To read this content please select one of the options below:

Please note you do not have access to teaching notes, mapping the scientific research on alternative momentum investing: a bibliometric analysis.

Journal of Economic and Administrative Sciences

ISSN : 1026-4116

Article publication date: 29 April 2021

Issue publication date: 1 December 2022

This study aims to recognize the current dynamics, prolific contributors and salient trends and propose future research directions in the area of alternative momentum investing.

Design/methodology/approach

The study uses a blend of electronic database and forward reference searching to ensure the incorporation of all the significant studies. With the help of the Scopus database, the present study retrieves 122 research papers published from 1999 to 2020.

The results reveal that alternative momentum investing is an emerging area in the field of momentum investing. However, this area has witnessed an exponential growth in last ten years. The study also finds that North American, West European and East Asian countries dominate in total research publications. Through network citation analysis, the study identifies five major clusters: industrial momentum, earnings momentum, 52-week high momentum, time-series momentum and risk-managed momentum.

Research limitations/implications

The present review will serve as a guide for financial researchers who intend to work on alternative momentum approaches. The study proposes several unexplored research themes in alternative momentum investing on which future studies can focus.

Originality/value

The study embellishes the existing literature on momentum investing by contributing the first bibliometric review on alternative momentum approaches.

- Alternative momentum

- Bibliometric analysis

- Systematic review

Acknowledgements

In the interest of transparency, data sharing and reproducibility, the author(s) of this article have made the data underlying their research openly available. It can be accessed using the following link: https://www.bibliometrix.org/Biblioshiny.html ; https://www.vosviewer.com/

Authors are thankful to Geetu Aggarwal and Dr. Pooja Goel for their help and guidance.

Singh, S. , Walia, N. , Saravanan, S. , Jain, P. , Singh, A. and jain, J. (2022), "Mapping the scientific research on alternative momentum investing: a bibliometric analysis", Journal of Economic and Administrative Sciences , Vol. 38 No. 4, pp. 619-636. https://doi.org/10.1108/JEAS-11-2020-0185

Emerald Publishing Limited

Copyright © 2021, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

Momentum investing: a systematic literature review and bibliometric analysis

- Published: 02 November 2020

- Volume 72 , pages 87–113, ( 2022 )

Cite this article

- Simarjeet Singh ORCID: orcid.org/0000-0003-3497-2177 1 &

- Nidhi Walia ORCID: orcid.org/0000-0002-3197-2326 1

3153 Accesses

16 Citations

Explore all metrics

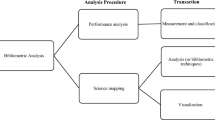

This comprehensive research study aims to highlight the evolution of momentum investing research and identify the mature and emerging themes in momentum investing. This study reviews 532 research studies published between 1993 and 2019. The study uses a combination of various bibliometric and network analysis tools to identify the most influential research studies, key journals and leading authors. Bibliometric and network analysis also help in the broader classification of research studies into four major categories. Further, a rigorous investigation of these research studies identifies various loopholes and propose actionable themes for next-generation research.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

How to design bibliometric research: an overview and a framework proposal

The Evolution of the Dynamic Capabilities Framework

The art of crafting a systematic literature review in entrepreneurship research

Conservatism refers to the tendency of investors to stick with their original beliefs (past information) which results in a slow reaction to new information.

Investors’ myopia signifies investors’ propensity to overweight the temporary price changes than long-run intrinsic value (Docherty and Hurst 2018 ).

Daniel et al. ( 1998 ) find that overconfident traders pay more attention to own private information than public information. Self-attribution cause continuing overreaction if public information validates the private information.

4 Disposition effect refers to the investors’ tendency to hold losing stocks longer than winning stocks (Shefrin and Statman 1985 ).

Total volatility of a stock's return can be divided into two portions (a) explainable portion (b) residual portion. The residual portion (the portion of total volatility of a stock's return that cannot be captured by market model) is called idiosyncratic volatility.

Cooper et al. ( 2004 ) define up and down market states with the help of lagged 36 months' market return. For a particular month, if lagged 36 months' market return is positive, then the market is said to be in UP market state; otherwise, the market is said to be in downstate.

Adebambo BN, Yan X (2016) Momentum, reversals, and fund manager overconfidence. Financ Manage 45:609–639. https://doi.org/10.1111/fima.12128

Article Google Scholar

Andrei D, Cujean J (2017) Information percolation, momentum and reversal. J Financ Econ 123:617–645. https://doi.org/10.1016/j.jfineco.2016.05.012

Antoniou C, Doukas JA, Subrahmanyam A (2013) Cognitive dissonance, sentiment, and momentum. J Financ Quant Anal 48:245–275. https://doi.org/10.1017/S0022109012000592

Arena MP, Haggard KS, Yan X (2008) Price momentum and idiosyncratic volatility. Financ Rev 43:159–190. https://doi.org/10.1111/j.1540-6288.2008.00190.x

