in the price level of goods and services in an economy over a period of time. The inflation rate rises so quickly that the prices of goods and services increase rapidly. This causes the value of money to fall and people to lose their savings. Hyper inflation is often caused by a country printing too much money to pay for its expenses.

In economics hyperinflation is very high and typically accelerating inflation. It quickly erodes the real value of people’s savings and makes it difficult to plan long-term purchases. A sustained period of hyperinflation is usually accompanied by a widespread deterioration in economic activity leading to a sharp increase in unemployment and often political instability.

Table of Contents

What is Hyper Inflation?

Hyperinflation is a very rapid and excessive increase in prices. It is usually caused by an increase in the money supply, which then causes more money to chase after fewer goods and services. This results in a vicious cycle where prices continue to go up at an ever-increasing rate. Hyperinflation can be extremely destructive to an economy as it can lead to a complete breakdown in the currency system and make it very difficult for people to save or plan for the future.

Current Global Hyperinflation

In economics hyperinflation is very high and typically accelerating inflation. It quickly erodes the real value of money as the prices of goods increase faster than the currency can be produced. The causes of hyperinflation are often disputed by economists. Some believe that it requires “excessive” money printing by the government while others attribute it to a collapse in aggregate demand or credit.

Hyperinflation is usually caused by a large increase in the money supply which is not supported by a corresponding growth in the output of goods and services. This results in an increase in prices (inflation) and as people lose confidence in the currency they begin to hoard it or spend it as quickly as possible (demand pull inflation).

left unchecked hyperinflation can be extremely destructive: it leads to a loss of confidence in the government a breakdown in social order and eventually to economic collapse.

At present hyper inflation is due to Russia Ukraine war and corona pandemic. There are some other contributing factor too. This phenomenon of hyper inflation is global in nature, as it is affecting USA and Western countries too. Sri Lanka has defaulted. Pakistan is near to default. There is need of collective efforts by all countries of the world to avoid great depression after 100 years.

Hyper Inflation Example

Hyperinflation is a very real phenomenon that can have devastating effects on an economy. It is defined as a sustained increase in the price level of goods and services in an economy over a period of time. This inflationary spiral is usually caused by the printing of large amounts of money by the government or the central bank to finance its spending. This excessive money supply leads to a decrease in the purchasing power of the currency which leads to higher prices for goods and services. As people lose faith in the currency they start hoarding other assets such as gold or foreign currency which further drives up prices.

Causes of Hyper Inflation

Hyper inflation happens when prices for goods and services rise very quickly. It can be caused by an increase in the money supply which leads to more money chasing fewer goods. This can happen when a country prints too much money to pay for its debt or to finance its war effort. Other causes of hyperinflation include a decrease in tax revenue (leading to more government borrowing) and a decrease in production (leading to higher unemployment and less spending).

Effects of Hyper Inflation on Economy & General Public

Hyperinflation is when prices for basic goods and services rise rapidly. It can be caused by an increase in the money supply loss of confidence in a currency or a decrease in the supply of goods or services. Hyper inflation often leads to a decrease in the purchasing power of a currency, which results in people hoarding goods and services instead of using currency. This can lead to a decrease in production and an increase in unemployment. Hyperinflation can also lead to civil unrest and even revolution.

Solutions of Hyper Inflation

Hyperinflation is a very rapid or out-of-control increase in prices. It happens when the money supply grows much faster than the economy. This causes people to lose faith in their currency. As a result they start buying goods with their currency before it loses even more value. This creates a self-perpetuating inflationary spiral.

Hyperinflation is a very serious economic problem that can cause widespread economic hardship. There are a number of possible solutions to hyperinflation but the most effective ones tend to be aggressive and controversial. One popular solution is to simply print more money which can help to stimulate the economy and increase the money supply. Another solution is to raise taxes which can help to reduce the amount of money in circulation and slow down the rate of inflation. Finally another solution is to implement strict price controls which can help to keep prices from rising too rapidly.

These are also some solutions to hyperinflation:

1. Reducing the money supply. The government can do this by selling assets raising taxes or reducing spending.

2 Introducing a new currency. This is often done by pegging the new currency to a stable asset such as gold or another currency.

3 Price controls. The government can impose price controls which limit how much businesses can charge for goods and services.

4 Wages and benefits controls. The government can also control wages and benefits which can help to keep inflation in check.

What was Great Depression 1930?

The Great Depression was a severe worldwide economic downturn that took place mostly during the 1930s beginning in the United States. The timing of the Great Depression varied across nations; in most countries it started in 1929 and lasted until about 1939. It was the longest deepest and most widespread depression of the 20th century. The Great Depression began in the United States after a major fall in stock prices that began around September 4 1929 and became worldwide news with the stock market crash of October 29 1929 (known as Black Tuesday). Between 1929 and 1932 worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by 1933; however in many countries the negative effects of the Great Depression lasted until after World War II. Hyperinflation was the key feature of this great depression.

Hyper Inflation During Great Depression

The effects of the Great Depression were severe and widespread. The most visible effect was the mass unemployment of workers but other effects included homelessness, malnutrition and Dust Bowl conditions in agricultural areas. One of the worst aspects of the Great Depression was hyper inflation which caused drastic increases in the prices of goods and services. This made it difficult for people to afford basic necessities and many businesses closed their doors.

Hyper Inflation Explained

Hyperinflation is a situation where prices for goods and services rise rapidly. This causes the value of money to fall. People may start using other items such as cigarettes as money.

Hyperinflation often happens when a country’s government prints too much money. This can happen during a war or other economic crisis. It can also happen when a country’s inflation rate is high and keeps increasing.

Hyper inflation can cause people to lose their life savings. It can also make it hard to buy food and other necessities.

Hyper Inflation in Pakistan

In Pakistan, inflation has been a ongoing problem. In recent years, the issue of inflation has gotten worse, with prices rising at an alarming rate. This inflation has caused many problems for the people of Pakistan, including a decrease in the purchasing power of the Pakistani Rupee.

Reasons Behind Hyper Inflation in Pakistan

The main cause of hyper inflation in Pakistan is the country’s fiscal deficit. This deficit occurs when the government spends more money than it takes in through taxes and other revenues. In order to finance this deficit, the government has to print more money, which causes the money supply to increase and the value of the Rupee to decrease. As the money supply increases, prices go up, and inflation results.

