(604) 681-7185 [email protected]

Constellation Client Login | Quadrus Client Login

Financial Case Studies

Case studies and financial recommendations by dld financial group ltd..

Our industry expertise combined with our unique process ensures that our financial planning solutions are seamlessly tailored to your personal goals and aspirations.

- Home Ownership

Pacific Bolt Manufacturing Ltd

James and Anna

Michael and Alexis

John and Sarah

Ryan and Rachel

"I've been with Ryan at DLD since 2019. He is professional with a sense of humour and gives you plenty of options to choose from (and his honest opinion on what works best for you and your goals)"

Kelly F - Brewer

"Working with Ryan has been great. He makes things very easy to understand and is very flexible to our goals. He understands when certain life situations get in the way and he is very easily able to adapt your financial plan to suit your needs. He has given us a lot of clarity in a time that could be very stressful. Thanks Ryan for all your help! We appreciate you! C and K"

Connor L - Physiotherapist

Ryan Stanimir has been an excellent resource and support for me since 2017. I would definitely recommend his services."

Nhan P - Interior Designer

"Experience has been phenomenal, since the very beginning, the way information is presented is very clear, they take you through a whole planning process that accommodates best for you to reach your financial goals. Regular updates and new opportunities, as well as flexibility make me feel very good and happy at my financial future."

William Z - Chef

"Ryan Stanimir is a great advisor, very efficient and easy to talk to as he takes the time to make sure you fully understand the decisions you make."

Brad P - Foreman

"Ryan has been thorough, friendly, and knowledgeable! We feel safe knowing that he is looking out for us and listening to our needs."

Deanna T - Public Health

"Ryan has been very attentive to our financial planning needs and provides excellent service. Look forward to many more years of building the portfolio together."

Craig T - Senior HR Manager

"Ryan is great to work with. He is always willing to help and provide suggestions. I would highly recommend to anyone who is looking for financial advice!!! I look forward to our investment chats."

Christine H - IT Security

"DLD provides proactive advice and they keep me on top of my investment planning. They have taken the time to understand my situation and provide a tailored plan."

Mark N - Lawyer and Partner

"Dave anticipates our needs before we even know they are our needs. Dave has a calm, approachable manner that takes a lot of the mystery out of financial planning and makes it digestible and understandable. We feel like we have a solid approach to retirement, which creates peace of mind."

Kacey K - Lawyer and Partner

"Really take the time to explain everything. Personal service, helpful, respond very quickly to emails or phone calls."

Jackie P - Film Production Professional

"Very professional and pro active. I really appreciate Dave's high level of professional expertise and his dedication to providing a personalized investment plan for me and my family and any clients that I refer."

Sean P - Accountant

"Quick response time to inquiries and accessibility."

Steven A - Lawyer and Director

"Easy to work with and great advice. Dave and team great to work with and know their stuff!!"

Eric B - Insurance Provider

"Doing a great job! Dave is always there for me with great advice and helpful products and services! He provides outstanding service."

Andre P - Consultant

"The whole team is very approachable. I never have a worry that I'm coming to you with a stupid question. Dave, Jasmeen and the team are incredible! Always available to answer even the simplest question. It's easy to work with them and takes the stress off our shoulders."

Samantha B - Marketing Manager

"Dave is always available with helpful advice. I have worked with the team at DLD Financial for many years. I am always impressed with their knowledge and responsiveness. I'm very satisfied with the service that I receive and would recommend Dave Drummond and his team to friends and family!"

John F - Lawyer

"DLD Financial, Ltd. has been excellent to work with for our financial planning needs. They are always available and well informed about the different investment tools and mechanisms that are available."

Christopher G - Biologist

"Thank you David and the team over at DLD Financial for all your support over the years. A pleasure to do business with."

Gabe H - Mortgage Broker

"I signed up with DLD Financial and my advisor, David Drummond. in December of 2017 and I couldn't be happier. I know for a fact, that I would never be on track towards my retirement goals the way I am with DLD. I feel confident that I have a financial profile that is managed for me and my needs and is looked at on a regular basis. I like that David keeps me updated to industry changes and fluctuations and quells any anxiety I may have about the financial ups and downs of investing. It's been a great experience so far and I look forward to seeing the growth as I save for my future. I feel very confident with the expertise and the support I get with DLD Financial and would highly recommend them to anyone who is looking to get honest, expert and personal one-on-one financial advice and retirement planning. I like the personal touch and involvement. I don't feel like a number. I feel valued.

Robyn W - Film Producer

"DLD has been my financial advisor for over a decade. The whole team is dependable and reliable."

Christopher S - Lawyer & Partner

"Kelly has been an amazing advisor for our personal investment and my family business for years. Highly recommended!!!"

Olivia Y – HR Professional

"We've been working with Kelly and her team for several years and have always appreciated her relevant and timely advice and support as we navigate life changes, career moves and our financial goals."

Claudia P - Lawyer

"Kelly is professional and thorough and most importantly we trust her. She takes the time to understand the full picture, and provides strategic advice and a financial plan that aligns to our goals. We are fortunate to work with her."

Raina C – Sr. Partner Executive

"Kelly and her team have been incredible to work with. Attentive and caring, she really looks after her clients. She is very professional and knowledgeable in determining your goals for family planning and retirement goals. Nothing but good experiences working with her and her team."

Wayne C - Realtor

"Kelly Ho is an exceptional financial planner. Working closely with her on mutual clients, I have witnessed her professionalism, expertise, and dedication firsthand. Her clients consistently praise her for the outstanding service and advice she provides. Kelly's personalized approach, comprehensive knowledge, and genuine care make her a standout in her field. I wholeheartedly recommend her as a trusted financial planner."

Matthew P– Mortgage Broker

"I have had excellent experience with Kelly at DLD for the past 10 years. They were recommended to me by my accounting firm (Renaissance Group, also a top notch firm). I was a new dad, with a mortgage, new business, and a huge potential tax liability for my dependents if anything were to happen to me. Kelly was helpful in insurance selection and financial planning. I would highly recommend Kelly and the team at DLD."

Stephen C – Investment Professional

"Kelly takes good care of our financial needs. Her expertise, friendly and personalized approach, and deep knowledge of planning strategies make her an invaluable asset. I especially appreciate it when I nod like I understand the technical details of what she is describing (but I don't) and she sees through it and provides a simpler explanation of we need to support our decision-making. I highly recommend Kelly and DLD for their exceptional services and commitment to client success."

Tony T - Pharmacist

"Working with Kelly Ho and the team at DLD has been a pleasure. They are organized, efficient, understanding and thorough and have helped us come up with a game plan that enables us to have great peace of mind moving forward. Thanks Kelly!"

Debbie & David R- Lawyer and Engineer

"Kelly and her team are fantastic. They ensure to keep me focused on my financial goals, and push me to make sure I'm achieving the plan we have set-out. They follow-up regularly with me, and always remember where we left off."

Lisa N - Lawyer

"I feel like my financial future is good hands and it's reassuring to have Kelly at the helm. Kelly is both direct and compassionate, and she (and Linda!) are a pleasure to deal with."

Claire H - Lawyer

"Kelly has assisted me and my spouse with addressing retirement planning, critical illness insurance, and planning that made home ownership a reality. Kelly started working with me shortly after a significant career change when my financial situation was limited. Over the last number of years she has assisted us with strategic planning as my financial picture has improved and through major life milestones, marriage and parenthood. Her advice has addressed my personal situation and assisted with planning for a secure and prosperous future. Kelly and the whole DLD team have been fantastic."

Jennifer G - Lawyer

"Introduced by reference, Kelly Ho has been a great advisor, my first financial planner. I have full confidence in her strategy and she is reassuring when needed."

Lynn S – Regional Retail Manager

"Kelly is on her game! Thorough, efficient with her time and mine. Easy to trust!"