Asem E (2009) Dividends and price momentum. J Bank Finance 33:486–494. https://doi.org/10.1016/j.jbankfin.2008.09.004

Asem E, Tian GY (2010) Market dynamics and momentum profits. J Financ Quant Anal 45:1549–1562. https://doi.org/10.1017/S0022109010000542

Asness CS, Moskowitz TJ, Pedersen LH (2013) Value and momentum everywhere. J Finance 68:929–985. https://doi.org/10.1111/jofi.12021

Avramov D, Chordia T, Jostova G, Philipov A (2007) Momentum and Credit Rating. J Finance 62:2503–2520. https://doi.org/10.1111/j.1540-6261.2007.01282.x

Baas J, Schotten M, Plume A et al (2020) Scopus as a curated, high-quality bibliometric data source for academic research in quantitative science studies. Quant Sci Stud 1:377–386. https://doi.org/10.1162/qss_a_00019

Bailey C, Madden A, Alfes K, Fletcher L (2017) The meaning, antecedents and outcomes of employee engagement: a narrative synthesis. Int J Manag Rev 19:31–53. https://doi.org/10.1111/ijmr.12077

Balvers RJ, Wu Y (2006) Momentum and mean reversion across national equity markets. J Empir Finance 13:24–48. https://doi.org/10.1016/j.jempfin.2005.05.001

Bandarchuk P, Hilscher J (2013) Sources of momentum profits: evidence on the irrelevance of characteristics. Rev Financ 17:809–845. https://doi.org/10.1093/rof/rfr036

Bansal R, Dittmar RF, Lundblad CT (2005) Consumption, dividends, and the cross section of equity returns. J Finance 60:1639–1672. https://doi.org/10.1111/j.1540-6261.2005.00776.x

Barberis N, Shleifer A, Vishny R (1998) A model of investor sentiment. J Financ Econ 49:307–343. https://doi.org/10.1016/S0304-405X(98)00027-0

Barroso P, Santa-Clara P (2015) Momentum has its moments. J Financ Econ 116:111–120. https://doi.org/10.1016/j.jfineco.2014.11.010

Basu S (1983) The relationship between earnings’ yield, market value and return for NYSE common stocks: further evidence. J Financ Econ 12:129–156. https://doi.org/10.1016/0304-405X(83)90031-4

Beracha E, Skiba H (2011) Momentum in residential real estate. J Real Estate Finan Econ 43:299–320. https://doi.org/10.1007/s11146-009-9210-2

Berk JB, Green RC, Naik V (1999) Optimal investment, growth options, and security returns. J Finance 54:1553–1607. https://doi.org/10.1111/0022-1082.00161

Bhatt Y, Ghuman K, Dhir A (2020) Sustainable manufacturing. Bibliometrics and content analysis. J Clean Prod. https://doi.org/10.1016/j.jclepro.2020.120988

Bianchi RJ, Drew ME, Fan JH (2015) Combining momentum with reversal in commodity futures. J Bank Finance 59:423–444. https://doi.org/10.1016/j.jbankfin.2015.07.006

Bird R, Gao X, Yeung D (2017) Time-series and cross-sectional momentum strategies under alternative implementation strategies. Austral J Manag 42:230–251. https://doi.org/10.1177/0312896215619965

Blitz D, Huij J, Martens M (2011) Residual momentum. J Empir Finance 18:506–521. https://doi.org/10.1016/j.jempfin.2011.01.003

Blitz D, Hanauer MX, Vidojevic M (2020) The idiosyncratic momentum anomaly. Int Rev Econ Finance 69:932–957. https://doi.org/10.1016/j.iref.2020.05.008

Booth G, Fung H-G, Leung WK (2016) A risk-return explanation of the momentum-reversal “anomaly”. J Empir Finance 35:68–77. https://doi.org/10.1016/j.jempfin.2015.10.007

Cai Y-J, Lo CKY (2020) Omni-channel management in the new retailing era: a systematic review and future research agenda. Int J Prod Econ 229:107729. https://doi.org/10.1016/j.ijpe.2020.107729

Cakici N, Fabozzi FJ, Tan S (2013) Size, value, and momentum in emerging market stock returns. Emerg Mark Rev 16:46–65. https://doi.org/10.1016/j.ememar.2013.03.001

Carhart MM (1997) On Persistence in Mutual Fund Performance. J Finance 52:57–82. https://doi.org/10.1111/j.1540-6261.1997.tb03808.x

Chan LKC, Lakonishok J (2004) Value and growth investing: review and update. Financ Anal J 60:71–86. https://doi.org/10.2469/faj.v60.n1.2593

Chan LKC, Jegadeesh N, Lakonishok J (1996) Momentum strategies. J Finance 51:1681–1713. https://doi.org/10.1111/j.1540-6261.1996.tb05222.x