Fiscal deficit is not the only cause of inflation in Pakistan. Other factors, such as the country’s trade deficit and the current account deficit, also contribute to the problem. The trade deficit occurs when Pakistan imports more goods and services than it exports. This deficit is financed by borrowing from other countries or by printing more money, both of which contribute to inflation. The current account deficit is the difference between the amount of money coming into Pakistan and the amount of money leaving the country. This deficit is also financed by borrowing or by printing more money, and both of these options contribute to inflation.

Negative Effects of Hyper Inflation on People & Economy of Pakistan

Hyper inflation has many negative effects on the people of Pakistan. The most obvious effect is the decrease in the purchasing power of the Rupee. As prices go up, the Rupee buys less and less. This decrease in purchasing power hits the poor the hardest, as they spend a greater portion of their income on essential items such as food and clothing. Inflation also reduces the value of savings, as the purchasing power of money saved decreases over time.

Hyper inflation also has negative effects on Pakistan’s economy as a whole. When prices go up, businesses have to increase their prices as well, which can lead to a decrease in demand for their products. This decrease in demand can lead to layoffs and a decrease in production. Inflation can also lead to higher interest rates, as businesses borrow more money to finance their operations. Higher interest rates lead to a decrease in investment and a further slowdown in economic growth.

Pakistan Government’s Initiative to Overcome Hyper Inflation

The Pakistani government has taken several steps to try to control hyperinflation. One of the most important steps has been to cut spending. The government has also raised taxes and implemented other austerity measures. While these measures may help to reduce the deficit and slow the rate of inflation, they come at a cost. The measures implemented by the government have led to a decrease in economic growth and an increase in unemployment.

Conclusion The best way to control inflation is to reduce the fiscal deficit. This can be done by cutting government spending, raising taxes, or both. Reducing the deficit will require difficult decisions by the government, but it is necessary to control inflation and protect the economy from the negative effects of high prices. Hopefully you will like this English essay on hyper inflation . Studysolutions.pk has also given an Urdu essay on hyperinflation on this page.

Benazir Bhutto Biography, Achievements, Facts, Family Life, Political Ideology

I am a professional content writer and have experience of 10 years. I also launched first ever English monthly magazine of human rights in Pakistan. Majority of content on this website is written by me.

Pakistan Development Update October 2022: Inflation and the Poor - Executive Summary in Urdu

2/10/2023 03:04:00 PM

Macroeconomics, Trade and Investment

World Bank Annual Report (The World Bank Annual Report)

South Asia (SAR)

Inflation,Macroeconomic Management,Macroeconomics and Economic Growth

MAIN DOCUMENT

October-2022-Urdu-Pakistan-Development-Update-Executive-Summary.pdf

Download statistics

Total Downloads** :

Download Stats

**Download statistics measured since January 1st, 2014.

Essay on Inflation: Types, Causes and Effects

Essay on Inflation!

Essay on the Meaning of Inflation:

Inflation and unemployment are the two most talked-about words in the contemporary society. These two are the big problems that plague all the economies. Almost everyone is sure that he knows what inflation exactly is, but it remains a source of great deal of confusion because it is difficult to define it unambiguously.

Inflation is often defined in terms of its supposed causes. Inflation exists when money supply exceeds available goods and services. Or inflation is attributed to budget deficit financing. A deficit budget may be financed by additional money creation. But the situation of monetary expansion or budget deficit may not cause price level to rise. Hence the difficulty of defining ‘inflation’ .

Inflation may be defined as ‘a sustained upward trend in the general level of prices’ and not the price of only one or two goods. G. Ackley defined inflation as ‘a persistent and appreciable rise in the general level or average of prices’ . In other words, inflation is a state of rising price level, but not rise in the price level. It is not high prices but rising prices that constitute inflation.

ADVERTISEMENTS:

It is an increase in the overall price level. A small rise in prices or a sudden rise in prices is not inflation since these may reflect the short term workings of the market. It is to be pointed out here that inflation is a state of disequilibrium when there occurs a sustained rise in price level.

It is inflation if the prices of most goods go up. However, it is difficult to detect whether there is an upward trend in prices and whether this trend is sustained. That is why inflation is difficult to define in an unambiguous sense.

Let’s measure inflation rate. Suppose, in December 2007, the consumer price index was 193.6 and, in December 2008 it was 223.8. Thus the inflation rate during the last one year was 223.8 – 193.6/193.6 × 100 = 15.6%.

As inflation is a state of rising prices, deflation may be defined as a state of falling prices but not fall in prices. Deflation is, thus, the opposite of inflation, i.e., rise in the value or purchasing power of money. Disinflation is a slowing down of the rate of inflation.

Essay on the Types of Inflation :

As the nature of inflation is not uniform in an economy for all the time, it is wise to distinguish between different types of inflation. Such analysis is useful to study the distributional and other effects of inflation as well as to recommend anti-inflationary policies.

Inflation may be caused by a variety of factors. Its intensity or pace may be different at different times. It may also be classified in accordance with the reactions of the government toward inflation.

Thus, one may observe different types of inflation in the contemporary society:

(a) According to Causes:

i. Currency Inflation:

This type of inflation is caused by the printing of currency notes.

ii. Credit Inflation:

Being profit-making institutions, commercial banks sanction more loans and advances to the public than what the economy needs. Such credit expansion leads to a rise in price level.

iii. Deficit-Induced Inflation:

The budget of the government reflects a deficit when expenditure exceeds revenue. To meet this gap, the government may ask the central bank to print additional money. Since pumping of additional money is required to meet the budget deficit, any price rise may be called deficit-induced inflation.

iv. Demand-Pull Inflation:

An increase in aggregate demand over the available output leads to a rise in the price level. Such inflation is called demand-pull inflation (henceforth DPI). But why does aggregate demand rise? Classical economists attribute this rise in aggregate demand to money supply.

If the supply of money in an economy exceeds the available goods and services, DPI appears. It has been described by Coulborn as a situation of “too much money chasing too few goods” .

Note that, in this region, price level begins to rise. Ultimately, the economy reaches full employment situation, i.e., Range 3, where output does not rise but price level is pulled upward. This is demand-pull inflation. The essence of this type of inflation is “too much spending chasing too few goods.”