Becky H – Registered Nurse

Kelly Ho is trustworthy and dependable when it comes to financial planning and investing. She is very knowledgeable, but remains approachable. She makes time for her clients and checks in regularly. DLD provides lots of useful seminars and informational emails as well.

Alexandra M - Lawyer

"The results were very good, and looking forward, everything looks amazing. DLD is in the top 3 on my speed dial whenever a major decision needs to be made."

Trevor Borland - Pacific Bolt Manufacturing Ltd

“It’s tough finding a financial advisor to trust – how can you know they want what’s best for you? But Dave is that guy – he understands competing current/future priorities and takes the time to get to know his client’s needs. I was particularly impressed when he devised a creative solution to a complex pension/RRSP adjustment scenario that I would never have come to on my own. I always trust he has our best interests at heart!”

Jennifer Wong - University Professor

"During our ownership and rebranding transition, we engaged Ryan Stanimir at DLD Financial Group Ltd to assist us with employee offering and retainment consultation. Ryan provided a thorough industry comparison, demonstrating substantial and sustainable savings opportunities while enhancing our benefits offering to current and future staff. True Mechanical's management group deeply appreciated DLD Financial Group Ltd's long-term vision and trusted their people, financial expertise, and systems."

Rafal Choroba, Principal - True Mechanical

"When I was introduced to Dave and his team at DLD Financial, there was min-correlation and cohesion in my planning. The team at DLD produced a plan that combined tax effective growth of personal and coup assets. The net worth forecasting is among my favourite tools to review each year with Dave."

John Fiddick, Partner - Whitelaw Twining

"We started as a small mining firm and have grown both in complexity and numbers. Ryan at DLD Financial Group Ltd has helped with our benefits planning for many years. He’s been very proactive with advanced reporting to ensure we are as informed as possible. For example, we had some international employees that required coverage that Ryan navigated expertly. We’d highly recommend their organization."

Andrew MacRitchie, CFO - Skeena Resources

"I am very pleased to comment on the excellent advice and financial planning I have experienced working with Kelly. When I first came to her, I was concerned that I wouldn't have the financial resources to enjoy retirement. She listened to my concerns and priorities and helped build and shape my financial profile through her highly effective, knowledgeable, and collaborative working style. Given her excellent mentorship and advice, I have been able to retire with a real sense of security over my financial future. I look forward to working with Kelly for years to come."

Dr. Arlene Y, University Professor

"We use Ryan at DLD Financial Group for our employee benefits. He is always organized, has all the info we need and makes sure we get the best rate possible … we love this guy!"

Erik Jensen, owner, Sprucehill Custom Homes and Renovations

"Kelly has been such a close trusted advisor, and helped us navigate big chapters of our lives. And we wouldn’t be where we are today without her involvement. I cannot recommend Kelly and DLD Financial highly enough!"

Dr. Nathan U. & Arthur Y., Physician & Project Manager

"One key thing that sets Kelly and DLD Financial apart is the philosophy of how they do business. Working with them is like working with family. And while their boutique size allows for a very personalized approach, they have access to the full range of financial products to meet their client’s needs."

"Kelly and the DLD Financial team have been close, trusted partners who have provided valued financial planning advice to support every step of our professional and personal lives. Through DLD's Strategic Planning Process' comprehensive assessment and goal-setting method, we were able to identify the right products and approaches to achieve our personal and professional financial planning objectives."

"Kelly takes a genuine interest in my life, is always even keeled, focused on how to achieve long term goals and willing to take the time needed to answer my questions, even the hard questions."

Matt L., Legal Counsel, BC Public School Employers' Association

"Dave continues to impress me with his knowledge and expertise when providing financial advice."

Andre Powell, Partner - Deetkan Group

“Dave treats my finances in the same way he would his own, which is key for me. Thanks to everyone at DLD for making this one of the best financial decisions I’ve made as a small business owner. ”

Leigh Walker, Partner - Lawrenson Walker Realty Advisors Ltd.

"Kelly has taken me from a high-earner without much to show for it, to a guy with a solid financial plan. She provides sound, personalized and practical advice tailored specifically to my needs. She is invaluable to me and my family."

Martin Sheard, Founder - Inlet Employment Law

“Kelly has played an integral role in building my personal financial well-being over the past 10 years. I would highly recommend her services to others as she is knowledgeable, friendly and an expert in her field.”

Victor Kam, Senior Tech Art Consultant - Unity Technologies

"I would recommend Dave and his team to friends and family without hesitation."

Nick Demare, CA, President - Chase Management Ltd.

"As the owner of a business that fabricates precision gears, I know the importance of paying attention to all the details. Kelly understands this concept and has always been a pleasure to deal with."

Vinnie Lai, Owner - www.goldengear.ca

"Dave's intuitive and innovative advice has allowed me to implement different and successful approaches to my personal and corporate finances. I appreciate the high level of service, level of commitment, and the regular reviews."

"The step by step process that DLD uses has enabled me to allocate money where it best suits my needs and goals. I feel confident about my future knowing that my finances are in line without having to sacrifice my current lifestyle."

David J. Bell, Partner - www.guildyule.com

"Kelly Ho is a great financial planner. Her professionalism and strong ethics shine through along with her friendly, open manner."

James Leong, Lawyer

"I would recommend Kelly to any young professional looking to plan for a lifetime of financial success!"

Becca Young, SVP Strategy & Creative - Weber Shandwick Canada

Login Sign Up

Ross and Emily: A Retirement Planning “Case Study”

Retirement is a significant milestone in one’s life, representing a well-deserved transition from the daily grind to a more relaxed and fulfilling chapter. However, for many Canadians, the path to a worry-free retirement can be filled with uncertainties and financial challenges. In this blog post, we’ll follow the journey of Ross and Emily, a married couple on the brink of retirement, as they navigate the intricacies of retirement planning and discover a path to financial freedom.

Ross and Emily

Ross and Emily are planning to retire at the end of this year. As the day draws nearer, a sense of alarm begins to creep in. They think they are in a good financial position, but they aren’t sure. Although they’ve committed themselves to this path, they are feeling a sense of disequilibrium. Ross turned 64 and Emily 62 earlier this year. Are they truly ready?

This tension, or discrepancy if you will, between Ross and Emily’s stated plan to retire at the end of the year and their lack of confidence in their ability to retire successfully, which they define as having enough money to live a contented retirement lifestyle for the remainder of their lives, is not uncommon. Many couples delay retirement for several years beyond what’s necessary.

Habits Die Hard

Part of the reason is that Canadians who are disciplined in their saving habits find it extremely difficult to turn saving off and start spending instead. Ross and Emily are going to be successful retirees because they were successful savers for the last 40 years. However, a habit that has been trained into a couple’s lifestyle for that many years cannot be simply turned 180 degrees. The drive to save, to enable them to retire without worry, is the same drive that keeps them uncertain. Saving and investing are straightforward. Retirement, on the other hand, is full of uncertainty. According to William Sharpe, a winner of the Economics Nobel, the hardest problem in finance is retirement spending. While we all know people who have retired successfully, the challenge is not so much retirement itself as the uncertainties associated with retirement.

Variables Not in Our Control

Consider the things that are not in a retiree’s control. We might have a reasonable sense of our life expectancy. A Canadian who has made it to age 60-65 has about a 50/50 chance of making it to age 89 or so. However, we don’t know if we are going to draw the short end of the stick and die earlier than our peers or live well beyond the average and eventually join the increasingly common centenarian club.

Inflation Rate

For many years, we have been experiencing low inflation. According to the Bank of Canada , in April 2020 the median Consumer Price Index (CPI) showed a rate of 1.9%. In April 2021, the CPI had increased to 2.3%, and increased again, to 4.7% in April 2022. However, the April 2023 figure dropped to 4.2%. Regardless of whether the CPI continues to decline, holds steady, or increases again, it is out of our control. Larger economic forces are at work. The best we can do is construct a reasonable response to inflation.