Chang RP, Ko K-C, Nakano S, Ghon Rhee S (2018) Residual momentum in Japan. J Empir Finance 45:283–299. https://doi.org/10.1016/j.jempfin.2017.11.005

Cheema MA, Nartea GV (2014) Momentum returns and information uncertainty: evidence from China. Pac-Basin Finance J 30:173–188. https://doi.org/10.1016/j.pacfin.2014.10.002

Chen Z, Lu A (2017) Slow diffusion of information and price momentum in stocks: evidence from options markets. J Bank Finance 75:98–108. https://doi.org/10.1016/j.jbankfin.2016.11.010

Chordia T, Shivakumar L (2002) Momentum, business cycle, and time-varying expected returns. J Finance 57:985–1019. https://doi.org/10.1111/1540-6261.00449

Chordia T, Shivakumar L (2006) Earnings and price momentum. J Financ Econ 80:627–656. https://doi.org/10.1016/j.jfineco.2005.05.005

Chui ACW, Wei KCJ, Titman S (2000) Momentum, legal systems and ownership structure: an analysis of asian stock markets. Social Science Research Network, Rochester

Google Scholar

Chui ACW, Titman S, Wei KCJ (2003) Intra-industry momentum: the case of REITs. J Financ Mark 6:363–387. https://doi.org/10.1016/S1386-4181(03)00002-8

Chui ACW, Titman S, Wei KCJ (2010) Individualism and momentum around the world. J Finance 65:361–392. https://doi.org/10.1111/j.1540-6261.2009.01532.x

Conrad J, Kaul G (1998) An anatomy of trading strategies. Rev Financ Stud 11:489–519. https://doi.org/10.1093/rfs/11.3.489

Cooper MJ, Gutierrez RC, Hameed A (2004) Market states and momentum. J Finance 59:1345–1365. https://doi.org/10.1111/j.1540-6261.2004.00665.x

Da Z, Gurun UG, Warachka M (2014) Frog in the pan: continuous information and momentum. Rev Financ Stud 27:2171–2218. https://doi.org/10.1093/rfs/hhu003

Daniel K, Moskowitz TJ (2016) Momentum crashes. J Financ Econ 122:221–247. https://doi.org/10.1016/j.jfineco.2015.12.002

Daniel K, Hirshleifer D, Subrahmanyam A (1998) Investor psychology and security market under- and overreactions. J Finance 53:1839–1885. https://doi.org/10.1111/0022-1082.00077

Demir I, Muthuswamy J, Walter T (2004) Momentum returns in Australian equities: the influences of size, risk, liquidity and return computation. Pac-Basin Finance J 12:143–158. https://doi.org/10.1016/j.pacfin.2003.07.002

Demirer R, Zhang H (2019) Industry herding and the profitability of momentum strategies during market crises. J Behav Finance 20:195–212. https://doi.org/10.1080/15427560.2018.1505728

Derwall J, Huij J, Brounen D, Marquering W (2009) REIT momentum and the performance of real estate mutual funds. Financ Anal J 65:24–34. https://doi.org/10.2469/faj.v65.n5.4

Dobrynskaya V (2019) Avoiding momentum crashes: dynamic momentum and contrarian trading. J Int Financ Mark Inst Money 63:101141. https://doi.org/10.1016/j.intfin.2019.101141

Docherty P, Hurst G (2018) Investor myopia and the momentum premium across international equity markets. J Financ Quant Anal 53:2465–2490. https://doi.org/10.1017/S0022109018000431

Doukas JA, McKnight PJ (2005) European momentum strategies, information diffusion, and investor conservatism. Eur Financ Manag 11:313–338. https://doi.org/10.1111/j.1354-7798.2005.00286.x

Du D (2008) The 52-week high and momentum investing in international stock indexes. Q Rev Econ Finance 48:61–77. https://doi.org/10.1016/j.qref.2007.02.001

Durand RB, Limkriangkrai M, Smith G (2006) Momentum in Australia—a note. Austral J Manag 31:355–364. https://doi.org/10.1177/031289620603100209

Dzikowski P (2018) A bibliometric analysis of born global firms. J Bus Res 85:281–294. https://doi.org/10.1016/j.jbusres.2017.12.054

Eduardsen J, Marinova S (2020) Internationalisation and risk: literature review, integrative framework and research agenda. Int Bus Rev 29:101688. https://doi.org/10.1016/j.ibusrev.2020.101688

Fahimnia B, Sarkis J, Davarzani H (2015) Green supply chain management: a review and bibliometric analysis. Int J Prod Econ 162:101–114. https://doi.org/10.1016/j.ijpe.2015.01.003

Fama EF (1970) Efficient capital markets: a review of theory and empirical work. J Finance 25:383–417. https://doi.org/10.2307/2325486

Fama EF, French KR (2012) Size, value, and momentum in international stock returns. J Financ Econ 105:457–472. https://doi.org/10.1016/j.jfineco.2012.05.011