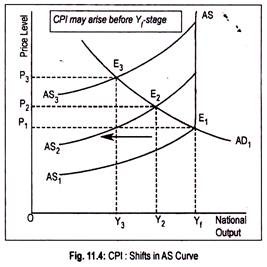

v. Cost-Push Inflation:

Inflation in an economy may arise from the overall increase in the cost of production. This type of inflation is known as cost-push inflation (henceforth CPI). Cost of production may rise due to increase in the price of raw materials, wages, etc. Often trade unions are blamed for wage rise since wage rate is not market-determined. Higher wage means higher cost of production.

Prices of commodities are thereby increased. A wage-price spiral comes into operation. But, at the same time, firms are to be blamed also for the price rise since they simply raise prices to expand their profit margins. Thus we have two important variants of CPI: wage-push inflation and profit-push inflation. Anyway, CPI stems from the leftward shift of the aggregate supply curve.

The price level thus determined is OP 1 . As aggregate demand curve shifts to AD 2 , price level rises to OP 2 . Thus, an increase in aggregate demand at the full employment stage leads to an increase in price level only, rather than the level of output. However, how much price level will rise following an increase in aggregate demand depends on the slope of the AS curve.

Causes of Demand-Pull Inflation :

DPI originates in the monetary sector. Monetarists’ argument that “only money matters” is based on the assumption that at or near full employment, excessive money supply will increase aggregate demand and will thus cause inflation.

An increase in nominal money supply shifts aggregate demand curve rightward. This enables people to hold excess cash balances. Spending of excess cash balances by them causes price level to rise. Price level will continue to rise until aggregate demand equals aggregate supply.

Keynesians argue that inflation originates in the non-monetary sector or the real sector. Aggregate demand may rise if there is an increase in consumption expenditure following a tax cut. There may be an autonomous increase in business investment or government expenditure. Governmental expenditure is inflationary if the needed money is procured by the government by printing additional money.

In brief, an increase in aggregate demand i.e., increase in (C + I + G + X – M) causes price level to rise. However, aggregate demand may rise following an increase in money supply generated by the printing of additional money (classical argument) which drives prices upward. Thus, money plays a vital role. That is why Milton Friedman believes that inflation is always and everywhere a monetary phenomenon.

There are other reasons that may push aggregate demand and, hence, price level upwards. For instance, growth of population stimulates aggregate demand. Higher export earnings increase the purchasing power of the exporting countries.

Additional purchasing power means additional aggregate demand. Purchasing power and, hence, aggregate demand, may also go up if government repays public debt. Again, there is a tendency on the part of the holders of black money to spend on conspicuous consumption goods. Such tendency fuels inflationary fire. Thus, DPI is caused by a variety of factors.

Cost-Push Inflation Theory :

In addition to aggregate demand, aggregate supply also generates inflationary process. As inflation is caused by a leftward shift of the aggregate supply, we call it CPI. CPI is usually associated with the non-monetary factors. CPI arises due to the increase in cost of production. Cost of production may rise due to a rise in the cost of raw materials or increase in wages.

Such increases in costs are passed on to consumers by firms by raising the prices of the products. Rising wages lead to rising costs. Rising costs lead to rising prices. And rising prices, again, prompt trade unions to demand higher wages. Thus, an inflationary wage-price spiral starts.

This causes aggregate supply curve to shift leftward. This can be demonstrated graphically (Fig. 11.4) where AS 1 is the initial aggregate supply curve. Below the full employment stage this AS curve is positive sloping and at full employment stage it becomes perfectly inelastic. Intersection point (E 1 ) of AD 1 and AS 1 curves determines the price level.

Now, there is a leftward shift of aggregate supply curve to AS 2 . With no change in aggregate demand, this causes price level to rise to OP 2 and output to fall to OY 2 .

With the reduction in output, employment in the economy declines or unemployment rises. Further shift in the AS curve to AS 2 results in higher price level (OP 3 ) and a lower volume of aggregate output (OY 3 ). Thus, CPI may arise even below the full employment (Y f ) stage.

Causes of CPI :

It is the cost factors that pull the prices upward. One of the important causes of price rise is the rise in price of raw materials. For instance, by an administrative order the government may hike the price of petrol or diesel or freight rate. Firms buy these inputs now at a higher price. This leads to an upward pressure on cost of production.

Not only this, CPI is often imported from outside the economy. Increase in the price of petrol by OPEC compels the government to increase the price of petrol and diesel. These two important raw materials are needed by every sector, especially the transport sector. As a result, transport costs go up resulting in higher general price level.

Again, CPI may be induced by wage-push inflation or profit-push inflation. Trade unions demand higher money wages as a compensation against inflationary price rise. If increase in money wages exceeds labour productivity, aggregate supply will shift upward and leftward. Firms often exercise power by pushing up prices independently of consumer demand to expand their profit margins.

Fiscal policy changes, such as an increase in tax rates leads to an upward pressure in cost of production. For instance, an overall increase in excise tax of mass consumption goods is definitely inflationary. That is why government is then accused of causing inflation.

Finally, production setbacks may result in decreases in output. Natural disaster, exhaustion of natural resources, work stoppages, electric power cuts, etc., may cause aggregate output to decline.

In the midst of this output reduction, artificial scarcity of any goods by traders and hoarders just simply ignite the situation.

Inefficiency, corruption, mismanagement of the economy may also be the other reasons. Thus, inflation is caused by the interplay of various factors. A particular factor cannot be held responsible for inflationary price rise.

Essay on the Effects of Inflation :

People’s desires are inconsistent. When they act as buyers they want prices of goods and services to remain stable but as sellers they expect the prices of goods and services should go up. Such a happy outcome may arise for some individuals; “but, when this happens, others will be getting the worst of both worlds.” Since inflation reduces purchasing power it is bad.

The old people are in the habit of recalling the days when the price of say, meat per kilogram cost just 10 rupees. Today it is Rs. 250 per kilogram. This is true for all other commodities. When they enjoyed a better living standard. Imagine today, how worse we are! But meanwhile, wages and salaries of people have risen to a great height, compared to the ‘good old days’. This goes unusually untold.

When price level goes up, there is both a gainer and a loser. To evaluate the consequence of inflation, one must identify the nature of inflation which may be anticipated and unanticipated. If inflation is anticipated, people can adjust with the new situation and costs of inflation to the society will be smaller.

In reality, people cannot predict accurately future events or people often make mistakes in predicting the course of inflation. In other words, inflation may be unanticipated when people fail to adjust completely. This creates various problems.