Variables in Our Control

Among the following variables, there is some degree of control available to us.

Required Annual Income in Retirement

The income we need is somewhat within our control. We can alter our lifestyles to increase or decrease our cost of living. For example, Ross and Emily may have used two vehicles before retiring, but perhaps they only need one after retiring. Their work may have required that they live in a major city with more expensive housing costs. Upon retiring they may choose to move to a community where it is less costly to live. On the other hand, in the early years of retirement when energy is still available, travelling may become a major source of expenses.

Accumulated Retirement Savings

There are multiple sources of retirement savings. During our working years, we have a fair bit of control. We can seek out jobs that offer good pension plans or higher incomes. Not everyone can move for work, however, which may limit job prospects. And in these days when couples are typically both working, moving to take advantage of a job opportunity for one spouse may negatively impact the prospects of the other spouse.

Nevertheless, within certain personal limits, it can be argued that choices are available to us concerning saving up for retirement.

Saving Rate

According to Statistics Canada , the average household saving rate was 6.0% in the fourth quarter of 2022. Given the high cost of housing and other living expenses these days, that Canadians manage to save anything at all is laudable. But of course, many save much higher percentages. Those who subscribe to the FIRE (Financial Independence, Retire Early) movement are routinely saving 50% or more of their income to become independent of the need to rely on a job to sustain themselves. Not all aspire to join this lifestyle, but I suggest that it does make the point that many Canadians can improve their saving rate and thereby improve their situation in retirement.

Another benefit of increasing the percentage of income that we save is that we establish a lifestyle that lives on less now and trains us for that lifestyle later in life as well.

Expected Investment Returns

No, this does not mean that we can control how much of a return we will get from our investments. The word “expected” is a deliberate choice. In a recent blog post, I wrote about projected investment return guidelines as published by FP Canada. Based on several factors, FP Canada projects long-term expected returns for various investment categories. For the risk-averse among us who keep all our money in cash or cash equivalents, things like savings accounts, money market mutual funds, cashable or short-term GICs, etc., the expected return is about 2.3% before fees and taxes. In a world where long-term inflation is projected at 2.1%, the return is likely negative. In other words, “risk-free” savings will tend to put our ability to live a contented lifestyle at risk. The point is that by going further out on the risk spectrum, retirees and near-retirees can increase their expected returns. There may be somewhat greater fluctuation in investment returns from year to year, but probabilities suggest that adding a bit more risk in exchange for the potential for greater investment returns is the way to go. Having said that, that risk needs to be calibrated to not just our financial needs in retirement, but our ability to cope with the increased probability of negative returns like many long-term investors experienced in 2022. Of course, someone who is in the enviable position of having a well-funded pension plan that adjusts for inflation may need to take little or no risk at all.

Developing a Retirement Plan

We spend a lot of time on certain decisions and justifiably so. Momentous decisions are made about marriage or the purchase of a home. I wonder, though, whether we put more time into deciding what kind of vehicle to buy than we do about developing a retirement plan. The previous paragraphs sought to point out that there are a lot of impactful decisions that we have some degree of control over.

Let’s return to Ross and Emily to learn a little more about their situation immediately before retirement. They don’t know how long they will live but decide that Ross’s health history argues that at age 64, they should plan for him to live to age 90. For her part, Emily’s health history and the general tendency of women to outlive men leads them to project her lifespan to age 100. Even though how long they live is out of their control, beginning to develop a plan gives them a sense of confidence that they can control more than they thought.

The Retirement Plan

Ross and Emily decide that it is time to hire a financial planner to give them some reasonable projections for their retirement.

Income and Expenses

Ross and Emily have been spending between $50,000 and $75,000 after tax each year for the last several years. This has allowed them to build up financial assets worth $3 million, which includes about $500,000 in inheritances they have received from the estates of their respective parents.

After testing various assumptions, their planner tells them they can easily spend an inflation-adjusted $100,000 per year without running out of money. In addition, they plan on spending $50,000 annually for the first three years of their retirement on renovations to their home. Also, in 2027 and every 10 years thereafter, they plan to spend approximately $40,000 on a new vehicle. In fact, at this rate, they anticipate that in nominal dollar terms, Emily is likely to die at age 100 with more money than they started with.

Both Ross and Emily have decided that they will delay receiving CPP and OAS until they turn 70. They don’t need the money immediately, and the benefit of increased payments is an extra level of reassurance in the event of disastrous investment returns.

Investments

Ross and Emily both have RRSPs, TFSAs, defined contribution pension plans, and non-registered accounts worth a combined $3 million in a combination of index funds and Guaranteed Investment Certificates (GICs). Their asset mix is currently 54% equity and 46% fixed income and cash equivalents. After reviewing some risk assessment questionnaires, they decide that they could moderate their asset mix somewhat to 50/50 equity/fixed income.

Emily also has a Defined Benefit pension plan that is not indexed for inflation. She is already receiving payments of $800 per month.

Their planner recommends that they spend down their RRSP/RRIFs in the first few years of their retirement and spend down their defined contribution plans, which they plan to convert to LIFs, next. Ross and Emily can sustain the balance of their retirement spending need from the income generated by their non-registered assets as well as small withdrawals from the capital. However, projections indicate that the non-registered accounts will continue to grow. Although they don’t contribute to their TFSAs anymore after retiring, neither do they need to withdraw any funds. Ross and Emily have designated their TFSAs as well as their house as assets set aside for an inheritance.

Although no one likes to pay taxes, Ross and Emily know that their registered accounts will have taxes due anyway. They would rather pay those taxes earlier than leave heavily taxed assets to their heirs. The TFSAs will be tax-free, or nearly so, when the surviving spouse, presumed to be Emily, dies. While the non-registered accounts are taxable, only the capital gains portion needs to be worried about.

They also plan to mitigate their taxes somewhat by continuing their pattern of donating to registered Canadian charities. They like the idea of contributing to worthy causes while simultaneously getting a tax credit for donations.

Emily had privately purchased term life insurance when she was younger. In their last 10 years, however, she let that lapse, as there were no longer any debts to cover, and their children had reached adulthood. Ross was not eligible for privately purchased life insurance. They both have group policies that will disappear when they retire. They have been assured that they have sufficient funds to cover the needs of the surviving spouse.

Legal Matters

Both Ross and Emily have appointed each other as powers of attorney to handle their financial and personal care issues if they lose the necessary competency to handle those affairs themselves. They are giving some consideration to appointing one of their children as alternates but have not done so yet.

The Outcome

Thanks to the review of their assets and spending, Ross and Emily feel encouraged and confident as they enter retirement. With the help of their financial planner, they have anticipated several of the consequences that may arise and have taken steps to secure their financial well-being over the long term.

Ross and Emily’s journey is a mash-up of existing and fictitious financial planning clients. The amount of money they have may be substantial and it has been buttressed by inheritances. However, they did not work in jobs with “gold-plated” pensions. Their lifestyle while working has been marked by a degree of frugality that allowed them to accumulate significant assets. As you embark on your own retirement planning journey, remember that there is much that remains in your control. Some professional guidance to help you make decisions for your long-term benefit can lead you on a journey to a contented and enjoyable retirement.

This is the 198th blog post for Russ Writes , first published on 2023-05-22

If you would like to discuss this or other posts, connect on Facebook , Twitter , LinkedIn , or Instagram .

Click here to contact me for an appointment.

Disclaimer: This blog post is intended for general information and discussion purposes only. It should not be relied upon for investment, insurance, tax, or legal decisions.