Fan M, Li Y, Liu J (2018) Risk adjusted momentum strategies: a comparison between constant and dynamic volatility scaling approaches. Res Int Bus Finance 46:131–140. https://doi.org/10.1016/j.ribaf.2017.12.004

Filippou I, Gozluklu AE, Taylor MP (2018) Global political risk and currency momentum. J Financ Quant Anal 53:2227–2259. https://doi.org/10.1017/S0022109018000686

Fisch C, Block J (2018) Six tips for your (systematic) literature review in business and management research. Manag Rev Q 68:103–106. https://doi.org/10.1007/s11301-018-0142-x

Fuertes A-M, Miffre J, Fernandez-Perez A (2015) Commodity strategies based on momentum, term structure, and idiosyncratic volatility. J Futures Mark 35:274–297. https://doi.org/10.1002/fut.21656

Galariotis CE (2014) Contrarian and momentum trading: a review of the literature. Rev Behav Finance 6:63–82. https://doi.org/10.1108/RBF-12-2013-0043

Garcia-Feijoo L, Jensen GR, Jensen TK (2018) Momentum and funding conditions. J Bank Finance 88:312–329. https://doi.org/10.1016/j.jbankfin.2018.01.001

Gaunt C, Gray P (2003) Short-term autocorrelation in Australian equities. Austral J Manag 28:97–117. https://doi.org/10.1177/031289620302800105

George TJ, Hwang C-Y (2004) The 52-week high and momentum investing. J Finance 59:2145–2176. https://doi.org/10.1111/j.1540-6261.2004.00695.x

Goyal A, Jegadeesh N (2018) Cross-sectional and time-series tests of return predictability: what is the difference? Rev Financ Stud 31:1784–1824. https://doi.org/10.1093/rfs/hhx131

Griffin JM, Ji X, Martin JS (2003) Momentum investing and business cycle risk: evidence from pole to pole. J Finance 58:2515–2547. https://doi.org/10.1046/j.1540-6261.2003.00614.x

Grinblatt M, Han B (2005) Prospect theory, mental accounting, and momentum. J Financ Econ 78:311–339. https://doi.org/10.1016/j.jfineco.2004.10.006

Grinblatt M, Titman S, Wermers R (1995) Momentum investment strategies, portfolio performance, and herding: a study of mutual fund behavior. Am Econ Rev 85:1088–1105

Grobys K, Sapkota N (2019) Cryptocurrencies and momentum. Econ Lett 180:6–10. https://doi.org/10.1016/j.econlet.2019.03.028

Gupta K, Locke S, Scrimgeour F (2010) International comparison of returns from conventional, industrial and 52-week high momentum strategies. J Int Financ Mark Inst Money 20:423–435. https://doi.org/10.1016/j.intfin.2010.06.002

Hameed A, Kusnadi Y (2002) Momentum strategies: evidence from Pacific basin stock markets. J Financ Res 25:383–397. https://doi.org/10.1111/1475-6803.00025

Han X, Li Y (2017) Can investor sentiment be a momentum time-series predictor? Evidence from China. J Empir Finance 42:212–239. https://doi.org/10.1016/j.jempfin.2017.04.001

He X-Z, Li K (2015) Profitability of time series momentum. J Bank Finance 53:140–157. https://doi.org/10.1016/j.jbankfin.2014.12.017

He X-Z, Li K, Li Y (2018) Asset allocation with time series momentum and reversal. J Econ Dyn Control 91:441–457. https://doi.org/10.1016/j.jedc.2018.02.004

Heston SL, Rouwenhorst KG, Wessels RE (1999) The role of beta and size in the cross-section of european stock returns. Eur Financ Manag 5:9–27. https://doi.org/10.1111/1468-036X.00077

Hillert A, Jacobs H, Müller S (2014) Media makes momentum. Rev Financ Stud 27:3467–3501. https://doi.org/10.1093/rfs/hhu061

Hon MT, Tonks I (2003) Momentum in the UK stock market. J Multinatl Financ Manag 13:43–70. https://doi.org/10.1016/S1042-444X(02)00022-1

Hong H, Stein JC (1999) A unified theory of underreaction, momentum trading, and overreaction in asset markets. J Finance 54:2143–2184. https://doi.org/10.1111/0022-1082.00184

Hong H, Lim T, Stein JC (2000) Bad news travels slowly: size, analyst coverage, and the profitability of momentum strategies. J Finance 55:265–295. https://doi.org/10.1111/0022-1082.00206

Hur J, Singh V (2019) How do disposition effect and anchoring bias interact to impact momentum in stock returns? J Empir Finance 53:238–256. https://doi.org/10.1016/j.jempfin.2019.07.007

Hur J, Pritamani M, Sharma V (2010) Momentum and the disposition effect: the role of individual investors. Financ Manag 39:1155–1176. https://doi.org/10.1111/j.1755-053X.2010.01107.x