One can study the effects of unanticipated inflation under two broad headings:

(i) Effect on distribution of income and wealth

(ii) Effect on economic growth.

(a) Effects of Inflation on Income and Wealth Distribution :

During inflation, usually people experience rise in incomes. But some people gain during inflation at the expense of others. Some individuals gain because their money incomes rise more rapidly than the prices and some lose because prices rise more rapidly than their incomes during inflation. Thus, it redistributes income and wealth.

Though no conclusive evidence can be cited, it can be asserted that following categories of people are affected by inflation differently:

i. Creditors and Debtors:

Borrowers gain and lenders lose during inflation because debts are fixed in rupee terms. When debts are repaid their real value declines by the price level increase and, hence, creditors lose. An individual may be interested in buying a house by taking a loan of Rs. 7 lakh from an institution for 7 years.

The borrower now welcomes inflation since he will have to pay less in real terms than when it was borrowed. Lender, in the process, loses since the rate of interest payable remains unaltered as per agreement. Because of inflation, the borrower is given ‘dear’ rupees, but pays back ‘cheap’ rupees.

However, if in an inflation-ridden economy creditors chronically loose, it is wise not to advance loans or to shut down business. Never does it happen. Rather, the loan- giving institution makes adequate safeguard against the erosion of real value.

ii. Bond and Debenture-Holders:

In an economy, there are some people who live on interest income—they suffer most.

Bondholders earn fixed interest income:

These people suffer a reduction in real income when prices rise. In other words, the value of one’s savings decline if the interest rate falls short of inflation rate. Similarly, beneficiaries from life insurance programmes are also hit badly by inflation since real value of savings deteriorate.

iii. Investors:

People who put their money in shares during inflation are expected to gain since the possibility of earning business profit brightens. Higher profit induces owners of firms to distribute profit among investors or shareholders.

iv. Salaried People and Wage-Earners:

Anyone earning a fixed income is damaged by inflation. Sometimes, unionized worker succeeds in raising wage rates of white-collar workers as a compensation against price rise. But wage rate changes with a long time lag. In other words, wage rate increases always lag behind price increases.

Naturally, inflation results in a reduction in real purchasing power of fixed income earners. On the other hand, people earning flexible incomes may gain during inflation. The nominal incomes of such people outstrip the general price rise. As a result, real incomes of this income group increase.

v. Profit-Earners, Speculators and Black Marketeers:

It is argued that profit-earners gain from inflation. Profit tends to rise during inflation. Seeing inflation, businessmen raise the prices of their products. This results in a bigger profit. Profit margin, however, may not be high when the rate of inflation climbs to a high level.

However, speculators dealing in business in essential commodities usually stand to gain by inflation. Black marketeers are also benefited by inflation.

Thus, there occurs a redistribution of income and wealth. It is said that rich becomes richer and poor becomes poorer during inflation. However, no such hard and fast generalizations can be made. It is clear that someone wins and someone loses from inflation.

These effects of inflation may persist if inflation is unanticipated. However, the redistributive burdens of inflation on income and wealth are most likely to be minimal if inflation is anticipated by the people.

With anticipated inflation, people can build up their strategies to cope with inflation. If the annual rate of inflation in an economy is anticipated correctly people will try to protect them against losses resulting from inflation.

Workers will demand 10 p.c. wage increase if inflation is expected to rise by 10 p.c. Similarly, a percentage of inflation premium will be demanded by creditors from debtors. Business firms will also fix prices of their products in accordance with the anticipated price rise. Now if the entire society “learns to live with inflation” , the redistributive effect of inflation will be minimal.

However, it is difficult to anticipate properly every episode of inflation. Further, even if it is anticipated it cannot be perfect. In addition, adjustment with the new expected inflationary conditions may not be possible for all categories of people. Thus, adverse redistributive effects are likely to occur.

Finally, anticipated inflation may also be costly to the society. If people’s expectation regarding future price rise become stronger they will hold less liquid money. Mere holding of cash balances during inflation is unwise since its real value declines. That is why people use their money balances in buying real estate, gold, jewellery, etc.

Such investment is referred to as unproductive investment. Thus, during inflation of anticipated variety, there occurs a diversion of resources from priority to non-priority or unproductive sectors.

b. Effect on Production and Economic Growth :

Inflation may or may not result in higher output. Below the full employment stage, inflation has a favourable effect on production. In general, profit is a rising function of the price level. An inflationary situation gives an incentive to businessmen to raise prices of their products so as to earn higher doses of profit.

Rising price and rising profit encourage firms to make larger investments. As a result, the multiplier effect of investment will come into operation resulting in higher national output. However, such a favourable effect of inflation will be temporary if wages and production costs rise very rapidly.

Further, inflationary situation may be associated with the fall in output, particularly if inflation is of the cost-push variety. Thus, there is no strict relationship between prices and output. An increase in aggregate demand will increase both prices and output, but a supply shock will raise prices and lower output.

Inflation may also lower down further production levels. It is commonly assumed that if inflationary tendencies nurtured by experienced inflation persist in future, people will now save less and consume more. Rising saving propensities will result in lower further outputs.

One may also argue that inflation creates an air of uncertainty in the minds of business community, particularly when the rate of inflation fluctuates. In the midst of rising inflationary trend, firms cannot accurately estimate their costs and revenues. Under the circumstance, business firms may be deterred in investing. This will adversely affect the growth performance of the economy.

However, slight dose of inflation is necessary for economic growth. Mild inflation has an encouraging effect on national output. But it is difficult to make the price rise of a creeping variety. High rate of inflation acts as a disincentive to long run economic growth. The way the hyperinflation affects economic growth is summed up here.

We know that hyperinflation discourages savings. A fall in savings means a lower rate of capital formation. A low rate of capital formation hinders economic growth. Further, during excessive price rise, there occurs an increase in unproductive investment in real estate, gold, jewellery, etc.

Above all, speculative businesses flourish during inflation resulting in artificial scarcities and, hence, further rise in prices. Again, following hyperinflation, export earnings decline resulting in a wide imbalance in the balance of payments account.

Often, galloping inflation results in a ‘flight’ of capital to foreign countries since people lose confidence and faith over the monetary arrangements of the country, thereby resulting in a scarcity of resources. Finally, real value of tax revenue also declines under the impact of hyperinflation. Government then experiences a shortfall in investible resources.