Image by Susanne Nicolin from Pixabay

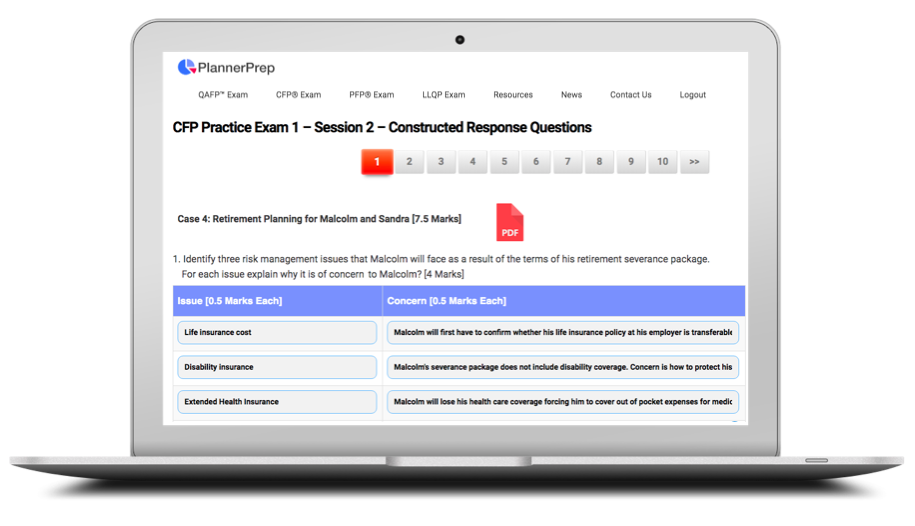

Case Study: Young and Ambitious

Excellence through Preparation

Your comprehensive source of practice exams and study guides for the most recognized financial planning designations in canada, about plannerprep.

Support your preparation and studying with PlannerPrep’s comprehensive packages of practice exams and study guides

Save precious time by preparing faster and improve your chances of passing the exam on your first attempt thanks to our simulated practice exams and premium study guide content.

Our focused content, competitive pricing and simple to use platform allows you to study when and where you want. Our dedicated team of financial planners have prepared our Practice Exams and Study Guides that focus on the mastery of concepts by rigorously applying what you’ve learned and strategically tackling large volumes of exam content.

Main Features

Practice exams structured to simulate the actual fp canada exams.

- Our CFP and QAFP practice exams have the same number of multiple choice and case study questions as the official exams.

- PlannerPrep’s software makes the experience of taking the practice exams as relevant as possible

- All practice exams include detailed answer key with explanations and traceability to competency profiles

- Multiple attempts available for each practice exam

Focused Study Guides Reduce Your Study Time

- Our comprehensive Study Guides cover all competency areas and financial planning areas

- Downloadable PDF included for smartphones, computers and print-outs

- Focused content ensure study time is as efficient as possible

Multiple Choice Question Banks

- CFP and PFP Question Banks contain 500 multiple choice questions each

- LLQP Question Bank contains 1,000 multiple choice questions

- Correct answers and rationale available after each questions

- Results based on financial planning area

- Customize question formats to create question bank subsets to focus on specific financial planning areas

Affordable Product Bundles

- Choose the product bundle most suitable to your needs and save

- Leverage the power of our full set of products and content to succeed

Comprehensive Content

- 3 QAFP Practice Exams include 60 multiple choice questions based on 6 full case studies

- 3 CFP Practice Exams include 30+ constructed response questions

- Over 2,000 multiple choice questions across all our products

- Study Guides cover all financial planning areas in 300+ pages

PlannerPrep’s Testimonials

I wanted to reach out and let you know that your material helped during my writing of the October CFP Exam, I passed and found the exam to be easier than I thought it’d be. Having now used your QAFP and CFP materials, I wanted to say thank you. I found it very helpful in both cases, and unbelievably priced compared to what else is out there.

I just wrote my AFP1 and passed the exam. Your practice questions were extremely helpful.

I found your study material very helpful in studying for the CFP exam. I ended up passing the November 2021 exam.

PlannerPrep is a great resource for preparing for the CFP Exam. With 500 questions to select from, I definitely got my reps in. I like how you can select questions from any financial planning area to focus on.

This was great resource for the QAFP exam. Their case studies were in depth and challenging. Worth the investment in time and money.

I’m happy I stumbled across PlannerPrep. Their financial planner exam questions were challenging. The calculation questions have always been a challenge for me but they provide detail answers and where I went wrong. Thanks again!

Latest News

Mastering Your RRIF: Tips to Avoid Costly Withdrawal Penalties

Tips for Efficiently Managing RRIF Withdrawals and Avoiding Hefty Penalties Registered Retirement Savings Plans (RRSPs) eventually have to be taxed as income once withdrawn. Often, after conversion into a Registered Retirement Income Fund (RRIF), a specific percentage must be withdrawn each year. Financial planners have various strategies to reduce taxes on RRIF withdrawals, especially when […]

The Importance of Staying Invested

Despite the difficulty markets that appear during economic cycles, the greatest danger for long-term investors is not experiencing financial loss, but rather not having enough. That’s why maintaining a diversified portfolio is essential. While there is no guaranteed solution, there are three straightforward and effective investment strategies that can help. 1. Avoid Extremes There […]

Managing Income for Seniors

Strategies and Solutions The increasing number of seniors who opt to continue working during their retirement years face the challenge of finding ways to minimize their tax burden on multiple sources of income. This includes income from employment, the Canada Pension Plan, Old Age Security, pensions, registered investments, and non-registered investments. The challenge lies in […]

Brought to you by:

Smith Family Financial Plan (A)

By: Brian Lane, Johnstone Nathalie

The Smith family is in a cash crunch. Even with a combined gross family income of $80,000 per year, monthly cash outflows are still greater than inflows. Joel and Amber Smith are aware of these cash…

- Length: 6 page(s)

- Publication Date: Jul 17, 2013

- Discipline: Finance

- Product #: W13292-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

The Smith family is in a cash crunch. Even with a combined gross family income of $80,000 per year, monthly cash outflows are still greater than inflows. Joel and Amber Smith are aware of these cash flow problems, but do not understand where their money goes and struggle to set financial goals. They have contacted a financial advisory firm to help them develop a plan and set realistic future goals. The Smiths face financial problems common to young families such as saving for their retirement and children's education, paying down credit card debt, paying down (and possibly refinancing) their mortgage, buying a new vehicle, and providing adequate healthcare insurance. Students are tasked with playing the role of the family's financial advisor and helping them bring their finances under control. The case is built in two parts, (A) and (B). These can be used in separate 75- to 90-minute classes, with Smith Family Financial Plan (A) covered at the midpoint of the course and Smith Family Financial Plan (B), product 9B13N006, covered near the end. Alternatively, it can be used as a two-part major assignment, with Part (A) as the first major submission and Part (B) as the second.

Authors Brian Lane and Nathalie Johnstone are affiliated with University of Saskatchewan.

Learning Objectives

This case series engages students in evaluating financial-planning alternatives and considering the effects of their recommendations on client goals. It places students in the role of a financial advisor and introduces them to the personal financial-planning process, with emphasis on personal financial statements and liquidity issues, insurance, investments, taxation, and retirement planning. This case was designed to complement the curriculum of an upper year undergraduate personal finance class and simulates the professional financial-planning environment of meeting with clients and developing financial plans. This case asks students to:Assess short-term and long-term financial goals while considering the time value of money.Create personal financial statements.Identify liquidity issues (banking, money management and personal credit).Assist clients in personal tax planning.Discuss the most effective way to finance large purchases to best meet client goals (personal loans and houses).