Hurn S, Pavlov V (2003) Momentum in Australian stock returns. Austral J Manag 28:141–155. https://doi.org/10.1177/031289620302800202

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: implications for stock market efficiency. J Finance 48:65–91. https://doi.org/10.1111/j.1540-6261.1993.tb04702.x

Jegadeesh N, Titman S (2001) Profitability of momentum strategies: an evaluation of alternative explanations. J Finance 56:699–720. https://doi.org/10.1111/0022-1082.00342

Jiang G, Li D, Li G (2012) Capital investment and momentum strategies. Rev Quant Finan Acc 39:165–188. https://doi.org/10.1007/s11156-011-0250-3

Johnson TC (2002) Rational momentum effects. J Finance 57:585–608. https://doi.org/10.1111/1540-6261.00435

Jostova G, Nikolova S, Philipov A, Stahel CW (2013) Momentum in corporate bond returns. Rev Financ Stud 26:1649–1693. https://doi.org/10.1093/rfs/hht022

Kang J, Liu M-H, Ni SX (2002) Contrarian and momentum strategies in the China stock market: 1993–2000. Pac-Basin Finance J 10:243–265. https://doi.org/10.1016/S0927-538X(02)00046-X

Kassouf ST (1968) Stock price random walks: some supporting evidence. Rev Econ Stat 50:275–278. https://doi.org/10.2307/1926204

Kim AY, Tse Y, Wald JK (2016) Time series momentum and volatility scaling. J Financ Mark 30:103–124. https://doi.org/10.1016/j.finmar.2016.05.003

Korajczyk RA, Sadka R (2004) Are momentum profits robust to trading costs? J Finance 59:1039–1082. https://doi.org/10.1111/j.1540-6261.2004.00656.x

Lee CMC, Swaminathan B (2000) Price momentum and trading volume. J Finance 55:2017–2069. https://doi.org/10.1111/0022-1082.00280

Leuthold RM (1972) Random walk and price trends: the live cattle futures market. J Finance 27:879–889. https://doi.org/10.2307/2978675

Levy RA (1967) Relative strength as a criterion for investment selection. J Finance 22:595–610. https://doi.org/10.2307/2326004

Li J (2017) Explaining momentum and value simultaneously. Manag Sci 64:4239–4260. https://doi.org/10.1287/mnsc.2017.2735

Lim BY, Wang J, Yao Y (2018) Time-series momentum in nearly 100 years of stock returns. J Bank Finance 97:283–296. https://doi.org/10.1016/j.jbankfin.2018.10.010

Lin Q (2019) Residual momentum and the cross-section of stock returns: Chinese evidence. Finance Res Lett 29:206–215. https://doi.org/10.1016/j.frl.2018.07.009

Liu LX, Zhang L (2008) Momentum profits, factor pricing, and macroeconomic risk. Rev Financ Stud 21:2417–2448. https://doi.org/10.1093/rfs/hhn090

Liu M, Liu Q, Ma T (2011) The 52-week high momentum strategy in international stock markets. J Int Money Finance 30:180–204. https://doi.org/10.1016/j.jimonfin.2010.08.004

Ma N, Guan J, Zhao Y (2008) Bringing PageRank to the citation analysis. Inf Process Manag 44:800–810. https://doi.org/10.1016/j.ipm.2007.06.006

Maheshwari S, Dhankar RS (2017) Momentum anomaly: evidence from the Indian stock market. J Adv Manag Res 14:3–22. https://doi.org/10.1108/JAMR-11-2015-0081

Marshall BR, Cahan RM (2005) Is the 52-week high momentum strategy profitable outside the US? Appl Financ Econ 15:1259–1267. https://doi.org/10.1080/09603100500386008

Martínez-López FJ, Merigó JM, Valenzuela-Fernández L, Nicolás C (2018) Fifty years of the European Journal of Marketing: a bibliometric analysis. Eur J Mark 52:439–468. https://doi.org/10.1108/EJM-11-2017-0853

Menkhoff L, Sarno L, Schmeling M, Schrimpf A (2012) Currency momentum strategies. J Financ Econ 106:660–684. https://doi.org/10.1016/j.jfineco.2012.06.009

Miffre J, Rallis G (2007) Momentum strategies in commodity futures markets. J Bank Finance 31:1863–1886. https://doi.org/10.1016/j.jbankfin.2006.12.005

Min B-K, Kim TS (2016) Momentum and downside risk. J Bank Finance 72:S104–S118. https://doi.org/10.1016/j.jbankfin.2016.04.005

Moreira A, Muir T (2017) Volatility-managed portfolios. J Finance 72:1611–1644. https://doi.org/10.1111/jofi.12513

Moskowitz TJ, Grinblatt M (1999) Do industries explain momentum? J Finance 54:1249–1290. https://doi.org/10.1111/0022-1082.00146