Thus, economists and policy makers are unanimous regarding the dangers of high price rise. But the consequence of hyperinflation is disastrous. In the past, some of the world economies (e.g., Germany after the First World War (1914-1918), Latin American countries in the 1980s) had been greatly ravaged by hyperinflation.

The German Inflation of 1920s was also Catastrophic:

During 1922, the German price level went up 5,470 per cent, in 1923, the situation worsened; the German price level rose 1,300,000,000 times. By October of 1923, the postage of the lightest letter sent from Germany to the United States was 200,000 marks.

Butter cost 1.5 million marks per pound, meat 2 million marks, a loaf of bread 200,000 marks, and an egg 60,000 marks Prices increased so rapidly that waiters changed the prices on the menu several times during the course of a lunch!! Sometimes, customers had to pay double the price listed on the menu when they observed it first!!!

During October 2008, Zimbabwe, under the President-ship of Robert G. Mugabe, experienced 231,000,000 p.c. (2.31 million p.c.) as against 1.2 million p.c. price rise in September 2008—a record after 1923. It is an unbelievable rate. In May 2008, the cost of price of a toilet paper itself and not the costs of the roll of the toilet paper came to 417 Zimbabwean dollars.

Anyway, people are harassed ultimately by the high rate of inflation. That is why it is said that ‘inflation is our public enemy number one’. Rising inflation rate is a sign of failure on the part of the government.

Related Articles:

- Essay on the Causes of Inflation (473 Words)

- Cost-Push Inflation and Demand-Pull or Mixed Inflation

- Demand Pull Inflation and Cost Push Inflation | Money

- Essay on Inflation: Meaning, Measurement and Causes

Premium Content

- Republic Policy

Constitutional Law

Criminal Law

International Law

Civil Service Law

Recruitment

Appointment

Civil Services Reforms

Legislature

Fundamental Rights

Civil & Political Rights

Economic, Social & Cultural Rights

Focused Rights

Political Philosophy

Political Economy

International Relations

National Politics

- Organization

Zafar Iqbal

Inflation, in its simplest form, is the sustained rise in the general price level of goods and services in an economy over time. It translates to a decrease in the purchasing power of your money, meaning you could buy fewer goods and services with the same amount of money compared to the previous year.

Causes of Inflation:

Several factors can trigger inflation, often intertwined and acting in concert. Here are some key culprits:

- Excess Money Supply: When the central bank prints more money or lends more credit than the economy needs, it leads to an oversupply of money chasing the same amount of goods and services. This excess demand pushes prices up, causing inflation.

- Rising Production Costs: Increased costs of raw materials, labor, energy, and transportation can trickle down to final product prices, contributing to inflation. This “cost-push” inflation can occur due to global factors like commodity price surges or local inefficiencies in production and distribution.

- Demand Outpacing Supply: When consumer demand for goods and services exceeds the available supply, producers can raise prices to meet this demand, leading to inflation. This often happens during economic booms or periods of high disposable income.

- Exchange Rate Fluctuations: A depreciating currency against foreign currencies makes imported goods more expensive, translating to higher prices for consumers and contributing to inflation. Conversely, a rapidly appreciating currency can hurt exports and stall economic growth, also triggering inflation in some cases.

- Government Policies: Certain government policies, like price controls or excessive deficit spending, can distort market mechanisms and contribute to inflation. Moreover, taxes and regulations that increase production costs can also exert upward pressure on prices.

Controlling Inflation: A Balancing Act

There’s no single magic bullet to control inflation, and different approaches have varying degrees of effectiveness depending on the underlying causes. Here are some key policy options:

- Monetary Policy: Central banks play a crucial role by manipulating interest rates and money supply. Raising interest rates discourages borrowing and spending, reducing excess demand and tempering inflation. Conversely, lowering interest rates can stimulate economic activity during periods of low inflation or recession.

- Fiscal Policy: The government can adjust its spending and tax policies to influence inflation. Reducing government spending and enacting targeted taxes can decrease the money supply in circulation and dampen demand-driven inflation. However, drastic cuts in spending can also hinder economic growth, requiring careful calibration.

- Supply-Side Strategies: Investing in infrastructure, education, and technology can boost productivity and efficiency, thereby increasing the supply of goods and services. This helps contain inflation by addressing cost-push pressures and mitigating shortages.

- Exchange Rate Management: Central banks can intervene in the foreign exchange market to influence the value of the currency. Stabilizing the exchange rate can help control imported inflation and promote export competitiveness. However, excessive market intervention can distort trade patterns and create new economic imbalances.

- Income Policy: In rare cases, governments may resort to temporary wage and price controls to directly suppress inflation. However, these measures can often lead to inefficiencies, distortions, and black markets, making them a challenging and controversial tool.

The Importance of Context and Balance:

The effectiveness of any inflation control strategy depends on the specific economic context and the dominant inflation drivers. A one-size-fits-all approach can be counterproductive, and policymakers need to carefully consider the potential trade-offs and unintended consequences of each intervention. For example, an aggressive tightening of monetary policy can slow down economic growth and increase unemployment, while excessive fiscal austerity can stifle demand and hurt businesses.

Ultimately, controlling inflation requires a balanced and coordinated approach that addresses the underlying causes while minimizing any negative side effects. This can be a complex and delicate task, demanding constant monitoring, adjustments, and collaboration between central banks, governments, and other stakeholders.

Remember, inflation is a complex phenomenon with multiple contributing factors, and tackling it effectively requires a nuanced understanding of these causes and a careful application of various policy tools.

Pakistan has been grappling with high inflation for over a year now. In December 2023, consumer prices were 29.7% higher compared to December 2022, and every month for more than a year, the year-on-year inflation rate has been above 20%. While there was some positive news in the recent inflation data, with prices rising only 0.8% over November, much work remains to be done to bring inflation under control.

Understanding the Root Cause: Excess Money Supply

To understand Pakistan’s inflation problem, we can imagine a simple economy with three sellers each selling a food packet and three buyers, each given Rs100 by the government. In this scenario, each food packet would logically sell for Rs100. Now, if the international price of these food packets is one dollar, the exchange rate would be one dollar to Rs100.

If the government were to double the amount of money it gives to each buyer, to Rs200, while keeping the number of food packets the same, the price of each packet would also double, to Rs200. This is because there is now twice as much money chasing the same amount of goods. To put it simply, printing more money without increasing the production of goods leads to inflation.