Jul 17, 2013 (Revised: May 24, 2013)

Discipline:

Geographies:

Industries:

Financial service sector

Ivey Publishing

W13292-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

- Downloadable Forms

- Financial Solutions

- Graduates and Young Adults

- Young Couples and Parents with Children

- Middle Age and Approaching Retirement

- People Experiencing Life Changes

- The Financial Planning Process

- Defining Goals and Assembling Financials

- Financial Diagnostics

- Recommendations

- Implementation and Exectution

- Monitoring and Adjustments

- Young Married Couple with Children (Planning their Future)

- Single Professional (Managing Debt)

- Married Couple (Preparing for Retirement)

- Married Couple (Managing Proceeds of a Sale)

- Single Individual

Case Studies and Results

Young family - planning their future, single professional - managing debt, married couple - planning for retirement, married couple - managing proceeds from a sale, single individual - pursuing an mba.

David was recently promoted earlier this year as Director of Engineering for a very large oil and gas exploration firm in Farmington, NM. His salary is $150,000 per year plus substantial bonus opportunities and equity share of the firm. Tiffany is a graduate of an East Coast liberal arts college specializing in health care issues. She has worked as a consultant and now she is a full-time mom. They are devoted to their family and live well within their means. They have accumulated a substantial balance in their checking account. As a family they enjoy camping in the mountains in Southwest Colorado.

Step 1: What is important to David and Tiffany?

Step 2: financial diagnostics.

Tax Bracket: 33%

Anticipated taxes $63,250

Contributions to 401(k) plan: $150 per pay period or $3,600 per year. Contributions are primarily in an international fund.

Group Life Insurance: $150,000

Existing Mortgage Interest Rate: 6.125%, Current Rate: 2.85% (Rate as of February 2013)

Step 3: Goals Based Recommendation

- Establish a will or trust and name a guardian for the children.

- David: Purchase a $500,000 10 year term life insurance and a $1,000,000 20 year term.

- Tiffany: Purchase a $250,000 10 year term life insurance and a $500,000 20 year term.

- Refinance Mortgage to lower payments and save interest and pay off auto loan

- Maximize 401(K) contribution and reallocate retirement investments

- Establish Educational 529 plans for children, reserve a fund for David’s MBA

- Provide tax clarity to prepare David and Tiffany for the higher tax situation

Step 4: Implementation and Execution of Recommendation

- Set up an appointment with attorney to prepare an estate plans, including preparing documents.

- Meet with independent life insurance agent to compare and select term life insurance policies

- Meet with mortgage lender to refinance. Auto loan was paid off.

- Meet with human resource representative to increase 401(k) contribution and reallocate retirement investments.

- Meet with accountant to determine an prepare for higher income taxes and affirm tax saving practices

- Meet with an Investment Advisor to fund 529 plans and begin an investment savings program

Funding Retirement produced a tax deferred savings of $4,644 annually. The projected retirement and investment savings is estimated to have a balance of $750,000 in 10 years and well over $1,500,000 in 20 years. Based on that number it was determined that effective use of term life insurance will provide the protection gap until those balances are reached. The staggered term resulted in a total of $2,250,000 of insurance at a minimal cost of $750 annually. The mortgage refinance provided monthly savings of $283. Overall the saving and investment programs more than offset the cost of annual life insurance policies and the one-time expense of preparing an estate plan.

The information provided here is intended to be educational and should not be considered or construed as legal, accounting (tax), or financial planning advice. The strategies described may not be suitable for all individuals. Examples are provided for illustrative purposes only, and no representation is made that a person acting on these examples will achieve the results shown.

Although every effort has been made to assure the integrity of this material (including the reliability of websites referred to in the text), no representation or warranty is given as to accuracy or completeness. We encourage you to consult with legal and accounting professionals (as appropriate) before applying any of the strategies discussed to your particular circumstances.

Kathy, age 44, is a radiologist in Taos who purchased a home in 2006 prior to the mortgage crises. Her home was in need of repairs and obtained a second mortgage and third mortgage, one was for a new roof and the other was to upgrade the electrical. In addition she had to borrow from her retirement plan in order to make other renovations. She also has credit card debt, student loans and a car loan. The burden of debt is overwhelming especially since she estimates that she purchased her home at the top of the market and the home value is less than the total outstanding mortgage debt. Her salary is $67,000 per year and that does not include the rent she receives from her roommate. Kathy is a hard worker and has worked extra hours to cover her debt. She does some travel to visit her family in another state. She also has been involved in business ventures. She is savvy and knows that she needs to deal with her financial issues. She does maintain a 403(b) fund and contributes to receive the maximum matching employer contribution. Her cash flow is restricted because of the amount of debt she carries.

Step 1: What is important to Kathy?

Tax Bracket: 25%

Anticipated taxes: $6,770

Contributions to 401(k) plan: $100 per pay period or $3,600 per year. Retirement contributions are allocated to a well defined structured investment program.

Group Life Insurance: $65.000 and a universal life policy $13,000

Existing Mortgage Interest Rate: 6.0%, Current Rate: 4.5% (Home Affordable Refinance Program)

- Refinance first mortgage and pay off credit card debt. Upon payment of credit card debt,apply those payments to principal on second mortgage.

- Half of the $205 savings on the mortgage payment should be applied to the retirement plan.

- Upon the 403(b) loan payoff in two years, apply the 200 per monthly payments as retirement contributions.

- Make an appointment with an attorney to establish an estate plan.

Step 4: Implementation and Execution

- Set up an appointment with mortgage lender to refinance first mortgage. Increased principal payments to pay off credit card debt. Further principal reductions on other loans will continue as each debt is paid off.

- Increased initial contributions to retirement plan.

- Opted to defer an appointment with an attorney. Kathy will use the health care power forms provided by her employer.

- Will continue to set aside money for emergency saving.

Refinancing the mortgage provided $2,400 saving to Kathy’s mortgage payments, the term length did not change. Kathy will have no debt by the time she retires. Concurrently, Kathy will add to her retirement plan. It is projected that upon retirement she will have accumulated $469,000 by the time she retires based on an assumed 5% annual return. The first two years the cash flow will be tight, however, as debt is paid off, there should be ample surplus in her cash flow to provide more leisure spending.

The information provided here is intended to be educational and should not be considered or construed as legal, accounting (tax), or financial planning advice. The strategies described may not be suitable for all individuals. Examples are provided for illustrative purposes only, and no representation is made that a person acting on these examples will achieve the results shown.

Although every effort has been made to assure the integrity of this material (including the reliability of websites referred to in the text), no representation or warranty is given as to accuracy or completeness. We encourage you to consult with legal and accounting professionals (as appropriate) before applying any of the strategies discussed to your particular circumstances.

Albert , age 73 and Anne, age 67 live in Las Cruces. Albert is a painting contractor and Cynthia teaches part-time at NM State University. Because of their transitional life from one college to another they have rented rather than purchased a home. Home ownership did not occur until the past five years. They were dedicated to providing for their daughter’s education. Now they are approaching retirement and drawing on Social Security even though both are still employed. Albert sees that, although he enjoys his profession, he finds that he is less physically able to continue painting. Cynthia would like to retire in two years and both would love to pursue art studies and literature. Their primary concern is a stronger retirement and to pay off debt. They live a modest lifestyle. Albert prepares the household tax returns.

Step 1: What is important to Albert and Cynthia?

Tax Bracket: 15% Federal and 4.9% New Mexico

Itemize: They cannot itemize deductions

Other tax issues: They are receiving Social Security Benefits and 85% of the benefits are taxable. Anticipated taxes: $8,044

Contributions to 403(b) plan: $200 per pay period or $3,600 per year. Retirement contributions are allocated to 50% cash and 50% equities. Tax savings comparison was calculated.

Met with an owner of a national tax preparation firm and ran tax scenarios on their tax software. This determined the impact of maximizing 403(b) contributions. In addition the tax preparer provided tax advice on Albert’s business.

- It was determined that Cynthia should maximize her contribution from $200 per pay period to 846 per pay period. In addition their retirement asset allocation was reviewed and recommended alignment to a strategy appropriate for their stage in life. Retirement projections were prepared and determined that Cynthia and Albert could retire in two years based on their current living standards and if she maximize her retirement contributions.