Moskowitz TJ, Ooi YH, Pedersen LH (2012) Time series momentum. J Financ Econ 104:228–250. https://doi.org/10.1016/j.jfineco.2011.11.003

Muga L, Santamaría R (2007) The momentum effect in Latin American emerging markets. Emerg Mark Finance Trade 43:24–45. https://doi.org/10.2753/REE1540-496X430402

Narayan PK, Ahmed HA, Narayan S (2015) Do momentum-based trading strategies work in the commodity futures markets? J Futures Mark 35:868–891. https://doi.org/10.1002/fut.21685

Naughton T, Truong C, Veeraraghavan M (2008) Momentum strategies and stock returns: Chinese evidence. Pac-Basin Finance J 16:476–492. https://doi.org/10.1016/j.pacfin.2007.10.001

Novy-Marx R (2012) Is momentum really momentum? J Financ Econ 103:429–453. https://doi.org/10.1016/j.jfineco.2011.05.003

Nyberg P, Pöyry S (2014) Firm expansion and stock price momentum. Rev Finance 18:1465–1505. https://doi.org/10.1093/rof/rft034

Okunev J, White D (2003) Do momentum-based strategies still work in foreign currency markets? J Financ Quant Anal 38:425–447. https://doi.org/10.2307/4126758

Pan L, Tang Y, Xu J (2013) Weekly momentum by return interval ranking. Pac-Basin Finance J 21:1191–1208. https://doi.org/10.1016/j.pacfin.2012.06.001

Ponomarev IV, Lawton BK, Williams DE, Schnell JD (2014) Breakthrough paper indicator 2.0: can geographical diversity and interdisciplinarity improve the accuracy of outstanding papers prediction? Scientometrics 100:755–765. https://doi.org/10.1007/s11192-014-1320-9

Radicchi F, Castellano C, Cecconi F et al (2004) Defining and identifying communities in networks. PNAS 101:2658–2663. https://doi.org/10.1073/pnas.0400054101

Rousseau DM, Manning J, Denyer D (2008) 11 Evidence in management and organizational science: assembling the field’s full weight of scientific knowledge through syntheses. Annals 2:475–515. https://doi.org/10.5465/19416520802211651

Rouwenhorst KG (1998) International momentum strategies. J Finance 53:267–284. https://doi.org/10.1111/0022-1082.95722

Rouwenhorst KG (1999) Local return factors and turnover in emerging stock markets. J Finance 54:1439–1464. https://doi.org/10.1111/0022-1082.00151

Ruenzi S, Weigert F (2018) Momentum and crash sensitivity. Econ Lett 165:77–81. https://doi.org/10.1016/j.econlet.2018.01.031

Sadka R (2006) Momentum and post-earnings-announcement drift anomalies: the role of liquidity risk. J Financ Econ 80:309–349. https://doi.org/10.1016/j.jfineco.2005.04.005

Sagi JS, Seasholes MS (2007) Firm-specific attributes and the cross-section of momentum. J Financ Econ 84:389–434. https://doi.org/10.1016/j.jfineco.2006.02.002

Sapp T, Tiwari A (2004) Does stock return momentum explain the “smart money” effect? J Finance 59:2605–2622. https://doi.org/10.1111/j.1540-6261.2004.00710.x

Schiereck D, Bondt WD, Weber M (1999) Contrarian and momentum strategies in Germany. Financ Anal J 55:104–116. https://doi.org/10.2469/faj.v55.n6.2317

Sehgal S, Jain S (2011) Short-term momentum patterns in stock and sectoral returns: evidence from India. J Adv Manag Res 8:99–122. https://doi.org/10.1108/09727981111129327

Serban AF (2010) Combining mean reversion and momentum trading strategies in foreign exchange markets. J Bank Finance 34:2720–2727. https://doi.org/10.1016/j.jbankfin.2010.05.011

Shefrin H, Statman M (1985) The disposition to sell winners too early and ride losers too long: theory and evidence. J Finance 40:777–790. https://doi.org/10.1111/j.1540-6261.1985.tb05002.x

Shi H-L, Zhou W-X (2017) Time series momentum and contrarian effects in the Chinese stock market. Phys A 483:309–318. https://doi.org/10.1016/j.physa.2017.04.139

Siganos A (2010) Can small investors exploit the momentum effect? Financ Mark Portf Manag 24:171–192. https://doi.org/10.1007/s11408-009-0120-3

Singh S, Walia N, Jain J, Garg A (2020) Taming momentum crashes through triple momentum investing. J Public Aff. https://doi.org/10.1002/pa.2525

Sloan RG (1996) Do stock prices fully reflect information in accruals and cash flows about future earnings? Account Rev 71:289–315

Small H (1973) Co-citation in the scientific literature: a new measure of the relationship between two documents. J Am Soc Inform Sci 24:265–269. https://doi.org/10.1002/asi.4630240406