Pakistan’s Budget Deficit and Money Supply

This is precisely what has been happening in Pakistan. In recent years, the government’s budget deficit has ballooned. To finance this deficit, the government has been borrowing heavily from the central bank, which has led to an increase in the money supply. As more rupees chase the same amount of goods, prices have risen.

The Role of Interest Rates

The State Bank of Pakistan (SBP) has been raising interest rates in an attempt to curb inflation by reducing borrowing and spending. This policy has been successful in slowing down private sector borrowing, but unfortunately, the government has not been able to reduce its own borrowing in response to higher interest rates. This has continued to put upward pressure on the money supply and inflation.

Investing in Human Capital and Productivity

While controlling the budget deficit and managing the money supply are crucial to reducing inflation, long-term growth requires investments in human capital and increasing the country’s productive capacity. Pakistan has a long way to go in this regard. A significant portion of the population lacks basic education and skills, which hinders economic growth and productivity.

Maintaining a Flexible Exchange Rate

Finally, it is important to maintain a flexible, market-driven exchange rate. When the government artificially keeps the rupee’s value high by selling dollars in the interbank market, it discourages exports and encourages imports, further widening the current account deficit. A flexible exchange rate allows exports to become more competitive and helps to balance the current account.

Conclusion: No Magic Solutions, but a Path Forward

There are no quick fixes to Pakistan’s economic problems. The country is poor and faces significant challenges, but there is a path forward. Reducing the budget deficit, investing in education and skills development, and maintaining a flexible exchange rate are crucial steps towards building a more stable and prosperous Pakistan. By pursuing sound economic policies and investing in its people, Pakistan can break the cycle of high inflation and lay the foundation for sustainable long-term growth.

Please, subscribe to the YouTube channel of republicpolicy.com

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the Blog

The Critical Importance of Tax Reforms in Pakistan

Implausible Deniability in Pakistan’s Institutions: A Complex and Enigmatic Issue

Pakistan Needs a Strong Climate Action against Climate Challenges

The Enigma of US Foreign Aid

China Extending Diplomacy to Europe

Electricity costs in Pakistan: Discrimination among consumer segments

A letter to CM Punjab by a Civil Servant Calling to Implement laws & Merit on Civil Services

The Significance of Middle East Politics for the Region & the World

Significance of Parliamentary Committees for Parliamentary System in Pakistan

The Power of Propaganda in Shaping Narratives

Support our cause.

"Republic Policy Think Tank, a team of dedicated volunteers, is working tirelessly to make Pakistan a thriving republic. We champion reforms, advocate for good governance, and fight for human rights, the rule of law, and a strong federal system. Your contribution, big or small, fuels our fight. Donate today and help us build a brighter future for all."

Qiuck Links

- Op Ed columns

Contact Details

- Editor: +923006650789

- Lahore Office: +923014243788

- E-mail: [email protected]

- Lahore Office: 143-Gull-e-Daman, College Road, Lahore

- Islamabad Office: Zafar qamar and Co. Office No. 7, 1st Floor, Qasim Arcade, Street 124, G-13/4 Mini Market, Adjacent to Masjid Ali Murtaza, Islamabad

- Submission Guidelines

- Terms & Conditions

- Privacy & Policy

Copyright © 2024 Republic Policy

| Developed and managed by Abdcorp.co

Famous Personalities

- Economic Challenges

- Environmental Issues

- Educational System and Corruption

- Founding Fathers

- Historical Figures

- Corruption and Greed

- Terms of Use

- Privacy Policy

Select Page

- Essay on Inflation in Pakistan: Revealing Causes and Consequences

Posted by wisemindsphere.com | Aug 15, 2023 | Economic Challenges | 0 |

Inflation , a persistent rise in the general price level of goods and services, is a pressing economic concern that has cast its shadow over Pakistan’s economy for years. In this essay on inflation in Pakistan, exploring the root causes and the far-reaching impact of inflation on the nation’s economy and its people will be explored.

Reasons behind Inflation in Pakistan

The reasons behind inflation in Pakistan are as diverse as they are complex. One of the primary drivers is the demand-pull inflation, where excessive demand for goods and services outpaces supply. Government spending, often financed through borrowing from the central bank, adds fuel to this fire. Moreover, supply-side factors, such as energy shortages, agricultural production constraints, and inefficiencies in distribution networks, contribute to price hikes. External factors, like global oil price fluctuations, can also send ripples through the economy, impacting inflation rates.

Monetary Policy and Inflation

The role of monetary policy in exacerbating or mitigating inflation cannot be understated. Pakistan’s central bank, the State Bank of Pakistan, plays a pivotal role in managing the money supply and interest rates. If monetary policy is loose – characterized by excessive money supply and low interest rates – it can spur demand but also contribute to inflationary pressures. Conversely, a tight monetary policy can help curb inflation but may also slow down economic growth.

Impact of Inflation in Pakistan

The impact of inflation in Pakistan is felt on various fronts, affecting both individuals and the broader economy. On a personal level, rising prices erode purchasing power, leading to reduced standards of living. The cost of essential goods like food and fuel takes a larger share of household budgets, leaving less room for discretionary spending. For the poorest segments of society, this can push them further into poverty.

Inflation’s Ripple Effect on the Economy

Inflation’s effects reverberate throughout the economy, impacting businesses and industries alike. Entrepreneurs face uncertainty in production costs, which can disrupt investment and expansion plans. Businesses may also struggle to afford higher wages for their employees, leading to labor disputes. Moreover, inflation distorts economic planning and decision-making, making long-term investments riskier due to unpredictable future costs.

Challenges to Fiscal Policy

Fiscal policy, which involves government spending and taxation, can either mitigate or exacerbate inflation. High levels of government borrowing to finance budget deficits can contribute to money supply growth, driving inflation upwards. Similarly, inefficient tax collection systems limit government revenue, forcing it to rely on borrowing. Achieving a balance between necessary public spending and responsible fiscal management is crucial to combating inflation.

Inflation’s Impact on Savings and Investment

Inflation’s corrosive impact extends to savings and investment. High inflation erodes the real value of savings, discouraging people from putting money aside for the future. This can have dire consequences for retirement planning and financial stability. Moreover, investment decisions become riskier in an inflationary environment, as the uncertainty about future returns complicates business strategies.