- That they prepare for the meeting with an attorney.

- That they have their financial plan available for their daughter in the event she needs to assist.

- That they utilize a tax preparation professional.

- Their budget and goals for education, travel, hobby and charity are doable.

Step 4: Implementation and Execution of Recommendations

- Cynthia increased her retirement contribution from $200 to $846 per pay period. She also further diversified her cash position to several diversified bond strategies. Her equities were reallocated to represent large-cap, mid-cap, small-cap, international developed and emerging market funds. In addition a real estate trust and a commodity index fund were represented in the retirement portfolio.

- An appointment was made with a local attorney to draft their estate plan.

- Two sets of plans were provided; one for Albert and Cynthia and the other for their daughter.

- Albert will consider the tax preparer’s advice and engage their services the following tax year.

- The projects, travel, charity and seminars are budgeted.

Maximizing the 403(b) contribution will enable Cynthia and Albert to save $4,380 in taxes. In addition, the 403(b) contributions will add $44,000 of principal to their retirement balance over the next two years. The advice of the tax preparer will also save them an additional $1,000 in taxes. Their attorney completed the estate plan. Also they are preparing for their trip to France and they have completed the garden arbor. Finally, they know that their budget will allow for charity and seminars.

The information provided here is intended to be educational and should not be considered or construed as legal, accounting (tax), or financial planning advice. The strategies described may not be suitable for all individuals. Examples are provided for illustrative purposes only, and no representation is made that a person acting on these examples will achieve the results shown.

Although every effort has been made to assure the integrity of this material (including the reliability of websites referred to in the text), no representation or warranty is given as to accuracy or completeness. We encourage you to consult with legal and accounting professionals (as appropriate) before applying any of the strategies discussed to your particular circumstances.

Michael , age 61 and Anne, age 58 live in Albuquerque. Michael works at a major laboratory and Anne teaches music part-time at a local high school. Anne’s family large owns a large concrete company in San Diego of which she owned a partial interest. Her siblings purchased her share which amounted to around $7,000,000 and she has kept part of the money in cash. Since the housing market in California has severely declined, Anne wants to make set aside ample reserves to help her family’s business weather through the difficult time. One of the concerns is that monies have been spread to various banks in Albuquerque and much of it is uninsured. In addition there is not a structure to provide for bond investments. Michael and Anne are self-sufficient from their employment salary and do not rely on either the income or principal of the family business proceeds. Preservation of the business proceeds is important; however they appreciate the need for equity investments to provide diversification and to stay ahead of inflation. They hold no debt and are able to cover the educational expenses of their sons.

Step 1: What is important to Michael and Anne?

Tax Bracket: 33% Anticipated taxes: $40,000

Contributions to 401(k) plan: $100 per pay period or $3,600 per year. Retirement contributions are allocated to a conservative fixed income program.

- It was determined that $2,000,000 should be set aside to either lend or invest in the family concrete business.

- Invest the remaining proceeds in an asset allocation strategy

- Make an appointment with an attorney to establish an estate plan.

- Increase the contribution to their company retirement plan.

- Of the $2,000,000 set aside as an emergency reserve for the family business, Michael and Anne felt it would be best to establish a mini bond ladder that did not extend beyond a three year term.

- Michael and Anne met with their investment advisors to implement a coordinated asset allocation strategy. Therefore they divided up the assets to provided a combined 50% bond/50% equity split. This consisted of municipals, cds, on a bond ladder that does not exceed 12 years. The equities were managed among large-cap, mid-cap, small-cap, international developed and emerging markets. Other positions included real estate trusts and a commodity index.

- They met with an attorney specializing in estate planning. This attorney established irrevocable life insurance trust to provide for estate taxes.

- Michael met with the human resources to increase his contribution to his retirement plan.

Restructuring the investment program increased their investment income from $50,000 to $200,000. Much of the income was from tax free municipal bonds and reduced taxes on qualified dividends. They did realize an increase in their tax bracket, but that was manageable. The estate plan is now in place and they are prepared for the various tax changes that could come about.

Miguel, age 28, is a research analyst for an American company that has an office in Madrid, Spain. He is single and no dependents. Miguel desires to obtain his MBA at a top-tier business school. His educational endeavor will be a major expense. Although Miguel is an American citizen, he pays both US and Spanish taxes and participates in the Spanish health care and retirement programs. Miguel monitors his income and spending. He also sets aside savings for investments as well as contributes to his retirement plans.

Step 1: What is important to Miguel?

Bracket: 29.7% (Foreign Tax Bracket) Anticipated taxes: $13,283

Contributions to retirement plan: $308 per pay period or $7,380 per year. Retirement contributions are allocated to a well defined structured investment program.

- Miguel has saving in the amount of $46,000

- Miguel has retirement savings with a provision that he can draw without penalty provided it is used to fund education

- Miguel will still need to rely on student loan ranging from 6.8% to 7.9% interest rates. However the above savings will reduce the reliance on such loans.

- Funding Source and Outlay – A plan was made to determine on when and how to draw on the mentioned resources to reduce the tax impact and the amount of loans necessary to finance his MBA.

- Loan Balance and Monthly Payment – A projection was made to determine what his student loan payment obligations will be after he obtains his MBA

- Miguel worked with his accountant to run a mock tax preparation to make sure there were no tax surprises in both foreign and US taxes. This plan was submitted as part of his application to one of the above MBA programs on how he intends to finance his education.

Miguel was accepted to the MBA of his choice and will be beginning the program in the Fall of 2014.

Although every effort has been made to assure the integrity of this material (including the reliability of websites referred to in the text), no representation or warranty is given as to accuracy or completeness. We encourage you to consult with legal and accounting professionals (as appropriate) before applying any of the strategies discussed to your particular circumstances.

- Free Goals Assessment

- Your Personal Financial Trainer

Contact Information

Thomas Bustamante [email protected] (505) 231-4607

Bustamante Financial Planning LLC is a registered investment advisor with the state of New Mexico. As such, it is registered to transact business with and provide investment advice to New Mexico residents. Only general information on available services is available through this website. In addition, it adheres to the de minimis requirements of other states for out-of-state clients.

© 2024 Bustamante Financial Planning

Your Browser Is Out Of Date.

To get the best possible experience using our site we recommend that you upgrade to a modern browser such as Google Chrome .

The Canadian Institute of Financial Planning Case Challenge

This case challenge is an opportunity for students to build on their financial services knowledge. They develop a comprehensive financial plan based on a mock scenario.

Schools / Chiu School of Business / Initiatives / Case Challenges / CIFP Challenge

Initiatives, case challenges.

- Alberta Deans of Business Case Competition

- CIFP Challenge

- HRC West Case Competition

Social Entrepreneurship

About the CIFP Case Challenge

Students in the Financial Services major are selected to represent Bow Valley College every year. During the challenge, teams develop a case analysis, recommendations, and an implementation plan before presenting their solution to a panel of financial planning professionals. This is a notable opportunity for our students to gain team building, time management, interpersonal, and presentation skills. As well, students have an opportunity to network with the sponsoring organizations.

April 02, 2022

This year’s CIFP Case Challenge was held virtually with participants across Canada showcasing their financial planning skills.

Coached by Raj Brar, three learners from the Bow Valley College participated ( Aj Lyn Guillermo, Braden Mcleod, and Kenil Shah). Our team was awarded 5 th place!

“The personal financial planning courses at BVC are packed with so much information. The Case Competition gave me an opportunity to apply that knowledge. Each practice leading up to the competition solidified something I learned in class. Not only did it help me retain knowledge, but it also gave me near real-world experiences. Coming out of the Case Competition, I am more confident, knowledgeable, and excited about the future.” – Braden Mcleod

March 25, 2021

In adapting with our new reality with the widespread COVID 19 pandemic, the Canadian Institute of Financial Planning adjusted and formatted their very first virtual financial planning case challenge.