Solnik BH (1973) Note on the validity of the random walk for european stock prices. J Finance 28:1151–1159. https://doi.org/10.1111/j.1540-6261.1973.tb01447.x

Stambaugh RF, Yu J, Yuan Y (2012) The short of it: investor sentiment and anomalies. J Financ Econ 104:288–302. https://doi.org/10.1016/j.jfineco.2011.12.001

Subrahmanyam A (2018) Equity market momentum: a synthesis of the literature and suggestions for future work. Pac-Basin Finance J 51:291–296. https://doi.org/10.1016/j.pacfin.2018.08.004

Tranfield D, Denyer D, Smart P (2003) Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br J Manag 14:207–222. https://doi.org/10.1111/1467-8551.00375

Vanstone BJ, Hahn T (2017) Australian momentum: performance, capacity and the GFC effect. Account Finance 57:261–287. https://doi.org/10.1111/acfi.12140

Vayanos D, Woolley P (2013) An institutional theory of momentum and reversal. Rev Financ Stud 26:1087–1145. https://doi.org/10.1093/rfs/hht014

Wang KQ, Xu J (2015) Market volatility and momentum. J Empir Finance 30:79–91. https://doi.org/10.1016/j.jempfin.2014.11.009

Xu X, Chen X, Jia F et al (2018) Supply chain finance: a systematic literature review and bibliometric analysis. Int J Prod Econ 204:160–173. https://doi.org/10.1016/j.ijpe.2018.08.003

Yang Y, Gebka B, Hudson R (2019) Momentum effects in China: a review of the literature and an empirical explanation of prevailing controversies. Res Int Bus Finance 47:78–101. https://doi.org/10.1016/j.ribaf.2018.07.003

Zaremba A, Shemer J “Koby” (2018) The trend is your friend: momentum investing. In: Zaremba A, Shemer J “Koby” (eds) Price-based investment strategies: how research discoveries reinvented technical analysis. Springer, Cham, pp 17–86

Zhou H, Geppert J, Kong D (2010) An anatomy of trading strategies: evidence from China. Emerg Mark Finance Trade 46:66–79. https://doi.org/10.2753/REE1540-496X460205

Zoghlami F (2013) Momentum effect in stocks’ returns between the rational and the behavioural financial theories. International Journal of Finance and Banking Studies 2:1–10. https://doi.org/10.20525/ijfbs.v2i1.136

Download references

Author information

Authors and affiliations.

University School of Applied Management, Punjabi University, Patiala, India

Simarjeet Singh & Nidhi Walia

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Simarjeet Singh .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Singh, S., Walia, N. Momentum investing: a systematic literature review and bibliometric analysis. Manag Rev Q 72 , 87–113 (2022). https://doi.org/10.1007/s11301-020-00205-6

Download citation

Received : 15 December 2019

Accepted : 23 October 2020

Published : 02 November 2020

Issue Date : February 2022

DOI : https://doi.org/10.1007/s11301-020-00205-6

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Momentum investing

- Bibliometric analysis

- Citation analysis

- Content analysis

JEL Classification

- Find a journal

- Publish with us

- Track your research

Browse Econ Literature

- Working papers

- Software components

- Book chapters

- JEL classification

More features

- Subscribe to new research

RePEc Biblio

Author registration.

- Economics Virtual Seminar Calendar NEW!

Momentum investing: a systematic literature review and bibliometric analysis

- Author & abstract

- 122 References

- 4 Citations

- Most related

- Related works & more

Corrections

(Punjabi University)

Suggested Citation

Download full text from publisher, references listed on ideas.

Follow serials, authors, keywords & more

Public profiles for Economics researchers

Various research rankings in Economics

RePEc Genealogy

Who was a student of whom, using RePEc

Curated articles & papers on economics topics

Upload your paper to be listed on RePEc and IDEAS

New papers by email

Subscribe to new additions to RePEc

EconAcademics

Blog aggregator for economics research

Cases of plagiarism in Economics

About RePEc

Initiative for open bibliographies in Economics

News about RePEc

Questions about IDEAS and RePEc

RePEc volunteers

Participating archives

Publishers indexing in RePEc

Privacy statement

Found an error or omission?

Opportunities to help RePEc

Get papers listed

Have your research listed on RePEc

Open a RePEc archive

Have your institution's/publisher's output listed on RePEc

Get RePEc data

Use data assembled by RePEc

IMAGES

VIDEO

COMMENTS

This comprehensive research study aims to highlight the evolution of momentum investing research and identify the mature and emerging themes in momentum investing. This study reviews 532 research studies published between 1993 and 2019. The study uses a combination of various bibliometric and network analysis tools to identify the most influential research studies, key journals and leading ...

This study has employed a systematic literature review (SLR) methodology to ensure the transparent and comprehensive coverage of the literature (Denyer and Tranfield 2009). The motivation behind ...