Tackling Inflation: The Way Forward

Addressing inflation in Pakistan requires a multi-pronged approach that involves coordination between various economic policy levers. Fiscal discipline is paramount, necessitating prudent management of government expenditure and revenue. Monetary policy should strike a delicate balance between stimulating economic growth and containing inflation. Structural reforms, such as improving energy production, enhancing agricultural productivity, and investing in infrastructure, can mitigate supply-side constraints that fuel inflation.

Inflation in Pakistan remains a formidable challenge that demands strategic and coordinated efforts. Understanding the reasons behind inflation, comprehending its impact on the economy and individuals, and implementing effective policies are crucial steps toward achieving price stability and fostering sustainable economic growth. As the nation strives to navigate these economic waters, the careful calibration of policies and the commitment to reform hold the promise of a more stable and prosperous future for Pakistan.

About The Author

wisemindsphere.com

Related posts.

- Essay on Energy Crisis in Pakistan: Unraveling Causes and Charting Solutions

August 15, 2023

Essay on Inflation Unveiled: Causes, Consequences, and Economic Realities

July 30, 2023

Recent Posts

- Essay on Floods in Pakistan

- Essay on Education: Education’s Empowering Capacity for Transformation

- Essay on Allama Iqbal: The Awesome Poet of the East and Enlightened Visionary of Pakistan

Recent Comments

- August 2023

Megan Sharp

Earl M. Kinkade

Can you write essays for free?

Sometimes our managers receive ambiguous questions from the site. At first, we did not know how to correctly respond to such requests, but we are progressing every day, so we have improved our support service. Our consultants will competently answer strange suggestions and recommend a different way to solve the problem.

The question of whether we can write a text for the user for free no longer surprises anyone from the team. For those who still do not know the answer, read the description of the online platform in more detail.

We love our job very much and are ready to write essays even for free. We want to help people and make their lives better, but if the team does not receive money, then their life will become very bad. Each work must be paid and specialists from the team also want to receive remuneration for their work. For our clients, we have created the most affordable prices so that a student can afford this service. But we cannot be left completely without a salary, because every author has needs for food, housing and recreation.

We hope that you will understand us and agree to such working conditions, and if not, then there are other agencies on the Internet that you can ask for such an option.

Finished Papers

Will I get caught if I buy an essay?

The most popular question from clients and people on the forums is how not to get caught up in the fact that you bought an essay, and did not write it yourself. Students are very afraid that they will be exposed and expelled from the university or they will simply lose their money, because they will have to redo the work themselves.

If you've chosen a good online research and essay writing service, then you don't have to worry. The writers from the firm conduct their own exploratory research, add scientific facts and back it up with the personal knowledge. None of them copy information from the Internet or steal ready-made articles. Even if this is not enough for the client, he can personally go to the anti-plagiarism website and check the finished document. Of course, the staff of the sites themselves carry out such checks, but no one can forbid you to make sure of the uniqueness of the article for yourself.

Thanks to the privacy policy on web platforms, no one will disclose your personal data and transfer to third parties. You are completely safe from start to finish.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

You are free to order a full plagiarism PDF report while placing the order or afterwards by contacting our Customer Support Team.

Search results

Saved words

Showing results for "inflation"

KHud-pasandii

inflationist

افراط پَسند

inflationary

Inflationism, urdu words for inflation, ɪnˈfleɪ.ʃən, inflation के उर्दू अर्थ, inflation کے اردو معانی, tags for inflation.

English meaning of inflation , inflation meaning in english, inflation translation and definition in English. inflation का मतलब (मीनिंग) अंग्रेजी (इंग्लिश) में जाने | Khair meaning in hindi

Top Searched Words

today, present moment

Citation Index : See the sources referred to in building Rekhta Dictionary

Critique us ( inflation )

Upload image let’s build the first online dictionary of urdu words where readers literally ‘see’ meanings along with reading them. if you have pictures that make meanings crystal clear, feel free to upload them here. our team will assess and assign due credit for your caring contributions.">learn more.

Display Name

Attach Image

Delete 44 saved words?

Do you really want to delete these records? This process cannot be undone

Want to show word meaning

Do you really want to Show these meaning? This process cannot be undone

Download Mobile app

Urdu poetry, urdu shayari, shayari in urdu, poetry in urdu

The best way to learn Urdu online

World of Hindi language and literature

Online Treasure of Sufi and Sant Poetry

Saved Words No saved words yet

Support rekhta dictionary. donate to promote urdu.

The Rekhta Dictionary is a significant initiative of Rekhta Foundation towards preservation and promotion of Urdu language. A dedicated team is continuously working to make you get authentic meanings of Urdu words with ease and speed. Kindly donate to help us sustain our efforts towards building the best trilingual Urdu dictionary for all. Your contributions are eligible for Tax benefit under section 80G.

Finished Papers

Charita Davis

Megan Sharp

Online Essay Writing Service to Reach Academic Success.

Are you looking for the best essay writing service to help you with meeting your academic goals? You are lucky because your search has ended. is a place where all students get exactly what they need: customized academic papers written by experts with vast knowledge in all fields of study. All of our writers are dedicated to their job and do their best to produce all types of academic papers of superior quality. We have experts even in very specific fields of study, so you will definitely find a writer who can manage your order.

Finished Papers

offers three types of essay writers: the best available writer aka. standard, a top-level writer, and a premium essay expert. Every class, or type, of an essay writer has its own pros and cons. Depending on the difficulty of your assignment and the deadline, you can choose the desired type of writer to fit in your schedule and budget. We guarantee that every writer will be a subject-matter expert with proper writing skills and background knowledge across all high school, college, and university subjects. Also, we don’t work with undergraduates or dropouts, focusing more on Bachelor, Master, and Doctoral level writers (yes, we offer writers with Ph.D. degrees!)

Customer Reviews

Know Us Better

- Knowledge Base

- Referencing Styles

- Know Our Consultance

- Revision and Refund Policy

- Terms Of Use

Write essay for me and soar high!

We always had the trust of our customers, and this is due to the superior quality of our writing. No sign of plagiarism is to be found within any content of the entire draft that we write. The writings are thoroughly checked through anti-plagiarism software. Also, you can check some of the feedback stated by our customers and then ask us to write essay for me.

Finished Papers

When you write an essay for me, how can I use it?

Gustavo Almeida Correia

Fill up the form and submit

On the order page of our write essay service website, you will be given a form that includes requirements. You will have to fill it up and submit.