Coached by Christy Hemmingway, three learners from the Bow Valley College participated ( Carlo Vincent Sarmiento, Kenil Shah, and Tan Kiet Truong). Our team was awarded 3 rd place nationwide!

“The CIFP competition was a one in a million experience! The competition helped me be prepared to be a financial advisor as real-world case studies were used. I was able to apply what I learned from my courses. Our mentors, Christy and Raj, and my groupmates, Kiet and Kenil, were real professionals. It was great working with them as a team and winning 3rd place for BVC! I would highly recommend other students to participate in this competition. Not only would you have a glimpse of the Financial Services industry, but you will get a chance to network with industry professionals.”

– Carlo Vincent Sarmiento

With Bow Valley College’s ongoing commitment to provide exceptional experiences to our financial services learners, two teams registered to participate in the Canadian Institute of Financial Planning Case Challenge.

The two teams, coached and mentored by Financial Services instructors Christy Hemmingway and Raj Brar, included: Olayinka (Yinka) Okunola, Manpreet (Mannu) Kaur, and Mercy Ward as well as Adrialyn Estepa, Giang (Erin) Nguyen, and Oludewa (Deborah) Emesiobi.

In preparing for this challenge, our learners met for 5 hours a week from the second week of January to the first week of March. Unfortunately, due to the widespread COVID 19 pandemic, the CIFP Case Challenge was cancelled. To honor our learner’s time and dedication to this venture, both teams had an opportunity to present on campus in front of faculty and peers.

March 23, 2019

The Bow Valley College was proud to participate in this year’s CIFP Case Challenge held at the Northern Alberta Institute of Technology. Two teams from Bow Valley College presented and showcased their financial planning skills.

The two teams, coached and mentored by Financial Services instructor Raj Brar included: Aaryan Khurana, Jurgen Valderrama, and Ritika Garg, as well as Arshdeep Boughan, Donny Burgess, and Jacky Yim. Our teams placed 5 th and 6 th rank respectfully.

March 10, 2018

On March 10 th , Bow Valley College was honoured to host the Canadian Institute of Financial Planning (CIFP) Case Challenge, Western Regional. The competition brings together schools from the Western provinces to compete in formulating a financial plan in a short period of time.

This full-day event was followed up with a dinner and presentation of the winners. The real work began in the morning where teams had just two hours to analyze the case, develop a financial plan, and prepare a presentation. Teams later presented their plans to a panel of judges from the Financial Industry. This year’s competition included teams from Bow Valley College (2 teams), SAIT (2 teams), NAIT, and Red River College.

The Chiu School of Business team, coached and mentored by Financial Services instructors Christy Hemmingway and Raj Brar, included: Anuj Patel, André Kimerling , Joseph Amaral, Deepankar Sharma, Gurleen Benipal, and Leticia Marques . “ It is a high-pressure competition for the students involved ,” states Christy, “ but provides students with an incredible opportunity for learning .”

While the BVC teams did not place, they did an exceptional job in their financial plans and presentations to the industry judges. We are incredibly proud of their initiative, commitment, and accomplishments. This year’s winners of the CIFP Case Challenge were: 1 st place: Red River College, 2 nd place: SAIT, 3 rd place: SAIT.

March 11, 2017

The Chiu School of Business team, Aleksandra Iurkovets, Devang Purohit, and Raphael Maningo, described this event as a great learning opportunity in financial planning that helped them to further develop confidence in presentation skills and public speaking as well. The instructors worked directly with the case team for the past three months to ensure they were ready with the appropriate knowledge to feel confident in any financial planning situation with potential clients.

"I couldn't be more proud of our team this year as they represented not only themselves but Bow Valley College incredibly well ," stated Christy Hemmingway, Lead Instructor.

Your cart is currently empty.

Browse Available Courses

- If you are currently studying in a post-secondary program at BVC, please register for your courses via mybvc to ensure your enrolments and fees are processed appropriately.

- Cart total based on domestic tuition rates. For information about International Tuition rates please see Additional Fees Apply

- If you anticipate applying for a student loan, your payment will be refunded to you based on your loan award once your funding has been received by BVC.

We use cookies to ensure that we give you the best experience on our website. Learn more in our privacy policy

- Financial Planning Case Studies

Here are some planning scenarios that might be applicable to your situation.

1 Lance – Getting an early start on retirement savings.

2 Nancy – Maximizing your registered account opportunities.

3 Ted – Tax sheltered growth of RRSP.

4 Margret – Putting more away for your future.

5 Alexander – Taking on more risk for better rewards.

6 Lisa – Increasing your returns.

7 Kevin – Funding estate taxes.

- What We Believe

- The Financial Planning Process

- Testimonials

- Life Insurance

- Critical Illness Insurance

- Disability Insurance

- Long Term Care Insurance

- Health & Dental Insurance

- Travel Insurance

- Group Benefit Plans

- Medical Underwriting

- SAVE MONEY ON YOUR MORTGAGE

- The Vicennial Project

- All Columns

- Education Funding

- Estate Planning

- Income Tax Planning

- Insurance Columns

- Money Management

- Investment Management

- Planning Encyclopedia

- Retirement Planning

- Risk Management

- Ask The Expert

- Receive Newsletters

- The Prosperity Book

Download the Prosperity App

"So many people spend their health gaining wealth, and then have to spend their wealth to regain their health." ~ A.J. Reb Materi, Our Family

© 2024 Brad Brain Financial Planning Inc. The information in this communication is subject to change without notice.

Financial Planning Challenge

This distinctive three phased competition is designed exclusively for undergraduate degree programs registered with CFP Board.

In the first phase of the competition, all student teams will be given profiles for two hypothetical clients and must prepare a comprehensive financial plan. After the first phase is judged and awarded, the top eight teams will advance to the next phases of the competition to be held in the fall. All teams must orally present their case studies to a panel of judges and participate in the "How Do You Know?" Challenge. The top three winning teams will be awarded a monetary scholarship for their school. Judges will be selected by each presenting organization and will assess student teams on demonstrating the CFP Board Financial Plan Development Course requirement.

In recognition for the hours of research, application and presentation preparation, CFP Board will provide each team member hours toward the Experience requirement leading to certification. Students participating in phase 1 will be awarded 20 hours.

2024 Competition Timeline

June 7 – Phase 1 Case Submission Deadline

July 29 – Top 8 Student Teams Announced

Week of July 29 – Academic Advisor Conference Call

September 17 – Orientation

September 18 – Phase 2: Financial Planning Case Study Oral Presentations

September 19 – Phase 3: "How Do You Know?" Challenge

September 18-20 – Students Participate in Annual Conference Networking and Learning Opportunities