Momentum investing: a systematic literature review and bibliometric analysis. Abstract: Abstract This comprehensive research study aims to highlight the evolution of momentum investing research and identify the mature and emerging themes in momentum investing. This study reviews 532 research studies published between 1993 and 2019. The study ...

Background: This study provides a bibliometric analysis of momentum investment strategies, examining their historical evolution, behavioral dynamics, and the challenges faced by professionals in ...

The study deploys bibliometric analysis, appropriate for deriving insights from the vast extant literature. However, a meta-analysis might offer deeper insights into specific dimensions of the research topic. Besides, the study's findings are based on Scopus indexed articles analyzed using bibilioshiny; the database and software limitations might have affected the findings.

Simarjeet Singh Paper - Free download as PDF File (.pdf), Text File (.txt) or read online for free.

Cai Y-J, Lo CKY (2020) Omni-channel management in the new retailing era: a systematic review and future research agenda. Int J Prod Econ 229:107729. https://doi.org/10.1016/j.ijpe.2020.107729

Methods: Employing a Bibliometric Analytical framework, the study systematically maps the knowledge structure of momentum investment strategies. It utilizes the Dimensions database for scholarly journal searches and examines peer-reviewed research publications spanning from 1993 to 2024. This method enables the identification of key research works, emerging trends, and an assessment of the ...

The results reveal that alternative momentum investing is an emerging area in the field of momentum investing. However, this area has witnessed an exponential growth in last ten years. The study also finds that North American, West European and East Asian countries dominate in total research publications. Through network citation analysis, the study identifies five major clusters: industrial ...

Abstract. This comprehensive research study aims to highlight the evolution of momentum investing research and identify the mature and emerging themes in momentum investing. This study reviews 532 research studies published between 1993 and 2019. The study uses a combination of various bibliometric and network analy-sis tools to identify the ...

Through a systematic literature review methodology, this study retrieves a database of 400 academic works published between 1965 and 2020. Using rigorous bibliometric and visualization tools, it identifies four major research clusters: (1) competing explanations of the value premium, (2) anomalies research, (3) momentum and fundamentals, and (4

The study proposes several unexplored research themes in alternative momentum investing on which future studies can focus.Originality/valueThe study embellishes the existing literature on momentum investing by contributing the first bibliometric review on alternative momentum approaches.

The field of personal finance has gained research momentum since the financial crisis of 2008, however, only few comprehensive reviews have been conducted to date. This study adopts a systematic review methodology to build a knowledge structure on financial well-being. By combining bibliometric tools and content analysis, this study aims to capture insights not provided in earlier reviews ...

The bibliometric analysis and systematic literature review investigate the factors influencing ESG performance, aiming to identify the key contributors, emerging patterns from the past research and the knowledge growth for potential future directions ( Table 7 ).

Through network citation analysis, the study identifies five major clusters: industrial momentum, earnings momentum, 52-week high momentum, time-series momentum and risk-managed momentum.

Purpose - This study aims to recognize the current dynamics, prolific contributors and salient trends and propose future research directions in the area of alternative momentum investing. Design/methodology/approach - The study uses a blend of electronic database and forward reference searching to ensure the incorporation of all the significant studies. With the help of the Scopus database ...

In this article, we detail methodological steps for how researchers can conduct systematic literature reviews and offer examples of bibliometric approaches to visualise results. The article is structured as follows. First, we provide a background information on the increasing interest in conducting systematic literature reviews. Next, we review the different steps involved in conducting a ...

This comprehensive research study aims to highlight the evolution of momentum investing research and identify the mature and emerging themes in momentum investing. This study reviews 532 research studies published between 1993 and 2019. The study uses a combination of various bibliometric and network analysis tools to identify the most influential research studies, key journals and leading ...

Bibliometric studies have proven useful in helping researchers better explore the current research trends within a particular field of study. This study analyzes academic research on herd behavior in financial markets conducted over 30 years. The Web of Science database was selected to collect bibliographic material and provide various bibliometric indicators, including the number of citations ...

The number of scientific publications has been increasing in the past years ( Bornmann & Mutz, 2015 ), thus selecting relevant literature is a critical step for systematic reviews, which may involve qualitative and/or quantitative criteria. In this sense, the Knowledge Development Process-Constructivist (Proknow-C) ( Ensslin, Ensslin, Lacerda, & Tasca, 2010; Ensslin, Dutra, Ensslin, Chaves ...

As the level of consumer purchasing power increases, member subscription services in retailing are broadly recognized, and more consumers prefer to join merchant membership systems to enjoy member special benefits, either for a fee or free. Amazon attracted about 30 million new Prime members in each of 2020 and 2021 ( Steiner, 2022 ), and had 168.5 million U.S. members as of 2022 ( Coppola ...

A comprehensive bibliometric analysis of applications of big data analytics in enterprises with a total of 1727 articles from the Scopus database identified four major thematic areas in the extant literature.