In the order page to write an essay for me, once you have filled up the form and submitted it, you will be automatically redirected to the payment gateway page. There you will be required to pay the entire amount for taking up the service and writing from my experts. We will ask you to pay the entire amount before the service as that gives us an assurance that you will come back to get the final draft that we write and lets us build our trust in you to write my essay for me. It also helps us to build up a mutual relationship with you while we write, as that would ease out the writing process. You are free to ask us for free revisions until you are completely satisfied with the service that we write.

Avail our cheap essay writer service in just 4 simple steps

If you can’t write your essay, then the best solution is to hire an essay helper. Since you need a 100% original paper to hand in without a hitch, then a copy-pasted stuff from the internet won’t cut it. To get a top score and avoid trouble, it’s necessary to submit a fully authentic essay. Can you do it on your own? No, I don’t have time and intention to write my essay now! In such a case, step on a straight road of becoming a customer of our academic helping platform where every student can count on efficient, timely, and cheap assistance with your research papers, namely the essays.

Customer Reviews

IMAGES

VIDEO

COMMENTS

مہنگائی پر ایک مضمون | Essay On Mehangai In Urdu. آج کے زمانے میں کوئی نہیں جو بڑھتی ہوئی مہنگائی سے پریشان نہ ہو۔. ویسے تو مہنگائی ایک بین الاقوامی مسئلہ ہے۔. دنیا کے سبھی ملکوں میں ضروریات زندگی کی چیزوں ...

In this essay on inflation in Pakistan, we will look at the causes, effects, and solutions to this issue that has been affecting the country for decades. The term 'inflation' refers to a sustained rise in the prices of goods and services in an economy. In Pakistan, inflation has been a major concern since the late 1990s, with the Consumer ...

Rising Prices / Inflation Essay 300 - 400 words. This essay is suitable for class 10 and class 12, 2nd year. The essay covers details about the recent inflation and rising prices in Pakistan. The essay topics has been given in 2nd year smart syllabus 2020.

Reasons, Solution, Effects, Hyper Inflation in Pakistan (Essay in Urdu & English) Hyperinflation is a very rapid or out-of-control inflation. It occurs when there is a continuing increase in the price level of goods and services in an economy over a period of time. The inflation rate rises so quickly that the prices of goods and services ...

This video lecture is all about Inflation; its types, reasons and consequences.Other Economic Issues of PakistanPoverty -- https://youtu.be/IwtMsWGMuQ8 Unemp...

Inflation is again high in Pakistan, having risen further to 8.2 per cent in February 2019. Increase in Inflation rates comes with its own costs. For the poor, a rise in the prices of essential items (if it exceeds income growth) can be a death knell, both literally (for subsistence households), and indirectly, due to the inability to afford ...

Document Name. Pakistan Development Update October 2022: Inflation and the Poor - Executive Summary in Urdu. Document Date. 2/10/2023 03:04:00 PM. Web Publish Date. 2/10/2023 03:04:00 PM. Authors. Macroeconomics, Trade and Investment. Document Type.

This Video Give Basic Concept of What is inflation its major causes with examples? (Urdu / Hindi)My Recommenmd Amazing Gears & Products:1. Books: https://am...

Created in Urdu by Shariq TharaAbout Khan Academy: Khan Academy is a nonprofit with a mission to provide a free, world-class education for anyone, anywhere. ...

Essay on Inflation! Essay on the Meaning of Inflation: Inflation and unemployment are the two most talked-about words in the contemporary society. These two are the big problems that plague all the economies. Almost everyone is sure that he knows what inflation exactly is, but it remains a source of great deal of confusion because it is difficult to define it unambiguously. Inflation is often ...

Headline CPI inflation for January has spiked to over 14 per cent year-on-year, a multi-year high, with food inflation surging to 19.5pc for urban consumers and 23.8pc for rural households. For an economy on the up, with high rates of jobs-creating growth and rising incomes, even a moderately high rate of inflation is generally tolerable, in ...

In December 2023, consumer prices were 29.7% higher compared to December 2022, and every month for more than a year, the year-on-year inflation rate has been above 20%. While there was some positive news in the recent inflation data, with prices rising only 0.8% over November, much work remains to be done to bring inflation under control.

Inflation, a persistent rise in the general price level of goods and services, is a pressing economic concern that has cast its shadow over Pakistan's economy for years.In this essay on inflation in Pakistan, exploring the root causes and the far-reaching impact of inflation on the nation's economy and its people will be explored.

Inflation Essay Topic In Urdu | Best Writing Service. Our company has been among the leaders for a long time, therefore, it modernizes its services every day. This applies to all points of cooperation, but we pay special attention to the speed of writing an essay. Of course, our specialists who have extensive experience can write the text ...

Inflation Essay In Urdu, Argument Essay About Criminal Justice, Tips For Writing A Speech To Parents, Computer Manufacturer Free Business Plan, Using Your Business Plan, How To Write An Analytical Essay Grapic Organizer, Proposal Cover Letter Word Template 4423 Orders prepared

According to economic survey 2002-03 The inflation rate in Pakistan was 3.3 percent. This is a lower rate of inflation. However, it has been at very high level during 1980s and 1999s. From 1999 to 2004, the average inflation rate in the country has been 3.71 percent. There are two types of inflation, as: (i) Demand pull inflation (ii) Cost push ...

A vast treasure of Urdu words offering a blissful explorative experience through a gallery of meanings, sounds, idioms and proverbs with poetic demonstrations. See Urdu words and phrases for inflation in Rekhta English to Urdu Dictionary.

Inflation Essay Topic In Urdu | Best Writing Service. View Sample. We select our writers from various domains of academics and constantly focus on enhancing their skills for our writing essay services. All of them have had expertise in this academic world for more than 5 years now and hold significantly higher degrees of education.

At Essayswriting, it all depends on the timeline you put in it. Professional authors can write an essay in 3 hours, if there is a certain volume, but it must be borne in mind that with such a service the price will be the highest. The cheapest estimate is the work that needs to be done in 14 days. Then 275 words will cost you $ 10, while 3 ...

Essay Writing on Inflation Mahengai Urdu Essay | 4 for Class 5 and 8 Mazmoon By Muhammad Rehman#muhammadrehman #urduessay #urdumazmoon https://hamzaessay.blo...