Competition Materials

2024 case study, additional case documentation financial planning challenge guidelines , registration form, phase 1: grading rubric, phase 2: presentation grading rubric, eligibility, teams may consist of up to three undergraduate students. students may not participate in more than one team., all participating students must be enrolled in an undergraduate degree program registered with cfp board as of may 1 or spring semester., students considered graduate students by their school may not participate., each team must be represented by an academic advisor throughout the competition., students are prohibited from seeking advice from professionals or from persons not participating in the challenge., limit one team per school., additional details can be found in the financial planning challenge guidelines., the top eight (8) student teams based on their phase 1 score. these teams will advance to the final phases of the competition held in conjunction with fpa annual conference. teams will be provided roundtrip airfare/transportation, lodging, $75 gift card, complimentary fpa annual conference registration, 1 year of fpa membership plus 60 hours toward the experience requirement leading to certification., in addition, the top three (3) teams will be awarded the following:, 1st place overall: $10,000 scholarship for their school and full scholarship to fpa's highly acclaimed residency program ., 2nd place overall: $5,000 scholarship for their school, 3rd place overall: $1,000 scholarship for their school, previous finalists and case studies, 2023 financial planning challenge, finalists: first place- texas tech university; second place - university of akron; third place - university of arizona, 2023 case study , 2022 financial planning challenge, finalists: first place - utah valley university; second place - kansas state university; third place - fort hays state university 2022 case study, 2021 financial planning challenge, finalists: first place - texas tech university; second place - kansas state university; third place - fort hays state university 2021 case study, 2020 financial planning challenge , finalists: first place - texas tech university; second place - utah valley university; third place - university of wisconsin, 2020 case study , 2019 financial planning challenge, finalists: first place - utah valley university; second place - kansas state university; third place - texas tech university, 2019 case study, 2018 financial planning challenge, finalists: first place - texas tech university; second place - utah valley university; third place - kansas state university, 2018 case study , 2017 financial planning challenge, finalists: first place - utah valley university; second place - university of illinois at urbana-champaign; third place - texas a&m university, 2017 case study , 2016 financial planning challenge, finalists: first place - william paterson university; second place - the university of akron; third place: kansas state university, 2016 case study, 2015 financial planning challenge, finalists: first place - kansas state university; second place - the university of akron; third place: utah valley university, 2015 case study, 2014 financial planning challenge, finalists: first place - the university of akron; second place - utah valley university; third place: william paterson university, 2014 case study.

September 8, 2017

Financial plan with solutions of a real life case study.

Sadique Neelgund

Note – This case study is published in Steven Fernandes book There is always a financial solution … published by Bestsellers18 which is a compilation of different case studies. Sharing here with permission of author.

Name – Abhishek Goel (30)

Family – Father (67), Mother (63)

Resides in – Delhi

Occupation : Service

Job Details : Works as Chief Manager Claims for a Private General insurance company.

Background:

Abhishek is single and stays with his parents in his father’s house in Delhi. He has an elder brother who works abroad. Abhishek remembers that at an early age he got a first-hand experience on savings when his parents encouraged both the brothers to open a children’s bank account which was being operated from the school premises. Both brothers started saving Rs. 5 per month and this money was utilised in the next academic year to purchase some books, stationery, etc. His father used to work in an engineering firm while his mother was a teacher. When he was in the first standard, his father’s company faced lockout and for nearly 2 years the family survived on his mother’s income. His father got an opportunity to work in the gulf later and for some time the family’s finances were on track.

Again, tragedy struck when his mother had to give up her job due to health reasons. After working for a couple of years abroad, his father’s firm closed down and he had to come back. His mother started taking tuitions at home to make ends meet. Since the convent school where the siblings were studying were aided by the government, they did not have to pay any fees for their secondary school education. Abhishek’s mother ensured that every expense was monitored and followed a strict budget. Both the brothers understood the family’s grim financial situation and consciously supressed their desires for story books/ toys etc. The difficult financial situation made the brothers realise that good education and qualification was the single most path to getting a good job and ensure financial stability. With the generous help from charitable donors Abhishek and his brother got interest free loans to complete their higher education. Abhishek completed his BE in Automobile engineering while his brother did is Hotel management.

Even during his first few years of college, Abhishek had started earning by giving tuitions. Part of this money was deposited in his bank and rest was given to his mother to manage the family’s expenses. Abhishek has had a very good rise in his career in the last 9 years since he has been working and presently he is in a very good position with a well-known General insurance company. Since he has been only exposed to traditional investment options like Insurance, Post office and FD schemes, Abhishek started his investment journey from 2007 with these products. To save tax he purchased traditional insurance policies and invested the rest in Fixed deposits. Even then he has been able to create a good investment basket because he has kept his expenses to the minimum and tried to save as much as he could.

Last year he booked an under construction flat worth Rs. 62 lakhs for which he paid the down-payment of 10% from his own savings. He is expected to get possession of the flat by December 2018. So far, he has taken a loan of Rs. 18.50 lakhs and he intends to try and pay as much as he can from his own sources in the next 2 years before possession.

Savings habit: In almost all cases with a few exceptions, our parents are the initiators into the world of savings and investments. Abhishek too understood the importance of savings through his parents who encouraged him right from his school day. He had never looked back ever since. Most of us lose our way once we get caught up in our work and other family responsibilities. Abhishek continues this habit till today and now savings has become an integral part of his responsibilities. He only needs guidance on how/ where to invest the savings.

Insurance as an investment: Most people buy insurance as an investment product or rather it is sold that way to make it attractive for the buyer. Investment oriented insurance policies are of two types – Traditional and Unit linked. Traditional policies typically invest in government bonds, approved securities and instruments which provide fixed income while Unit linked policies invest in instruments varying from government bonds to equities as per the fund chosen by the investor.

Traditional insurance policies typically don’t provide more than 5-6% returns over the long term while equity oriented funds in unit linked policies can fare better than traditional policies in the long run. Therefore, traditional insurance policies don’t serve as a good investment for the long term. How can a product which cannot beat inflation help you to reach your long-term goals? Abhishek made an early start but due to lack of knowledge and with a view of saving tax, he invested in traditional insurance policies, allocating a good amount of premium.

What is the present situation?

Basic Numbers

Monthly Income: Rs 90000

Monthly surplus: Rs. 32522

Networth Statement

ASSET ALLOCATION

Emergency fund: Apart from the savings account, the fixed deposits provide a decent back up In case of any emergency.

Life insurance : Abhishek is covered for Rs. 1.09 crores through 1 term pan of 1 crore and two traditional plans. He also has a traditional pension plan for which his monthly contribution is Rs. 8145 and the maturity is in 2041. He has a limited premium traditional policy where the last payment is to be done next year. The last policy is an endowment policy which will mature in 2028.

Health Insurance : Abhishek is covered for Rs. 5 lakhs through his employer group insurance policy. His parents are covered for Rs. 2 lakhs each through a separate policy. He also has a separate health cover of Rs. 15 lakhs through a combination of mediclaim and top up policy.

Investments: Investments are very well diversified into debt and equity with debt comprising 55% of the allocation and equity at 45%. Property has been excluded as its for self-consumption.

Liabilities: Presently there is only 1 loan which is a home loan taken on the under-construction property.

Abhishek has opted for EMI payments (instead of only pre EMI interest) as it enables him to claim tax benefits on both principal and interest payments as well as loan outstanding keeps reducing with each EMI payment.

Risk Profile: Moderate

Recommendations:

Emergency fund: Abhishek needs to maintain an emergency fund of Rs. 1.75 lakhs, which should take care of nearly 3 months of expenses. Presently he has maintained Rs. 1.05 lakhs in savings account which can be maintained as it is and additionally he should move Rs. 70000 from his FDs into a liquid fund.

Accident Insurance: Abhishek should take a personal accident comprehensive policy which will cover for accidental death, permanent and partial disability including weekly/monthly compensation for loss of work due to total temporary disability. A PA cover of Rs. 50 lakhs with a TTD cover of Rs. 15 lakhs are suggested. The premium for this will be approximately Rs. 7000

Life Insurance: Considering the financial goals and outstanding liabilities, Abhishek’s cover is adequate. He needs to stop the traditional pension policy as well as the endowment policy which matures in 2028. The yield on these policies are less than 6% and hence coming out of those will make sense now rather than continue them till maturity which is more than 12 years to 20 years from now. Surrender of the 2 policies will fetch him approximately Rs. 3 lakhs. He should revisit the cover post marriage.

Health Insurance: The present cover is adequate as per his age. He should include his wife’s name when he gets married next year.

Debt Management: Even though the actual loan approval amount is Rs. 50 lakhs, Abhishek should not take the full disbursement. He should try and use his own sources to pay for the property and keep the loan to less than Rs. 30 lakhs. A higher loan and EMI can hamper future goals. He can use the Rs. 3 lakhs from insurance surrender to pay for slab wise payments. The policy surrender will also enable the increase in surplus amount every month.